Attached files

| file | filename |

|---|---|

| EX-31.2 - China Housing & Land Development, Inc. | v163561_ex31-2.htm |

| EX-23.2 - China Housing & Land Development, Inc. | v163561_ex23-2.htm |

| EX-32.1 - China Housing & Land Development, Inc. | v163561_ex32-1.htm |

| EX-31.1 - China Housing & Land Development, Inc. | v163561_ex31-1.htm |

| EX-32.2 - China Housing & Land Development, Inc. | v163561_ex32-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

Amendment

No. 3

x ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2008

OR

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the transition period from ____________ to ____________

Commission

file number: 333-105903

|

China

Housing & Land Development, Inc.

|

|

(Exact

name of registrant as specified in our

charter)

|

|

NEVADA

|

20-1334845

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(I.R.S.

Employer Identification No.)

|

|

6

Youyi Dong Lu, Han Yuan 4 Lou

Xi'an,

Shaanxi Province

China

710054

|

|

(Address

of principal executive offices) (Zip

Code)

|

|

(Registrant's

telephone number, including area code)

|

|

86-29-82582632

|

(Former

name, former address and former fiscal year,

if

changed since last report)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

|

Title

of each class

|

Name

of each exchange on

which

registered

|

|

Common

Stock, $ .001 par value per share

|

NASDAQ

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes p No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes p

No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes x No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|||

|

Non-accelerated filer ¨

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

||

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

p No x

The

number of shares outstanding of our common stock as of June 30, 2008, was

30,143,757 shares. The aggregate market value of the common stock held by

non-affiliates (12,702,110 shares), based on the closing market price ($3.99 per

share) of the common stock as of June 30, 2008 was $50,681,419.

As of

March 25, 2009 the number of shares of the registrant’s classes of common stock

outstanding was 30,948,340, though they mean the same.

|

Class

|

Outstanding

at March 25, 2009

|

|

Common

Stock, $ .001 par value per share

|

30,948,340

shares

|

DOCUMENTS

INCORPORATED BY REFERENCE

|

Document

|

Parts

Into Which Incorporated

|

|

None

|

Not

applicable

|

EXPLANATORY

NOTE

This

Amendment No. 3 to our annual report on Form 10-K initially filed with the

Securities and Exchange Commission (the “Commission”) on March 25, 2009 is being

filed in response to the Commission’s comment letter dated August 18,

2009. In

additional, this Amendment No. 3 to our annual report on Form 10-K is being

filed to correct certain financial data and disclosure including Management’s

Discussion and Analysts of Financial Condition and Results of Operations and to

restate our consolidated financial statements.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

annual report includes forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended. All statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements, including, but not

limited to, statements regarding our future financial position, business

strategy and plans and objectives of management for future operations. When used

in this filing, the words believe, may, will, estimate, continue, anticipate,

intend, expect, and similar expressions are intended to identify forward-looking

statements.

We have

based these forward-looking statements largely on our current expectations and

projections about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy, short-term

and long-term business operations and objectives, and financial needs.

These forward-looking statements are subject to certain risks and

uncertainties that could cause our actual results to differ materially from

those reflected in the forward-looking statements. Factors that could cause or

contribute to such differences include, but are not limited to the risks

discussed under the heading “Risk Factors”. Except as required by law, we assume

no obligation to update these forward-looking statements publicly or to update

the reasons actual results could differ materially from those anticipated in

these forward-looking statements.

In light

of these risks, uncertainties, and assumptions, the forward-looking events and

circumstances discussed in this annual report may not occur and actual results

could differ materially and adversely from those anticipated or implied in the

forward-looking statements. Accordingly, readers are cautioned not to place

undue reliance on such forward-looking statements.

TABLE

OF CONTENT

|

PART

I

|

||

|

ITEM

1

|

BUSINESS

|

1

|

|

ITEM

1A

|

RISK

FACTORS

|

18

|

|

ITEM

2

|

PROPERTIES

|

24

|

|

ITEM

3

|

LEGAL

PROCEEDINGS

|

25

|

|

ITEM

4

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

25

|

|

PART

II

|

||

|

ITEM

5

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

25

|

|

ITEM

6

|

SELECTED

FINANCIAL DATA

|

26

|

|

ITEM

7

|

MANAGEMENT

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

27

|

|

ITEM

7A

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

41

|

|

ITEM

8

|

FINANCIAL

STATEMENT AND SUPPLEMENTARY DATA

|

42

|

|

ITEM

9

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURES

|

66

|

|

ITEM

9A(T)

|

CONTROLS

AND PROCEDURES

|

66

|

|

ITEM

9B

|

OTHER

INFORMATION

|

67

|

|

PART

III

|

||

|

ITEM

10

|

DIRECTORS

AND EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

68

|

|

ITEM

11

|

EXECUTIVE

COMPENSATION

|

71

|

|

ITEM

12

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

73

|

|

ITEM

13

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

73

|

|

ITEM

14

|

PRINCIPAL

ACCOUNTING FEES AND SERVICES

|

74

|

|

PART

IV

|

||

|

ITEM

15

|

EXHIBITS

AND REPORTS ON FORM 10-K

|

75

|

|

SIGNATURES

|

76

|

|

PART

I

ITEM

1. BUSINESS

China

Housing & Land Development, Inc., is a leading developer of residential and

commercial properties in northwest China. The Company is based in Xi’an, the

capital city of China’s Shaanxi province. Since 1992, China Housing has been

engaged in the acquisition, development, management, and sales of residential

and commercial real estate properties and land through its subsidiaries in

China.

China

Housing & Land Development is the first and only Chinese real estate

development company traded on NASDAQ.

By

leveraging its strong background and capability, China Housing & Land

Development has been able to capitalize on the supply of available land and

develop residential and commercial properties, further increase China Housing's

brand recognition, and outperform its competitors in the development of medium

size residential and commercial real estate projects in greater

Xi'an.

China

Housing & Land Development is the number one non-government middle-and-upper

income residential real estate development company in Xi'an.

Company

History

China

Housing & Land Development, Inc. (China Housing, we, our, us, or the

Company) was incorporated in the state of Nevada on July 6, 2004, as Pacific

Northwest Productions Inc., (Pacific). On April 21, 2006, Pacific entered into

and completed a share purchase agreement with Xi’an Tsining Housing Development

Co., Ltd., (Tsining), a corporation formed under the laws of the People’s

Republic of China on September 7, 1999. Pursuant to the purchase agreement,

Pacific acquired all of the issued and outstanding capital stock of Tsining in

exchange for 16,000,000 (post-split) shares of Pacific’s common

stock.

Concurrent

with the completion of the purchase agreement and as a condition thereof,

Pacific entered into an agreement with Deljit Bains and Davinder Bains, the then

executive officers, pursuant to which they each returned 4,000,000 (post-split)

shares (8,000,000 shares in total) of Pacific’s common stock to the company for

cancellation. They were not compensated in any way for the cancellation of their

shares of the Pacific common stock. Upon completion of the foregoing

transactions, Pacific had an aggregate of 20,000,000 shares of common stock

issued and outstanding.

