Attached files

| file | filename |

|---|---|

| 8-K - 8K RE Q3'09 WENDY'S/ARBY'S GROUP EARNINGS CALL PRESENTATION NOV. 5, 2009 - Wendy's Co | form8-k2009q3slides.htm |

EXHIBIT

99.1

Steve Hare

Chief Financial Officer

Third

Quarter 2009

Earnings Call

Earnings Call

November

5, 2009

Opening

Comments

John

Barker

SVP and Chief Communications Officer

SVP and Chief Communications Officer

2

n Third

Quarter Highlights - Roland Smith

− Business

overview

− Third

quarter financial highlights

− Key

profit drivers

n Financial

Results - Steve Hare

− Consolidated

financial overview

− Brand

operating results

− Dividend

and stock repurchase program

n Brand

Updates, Growth Opportunities and Outlook -

Roland Smith

Roland Smith

n Q&A

Today’s

earnings release and financial statements are available on the

Investor

Relations section of our website at www.wendysarbys.com.

Agenda

3

Wendy’s/Arby’s

Group Reported Today:

n Third

Quarter and YTD Results

− Q3

2009 and YTD are not comparable to 2008 due to the merger

n Balance

Sheet Highlights

n Adjusted

EBITDA Compared to Pro-Forma Adjusted

EBITDA

EBITDA

n Selected

Financial Highlights for Each Brand

n Form

10-Q

Third

Quarter 2009

4

Forward-Looking

Statements and

Regulation G

Regulation G

This

presentation, and certain information that management may discuss in

connection

with this presentation, may contain statements that are not historical facts, including,

importantly, information concerning possible or assumed future results of our operations.

Those statements constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 (the “Reform Act”). For all our forward-

looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Reform Act.

with this presentation, may contain statements that are not historical facts, including,

importantly, information concerning possible or assumed future results of our operations.

Those statements constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 (the “Reform Act”). For all our forward-

looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Reform Act.

Many

important factors could affect our future results and could cause those results

to

differ materially from those expressed in or implied by our forward-looking statements.

Such factors, all of which are difficult or impossible to predict accurately, and many of

which are beyond our control, include but are not limited to those identified under the

caption “Forward-Looking Statements” in our most recent earnings press release and in

the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk

Factors” sections of our most recent Form 10-K and subsequent Form 10-Qs.

differ materially from those expressed in or implied by our forward-looking statements.

Such factors, all of which are difficult or impossible to predict accurately, and many of

which are beyond our control, include but are not limited to those identified under the

caption “Forward-Looking Statements” in our most recent earnings press release and in

the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk

Factors” sections of our most recent Form 10-K and subsequent Form 10-Qs.

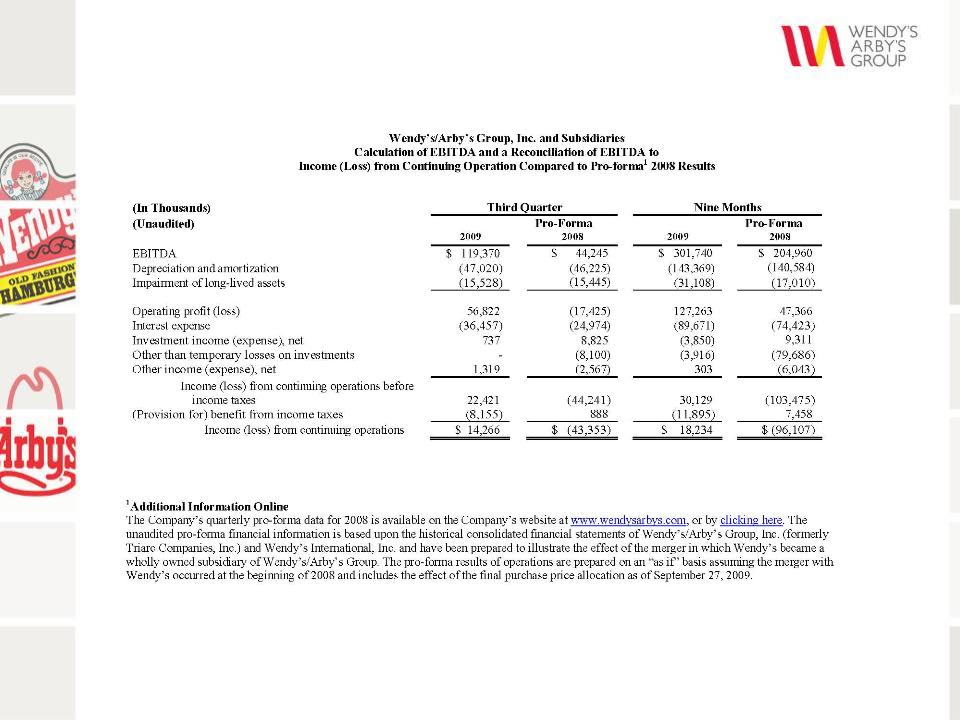

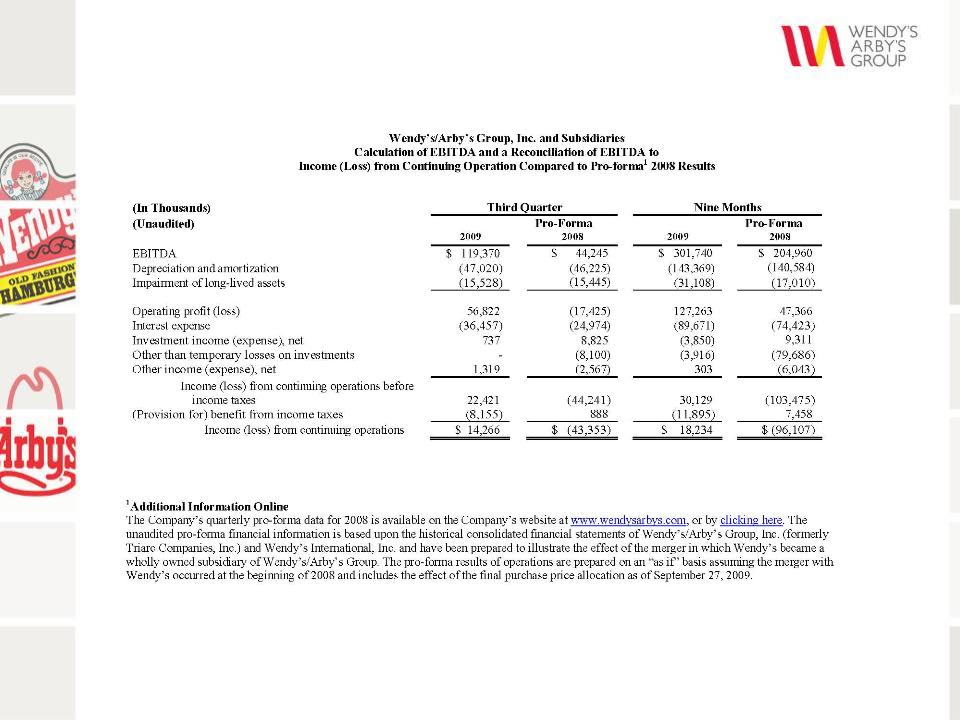

In

addition, this presentation and certain information management may discuss

in

connection with this presentation reference non-GAAP financial measures, such as

earnings before interest, taxes, depreciation and amortization, or EBITDA.

Reconciliations of non-GAAP financial measures to the most directly comparable GAAP

financial measure are in the Appendix to this presentation, and are included in the

earnings release and posted on the Investor Relations section of our website.

connection with this presentation reference non-GAAP financial measures, such as

earnings before interest, taxes, depreciation and amortization, or EBITDA.

Reconciliations of non-GAAP financial measures to the most directly comparable GAAP

financial measure are in the Appendix to this presentation, and are included in the

earnings release and posted on the Investor Relations section of our website.

