Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Theravance Biopharma, Inc. | tm2127424d1_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - Theravance Biopharma, Inc. | tm2127424d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Theravance Biopharma, Inc. | tm2127424d1_ex99-1.htm |

| 8-K - FORM 8-K - Theravance Biopharma, Inc. | tm2127424d1_8k.htm |

Exhibit 99.4

A New, Focused Theravance Biopharma September 15, 2021 THERAVANCE BIOPHARMA ® , THERAVANCE ® , the Cross/Star logo and MEDICINES THAT MAKE A DIFFERENCE ® are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries). All third party trademarks used herein are the property of their respective owners. © 2021 Theravance Biopharma. All rights reserved.

Under the safe harbor provisions of the U . S . Private Securities Litigation Reform Act of 1995 , the company cautions investors that any forward - looking statements or projections made by the company are subject to risks and uncertainties that may cause actual results to differ materially from the forward - looking statements or projections . Examples of forward - looking statements in this presentation may include the Company's goals, designs, strategies, plans and objectives, the impact of the Company’s restructuring plan, ability to provide value to shareholders, the Company's regulatory strategies and timing of clinical studies (including the data therefrom), the potential characteristics, benefits and mechanisms of action of the Company's product and product candidates, the potential that the Company's research programs will progress product candidates into the clinic, the Company's expectations for product candidates through development and the market for products being commercialized, the Company's expectations regarding its allocation of resources, potential regulatory actions and commercialization (including differentiation from other products or potential products and addressable market), product sales or profit share revenue and the Company's expectations for its expenses, excluding share - based compensation and other financial results . The company’s forward - looking statements are based on the estimates and assumptions of management as of the date of this presentation and are subject to risks and uncertainties that may cause the actual results to be materially different than those projected, such as risks related to the impacts on the COVID - 19 global pandemic on our business, disagreements with Innoviva, Inc . and TRC LLC, the uncertainty of arbitration and litigation and the possibility that the results of these proceedings could be adverse to the Company, additional future analysis of the data resulting from our clinical trial(s), delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non - clinical studies indicate the Company's compounds, products or product candidates are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, the feasibility of undertaking future clinical trials based on policies and feedback from regulatory authorities, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, ability to retain key personnel, the impact of the Company’s restructuring actions on its employees, partners and others . Other risks affecting Theravance Biopharma are in the company's Form 10 - Q filed with the SEC on August 5 , 2021 , and other periodic reports filed with the SEC . Forward - looking statements 2

A new, focused Theravance Biopharma 1. Excludes share - based compensation and any one - time costs related to strategic action. 2. Source: Bloomberg Consensus Sept 2021. COPD, chronic obstructive pulmonary disease; JAK, Janus kinase; PIFR, peak inspiratory flow rate. 3 ‣ Significant cost reduction program reduces Company size to become sustainably cash - flow positive beginning 2H 2022 – Headcount will be reduced by ~75% (~270 positions); ~75% of reduction completed Nov 2021, remainder Feb 2022 – Total annualized operating expense 1 savings of ~$165 million in 2022, compared to Company’s updated 2021 Financial Guidance ‣ Focus on leveraging expertise in developing and commercializing respiratory therapeutics – Track record of innovation leading to several approved COPD and asthma medicines, including: ▪ TRELEGY: a respiratory medicine developed by Glaxo Group Limited in collaboration with the Company ▪ YUPELRI ® : discovered and developed by Theravance Biopharma, and is now commercialized in partnership with Viatris – Strong, growing cash flows from TRELEGY and YUPELRI provide significant value to shareholders – TRELEGY and YUPELRI have significant potential for future growth ▪ TRELEGY: high growth, long - patent life respiratory medicine expected to generate peak - year global sales upwards of $3.0 billion annually 2 ▪ YUPELRI: remains early in its product lifecycle and has demonstrated quarter over quarter market share growth ‣ R&D investment streamlined to focus on core respiratory opportunities – PIFR clinical study, in partnership with Viatris , intended to support YUPELRI label expansion in order to significantly increase YUPELRI’s addressable market – Investigational inhaled JAK inhibitor portfolio; includes nezulcitinib (TD - 0903), initially targeting acute lung injury ‣ Maximize value of non - core assets and partnerships ‣ Optimize capital structure as financial flexibility increases to maximize total shareholder return

