Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HIGHWATER ETHANOL LLC | highwater-20210916.htm |

Highwater Ethanol, LLC completed 12 years of operations in mid - August 2021! Progress on operations and debt reduction has been a focal point! The past 24 months have been interesting times in the ethanol industry. We have seen the highs and lows in ethanol pricing during this time as ethanol ranged in price from $.90 per gallon to $2.25 per gallon. We filed our Form 10-Q for the quarter ended July 31, 2021 on September 10, 2021. Highwater reported net income of $10,583,041 for the nine months ended July 31, 2021. At the end of our third quarter, we had approximately $1.5 million remaining on our Term Revolver which is used for operating debt and approximately $4 million remaining on the 2020 Term Loan which we used primarily for our High Purity alcohol system. We believe this positions us well for the future. Operations and efficiencies in production remain a focal point for the Highwater team. We are currently producing an average of approximately 3.04 gallons of denatured ethanol for every bushel of corn ground. Highwater continues to produce ethanol at a rate of approximately 65 – 66 million gallons per year. We have been flexible on our production rate when margins warrant it. Demand for ethanol has begun to return to near pre-COVID-19 pandemic usage. We are optimistic that as we move forward demand will begin to stabilize. Corn oil continues to improve as we make adjustments. We are averaging between .88 – 1 pound of corn oil per bushel. We believe efficiencies will be very important as margins will likely continue to be up and down. We intend to review enzymes, yeast and other items to ensure the best efficiencies. We are proud of our team for maintaining these production rates! Highwater has diversified its products. Our mainstay is of course ethanol for transportation fuel. We also recently installed equipment to produce 190 proof High Purity alcohol which we anticipate will be online in the fourth quarter. Dried distillers grains, modified distillers grains and corn oil round out our product line. Highwater continues to review other potential ways to diversify our products. Highwater offers very competitive prices in order to develop strong relationships with area producers. We want to be the first place that you offer your corn. We anticipate that this fall corn quality and corn bushels will be down from 2020. However, we believe that this region will still produce good quality corn, which will allow us to maintain our efficiencies. We wish all producers a safe and blessed harvest! September 2021 Fall Newsletter Contact Information: 24500 US HWY 14 PO BOX 96 Lamberton, MN 56152 PHONE: (507) 752-6160 FAX: (507) 752-6162 TOLL FREE: (888) 667-3385 E-MAIL: info@highwaterethanol.com WEB ADDRESS: highwaterethanol.com Highwater Ethanol, LLC Investor Update From the Desk of Highwater Ethanol, LLC CEO Brian Kletscher

HIGHWATER ETHANOL, LLC Industry Information. E15 and Exports should be a continued priority for 2022. Exports are needed to support a very efficient U.S Ethanol industry which has reduced production of ethanol approximately 10% to match the reduction of ethanol used in the United States due to the COVID-19 pandemic. As production capacity is available in the U.S. exports will be the key for the industry in the future. We anticipate and look forward to increased interest from countries including Mexico, Canada, China and Japan with the on-going trade agreements, as well as continued interest from Vietnam, Philippines, India and many others. We encourage you to use a higher blend such as E15, E30 or E85! We believe that use of higher blends will continue to reduce our dependence on crude oil and contribute to cleaner air!! Highwater continues to support E10 blend, E15 blend for 2001 and newer vehicles and higher blends if you have a flex fuel vehicle. We believe the ethanol industry can respond to meeting the higher blend rates. Highwater