Attached files

| file | filename |

|---|---|

| 8-K - Essex Rental Corp. | v166771_8k.htm |

Investor Presentation

November 2009

Essex Rental Corp

2

Important Notice

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is an outline of matters for discussion only.

Some of the statements in this presentation and other written and oral statements made from time to time by the Company and its representatives are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent and belief or current expectations of Essex and its management team and may be identified by the use of words like "anticipate", "believe", "estimate", "expect", "intend", "may", "plan", "will", "should", "seek", the negative of these terms or other comparable terminology. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from Essex’s expectations include, without limitation, the continued ability of Essex to successfully execute its business plan, the possibility of a change in demand for the products and services that Essex provides (through its subsidiary, Essex Crane), intense competition which may require us to lower prices or offer more favorable terms of sale, our reliance on third party suppliers, our indebtedness which could limit our operational and financial flexibility, global economic factors including interest rates, general economic conditions, geopolitical events and regulatory changes, our dependence on our management team and key personnel, as well as other relevant risks detailed in our Annual Report on Form 10-K and subsequent periodic reports filed with the Securities and Exchange Commission and available on our website, www.essexcrane.com. The factors listed here are not exhaustive. Many of these uncertainties and risks are difficult to predict and beyond management’s control. Forward-looking statements are not guarantees of future performance, results or events. Essex assumes no obligation to update or supplement forward-looking information in this press release whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results or financial conditions, or otherwise.

This presentation contains unaudited non-GAAP financial measures, including Total EBITDA, and Rental EBITDA. Management believes that the presentation of these non-GAAP financial measures serves to enhance understanding of Essex’s individual operating and financial performance. These non-GAAP financial measures should be considered in addition to, but not as substitutes for, the most directly comparable U.S. GAAP measures. A reconciliation of Total EBITDA and Rental EBITDA to income from operations for the nine months ended September 30, 2009 can be found in Essex’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on November 4, 2009.

The historical 2004 financial information and data of Essex Crane contained in this presentation is unaudited and was prepared by Essex Crane as a private company prior to its acquisition by the Company, and may not conform to SEC regulation S-X.

We believe the non-Company information provided herein is reliable, as of the date hereof, but do not warrant its accuracy or completeness. In preparing these materials, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Except as required by law, the Company, Essex and their respective directors, officers, employees, agents and consultants make no representation or warranty as to the accuracy or completeness of the non-Company information contained in this document, and take no responsibility under any circumstances for any loss or damage suffered as a result of any omission, inadequacy, or inaccuracy in this document.

Neither the Company nor Essex Crane guarantees the performance or return of capital from investments.

©2009 Essex Rental Corp.

3

Definitions

OLV: Orderly Liquidation Value as assessed by independent specialist equipment appraisers in

September 2009

Replacement Value: The cost required to replicate the current aggregate lifting tonnage of Essex’s fleet

with crawlers being produced today

CAGR: Compound Annual Growth Rate

Rental EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization generated in the

ordinary course of business, which does not include sales of equipment

Total EBITDA: Rental EBITDA + gain on sale of equipment

Free Cash Flow (“FCF”): Rental EBITDA – Maintenance Capital Expenditure – Interest Expense –

Taxes – Net Crane Investment

Net Crane Investment: Equipment Purchases – Equipment Sales

Note: The historical 2004 financial information and data of Essex Crane contained in this presentation is unaudited and was prepared

by Essex Crane as a private company prior to its acquisition by the Company,

and may not conform to SEC regulation S-X.

| 4

Introduction

1

5

Introduction to Essex

Notes:

(1)

Source: International Crane and Specialized Transport, June 2009

(2)

As assessed by independent specialist equipment appraisers in September 2009

(3)

Essex management estimates

Essex owns one of the largest rental fleet of heavy lift crawler cranes in

North America(1)

>350 cranes and attachments, OLV and estimated Replacement Value

of > $260 million(2) and > $450 million(3) respectively

#1 North American “bare” crawler crane rental company(1)

50-year operating history

Majority of revenue is derived from infrastructure-related projects, which

Essex believes benefit from powerful secular trends

Bridge and road construction, power, water treatment, refineries,

alternative energy and other infrastructure-related projects comprise

majority of revenues

Historically, 40% of revenues generated from public works projects(3)

35% of revenues generated from repair and maintenance projects(3)

