Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNION DRILLING INC | d8k.htm |

Chris Strong President & Chief Executive Officer (NASDAQ: UDRL) November 2009 Exhibit 99.1 |

1 Statements made during this presentation contain forward-looking statements.

Although the Company believes that the expectations reflected in such

forward-looking statements are reasonable, it can give no assurance that

such expectations will prove to be correct. Such statements are subject to

certain risks, uncertainties and assumptions, including, among other

matters: the Company's future financial and operating performance and

results; the Company's business strategy; continued availability of qualified personnel; sources and availability of funds necessary to conduct operations and complete acquisitions; industry trends; the continued strength or weakness of the

contract land drilling industry in the geographic areas in which it operates; decisions about onshore exploration and development projects to be made by oil and gas companies; the Company's plans and forecasts; fluctuations in demand for, market

prices of, and supply levels of oil and natural gas; any material reduction in the

levels of exploration and development activities in the Company's areas of operations; expense of current or future litigation; risks associated with drilling wells; operating

difficulties related to drilling for natural gas, including unfavorable

weather conditions; competition and the highly competitive nature of the

Company's business; availability, terms and deployment of capital; general economic and business conditions; governmental regulations, particularly relating to federal income taxes and the environment and

workplace safety; terrorist attacks or war; and fluctuations in interest

rates. Should one or more of these risks materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those

expected. These risks, as well as others, are discussed in greater detail in

the Company's public filings with the Securities and Exchange

Commission. SAFE HARBOR STATEMENT |

2 UDI focuses on unconventional natural gas drilling in major U.S. shale formations — Horizontal drilling increases wellbore contact with the formation, resulting in higher drainage rates Founded in 1997 with 12 rigs drilling in Appalachian Basin IPO in November 2005 UDI has a fleet of 71 marketed rigs as of 11/9/2009 COMPANY OVERVIEW UDI is a U.S. land driller with operations that primarily support natural gas production |

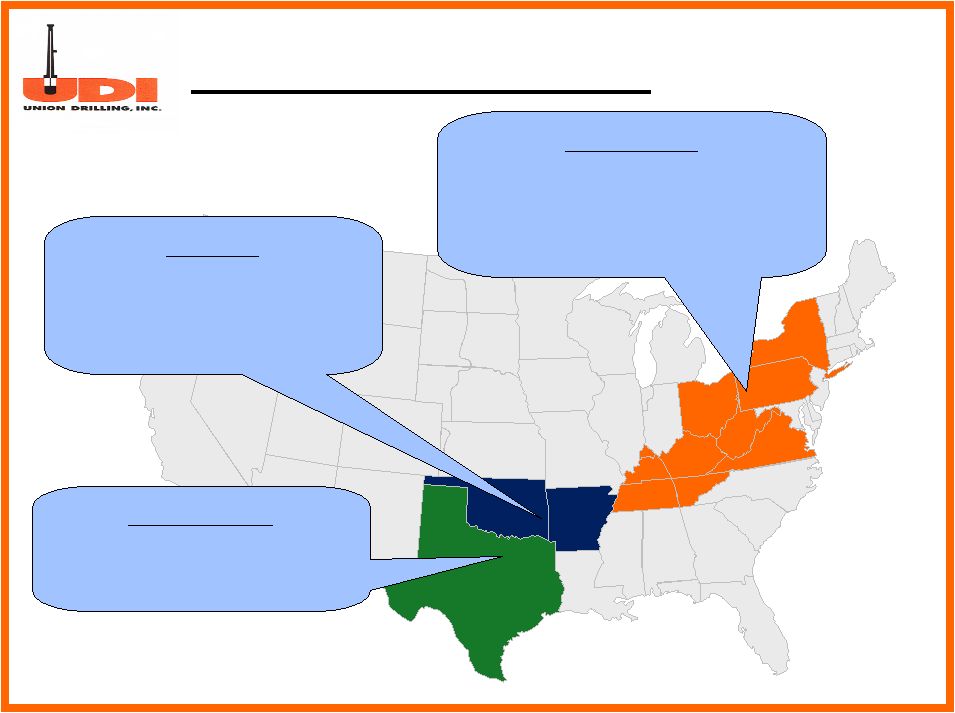

3 COMPANY OVERVIEW Arkoma •Fayetteville Shale, Caney Shale •21 total rigs •20 equipped for horizontal drilling •21equipped for underbalanced drilling North Texas •Barnett Shale, Permian Basin •18 total rigs •16 equipped for horizontal drilling Appalachia •Marcellus & Huron Shales, Clinton/Medina Sands, CBM •32 total rigs •17 equipped for horizontal drilling •27 equipped for underbalanced drilling |

4 Operate in higher growth unconventional markets Focus on markets with lower F&D costs and adequate takeaway capacity Transition crews from shallow legacy equipment to larger rigs for deeper shale plays Pursue multi-rig term relationships with larger operators Relocate rigs as necessary to achieve higher returns Don’t overpay for assets to achieve more rapid growth Invest in equipment and crews to be the preferred provider STRATEGY |

INVESTMENT CONSIDERATIONS |

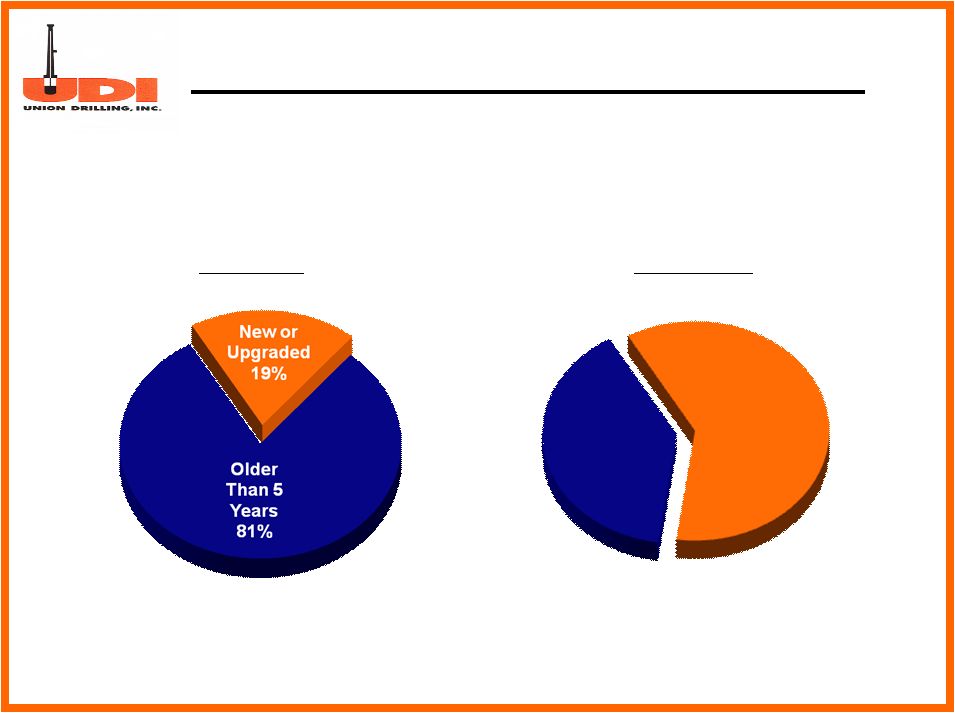

6 New or Upgraded 61% Older Than 5 Years (1) 39% 1/1/2006 9/30/2009 UDRL has built new rigs and upgraded many others since 2005 IPO INVESTMENT CONSIDERATIONS (1) Excludes rigs that were constructed or underwent major refurbishment after January

1, 2004. > > $294 Million > >

|

7 Track Record of Opportunistic and Disciplined Growth Historically, UDI has acquired used rigs at or near appraised asset value When prices rose sharply on used rigs in 2005-2006, management decided to buy new rigs, rather than pay new rig prices for 30 year old equipment In 2007-2008 UDI pursued a balanced approach between building new rigs and upgrading existing rigs while signing term contracts to cover most of the cost As a result, 2006 – 2009 cap-x of $294M offset by less than $3M of rig impairment write-downs and current debt is $10million Going forward, we anticipate acquisition / consolidation opportunities resulting from tough market conditions INVESTMENT CONSIDERATIONS |

8 Hedged Against Market Risk with Term Contract Coverage INVESTMENT CONSIDERATIONS The Company estimates $8 million of gross margin covered by term contracts for Q4’09 and $24 million for 2010 Virtually all rig purchases and upgrades have been covered by term contracts that will recover most if not all of the capital expenditures |

9 Strong Market Share Position in Appalachian Basin Well-known independents have acquired substantial acreage Due to terrain and load limitations, the Marcellus has greater barriers to entry than other rig markets UDI has yards, trucking, and experienced people in place Growth aided by large existing footprint in this rapidly developing play Low F & D costs & gas basis premium relative to other plays provide higher average equipment utilization through the cycles INVESTMENT CONSIDERATIONS Marcellus Shale Opportunities: |

10 Numerous well-known independents in Appalachia, including: — Anadarko — Atlas — Cabot — Chesapeake — Chief — EOG — Equitable — EXCO — Marathon — Range — Rex — Southwestern — Stone — Talisman — XTO — Norse Energy — Phillips — Fortuna — Consol Energy UDI, as one of the established drillers in the Appalachian Basin, is well-positioned to benefit from increasing activity in the region Strong Market Share Position in Appalachian Basin INVESTMENT CONSIDERATIONS |

11 FINANCIAL OVERVIEW |

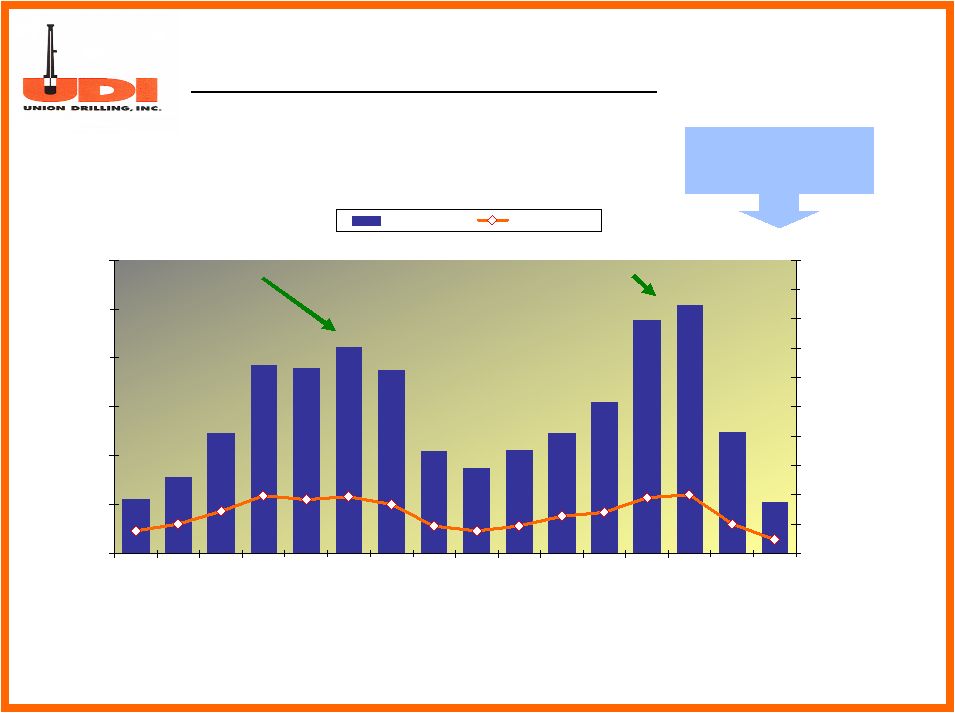

12 FINANCIAL OVERVIEW $68 $142 $257 $289 $303 $128 0 50 100 150 200 250 300 350 2004 2005 2006 2007 2008 YTD '09 0 5 10 15 20 25 Revenue Dayrate ($ millions) ($ thousands) Revenue/Day $10.6k $11.6k $14.3k $16.6k $17.3k $17.6 Utilization 50% 62% 76% 68% 68% 38% |

13 FINANCIAL OVERVIEW $13 $27 $81 $94 $73 $26 0 2 4 6 8 10 0 10 20 30 40 50 60 70 80 90 100 2004 2005 2006 2007 2008 YTD '09 EBITDA Margin / day ($ millions) ($ thousands) Margin/Day $2.8k $3.2k $5.6k $6.7k $6.1k $6.3k |

14 $0 $10 $20 $30 $40 $50 $60 Q4'05 Q1'06 Q2'06 Q3'06 Q4'06 Q1'07 Q2'07 Q3'07 Q4'07 Q1'08 Q2'08 Q3'08 Q4'08 Q1'09 Q2'09 Q3'09 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total Debt Debt-to-Cap Disciplined Capital Structure ($ millions) FINANCIAL OVERVIEW 6 new NOV rigs 4 new rigs / 7 upgrades $82.7M available |

INDUSTRY FUNDAMENTALS |

16 Supply/demand imbalance has driven down natural gas price Lower price leads E&P companies to stop drilling new wells Production has declined due to reduction in drilling Consumption should rise as economy recovers Reversal in supply/demand trends will lead to natural gas recovery The question is WHEN? Natural gas prices have begun to show signs of improvement in recent months INDUSTRY FUNDAMENTALS Natural Gas Trends |

17 INDUSTRY FUNDAMENTALS Wells have much higher average depletion rates now Rig count has fallen more rapidly than in past cycles Supply response may occur sooner this time around Source: Baker Hughes. Historical Rig-Count Declines 40% 50% 60% 70% 80% 90% 100% 1 8 15 22 29 36 43 50 57 64 71 |

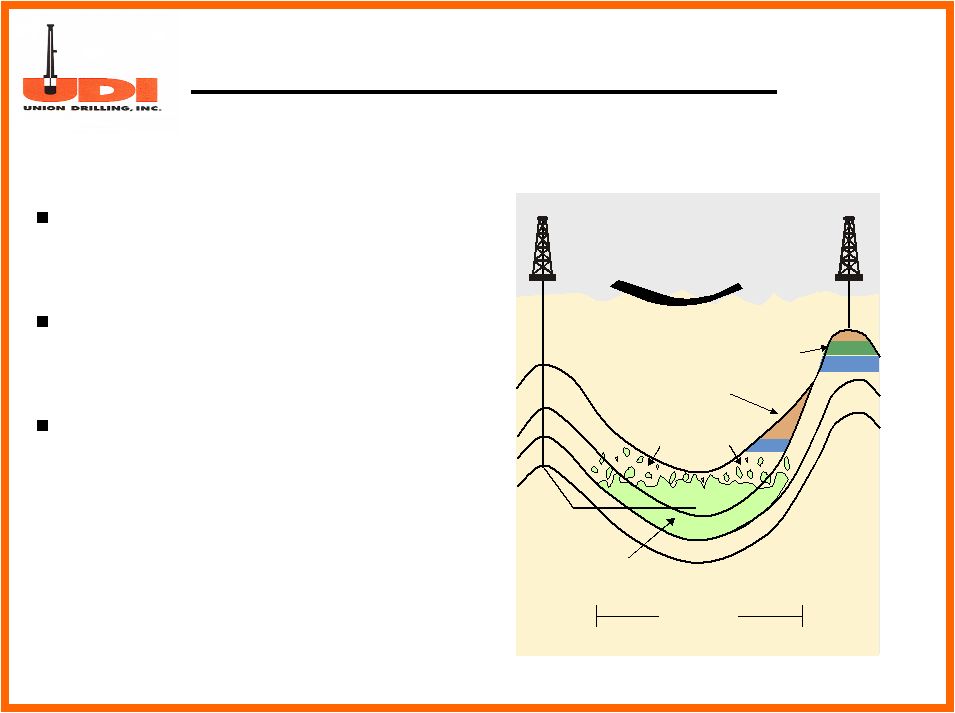

18 Unconventional gas is found in continuous accumulations trapped within the reservoir rock Horizontal drilling into unconventional formations yields greater reserves per well and faster drainage rates Union Drilling is well-positioned in several domestic shale plays — Barnett — Marcellus — Huron — Fayetteville — Caney Conventional vs. Unconventional Gas Drilling Tens of miles Coalbed gas Land surface Conventional stratigraphic oil accumulation Conventional stratigraphic gas accumulation Water Unconventional gas accumulation Transition zones INDUSTRY FUNDAMENTALS |

19 1 1 Unconventional resource plays are more rapidly developed utilizing horizontal drilling techniques Horizontal drilling rig count has grown at a faster rate than the vertical drilling rig count UDI is well-positioned to benefit from these trends — 75% of rig fleet equipped to drill horizontally Unconventional Gas Trends Source: Drilling Contractor Magazine 0 200 400 600 800 1000 1200 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Horizontal Vertical Vertical vs. Horizontal Rig Counts Source: Baker Hughes, Inc. 48% Decline 451% Growth INDUSTRY FUNDAMENTALS 1 From January 9, 2004 to November 6, 2009 |

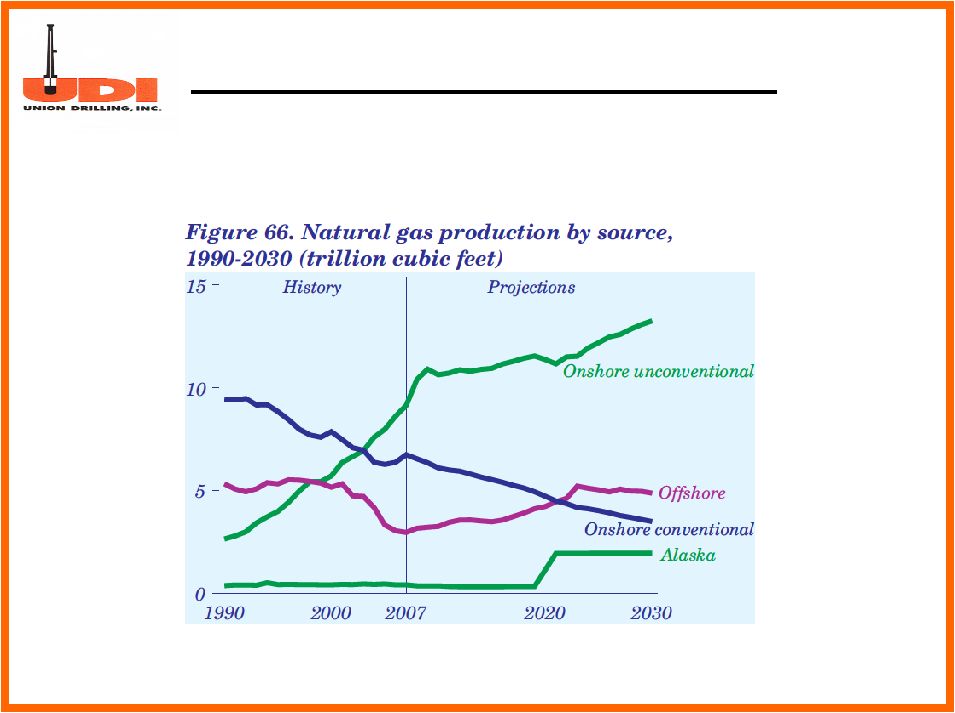

20 U.S. Dry Natural Gas Production Source: EIA Annual Energy Outlook 2009 INDUSTRY FUNDAMENTALS

|

21 Rig fleet configured to drill for unconventional natural gas reserves, with a focus on horizontal shale plays Track record of opportunistic and disciplined growth Strong market share position in the Appalachian Basin, which is benefiting from increased upstream capital spending Hedged against market risk with term contract coverage Conservative balance sheet with significant dry-powder SUMMARY |

22 THANK YOU (NASDAQ: UDRL) |