Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LAKELAND BANCORP INC | d173817d8k.htm |

Fixed Income Investor Presentation September 2021 Exhibit 99.1

Forward Looking Statements 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page This presentation contains forward-looking statements with respect to Lakeland Bancorp, Inc. (“Lakeland Bancorp”) that are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates”, “projects”, “intends”, “estimates”, “expects”, “believes”, “plans”, “may”, “will”, “should”, “could” and other similar expressions are intended to identify such forward looking statements. These forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Lakeland Bancorp to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others: Changes in the financial services industry and the U.S. and global capital markets; Changes in economic conditions nationally, regionally and in the Company’s markets; Demand for our financial products and services in our market area; Major catastrophes such as floods or other natural or human disasters and infectious disease outbreaks, including the current coronavirus (COVID-19) pandemic, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; The nature and timing of actions of the Federal Reserve Board and other regulators; The effect of and associated costs of compliance with additional regulations, including those of the Consumer Finance Protection Bureau, required for companies with more than $10 billion in assets; The nature and timing of legislation and/or accounting policies affecting the financial services industry; Volatility in interest rates; Fluctuations in real estate values in our market area; The composition and credit quality of our loan and investment portfolios; Changes in the level and direction of loan delinquencies and charge-offs and changes in estimates of the adequacy of the allowance for credit losses; Our ability to access cost-effective funding; Our ability to continue to implement our business strategies, including our ability to complete acquisitions or fully achieve cost savings or revenue growth associated with acquisitions; Our ability to manage market risk, credit risk and operational risk; Timing of revenue and expenditures; Adverse changes in the securities markets; Failure to realize anticipated efficiencies and synergies from the merger of 1st Constitution Bancorp into Lakeland Bancorp and the merger of 1st Constitution Bank into Lakeland Bank; Our ability to enter new markets successfully and capitalize on growth opportunities; Return on investment decisions; System failures or cyber-security breaches of our information technology infrastructure and those of our third-party service providers; Successful implementation, deployment and upgrades of new and existing technology, systems, services and products; Customers’ acceptance of Lakeland Bancorp’s products and services; Our ability to retain key employees; Other risks and uncertainties, including those occurring in the U.S. and world financial systems; and The risk that our analysis of these risks and forces could be incorrect and/or that the strategies developed to address them could be unsuccessful Additional factors that could cause results to differ materially from those described above can be found in Lakeland Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such reports, as well as in subsequent Securities and Exchange Commission (“Commission”) filings, each of which is on file with the Commission and available in the “Investors Relations” section of Lakeland Bancorp’s website, www.lakelandbank.com, under the heading “Documents” and in other documents Lakeland Bancorp files with the Commission. Lakeland Bancorp assumes no obligation for updating any such forward-looking statements at any time.

