Attached files

| file | filename |

|---|---|

| EX-23.1 - Immix Biopharma, Inc. | ex23-1.htm |

As filed with the U.S. Securities and Exchange Commission on September 16, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

IMMIX BIOPHARMA, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 2834 | 45-4869378 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11400 West Olympic Blvd., Suite 200

Los Angeles, CA 90064

(310) 651-8041

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Ilya Rachman, MD PhD

Chief Executive Officer

11400 West Olympic Blvd., Suite 200

Los Angeles, CA 90064

(310) 651-8041

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeffrey J. Fessler, Esq. Nazia J. Khan, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112-0015 Tel.: (212) 653-8700 |

Gabriel Morris Chief Financial Officer 11400 West Olympic Blvd., Suite 200 Los Angeles, CA 90064 Tel.: (310) 651-8041

|

Anthony J. Marsico, Esq. Anthony Epps, Esq. Dorsey & Whitney LLP 51 West 52nd Street New York, NY 10019-6119 Tel.: (212) 415-9200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||||

| Common Stock, par value $0.0001 per share | $ | 24,750,000 | $ | 2,701 | ||||

| Total: | $ | 24,750,000 | $ | 2,701 |

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any.

|

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED SEPTEMBER 16, 2021 |

Shares

Common Stock

Immix Biopharma, Inc.

This is a firm commitment initial public offering of shares of Immix Biopharma, Inc. common stock. Prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We intend to apply to list our shares on The Nasdaq Capital Market under the symbol “IMMX.”

We are an emerging growth company under the Jumpstart our Business Startups Act of 2012 (“JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ |

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1% of the public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 129 for additional information regarding underwriters’ compensation. |

The underwriters expect to deliver our shares in the offering on or about , 2021.

ThinkEquity

The date of this prospectus is , 2021

| 2 |

TABLE OF CONTENTS

We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you.

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of these securities.

All trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

| 3 |

The following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless context requires otherwise, references to “we,” “us,” “our,” “IMMX” “ImmixBio” “Immix Biopharma,” or “the Company” refer to Immix Biopharma, Inc. and its subsidiary.

