Attached files

| file | filename |

|---|---|

| EX-10.2 - COPY OF MASTER FRANCHISE AGREEMENT - WB Burgers Asia, Inc. | masterfranchisecopy.htm |

| EX-10.1 - ACQUISITION AGREEMENT - WB Burgers Asia, Inc. | acqagreement.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 14, 2021

|

WB Burgers Asia, Inc.

|

| (Exact name of registrant as specified in its charter) |

| Nevada | 000-56233 | 00-0000000 | ||

| (state or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

|

3F K’s Minamiaoyama 6-6-20 Minamiaoyama, Minato-ku, Tokyo 107-0062, Japan |

107-0062 | |

| (address of principal executive offices) | (zip code) |

| 81-90-6002-4978 |

| (registrant’s telephone number, including area code) |

|

N/A |

| (former name or former mailing address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Note: “We”, “Us”, and or “The Company” refer to WB Burgers Asia, Inc., a Nevada Company.

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predicts”, or “should”, or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may appear in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements to vary. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

All dollar amounts used throughout this Report are in US Dollars, unless otherwise stated. All amounts in Japanese Yen used throughout this Report are preceded by JPY, for example JPY 500, is referring to 500 Japanese Yen.

-1-

-2-

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On September 14, 2021, we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to forgive any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

The aforementioned Acquisition Agreement is attached herein as Exhibit 10.1. All references to the Acquisition Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka.

WB Burgers Japan Co., Ltd., referred to herein as “WBJ”, which we now operate through and share the same business plan of, holds the rights to the “Master Franchise Agreement” with Jakes’ Franchising LLC, a Delaware Limited Liability Company, as it pertains to the establishment and operation of Wayback Burger Restaurants within the country of Japan.

The Master Franchise Agreement provides WBJ the right to establish and operate Wayback Burgers restaurants in the country of Japan, and also license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBJ the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

WB Burgers Japan Co., Ltd. seeks to make “Wayback Burgers” a nationally recognized brand, if not a household name, within the country of Japan through the promotion and opening of various Wayback Burgers Restaurants. Currently, it is negotiating a lease space with Arai Co., Ltd., a Japanese realty group for the lease of a space it hopes to make its first Wayback Burgers location in the country of Japan. Our current, and future plans are detailed in more specificity below beginning on page 6.

Information Regarding our Share Structure:

White Knight Co., Ltd. is our controlling shareholder. White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka.

Following the issuance of restricted common stock, pursuant to the Acquisition Agreement described above, we now have 1,010,454,545 shares of Common Stock and 1,000,000 shares of Series A Preferred Stock issued and outstanding. Our controlling shareholder White Knight Co., Ltd., and our sole officer and Director, Koichi Ishizuka, collectively own 653,698,686 shares of our common stock and 1,000,000 Shares of Preferred Series A Stock.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Effective September 14, 2021, we consummated an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to forgive any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021.

ITEM 5.06 CHANGE IN SHELL COMPANY STATUS

Upon the closing of the “Acquisition Agreement” (as described in Item 1.01 and 2.01, above), we ceased our status as a “shell company,” as defined in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”).

Additionally, in connection with the consummation of the closing of the Acquisition Agreement, the Company changed its business focus to that of our wholly owned subsidiary, which is the establishment and operation of Wayback Burger Restaurants within the country of Japan under the Master Franchise Agreement it entered into with Jakes Franchising, LLC, a Delaware Limited Liability Company. A full copy of the Master Franchise Agreement is attached herein as Exhibit 10.2.

Given we are no longer a shell company, we have set forth herein the information, including the information with respect to our new operations, that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting our common stock in this Report on Form 8-K.

-3-

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed an Acquisition Agreement, which caused the Company to cease being defined as a “shell company” under the Securities Act of 1933, as amended. Item 2.01(f) of Form 8-K requires that if a registrant was a shell company, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the closing of the Acquisition Purchase Agreement, except that information relating to periods prior to the date of the Acquisition Purchase Agreement only relates to the Company, unless otherwise specifically indicated.

Corporate History

We were originally incorporated in the state of Nevada on August 30, 2019, under the name Business Solutions Plus, Inc.

On August 30, 2019, Paul Moody was appointed Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On February 9, 2021, the Company filed, with the Secretary of State of Nevada (“NSOS”), Restated Articles of Incorporation.

On March 4, 2021, Business Solutions Plus, Inc., (the “Company” or “Successor”) announced on Form 8-K plans to participate in a holding company reorganization (“the Reorganization” or “Merger”) with InterActive Leisure Systems, Inc. (“IALS” or “Predecessor”), the Company and Business Solutions Merger Sub, Inc. (“Merger Sub”), collectively (the “Constituent Corporations”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250.

Immediately prior to the Reorganization, the Company was a direct and wholly owned subsidiary of Interactive Leisure Systems, Inc. and Business Solutions Merger Sub, Inc. was a direct and wholly owned subsidiary of the Company.

As disclosed in our 8-K filed on March 26, 2021, the above mentioned Reorganization was legally effective as of March 31, 2021.

Each share of Predecessor’s common stock issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of Successor common stock. The control shareholder, (at the time) of the Predecessor, Flint Consulting Services, LLC, (“Flint”) a Wyoming limited liability company became the same control shareholder of the Successor. Jeffrey DeNunzio, as sole member of Flint is (was) deemed to be the indirect and beneficial holder of 405,516,868 shares of Common Stock and 1,000,000 shares of Series A Preferred Stock of the Company representing approximately 93.70% voting control of the Company. Paul Moody, (our now former sole officer/director), was the same officer/director of the Predecessor. There are/were no other shareholders or any officer/director holding at least 5% of the outstanding voting shares of the Company.

