Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Ortho Clinical Diagnostics Holdings plc | d194092dex232.htm |

| EX-5.1 - EX-5.1 - Ortho Clinical Diagnostics Holdings plc | d194092dex51.htm |

| EX-1.1 - EX-1.1 - Ortho Clinical Diagnostics Holdings plc | d194092dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 7, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Ortho Clinical Diagnostics Holdings plc

(Exact name of registrant as specified in its charter)

| England and Wales | 2835 | 98-1574150 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1001 Route 202

Raritan, New Jersey 08869

908-218-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael A. Schlesinger

Executive Vice President, General Counsel and Secretary

Ortho Clinical Diagnostics Holdings plc

1001 Route 202

Raritan, New Jersey 08869

908-218-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Patrick H. Shannon Jason M. Licht Latham & Watkins LLP 555 Eleventh Street, NW—Suite 1000 Washington, D.C. 20004 Tel: (202) 637-2200 Fax: (202) 637-2201 |

William J. Miller Noah B. Newitz Cahill Gordon & Reindel LLP 32 Old Slip New York, New York 10005 Tel: (212) 701-3000 Fax: (212) 269-5420 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be Registered(1) |

Proposed maximum offering price per ordinary share(2) |

Proposed maximum aggregate offering price (1)(2) |

Amount of registration fee | ||||

| Ordinary shares, $0.00001 par value per ordinary share |

25,300,000 | $20.38 | $515,614,000 | $56,253.49 | ||||

|

| ||||||||

| (1) | Includes 3,300,000 shares that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee. In accordance with Rule 457(c) under the Securities Act of 1933, as amended, the maximum offering price per share and maximum aggregate offering price are based on the average of the high and low sales price of the Registrant’s ordinary shares as reported by the NASDAQ Global Select Market on August 31, 2021, which date is within five business days prior to filing this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling shareholder is not soliciting offers to buy the securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated September 7, 2021

Prospectus

22,000,000 Shares

Ortho Clinical Diagnostics Holdings plc

Ordinary shares

This is a public offering of ordinary shares of Ortho Clinical Diagnostics Holdings plc.

The selling shareholder identified in this prospectus is offering 22,000,000 of our ordinary shares. We are not selling any ordinary shares under this prospectus and will not receive any proceeds from the sale of the shares by the selling shareholder.

Our ordinary shares are listed and traded on the NASDAQ Global Select Market (“Nasdaq”) under the symbol “OCDX.” On September 3, 2021, the last reported sale price of our ordinary shares on Nasdaq was $20.40 per ordinary share.

Investing in our ordinary shares involves risks that are described in the “Risk Factors” section beginning on page 17 of this prospectus and the risk factors in the documents incorporated by reference in this prospectus.

| Per share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

|

|

|

|

|

|||||

| Proceeds, before expenses, to selling shareholder |

$ | $ | ||||||

|

|

|

|

|

|||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters may also exercise their option to purchase up to an additional 3,300,000 ordinary shares from the selling shareholder, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ordinary shares will be ready for delivery on or about , 2021.

| Goldman Sachs & Co. LLC | J. P. Morgan |

The date of this prospectus is , 2021.

Table of Contents

| Page | ||||

| 1 | ||||

| 17 | ||||

| 24 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 33 | ||||

| 51 | ||||

| 54 | ||||

| 62 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

We, the selling shareholder and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses that we have prepared. We, the selling shareholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ordinary shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ordinary shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

For investors outside the United States: We, the selling shareholder and the underwriters have not done anything that would permit a public offering of our ordinary shares or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside of the United States.

Basis of Presentation

Unless otherwise indicated or the context otherwise requires, references in this prospectus to:

| • | the term “2025 Notes” refers to the 7.375% Senior Notes due 2025 issued by the Lux Co-Issuer and the U.S. Co-Issuer; |

| • | the term “2025 Notes Indenture” refers to the indenture governing the 2025 Notes, as amended, supplemented or otherwise modified from time to time; |

| • | the term “2028 Notes” refers to the 7.250% Senior Notes due 2028 issued by the Lux Co-Issuer and the U.S. Co-Issuer; |

| • | the term “2028 Notes Indenture” refers to the indenture governing the 2028 Notes, as amended, supplemented or otherwise modified from time to time; |

| • | the term “Acquisition” refers to the acquisition by Ortho-Clinical Diagnostics Bermuda Co. Ltd., a Bermuda exempted limited liability company and the Company’s predecessor (“Bermuda |

i

Table of Contents

| Holdco”), pursuant to a stock and asset purchase agreement, dated January 16, 2014 (the “Acquisition Agreement”), of (i) certain assets and liabilities and (ii) all of the equity interests and substantially all of the assets and liabilities of certain entities which, together with their subsidiaries, comprised the Ortho Clinical Diagnostics business from Johnson & Johnson; |

| • | the term “assay” refers to an investigative (analytic) procedure in laboratory medicine, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence or amount or the functional activity of a target entity (the analyte), which can be a drug or biochemical substance or a cell in an organism or organic sample; |

| • | the term “consumables” refers to miscellaneous items such as calibrators, pipettes and controls, which are run on our instruments in conjunction with and in support of assays and reagents; |

| • | the term “Credit Agreement” refers to that certain credit agreement governing our Senior Secured Credit Facilities; |

| • | the term “emerging markets” refers to all countries where we operate other than Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, the United States and certain other developed countries; |

| • | the term “GAAP” refers to the generally accepted accounting principles in the United States of America; |

| • | the term “Holdings” refers to Ortho-Clinical Diagnostics Holdings Luxembourg S.à r.l., a société à responsabilité limitée organized under the laws of the Grand Duchy of Luxembourg, having its registered office at 89C, rue Pafebruch, L-8308 Capellen, Grand Duchy of Luxembourg and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés de Luxembourg) under number B185679 and a direct, wholly owned subsidiary of UK Holdco; |

| • | the term “Joint Business” refers to a long-term collaboration agreement with Grifols Diagnostic Solutions, Inc. that encompasses certain Clinical Laboratories and Donor Screening products; |

| • | the term “laboratories,” when we refer to our customers, refers to testing sites that process and provide results for in vitro diagnostic tests within hospitals, independent reference labs, physician office labs or physician clinics; |

| • | the term “Lux Co-Issuer” refers to Ortho-Clinical Diagnostics S.A., a société anonyme organized under the laws of the Grand Duchy of Luxembourg, having its registered office at 89C, rue Pafebruch, L-8308 Capellen Luxembourg and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés de Luxembourg) under number B 185693 and an indirect, wholly owned subsidiary of the Company; |

| • | the terms “Principal Shareholder” and “Carlyle” refer to The Carlyle Group Inc. and its affiliates; |

| • | the term “reagent” refers to a substance that is added during a test in order to bring about a reaction. The resulting reaction is used to confirm the presence of another substance. Our reagents are used to identify different properties of blood; |

| • | the term “Senior Notes” refers, collectively, to the 2025 Notes and the 2028 Notes; |

| • | the term “Senior Secured Credit Facilities” refers to (a) the senior secured term loan facility in an original amount of $2,175.0 million, as increased by the incremental term loan (the “Incremental Term Loan”) of $200 million (collectively, the “Dollar Term Loan Facility”), (b) the euro-denominated senior secured term loan facility in an amount equal to €337.4 million (the |

ii

Table of Contents

| “Euro Term Loan Facility” and, together with the Dollar Term Loan Facility, the “Term Loan Facilities”), and (c) the multi-currency senior secured revolving facility with commitments of $500.0 million (the “Revolving Credit Facility”); |

| • | the term “throughput” refers to the number of tests performed during a certain time period; |

| • | the term “U.K. TopCo” refers to Ortho Clinical Diagnostics Holdings plc and not any of its subsidiaries; |

| • | the term “U.S. Co-Issuer” refers to Ortho-Clinical Diagnostics, Inc., a corporation incorporated under the laws of the State of New York and an indirect, wholly owned subsidiary of the Company; |

| • | the terms “we,” “us,” “our,” “its,” our “Company” and “Ortho” refer to Ortho Clinical Diagnostics Holdings plc, a public limited company incorporated under the laws of England and Wales, and its consolidated subsidiaries. |