Overview

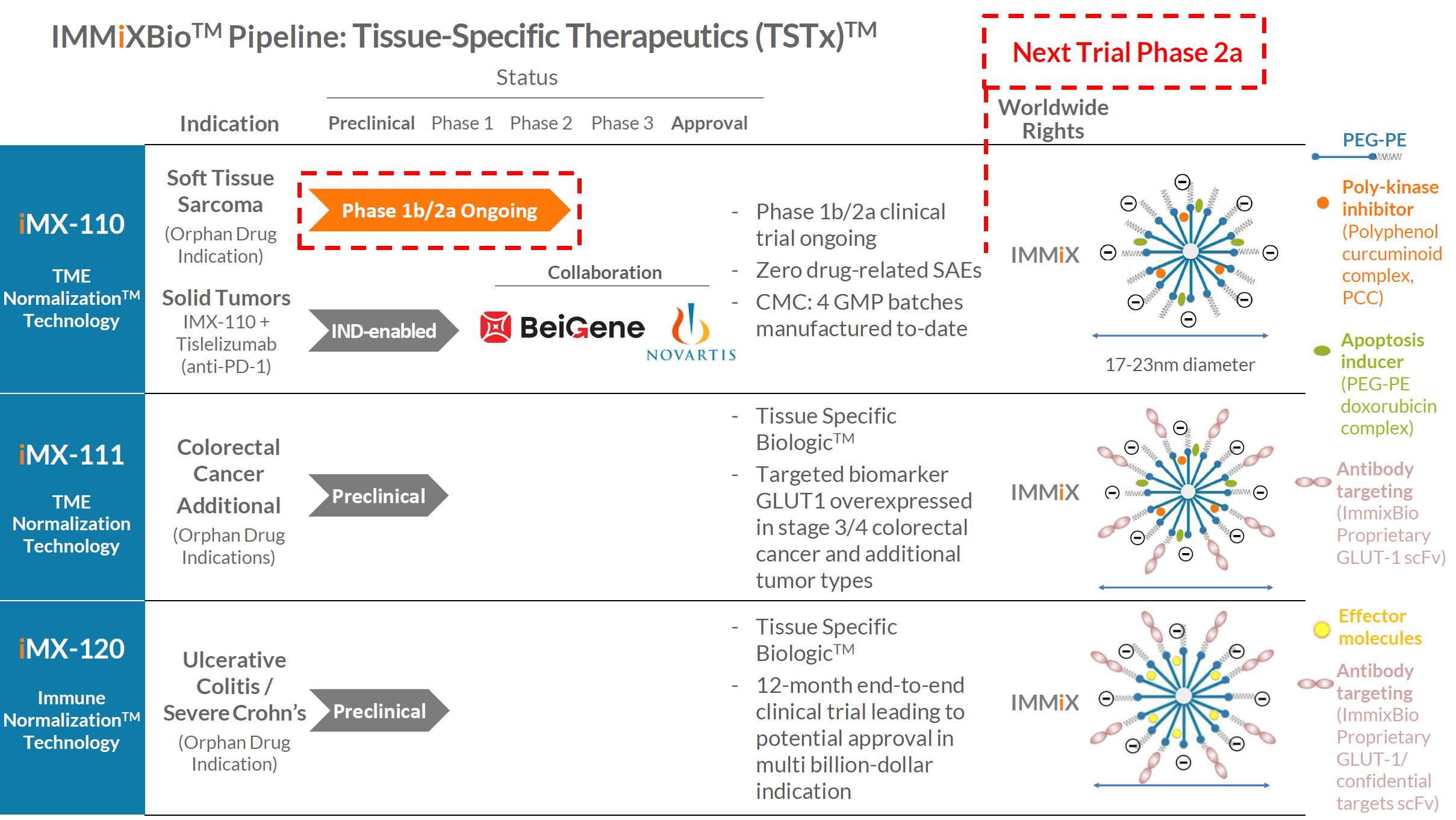

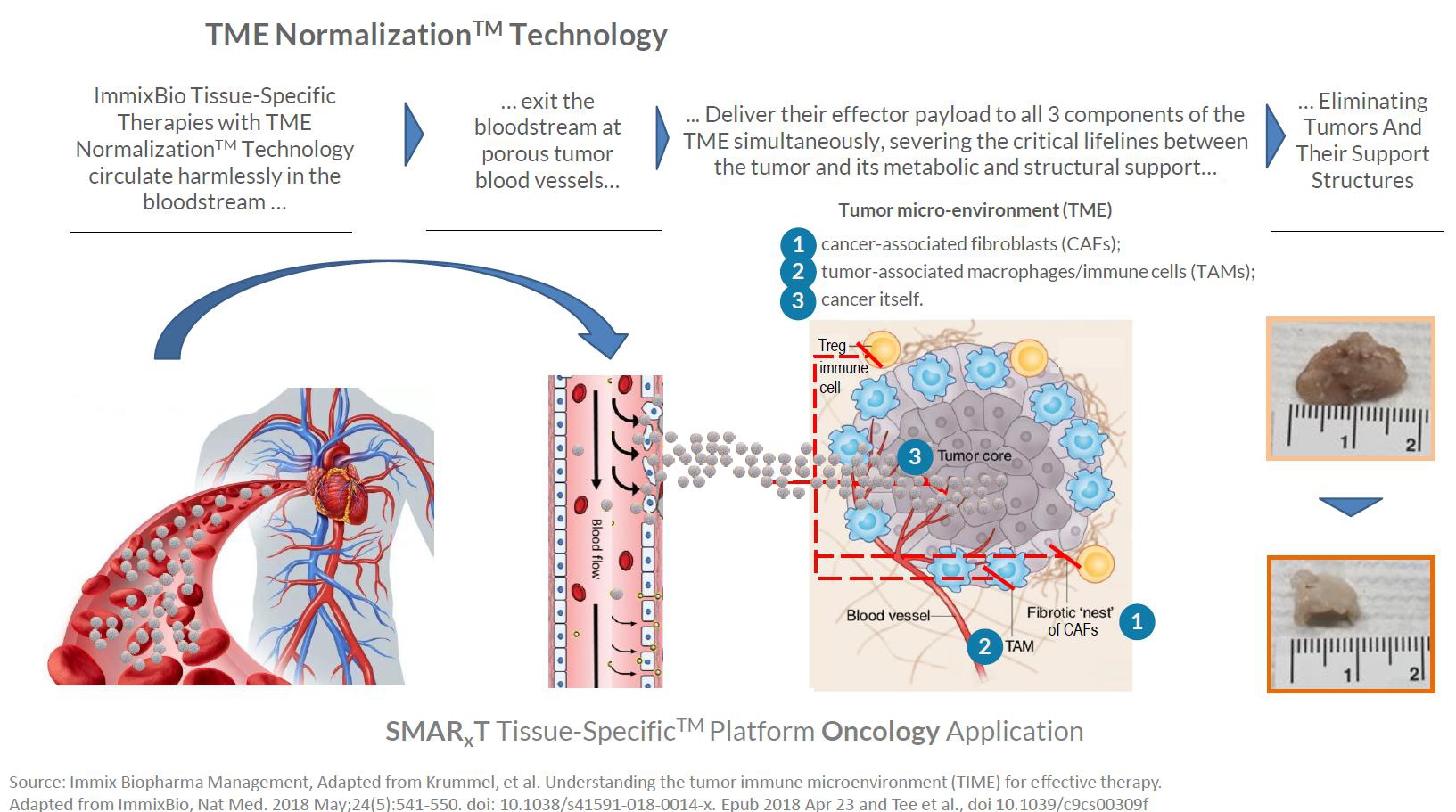

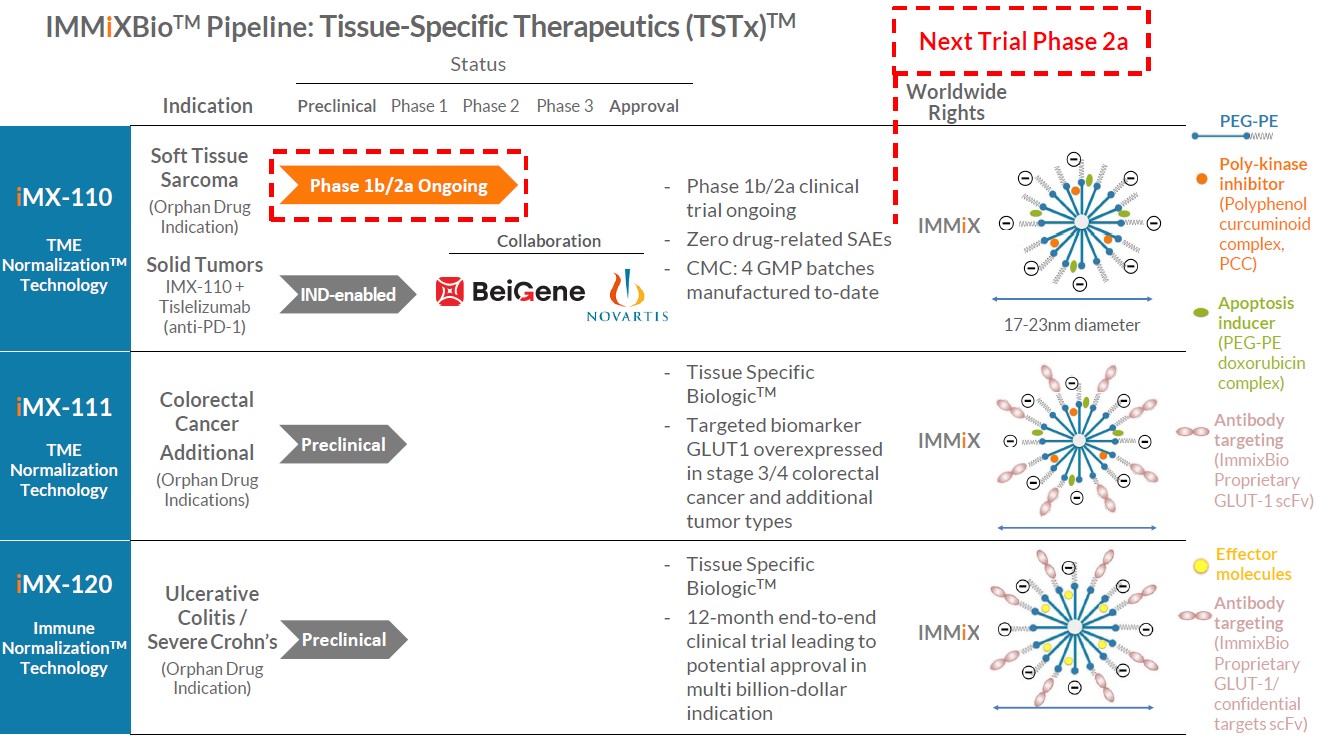

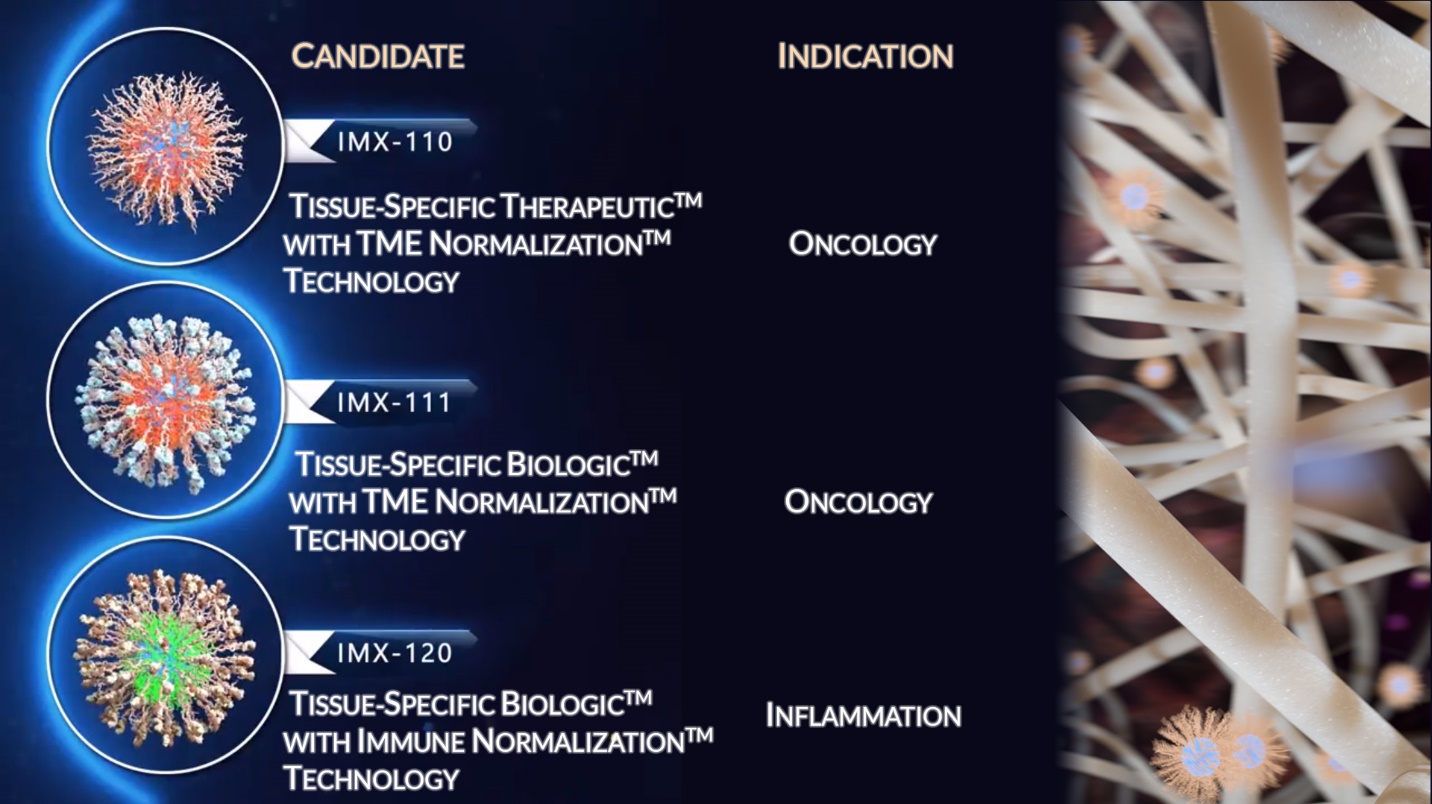

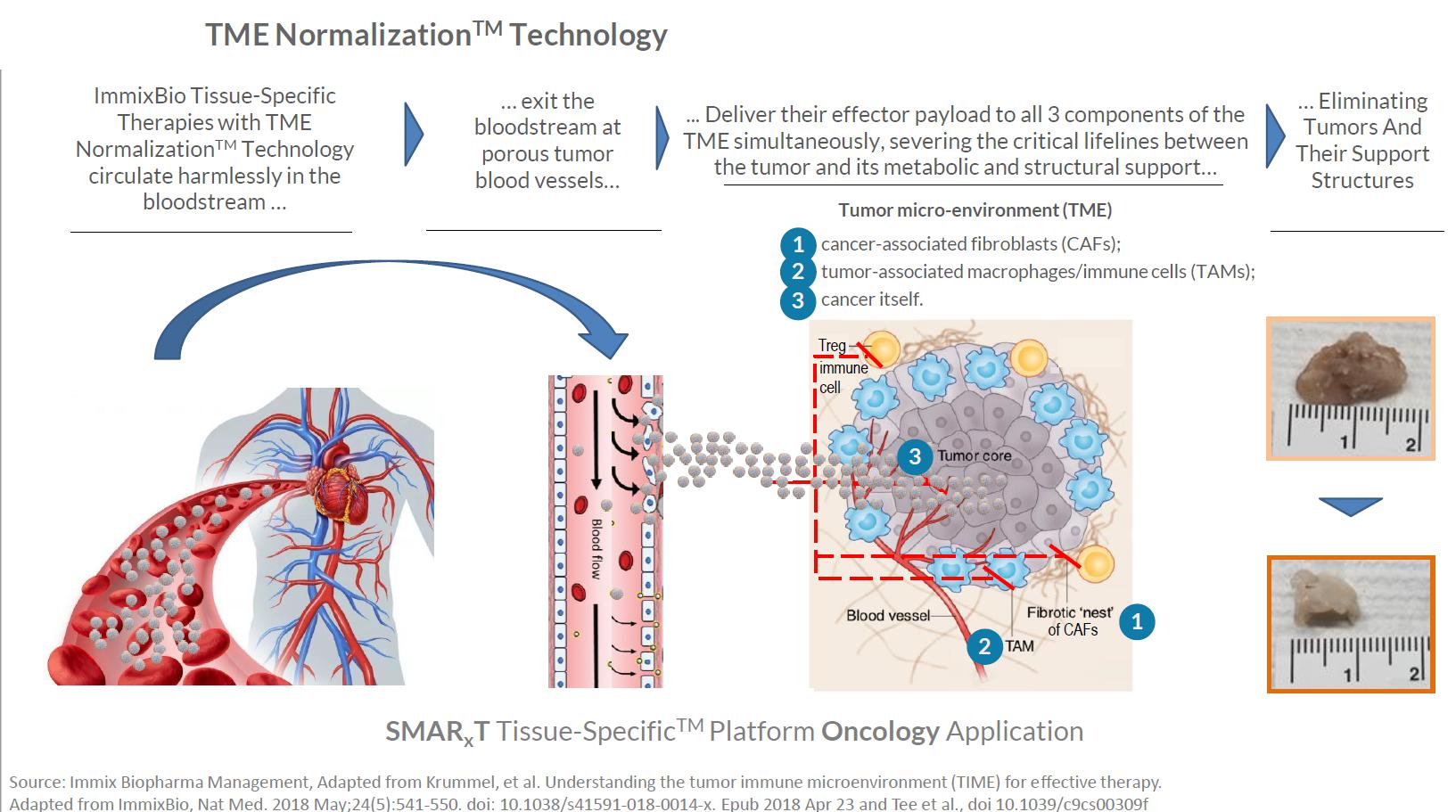

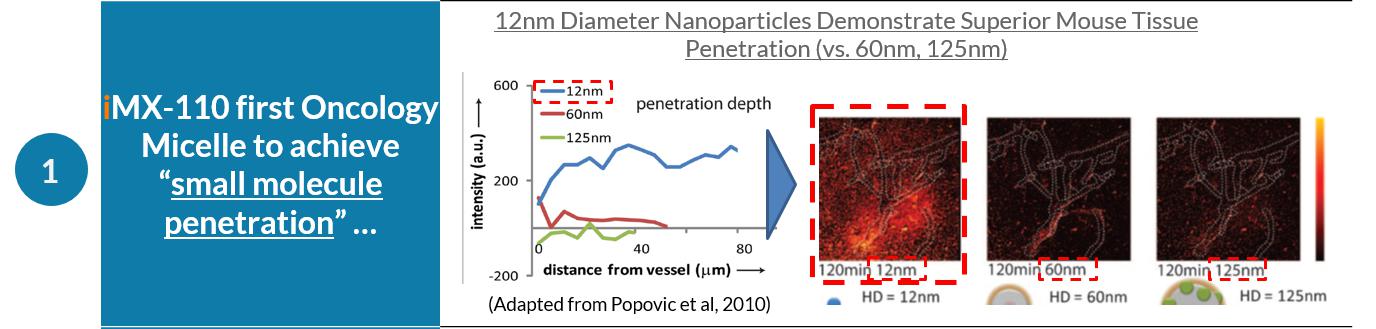

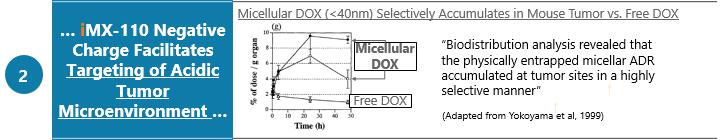

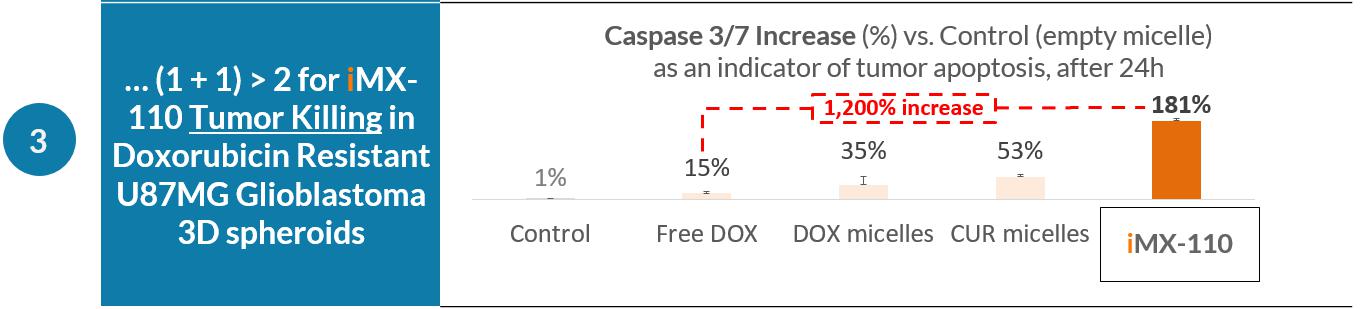

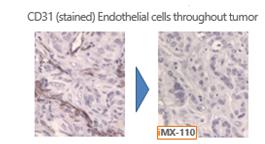

We are a clinical-stage biopharmaceutical company developing a novel class of Tissue-Specific Therapeutics (“TSTx”)TM in oncology and inflammation. Our lead asset, IMX-110, is currently in Phase 1b/2a clinical trials for solid tumors in the United States and Australia. IMX-110 is a negatively-charged TSTx that simultaneously disables resistance pathways with a poly-kinase inhibitor (which inhibits multiple kinases simultaneously), and induces tumor cell death with an apoptosis inducer (which activates apoptosis, a non-inflammatory programmed cell death pathway), leveraging our TME NormalizationTM Technology, delivered deep into the tumor micro-environment (“TME”). Our proprietary System Multi-Action RegulaTors SMARxT Tissue-SpecificTM Platform produces drugs that accumulate at intended therapeutic sites at 3-5 times the rate of conventional medicines. Our TME Normalization™ Technology allows our drug candidates to circulate in the bloodstream, exit through tumor blood vessels and simultaneously attack all components of the TME. As of the date of this prospectus, we have not generated any revenues. Since inception, we have devoted substantially all of our resources to developing product and technology rights, conducting research and development, organizing and staffing our Company, business planning and raising capital.