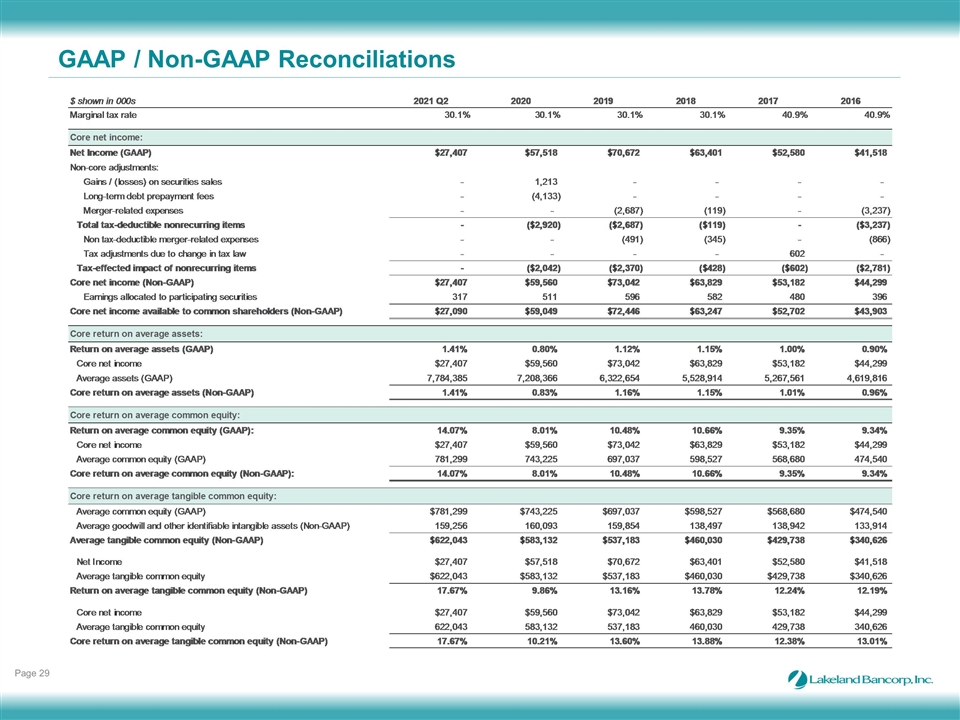

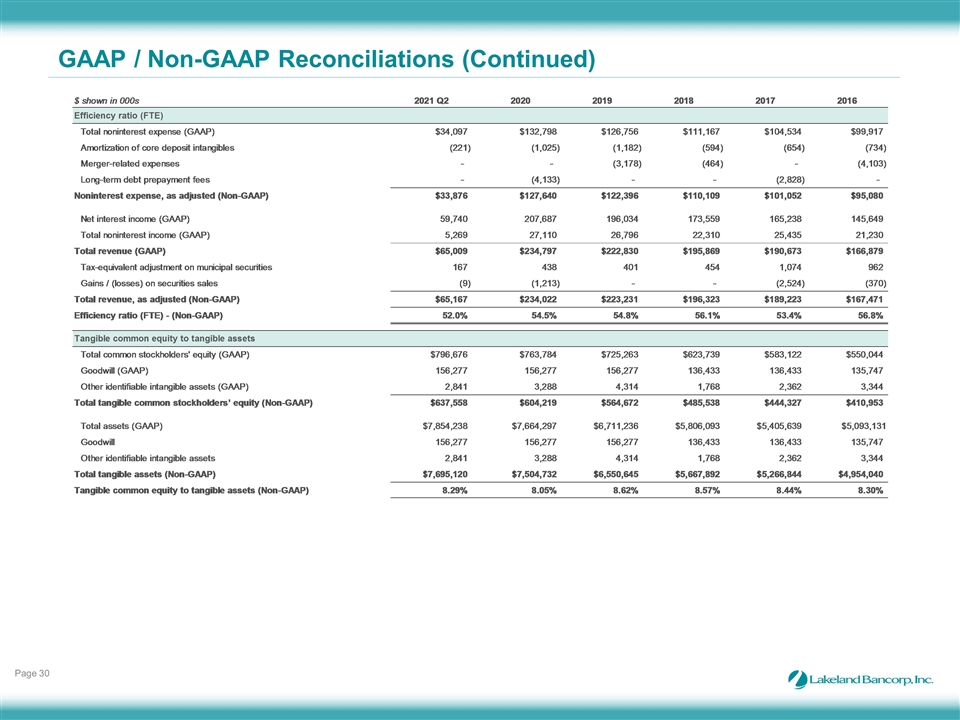

Additional Information Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Non-GAAP Financial Measures In addition to financial measures presented according to generally accepted accounting principles in the United States (“GAAP”), this presentation contains non-GAAP financial measures. We believe the non-GAAP financial measures provide useful information in understanding our results of operations because they facilitate comparisons with the performance of other companies in the financial services industry. Although we believe the non-GAAP financial measures enhance the understanding of our business and financial results, they should not be considered a substitute for or more important than the comparable GAAP financial measures, nor are they necessarily comparable with similar non-GAAP financial measures that other companies may present. A reconciliation of non-GAAP financial measures with the comparable GAAP financial measures appears at the end of this presentation.

