Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TECOGEN INC. | form8-krehcwainwrightconf.htm |

TECOGEN INVESTOR PRESENTATION SEPTEMBER 13, 2021 OTC: TGEN CLEAN ENERGY SOLUTIONS BENJAMIN LOCKE, CEO ABINAND RANGESH, CFO

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 2

Providing resiliency and energy savings with a cleaner environmental footprint >3,000 Units Shipped

ENERGY AND RESILIENCY CLEAN COOLING Chillers with lower operating cost and lower greenhouse gas footprint compared to an equivalent electric chiller EMISSIONS CONTROLS Proprietary modular microgrids for energy savings, greenhouse gas (GHG) reductions and resiliency to grid outages Near zero NOx, CO, and hydrocarbons (HC) emissions systems for gasoline, propane and natural gas engines

DISTRIBUTED GENERATION AND CHILLERS SHIPPED 3,000+ KWH GENERATED 1,968,913,337 FACTS ABOUT US METRIC TONS OF CO2 SAVED 97,143 PRODUCT RUN HOURS 52,156,171 5 NUMBER OF OPERATIONAL U.S. MICROGRIDS IN 2019 #3

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements. We have 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN RELIABLE POWER, COOLING AND HEAT Sales of microgrid, cogeneration, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and controlled environment agriculture PRODUCT SALES We sell electricity and thermal energy produced by our equipment onsite at customer facilities. ENERGY AS A SERVICE (EAAS) 6

PATHWAY TO GROWTH Commercial Introduction of Tecochill Air Cooled Chillers that incorporate Tecogen’s Proprietary Hybrid Drive technology by Q4 2022. New Tecochill AC Chiller will enable further penetration in core markets such as controlled environment agriculture and healthcare. Continued licensing of Ultera emissions system to engine manufacturers. Goal is to obtain first EPA certified near zero emissions fork truck engine with Ultera by mid-2022. Clean Microgrids using Proprietary Inverter and Power Control Technology in combination with other energy technologies including solar and battery 2021 TO 2023 7 Growth of existing microgrid, chiller products and service contracts into new segments and geographies by expanding sales agent and manufacturers representative network with goal of achieving profitability from operations.

EXPAND SALES NETWORKS TO NEW GEOGRAPHIES AND MARKETS Continued growth of service contract revenues Expand sales networks for chiller products into high value clean cooling markets such as controlled environment agriculture and industrial refrigeration GROWTH OF CORE BUSINESS Continued sales of proprietary Inverde Microgrid System for energy savings, greenhouse gas (GHG) reductions and resiliency to grid outages Opportunistic growth of Energy as a Service (EAAS) revenue segment 1200 ton Tecochill Modular Chiller Plant (MCP) for cannabis cultivation facility in MA 300 kW Microgrid in New Jersey 8

