Attached files

| file | filename |

|---|---|

| 8-K - Armour Residential REIT, Inc. | i10717.htm |

Exhibit 99.1

Confidential Information Statement and Regulatory Disclosure |

Certain statements made in this presentation regarding ARMOUR Residential REIT, Inc. (“ARMOUR”: or the “Company”:), and any other statements regarding ARMOUR’s future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact (including statements containing the words “believes,”: “plans,”: “anticipates,”: “expects,”: “estimates”: and similar expressions) should also be considered forward-looking statements. Forward-looking statements include but are not limited to statements regarding the projections for the ARMOUR business, and plans for future growth and operational improvements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. ARMOUR assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

The following materials constitute confidential information, and by reviewing it, you agree to maintain it in strict confidence. If you do not agree to maintain this material in strict confidence, then you are not authorized to review it and are instructed to return it immediately. This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities, financial instruments, or common or privately issued stock. The statements, information and estimates contained herein are based on information that the presenter believes to be reliable as of today's date, but cannot be represented that such statements, information or estimates are complete or accurate.

2

ARMOUR REIT |

• ARMOUR Residential REIT, Inc.

ARMOUR Residential REIT, Inc. (“ARMOUR”) is a real estate investment trust that invests only in Agency residential mortgage securities issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Government National Mortgage Association (Ginnie Mae).

ARMOUR Residential REIT, Inc. (“ARMOUR”) is a real estate investment trust that invests only in Agency residential mortgage securities issued by the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Government National Mortgage Association (Ginnie Mae).

• ARMOUR’s Investment Objective

ARMOUR intends to earn a return on the spread between the yield on the mortgage assets the company owns and the costs to fund those assets (plus the cost of operations). ARMOUR will use leverage, typically between 6 and 10 times, to enhance the returns for investors

ARMOUR intends to earn a return on the spread between the yield on the mortgage assets the company owns and the costs to fund those assets (plus the cost of operations). ARMOUR will use leverage, typically between 6 and 10 times, to enhance the returns for investors

• ARMOUR’s Liability Strategy

ARMOUR’s assets will typically be leveraged through funding in the REPO market.

ARMOUR’s assets will typically be leveraged through funding in the REPO market.

• ARMOUR’s Corporate Mission

ARMOUR will endeavor to produce superior returns (dividends) while attracting, retaining, and growing equity capital.

ARMOUR will endeavor to produce superior returns (dividends) while attracting, retaining, and growing equity capital.

3

Exceptionally Good Market Opportunity |

Market Conditions are Exceptionally Favorable for ARMOUR’s Business Model

Agency residential mortgage valuations are historically very attractive vs. funding rates, swaps and U.S. Treasuries which provides for mid to high teens return on equity opportunities.

Agency residential mortgage valuations are historically very attractive vs. funding rates, swaps and U.S. Treasuries which provides for mid to high teens return on equity opportunities.

Borrowers have become inelastic relative to the ability to refinance due to deteriorating household credit and lower housing prices (despite the U.S. Treasury efforts to lower mortgage rates).

Borrowers have become inelastic relative to the ability to refinance due to deteriorating household credit and lower housing prices (despite the U.S. Treasury efforts to lower mortgage rates).

U.S. Government support for Fannie Mae and Freddie Mac is no longer ambiguous. Agency mortgage prices/yields do not yet reflect this support.

U.S. Government support for Fannie Mae and Freddie Mac is no longer ambiguous. Agency mortgage prices/yields do not yet reflect this support.

Favorable low funding rates and the steep yield curve are likely to persist (though the ARMOUR business can be profitable in most yield curve environments and curve configurations).

Favorable low funding rates and the steep yield curve are likely to persist (though the ARMOUR business can be profitable in most yield curve environments and curve configurations).

4

Why ARMOUR REIT Today for Investors? |

• Income

Mid to high teens gross return on equity opportunities in a government guaranteed liquid asset class.

Mid to high teens gross return on equity opportunities in a government guaranteed liquid asset class.

• No other investment sector (with no credit risk) is earning mid teens net ROEs now and paying it out quarterly in cash.

• ARMOUR believes that today’s low rate financing environment will continue for the foreseeable future which will allow for continued spread income.