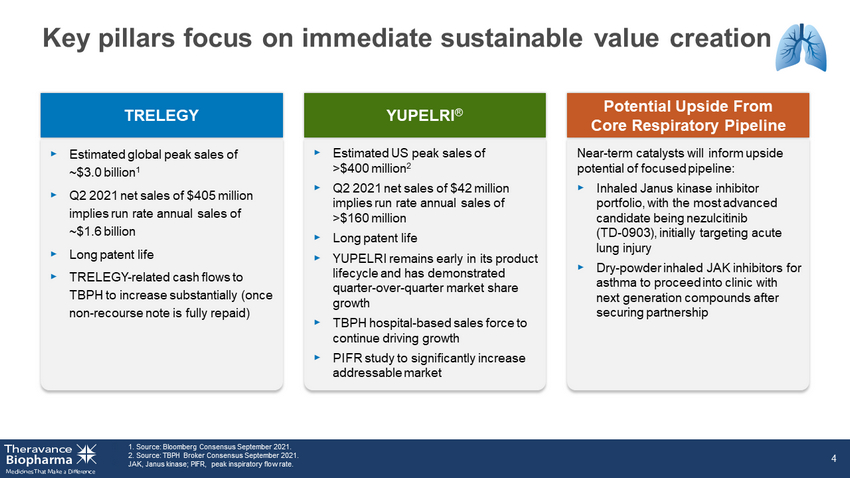

Key pillars focus on immediate sustainable value creation 1. Source: Bloomberg Consensus Sept 2021. 2. Source: TBPH Broker Consensus Sept 2021. 2. JAK, Janus kinase; PIFR, peak inspiratory flow rate. 4 TRELEGY YUPELRI ® Potential Upside From Core Respiratory Pipeline ‣ Estimated global peak sales of ~$3.0 billion 1 ‣ Q2 2021 net sales of $405 million implies run rate annual sales of ~$1.6 billion ‣ Long patent life ‣ TRELEGY - related cash flows to TBPH to increase substantially (once non - recourse note is fully repaid) ‣ Estimated US peak sales of >$400 million 2 ‣ Q2 2021 net sales of $42 million implies run rate annual sales of >$160 million ‣ Long patent life ‣ YUPELRI remains early in its product lifecycle and has demonstrated quarter over quarter market share growth ‣ TBPH hospital - based sales force to continue driving growth ‣ PIFR study to significantly increase addressable market Near - term catalysts will inform upside potential of focused pipeline: ‣ Inhaled Janus kinase inhibitor portfolio, with the most advanced candidate being nezulcitinib (TD - 0903), initially targeting acute lung injury ‣ Dry - powder inhaled JAK inhibitors for asthma to proceed into clinic with next generation compounds after securing partnership

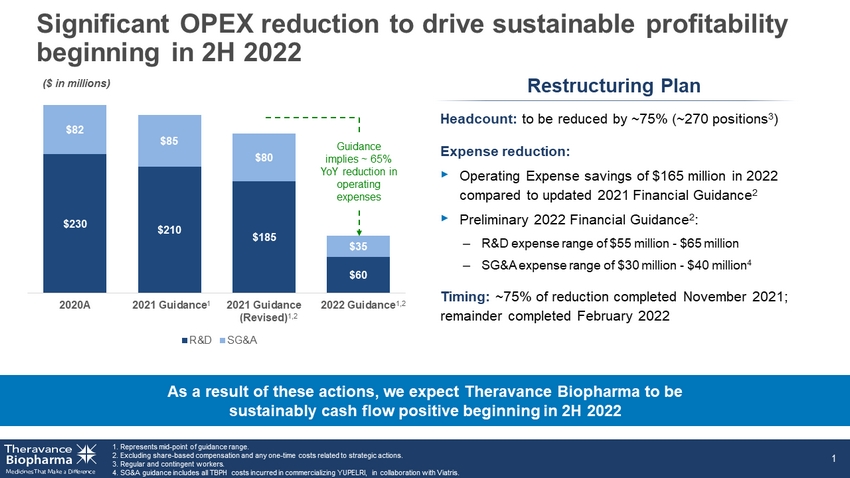

$230

$210 $185 $60 $82 $85 $80 $35 2020A 2021 Guidance 2021 Guidance (Revised) 2022 Guidance R&D SG&A Significant OPEX reduction to

drive sustainable profitability beginning in 2H 2022 1. Represents mid - point of guidance range. 2. Excluding share - based compensation

and any one - time costs related to strategic actions. 3. Regular and contingent workers. 4. SG&A guidance includes all TBPH costs

incurred in commercializing YUPELRI, in collaboration with Viatris . 1 Headcount: to be reduced by ~75% (~270 positions 3 ) Expense reduction:

‣ Operating Expense savings of $165 million in 2022 compared to updated 2021 Financial Guidance 2 ‣ Preliminary 2022 Financial

Guidance 2 : – R&D expense range of $55 million - $65 million – SG&A expense range of $30 million - $40 million 4

Timing: ~75% of reduction completed November 2021; remainder completed February 2022 As a result of these actions, we expect Theravance

