Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - UNIVERSAL BIOSENSORS INC | ex_284061.htm |

| 8-K - FORM 8-K - UNIVERSAL BIOSENSORS INC | ubi20210915_8k.htm |

Exhibit 10.2

Universal Biosensors Inc.

Employee Incentive Plan

Plan Rules

|

1. |

Introduction |

This Plan sets outs the rules under which Eligible Persons may, at the invitation of the Company, acquire Awards to acquire CDIs in the Company.

|

2. |

Definitions and Interpretation |

|

2.1 |

In these rules, unless the contrary intention appears, the following terms have the following meanings: |

ASX means ASX Limited ABN 98 008 624 691 or a market conducted by it (as the context requires);

Award means:

|

(a) |

an Option; |

|

(b) |

a Performance Right; |

|

(c) |

CDI; or |

|

(d) |

a Restricted CDI, |

(as applicable), or such other instrument that the Board determines, granted under these Rules in the absolute discretion of the Board and as specified in an offer;

Board means the board of directors of the Company or any relevant committee of that board (as applicable);

Bonus Issue means a Pro Rata Issue of CDIs to holders of CDIs for which no consideration is payable by them;

Business Day means any day except Saturday or Sunday or other public holiday in the State of Victoria, Australia;

CDI means a chess depositary interest, representing a Share;

Company means Universal Biosensors Inc.;

Eligible Person means any person considered by the Board to be employed by the Company or any other entity in the Group on a permanent basis (whether full time, part time or on a long term casual basis) and includes all executive and non-executive directors of the Company or any other person determined by the Board to be an employee for the purposes of this Plan; provided that such person is not a resident of the United States (other than employees on temporary assignment in the United States);

Exchange Act means the Securities Exchange Act 1934 as amended from time to time;

Exemption Conditions means the conditions set out in section 83A-35 of the Tax Act, as amended from time to time;

Exercise Price means the amount payable to exercise an Award following vesting as set out in an invitation (as adjusted or amended in accordance with these Rules);

Group means the group of related or associated companies of which the Company is the holding company and includes any entity designated by the Board to be a member of the Group (even though not a subsidiary of the Company);

Holding Lock means a mechanism arranged or approved by the Remuneration Committee and administered by the Company that prevents CDIs being transferred or otherwise disposed of by a Participant during the Restriction Period so as to ensure the Exemption Conditions are satisfied.

Liquidity Event means:

|

(a) |

the date on which an agreement for the sale of the share capital of the Company is entered into or the acquisition by one of the shareholders of fifty percent (50%) or greater of the remaining Shares, other than in the context of a solvent reconstruction where underlying beneficial ownership remains substantially unchanged; |

|

(b) |

the date on which an agreement for the disposal by whatever means (including without limitation by sale, transfer, licence, declaration of trust or otherwise) of the whole or substantially the whole of the property, business or undertaking of the Company is entered into; or |

reorganisation, merger or consolidation of the Company with another entity in which the Company will not survive.

Listed means that the Company is admitted to the official list of, or otherwise quoted on, a securities exchange;

Listing Rules means the Listing Rules of the ASX, as amended from time to time;

Option means an option to subscribe for an Award in the Company and granted under this Plan;

Participant means an Eligible Person who accepts an offer and holds an Award issued pursuant to this Plan and includes, if a Participant dies or becomes subject to a legal disability, the legal personal representative of the Participant.

Performance Right means an Award specified by the relevant notice of grant to be a 'Performance Right';

Plan means this Employee Incentive Plan;

Pro Rata Issue has the meaning given in the Listing Rules;

[Remuneration Committee means the remuneration committee of the Company];

Restricted CDIs has the meaning given to that term in clause 14;

Rules means the rules of this Plan;

Securities Act means the Securities Act of 1933 as amended from time to time;

Security Interest means a mortgage, charge, pledge, lien, encumbrance or other third party interest;

Securities Trading Policy means the Company's trading policy with respect to CDIs as amended from time to time;

Share means a fully paid share of common stock in the capital of the Company;