Immediately prior to the Effective Time, and under the respective articles of incorporation of Predecessor and Successor, the Successor Capital Stock had the same designations, rights, and powers and preferences, and the qualifications, limitations and restrictions thereof, as the Predecessor Capital Stock which was automatically converted pursuant to the reorganization.

Immediately prior to the Effective Time, the articles of incorporation and bylaws of Successor, as the holding company, contain provisions identical to the Articles of Incorporation and Bylaws of Predecessor immediately prior to the merger, other than as permitted by NRS 92A.200.

Immediately prior to the Effective Time, the articles of incorporation of Predecessor stated that any act or transaction by or involving the Predecessor, other than the election or removal of directors of the Predecessor, that requires for its adoption under the NRS or the Articles of Incorporation of Predecessor the approval of the stockholders of the Predecessor, shall require in addition the approval of the stockholders of Successor (or any successor thereto by merger), by the same vote as is required by the articles of Incorporation and/or the bylaws of the Predecessor.

Immediately prior to the Effective Time, the articles of incorporation and bylaws of Successor and Merger Sub were identical to the articles of incorporation and bylaws of Predecessor immediately prior to the merger, other than as permitted by NRS 92A.200;

The Boards of Directors of Predecessor, Successor, and Merger Sub approved the Reorganization, shareholder approval not being required pursuant to NRS 92A.180;

The Reorganization constituted a tax-free organization pursuant to Section 368(a)(1) of the Internal Revenue Code;

Successor common stock traded in the OTC Markets under the Predecessor ticker symbol “IALS” under which the common stock of Predecessor previously listed and traded until the new ticker symbol “BSPI” was announced April 14, 2021 on the Financial Industry Regulatory Authority’s daily list with a market effective date of April 15, 2021. The CUSIP Number 45841W107 for IALS’s common stock was suspended upon market effectiveness. The Company received a new CUSIP Number 12330M107.

After completion of the Holding Company Reorganization, the Company cancelled all of its stock held in Predecessor resulting in the Company as a stand-alone and separate entity with no subsidiaries, no assets and negligible liabilities. The Company abandoned the business plan of its Predecessor and resumed its former business plan of a blank check company after completion of the Merger.

On May 4, 2021, Business Solutions Plus, Inc., a Nevada Corporation (the “Company”), entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

On May 7, 2021, Mr. Paul Moody resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On May 7, 2021, Mr. Koichi Ishizuka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

A Certificate of Amendment to change our name, from Business Solutions Plus, Inc., to WB Burgers Asia, Inc. was filed with the Nevada Secretary of State on June 18, 2021 with a legal effective date of July 2, 2021. The name change to WB Burgers Asia, Inc., as well as a change of our ticker symbol from BSPI to WBBA, was announced by FINRA, via their “daily list”, on July 7, 2021, with a market effective date of both on July 8, 2021. The new CUSIP number associated with our common stock, as of the market effective date of July 8, 2021, is 94684P100.

On July 1, 2021 we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State, resulting in an increase to our authorized shares of common stock from 500,000,000 to 1,500,000,000.

Subsequent to the above action, on or about July 1, 2021, we sold 9,090,909 shares of restricted common stock to SJ Capital Co., Ltd., a Japanese Company, at a price of $0.20 per share of common stock. The total subscription amount paid by SJ Capital Co., Ltd. was approximately $1,818,181.80 or approximately 200,000,000 Japanese Yen.

SJ Capital Co., Ltd., is owned and controlled by Senju Pharmaceutical Co., Ltd., a Japanese Company.

Mr. Takeshi Sugisawa, the President of SJ Capital Co., Ltd., authorized the above transaction on behalf of SJ Capital Co., Ltd. Both SJ Capital Co., Ltd., and Senju Pharmaceutical Co., Ltd. are considered non-related parties to the Company.

The proceeds from the above sale of shares are to be used by the Company for working capital.

-4-

Table of Contents

On August 24, 2021, we sold 1,363,636 shares of restricted common stock to Yasuhiko Miyazaki, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Yasuhiko Miyazaki was approximately $272,727 or approximately 30,000,000 Japanese Yen. Mr. Yasuhiko Miyazaki is not a related party to the Company. The proceeds from the above sale of shares are to be used by the Company for working capital.

In regards to all of the above transactions, the Company claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales/issuances of the stock since the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On August 30, 2021, our largest controlling shareholder, White Knight Co., Ltd., a Japanese Company, owned and controlled by our sole officer and Director, Koichi Ishizuka, sold a total of 353,181,818 shares of restricted common stock of the Company to the following parties in the respective quantities:

| Name of Purchaser | Common Shares Purchased | Price Paid Per Share | Total Amount Paid ($) | ||

|---|---|---|---|---|---|

| Koichi Ishizuka | 101,363,636 | $0.0001 | 10,136.00 | ||

| Rei Ishizuka 1 | 50,000,000 | $0.0001 | 5,000.00 | ||

| Kiyoshi Noda | 100,909,091 | $0.0001 | 10,091.00 | ||

| Yuma Muranushi | 100,909,091 | $0.0001 | 10,091.00 |

1 Rei Ishizuka is the wife of our sole officer and Director, Mr. Koichi Ishizuka.

In regards to all of the above transactions White Knight Co., Ltd. claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On September 14, 2021 we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to forgive any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

In regards to the above transaction, the Company claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales/issuances of the stock since the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The aforementioned Acquisition Agreement agreement is attached herein as Exhibit 10.1. All references to the Acquisition Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka. White Knight Co., Ltd. is our largest controlling shareholder.

