Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - UNIVERSAL BIOSENSORS INC | ex_284062.htm |

| 8-K - FORM 8-K - UNIVERSAL BIOSENSORS INC | ubi20210915_8k.htm |

Exhibit 10.1

Rules of Universal Biosensors Inc. Option Plan

|

1 |

Definitions and interpretation |

|

1.1 |

Definitions |

In these Rules, unless the contrary intention appears:

|

(1) |

Accelerated Vesting Event means the occurrence of: |

|

(a) |

a Special Circumstance in respect of a Participant; or |

|

(b) |

a Control Event; |

|

(2) |

Applicable Law means one or more, as the context requires of: |

|

(a) |

the Corporations Act; |

|

(b) |

Corporations Regulations; |

|

(c) |

the Listing Rules; |

|

(d) |

the ASX Settlement Operating Rules; |

|

(e) |

the Tax Act; |

|

(f) |

the Tax Administration Act; |

|

(g) |

any other applicable practice note, policy statement, class order, declaration, guideline, policy, procedure, ruling or guidance note made to clarify or expand any of (a) to (f) above; and |

|

(h) |

the Constitution; |

|

(3) |

ASIC means the Australian Securities and Investments Commission; |

|

(4) |

Associated Company means at any time any body corporate that at that time is a related body corporate of the Company within the meaning of section 50 of the Corporations Act; |

|

(5) |

ASX Settlement Operating Rules means the operating rules of ASX Settlement Pty Limited ACN 008 504 532; |

|

(6) |

ASX means ASX Limited ACN 008 624 691 or a market conducted by it (as the context requires); |

|

(7) |

Board means all or some of the Directors of the Company acting as a board or, where appropriate, a committee of the Board; |

|

(8) |

Bonus Issue means a Pro Rata Issue of CDIs to holders of CDIs for which no consideration is payable by them; |

|

(9) |

Business Day has the meaning given to that term in the Listing Rules; |

|

(10) |

CDI means a chess depositary interest, representing a Share in the capital of the Company; |

|

(11) |

Certificate means, with respect to an Option, a certificate issued under these Rules in the form approved by the Plan Committee from time to time; |

|

(12) |

Company means Universal Biosensors Inc. ARBN 51 121 559 993; |

|

(13) |

Constitution means the Company’s constitution; |

|

(14) |

Control of an entity means having the right: |

|

(a) |

to vote 70% (or more) of the votes that can be cast on the election or removal of the entity’s directors; |

|

(b) |

to appoint or remove directors who possess 50% (or more) of the votes exercisable by all directors of the entity; or |

|

(c) |

to 70% (or more) of the profits or distributions of the entity or of its net liquidation proceeds. |

For this definition, if the entity does not have a board of directors, ‘director’ means a member of the entity’s governing body with a role similar to a board of directors;

|

(15) |

Control Event means any of the following: |

|

(a) |

an offer is made by a person to acquire all of the CDIs (or any CDIs that are not at the time owned by the offeror or any person acting in concert with the offeror) and, after announcement of the offer, the offeror (being a person who did not Control the Company prior to the offer) acquires Control of the Company; |

|

(b) |

any other event occurs which causes a change in Control of the Company; or |

|

(c) |

any other event which the Plan Committee reasonably considers should be regarded as a Control Event; |

|

(16) |

Corporations Act means the Corporations Act 2001 (Cth); |

|

(17) |

Corporations Regulations means any and all regulations made under the Corporations Act; |

|

(18) |

Date of Grant means, with respect to an Option, the date on which the Plan Committee grants the Option to You; |

|

(19) |

Director means a person holding the office of director; |

|

(20) |

Dispose includes sell, assign, transfer or otherwise encumber; |

|

(21) |

Employee means a person in respect of whom the Company or a Subsidiary of the Company is the employer or is deemed to be the employer for the purposes of section 83A-35 of the Tax Act; |

|

(22) |

Exercise Date means the date on which a Notice of Exercise is provided to the Company; |

|

(23) |

Exercise Period means the period commencing on the First Exercise Date and ending on the Last Exercise Date; |

