Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL PACIFIC FINANCIAL CORP | cpf-20210908.htm |

Investor Presentation September 2021

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our various business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the adverse effects of the COVID-19 pandemic virus on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees as well as the effects of government programs and initiatives in response to COVID-19; the impact of our participation in the Paycheck Protection Program (“PPP”) and fulfillment of government guarantees on our PPP loans; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement our RISE2020 initiative; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic virus and disease, including COVID-19) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); inflation, interest rate, securities market and monetary fluctuations, including the anticipated replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; pandemic virus and disease, including COVID-19; changes in consumer spending, borrowing and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; cybersecurity and data privacy breaches and the consequence therefrom; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the forward-looking statements contained in this Form 8-K. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. Paul Yonamine Chief Executive Officer David Morimoto Chief Financial Officer Catherine Ngo President Kevin Dahlstrom Chief Marketing Officer Arnold Martines Chief Banking Officer

4Central Pacific Financial Corp. Central Pacific Financial - Corporate Profile MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CENTRAL PACIFIC BANK (CPB) TOTAL ASSETS $7.2 BILLION MARKET CAP $710 MILLION SHARE PRICE $25.31 DIVIDEND YIELD 3.67% Central Pacific Financial Corp. is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 31 branches across the State. CPB is a market leader in residential mortgage, small business banking and digital banking. Note: Total assets as of 6/30/21. Other Market Information above as of 8/31/21.

5Central Pacific Financial Corp. 2nd Quarter 2021 Highlights PROFITABILITY NET INCOME / DILUTED EPS $18.7 Million / $0.66 ROA/ROE 1.06% / 13.56% NET INTEREST MARGIN 3.16% Actual 2.93% Normalized* EFFICIENCY RATIO 66.2% * Normalized to exclude PPP impact, refer to slide 24 for additional details. 1 Net charge-offs (NCOs) are annualized 2 Classified assets + OREO / Tier 1 Capital + ACL ASSET QUALITY NPAs/TOTAL ASSETS 0.09% NCOs/AVERAGE LOANS1 0.06% CLASSIFIED ASSET RATIO2 6.20% ACL COVERAGE* 1.68% CAPITAL QTRLY DIVIDEND $0.24 per share CET1 11.6% TIER 1 LEVERAGE* 9.3% TCE* 8.2% • Highest pre-tax income since 2007 • Resumed share repurchase program • Core loan growth 9% LQA and core deposit growth 20% LQA • $6.4 billion in total deposits at an average cost 0.06%