WB Burgers Japan Co., Ltd., referred to herein as “WBJ”, which we now operate through and share the same business plan of, holds the rights to the “Master Franchise Agreement” with Jakes’ Franchising LLC, a Delaware Limited Liability Company, as it pertains to the establishment and operation of Wayback Burger Restaurants within the country of Japan.

The Master Franchise Agreement provides WBJ the right to establish and operate Wayback Burgers restaurants in the country of Japan, and also license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBJ the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

WB Burgers Japan Co., Ltd. seeks to make “Wayback Burgers” a nationally recognized brand, if not a household name, within the country of Japan through the promotion and opening of various Wayback Burgers Restaurants. Currently, it is negotiating a lease space with Arai Co., Ltd., a Japanese realty group for the lease of a space it hopes to make its first Wayback Burgers location in the country of Japan. Our current, and future plans are detailed in more specificity below beginning on page 6.

Following the adoption of the business plan of our wholly owned subsidiary, WB Burgers Japan Co., Ltd., on September 14, 2021, we ceased to be a shell company.

-5-

Japanese Food-Service Market

The Japanese Food-Service Market is Segmented by Type (Full-service Restaurants, Quick Service Restaurants, Cafes, Bars, 100% Home Delivery Restaurants, Street Stalls and Kiosks) and Structure (Independent Consumer Food Service and Chained Consumer Food Service). We believe Japanese consumers, in general, tend to be highly demanding, putting great emphasis on quality and branding and are willing to spend more resources on value-added products.

The Japanese food service market was valued at USD 142.84 billion in 2020, and it is projected to witness a CAGR of 0.84% during the forecast period, 2021 - 2026. The coronavirus pandemic has made short-term projections hard to predict, with sales in March 2020 down almost 40% for some food companies. Japanese food service operators, which rely on lunch and dinner demand from business workers, are also suffering as more companies have employees working from home at the government’s request.

According to a report released by TableCheck Inc., the percentage of reservations (dining reservations) being canceled increased about 3.6 times before the pandemic for groups of 10 or more. A French restaurant and bar named Scene near Hachioji Station on the Keio Line, earlier in June 2020, launched take out and delivery services which we believe many others will begin offering if not already, due in part to the changing attitudes of dining out as a result of the ongoing pandemic. We believe take-out and delivery services, along with menu options that are quick to prepare, increasing in consumer demand.

The variety of restaurants and menu items available in the Japanese food service industry continues to expand in the country, as Japanese consumers are interested in trying a new and vast variety of cuisines, which are available at their convenience in Japan. Food from Europe, Asia, Australia, and the Americas are becoming increasingly popular, partly due to a large number of Japanese traveling abroad every year.

The Japanese food service market is highly competitive, with a major market share held by prominent companies, such as McDonald’s Corporation, Yum! Brands Inc., Zensho Holdings Co. Ltd, Skylark Group, MOS Food Services Inc., and Yoshinoya Holdings Co. Ltd. Zensho Holdings Co. Ltd, with the largest market share of 2.76% in 2020, emerging as the market leader, and Skylark Group holding the second-largest share with 1.66%.

Currently, in the Japanese market, hamburgers and related fast food options have been prevalent, with high-end gourmet hamburgers being in the most expensive category consisting usually of single restaurant locations, followed by lesser expensive hamburger options via chain restaurants such as Shake Shack and MOS Premiums. The size of the current market for hamburgers in Japan is approximately $6.6 Billion (2020), and has been steadily increasing ever since 2015. It is also projected to grow by approximately 5% over the next few years. Hamburgers are considered to be one of the few food categories that were not affected by COVID-19 in Japan and were able to take advantage of home deliveries and to-go orders during the pandemic. (Source: Fuji Keizai Group 2020.)

Business Information

Master Franchise Agreement and Related Information

On September 14, 2021, we acquired 100% of the equity interest of WB Burgers Japan Co., Ltd., a Japan Company. Following the acquisition, we ceased to be a shell company and adopted the same business plan as that of our now wholly owned subsidiary, WB Burgers Japan Co., Ltd. Within this section, all references to “the Company”, “WB Burgers”, and or WBBA refer to WB Burgers Asia, Inc. and WB Burgers Japan Co., Ltd. as one collective party.

WBBA holds the rights to the “Master Franchise Agreement” with Jakes’ Franchising LLC, a Delaware Limited Liability Company, as it pertains to the establishment and operation of Wayback Burger Restaurants within the country of Japan.

The Master Franchise Agreement provides WBBA the right to establish and operate Wayback Burgers restaurants in the country of Japan, and also license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBBA the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

WBBA seeks to make “Wayback Burgers” a nationally recognized brand, if not a household name, within the country of Japan through the promotion and opening of various Wayback Burgers Restaurants.