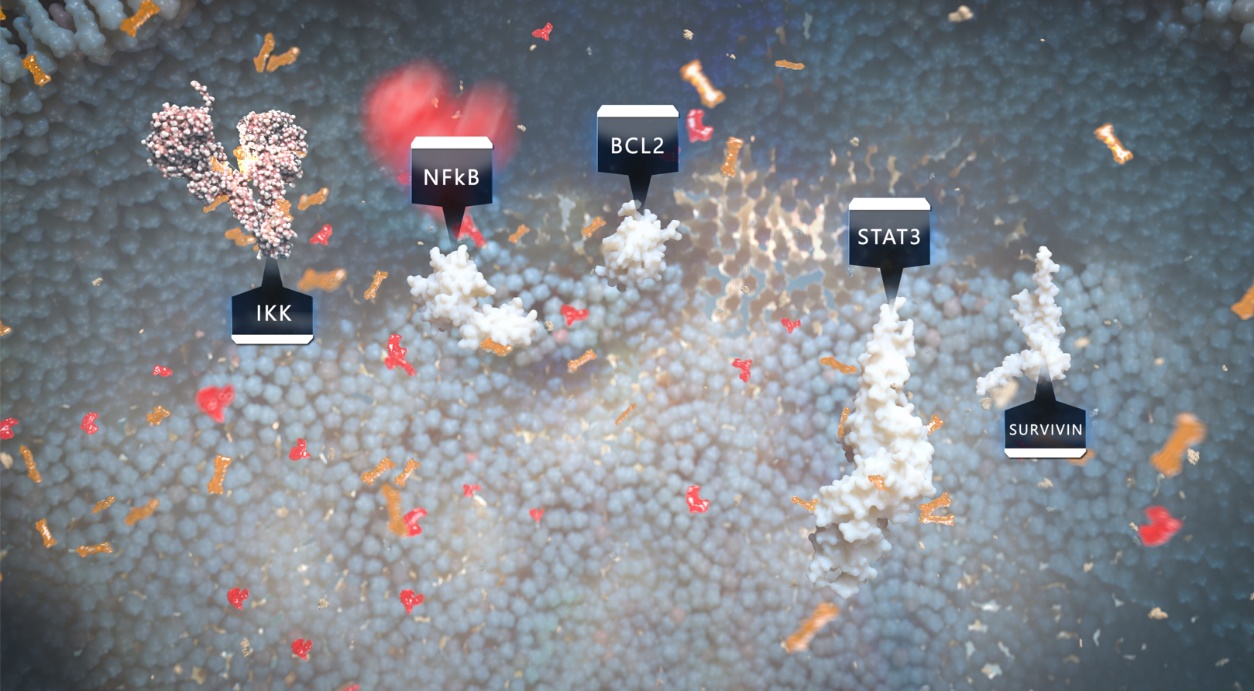

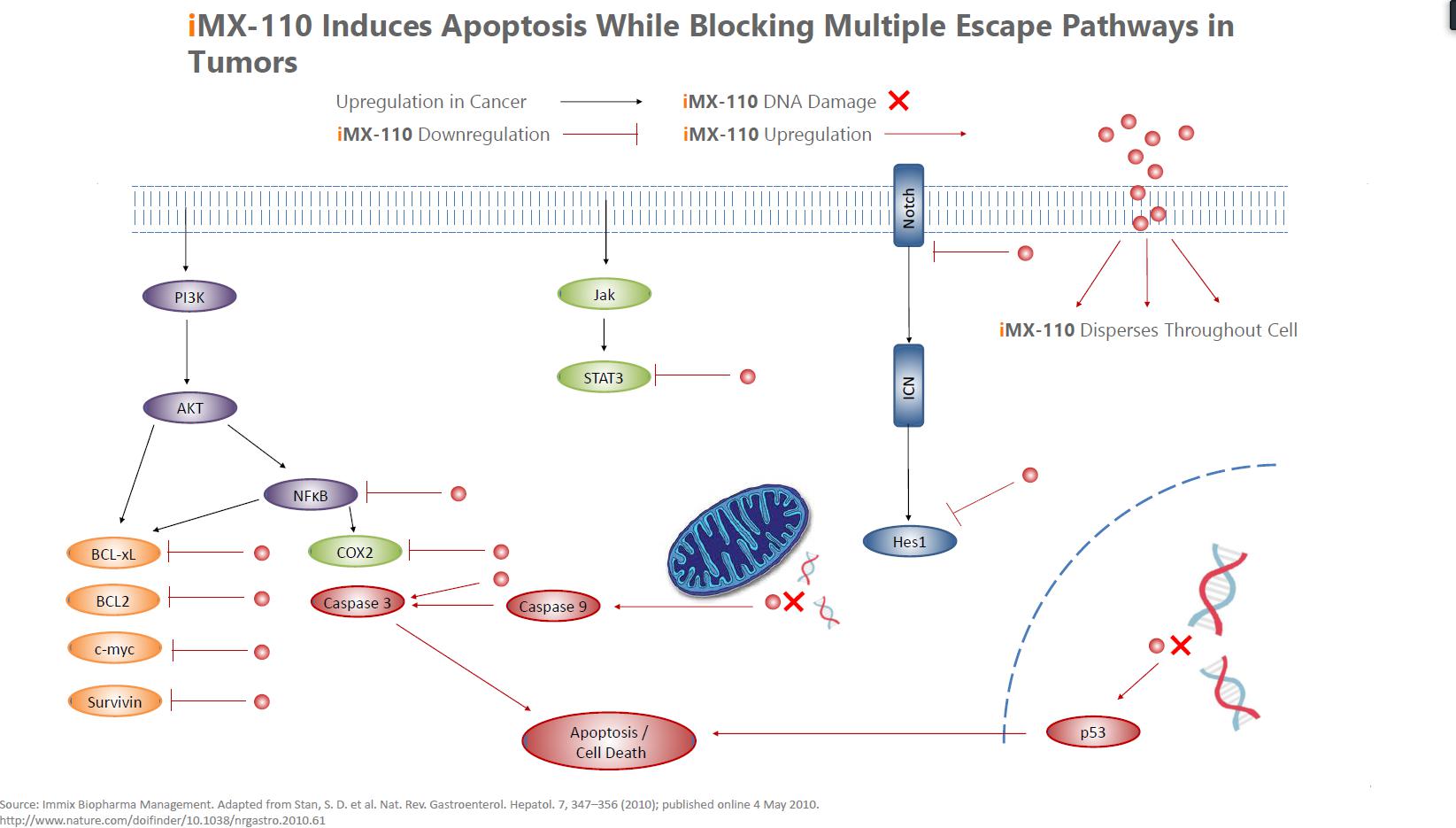

Our Lead Product Candidate

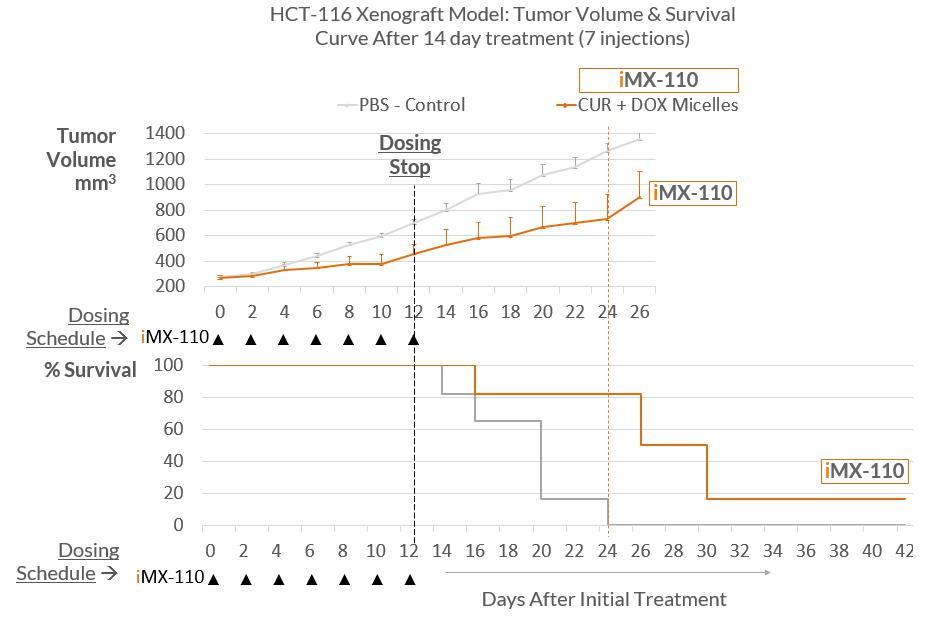

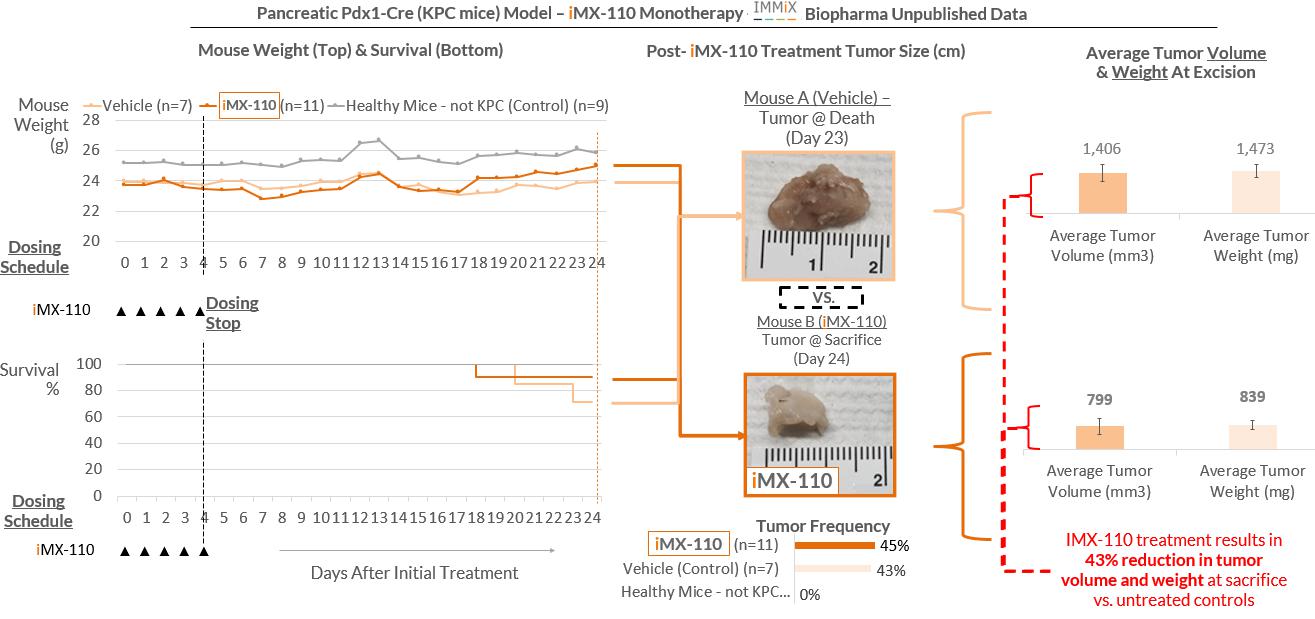

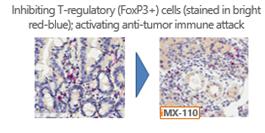

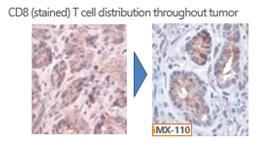

IMX-110, currently in Phase 1b/2a clinical trials, is a Tissue-Specific TherapeuticTM with TME NormalizationTM, a technology that we are developing initially for soft tissue sarcoma (“STS”). Tumor growth is sustained by hypoxia (low oxygen concentration) and acidosis (an excessively acidic condition) which produce recurring waves of activation of multiple kinases that upregulate NF-κB, STAT3 and other key transcriptional factors which cause recurrent inflammation. This inflammatory environment activates the TME to provide metabolic and structural support to the tumor and to recruit Treg T-cells (immune cells suppressing immune response) to suppress anti-tumor immune response. IMX-110’s poly-kinase inhibitor polyphenol curcuminoid complex (“PCC”), halts this fundamental tumor-sustaining inflammation by blocking multiple kinases and interfering with NF-κB and STAT3 activation, interrupting the positive feedback loop underlying the inflammatory cycle. With tumor-sustaining inflammation halted, IMX-110’s apoptosis inducer (Polyethylene glycol – phosphatidylethanolamine (“PEG-PE”)-doxorubicin complex) is then able to induce tumor cell death where conventional therapies have been hampered by resistance caused by NF-κB and STAT3 activation.

