As filed with the Securities and Exchange Commission on

October 20, 2009

Registration

No. 333-160986

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 3

to

Form S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF

1933

ANCESTRY.COM INC.

(Exact name of registrant as

specified in its charter)

| |

|

|

|

|

|

DELAWARE

|

|

7379

|

|

26-1235962

|

(State or other jurisdiction

of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

360 West 4800 North

Provo, UT 84604

(801) 705-7000

(Address, including zip code,

and telephone number, including area code, of registrant’s

principal executive offices)

Timothy Sullivan

Chief Executive Officer

360 West 4800 North

Provo, UT 84604

(801) 705-7000

(Name, address, including zip

code, and telephone number, including area code, of agent for

service)

Copies to:

| |

|

|

Barbara L. Becker

Stewart L. McDowell

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, NY 10166

Tel: (212) 351-4000

Fax: (212) 351-4035

|

|

Jeffrey D. Saper

Robert G. Day

Wilson Sonsini Goodrich & Rosati

Professional Corporation

650 Page Mill Road

Palo Alto, CA 94304

Tel: (650) 493-9300

Fax: (650) 565-5147

|

Approximate date of commencement of proposed sale to the

public: As soon as practicable after this

registration statement becomes effective.

If any of the securities being registered on this form are to be

offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933, check the

following

box. o

If this form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, check

the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same

offering. o

If this form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

If this form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule

12b-2 of the

Exchange Act. (Check one):

| |

|

|

|

|

|

|

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer þ

|

|

Smaller reporting company o

|

|

|

|

|

|

(Do not check if a smaller reporting company)

|

|

|

CALCULATION

OF REGISTRATION FEE

| |

|

|

|

|

|

|

|

|

|

Title of Each Class of

|

|

|

Amount to be

|

|

|

Proposed Maximum

|

|

|

Amount of

|

|

Securities to be Registered

|

|

|

Registered(1)

|

|

|

Aggregate Offering Price(2)

|

|

|

Registration Fee(3)

|

|

Common Stock, $0.001 par value

|

|

|

8,518,518

|

|

|

$123,518,511

|

|

|

$6,892.33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Includes 1,111,111 shares that the underwriters have the

option to purchase to cover overallotments, if any.

|

|

|

| (2) |

Estimated solely for the purpose of calculating the registration

fee in accordance with Rule 457(a) under the Securities Act

of 1933, as amended.

|

|

|

| (3) |

A filing fee of $4,185 was previously paid in connection with

the initial filing of this Registration Statement on

August 3, 2009. The aggregate filing fee of $6,892.33 is

being offset by the $4,185 previously paid.

|

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective

date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the Registration

Statement shall become effective on such date as the Commission

acting pursuant to such Section 8(a) may determine.

The

information in this prospectus is not complete and may be

changed. We and the selling stockholders may not sell these

securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and we and the selling

stockholders are not soliciting offers to buy these securities

in any state where the offer or sale is not permitted.

|

PROSPECTUS

(Subject to Completion)

Issued

October 20, 2009

7,407,407 Shares

COMMON STOCK

Ancestry.com Inc. is offering 4,074,074 shares of its

common stock and the selling stockholders are offering

3,333,333 shares of common stock. We will not receive any

proceeds from the sale of shares by the selling stockholders.

This is our initial public offering and no public market

currently exists for our shares. We anticipate that the initial

public offering price of our common stock will be between $12.50

and $14.50 per share.

We have applied to list our common stock on the Nasdaq

Global Select Market under the symbol ACOM.

Investing in the common stock involves risks. See

“Risk Factors” beginning on page 13.

PRICE $ A SHARE

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriting

|

|

|

|

|

|

|

|

Price to

|

|

Discounts and

|

|

Proceeds to

|

|

Proceeds to Selling

|

|

|

|

Public

|

|

Commissions

|

|

Company

|

|

Stockholders

|

|

Per Share

|

|

$

|

|

$

|

|

$

|

|

$

|

|

Total

|

|

$

|

|

$

|

|

$

|

|

$

|

Ancestry.com Inc. has granted the underwriters the right to

purchase up to an additional 611,112 shares of common stock

to cover over-allotments and the selling stockholders have

granted the underwriters the right to purchase up to an

additional 499,999 shares of common stock to cover

over-allotments.

The Securities and Exchange Commission and state securities

regulators have not approved or disapproved these securities, or

determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock

to purchasers on ,

2009.

|

|

| MORGAN

STANLEY |

BofA MERRILL LYNCH |

|

|

|

| JEFFERIES &

COMPANY |

PIPER JAFFRAY |

BMO CAPITAL MARKETS |

,

2009

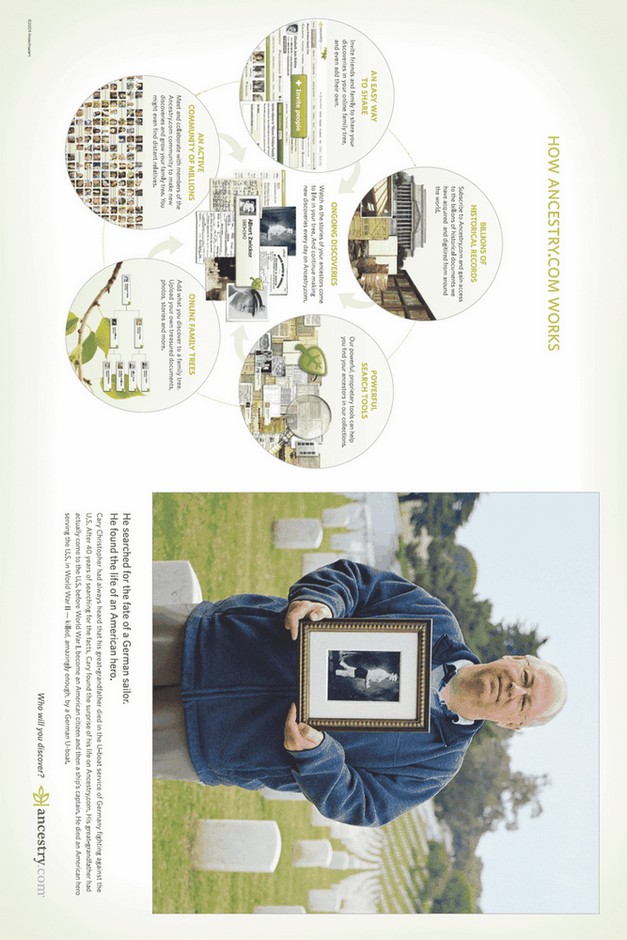

| 87% of Americans have an interest in their family history.* Every month, millions turn to