Tax includes any tax, levy, impost, deduction, charge, rate, contribution, duty or withholding which is assessed (or deemed to be assessed), levied, imposed or made by any government or any governmental, semi-governmental or judicial entity or authority together with any interest, penalty, fine, charge, fee or other amount assessed (or deemed to be assessed), levied, imposed or made on or in respect of any or all of the foregoing; and

Tax Act means the Income Tax Assessment Act 1997 (Cth) as amended.

|

2.2 |

In these Rules, except where the context otherwise requires: |

|

(a) |

the singular includes the plural and vice versa; |

|

(b) |

a reference to the whole or part of any legislation includes any amendment, consolidation or re-enactment of the legislation or any legislative provision substituted for the legislation and references to specific provisions includes references to successor provisions in any substituted legislation; and |

|

(c) |

headings are inserted for convenience only and do not affect construction or interpretation of these Rules. |

|

3. |

Commencement of the Plan |

This Plan takes effect on and from the date determined by the Board.

|

4. |

Rules |

The Plan shall operate in accordance with these Rules which bind the Company and each other company in the Group, and each Eligible Person and/or Participant.

|

5. |

Compliance |

|

5.1 |

No offer may be made to an Eligible Person and no Awards may be issued or transferred under the Plan if to do so would contravene any applicable laws, regulations, the Listing Rules or these Rules. |

|

5.2 |

If and to the extent applicable at any time, the issue of Awards under this Plan or to a particular Eligible Persons is subject to receipt of any necessary shareholder or other approvals under: |

|

(a) |

the Securities Act or any other law applicable to the Company; and |

|

(b) |

if the Company is Listed, the applicable Listing Rules. |

|

5.3 |

The Plan (in respect of both its terms and operation) and Awards issued to or acquired by Eligible Employees under the Plan shall satisfy the Exemption Conditions so as to permit the application of sub-sections 83A-35(1) and (2) of the Tax Act to Participants (or applicable successor provisions). |

|

6. |

Maximum Number of Awards |

|

6.1 |

The maximum number of Awards that may be granted to Participants under this Plan from time to time is limited to such number as: |

|

(a) |

is consistent with the by-laws, certificate of incorporation or other constituent documentation of the Company (as applicable); |

|

(b) |

is consistent with any regulatory constraints under the Securities Act or any other law, rule or regulation applicable to the Company, including any instruments of relief issued by ASIC from time to time relating to employee incentive schemes which the Company is relying on; |

|

(c) |

if the Company is Listed, is consistent with any applicable Listing Rules; and |

|

(d) |

is determined by the Board from time to time having regard to the limitation set out in subclauses (a) to (c) inclusive. |

|

7. |

Eligibility |

|

7.1 |

Unless the Remuneration Committee determines otherwise, Awards may be issued or transferred to a Participant under this Plan only if at both: |

|

(a) |

the date of the offer; and |

|

(b) |

the date that the Awards are intended to be issued or transferred to the Eligible Person or Participant for the purposes of the offer, |

the person is an Eligible Person and that person satisfies such other criteria the Board may from time to time decide for participation in the Plan.

|

7.2 |

Subject to complying with section 83A-35 of the Tax Act , the Company reserves the right to refuse participation in the Plan in whole or in part for any particular individual or group of individuals, even if eligibility criteria has been satisfied for participation. |

|

8. |

Invitation |

|

8.1 |

Subject to these Rules and the Tax Act, the Remuneration Committee may from time to time issue offers on behalf of the Company to such Eligible Employees and existing Participants as are determined by the Remuneration Committee to participate in the Plan. |

|

8.2 |

Awards must be granted on the terms of this Plan and any other terms specified in the notice of grant pursuant to which the Awards are offered to each Eligible Person. |

|

8.3 |

Subject to complying with Section 83A-35 of the Tax Act, each offer: |

|

(a) |

will be made in the manner and form determined by the Remuneration Committee from time to time; |

|

(b) |

will specify such matters as the Remuneration Committee determines are applicable, including without limitation: |

|

(1) |

the specified number or value of Awards being offered; and |

|

(2) |

any conditions or restrictions that the Remuneration Committee may determine attached to the offer; and |