Exposure to residential and light commercial construction is minimal

Revenue generated from:

“Bare” (non-Essex operated) crane and attachment rental

Rental contracts are typically 6-18 months

Customers are responsible for most repair and maintenance during

lease, which minimizes Essex’s maintenance capital expenditures

6

Investment Highlights

Strong long-term secular trend

Attractive business characteristics

Over 90% of revenue generated from infrastructure and energy-related projects

Investment in infrastructure by government stimulus program is expected to be an indirect driver affecting

future crawler crane rates in the US

Product substitution risk is believed to be minimal

Market leader in heavy lift segment(1)

Well balanced target market (diversity of industries, customers served and geographic scope)

Fleet size and equipment mix provide competitive advantage

Simple business model – low operational risk and attractive margins

Low relative cost position versus Replacement Value or OLV

Assets have 30-50 year economic lives, limited technological obsolescence risk and require minimal

maintenance capital expenditures; proven history of maintaining market resale value

Notes:

(1)

Source: International Crane and Specialized Transport June 2009

Strong free cash flow and good return model

Strong free cash flow model

Excess cash flow will be used to pay down debt and to repurchase shares and warrants

Limited maintenance capital expenditures (estimated $2-3 million per year)

Return on capital versus return of capital economic model

7

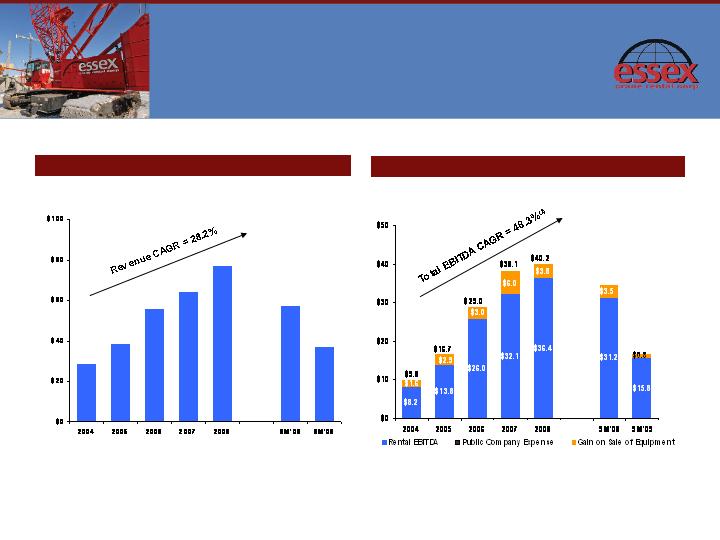

($ millions)

Rental Revenues(2)

Annual Summary Financial

Information

($ millions)

Total EBITDA

Notes:

1.

Source: Essex Crane and Essex audited (2005-2008) and unaudited (2004, 9M’08 and 9M’09) financials.

2.

Rental Revenue includes revenue from rentals, repairs & maintenance, and transportation services but excludes used rental equipment sales.

3.

2008 Total EBITDA of $40.2 million is after $2.2 million of public company expenses and one time expenses of $5.2 million associated with Essex Rental Corp’s

(formerly Hyde Park Acquisition Corp.) acquisition

of Essex Crane Rental Corp. and excludes the impact of the $23.9 million goodwill impairment charge recorded in

the fourth quarter of 2008.

4.

9M’09 Total EBITDA was reduced by $2.0 million of public company expenses.

5.

The historical 2004 financial information and data of Essex Crane contained in this presentation is unaudited and was prepared by Essex Crane as a private

company prior to its acquisition by the Company, and

may not conform to SEC regulation S-X.

$34.7

$16.6

(4)

(3)