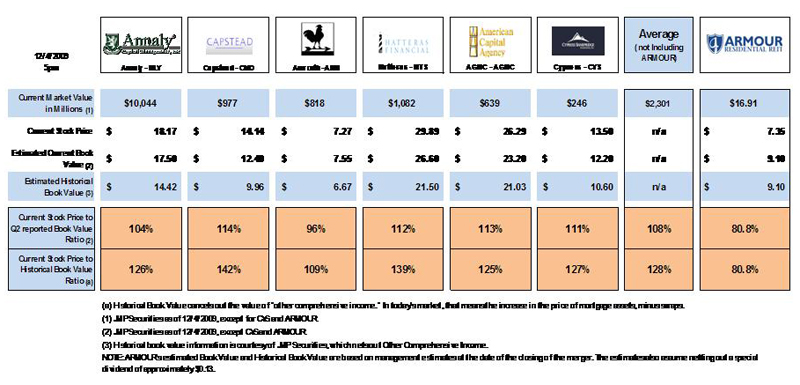

• Valuation

ARMOUR (“ARR”:) is trading under book value.

ARMOUR (“ARR”:) is trading under book value.

• As a group average, the six publicly traded RMBS REITs have had equity valuations as high as 125% of book during the current year (see page 7 for current valuations).

• As investors see continued mid to high teens dividend performance, the equity valuations could reach higher multiples to book value.

• Experience and Execution

ARMOUR is managed by two very experienced mortgage & capital markets professionals who have successfully executed mortgage, asset backed and REIT business models.

ARMOUR is managed by two very experienced mortgage & capital markets professionals who have successfully executed mortgage, asset backed and REIT business models.

• Forty-seven years of combined experience in mortgage and asset backed securities.

5

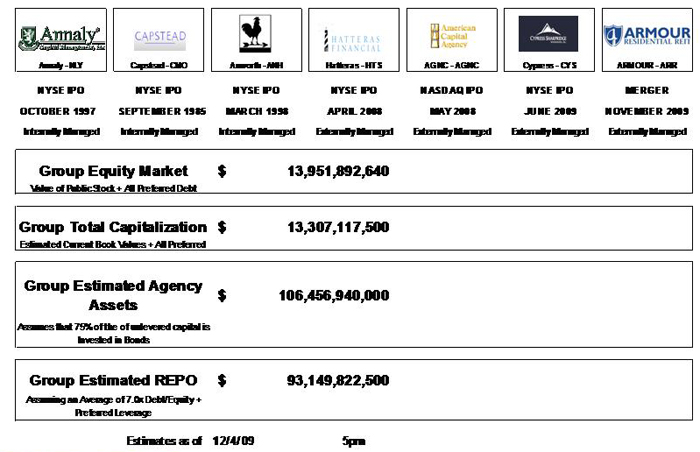

Agency Only Publicly Traded REITs |

6

Agency Only Public REIT Snapshot |

7

Agency Only REIT Valuations |

8

Differentiating ARMOUR |

9

Differentiating ARMOUR vs. Other Agency RMBS REITs |

• ARMOUR trades Excess Returns for Consistency

Low duration portfolio and extensive use of futures and/or swaps to limit rate risk.

Low duration portfolio and extensive use of futures and/or swaps to limit rate risk.

• ARMOUR’s net balance sheet duration (equity duration) is targeted to be 1.5 or lower when the effect of futures and/or swap positions (or caps) is included.

• ARMOUR’s average gross asset duration is targeted to be 2.5 or lower, which is lower than most agency REITs.

Innovative approach to liquidity management.

Innovative approach to liquidity management.

• ARMOUR will keep approximately 40% of unlevered equity in cash.

• This is approximately three times the industry historical standard.

• The ARMOUR manager previously was the first to establish a credit facility which used agency mortgage principal receivables as collateral and was the first agency RMBS REIT manager to establish a multi-billion 360 day REPO ’stand-by’ with pre-set borrowing rates and haircuts which could be accessed at any time during the year; with the only covenant being proper on time financial reporting.