References to a year refer to our fiscal years ended on the Sunday nearest December 31 of the specified year and consist of 52 weeks (for example, the terms “2020” and “fiscal 2020” refer to our fiscal year ended January 3, 2021, the terms “2019” and “fiscal 2019” refer to our fiscal year ended December 29, 2019 and the terms “2018” and “fiscal 2018” refer to our fiscal year ended December 30, 2018).

References to our customers mean those customers we directly sell our products and services to, such as hospitals, clinics and our distributors. References to our end-customers mean customers who use our products, which include hospitals and clinics.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Trademarks and Service Marks

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are our service marks or trademarks. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. The trademarks we own or have the right to use include, among others, ORTHO®, ORTHO CLINICAL DIAGNOSTICS®, ORTHO VISION™, BIOVUE® and VITROS®. Solely for convenience, in some cases, the trademarks, service marks and trade names referred to in this prospectus are listed without the applicable ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

Market, Industry and Other Data

Throughout this prospectus, we refer to our market position or market share in various markets or regions. These references represent our best estimates of our market share at the time of this prospectus and are based on management’s knowledge of the industry and the market data and other statistical information obtained from independent industry publications, reports by market research firms or other published independent sources. We confirm that such information has been accurately reproduced and that, so far as we are aware, and are able to ascertain from information published by

iii

Table of Contents

publicly available sources and other publications, no facts have been omitted which would render the reproduced information inaccurate or misleading. Industry publications, reports and other published data generally state that the information contained therein has been obtained from sources believed to be reliable. Certain other market and industry data included in this prospectus, including the size of certain markets, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate.

Unless specifically noted otherwise, information presented in this prospectus with respect to our position relative to other industry participants is based on information or sources for the year ended December 31, 2020. Market size and market growth information presented in this prospectus reflects estimates of market sizes and growth in such markets for the year ended December 31, 2020 and for the years ended December 31, 2020 through 2025, respectively. In each such case, management believes such information presented represents the most recent data available to the Company.

Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus and Ortho Clinical Diagnostics Holdings plc’s Annual Report on Form 10-K for the fiscal year ended January 3, 2021 (“Ortho’s 2020 Form 10-K”). These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

Use of Non-GAAP Financial Measures

Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate are our key non-GAAP financial measures. For more information about how we use these non-GAAP financial measures in our business, the limitations of these measures and a reconciliation of these measures to the most directly comparable GAAP measures, see “Prospectus Summary—Summary Consolidated Financial Data.” Adjusted EBITDA consists of net loss before interest expense, net, provision for (benefit from) income taxes and depreciation and amortization and eliminates (i) non-operating income or expense and (ii) impacts of certain non-cash, unusual or other items that are included in net loss that we do not consider indicative of our ongoing operating performance. Management EBITDA consists of Adjusted EBITDA plus certain other management adjustments. Adjusted Net Income consists of net loss before amortization and the elimination of (i) non-operating income or expense and (ii) impacts of certain non-cash, unusual or other items that are included in net loss that we do not consider indicative of our ongoing operating performance. Core revenue constant currency growth rate refers to the growth rate of revenue generated in our Clinical Laboratories and our Transfusion Medicine lines of business, which historically make up more than 95% of our net revenue, with any local currency revenue for all reporting periods translated into U.S. dollars using internally-derived foreign currency exchange rates held constant for each year. As needed, we translate prior periods based on our internally-derived currency exchange rates used for the current period in order to remove the impact of foreign currency exchange fluctuation.

We use these financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Additionally, Management EBITDA was the basis we used for assessing the profitability of our geographic-based reportable segments and was also utilized as a basis for calculating certain management incentive compensation programs through January 3, 2021. During the fiscal first quarter ended April 4, 2021, we changed the basis by which we measure segment profit or loss and calculate certain management incentive compensation programs from Management EBITDA to Adjusted EBITDA. In the case of Adjusted

iv

Table of Contents

EBITDA and Adjusted Net Income, we believe that making such adjustments provides management and investors meaningful information to understand our operating performance and ability to analyze financial and business trends on a period-to-period basis. We believe that the presentation of these financial measures enhances an investor’s understanding of our financial performance. We use certain of these financial measures for business planning purposes and measuring our performance relative to that of our competitors.

Other companies in our industry may calculate Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate differently than we do. As a result, these financial measures have limitations as analytical and comparative tools and you should not consider these items in isolation, or as a substitute for analysis of our results as reported under GAAP. Adjusted EBITDA, Management EBITDA and Adjusted Net Income should not be considered as measures of discretionary cash available to us to invest in the growth of our business. In calculating these financial measures, we make certain adjustments that are based on assumptions and estimates that may prove to have been inaccurate. In addition, in evaluating these financial measures, you should be aware that in the future we may incur expenses similar to those eliminated in the presentation of these metrics included in this prospectus. Our presentation of Adjusted EBITDA, Management EBITDA and Adjusted Net Income should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations include the fact that:

| • | Adjusted EBITDA and Management EBITDA: |

| • | do not reflect the significant interest expense on our debt, including the Senior Secured Credit Facilities, the 2025 Notes and the 2028 Notes; |

| • | eliminate the impact of income taxes on our results of operations; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA and Management EBITDA do not reflect any cash requirements for such replacements; |

| • | Adjusted Net Income eliminates the effects of amortization related to purchased intangibles; and |

| • | Core revenue constant currency growth rate eliminates the effects of foreign currency exchange rate fluctuations. |

We compensate for these limitations by relying primarily on our GAAP results and using these financial measures only as a supplement to our GAAP results. For an explanation of the components of Core revenue constant currency growth rate, see footnotes (2) and (3) in “Prospectus summary—Summary consolidated financial data,” and for an explanation of the components of Adjusted EBITDA, Management EBITDA and Adjusted Net Income, see footnotes (4) and (5) in “Prospectus summary—Summary consolidated financial data.”

In calculating these financial measures, we make certain adjustments that are based on assumptions and estimates that may prove to have been inaccurate. In addition, in evaluating these financial measures, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation. Our presentation of these metrics should not be construed as an inference that our future results will not be affected by unusual or non-recurring items or changes in our customer base. Additionally, our presentation of Adjusted EBITDA may differ from that included in the

v

Table of Contents

Credit Agreement, the 2025 Notes Indenture and the 2028 Notes Indenture for purposes of covenant calculation.