Background

The first Wayback Burgers, previously known as Jake’s Wayback Burgers, began with a single location in Newark, Delaware approximately thirty years ago in 1991, offering a combination of burgers, hot dogs, fries, milkshakes, and other similar menu options. Since then, it has reached a global scale with a presence in the US, Europe, Africa, and Asia with hundreds of corporate owned restaurants and over five hundred franchise locations worldwide offering much of the same comfort items many have grown accustomed to, with the addition of a few menu items specifically geared toward the pallets of those in various demographics.

The products we seek to offer in our anticipated location(s), and those we seek to franchise to within Japan, will also offer many of the same product offerings many are accustomed to elsewhere such as hamburgers, hot dogs chicken sandwiches, hand-dipped milkshakes, various side dishes, fresh salad, kid’s meals, refreshing drinks and alcoholic beverages. We intend to source our ingredients in any of our future location(s) from highly regarded local Japanese suppliers in order to satisfy the food quality standards as set by Wayback Burgers Inc., within the United States.

Our First Location

Currently, we are negotiating a lease space with Arai Co., Ltd., a Japanese realty group for the lease of a space we hope to make our first Wayback Burgers location in the country of Japan. The property is located in the popular shopping plaza of Omotesando located in the Tokyo prefecture. We believe the high volume of foot traffic and shopping will yield a large group of patrons seeking to try our product offerings. Currently, we have inspected the property in detail and are in discussions with the local fire department as to what is needed to bring the space up to code in respect to a restaurant that can house upwards of several hundred patrons at a time. We are also in discussions with Arai Co., Ltd. regarding what measures need to be taken to create handicap accessible areas and to improve upon existing structures that had been put in place by the previous tenant.

-6-

Table of Contents

We are also in the midst of conversations with the adjacent apartment complex as it pertains to volume restrictions and patrons dining outside during nighttime hours. Currently, the adjacent apartment complex has tentatively agreed to allow guests of our proposed restaurant to dine outside through 9:30pm however, we’d prefer it be 10:00pm. These and many other factors are in flux, and the fact they are in flux is the reason we have not yet signed the lease with Arai Co., Ltd. although, we do anticipate hashing out such details and moving forward within the next one to two months. If, we are not able to secure this particular space, we will seek out a comparable space, also in what we believe to be a high traffic area in Tokyo.

Below is a photograph of the space we seek to lease from Arai Co., Ltd. (second floor). Logos and branding of neighboring business have been blurred out in the below image.

Once we are able to secure and sign a lease for our initial restaurant space, we seek to open within a few months thereafter once we are able to hire qualified staff. Currently, we have already vetted out and pre-emptively hired various employees such as line cooks and other workers for when we do open our first location. We believe we will need to hire approximately 11 employees to efficiently operate our first restaurant location. Our personnel plan calls for a minimum of one store manager, licensed to cook, with the ability to manage between eight to ten employees. We will require that our store manager has the requisite training and skillset to take spearhead breakfast and dinner menu creation, as well as procurement and cost vs profit calculations. The eight to ten employees will be a combination of full-time and part-time employees who will operate our flagship store between the hours of 7:00 am to 11:00 pm. Specialized training for our staff will include, but not strictly be limited to, food preparation, cooking, POS (point of sale) operations, sanitation, etc.

Marketing Strategy

In order to grow an initial customer base, from which we intend to launch future expansion efforts, our marketing strategy begins with the physical location of our flagship restaurant. Our plan, at present, is to select a suitable location in an area of Omotesando with high foot-traffic that can serve to attract not only customers, but also future franchisee prospects throughout Japan. For future franchisee locations, we intend to identify areas where competitors are not already located, such as road-side in the outskirts of major cities, and open our restaurants in these areas.

However, we do not intend to rely solely on physical location in order to attract customers, we also are in the development stages of a robust marketing stratagem comprised, in part, of SNS (social networking service) marketing through collaboration with influencers and celebrities, magazine advertisements, and expansive television and media appearances. The specifics of these marketing initiatives are in the planning stages, and have not yet been determined in sufficient detail to disclose in their entirety.

Wayback Burgers in Japan intends to position itself as a newly entered and authentic American hamburger brand, comparable to our competitor Shack Shake, while contrasting ourselves through offering higher quality foods at comparable price points. We plan to achieve this by focusing on the ingredients, such as the option of vegetables in our hamburgers, the increased diameter of our meat patties, and the overall volume of our menu items. Additionally, we intend to offer original Japanese breakfast and dinner menu options, as well as forming a special collaboration focused on all-plant based alternative foods with Next Meats, Co., Ltd., a Japanese alternative meat company.

Expansion Plans

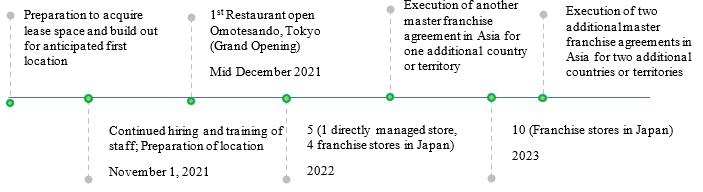

We have forecasted our expansion plans, as depicted in the image above, over the next few years. However, when our operations commence, we may find that our plans may be materially altered, expanded, or curtailed as dictated by market forces at the time. As such, our expansion plans should be read as a framework for our future goals, but not a guarantee that we will carry out any or all such operations in the indicated timeline.