As a

result of the merger, Tsining’s stockholders owned approximately 80 percent of

the combined company and the directors and executive officers of Tsining became

the directors and executive officers of Pacific. Accordingly, the transaction

has been accounted for as a reverse acquisition of Pacific by Tsining, resulting

in a recapitalization of Tsining rather than as a business combination. Tsining

is deemed to be the purchaser and surviving company for accounting

purposes.

Accordingly,

our assets and liabilities are included in the balance sheet at their historical

book values and the results of operations of Tsining have been presented for the

comparative prior period. The historical cost of the net liabilities of Pacific

that were acquired was $432. Pro forma information is not presented since the

financial statements of Pacific are insignificant.

On May 5,

2006, Pacific Northwest Productions Inc., changed its name to China Housing

& Land Development, Inc., and the stockholders approved a stock dividend of

seven shares for each share held, which was accounted for as an eight-to-one

forward stock split. All shares and per share data have been restated

retrospectively.

In March

2007, China Housing acquired 100 percent of the equity of Xi’an New Land

Development Co., Ltd, (New Land). The total purchase price for the acquisition

is RMB 270 million, approximately $35 million. New Land was originally

incorporated in September 2003 in Xi’an, Shaanxi province, China. In 2006, New

Land entered into an agreement with Baqiao District Government of Xi’an to

develop Baqiao Science & Technology Industrial Park, a provincial

development zone in Shaanxi Province, under which New Land has the exclusive

right to purchase and develop approximately 487 acres in Baqiao

Park.

In

November 2008, China Housing agreed to form a joint venture with Prax Capital

Real Estate Holding Ltd., to finance the development of the first 79 acres

within the Baqiao project. As planned, the joint venture was subsequently formed

in late December and announced in January 2009 after all documentation and

permits had been approved.

- 1

-

In

January, 2009, the Company completed the acquisition of Xi’an Xinxing Property

Management Co., Ltd. (“Xinxing”). Xinxing was privately owned and provides

property management services to most of China Housing’s past residential and

commercial projects, as well as to other prominent customers like the Xi’an

branch office building of the People’s Bank of China, China Xi’an Electric Group

headquarters, Shaanxi Bureau of State Taxation offices, and the Xi’an University

of International Studies, to name a few. Xinxing’s current service area totals

1.67 million square meters in 43 facilities that include residential,

commercial, and school buildings and parks. Xinxing’s revenues in 2008 were RMB

15.42 million, net income was RMB 1.82 million, and assets at yearend

2008 totaled RMB 11.29 million. Total consideration for the acquisition

will be RMB 12 million.

China

Housing, through subsidiaries, is engaged in the development, construction, and

sale of residential and commercial real estate units, as well as land

development in the People’s Republic of China (“China”). Tsining has completed a

number of significant real estate development and construction projects in

Xi’an, and is considered as the leading private developer of middle and upper

income housing in Xi’an. Tsining intends to continue investing in Xi’an, in the

Shaanxi province, and potentially in other developing urban markets in western

China. New Land improves and develops land and performs infrastructure projects

for local governments, frequently in conjunction with China Housing’s planned

housing projects. The infrastructure work can include engineering and

installation of water systems, roads, sewer systems, waterway damns and bridges,

and public park facilities. As compensation for the infrastructure work, New

Land often receives the prime land in the development from local government, on

which China Housing usually constructs and sells residential and or

commercial facilities.

We

maintain our statutory registered agent's office at 711 S. Carson Street, Suite

4, Carson City, Nevada 89701.

Our

corporate offices are located at 6 Youyi Lu, Han Yuan 4th Floor, Xi’an, China.

Our telephone number at that location is +86-29-8258-2632.

Notable

Company Events in 2008

Notable

company events or activities affecting China Housing’s 2008 consolidated

financial results include the following:

|

▪

|

On

January 1, China Housing adopted the percentage of completion method of

accounting for building construction projects. Infrastructure construction

work and sales of land continue to be reported only at the completion of

each project, using the full accrual method of

accounting.

|

|

▪

|

In

January, the company issued $20 million in senior secured convertible

debt.

|

|

▪

|

In

May, China Housing became the first and only Chinese real estate

development company to trade on NASDAQ. Ticker symbol is

CHLN.

|

|

▪

|

In

July, the company received a RMB 1 billion construction line of credit

with the China Construction Bank Shaanxi Branch. In September, China

Housing also received a RMB 35 million infrastructure construction line of

credit with the Xi'an Commercial

Bank.

|

|

▪

|

In

October, the company selected the world- renowned U.S. architecture and

engineering firm of Leo A Daly to provide site planning and detailed

architectural designs for the first 79 acres within the Baqiao

project.

|

|

▪

|

In

November, China Housing agreed to form a joint venture with Prax Capital

Real Estate Holding Ltd., to finance the development of the first 79 acres

within the Baqiao project. As planned, the joint venture was formed in

late December, subject to certain conditions and approvals, which were

subsequently satisfied; the completion of the joint venture’s formation

was announced in January 2009.

|

- 2

-

|

Industry

Overview

China’s

economic growth

China

has experienced rapid economic growth in the last 20 years. According to

China’s Department of Commercial Affairs, China’s gross domestic product

(GDP) achieved an annual growth rate of 17.1 percent from 2004 to 2008.

According to the National Statistics Bureau of China, the GDP of China in

2008 was RMB 30.1 billion, up 9.0 percent over 2007. Despite the

current global economic crisis, China is expected to achieve relatively

good economic growth in the next several years, compared to many other

major economies in the world.

Sources:

World Economic Outlook database, IMF.

Xi’an:

economic growth higher than China

Xi’an

served as the capital of China during 13 dynasties (from West Zhou in 1066

BC to Tang in 907 AD) and is well known for its Terracotta Army and other

famous historic landmarks. It is now the largest metropolis in

northwestern China, and one of the ten largest nationwide. A new wave of

economic growth is occurring in tier two cities, and Xi’an has benefitted

from the government’s “Go West” policy, which plans to develop Xi’an into

a regional economic center.

With

this rich heritage as a foundation, today the city’s economic leadership

is based on its high-technology, pharmaceutical, military, aerospace,

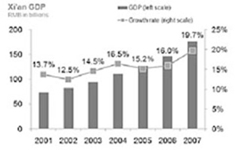

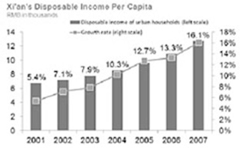

tourism, and advanced education industries. Xi’an recorded a CAGR of 16.0

percent for GDP and a CAGR of 12.3 percent for GDP per capita between 2001

and 2007.

|

|

|

|

Source:

Xi’an Municipal Bureau of Statistics.

- 3

-

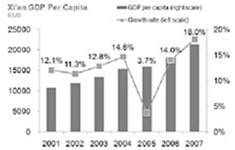

Driven by

the government’s “Go West” policy and the city’s highly productive workforce,

Xi’an has experienced a relatively stronger growth compared with other

second-tier cities in 2008. Xi’an’s gross domestic product grew 15.6 percent in

2008, compared with 9.0 percent in 2008 for all of China. Similar to other tier

two cities, the historically significant city of Xi’an in northwestern China

is experiencing an economic renaissance. Compared to tier one cities, we

believe Xi’an will continue its growth momentum in the next few years, and we

also expect that its strong economic fundamentals, compared to other tier two

cities, will provide a solid foundation for growth in the real estate

sector.

|

|

Source:

The Municipal Bureau of Statistics for the cities shown above.