Where You Can Find Additional Information

We have filed with the Securities Exchange Commission (the “SEC”) a registration statement on Form S-1 under the Securities Act (the “Registration Statement”) with respect to the ordinary shares offered by this prospectus. This prospectus is a part of the Registration Statement and does not contain all of the information set forth in the Registration Statement and its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us and our ordinary shares, you should refer to the Registration Statement and its exhibits and schedules.

We file annual, quarterly and current reports and other information with the SEC. Our filings with the SEC are available to the public on the SEC’s website at http://www.sec.gov. Those filings are also available to the public on, or accessible through, our website under the heading “Investor Relations” at www.orthoclinicaldiagnostics.com. The information we file with the SEC (except as described below in “Incorporation by reference”) or contained on or accessible through our corporate website or any other website that we may maintain is not part of this prospectus or the Registration Statement of which this prospectus is a part.

Incorporation by Reference

The rules of the SEC allow us to incorporate by reference information we file with the SEC. This means that we are disclosing important information to you by referring to other documents. The information incorporated by reference is considered to be part of this prospectus. To the extent there are inconsistencies between the information contained in this prospectus and the information contained in the documents filed with the SEC prior to the date of this prospectus and incorporated by reference, the information in this prospectus shall be deemed to supersede the information in such incorporated documents. We incorporate by reference the documents listed below (other than any portions thereof, which under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable SEC rules, are not deemed “filed” under the Exchange Act):

| • | Ortho’s 2020 Form 10-K; |

| • | our Quarterly Reports on Form 10-Q for the quarterly period ended April 4, 2021 and for the quarterly period ended July 4, 2021 (such Quarterly Report on Form 10-Q for the quarterly period ended July 4, 2021, “Ortho’s 2021 Q2 Form 10-Q”); and |

| • | our Current Reports on Form 8-K filed with the SEC on February 4, 2021, February 9, 2021, February 23, 2021, May 3, 2021, May 11, 2021, May 25, 2021 and June 15, 2021. |

If we have incorporated by reference any statement or information in this prospectus and we subsequently modify that statement or information with information contained in this prospectus, the statement or information previously incorporated in this prospectus is also modified or superseded in the same manner. We will provide without charge to each person to whom a copy of this prospectus has been delivered, a copy of any and all of these filings. You may request a copy of these filings by writing to us at:

Investor Relations

1001 Route 202

Raritan, New Jersey 08869

e-mail: InvestorRelations@OrthoClinialDiagnostics.com

Exhibits to any documents incorporated by reference in this prospectus will not be sent, however, unless those exhibits have been specifically referenced in this prospectus.

vi

Table of Contents

This prospectus summary highlights selected information contained or incorporated by reference in this prospectus and may not contain all of the information that you should consider in making your investment decision. For a more complete understanding of our company and this offering and before making any investment decision regarding our ordinary shares, you should read this entire prospectus and the information incorporated by reference, including “Risk Factors.”

Our Company

We are a pure-play in vitro diagnostics (“IVD”) business driven by our credo, “Because Every Test is A Life.” This guiding principle reflects the crucial role diagnostics play in global health and guides our priorities as an organization. As a leader in IVD, we impact approximately 800,000 patients every day. We are dedicated to improving outcomes for these patients and saving lives through providing innovative and reliable diagnostic testing solutions to the clinical laboratory and transfusion medicine communities. Our global infrastructure and commercial reach allow us to serve these markets with significant scale. We have an intense focus on the customer. We support our customers with high quality diagnostic instrumentation, a broad test portfolio and market leading service. Our products deliver consistently fast, accurate and reliable results that allow clinicians to make better-informed treatment decisions. Our business model generates significant recurring revenues and strong cash flow streams from ongoing sales of high margin consumables. In 2020, these consumables contributed approximately 93% of our total revenue. We maintain close connectivity with our customers through our global presence, with approximately 4,700 employees, including approximately 2,200 commercial sales, service and marketing teammates. This global organization allows us to support our customers across more than 130 countries and territories.

We have been pioneering life-impacting advances in diagnostics for over 80 years, from our earliest work in blood typing, to our innovation in infectious diseases and our latest developments in laboratory solutions. In 2014, we were acquired by The Carlyle Group from Johnson & Johnson and became an independent organization, solely focused on delivering high quality IVD products and service to our diagnostic customer base. At the time of the separation, our business had global scale, a reputation for high quality products, a strong quality management system and a research and development team with extensive scientific expertise. Over the past six years, we have significantly invested in our business with the objective of creating a highly efficient, innovative and lean organization capable of scaling to meet our customers’ needs. These investments included the following focus areas:

| • | Infrastructure: We invested over $500 million in IT, finance, supply chain and other support functions to build out our infrastructure and capabilities as a standalone business and drive long-term, profitable growth. |

| • | Research and development: We increased our focus on innovation by investing over $650 million in research and development to enhance our existing capabilities and develop new instruments and assays to supplement our portfolio. |

| • | Commercial: We redesigned our go-to-market strategy across all key regions, expanded our sales force, implemented new customer information systems and launched ORTHOCARE to enhance our service capabilities. |

| • | Operations: We consolidated and streamlined our manufacturing capabilities and other global functions to improve profitability and cash flow, achieving more than $200 million in savings since our acquisition by Carlyle. |

1

Table of Contents

| • | Leadership: To capitalize on these investments, we recruited a highly qualified management team of experienced diagnostic and healthcare leaders focused on our customers and accelerated growth. |

With these investments, we have reinvigorated our portfolio, transformed our commercial model and emerged as a focused leader in the IVD market, which we believe positions our business for future growth.

IVD testing is a critical tool in evaluating health in many different settings around the world. IVD is a core component of routine health care check-ups for those who are presenting with symptoms or require procedures, and it influences up to 70% of critical healthcare clinical decision-making. Consequently, our IVD solutions have a profound impact on the assessment of health and the delivery of care. IVD is also critical in monitoring the transmission and spread of infectious disease outbreaks, where Ortho’s longstanding excellence in infectious disease testing is particularly relevant. Our solutions are central to the operations of hospitals, clinics, blood banks and donor centers around the world, where they are used to help diagnose certain conditions, such as cancer or heart attacks, and infectious diseases, such as hepatitis, HIV, and most recently, COVID-19, where we have launched two antibody tests and an antigen test, and we are actively expanding our menu of tests to address the global pandemic.

We operate in an approximately $27 billion addressable market, which is expected to grow at a compound annual growth rate (“CAGR”) of approximately 5% from 2020 to 2025. We compete in the two largest IVD markets, Immunoassay and Clinical Chemistry, which together comprise our Clinical Laboratories business and represent approximately $25 billion of our current addressable market. We expect our Clinical Laboratories business will be favorably impacted by an aging population, an increased need for testing of chronic conditions, the expansion of access to healthcare services, the emergence of new disease states and other macro trends. We are also the global leader in Transfusion Medicine, which includes hospital-based Immunohematology and Donor Screening for blood and plasma at hospitals and other donation centers. Transfusion Medicine represents approximately $2 billion of our current addressable market. We expect our Transfusion Medicine business will be favorably impacted by increases in the number and type of surgical procedures, an aging population and other macro trends. There is significant overlap in our customer base given we currently sell to about 70% of the hospitals in the United States, and we are often able to leverage our leadership within Transfusion Medicine to cross-sell our Clinical Laboratories solutions. Because we focus primarily on acute or critical care diagnostics that are core to therapeutic decisions in hospitals, our markets are relatively resilient across business cycles. We offer our products and services globally, with distinct offerings targeted to the needs of customers in developed and emerging markets.