Third

Quarter 2009 Highlights

Roland

Smith

President & Chief Executive Officer

President & Chief Executive Officer

6

n Wendy’s/Arby’s

Group: 3rd Largest QSR Company

in the U.S.

n Solid

Earnings Growth in a Challenging Market

n Margin

Improvement at Wendy’s

− Ahead

of plan to generate $100 million in incremental annual EBITDA by

improving Wendy’s restaurant margins by 500 basis points by end of 2011

improving Wendy’s restaurant margins by 500 basis points by end of 2011

n Cost

Savings through Wendy’s/Arby’s Integration

− Ahead

of plan to achieve G&A savings goal of $60 million on an annualized

basis by end of 2011 and beginning to work on additional cost saving

opportunities

basis by end of 2011 and beginning to work on additional cost saving

opportunities

n Significant

Product Innovation

− Introduced

new premium products - Arby’s Roastburger™ and Wendy’s

Boneless Wings and Bacon Deluxe Cheeseburger

Boneless Wings and Bacon Deluxe Cheeseburger

n Implementing

Improved Value Strategies at Each Brand

n Revitalizing

the Wendy’s Brand with New Advertising Campaign

n Signed

Agreement to form Wendy’s Purchasing Co-op

n Strong

Cash Flow and Financial Flexibility

First

Year Accomplishments

7

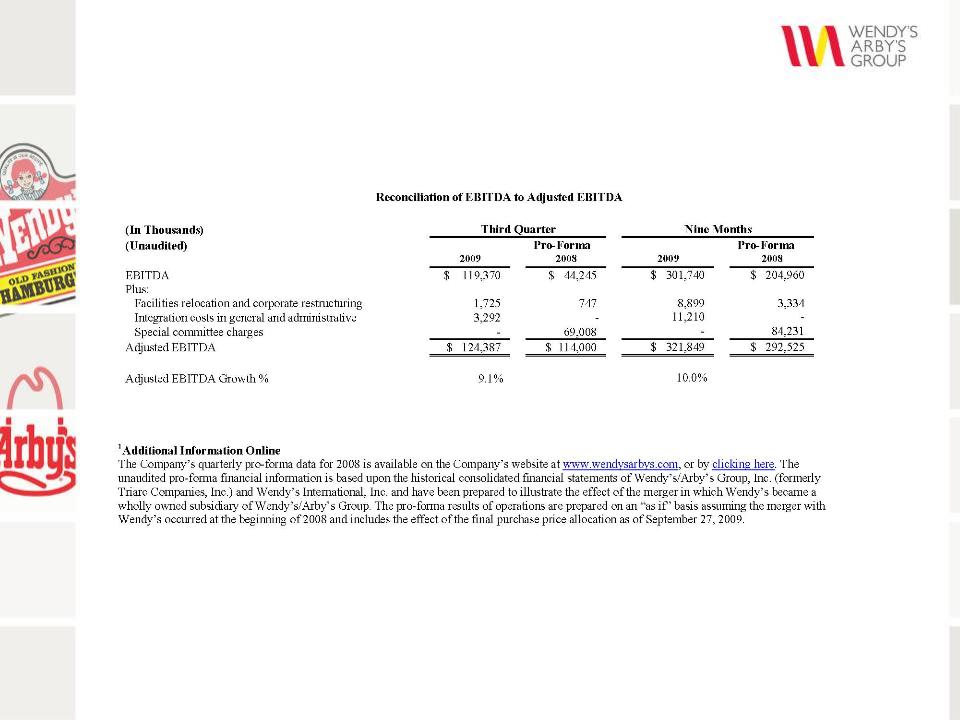

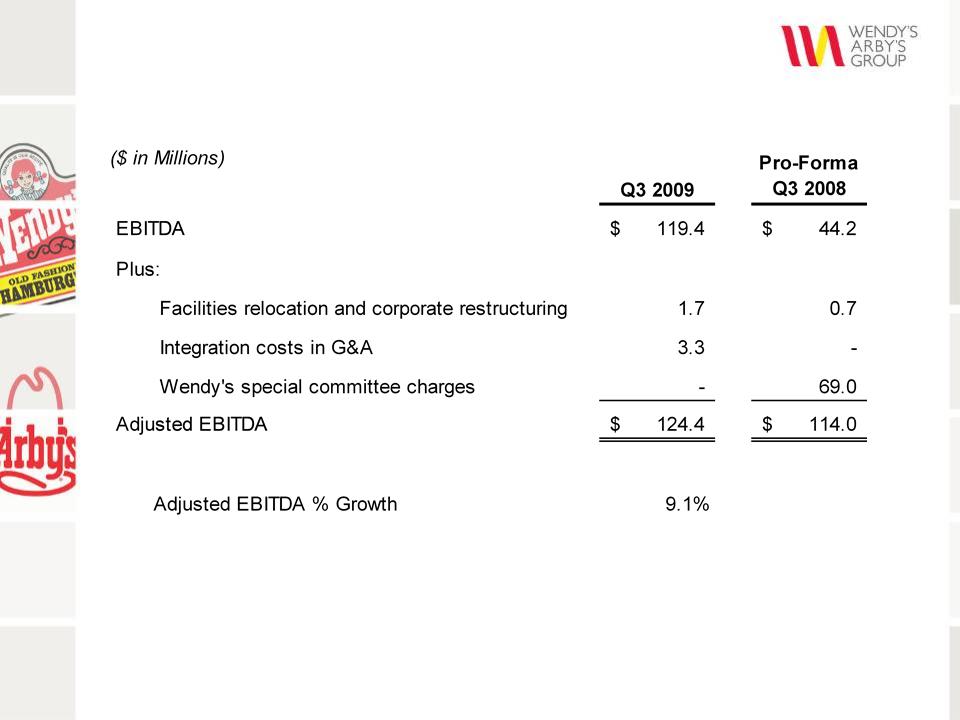

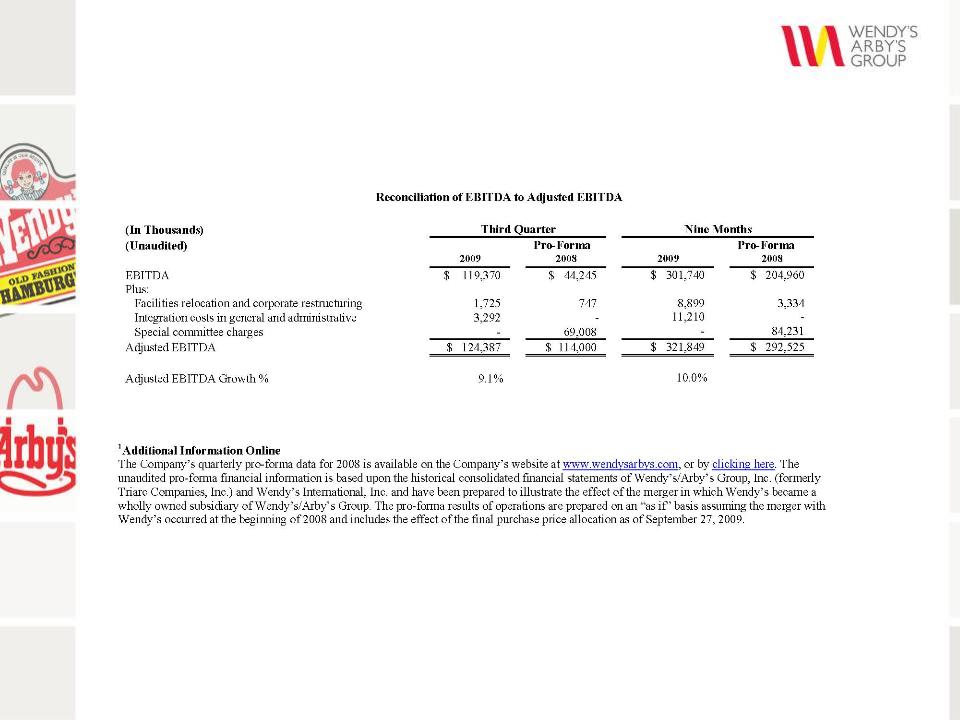

n Adjusted

EBITDA Grew 9.1% to $124.4 million*

n Strong

Performance at Wendy’s

− Positive

systemwide same-store sales, excluding breakfast removal

− 400

basis points improvement in company-operated margin

n Sales

and Margins Declined at Arby’s

− Launched

1st Phase of

Arby’s Everyday Value Platform in October

*See

Appendix.