|

(c) |

where the Award offer is for a grant of an Option or Performance Right, must include the following information: |

|

(1) |

if the Award is an Option, the requirements for exercising the Option, including any Exercise Price that will be payable and the period or periods in which the Option may be exercised; |

|

(2) |

the dates or circumstances in which Option or Performance Right may lapse; and |

|

(3) |

any other conditions which must be satisfied before the Awards vest in the Participant or are otherwise exercisable by the Participant. |

|

8.4 |

An offer under the Plan is personal to the Eligible Person or Participant (as the case may be) to whom it is made and, accordingly, the offer may only be accepted by, and Awards may be provided only to, the Eligible Person or Participant to whom the offer is made. |

|

9. |

Acceptance |

|

9.1 |

The method and form of acceptance of an offer will be determined by the Remuneration Committee from time to time. |

|

9.2 |

On acceptance of an offer in accordance with the requirements determined under clause 9.1, the Eligible Person or existing Participant (as the case may be) will be taken to have: |

|

(a) |

be bound by the constituent documents of the Company, including the Company’s by-laws and certificate of incorporation and (upon an issue of CDIs) become a member of the Company; |

|

(b) |

agreed to become a Participant and be bound by these Rules; and |

|

(c) |

irrevocably subscribe for Awards under the Plan in accordance with the terms of the offer and the acceptance form accompanying the offer. |

|

10. |

Acceptance of Awards |

|

10.1 |

The acceptance form of an Eligible Person or existing Participant, is subject to acceptance by the Remuneration Committee in accordance with clause 10.4. |

|

10.2 |

Upon acceptance by the Remuneration Committee of a duly completed and signed acceptance form, the Company must, in accordance with the terms of the offer, issue to the Eligible Person or Participant, or arrange the transfer to the Eligible Person or Participant of, the number of Awards that the Eligible Person or Participant validly offers to acquire. |

|

10.3 |

The number of Awards to be registered in any Participant's name will be the number set out in the offer and as accepted by an Eligible Person or Participant in an acceptance form. |

|

10.4 |

Unless provided for otherwise in an offer, the Remuneration Committee will be deemed to have accepted an Eligible Person's or Participant's acceptance form when it has registered the relevant Awards in the name of the Eligible Person or Participant. Nothing in any offer or acceptance form, or in these Rules, will be taken to confer on any Eligible Person or Participant any right or title to or interest in, any Awards until the Awards are so issued, allotted and registered. |

|

10.5 |

The Company will give notice, or cause notice to be given, to a Participant (or any person authorised to receive such notice on the Participant's behalf), in accordance with the Listing Rules, of the registration in the Participant's name of Awards acquired for the Participant under the Plan. |

|

11. |

Acquisition of an Award |

|

11.1 |

Awards may be acquired for registration in the name of a Participant: |

|

(a) |

by way of an allotment and issue of CDIs by the Company; |

|

(b) |

by the Company purchasing CDIs in the ordinary course of trading or otherwise on the ASX; or |

|

(c) |

by the Company purchasing CDIs by off-market purchases. |

|

11.2 |

The Company may: |

|

(a) |

issue or transfer Awards to Participants for no consideration; or |

|

(b) |

require the Eligible Person to pay application money for or on account of Awards to be acquired under the Plan. |

|

11.3 |

The Company is authorised, but not required, to bear all brokerage, commission, stamp duty or other transaction costs and expenses payable in connection with the acquisition of Awards under the Plan. |

|

12. |

Rights attaching to CDIs |

|

12.1 |

CDIs allotted or transferred under the Plan shall: |

|

(a) |

be fully paid; |

|

(b) |

rank equally with all other existing CDIs on issue; and |

|

(c) |

be subject to any restrictions of conditions as determined by the Remuneration Committee or otherwise by this Plan. |

|

12.2 |

A Participant: |

|

(a) |

is entitled to receive any dividend paid on CDIs registered in the Participant's name; |

|

(b) |

may exercise any voting rights attaching to those CDIs, or may appoint a proxy to represent and vote for him or her, at any meeting of the members of the Company; and |

|

(c) |

subject to clause 19.9, participate in all rights issues, bonus share issues in respect of those CDIs, |

which have a record date for determining entitlements on or after the date of issue or registration of those CDIs.