Today, we operate two lines of business, Clinical Laboratories and Transfusion Medicine, which together generate our core revenue:

| • | Clinical Laboratories: Comprised of Clinical Chemistry, which is the measurement of target chemicals in bodily fluids for the evaluation of health and the clinical management of patients, and Immunoassay, which is the measurement of proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health. |

| • | Transfusion Medicine: Comprised of Donor Screening, where blood and plasma is screened at donation for blood type and target diseases, and Immunohematology, where blood is typed and screened at the hospital blood bank before being transfused into the patient. |

2

Table of Contents

Our broad offerings allow us to support our customer base and maximize the opportunity to provide each of our customers with a comprehensive array of products and services over time. We refer to this mutually beneficial approach as focusing on Lifetime Customer Value (“LCV”). Our focus on LCV underpins everything we do, from the design and execution of our commercial and service model, to our instrument and assay innovation, to the composition of our global footprint. Our approach has informed our choice to focus on medium- to high-volume laboratories, which in turn has helped us become a focused leader in our selected markets and transformed our financial profile. We intend to continue to invest in and evolve our LCV framework to best support our customers and maximize our financial results.

As an example, we may begin a Clinical Laboratories customer relationship by providing a standalone instrument (often a clinical chemistry analyzer) and a set of assays that are relevant to that customer’s specific testing needs. As the customer and its testing needs grow, we look to migrate the customer, where appropriate, to an integrated analyzer that performs both clinical chemistry and immunoassay testing. This migration helps us increase our customers’ testing capabilities as well as the revenue we generate from customers. For our larger customers, we ultimately may expand their testing throughput by installing automation tracks that connect multiple analyzers along the automation track, while providing the full suite of our ever-expanding assay menu. As we have significantly expanded our test menu offering, our integrated analyzers are now more often where our Clinical Laboratories relationship starts. In Transfusion Medicine, the life cycle is similar, as customers graduate from manual testing processes to semi-automated capabilities to fully-automated blood and plasma screening instrumentation as their testing volumes and technical competencies grow over time. We focus on building long-term customer relationships and continuing to enhance both our offering and the customer’s ability to care for their patients—ultimately deepening our commercial relationship and driving our financial model.

We believe that the strong clinical performance of our assays, our instruments’ ease-of-use and reliability, our best-in-class customer service and low total cost of ownership contribute to our high revenue retention rate of approximately 98% in 2020. We have longstanding relationships with customers, with an average Clinical Laboratories customer relationship of almost 13 years and an average Transfusion Medicine customer relationship of almost 15 years. Our customer relationships are particularly strong in the medium- to high-volume laboratories (our “Focus Markets”), which compares to the broader market that includes low- and ultra high-volume laboratories. In addition, our dry slide technology has an environmentally friendly profile as it doesn’t require water system plumbing, it reduces hazardous waste and it requires less space for liquid storage. All of these attributes resonate particularly well with customers who are pursuing environmental goals or customers who operate in regions with scarce water supply.

Our revenue is driven by a “razor-razor blade” business model. Through this model, we generally sell or place instruments under long-term contracts, which support the ongoing sale of our assays, reagents and consumables. Our instruments are closed systems, requiring customers to purchase the assays, reagents and consumables from us. These sales generate a high proportion of recurring revenues. As of July 4, 2021, we had an installed base of approximately 20,300 instruments, which increased approximately 4% since June 28, 2020. We also generate non-core revenue, including through our contract manufacturing business and certain business collaborations, which accounted for approximately 3% of our net revenue during the fiscal year ended January 3, 2021. During the fiscal year ended January 3, 2021, we recorded net revenue of $1,766.2 million, net loss of $211.9 million and Adjusted EBITDA of $456.0 million. During the fiscal six months ended July 4, 2021, we recorded net revenue of $999.3 million, net loss of $59.1 million and Adjusted EBITDA of $280.6 million. As of July 4, 2021, we had total indebtedness of $2,295.0 million, and for the fiscal six months ended July 4,

3

Table of Contents

2021, our interest expense was $76.4 million. We note that our net revenue for the fiscal six months ended July 4, 2021 was 25.2% higher as compared to the prior year period, mainly driven by our core lines of business, as we recorded higher revenues in all geographic segments of our Clinical Laboratories business, and in certain geographic segments of our Transfusion Medicine business as well as a positive impact from foreign currency fluctuations, which was primarily driven by the weakening of the U.S. dollar against a variety of currencies, primarily the Euro, British Pound and Chinese Yuan, partially offset by the strengthening of the Brazilian Real. We note that our net revenue for the 2020 fiscal year was impacted by the global COVID-19 pandemic primarily due to decreased shipments to customers, most notably during the fiscal second quarter ended June 28, 2020. However, during the fiscal third quarter ended September 27, 2020, we began to experience a rebound towards the positive quarterly trajectory we saw prior to the beginning of the pandemic. As an example of such quarterly trajectory, during the four quarters prior to the fiscal second quarter ended June 28, 2020, our quarterly core revenue (excluding local HCV) was growing in the range of approximately 3.8% to 5.8% on a constant currency basis as compared to the relevant prior year period. Beginning in the fiscal third quarter ended September 27, 2020, and continuing through the fiscal second quarter ended July 4, 2021, we have returned to growth in our core revenue (excluding local HCV) on a constant currency basis, most recently increasing 25.0% during the fiscal second quarter ended July 4, 2021 as compared to the prior year period.

Our Competitive Strengths

We believe we are well-positioned to drive sustained and profitable growth through our relentless focus on LCV. This customer-centric approach informs the execution of our commercial and service model and underpins our go-to-market strategy. Our customer focus allows us to retain and grow our customers by providing a superior customer experience driven by unparalleled quality of service, continuous innovation and access to a diverse product portfolio. We are able to leverage our global footprint to gain differentiated and leading positions across our Focus Markets. This intense focus on our customers has resulted in an attractive business model with high recurring revenues that allows us to continue to invest to reinforce our competitive strengths, which include:

| • | Intense customer focus enabled by our broad portfolio and market leading positions; |

| • | Superior customer experience and brand loyalty resulting in high customer retention and win rates; |

| • | Highly compelling solutions supported by our leading and innovative research and development capabilities; |

| • | Extensive and balanced global commercial footprint with reinvigorated focus on growth; |

| • | Disciplined approach to streamline operations and optimize our cost structure; and |

| • | Deeply committed leadership team with broad experience in healthcare and diagnostics. |

Our Growth Strategy

Our heritage and strength lie in our long-term customer relationships and trusted brand, which create a steady base of recurring revenue and a foundation for future growth. By focusing on LCV, we identify ways in which we can utilize product innovation and impactful customer service and solutions to deepen these partnerships and add value over time. We plan to grow our business by broadening our existing relationships, winning new customers and targeting high-growth end markets and adjacencies. We are focused on sustainable long-term growth through commercial excellence that