|

(24) |

Exercise Price means the subscription price per CDI payable by the holder of an Option on the exercise of the Option, being the amount determined in accordance with Rule 5.5; |

|

(25) |

First Exercise Date with respect to an Option means the day of the Vesting Date; |

|

(26) |

Group means the Company and each Group Company; |

|

(27) |

Group Company means: |

|

(a) |

a Holding Company or Subsidiary of the Company; and |

|

(b) |

a Subsidiary of the Holding Company of the Company; |

|

(28) |

Last Exercise Date with respect to an Option means, unless otherwise specified in a Certificate in respect of that Option: |

|

(a) |

the date 4 years after the Date of Grant for Tranche 1; |

|

(b) |

the date 5 years after the Date of Grant for Tranche 2 and 3; or |

|

(c) |

if a Special Circumstance arises in respect of a Participant during those periods, then the date 12 months (or such longer period as may be determined by the Plan Committee) after the Special Circumstance arises; |

|

(29) |

Legal Personal Representative means the executor of the will or an administrator of the estate of a deceased person, the trustee of the estate of a person under a legal disability or a person who holds an enduring power of attorney granted by another person; |

|

(30) |

Listing Rules means the ASX Listing Rules; |

|

(31) |

Notice of Exercise means a duly completed and executed notice of exercise of an Option by a Participant, in the form approved by the Plan Committee from time to time; |

|

(32) |

Official Quotation has the meaning given to it in the Listing Rules; |

|

(33) |

Option means a right issued to You to subscribe for a CDI on payment of the Exercise Price and otherwise on the terms and conditions of this Plan; |

|

(34) |

Participant or You means a person who holds Options issued under the Plan and includes, if a Participant dies or becomes subject to a legal disability, the Legal Personal Representative of the Participant; |

|

(35) |

Plan means the Company’s Option Plan governed by these Rules; |

|

(36) |

Plan Committee means the Nomination and Remuneration Committee or another committee of the Board to which power to administer the Plan has been delegated or if there has been no delegation, the Board; |

|

(37) |

Pro Rata Issue has the meaning given in the Listing Rules; |

|

(38) |

Purpose means, in relation to the collection of personal information as contemplated by Rule 20, the facilitation of the operation and the administration of the Plan; |

|

(39) |

Redundancy means the termination or cessation of a Participant's employment or office with the Company and all Group Companies due to a determination that the need to employ a person for the particular kind of work carried out by that Participant has ceased (but, for the avoidance of any doubt, does not include the dismissal of any Participant for personal or disciplinary reasons or where the Participant leaves the employ of the Company of his or her own accord); |

|

(40) |

Related Body Corporate, Subsidiary and Holding Company each has the meaning given in section 9 of the Corporations Act; |

|

(41) |

Rules means this document, including any schedule or annexure to it; |

|

(42) |

Security Interest means: |

|

(a) |

a mortgage, charge, assignment by way of security, pledge, lien, hypothecation, title retention arrangement, encumbrance or other third party interest of any nature; |

|

(b) |

any arrangement having a commercial effect equivalent to anything in (a); and |

|

(c) |

any agreement to create an interest described in (a) or an arrangement described in (b); |

|

(43) |

Share means a fully paid ordinary share in the capital of the Company; |

|

(44) |

Shareholder means a holder of a CDI or CDIs; |

|

(45) |

Securities Act means the U.S. Securities Act of 1933 as amended from time to time; |

|

(46) |

Securities Trading Policy means the Company’s trading policy with respect to CDIs; |

|

(47) |

Special Circumstance means with respect to a Participant: |

|

(a) |

Total and Permanent Disablement; |

|

(b) |

death; and |

|

(c) |

Redundancy; |

|

(48) |

Specific Terms means, in relation to an invitation to participate under the Plan, the specific terms and conditions (including any terms and condition under Rule 5.2(5)) of the invitation; |

|

(49) |

Tax includes any tax (direct or indirect), levy, impost, GST, deduction, charge, rate, contribution, duty or withholding which is assessed (or deemed to be assessed), levied, imposed or made by any government or any governmental, semi-governmental or judicial entity or authority together with any interest, penalty, fine, charge, fee or other amount assessed (or deemed to be assessed), levied, imposed or made on or in respect of any or all of the foregoing; |