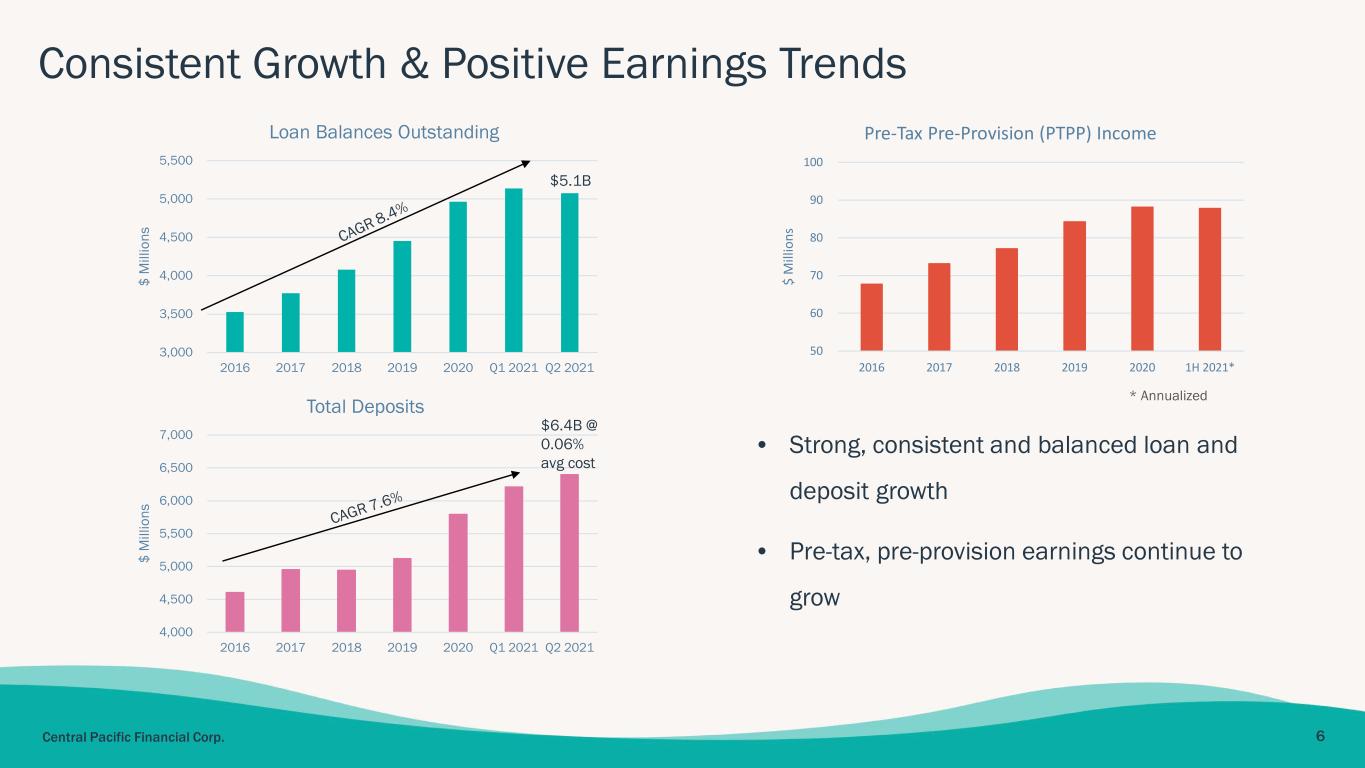

6Central Pacific Financial Corp. Consistent Growth & Positive Earnings Trends * Annualized 4,000 4,500 5,000 5,500 6,000 6,500 7,000 2016 2017 2018 2019 2020 Q1 2021 Q2 2021 $ M ill io ns Total Deposits $6.4B @ 0.06% avg cost 3,000 3,500 4,000 4,500 5,000 5,500 2016 2017 2018 2019 2020 Q1 2021 Q2 2021 $ M ill io ns Loan Balances Outstanding $5.1B • Strong, consistent and balanced loan and deposit growth • Pre-tax, pre-provision earnings continue to grow 50 60 70 80 90 100 2016 2017 2018 2019 2020 1H 2021* $ M ill io ns Pre-Tax Pre-Provision (PTPP) Income

7Central Pacific Financial Corp. Resilient Hawaii Market STRENGTHS AND RECOVERY FACTORS • Notwithstanding the recent uptick in case counts, Hawaii still has the 2nd lowest per capita COVID-19 case rate in the nation1 • Approximately 63% of Hawaii residents are fully vaccinated2 • Visitor arrivals rebounded to nearly pre-pandemic levels in the summer of 2021, but has trended lower recently • Housing prices remain extremely strong with the Oahu median home sales price exceeding $1 million in August 2021 • Unemployment rate improved to 7.3% in July 2021 compared to a peak of 22% in April 2020 * Source: Department of Business Economic Development & Tourism. Includes visitors, returning residents, and intended residents. Excludes flights from Canada. DAILY PASSENGER COUNTS TO HAWAII* 1 Source: Centers for Disease Control (CDC), as of August 31, 2021 (since the beginning of the pandemic). 2 Source: Health.Hawaii.gov, as of August 31, 2021. $1.05MM $500 $600 $700 $800 $900 $1,000 $1,100 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 Ja n- 21 Fe b- 21 M ar -2 1 Ap r-2 1 M ay -2 1 Ju n- 21 Ju l-2 1 Au g- 21 OAHU SINGLE FAMILY HOME MEDIAN SALES PRICE ($ IN THOUSANDS)

8Central Pacific Financial Corp. Shareholder Value Drivers Innovation & Digital Banking Small Business & Residential Mortgage Leader Japan Competitive Advantage Efficiency Strategies 1 2 3 4 Solid Credit, Capital and Liquidity5

9Central Pacific Financial Corp. 2Q 2021 COMING SOON 1Q 2021 2H 2020 1H 2020 Online Account Opening Consumer platform to open deposit accounts and term loans launched January 2021 Business Online Banking New platform designed for small businesses launched February 2021 Online/Mobile Banking New consumer platform launched in August 2020. Concept Branch Temporary main branch for concept innovation and testing Innovation & Digital Banking Accomplishments ATMs Full ATM network upgrade completed in November 2020 Contactless Debit Cards Issued to all customers in May-June 2021 Online Chat Online chat to enhance CX available since April 2021 New Digital Checking Account Waitlist and countdown campaign coming October 2021

