Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TAYLOR CAPITAL GROUP INC | d8k.htm |

Exhibit 99.1 |

2 2 Forward-Looking Statement This presentation contains certain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include expressions such as “may,” “might,” “plan,” “prudent,” “potential,” “should,” “will,” “expect,” “anticipate,” “believe,” “intend,” “could,” and “estimate,” and reflect our current expectations and projections about future events. Actual results could materially differ from those presented due to a variety of internal and external factors. Except as required by the SEC, we undertake no obligation to release revisions or report events or circumstances after the date of this presentation. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in our SEC filings, including, but not limited to, our report on Form 10-K; our reports on Form 10-Q; and other filings. Copies of these filings may be obtained on our website at www.taylorcapitalgroup.com or the SEC’s website at www.sec.gov. |

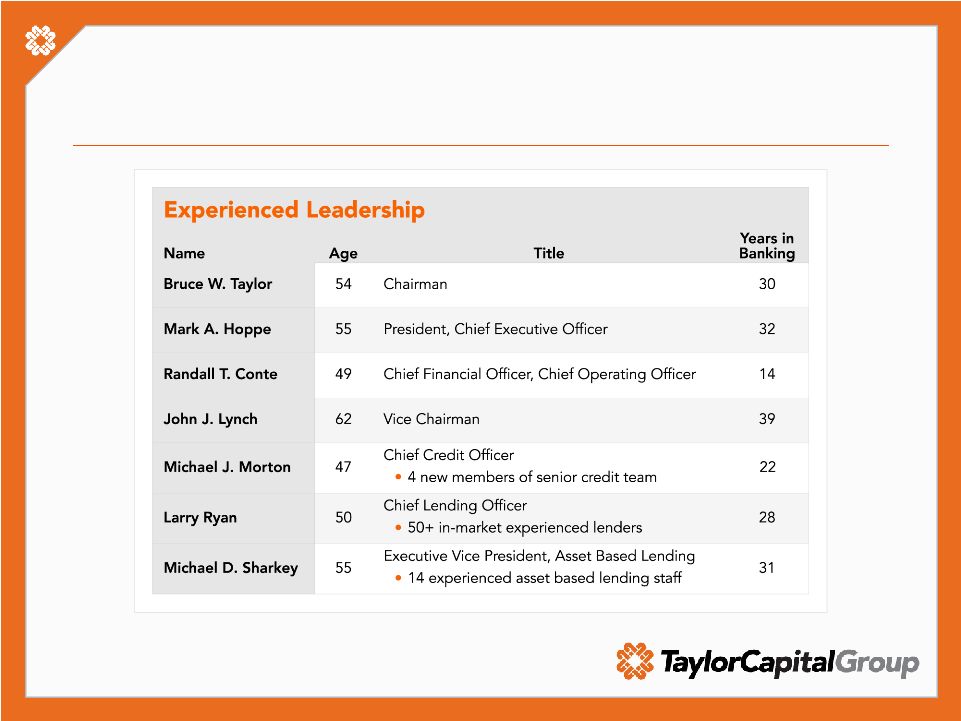

3 3 Taylor Capital Group • Holding company for Cole Taylor Bank – Chicago’s ninth largest bank – 421 employees – Nine banking centers – $4.5 billion in assets • Segment-focused commercial lender – Chicago’s banking specialist for closely-held businesses |

4 4 Building on Our Legacy • Founded by business owners for business owners in 1929 • Evolved through three generations of family management • Refocused on core commercial lending business – Shed non-strategic activities – Market disruption offered significant opportunity – Invested in senior management, commercial and credit talent – Raised capital – Added locally connected, experienced Board members |

5 Focus on Core Commercial Business 5 |

6 Focus on Core Commercial Business • Experienced new directors – Harrison I. Steans • Former Chairman, LaSalle National Bank and NBD Illinois – Jennifer W. Steans • President, Financial Investments Corp. • Chairman, USAmeribancorp, Inc. – Michael H. Moskow • Past President & CEO, Federal Reserve Bank of Chicago – M. Hill Hammock • Former Vice Chairman & COO, LaSalle Bank – C. Bryan Daniels • Co-founder and Principal, Prairie Capital, L.P. 6 |