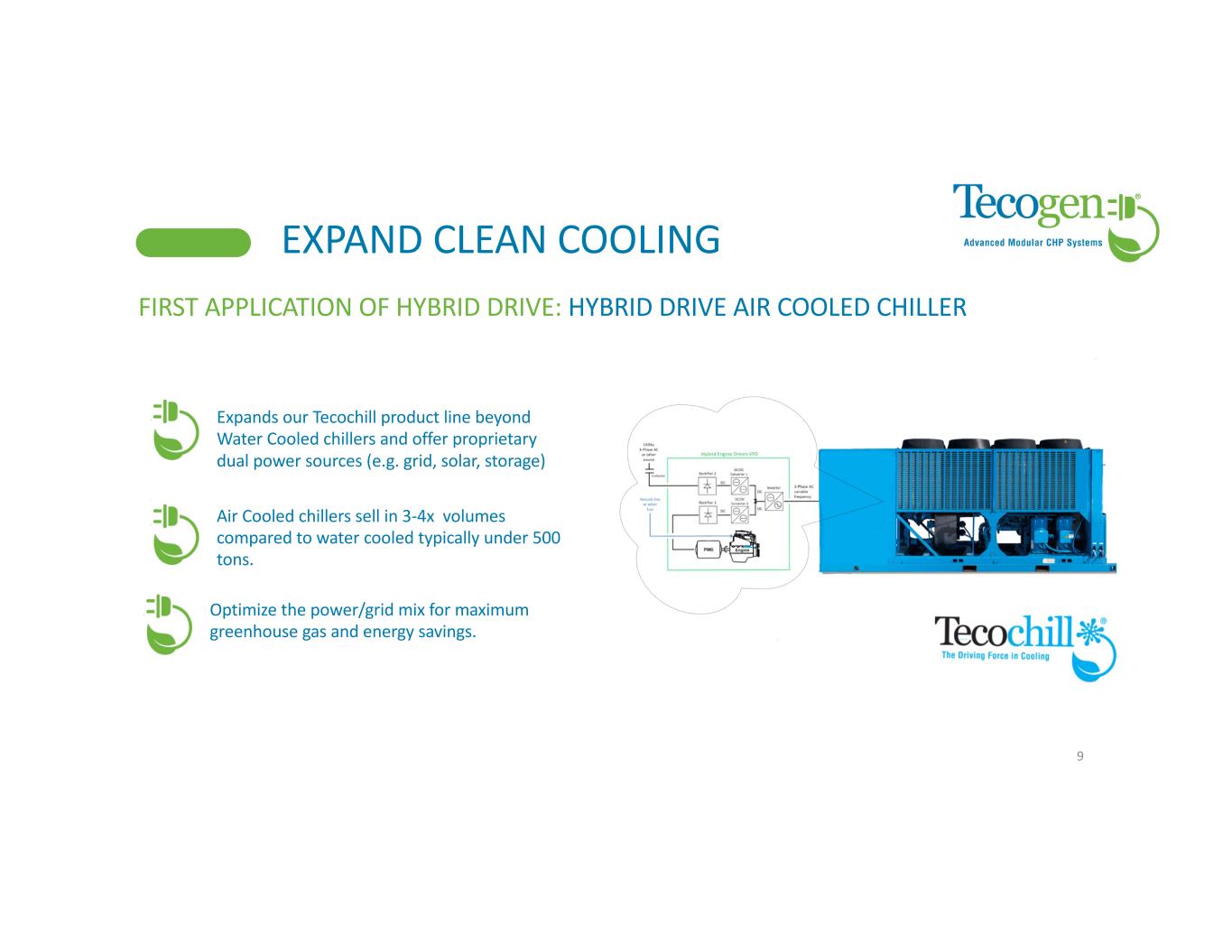

FIRST APPLICATION OF HYBRID DRIVE: HYBRID DRIVE AIR COOLED CHILLER Optimize the power/grid mix for maximum greenhouse gas and energy savings. Air Cooled chillers sell in 3-4x volumes compared to water cooled typically under 500 tons. EXPAND CLEAN COOLING 9 Expands our Tecochill product line beyond Water Cooled chillers and offer proprietary dual power sources (e.g. grid, solar, storage)

With an air-cooled offering we will be able to target opportunities from 100 tons to 1200 tons. The air cooled chiller will also provide us the capability to run on electricity or gas providing resiliency which is valued in process applications. Process cooling typically involves cooling and de-humidification simultaneously. Our chillers provide significant economic advantages vs electric chillers. CLEAN COOLING MARKET POTENTIAL TARGET PROCESS COOLING/HEATING SOLUTIONS: 100 TONS TO 1200 TONS 10 North American Process Cooling Market Currently addressable by Water Cooled Tecochill To be addressed by Air Cooled Tecochill > $800m Addressable Market

OTHER MARKETS FOR HYBRID DRIVE Air Handlers Heat Pumps Air compressors Modular Refrigeration Plants Hybrid drive can be used across a range of cooling products to create a portfolio of clean cooling solutions. Scalable expansion potential in high volume markets 11

EXPAND MICROGRID OFFERING CLEAN MICROGRIDS PREDICTED TO GROW AT 19% CAGR WITH A GLOBAL MARKET SIZE OF >$47BN BY 2025 1 Increased future load on the electrical grid due to EV charging and electrification Utility tariffs increasingly becoming time of day based with bonus payments for curtailment of peak power Renewable energy output varies with wind and sun but demand for power does not Resiliency becoming increasingly important due to extreme weather events or utility disruption (1) https://guidehouseinsights.com/reports/market-data-utility-microgrids 12

CLEAN MICROGRIDS ENABLING THE CLEAN ENERGY FUTURE 13 Tecogen proprietary microgrid technology acts as the hub to seamlessly integrate multiple DG inputs Optimize the power mix for maximum greenhouse gas and energy savings. When the utility power goes out, we continue to keep the lights on.

