Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sight Sciences, Inc. | sght-20210909.htm |

Delivering the Power of Sight Investor Presentation September 2021 ™

1 Forward Looking Statements This presentation, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this presentation or during the earnings call that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These statements often include words such as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions. We base these forward-looking statements on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances at such time. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our business, results of operations and financial condition and could cause actual results to differ materially from those expressed in the forward-looking statements. These statements are not guarantees of future performance or results. The forward-looking statements are subject to and involve risks, uncertainties and assumptions, and you should not place undue reliance on these forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following: estimates of our total addressable market, future revenue, expenses, capital requirements, and our needs for additional financing; our ability to enter into and compete in new markets; execution of our market strategies; the impact of the COVID-19 pandemic on our business, our customers’ and suppliers’ businesses and the general economy; our ability to compete effectively with existing competitors and new market entrants; our ability to scale our infrastructure; our ability to manage and grow our business by expanding our sales to existing customers or introducing our products to new customers; our ability to establish and maintain intellectual property protection for our products or avoid claims of infringement; potential effects of extensive government regulation; our abilities to obtain and maintain regulatory approvals and clearances for our products that support our business strategies and growth; our ability to successfully execute our clinical trial roadmap our ability to obtain and maintain sufficient reimbursement for our products; our abilities to protect and scale our intellectual property portfolio; our ability to hire and retain key personnel; our ability to obtain financing in future offerings; the volatility of the trading price of our common stock; our expectation regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act (the “JOBS Act”); and our ability to maintain proper and effective internal controls. These cautionary statements should not be construed by you to be exhaustive and are made only as of the date of this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Certain information contained in this presentation relates to, or is based on, studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its own estimates and research are reliable, such estimates and research have not been verified by any independent source. We have proprietary rights to trademarks, trade names and service marks appearing in this presentation that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this presentation without the ® and ™ symbols, but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this presentation are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. Without limitation, SIGHT SCIENCES™, OMNI®, and TEARCARE® are trademarks of Sight Sciences, Inc. in the United States and other countries.

2 Transform Ophthalmology and Optometry through products that target the underlying causes of the world’s most prevalent eye diseases Establish new treatment paradigms and create an interventional mindset in Eyecare to replace conventional outdated approaches Our Mission

Our World Class Team 3 Paul Badawi Chief Executive Officer and Co-Founder Dr. David Badawi, MD Chief Technology Officer and Co-Founder Jesse Selnick Chief Financial Officer Shawn O’Neil Chief Commercial Officer Sam Park Chief Operating Officer Jeremy Hayden Chief Legal Officer Dr. Reay Brown, MD Chief Medical Officer Prominent ophthalmologist and inventor of much of the IP in MIGS Kavita Dhamdhere, MD, PhD Vice President, Clinical Development Stacie Rodgers Vice President, Human Resources Tom Huang Head of Corporate Strategy and Development John Liu Senior Vice President, Global Market Access Kathy Chester Vice President, Regulatory Affairs

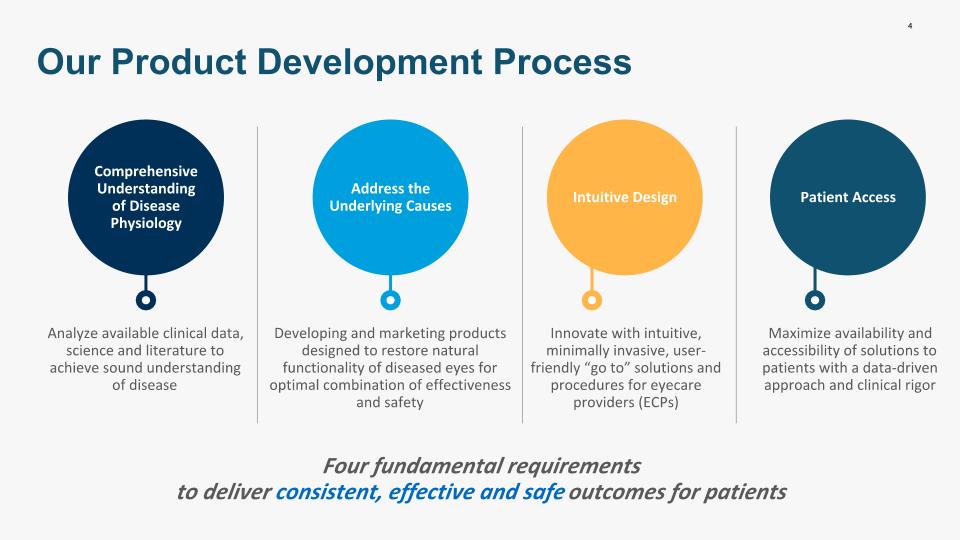

4 Four fundamental requirements to deliver consistent, effective and safe outcomes for patients Our Product Development Process Comprehensive Understanding of Disease Physiology Analyze available clinical data, science and literature to achieve sound understanding of disease Address the Underlying Causes Developing and marketing products designed to restore natural functionality of diseased eyes for optimal combination of effectiveness and safety Intuitive Design Innovate with intuitive, minimally invasive, user-friendly “go to” solutions and procedures for eyecare providers (ECPs) Patient Access Maximize availability and accessibility of solutions to patients with a data-driven approach and clinical rigor

5 Developing and Commercializing Products That We Believe Will Disrupt Two Major Eyecare Categories Large, unmet market need Differentiated, innovative, intuitive design Robust clinical data Maximized patient access Comprehensive IP protection Demonstrated growth & strong financial profile