4

Table of Contents

maximizes LCV, strengthens existing relationships through superior service and delivers innovative products for our customers and their patients. The key elements of our strategy to accelerate and sustain revenue growth and operating leverage include:

| • | Focusing relentlessly on maximizing LCV, which is designed to produce and maintain a growing and recurring, high margin, durable financial profile and contributes to growth; |

| • | Providing an unparalleled customer experience to retain and attract existing and new customers; |

| • | Leveraging our global footprint to deliver innovative solutions to meet our customers’ needs in both developed and emerging markets; |

| • | Creating meaningful product innovation through menu expansion, development of novel instruments and enhancement of automation and informatics; |

| • | Continuing to identify operating efficiencies to allow for reinvestment in growth and improve margins; and |

| • | Pursuing business development opportunities, partnerships and strategic acquisitions to enter adjacencies or expand our current business units. |

Our Products and Services

Clinical Laboratories

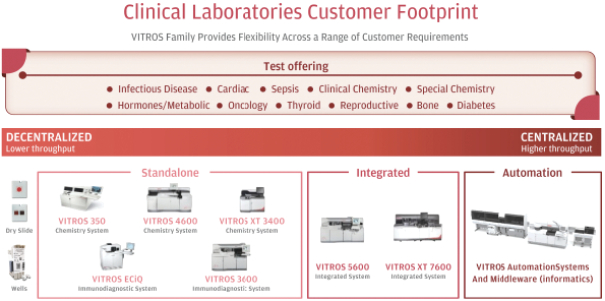

Our Clinical Laboratories business focuses on clinical chemistry and immunoassay instruments and tests to detect and monitor disease progression across a broad spectrum of therapeutic areas. Our flagship Clinical Laboratories platform is the VITROS family of instruments, which includes a series of clinical chemistry, immunoassay, integrated (combined chemistry and immunoassay) systems and automation and middleware solutions. VITROS instruments are placed in centralized, higher-throughput testing sites (hospitals and laboratories) and decentralized, lower-throughput sites (physician offices, clinics and specialty settings).

5

Table of Contents

Transfusion Medicine

Immunohematology

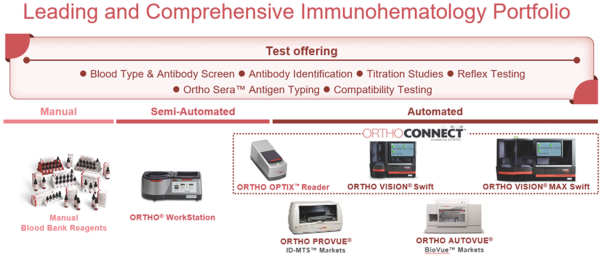

Within Transfusion Medicine, our Immunohematology business is focused on immunohematology instruments and tests used for blood typing to ensure patient-donor compatibility in blood transfusions. Our newly launched flagship Immunohematology analyzers are the ORTHO VISION Swift and ORTHO VISION Max Swift systems that automate blood typing and serology disease screening for blood banks. In addition, we sell the semi-automated ORTHO Workstation for blood bank customers that have lower volumes or need for test automation.

Donor Screening

Our Donor Screening business is focused on instruments and tests used for blood and plasma screening for infectious diseases for customers, which include some of the largest donor testing institutions, primarily in the United States. In Donor Screening, our core instrument offering is the ORTHO VERSEIA Integrated Processor—an automated pipetting and processing system that brings together the ORTHO VERSEIA pipettor and ORTHO Summit Processor to enable end-to-end pipetting and processing.

Our Services

In addition to the products we provide, ORTHOCARE Services are a critical element of how we deliver value to our customers. As of March 2021, we have approximately 900 service teammates globally. We employ highly trained service professionals including over 350 laboratory specialists with advanced qualifications. For example, more than 95% of our U.S. laboratory specialists have medical technician degrees.

Risks Related to our Business

Investing in our ordinary shares involves a high degree of risk. You should carefully consider these risks before investing in our ordinary shares, including the risks related to our business and

6

Table of Contents

industry described under “Risk Factors” in Ortho’s 2020 Form 10-K, which are incorporated by reference herein. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of our ordinary shares and result in a loss of all or a portion of your investment:

| • | the ongoing global coronavirus (COVID-19) pandemic; |

| • | increased competition; |

| • | manufacturing problems or delays or failure to develop and market new or enhanced products or services; |

| • | adverse developments in global market, economic and political conditions; |

| • | our ability to obtain additional capital on commercially reasonable terms may be limited or non-existent; |

| • | our inability to implement our strategies for improving growth or to realize the anticipated benefits of any acquisitions and divestitures, including as a result of difficulties integrating acquired businesses with, or disposing of divested businesses from, our current operations; |

| • | a need to recognize impairment charges related to goodwill, identified intangible assets and fixed assets; |

| • | our ability to operate according to our business strategy should our collaboration partners fail to fulfill their obligations; |

| • | risk that the insurance we maintain may not fully cover all potential exposures; |

| • | product recalls or negative publicity may harm our reputation or market acceptance of our products; |

| • | decreases in the number of surgical procedures performed, and the resulting decrease in blood demand; |

| • | fluctuations in our cash flows as a result of our reagent rental model; |

| • | terrorist acts, conflicts, wars and natural disasters that may materially adversely affect our business, financial condition and results of operations; |

| • | the outcome of legal proceedings instituted against us and/or others; |

| • | risks associated with our non-U.S. operations, including currency translation risks, the impact of possible new tariffs and compliance with applicable trade embargoes; |

| • | the effect of the United Kingdom’s withdrawal from the European Union; |

| • | our inability to deliver products and services that meet customers’ needs and expectations; |

| • | failure to maintain a high level of confidence in our products; |

| • | significant changes in the healthcare industry and related industries that we serve, in an effort to reduce costs; |

| • | reductions in government funding and reimbursement to our customers; |

| • | price increases or interruptions in the supply of raw materials, components for our products, and products and services provided to us by certain key suppliers and manufacturers; |

| • | our ability to recruit and retain the experienced and skilled personnel we need to compete; |

7

Table of Contents

| • | work stoppages, union negotiations, labor disputes and other matters associated with our labor force; |

| • | consolidation of our customer base and the formation of group purchasing organizations; |

| • | unexpected payments to any pension plans applicable to our employees; |

| • | our inability to obtain required clearances or approvals for our products; |

| • | failure to comply with applicable regulations, which may result in significant costs or the suspension or withdrawal of previously obtained clearances or approvals; |

| • | the inability of government agencies to hire, retain or deploy personnel or otherwise prevent new or modified products from being developed, cleared or approved or commercialized in a timely manner; |

| • | disruptions resulting from President Biden’s invocation of the Defense Production Act; |

| • | our inability to maintain our data management and information technology systems; |

| • | data corruption, cyber-based attacks, security breaches and privacy violations; |

| • | our inability to protect and enforce our intellectual property rights or defend against intellectual property infringement suits against us by third parties; |

| • | risks related to changes in income tax laws and regulations; |

| • | risks related to our substantial indebtedness, which includes $1,292.8 million outstanding under our Dollar Term Loan Facility, $380.9 million outstanding under our Euro Term Loan Facility, $240.0 million aggregate principal amount of 2025 Notes outstanding and $405.0 million aggregate principal amount of 2028 Notes outstanding, in each case, as of July 4, 2021; |

| • | our ability to generate cash flow to service our substantial debt obligations; |

| • | risks related to this offering and ownership of our ordinary shares; and |

| • | other factors set forth under “Risk Factors” in this prospectus or in the documents incorporated by reference herein. |