EMISSIONS TECHNOLOGY On completion, may enable faster adoption for Ultera in forklifts and non-road engines through strategic partnerships and licensing agreements. Ultera – removing barriers to adoption Catalyst materials such as Rhodium are becoming scarce. Prices of Rh have gone from $800/oz to $18,000/oz in 5 years. Pd has risen from $700 to $2500/oz. 14 Ultera is a proprietary ultra-clean emissions control technology that consistently reduces CO, NOx, and hydrocarbons to near zero levels for spark ignited, rich burn, internal combustion engines. New catalyst developed by SWRI for Tecogen has the potential to be more cost effective than existing catalysts as it may allow us to reduce the precious metal loading on the first stage catalyst.

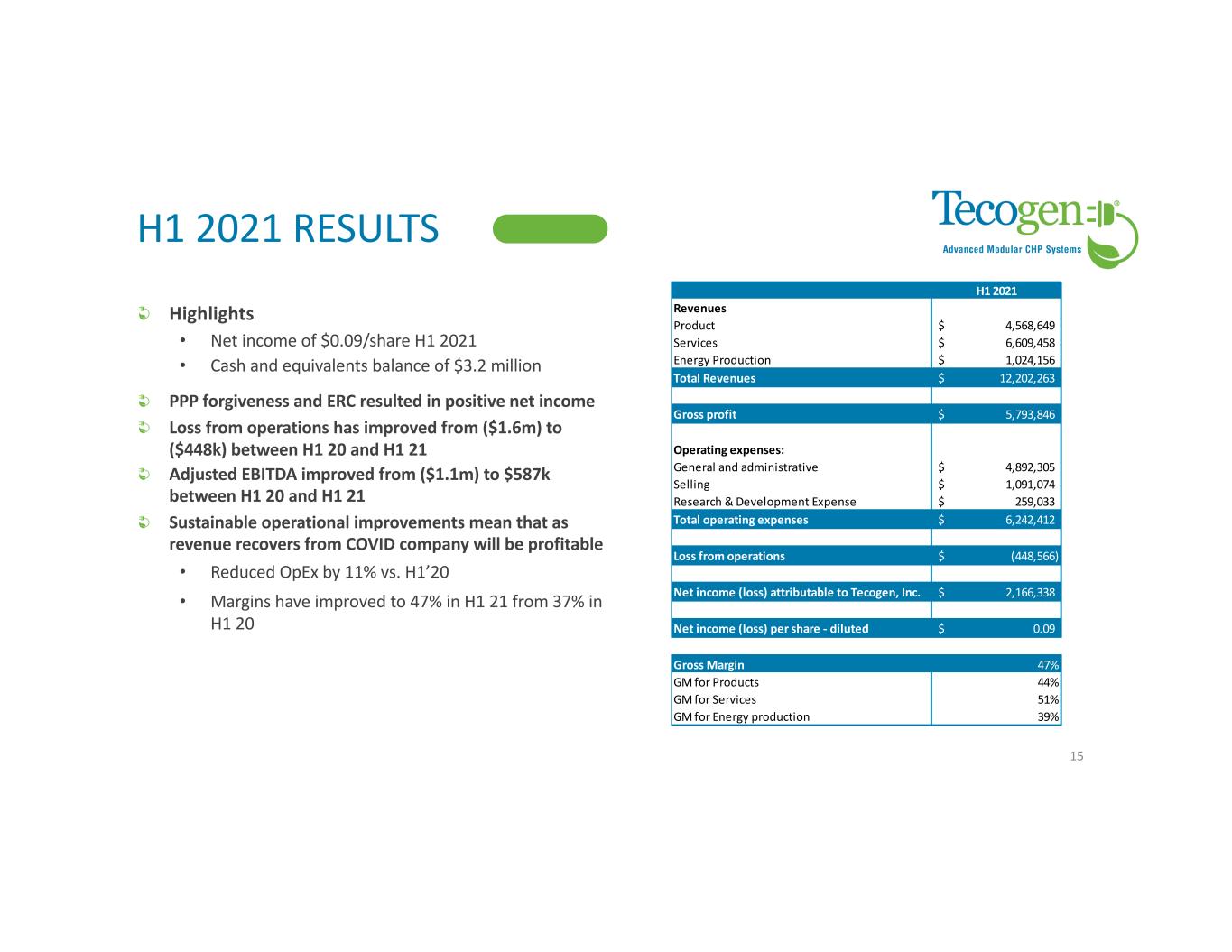

H1 2021 RESULTS Highlights • Net income of $0.09/share H1 2021 • Cash and equivalents balance of $3.2 million PPP forgiveness and ERC resulted in positive net income Loss from operations has improved from ($1.6m) to ($448k) between H1 20 and H1 21 Adjusted EBITDA improved from ($1.1m) to $587k between H1 20 and H1 21 Sustainable operational improvements mean that as revenue recovers from COVID company will be profitable • Reduced OpEx by 11% vs. H1’20 • Margins have improved to 47% in H1 21 from 37% in H1 20 15 H1 2021 Revenues Product 4,568,649$ Services 6,609,458$ Energy Production 1,024,156$ Total Revenues 12,202,263$ Gross profit 5,793,846$ Operating expenses: General and administrative 4,892,305$ Selling 1,091,074$ Research & Development Expense 259,033$ Total operating expenses 6,242,412$ Loss from operations (448,566)$ Net income (loss) attributable to Tecogen, Inc. 2,166,338$ Net income (loss) per share - diluted 0.09$ Gross Margin 47% GM for Products 44% GM for Services 51% GM for Energy production 39%

LONG TERM SERVICE REVENUE 16 RECURRING REVENUE STREAMS: 55% OF OVERALL REVENUE, >7% ANNUAL GROWTH RATE $- $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Re ve nu e ($ ) Service Revenue by Quarter Service contracts