At present our expansion plans are as follows:

| - | We are currently in the midst of negotiating a lease agreement for our fist location, currently planned for Omotesando which will be within shopping range of Aoyama and Hajajuku. During this period of time we are also seeking to hire the necessary staff (approximately 11 employees) to manage and operate our flagship location. |

| - | We anticipate that hiring will continue into November, during which time training of staff will remain ongoing and the flagship location will continue to prepare for its forthcoming grand opening. |

| - | In mid-December we aim to open our first flagship restaurant location in Omotesando, Tokyo. |

| - | Over the course of 2022, we are aiming to open five Wayback Burgers restaurants throughout Japan, with one of these restaurants directly managed by us while the remaining four would ideally be franchise locations. This number may increase or decrease depending on the results of our operations. |

| - | Additionally, during 2022, we intend to execute another master franchise agreement in Asia for the right to open Wayback Burgers restaurants in another Asian country or territory. We have not yet identified which country or territory we will seek to acquire these rights for first. As noted previously, we have the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan. |

| - | By the year 2023, we intend for there to be ten Wayback Burgers Franchise locations open throughout Japan. We also intend, during 2023, to execute two additional Master Franchise Agreements in Asia to establish and operate Wayback Burgers restaurant locations in additional Asian countries or territories. |

-7-

Partnerships

The company believes partnerships are a vital means to expansion and that partnerships with other food institutions or distributors may allow the Company to provide menu items that might appeal to a larger demographic within the Japanese market.

Our current officer and Director, Koichi Ishizuka has existing ties and relationships with Next Meats Co., Ltd. a Japanese alternative meat company, that produces and sells lab grown and meat alternatives to consumers. It is the Company’s goal that it will be able to integrate such alternative meat options into its menu, and potentially create customized menu options as provided by Next Meats Co., Ltd. Menu alterations are subject to approval by Jake’s Franchising, LLC. It is the belief of the management that such offerings can gain a larger market share in the country of Japan allowing for greater growth potential. Of course, this is speculative and such plans may not materialize. It is also possible that if such plans do materialize they may not result in the expected level of growth the Company forecasts as a result of the partnership or partnerships it enters into.

It should be noted that Koichi ishizuka has an equity interest in Next Meats Co., Ltd. He also currently serves as Chief Financial Officer of Next Meats Holdings, Inc., a Nevada Company, that has entered into an agreement to acquire Next Meats Co., Ltd. pending various conditions be met.

Government Regulations

The below does not extensively detail every single law and regulation to which the Company may be subject to, but rather provides an overview of the kind of food safety standards to which our restaurant(s) will be held.

The main law that governs food quality and integrity in Japan is the Food Sanitation Act ("FSA") and the law that comprehensively governs food labelling regulation is the Food Labelling Act.

The FSA regulates food quality and integrity by:

- Establishing standards and specifications for food, additives, apparatus, and food containers and packaging;

- Providing for inspection to see whether the established standards are met;

- Providing for hygiene management in the manufacture and sale of food; and

- Requiring food businesses to be licensed.

Under the FSA, additives and foods containing additives must not be sold, or be produced, imported, processed, used, stored, or displayed for marketing purposes unless the Minister of Health, Labour and Welfare ("MHLW") has declared them as having no risk to human health after seeking the views of the Pharmaceutical Affairs and Food Sanitation Council ("PAFSC"). In addition, it is not permissible to add any processing aids, vitamins, minerals, novel foods or nutritive substances to food unless they have been expressly declared by the MHLW as having no risk to human health.

The MHLW may establish specifications for methods of producing, processing, using, cooking, or preserving food or additives to be served to the public for marketing purposes ("Specifications"), or may establish standards for food ingredients or additives to be served to the public for marketing purposes ("Standards") pursuant to the FSA. Accordingly, where substances are allowed to be added to food, they may only be used within the limits expressly set by the Specifications and Standards.

Employees

Currently, we, “WB Burgers Asia, Inc.”, have only one employee, our sole officer and Director Koichi Ishizuka, who is not compensated at present for his services. Our now wholly subsidiary, WB Burgers Japan Co., Ltd. has two officers, Koichi Ishizuka, Chief Executive Officer, and Mitsuru Anthony, Chief Operating Officer. The biographical information for Mr. Koichi Ishizuka is detailed herein on page 13 and the biographical information for Mr. Mitsuru Anthony is directly below:

Mitsuru Anthony Ueno

Mitsuru Anthony Ueno, age 47, graduated from UCLA in 2000 with a BA in Italian and Special Fields. In 2010, he obtained his MAFED (Master in Fashion, Experience & Design) from SDA Bocconi School of Management in Milan, Italy. Mr. Ueno is an international marketing, branding and cross border business management specialist and has nearly 20 years of foreign study and working experience. In 2017, Mr. Ueno founded, and remains the owner of, Artigiappone, a Japanese Company offering a handmade bespoke suit brand. Also in 2017, he became an Executive Producer at Photozou Co., Ltd. (Japan), a Company operating an online photo sharing website. In 2019, he became Chief Executive Officer of Forcellon Holding, Inc. Pte. Ltd., a Singapore Company providing international business management and consulting services.

Aside from the two officers of WB Burgers Japan Co., Ltd., the Company has also hired four staff members, out of the anticipated eleven that will be required, to operate our flagship restaurant location. Further, we have identified a Chef candidate, but negotiations are ongoing. We will require that our store manager and Chef has the requisite training and skillset to take spearhead breakfast and dinner menu creation, as well as procurement and cost vs profit calculations. The eight to ten employees will be a combination of full-time and part-time employees who will operate our flagship store between the hours of 7:00 am to 11:00 pm. Specialized training for our staff will include, but not strictly be limited to, food preparation, cooking, POS (point of sale) operations, sanitation, etc.