|

(50) |

Tax Act means the Income Tax Assessment Act 1936 (Cth) or the Income Tax Assessment Act 1997 (Cth) or both, as the context requires; |

|

(51) |

Tax Administration Act means the Taxation Administration Act 1953 (Cth); |

|

(52) |

Total and Permanent Disablement means, in relation to any Participant, that the Participant has, in the opinion of the Plan Committee (such opinion to be reasonably held), after considering such medical and other evidence as it sees fit, become incapacitated to such an extent as to render the Participant unlikely ever to engage in any occupation for which he is reasonably qualified by education, training or experience; |

|

(53) |

Vesting Conditions has the meaning given in Rule 6.2; and |

|

(54) |

Vesting Date means the date specified in a Certificate in respect of the Option or, if no date is specified, then the third anniversary of the Date of Grant of the Option; or such other date as the Plan Committee in accordance with Rule 6.3 may substitute for that date. |

|

1.2 |

Interpretation |

In these Rules, unless the context otherwise requires:

|

(1) |

headings are for convenience only and do not affect the interpretation of these Rules; |

|

(2) |

reference to any legislation or a provision of any legislation includes a modification or re-enactment of the legislation or a legislative provision substituted for, and all legislation and statutory instruments and regulations issued under, the legislation; |

|

(3) |

words denoting the singular include the plural and vice versa; |

|

(4) |

words denoting a gender include the other genders; |

|

(5) |

reference to any document or agreement includes reference to that document or agreement as amended, novated, supplemented, varied or replaced from time to time; |

|

(6) |

where any word or phrase is given a defined meaning in these Rules, any part of speech or other grammatical form of that word or phrase has a corresponding meaning; |

|

(7) |

reference to a rule or paragraph is a reference to a rule or paragraph of these Rules, or the corresponding Rule or Rules of the Plan as amended from time to time; |

|

(8) |

a reference to the Constitution includes a reference to any provision having substantially the same effect which is substituted for or replaces the Constitution; |

|

(9) |

a Participant does not cease to be employed by a company in the Group where the Participant ceases to be employed by a company in the Group, but contemporaneously commences employment with another company in the Group; |

|

(10) |

reference to time is a reference to the time in Melbourne, Australia; and |

|

(11) |

where an act or thing must be done on a particular day or within a particular period, that act or thing must be done before, and that period ends at, 5.00pm on the relevant day. |

|

1.3 |

Primary instruments |

These Rules are to be interpreted subject to the Applicable Laws.

|

2 |

The Plan |

The purpose of the Plan is to provide You with an opportunity to share in the growth in value of the CDIs and to encourage them to improve the performance of the Company and its return to Shareholders. It is intended that the Plan will enable the Group to retain and attract skilled and experienced employees and provide You with the motivation to make the Group more successful.

|

3 |

Principal conditions |

|

3.1 |

Options issued only to Employees |

No Options may be issued to You under the Plan unless You remain an Employee as at the Date of Grant, or the Plan Committee determines otherwise.

|

3.2 |

Compliance with laws |

No Option may be issued to, or exercised by, You, and the Company is not obliged to issue any CDIs to You on the exercise of any Option, if to do so would contravene an Applicable Law, including Listing Rules 6.15 to 6.24 and 10.11 to 10.14.

|

4 |

Operation of the Plan |

The Plan operates according to these Rules which bind the Company, any Subsidiary and each Participant.

|

5 |

Issue of Options |

|

5.1 |

Plan Committee may determine issue |

Subject to these Rules, the Plan Committee may from time to time determine that the Company will offer additional Options to You.