Third

Quarter Business Overview

8

Wendy’s

Third Quarter Results

North

America Same-Store Sales

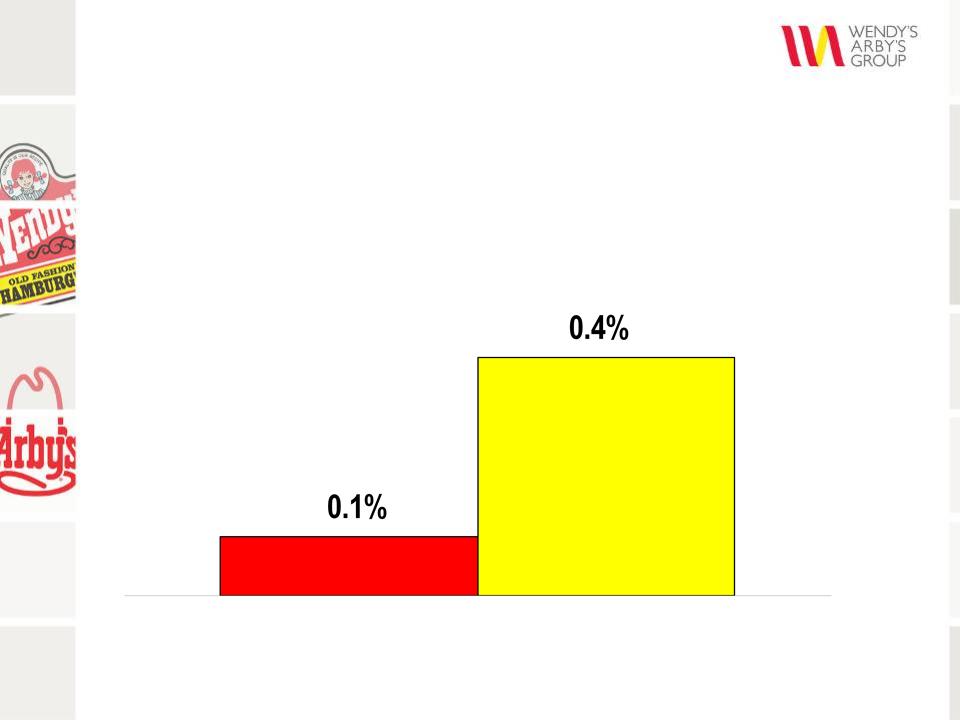

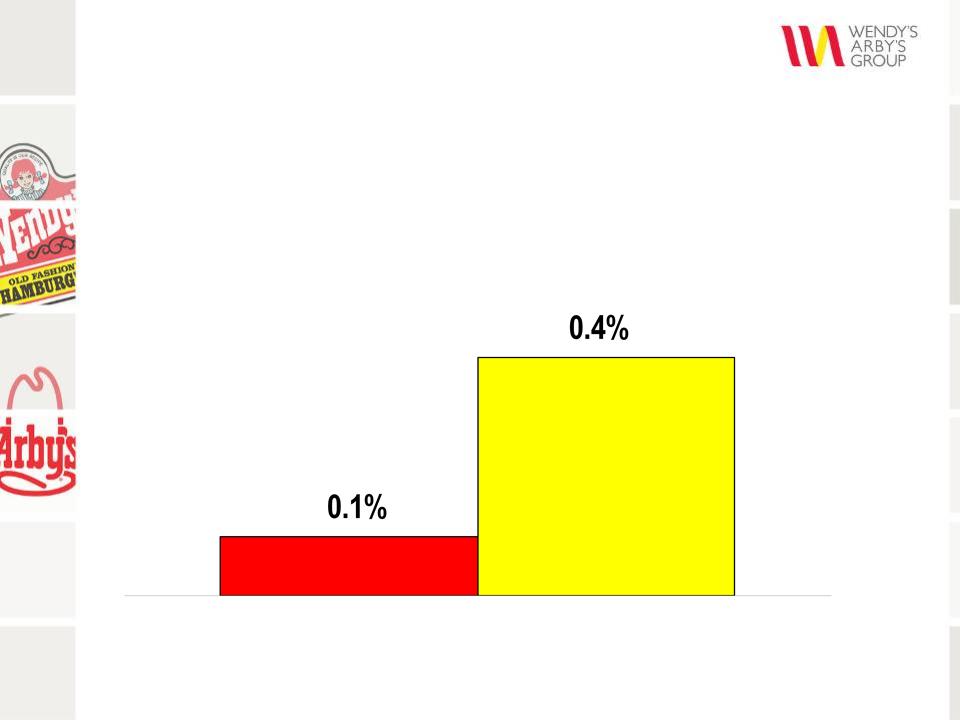

n Third

Quarter Same-Store Sales, Excluding the Impact of

Breakfast, were Positive

Breakfast, were Positive

Company

excl

breakfast

breakfast

Franchise

9

Wendy’s

Third Quarter Results

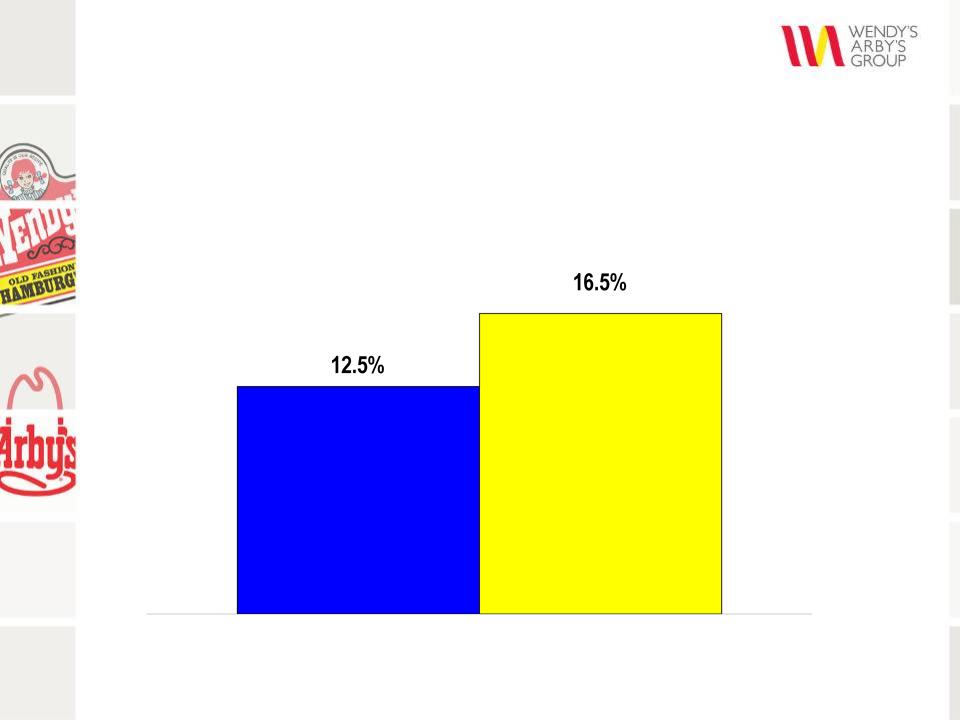

Restaurant

Margin

n Q3

2009 Company-Operated Restaurant Margin was +400 bps

vs. Year Ago

vs. Year Ago

Q3

2008

Q3

2009

10

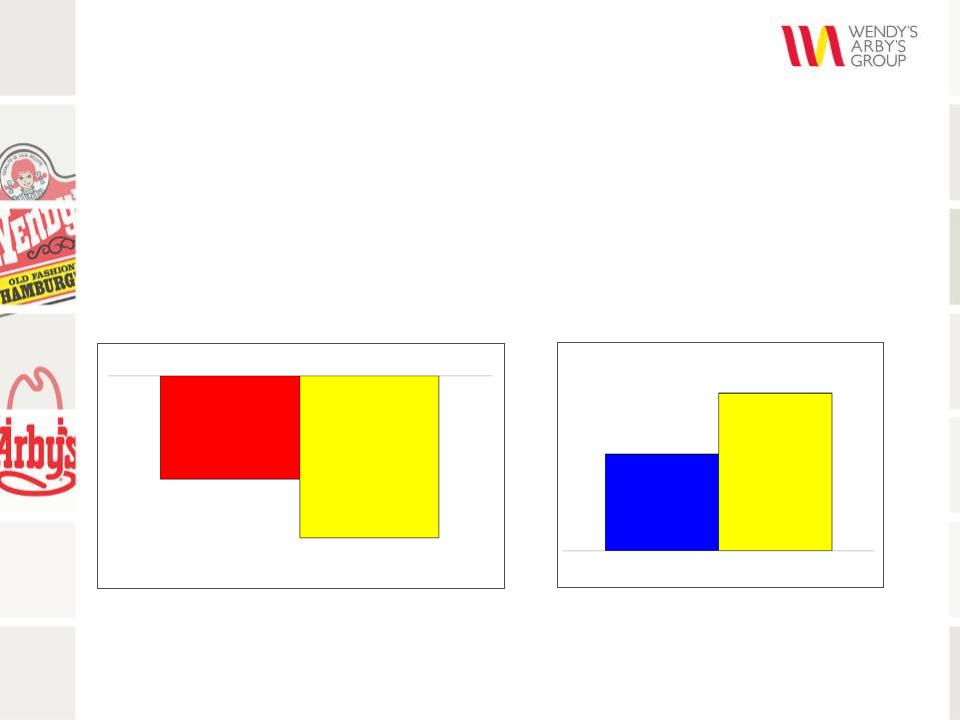

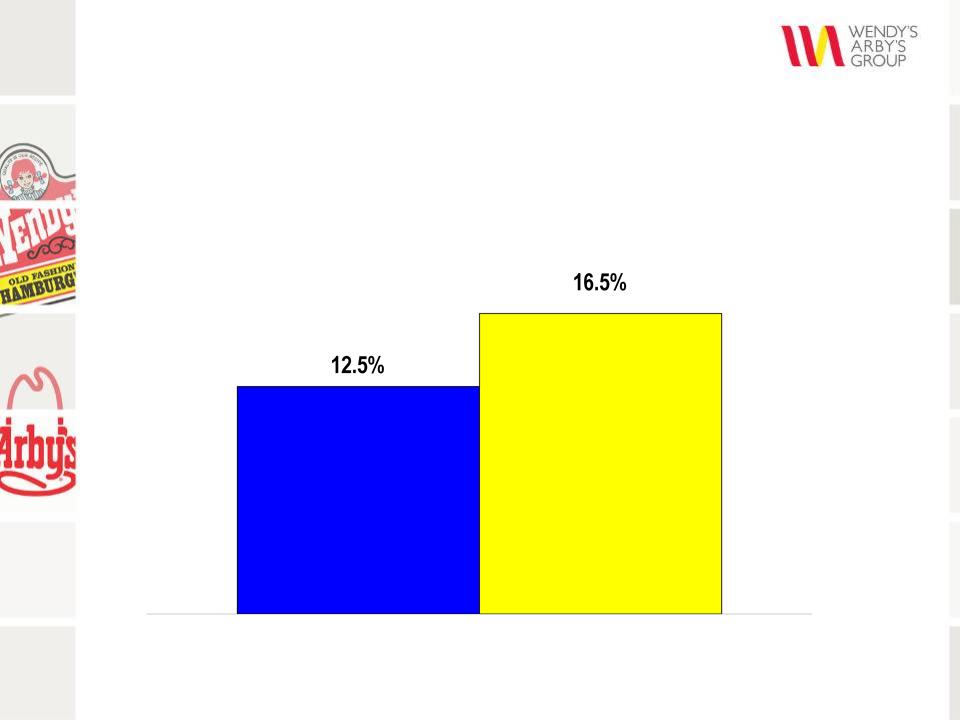

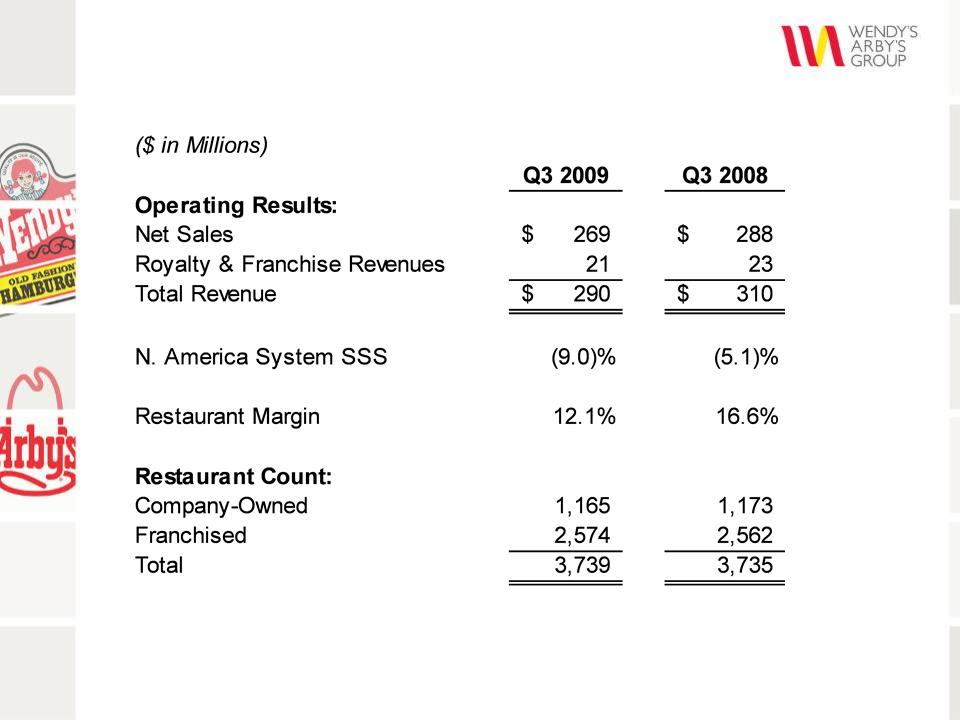

Arby’s