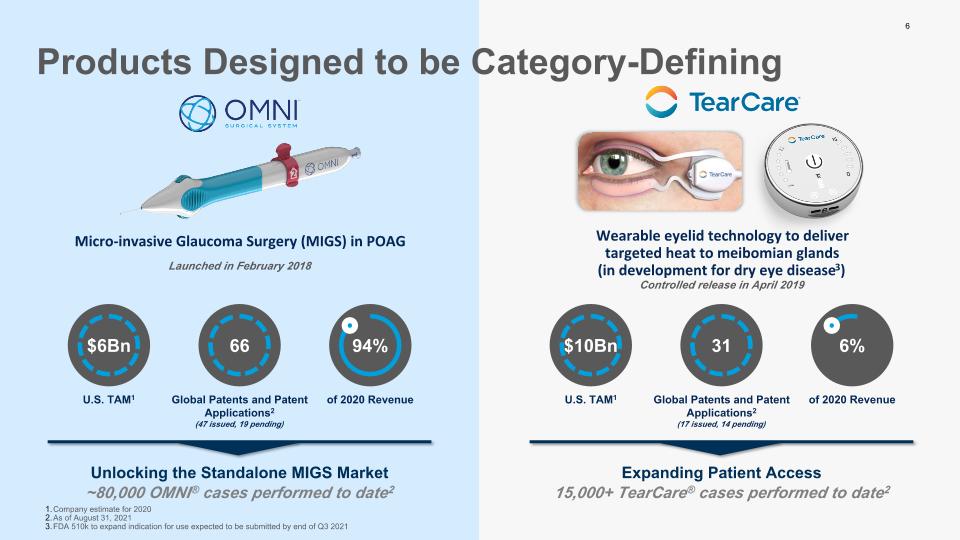

Micro-invasive Glaucoma Surgery (MIGS) in POAG Launched in February 2018 Wearable eyelid technology to deliver targeted heat to meibomian glands (in development for dry eye disease3) Controlled release in April 2019 U.S. TAM1 of 2020 Revenue $6Bn 94% 66 Global Patents and Patent Applications2 (47 issued, 19 pending) U.S. TAM1 of 2020 Revenue $10Bn 6% 31 Global Patents and Patent Applications2 (17 issued, 14 pending) Company estimate for 2020 As of August 31, 2021 FDA 510k to expand indication for use expected to be submitted by end of Q3 2021 Unlocking the Standalone MIGS Market Expanding Patient Access ~80,000 OMNI® cases performed to date2 15,000+ TearCare® cases performed to date2 6 Products Designed to be Category-Defining

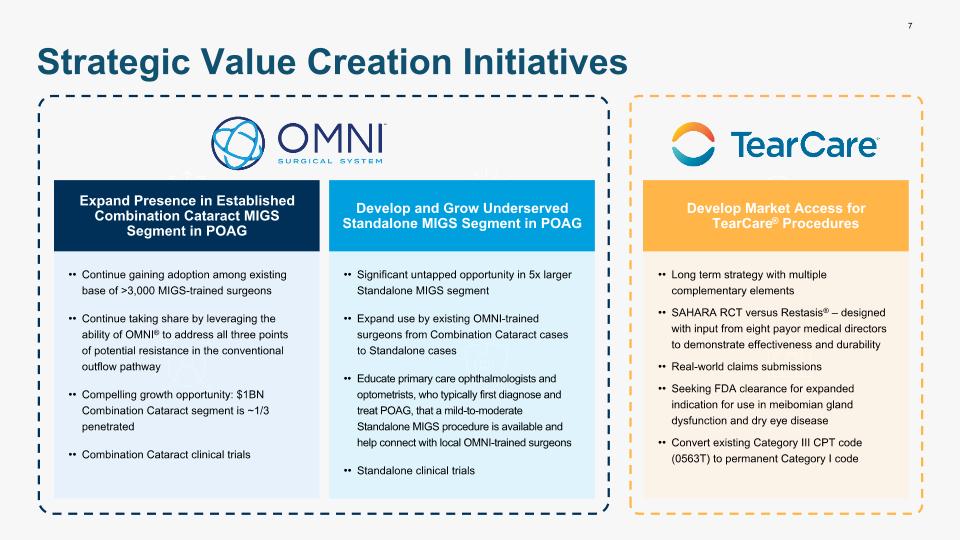

7 Strategic Value Creation Initiatives Expand Presence in Established Combination Cataract MIGS Segment in POAG Continue gaining adoption among existing base of >3,000 MIGS-trained surgeons Continue taking share by leveraging the ability of OMNI® to address all three points of potential resistance in the conventional outflow pathway Compelling growth opportunity: $1BN Combination Cataract segment is ~1/3 penetrated Combination Cataract clinical trials Develop and Grow Underserved Standalone MIGS Segment in POAG Significant untapped opportunity in 5x larger Standalone MIGS segment Expand use by existing OMNI-trained surgeons from Combination Cataract cases to Standalone cases Educate primary care ophthalmologists and optometrists, who typically first diagnose and treat POAG, that a mild-to-moderate Standalone MIGS procedure is available and help connect with local OMNI-trained surgeons Standalone clinical trials Develop Market Access for TearCare® Procedures Long term strategy with multiple complementary elements SAHARA RCT versus Restasis® – designed with input from eight payor medical directors to demonstrate effectiveness and durability Real-world claims submissions Seeking FDA clearance for expanded indication for use in meibomian gland dysfunction and dry eye disease Convert existing Category III CPT code (0563T) to permanent Category I code

Primary Open-Angle Glaucoma ™

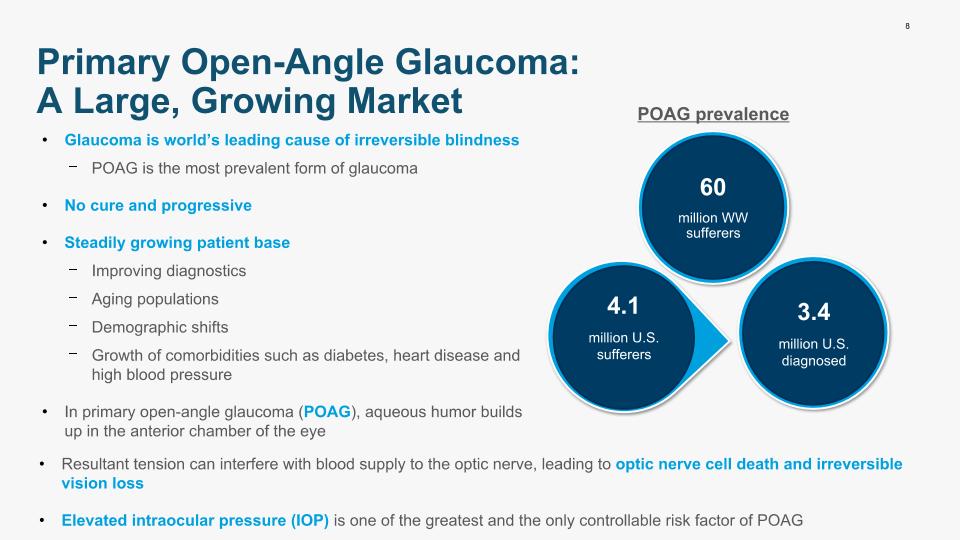

Glaucoma is world’s leading cause of irreversible blindness POAG is the most prevalent form of glaucoma No cure and progressive Steadily growing patient base Improving diagnostics Aging populations Demographic shifts Growth of comorbidities such as diabetes, heart disease and high blood pressure In primary open-angle glaucoma (POAG), aqueous humor builds up in the anterior chamber of the eye 8 4.1 million U.S. sufferers 3.4 million U.S. diagnosed 60 million WW sufferers POAG prevalence Resultant tension can interfere with blood supply to the optic nerve, leading to optic nerve cell death and irreversible vision loss Elevated intraocular pressure (IOP) is one of the greatest and the only controllable risk factor of POAG Primary Open-Angle Glaucoma: A Large, Growing Market

9 Current Global POAG Treatment Market Rx medications currently have the supermajority of treatment share (estimated >80%) Conventional surgery has been a last line therapy MIGS are transforming POAG treatment, but still well underpenetrated (estimated <10%) Fastest growing treatment segment (25%-37% est. W.W. 2020-2025 CAGR) Growth driven by fast recovery times, attractive safety profile, low rate of side effects Disproportionately performed in combination with cataract surgery today since trabecular bypass stents (which are only indicated for use in combination with cataract surgery in the U.S.) were first MIGS entrants Our definition of MIGS = minimally invasive glaucoma procedures utilizing an ab interno approach though a single, clear corneal microincision