-8-

Competition

The Japan food service market is highly competitive, with a major market share held by prominent companies, such as McDonald’s Corporation, Yum! Brands Inc., Zensho Holdings Co. Ltd, Skylark Group, MOS Food Services Inc., and Yoshinoya Holdings Co. Ltd.

At present, we consider our primary competitor to be Shake Shack, which entered the Japanese market in November of 2015. At present, Shake Shack has a total of twelve restaurant locations open within the country, including locations in Tokyo, Yokohama, Kyoto and Osaka, respectively. We consider Shack Shake to be our primary competition because they sell hamburgers and related foods similar to ours, their foods are not pre-cooked, and they give their customers a beeper until the food is ready to be served, which is comparable to our own operations. We believe that our extensive marketing plans, strategic partnerships, and our branding will provide us with the means to compete effectively in this highly competitive market.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us.

We qualify as a smaller reporting company, as defined by Item 10 of Regulation S-K and, thus, are not required to provide the information required by this Item.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Summary of Current Operations

On September 14, 2021, we acquired 100% of the equity interest of WB Burgers Japan Co., Ltd., a Japan Company. Following the acquisition, we ceased to be a shell company and adopted the same business plan as that of our now wholly owned subsidiary, WB Burgers Japan Co., Ltd.

Through our wholly owned subsidiary, we hold the rights to the “Master Franchise Agreement” with Jakes’ Franchising LLC, a Delaware Limited Liability Company, as it pertains to the establishment and operation of Wayback Burger Restaurants within the country of Japan.

The Master Franchise Agreement provides WB Burgers Japan Co., Ltd. right to establish and operate Wayback Burgers restaurants in the country of Japan, and also license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WB Burgers Japan Co., Ltd. the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

We seek to make “Wayback Burgers” a nationally recognized brand, if not a household name, within the country of Japan through the promotion and opening of various Wayback Burgers Restaurants.

Fiscal Year End

Our fiscal year end is July 31st and the fiscal year end of our wholly owned subsidiary, WB Burges Japan Co., Ltd. is May 31st.

-9-

Results of Operations - WB Burgers Japan Co.

WB Burgers Japan Co. Ltd., referred to herein as “WBJ”, was incorporated on April 14, 2021 in Tokyo, Japan.

As of May 31, 2021, our wholly owned subsidiary, WB Burgers Japan Co., Ltd. had total assets of $2,791,980, and no revenues to report for the year ended May 31, 2021.

For the Period April 14, 2021 (Inception) to May 31, 2021 WB Burgers Japan Co., Ltd. had a net loss of $132. Prior to our acquisition of WB Burgers Japan Co., Ltd. on September 14, 2021, WBJ had 10,000 shares of common stock issued and outstanding, all of which were held by White Knight Co., Ltd. Koichi Ishizuka, owns and controls White Knight Co., Ltd.

On September 14, 2021, we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to forgive any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

On April 14, 2021, WBJ entered into a Master Franchise Agreement, “the Master Franchise Agreement”, with Jake’s Franchising, LLC (“Franchisor”). The Master Franchise Agreement provides WBJ the rights to establish and operate Wayback Burgers restaurants in the country of Japan, and license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBJ the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

Upon entering into the Master Franchise Agreement a non-refundable deposit of $100,000 was made to the Franchisor on behalf of WBJ, by related party, White Knight Co., Ltd (“White Knight”).

White Knight is controlled by our sole director, Koichi Ishizuka. The remainder of the franchise fee, $2,600,000, was recorded as payable to the Franchisor as of May 31, 2021. The remaining fee of $2,600,000, due to Jakes Franchising LLC, was paid in full by the Company on June 9, 2021. On June 9, 2021, upon remittance of the balance of $2,600,000 the Master Franchise Agreement was deemed to be effective and was subsequently, executed by all parties.

Results of Operations - WB Burgers Asia, Inc.

Prior to our acquisition of WB Burgers Japan Co., Ltd., we were deemed to be a blank check shell company. As of May 31, 2021 and July 31, 2020 we had no assets. For the year ended July 31, 2020 and the ten months ended May 31, 2021 we had no revenues. For the ten months ended May 31, 2021 we had a net loss of $116,113 and for the period August 30, 2019 (Inception) to May 31, 2020, a net loss of $2,074. Our net loss for both periods was attributable to general and administrative expenses.

Information Regarding our Share Structure:

White Knight Co., Ltd. is our controlling shareholder. White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka.

We have 1,010,454,545 shares of Common Stock and 1,000,000 shares of Series A Preferred Stock issued and outstanding.