Third Quarter Results

North

America Same-Store Sales

n Same-store

Sales Impacted by Significant Competitor

Discounting

Discounting

n Margins

Decreased Driven Primarily Due to Significant

Deleveraging

Deleveraging

Restaurant

Margin

Q3

2009

Q3

2008

12.1%

16.6%

-6.5%

-10.2%

Company

Franchise

Q3

2009

11

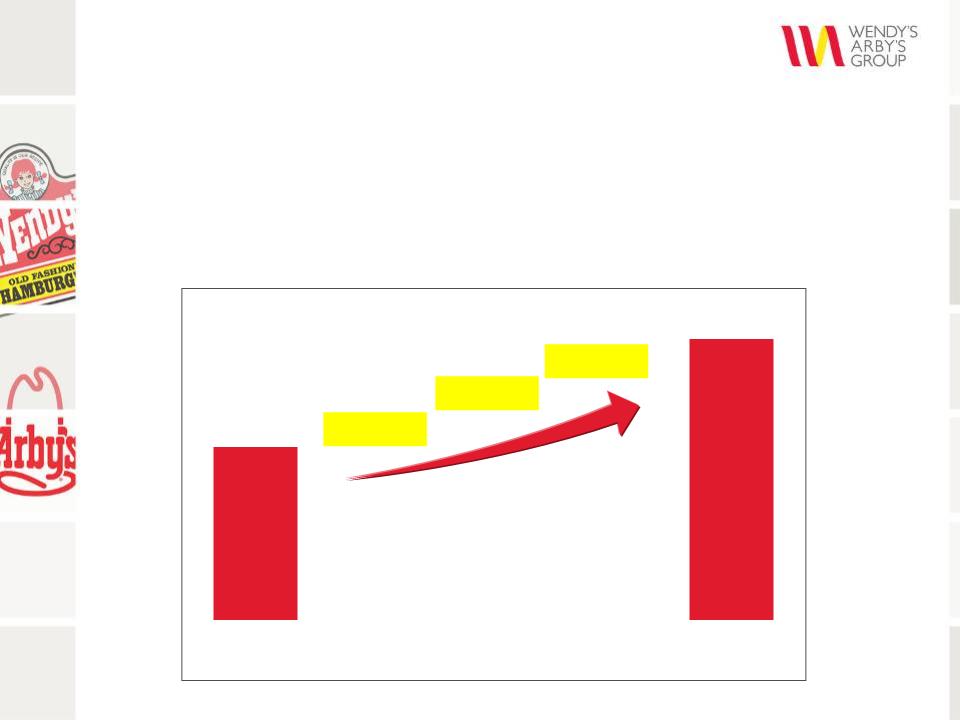

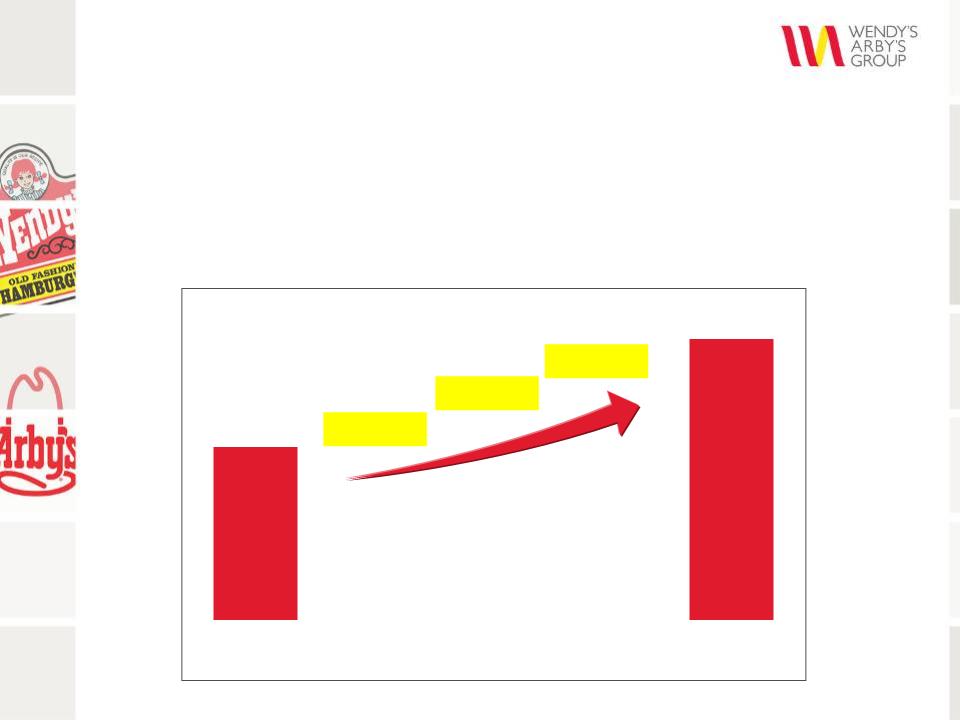

n Delivered

400 bps Improvement in Q3 and +300 bps YTD

n Expect

to Exceed +250 bps for the Full-Year 2009

n Remain

Confident in Our Ability to Achieve +500 bps by 2011

Original

Margin Improvement Targets by Year

150-170

bps

2008 2009 2010 2011 2011

Target Target Target Target

11.7%