Ancestry.com® for answers.** Ancestry.com is the world’s largest online collection of family

history resources — including records, photos, stories, family trees and a collaborative community

of over a million subscribers worldwide. Our mission is to help everyone discover, preserve and

share their family history. * Based on a survey commissioned by Ancestry.com and conducted by

Harris Interactive July 15-17, 2009 via its QuickQuery online omnibus service interviewing a

nationwide sample of 2,066 U.S. adults aged 18+, of which 87% indicated that they were either “very

interested” (33%), “interested” (28%) or “somewhat interested” (26%) in learning about their

family’s history. Results were weighted as needed for age, sex, race/ethnicity, education, region,

and household income. Propensity score weighting was also used to adjust for respondents’

propensity to be online. ** comScore, 2009 ©2009 Ancestry.com |

TABLE OF

CONTENTS

You should rely only on the information contained in this

prospectus or in any free-writing prospectus we may authorize to

be delivered or made available to you. We have not, the selling

stockholders have not and the underwriters have not authorized

anyone to provide you with additional or different information.

We and the selling stockholders are offering to sell, and

seeking offers to buy, shares of our common stock only in

jurisdictions where offers and sales are permitted. The

information in this prospectus or any free-writing prospectus is

accurate only as of its date, regardless of its time of delivery

or of any sale of shares of our common stock. Our business,

financial condition, results of operations and prospects may

have changed since that date.

Until ,

2009 (25 days after the commencement of this offering), all

dealers that buy, sell or trade shares of our common stock,

whether or not participating in this offering, may be required

to deliver a prospectus. This delivery requirement is in

addition to the obligation of dealers to deliver a prospectus

when acting as underwriters and with respect to their unsold

allotments or subscriptions.

For investors outside the United States: We have not, the

selling stockholders have not and the underwriters have not done

anything that would permit this offering, or possession or

distribution of this prospectus, in any jurisdiction where

action for that purpose is required, other than in the United

States. Persons outside the United States who come into

possession of this prospectus must inform themselves about, and

observe any restrictions relating to, the offering of the shares

of common stock and the distribution of this prospectus outside

of the United States.

i

PROSPECTUS

SUMMARY

This summary highlights information contained elsewhere in

this prospectus and does not contain all of the information that

you should consider in making your investment decision. Before

investing in our common stock, you should carefully read this

entire prospectus, including our consolidated financial

statements and the related notes and the information set forth

under the headings “Risk Factors” and

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” in each case included

elsewhere in this prospectus. All information in this prospectus

has been adjusted to give effect to a 1-for-2 reverse stock

split of our common stock that will be effective immediately

prior to the consummation of the offering.

ANCESTRY.COM

INC.

Mission

Ancestry.com’s mission is to help everyone discover,

preserve and share their family history.

Overview

Ancestry.com is the world’s largest online resource for

family history, with more than one million paying subscribers

around the world as of September 30, 2009. We have been a

leader in the family history market for over 20 years and

have helped pioneer the market for online family history

research. We believe that most people have a fundamental desire

to understand who they are and from where they came, and that

anyone interested in discovering, preserving and sharing their

family history is a potential user of Ancestry.com. We strive to

make our service valuable to individuals ranging from the most

committed family historians to those taking their first steps

towards satisfying their curiosity about their family stories.

The foundation of our service is an extensive and unique

collection of billions of historical records that we have

digitized, indexed and put online over the past 12 years.

We have developed efficient and proprietary systems for

digitizing handwritten historical documents, and have

established relationships with national, state and local

government archives, historical societies, religious

institutions and private collectors of historical content around

the world. These digital records and documents, combined with

our proprietary online search technologies and tools, enable our

subscribers to research their family history, build their family

trees and make meaningful discoveries about the lives of their

ancestors.

We have built the world’s largest online community of

people interested in their family histories, and we believe that

this network is highly valuable to our subscribers. Our

community is a large and growing source of user-generated

content uniquely focused on family history. Over the past three

years, our registered users have created over 12 million

family trees containing more than 1.25 billion profiles.

They have uploaded and attached to their trees over

26 million photographs, scanned documents, written stories

and audio clips. This growing pool of user-generated content

adds color and context to the family histories assembled from

the digitized historical documents found on Ancestry.com. Our

subscribers also have attached to their trees over

333 million records from our company-acquired content

collection, a process that is helping further organize this

collection by associating specific records with people in family

trees.

In addition, we are deploying tools and technologies to

facilitate social networking and crowd sourcing, a means of

leveraging collaborative efforts. These tools and technologies

are intended to provide our subscribers with an expanding family

history collaboration network in which insights and discoveries

are shared by relatives, distant and close. Our service also

provides a platform from which our subscribers can share their

stories. Subscribers can invite family and friends to help build

their family trees, add personal memories and upload photographs

and stories of their own.

We provide ongoing value to our subscribers by regularly adding

new historical content, enhancing our websites with new tools

and features and enabling greater collaboration among our users

through the growth of our global community. Our plan to achieve

long-term and sustainable growth is to increase our subscriber

base in the United States and around the world by serving our

loyal base of existing subscribers and by attracting new

1

subscribers. Our revenues have increased from

$122.6 million in 2004 to $197.6 million in 2008, a

compound annual growth rate of 12.7%.