|

5.2 |

Form of invitation |

The Board must give to You an Application to complete, sign and return to the Company, together with the following information:

|

(1) |

either: |

|

(a) |

the number of Options to which the invitation relates; or |

|

(b) |

the basis on which the number of Options to which the invitation relates is to be determined; |

|

(2) |

either: |

|

(a) |

the Vesting Date and the Last Exercise Date; or |

|

(b) |

the basis on which the Vesting Date and the Last Exercise Date are to be determined; |

|

(3) |

either: |

|

(a) |

the Exercise Price; or |

|

(b) |

the basis on which the Exercise Price is to be determined; |

|

(4) |

the performance conditions attaching to the Options (if any); |

|

(5) |

any other terms and conditions relating to the grant of the Options or the delivery of any CDIs on exercise of the Options which, in the opinion of the Plan Committee, are fair and reasonable but not inconsistent with these Rules, |

and the following documents:

|

(6) |

a summary or a copy of these Rules; and |

|

(7) |

any other information or documents that the Applicable Laws require the Company to give to You. |

|

5.3 |

Offer and acceptance |

By completing, signing and returning the Application given to You under Rule 5.2, You offer to participate under the Plan and, on acceptance by the Plan Committee of the offer a contract is formed between the Company and You on the terms and conditions of:

|

(1) |

these Rules; and |

|

(2) |

the Specific Terms. |

|

5.4 |

Limit on Number of Options |

The number of Options the subject of the offer to You is as determined by the Plan Committee.

|

5.5 |

Exercise Price |

Subject to any adjustment under Rule 11, the Exercise Price in respect of an Option is as determined by the Plan Committee.

|

5.6 |

Exercise Price in Australian dollars |

Subject to Rule 7.4, the Exercise Price in respect of an Option must be denominated and payable in Australian dollars.

|

5.7 |

Becoming a Participant |

On the issue of an Option to You, You become a Participant and are bound by these Rules.

|

5.8 |

Certificates |

The Company must give a Participant one or more Certificates stating (or which, if applicable, attaches a separate document stating):

|

(1) |

the number of Options issued to the Participant; |

|

(2) |

the Exercise Price of those Options or the basis on which it is to be determined; |

|

(3) |

the Date of Grant of those Options; |

|

(4) |

the Vesting Date of the Options or the basis on which it is to be determined; |

|

(5) |

the expected Last Exercise Date of the Options or the basis on which it is to be determined; and |

|

(6) |

any other specific terms and conditions applicable. |

|

5.9 |

Consideration for Options |

An Option will be issued for consideration comprising the services that are expected to be provided by You to or for the benefit of the Group, but no further monetary or other consideration will be payable in respect of the issue of an Option.

|

5.10 |

Entitlement to CDIs |

Subject to these Rules, each Option confers on its holder the entitlement to subscribe for and be issued one CDI at the Exercise Price.

|

5.11 |

Quotation of Options |

The Company will not apply for Official Quotation of any Options.

|

5.12 |

Interest in CDIs |

A Participant has no interest in a CDI the subject of an Option held by the Participant unless and until the CDI is issued to that Participant under these Rules.

|

6 |

Vesting of Options |

|

6.1 |

Vesting |

Subject to Rule 6.2, an Option vests on the Vesting Date.

|

6.2 |

Vesting Conditions |

Subject to Rule 6.3, the vesting of any Option held by the Participant is subject to, the Participant having been an employee, or a deemed employee for the purposes of section 83A-35 of the Tax Act, of a company within the Group at all times between the Date of Grant and the Vesting Date (inclusive).

|

6.3 |

Vesting brought forward |

|

(1) |

If an Accelerated Vesting Event occurs while a Participant is employed with the Group and before the Vesting Date, the Plan Committee may, at its discretion: |

|

(a) |

bring forward the vesting of all Options held by the Participant to a date determined by the Plan Committee; and |

|

(b) |

waive or vary any Vesting Conditions in regard to any Options. |

|

(2) |

If the Plan Committee determines to bring forward the vesting of an Option and waive or vary the Vesting Conditions under Rule 6.3(1)(a), the Company: |

|

(a) |

must within 14 days of the alteration give notice to each Participant affected by the Accelerated Vesting Event in respect of the Option held by the Participant; and |

|

(b) |

may issue a replacement Certificate for the Option. |

|

6.4 |

Lapse of unvested Options |

Subject to Rule 6.5, if the Vesting Conditions in relation to an Option are not satisfied before 5pm on the Vesting Date, the Options will lapse at 5pm on the Vesting Date (or the earlier date on which the Participant ceases to be an employee of the Company).