16.7%

160-180

bps

160-180

bps

Wendy’s

Restaurant Margin

12

2008

2009

2010

2011

$60

million Target

Additional

Savings

Savings

n Ahead

of Schedule to Achieve Cost Savings Goal of

$60

Million through Synergies and Efficiencies

n Key

Projects Under Way

− Shared

Services Center in place

− Completing

IT rationalization projects

− Signed

agreement to form Wendy’s purchasing co-op

n Working

on Additional Cost Saving Opportunities

G&A

Synergies and Efficiencies

Financial

Overview

Steve Hare

Chief Financial Officer

14

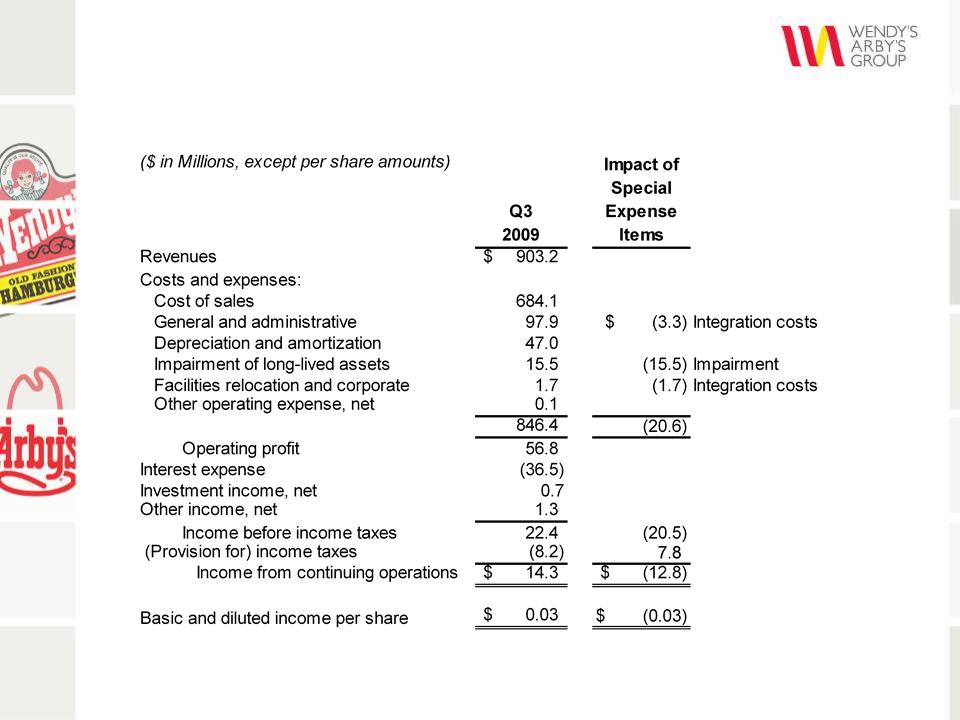

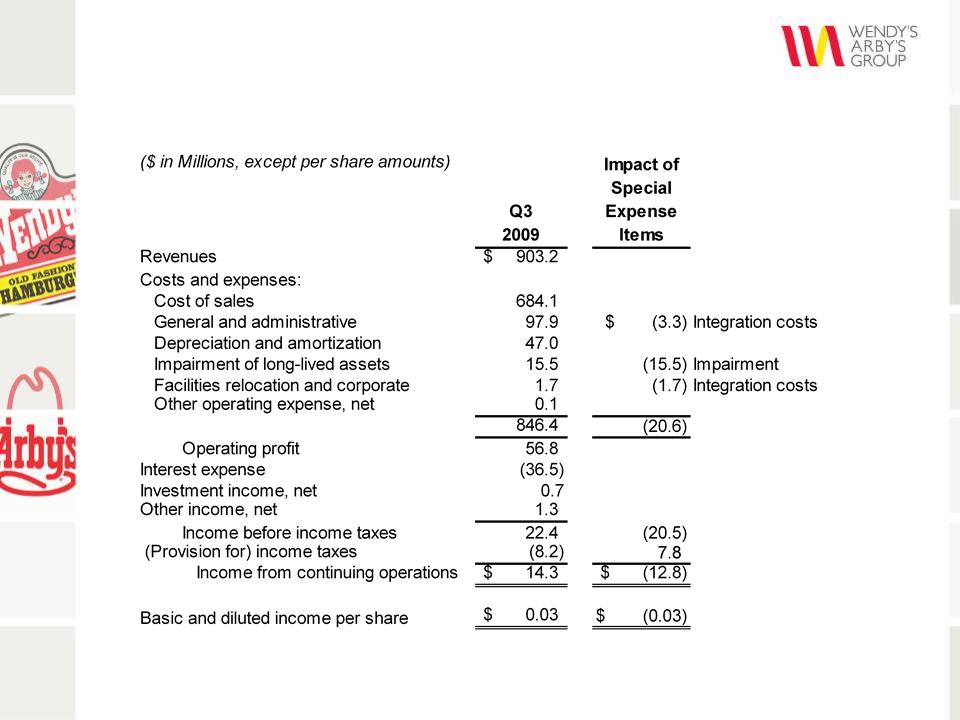

Q3

Consolidated Operating Results

15

*See

Appendix.