Future Plans

As detailed within our business plan we seek to begin monetizing upon our Master Franchise Agreement held by WB Burgers Japan Co., Ltd., our wholly owned subsidiary. Through our wholly owned subsidiary we seek to open our first Wayback Burgers location in Tokyo by the end of 2021, and thereafter open additional locations in Japan through franchisees we may attract through promotional activities detailed above in our business plan beginning on page 6. We intend to use available cash from monies that we had raised through the sale of common stock to various investors in reliance on Regulation S of the Securities Act of 1933, as amended ("Regulation S"). We also intend to use monies that may be provided by our officer and director Koichi Ishizuka, although Mr. Ishizuka has no obligation to provide or loan us funds.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the date of this report, the Company has 1,010,454,545 shares of common stock and 1,000,000 shares of Series A Preferred Stock issued and outstanding. which number of issued and outstanding shares of common stock and preferred stock have been used throughout this report.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares Preferred Stock Are Able to Vote | Preferred Stock Voting Percentage Beneficially Owned | Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors | |||||

| Koichi Ishizuka 1 | 101,363,636 | 10.03% | 0 | 0.0% | 5.04% |

| 5% or greater Shareholders (of any class) | |||||

| White Knight Co., Ltd. 2 | 552,335,050 | 54.66% | 1,000,000 | 100.0% | 77.21% |

| Kiyoshi Noda | 100,909,091 | 9.99% | 0 | 0% | 5.02% |

| Yuma Muranushi | 100,909,091 | 9.99% | 0 | 0% | 5.02% |

| Total | 855,516,868 | 84.67% | 1,000,000 | 100% | 92.29% |

1 The row above for Koichi Ishizuka denotes shares held under his personal name.

2 White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

-10-

DIRECTORS AND EXECUTIVE OFFICERS

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of the WB Burgers Asia, Inc. following the Acquisition Agreement are provided below:

WB Burgers Asia, Inc.

| NAME | AGE | POSITION | |||||

| Koichi Ishizuka | 50 | Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Director | |||||

Koichi Ishizuka

Mr. Koichi Ishizuka, age 49, attended the University of Aoyama Gakuin where he received his MBA in 2004. Several years later in 2011 he graduated from the Advanced Management Program at Harvard School of Business. Following Mr. Ishizuka’s formal education, he took a position as the head of marketing with Thomson Reuters, a mass media and information firm. Thereafter, he served as the CEO of Xinhua Finance Japan in 2006, Fate Corporation in 2008, and LCA Holdings., Ltd in 2009. Currently, Mr. Ishizuka serves as the Chief Executive Officer of OFF Line Co., Ltd., Photozou Co., Ltd., Photozou Holdings, Inc., Photozou Koukoku Co., Ltd., Off Line International, Inc. and OFF Line Japan Co., Ltd. He has held the position of CEO with OFF Line Co., Ltd. since 2013, Photozou Co., Ltd since 2016, Photozou Holdings, Inc since 2017, Photozou Koukoku Co., Ltd. since 2017, Off Line International, Inc. since 2019 and OFF Line Japan Co., Ltd. since 2018. On November 18, 2020, he was appointed as Chief Financial Officer of Next Meats Holdings, Inc., a position he still holds today. Koichi Ishizuka also has an equity interest in Next Meats Holdings, Inc. Koichi Ishizuka is also Chief Financial officer of Next Meats Co., Ltd., a Japanese alternative meat company. It should be noted Koich Ishizuka is currently also a minority shareholder of Next Meats Co., Ltd. Since its inception on April 14, 2021, Koichi Ishizuka has served as CEO of WB Burgers Japan Co., Ltd., a Japanese Company. On July 23, 2021, Mr. Koichi Ishizuka was appointed as the Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director of Catapult Solutions, Inc., which is now known as Dr. Foods, Inc.

Corporate governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

-11-

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert" as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company do not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our officers and directors have not been involved in any of the following events during the past ten years.

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

-12-

Summary Compensation Table:

Name and principal position |

Year Ended July 31 | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

Koichi Ishizuka Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director |

2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Paul Moody, Former Sole Officer and Director |

2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Note to above table: On May 7, 2021, Mr. Paul Moody resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director. On May 7, 2021, Mr. Koichi Ishizuka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

Compensation of Directors

The table above summarizes all compensation of our directors through our most recent fiscal year end July 31, 2021.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors.

-13-

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executive or any future executives a salary, and/or issue them shares of common stock issued in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock based compensation to certain executives, which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, in the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

WB Burgers Asia, Inc.

On May 4, 2021, Business Solutions Plus, Inc., a Nevada Corporation (the “Company”), entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

On May 7, 2021, Mr. Paul Moody resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On May 7, 2021, Mr. Koichi Ishizuka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On August 30, 2021, our largest controlling shareholder, White Knight Co., Ltd., a Japanese Company, owned and controlled by our sole officer and Director, Koichi Ishizuka, sold a total of 353,181,818 shares of restricted common stock of the Company to the following parties in the respective quantities:

| Name of Purchaser | Common Shares Purchased | Price Paid Per Share | Total Amount Paid ($) | ||

|---|---|---|---|---|---|

| Koichi Ishizuka | 101,363,636 | $0.0001 | 10,136.00 | ||

| Rei Ishizuka 1 | 50,000,000 | $0.0001 | 5,000.00 | ||

| Kiyoshi Noda | 100,909,091 | $0.0001 | 10,091.00 | ||

| Yuma Muranushi | 100,909,091 | $0.0001 | 10,091.00 |

1 Rei Ishizuka is the wife of our sole officer and Director, Mr. Koichi Ishizuka.

In regards to all of the above transactions White Knight Co., Ltd. claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

-14-

On September 14, 2021, we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to forgive any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

In regards to the above transaction, the Company claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales/issuances of the stock since the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The aforementioned Acquisition Agreement agreement is attached herein as Exhibit 10.1. All references to the Acquisition Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka. White Knight Co., Ltd. is our largest controlling shareholder.