Industry

Background

Societies around the world have historically documented the

names, dates and places associated with important events of

their citizenry. However, due to the vast, dispersed and

disorganized nature of these data collections, the process of

researching family history generally has been time consuming,

painstaking and expensive. The introduction of web-based

technologies greatly enhances opportunities to make family

history research easier, but businesses attempting to leverage

the Internet must tailor their products and services to address

the distinctive challenges of family history research.

The

Ancestry.com Solution

Through the design and development of a unique consumer Internet

application and underlying proprietary technologies, substantial

investment in content and the aggregation of network scale, we

are revolutionizing how people discover, preserve and share

their family history. Our solution includes:

Consumer

Benefits

Easy-to-use

website. Our technology platform makes family

history research and networking easier, more enjoyable and more

rewarding. We seek to make Ancestry.com relevant and easy to use

for both new and experienced subscribers, and we continue to

advance our online tools to help our subscribers efficiently

search our content, organize their research, collaborate with

others and share their stories.

Easy access to comprehensive data sources. We

have aggregated and organized a comprehensive collection of

historical records, with a particular emphasis on records from

the United States, the United Kingdom and Canada. Our

technologies allow subscribers to locate relevant family history

records quickly and easily, resulting in a rewarding experience

for new subscribers and experienced family historians alike.

Subscribers input information that they know about their

relatives, however limited, and can immediately view the vast

content sources available to populate their family trees. Our

proprietary record hinting technology suggests content to our

subscribers, alerting them through “hints” delivered

online and by email of potential matches to further populate

their trees from our company-acquired and user-generated content.

Valuable community. Our community of family

history enthusiasts is a significant component of our

subscription value proposition. Our subscribers can collaborate,

contribute content and assist each other with family history

research. The publicly available family trees created by our

registered users can provide new subscribers with a substantial

head start researching their families and the opportunity to

connect with relatives interested and engaged in the discovery

and preservation of a shared family lineage.

Competitive

Advantages

Proprietary technology platform provides robust search

capability and ease of use. We have built a

scalable, proprietary technology platform. Our search technology

is designed to deal with the inherent difficulties of searching

historical content. Our record hinting technology locates and

pushes relevant content to our registered users. Our

digitization and indexing processes streamline the complex and

time-consuming task of putting historical records online.

Extensive and accessible content

collection. We have digitized and indexed the

largest online collection of family history records in the

world, with collections from the United States, the United

Kingdom, Australia and Canada, as well as Germany, France,

Italy, Sweden and China. We have invested approximately

$80 million to date in making this content available to

subscribers and continue to invest a substantial amount of time

and money to acquire or license, digitize, index and publish

additional records for our subscribers. In total, our

collections represent over four billion records and an estimated

eight billion names.

Community of dedicated and highly engaged subscribers

enhances our value proposition. We have an active

and dedicated community of subscribers, approximately 43% of

whom have been subscribers for more

2

than two years as of September 30, 2009. In the eight

months ended August 2009, visitors to our websites spent an

average of 18.8 minutes on our websites per usage day,

according to monthly data from comScore. We believe our online

community is highly valuable to our subscribers, because the

ever expanding pool of user-generated content and collaboration

and sharing opportunities can significantly enhance the family

history research process.

Growth

Strategy

Our goal is to remain the leading online resource for family

history and to grow our subscriber base in the United States and

around the world by offering a superior value proposition to

anyone interested in learning more about their family history.

We will focus on retaining our loyal base of existing

subscribers, on acquiring new subscribers and on expanding the

market to new consumers. In pursuit of these goals, we will

continue to focus on the following objectives:

Continue to build our premium brand and drive category

awareness. Over the past three years, we have

expanded and improved our consumer marketing activities in the

United States, which we believe has substantially increased our

brand awareness. We believe that continued investments in

consumer marketing and promotion will allow us to enhance our

premium brand, increase awareness of the family history category

and enhance our ability to acquire new subscribers.

Further improve our product and user

experience. We believe that investments in our

product platform can make family history research easier, more

enjoyable and more accessible. We continuously seek to advance

and improve our core search and hinting technologies, our

document image viewer, our family tree building and viewing

experience and our sharing and publishing capabilities. We

believe that we can leverage the latest web technologies to

further transform the way people discover family history online.

Regularly add new content. A vast universe of

historical records around the world is yet to be digitized, and

we intend to continue to expand our collection of digital

historical records. We will seek to maintain and extend our

existing relationships with archives and other holders of

content throughout the world and to find new sources of unique

family history content. We also plan to continue to promote the

growth of user-generated content by making the Ancestry.com

websites even better places to upload and share personal family

history documents and memories.

Enhance our collaboration technologies. With

more than one million subscribers around the world as of

September 30, 2009, we believe that we have the scale to

further expand our unique family history collaboration network

and to help relatives share insights and discoveries about

common ancestors. We believe that collaboration is a fundamental

part of family history research and that social networking

technologies applied to family history research can provide our

subscribers with even greater value. We intend to make family

history research more collaborative and appealing to a larger

market.

Grow our business internationally. We believe

that our business model of digitizing historical content and

making records available online has appeal in multiple markets

around the world, and we will seek to implement this model in

other international markets. In the third quarter of 2009, we

launched an initial version of Mundia.com, a lower-priced family

history networking product intended for markets where we do not

have a presence.