$28.5

$38.6

$55.7

$64.5

$76.9

$57.5

$36.9

8

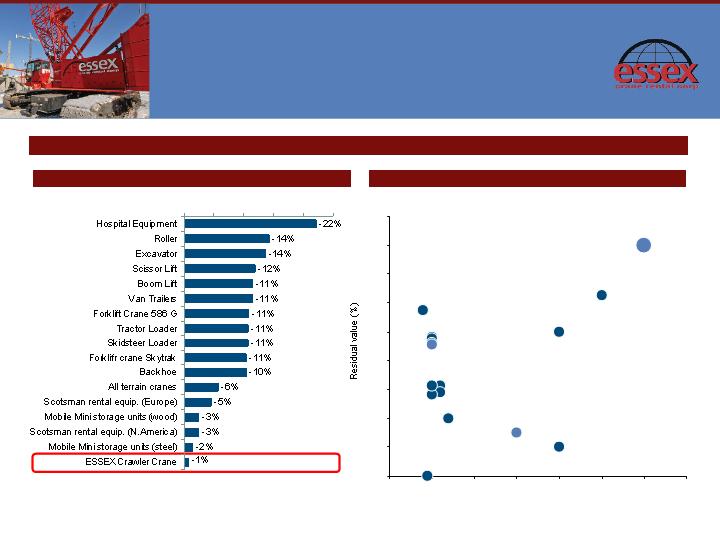

Return on Capital vs. Return of

Capital

Notes:

1.

Asset depreciation represents equipment market value depreciation

2.

Annual Depreciation % = (1 – Residual Value %) / Lifespan.

3.

Source: Oliver Wyman Essex Crane Assessment

Asset Depreciation (1) Benchmark: Residual Value vs. Lifespan

Asset Depreciation (1) Benchmark: Annual Depreciation %(2)

Crawler cranes stand out from other equipment types due to their superior lifespan and residual value characteristics

Rental Lifespan (years)

Van trailers

Boom Lift

Scissor Lift

Roller

Backhoe

Tractor Loader

Forklift Crane

Excavator

Skidsteer Loader

Hospital

equipment

Mobile Mini

storage units

(steel)

Scotsman rental

equipment (North

America)

Mobile Mini

storage units

(wood)

Scotsman rental

equipment

(Europe)

All terrain cranes

ESSEX

Crawler Crane

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

0

5

10

15

20

25

30

35

| 9

Heavy Crane Rental

Industry

2

10

U.S. Heavy Crane Rental Industry

Segments

Notes:

1.

Source: Manufacturer reports and Essex management estimates

2.

Crawler crane prices reflect models in Essex’s heavy-lift niche. Light and super heavy-lift crawler cranes can range from $0.5 million to over $5 million

Crane Type

Crawler

All Terrain (ATs)

Rough Terrain (RTs)

Tower

Truck

Max. Lift Cap. (tons)

1,500

600

130

80

150

Max. Reach Cap. (ft.)

700

400

250

350

250

Price New ($ ‘000)

$800 - $2,500 (2)

$500 - $3,000

$250 - $1,000

$300 - $1,000

$300 - $800

Avg. Life (years)

50+

15+

15+

30+

15+

Rental Duration

Long-term

Short-term

Short-term

Long-term

Short-term

Key End Markets

Highways, large

bridges, railroads

Public infrastructure

(stadiums, garages)

Power generation

Sewer / water

treatment

Petrochemicals

Industrial / marine

Petrochemical

maintenance

Railroads

Highways

Office Towers

Apartments

Condominiums

Other Commercial &

Residential

Secondary type

used in variety of

markets including

sewer / water

treatment,

petrochemicals

maintenance and

public infrastructure

projects

Condominiums

Other Residential

Nuclear power

Sewer / water

treatment

High rise (>10 story)

Office Towers

Condominiums

Apartment Buildings

Railroads

Highways

Condominiums

Apartment Buildings

Other Residential

Crawlers typically service infrastructure projects, are non-substitutable and are often rented for longer periods than other crane classes

Comparison of Major Crane Types in the North American Market(1)