|

6.5 |

Waiver of Vesting Conditions |

The Plan Committee may, at its discretion, by notice to the Participant waive or vary any Vesting Conditions in regard to any Option at any time.

|

7 |

Exercise of Options |

|

7.1 |

Exercise during Exercise Period |

Subject to these Rules and the terms on which an Option is issued, an Option may be exercised at any time during the Exercise Period for that Option.

|

7.2 |

Exercise before Exercise Period |

Subject to these Rules, an Option may be exercised before the Exercise Period if permitted under Rule 11.5.

|

7.3 |

Exercise of Options |

Subject to these Rules, an Option which has not lapsed may be exercised by the Participant giving to the Company:

|

(1) |

a Notice of Exercise signed by the Participant; |

|

(2) |

the Certificate for the Option; and |

|

(3) |

subject to Rule 7.4, a cheque payable to the Company (or another form of payment acceptable to the Board) in the amount being the product of: |

|

(a) |

the number of Options then being exercised by the Participant; and |

|

(b) |

the Exercise Price. |

Subject to Rule 7.4, the Notice of Exercise is only effective (and only becomes effective) when any cheque received in payment of the Exercise Price has been honoured on presentation or when any electronic funds transfer in payment of the Exercise Price has deposited cleared funds in the Company’s bank account.

|

7.4 |

Net settlement |

On request from a Participant, the Board will apply a net settlement procedure as follows in respect of Options with an Exercise Price that is not nil:

|

(1) |

the Participant will not be required to pay the Exercise Price for the Options which are exercised; and |

|

(2) |

the number of CDIs which must be issued to the Participant as a result of the Exercise is the number given by the following formula: |

Where:

N = the number of CDIs to be issued resulting from the exercise, rounded up in the event of fractional entitlements;

n = the total number of CDIs which would be issued as a result of the Exercise of the Options pursuant to Rule 7.3 if the Participant paid the Exercise Price for each Option pursuant to Rule 7.3(3)(b);

EP = the aggregate of the Exercise Prices for all Options Exercised by the Participant pursuant to Rule 7.3, expressed in dollars and cents;

P = the volume weighted average price (calculated to two decimal places) for the CDIs traded on the financial market conducted by the ASX (or such other financial market determined by the Board from time to time) during the 5 trading days prior to the date on which the Options are Exercised, expressed on a per share basis, in dollars and cents rounded down to the nearest whole cent.

|

7.5 |

Issue of CDIs |

Subject to these Rules, within 10 Business Days after the Notice of Exercise referred to in Rule 7.3 becomes effective, the Company must:

|

(1) |

transfer (or procure the transfer) or issue the number of CDIs specified in the Notice of Exercise to the Participant; |

|

(2) |

cancel the Certificate for the Options being exercised; and |

|

(3) |

if applicable, issue a new Certificate for any remaining Options covered by the Certificate accompanying the Notice of Exercise. |

|

7.6 |

Exercise all or some Options |

|

(1) |

A Participant may only exercise Options in multiples of 100 or another multiple as the Plan Committee determines unless the Participant exercises all Options covered by a Certificate able to be exercised by him or her at that time. |

|

(2) |

The exercise by a Participant of only some of the Options held by the Participant does not affect the Participant's right to exercise at a later date other Options held by the Participant (whether those other Options have the same First Exercise Date or otherwise). |

|

7.7 |

Quotation of CDIs |

If other CDIs are officially quoted on the ASX at the time of issue of CDIs under this Plan, the Company must, within the time frame required by the Listing Rules, apply for Official Quotation of the CDIs.