China

Real Estate Industry Factors

Structural

long-term growth

China’s

real estate sector is in the early stage of a long-term growth cycle, supported

by growth in its gross domestic product (GDP), rising demand for housing, and

substantial structural changes similar to those of Japan in the early 1970s and

Hong Kong of early 1980s. Hong Kong’s property market, for example, increased in

value by 8 times between 1980 and 1997, or a compound annual growth rate of

about 15 percent, while Japan’s property boom ran for more than 20 years from

early 1970s to the early 1990s. There are many fundamental similarities among

the growth paths of these three economies.

China’s

real estate bull market began more than six years ago. Despite the moderations

in growth caused by the global economic weakness, we believe the fundamental

structural forces in China support continued growing demand for real estate in

China during the next 10 years. The two key industry drivers for this long-term

real estate demand in China are the dramatic migration of people from rural to

urban areas and the rising disposable income per capita in the

cities.

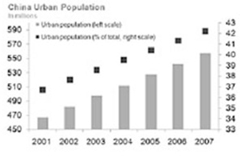

China is

continuing its rapid urbanization process. In 2006, there were more than 577

million Chinese living in urban areas, accounting for about 44 percent of total

population of about 1.31 billion. According to the National Bureau of Statistics

of China, by the end of 2008, China’s urban population had reached 600 million.

The State Council of China estimated in 2007 that China’s urban population in

2020 would comprise about 870 million people or about 60 percent of the total

population of 1.45 billion.

Another

source, the United Nations’

State of World Population 2007, reports that about 18 million people in

China are expected to migrate from rural to urban areas each year, and that the

urban population would reach about 877 million in the next 10

years.

|

|

Sources:

The World Bank’s World Development Indicators and National Bureau of

Statistics.

- 4

-

Regardless

of which projection you prefer, it is reasonable to expect that the migration

into urban areas is likely to continue, both because of the potential for higher

income and greater wealth accumulation, and because of the evolution of China’s

farming toward larger-scale and more efficient methods that require fewer people

to do the agricultural work.

With the

substantial housing demand created by the structural shift of the migration, the

urban real estate market has been thriving, and that long-term trend is expected

to continue.

Higher

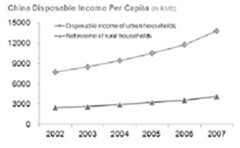

disposable incomes encourage home ownership

Rural

dwellers are drawn to cities primarily by the potential of higher incomes and

greater wealth, because urban jobs generally pay higher wages and

salaries.

The data

below from the National Bureau of Statistics of China shows that both disposable

income and wealth accumulation are higher for urban dwellers and confirms the

economic attractiveness of the migration from rural to urban areas.

|

Annual

per capita

disposable

income and

expenses

(RMB)

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

||||||||||||||||||

|

Urban

per capita

|

||||||||||||||||||||||||

|

Disposable

income of urban households

|

7703.00

|

8472.00

|

9422.00

|

10493.00

|

11759.45

|

13786.00

|

||||||||||||||||||

|

Consumption

expenditures of urban households

|

6030.00

|

6511.00

|

7182.00

|

7943.00

|

8696.55

|

9997.50

|

||||||||||||||||||

|

Net

increase in wealth, urban

|

1673.00

|

1961.00

|

2240.00

|

2550.00

|

3062.90

|

3788.50

|

||||||||||||||||||

|

Rural

per capita

|

||||||||||||||||||||||||

|

Net

income of rural households

|

2476.00

|

2622.00

|

2936.00

|

3255

|

3587.0

|

4140.36

|

||||||||||||||||||

|

Living

expenditures of rural households

|

1834.00

|

1943.00

|

2185.00

|

2555.00

|

2829

|

3223.85

|

||||||||||||||||||

|

Net

increase in wealth, rural

|

642.00

|

679.00

|

751.00

|

700.00

|

758.00

|

916.51

|

||||||||||||||||||

Source:

The National Bureau of Statistics of China.

China

real estate: Quite warm but still comparatively undervalued

Despite

the significant appreciation of property prices in China in recent years,

comparative analysis of fundamental factors indicate that prices are still

reasonable.

Studies

have shown that a key underlying driver for property market growth is per capita

GDP. Recent International Monetary Fund studies report that China’s recent

property appreciation is supported by strong personal economic growth. When

compared using “price per capita GDP” in the U.S. and India, China’s property

market appears undervalued. For example, although Shanghai represents the most

expensive property market in China, India’s Mumbai (Bombay) has seen real estate

prices grow to more than twice those of Shanghai, even though China has higher

economic growth.

Growth

in second-tier and third-tier markets

Just as

the rapid economic growth in eastern China’s large cities has created a healthy

demand in the east coast real estate property market in recent years, the

economic multiplier effect of economic growth moving from the first-tier cities

to the second- and third-tier cities is likely to create increases in growth for

the real estate markets in those cities.

In search

of lower costs, an educated talent pool, and new markets, multinational

corporations have been expanding out of mega cities, like Beijing, Shanghai, and

Shenzhen, into neighboring and inland cities.

Intel,

for example, has opened a development center in Chengdu, while the Liberty

Mutual Group, the U.S. insurance giant, has chosen Chongqing for its Chinese

headquarters. Unilever has relocated its Chinese headquarters from Shanghai to

the neighboring province of Hefei due to the lower labor and land costs and its

strategic location.

- 5

-

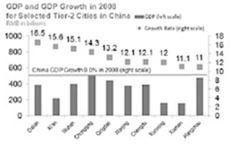

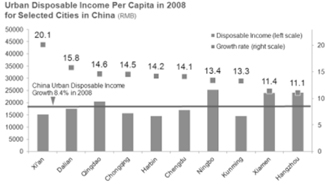

The

wealth gap is expected to narrow between the first-tier and second-tier

cities.

Rising

disposable income in the second-tier cities has lured top luxury goods

manufacturers, including LVMH Group, to expand aggressively into key second-tier

cities. The Chinese government has also been instrumental in stimulating

regional growth by designating certain second-tier regions as priority zones.

These actions are benefitting Xi’an, the Company’s primary market. Xi’an’s urban

disposable income grew 20.1 percent in 2008.

Source:

The Municipal Bureau of Statistics for the cities shown above.

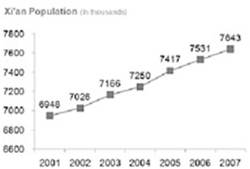

Xi’an

Real Estate Market Factors

City

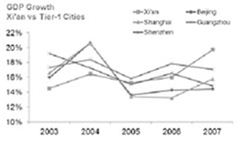

of Xi’an: first class in the second tier

As the

ripple effect of economic growth continues to permeate second-tier cities and

create a healthy environment for real estate development, leading indicators are

signaling continuing moderate growth in local property markets.

|

|

Source:

Xi’an Municipal Bureau of Statistics.

Growth

factors include the transition of certain industries to higher value-added

business, especially high-technology and services, rising GDP per capita (shown

above), increasing foreign investments, and expanding foreign retailing and

hotel operations. In addition, concerted efforts by the local governments to

create clear strategies, institute attractive policies, and invest in the

necessary infrastructure are all focused on creating favorable investment

environments in their cities.