Risks

Associated with Our Business

Our business is subject to numerous risks and uncertainties, as

discussed more fully in the section entitled “Risk

Factors” immediately following this prospectus summary. We

generate substantially all of our revenues from subscriptions to

our products and services, and if our efforts to satisfy, retain

and attract subscribers are not successful, we may experience

higher rates of monthly subscriber churn and our revenues and

profitability could be adversely affected. We face competition

from a number of sources, some of which provide access to

records free of charge. Because of our dependence on family

history products and services for substantially all of our

revenues, factors such as changes in consumer preferences for

our products and challenges in acquiring and making available

online historical content may have a disproportionately greater

impact on us than if we offered multiple products

3

and services. Our attempts to grow internationally may prove

difficult due to, among other things, legislation in various

jurisdictions, cultural impediments, and costs and difficulties

associated with acquiring relevant content. Additionally, our

recent revenue growth may not be sustainable.

The

Spectrum Investment

We operated as The Generations Network, Inc., which we refer to

as the predecessor, until December 5, 2007. On

December 5, 2007, Generations Holding, Inc., which we refer

to as the successor, acquired The Generations Network, Inc. in

connection with an investment by Spectrum Equity

Investors V, L.P. and certain of its affiliates, which we

refer to collectively as Spectrum. The successor was created for

the sole purpose of acquiring the predecessor and had no prior

operations.

The total purchase price for this transaction, which we refer to

as the Spectrum investment, was $354.8 million, at an

effective per share price of $5.40. The total purchase price

consisted of $249.1 million of cash, $95.7 million in

value of previously owned stock of predecessor,

$8.2 million of stock option fair value assumed by the

successor and $1.8 million of transaction related expenses.

The cash consisted of approximately $100 million invested

by Spectrum, $9.8 million invested by other shareholders

and $140 million of borrowings under the term loan portion

of our credit facility. Spectrum invested equity of our

predecessor with an aggregate value of $38.6 million.

Spectrum and certain of its affiliates currently hold

approximately 67% of the outstanding shares of our common stock.

The remaining approximately 33% of our currently outstanding

shares of common stock is primarily held by a variety of

corporate and individual investors and employees, including

affiliates of Crosslink Capital, Inc., W Capital Partners II,

L.P., the JLS Revocable Trust and Timothy Sullivan, our

president and chief executive officer, who obtained their shares

of our common stock in connection with the Spectrum investment

by contributing equity valued at an aggregate amount of

$57.1 million or investing cash in the aggregate amount of

$9.8 million. A small percentage of our outstanding common

stock is also held by current or former employees who exercised

stock options. See “Related Party Transactions” for

further information about the terms of the Spectrum investment.

As a result of the accounting for the Spectrum investment, our

fiscal year 2007 is divided into a predecessor period from

January 1, 2007 through December 5, 2007 and a

successor period from December 6, 2007 through

December 31, 2007.

Corporate

Information

Our principal executive offices are located at 360 West

4800 North, Provo, UT 84604, and our telephone number at that

address is

(801) 705-7000.

Our corporate website address is www.ancestry.com. We do

not incorporate the information contained on, or accessible

through, our corporate website into this prospectus, and you

should not consider it part of this prospectus. We were

originally incorporated in Utah in 1983 under the name Ancestry,

Inc. We changed our name to Ancestry.com, Inc. in July 1998 and

reincorporated in Delaware in November 1998. Our name was

subsequently changed to MyFamily.com, Inc. in November 1999, and

then to The Generations Network, Inc. in November 2006.

In July 2009, to better align our corporate identity with the

premier branding of Ancestry.com, we changed our name to

Ancestry.com Inc. References herein to “Ancestry.com,”

the “company,” “we,” “our” and

“us” refer to the operations of Ancestry.com Inc. and

its consolidated subsidiaries in both the predecessor and

successor periods, unless otherwise specified. We are a holding

company, and substantially all of our operations are conducted

by our wholly-owned subsidiary Ancestry.com Operations Inc.,

which we refer to as the operating company, and its

subsidiaries. Our operations consist primarily of our flagship

website Ancestry.com, which is a part of a global family of

websites that includes Ancestry.co.uk, Ancestry.com.au,

Ancestry.ca, Ancestry.de, Ancestry.fr, Ancestry.it and

Ancestry.se. We refer to these websites collectively as the

Ancestry.com websites.

4

Terminology

In this prospectus we use the terms subscriber, registered user,

record, database and title.

A subscriber is an individual who pays for renewable access to

one of our Ancestry.com websites, and a registered user is a

person who has registered on one of our Ancestry.com websites,

including subscribers.

We use the term “record” in different ways depending

on the content source. When referring to a number of records in

certain of our company-acquired content collections, such as a

census record, we mean information about each specific person.

For example, a draft card will typically be counted as one

record, as will each line in a census, because each contains

information about a specific individual. When referring to

unstructured data, such as a newspaper, we define each page in

those data sources as a record. When referring to a number of

databases, we mean groups of records we have distinguished as

unique sets based on one or more common characteristics shared

by the records in each set, such as a common time period, place

or subject matter. When referring to a number of titles, we mean

an individual book, directory or newspaper title. For example,

The New York Times counts as a single title, regardless

of the number of editions we have online.

5

THE

OFFERING

| |

|

|

|

Common stock offered by Ancestry.com

|

|

4,074,074 shares

|

|

Common stock offered by the selling stockholders

|

|

3,333,333 shares

|

|

Total common stock offered

|

|

7,407,407 shares

|

|

Total common stock to be outstanding after this offering

|

|

42,402,916 shares

|

|

Use of proceeds

|

|

We expect to use the net proceeds from this offering as follows:

|

|

|

|

• approximately $12.1 million to

repay a portion of our credit facility; and

|

|

|

|

• the remainder for working capital and

other general corporate purposes, which may include the

acquisition of other businesses, products or technologies;

however, we do not have commitments for any acquisitions at this

time.

|

|

|

|

We will not receive any proceeds from the sale of shares by the

selling stockholders. See “Use of Proceeds.”

|

|

Risk Factors

|

|

See “Risk Factors” for a discussion of factors that

you should consider carefully before deciding whether to

purchase shares of our common stock.