10

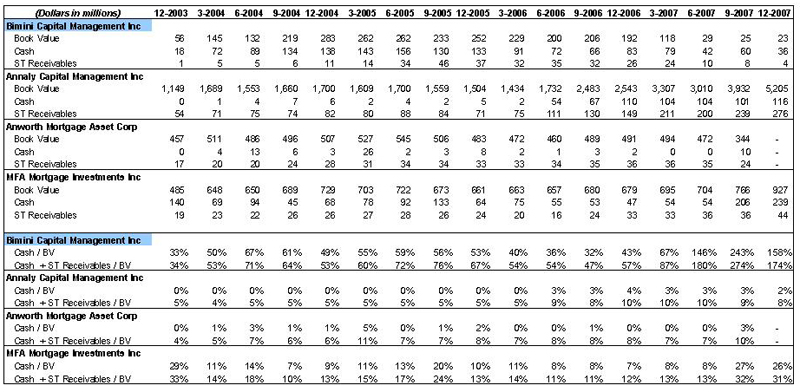

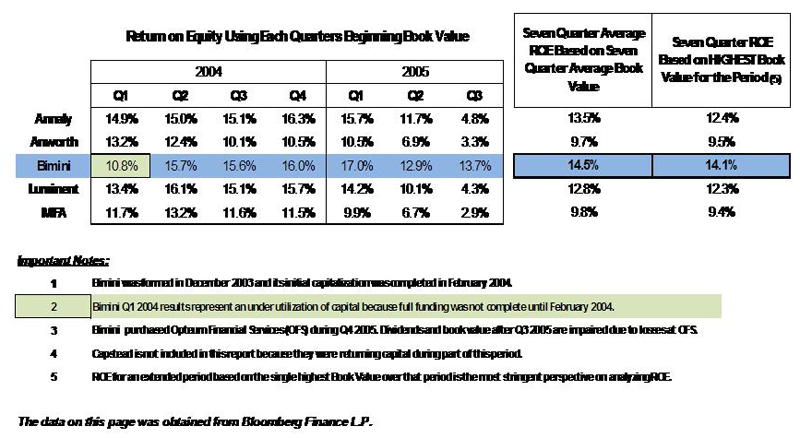

Jeff Zimmer’s Prior Company (Bimini) Maintained Large Amounts of Cash on |

11

Today’s Investment Opportunities |

12

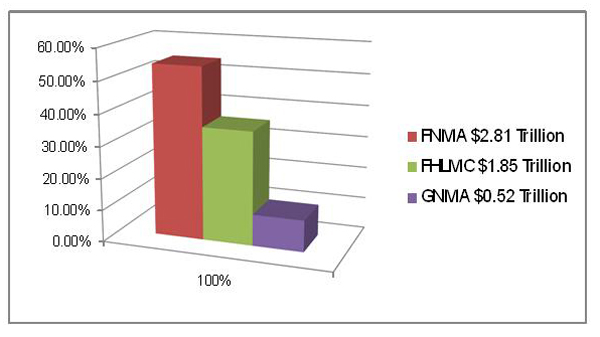

$11 Trillion U.S. Mortgages Outstanding |

$5.18 Trillion of the $11Trillion of U.S. One to

Four Family Mortgages are Agency Mortgages

(FNMA, FHLMC and GNMA).

There is plenty for ARMOUR to buy.