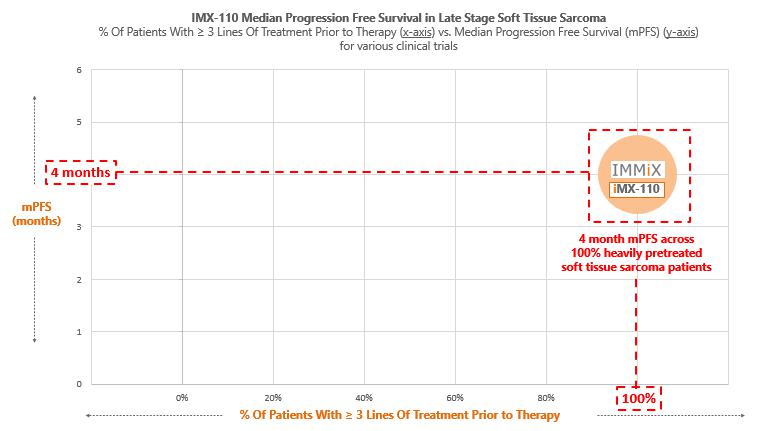

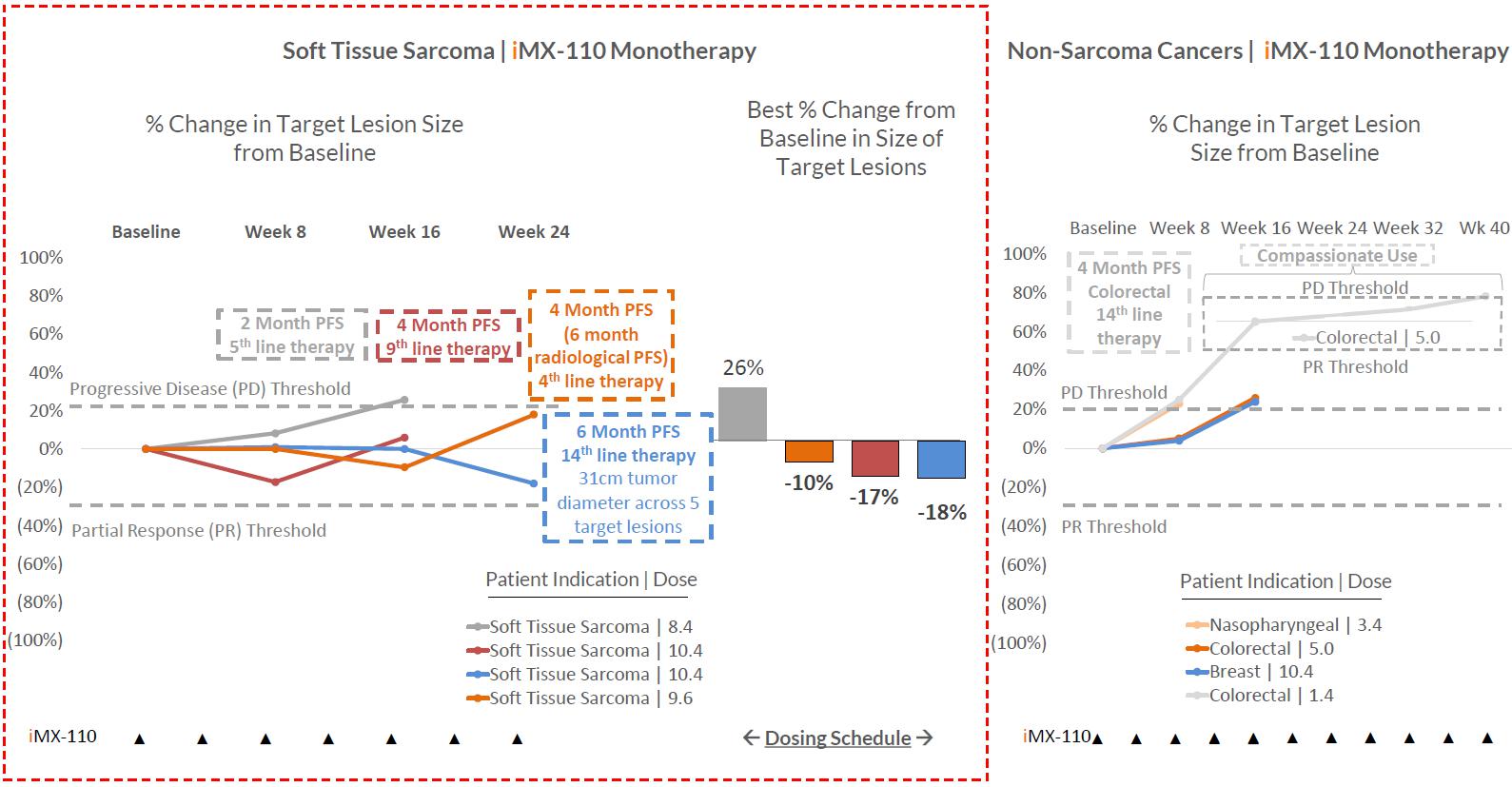

As of September 2021, we have treated 14 patients in our ongoing Phase 1b/2a clinical trial in the United States and Australia. 100% of these patients received between 3 and 13 lines of therapy prior to IMX-110. Zero drug-related serious adverse events and zero dose interruptions due to toxicity have been observed in our Phase 1b/2a clinical trial to date. In our trial, we observed radiological progression-free-survival of 6 months in 50% of our STS patients, with a 4-month median progression free survival (“mPFS”) across all STS patients. mPFS is the time that patients live without their cancer progressing. The trial includes patients with leiomyosarcoma, carcinosarcoma, poorly differentiated soft tissue sarcoma, cholangiocarcinoma, colorectal cancer, prostate cancer, pancreatic cancer, esophageal cancer, breast cancer, and nasopharyngeal cancer.

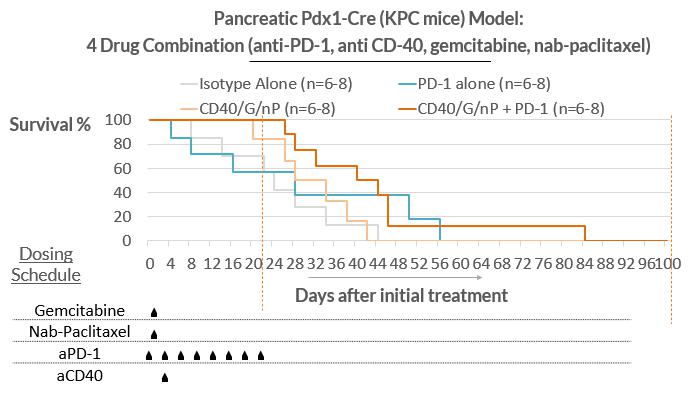

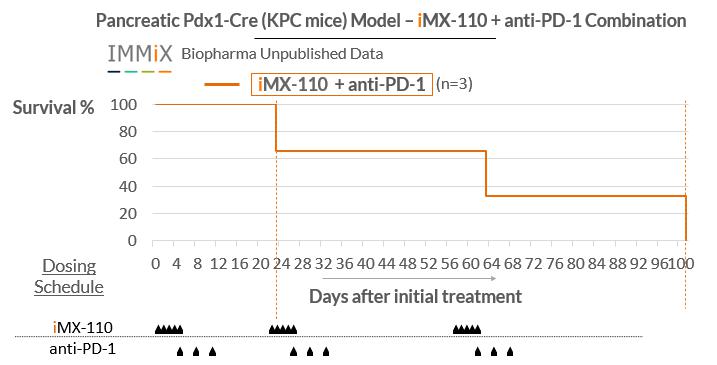

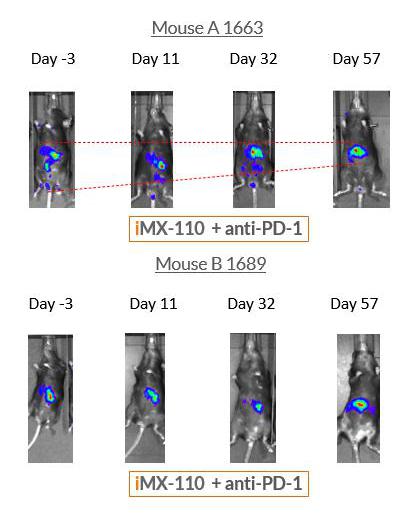

In August 2021, we entered into a Clinical Collaboration and Supply Agreement with BeiGene Ltd. (“BeiGene”) for a combination Phase 1b clinical trial in solid tumors of IMX-110 and anti-PD-1 Tislelizumab (the subject of a collaboration and license agreement among BeiGene and Novartis). In genetic mouse models of pancreatic cancer, IMX-110 has demonstrated an immunomodulation effect, turning “cold” tumors “hot,” and, in combination with murine anti-PD-1, IMX-110 produced extended survival versus multi-drug combinations. The goal of this study is to demonstrate the potential for TSTx to be an integral component of combination therapies for a wide range of advanced solid tumors.

| 4 |

Our Other Candidates

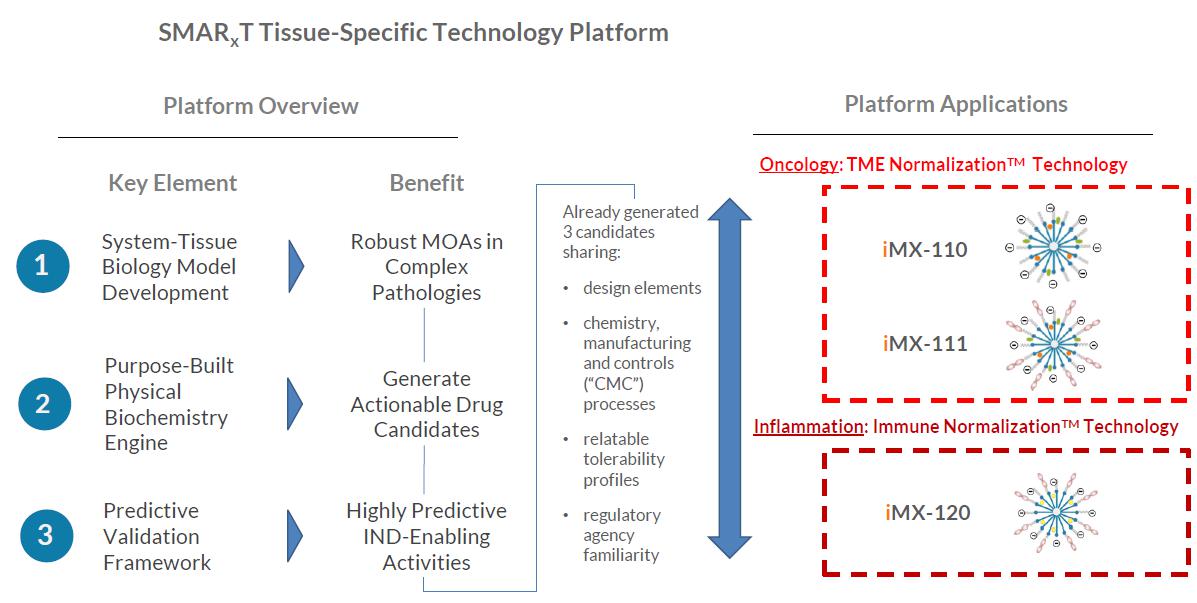

Our SMARxT Tissue-SpecificTM Platform has produced additional drug candidates which share design and chemistry, manufacturing and controls (“CMC”) processes with our lead candidate, resulting in tolerability profiles that may be similar to our lead product candidate, as well as regulatory agency familiarity, and a consistent multi-target therapeutic approach.