10Central Pacific Financial Corp. Marketing Innovation: ‘CPB Ambassadors’

11Central Pacific Financial Corp. Small Business Leader SMALL BUSINESSES SBA Lender of the Year Category II, 7 years in a row Originated more loans than the 3 other large Hawaii banks combined1 Innovative Programs & Technology CPB Foundation recently announced a financial management and networking accelerator program for local women entrepreneurs called ‘WE by Rising Tide’ Recently launched a new online banking system specially designed for small businesses, with online account opening feature under development Niche Markets CPB has strong market share in the dental and physician niche, being the primary bank to nearly half of the dentists and a quarter of the physicians in the State of Hawaii 1 As reported by the SBA for the 2019 year. 2020 is not available.

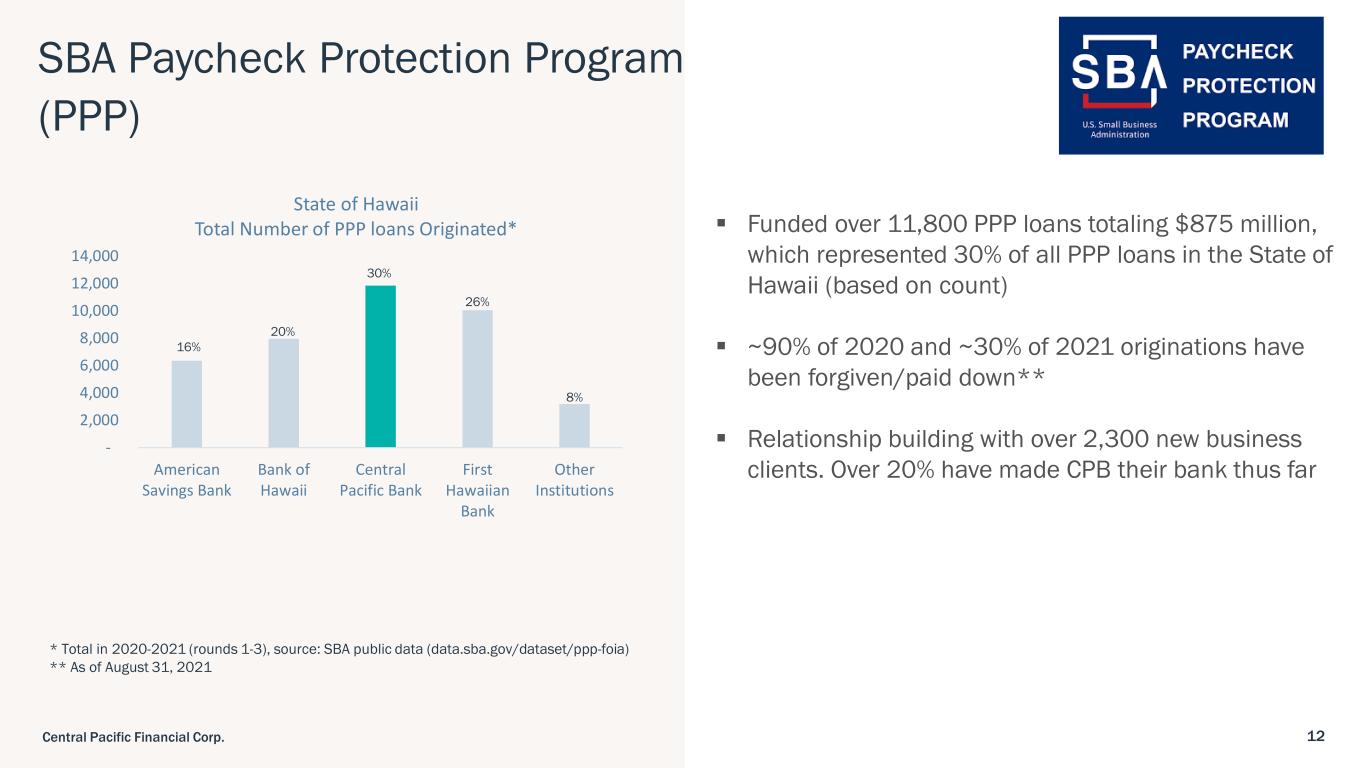

12Central Pacific Financial Corp. SBA Paycheck Protection Program (PPP) Funded over 11,800 PPP loans totaling $875 million, which represented 30% of all PPP loans in the State of Hawaii (based on count) ~90% of 2020 and ~30% of 2021 originations have been forgiven/paid down** Relationship building with over 2,300 new business clients. Over 20% have made CPB their bank thus far * Total in 2020-2021 (rounds 1-3), source: SBA public data (data.sba.gov/dataset/ppp-foia) ** As of August 31, 2021 - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 American Savings Bank Bank of Hawaii Central Pacific Bank First Hawaiian Bank Other Institutions State of Hawaii Total Number of PPP loans Originated* 20% 30% 26% 8% 16%