13

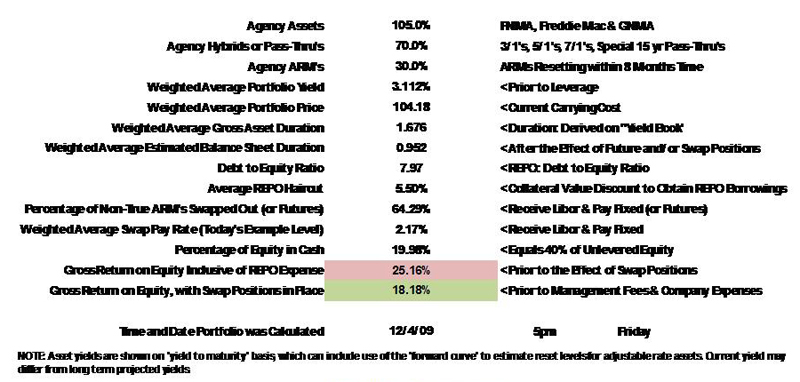

ARMOUR Proxy Portfolio Snapshot |

See details on the following pages

14

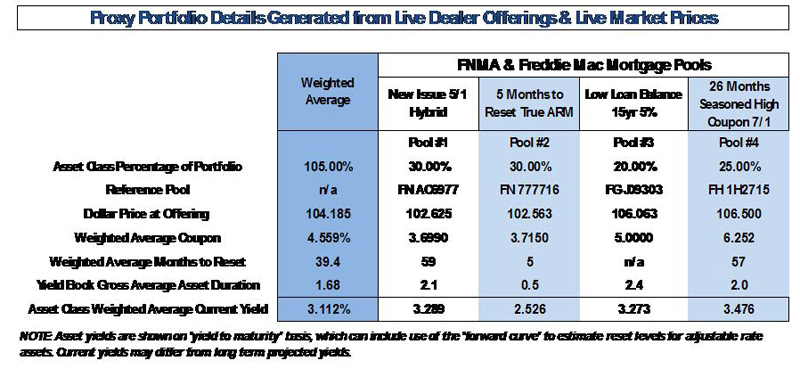

ARMOUR Proxy Asset Detail |

15

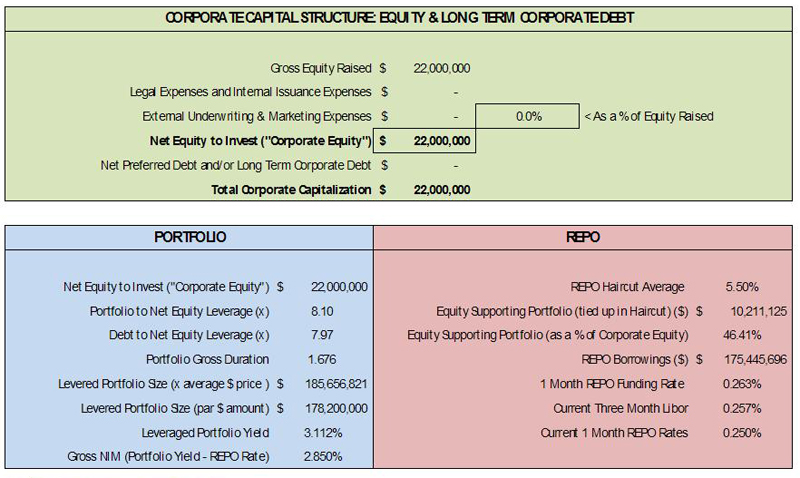

ARMOUR Capital Structure, Portfolio & REPO Position Detail |

16

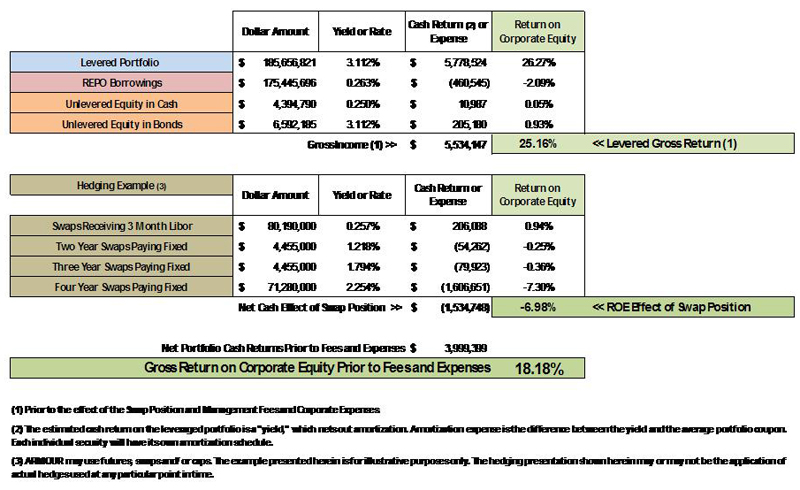

Today’s ARMOUR Gross ROE Opportunity Hedging Could Cost ARMOUR |

17

Managing ARMOUR |

18

Management Structure |

• Managing ARMOUR

ARMOUR is externally managed by ARMOUR Residential Management LLC (“ARRM”:).

ARMOUR is externally managed by ARMOUR Residential Management LLC (“ARRM”:).

• ARMOUR Management Team

ARMOUR is managed by Co-Chief Executive Officer and President Jeffrey J. Zimmer and Co-Chief Executive Officer, Chief Investment Officer and Head of Risk Management Scott J. Ulm.

ARMOUR is managed by Co-Chief Executive Officer and President Jeffrey J. Zimmer and Co-Chief Executive Officer, Chief Investment Officer and Head of Risk Management Scott J. Ulm.

• Management Fee

ARMOUR will be managed with the same cost efficiencies as internally managed structures .