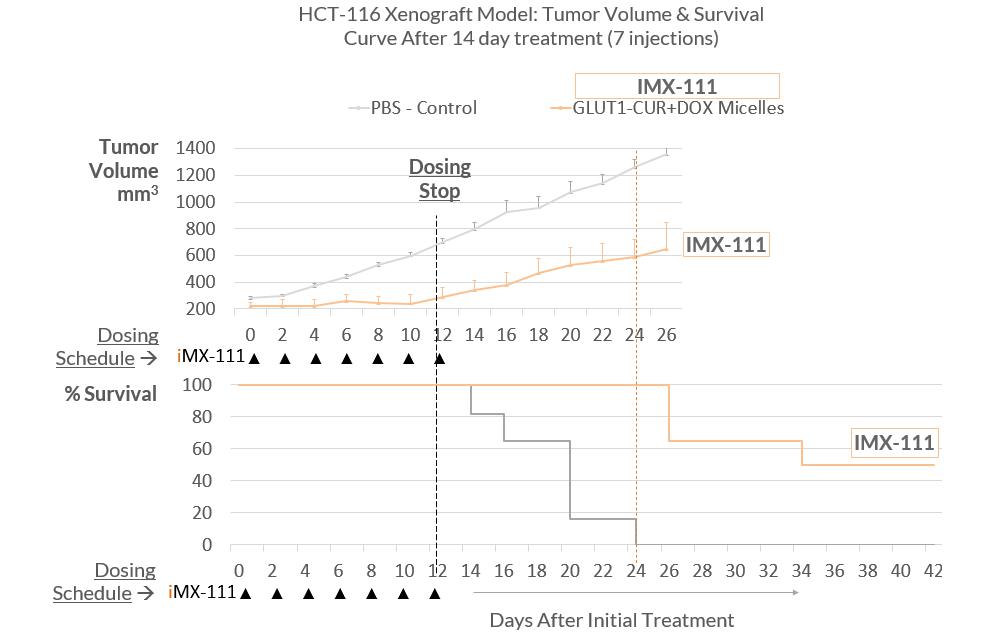

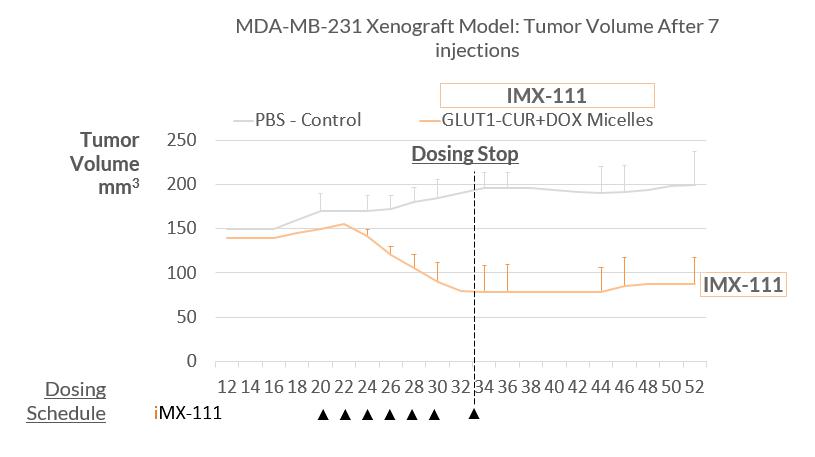

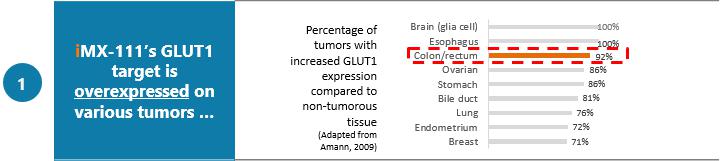

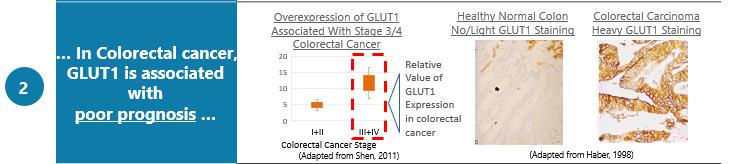

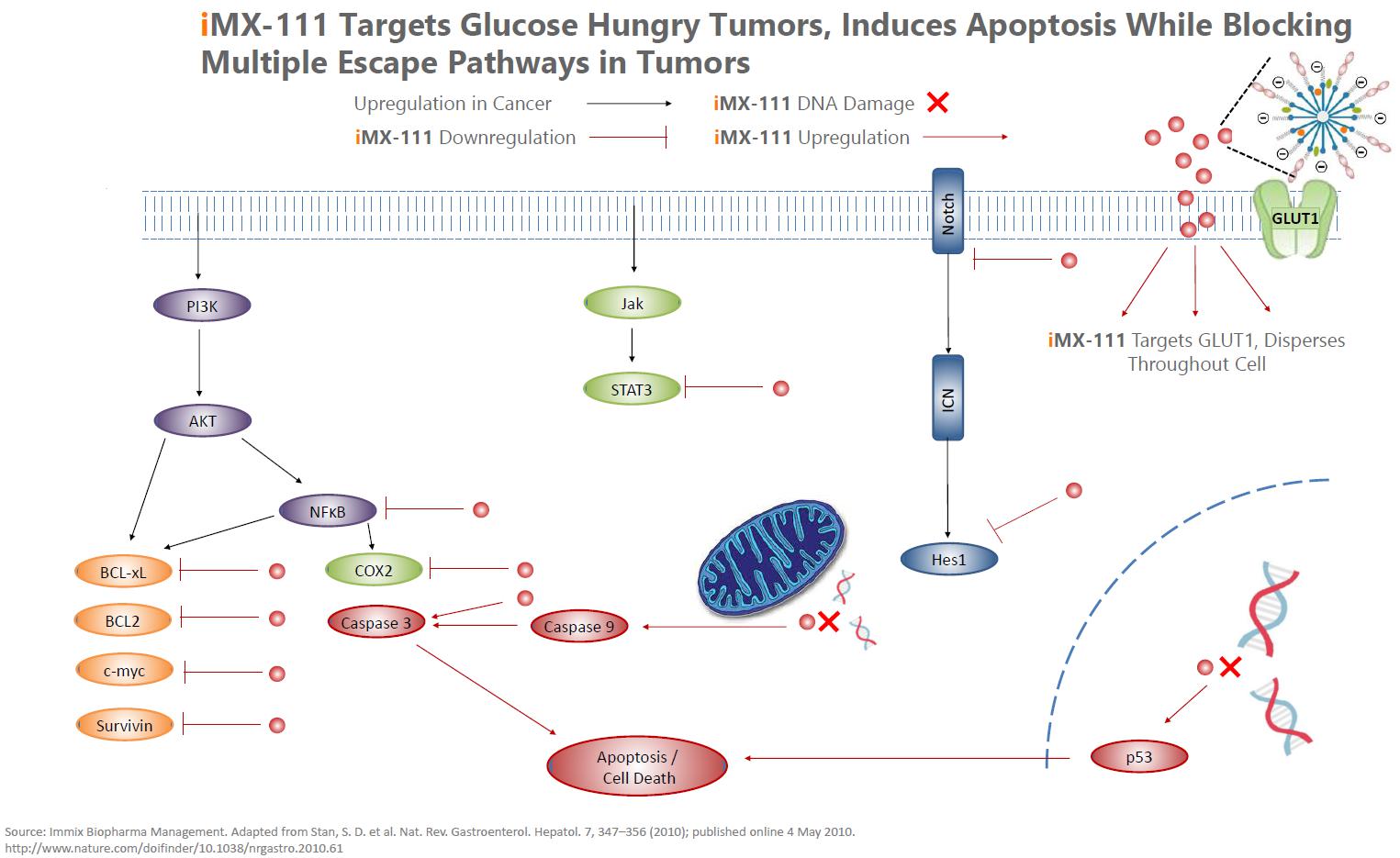

IMX-111 is a Tissue-Specific BiologicTM built on our TME NormalizationTM Technology with proprietary GLUT1 antibody biomarker targeting coupled with our poly-kinase inhibitor / apoptosis inducer. IMX-111 takes advantage of the fact that GLUT1 is an essential cancer biomarker that is overexpressed on 92% of colorectal cancer cells and other tumor types. Furthermore, the degree of its overexpression correlates with more advanced stages of tumor progression. Building on the well-tolerated profile of our lead candidate from our ongoing clinical trial, IMX-111 is the first cancer therapeutic to take advantage of GLUT1 overexpression in cancer.

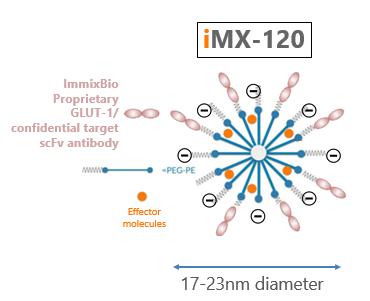

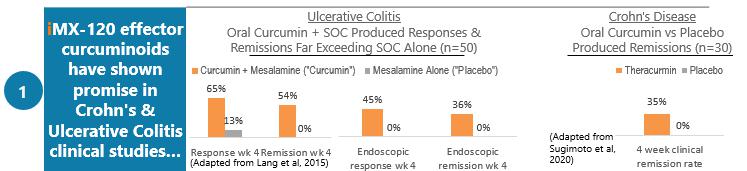

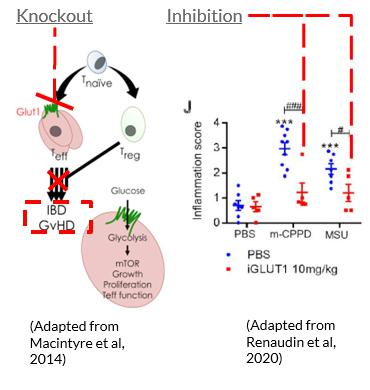

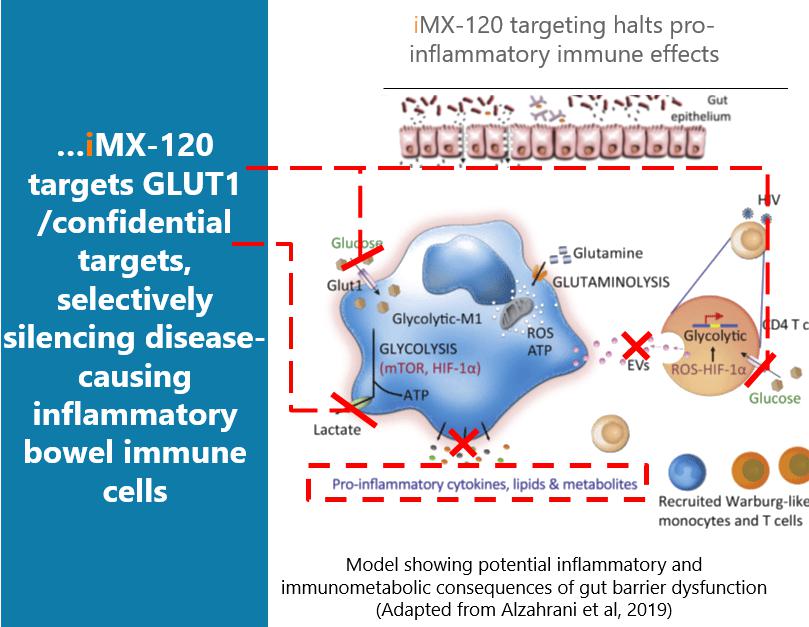

IMX-120 is a Tissue-Specific BiologicTM built on our Immune Normalization TechnologyTM for inflammatory bowel disease with proprietary GLUT1 antibody biomarker targeting coupled with polyphenol poly-kinase inhibitors. IMX-120 takes advantage of the fact that overexpression and activation of GLUT1 on overactive immune cells has been shown to be widely present in patients with inflammatory bowel diseases (“IBD”). Similar to tumor growth, the inflammatory processes active in IBD are caused by recurring waves of activation of multiple kinases that upregulate NF-κB, STAT3 and other key transcriptional factors. IMX-120’s polyphenol poly-kinase inhibitors block upstream kinase signal transduction systems that activate NF-κB and STAT3. GLUT1 presents an ideal targeting moiety (component of a drug) for these overactive immune cells, allowing for tissue-specific delivery of IMX-120.

Figure 1: Our Pipeline

| 5 |

Our Platform and Technologies

Our SMARxT Tissue-Specific Platform consists of 3 key elements: first, System-Tissue Biology Model Development, which allows us to develop robust mechanisms of action in complex pathologies; second, Purpose-Built Physical Biochemistry Engine, which allows us to generate actionable drug candidates; and third, Predictive Valuation Framework, which allows us to conduct highly predictive Investigational New Drug (“IND”)-enabling activities. The application of this platform in oncology is TME NormalizationTM Technology, and in inflammation is Immune NormalizationTM Technology.

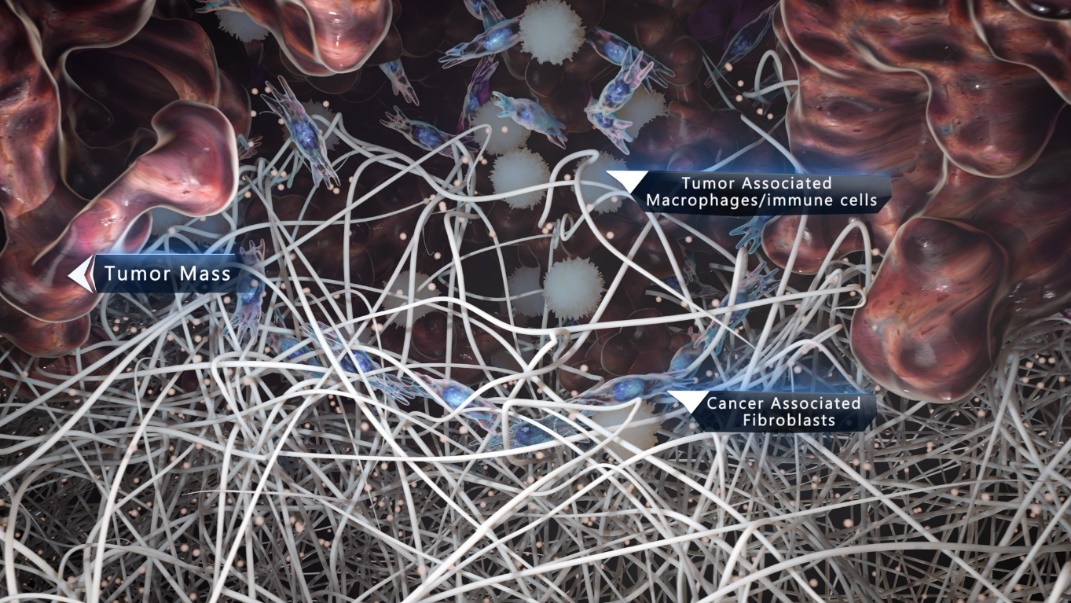

The TME is made up of a tightly packed mass of: 1) cancer associated fibroblasts (“CAFs”), 2) tumor-associated macrophages/immune cells (“TAMs”), and 3) cancer itself. The TME’s biophysical properties include regions of varying degrees of hypoxia, acidosis and an immunosuppressive milieu. As cancer cells outgrow their blood supply, the resulting hypoxia and acidosis shift their metabolism towards glycolysis, lactate and lipids. This, in turn, shapes the responses of proximal fibroblasts and resident immune cells. Fibroblasts begin to secrete lactate that is taken up by nearby cancer cells and consumed as fuel. Lactate in the TME reprograms the macrophages toward the M2 “tolerant” pro-inflammatory phenotype that drives immunosuppression. At the same time, the TME hypoxia produces increased levels of reactive oxygen species that enhance tumorigenicity (tendency to form tumors) and immunosuppressive functions of Treg T-cells, as well as resistance to immune drugs such as PD-1/PD-L1 inhibitors. Our TME NormalizationTM Technology reverses the hypoxia- and acidosis-activated genetic programs in every cellular component of the TME, “normalizing” the TME, and reactivating apoptosis cell death pathways. This technology offers an attractive opportunity to reshape the pathological niche that is the TME and overcome the critical factors that have hampered available treatments to date.

Our TME NormalizationTM Technology causes tumor apoptosis, a non-inflammatory tumor-cell death (instead of necroptosis, which results in repeat reignition of the inflammatory cascade leading to tumor progression). Thus, when the inflammatory cascade is inhibited, tumor resistance can be suppressed, enabling tumor cell apoptosis by ImmixBio therapies.