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

Management Presenters 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Thomas J. Shara President & CEO Thomas F. Splaine Executive VP & CFO President and Chief Executive Officer of Lakeland Bancorp, Inc. and Lakeland Bank since April 2008 Formerly President and Chief Lending Officer of TD Banknorth’s (now TD Bank) Mid-Atlantic Division, which includes New Jersey, New York and Pennsylvania Served as Executive Vice President and Senior Loan Officer at Hudson United Bank, a $9 billion commercial bank, where he oversaw organic growth and was responsible for integrating over 30 acquisitions Currently serves on the Board of Trustees of the Boys and Girls Club of Paterson and Passaic, N.J., the Board of Directors of the Commerce and Industry Association of New Jersey, Board of Trustees of Chilton Medical Center Foundation, Board of Trustees of the Ramapo College Foundation, and is former Chairman of the New Jersey Bankers Association board Earned a Master’s degree in Business Administration as well as a Bachelor of Science from Fairleigh Dickinson University Executive Vice President, Chief Financial Officer of Lakeland Bancorp, Inc. since March 2017 Began career at Lakeland Bank as Senior Vice President and Chief Accounting Officer in 2016 Formerly employed by Investors Bank from 2004 until 2015 in various positions including including Chief Financial Officer; Senior Vice President – Financial Planning and Analysis and Investor Relations Prior to joining Investors Bank, he served as Director of Financial Reporting for Hewlett-Packard Financial Services from 2002 to 2004 Earned both an undergraduate degree in accounting and a Master's degree in Business Administration from Rider University To be confirmed by management John F. Rath Executive VP & CLO Executive Vice President, Chief Lending Officer of Lakeland Bank Joined Lakeland Bank in March 2015 as Senior Vice President and Group Manager Responsible for Middle Market and C&I lending, Asset Based Lending and Equipment Finance Previously employed by TD Bank for over 16 years as Senior Vice President and Group Manager responsible for Middle Market, Commercial and Small Business lending activities in the Lower Hudson Valley Also served The Bank of New York for 18 years where he held various positions Over 35 years of banking experience