|

7.8 |

CDIs rank equally |

Subject to the restrictions imposed under Rule 10, all CDIs allotted on the exercise of Options granted under this Plan rank pari passu in all respects with CDIs previously issued and, in particular, entitle the holders to participate fully in:

|

(1) |

dividends in respect of the underlying Shares with a record date on or after the date of allotment; and |

|

(2) |

all issues of securities made or offered pro rata to holders of CDIs. |

|

8 |

Lapse of Options |

|

8.1 |

Lapse of vested Options |

Unless otherwise specified in the Certificate or determined otherwise by the Plan Committee, an Option which has vested with the Participant lapses on the earlier of:

|

(1) |

the Last Exercise Date; |

|

(2) |

a determination of the Plan Committee that the Option should lapse because the Participant, in the Plan Committee's opinion: |

|

(a) |

has been dismissed or removed from office for a reason which entitles a company in the Group to dismiss the Participant without notice; |

|

(b) |

has committed an act of fraud, defalcation or gross misconduct in relation to the affairs of that company (whether or not charged with an offence); or |

|

(c) |

has done an act which brings the Group or any company in the Group into disrepute; and |

|

(3) |

the date determined by the Plan Committee (which in no event will be more than six months) after the date of termination of employment of the Participant with the Group (other than due to the occurrence of a Special Circumstance). |

|

8.2 |

Options cease |

If a Participant fails for any reason to exercise all the Options registered in the Participant's name before the occurrence of a circumstance set out in Rule 8.1, those Options that the Participant:

|

(1) |

would have been entitled to exercise and that have not been exercised; and |

|

(2) |

may have had a right or entitlement to have vested in the Participant, |

lapse and all rights of a Participant under the Plan in respect of those Options cease.

|

9 |

Dealings with Options |

|

9.1 |

Options personal |

Except where an Option has been transferred under Rule 9.3, an Option held by a Participant is personal to the Participant and may not be exercised by another person.

|

9.2 |

No unauthorised disposal |

Except as permitted under Rule 9.3, a Participant must not dispose of or grant a Security Interest over or otherwise deal with an Option or an interest in an Option, and the Security Interest or disposal or dealing is not recognised in any manner by the Company.

|

9.3 |

Disposal with prior written approval |

The rights and entitlements of a Participant to Options may be transferred, assigned, encumbered or otherwise disposed of by the Participant:

|

(1) |

by transmission on death of the Participant; or |

|

(2) |

with the prior written agreement of the Board or the Chairman of the Board (which consent shall not be unreasonably delayed or withheld) and in accordance with Regulation S promulgated under the Securities Act. |

|

10 |

Dealings with CDIs |

|

10.1 |

Securities Trading Policy |

The Participant must comply with the Securities Trading Policy at all times, including for CDIs issued under Rule 7.4.

|

10.2 |

Each certificate representing the CDIs issued under Rule 7.4 or underlying Shares (as applicable) will bear the following legend: |

“The shares represented by this certificate have been issued in reliance on Regulation S promulgated under US Securities Act of 1933 (“Securities Act”) and may not be transferred except in accordance with Regulation S, pursuant to registration under the Securities Act or pursuant to an available exemption from registration”

|

11 |

Participation rights, bonus issues, rights issues, reorganisations of capital and winding up |

|

11.1 |

New issues |

Subject to the Listing Rules, a Participant is only entitled to participate (in respect of an Option granted under the Plan) in a new issue of CDIs to existing shareholders generally if the Participant has validly exercised his or her Options within the relevant Exercise Period and become a Shareholder prior to the relevant record date, and is then only entitled to participate in relation to CDIs of which the Participant is the registered holder.

|

11.2 |

Pro Rata Issues |

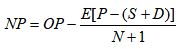

If the Company makes a Pro Rata Issue, the Exercise Price of each Option will be reduced with the new exercise price of each Option to be calculated in accordance with the following formula:

where:

NP = the new exercise price of the Option

OP = the old exercise price of the Option

E = the number of underlying securities into which one Option is exercisable

P = the average Market Price (as that term is defined in the Listing Rules) per CDI (weighted by volume) of the underlying securities during the 5 trading days ending on the day before the ex rights date or ex entitlements date

S = the subscription price for a security to be issued under the Pro Rata Issue

D = the amount of any dividend due but not yet paid on the existing underlying securities (except those securities to be issued under the Pro Rata Issue)

N = the number of existing securities with rights or entitlements that must be held to receive a right to one new security under the Pro Rata Issue

No change will be made to the number of CDIs to which You are entitled.