continues to work with Minnesota Bio Fuels Association to promote ethanol use and we are working to move E15 forward in the State of Minnesota. Minnesota currently has over 400 E15 pumps available as well as many blend pumps to ensure the consumer has a choice. As owners in the ethanol industry, each member should be doing his or her part in using a higher blend of ethanol and asking for the higher blends of ethanol if it is currently not available in your area. Where do electric vehicles fit into all of this? We believe electric vehicles will continue to be manufactured and sold. However, we believe that the bigger question that needs to be asked is what is sustainable longer term? Ethanol is proven to reduce greenhouse gas emissions. Information still needs to be gathered on electric vehicles and the potential impact that has on the environment which should include examining the production of electricity, mining the material to produce the batteries and disposal of batteries. We believe that ethanol will continue to be a vital part of our transportation fuel into the future! We are members of the Renewable Fuels Association and American Coalition for Ethanol. These entities do a great job in representing the ethanol industry at the Federal level. Our Mission Statement: “To successfully operate a bio – energy facility, which will be profitable to our investor owners while contributing to the economic growth in the region. Highwater is committed to the present while focusing on the future.” Highwaters Vision Statement: Highwater will identify opportunities that position the business to provide sustainable competitive advantages through short and long - term core investments. A few core priorities that were identified include: 1) remain a low cost, efficient and high-quality producer; 2) Review new technology opportunities; 3) Review all opportunities within our core business; and 4) Continue long term debt reduction. We encourage you to visit our web page at highwaterethanol.com. This website will give you markets, weather, investor information and related items. Like us on Facebook! If you are ever passing through the area and would like a tour of your facility, please stop by as we would be very happy to walk you through the facility. Our management team consists of: Luke Schneider, CFO, Derek Trapp Co-Plant/Production Manager, Dillon Imker Co- Plant/Production Manager, Tom Streifel, Risk/Commodity, Jon Osland, Maintenance Manager, Lisa Landkammer, EHS Manager and Derek Schultz, Lab Manager. We have positioned our team to be successful in the ethanol industry. Have a safe and successful harvest! We will take care of the present as we focus on the future!!! Brian Kletscher, CEO Highwater Ethanol, LLC 2

HIGHWATER ETHANOL, LLC Page 3 of 5 Co-Plant Managers Derek Trapp & Dillon Imker The team at Highwater has had another busy year. As we work through 2021, we have seen a lot of good things. With all good things there is always obstacles but with a great team nothing is impossible! As you may recall we started installing a new distillation last winter so we can produce industrial Grade 190 proof to be used in the pharmaceutical market. The team has been busy putting all the right pieces together to make the best quality product. After the trying times 2020 presented we will be prepared to produce another revenue stream to make Highwater more diverse during trying times. This year we have seen a few obstacles that we haven’t seen since 2012. With very little rain in our area and the surrounding area we have been monitoring our water sources. You may recall we added an additional water source for dry years like this. We have been able to continue pulling water from the Sioux Rock Quarry but not enough to maintain. We have relied on our wells to help fill the void the dry year has presented. With recent rainfall in the area, it has already helped Highwater significantly. This year’s dry weather has also affected the corn crop that is to be harvested this fall. We