|

13. |

Quotation of Awards and CDIs |

|

13.1 |

Awards may not be quoted on any securities exchange on which the Company is Listed. |

|

13.2 |

The Company shall apply to ASX for official quotation of any new Awards (excluding any Restricted CDIs) issued under or for the purposes of the Plan in accordance with the Listing Rules. |

|

14. |

Restrictions on CDIs |

|

14.1 |

A Participant must not transfer, sell or otherwise dispose of, or grant (or purport to grant) any Security Interest in or over or otherwise dispose of or deal with (or purport to otherwise dispose of or deal with) any CDIs acquired under the Plan while they are Restricted CDIs. The Company may refuse to acknowledge, deal with, accept or register any disposal or purported disposal, of any or all of the Restricted CDIs. |

|

14.2 |

CDIs granted under this plan (other than as a result of the vesting of a Performance Right) will be considered Restricted CDIs from the date the CDIs are registered in the name of the Participant until the earlier of: |

|

(a) |

the date three years after the relevant date the CDIs are registered in the name of the Participant or such other date as may be determined by the Remuneration Committee in its discretion so as to satisfy the Exemption Conditions; or |

|

(b) |

the day after the date on which the Participant ceases or first ceases to be employed by a body corporate in the Group. |

|

14.3 |

A Holding Lock may be applied by the Company to Restricted CDIs and maintained for the duration of the period that those CDIs are Restricted CDIs. A Participant must not request the removal of the Holding Lock (or permit or authorise another person to do so). |

|

14.4 |

The Company shall be entitled to prescribe, take and enforce such action, steps or arrangements as it considers necessary, desirable or appropriate to enforce or give further effect to the provisions of this clause 14 in order to ensure that the Exemption Conditions and these Rules are satisfied. |

|

14.5 |

After the CDIs cease to be Restricted CDIs: |

|

(a) |

a Participant shall be entitled to submit a request to the Company for the CDIs to be released from the Plan; and |

|

(b) |

the Remuneration Committee shall be entitled at any time to release the CDIs from the Plan notwithstanding that the Participant may not have requested that the CDIs be released. |

|

15. |

Vesting and lapsing of Performance Rights and Options |

|

15.1 |

Subject to any express clause of these Rules, any Award (including Performance Right or an Option) will only vest (and, in the case of an Option, become exercisable) where each vesting conditions and any additional terms specified in the invitation letter for that Award (including Performance Right or Option) have been satisfied or otherwise waived by the Board. |

|

15.2 |

Vesting occurs upon notification from the Company to the Participant that an Award (including Performance Right or an Option) has vested pursuant to this clause 15. |

|

15.3 |

On the vesting of a Performance Right in accordance with clause 15.2, or (subject to clause 15.4) exercise of an Option in accordance with clause 16, the Company must allocate a CDI to the Participant: |

|

(a) |

by way of an allotment and issue of CDIs by the Company; |

|

(b) |

by the Company purchasing CDIs in the ordinary course of trading or otherwise on the ASX; or |

|

(c) |

by the Company purchasing CDIs by off-market purchases. |

|

15.4 |

The Company is not obliged to issue CDIs unless it has received cleared funds on account of the Exercise Price of Options. |

|

15.5 |

A Performance Right or Option will lapse on the earliest to occur of: |

|

(a) |

a date or circumstance specified in the invitation for that Performance Right or Option or a provision of these Rules as to when a Performance Right or Option lapses or expires; |

|

(b) |

failure to meet a vesting condition within the relevant vesting period specified in the invitation for that Award, or failure to meet any other condition applicable to that Award within the period specified in the invitation for that Award; or |

|

(c) |

the receipt by the Company of a notice in writing from a Participant that the Participant has elected to surrender the Award. |

|

15.6 |

Without limiting clause 15.5 , if a Participant ceases to be an Eligible Person (other than through the death or permanent disability of the Participant): |