| 11

Company Overview

3

12

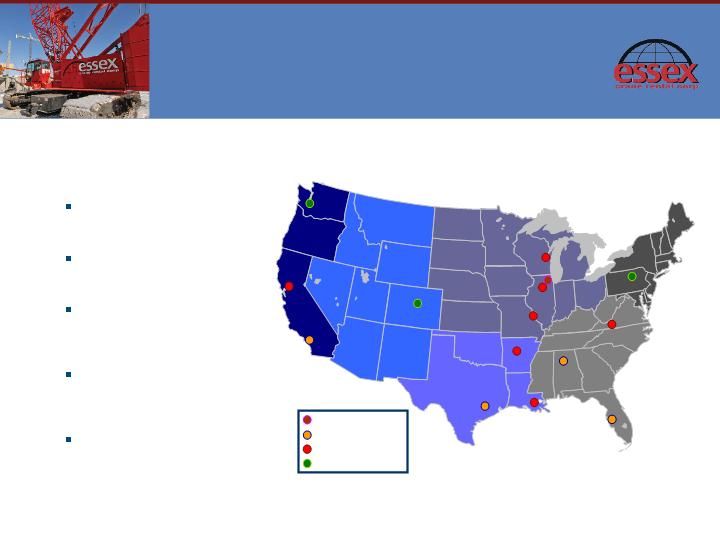

Company Highlights

Head Office

Service Center

Equipment Storage Yard

Satellite Service Center

Key Attributes

Simple business model: bare

(un-manned) rentals

Highly predictable: 6-18 month

contracts

Assets have 30-50 year

economic lives and limited

technological obsolescence risk

Well balanced target market

(industries and customers served

and geography)

Assets have a proven history of

maintaining secondary market re-

sale value

13

Essex’s Competition

Notes:

1.

Source: International Cranes and Specialized Transport, June 2009

2.

Bolded companies represent family owned and operated crawler crane rental companies

3.

Crawler equipment includes all cranes and attachments

4.

Essex management estimate of primary geographic presence (SE=Southeast; NE=Northeast)

5.

Essex management estimate of number of Lampson crawler equipment in North America

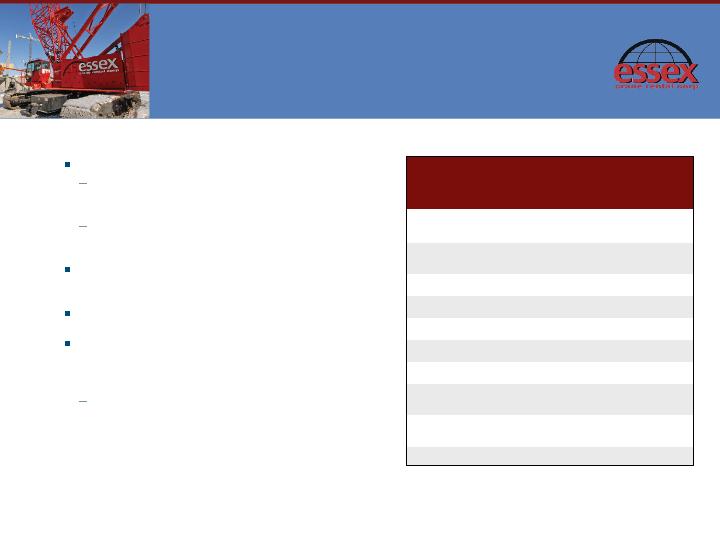

Top 10 North American Based Crawler Crane Fleets(1)

Name(2)

Crawler

Equipment (3)

Region (4)

1

ALL Erection & Crane

Rental

457

National

2

Essex Crane Rental Corp.

376

National

3

Lampson International

285(5)

National

4

Maxim Crane Works

293

National

5

Amquip Corp.

127

East

6

M.D. Moody Sons Inc.

125 (Est.)

SE

7

J.F. Lomma

65

NE

8

Ray Anthony

International

55

National

9

Buckner Heavy Lift

Cranes

53

NE

10

Biggie Crane Service

52

West

The crawler crane industry is fragmented:

Essex is the largest player in the bare crawler crane

rental industry owning a large share of the crawler

cranes in excess of 100 ton lifting capacity in the U.S.

Numerous acquisition opportunities of companies in the

top 10 of the crawler crane industry, both national and

regional players

Many competitors are focused on smaller lifting equipment

and therefore are more closely tied to residential and

commercial construction cycles

Minimal competition with general equipment rental

companies (e.g. United Rentals, H&E Equipment Rentals)

Management believes a new market entrant would face a

significant competitive economic disadvantage given the

cost of replicating Essex’s fleet, which is estimated to equal

in excess of $450 million.