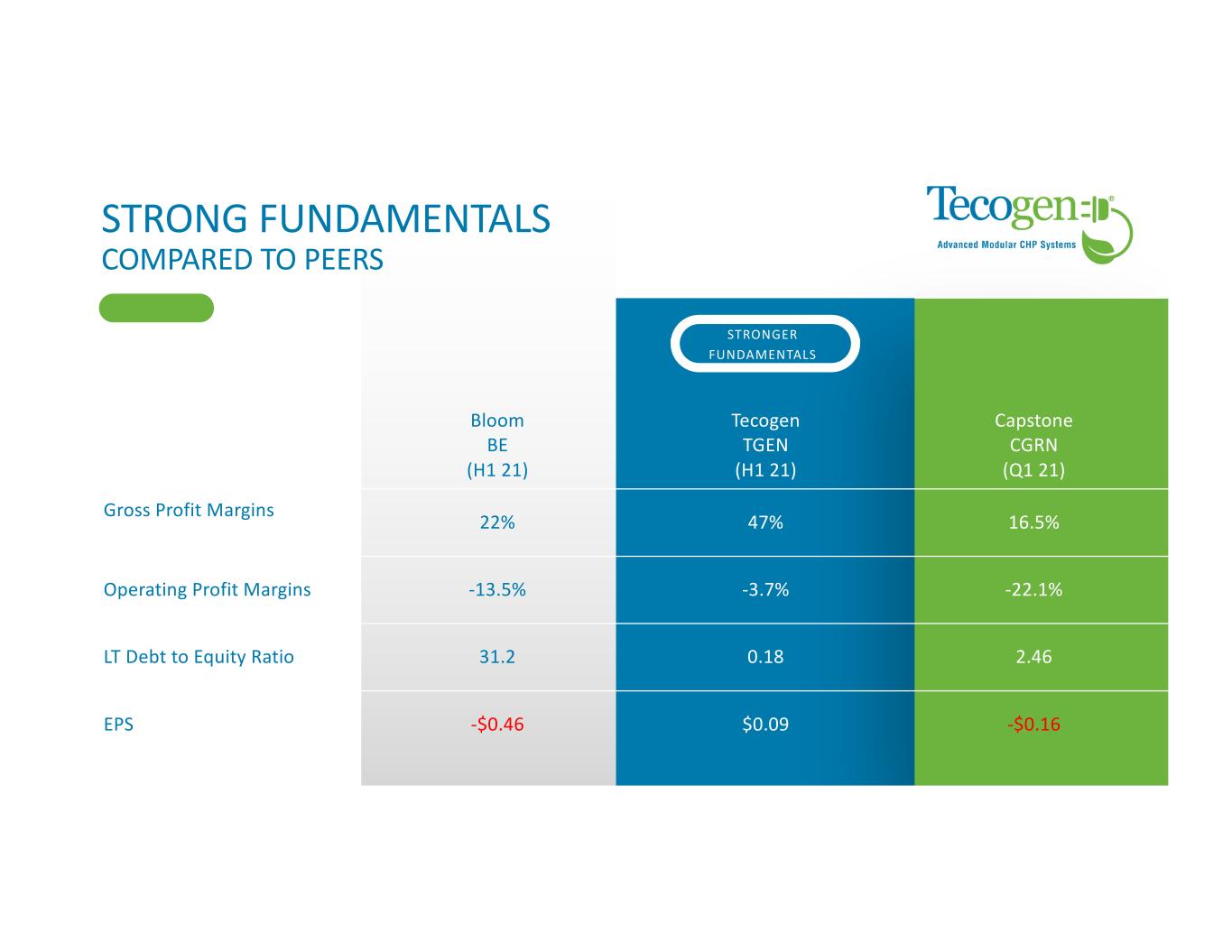

STRONGER FUNDAMENTALS Bloom BE (H1 21) Tecogen TGEN (H1 21) Capstone CGRN (Q1 21) Gross Profit Margins 22% 47% 16.5% Operating Profit Margins -13.5% -3.7% -22.1% LT Debt to Equity Ratio 31.2 0.18 2.46 EPS -$0.46 $0.09 -$0.16 STRONG FUNDAMENTALS COMPARED TO PEERS

WHY INVEST IN TECOGEN The new products we are launching will allow us to address gaps in our product offering while offering the same competitive advantages, hence strengthening our market position. We are close to breakeven and as we replicate our sales channels and service centers to address new markets we expect to be profitable. We have strong margins and our chillers in particular have a strong competitive advantage in the markets we operate in. Now that we have sufficient run hours on our products in demanding process applications, we have established customer confidence in our products. This acts as a barrier to entry to competitors and with our sale channel optimization, we expect to significantly increase market share. SCALING POTENTIAL OF CORE BUSINESS NEW PRODUCTS IP Tecogen has a track record of product innovation; our inverter and emissions technology are protected by strong IP and our licensing contracts for Ultera are starting to reach certification milestones. We expect to start seeing add on revenue from this area over the upcoming years. 18

LEADERSHIP TEAM CEO BENJAMIN LOCKE Benjamin M. Locke has been a member of the Company's board of directors since June 2018. Mr. Locke has been the Company's Co-Chief Executive Officer since 2014 and as of March 29, 2018 he became the sole Chief Executive Officer of Tecogen. Mr. Locke was the Director of Corporate Strategy for Tecogen and was promoted to General Manager prior to his appointment as Co-Chief Executive Officer of Tecogen. In October of 2014, Mr. Locke began serving as Co-Chief Executive Officer of ADGE and continued to serve as Co-Chief Executive Officer until the completion of the ADGE Merger. Previously, Mr. Locke was the Director of Business Development and Government Affairs at Metabolix, a bioplastics technology development and commercialization