|

(a) |

all Awards granted to a Participant which have not vested automatically lapse; and |

|

(b) |

all Awards granted to the Participant which have vested lapse on the expiry of 90 days (or such longer period as determined by the Board) after the date on which the Participant ceases to be an employee, unless the employee ceases to be an employee as a result of termination for dishonesty, fraud or cause (as defined under applicable law) in which case the Awards lapse immediately on ceasing to be an Eligible Person. |

|

15.7 |

On the death or permanent disability of a Participant: |

|

(a) |

all Awards granted to a Participant which have not vested automatically lapse; and |

|

(b) |

notwithstanding anything to the contrary in these Rules, the Awards which have already vested in the Participant prior to death or permanent disability, lapse on the expiry of 12 months after the date of the Participant's death or disability (except to the extent that the executor or beneficiaries of that Participant's estate exercise any or all of those Awards). |

|

16. |

Exercise of Options |

|

16.1 |

Where the Award is an Option and is subject to vesting conditions, it may only be exercised if it has vested and before it expires. |

|

16.2 |

When exercised, each Option held by a Participant entitles the Participant to subscribe for and to be issued one CDI (representing one fully paid underlying Share)). The subscription price for the CDI is equal to and satisfied by payment of the Exercise Price of the Option. |

|

16.3 |

No Option may be exercised if the issuance of CDIs upon exercise or the method of payment of consideration for such CDIs would constitute a violation of any applicable securities or other law or regulation. Unless the CDIs or underlying Shares are registered under the Securities Act and any applicable state securities law, as a condition to exercising an Option, the Participant shall provide the Company with such written assurances as the Company deems appropriate for the Option grant and exercise to qualify for exemption from registration. The assurances shall include a representation that such Participant is not a resident of the United States and may include, among others, a representation that the Participant intends to hold the CDIs for investment and not for distribution to the public. The Company has no obligation to register the Options or CDIs under the Securities Act or any other law or to otherwise take any actions or incur any expenses to comply with an applicable securities or other law or regulation. |

|

16.4 |

A Participant may exercise Options by lodging with the Company a notice of exercise in a form approved or accepted by the Board accompanied by payment of the aggregate Exercise Price for the Options the subject of the notice. |

|

17. |

Transfer |

|

17.1 |

A Participant may not sell, assign, transfer, grant a Security Interest over or otherwise deal with a Award that has been granted to them, unless the relevant dealing is effected by force of law on death or legal incapacity to the Participant’s legal personal representative. The Company may require that an Award be forfeited if a sale, assignment, transfer, dealing or grant of a Security Interest occurs or is purported to occur other than in accordance with these Rules.Each certificate representing the CDIs or Shares (as applicable) will bear the following legend: |

“The shares represented by this certificate have been issued in reliance on Regulation S promulgated under US Securities Act of 1933 (“Securities Act”) and may not be transferred except in accordance with Regulation S, pursuant to registration under the Securities Act or pursuant to an available exemption from registration”

|

18. |

Takeovers or Liquidity Events |

|

18.1 |

Notwithstanding anything to the contrary in these Rules, if a takeover bid is made or other formal scheme is proposed for the acquisition of some or all of the shares in the capital of the Company, a Participant may, if: |

|

(a) |

acceptance of the bid or scheme is recommended by the Directors; and |

|

(b) |

the Directors resolve to end the restriction on sale of the Awards under the Plan for the purpose of transfer to the bidder, |

accept on such terms the Participant decides in respect of some or all of the Awards registered in his or her name.

|

18.2 |

On the occurrence of a Liquidity Event: |

|

(a) |

all Awards which have not yet vested, immediately vest and all Options become exercisable ten Business Days preceding the Liquidity Event. |

|

(b) |

the Company shall give each holder of an outstanding Award (including exercisable Option or vested Performance Rights) written notice of any Liquidity Event as soon as reasonably practicable except: |

|

(1) |

in those cases where the Options will continue to be exercisable, or Performance Rights will remain outstanding, for securities in the same amount (subject to adjustment to any Exercise Price) and of the same class as the securities into which the outstanding common stock of the Company will be converted as a result of the Liquidity Event; or |