|

|

Nasdaq Global Select Market symbol

|

|

ACOM

|

Except as otherwise indicated, all information in this

prospectus:

|

|

|

| |

•

|

assumes a reverse stock split of 1-for-2 of our shares of common

stock effective immediately prior to the consummation of this

offering;

|

|

|

|

| |

•

|

assumes that the underwriters will not exercise their option to

purchase 611,112 additional shares from us and 499,999

additional shares from the selling stockholders;

|

|

|

|

| |

•

|

excludes 10,326,588 shares issuable upon the exercise of

options outstanding as of September 30, 2009 with a

weighted average exercise price of $5.21 per share; and

|

|

|

|

| |

•

|

excludes an estimated 2,120,146 shares reserved for issuance

pursuant to future grants of awards under our 2009 Stock

Incentive Plan as of the date of this prospectus.

|

6

SUMMARY

CONSOLIDATED HISTORICAL AND UNAUDITED PRO FORMA FINANCIAL

DATA

The following tables summarize the consolidated historical and

unaudited pro forma financial and operating data for the periods

indicated. The summary consolidated statements of operations

data presented below for the year ended December 31, 2006,

the predecessor period from January 1, 2007 through

December 5, 2007, the successor period from

December 6, 2007 through December 31, 2007 and the

year ended December 31, 2008 have been derived from our

consolidated financial statements which have been audited by

Ernst & Young LLP, an independent registered public

accounting firm and included elsewhere in this prospectus. The

summary consolidated statements of operations data for the nine

month periods ended September 30, 2008 and 2009 and the

balance sheet data at September 30, 2009 are derived from

our unaudited interim consolidated financial statements included

elsewhere in this prospectus and include all adjustments,

consisting of normal and recurring adjustments, that we consider

necessary for a fair presentation of the financial position and

results of operations as of and for such periods. Operating

results for the nine months ended September 30, 2009 are

not necessarily indicative of the results that may be expected

for the full 2009 fiscal year. The unaudited consolidated pro

forma financial data for the fiscal year ended December 31,

2007 has been prepared to give effect to the Spectrum investment

in the manner described under “Unaudited Consolidated Pro

Forma Financial Data” and the notes thereto. The pro forma

adjustments are based upon available information and certain

assumptions that we believe are reasonable. The unaudited

consolidated pro forma financial data are for informational

purposes only and do not purport to represent what our results

of operations actually would have been if the Spectrum

investment had occurred on January 1, 2007, and such data

do not purport to project the results of operations for any

future period. See “Risk Factors” and the notes to our

consolidated financial statements included elsewhere in this

prospectus. You should read the summary data presented below in

conjunction with our consolidated financial statements, the

notes to our consolidated financial statements, “Unaudited

Consolidated Pro Forma Financial Data” on page 38 of

this prospectus and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations”

included elsewhere in this prospectus.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor

|

|

|

|

Successor

|

|

|

Pro Forma

|

|

|

Successor

|

|

|

|

|

|

|

|

Period from

|

|

|

|

Period from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

Jan. 1, 2007

|

|

|

|

Dec. 6, 2007

|

|

|

Year Ended

|

|

|

Year Ended

|

|

|

Nine Months Ended

|

|

|

|

|

December 31,

|

|

|

through

|

|

|

|

through

|

|

|

December 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

|

|

2006

|

|

|

Dec. 5, 2007

|

|

|

|

Dec. 31, 2007

|

|

|

2007

|

|

|

2008

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands, except per share data)

|

|

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription revenues

|

|

$

|

137,643

|

|

|

$

|

141,141

|

|

|

|

$

|

11,692

|

|

|

$

|

152,833

|

|

|

$

|

181,391

|

|

|

$

|

133,616

|

|

|

$

|

152,506

|

|

|

Product and other revenues

|

|

|

12,909

|

|

|

|

12,269

|

|

|

|

|

1,278

|

|

|

|

13,547

|

|

|

|

16,200

|

|

|

|

11,542

|

|

|

|

12,287

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

150,552

|

|

|

|

153,410

|

|

|

|

|

12,970

|

|

|

|

166,380

|

|

|

|

197,591

|

|

|

|

145,158

|

|

|

|

164,793

|

|

|

Cost of revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of subscription revenues