Biopharma to be sustainably cash flow positive beginning in 2H 2022 ($ in millions) Restructuring Plan Guidance implies ~ 65% YoY reduction

in operating expenses 1,2 1,2 1

$230

$210 $185 $60 $82 $85 $80 $35 2020A 2021 Guidance 2021 Guidance (Revised) 2022 Guidance R&D SG&A Significant OPEX reduction to

drive sustainable profitability beginning in 2H 2022 1. Represents mid - point of guidance range. 2. Excluding share - based compensation

and any one - time costs related to strategic actions. 3. Regular and contingent workers. 4. SG&A guidance includes all TBPH costs

incurred in commercializing YUPELRI, in collaboration with Viatris . 1 Headcount: to be reduced by ~75% (~270 positions 3 ) Expense reduction:

‣ Operating Expense savings of $165 million in 2022 compared to updated 2021 Financial Guidance 2 ‣ Preliminary 2022 Financial

Guidance 2 : – R&D expense range of $55 million - $65 million – SG&A expense range of $30 million - $40 million 4

Timing: ~75% of reduction completed November 2021; remainder completed February 2022 As a result of these actions, we expect Theravance

Biopharma to be sustainably cash flow positive beginning in 2H 2022 ($ in millions) Restructuring Plan Guidance implies ~ 65% YoY reduction

in operating expenses 1,2 1,2 1

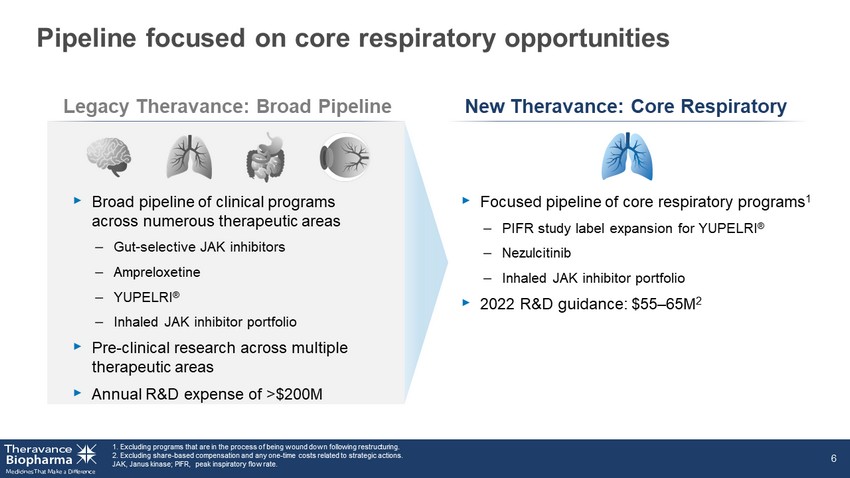

Pipeline focused on core respiratory opportunities 1. Excluding programs that are in the process of being wound down following restructuring. 2. Excluding share - based compensation and any one - time costs related to strategic actions. JAK, Janus kinase; PIFR, peak inspiratory flow rate. 6 Legacy Theravance: Broad Pipeline New Theravance: Core Respiratory ‣ Focused pipeline of core respiratory programs 1 – PIFR study label expansion for YUPELRI ® – Nezulcitinib – Inhaled JAK inhibitor portfolio ‣ 2022 R&D guidance: $55 – 65M 2 ‣ Broad pipeline of clinical programs across numerous therapeutic areas – Gut - selective JAK inhibitors – Ampreloxetine – YUPELRI ® – Inhaled JAK inhibitor portfolio ‣ Pre - clinical research across multiple therapeutic areas ‣ Annual R&D expense of >$200M