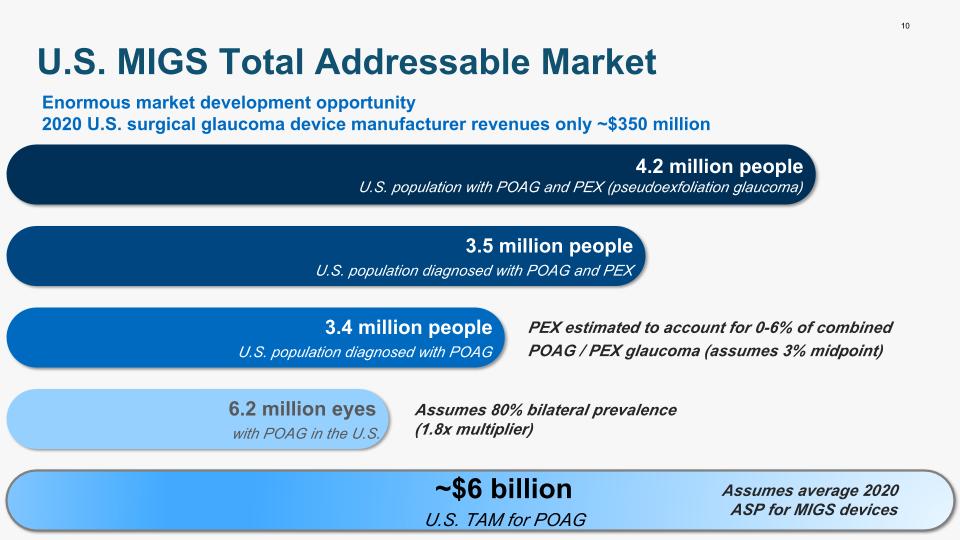

10 U.S. MIGS Total Addressable Market 4.2 million people U.S. population with POAG and PEX (pseudoexfoliation glaucoma) 3.5 million people U.S. population diagnosed with POAG and PEX 3.4 million people U.S. population diagnosed with POAG 6.2 million eyes with POAG in the U.S. ~$6 billion U.S. TAM for POAG Assumes average 2020 ASP for MIGS devices Assumes 80% bilateral prevalence (1.8x multiplier) PEX estimated to account for 0-6% of combined POAG / PEX glaucoma (assumes 3% midpoint) Enormous market development opportunity 2020 U.S. surgical glaucoma device manufacturer revenues only ~$350 million

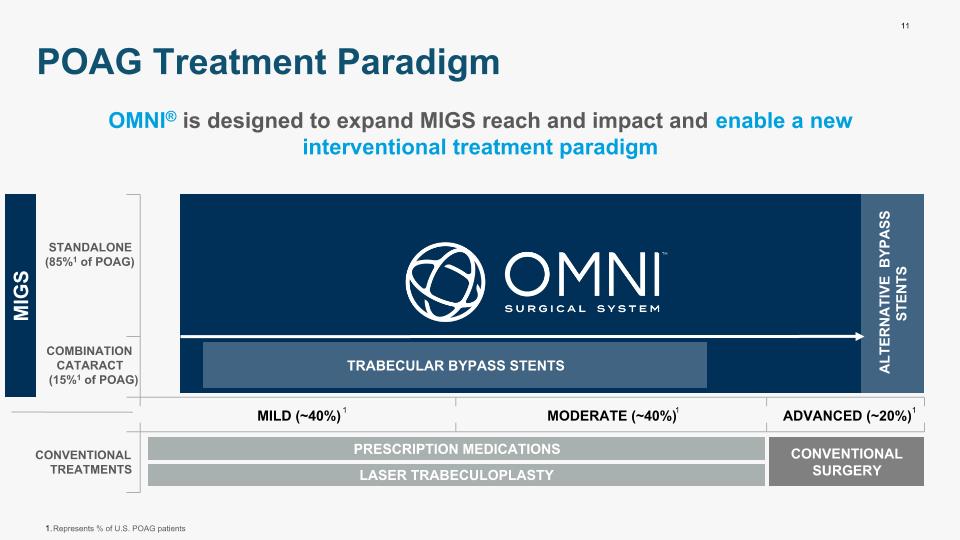

11 POAG Treatment Paradigm PRESCRIPTION MEDICATIONS OMNI® is designed to expand MIGS reach and impact and enable a new interventional treatment paradigm STANDALONE (85%1 of POAG) COMBINATION CATARACT (15%1 of POAG) CONVENTIONAL TREATMENTS TRABECULAR BYPASS STENTS LASER TRABECULOPLASTY CONVENTIONAL SURGERY MILD (~40%) MODERATE (~40%) ADVANCED (~20%) Represents % of U.S. POAG patients 1 1 1 ALTERNATIVE BYPASS STENTS MIGS

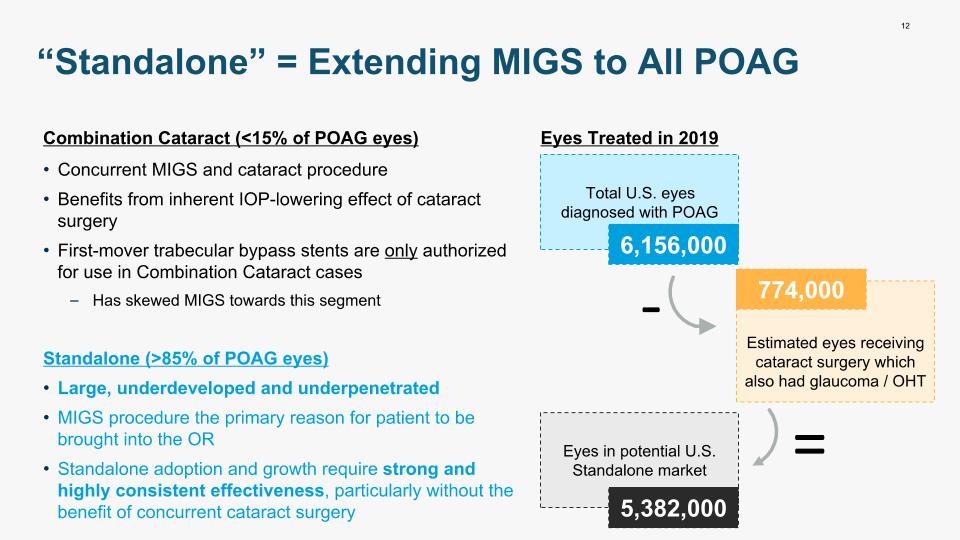

Combination Cataract (<15% of POAG eyes) Concurrent MIGS and cataract procedure Benefits from inherent IOP-lowering effect of cataract surgery First-mover trabecular bypass stents are only authorized for use in Combination Cataract cases Has skewed MIGS towards this segment Standalone (>85% of POAG eyes) Large, underdeveloped and underpenetrated MIGS procedure the primary reason for patient to be brought into the OR Standalone adoption and growth require strong and highly consistent effectiveness, particularly without the benefit of concurrent cataract surgery 12 “Standalone” = Extending MIGS to All POAG >85% Eyes Treated in 2019 Total U.S. eyes diagnosed with POAG 6,156,000 Estimated eyes receiving cataract surgery which also had glaucoma / OHT 774,000 Eyes in potential U.S. Standalone market 5,382,000 - =