ARMOUR will be managed with the same cost efficiencies as internally managed structures .

ARRM receives a base fee of 1% on gross equity raised up to $50 million in equity; 1.5% on all equity raised up to $1 billion after $50 million is raised; and 0.75% on equity raised thereafter.

ARRM receives a base fee of 1% on gross equity raised up to $50 million in equity; 1.5% on all equity raised up to $1 billion after $50 million is raised; and 0.75% on equity raised thereafter.

There is no incentive or performance fee structure.

There is no incentive or performance fee structure.

19

ARMOUR Senior Team |

Scott J. Ulm is the Co-Chief Executive Officer, Chief Investment Officer, and Head of Risk Management of ARMOUR. Mr. Ulm has 23 years of structured finance and debt capital markets experience, including mortgage-backed securities. Since 2005, Mr. Ulm has been Chief Executive Officer of Litchfield Capital Holdings. From 1986 to 2005, he held a variety of senior positions at Credit Suisse both in New York and London including Global Head of Asset-Backed Securities, Head of United States and European Debt Capital Markets and the Global Co-Head of Collateralized Debt Obligations, both cash and synthetic. While at Credit Suisse, Mr. Ulm was responsible for the underwriting and execution of more than $100 billion of mortgage- and asset-backed securities. Mr. Ulm has advised numerous U.S., European, and Asian financial institutions and corporations on balance sheet and capital raising matters. At Credit Suisse, he was a member of the Fixed Income Operating Committee and the European Investment Banking Operating Committee. Mr. Ulm holds a BA summa cum laude from Amherst College, an MBA from Yale School of Management and a JD from Yale Law School.

Jeffrey J. Zimmer is the Co-Chief Executive Officer and President of ARMOUR. Mr. Zimmer has significant experience in the mortgage-backed securities market over a 25 year period. From 2003 through April 2008 he was President and Chief Executive Officer of Bimini Capital Management, Inc. a publicly traded REIT which owned as much as $4 billion of agency mortgage assets. He was co-founder of the company, took it public, and orchestrated secondary public offerings and long term debt issuance. Prior to that he was a managing Director at RBS/Greenwich Capital in the Mortgage-Backed and Asset-Backed Department from 1990 through 2003 where he held various positions that included working closely with some of the nation’s largest mortgage banks, hedge funds, and investment management firms on various mortgage-backed securities investments. He has sold and researched almost every type of mortgage-backed security in his many years in the mortgage business. He has negotiated terms on and participated in the completion of dozens of new underwritten public and privately placed mortgage-backed deals. Mr. Zimmer was employed at Drexel Burnham Lambert in the institutional mortgage-backed sales area from 1984 until 1990. He received his MBA in finance from Babson College in and a BA in economics and speech communication from Denison University.

20

ARMOUR Team |

Experience

Leveraged balance sheet, risk management and liquidity management.

Leveraged balance sheet, risk management and liquidity management.

Portfolio management and funding (liability/repo) management.

Portfolio management and funding (liability/repo) management.

Capital raises (equity and debt).

Capital raises (equity and debt).

Long term relationships with industry research analysts, credit officers and bankers.

Long term relationships with industry research analysts, credit officers and bankers.

ARMOUR Operating Staff

ARMOUR has hired Amber K. Luedke to be Chief Accounting Officer. Ms. Luedke was most recently Head of Tax Accounting for Thornburg Mortgage. Prior to that Ms. Luedke was Treasurer for Bimini Capital Management. ARMOUR will soon announce that an additional Portfolio Manager, CFA will join the ARMOUR team.

ARMOUR has hired Amber K. Luedke to be Chief Accounting Officer. Ms. Luedke was most recently Head of Tax Accounting for Thornburg Mortgage. Prior to that Ms. Luedke was Treasurer for Bimini Capital Management. ARMOUR will soon announce that an additional Portfolio Manager, CFA will join the ARMOUR team.

ARMOUR Clearing and REPO Placement

ARMOUR back office operations, clearing and repo placement services is conducted by AVM LP which employs over 100 professionals and clears approximately $3 trillion in securities annually (www.avmlp.com).

ARMOUR back office operations, clearing and repo placement services is conducted by AVM LP which employs over 100 professionals and clears approximately $3 trillion in securities annually (www.avmlp.com).

ARMOUR Audit and Legal Professionals

Eisner LLP will audit ARMOUR and Akerman Senterfitt will provide legal services.