13Central Pacific Financial Corp. Residential Mortgage Strength in Hawaii SMALL BUSINESSES • $1.2 Billion in total production in 2020; $0.6 Billion total production in 2021 YTD through June • #2 lender in Hawaii in total purchase mortgage volume in 2020 and 2021 YTD through June • Lead partner with developers on many large condominium developments • Unique mortgage broker joint-venture model • Provides significant cross-sale opportunities

14Central Pacific Financial Corp. Japan Competitive Advantage CPB JAPAN ADVISORS GROUP • Partnership with several top Japanese Executives, including formerly or currently from: Nippon Paint Holdings, MUFG, Sony Hawaii, Wells Fargo Securities-Japan TSUBASA ALLIANCE • Strategic financial alliance of 11 regional banks in Japan, including: Chiba Bank, Daishi Bank, Chugoku Bank, among others EXECUTIVE NETWORK • Paul Yonamine is a Director of SMBC and the Board Chair of the U.S. Japan Council. He previously served as the IBM Japan President and led KPMG Consulting in Japan • Hikaru Utsugi, head of CPB International banking spent 30+ years at Mitsubishi UFJ Bank

15Central Pacific Financial Corp. Efficiency Strategies Branch Consolidation - 4 branches consolidated in 2020 - With continued migration to digital, additional branches under consideration Real Estate Optimization - Backoffice space consolidation - Purchasing strategic real estate locations Process Automation - Straight through processing - Data simplification and standardization

16Central Pacific Financial Corp. Strong Credit Metrics * Excludes the PPP loan portfolio from total loans. Note: Peer Average includes banks $3-10B in assets. Source S&P Global. $0 $20 $40 $60 $80 $100 0.90% 1.10% 1.30% 1.50% 1.70% 1.90% 2Q20* 3Q20* 4Q20* 1Q21* 2Q21* ALLOWANCE FOR CREDIT LOSSES (ACL) ACL in $ Millions (right) ACL/Total Loans (left) Peer Average (left) $0 $20 $40 $60 $80 $100 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2Q20 3Q20 4Q20 1Q21 2Q21 NON PERFORMING LOANS NPLs in $ Millions (right) NPL /Total Loans (left) Peer Average (left) $0 $20 $40 $60 $80 $100 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 2Q20 3Q20 4Q20 1Q21 2Q21 NET CHARGE-OFFS Net Charge-offs in $ Millions (right) NCO/Avg Loans (left) Peer Average (left) $0 $20 $40 $60 $80 $100 3.00% 5.00% 7.00% 9.00% 11.00% 13.00% 15.00% 2Q20 3Q20 4Q20 1Q21 2Q21 CLASSIFIED ASSETS Classified Assets + OREO (right) Classified Assets + OREO/Tier 1 Capital + ACL (left) Peer Average (left)

17Central Pacific Financial Corp. Solid Liquidity & Capital Position STRONG CAPITAL • $230 million capital cushion to the well-capitalized Total RBC minimum of 10% at 6/30/21 • $55 million subordinated note offering completed in October 2020 • Resumed share purchases in 2Q 2021 under the $25 million share repurchase Board authorization • Quarterly cash dividend of $0.24 per share declared in July 2021 AMPLE LIQUIDITY • At 6/30/2021, over $2.5 billion in available alternative sources of liquidity, including $1.6 billion in FHLB/FRB lines and $0.9 billion in unpledged investment securities * Excludes the PPP impact to the assets denominator, refer to slide 24 for more details. 11.6% 1.1% 2.2% 9.3% 8.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Risk-based Capital Tier 1 Leverage Excl PPP* TCE Excl PPP* REGULATORY CAPITAL RATIOS AS OF JUNE 30, 2021 Tier 2 Tier 1 CET1 14.9% Total RBC