$215 million purchase price versus estimated at more

than $450 million cost to replicate fleet with new

equipment

14

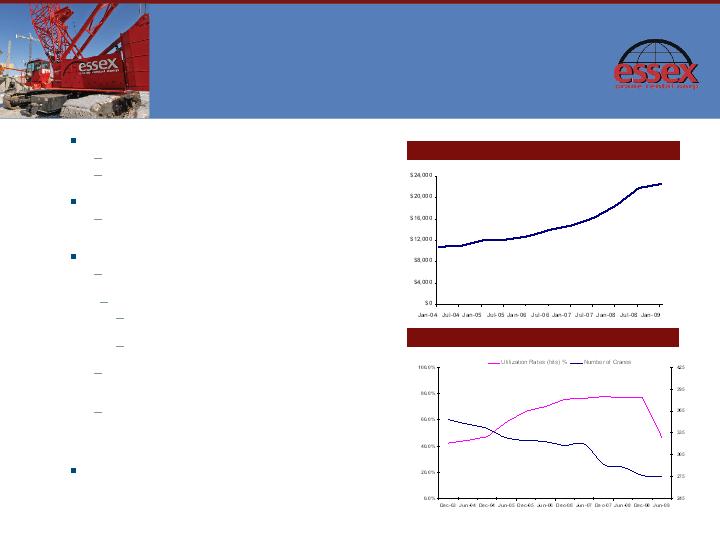

Essex Rental Fleet

Essex operates a fleet of >350 cranes and attachments

Fleet diversified by lift capacity

Status as large customer provides preferential pricing and lead-

time arrangements with crane manufacturers

Manitowoc and Liebherr cranes represent 100% of fleet by units

Average lifting capacity has increased from 177 tons in 2003 to

presently 250 tons as a result of Essex’s fleet re-positioning

strategy

Consistently rebalancing fleet mix:

Focus on acquiring heavier tonnage cranes and selling older,

lighter tonnage models

For nine months ended 9/30/09:

Sold 12 cranes to overseas concerns or domestic fixed

operators, with average lifting capacity of 163 tons

Took delivery of 10 new larger lifting capacity cranes with

average lifting capacity of 330 tons

Management believes heavier cranes are in shorter supply and

in higher demand than lighter cranes, which has translated into

a more favorable pricing dynamic and higher utilization rates

Heavier lift capacity cranes exist in smaller quantities in the

marketplace and with fewer suppliers. Management believes

there will be

a growth in demand for these cranes in the future

and that the tighter supply and growth opportunities will produce

higher revenue and margins (returns)

Rental rate increases expected to follow increased utilization rates

Average Monthly Rental Rates for Essex Fleet(1)

Notes:

1.

Source: Essex

2.

Based on “hits” method utilization

Fleet Utilization and Size(1)(2)

15

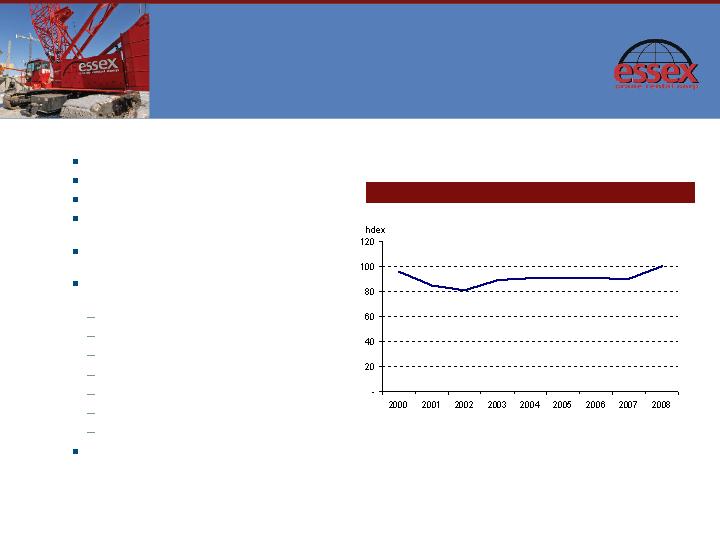

Stable Underlying Asset Value

Note: Line represents the annual OLV of a representative static group of Essex cranes

as a % of their OLV in April 2000

Extended usable lives of up to 50 years

Average fleet age of 16 years(1)

Current OLV in excess of $260 million

Approximately $177 million invested in crawler fleet

since 1995

Estimated Replacement Value of fleet is in excess of

$450 million(2)

Management believes fleet has retained value due

to a number of factors:

Substantial initial investment

High structural steel content

Replaceable components

Low duty-cycle

Enduring technology

Essex investment and maintenance expertise

Strong global demand

Fleet sales have averaged 100% of OLV from 2000

through December 2008(3)

and have averaged over

115% of OLV in 2009

Notes:

1.

Represents an OLV-weighted average age of the entire crane fleet

2.

Essex management estimates

3.