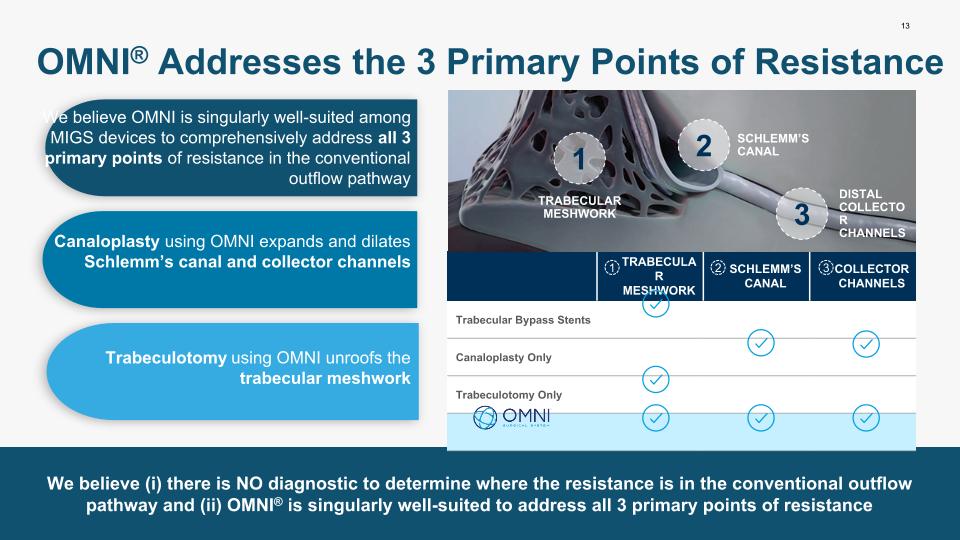

13 We believe (i) there is NO diagnostic to determine where the resistance is in the conventional outflow pathway and (ii) OMNI® is singularly well-suited to address all 3 primary points of resistance OMNI® Addresses the 3 Primary Points of Resistance TRABECULAR MESHWORK SCHLEMM’S CANAL COLLECTOR CHANNELS Trabecular Bypass Stents Canaloplasty Only Trabeculotomy Only 1 2 3 1 2 3 TRABECULAR MESHWORK SCHLEMM’S CANAL DISTAL COLLECTOR CHANNELS Canaloplasty using OMNI expands and dilates Schlemm’s canal and collector channels We believe OMNI is singularly well-suited among MIGS devices to comprehensively address all 3 primary points of resistance in the conventional outflow pathway Trabeculotomy using OMNI unroofs the trabecular meshwork

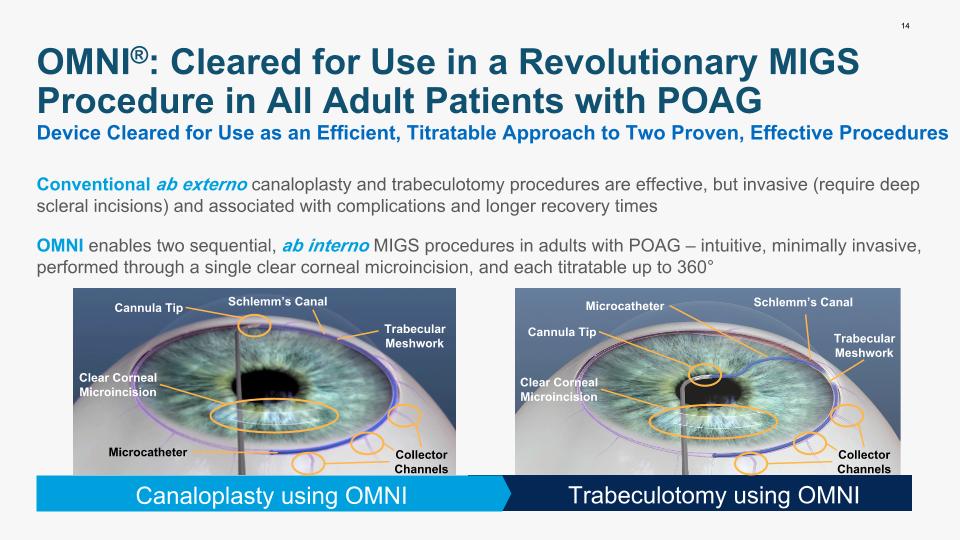

14 OMNI®: Cleared for Use in a Revolutionary MIGS Procedure in All Adult Patients with POAG OMNI enables two sequential, ab interno MIGS procedures in adults with POAG – intuitive, minimally invasive, performed through a single clear corneal microincision, and each titratable up to 360° Trabeculotomy using OMNI Canaloplasty using OMNI Device Cleared for Use as an Efficient, Titratable Approach to Two Proven, Effective Procedures Conventional ab externo canaloplasty and trabeculotomy procedures are effective, but invasive (require deep scleral incisions) and associated with complications and longer recovery times Schlemm’s Canal Schlemm’s Canal Trabecular Meshwork Trabecular Meshwork Collector Channels Cannula Tip Cannula Tip Microcatheter Microcatheter Clear Corneal Microincision Clear Corneal Microincision Collector Channels