|

|

|

27,344

|

|

|

|

33,590

|

|

|

|

|

2,462

|

|

|

|

36,212

|

|

|

|

38,187

|

|

|

|

27,699

|

|

|

|

29,755

|

|

|

Cost of product and other revenues

|

|

|

3,695

|

|

|

|

2,552

|

|

|

|

|

500

|

|

|

|

3,052

|

|

|

|

5,427

|

|

|

|

3,292

|

|

|

|

4,213

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cost of revenues

|

|

|

31,039

|

|

|

|

36,142

|

|

|

|

|

2,962

|

|

|

|

39,264

|

|

|

|

43,614

|

|

|

|

30,991

|

|

|

|

33,968

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

119,513

|

|

|

|

117,268

|

|

|

|

|

10,008

|

|

|

|

127,116

|

|

|

|

153,977

|

|

|

|

114,167

|

|

|

|

130,825

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology and development

|

|

|

28,280

|

|

|

|

31,255

|

|

|

|

|

3,517

|

|

|

|

33,754

|

|

|

|

33,206

|

|

|

|

23,705

|

|

|

|

26,690

|

|

|

Marketing and advertising

|

|

|

51,421

|

|

|

|

42,400

|

|

|

|

|

3,157

|

|

|

|

45,607

|

|

|

|

52,341

|

|

|

|

36,634

|

|

|

|

44,226

|

|

|

General and administrative

|

|

|

26,978

|

|

|

|

20,723

|

|

|

|

|

2,142

|

|

|

|

22,964

|

|

|

|

28,931

|

|

|

|

21,035

|

|

|

|

24,569

|

|

|

Amortization of acquired intangible assets

|

|

|

2,216

|

|

|

|

2,132

|

|

|

|

|

1,542

|

|

|

|

24,061

|

|

|

|

23,779

|

|

|

|

17,832

|

|

|

|

12,165

|

|

|

Transaction related expenses

|

|

|

—

|

|

|

|

9,530

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

108,895

|

|

|

|

106,040

|

|

|

|

|

10,358

|

|

|

|

126,386

|

|

|

|

138,257

|

|

|

|

99,206

|

|

|

|

107,650

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor

|

|

|

|

Successor

|

|

|

Pro Forma

|

|

|

Successor

|

|

|

|

|

|

|

|

Period from

|

|

|

|

Period from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

Jan. 1, 2007

|

|

|

|

Dec. 6, 2007

|

|

|

Year Ended

|

|

|

Year Ended

|

|

|

Nine Months Ended

|

|

|

|

|

December 31,

|

|

|

through

|

|

|

|

through

|

|

|

December 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

|

|

2006

|

|

|

Dec. 5, 2007

|

|

|

|

Dec. 31, 2007

|

|

|

2007

|

|

|

2008

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands, except per share data)

|

|

|

Income (loss) from operations

|

|

|

10,618

|

|

|

|

11,228

|

|

|

|

|

(350

|

)

|

|

|

730

|

|

|

|

15,720

|

|

|

|

14,961

|

|

|

|

23,175

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(946

|

)

|

|

|

(756

|

)

|

|

|

|

(1,146

|

)

|

|

|

(12,841

|

)

|

|

|

(12,355

|

)

|

|

|

(9,327

|

)

|

|

|

(4,784

|

)

|

|

Interest income

|

|

|

2,238

|

|

|

|

2,051

|

|

|

|

|

289

|

|

|

|

348

|

|

|

|

872

|

|

|

|

632

|

|

|

|

746

|

|

|

Other income (expense), net

|

|

|

834

|

|

|

|

266

|

|

|

|

|

7

|

|

|

|

273

|

|

|

|

(8

|

)

|

|

|

(18

|

)

|

|

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

12,744

|

|

|

|

12,789

|

|

|

|

|

(1,200

|

)

|

|

|

(11,490

|

)

|

|

|

4,229

|

|

|

|

6,248

|

|

|

|

19,151

|

|

|

Income tax (expense) benefit

|

|

|

(4,595

|

)

|

|

|

(5,018

|

)

|

|

|

|

(103

|

)

|

|

|

4,251

|

|

|

|

(1,845

|

)

|

|

|

(2,748

|

)

|

|

|

(6,927

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

8,149

|

|

|

$

|

7,771

|

|

|

|

$

|

(1,303

|

)

|

|

$

|

(7,239

|

)

|

|

$

|

2,384

|

|

|

$

|

3,500

|

|

|

$

|

12,224

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common

share:(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.06

|

|

|

$

|

0.09

|

|

|

$

|

0.32

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.06

|

|

|

$

|

0.09

|

|

|

$

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

In connection with the Spectrum

investment, we were recapitalized. As a result, the capital

structure of our predecessor is not comparable to that of the

successor. Accordingly, net income per common share is not

comparable or meaningful for periods prior to 2008 and has not

been presented.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor

|

|

|

|

Successor

|

|

|

|

|

|

|

|

Period from

|

|

|

|

Period from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

Jan. 1, 2007

|

|

|

|

Dec. 6, 2007

|

|

|

Year Ended

|

|

|

Nine Months Ended

|

|

|

|

|

December 31,

|

|

|

through

|

|

|

|

through

|

|

|

December 31,

|

|

|

September 30,

|

|

|

|

|

2006

|

|

|

Dec. 5, 2007

|

|

|

|

Dec. 31, 2007

|

|

|

2008

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands)

|

|

|

Other Financial Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted

EBITDA(1)

|

|

$

|

30,455

|

|

|

$

|

39,344

|

|

|

|

$

|

3,755

|

|

|

$

|

62,645

|

|

|

$

|

49,062

|

|

|

$

|

52,878

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash

flow(1)

|

|

|

4,212

|

|

|

|

14,025

|

|

|

|

|

1,774

|

|

|

|

31,712

|

|

|

|

28,018

|

|

|

|

23,848

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense included in:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of subscription revenues

|

|

$

|

31

|

|

|

$

|

73

|

|

|

|

$

|

3

|

|

|

$

|

80

|

|

|

$

|

60

|

|

|

$

|

78

|

|

|

Technology and development

|

|

|

224

|

|

|

|

260

|

|

|

|

|

23

|

|

|

|

1,132

|

|

|

|

791

|

|

|

|

1,223

|

|

|

Marketing and advertising

|

|

|

196

|

|

|

|

279

|

|

|

|

|

27

|

|

|

|

254

|

|

|

|

180

|

|

|

|

273

|

|

|

General and administrative

|

|

|

3,338

|

|

|

|

286

|

|

|

|

|

24

|

|

|

|

3,206

|

|

|

|

2,478

|

|

|

|

2,691

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stock-based compensation expense

|

|

$

|

3,789

|

|

|

$

|

898

|

|

|

|

$

|

77

|

|

|

$

|

4,672

|

|

|

$

|

3,509

|

|

|

$

|

4,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Income from operations and net

income, and therefore adjusted EBITDA and free cash flow,

include an expense related to a settlement in the third quarter

of 2009 of a claim regarding the timeliness and accuracy of a

content index we created. The settlement resulted in an expense

of approximately $2.3 million in 2009.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