Source: Essex

Essex Crane Fleet OLV Index(3)

Less than 2% economic

depreciation per annum

16

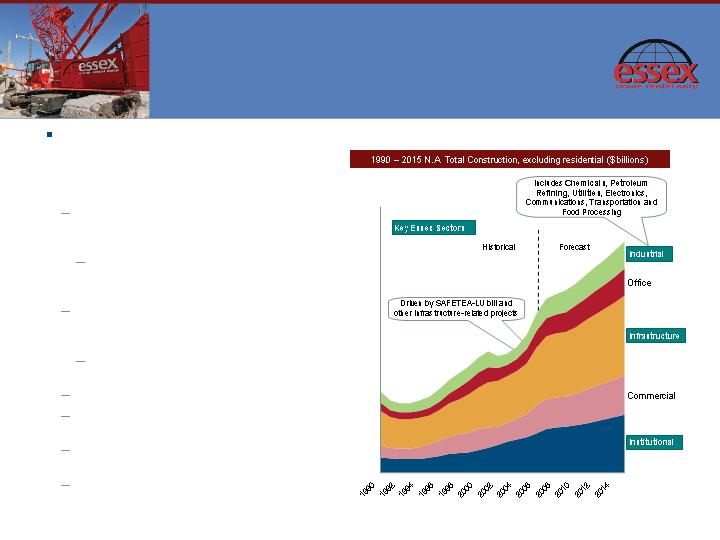

Essex End Market Overview

Source: Oliver Wyman Essex Crane

Assessment

Despite overall weakness in the infrastructure &

construction markets in the first nine months of

2009, Essex has begun to see an increase in

bookings & expects to see a slow recovery starting

early 2010. Demand drivers include:

American Recovery & Reinvestment Act (Federal

Stimulus Plan) expected to fund increased

building activity in many of Essex’ end markets

$50 billion allocated for transportation related

projects such as heavy highway work and

large bridge construction

$244.1 billion SAFETEA-LU bill and renewed

focus on US bridge system positive for

transportation infrastructure

A significantly larger highway bill is under

consideration in Congress

Growing push for new nuclear power facilities

New Orleans levee contracts currently being

awarded

Upgrade of existing national infrastructure –

power and water utilities

Pipeline of social infrastructure projects – i.e.

municipalities building convention / stadium

facilities

0

200

400

600

800

1,000

1,200

1,400

17

Essex’s End Markets

Essex 2002 Rental Revenues by End Market

Less exposure to power,

greater diversification

Industrial / Marine (33%)

Industrial Facilities

Factories

Petrochemicals (22%)

Chemical Plants

Petrochemical

Plants

General Building (6%)

Hospitals

Stadiums

Power (18%)

Power Plants

Wind Power

Transportation (14%)

Road construction

Bridge construction

Sewer & Water (1%)

Sewers

Water Treatment

Essex 2009 Rental Revenues by End Market

18

Growth Opportunities

Leverage extensive relationships and success in selling used equipment at premium prices

Provide “one stop shop” model: rent to own or try before you buy

Expand used equipment sales by purchasing used crawlers for refurbishment and sale

Management believes its relationships with international manufacturers and market players provide additional equipment

purchasing and used equipment sales opportunities

Distribution of New and Used Equipment

Organic Growth

Expected longer term growth in demand for heavy lifting equipment driving increases in rental and utilization rates

Updating fleet with heavier tonnage cranes and replacing older, lighter, less utilized equipment

Purchasing power benefits from crane manufacturer relationships

Equipment purchases of new heavier lift equipment of $53 million the last three years are expected to drive growth in 2010

Expanding customer base to take advantage of future infrastructure projects

Acquisitions / Consolidation

The fragmented rental industry is expected to consolidate

Many competitors are family owned and management expects a number of these to become available over time

Further diversification would enable expansion of current national footprint to markets in the Northeast and the West

| 19

Summary Financial

Information and

Valuation

4

20

Summary Financial Information

Notes:

1.

Source: Essex

2.

Total Rental Related Revenues excludes used rental equipment sales.

3.

2008 financial information includes $5.2 million of one-time non-recurring transaction costs incurred related to Essex Rental Corp’s (formerly Hyde Park Acquisition Corp.)

acquisition of Essex Crane Rental.

4.

Based on “hits” method utilization.

5.