|

11.3 |

Bonus Issues |

Subject to the Listing Rules, if there is a Bonus Issue to the holders of CDIs, the number of CDIs over which an Option is exercisable will be increased by the number of CDIs which the holder of the Option would have received if the Option had been exercised before the record date for the Bonus Issue.

|

11.4 |

Reconstructions |

In the event that, prior to the exercise of an Option, there is a reconstruction (including a consolidation, subdivision, reduction or return) of the issued capital of the Company, then the rights of the Participant including the number of Options that each Participant is entitled or the Exercise Price (if any), or both, will be reconstructed in the manner permitted by the Listing Rules.

|

11.5 |

Winding up |

If (whether before or during the Exercise Period) a resolution for a members' voluntary winding up of the Company is proposed (other than for the purpose of a reconstruction or amalgamation) the Plan Committee may, in its absolute discretion, give written notice to Participants of the proposed resolution. Subject to the Exercise Conditions, the Participants may, during the period referred to in the notice, exercise their Options if the Last Exercise Date for the Options has not expired.

|

11.6 |

Fractions of CDIs |

For the purposes of this Rule 11, if Options are exercised simultaneously, then the Participant may aggregate the number of CDIs or fractions of CDIs for which the Participant is entitled to subscribe. Fractions in the aggregate number only will be disregarded in determining the total entitlement of a Participant.

|

11.7 |

Calculations and adjustments |

Any calculations or adjustments which are required to be made under this Rule 11 will be made by the Plan Committee and, in the absence of manifest error, are final and conclusive and binding on the Company and the Participant.

|

11.8 |

Notice of change |

To the extent required by the Listing Rules, the Company must give notice to each Participant of any adjustment to the number of CDIs for which the Participant is entitled to subscribe or to the Exercise Price pursuant to the provisions of this Rule 11.

|

12 |

Administration of the Plan |

|

12.1 |

Administration |

The Plan is administered by the Plan Committee.

|

12.2 |

Powers of the Plan Committee |

The Plan Committee has power to:

|

(1) |

determine appropriate procedures and make regulations for the administration of the Plan which are consistent with these Rules; |

|

(2) |

resolve conclusively all questions of fact or interpretation arising in connection with the Plan; |

|

(3) |

terminate or suspend the operation of the Plan at any time, provided that the termination or suspension does not adversely affect or prejudice the rights of Participants holding Options at that time; |

|

(4) |

delegate those functions and powers it considers appropriate, for the efficient administration of the Plan, to any person or persons whom the Plan Committee reasonably believes to be capable of performing those functions and exercising those powers; |

|

(5) |

take and rely upon independent professional or expert advice in or in relation to the exercise of any of their powers or discretions under these Rules; |

|

(6) |

administer the Plan in accordance with these Rules as and to the extent provided in these Rules; and |

|

(7) |

make regulations for the operation of the Plan consistent with these Rules. |

|

12.3 |

Exercise of powers or discretion |

Any power or discretion which is conferred on the Plan Committee or Board by these Rules may be exercised by the Plan Committee or Board in the interests or for the benefit of the Company, and the Plan Committee or Board is not, in exercising that power or discretion, under any fiduciary or other obligation to another person.

|

12.4 |

Determinations |

Where these Rules provide for a determination, decision, approval or opinion of the Plan Committee or Board, that determination, decision, approval or opinion may be made or given by the Plan Committee or Board (as applicable) in its absolute discretion.

|

12.5 |

Expenses and costs |

Subject to these Rules, the Company and its Subsidiaries must pay all expenses, costs and charges incurred in the administration of the Plan in the amounts and proportions as they shall agree.

|

12.6 |

Tax |

No company in the Group or any adviser to a company in the Group or the Board is liable for any Tax which may become payable by a Participant in the Plan and none of them represent or warrant that any person will gain any taxation advantage by participating in the Plan.

|

12.7 |

Deferred Taxation |

Unless a Plan Offer expressly indicates otherwise, Subdivision 83A-C of the Income Tax Assessment Act 1997 (Cth) applies to any grants of Options under the Plan (subject to the requirements of that Act).

|

13 |

Amendment to Rules |

|

13.1 |

Amendment |

Subject to Rules 13.2 and 13.3, the Company may at any time by written instrument or by resolution of the Board, amend all or any of the provisions of these Rules (including this Rule 13).