company. In that role, he was responsible for developing and executing plans for partnerships, joint ventures, acquisitions, and other strategic arrangements for commercializing profitable clean energy technologies. Prior to joining Metabolix in 2001, Mr. Locke was Vice President of Research at Innovative Imaging Systems, or IISI, a high-technology R&D company. At IISI, he drove the development and implementation of growth strategies for the funding of specialty electronic systems for the United States Government. Mr. Locke has a B.S. in Physics from the University of Massachusetts, a M.S. in Electrical Engineering from Tufts University, and an M.B.A. in Corporate Finance from Boston University. Abinand Rangesh has been with the Company since 2016 and has held roles in various divisions including sales, business development and most recently being Vice President and Director of Corporate Strategy. Prior to joining Tecogen, he led startup companies in the green energy and software space. In addition, Dr. Rangesh has multiple design patents and has published multiple scientific papers in peer reviewed journals. Dr. Rangesh earned both his Ph.D. and undergraduate degrees in engineering from the University of Cambridge, United Kingdom. CFO ABINAND RANGESH President & COO ROBERT PANORA Robert Panora has served as President of Tecogen since 2000. Mr. Panora had been General Manager of Tecogen’s Product Group since 1990 and Manager of Product Development, Engineering Manager, and Operations Manager of the Company since 1984. Over his 41-year tenure with Tecogen, he has been responsible for sales and marketing, engineering, service and manufacturing. He contributed to the development of our first product, the CM-60 cogeneration module, and was Program Manager for the cogeneration and chiller projects that followed. Mr. Panora has had considerable influence on many aspects of our business, from building the employee team, to conceptualizing product designs and authoring many of the original business documents, sales tools, and product literature pieces. Mr. Panora holds B.S. and M.S. degrees in Chemical Engineering from Tufts University.