Mahalo

19Central Pacific Financial Corp. Appendix

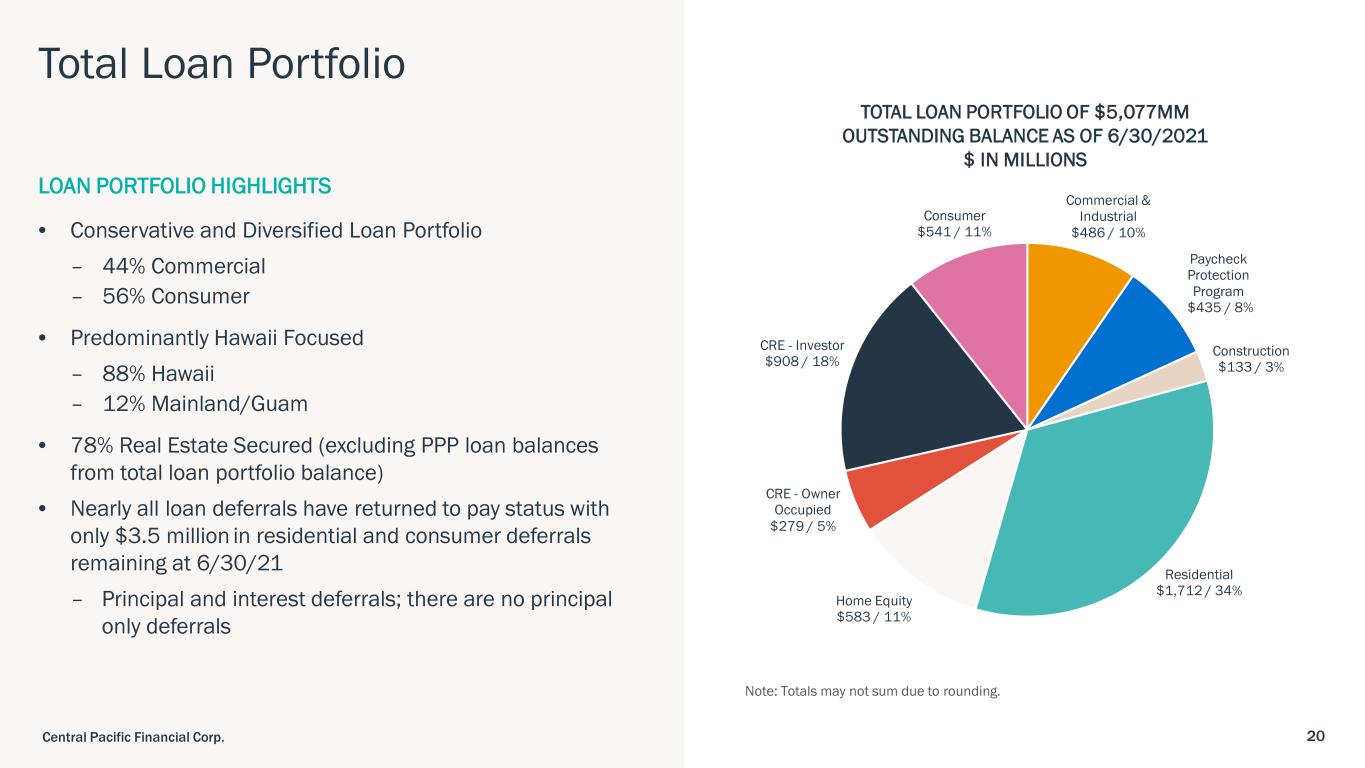

20Central Pacific Financial Corp. Total Loan Portfolio LOAN PORTFOLIO HIGHLIGHTS • Conservative and Diversified Loan Portfolio – 44% Commercial – 56% Consumer • Predominantly Hawaii Focused – 88% Hawaii – 12% Mainland/Guam • 78% Real Estate Secured (excluding PPP loan balances from total loan portfolio balance) • Nearly all loan deferrals have returned to pay status with only $3.5 million in residential and consumer deferrals remaining at 6/30/21 – Principal and interest deferrals; there are no principal only deferrals Note: Totals may not sum due to rounding. TOTAL LOAN PORTFOLIO OF $5,077MM OUTSTANDING BALANCE AS OF 6/30/2021 $ IN MILLIONS Commercial & Industrial $486 / 10% Paycheck Protection Program $435 / 8% Construction $133 / 3% Residential $1,712 / 34% Home Equity $583 / 11% CRE - Owner Occupied $279 / 5% CRE - Investor $908 / 18% Consumer $541 / 11%