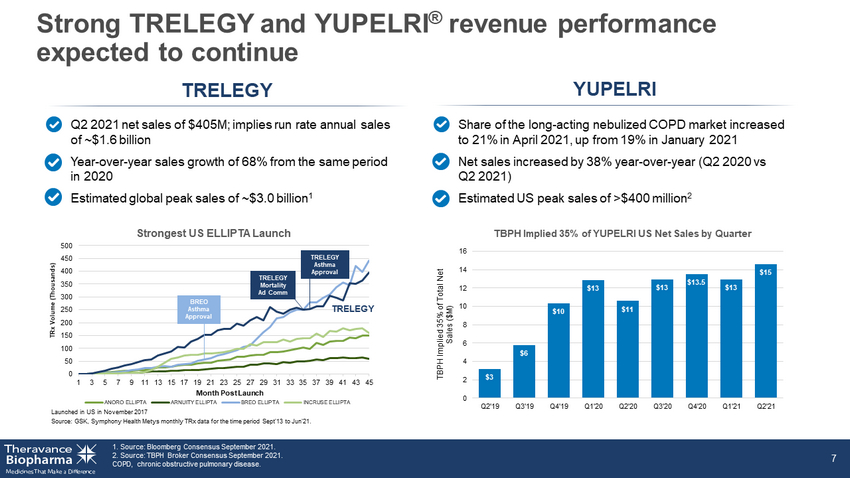

Strong TRELEGY and YUPELRI ® revenue performance expected to continue 1. Source: Bloomberg Consensus Sept 2021. 2. Source: TBPH Broker Consensus Sept 2021. COPD, chronic obstructive pulmonary disease. 7 TRELEGY YUPELRI Q2 2021 net sales of $405M; implies run rate annual sales of ~$1.6B Year - over - year sales growth of 68% from the same period in 2020 Estimated global peak sales of ~$3.0 billion 1 Share of the long - acting nebulized COPD market increased to 21% in April 2021, up from 19% in January 2021 Net sales increased by 38% year - over - year (Q2 2020 vs Q2 2021) Estimated US peak sales of >$400 million 2 TBPH Implied 35% of Total Net Sales ($M) $3 $6 $10 $13 $11 $13 $13.5 $13 $15 0 2 4 6 8 10 12 14 16 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 0 50 100 150 200 250 300 350 400 450 500 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 TRx Volume (Thousands) Month Post Launch Strongest US ELLIPTA Launch ANORO ELLIPTA ARNUITY ELLIPTA BREO ELLIPTA INCRUSE ELLIPTA TRELEGY Launched in US in November 2017 Source: GSK, Symphony Health Metys monthly TRx data for the time period Sept'13 to Jun'21. TRELEGY Mortality Ad Comm BREO Asthma Approval TRELEGY Asthma Approval TBPH Implied 35% of YUPELRI US Net Sales by Quarter

A new, focused Theravance Biopharma 8 ‣ Significant cost reduction program reduces Company size to become sustainably cash - flow positive beginning 2H 2022 ‣ Focus on leveraging expertise in developing and commercializing respiratory therapeutics ‣ R&D investment streamlined to focus on core respiratory opportunities ‣ Maximize value of non - core assets and partnerships ‣ Optimize capital structure as financial flexibility increases to maximize total shareholder return

About YUPELRI ® (revefenacin) inhalation solution YUPELRI ® (revefenacin) inhalation solution is a once - daily nebulized LAMA approved for the maintenance treatment of COPD in the US . Market research by Theravance Biopharma indicates approximately 9 % of the treated COPD patients in the US use nebulizers for ongoing maintenance therapy . 1 LAMAs are a cornerstone of maintenance therapy for COPD and YUPELRI ® is positioned as the first once - daily single - agent bronchodilator product for COPD patients who require, or prefer, nebulized therapy . YUPELRI ® ’s stability in both metered dose inhaler and dry powder device formulations suggest that this LAMA could also serve as a foundation for novel handheld combination products . 1. TBPH market research (N=160 physicians); refers to US COPD patients. COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist. 9

YUPELRI ® (revefenacin) inhalation solution YUPELRI ® inhalation solution is indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD) . Important Safety Information (US) YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product . YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i . e . , as rescue therapy for the treatment of acute episodes of bronchospasm . Acute symptoms should be treated with an inhaled short - acting beta 2 - agonist . As with other inhaled medicines, YUPELRI can produce paradoxical bronchospasm that may be life - threatening . If paradoxical bronchospasm occurs following dosing with YUPELRI, it should be treated immediately with an inhaled, short - acting bronchodilator . YUPELRI should be discontinued immediately and alternative therapy should be instituted . YUPELRI should be used with caution in patients with narrow - angle glaucoma . Patients should be instructed to immediately consult their healthcare provider if they develop any signs and symptoms of acute narrow - angle glaucoma, including eye pain or discomfort, blurred vision, visual halos or colored images in association with red eyes from conjunctival congestion and corneal edema . Worsening of urinary retention may occur . Use with caution in patients with prostatic hyperplasia or bladder - neck obstruction and instruct patients to contact a healthcare provider immediately if symptoms occur . Immediate hypersensitivity reactions may occur after administration of YUPELRI . If a reaction occurs, YUPELRI should be stopped at once and alternative treatments considered . The most common adverse reactions occurring in clinical trials at an incidence greater than or equal to 2 % in the YUPELRI group, and higher than placebo, included cough, nasopharyngitis, upper respiratory infection, headache and back pain . Coadministration of anticholinergic medicines or OATP 1 B 1 and OATP 1 B 3 inhibitors with YUPELRI is not recommended . YUPELRI is not recommended in patients with any degree of hepatic impairment . OATP, organic anion transporting polypeptide. 10