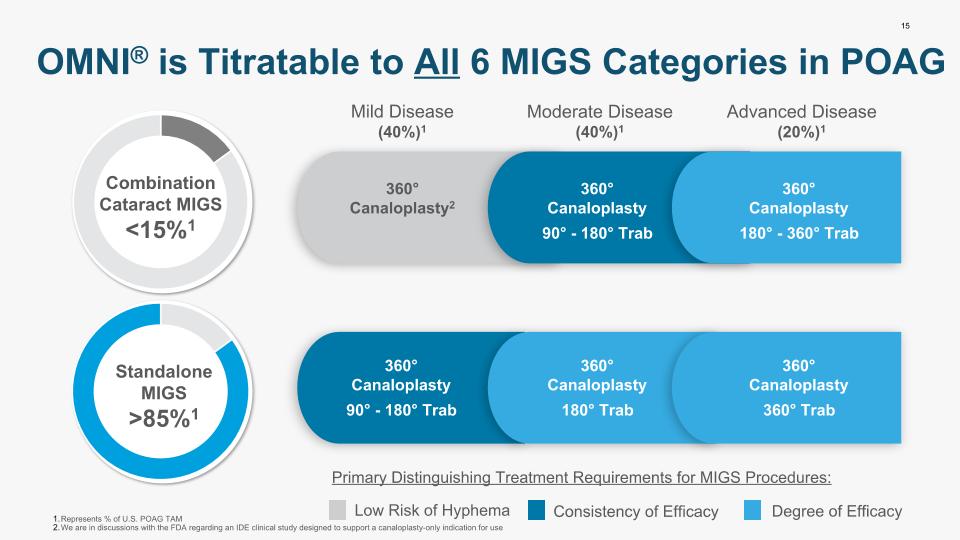

15 OMNI® is Titratable to All 6 MIGS Categories in POAG Low Risk of Hyphema Consistency of Efficacy Degree of Efficacy Represents % of U.S. POAG TAM We are in discussions with the FDA regarding an IDE clinical study designed to support a canaloplasty-only indication for use Mild Disease (40%)1 Moderate Disease (40%)1 Advanced Disease (20%)1 Primary Distinguishing Treatment Requirements for MIGS Procedures: 360° Canaloplasty2 360° Canaloplasty 90° - 180° Trab 360° Canaloplasty 90° - 180° Trab 360° Canaloplasty 180° Trab 360° Canaloplasty 180° - 360° Trab 360° Canaloplasty 360° Trab Combination Cataract MIGS <15%1 Standalone MIGS >85%1

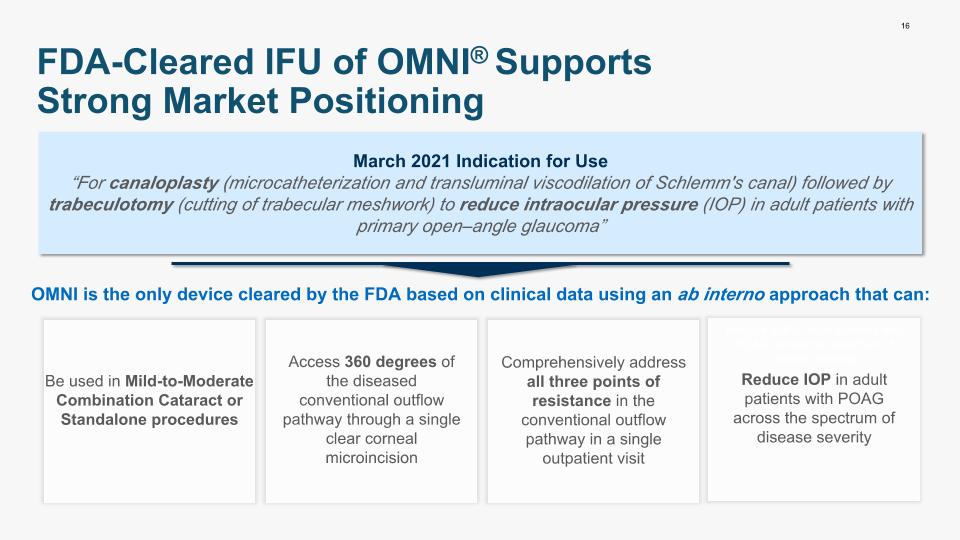

16 FDA-Cleared IFU of OMNI® Supports Strong Market Positioning March 2021 Indication for Use “For canaloplasty (microcatheterization and transluminal viscodilation of Schlemm's canal) followed by trabeculotomy (cutting of trabecular meshwork) to reduce intraocular pressure (IOP) in adult patients with primary open–angle glaucoma” OMNI is the only device cleared by the FDA based on clinical data using an ab interno approach that can: Reduce IOP in adult patients with POAG across the spectrum of disease severity Reduce IOP in adult patients with POAG across the spectrum of disease severity Be used in Mild-to-Moderate Combination Cataract or Standalone procedures Access 360 degrees of the diseased conventional outflow pathway through a single clear corneal microincision Comprehensively address all three points of resistance in the conventional outflow pathway in a single outpatient visit

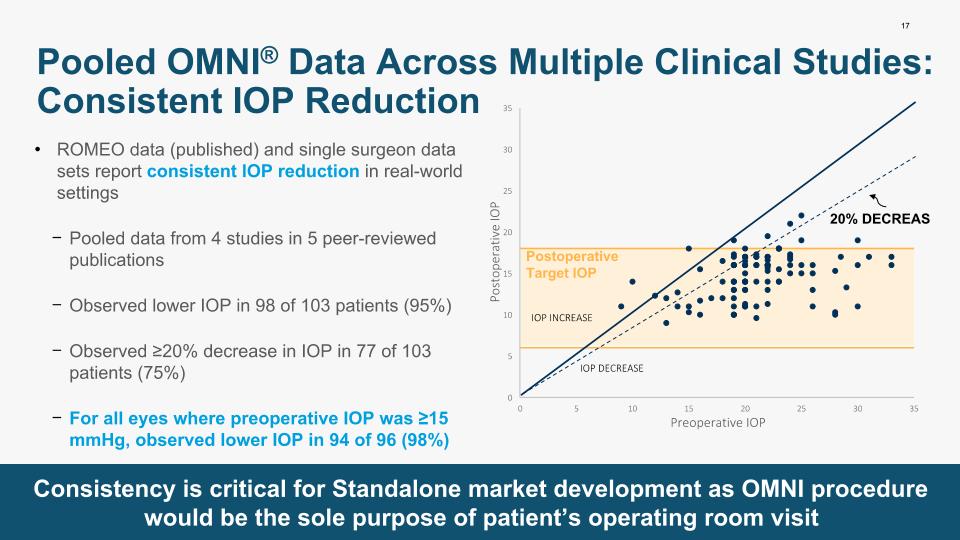

17 ROMEO data (published) and single surgeon data sets report consistent IOP reduction in real-world settings Pooled data from 4 studies in 5 peer-reviewed publications Observed lower IOP in 98 of 103 patients (95%) Observed ≥20% decrease in IOP in 77 of 103 patients (75%) For all eyes where preoperative IOP was ≥15 mmHg, observed lower IOP in 94 of 96 (98%) Pooled OMNI® Data Across Multiple Clinical Studies: Consistent IOP Reduction Consistency is critical for Standalone market development as OMNI procedure would be the sole purpose of patient’s operating room visit IOP INCREASE IOP DECREASE 20% DECREASE Postoperative Target IOP