Eisner LLP will audit ARMOUR and Akerman Senterfitt will provide legal services.

21

Jeff Zimmer Record as an Agency REIT Only Manager |

22

Board Biographies |

23

Board Member Biographies |

Daniel C. Staton is the President, CEO and Director of Enterprise Acquisition Corp. and will be the Non-Executive Chairman of ARMOUR. Mr. Staton has over 10 years experience sourcing private equity and venture capital investments. Since 2003, he has been Managing Director of private equity firm Staton Capital LLC. Between 1997 and 2007, Mr. Staton was President of The Walnut Group, a private investment firm, where he served as initial investor Director of Build-A-Bear Workshop, initial investor in Deal$: Nothing Over a Dollar (until its sale to Supervalu Inc.), and Director of Skylight Financial. Prior to The Walnut Group, Mr. Staton was General Manager and Partner of Duke Associates from 1981 until its IPO in 1993, and then served as COO and Director of Duke Realty Investments, Inc. (NYSE: DRE) until 1997. Mr. Staton also served as Chairman of the Board of Storage Realty Trust from 1997 to 1999, when he led its merger with Public Storage (NYSE: PSA), where he continues to serve as a Director. Mr. Staton supplements his professional network by co-producing and investing in numerous Broadway musicals as well as relationships with not-for-profit organizations. Mr. Staton majored in Finance at the University of Missouri and holds a B.S. degree in Specialized Business from Ohio University and a B.S. degree in Business (Management) from California Coast University.

Marc H. Bell is the Chairman of the Board of Directors and Treasurer of Enterprise Acquisition Corp. and will be a Director of ARMOUR. Mr. Bell has served as Managing Director of Marc Bell Capital Partners LLC, an investment firm which invests in media and entertainment ventures, real estate, and distressed assets since 2003, and has also served as the President and Chief Executive Officer of FriendFinder Networks Inc. since 2004. Previously, Mr. Bell was the founder and President of Globix Corporation, a full-service commercial Internet Service Provider with data centers and a private network with over 20,000 miles of fiber spanning the globe. Mr. Bell served as Chairman of the Board of Globix Corporation from 1998 to 2002 and Chief Executive Officer from 1998 to 2001. Mr. Bell was also a member of the Board of Directors of EDGAR Online, Inc., an Internet-based provider of filings made by public companies with the SEC, from 1998 to 2000. Mr. Bell has also been a co-producer of Broadway musicals, and serves as a member of the Board of Trustees of New York University and New York University School of Medicine. Mr. Bell holds a B.S. degree in Accounting from Babson College and an M.S. degree in Real Estate Development from New York University.

24

Board Member Biographies |

Thomas K. Guba (Independent Director) Mr. Guba has been the senior executive or head trader of various Wall Street mortgage and government departments in his thirty four years in the securities business. From 2002 through 2008, Mr. Guba was President and Principal of the Winter Group, a fully integrated mortgage platform and money management firm. Prior to 2002, he was Managing Director of Structured Product Sales at Credit Suisse First Boston (2000 through 2002), Managing Director and Department Manager of Mortgages and U.S. Treasuries at Donaldson Lufkin Jenrette, which was subsequently purchased by Credit Suisse First Boston (1994 through 2000), Executive Vice President and Head of Global Fixed Income at Smith Barney (1993 through 1994), Managing Director of the Mortgage and U.S. Treasuries Department at Mabon Securities (1990 through 1993), Senior Vice President and Mortgage Department Manager at Drexel Burnham Lambert (1984 through 1990), Senior Vice President and Head Mortgage Trader at Paine Webber (1977 through 1984) and a trader of mortgaged backed securities at Bache & Co. (1975 through 1977). Mr. Guba was also a Second Lieutenant, Military Police Corps, in the United States Army (1972 through 1974). Mr. Guba received his BA in political science from Cornell University in 1972 and his MBA in finance from New York University in 1979.