Figure 2: TME NormalizationTM Technology

Our Strategy

Our strategy is to capitalize on the clinical progress already made to-date by our lead drug candidate and extend the SMARxT Tissue-SpecificTM Platform to capture market share across multiple indications, initially in oncology and inflammation.

| 6 |

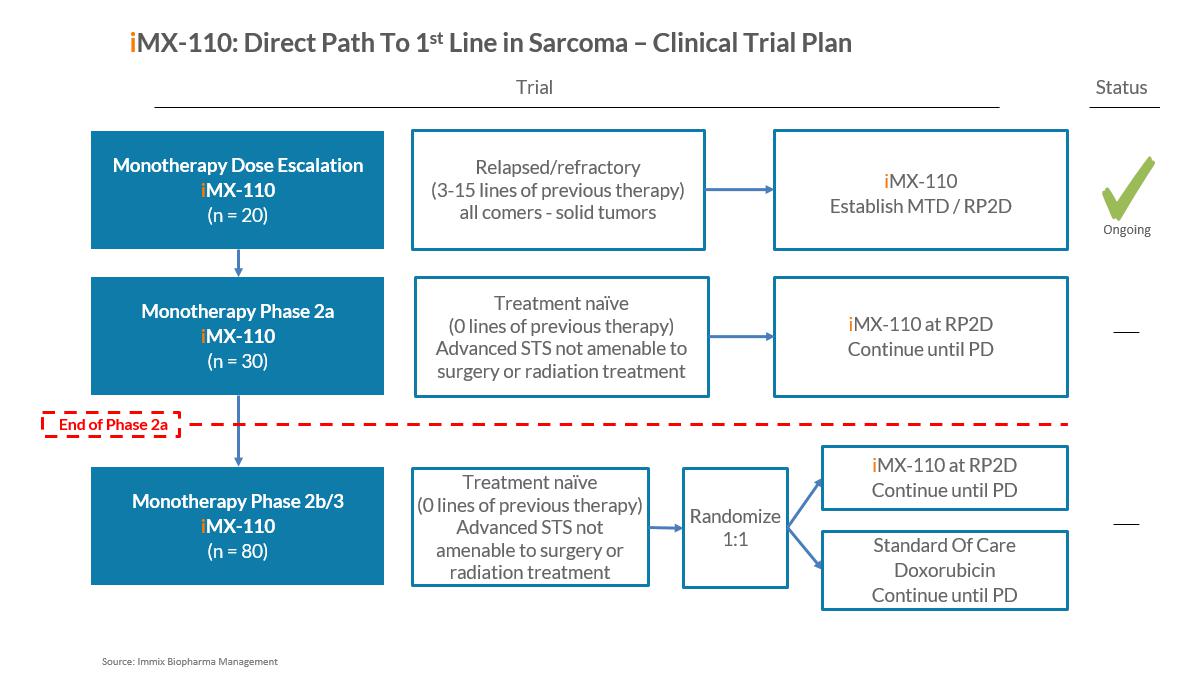

We plan to treat an additional 30 STS patients in our Phase 2a trial with IMX-110 as a first-line therapy. We expect our Phase 2a trial to require around 24 months after the first patient is dosed in 2022. Our rationale for IMX-110 as a first-line therapy in STS is the following:

| ● | encouraging clinical trial mPFS (4 month mPFS) data and tolerability data in our IMX-110 Phase 1b dose escalation trial; | |

| ● | we have identified precedent FDA clinical trial design for a first-line treatment; and | |

| ● | interest from leading STS principal investigators (“PIs”). |

Given IMX-110’s novel feature of co-delivery of a resistance-suppressing poly-kinase inhibitor with an apoptosis inducer, we believe IMX-110 can be used for treatment-resistant STS and other advanced, treatment-resistant cancers.

We believe IMX-110 can become a first-line therapy in STS and multiple other solid tumors, improving tolerability and progression free survival, while providing an alternative to conventional doxorubicin, a current first-line therapy initially approved for medical use in the United States in 1974.

Furthermore, IMX-110 represents a paradigm shift away from a focus on cytotoxic or targeted therapies alone which, while produce initial tumor shrinkage, simultaneously activate pathways that lead to cancer relapse and treatment resistance.

Additionally, pursuant to our Clinical Collaboration and Supply Agreement with BeiGene, we plan to conduct an up to 30-patient combination Phase 1b clinical trial in solid tumors of IMX-110 and anti-PD-1 Tislelizumab (the subject of a collaboration and license agreement among BeiGene and Novartis). We plan to dose the first patient in this trial in 2022.

With respect to our additional 2 drug candidates, we plan to conduct IND-enabling studies for IMX-111 by mid-2022, pursuing advanced colorectal cancer as the initial indication. We anticipate filing an IND for IMX-111 in 2023. We plan to conduct IND-enabling studies for IMX-120 by mid-2022, pursuing ulcerative colitis and severe Crohn’s disease indications. We anticipate filing an IND for IMX-120 in 2023.

Our Market Opportunity

STS is a rare cancer that begins in the tissues that connect, support, and surround the body structures. These tissues include muscle, fat, blood vessels, tendons, nerves and joint linings. The global STS market is estimated to reach approximately $6.5 billion by 2030 from the estimated $2.9 billion in 2019. Globally, there are roughly 116,000 new cases of STSs each year, of which 21,500 are in the European Union and 40,500 are in China. According to the American Cancer Society, there were roughly 13,000 new cases of STS in the United States during 2020. Approximately 160,000 people live with soft tissue cancers in the United States.

Colorectal cancers are cancers that arise from the colon, rectum and anus. The colorectal cancer market is estimated to reach approximately $31.2 billion by 2025 from the estimated $26.3 billion in 2019. According to the American Cancer Society, there were roughly 149,500 new cases of colorectal cancer in the United States. Globally, there are roughly 1,930,000 new cases of colorectal cancer each year, of which 519,500 are in Europe, 148,500 are in Japan, 20,500 are in Australia and New Zealand, and 555,000 are in China.

Inflammatory bowel disease is a complex disease with many contributing factors, primarily caused by an overactive immune system. Ulcerative colitis and Crohn’s disease are two of the most common forms of inflammatory bowel disease. The inflammatory bowel disease market is expected to reach $21.4 billion by 2024 from the existing $18.4 billion in 2019. Inflammatory bowel disease is estimated to affect over 2,000,000 people in the United States and over 5,000,000 people globally.

| 7 |

Our Team

We have assembled an outstanding management team to develop Tissue-Specific Therapeutics (TSTx) TM for patients with cancer and inflammatory diseases. Members of our management team have experience leading organizations that have run clinical trials, raised significant capital, been involved in several multimillion-dollar strategic transactions, and advanced multiple oncology therapeutics from early-stage research to clinical trials, ultimately to regulatory approval and commercialization. Our team’s select accomplishments include:

| - | Our Chief Executive Officer is a MD/PhD physician/scientist who co-founded ImmixBio in 2012 after serving as a clinical investigator for drugs produced by GlaxoSmithKline and Eli Lilly. At ImmixBio, he raised funding from family offices and venture capital funds, recruited our team and designed and oversaw our clinical trials. | |

| - | Our Chief Medical Officer and Head of Clinical Development is an experienced pharmaceutical physician executive with a successful track record at Roche/Genentech, AstraZeneca, and GlaxoSmithKline of development and post-marketing activities of a number of cancer therapeutics, including pertuzumab in breast cancer indications (marketed as PERJETA® by Roche) and other therapeutics. | |

| - | Our Chief Financial Officer previously raised $81 million as the interim Chief Financial Officer of Zap Surgical Systems, a brain radiosurgery company. Prior, he participated in greater than $50 billion in completed transactions, responsible for cross-border mergers and acquisitions transactions at Goldman Sachs & Co. and other global investment banks. | |

| - | Our Head of Chemistry, Manufacturing, and Control was previously VP - Manufacturing and Supply Chain Operations for Jazz Pharmaceuticals, Zosano Pharma, Talon Therapeutics, Connetics Pharmaceuticals, and ALZA Corp, and is a pharmaceutical executive with extensive CMC experience in organizations ranging from start-ups to large pharmaceutical companies. | |

| - | Our Scientific Co-founder is University Distinguished Professor of Pharmaceutical Sciences and Director, Center for Pharmaceutical Biotechnology and Nanomedicine, Northeastern University, Boston, and prior Massachusetts General Hospital/Harvard Medical School Head of Chemistry Program, Center for Imaging and Pharmaceutical Research. In 2011, Times Higher Education ranked him number 2 among top world scientists in pharmacology for the period of 2000-2010. |

We are supported by our advisors who are leading experts in oncology and inflammation, including Larry Norton, MD, Senior Vice President, Office of the President; Medical Director, Evelyn H. Lauder Breast Center, Memorial Sloan Kettering Cancer Center, and Professor of Medicine, Weill-Cornell Medical College; Galit Lahav, PhD, Novartis Professor of Systems Biology and Department Chair, Systems Biology at Harvard Medical School; and George W. Sledge, MD, Professor and former Chief of Medical Oncology at Stanford University Medical Center. Our arrangements with these individuals do not entitle us to any of their existing or future intellectual property derived from their independent research or research with other third parties.

Our board of directors includes Magda Marquet, PhD who co-founded Althea Technologies and guided Althea to acquisition by Ajinomoto, a global Japanese company and leader in amino acid technology, Jane Buchan, PhD, who co-founded PAAMCO in 2000 which under her leadership grew to $32 billion in assets under management, and Carey Ng, PhD, a Managing Director of Mesa Verde Venture Partners and Member of the Investment Committee, whose invested portfolio companies have been acquired by Merck & Co., Abbvie, Takeda, Supernus, and Exact Sciences.

| 8 |

Summary of Risk Factors

Our business is subject to a number of risks of which you should be aware of before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. Some of these risks include the following:

| ● | We have incurred substantial losses since our inception and anticipate that we will continue to incur substantial and increasing losses for the foreseeable future. | |

| ● | We need significant additional financing to fund our operations and complete the development and, if approved, the commercialization of our product candidates. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts. | |

| ● | Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our product candidates on unfavorable terms to us. | |

| ● | There is substantial doubt about our ability to continue as a going concern. | |

| ● | We have a limited number of product candidates, all which are still in early clinical or pre-clinical development. If we do not obtain regulatory approval of one or more of our product candidates, or experience significant delays in doing so, our business will be materially adversely affected. | |

| ● | Clinical trials are expensive, time consuming, difficult to design and implement, and involve uncertain outcomes. Results of previous pre-clinical studies and clinical trials may not be predictive of future results, and the results of our current and planned clinical trials may not satisfy the requirements of the FDA or other regulatory authorities. | |

| ● | We may find it difficult to enroll patients in our clinical trials given the limited number of patients who have the diseases for which our product candidates are being studied which could delay or prevent the start of clinical trials for our product candidates. | |

| ● | Our product candidates may have undesirable side effects that may delay or prevent marketing approval or, if approval is received, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales. | |

| ● | We are dependent on third parties for manufacturing and marketing of our product candidates. If we are not able to secure favorable arrangements with such third parties or the third parties upon whom we rely do not perform, including failure to perform to our specifications or comply with applicable regulations, our business and financial condition could be harmed. | |

| ● | If any of our product candidates receive regulatory approval, the approved products may not achieve broad market acceptance among physicians, patients, the medical community and third-party payors, in which case revenue generated from their sales would be limited. | |

| ● | Even if we receive regulatory approval to commercialize any of the product candidates that we develop, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense. | |

| ● | If any product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates. | |

| ● | Current and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain for such product candidates. If we fail to comply with regulations, we could face substantial enforcement actions, including civil and criminal penalties and our business, operations and financial condition could be adversely affected. | |

| ● | If the market opportunities for our current and potential future product candidates are smaller than we believe they are, our ability to generate product revenue may be adversely affected and our business may suffer. | |

| ● | Our products will face significant competition, and if they are unable to compete successfully, our business will suffer. | |

| ● | Any international operations we undertake may subject us to risks inherent with operations outside of the United States. | |

| ● | We may be subject to claims that our employees, consultants or independent contractors have wrongfully used or disclosed alleged trade secrets. |

| 9 |

| ● | Our intellectual property may not be sufficient to protect our product candidates from competition, which may negatively affect our business. We may incur substantial costs as a result of litigation or other proceedings relating to patents and other intellectual property rights. | |

| ● | An active trading market for our common stock may not develop, and you may not be able to sell your common stock at or above the initial public offering price. | |

| ● | Because certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions requiring stockholder approval. |

Corporate Information

We were incorporated as a California limited liability company in 2012 and converted to a Delaware corporation in January 2014. In August 2016, we established a wholly-owned Australian subsidiary, Immix Biopharma Australia Pty Ltd., in order to conduct various pre-clinical and clinical activities for the development of our product candidates. Our principal executive offices are located at 11400 West Olympic Blvd., Suite 200, Los Angeles, CA 90064 and our telephone number is (310) 651-8041. Our website address is www.immixbio.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common shares.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

As a company with less than $1.07 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined in the JOBS Act. As an emerging growth company, we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved; and | |

| ● | an exemption from compliance with the requirements of the Public Company Accounting Oversight Board regarding the communication of critical audit matters in the auditor’s report on financial statements. |

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. As an emerging growth company, we intend to take advantage of an extended transition period for complying with new or revised accounting standards as permitted by the JOBS Act. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies, which may make comparison of our financial statements to those of other public companies more difficult.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including:

| ● | not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; | |

| ● | scaled executive compensation disclosures; and | |

| ● | the requirement to provide only two years of audited financial statements, instead of three years. |

| 10 |

THE OFFERING

| Shares being offered | shares of common stock |

| Underwriters’ over-allotment option | We have granted the underwriters a 45 day option from the date of this prospectus to purchase up to an additional shares (15% of the total number of shares to be offered by us in the offering.) |

| Number of shares of common stock to be outstanding after this offering (1) | shares (or shares if the underwriters exercise the option to purchase additional shares in full). |

| Use of proceeds | We expect to receive net proceeds, after deducting underwriting discounts and commissions and estimated expenses payable by us, of approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional shares in full), based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus. We intend to use the net proceeds from this offering to fund our planned IMX-110 Phase 2a clinical trial in STS and our IMX-110 + tislelizumab Phase 1b combination trial, for IND-enabling studies for IMX-111 (colorectal cancer) and IMX-120 (inflammatory bowel disease), and for working capital and other general corporate purposes. We may also use a portion of the net proceeds to in-license, acquire or invest in complementary businesses or products, however, we have no current commitments or obligations to do so. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Lock-up | In connection with our initial public offering, we, our directors and executive officers have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 12 months following the closing of the offering of the shares. In addition, our stockholders have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 6 months following the closing of the offering of the shares. See “Underwriting” for more information. |

| Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 14, and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

| Proposed Nasdaq Capital Market Symbol | “IMMX” |

(1) The number of shares of our common stock to be outstanding after this offering is based on 1,125,000 shares of our common stock outstanding as of September 13, 2021, and excludes as of that date:

| ● | 440,328 shares of common stock issuable upon exercise of stock options at a weighted-average exercise price of $4.61 per share; | |

| ● | 52,000 shares of common stock issuable upon exercise of warrants at a weighted-average exercise price of $2.40 per share; | |

| ● | 446,712 shares of common stock reserved for future issuance under our 2016 and 2021 Equity Incentive Plans; | |

| ● | shares of common stock issuable upon the automatic conversion of outstanding convertible notes in the aggregate amount of $4,310,000, including interest accrued thereon, assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus; and | |

| ● | shares of common stock issuable upon exercise of warrants to be issued to the representative of the underwriters as part of this offering at an exercise price of $ (assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus)). |