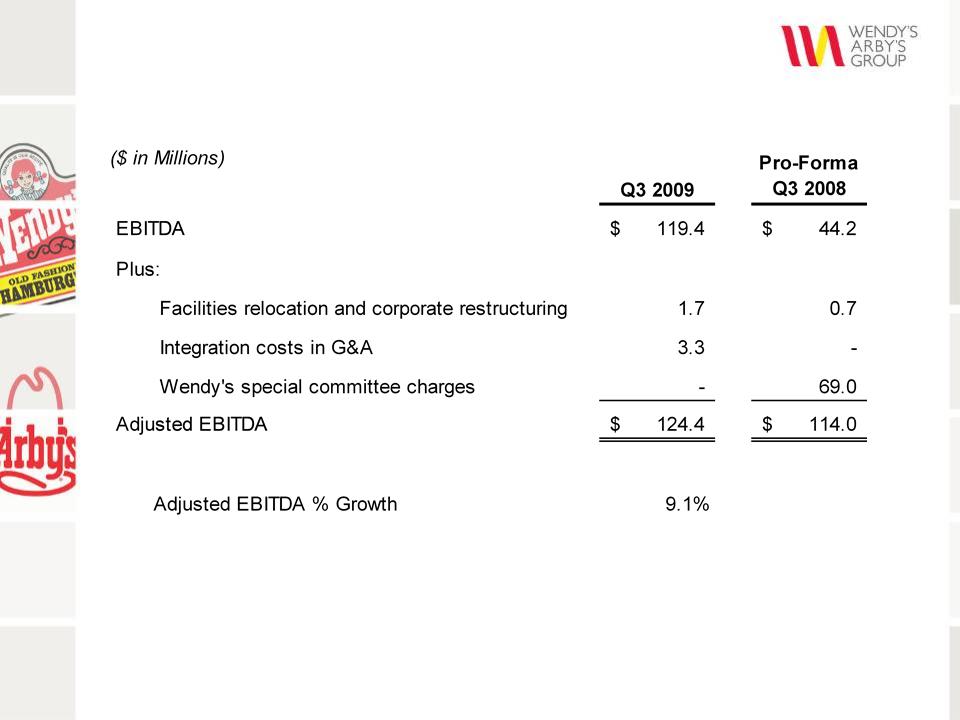

Q3

EBITDA and Adjusted EBITDA*

16

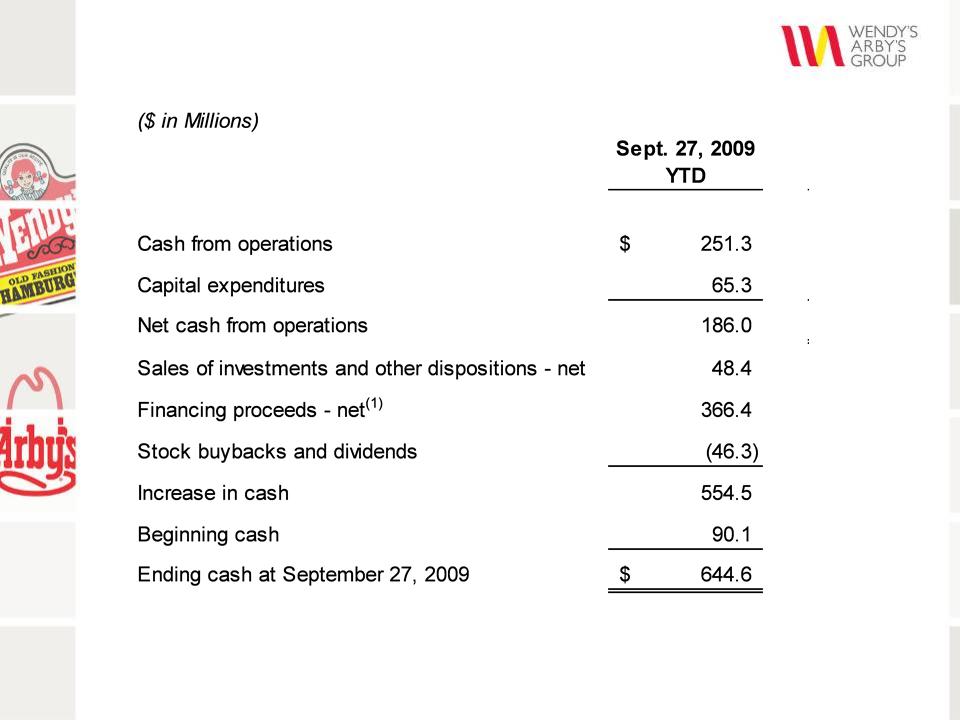

(1) Includes $1.1

million of net cash from exchange rate changes and discontinued

operations

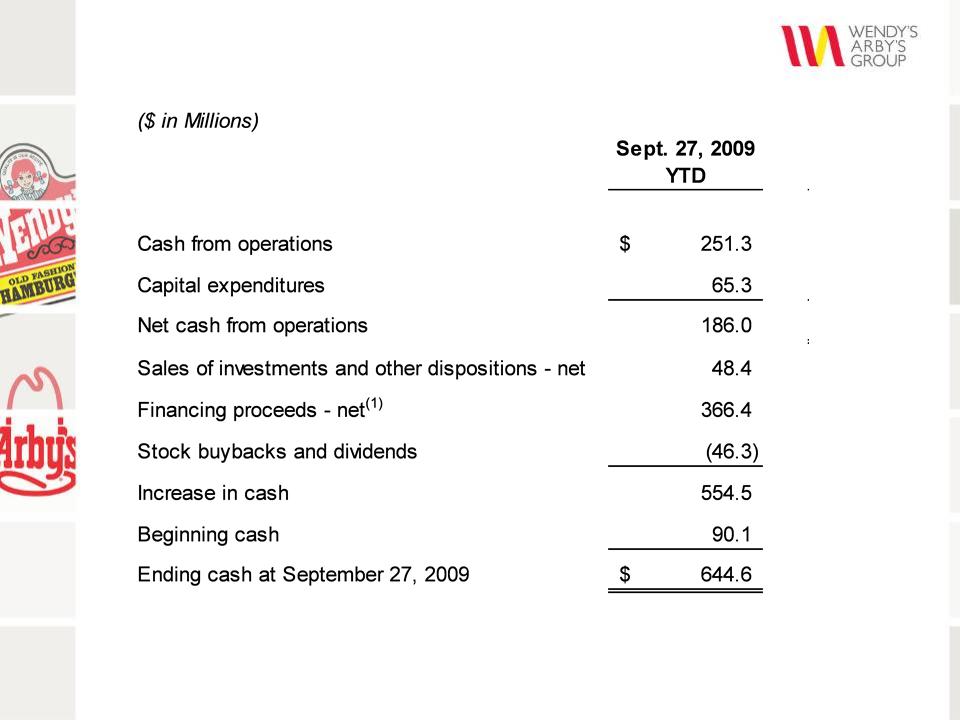

Cash

Flow - 2009 YTD

17

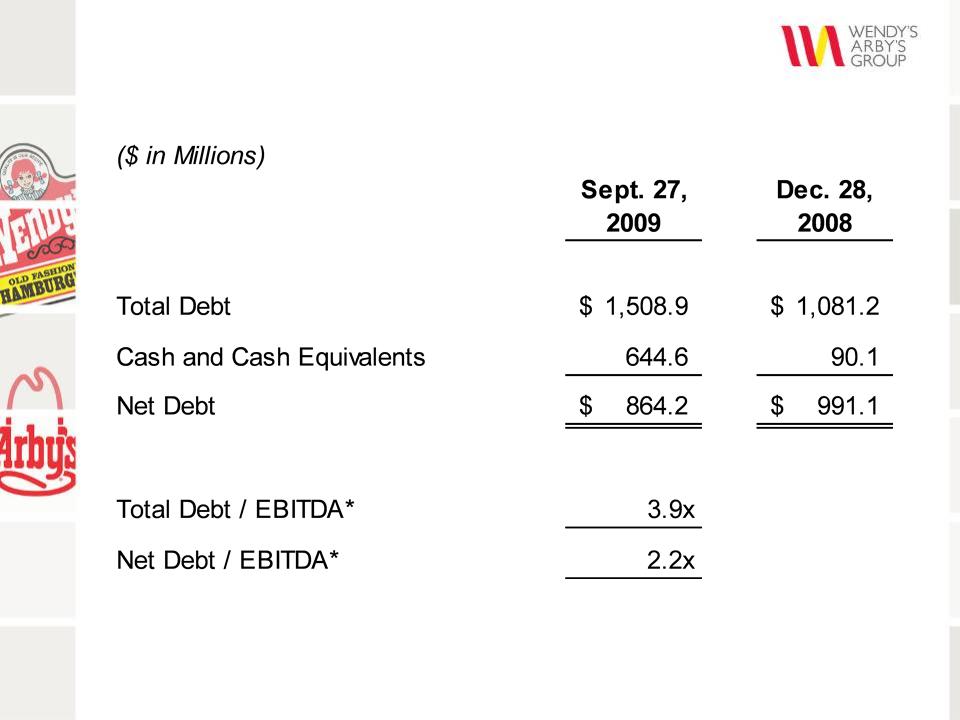

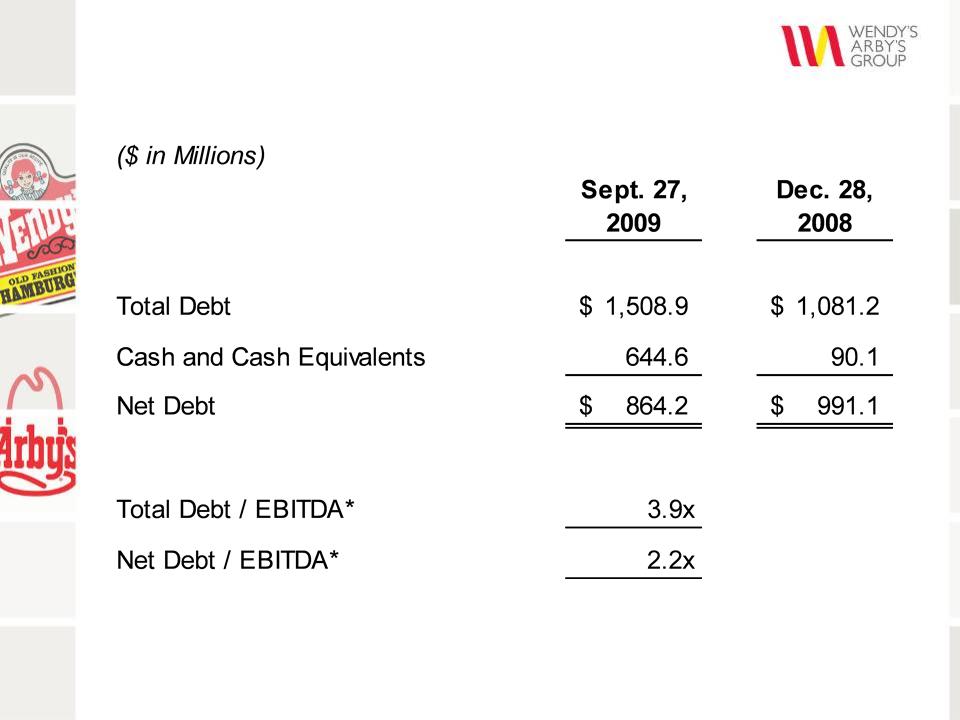

*

Represents trailing twelve month pro-forma adjusted EBITDA

Debt

Capitalization

18

*See

Appendix

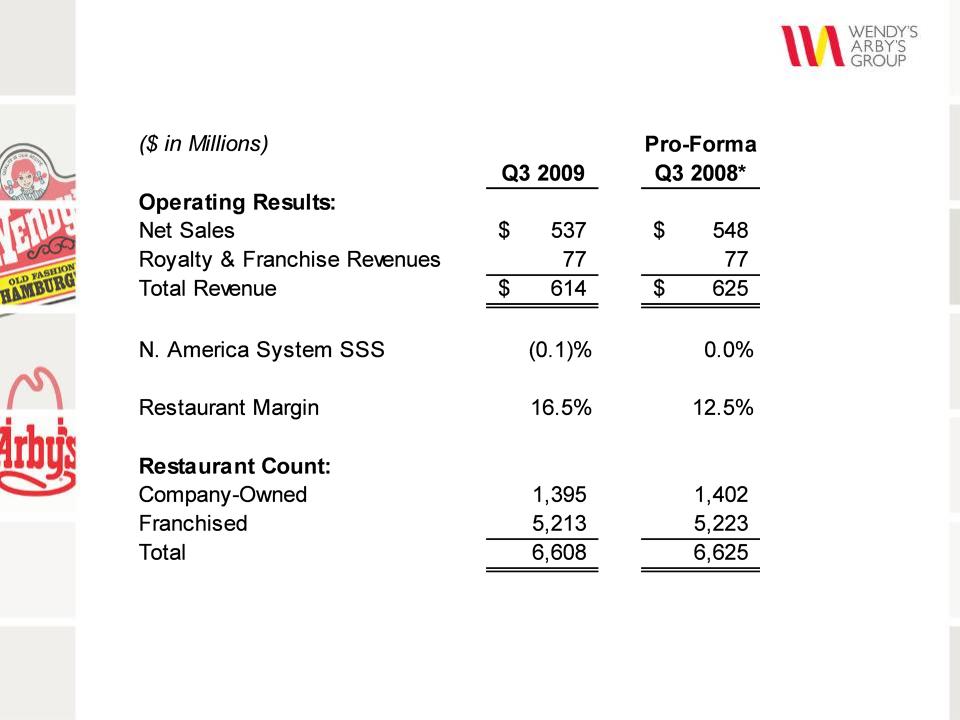

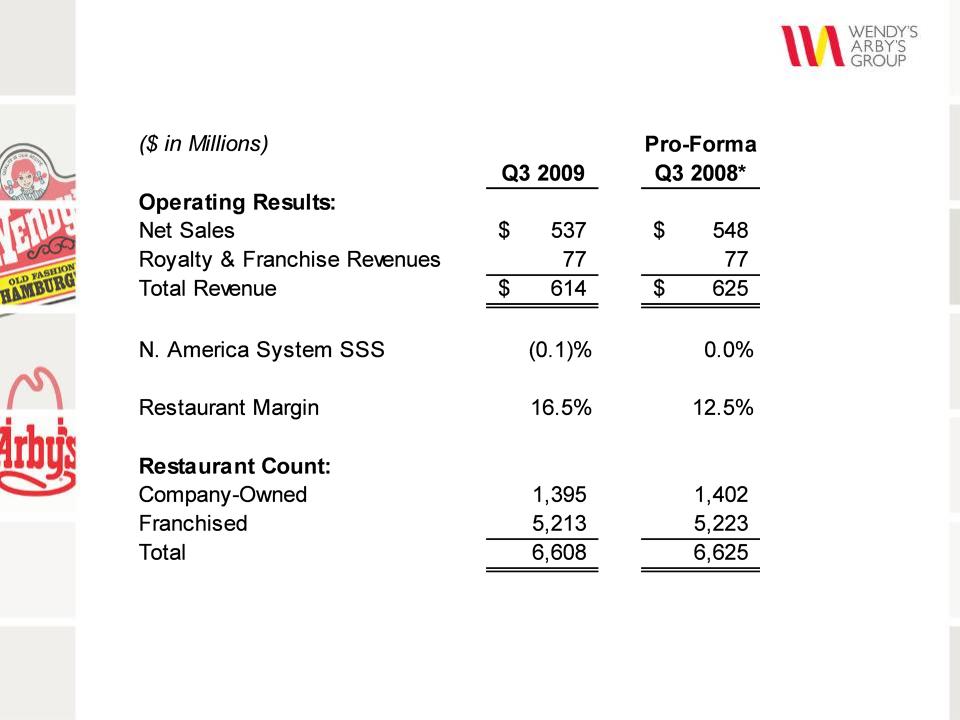

Q3

Wendy’s Brand Operating Results

19

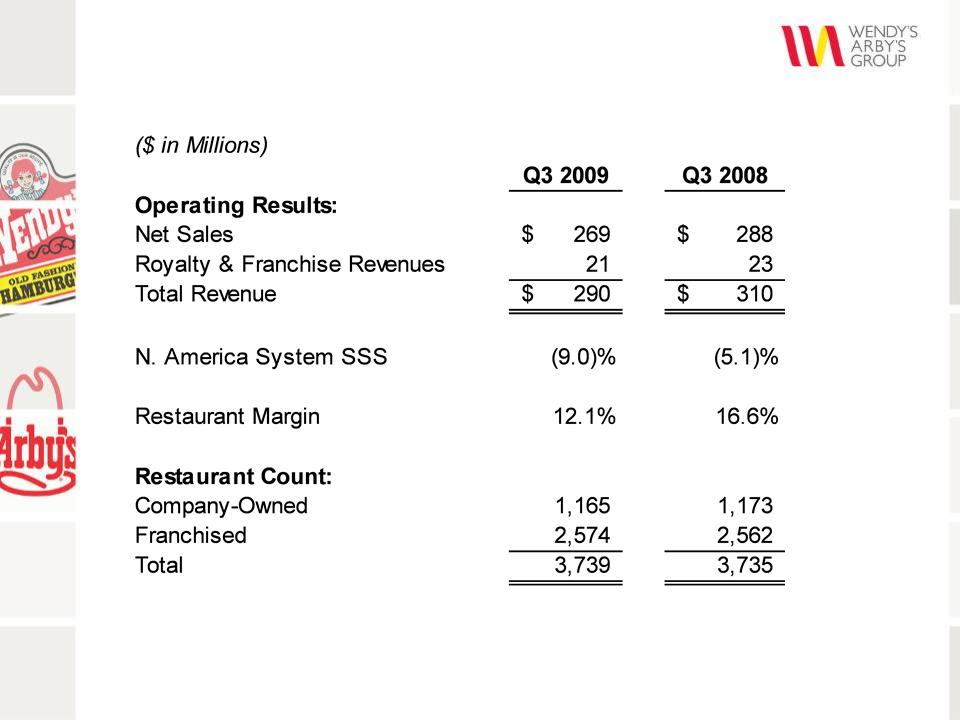

Q3

Arby’s Brand Operating Results

20

n Will

Manage Food and Related Product Purchases and

Distribution Services

Distribution Services

n Offers

Cost Savings Opportunities While Maintaining the

Quality of the Wendy’s Brand

Quality of the Wendy’s Brand

n Company

Committed $15.5 Million for Initial Startup

− Expensed

in the fourth quarter

− Paid

over the next 18 months

n Operating

Costs Of QSCC will be Paid by All Members

Including Franchisees after an Initial Startup Period

Including Franchisees after an Initial Startup Period