Year Ended December 31,

|

|

September 30,

|

|

|

|

2006

|

|

2007

|

|

2008

|

|

2008

|

|

2009

|

|

|

|

Other

Data:(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

subscribers(2)

|

|

|

734,386

|

|

|

|

832,193

|

|

|

|

913,683

|

|

|

|

893,882

|

|

|

|

1,028,180

|

|

|

Subscriber additions

|

|

|

569,851

|

|

|

|

479,663

|

|

|

|

556,045

|

|

|

|

412,276

|

|

|

|

508,750

|

|

|

Monthly

churn(3)

|

|

|

|

|

|

|

3.5

|

%

|

|

|

4.0

|

%

|

|

|

4.0

|

%

|

|

|

3.9

|

%

|

|

Subscriber acquisition

cost(4)

|

|

$

|

49.29

|

|

|

$

|

70.96

|

|

|

$

|

71.99

|

|

|

$

|

69.46

|

|

|

$

|

68.32

|

|

|

Average monthly revenue per

subscriber(4)

|

|

$

|

14.52

|

|

|

$

|

14.83

|

|

|

$

|

16.09

|

|

|

$

|

15.95

|

|

|

$

|

16.50

|

|

|

|

|

|

(1)

|

|

The terms total subscribers,

monthly churn, subscriber acquisition cost and average monthly

revenue per subscriber are defined in the

“Management’s Discussion and Analysis of Financial

Condition and Results of Operation — Key Business

Metrics” section.

|

|

(2)

|

|

Total subscribers were 600,411 and

681,632 for the years ended December 31, 2004 and 2005,

respectively.

|

|

(3)

|

|

Monthly churn is the average

monthly churn for the quarters included in the periods shown.

Monthly churn is not comparable for the year ended

December 31, 2006 due to a change in the packaging of our

products and services, and accordingly, has not been presented.

|

|

(4)

|

|

Based on pro forma expenses and

revenues for 2007. See “Unaudited Consolidated Pro Forma

Financial Data” on page 38 of this prospectus.

|

8

| |

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2009

|

|

|

|

|

Actual

|

|

|

As adjusted

|

|

|

|

|

(in thousands)

|

|

|

|

|

Balance Sheet

Data:(1)

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments

|

|

$

|

60,593

|

|

|

$

|

96,893

|

|

|

Total assets

|

|

|

476,296

|

|

|

|

512,596

|

|

|

Deferred revenues

|

|

|

69,850

|

|

|

|

69,850

|

|

|

Long-term debt (including current portion)

|

|

|

114,669

|

|

|

|

102,569

|

|

|

Total liabilities

|

|

|

239,482

|

|

|

|

227,382

|

|

|

Total stockholders’ equity

|

|

|

236,814

|

|

|

|

285,214

|

|

|

|

|

|

(1)

|

|

We have presented this summary

balance sheet (i) on an actual basis and (ii) on an as

adjusted basis to reflect our sale of 4,074,074 shares of

our common stock in this offering at an assumed initial public

offering price of $13.50 per share, which is the midpoint

of the range set forth on the cover page of this prospectus,

after deducting estimated underwriting discounts and commissions

and estimated offering expenses payable by us and the

application of the net proceeds of this offering as set forth

herein. Each $1.00 increase or decrease in the assumed initial

public price of $13.50 per share, the midpoint of the range set

forth on the cover page of this prospectus, would increase or

decrease the amount of cash and cash equivalents by

approximately $2.8 million, total stockholders’ equity

by approximately $3.8 million, and long term debt

(including current portion) by approximately $1.0 million,

assuming the number of shares offered by us as set forth on the

cover page of this prospectus remains the same and after

deducting the estimated underwriting discounts and commissions

and estimated expenses payable by us. The as adjusted

information presented is illustrative only and will change based

on the actual initial public offering price and other terms of

this offering determined at pricing.

|

Definitions

of Other Financial Data

Adjusted EBITDA. We define adjusted EBITDA as net

income (loss) plus net interest (income) expense; income tax

expense; non-cash charges including depreciation, amortization,

impairment of intangible assets and stock-based compensation

expense; other (income) expense and expenses associated with the

Spectrum investment, such as in-process research and development

and transaction expenses.

Free cash flow. We define free cash flow as net

income (loss) plus net interest (income) expense; income tax

expense; non-cash charges including depreciation, amortization,

impairment of intangible assets and stock-based compensation

expense; other (income) expense and expenses associated with the

Spectrum investment, such as in-process research and development

and transaction expenses, and minus capitalization of content

database costs, capital expenditures and cash paid for income

taxes and interest expense.

Discussion

of other financial data

Adjusted EBITDA and free cash flow are financial data that are

not calculated in accordance with GAAP. The table below provides

a reconciliation of these non-GAAP financial measures to net

income (loss), the most directly comparable financial measure

calculated and presented in accordance with GAAP. Adjusted

EBITDA and free cash flow should not be considered as an

alternative to net income, income from operations or any other

measure of financial performance calculated and presented in

accordance with GAAP. Our adjusted EBITDA or free cash flow may

not be comparable to similarly titled measures of other

companies because other companies may not calculate adjusted

EBITDA or free cash flow or similarly titled measures in the

same manner as we do. We prepare adjusted EBITDA and free cash

flow to eliminate the impact of items that we do not consider

indicative of our core operating performance. We encourage you

to evaluate these adjustments and the reasons we consider them

appropriate, as well as the material limitations of non-GAAP

measures and the manner in which we compensate for those

limitations.

Our management uses adjusted EBITDA and is increasingly using

free cash flow:

|

|

|

| |

•

|

as measures of operating performance;

|

| |

| |

•

|

as factors when determining management’s incentive

compensation;

|

| |

| |

•

|

for planning purposes, including the preparation of our annual

operating budget;

|

9

|

|

|

| |

•

|

to allocate resources to enhance the financial performance of

our business;

|

| |

| |

•

|

to evaluate the effectiveness of our business

strategies; and

|

| |

| |

•

|

in communications with our board of directors concerning our

financial performance.

|

Management also uses adjusted EBITDA to evaluate compliance with

the debt covenants in our credit facility, which include an

EBITDA covenant that is substantially similar to adjusted

EBITDA. The definition of EBITDA under our credit facility

differs from our definition of adjusted EBITDA in this

prospectus primarily because the definition in the credit

facility does not exclude interest income (though it does

exclude interest expense) and other income (expense). See

“Management’s Discussion and Analysis of Financial

Condition — Liquidity and Capital

Resources’’ for a description of our credit facility.