|

(2) |

in respect of Options, in those cases where the fair market value of the consideration distributable with respect to each CDI is likely to be less than the Exercise Price of the Option; |

|

(c) |

the Company may cancel any outstanding exercisable Option that is not exercised within five Business Days before a Liquidity Event, without prior notice, by paying the Participant an amount equal to the fair market value of the consideration that the Participant would receive in exchange for the CDIs underlying the Option, less the Exercise Price of the Option. |

|

(d) |

all unexercised Options shall terminate upon the closing of a Liquidity Event unless the successor entity assumes the Options or substitutes options to purchase substantially equivalent securities of the successor or its parent or subsidiary. |

|

19. |

Variations of Capital |

|

19.1 |

Prior to the allocation of CDIs upon the exercise of an Award (Options or the vesting of Performance Rights or other), the Board may, in its discretion, determine in respect of Awards (other than Restricted CDIs) to: |

|

(a) |

make adjustments to the terms of an Award granted to that Participant; or |

|

(b) |

grant additional Awards to that Participant, |

in order to minimise or eliminate any material advantage or disadvantage to a Participant resulting from a corporate action by the Company or a capital reconstruction of the Company, including a return of capital.

|

19.2 |

The applicable adjustment under clause 19.1 may be to one or more of the following: |

|

(a) |

the number of Awards (other than Restricted CDIs) to which each Participant is entitled; |

|

(b) |

the number of CDIs to which each Participant is entitled upon exercise of an Award (including Options or vesting of Performance Rights or other); |

|

19.3 |

In the event that, prior to the exercise of an Award, there is a reconstruction (including a consolidation, subdivision, reduction or return) of the issued capital of the Company, then the rights of the Participant including the number of Award that each Participant is entitled or the Exercise Price (if any), or both, will be reconstructed in the manner permitted by the Listing Rules. |

|

19.4 |

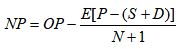

If the Company makes a Pro Rata Issue, the Exercise Price of each Award will be reduced with the new exercise price of each Award to be calculated in accordance with the following formula: |

where:

NP = the new exercise price of the Award

OP = the old exercise price of the Award

E = the number of underlying securities into which one Award is exercisable

P = the average Market Price (as that term is defined in the Listing Rules) per CDI (weighted by volume) of the underlying securities during the 5 trading days ending on the day before the ex rights date or ex entitlements date

S = the subscription price for a security to be issued under the Pro Rata Issue

D = the amount of any dividend due but not yet paid on the existing underlying securities (except those securities to be issued under the Pro Rata Issue)

N = the number of existing securities with rights or entitlements that must be held to receive a right to one new security under the Pro Rata Issue

No change will be made to the number of CDIs to which the Participant is entitled.

|

19.5 |

Subject to the Listing Rules, if there is a Bonus Issue to the holders of CDIs, the number of CDIs over which an Award is exercisable will be increased by the number of CDIs which the holder of the Award would have received if the Award had been exercised before the record date for the Bonus Issue. |

|

19.6 |

The terms of this clause 19 relating to reconstructions, stock dividends and returns of capital may be applied on more than one occasion such that their effects may be cumulative. It is intended that the adjustments they progressively effect will be such as to reflect in relation to the CDIs subject to Awards, the adjustments which on the occasions in question are progressively effected in relation to CDIs already on issue. |

|

19.7 |

If (whether before or during the expiry date for an Award) a resolution for a members' voluntary winding up of the Company is proposed (other than for the purpose of a reconstruction or amalgamation) the Board may, in its absolute discretion, give written notice to Participants of the proposed resolution. Subject to any exercise conditions, a Participant may, during the period referred to in the notice, exercise any Award if the Award has not expired. |

|

19.8 |

Whenever the number of CDIs subject to Award or the Exercise Price is adjusted in accordance with these rules, the Company will give notice of the adjustment to the Participant holding the Award. |

|

19.9 |

Subject to this clause 19, during the currency of any Award and prior to their exercise, the holders of any Award are not entitled to participate in any new issue of CDIs of the Company as a result of their holding of the Award. |