21Central Pacific Financial Corp. SBA Paycheck Protection Program (PPP) IN $ MILLIONS (except for loan count) As of 6/30/21 ROUND 1 & 2 (2020) ROUND 3 (2021) FUNDED $/COUNT $558.9 ~7,200 LOANS $320.9 ~4,600 LOANS FORGIVENESS/ PAYDOWNS TO DATE $397.1 $32.2 EARNED NET FEES TO DATE $17.0 $3.6 UNEARNED NET FEES 6/30/21 $2.1 $13.8 NET BALANCE AT 6/30/21 $159.7 $274.9

22Central Pacific Financial Corp. Environmental, Social & Governance (ESG) 2020 ESG report can be viewed here: https://www.cpb.bank/esg Includes the 4 pillars below:

23Central Pacific Financial Corp Historical Financial Highlights QTD QTD ($ in millions) 2Q21 1Q21 2020 2019 2018 2017 2016 Balance Sheet (period end data) Loans and leases 5,077.3$ 5,137.8$ 4,964.1$ 4,449.5$ 4,078.4$ 3,770.6$ 3,524.9$ Total assets 7,178.5 6,979.3 6,594.6 6,012.7 5,807.0 5,623.7 5,384.2 Total deposits 6,397.2 6,209.0 5,796.1 5,120.0 4,946.5 4,956.4 4,608.2 Total shareholders' equity 552.8 542.9 546.7 528.5 491.7 500.0 504.7 Income Statement Net interest income 52.1$ 49.8$ 197.7$ 184.1$ 173.0$ 167.7$ 158.0$ Provision (credit) for credit losses (3.4) (0.8) 42.1 6.3 (1.5) (2.6) (5.4) Other operating income 10.5 10.7 45.2 41.8 38.8 36.5 42.3 Other operating expense 41.4 37.8 151.7 141.6 135.1 131.0 132.4 Income taxes (benefit) 5.9 5.5 11.8 19.6 18.8 34.6 26.3 Net income 18.7 18.0 37.3 58.3 59.5 41.2 47.0 Prof itability Return on average assets 1.06% 1.07% 0.58% 0.99% 1.05% 0.75% 0.90% Return on average shareholders' equity 13.56% 13.07% 6.85% 11.36% 12.22% 8.03% 9.16% Efficiency ratio 66.13% 62.48% 62.45% 62.68% 63.79% 64.15% 66.10% Net interest margin 3.16% 3.19% 3.30% 3.35% 3.22% 3.28% 3.27% Capital Adequacy (period end data) Leverage capital ratio 8.56% 8.85% 8.81% 9.53% 9.88% 10.35% 10.64% Total risk-based capital ratio 14.93% 15.37% 15.10% 13.64% 14.69% 15.92% 15.49% Asset Quality Net loan chargeoffs/average loans 0.06% 0.06% 0.15% 0.15% 0.02% 0.11% 0.03% Nonaccrual loans/total loans (period end) 0.13% 0.14% 0.12% 0.03% 0.06% 0.07% 0.24% YEAR ENDED DECEMBER 31,

24Central Pacific Financial Corp. Non-GAAP Financial Measures - Excluding PPP 1. Net interest income excludes PPP interest income less an assumed funding cost of 0.25% and PPP net loan fee income; Total Avg. Interest-Earning Assets excludes average PPP loan balances; Total Assets excludes period-end PPP loan balance; Average Assets excludes average PPP loan balances. 2. Net interest income shown on a taxable equivalent basis. 3. Net interest margin calculation annualizes net interest income based on the day count interest payment conventions at the interest-earning asset or interest-bearing liability level (i.e. 30/360, actual/actual). The Company believes the following non-GAAP financial measures provides useful information about our operating results and enhances the overall understanding of our past performance and future performance. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. In $ Millions Jun. 30, 2021 Actual PPP Exclusions1 Jun. 30, 2021 Adjusted Quarter-ended 6/30/21: Net Interest Income2 52.2$ (7.9)$ 44.3$ Total Avg. Interest-Earning Assets 6,606.8$ (553.0)$ 6,053.8$ Net Interest Margin3 3.16% 2.93% Tangible Common Equity 552.8$ 552.8$ Total Assets 7,178.5$ (434.6)$ 6,743.9$ Tangible Common Equity Ratio 7.70% 8.20% Tier 1 Capital 602.7$ 602.7$ Average Assets for Lev. Ratio 7,039.7$ (553.0)$ 6,486.7$ Leverage Capital Ratio 8.56% 9.29%