The city

of Xi’an has demonstrated all of these characteristics.

Transformation

and urbanization

Xi’an

served as the capital of China during 13 dynasties (from West Zhou in 1066 BC to

Tang in 907 AD) and is well known for its Terracotta Army and other famous

historic landmarks. With that rich heritage as a foundation, today the city’s

economic leadership is based on its high-technology, pharmaceutical, military,

aerospace, tourism, and advanced education industries.

Xi’an

also is being transformed into a high-tech international city that offers a

large and educated work force. The city has China’s third largest

university-educated workforce, making it a hotbed for research &

development, high-technology manufacturing, and information technology

solutions.

Xi’an has

begun to attract well-known high-tech companies, including IBM, Applied

Materials, Micron Technology, and Infineon. Applied Materials, for example,

selected Xi’an for its $255 million phase one R&D center that will design

and develop equipment for semiconductor chip manufacturing. In addition, Micron

Technology has invested $250 million in Xi’an for packaging and testing of

semiconductor chips.

- 6

-

China has

announced its intention to become a world-class center for information

technology research and development, production, outsourcing, and services to

rival and perhaps surpass the success of India’s IT industry. Xi’an plays an

important role in that effort, having been designated by the government as one

of five China Outsourcing Bases. Similar to Bangalore and Hyderabad, the Xi’an

government is carving out a niche in IT outsourcing by creating the 400,000

square-meter Xi’an Software Park. The park has already attracted top software

and technology companies, including IBM, which is the government’s joint venture

partner in creating the software park. Sybase, SPSS, Nortel, Fujouru, and NEC

are already operating in the park. The Xi’an government anticipates that the

city’s IT outsourcing workforce will grow to 200,000 by 2010.

The Xi’an

government has a clear master plan through the year 2020 to foster economic

transformation and urbanization. For example, Xi’an is now limiting development

in the city’s famous historical Gated Wall City (or Inner Ring), which will be

revamped primarily for tourism. The city plans to relocate about 450,000

residents from the Inner Ring to the second, third, and fourth rings of the city

and beyond.

One of

the most ambitious plans is the development of a new satellite city in the

Baqiao district, about 8 kilometers from Xi’an’s center. The Xi’an government is

developing the Baqiao district into the “First Water City of the West”, complete

with high-end residential properties and hotels, international convention

centers, and a high-technology industry center. The new urban area will be home

for 900,000 middle-to-upper income residents and for firms in industries that

include R&D, services, and high-technology, plus the potential headquarters

for the Chinese operations of multinational corporations.

Emerging

as an international city

Xi’an’s

government has been proactive in enhancing the city’s international image by

hosting world class events like the Euro-Asia Economic Forum every second year

and the Formula One Powerboat World Championship. In November 2007, Xi’an hosted

the Euro-Asia Economic Forum in the Baqiao district, where high level delegates

held discussions on economic issues related to energy, finance, tourism, and

other cooperative industries. Baqiao is the permanent venue for the

Euro-Asia Economic Forum. On October 5, 2007, Xi’an hosted the Formula One

Powerboat World Championship on the Ba River near China Housing’s development

site.

To

attract international tourists, Xi’an is leveraging its famous historical and

cultural significance. Xi’an has revamped its tourism infrastructure in numerous

ways, including the redevelopment of the famous Terracotta theme park. It also

has selected China’s largest construction company to build a RMB 20 billion

($2.5 billion) theme park and a residential and commercial redevelopment project

on the grounds of the famous Da Ming Gong Palace that was built 1,300 years ago

during the Tang Dynasty.

The city

has also revamped its tourism infrastructure to attract international travelers

and is drawing large foreign retailers. The big box retailers have entered

Xi’an, including Wal-mart, Carrefour of France, and Metro of Germany. Xi’an’s

historic mystique and economic potential has also lured top luxury brands,

including Louis Vuitton, Gucci, Prada, and Versace to Xi’an.

Attracting

world-class investors

Property

markets in nearly all of China’s major cities have benefitted from capital

investments by major international developers, especially those from Hong Kong.

Xi’an is no exception.

Top Hong

Kong developer Henderson Land has signed agreements to develop two residential

projects in Xi’an. Partnering with Surbana, a unit of Singapore’s Temasek,

Henderson plans to develop a 30,000 unit residential project with a GFA of 1.5

million square meters and a budgeted cost of RMB 5 billion. Henderson will

develop 1,200 units for its second project with an estimated cost of RMB 1.3

billion. The projects give Baqiao a major vote of confidence because Henderson

Land and Temasek are two of the leading property developers and investors in

Asia. With developments adjacent to China Housing’s site, Henderson &

Temasek’s second project should benefit China Housing’s JunJing II residential

project. Because China Housing’s land was acquired at a substantially lower

cost, China Housing expects healthy margins from the JunJing II project when the

construction is finished.

Prices

catching up to fundamentals

Good

demographic and economic factors, including emerging high-tech industries and

increasing foreign capital inflow, bode well for Xi’an’s future

growth.

In 2007,

the average urban living area per person was 23.4 square meters in

Xi’an, slightly higher than China’s urban average of 22.6 square meters per

person in the same year. Xi’an has announced plans to increase the average

living area per person to 31.1 square meters by 2020, which will require an

additional 130 million square meters of new development by 2020. That growth

target is already creating significant opportunity for property

developers.

- 7

-

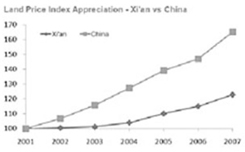

Despite

the solid economic growth and rising housing demand, real estate prices in Xi’an

are still less than half of those in the mega cities such

as Shanghai, Beijing, and Shenzhen. As shown below, land appreciation

since 2001 is lower than the national average and the gap of property

appreciation between Xi’an and tier-one cities has widened since

2002.

|

|

Sources:

National Bureau of Statistics and E-House China Real Estate Research Institute,

Xi’an Branch.

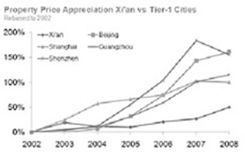

Xi’an:

Growing, leading, and still affordable

The

central government’s “Go West” policy has designated Xi’an as the regional

economic center of western China. To further encourage western China’s

development, the central government has planned to establish the Central Shanxi

Plain Economic region that will help enable the free flow of people, skills,

capital, and trade among the western provinces. Xi’an, as the economic center of

the west, will play a unique leadership role among the western tier-two

cities.

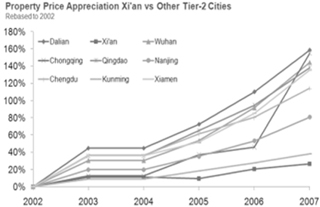

Despite

its role as the economic center of the west, compared with other tier-two

cities, shown below, Xi’an’s new-property price appreciation since 2002 is

relatively modest, making Xi’an still a very affordable city.

Sources:

E-House China Real Estate Research Institute.

2008

and Early 2009 Xi’an market update

In 2007,

China experienced the highest rise in residential property prices in the world.

The first half of 2008, however, saw a marked slowdown. The housing price index

for 70 major cities rose 7 percent in July 2008 from July 2007, the smallest

increase yet in 2008, following by a decline in those 70 cities in the fourth

quarter of 2008.