Our Principal Shareholder

Our Principal Shareholder is an investment fund affiliated with Carlyle. Carlyle acquired us from Johnson & Johnson in 2014 for aggregate consideration of $3,893.1 million, including debt financing consisting of $2,175.0 million of term loans pursuant to the Credit Agreement and $1,300.0 million of senior unsecured notes, all of which has since been refinanced. Affiliates of Carlyle currently hold approximately $61.0 million of indebtedness under the Dollar Term Loan Facility and approximately €56.4 million of indebtedness under the Euro Term Loan Facility. Pursuant to our articles of association, Carlyle has the right to appoint a number of the members of our board of directors. In addition, we are party to a shareholders agreement with Carlyle, pursuant to which Carlyle has the right to cause us to file registration statements under the Securities Act covering resales of our ordinary shares held by Carlyle, subject to certain exceptions.

Founded in 1987, Carlyle is a global investment firm and one of the world’s largest global private equity firms with approximately $276 billion of assets under management across 415 investment vehicles as of June 30, 2021. Carlyle invests across three segments—Global Private Equity, Global Credit, and Investment Solutions—in North America, South America, Europe, the Middle East, Africa

8

Table of Contents

and Asia. Carlyle has expertise in various industries, including aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, industrials & transportation, technology & business services and telecommunications & media. Carlyle employs approximately 1,800 employees, including more than 675 investment professionals, in 27 offices across five continents.

Carlyle is one of the leading private equity investors in the healthcare sector, having completed 80 total healthcare transactions representing approximately $16 billion in equity invested since inception. Recent transactions include Grand Rounds (tech-enabled expert medical opinion and healthcare quality and clinical navigation provider), TriNetX (a global health research network optimizing clinical research), Sedgwick (a global multiline claims management firm), One Medical (technology-enabled primary care provider), CorroHealth (a business service provider for healthcare companies), Millicent (a pharmaceutical company), MedRisk (a physical therapy-focused workers’ compensation solutions company), Albany Molecular Research (a pharmaceutical contract development and manufacturing organization), WellDyneRx (an independent pharmacy benefit manager), Rede D’Or São Luiz S.A. (a leading hospital provider in Brazil) and Pharmaceutical Product Development (a global contract research organization).

Corporate Information

U.K. TopCo is a public limited company incorporated under the laws of England and Wales with the legal name Ortho Clinical Diagnostics Holdings plc and with the company number 13084624. Our principal executive offices are located at 1001 Route 202, Raritan, New Jersey 08869. Our telephone number at this address is 908-218-8000. Ortho’s registered address is Felindre Meadows, Pencoed, Bridgend, Mid Glamorgan, Wales, CF35 5PZ. Our website address is www.orthoclinicaldiagnostics.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus, and inclusion of our website address in this prospectus is an inactive textual reference only. You should rely only on the information contained in this prospectus and in the documents incorporated by reference herein when making a decision as to whether to invest in the ordinary shares.

9

Table of Contents

THE OFFERING

| Ordinary shares offered by the selling shareholder |

22,000,000 shares. |

| Ordinary shares to be outstanding immediately after this offering |

234,921,002 shares. |

| Option to purchase additional ordinary shares |

The selling shareholder has granted to the underwriters an option to purchase up to 3,300,000 additional ordinary shares from us at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

The selling shareholder will receive all of the net proceeds from the sale of the ordinary shares in this offering. We will not receive any proceeds from the sale of the ordinary shares by the selling shareholder or if the underwriters exercise their option to purchase additional ordinary shares. See “Use of Proceeds.” |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus and incorporated by reference herein for a discussion of the factors you should consider carefully before deciding to invest in our ordinary shares. |

| Dividend policy |

We currently do not intend to declare any dividends on our ordinary shares in the foreseeable future. Our ability to pay dividends on our ordinary shares may be limited by the covenants contained in the agreements governing the Senior Notes and the Senior Secured Credit Facilities and applicable law. See “Dividend Policy.” |

| Nasdaq symbol |

“OCDX.” |

Except as otherwise indicated, all information in this prospectus regarding the number of ordinary shares that will be outstanding immediately after this offering is based on 234,921,002 ordinary shares outstanding as of July 4, 2021 and:

| • | does not reflect 15,857,759 ordinary shares issuable upon the exercise of options outstanding as of July 4, 2021 with a weighted average exercise price of $9.76 per ordinary share; and |

| • | does not reflect 7,864,810 ordinary shares available for future issuance under our Incentive Award Plan (the “2021 Incentive Award Plan”) (including shares subject to existing equity awards). |

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize the consolidated financial data of Ortho Clinical Diagnostics Holdings plc for the periods and dates indicated. The summary historical consolidated financial data as of and for each of the fiscal years ended January 3, 2021, December 29, 2019, December 30, 2018, December 31, 2017 and January 1, 2017 have been prepared in accordance with GAAP. The balance sheet data as of July 4, 2021 and the statement of operations and cash flow data for the fiscal six months ended July 4, 2021 and June 28, 2020 have been derived from our unaudited consolidated financial statements incorporated by reference from Ortho’s 2021 Q2 Form 10-Q. The statement of operations and cash flow data for the years ended January 3, 2021, December 29, 2019 and December 30, 2018 has been derived from our audited consolidated financial statements incorporated by reference from Ortho’s 2020 Form 10-K. The statement of operations and cash flow data for the years ended December 31, 2017 and January 1, 2017 have been derived from our audited consolidated financial statements not included or incorporated by reference in this prospectus. In the opinion of management, the unaudited financial statements include all adjustments, consisting of only normal and recurring adjustments, necessary for a fair statement of such financial data.

Our historical financial data is not necessarily indicative of our future performance. The summary consolidated financial data set forth below should be read in conjunction with the sections herein entitled “Risk Factors” and “Capitalization” as well as Ortho’s 2020 Form 10-K and Ortho’s 2021 Q2 Form 10-Q, including our unaudited consolidated financial statements and audited consolidated financial statements, incorporated by reference in this prospectus.

| Fiscal six months ended |

Fiscal year ended | |||||||||||||||||||||||||||

| ($ in millions, except per share data) |

July 4, 2021 |

June 28, 2020 |

January 3, 2021 |

December 29, 2019 |

December 30, 2018 |

December 31, 2017 |

January 1, 2017 |

|||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||||||

| Net revenue |

$ | 999.3 | $ | 798.5 | $ | 1,766.2 | $ | 1,801.5 | $ | 1,787.3 | $ | 1,781.7 | $ | 1,695.6 | ||||||||||||||

| Cost of revenue, excluding amortization of intangible assets |

496.3 | 416.1 | 908.2 | 922.4 | 930.5 | 897.7 | 906.3 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross profit |

503.0 | 382.4 | 858.0 | 879.1 | 856.8 | 884.0 | 789.3 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Selling, marketing and administrative expenses |