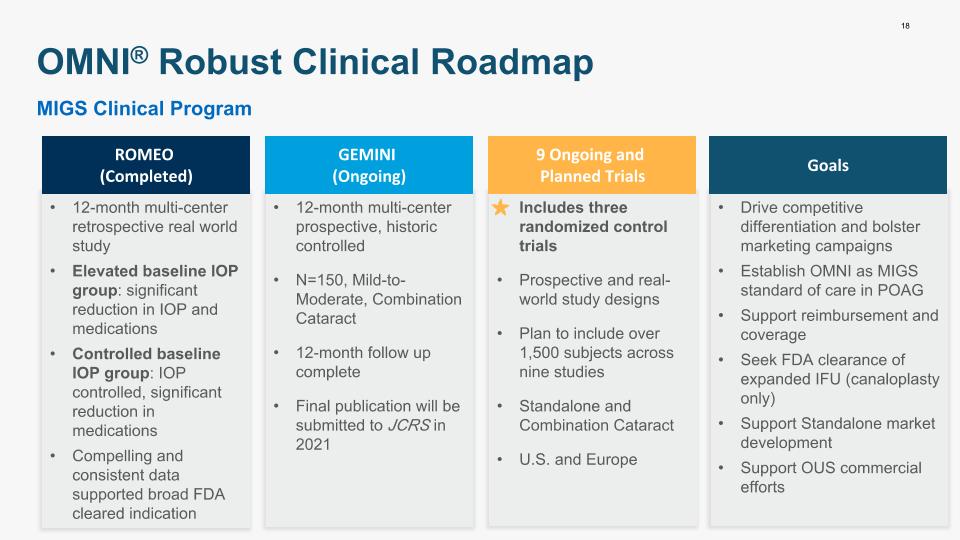

12-month multi-center retrospective real world study Elevated baseline IOP group: significant reduction in IOP and medications Controlled baseline IOP group: IOP controlled, significant reduction in medications Compelling and consistent data supported broad FDA cleared indication Includes three randomized control trials Prospective and real-world study designs Plan to include over 1,500 subjects across nine studies Standalone and Combination Cataract U.S. and Europe Drive competitive differentiation and bolster marketing campaigns Establish OMNI as MIGS standard of care in POAG Support reimbursement and coverage Seek FDA clearance of expanded IFU (canaloplasty only) Support Standalone market development Support OUS commercial efforts 12-month multi-center prospective, historic controlled N=150, Mild-to-Moderate, Combination Cataract 12-month follow up complete Final publication will be submitted to JCRS in 2021 18 OMNI® Robust Clinical Roadmap ROMEO (Completed) GEMINI (Ongoing) 9 Ongoing and Planned Trials Goals MIGS Clinical Program

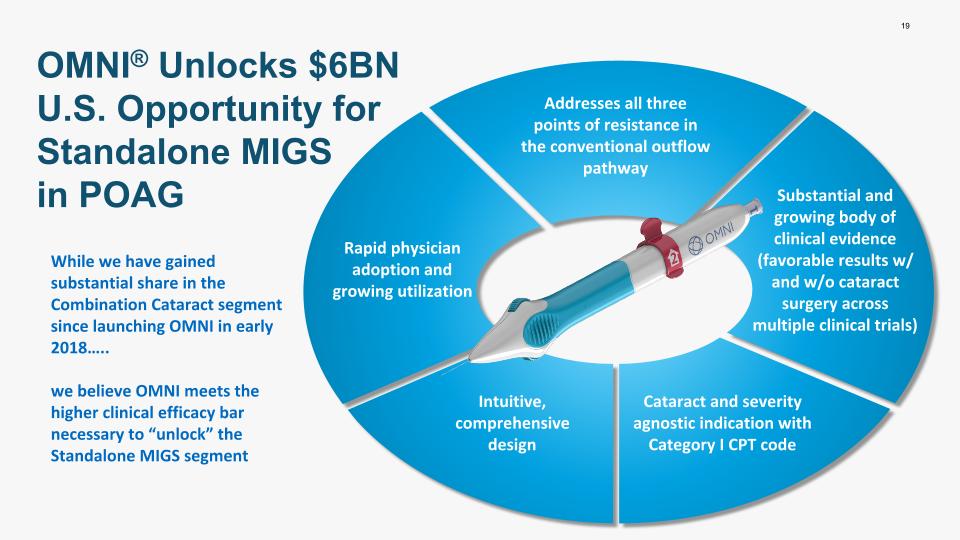

19 OMNI® Unlocks $6BN U.S. Opportunity for Standalone MIGS in POAG Addresses all three points of resistance in the conventional outflow pathway Substantial and growing body of clinical evidence (favorable results w/ and w/o cataract surgery across multiple clinical trials) Cataract and severity agnostic indication with Category I CPT code Rapid physician adoption and growing utilization Intuitive, comprehensive design While we have gained substantial share in the Combination Cataract segment since launching OMNI in early 2018….. we believe OMNI meets the higher clinical efficacy bar necessary to “unlock” the Standalone MIGS segment

Dry Eye Disease ™

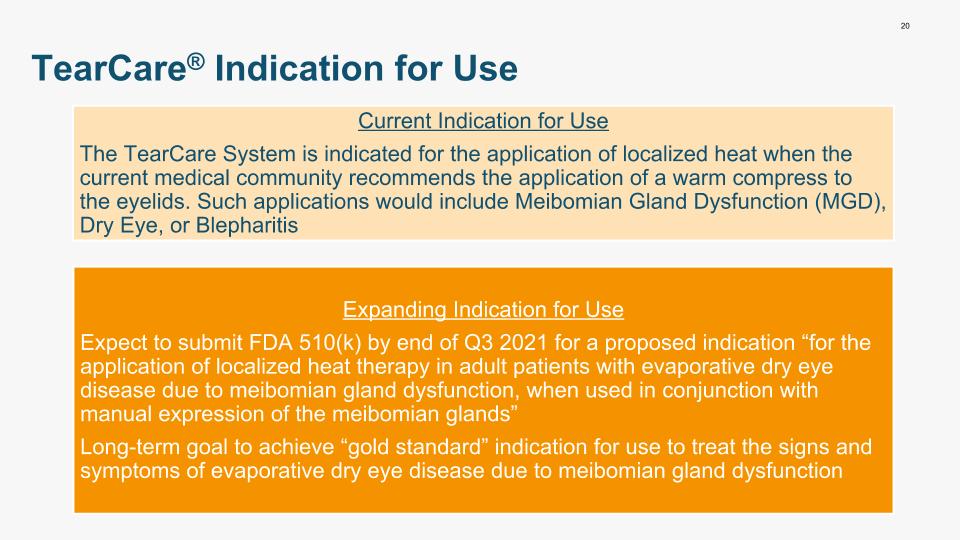

20 TearCare® Indication for Use Current Indication for Use The TearCare System is indicated for the application of localized heat when the current medical community recommends the application of a warm compress to the eyelids. Such applications would include Meibomian Gland Dysfunction (MGD), Dry Eye, or Blepharitis Expanding Indication for Use Expect to submit FDA 510(k) by end of Q3 2021 for a proposed indication “for the application of localized heat therapy in adult patients with evaporative dry eye disease due to meibomian gland dysfunction, when used in conjunction with manual expression of the meibomian glands” Long-term goal to achieve “gold standard” indication for use to treat the signs and symptoms of evaporative dry eye disease due to meibomian gland dysfunction