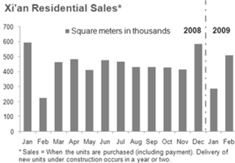

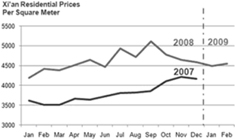

The real

estate sector in Xi’an was influenced by that broader market decline, with both

prices and volume in Xi’an falling in the fourth quarter 2008. Given the global

economic uncertainty, we believe many consumers chose to delay their new housing

decisions until the falling prices stabilized.

The Xi’an

real estate market warmed in January and February 2009, with consumers

apparently sensing that it was time to buy. Both sales volume and prices were up

as illustrated below.

Residential

pre-sales volume, measured by per square meter sold in the January-February 2009

period, increased 5.9 percent from the same two-month period of 2007, perhaps

indicating that the outlook for the Xi’an housing market may be

improving.

- 8

-

Residential

pre-sales average price per square meter increased by 4.5 percent in

January and by 7.0 percent in February 2009 compared with January and February

of 2008.

China

Housing’s pre-sales volume and prices in January and February 2009 were up over

the same periods of 2007, as well.

While the

volume and price increases in January and February are good news, it is still

too early to determine if the increases were caused by a temporary release of

pent up demand or by a sustainable upturn in the Xi’an housing

market.

|

|

|

|

|

Sources:

E-House China Real Estate Research Institute, Xi’an

Branch.

|

February

2007 and January 2008 reflect the holiday Lunar

New Year

and Spring Festival periods in China.

Sources:

E-House China Real Estate Research Institute, Xi’an Branch.

Economic

and Industry Stimulus Programs of 2008 and early 2009

Xi’an’s

real estate stimulation in 2008

To

stimulate its housing market, in August 2008, the Xi’an municipal government

announced a series of favorable new policies to encourage the growth of its

housing market by making homes more available and more affordable for Xi’an

citizens and by providing support and improvements for real estate

developers.

The Xi’an

municipal government’s new policy consists of three broad actions, which will be

in effect through the end of 2009. First, the Xi’an government is providing

subsidy discounts to consumers for housing purchases that will vary primarily by

the size of the home. Buyers will receive subsidized discounts on their home

purchase prices, with a 1.5 percent subsidy on apartments less than 90 square

meters, a 1.0 percent on medium-sized homes, and a 0.5 percent

for apartments larger than 144 square meters.

Second,

the Xi’an city government is relaxing qualifications for residential housing

loans, increasing the total RMB available for each loan, and reducing the

interest rates on the loans.

And

third, real estate developers will be able to receive subsidies and supports on

loans and land rights purchases, plus reductions in fees and taxes, and will

also benefit from streamlined project planning, approval, and oversight

processes by the city.

- 9

-

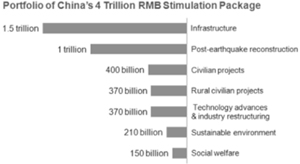

China’s

4 trillion RMB stimulation package of 2008

In

response to the global financial crisis, the People’s Republic of China

announced a 4 trillion RMB stimulation program on November 27, 2008.

Subsequently, on March 6, 2009, the National Development and Reform Commission

Director, Mr. Zhang Ping, announced a reshaping of that economic stimulus

package that retained the investment total of 4 trillion RMB but adjusted its

focus. Within the 4 trillion RMB package, about 400 billion RMB will go toward

civil works, including low-income housing and renovation. Two additional

categories (technology advances & industry restructuring for 370 billion RMB

and infrastructure for 1.5 trillion RMB) are also expected to benefit Xi’an’s

industries, and therefore further support demand in the city’s real estate

market.

Source:

Zhang Ping, National Development and Reform Commission, press conference, March

6, 2009.

China’s

10-industry stimulation of 2009

On

February 26, 2009, China’s State Council reinforced China’s 2008 stimulation

package by further measures to stimulate specific industries in 2009. The

industries include automobile, iron and steel, textiles, equipment

manufacturing, shipbuilding, electronics and information technology,

petrochemicals, light industries, nonferrous metals, and logistics.

Cautionary

disclaimer

Although

the individuals and governments around the world hope that government

stimulation efforts will have the desired effects, the global economy and global

financial markets have not yet stabilized, so the true effects of these and

perhaps additional stimulation efforts by local, provincial, and national

governments in China, as well as by other countries, remain unknowable at the

moment.

Our

Goal

Our goal

is to become the leading residential property developer in Xi’an and in other

urban markets in western China, measured by the combination of high customer

satisfaction, high quality design and construction, the gross floor area created

each year, total assets, and return on investment (IRR).

Our

Strategies

|

1.

|

Focus

on continuing to serve the greater Xi’an market and on expanding our real

estate development business into the leading urban markets in western

China, because western China —

|

|

▪

|

accounts

for about half the geographic area of China in total and a growing share

of the country’s population,

|

|

▪

|

has

substantial natural resources that are being mined and that are creating

jobs and higher incomes per capita,

|

|

|

▪

|

has

high potential GDP growth, creating higher disposable

incomes,

|

|

▪

|

has

high population growth due to —

|

|

▪

|

China’s

Go West policy that encourages people to move from the tier 1 cities to

smaller cities in the west,

|

|

▪

|

China’s

rural to urban migration, and

|

|

▪

|

the

emerging economies based on resource exploitation and plans for industry

diversification, and

|

|

▪

|

is

a market that is just emerging, so the development cost will be relatively

inexpensive but the potential price appreciation should be

attractive.

|

|

2.

|

Serve

the rapidly growing middle and upper income

families.

|

Our

target market customers appreciate our high quality and can afford our

attractive cost-effective apartments.

- 10

-

|

3.

|

Maintain

modern cost control systems to ensure cost-effective and efficient

operations.

|

We have

established modern processes and systems to analyze and manage all functions in

our company, including operating and construction schedules and associated

costs, land rights acquisition costs, cash, working capital, assets,

liabilities, bidding and selection processes, and capital

expenditures.

|

4.

|

Leverage

our strong brand.

|

With more

than 16 years in the Xi’an real estate market, China Housing has built a widely

recognized brand, using the Tsining name, that is known for high quality at

reasonable prices. Each of our seven completed projects has strengthened our

reputation, and we believe our current projects will do the same.

Our

acquisition of the Xi’an Xinxing property management company in early 2009 will

further strengthen our high-quality brand by providing outstanding property

management services to customers long after they have purchased their

apartments. The buildings and grounds will be better maintained, and the value

of the apartments should be better retained.

Our

strong brand gives us a competitive advantage in acquiring property rights,

attracting customers, negotiating prices, achieving target internal rates of

return, and expanding into other markets.

|

5.

|

Use

our access in the global capital markets to expand our organic growth and

increase our prudent acquisitions and

expansions.

|

Because

we have an unblemished record as a borrower, we have good access to capital,

both in China, and in the global capital markets. Our listing on NASDAQ in 2008

broadened investors’ and bankers’ awareness, recognition, and interest in our

Company, which has already made our access to capital easier and at relatively

lower costs.