|

13.2 |

Accrued Rights |

No amendment of the provisions of these Rules may reduce the accrued rights of any Participant in respect of Options or CDIs issued under the Plan prior to the date of the amendment, other than:

|

(1) |

an amendment introduced primarily: |

|

(a) |

for the purpose of complying with or conforming to present or future State, Territory or Commonwealth legal requirements governing or regulating the maintenance or operation of the Plan or like plans; |

|

(b) |

to correct any manifest error or mistake; |

|

(c) |

to enable contributions or other amounts paid by the Company in respect of the Plan to qualify as income tax deductions; |

|

(d) |

to enable the Participant or the Company to reduce the amount of fringe benefits tax under the Fringe Benefits Tax Assessment Act 1986, the amount of tax under the Tax Act or the amount of any other tax or impost that may otherwise be payable by the Participant or the Company in relation to the Plan; |

|

(e) |

for the purpose of enabling Participants generally (but not necessarily each Participant) to receive a more favourable taxation treatment in respect of their participation in the Plan; or |

|

(f) |

to enable the Company to comply with the Corporations Act, the Listing Rules or any other legal requirement; or |

|

(2) |

with the consent of Participants who between them hold not less than 75% of the total number of those Options or CDIs held by all those Participants before making the amendment. |

|

13.3 |

Listing Rules |

No amendment may be made except in accordance with and in the manner stipulated (if any) by the Listing Rules.

|

13.4 |

Retrospectivity |

Subject to the above provisions of this Rule 13, any amendment made under Rule 13.1 may be given such retrospective effect as is specified in the resolution by which the amendment is made and, if so stated, amendments to these Rules, including the terms applicable to Options and CDIs issued under this Plan, have the effect of automatically amending the terms of Options and CDIs issued and still subject to these Rules.

|

14 |

Financial assistance |

|

14.1 |

Subject to the requirements of any Applicable Law, the Company may provide financial assistance to You in connection with the issue or exercise of an Option under the Plan. |

|

15 |

Rights of Participants |

|

15.1 |

No conferred rights |

These Rules:

|

(1) |

do not confer on You the right to receive any Options; |

|

(2) |

do not confer on You the right to continue as an Employee; |

|

(3) |

do not affect any rights which the Company or a Subsidiary may have to terminate the employment of a Participant; and |

|

(4) |

may not be used to increase damages in an action brought against the Company or a Subsidiary in respect of that termination. |

|

15.2 |

Voting at general meetings |

Participants do not, as Participants, have any right to attend or vote at general meetings of Shareholders.

|

16 |

Notices |

Notices may be given by the Company to Participants in any manner that the Plan Committee may from time to time determine.

|

17 |

Severance |

If any of these Rules are void, voidable or unenforceable, that provision will be severed and the remainder of these Rules will have full force and effect.

|

18 |

Governing law & jurisdiction |

These Rules and the rights and obligations of Participants under the Plan are governed by the law of Victoria and the Commonwealth of Australia, and each Participant irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Victoria and the Commonwealth of Australia.

|

19 |

Advice |

You should obtain your own independent advice at your own expense on the financial, taxation and other consequences to them of or relating to participation in the Plan.

|

20 |

Data protection |

|

20.1 |

Collection and purpose |

The Company needs to collect personal information about You for the Purpose. If this personal information is not provided to the Company, the Company may not be able to achieve the Purpose.

|

20.2 |

Consent |

By completing and returning the Application, You authorise and instruct each company in the Group and any agent of any company in the Group:

|

(1) |

to collect, disclose and transfer between each other (including those located outside Australia) any personal information as the Company may request; |

|

(2) |

to disclose any personal information to the Australian Taxation Office, ASX, ASIC or any governmental agency or authority as may be required in connection with the administration of the Plan; |

|

(3) |

to store and process personal information, |

in accordance with the Purpose. You may withdraw this authorisation.

|

20.3 |

Access to personal information |

You may access any personal information held by the Company by contacting the Company Secretary and may require any personal information to be corrected if that personal information is inaccurate or incomplete.