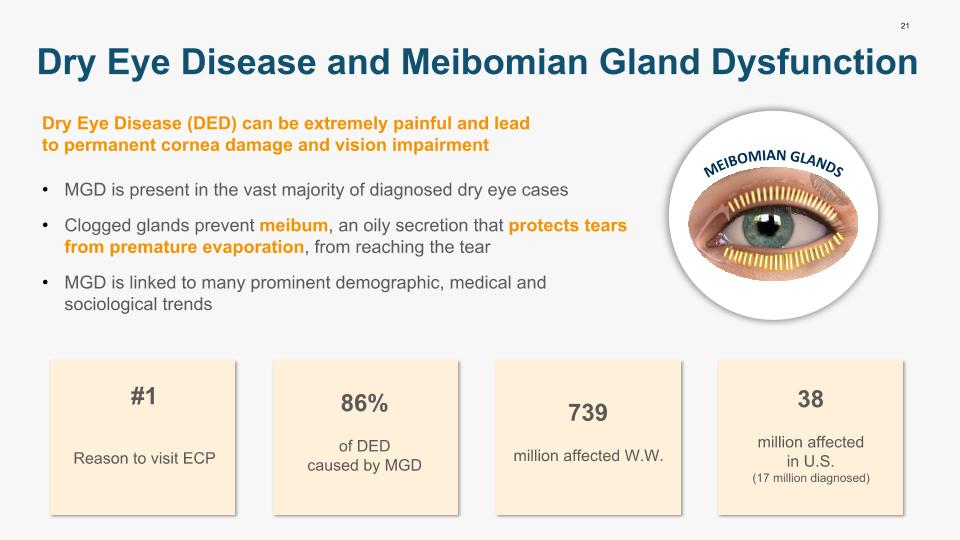

21 Dry Eye Disease and Meibomian Gland Dysfunction MEIBOMIAN GLANDS Dry Eye Disease (DED) can be extremely painful and lead to permanent cornea damage and vision impairment MGD is present in the vast majority of diagnosed dry eye cases Clogged glands prevent meibum, an oily secretion that protects tears from premature evaporation, from reaching the tear MGD is linked to many prominent demographic, medical and sociological trends #1 Reason to visit ECP 86% of DED caused by MGD 739 million affected W.W. 38 million affected in U.S. (17 million diagnosed)

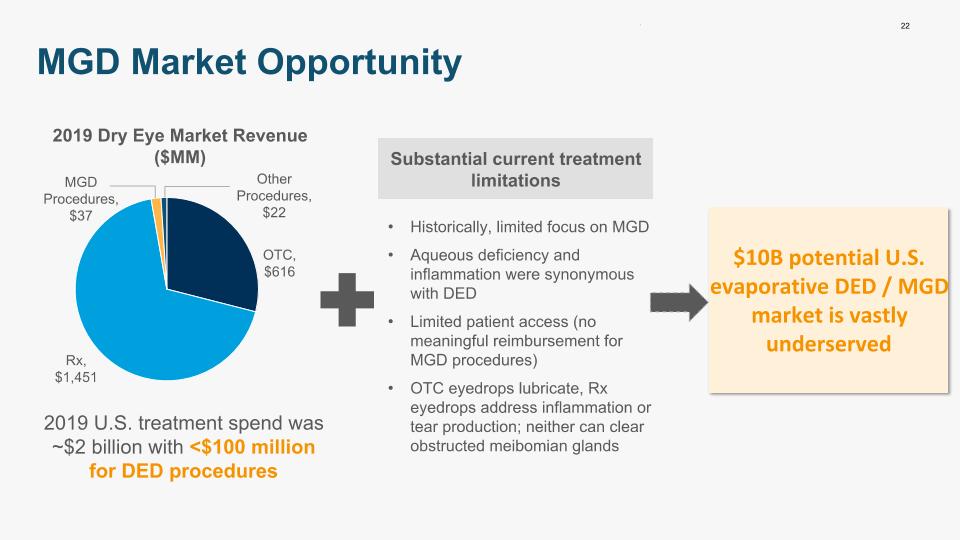

22 MGD Market Opportunity $10B potential U.S. evaporative DED / MGD market is vastly underserved 2019 U.S. treatment spend was ~$2 billion with <$100 million for DED procedures Substantial current treatment limitations Historically, limited focus on MGD Aqueous deficiency and inflammation were synonymous with DED Limited patient access (no meaningful reimbursement for MGD procedures) OTC eyedrops lubricate, Rx eyedrops address inflammation or tear production; neither can clear obstructed meibomian glands 2019 Dry Eye Market Revenue ($MM)

23 Our Solution: TearCare® We are developing TearCare® as a wearable, open-eye device to deliver optimal heat to the eyelids to melt meibum obstructions; seeking indication for use to address evaporative dry eye due to MGD Heat Therapy Development Program Regulatory Status Intuitive Design In MGD patients, meibum hardens within the meibomian glands and forms obstructions TearCare is designed to melt gland obstructions with precise heat and enable clearance or removal by an ECP Designed for Intuitive provider training and comfortable patient experience SmartLids™ are designed to conform to variable eyelid anatomy and heat glands to a proven temperature to “prime” meibum through natural blinking Currently marketed as a Class II, 510(k)-exempt powered heating pad Developing product for an expanded indication for the application of localized heat therapy in adult patients with DED due to MGD in conjunction with manual expression of meibomian glands

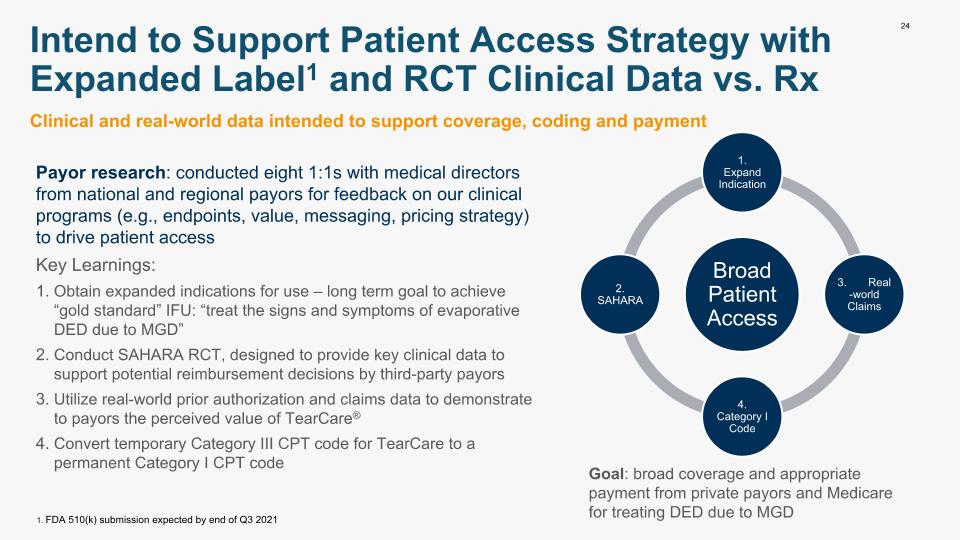

24 Intend to Support Patient Access Strategy with Expanded Label1 and RCT Clinical Data vs. Rx Clinical and real-world data intended to support coverage, coding and payment Payor research: conducted eight 1:1s with medical directors from national and regional payors for feedback on our clinical programs (e.g., endpoints, value, messaging, pricing strategy) to drive patient access Key Learnings: Obtain expanded indications for use – long term goal to achieve “gold standard” IFU: “treat the signs and symptoms of evaporative DED due to MGD” Conduct SAHARA RCT, designed to provide key clinical data to support potential reimbursement decisions by third-party payors Utilize real-world prior authorization and claims data to demonstrate to payors the perceived value of TearCare® Convert temporary Category III CPT code for TearCare to a permanent Category I CPT code Broad Patient Access 1. Expand Indication 3. Real-world Claims 4. Category I Code 2. SAHARA Goal: broad coverage and appropriate payment from private payors and Medicare for treating DED due to MGD 1. FDA 510(k) submission expected by end of Q3 2021