are looking at a corn crop that is going to bring a lot of variabilities. Through out the year rains have been hit and miss across the surrounding area. This year’s weather is going to produce a great crop in some areas and a poor crop in others. The team at Highwater is prepared to make the best out of both. As we look at this year, we have had a lot of good things come our way. Ethanol prices have rebounded and margins have been good for Highwater. The team at Highwater has done a great job at making the most out of this opportunity. • This year we have averaged 3.04 gallons of denatured ethanol produced per bushel of corn. We continue to run at approximately 185,000 gallons per day. • Corn Oil continues to be a big focus for the team. Corn oil prices have almost tripled since last year at this time. The team at Highwater continue to make the most out of this market. We have been able to increase our corn oil yield pounds per bushel from 0.84 in December 2020 to 1.067 in August 2021. • We started selling cellulosic ethanol into the California market. We have currently shipped one full unit train and multiple single railcars to California. Cellulosic Ethanol production is verified through third party lab testing. These results determine how much cellulosic ethanol is produced for the California market. The gallons shipped to California offer a premium over the gallons sold in our current market. • We had our scheduled fall shutdown on August 23rd – 26th. We were able to complete all tasks on our schedule and get the plant running smoothly. We ask a lot out of our team during shutdown and they always do a great job! It was another safe and successful shutdown! We will continue to work hard, making the most out of every opportunity! Derek Trapp & Dillon Imker 3

HIGHWATER ETHANOL, LLC Election of Governors At the Company’s 2021 Annual Meeting, the terms of the Company’s Group II Governors concluded and the Company’s Members elected three incumbent Group II Governors George Goblish, Mark Pankonin and Luke Spalj to serve additional three-year terms. At the 2022 Annual Meeting, the Members of the Company will elect three Governors for the expiring terms of the Group III Governors. The Governors elected at the 2022 Annual Meeting will serve a three-year term, expiring at the Company’s 2025 Annual Meeting. The three Group III Governors are currently – Ron Jorgenson, Russ Derickson and Mike Landuyt. Nominations Nominees for elected Governors must be named by: a) the current Governors; b) a Nominating Committee established by the Governors; or c) through nomination by a Member entitled to vote in the election of Governors. The Company has established a Nominating Committee, which operates under a charter adopted by the Board of Governors in November 2009. Pursuant to the Nominating Committee’s charter, the Nominating Committee’s role is to recommend candidates for election to the Company’s Board of Governors. The Nominating Committee meets in December and/or January to identify and recommend candidates to the full Board of Governors at the January Board meeting. The charter sets forth the process for the Nominating Committee to use in recommending nominees. The Nominating Committee may solicit names of candidates for their consideration from Members. As mentioned above, Members may also nominate persons to be elected Governors of the Company by following the procedures explained in Section 5.3(b) of the Third Amended and Restated Operating Agreement. Section 5.3(b) requires that written notice of a Member’s intent to nominate an individual for governor must be given not less than 120 calendar days before the anniversary date of the release of the Company’s proxy materials to Members in connection with the previous year’s annual meeting. However, if the date of the current year’s meeting is changed by more than 30 days form the anniversary date of the previous year’s meeting, then the deadline is a reasonable time, as determined by the Board of Governors, before the