270.2 | 226.9 | 489.6 | 515.1 | 491.6 | 499.8 | 531.5 | |||||||||||||||||||||

| Research and development expense |

59.3 | 49.4 | 112.9 | 98.0 | 98.7 | 96.4 | 99.9 | |||||||||||||||||||||

| Amortization of intangible assets |

66.9 | 65.6 | 131.9 | 131.7 | 128.8 | 162.0 | 159.6 | |||||||||||||||||||||

| Intangible asset impairment charge |

— | — | — | — | — | 11.0 | — | |||||||||||||||||||||

| Other operating expense, net |

17.9 | 13.3 | 35.3 | 48.8 | 71.2 | 79.5 | 54.3 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

414.2 | 355.2 | 769.7 | 793.6 | 790.3 | 848.7 | 845.3 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from operations |

88.8 | 27.2 | 88.3 | 85.5 | 66.5 | 35.3 | (56.0 | ) | ||||||||||||||||||||

| Other expense (income): |

||||||||||||||||||||||||||||

| Interest expense, net |

76.4 | 99.7 | 198.2 | 231.4 | 235.6 | 239.8 | 216.9 | |||||||||||||||||||||

| Tax indemnification (income) expense |

(0.4 | ) | (4.9 | ) | 31.2 | 29.2 | (13.1 | ) | (124.1 | ) | 5.5 | |||||||||||||||||

| Other expense (income), net |

53.4 | 67.0 | 84.2 | 5.7 | 61.6 | (66.1 | ) | 109.3 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other expense, net |

129.4 | 161.8 | 313.6 | 266.3 | 284.1 | 49.6 | 331.7 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

11

Table of Contents

| Fiscal six months ended |

Fiscal year ended | |||||||||||||||||||||||||||

| ($ in millions, except per share data) |

July 4, 2021 |

June 28, 2020 |

January 3, 2021 |

December 29, 2019 |

December 30, 2018 |

December 31, 2017 |

January 1, 2017 |

|||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||

| Loss before provision for (benefit from) income taxes |

(40.7 | ) | (134.6 | ) | (225.3 | ) | (180.8 | ) | (217.6 | ) | (14.3 | ) | (387.7 | ) | ||||||||||||||

| Provision for (benefit from) income taxes |

18.4 | 7.9 | (13.4 | ) | (23.9 | ) | 31.2 | 102.0 | 3.0 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |

$ | (59.1 | ) | $ | (142.5 | ) | $ | (211.9 | ) | $ | (156.9 | ) | $ | (248.8 | ) | $ | (116.3 | ) | $ | (390.7 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Per share data: |

||||||||||||||||||||||||||||

| Basic and diluted net loss per share attributable to ordinary shareholders |

$ | (0.27 | ) | $ | (0.97 | ) | $ | (1.45 | ) | $ | (1.08 | ) | $ | (1.72 | ) | $ | (0.80 | ) | $ | (2.71 | ) | |||||||

| Basic and diluted weighted-average ordinary shares outstanding |

220.4 | 146.3 | 146.3 | 145.5 | 145.1 | 144.8 | 144.4 | |||||||||||||||||||||

| Cash flow data: |

||||||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||||||

| Operating activities |

$ | 122.8 | $ | (63.5 | ) | $ | 46.1 | $ | 143.0 | $ | 69.6 | $ | 68.0 | $ | (59.9 | ) | ||||||||||||

| Investing activities |

(4.3 | ) | (25.5 | ) | (45.4 | ) | (68.5 | ) | (87.1 | ) | (118.0 | ) | (187.4 | ) | ||||||||||||||

| Financing activities |

(50.2 | ) | 88.0 | 55.8 | (64.4 | ) | (8.2 | ) | 84.9 | 159.0 | ||||||||||||||||||

| Cash paid for interest |

83.6 | 105.6 | 191.8 | 189.7 | 218.8 | 222.3 | 201.8 | |||||||||||||||||||||

| Cash paid for income taxes, net |

8.3 | 10.8 | 16.8 | 8.4 | 13.4 | 9.1 | 20.6 | |||||||||||||||||||||

| As of | ||||||||||||||||||||||||

| ($ in millions) | July 4, 2021 |

January 3, 2021 |

December 29, 2019 |

December 30, 2018 |

December 31, 2017 |

January 1, 2017 |

||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Consolidated balance sheet data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 200.9 | $ | 132.8 | $ | 72.0 | $ | 56.4 | $ | 93.3 | $ | 60.8 | ||||||||||||

| Total assets |

3,304.2 | 3,401.5 | 3,589.2 | 3,687.4 | 3,936.8 | 3,865.7 | ||||||||||||||||||

| Working capital(1) |

389.8 | 230.8 | 138.7 | 188.8 | 234.0 | 79.0 | ||||||||||||||||||

| Total liabilities |

2,928.7 | 4,412.3 | 4,402.0 | 4,342.1 | 4,353.5 | 4,195.4 | ||||||||||||||||||

| Accumulated deficit |

(1,976.6 | ) | (1,917.5 | ) | (1,705.6 | ) | (1,548.9 | ) | (1,312.0 | ) | (1,195.7 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total shareholders’ equity (deficit) |

375.6 | (1,010.8 | ) | (812.8 | ) | (654.7 | ) | (416.7 | ) | (329.7 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Fiscal six months ended |

Fiscal year ended | |||||||||||||||||||||||

| ($ in millions) | July 4, 2021 |

June 28, 2020 |

January 3, 2021 |

December 29, 2019 |

December 30, 2018 |

December 31, 2017 |

||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Other financial and operating data |

||||||||||||||||||||||||

| Net revenue—Clinical Laboratories |

$ | 663.1 | $ | 516.6 | $ | 1,154.2 | $ | 1,142.3 | $ | 1,102.5 | $ | 1,097.9 | ||||||||||||

| Net revenue—Transfusion Medicine |

323.8 | 273.9 | 580.6 | 598.0 | 616.1 | 598.7 | ||||||||||||||||||

| Core revenue(2) |

986.9 | 790.5 | 1,734.8 | 1,740.3 | 1,718.6 | 1,696.6 | ||||||||||||||||||

| Core revenue growth rate(2) |

24.8 | % | (6.9 | )% | (0.3 | %) | 1.3 | % | 1.3 | % | 4.8 | % | ||||||||||||

| Core revenue constant currency growth rate(2)(3) |

21.8 | % | (5.2 | )% | 0.4 | % | 2.9 | % | 1.0 | % | 4.8 | % | ||||||||||||

| Adjusted EBITDA(4)(5) |

280.6 | 202.9 | 456.0 | 477.5 | 467.8 | 477.6 | ||||||||||||||||||

| Adjusted EBITDA margin(4)(5)(6) |

28.1 | % | 25.4 | % | 25.8 | % | 26.5 | % | 26.2 | % | 26.8 | % | ||||||||||||

| Adjusted Net Income(4)(5) |

94.0 | 1.1 | 51.2 | 32.7 | 6.7 | 39.9 | ||||||||||||||||||

| (1) | We define working capital as current assets less current liabilities. Refer to our consolidated financial statements incorporated by reference in this prospectus for further details regarding our current assets and current liabilities. |

| (2) | Core revenue refers collectively to revenue generated in our Clinical Laboratories and our Transfusion Medicine lines of business which historically make up more than 95% of our net revenue. |