John “Jack” P. Hollihan III (Independent Director) Mr. Hollihan has over 25 years of investment banking and investment experience. Mr. Hollihan was formerly the Head of European Investment Banking for Banc of America Securities (“BAS”:), where he was a member of the BAS European Capital Committee and Board, and where he had responsibility for a loan book of $8 Billion. Prior to that, Mr. Hollihan was Head of Global Project and Asset Based Finance and Leasing at Morgan Stanley and was a member of the Morgan Stanley International Investment Banking Operating Committee. In that capacity, he managed $45 billion in asset based and structured financings and leasing arrangements. He is a former trustee of American Financial Realty Trust (NYSE: “AFR”:) and currently the lead independent director of City Financial Investment Company Limited (London) and Executive Chairman of Litchfield Capital Holdings (Connecticut). Mr. Hollihan received B.S. (Wharton) and B.A. degrees from the University of Pennsylvania, and a J.D. from the University of Virginia School of Law.

25

25

Board Member Biographies |

Stewart J. Paperin (Independent Director) Mr. Paperin has served as Executive Vice President of the Soros Foundation, a worldwide private philanthropic foundation, since 1996, where he oversees financial, administrative and economic development activities. From 1996 to July 2005, Mr. Paperin served as a Senior Advisor and portfolio manager for Soros Fund Management LLC, a financial services company, and since July 2005 has served as a consultant to Soros Fund Management LLC. From 1996 to 2007, Mr. Paperin served as a Director of Penn Octane Corporation (Nasdaq: “POCC”:), a company engaged in the purchase, transportation and sale of liquefied petroleum gas. Prior to joining the Soros organizations, Mr. Paperin served as President of Brooke Group International, an investment firm concentrated on the former Soviet Union, from 1990 to 1993, and as Senior Vice President and Chief Financial Officer of Western Union Corporation, a provider of money transfer and message services which was controlled by Brooke Group, from 1989 to 1991. Mr. Paperin currently serves as a member of the Board of Directors of Community Bankers Acquisition Corp., a blank check company formed to acquire an operating business in the banking industry (AMEX: BTC). Mr. Paperin holds a B.A. degree and an M.S. degree from the State University of New York at Binghamton. He is a member of the Council for Foreign Relations and was awarded an honorary Doctor of Humane Letters by the State University of New York.

Jordan Zimmerman (Independent Director) Mr. Zimmerman is Founder and Chairman of Zimmerman Advertising, the 15th largest advertising agency in the country, with published annual billings in excess of $2 billion. Since its founding in 1984, Mr. Zimmerman led his agency from its origin as a regional automotive advertising agency into a national retail firm, with more than 1,000 associates and 22 offices, serving clients in virtually every retail sector, including: fast food, sports, real estate, spirits, furniture, financial services, office supply retailers, travel and retail discounters. In 1999, Mr. Zimmerman sold Zimmerman Advertising to Omnicom, a leading global marketing and corporate communications company and a premier holding company for such top advertising agencies as BBDO, DDB, TBWA Chiat and others. Mr. Zimmerman has supported and led many local and national non-profit organizations and charities, including: Make a Wish Foundation, Crohn's and Colitis Foundation and Songs for Love. He is a member of the board for Take Stock in Children, Pine Crest School of Boca Raton and the Cleveland Clinic Florida. Mr. Zimmerman is a co-owner of the Florida Panthers and the Tampa Bay Lightning, both NHL hockey teams. Mr. Zimmerman holds an M.B.A. degree from the University of South Florida.

26

Board Member Biographies |

Robert C. Hain has been Chairman of City Financial Investment Company Limited since 2006 and a member of Shadbolt Partners LLP since 2005, both companies of which are engaged in asset management in the United Kingdom and Europe. City Financial and its affiliates acquire, rejuvenate and grow mutual fund and similar investment management businesses, and provide strategic advice to a select group of owners of investment management firms. Previously Mr. Hain was Chief Executive Officer of Invesco Perpetual, a prominent British asset manager, from 2002 to 2004, and Chief Executive Officer of Invesco Trimark, a Canadian mutual fund company, from 1998 to 2002. Mr. Hain was a member of the Executive Management Committee of Amvescap Plc (now Invesco Ltd), from 1998 to 2005. Mr. Hain’s career in financial services includes senior executive positions in marketing, private banking and retail financial services in North America and Europe, and has comprised major acquisitions, integrations, and product and service delivery innovations that altered the competitive landscape. In addition, Mr. Hain has served on the boards and committees of financial services, business, arts, health and social services organizations at the national and local levels in Toronto, Zurich, Winnipeg, Halifax and London. He received degrees from the University of Toronto (Innis College) and the University of Oxford (Merton College) in 1976 and 1978 respectively.

27

28