Management believes that the use of adjusted EBITDA and free

cash flow provides consistency and comparability with our past

financial performance, facilitates period to period comparisons

of operations, and also facilitates comparisons with other peer

companies, many of which use similar non-GAAP financial measures

to supplement their GAAP results. Management believes that it is

useful to exclude non-cash charges such as depreciation,

amortization, impairment of intangible assets and stock-based

compensation from adjusted EBITDA and free cash flow because (i)

the amount of such non-cash expenses in any specific period may

not directly correlate to the underlying performance of our

business operations and (ii) such expenses can vary

significantly between periods as a result of new acquisitions,

full amortization of previously acquired tangible and intangible

assets or the timing of new stock-based awards, as the case may

be.

More specifically, we believe it is appropriate to exclude

stock-based compensation expense from adjusted EBITDA and free

cash flow because non-cash equity grants made at a certain price

and point in time do not reflect how our business is performing

at any particular time. While we believe that stockholders

should have information about any dilutive effect of outstanding

options and the cost of that compensation, we also believe that

stockholders should have the ability to view the

non-GAAP

financial measures that exclude these costs that management uses

to evaluate our business. The determination of stock-based

compensation expense is based on many subjective inputs at a

point in time and many of these inputs are not necessarily

directly related to the performance of our business. Therefore,

excluding this cost gives us a clearer view of the operating

performance of our business. Because of varying available

valuation methodologies, subjective assumptions and the variety

of award types that companies may use under Statement of

Financial Accounting Standards No. 123(R), which governs

the accounting treatment for

stock-based

compensation, as well as the impact of non-operational factors

such as our share price, on the magnitude of this expense,

management believes that providing

non-GAAP

financial measures that exclude this stock-based compensation

expense allows investors and analysts to make meaningful

comparisons between our operating results with those of other

companies. Stock-based compensation has been a significant

non-cash recurring expense in our business and has been used as

a key incentive offered to our employees. We believe such

compensation contributed to the revenues earned during the

periods presented and also believe it will contribute to the

generation of future period revenues. Stock-based compensation

expense will recur in future periods for GAAP purposes. There

are material limitations to our exclusion of stock-based

compensation from adjusted EBITDA and free cash flow, primarily

that these expenses reduce our GAAP net income. See below for a

further discussion of these limitations on our use of adjusted

EBITDA and free cash flow as an analytical tool, as well as the

manner in which management compensates for these limitations.

We believe it is appropriate to exclude depreciation and

amortization from adjusted EBITDA and free cash flow because

depreciation is a function of our capital expenditures which are

included in our cash flow measure, while amortization reflects

other asset acquisitions made at a point in time and their

associated costs. In analyzing the performance of our business

currently, management believes it is helpful also to consider

the business without taking into account costs or benefits

accruing from historical decisions on infrastructure and

capacity. While these matters do affect the overall financial

health of our company, they are separately evaluated and relate

to historic decisions that do not affect current operations of

our business on a cash flow basis. Further, depreciation and

amortization do not result in ongoing cash expenditures.

Investors should note that the use of assets being depreciated

or amortized contributed to revenues earned during the periods

presented and will continue to contribute to future period

revenues. This depreciation and amortization expense will recur

in future periods for GAAP purposes. There are material

limitations to our exclusion of depreciation and amortization

from adjusted

10

EBITDA and free cash flow, primarily that these expenses reduce

our GAAP net income and the assets being depreciated or

amortized will often have to be replaced in the future,

resulting in future cash requirements. See below for a further

discussion of these limitations on our use of adjusted EBITDA

and free cash flow as an analytical tool, as well as the manner

in which management compensates for these limitations.

We believe it is appropriate to exclude impairment of intangible

assets and acquired in-process research and development from

adjusted EBITDA and free cash flow because these charges relate

to specific past events. In analyzing the performance of our

business currently, management believes it is helpful also to

consider the business without taking into account costs or

benefits accruing from historical decisions or acquisitions.

Further, these charges do not result in ongoing cash

expenditures. There are material limitations to our exclusion of

impairment of intangible assets and in-process research and

design from adjusted EBITDA and free cash flow, primarily that

these expenses reduce our GAAP net income. See below for a

further discussion of these limitations on our use of adjusted

EBITDA and free cash flow as an analytical tool, as well as the

manner in which management compensates for these limitations.

Management believes that it is useful to exclude other income

(expense) from adjusted EBITDA and free cash flow because that

line item consists of items that do not correlate to the

underlying performance of our business, such as retirement and

disposal of non-operating assets and gain or loss on

non-operating investments. Management also believes that it is

useful to exclude transaction expenses and in-process research

and development expense associated with the Spectrum investment

because these expenses were incurred in connection with the

investment and therefore do not occur regularly. There are

material limitations to our exclusion of other income (expense)

from adjusted EBITDA and free cash flow, primarily that these

may include cash income or expense that increase or reduce our

GAAP net income. See below for a further discussion of these

limitations on our use of adjusted EBITDA and free cash flow as

an analytical tool, as well as the manner in which management

compensates for these limitations.

We believe adjusted EBITDA and free cash flow are useful to

investors in evaluating our operating performance because

securities analysts use adjusted EBITDA and free cash flow as

supplemental measures to evaluate the overall operating

performance of companies and we anticipate that our investor and

analyst presentations after we are public will include adjusted

EBITDA and free cash flow.

Material

limitations of non-GAAP measures

Although adjusted EBITDA and free cash flow are frequently used

by investors and securities analysts in their evaluations of

companies, adjusted EBITDA and free cash flow each have

limitations as an analytical tool, and you should not consider

them in isolation or as a substitute for analysis of our results