LEADERSHIP TEAM Roger Deschenes has led accounting and finance functions in high-technology manufacturing and consumer products and distribution companies for over 30 years, including as Division Chief Financial Officer at L3 Security Detection Systems, Inc. in 2017 and 2018, and as Vice President, Finance, Chief Financial Officer and Chief Accounting Officer at Implant Sciences Corporation from 2010 to 2017. Mr. Deschenes received a B.S. in Business Administration from Salem State University and is a Certified Management Accountant. CAO ROGER DESCHENES General Counsel JACK WHITING John K. Whiting, IV has been the Company's General Counsel since January 2018, handling all legal matters for the company, including commercial transactional matters, corporate financing and governance matters, securities compliance work and SEC filings, and providing support for risk management and the consideration of strategic options. Since April 2017 Mr. Whiting has also served as General Counsel & CFO of Inspired Therapeutics LLC. Previously, he served as Vice President, General Counsel & Secretary of Vero Biotech LLC (from January 2012 to 2017), as Vice President, General Counsel & Secretary of Pharos LLC and Levitronix LLC (from 2009 through 2011), as Vice President & General Counsel of American Renal Associates Inc. (from 2002 to 2008), and as Associate General Counsel of Thermo Electron Corporation (now Thermo Fisher Scientific Inc.) (from 1996 through 2002). Mr. Whiting holds a B.A. in Political Science and History from the University of Vermont, a J.D. from Boston University School of Law, and an MBA from F.W. Olin Graduate School of Business at Babson College. Joseph Gehret is our Chief Technical Officer. Mr. Gehret is responsible for leading technology development at Tecogen and defining the company’s research and development efforts. With an expansive depth and breadth of classic, as well as cutting edge technology, he has been integral in the development of all Tecogen products and technology for 30 years. He is the primary author on all of Tecogen’s major patents. In addition to leadership roles in all Tecogen technology development, Mr. Gehret has designed and developed the necessary hardware, as well as the software code, for all of Tecogen’s product lines. Mr. Gehret holds a B.S. in Mechanical Engineering and an M.S. in Nuclear Engineering, both from the Massachusetts Institute of Technology. CTO JOSEPH GEHRET