7 7 Raised Capital • Strategic opportunity to expand core business • Recognized need for capital early • Raised $120 million of capital in September, 2008 – $60 million convertible preferred stock at Taylor Capital Group – $60 million in units composed of: • Subordinated debt at Cole Taylor Bank • Warrants to purchase shares of Taylor Capital Group • Received $105 million in TARP capital from U.S. Treasury in November, 2008 |

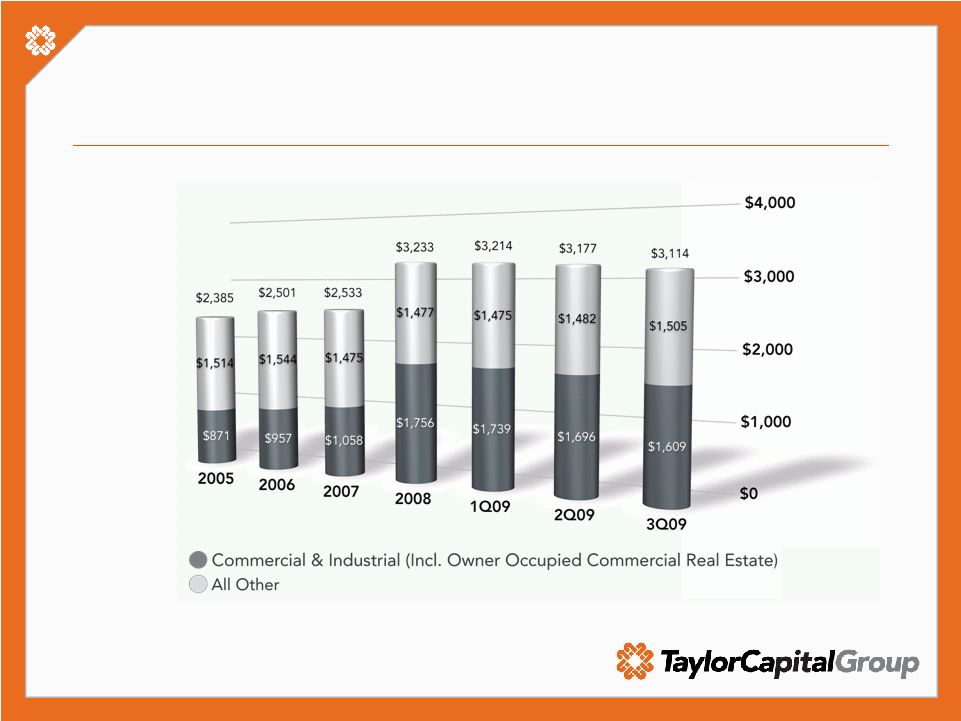

8 8 Early Results: Strategic Loan Growth |

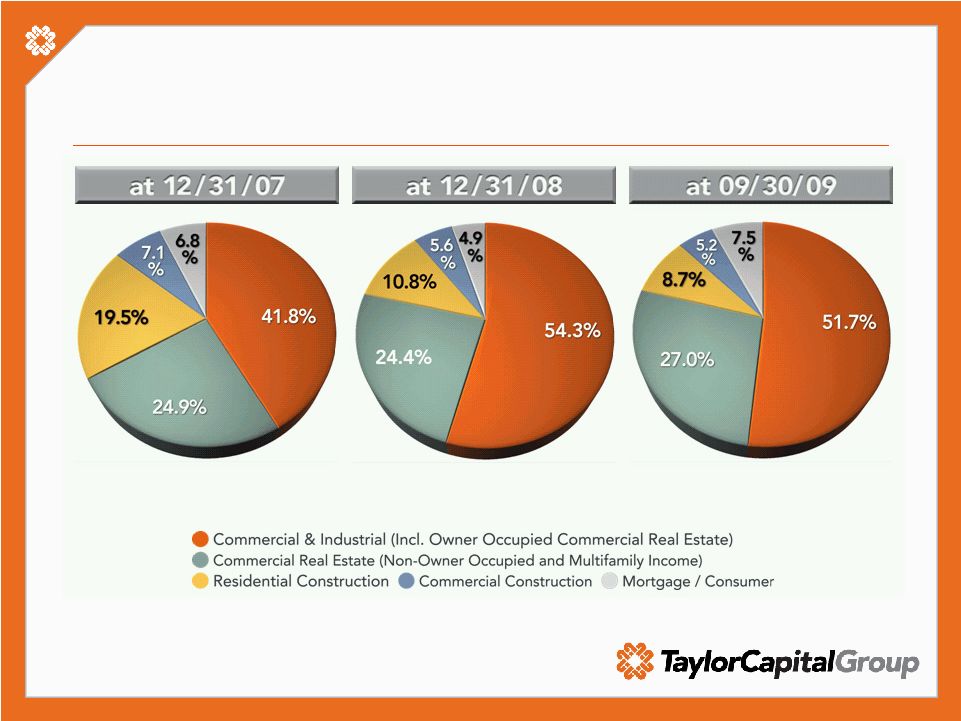

9 9 Early Results: Improved Loan Mix Total $2,533,333 Total $3,233,260 Total $3,114,253 |

10 Early Results: Growth in Relationships • Commercial banking – 333 new commercial banking relationships – $1.2 billion in new loan fundings – $361 million in new deposits • Asset based lending – 6 offices – $302 million in new loan commitments – $154 million in new loan fundings – $4.7 million in closing fees – $18.0 million in deposits 10 |

11 Early Results: Relationship Profitability • Implemented floors on new credits • Executing more swaps • Acquiring customer deposit and cash management business • Selling more services per client 11 |

12 12 Marketplace Trends • Competition for new business heating up • Floors at competitor banks reduced or eliminated • Asset quality deteriorated at local institutions in Q309 |

13 Marketplace Trends: Our Response • Cole Taylor Bank will respond to these trends with continued focus on: – Asset quality – Deposit generation – Cash management / fee income – Pricing discipline – Controlled growth |

14 14 2010 Continued Focus: Asset Quality • Economic challenges serious and ongoing • Experienced lenders know clients, market • Credit team averaging 25+ years experience • Aggressive approach towards recognizing, reserving and charging off problem credits • Enhanced loss mitigation through ABL • Reserve to nonaccruals above peers • Proactive approach to disposition of NPA |