Except as otherwise indicated herein, all information in this prospectus assumes or gives effect to:

| ● | a 1-for- stock split of our common effected on , 2021 pursuant to which (i) every shares of outstanding common stock was decreased to one share of common stock, (ii) the number of shares of common stock for which each outstanding warrant and option to purchase common stock is exercisable was proportionally decreased on a 1-for- basis and (iii) the exercise price of each outstanding warrant and option to purchase common stock was proportionately increased on a 1-for- basis (the “Reverse Stock Split”). No fractional shares will be issued as a result of the Reverse Stock Split. Any fractional shares resulting from the Reverse Stock Split shall be rounded up to the nearest whole share; | |

| ● | the automatic conversion of all of our outstanding convertible promissory notes in the aggregate amount of $4,310,000 into shares of our common stock, based upon an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus; and | |

| ● | no exercise by the underwriters of their option to purchase an additional shares of common stock. |

| 11 |

Summary Financial Data

The following tables set forth our summary financial data as of the dates and for the periods indicated. We have derived the summary statement of operations data for the years ended December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. The summary statement of operations data for the six months ended June 30, 2021 and 2020 and the summary balance sheet data as of June 30, 2021 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The following summary financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes and other information included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in the future and the results for the six months ended June 30, 2021 are not necessarily indicative of the results that may be expected for the full fiscal year.

Statement of Operations Data:

Years Ended December 31, | Six Months Ended June 30, (unaudited) | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | 248,149 | $ | 583,162 | $ | 87,601 | $ | 119,863 | ||||||||

| General and administrative expenses | 205,703 | 259,337 | 318,084 | 89,165 | ||||||||||||

| Loss from operations | (453,852 | ) | (842,499 | ) | (405,685 | ) | (209,028 | ) | ||||||||

| Interest expense | (101,976 | ) | (109,984 | ) | (81,409 | ) | (53,914 | ) | ||||||||

| Change in fair value of derivative liability | (575,000 | ) | — | (735,000 | ) | — | ||||||||||

| Other income | 512 | 224 | — | 510 | ||||||||||||

| Provision for income taxes | 17,547 | 20,552 | 3,199 | 3,533 | ||||||||||||

| Net loss | $ | (1,147,863 | ) | $ | (972,811 | ) | $ | (1,225,293 | ) | $ | (265,965 | ) | ||||

| Unaudited pro forma net loss per share, basic and diluted (1) | $ | $ | ||||||||||||||

| Unaudited pro forma weighted-average shares used in computing net loss per common share, basic and diluted (1) | ||||||||||||||||

(1) The unaudited pro forma basic and diluted weighted-average common shares outstanding used in the calculation of unaudited pro forma basic and diluted net loss per share attributable to common stockholders for the year ended December 31, 2020 and the six months ended June 30, 2021 have been prepared to give the effect to the automatic conversion of all outstanding convertible notes payable into shares of our common stock immediately prior to the closing of this offering, as if this offering had occurred on the later of the beginning of each period or the issuance date of the convertible notes payable.

Balance Sheet Data:

As of June 30, 2021 (unaudited) | ||||||||||||

| Actual | Pro Forma (1) | Pro Forma As Adjusted(2) | ||||||||||

| Cash | $ | 110,601 | $ | $ | ||||||||

| Working capital (deficit) | (5,703,569 | ) | ||||||||||

| Total assets | 351,582 | |||||||||||

| Derivative liability | 1,390,000 | |||||||||||

| Note payable | 50,000 | |||||||||||

| Convertible notes payable, including accrued interest | 4,571,111 | |||||||||||

| Total stockholders’ equity (deficit) | (5,850,775 | ) | ||||||||||

| 12 |

(1) The pro forma balance sheet data gives effect to (i) the automatic conversion of all of our convertible promissory notes and related accrued interest as of June 30, 2021 into shares of our common stock, based on the assumed initial public offering price of $ , the midpoint of the range set forth on the cover page of this prospectus, and (ii) the reclassification of the derivative liability related to embedded redemption features in our convertible promissory notes to additional paid-in capital.

(2) The pro forma as adjusted balance sheet data reflects our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing.

Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease the pro forma as adjusted cash, working capital (deficit), total assets and total stockholders’ equity (deficit) by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. A 1,000,000 share increase or decrease in the number of shares offered by us would increase or decrease the pro forma as adjusted cash, working capital (deficit), total assets and total stockholders’ equity (deficit) by approximately $ million, assuming that the assumed initial price to public remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. These unaudited adjustments are based upon available information and certain assumptions we believe are reasonable under the circumstances.

| 13 |

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should give careful consideration to the following risk factors, in addition to the other information included in this prospectus, including our financial statements and related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Financial Position and Capital Needs

We have incurred substantial losses since our inception and anticipate that we will continue to incur substantial and increasing losses for the foreseeable future.

We are a clinical-stage biopharmaceutical company focused on developing a novel class of TSTx in oncology and inflammation. Investment in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that a product candidate will fail to prove effective, gain regulatory approval or become commercially viable. We do not have any products approved by regulatory authorities and have not generated any revenues from collaboration or licensing agreements or product sales to date, and have incurred significant research, development and other expenses related to our ongoing operations and expect to continue to incur such expenses. As a result, we have not been profitable and have incurred significant operating losses since our inception. For the years ended December 31, 2020 and 2019, we reported net losses of $1,147,863 and $972,811, respectively. For the six months ended June 30, 2021, we reported a net loss of $1,225,293. As of December 31, 2020 and June 30, 2021, we had an accumulated deficit of $5,371,655 and $6,596,948, respectively.

We do not expect to generate revenues for many years, if at all. We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate these losses to increase as we continue to research, develop and seek regulatory approvals for our current product candidates and any additional product candidates we may acquire, and potentially begin to commercialize product candidates that may achieve regulatory approval. We may also encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. Our expenses will further increase as we:

| ● | conduct pre-clinical and clinical trials of our product candidates; | |

| ● | in-license or acquire the rights to, and pursue development of, other products, product candidates or technologies; | |

| ● | hire additional clinical, manufacturing, quality control, quality assurance and scientific personnel; | |

| ● | seek marketing approval for any product candidates that successfully complete clinical trials; | |

| ● | establish sales, marketing and distribution capabilities, if we receive, or expect to receive, marketing approval for any product candidates; | |

| ● | maintain, expand and protect our intellectual property portfolio; and | |

| ● | add operational, financial and management information systems and personnel. |

We need significant additional financing to fund our operations and complete the development and, if approved, the commercialization of our product candidates. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We believe the net proceeds of this offering, together with our existing cash, will be sufficient to meet our cash, operational and liquidity requirements for at least 12 months after the date of this prospectus; however, such cash will not be sufficient to complete development and obtain regulatory approval for our product candidates, and we will need to raise significant additional capital to help us do so. In addition, our operating plan may change as a result of many factors currently unknown to us, and we may need additional funds sooner than planned.

| 14 |

We expect to expend substantial resources for the foreseeable future to continue the clinical development and manufacturing of our product candidates. These expenditures will include costs associated with research and development, potentially acquiring new product candidates or technologies, conducting pre-clinical studies and clinical trials and potentially obtaining regulatory approvals and manufacturing products, as well as marketing and selling products approved for sale, if any.

Additional funds may not be available when we need them on terms that are acceptable to us, or at all. We have no committed source of additional capital. If adequate funds are not available to us on a timely basis, we may not be able to continue as a going concern or we may be required to delay, limit, reduce or terminate pre-clinical studies, clinical trials or other development activities for our product candidates or target indications, or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our product candidates.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our product candidates on unfavorable terms to us.

We may seek additional capital through a variety of means, including through private and public equity offerings and debt financings, collaborations, strategic alliances and marketing, distribution or licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, or through the issuance of shares under management or other types of contracts, or upon the exercise or conversion of outstanding derivative securities, the ownership interests of our stockholders will be diluted, and the terms of such financings may include liquidation or other preferences, anti-dilution rights, conversion and exercise price adjustments and other provisions that adversely affect the rights of our stockholders, including rights, preferences and privileges that are senior to those of our holders of common stock in the event of a liquidation. In addition, debt financing, if available, could include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures, entering into licensing arrangements, or declaring dividends and may require us to grant security interests in our assets, including our intellectual property. If we raise additional funds through collaborations, strategic alliances, or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, products or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may need to curtail or cease our operations.

There is substantial doubt about our ability to continue as a going concern.

As of December 31, 2020 and June 30, 2021, we had an accumulated deficit of $5,371,655 and $6,596,948, respectively, since inception and have not yet generated any revenue from operations. Management anticipates that its cash on hand is not sufficient to fund its planned operations. These factors raise substantial doubt regarding our ability to continue as a going concern. There is no guarantee that we will be able to secure additional financing, including in connection with this offering. Changes in our operating plans, our existing and anticipated working capital needs, costs related to legal proceedings we might become subject to in the future, the acceleration or modification of our development activities, any near-term or future expansion plans, increased expenses, potential acquisitions or other events may further affect our ability to continue as a going concern. Similarly, the report of our independent registered public accounting firm on our consolidated financial statements as of and for the year ended December 31, 2020 includes an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern. If we cannot continue as a viable entity, our securityholders may lose some or all of their investment in us.

| 15 |

We currently have no source of revenues. We may never generate revenues or achieve profitability.

Currently, we do not generate any revenues from product sales or otherwise. Even if we are able to successfully achieve regulatory approval for our product candidates, we do not know when we will generate revenues or become profitable, if at all. Our ability to generate revenues from product sales and achieve profitability will depend on our ability to successfully commercialize products, including our current product candidates and other product candidates that we may develop, in-license or acquire in the future. Our ability to generate revenues and achieve profitability also depends on a number of additional factors, including our ability to:

| ● | successfully complete development activities, including the necessary clinical trials; | |

| ● | complete and submit either Biologics License Applications (“BLAs”) or New Drug Applications (“NDAs”) to the FDA and obtain U.S. regulatory approval for indications for which there is a commercial market; | |

| ● | complete and submit applications to foreign regulatory authorities; | |

| ● | obtain regulatory approval in territories with viable market sizes; | |

| ● | obtain coverage and adequate reimbursement from third parties, including government and private payors; | |

| ● | set commercially viable prices for our products, if any; | |

| ● | establish and maintain supply and manufacturing relationships with reliable third parties, legally globally compliant manufacturing of bulk drug substances and drug products to maintain that supply; | |

| ● | develop distribution processes for our product candidates; | |

| ● | develop commercial quantities of our product candidates, if approved, at acceptable cost levels; | |

| ● | obtain additional funding if required to develop and commercialize our product candidates; | |

| ● | develop sales, marketing and distribution capabilities for products we intend to sell; | |

| ● | achieve market acceptance of our products; | |

| ● | attract, hire and retain qualified personnel; and | |

| ● | protect our intellectual property rights. |

Our revenues for any product candidates for which regulatory approval is obtained will be dependent, in part, upon the size of the markets in the territories for which it gains regulatory approval, the accepted price for the products, the ability to get reimbursement at any price, and whether we own the commercial rights for that territory. If the number of our addressable disease patients is not as significant as our estimates, the indication approved by regulatory authorities is narrower than we expect, or the reasonably accepted population for treatment is narrowed by competition, physician choice or treatment guidelines, we may not generate significant revenues from sales of such products, even if approved. In addition, we anticipate incurring significant costs associated with commercializing any approved product candidates. As a result, even if we generate revenues, we may not become profitable and may need to obtain additional funding to continue operations. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and may be forced to reduce our operations.

Our ability to use net operating losses to offset future taxable income may be subject to limitations.

As of December 31, 2020, we had federal net operating loss, or NOLs, carryforwards of approximately $710,000. Our NOLs generated in tax years ending on or prior to December 31, 2017 are only permitted to be carried forward for 20 years under applicable U.S. tax laws, and will begin to expire, if not utilized, beginning in 2027. These NOL carryforwards could expire unused and be unavailable to offset future income tax liabilities. Under the Tax Act, federal NOLs incurred in tax years ending after December 31, 2017 may be carried forward indefinitely, but the deductibility of such federal NOLs is limited. It is uncertain if and to what extent various states will conform to the Tax Act, or whether any further regulatory changes may be adopted in the future that could minimize its applicability. In addition, under Section 382 of the Internal Revenue Code of 1986, as amended, and certain corresponding provisions of state law, if a corporation undergoes an “ownership change,” which is generally defined as a greater than 50% change, by value, in the ownership of its equity over a three-year period, the corporation’s ability to use its pre-change NOL carryforwards and other pre-change tax attributes to offset its post-change income may be limited.

| 16 |

Risks Relating to the Development and Regulatory Approval of Our Product Candidates

We have a limited number of product candidates, all which are still in early clinical or pre-clinical development. If we do not obtain regulatory approval of one or more of our product candidates, or experience significant delays in doing so, our business will be materially adversely affected.