|

20. |

Plan Amendments |

|

20.1 |

The rights attaching to any Award may be amended by the Board subject to receipt of any necessary shareholder or other approval under: |

|

(a) |

the Securities Act or any other law applicable to the Company; and |

|

(b) |

if the Company is Listed, the applicable Listing Rules. |

|

20.2 |

If the Company is Listed and the provisions of this Plan or the terms of issue of the Award are inconsistent with the Listing Rules, then the Listing Rules prevail to the extent of any inconsistency and the terms of the Award will be deemed modified accordingly without further action by the Company, the Board or the holder of the Award being necessary. |

|

20.3 |

Without limiting the generality of clause 20.2, it is a term of each Award that, if the Company is Listed, the rights of the Participant who holds the Award are deemed modified from time to time as necessary to ensure the terms of the Award comply with the Listing Rules generally and in particular (but without limitation) as those rules apply to reorganisations of capital at the time of any re-organisation of the Company's capital, in each case despite any inconsistent provision in the terms of this Plan. |

|

20.4 |

Subject to clause 20.1 to 20.3 (inclusive) and, if the Company is Listed, to receipt of any necessary approvals under the Listing Rules, the terms of this Plan may be amended by the Board but without prejudice to the existing or accrued rights of Participants before any amendments are made. |

|

20.5 |

If the Company becomes subject to section 16 of the Exchange Act, this Plan shall be administered in accordance with rule 16b-3 promulgated under the Exchange Act, or any successor rule. Unless the Board determines otherwise in a specific case, [Awards / Shares] granted to persons subject to section 16(b) of the Exchange Act must comply with rule 16b-3 of the Exchange Act and shall contain such additional conditions or restrictions as may be required there under to qualify for the maximum exemption from section 16 with respect to Plan transactions. In addition to the extent necessary and desirable to comply with rule 16b-3 of the Exchange Act or with section 422 of the Internal Revenue Code (or any other applicable law or regulation, including the requirements of an established stock exchange), the Company shall obtain shareholder approval of any Plan amendment in such a manner and to such a degree as required. |

|

21. |

Administration of the Plan |

|

21.1 |

This Plan will be administered by the Remuneration Committee. The Remuneration Committee will have power to: |

|

(a) |

administer the Plan in accordance with these Rules as and to the extent provided in these Rules; |

|

(b) |

delegate to any persons for such period and on such terms as it sees fit, the exercise of any of its powers or discretions under this Plan; |

|

(c) |

determine appropriate procedures for administration of this Plan consistent with these Rules, including approving the form and content of forms and notices to be issued under this Plan; |

|

(d) |

resolve conclusively all questions of fact, construction, interpretation or ambiguity in connection with the terms or operation of this Plan and the terms of Awards or CDIs acquired under this Plan; |

|

(e) |

subject to the Listing Rules, amend, add to or waive any condition under the Plan or any restriction or other condition relating to any Awards allotted under the Plan; |

|

(f) |

take and rely upon independent professional or expert advice in or in relation to the exercise of any of their powers or discretions under these Rules; and |

|

(g) |

make regulations for the operation of the Plan which are not inconsistent with these Rules. |

|

21.2 |

Where these Rules provide for a determination, decision, approval or opinion of the Plan Committee or Board, such determination, decision, approval or opinion may be made or given by the Plan Committee or Board (as applicable) in its absolute discretion. |

|

21.3 |

Any power or discretion which is conferred on the Plan Committee or Board by these Rules may be exercised by the Plan Committee or Board (as applicable) in the interests or for the benefit of the Company and the Plan Committee or Board is not, in exercising any such power or discretion, under any fiduciary or other obligation to any other person. |

|

22. |

Amendments |

|

22.1 |

Subject to complying with Section 83A-35 of the Tax Act, the Board may at any time amend any of these Rules, or waive or modify the application of any of these Rules in relation to any Eligible Employee or Participant. |

|

22.2 |

The Board must not make an amendment under clause 22.1 which would adversely affect the rights of Participants who have been issued Awards under the Plan without first obtaining the consent of Participants who collectively hold 75% of the Awards affected by the amendment and any other approvals required under Applicable Laws. |