Company releases its proxy materials for the annual meeting of the Company. Therefore, if the 2022 Annual Meeting is held on March 10, 2022, Governor nominations must be submitted by Members by October 1, 2021. Each notice submitted by a Member must include the following: 1) the name and address of record of the Member who intends to make the nomination; 2) a representation that the Member is a holder of record of Units of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; 3) the name, age, business and residence addresses, and principal occupation or employment of each nominee; 4) a description of all arrangements or understandings between the Member and each nominee; 5) such other information regarding each nominee proposed by such Member as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission; and 6) the consent of each nominee to serve as a Governor of the Company if so elected. 4

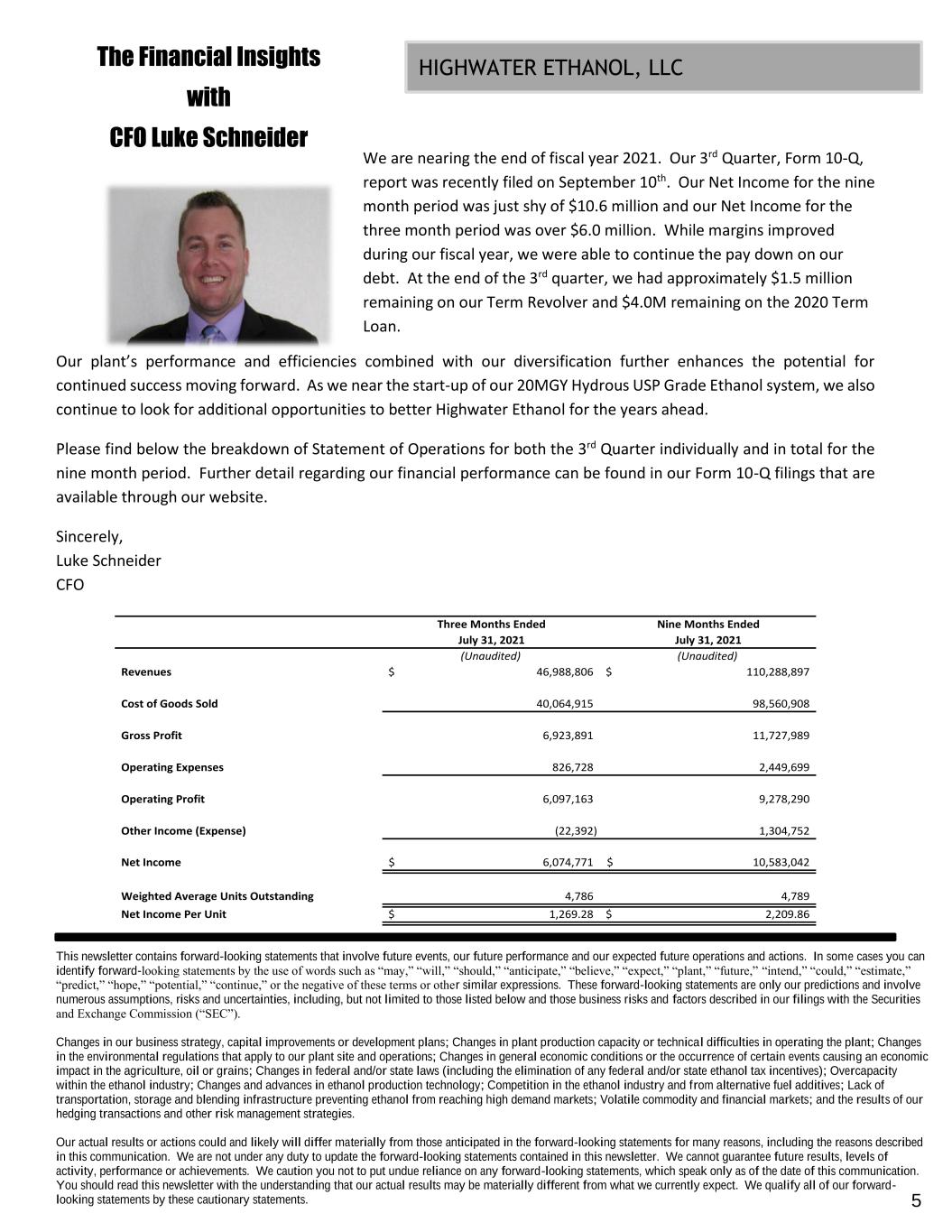

HIGHWATER ETHANOL, LLC Page 5 of 5 Our plant’s performance and efficiencies combined with our diversification further enhances the potential for continued success moving forward. As we near the start-up of our 20MGY Hydrous USP Grade Ethanol system, we also continue to look for additional opportunities to better Highwater Ethanol for the years ahead. Please find below the breakdown of Statement of Operations for both the 3rd Quarter individually and in total for the nine month period. Further detail regarding our financial performance can be found in our Form 10-Q filings that are available through our website. Sincerely, Luke Schneider CFO Three Months Ended Nine Months Ended July 31, 2021 July 31, 2021 (Unaudited) (Unaudited) Revenues 46,988,806$ 110,288,897$ Cost of Goods Sold 40,064,915 98,560,908 Gross Profit 6,923,891 11,727,989 Operating Expenses 826,728 2,449,699 Operating Profit 6,097,163 9,278,290 Other Income (Expense) (22,392) 1,304,752 Net Income 6,074,771$ 10,583,042$ Weighted Average Units Outstanding 4,786 4,789 Net Income Per Unit 1,269.28$ 2,209.86$ This newsletter contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plant,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described in our filings with the Securities and Exchange Commission (“SEC”). Changes in our business strategy, capital improvements or development plans; Changes in plant production capacity or technical difficulties in operating the plant; Changes in the environmental regulations that apply to our plant site and operations; Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or grains; Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives); Overcapacity within the ethanol industry; Changes and advances in ethanol production technology; Competition in the ethanol industry and from alternative fuel additives; Lack of transportation, storage and blending infrastructure preventing ethanol from reaching high demand markets; Volatile commodity and financial markets; and the results of our hedging transactions and other risk management strategies. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in this communication. We are not under any duty to update the forward-looking statements contained in this newsletter. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this communication. You should read this newsletter with the understanding that our actual results may be materially different from what we currently expect. We qualify all of our forward- looking statements by these cautionary statements. The Financial Insights with CFO Luke Schneider We are nearing the end of fiscal year 2021. Our 3rd Quarter, Form 10-Q, report was recently filed on September 10th. Our Net Income for the nine month period was just shy of $10.6 million and our Net Income for the three month period was over $6.0 million. While margins improved during our fiscal year, we were able to continue the pay down on our debt. At the end of the 3rd quarter, we had approximately $1.5 million remaining on our Term Revolver and $4.0M remaining on the 2020 Term Loan. 5