Our

Strengths

|

1.

|

We

are effectively positioned in greater Xi’an and expect to be similarly

positioned in our targeted

locations.

|

|

2.

|

We

understand and serve our chosen target market segments (middle and

middle-upper income families) well and have a proven ability to provide

large-scale high-quality housing that our customers desire and will

cherish for many years to come.

|

|

3.

|

We

have extensive core competencies, supplemented by training and development

programs. Our core competencies, listed below, are woven into every phase

of our real estate development business. Our staff works as one integrated

team on each phase. China Housing's core competencies

include:

|

|

▪

|

Land

analysis and acquisition,

|

|

▪

|

Site

planning and development,

|

|

▪

|

Design,

architecture, engineering, and

construction,

|

|

▪

|

Environmental

awareness and actions,

|

|

▪

|

Project

management,

|

|

▪

|

Finance,

|

|

▪

|

Marketing

and sales,

|

|

▪

|

Joint

ventures and co-developments,

|

|

▪

|

Government

relations,

|

|

▪

|

Property

management,

|

|

▪

|

Demolition

and recycling, and

|

|

▪

|

Acquisition

integration.

|

4. Our

experienced management team has a proven track record of high-quality

performance and high investment returns.

In every

position, we have effective and efficient people who focus on extending our

track record of successful operating and financial performance.

Our top

five leaders have a total of more than 85 years of relevant

experience.

- 11

-

|

5.

|

Our

access to the global capital

markets.

|

We

believe our good record with our banks and investors, plus the greater awareness

and recognition created by our listing on NASDAQ and our investor relations

program, will give us continuing access to adequate capital.

|

6.

|

Our

local market knowledge and familiarity with the real estate market and

participants in northwest China.

|

We know

the real estate market, the players, and the parcels. Usually, we have the best

relationships in the industry, which give us a substantial competitive advantage

— to acquire development rights and land rights, to select the best

subcontractors and suppliers, to have the most effective marketing and sales

programs, to attract the best leaders and staff, to support the government in

implementing its desired housing policies, and to achieve our target rates of

return on investment.

Our

Property Projects

We

provide three fundamental types of real estate development

products:

|

▪

|

High-rise

apartment buildings, typically 12 to 28 stories high, usually of

steel-reinforced concrete, that are completed within about 24 months after

securing all required permits.

|

|

▪

|

Mid-rise

apartment buildings, typically 7 to 11 stories high, usually of

steel-reinforced concrete, that are completed within 12 to 18 months after

securing all required permits.

|

|

▪

|

Low-rise

apartment buildings and villas, typically 2 to 6 stories high, often of

steel-reinforced concrete, that are completed within about 12 months after

securing all required permits.

|

Our

projects can be classified into one of four stages of development:

|

▪

|

Projects

under construction, where the building construction has started but has

not yet been completed;

|

|

▪

|

Projects

in process, which include developments where typically we have secured the

development and land use rights, and where the site planning,

architecture, engineering, and infrastructure work is

progressing;

|

|

▪

|

Projects

in planning, where we have purchased the development and or land use

rights for parcels of land as part of our project development pipeline.

The completion of projects on these sites is subject to adequate

financing, permits, licensing, and certain market conditions;

and

|

|

▪

|

Completed

projects, where the construction has been finished and most of the units

in the buildings have been sold, leased, or

rented.

|

Project

under construction

|

Project

name

|

Type of

Projects

|

Actual or

Estimated

Construction

Period

|

Actual or

Estimated Pre-

sale

Commencement

Date

|

Total

Site

Area

(m2)

|

Total

Gross

Floor Area

(m2)

|

Sold GFA

by December

31,

2008

(m2)

|

||||||||||||||

|

JunJing

II phase

one

|

|

Multi-Family

residential & Commercial

|

|

Q3/

2007

- Q3/2009

|

Q2/2008 |

|

39,524 | 136,012 | 57,098 | |||||||||||

|

JunJing

II phase

two

|

|

Multi-Family

residential & Commercial

|

|

Q2/2009

- Q2/2011

|

Q3/2009 |

|

29,800 | 112,556 | - | |||||||||||

|

Puhua

Project

|

|

Multi-Family

residential & Commercial

|

|

Q2/2009

- Q32014

|

Q3/2009 |

|

192,582 | 610,000 | - | |||||||||||

|

Project

name

|

Total

Number of

Units

|

Number of

Units sold

by

December

31,

2008

|

Estimated

Revenue

(million)

|

Contracted

Revenue by

Dec 31,

2008

(million)

|

Recognized

Revenue

by

December

31, 2008

(million)

|

|||||||||||||||

|

JunJing

II phase

one

|

1,182 | 559 |

95.6

|

33.6

|

23.8 | |||||||||||||||

|

|

|

|||||||||||||||||||

|

JunJing

II phase

two

|

1,015 | - | 94.1 | - | - | |||||||||||||||

|

Puhua

Project

|

5,000 | - | 700.0 | - | - | |||||||||||||||

- 12

-

JunJing II: JunJing II is

located at 38 East Hujiamiao, Xi’an, with total GFA about 248,568 square meters.

It is the first Canadian style residential community with “green and

energy-saving” characteristics, and won the “National Energy Saving Project.”

The project is divided into 2 phases, namely JunJing II phase one and JunJing II

phase two. We started the construction of JunJing II phase one in the third

quarter of 2007 and started the presale campaign in the second quarter of

2007.

As

of December 31, 2008, our customers have signed pre-sale purchase

agreements for apartments with purchase prices totaling $33.6 million, of which

we have recognized $23.8 million in revenues in 2008 based on the

percentage of completion method of accounting. Approximately $9.2 million of

pre-sale payments were booked as advances from customers and will be recognized

as revenues as construction advances.

Puhua: The Puhua project, the

Company’s 79 acre joint venture located in the Baqiao project, has a total land

area of 192,582 square meters and an expected gross floor area of

approximately 610,000 square meters. In November 2008, the Company entered into

an agreement with Prax Capital China Real Estate Fund I, Ltd., to form a

joint venture. The joint venture was formed in late 2008, subject to certain

conditions and approvals, which have been satisfied. Prax Capital Real

Estate Holdings Limited invested US$29.3 million in cash in the joint venture,

the joint venture acquired the land use rights early in the first quarter

of 2009, and the joint venture is proceeding with the project.

The

construction of the Puhua project began in June 2009. The whole project, which

consists of four phases, is expected to be completed in the third quarter of

2014, with estimated revenues of $700 million. We will begin accepting pre-sale

purchase agreements during the third quarter of 2009. Revenue from the pre-sales

will begin to be recognized upon the completion of the foundation.

Projects

under planning and in process

|

Project

name

|

Type of

Projects

|

Estimated

Construction

Period

|

Estimated Pre-

sale

Commencement

Date

|

Total Site

Area

(m2)

|

Total GFA

(m2)

|

Total

Number of

Units

|

||||||||||||||

|

Baqiao

New Development Zone

|

Land

Development

|

2009

-

2020

|

N/A

|

N/A

|

N/A

|

N/A

|

||||||||||||||

|

JunJing

III

|

|

Multi-Family

residential & Commercial

|

Q3/2009

- Q3/2011

|

Q3/2009

|

8,094

|

51,470

|

570

|

|||||||||||||

|

Park

Plaza

|

|

Multi-Family

residential & Commercial

|

Q4/2009

- Q4/2013

|

Q1/2010

|

44,250

|

200,000

|

2,000

|

|||||||||||||

|

Golden

Bay

|

Multi-Family

residential & Commercial

|

Q4/2010

- Q4/2014

|

Q1/2011

|

160,665

|

351,812

|

N/A

|

||||||||||||||

Baqiao New Development

Zone: On March 9, 2007, we entered into a Shares Transfer

Agreement with the shareholders of Xi’an New Land Development Co., Ltd. (New

Land), under which the Company acquired 32,000,000 shares of New Land,

constituting 100 percent equity ownership of New Land. This acquisition gave the

Company the exclusive right to develop and sell 487 acres of land in a

newly designated satellite city of Xi’an. We believe this represents a major

growth opportunity for the Company.