The historical 2004 financial information and data of Essex Crane contained in this presentation is unaudited and was prepared by Essex Crane as a private company

prior to its acquisition by the Company, and

may not conform to SEC regulation S-X.

6.

2008 financial information excludes the impact of the $23.9 million goodwill impairment charge recorded in the fourth quarter of 2008.

December 31 Year End

Historical Unaudited

Historical Audited

Unaudited

(USD $000's)

2004 (5)

2005

2006

2007

2008 (6)

9M'09

Total Rental Related Revenues (2)

$28,524

$38,583

$55,659

$64,532

$76,888

$36,922

Operating Expenses

(13,170)

(17,183)

(20,960)

(23,322)

(27,789)

(12,377)

Gross Profit

15,354

21,400

34,699

41,210

54,099

24,545

SG&A

(7,123)

(7,585)

(8,732)

(9,112)

(12,498)

(8,712)

One-time Transaction Costs (3)

-

-

-

-

(5,200)

-

Rental EBITDA

8,231

13,815

25,967

32,098

36,401

15,834

Rental EBITDA Margin (%)

28.9%

35.8%

46.7%

49.7%

47.3%

42.9%

Gain On Sale of Equipment

1,608

2,879

3,007

6,049

3,814

780

Total EBITDA

9,839

16,694

28,974

38,147

40,215

16,614

Equipment Sale Proceeds

5,454

7,841

5,980

13,233

8,440

6,074

Revenue + Equipment Sale Proceeds

33,978

46,424

61,639

77,765

85,328

42,996

Total EBITDA Margin %

29.0%

36.0%

47.0%

49.1%

47.1%

38.6%

Maintenance Capital Expenditure

(339)

(518)

(512)

(724)

(2,375)

(625)

Discretionary Crane Investment

(383)

(5,875)

(6,004)

(18,784)

(21,153)

(14,406)

Average Fleet Utilization Rate (4)

45.7%

57.8%

72.6%

76.3%

77.0%

51.4%

Average Monthly Rental Rate ($000's)

$11.3

$12.4

$13.8

$16.3

$21.4

$21.7

21

Valuation Snapshot

Debt outstanding (9/30/09): $133.3 million

$190 million facility size

5-year facility

Libor plus 225

2 financial covenants (only become effective if availability is below

$20 million)

14.1 million shares outstanding and 13.5 million warrants exercisable

at $5.00 per share through March 2011

Accumulated tax loss of $45.0 million, which has a present value of

approximately $16.9 million(1) (estimated present value of cash tax

saved of approximately $6.8 million(2))

(1) Discount rate of 15% used to calculate present value of accumulated tax loss.

(2) Assumes use of accumulated tax loss over a seven-year period.

22

Public Company Trading and Transaction Multiples (LTM EV/Total EBITDA)

Rental Asset Life and EBITDA

Multiple Comparison

Rental Equipment Useful Life

Source: Company filings, industry research

Notes: Data as of 9/04/08; Essex Transaction multiple calculated using LTM 9/30/08 EBITDA

0 Years 5 Years 10 Years 15 Years 20 Years 25 Years 30 Years 50 Years

Mean 6.7x

Transaction EBITDA Multiples Trading EBITDA Multiples Essex Transaction Total EBITDA Multiple

23

2009 Goals & 2010 Outlook

Focus on paying down debt in 2009 and continuation of share and warrant

repurchase plan using after tax free cash flow

Continue to sell older, lower-lift capacity cranes into used crane market

Sell at significant premium to orderly liquidation value and reinvest proceeds

into larger, higher capacity cranes

Proactive cost cutting program

Reduced salaries, head count, eliminated discretionary expenses wherever

possible, decreased use of 3

rd party vendors, and reduced overtime and

associated expenses

Annualized savings of $5 million

Starting early 2010, the Company expects to benefit from Federal Stimulus Bill

funded projects, that include highway and heavy bridge construction, civil works

programs, water and waste water treatment,

and alternative energy projects

24

Investment Summary

Market leader with a long industry heritage able to leverage scale

Committed management team; management and Board of Directors represent

ownership in excess of 50% of common shares outstanding

Strong free cash flow generation characteristics

Exposure to growing infrastructure-related end markets

Numerous organic and strategic growth opportunities

Attractive, flexible and committed debt facilities

Essex is considered to be an attractive investment opportunity for the following reasons: