Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-51630

UNION DRILLING, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 16-1537048 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 4055 International Plaza Suite 610 Fort Worth, Texas |

76109 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 817-735-8793

Registrant’s website: www.uniondrilling.com

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.01 Par Value | NASDAQ Global Select Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

The aggregate market value of the registrant’s voting and nonvoting common equity held by non-affiliates of the registrant as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $83,317,966 based on the last sales price of the registrant’s common stock on June 30, 2010 as reported on the NASDAQ Global Select Market. The determination of affiliate status for the purposes of this calculation is not necessarily a conclusive determination for other purposes. The calculation excludes shares held by directors and officers and by each stockholder whose ownership exceeded 10% of the Registrant’s outstanding Common Stock. Exclusion of these shares should not be construed to indicate that any such person controls, is controlled by or is under common control with the Registrant.

As of March 3, 2011, there were 25,182,345 shares of common stock, par value $0.01 per share, of the registrant issued and 23,182,345 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement related to the registrant’s 2011 Annual Meeting of Stockholders to be held on June 9, 2011 to be filed subsequently with the Securities and Exchange Commission, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

ii

Table of Contents

| Item 1. | Business |

We provide contract land drilling services and equipment to oil and natural gas producers in the United States. In addition to our drilling rigs, we provide the drilling crews and most of the ancillary equipment needed to operate our drilling rigs. We commenced operations in 1997 with 12 drilling rigs and related equipment acquired from an entity providing contract drilling services under the name “Union Drilling.” Through a combination of acquisitions, new rig construction and divestitures of older, smaller equipment, we currently operate a fleet of 71 marketed land drilling rigs. We presently focus our operations in selected oil and natural gas production regions in the United States. The drilling activity of our customers is highly dependent on many factors, including the market price of oil and natural gas, available capital, available drilling prospects, support services and market availability. These factors should not be considered an exhaustive list. See Item 1A. “Risk Factors.”

Many of our rigs operate in unconventional producing areas, which are characterized by formations with very low permeability rock, such as shales, tight sands and coal bed methane, or CBM, that require specialized drilling techniques to efficiently develop the oil or natural gas resources. Horizontal drilling is often used in these formations to increase the exposure of the wellbore to the oil or natural gas producing formation and increase drainage rates and production volumes. We have equipped 53 of our 71 rigs for drilling horizontal wells. As many of these areas are also characterized by hard rock formations entailing more difficult drilling conditions, we have equipped 50 of our 71 rigs with compressed air circulation systems, also known as underbalanced drilling, which provides higher penetration rates through hard rock formations when compared to traditional fluid-based circulation systems. We have also outfitted seven of our 71 rigs with walking or skidding systems which allow for multiple wells to be drilled in a single location to provide efficiency and to reduce the overall environmental impact. Moreover, we continue to enhance our fleet of drilling rigs with technological capabilities through upgrades, acquisitions or new rig construction in order to improve drilling productivity and reduce total well costs for our customers.

Our market

We provide drilling services to customers engaged in developing oil and natural gas bearing formations in selected areas of the United States. Our strategy is to focus on areas that have high growth potential, adequate takeaway capacity and low finding and development costs in order to maximize utilization and return on capital throughout the commodity price cycle. During 2010, oil prices rebounded while natural gas prices did not. In response to this development, we repositioned the majority of our Texas-based rigs that were previously drilling for natural gas into West Texas to drill for oil. In addition, several of our rigs drilling for natural gas are now concentrated in areas where the produced gas has a component of natural gas liquids that generate a higher return for our customers in the current price environment. Our principal operations are in the Appalachian Basin, extending from New York to Tennessee including the Marcellus, Huron, and Utica shales, as well as the Clinton, Medina, and Oriksany sands; the Arkoma Basin in eastern Oklahoma and Arkansas, including the Fayetteville, Caney, and Woodford shales; and the Fort Worth Basin in North Texas, including the Barnett Shale and in West Texas, the Permian and Delaware Basins.

Customers

We market our rigs to a number of customers, who are principally major or independent oil and natural gas producers. Repeat business from customers accounts for a substantial portion of our business. We do not invest in oil or natural gas properties and therefore, do not drill for our own account. In 2010, 2009 and 2008, we performed services for 78, 64, and 121 customers, respectively. In 2010, 2009 and 2008, our top 20 customers provided 80%, 89% and 71%, respectively, of our total revenue. The following table shows our three largest customers as a percentage of our total contract drilling revenue for each of the last three years.

3

Table of Contents

| Year |

Customer |

Total Contract Drilling Revenue Percentage |

||||

| 2010 | Exxon Mobil Corp (formerly XTO) | 26.9 | % | |||

| Chief Oil & Gas LLC | 14.0 | % | ||||

| Broad Oak Energy | 5.6 | % | ||||

| Total | 46.5 | % | ||||

| 2009 | Exxon Mobil Corp (formerly XTO) | 27.9 | % | |||

| Quicksilver Resources Inc. | 15.9 | % | ||||

| Chief Oil & Gas LLC | 10.9 | % | ||||

| Total | 54.7 | % | ||||

| 2008 | Exxon Mobile Corp (formerly XTO) | 17.7 | % | |||

| Quicksilver Resources Inc. | 12.4 | % | ||||

| Chief Oil & Gas LLC | 4.9 | % | ||||

| Total | 35.0 | % | ||||

Drilling contracts

We enter into written contracts with our customers for all rig deployments. The length of contracts has ranged from a one-well project to multi-year term for major exploration programs. Our contracts are obtained either through competitive bidding or through direct negotiations with customers. Our oil and natural gas drilling contracts provide for compensation on a daywork (fixed rate per day is charged) or footage (fixed rate per foot of hole drilled to a stated depth) basis. Contracts performed on a footage basis involve greater financial risk to us. In each of 2010 and 2009, approximately 96% of our revenues were derived from daywork contracts. The contract terms we offer generally depend on the complexity and risk of operations, the on-site drilling conditions, the type of equipment used and the anticipated duration of the work to be performed. In most instances, our contacts provide for additional payments related to rig mobilization and demobilization, as well as reimbursement of certain out-of-pocket costs.

As of December 31, 2010, we had 22 rigs under term contracts, which we define as a contract for drilling services with an original term in excess of six months. In some cases, a contract may be extended beyond the original term at prices mutually agreeable to us and the customer.

Our rig fleet

A land drilling rig consists of a derrick, a substructure, a hoisting system, a rotating system, pumps and holding tanks to circulate and clean drilling fluid, blowout preventers and other related equipment. Diesel engines are typically the main power sources for a drilling rig. There are numerous factors that differentiate land drilling rigs, including their power generation systems and their drilling depth capabilities. The actual drilling depth capability of a rig may be more or less than its rated depth capability due to numerous factors, including the size, weight and amount of the drill pipe on the rig. The intended well depth and the drill site conditions determine the amount of drill pipe and other equipment needed to drill a well.

Derrick hookload capacity and rig horsepower are the main drivers of depth rating. They determine a rig’s ability to lower, hoist and suspend casing and drilling pipe weight in the wellbore. Relative to total measured depth, horizontal wells have lower requirements on hookload and horsepower because casing, which is used to isolate the natural gas bearing formation from other geological features, is not run into the horizontal section of the well and once drill pipe is laying horizontally, its suspended weight and the power required to raise it decreases compared to a vertical wellbore of the same length.

We utilize rig horsepower to categorize our rigs into three sizes of rigs including small (less than 750 hp), medium (750-999 hp) and large rigs (>1,000 hp). During 2010, the overall improvement in the U.S. land drilling rig count was led by the large and medium rigs, and to a much lesser extent, the smaller rigs. At December 31, 2010, the utilization rates for our rigs were 100% for our large rigs, 71% for our medium rigs, and 30% for our small rigs.

4

Table of Contents

Circulating systems, which can be based on either fluid or compressed air, are used while drilling to evacuate cuttings and prevent the pipe from becoming stuck in the wellbore. Relative to vertical wells of the same measured depth, horizontal wells require greater circulating capability to move the cuttings from the horizontal section through a 90 degree curve to the initial vertical section of the wellbore.

The size and type of rig utilized depends, among other factors, upon well depth and site conditions. An active maintenance and replacement program during the life of a drilling rig permits upgrading of components on an individual basis. Over the life of a typical rig, due to the normal wear and tear of operating up to 24 hours a day, several of the major components, such as engines, air compressors, boosters and drill pipe, are replaced or rebuilt on a periodic basis as required. Other components, such as the substructure, mast and drawworks, can be utilized for extended periods of time with proper maintenance.

Our drilling rigs have engines that power the hoisting and rotating systems rated from 400 to 1,600 horsepower and derricks with weight suspension capacities from 110,000 to 760,000 pounds. Most of our rigs that are equipped for horizontal drilling have a pair of circulating pumps, each powered by engines that vary from 500 to 1,600 horsepower and our rigs that are capable of underbalanced drilling have two to four air compressors and one to two compression boosters, each with engines of 450 to 750 horsepower. Twenty-seven of our rigs also have top drive units that separate the power and control of the hoisting and rotating functions, which often provides better performance in horizontal drilling. Many larger drilling rigs capable of drilling in deep formations generate electricity from diesel engines and power electric motors attached to the equipment in the hoisting, rotating and circulating systems. We have eleven rigs of this design.

Due to the geologic characteristics in the Appalachian and Arkoma Basins, many of the wells drilled in these areas utilize underbalanced or air drilling. We believe that air drilling provides advantages over traditional fluid drilling techniques when drilling through hard rock formations. These advantages include improved drilling penetration rates, no fluid loss into the formation and minimized formation damage. We believe that we are one of the most experienced U.S. contractors using air drilling techniques.

We have outfitted seven of our rigs with either walking or skidding systems that allow for pad drilling, or drilling of multiple wellheads on one surface location in order to reduce the environmental impact of drilling because less surface area is disturbed, provide for less wear to our rig equipment and less time relocating the rig, all of which make it more efficient and less expensive to complete and produce the wells for our customers.

We believe that our drilling rigs and other related equipment are in good operating condition. Our employees perform periodic maintenance and repair work on our drilling rigs. We rely on various oilfield service companies for major repair work and overhaul of our drilling equipment when needed. We also engage in periodic improvement of our drilling equipment. In the event of major breakdowns or mechanical problems, our rigs could be subject to significant idle time and a resulting loss of revenue if the necessary repair services are not immediately available.

We also own a fleet of trucks that are used to move our rigs as well as bulldozers, forklifts, various vehicles and other equipment that is used to support the operation of our rigs.

The following table sets forth certain information regarding each of our marketed rigs as of February 28, 2011:

|

Rig # |

Division |

Drawworks |

Pumps |

Hook Load | ||||

| Rig 058 |

Appalachia | 1,600 | 1,600 | 750,000 | ||||

| Rig 054 |

Appalachia | 1,000 | 1,300 | 441,000 | ||||

| Rig 059 |

Appalachia | 1,000 | 1,600 | 400,000 | ||||

| Rig 060 |

Appalachia | 1,000 | 1,000 | 760,000 | ||||

| Rig 121 |

Appalachia | 1,000 | 1,600 | 500,000 | ||||

| Rig 207 |

Appalachia | 1,000 | 1,600 | 550,000 | ||||

| Rig 209 |

Appalachia | 1,000 | 1,300 | 550,000 | ||||

| Rig 021 |

Appalachia | 900 | 1,000 | 365,000 | ||||

| Rig 048 |

Appalachia | 900 | 1,000 | 410,000 |

5

Table of Contents

|

Rig # |

Division |

Drawworks |

Pumps |

Hook Load | ||||

| Rig 052 |

Appalachia | 900 | 1,600 | 365,000 | ||||

| Rig 124 |

Appalachia | 900 | 1,300 | 400,000 | ||||

| Rig 051 |

Appalachia | 850 | 800 | 300,000 | ||||

| Rig 053 |

Appalachia | 515 | 350 | 185,000 | ||||

| Rig 055 |

Appalachia | 515 | n/a | 185,000 | ||||

| Rig 056 |

Appalachia | 515 | n/a | 185,000 | ||||

| Rig 057 |

Appalachia | 515 | 550 | 185,000 | ||||

| Rig 037 |

Appalachia | 500 | 600 | 300,000 | ||||

| Rig 044 |

Appalachia | 500 | 800 | 275,000 | ||||

| Rig 045 |

Appalachia | 500 | n/a | 300,000 | ||||

| Rig 046 |

Appalachia | 500 | 1,000 | 300,000 | ||||

| Rig 001 |

Appalachia | 450 | 250 | 212,000 | ||||

| Rig 005 |

Appalachia | 450 | n/a | 240,000 | ||||

| Rig 015 |

Appalachia | 450 | 800 | 212,000 | ||||

| Rig 018 |

Appalachia | 450 | 400 | 224,000 | ||||

| Rig 020 |

Appalachia | 450 | 800 | 224,000 | ||||

| Rig 024 |

Appalachia | 450 | 600 | 300,000 | ||||

| Rig 025 |

Appalachia | 450 | 600 | 300,000 | ||||

| Rig 034 |

Appalachia | 450 | 600 | 300,000 | ||||

| Rig 035 |

Appalachia | 450 | 600 | 300,000 | ||||

| Rig 036 |

Appalachia | 450 | 600 | 300,000 | ||||

| Rig 042 |

Appalachia | 450 | 400 | 231,000 | ||||

| Rig 219 |

Arkoma | 1,500 | 1,600 | 750,000 | ||||

| Rig 122 |

Arkoma | 1,200 | 1,600 | 500,000 | ||||

| Rig 125 |

Arkoma | 1,000 | 1,600 | 500,000 | ||||

| Rig 126 |

Arkoma | 1,000 | 1,600 | 500,000 | ||||

| Rig 038 |

Arkoma | 900 | 900 | 358,000 | ||||

| Rig 047 |

Arkoma | 900 | 1,000 | 369,000 | ||||

| Rig 040 |

Arkoma | 800 | 800 | 358,000 | ||||

| Rig 104 |

Arkoma | 800 | 900 | 300,000 | ||||

| Rig 110 |

Arkoma | 800 | 1,000 | 500,000 | ||||

| Rig 112 |

Arkoma | 800 | 800 | 375,000 | ||||

| Rig 114 |

Arkoma | 800 | 800 | 250,000 | ||||

| Rig 116 |

Arkoma | 800 | 800 | 250,000 | ||||

| Rig 123 |

Arkoma | 800 | 1,000 | 390,000 | ||||

| Rig 211 |

Arkoma | 800 | 1,000 | 390,000 | ||||

| Rig 115 |

Arkoma | 700 | 900 | 250,000 | ||||

| Rig 032 |

Arkoma | 500 | 900 | 310,000 | ||||

| Rig 117 |

Arkoma | 500 | n/a | 110,000 | ||||

| Rig 119 |

Arkoma | 500 | 500 | 120,000 | ||||

| Rig 105 |

Arkoma | 450 | 800 | 260,000 | ||||

| Rig 220 |

Texas | 1,500 | 1,600 | 750,000 | ||||

| Rig 221 |

Texas | 1,500 | 1,600 | 750,000 | ||||

| Rig 222 |

Texas | 1,500 | 1,600 | 750,000 | ||||

| Rig 223 |

Texas | 1,500 | 1,600 | 750,000 | ||||

| Rig 224 |

Texas | 1,500 | 1,600 | 750,000 | ||||

| Rig 212 |

Texas | 1,400 | 1,300 | 420,000 | ||||

| Rig 216 |

Texas | 1,200 | 1,300 | 520,000 | ||||

| Rig 217 |

Texas | 1,000 | 1,300 | 550,000 | ||||

| Rig 225 |

Texas | 1,000 | 1,300 | 550,000 |

6

Table of Contents

|

Rig # |

Division |

Drawworks |

Pumps |

Hook Load | ||||

| Rig 227 |

Texas | 1,000 | 1,600 | 550,000 | ||||

| Rig 228 |

Texas | 1,000 | 1,300 | 550,000 | ||||

| Rig 229 |

Texas | 1,000 | 1,000 | 550,000 | ||||

| Rig 230 |

Texas | 1,000 | 800 | 650,000 | ||||

| Rig 214 |

Texas | 920 | 1000 | 390,000 | ||||

| Rig 206 |

Texas | 900 | 900 | 350,000 | ||||

| Rig 215 |

Texas | 900 | 1,000 | 420,000 | ||||

| Rig 226 |

Texas | 900 | 900 | 420,000 | ||||

| Rig 205 |

Texas | 750 | 800 | 350,000 | ||||

| Rig 210 |

Texas | 750 | 650 | 280,000 | ||||

| Rig 201 |

Texas | 650 | 500 | 300,000 | ||||

| Rig 203 |

Texas | 400 | 400 | 180,000 |

Competition

We encounter substantial competition from other land drilling contractors. The fact that drilling rigs are mobile and can be moved from one region to another in response to market conditions heightens the competition in the industry. Our principal competitors primarily include other publicly traded drilling companies and some of the larger, privately held drilling contractors. No single drilling company dominates within our regions. We believe crews, rig capability, pricing and rig availability are the primary factors our potential customers consider in determining which drilling contractor to select. In addition, we believe the following factors are important:

| • | the mobility and efficiency of the rigs; |

| • | the safety records of the rigs; |

| • | crew experience and skill; |

| • | customer relationships; |

| • | the offering of ancillary services; and |

| • | the ability to provide drilling equipment adaptable to, and personnel familiar with, current technologies and drilling techniques. |

While we must be competitive in our pricing, our strategy generally emphasizes the quality of our equipment, the safety record of our rigs and the experience of our rig crews to differentiate us from our competitors. Further, we have continued to enhance our safety and training initiatives including hiring a vice president of safety and training, investing in automation equipment across our fleet, rolling out behavior-based safety training to all levels of employees, and expanding our drug testing procedures.

Raw materials

The materials and supplies we use in our drilling operations include fuels, drill pipe and drill collars to operate drilling equipment, oil and lubricants to maintain equipment, paint and coating to protect equipment, as well as miscellaneous hardware, including hoses, belts, nuts and fasteners. We do not rely on a single source of supply for any of these items.

Seasonality

Certain of our operations in the Appalachian Basin are conducted in areas subject to extreme weather conditions and often in difficult terrain. During certain parts of the year, primarily in the winter and the spring, our operations are often hindered because of cold, snow or muddy conditions. Certain state and local governments impose restrictions on the movement of our equipment during parts of the year when the roads are susceptible to damage from the movement of heavy equipment. These restrictions are known as “frost laws.” Our operations can be limited from time to time by the difficulty of operating in certain weather conditions.

In the southern Appalachian Basin, our operations are limited primarily by winter weather in the fourth quarter and the first quarter. In the northern Appalachian Basin, our operations are limited primarily by the frost laws in the first quarter and the second quarter.

7

Table of Contents

Employees

As of February 28, 2011, we had approximately 1,220 employees. The number of employees fluctuates depending on the number of drilling projects we are engaged in at any particular time. None of our employment arrangements is subject to collective bargaining arrangements.

Government regulation and environmental matters

General

Many aspects of our operations are subject to federal, state and local, environmental, health and safety laws and regulations. We do not anticipate any material capital expenditures for environmental control facilities or extraordinary expenditures to comply with environmental rules and regulations in the foreseeable future. However, compliance costs under existing laws or under any new requirements could become material, and we could incur liability in any instance of noncompliance.

Environmental regulation

Our activities are subject to federal, state and local laws and regulations governing environmental quality, pollution control and the preservation of natural resources (including global climate change). These laws and regulations concern, among other things, air emissions, water use and disposal, the containment, disposal and recycling of waste materials, and reporting of the storage, use or release of certain chemicals or hazardous substances. Numerous federal and state environmental laws regulate drilling activities and impose liability for discharges of waste or spills, including those in coastal areas.

Except for the handling of waste directly generated from the operation and maintenance of our drilling rigs, such as waste oils and wash water, it is our practice, to the greatest extent practicable, to require our customers to contractually assume responsibility for compliance with environmental regulations. Laws and regulations protecting the environment have become more stringent in recent years, and may, in some circumstances, impose strict liability, rendering a person liable for environmental damage without regard to negligence or fault on the part of that person. These laws and regulations may expose us to liability for the conduct of or conditions caused by others, or for our own acts that were in compliance with all applicable laws at the time the acts were performed. The application of these requirements or adoption of new requirements could have a material adverse effect on us.

Environmental regulations that affect our customers also have an indirect impact on us. Increasingly stringent environmental regulation of the oil and natural gas industry has led to higher drilling costs and a more difficult and lengthy well permitting process. The primary environmental statutory and regulatory programs that affect our operations include The Oil Pollution Act of 1990 (OPA), and the Comprehensive Environmental Response, Compensation, and Liability Act, as amended (CERCLA). OPA pertains to the prevention of and response to spills or discharges of hazardous substances or oil into navigable waters. We have incurred no liability under OPA. CERCLA imposes liability, without regard to fault or the legality of the original conduct, on certain classes of persons with respect to the release of a “hazardous substance” into the environment. To date, we have not been named as a potentially responsible party under CERCLA.

Hazardous waste disposal

Our operations involve the generation or handling of materials that may be classified as hazardous waste and subject to various federal laws and comparable state statutes. The U.S. Environmental Protection Agency, or the EPA, and various state agencies have limited the disposal options for some hazardous and nonhazardous wastes. We believe that our operations are in material compliance with applicable environmental laws and regulations.

Health and safety matters

Our facilities and operations are also subject to the requirements of the federal Occupational Safety and Health Act, or OSHA, as well as comparable state and local laws that regulate the protection of worker health and safety. In addition, the OSHA hazard communication standard requires that we maintain certain information about any hazardous materials used or produced in our operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in material compliance with OSHA requirements, including general industry standards, record keeping requirements and monitoring of occupational exposure to regulated substances.

8

Table of Contents

Trucking regulations

We operate a fleet of trucks to transport our drilling rigs and related equipment. We operate as a private motor carrier, not as a common carrier for hire. We are licensed to perform both intrastate and interstate trucking operations. As a private motor carrier, we are subject to certain safety regulations issued by the U.S. Department of Transportation, or DOT, and comparable state regulatory agencies. These trucking regulations cover, among other things, driver operations, maintaining log books, truck manifest preparations, the placement of safety placards on our regulated trucks and trailers, driver drug and alcohol testing, safety of operation and equipment, and several other aspects of truck operations. Our trucking operations are also subject to certain OSHA requirements when our employees are loading or unloading equipment at a drilling site. We believe our trucking operations are in material compliance with applicable regulations.

Available Information

We were incorporated in the State of Delaware in 1997. Our principal executive offices are located at 4055 International Plaza, Suite 610, Fort Worth, Texas 76109. Our telephone number is 817-735-8793.

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or SEC. You may read and copy our reports, proxy statements and other information at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549-0213. You can request copies of these documents at prescribed rates by writing to the SEC at Public Reference Section, SEC, 100 F Street, N.E., Washington, D.C. 20549-0213. Please call the SEC at 1 800-SEC-0330 for more information about the operation of the public reference room. Our SEC filings are also available at the SEC’s website at www.sec.gov. Because our common stock is listed on the NASDAQ Global Select Market, you may also inspect reports, proxy statements and other financial information about us at the offices of the NASDAQ Global Select Market, One Liberty Plaza, 165 Broadway, New York, New York 10006.

You may obtain a free copy of our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after such reports have been filed with or furnished to the SEC on our website at www.uniondrilling.com or by contacting our Investor Relations Department at 817-735-8793. In addition, our Code of Ethics is available on our website.

| Item 1A. | Risk Factors |

Risks Relating to Our Business

We operate in a highly competitive industry with excess drilling capacity which can adversely affect our results of operations.

The contract land drilling services industry in which we operate is very competitive. Further, drilling rigs are mobile and can be moved from one region to another in response to market conditions, which heightens the competition in the industry. Over the last few years, there has been a substantial increase in the supply of land drilling rigs, whether through new construction or refurbishment. In recent months, while there has been an increase in land drilling activities, particularly oil and liquids-rich natural gas directed, it has been dominated by the large or higher performance rigs. As a result, there is currently excess capacity for smaller rigs. Excess capacity and price competition can negatively impact our revenue rates, utilization and profitability, as well as the value of our rig equipment, which could result in write-downs of our asset carrying values.

Our business and operations are substantially dependent upon, and affected by, the level of U.S. land-based oil and natural gas exploration and development activity, which has experienced significant volatility. If the level of that activity is depressed, our business and results of operations could be adversely affected.

Our business and operations are substantially dependent upon, and affected by, the level of U.S. land-based oil and natural gas exploration and development activity. Exploration and development activity determines the demand for contract land drilling and related services. We have no control over the factors driving the level of U.S. oil and natural gas exploration and development activity. If the level of that activity is depressed, our business and results of operations could be adversely affected. Other factors include, among others, the following:

| • | the market prices of oil and natural gas; |

9

Table of Contents

| • | market expectations about future prices of oil and natural gas; |

| • | the cost of producing and delivering oil and natural gas; |

| • | the capacity of the oil and natural gas pipeline network; |

| • | government regulations and trade restrictions; |

| • | the presence or absence of tax incentives; |

| • | national and international political and economic conditions; |

| • | levels of production by, and other activities of, the Organization of Petroleum Exporting Countries and other oil and natural gas producers; |

| • | the levels of imports of natural gas, whether by pipelines from Canada or Mexico or by tankers in the form of LNG; and |

| • | the development of alternate energy sources and the long-term effects of worldwide energy conservation measures. |

We cannot accurately predict the future level of demand for, or pricing of, oil and natural gas, for our contract drilling services or overall future conditions in the land-based contract drilling industry.

A weak global economy may affect the Company’s business.

As a result of volatility in natural gas prices and lingering uncertainty of when the global economic environment will experience a sustained recovery, the Company is unable to accurately predict the extent to which its customers will spend on exploration and development drilling or whether customers and /or vendors and suppliers will be able to access financing necessary to sustain or increase their current level of operations, fulfill their commitments and/or fund future operations and obligations. Furthermore, the Company is unable to predict the extent its existing customers will have continuing viability and capability to pay amounts owed to the Company. The overall weak economic environment continues to impact industry fundamentals, particularly demand for the smaller, conventional style drilling rigs. These conditions could have a material adverse effect on the Company’s business, including limiting the growth of our revenues and potential impairments of our rig fleet.

In the year ended December 31, 2010, we derived approximately 47% of our total revenues from our top three customers. The loss of any of our principal customers and the failure to remarket the rigs employed by those customers could have a material adverse effect on our financial condition and results of operations.

In the year ended December 31, 2010, our three largest customers accounted for approximately 27%, 14% and 6%, respectively, of our total revenues. Our principal customers may not continue to employ our services and we may not be able to successfully remarket the rigs. The loss of any of our principal customers and the failure to remarket the rigs utilized by those customers could have a material adverse effect on our financial condition and results of operations.

If we cannot keep our rigs utilized at profitable rates, our operating results could be adversely affected.

Our business has high fixed costs, and if we cannot keep our rigs utilized at profitable rates, our operating results could be adversely affected through reductions in our revenues and impairments of our rig fleet.

Increased competition in our drilling markets could adversely affect rates and utilization of our rigs, which could adversely affect our financial condition and results of operations.

We face competition from significantly larger domestic and international drilling contractors, many with greater resources. Their greater resources may enable them to allocate those resources into any of our regional markets. The additional competition in our markets, either by existing competitors or new entrants would increase the rig supply in those markets, which could adversely affect the rates we can charge and utilization levels we can achieve.

New technologies may cause our drilling methods or equipment to become less competitive, resulting in an adverse effect on our financial condition and results of operations.

Although we take measures to ensure that we use advanced oil and natural gas drilling technology, changes in technology or improvements in competitors’ equipment could make our equipment, especially our smaller, conventional rigs, less competitive or require significant capital investments to keep our equipment competitive.

10

Table of Contents

Term contracts may in certain instances be terminated without an early termination payment.

Term drilling contracts customarily provide for termination at the election of the customer, with an “early termination payment” to be paid to the Company if a contract is terminated prior to the expiration of the term. However, under certain limited circumstances, such as destruction of a drilling rig, limited capital resources of the customer or bankruptcy of the customer, no early termination payment may be paid to the Company or, if paid, not paid in full or in a timely manner. Even if an early termination payment is owed to the Company, the customer may not have the ability to timely pay (or pay at all) the early termination payment.

Increased or decreased demand among drilling contractors for consumable supplies, including fuel, and ancillary rig equipment, such as pumps, valves, drillpipe and engines, may lead to delays in obtaining these materials and our inability to operate our rigs in an efficient manner.

Most of our contracts provide that our customers bear the financial impact of increased fuel prices. However, prolonged shortages in the availability of fuel to run our drilling rigs resulting from action of the elements, warlike actions or other ‘Force Majeure’ events could result in the suspension of our contracts and have a material adverse effect on our financial condition and results of operations. We have periodically experienced increased lead times in purchasing ancillary equipment for our drilling rigs. To the extent there are significant delays in being able to purchase important components for our rigs, certain of our rigs may not be available for operation or may not be able to operate as efficiently as expected, which could adversely affect our financial condition and results of operations.

Reduced demand can drive suppliers from the market. With reduced suppliers, consumables for our operations may not be readily available. Additionally, suppliers may experience shortfalls in obtaining their materials and/or labor. Suppliers who have been regular providers to us may experience shortfalls and that may lead to delays as we secure other sources.

To the extent we acquire additional rigs in the future, we may experience difficulty integrating those acquisitions. Additionally, we may incur leverage to effect those acquisitions, which adds additional financial risk to our business. To the extent we incur additional leverage in financing acquisitions, it may adversely affect our financial position.

The process of integrating acquired rigs or newly constructed rigs may involve unforeseen difficulties and may require a disproportionate amount of management’s attention and other resources. We may not be able to successfully manage and integrate new rigs into our existing operations or successfully maintain the market share attributable to drilling rigs that we purchase. We also may encounter cost overruns related to newly constructed rigs or unexpected costs related to acquired rigs. To the extent we experience some or all of these difficulties, our financial condition could be adversely affected.

Expanding our fleet by building new rigs or acquiring rigs from third parties may cause us to incur additional financial leverage, increasing our financial risk, and debt service requirements, which could adversely affect our operating results and financial position.

We may decide to purchase or internally build additional drilling rigs and upgrade or refurbish some of our marketed drilling rigs. Any delay could result in a loss of revenue.

We may purchase or internally build additional drilling rigs and upgrade or refurbish some of our current drilling rigs. All of these projects are subject to risks of delay or cost overruns inherent in large construction projects. Among those risks are:

| • | shortages of equipment, materials or skilled labor; |

| • | long lead times or delays in the delivery of ordered materials and equipment; |

| • | engineering problems; |

| • | work stoppages; |

| • | weather interference; |

| • | availability of specialized services; and |

| • | cost increases. |

11

Table of Contents

These factors may contribute to delays in the delivery, upgrade or completion of the refurbishment of the drilling rigs, which could result in a loss of revenue. Additionally, we may incur higher costs than expected, which would adversely affect the economics of the investment in such rigs.

We may not be able to raise additional funds through public or private financings or additional borrowings, which could have a material adverse effect on our financial condition.

The contract drilling industry is capital intensive. Our cash flow from operations and the continued availability of credit are subject to a number of variables, including general economic conditions, and more specifically, our rig utilization rates, operating margins and ability to control costs and obtain contracts in a competitive industry. Our cash flow from operations and present borrowing capacity may not be sufficient to fund our anticipated acquisition program, capital expenditures and working capital requirements. We may from time to time seek additional financing, either in the form of bank borrowings, sales of debt or equity securities or otherwise. To the extent our capital resources and cash flow from operations are at any time insufficient to fund our activities or repay our indebtedness as it becomes due, we will need to raise additional funds through public or private financings or additional borrowings. We may not be able to obtain any such capital resources in the amount or at the time when needed. If we are at any time not able to obtain the necessary capital resources, our financial condition and results of operations could be materially adversely affected.

We could be adversely affected if we lost the services of certain of our senior officers and key employees.

The success of our business is highly dependent upon the services, efforts and abilities of certain key employees, such as our regional managers and of Christopher D. Strong, our President and Chief Executive Officer, Tina L. Castillo, our Chief Financial Officer and David S. Goldberg, our General Counsel. Our business could be materially and adversely affected by the loss of any of these individuals. We have limited employment agreements with some key employees. We do not maintain key man life insurance on the lives of any of our executive officers.

Competition for experienced technical personnel may negatively impact our operations or financial results.

We utilize highly skilled personnel in operating and supporting our business. In times of high utilization, it can be difficult to retain, and in some cases, find qualified individuals. Although to date our operations have not been materially affected by competition for personnel, an inability to obtain or find a sufficient number of qualified personnel could materially impact our business, financial condition and results of operations.

Our operations could be adversely affected by abnormally poor weather conditions.

Our operations are conducted in areas subject to poor weather conditions, and often in difficult terrain. Primarily in the winter and spring, our operations are often curtailed because of cold, snow or muddy conditions. Unusually severe weather conditions could further curtail our operations and could have a material adverse effect on our financial condition and results of operations.

We have limited control over the timing of payment of our deferred tax liabilities.

We currently have deferred tax liabilities and have limited control over the timing of the payment of these deferrals. These deferred liabilities could come due at a time when our revenues are reduced. This could cause tax payments to be due at a time when our cash flow from operations is reduced. Such a situation could have a material adverse effect on our financial condition.

Our operations are subject to hazards inherent in the land drilling business beyond our control. If those risks are not adequately insured or indemnified against, our results of operations could be adversely affected.

Our operations are subject to many hazards inherent in the land drilling business, including, but not limited to:

| • | blowouts; |

| • | craterings; |

| • | fires; |

| • | explosions; |

| • | equipment failures; |

| • | poisonous gas emissions; |

| • | loss of well control; |

12

Table of Contents

| • | loss of hole; |

| • | damaged or lost equipment; and |

| • | damage or loss from inclement weather or natural disasters. |

These hazards are to some extent beyond our control and could cause, among other things:

| • | personal injury or death; |

| • | serious damage to or destruction of property and equipment; |

| • | suspension of drilling operations; and |

| • | damage to the environment, including damage to producing formations and surrounding areas. |

Our insurance policies for public liability and property damage to others and injury or death to persons are in some cases subject to large deductibles and may not be sufficient to protect us against liability for all consequences of well disasters, personal injury, extensive fire damage or damage to the environment. We may not be able to maintain adequate insurance in the future at rates we consider reasonable, or particular types of coverage may not be available. The occurrence of events, including any of the above-mentioned risks and hazards, that are not fully insured against or the failure of a customer that has agreed to indemnify us against certain liabilities to meet its indemnification obligations could subject us to significant liability and could have a material adverse effect on our financial condition and results of operations.

Our operations are subject to environmental, health and safety laws and regulations that may expose us to liabilities for noncompliance, which could adversely affect us.

The U.S. oil and natural gas industry is affected from time to time in varying degrees by political developments and federal, state and local environmental, health and safety laws and regulations applicable to our business. Our operations are vulnerable to certain risks arising from the numerous environmental health and safety laws and regulations. These laws and regulations may restrict the types, quantities and concentration of various substances that can be released into the environment in connection with drilling activities, require reporting of the storage, use or release of certain chemicals and hazardous substances, require removal or cleanup of contamination under certain circumstances, and impose substantial civil liabilities or criminal penalties for violations. Environmental laws and regulations may impose strict liability, rendering a company liable for environmental damage without regard to negligence or fault, and could expose us to liability for the conduct of, or conditions caused by, others, or for our acts that were in compliance with all applicable laws at the time such acts were performed. Moreover, there has been a trend in recent years toward stricter standards in environmental, health and safety legislation and regulation, which may continue. While the scientific debate concerning the impact of human activities on world climate change continues, we recognize the need to minimize in a commercially reasonable manner our impact on the environment, including the release of greenhouse gases.

We may incur material liability related to our operations under governmental regulations, including environmental, health and safety requirements. We cannot predict how existing laws and regulations may be interpreted by enforcement agencies or court rulings, whether additional laws and regulations will be adopted, or the effect such changes may have on our business, financial condition or results of operations. Because the requirements imposed by such laws and regulations are subject to change, we are unable to forecast the ultimate cost of compliance with such requirements. The modification of existing laws and regulations or the adoption of new laws or regulations, both in the U.S. and globally, which directly or indirectly curtail exploratory or development drilling for oil and natural gas for economic, political, environmental or other reasons could have a material adverse effect on us by limiting drilling opportunities.

New legislation and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays.

The EPA has commenced a study of the potential environmental impacts of hydraulic fracturing including the impact on drinking water sources and public health, and a committee of the U.S. House of Representatives is also conducting an investigation of hydraulic fracturing practices. Legislation has been introduced before Congress to provide for federal regulation of hydraulic fracturing and to require disclosure of the chemicals used in the fracturing process. In addition, some states (such as New York) have and others are considering adopting regulations that could restrict hydraulic fracturing in certain circumstances. Any new laws, regulations or permitting requirements regarding hydraulic fracturing could lead to operational delays, increased costs, or third party or governmental claims, and could result in additional burdens that could serve to delay or limit the drilling services we provide to third parties whose drilling operations could be impacted by these regulations or increase our costs of compliance and doing business as well as delay the development of unconventional gas resources from shale formations which are not commercial without the use of hydraulic fracturing.

13

Table of Contents

Our debt agreements contain restrictions that limit our flexibility in operating our business.

Our revolving credit facility contains various provisions that limit our ability to engage in specified types of transactions. These provisions limit our ability to, among other things:

| • | incur additional indebtedness; |

| • | issue certain preferred shares; |

| • | unless certain conditions are satisfied, pay dividends on or make distributions in respect of our capital stock or make other restricted payments; |

| • | make certain investments, including capital expenditures; |

| • | sell certain assets; |

| • | create liens; and |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets. |

Risks Related to Our Common Stock

Our principal stockholder has significant ownership.

As of February 28, 2011, Union Drilling Company LLC, our principal stockholder, owned approximately 34% of our outstanding common stock. As a result, Union Drilling Company LLC and its affiliates may substantially influence the outcome of stockholder votes, including votes concerning the election of directors, the adoption or amendment of provisions in our certificate of incorporation or bylaws and the approval of mergers and other significant corporate transactions. The existence of this level of ownership concentration makes it less likely that any small holder of our common stock will be able to affect the management or direction of Union Drilling. These factors may also have the effect of delaying or preventing a change in the management or voting control of Union Drilling.

Trading volume of our common stock may contribute to its price volatility.

Our common stock is traded on the NASDAQ Global Select Market. During the period from January 1, 2010 through February 28, 2011, the average daily trading volume of our common stock as reported by the NASDAQ Global Select Market was 60,695 shares. There can be no assurance that a more or less active trading market in our common stock will develop. As a result, relatively small or large trades may have a disproportionate impact on the price of our common stock and, therefore, may contribute to the price volatility of our common stock. As a result, our common stock may be subject to greater price volatility than the stock market when taken as a whole, or comparable securities of other contract drilling service providers, who may or may not have greater volumes.

The market price of our common stock has been, and may continue to be, volatile. During the period from January 1, 2010 through February 28, 2011, the trading price of our common stock ranged from $4.28 to $8.66 per share. Because of the limited trading market of our common stock and the price volatility of our common stock, you may be unable to fully sell shares of our common stock when you desire or at a price you desire.

We do not intend to pay cash dividends on our common stock in the foreseeable future, and therefore only appreciation of the price of our common stock, which may not occur, will provide a return to our stockholders.

We currently anticipate that we will retain all future earnings, if any, to finance growth and development of our business. We do not intend to pay cash dividends in the foreseeable future. Any payment of cash dividends will depend upon our financial condition, capital requirements, earnings and other factors deemed relevant by our board of directors. In addition, the terms of our revolving credit facility restrict us from paying dividends and making other distributions unless certain conditions are satisfied. As a result, presently only appreciation of the price of our common stock, which may not occur, will provide a return to our stockholders.

Provisions in our certificate of incorporation and bylaws as well as Delaware corporate law may make a takeover difficult.

Provisions in our certificate of incorporation and bylaws, as well as Delaware corporate law, may make it difficult and expensive for a third party to pursue a tender offer, change in control or takeover attempt that is opposed by our board of directors. These anti-takeover provisions could substantially impede the ability of public stockholders to benefit from a change in control or in a change to our management and board of directors.

14

Table of Contents

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Our principal executive offices are located in Fort Worth, Texas and include approximately 12,600 square feet of leased office space. Our contract drilling operations are conducted from eight field offices (three offices serving the Appalachian basin, three offices serving the Barnett and Permian basins, and two offices serving the Arkoma basin) which contain warehouse, office and yard space to support day-to-day operations, including the repair and maintenance of equipment, as well as the storage of equipment, inventory and supplies, and to facilitate administrative responsibilities and sales. We own three of our field office locations, while the rest are leased. We believe that none of the leased facilities is individually material to our operations and that our existing facilities are suitable and adequate to meet our needs.

| Item 3. | Legal Proceedings |

See Note 12 of the financial statements, included in “Item 8. Financial Statements and Supplementary Data” for a summary of our legal proceedings, such information being incorporated herein by reference.

| Item 4. | [Reserved] |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

As of February 28, 2011, 23,182,345 shares of our common stock were outstanding. As of February 28, 2011, the number of holders of record of our common stock was seven.

Our common stock trades on the NASDAQ Global Select Market under the symbol “UDRL.” The following table sets forth, for each of the periods indicated, the high and low trading price per share for our common stock on the NASDAQ Global Select Market:

| Low | High | |||||||

| Fiscal Year 2010 |

||||||||

| Fourth quarter |

$ | 4.28 | $ | 8.00 | ||||

| Third quarter |

$ | 4.40 | $ | 6.49 | ||||

| Second quarter |

$ | 4.81 | $ | 7.08 | ||||

| First quarter |

$ | 5.79 | $ | 8.39 | ||||

| Fiscal Year 2009 |

||||||||

| Fourth quarter |

$ | 5.80 | $ | 8.29 | ||||

| Third quarter |

$ | 5.36 | $ | 7.91 | ||||

| Second quarter |

$ | 3.44 | $ | 10.25 | ||||

| First quarter |

$ | 2.51 | $ | 6.38 | ||||

The last reported sales price for our common stock on the NASDAQ Global Select Market on February 28, 2011 was $7.74 per share.

We have not paid or declared any cash dividends on our common stock and currently intend to retain earnings to fund our working capital needs and growth opportunities. Any future dividends will be at the discretion of our board of directors after taking into account various factors it deems relevant, including our financial condition and performance, cash needs, income tax consequences and the restrictions Delaware and other applicable laws and our credit facilities then impose. Our debt arrangements include provisions that generally place certain limits on payment of cash dividends and share repurchases.

15

Table of Contents

Equity Compensation Plan Information

The following table provides information as of December 31, 2010 about our common stock that may be issued upon the exercise of options, warrants and rights granted to employees, consultants or members of the board of directors under all of our existing equity compensation plans:

| Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights |

Weighted average exercise price per share of outstanding options warrants and rights |

Number of shares of common stock remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a) ) |

||||||||||

| ( a ) | ( b ) | ( c ) | ||||||||||

| Equity compensation plans approved by security holders |

1,278,127(1) | $ | 9.66 | 372,617(2) | ||||||||

| (1) | Includes 176,545 shares of common stock issuable upon the exercise of options that were outstanding under our Amended and Restated 2000 Stock Option Plan and 1,101,582 shares of common stock issuable upon the exercise of options that were outstanding under our Amended and Restated 2005 Stock Incentive Plan, in each case, as of December 31, 2010. |

| (2) | These are available for future issuance under our Amended and Restated 2005 Stock Incentive Plan as of December 31, 2010. |

PERFORMANCE GRAPH

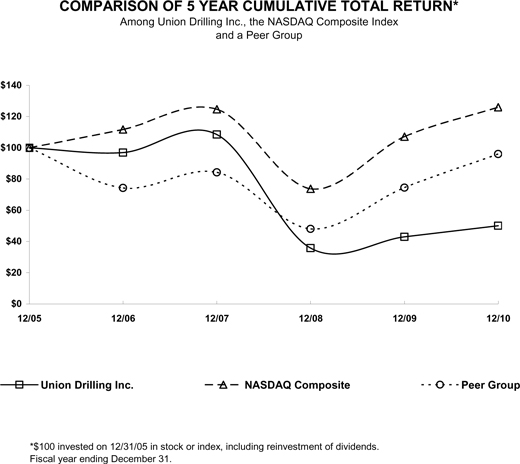

The following graph shows a comparison of the total cumulative returns over the past five year period of an investment of $100 in cash on November 22, 2005, the first trading day following our initial public offering, in (i) our common stock, (ii) the Nasdaq Composite Index, U.S. Companies, and (iii) a peer group index that the Company selected that includes 4 public companies within our industry. The companies that comprise the peer group index are Bronco Drilling Company, Inc., Helmerich & Payne, Inc., Patterson-UTI Energy, Inc. and Pioneer Drilling Company. The historical comparisons in the graph are required by the SEC and are not intended to forecast or be indicative of the possible future performance of our common stock. The graph assumes that all dividends have been reinvested (since November 2005, the Company has not declared any cash dividends).

| November 22, 2005 |

2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

| Union Drilling, Inc |

$ | 100 | $ | 97.71 | $ | 109.44 | $ | 36.02 | $ | 43.37 | $ | 50.10 | ||||||||||||

| NASDAQ Composite |

100 | 116.35 | 126.25 | 74.61 | 107.78 | 125.93 | ||||||||||||||||||

| Peer Group |

100 | 75.62 | 85.78 | 48.97 | 75.87 | 95.99 | ||||||||||||||||||

16

Table of Contents

The foregoing graph shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, notwithstanding any general statement contained in any such filing incorporating this Annual Report by reference, except to the extent the Company incorporates such graph by specific reference.

17

Table of Contents

| Item 6. | Selected Financial Data |

The following information derives from our audited financial statements. You should review this information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this report and the historical financial statements and related notes this report contains.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Revenues |

$ | 192,539 | $ | 168,922 | $ | 302,780 | $ | 289,035 | $ | 256,944 | ||||||||||

| (Loss) income from operations |

(25,330 | ) | (15,641 | ) | 20,389 | 53,291 | 54,487 | |||||||||||||

| (Loss) income before income taxes |

(24,982 | ) | (16,426 | ) | 20,361 | 52,852 | 54,270 | |||||||||||||

| Net (loss) income |

(16,068 | ) | (12,033 | ) | 7,750 | 30,832 | 31,852 | |||||||||||||

| (Loss) earnings per common share-basic |

(0.69 | ) | (0.55 | ) | 0.35 | 1.41 | 1.50 | |||||||||||||

| (Loss) earnings per common share-diluted |

(0.69 | ) | (0.55 | ) | 0.35 | 1.41 | 1.47 | |||||||||||||

| Long-term debt, including current portion and line of credit |

30,227 | 9,767 | 47,745 | 17,309 | 35,574 | |||||||||||||||

| Stockholders’ equity |

201,756 | 216,323 | 204,713 | 203,409 | 167,599 | |||||||||||||||

| Total assets |

300,010 | 293,010 | 336,605 | 277,308 | 257,418 | |||||||||||||||

| Calculation of EBITDA: |

||||||||||||||||||||

| Net (loss) income |

$ | (16,068 | ) | $ | (12,033 | ) | $ | 7,750 | $ | 30,832 | $ | 31,852 | ||||||||

| Interest expense |

1,005 | 794 | 845 | 1,824 | 527 | |||||||||||||||

| Income tax (benefit) expense |

(8,914 | ) | (4,393 | ) | 12,611 | 22,020 | 22,418 | |||||||||||||

| Depreciation and amortization |

49,932 | 47,719 | 44,298 | 39,072 | 24,820 | |||||||||||||||

| Impairment charge |

— | 4,069 | 7,909 | — | 1,000 | |||||||||||||||

| EBITDA |

$ | 25,955 | $ | 36,156 | $ | 73,413 | $ | 93,748 | $ | 80,617 | ||||||||||

EBITDA is earnings before net interest, income taxes, depreciation and amortization and non-cash impairment. The Company believes EBITDA is a useful measure of evaluating its financial performance because it is used by external users, such as investors, commercial banks, research analysts and others, to assess: (1) the financial performance of Union Drilling’s assets without regard to financing methods, capital structure or historical cost basis, (2) the ability of Union Drilling’s assets to generate cash sufficient to pay interest costs and support its indebtedness, and (3) Union Drilling’s operating performance and return on capital as compared to those of other entities in our industry, without regard to financing or capital structure. EBITDA is not a measure of financial performance under generally accepted accounting principles. However, EBITDA is a common alternative measure of operating performance used by investors, financial analysts and rating agencies. A reconciliation of EBITDA to net (loss) income is included above. EBITDA as presented may not be comparable to other similarly titled measures reported by other companies.

18

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This management’s discussion and analysis of financial condition and results of operations (“MD&A”) section of our Annual Report on Form 10-K discusses our results of operations, liquidity and capital resources, and certain factors that may affect our future results, including economic and industry-wide factors. You should read this MD&A in conjunction with our financial statements and accompanying notes included under Part II, Item 8, of this Annual Report.

Statements we make in the following MD&A discussion and in other parts of this report that express a belief, expectation or intention, as well as those which are not historical fact, are forward-looking statements within the meaning of the federal securities laws and are subject to risks, uncertainties and assumptions. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential” or similar words. These matters include statements concerning management’s plans and objectives relating to our operations or economic performance and related assumptions, including general economic and business conditions and industry trends, the continued strength or weakness of the contract land drilling industry in the geographic areas in which we operate, decisions about onshore exploration and development projects to be made by oil and gas companies, the highly competitive nature of our business, our future financial performance, including availability, terms and deployment of capital, the continued availability of qualified personnel, and changes in, or our failure or inability to comply with, government regulations, including those relating to workplace safety and the environment. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. Further, we specifically disclaim any duty to update any of the information set forth in this report, including any forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future events and, therefore, involve a number of assumptions, risks and uncertainties, including the risk factors described in Item 1A, “Risk Factors,” above. Management cautions that forward-looking statements are not guarantees, and our actual results could differ materially from those expressed or implied in the forward-looking statements.

Company Overview

Union Drilling, Inc. (“Union Drilling,” “Company” or “we”) provides contract land drilling services and equipment, primarily to oil and natural gas producers. In addition to drilling rigs, we provide the drilling crews and most of the ancillary equipment needed to operate our drilling rigs.

We provide drilling services to customers engaged in developing oil and natural gas bearing formations in selected areas of the United States. Our strategy is to focus on areas that have high growth potential, adequate takeaway capacity and low finding and development costs in order to maximize utilization and return on capital throughout the commodity price cycle. During 2010, oil prices rebounded while natural gas prices did not. In response to this development, we repositioned the majority of our Texas-based rigs that were previously drilling for natural gas into West Texas to drill for oil. In addition, several of our rigs drilling for natural gas are now concentrated in areas where the produced gas has a component of natural gas liquids that generate a higher return for our customers in the current price environment. Our principal operations are in the Appalachian Basin, extending from New York to Tennessee including the Marcellus, Huron, and Utica shales, as well as the Clinton, Medina, and Oriksany sands; the Arkoma Basin in eastern Oklahoma and Arkansas, including the Fayetteville, Caney, and Woodford shales; and the Fort Worth Basin in North Texas, including the Barnett Shale and in West Texas, the Permian and Delaware Basins.

We commenced operations in 1997 with 12 drilling rigs and related equipment acquired from an entity providing contract drilling services under the name “Union Drilling.” Through a combination of acquisitions, new rig construction and divestitures of older, smaller equipment, we currently operate a fleet of 71 marketed land drilling rigs. We continue to enhance our fleet of drilling rigs with technological capabilities through upgrades, acquisitions or new rig construction in order to improve drilling productivity and reduce total well costs for our customers. At various times, we remove rigs from our marketed fleet, and the components are sold or made available for use on our other rigs.

Key Indicators of Financial Performance for Management

Key performance measurements in our industry are rig utilization, revenue per revenue day and operating expenses per revenue day. Revenue days for each rig are days when the rig is earning revenues under a contract, which is usually a period from the date the rig begins moving to the drilling location until the rig is released from the contract. We compute rig utilization rates by dividing revenue days by total available days during a period. Total available days are the number of calendar days during the period that we have owned the marketed rig.

19

Table of Contents

The following table summarizes management’s key indicators of financial performance for each of the three years in the period ended December 31, 2010:

| Years Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Revenue days |

12,735 | 9,700 | 17,538 | |||||||||

| Average number of marketed rigs |

71.0 | 71.0 | 71.0 | |||||||||

| Marketed rig utilization rates |

49.1 | % | 37.4 | % | 67.5 | % | ||||||

| Revenue per revenue day |

$ | 15,119 | $ | 17,415 | $ | 17,264 | ||||||

| Operating expenses per revenue day |

$ | 11,256 | $ | 11,129 | $ | 11,181 | ||||||

Our business is substantially dependent on and affected by the level of U.S. land-based oil and natural gas exploration and development activity. As a result of the decline in natural gas prices commencing in the second half of 2008, overall demand for drilling services correspondingly decreased and we reached a utilization trough in the third quarter of 2009. Since that time, particularly during 2010, we experienced improvement in our marketed rig utilization rates due to a shift to oil drilling and relatively stable demand for natural gas drilling in shale plays. However, as term contracts with higher rates expired and re-priced in the current market, our revenue per revenue day declined in 2010 compared to 2009. In conjunction with the improvement of our marketed rig utilization, we incurred additional start up costs to return idled rigs to operations, which also decreased our drilling margin per revenue day.

We devote substantial resources to maintaining and upgrading our rig fleet. On a regular basis, we remove certain rigs from service to perform upgrades. In the short term, these actions result in fewer revenue days and slightly lower utilization; however, in the long term, we believe the upgrades will help the marketability of the rigs and improve their operating performance.

Critical Accounting Policies and Estimates

Revenue and cost recognition. We generate revenue principally by drilling wells for oil and natural gas producers under daywork or footage contracts, which provide for the drilling of single or multiple well projects. Revenues on daywork contracts are recognized based on the days worked at the dayrate each contract specifies. Mobilization fees are recognized as the related drilling services are provided. We recognize revenues on footage contracts based on the footage drilled for the applicable accounting period. Expenses are recognized based on the costs incurred during that same accounting period. Reimbursements received for out-of-pocket expenses are recorded as revenues and direct expenses.

Accounts receivable. We evaluate the creditworthiness of our customers based on their financial information, if available, information obtained from major industry suppliers, and our past experiences, if any, with the customer. In some instances, we require new customers to make prepayments. We typically invoice our customers semi-monthly during the performance of the contracts and upon completion of the contract, with payment due within 30 days. We established an allowance for doubtful accounts of $0.2 million and $1.4 million at December 31, 2010 and 2009, respectively. Any allowance established is subject to judgment and estimates made by management. We determine our allowance by considering a number of factors, including the length of time trade accounts receivable are past due, our previous loss history, our assessment of our customers’ current abilities to pay obligations to us and the condition of the general economy and the oil and natural gas industry as a whole. Our bad debt expense was $0.1 million, $1.1 million and $6.3 million for 2010, 2009 and 2008, respectively. We write off specific accounts receivable when we determine they are uncollectible. During 2010, we wrote off $1.3 million of accounts receivable for one customer. During 2009, we wrote off $1.2 million of accounts receivable for two customers.

At December 31, 2010 and 2009, our unbilled receivables totaled $1.4 million and $1.6 million, respectively, all of which relates to the revenue recognized, but not yet billed, on contracts in progress at December 31, 2010 and 2009, respectively. The $0.2 million decrease at December 31, 2010 compared to December 31, 2009 is due to the timing of progress billings.

20

Table of Contents

Asset impairments. We assess the impairment of long-lived assets whenever events or circumstances indicate that the asset’s carrying value may not be recoverable. Factors that could trigger an impairment review would be any significant negative trends in the industry or the general economy, our contract revenue rates, our rig utilization rates, cash flows generated from operating our drilling rigs, existence of term drilling contracts, current and future oil and natural gas prices, industry analysts’ outlook for the oil and gas industry and their view of our customers’ access to capital and the trends in the price of used drilling equipment observed by our management. If a review of our long-lived assets indicates that our carrying value exceeds the estimated undiscounted future cash flows, an impairment charge is made to adjust the carrying value to the estimated fair value. Cash flows are estimated by management considering factors such as expectations of future industry trends and the impact on dayrates, utilization and operating expenses; historical performance of the asset; the remaining expected life of the asset; any cash investment required to make the asset more marketable; suitability, specification and size of the rig; terminal value, as well as overall competitive dynamics. Use of different assumptions could result in an impairment charge different from that reported.

In 2010, no impairments were required due to modestly improving conditions in the U.S. land-based drilling industry.

Depreciation. We provide for depreciation of our drilling rigs, transportation and other equipment on a straight line method over useful lives that we have estimated and that range from two to 12 years. Unlike depreciation based on units-of-production, our approach to depreciation does not change when equipment becomes idle or when utilization changes. We continue to depreciate idled equipment on a straight-line basis despite the fact that our revenues and operating costs may vary with changes in utilization levels. Our estimates of the useful lives of our drilling, transportation and other equipment are based on our experience in the drilling industry with similar equipment.