Xi’an has

designated the Baqiao District as a major resettlement zone where the city

expects 900,000 middle to upper income people to settle. The Xi’an government

intends to generate a success similar to that created by Pudong for Shanghai,

which has resulted in new economic opportunities and provided housing for

Shanghai’s growing population.

The Xi’an

municipal government plans to invest 50 billion RMB (over $6 billion) in

infrastructure in the Baqiao New Development Zone. The construction of a

large-scale public wetland park is well underway; it will embellish the natural

environment adjacent to China Housing’s Baqiao project.

|

Through

its New Land subsidiary, China Housing sold 18.4 acres to another

developer in 2007 and generated about $24.41 million in

revenue.

In

2008, we established a joint venture with Prax Capital Real Estate

Holdings Limited (Prax Capital) to develop 79 acres within the Baqiao

project, which will be the first phase of the Baqiao project’s

development. Prax Capital invested $29.3 million cash in the joint

venture. The project is further described in Puhua section

below.

After

selling 18.4 acres and placing 79 acres in the joint venture, about 390

acres remained available for the Company to develop in the Baqiao

project.

JunJing III: JunJing

III is near our JunJing II project and the city expressway. It will

have an expected total gross floor area of about 51,470 square

meters. The project will consist of 3 high rise buildings, each 28 to 30

stories high. The project is targeting middle to high income customers who

require a high quality living environment and convenient transportation to

the city center. We plan to start construction during the third

quarter 2009 and the pre-sales during the same quarter. The total

estimated revenue from this project is about $46.0

million.

|

|

|

Park Plaza: In July 2009, the

Company entered into a Letter of Intent to acquire 44,250 square meters of land

in the center of Xi'an for the Park Plaza project. The Company intends to

develop a large mid-upper income residential and commercial development project

on this site, with a gross floor area of 200,000 square meters. The four-year

construction of Park Plaza is expected to begin in the fourth quarter 2009. We

anticipate accepting pre-sale purchase agreements in the second quarter of 2010,

and revenues from pre-sale agreements will be begin to be recognized upon the

completion of the foundation. The total revenue from Park Plaza is estimated to

be $206 million.

Golden Bay: The Golden Bay

project is located within the Baqiao project, with a total gross floor area of

351,812 square meters. The Golden Bay project will consist of a hotel, office

buildings, residential buildings, as well as a commercial area. Construction is

anticipated to begin in the fourth quarter of 2010, and we expect to begin

accepting pre-sale purchase agreements in the second quarter of 2011. Revenue

will be recognized upon the completion of the foundation.

- 13

-

Completed

Projects

|

Project name

|

Type of

Projects

|

Completion

Date

|

Total Site

Area

(m2)

|

Total GFA

(m2)

|

Total

Number of

Units

|

Number of

Units sold by

December

31,

2008

|

|||||||||||||||

|

Tsining

Mingyuan

|

|

Multi-Family

residential & Commercial

|

|

Q2/2000

|

17,526

|

53,055

|

303

|

303

|

|||||||||||||

|

Lidu

Mingyuan

|

|

Multi-Family

residential & Commercial

|

|

Q4/2001

|

5,289

|

8,284

|

56

|

56

|

|||||||||||||

|

Tsining

Hanyuan

|

Multi-Family

residential & Commercial

|

Q4/2003

|

3,026

|

32,229

|

238

|

238

|

|||||||||||||||

|

Tsining

Home IN

|

Multi-Family

residential & Commercial

|

Q4/2003

|

8,483

|

30,072

|

215

|

213

|

|||||||||||||||

|

Tsining

Gangwan

|

Multi-Family

residential & Commercial

|

Q4/2004

|

12,184

|

41,803

|

466

|

464

|

|||||||||||||||

|

Tsining-24G

|

Hotel,

Commercial

|

Q2/2006

|

8,227

|

43,563

|

773

|

672

|

|||||||||||||||

|

JunJing

I

|

Multi-Family

residential & Commercial

|

Q3/2006

|

55,588

|

167,931

|

1,671

|

1,566

|

|||||||||||||||

Tsining Mingyuan: 8 East

Youyi Road, Xi’an. The construction area was 53,055 square meters. Mingyuan is a

residential complex consisting of 303 apartments ranging from two to four

bedrooms. Construction commenced in March 1998 and was completed in April 2000.

In total, the project generated total sales of $19.98 million as of December 31,

2008.

Lidu Mingyuan: 25 East

Mutoushi, Xi’an. Located in the prime area near Xi’an historic Bell Tower, the

project covers 1.3 acres with a building area of 8,284 square meters, and has 56

apartments ranging from two to four bedrooms. The project began in October 2000

and was completed in November 2001. Total sales were $4.32 million as of

December 31, 2008

Tsining Hanyuan: 6 East Youyi

Road, Xi’an. Located in the south of Xi’an, the area is noted for its schools

and universities. The project was started in February 2002 and completed in

December 2003. It is comprised of 238 two and three bedroom apartments and

covering a total construction area of 32,229 square meters. The project

generated total sales of $14.05 million as of December 31, 2008

Tsining Home IN: 88 North

Xingqing Road, Xi’an. Located near the city center, the Home IN project consists

of 215 two and three bedroom western-style apartments. Total construction area

is 30,072 square meters. The project, completed in December 2003, generated

sales of $12.77 million in total sales as of December 31, 2008

Tsining GangWan: 123 Laodong

Road, Xi’an. Less than one mile from the western hi-tech industrial zone,

GangWan spans three acres and is comprised of eight buildings with a total

construction area of 41,803 square meters. The project began in April 2003 and

was completed in December 2004. GangWan has 466 apartments ranging from

one to three bedrooms. Total sales were $18.28 million as of December

31, 2008

Tsining-24G: 133 Changle Road, Xi’an.