12

Table of Contents

| (3) | When we use the term “constant currency,” it means that we have translated current period and prior period amounts from local currency to U.S. dollars using internally-derived currency exchange rates held constant for each year. As needed, we translate prior periods based on our internally-derived currency exchange rates used in the current period in order to remove the impact of foreign currency exchange fluctuation. This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP. The following table reconciles core revenue to core revenue constant currency growth rate for the periods presented: |

| Fiscal six months ended |

Fiscal year ended | |||||||||||||||||||

| ($ in millions) | July 4, 2021(a) |

June 28, 2020(a) |

January 3, 2021(a) |

December 29, 2019(a) |

December 30, 2018 |

|||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Core revenue |

$ | 986.9 | $ | 790.5 | $ | 1,734.8 | $ | 1,740.3 | $ | 1,718.6 | ||||||||||

| Foreign currency translation |

(13.6 | ) | 8.7 | 5.3 | (6.6 | ) | (31.6 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core revenue constant currency |

973.3 | 799.2 | 1,740.1 | 1,733.7 | 1,687.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core revenue constant currency growth rate |

21.8 | % | (5.2 | )% | 0.4 | % | 2.9 | % | 1.0 | % | ||||||||||

| (a) | Core revenue constant currency by quarter for fiscal 2019 and 2020 and year to date 2021 is as follows: |

| Fiscal quarter ended | ||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | July 4, 2021 |

April 4, 2021 |

January 3, 2021 |

September 27, 2020 |

June 28, 2020 |

March 29, 2020 |

December 29, 2019 |

September 29, 2019 |

June 30 2019 |

March 31, 2019 |

||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||

| Core revenue constant currency |

$ | 480.5 | $ | 492.8 | $ | 496.2 | $ | 444.7 | $ | 392.2 | $ | 407.0 | $ | 454.8 | $ | 435.9 | $ | 438.9 | $ | 404.0 | ||||||||||||||||||||

| Less: Local HCV(i) |

8.6 | 3.8 | 3.8 | 3.3 | 14.6 | 2.7 | 6.0 | 9.9 | 9.5 | 18.0 | ||||||||||||||||||||||||||||||

| Less: CoV-2 |

17.1 | 28.8 | 25.9 | 20.9 | 27.4 | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Core revenue constant currency (excl. local HCV and CoV-2) |

454.8 | 460.2 | 466.5 | 420.5 | 350.3 | 404.3 | 448.9 | 426.0 | 429.4 | 386.0 | ||||||||||||||||||||||||||||||

| Core revenue constant currency annual growth rate |

22.5 | % | 21.1 | % | 9.1 | % | 2.1 | % | (10.8 | )% | 0.9 | % | 2.9 | % | 5.5 | % | 3.7 | % | (0.5 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Core revenue constant currency annual growth rate (excl. local HCV) |

25.0 | % | 20.9 | % | 9.7 | % | 3.7 | % | (12.2 | )% | 4.8 | % | 4.3 | % | 5.8 | % | 3.8 | % | (3.0 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Core revenue constant currency annual growth rate (excl. local HCV and CoV-2) |

29.9 | % | 13.8 | % | 3.9 | % | (1.3 | )% | (18.4 | )% | 4.8 | % | 4.3 | % | 5.8 | % | 3.8 | % | (3.0 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (i) | During the fiscal three months ended March 31, 2019, we signed a supply agreement in Japan related to our HCV business. Revenue recognition is based on the timing of periodic shipments which may create unusual year-over-year variances in certain quarters. |

13

Table of Contents

| (4) | Adjusted EBITDA consists of net loss before interest expense, net, provision for (benefit from) income taxes and depreciation and amortization and eliminates (i) non-operating income or expense and (ii) impacts of certain non-cash, unusual or other items that are included in net loss that we do not consider indicative of our ongoing operating performance. Management EBITDA consists of Adjusted EBITDA plus certain other management adjustments and was the basis we used for assessing the profitability of our geographic-based reportable segments. Additionally, Management EBITDA was utilized as a basis for calculating certain management incentive compensation programs. Beginning in the fiscal first quarter ended April 4, 2021, we began using Adjusted EBITDA as the basis for assessing the profitability of our geographic-based reportable segments and as a basis for calculating certain management incentive compensation programs. Adjusted Net Income consists of net loss before amortization and the elimination of (i) non-operating income or expense and (ii) impacts of certain non-cash, unusual or other items that are included in net loss that we do not consider indicative of our ongoing operating performance. In the case of Adjusted EBITDA and Adjusted Net Income, we believe that making such adjustments provides management and investors meaningful information to understand our operating performance and ability to analyze financial and business trends on a period-to-period basis. |

| (5) | Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate are not calculated or presented in accordance with GAAP and other companies in our industry may calculate Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate differently than we do. As a result, these financial measures have limitations as analytical and comparative tools and you should not consider these items in isolation, or as a substitute for analysis of our results as reported under GAAP. Adjusted EBITDA, Management EBITDA and Adjusted Net Income should not be considered as measures of discretionary cash available to us to invest in the growth of our business. In calculating these financial measures, we make certain adjustments that are based on assumptions and estimates that may prove to have been inaccurate. In addition, in evaluating these financial measures, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation. Our presentation of Adjusted EBITDA, Management EBITDA and Adjusted Net Income should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. For additional information regarding Adjusted EBITDA, Management EBITDA, Adjusted Net Income and Core revenue constant currency growth rate and our use and presentation of those measures and the related risks, see “Use of Non-GAAP Financial Measures.” |

The following tables reconcile net loss to Adjusted EBITDA, Management EBITDA and Adjusted Net Income for the periods presented:

| Fiscal six months ended |

Fiscal year ended | |||||||||||||||||||||||

| ($ in millions) | July 4, 2021 |

June 28, 2020 |

January 3, 2021 |

December 29, 2019 |

December 30, 2018 |

December 31, 2017 |

||||||||||||||||||

| Net loss |

$ | (59.1 | ) | $ | (142.5 | ) | $ | (211.9 | ) | $ | (156.9 | ) | $ | (248.8 | ) | $ | (116.3 | ) | ||||||

| Interest expense, net |

76.4 | 99.7 | 198.2 | 231.4 | 235.6 | 239.8 | ||||||||||||||||||

| Provision for (benefit from) income taxes |

18.4 | 7.9 | (13.4 | ) | (23.9 | ) | 31.2 | 102.0 | ||||||||||||||||

| Depreciation and amortization |

165.8 | 159.7 | 325.9 | 327.5 | 332.2 | 333.3 | ||||||||||||||||||

| Unrealized foreign currency exchange losses (gains)(a) |

— | 52.3 | 63.0 | (19.6 | ) | 46.5 | (58.8 | ) | ||||||||||||||||

| Restructuring and severance-related costs(b) |

3.0 | 4.6 | 11.7 | 36.0 | 38.3 | 51.5 | ||||||||||||||||||

| Debt refinancing costs and loss on extinguishment of debt |

50.3 | 12.6 | 12.6 | — | 20.6 | 2.0 | ||||||||||||||||||

| Stock-based compensation(c) |