n Longer-term

Opportunity to Leverage QSCC and Arby’s Co-op

Combined Volume in Non-Brand Specific Purchases

Combined Volume in Non-Brand Specific Purchases

Wendy’s

New Purchasing Co-op

Quality Supply Chain Co-op (QSCC)

Quality Supply Chain Co-op (QSCC)

21

n Board

Amended Stock Repurchase Program and Increased

Authorization to $100 million

Authorization to $100 million

− Company

purchased $49 million of common stock as of October

26, 2009; 10.3 million shares for approximately $4.77 per share

26, 2009; 10.3 million shares for approximately $4.77 per share

− Authorization

will remain in effect through January 2, 2011

− Company

will repurchase additional shares as market

conditions warrant

conditions warrant

n Quarterly

Dividend

− $0.015

per share

− Payable

on December 15, 2009 to stockholders of record as of

December 1, 2009

December 1, 2009

Recent

Board Actions

Brand

Updates, Growth

Opportunities and Outlook

Opportunities and Outlook

Roland

Smith

President & Chief Executive Officer

President & Chief Executive Officer

23

n Unveiled

New Advertising Campaign in October

− “You

Know When It’s Real™”

− Reinforces

Wendy’s quality brand positioning

Re-Energizing

the Wendy’s Brand

24

n Launched

New Bacon Deluxe Cheeseburger in October

n Full

Pipeline of New Products in Various Test Phases

Re-Energizing

the Wendy’s Brand

25

n Launched

1st Phase of Everyday Value Strategy

– $5.01

Combos: One of

5 full-sized sandwiches + fries & drink

n 2nd

Phase will Feature Expansion of $1 Menu

Arby’s:

Balancing Premium and Value

26

n Announced

New SVP of International, Andy Skehan

n Wendy’s

and Arby’s are Under-Penetrated in International

Markets

Markets

n Potential

for 8,000 Restaurants Outside of North America

n 1st

International Dual-branded Restaurant Expected to

Open in Dubai in Early 2010

Open in Dubai in Early 2010

*Artist

rendering (not actual restaurant)

International

Growth

27

n 2009

Financial Outlook

n 10%

Growth in 2009 Year-to-Date Adjusted EBITDA*

n Strong

Performance at Wendy’s

n Implementing

Everyday Value Strategy at Arby’s

n Key

Profit Drivers Ahead of Plan

n Strong

Free Cash Flow

n Growth

Opportunities in International

n Average

Annual Adjusted EBITDA Growth in the Mid-Teens

through 2011

through 2011

*See

Appendix.

Summary

www.wendysarbys.com

Q&A

Appendix

30

31