We currently have no products approved for sale or marketing in any country, and may never be able to obtain regulatory approval for any of our product candidates. As a result, we are not currently permitted to market any of our product candidates in the United States or in any other country until we obtain regulatory approval from the FDA or regulatory authorities outside the United States. Our product candidates are in early stages of development and we have not submitted an application, or received marketing approval, for any of our product candidates. Obtaining regulatory approval of our product candidates will depend on many factors, including, but not limited to, the following:

| ● | successfully completing formulation and process development activities; | |

| ● | completing clinical trials that demonstrate the efficacy and safety of our product candidates; | |

| ● | receiving marketing approval from applicable regulatory authorities; | |

| ● | establishing commercial manufacturing capabilities; and | |

| ● | launching commercial sales, marketing and distribution operations. |

Many of these factors are wholly or partially beyond our control, including clinical advancement, the regulatory submission process and changes in the competitive landscape. If we do not achieve one or more of these targets in a timely manner, we could experience significant delays or may be unable to develop our product candidates at all, which may have a material adverse effect on our business and results of operations.

Clinical trials are expensive, time consuming, difficult to design and implement, and involve uncertain outcomes. Results of previous pre-clinical studies and clinical trials may not be predictive of future results, and the results of our current and planned clinical trials may not satisfy the requirements of the FDA or other regulatory authorities.

Positive or timely results from pre-clinical or early-stage trials do not ensure positive or timely results in late-stage clinical trials or product approval by the FDA or comparable foreign regulatory authorities. We will be required to demonstrate with substantial evidence through well-controlled clinical trials that our product candidates are safe and effective for use in a diverse population before we can seek regulatory approvals for their commercialization. Our planned clinical trials may produce negative or inconclusive results, and we or any of our current and future strategic partners may decide, or regulators may require us, to conduct additional clinical or pre-clinical testing.

Success in pre-clinical studies or early-stage clinical trials does not mean that future clinical trials or registration clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety and efficacy to the satisfaction of the FDA and foreign regulatory authorities, despite having progressed through pre-clinical studies and initial clinical trials. Product candidates that have shown promising results in early clinical trials may still suffer significant setbacks in subsequent clinical trials or registration clinical trials. For example, a number of companies in the biopharmaceutical industry, including those with greater resources and experience than us, have suffered significant setbacks in advanced clinical trials, even after obtaining promising results in earlier clinical trials. Similarly, pre-clinical interim results of a clinical trial are not necessarily predictive of final results.

| 17 |

If clinical trials for our product candidates are prolonged, delayed or stopped, we may be unable to obtain regulatory approval and commercialize our product candidates on a timely basis, or at all, which would require us to incur additional costs and delay our receipt of any product revenue.

We may experience delays in our ongoing or future pre-clinical studies or clinical trials, and we do not know whether future pre-clinical studies or clinical trials will begin on time, need to be redesigned, enroll an adequate number of patients or be completed on schedule, if at all. The commencement or completion of these planned clinical trials could be substantially delayed or prevented by many factors, including, but not limited to:

| ● | discussions with the FDA or other regulatory agencies regarding the scope or design of our clinical trials; | |

| ● | the limited number of, and competition for, suitable sites to conduct our clinical trials, many of which may already be engaged in other clinical trial programs, including some that may be for the same indication as our product candidates; | |

| ● | any delay or failure to obtain approval or agreement to commence a clinical trial in any of the countries where enrollment is planned; | |

| ● | inability to obtain sufficient funds required for a clinical trial; | |

| ● | clinical holds on, or other regulatory objections to, a new or ongoing clinical trial; | |

| ● | delay or failure to manufacture sufficient supplies of product candidates for our clinical trials; | |

| ● | delay or failure to reach agreement on acceptable clinical trial agreement terms or clinical trial protocols with prospective sites or clinical research organizations (“CROs”), the terms of which can be subject to extensive negotiation and may vary significantly among different sites or CROs; | |

| ● | delay or failure to obtain institutional review board (“IRB”) approval to conduct a clinical trial at a prospective site; | |

| ● | slower than expected rates of patient recruitment and enrollment; | |

| ● | failure of patients to complete the clinical trial; | |

| ● | the inability to enroll a sufficient number of patients in studies to ensure adequate statistical power to detect statistically significant treatment effects; | |

| ● | unforeseen safety issues, including severe or unexpected drug-related adverse effects experienced by patients, including possible deaths; | |

| ● | lack of efficacy during clinical trials; | |

| ● | termination of our clinical trials by one or more clinical trial sites; | |

| ● | inability or unwillingness of patients or clinical investigators to follow our clinical trial protocols; | |

| ● | inability to monitor patients adequately during or after treatment; | |

| ● | clinical study sites failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, deviating from the protocol or dropping out of a study; | |

| ● | inability to address any non-compliance with regulatory requirements or safety concerns that arise during the course of a clinical trial; | |

| ● | the need to repeat or terminate clinical trials as a result of inconclusive or negative results or unforeseen complications in testing; and | |

| ● | our clinical trials may be suspended or terminated upon a breach or pursuant to the terms of any agreement with, or for any other reason by, current or future strategic partners that have responsibility for the clinical development of any of our product candidates. |

Changes in regulatory requirements, policies and guidelines may also occur and we may need to significantly amend clinical trial protocols to reflect these changes with appropriate regulatory authorities. These changes may require us to renegotiate terms with CROs or resubmit clinical trial protocols to IRBs for re-examination, which may impact the costs, timing or successful completion of a clinical trial. Our clinical trials may be suspended or terminated at any time by the FDA, other regulatory authorities, the IRB overseeing the clinical trial at issue, any of our clinical trial sites with respect to that site, or us. Any failure or significant delay in commencing or completing clinical trials for our product candidates may adversely affect our ability to obtain regulatory approval and our commercial prospects and our ability to generate product revenue will be diminished.

| 18 |

The design or our execution of clinical trials may not support regulatory approval.

The design or execution of a clinical trial can determine whether its results will support regulatory approval and flaws in the design or execution of a clinical trial may not become apparent until the clinical trial is well advanced. In some instances, there can be significant variability in safety or efficacy results between different trials of the same product candidate due to numerous factors, including changes in trial protocols, differences in size and type of the patient populations, adherence to the dosing regimen and other trial protocols and the rate of dropout among clinical trial participants. We do not know whether any clinical trials we may conduct will demonstrate consistent or adequate efficacy and safety to obtain regulatory approval to market our product candidates.

Further, the FDA and comparable foreign regulatory authorities have substantial discretion in the approval process and in determining when or whether regulatory approval will be obtained for any of our product candidates. Our product candidates may not be approved even if they achieve their primary endpoints in future clinical trials. The FDA or foreign regulatory authorities may disagree with our trial design and our interpretation of data from pre-clinical studies and clinical trials. In addition, any of these regulatory authorities may change requirements for the approval of a product candidate even after reviewing and providing comments or advice on a protocol for clinical trial that has the potential to result in FDA or other agencies’ approval. In addition, such regulatory authorities may also approve a product candidate for fewer or more limited indications than we request or may grant approval contingent on the performance of costly post-marketing clinical trials. The FDA or foreign regulatory authorities may not approve the labeling claims that we believe would be necessary or desirable for the successful commercialization of our product candidates which may have a material adverse effect on our business.

We may find it difficult to enroll patients in our clinical trials given the limited number of patients who have the diseases for which our product candidates are being studied which could delay or prevent the start of clinical trials for our product candidates.

Identifying and qualifying patients to participate in clinical trials of our product candidate is essential to our success. The timing of our clinical trials depends in part on the rate at which we can recruit patients to participate in clinical trials of our product candidates, and we may experience delays in our clinical trials if we encounter difficulties in enrollment. If we experience delays in our clinical trials, the timeline for obtaining regulatory approval of our product candidates will most likely be delayed.

Many factors may affect our ability to identify, enroll and maintain qualified patients, including the following:

| ● | eligibility criteria of our ongoing and planned clinical trials with specific characteristics appropriate for inclusion in our clinical trials; | |

| ● | design of the clinical trial; | |

| ● | size and nature of the patient population; | |

| ● | patients’ perceptions as to risks and benefits of the product candidate under study and the participation in a clinical trial generally in relation to other available therapies, including any new drugs that may be approved for the indications we are investigating; | |

| ● | the availability and efficacy of competing therapies and clinical trials; | |

| ● | pendency of other trials underway in the same patient population; | |

| ● | willingness of physicians to participate in our planned clinical trials; | |

| ● | severity of the disease under investigation; | |

| ● | proximity of patients to clinical sites; | |

| ● | patients who do not complete the trials for personal reasons; and |

| 19 |

| ● | issues with CROs and/or with other vendors that handle our clinical trials. |

We may not be able to initiate or continue to support clinical trials of our product candidates for one or more indications, or any future product candidates if we are unable to locate and enroll a sufficient number of eligible participants in these trials as required by the FDA or other regulatory authorities. Even if we are able to enroll a sufficient number of patients in our clinical trials, if the pace of enrollment is slower than we expect, the development costs for our product candidates may increase and the completion of our trials may be delayed or our trials could become too expensive to complete.

If we experience delays in the completion of, or termination of, any clinical trials of our product candidates, the commercial prospects of our product candidates could be harmed, and our ability to generate product revenue from any of our product candidates could be delayed or prevented. In addition, any delays in completing our clinical trials would likely increase our overall costs, impair product candidate development and jeopardize our ability to obtain regulatory approval relative to our current plans. Any of these occurrences may harm our business, financial condition, and prospects significantly.

Our product candidates may have undesirable side effects that may delay or prevent marketing approval or, if approval is received, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales; no regulatory agency has made any such determination that any of our product candidates are safe or effective for use by the general public for any indication.

All of our product candidates are still in pre-clinical or early clinical development. Additionally, all of our product candidates are required to undergo ongoing safety testing in humans as part of clinical trials. Consequently, not all adverse effects of drugs can be predicted or anticipated. Unforeseen side effects from any of our product candidates could arise either during clinical development or, if approved by regulatory authorities, after the approved product has been marketed. Therefore, the results from clinical trials may not demonstrate a favorable safety profile in humans. The results of future clinical trials may show that our product candidates cause undesirable or unacceptable side effects, which could interrupt, delay or halt clinical trials, and result in delay of, or failure to obtain, marketing approval from the FDA or foreign regulatory authorities, or result in marketing approval from the FDA or foreign regulatory authorities with restrictive label warnings, limited patient populations or potential product liability claims. Even if we believe that our clinical trial and pre-clinical studies demonstrate the safety and efficacy of our product candidates, only the FDA and other comparable regulatory agencies may ultimately make such determination. No regulatory agency has made a determination that any of our product candidates are safe or effective for any indication.

If any of our product candidates receive marketing approval and we or others later identify undesirable or unacceptable side effects caused by such products:

| ● | regulatory authorities may require us to take our approved product off the market; | |

| ● | regulatory authorities may require the addition of labeling statements, specific warnings, and/or a contraindication or field alerts to physicians and pharmacies; | |

| ● | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; | |

| ● | we may be subject to limitations on how we may promote the product; | |

| ● | sales of the product may decrease significantly; | |

| ● | we may be subject to litigation or product liability claims; and | |

| ● | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase commercialization costs and expenses, which in turn could delay or prevent us from generating revenue from the sale of any future products.

| 20 |

We are dependent on third parties for manufacturing and marketing of our product candidates. If we are not able to secure favorable arrangements with such third parties, our business and financial condition could be harmed.

We will not manufacture any of our product candidates for commercial sale nor do we have the resources necessary to do so. In addition, we currently do not have the capability to market our drug products ourselves. In addition to our internal sales force efforts, we have contracted with and intend to continue to contract with specialized manufacturing companies to manufacture our product candidates. In connection with our efforts to commercialize our product candidates, we will seek to secure favorable arrangements with third parties to distribute, promote, market and sell our product candidates. If our internal sales force is unable to successfully distribute, market and promote our product candidates and we are not able to secure favorable commercial terms or arrangements with third parties for the distribution, marketing, promotion and sales of our product candidates, we may have to retain promotional and marketing rights and seek to develop the commercial resources necessary to promote or co-promote or co-market certain or all of our drug candidates to the appropriate channels of distribution in order to reach the specific medical market that we are targeting. We may not be able to enter into any partnering arrangements on this or any other basis. If we are not able to secure favorable partnering arrangements, or are unable to develop the appropriate resources necessary for the commercialization of our product candidates, our business and financial condition could be harmed.

In addition, we, or our potential commercial partners, may not successfully introduce our product candidates or such candidates may not achieve acceptance by patients, health care providers and insurance companies. Further, it is possible that we may not be able to secure arrangements to manufacture, market, distribute, promote and sell our proposed product candidates at favorable commercial terms that would permit us to make a profit. To the extent that corporate partners conduct clinical trials, we may not be able to control the design and conduct of these clinical trials.

If a third-party contract manufacturing organization (“CMO”) upon whom we rely to formulate and manufacture our product candidates does not perform, fails to manufacture according to our specifications or fails to comply with strict regulations, our pre-clinical studies or clinical trials could be adversely affected and the development of our product candidates could be delayed or terminated or we could incur significant additional expenses.