BOARD MEMBERS Director Earl R. Lewis III has served as Chairman of the Board and as Chief Executive Officer and President of FLIR Systems from 2000 through May 2013, and since May 2013 as Chairman of the Board and as a senior consultant to FLIR Systems. Mr. Lewis also served as Chairman of the Board of Harvard Bio Science from 2013 through June 2018, as CEO and President of Thermo Instrument Systems from 1998 to 2000, as President in 1997, and as COO in 1996. Mr. Lewis also served as CEO and President of Thermo Optek Corporation from 1994 to 1996, as President of Thermo Jarrell Ash Corporation from 1988 to 1994, and in senior operations and manufacturing roles at Thermo Jarrell Ash since 1984 and at other companies in previous years. Mr. Lewis holds a B.S. from Clarkson College of Technology. EARL R LEWIS III Lead Director Mr. Hatsopoulos is Lead Director of Tecogen. He has been a member of the Company's board of directors since its founding in 2000 (other than the period between June 6, 2018 and February 1, 2019). He was Tecogen's CEO until 2014 when he became Co-CEO until he retired in 2018. Mr. Hatsopoulos was also Chief Executive Officer and Director of American DG Energy Inc. from its inception in 2001 until 2014 when he became Co-CEO. He remained Co-CEO and Director until American DG Energy or ADGE merged with Tecogen in 2017. In addition, Mr. Hatsopoulos was Chairman of EuroSite Power Inc., a former affiliate of the Company, from 2009 until 2016. Mr. Hatsopoulos is a co- founder of Thermo Electron Corporation, which is now Thermo Fisher Scientific. He was formerly the President and Vice Chairman of the Board of Directors of that company. He is a former “Member of the Corporation” of Northeastern University. He graduated from Athens College in Greece and holds a B.S. in history and mathematics from Northeastern University, as well as honorary doctorates in business administration from Boston College and Northeastern University. JOHN HATSOPOULOS Director Dr. Ghoniem has been a member of the Company's board of directors since 2008. Dr. Ghoniem is the Ronald C. Crane Professor of Mechanical Engineering at MIT. He is also the Director of the Center for 21st Century Energy, and the head of Energy Science and Engineering at MIT, where he plays a leadership role in many energy-related activities, initiatives and programs. He joined MIT as an Assistant Professor in 1983. He is an associate fellow of the American Institute of Aeronautics and Astronautics, and Fellow of American Society of Mechanical Engineers. He was recently granted the KAUST Investigator Award. Dr. Ghoniem holds a Ph.D. in Mechanical Engineering from the University of California, Berkeley, and a M.S. and B.S. in Mechanical Engineering from Cairo University. AHMED GHONIEM Chairperson Ms. Galiteva has been the Company's Chairperson of the board of directors since 2005. Ms. Galiteva is founder and Chair of the Board for the Renewables 100 Policy Institute, a non-profit entity dedicated to the global advancements of renewable energy solutions since 2008. She is also Chairperson at the World Council for Renewable Energy (WCRE), which focuses on the development of legislative and policy initiatives to facilitate the introduction and growth of renewable energy technologies since 2003. Since 2011, she has served on the Board of Governors of the California Independent System Operator (CA ISO), providing direction and oversight for the CA ISO which operates the California electricity grid. Also, she is a principal at New Energy Options, Inc., a company focusing on advancing the integration of sustainable energy solutions since 2006. She has also been a strategic consultant with Renewable Energy Policy and Strategy Consulting since 2004. Ms. Galiteva holds a M.S in Environmental and Energy Law, a J.D. from Pace University School of Law, and a B.S. from Sofia University in Bulgaria. ANGELINA GALITEVA Director Fred Holubow served as a director of ANI Pharmaceuticals, Inc. from 1999 through May 2018 where he served on the Board's Audit and Finance Committee. Mr. Holubow is, and since 1984 has been a General Partner of Starbow Partners, an investor in early-stage healthcare ventures. In addition, Mr. Holubow serves as a Principal of Petard Risk Analysis, a position he has held since January 2012. From 2001 to December 2011 Mr. Holubow served as a Managing Director of William Harris Investors, Inc., a registered investment advisory firm, and from 1982 to 2001 he served as Vice President of Pegasus Associates, a registered investment advisory firm he co- founded. Mr. Holubow specializes in analyzing and investing in pharmaceutical and biotechnology companies. Mr. Holubow also previously served on the board of directors of the following public companies: Micrus Endovascular Corporation, ThermoRetec Corporation, Savient Pharmaceuticals, Inc. (formerly Bio- Technology General Corp.), Gynex Pharmaceuticals, Inc., and Unimed Pharmaceuticals, Inc. FRED HUBLOW Director Mr. Jenkins is a retired partner at Ernst & Young LLP where he provided accounting related services for a diversified client base for 36 years until February 2016 from offices in Boston, Massachusetts and in Manchester, New Hampshire where he served as Office Managing Partner for five years. Mr. Jenkins’ expertise includes matters related to initial public offerings, mergers and acquisitions transactions, financing transactions, and implementation of internal controls in connection with Sarbanes-Oxley compliance. Mr. Jenkins received a B.S in accounting from Bentley University in 1977. RALPH JENKINS