|

22.3 |

The Board may adopt additions, variations or modifications to the Rules applicable in any jurisdiction outside Australia under which Awards allocated under the Plan may be subject to additional or modified terms, having regard to any securities, exchange control or taxation laws or regulations or similar factors which may apply to the Participant or to the employer of the Participant in relation to the Awards. Any additional rule must conform to the basic principles of the Plan. |

|

23. |

Dealings with CDIs |

|

23.1 |

The Participant must comply with the Securities Trading Policy at all time, including in respect of Awards and CDIs issued under this Plan. |

|

24. |

Duties and Taxes |

|

24.1 |

The Company: |

|

(a) |

is not responsible for any duties or taxes which are or may become payable on the transfer, allotment or issue of Awards under the Plan or any other dealing with the Awards; and |

|

(b) |

may make any withholding or payment which it is required by law to make in connection with the Plan or the CDIs or Awards. |

|

24.2 |

Unless a Plan Offer expressly indicates otherwise, Subdivision 83A-C of the Income Tax Assessment Act 1997 (Cth) applies to any grants of Awards under the Plan (subject to the requirements of that Act). |

|

25. |

Rights of Participants |

|

25.1 |

The rights and obligations of a Participant under the terms of his or her employment by a company in the Group are not affected by his or her participation in the Plan. The Rules: |

|

(a) |

do not confer on any Employee the right to be offered any Award ; |

|

(b) |

do not confer on any Participant the right to continue as an Employee; |

|

(c) |

do not affect any rights which the Company or its Subsidiaries may have to terminate the employment of any Eligible Employee or Participant; and |

|

(d) |

may not be used to increase damages in any action brought against the Company or its Subsidiaries in respect of that termination. |

|

25.2 |

These Rules do not form part of, and will not be incorporated into, any contract of engagement or employment between a Participant and his or her employer. |

|

25.3 |

No Participant has any right to compensation or damages as a result of the termination of his or her employment by a company in the Group for any reason, so far as those rights arise or may arise from the Participant ceasing to have rights under the Plan as a result of the termination. |

|

26. |

Notices |

|

26.1 |

Service of all documents required by this Plan shall be deemed to be affected if the Company sends the document by post to the last address or facsimile number of the Participant known to the Company. |

|

26.2 |

A communication sent by post is deemed to be received on the third Business Day after posting. A communication sent by facsimile is deemed to be received at the time shown on the sender’s transmission report, if it shows that the transmission was successful. |

|

27. |

Termination of the Plan |

This Plan may be terminated at any time by resolution of the Board. Termination of this Plan will be without prejudice to the rights of Participants in respect of CDIs or Awards outstanding at the date of termination.

|

28. |

Governing Law |

These Rules and the rights and obligations of Participants under the Plan are governed by the law of Victoria and the Commonwealth of Australia, and each Participant irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Victoria and the Commonwealth of Australia.

|

29. |

Advice |

Participants should obtain their own independent advice at your own expense on the financial, taxation and other consequences to them of or relating to participation in the Plan.

|

30. |

Data protection |

|

30.1 |

The Company needs to collect personal information about Participants for the purpose of facilitating the operation and administration of the Plan (Purpose). If this personal information is not provided to the Company, the Company may not be able to achieve the purpose. |

|

30.2 |

By completing and returning an application to participate in the Plan, a Participant authorises and instructs each company in the Group and any agent of any company in the Group: |

|

(a) |

to collect, disclose and transfer between each other (including those located outside Australia) any personal information as the Company may request; |

|

(b) |

to disclose any personal information to the Australian Taxation Office, ASX, ASIC or any governmental agency or authority as may be required in connection with the administration of the Plan; |

|

(c) |

to store and process personal information, |

in accordance with the Purpose. Participants may withdraw this authorisation.

|

30.3 |

Participants may access any personal information held by the Company by contacting the Company Secretary and may require any personal information to be corrected if that personal information is inaccurate or incomplete. |

|

Universal Biosensors Inc. Employee Incentive Plan Plan Rules |