The Company’s sole officer and director, Koichi Ishizuka, paid expenses on behalf of the Company totaling $600 during the period ended May 31, 2021. The Company’s former sole officer and director, Paul Moody, paid expenses on behalf of the company totaling $4,013 during the period ended May 31, 2021. Former related party, Jeffrey DeNunzio, paid expenses on behalf of the company totaling $6,500 during the period ended May 31, 2021.

The $11,113 in total payments are considered contributions to the company with no expectation of repayment and are posted as additional paid-in capital.

The Company’s former sole officer and director, Paul Moody, paid expenses on behalf of the company totaling $1,074 during the period ended July 31, 2020.

The $1,074 in total payments are considered contributions to the company with no expectation of repayment and are posted as additional paid-in capital.

As of May 31, 2021 we utilized home office space of our management at no cost.

WB Burgers Japan Co., Ltd.

During the period ended May 31, 2021, 10,000 shares of common stock of WB Burgers Japan Co., Ltd., referred to herein as “WBJ”, were sold to related party White Knight Co., Ltd. (“White Knight”). White Knight is controlled by our sole director, Koichi Ishizuka.

On April 14, 2021 WBJ entered into a Master Franchise Agreement, “the Master Franchise Agreement”, with Jake’s Franchising, LLC (“Franchisor”). The Master Franchise Agreement provides WBJ the rights to establish and operate Wayback Burgers restaurants in the country of Japan, and license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBJ the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

Upon entering into the Master Franchise Agreement a non-refundable deposit of $100,000 was made to the Franchisor on behalf of the Company, by related party, White Knight Co., Ltd (“White Knight”).

White Knight is controlled by our sole director, Koichi Ishizuka. The remainder of the franchise fee, $2,600,000, was recorded as payable to the Franchisor as of May 31, 2021. The remaining fee of $2,600,000, due to Jakes Franchising LLC, was paid in full by WBJ on June 9, 2021. On June 9, 2021, upon remittance of the balance of $2,600,000 the Master Franchise Agreement was deemed to be effective and was subsequently, executed by all parties.

During the period ended May 31, 2021, White Knight paid an expense on behalf of WBJ in the amount of $100,000. This payment was considered a loan to WBJ and, prior to its future forgiveness on October 1, 2021, was bearing a 1% annual interest rate, originally payable April 15, 2023. The loan was also unsecured. As mentioned previously, the loan will be forgiven on October 1, 2021.

The remainder of the franchise fee, $2,600,000, due to Jakes Franchising, LLC was recorded as payable to the Franchisor as of May 31, 2021. The $2,600,000, due to Jakes Franchising LLC, was paid in full by WBJ on June 9, 2021. White Knight Co., Ltd. is not owed any monies as of the date of this report as it relates to any loans or debts.

As of May 31, 2021 we utilized office space of White Knight at no cost.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transaction.

-15-

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company's internal accounting controls, practices and policies.

Market Price of & dividends on the registrants common equity & related matters

(a) Market Information.

Our common stock is quoted on the OTC Pink under the symbol “WBBA” There is currently a limited trading market in the Company’s shares of common stock.

Over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Quarter Ended | High Bid | Low Bid |

| July 31, 2021 | $0.799 | $0.18 |

| April 30, 2021 1 | $0.475 | $0.20 |

1 We were a party to a corporate reorganization, legally effective as of March 31, 2021. Information regarding this reorganization is detailed herein on page 4. Prior to this reorganization, we have no information to report pursuant to the above table. The quarter ending April 30, 2021 only includes data stemming back to March 31, 2021.

(b) Holders.

As of the date of this current report on Form 8-K, we have 1,010,454,545 shares of common stock, $0.0001 par value, issued and outstanding and 1,000,000 shares of Series A preferred stock, $0.0001 par value, issued and outstanding.

As of the date of this report, we also have approximately 210 shareholders of record. This is inclusive of Cede and Co., which is deemed to be one shareholder of record. For further clarification, Cede & Co. is currently defined by the “NASDAQ”, as “a Nominee name for The Depository Trust Company, a large clearing house that holds shares in its name for banks, brokers and institutions in order to expedite the sale and transfer of stock.”

(c) Dividends.

We have not paid any cash dividends to date and do not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of our management to utilize all available funds for the development of our business.

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

RECENT SALES OF UNREGISTERED SECURITIES

On or about July 1, 2021, we sold 9,090,909 shares of restricted common stock to SJ Capital Co., Ltd., a Japanese Company, at a price of $0.20 per share of common stock. The total subscription amount paid by SJ Capital Co., Ltd. was approximately $1,818,181.80 or approximately 200,000,000 Japanese Yen.

SJ Capital Co., Ltd., is owned and controlled by Senju Pharmaceutical Co., Ltd., a Japanese Company.

Mr. Takeshi Sugisawa, the President of SJ Capital Co., Ltd., authorized the above transaction on behalf of SJ Capital Co., Ltd. Both SJ Capital Co., Ltd., and Senju Pharmaceutical Co., Ltd. are considered non-related parties to the Company.

The proceeds from the above sale of shares are to be used by the Company for working capital.

On August 24, 2021, we sold 1,363,636 shares of restricted common stock to Yasuhiko Miyazaki, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Yasuhiko Miyazaki was approximately $272,727 or approximately 30,000,000 Japanese Yen. Mr. Yasuhiko Miyazaki is not a related party to the Company. The proceeds from the above sale of shares are to be used by the Company for working capital.