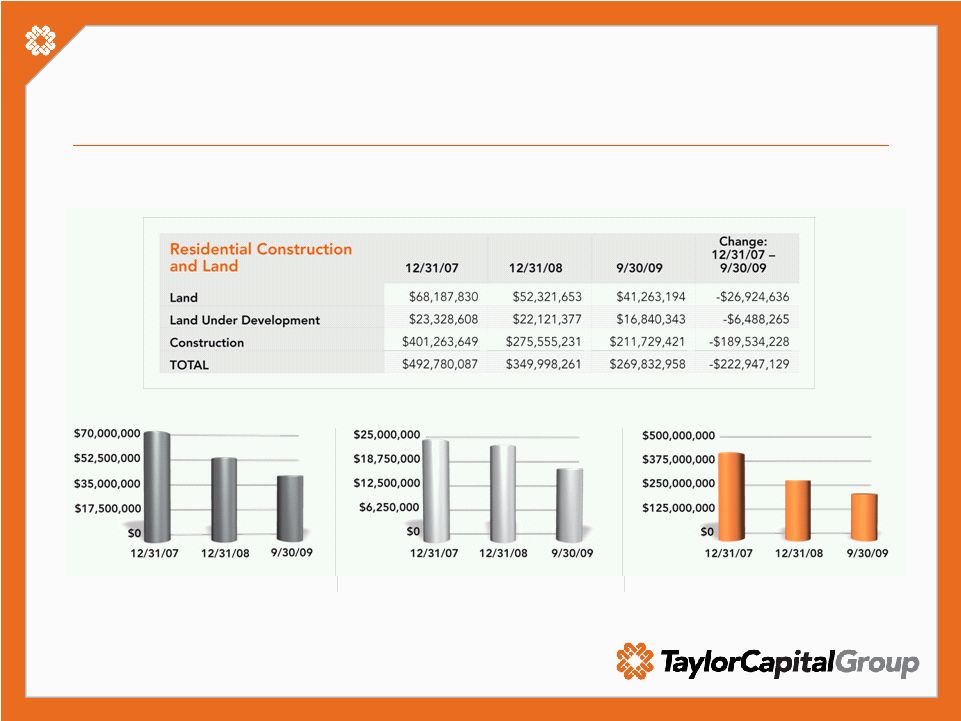

15 Asset Quality (continued) Reduced residential construction exposure Land Land Under Development Construction |

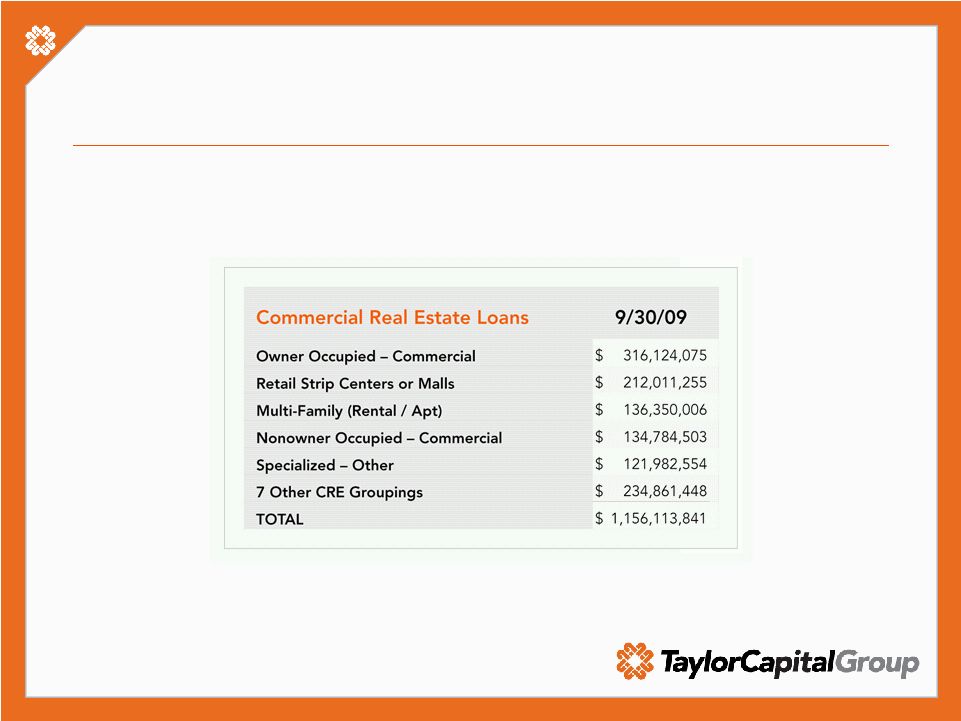

16 Asset Quality: Smaller CRE Portfolio Concentrations • Other CRE concentrations, post residential construction not nearly so large |