24G is a redevelopment of an existing 26 floor building, located in the center

of the most mature and developed commercial belt of the city. This upscale

development includes secured parking, cable TV, hot water, air conditioning,

natural gas access, internet connection, and exercise facilities. This project

was awarded “The Most Investment Potential Award in Xi’an city” in 2006,

Its target Customer were white-collar workers, small business owners and

traders, entrepreneurs. Total area available for residential use was 43,563

square meters, covering 372 one to three bedroom serviced apartments. The

project started construction in June 2005 and was completed in June 2006. Sales

totaled $38.22 million as of December 31, 2008

Tsining JunJing Garden I: 369

North Jinhua Road, Xi’an. It is the first German style residential &

commercial community in Xi’an, designed by the world-famous WSP architectural

design house. Its target Customer is local middle income families. The project

has 15 residential apartment buildings consisting of 1,230 one to five bedroom

apartments. The Garden features secured parking, cable TV, hot water, heating

systems, and access to natural gas. Total GFA available was 167,931 square

meters. JunJing Garden I was also a commercial venture that houses small

businesses serving the needs of JunJing Garden I residents and surrounding

residential communities. The project was completed in September 2006 and

generated total revenue $48.88 million as of December 31, 2008

- 14

-

Customers

Middle

income families comprise the Company’s primary residential customer group and

represent the fastest growing segment in Xi’an as well as China in general. The

annual income for the middle-income family targeted by the Company ranges

between RMB100,000 and RMB200,000. Xi’an’s per capita GDP has grown at a 12.5

percent CAGR during the most recently available five years (2002-2007)

with continued growth anticipated over the next five years with the

strengthening of Xi’an’s economic and cultural significance in the central and

western part of China. The middle-market niche segment partially insulates the

company from direct competition with the international and national developers

in Xi’an that are targeting primarily the high-end market due to their high cost

structure and brand recognition.

Marketing

The

Company currently has seven sales managers and more than 30 primarily

commission driven direct sales employees who are on site to

service prospective clients. Its marketing campaigns typically include

television, radio, billboard, and the internet. The company also has membership

program (gold and silver members) where existing and potential customers can pay

for “points” at a discount that can be redeemed for the purchase of

property units later. The program has been very popular and provides good a

indication of future project sales and creates better cash liquidity for the

Company. The Company has been focusing on building brand equity and has

hired a third-party evaluation company to survey both existing and potential

customers about the company’s services, recognition of our

“Tsining” brand, and so on. Every year the China Housing has

achieved customer satisfaction ratings between 80-85 percent, which is very

high.

Advertising

and sales promotion costs are expensed as incurred. Advertising expense totaled

$1,261,495 in 2008 and $781,998 in 2007. The company conducted an

aggressive marketing campaign during 2008 for Tsining JunJing II, which included

advertising and fully furnished showrooms where potential buyers could see

possible layouts and decorative effects. These showrooms have attracted hundreds

of potential buyers and continue to create buyer interest and result in

additional pre-sales purchase agreements.

Suppliers

The

supply of land is controlled by the government. There are generally three ways

in which we acquire land.

|

▪

|

Purchase

by auction held by the Land Consolidation and Rehabilitation

Center;

|

|

▪

|

Purchase

by auction held by court under bankruptcy

proceedings;

|

|

▪

|

Merger

with or acquisition of a state-owned enterprise that controls developable

land.

|

All such

purchases of land are required to be reported to and authorized by the Xi’an

Bureau of Land and Natural Resources.

As for

other suppliers of design and construction services, we typically selects the

lowest-cost provider through an open bidding process. Such service providers are

numerous in China and we foresee no difficulties in securing alternative sources

of services as needed.

Intellectual

Property

We

currently have no registered intellectual property.

Research

and Development

We have

not had any material research and development expenses over the past two years.

Due to the characteristic of the housing and land development industry,

“R&D” consists of marketing research. The funding of all marketing research

is expected to come from operating cash flow.

- 15

-

Governmental

and Environmental Regulation

To date,

we have been compliant with all registrations and requirements for the issuance

and maintenance of all licenses required by the applicable governing authorities

in China. These licenses include:

“Level 1

Qualification Certificate for Real Estate Development” authorized by the

Shaanxi Construction Bureau, effective from December 20, 2006 to December 20,

2009. License number JianKaiQi (2006) 603. The housing & land development

process is regulated by the Ministry of Construction and authorized by the local

offices of the Ministry. Each development project must obtain the following

licenses:

“License

for Construction Area Planning" and "License for Construction Project Planning",

authorized by Xi’an Bureau of Municipal Design;

“Building

Permit” authorized by the Committee of Municipal and Rural

Construction;

After

construction is complete, the project must obtain a validation certificate.

There are various standards that must be met to obtain this certificate. These

standards are regulated by Local Ministry of Construction Bureau.

Housing

and land development sales companies are regulated by the Ministry of Land &

Natural Resources and authorized by the local office of the Ministry. Each

project also has to be authorized and must obtain a “Commercial License for

Housing Sale” from the Real Estate Bureau.

Competition

The real

estate industry in China tier two cities is fragmented and highly competitive.

We compete primarily with local and regional property developers and an

increasing number of large national property developers have also started

to enter these markets.

There are

developers of various sizes targeting the Xi’an real estate market, including

pure developers, subsidiaries of traditional industries, and municipal

government real estate development companies. We have divided them into three

categories: local, national, and international. The national and international

developers tend to limit themselves to the high end residential markets in

Xi’an, targeting annual family income above RMB300,000, whereas China Housing

focuses on the middle tier with annual income between RMB 100,000 and RMB

200,000.

- 16

-

Typically,

the housing and land development industry is a regional business with mostly

local players competing with us for small to medium size projects.

Local

competition

The local

Xi’an development market is fragmented with close to 350 listed developers, most

of which are of small scale and scope and currently do not have active

development projects. Tsining is one of the four Level I rated

developers in Xi’an. The other three major local companies are government

related and one is publicly listed in Shanghai Stock Exchange.

Tande Co.

(Tiandiyuan) is considered the largest developer in Xi’an. It is a government

affiliated company that has been targeting primarily the High-tech Development

Zone. China Housing has not seen any direct competition with Tande

since China Housing focuses mainly on the eastern and southern part of

Xi’an. Tande targets primarily the southwestern Xi’an.

Xi’an

Jingfa Real Estate Co., Ltd., (Jingfa) is also a state owned enterprise. So

far, Jingfa has only engaged in one project in northern Xi’an. The Company

has not seen direct competition with Jingfa.

Shaanxi

International Trust & Investment Corp., was acquired by China Minsheng

Banking Corp., Ltd., in March 2008, and is no longer in real estate

development business.

With the

new stringent government policy striving to enhance buyers’ services and reduce

property development speculation, many smaller local developers are finding it

harder and harder to survive when faced with increased regulatory oversight,

weakened ability to borrow, and enhanced international competition. This

presents an attractive opportunity for well financed and managed companies like

China Housing to acquire developers with attractive parcels of

land.

National

or regional competition

The

larger scale national developers have increased their presence in Xi’an,

including Vanke, Greenland, Guangzhou R&F, Gemdale, and China Overseas &

Land. Most of these national players target the higher end markets due to their

higher cost base and better name recognition. Their projects are located in

Qujiang and the high-tech zone of Xi’an. The average price

of Gemdale’s projects in these areas is RMB 10,438 per square meter. China

Overseas & Land’s project is priced at about RMB 6,587 per square

meters. Since China Housing targets different income levels and geographic

regions than they do, we have not seen any significant direct competition with

these national players.

International

competition

There are

a number of top international developers starting to focus on Xi’an, including

Hutchinson Whampoa, Henderson Land, Surbana, Mapletree Group, GIC Group, and so

on.

Hong

Kong’s Henderson Land and Singapore’s Temasek are working on a 30,000 unit joint

project in the Baqiao district. Known as La Botanica, the project covers

about 323 acres, with a GFA about 3 million square meters, in which residences

account for about 85 percent of the GFA, with commercial spaces occupying the

remainder. Facilities will include restaurants, a shopping mall, entertainment,