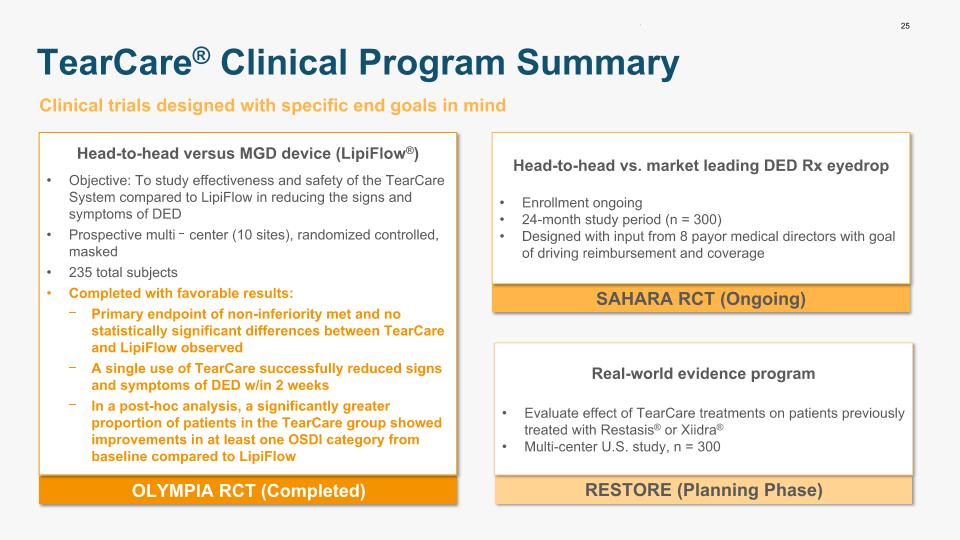

25 TearCare® Clinical Program Summary OLYMPIA RCT (Completed) Head-to-head versus MGD device (LipiFlow®) Objective: To study effectiveness and safety of the TearCare System compared to LipiFlow in reducing the signs and symptoms of DED Prospective multi‐center (10 sites), randomized controlled, masked 235 total subjects Completed with favorable results: Primary endpoint of non-inferiority met and no statistically significant differences between TearCare and LipiFlow observed A single use of TearCare successfully reduced signs and symptoms of DED w/in 2 weeks In a post-hoc analysis, a significantly greater proportion of patients in the TearCare group showed improvements in at least one OSDI category from baseline compared to LipiFlow Clinical trials designed with specific end goals in mind SAHARA RCT (Ongoing) RESTORE (Planning Phase) Head-to-head vs. market leading DED Rx eyedrop Enrollment ongoing 24-month study period (n = 300) Designed with input from 8 payor medical directors with goal of driving reimbursement and coverage Real-world evidence program Evaluate effect of TearCare treatments on patients previously treated with Restasis® or Xiidra® Multi-center U.S. study, n = 300

26 TearCare® Controlled Release - TearCare is currently marketed for the delivery of localized heat where the medical community recommends the application of a warm compress - Executing a controlled release of TearCare with ~10 direct outside sales reps since April 2019 - Successful patient-pay adoption Over 450 facilities added (through 8/31/21) Sizable base of steady reordering accounts - Messaging focused on personalized, open-eye application of heat through user-friendly technology 5 4 3 2 1 Establish market appropriate pricing programs consistent with strong RVU analysis Increase market awareness of MGD and product differentiation of the TearCare System Provide customers with reimbursement resources to support coverage / payment Partner with practices willing to advocate to health plans on behalf of MGD patients seeking access to the TearCare System Secure optimal payor coverage and appropriate payment for the TearCare System through partnerships with relevant societies, KOLs and other stakeholders Overview Strategy NOTE: TearCare is in development for the treatment of the signs and symptoms of evaporative dry eye, the primary form of dry eye disease

26 Financial Overview ™

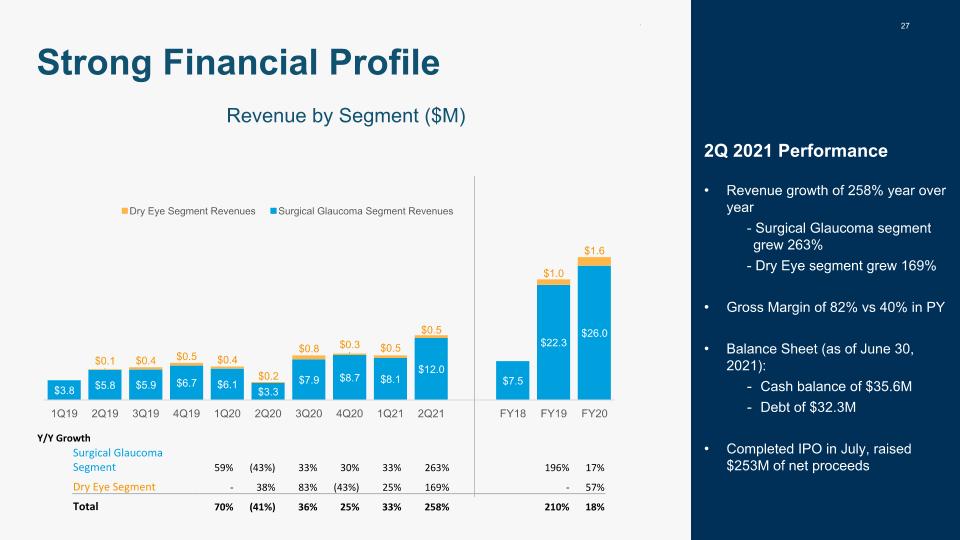

27 Strong Financial Profile Y/Y Growth Surgical Glaucoma Segment 59% (43%) 33% 30% 33% 263% 196% 17% Dry Eye Segment - 38% 83% (43%) 25% 169% - 57% Total 70% (41%) 36% 25% 33% 258% 210% 18% Revenue by Segment ($M) 2Q 2021 Performance Revenue growth of 258% year over year - Surgical Glaucoma segment grew 263% - Dry Eye segment grew 169% Gross Margin of 82% vs 40% in PY Balance Sheet (as of June 30, 2021): Cash balance of $35.6M Debt of $32.3M Completed IPO in July, raised $253M of net proceeds