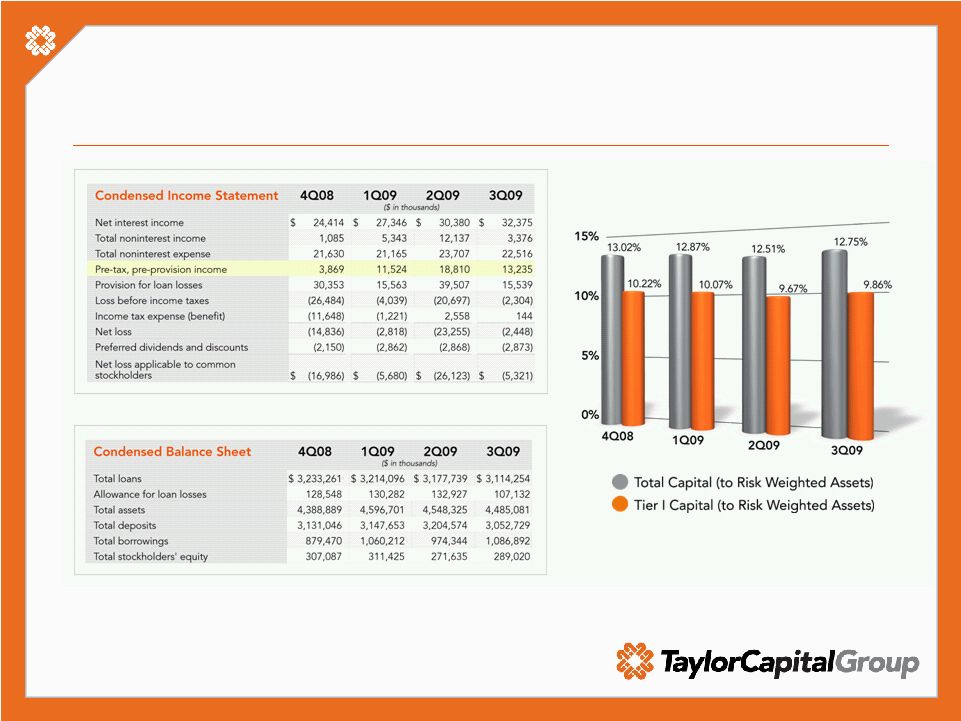

17 17 Financial Summary Capital Ratios |

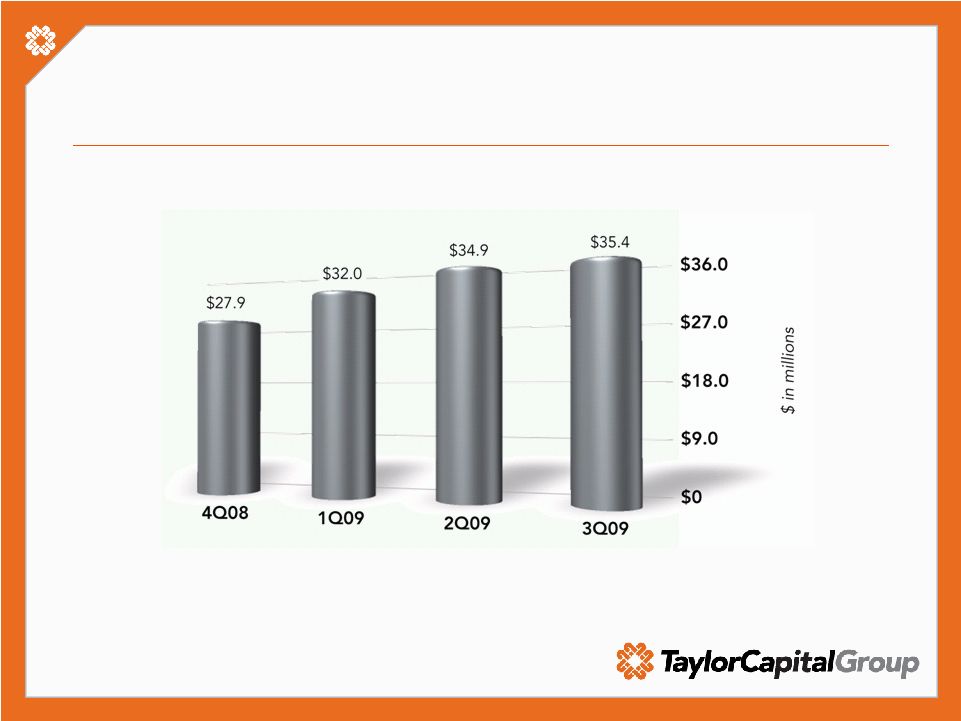

• Increasing Revenue 18 Total Revenues |

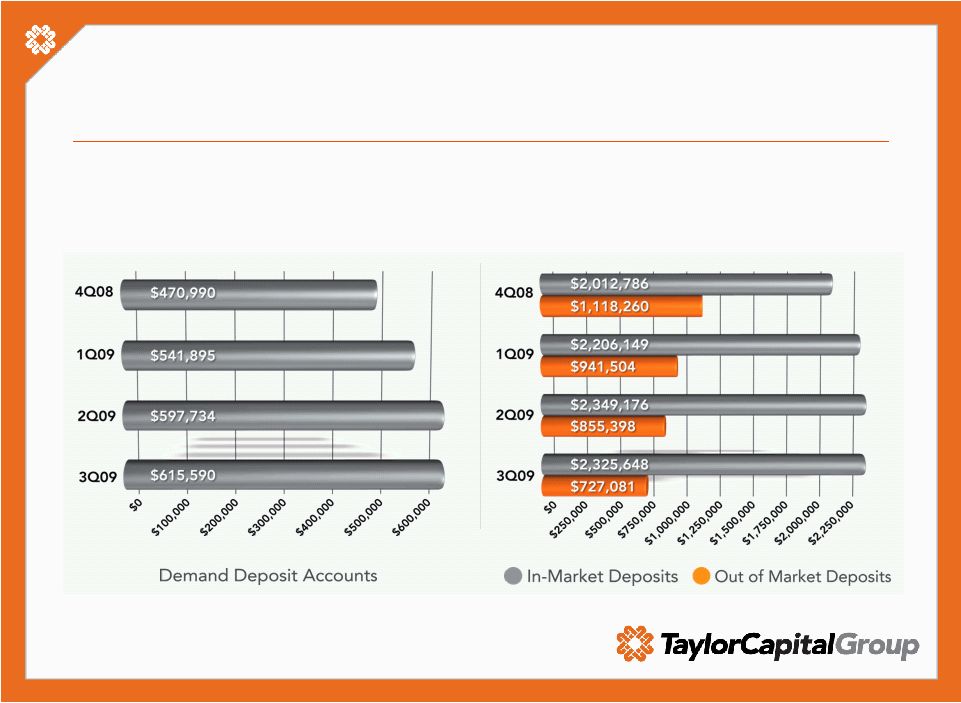

19 Reduced Funding Costs • Increased core relationship deposits • Reduced reliance on wholesale & brokered funding 19 |

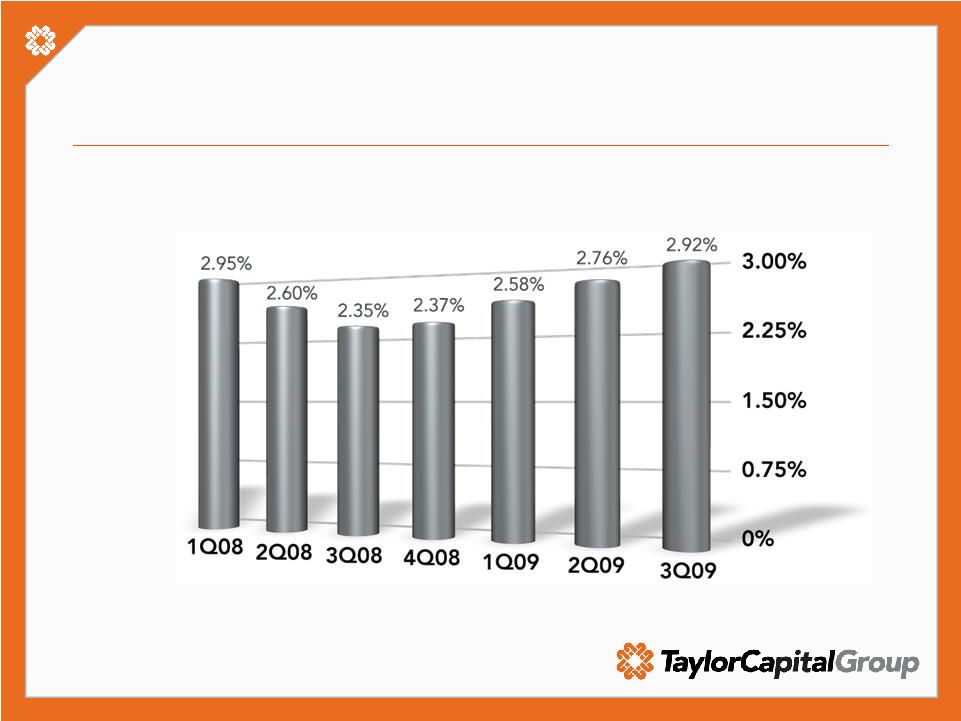

20 Reduced Funding Costs • Improved Net Interest Margin 20 |

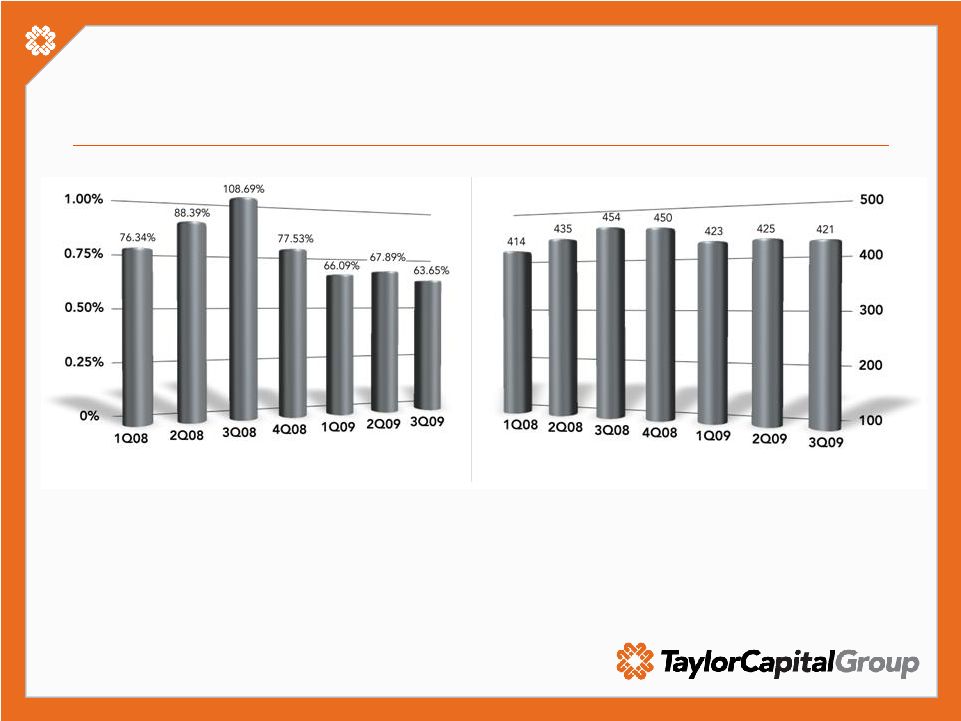

21 21 Controlling Expenses Improved Efficiency Ratio Full Time Employees |

22 22 Summary • Challenging economic conditions – Priority #1 is asset quality • Strong and clearly defined strategy – Focused on building our core business – Need for prudent growth – Grow revenue streams – Return to profitability |

23 23 Questions ? |

24 24 Thank you |