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

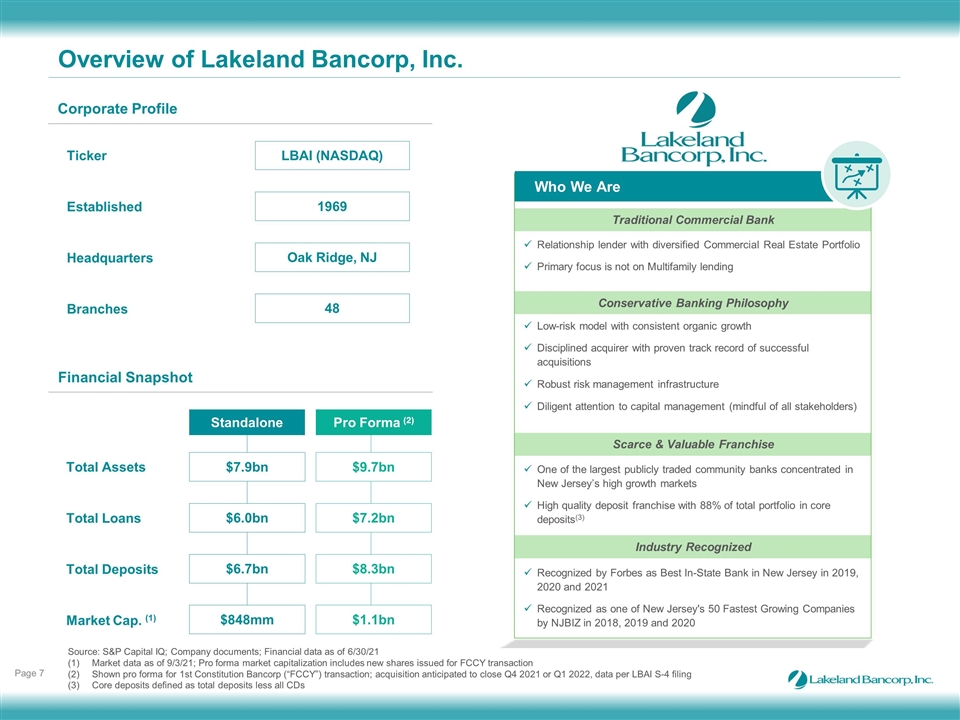

Overview of Lakeland Bancorp, Inc. 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Corporate Profile 48 Oak Ridge, NJ 1969 LBAI (NASDAQ) Ticker Established Headquarters Branches Financial Snapshot Traditional Commercial Bank Conservative Banking Philosophy Scarce & Valuable Franchise Industry Recognized Who We Are Relationship lender with diversified Commercial Real Estate Portfolio Primary focus is not on Multifamily lending Low-risk model with consistent organic growth Disciplined acquirer with proven track record of successful acquisitions Robust risk management infrastructure Diligent attention to capital management (mindful of all stakeholders) One of the largest publicly traded community banks concentrated in New Jersey’s high growth markets High quality deposit franchise with 88% of total portfolio in core deposits(3) Recognized by Forbes as Best In-State Bank in New Jersey in 2019, 2020 and 2021 Recognized as one of New Jersey's 50 Fastest Growing Companies by NJBIZ in 2018, 2019 and 2020 Source: S&P Capital IQ; Company documents; Financial data as of 6/30/21 Market data as of 9/3/21; Pro forma market capitalization includes new shares issued for FCCY transaction Shown pro forma for 1st Constitution Bancorp (“FCCY”) transaction; acquisition anticipated to close Q4 2021 or Q1 2022, data per LBAI S-4 filing Core deposits defined as total deposits less all CDs $848mm $6.7bn $6.0bn $7.9bn Total Assets Total Loans Total Deposits Market Cap. (1) $1.1bn $8.3bn $7.2bn $9.7bn Standalone Pro Forma (2)

Investment Highlights 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Premier New Jersey Community Bank With Strong Commercial Focus Top Tier Performing Institution Amongst Comparable Companies Prudent Risk Management Consistent Growth Story Strong Capital Position Stable, Low Cost Deposit Base

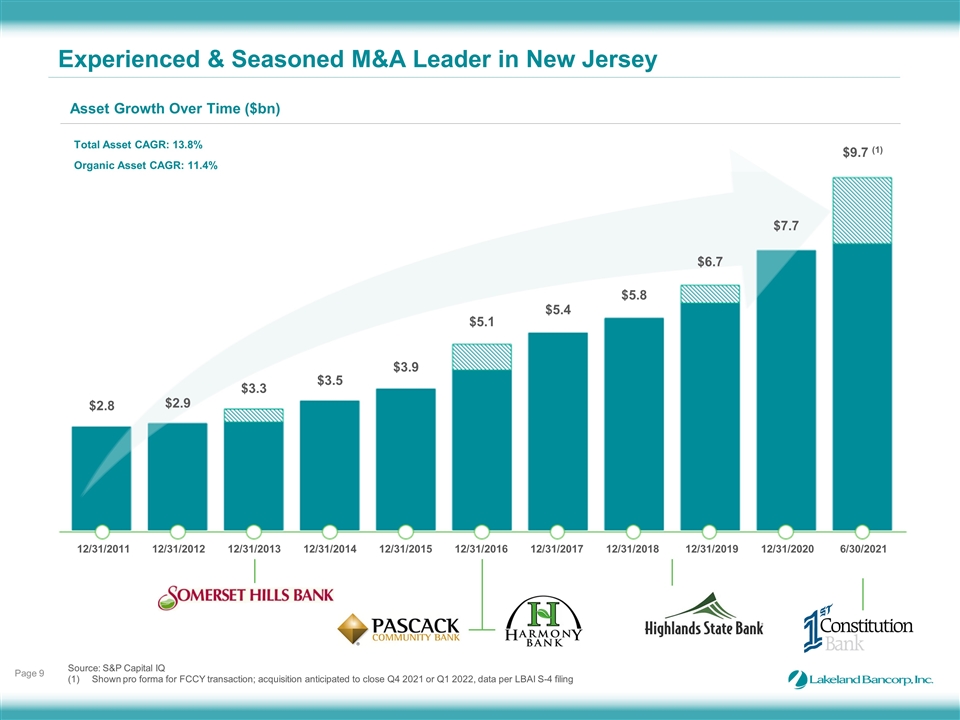

$5.8 Experienced & Seasoned M&A Leader in New Jersey 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 6/30/2021 $2.8 $2.9 $3.3 $3.5 $3.9 $5.1 $5.4 $6.7 $7.7 $9.7 (1) Source: S&P Capital IQ Shown pro forma for FCCY transaction; acquisition anticipated to close Q4 2021 or Q1 2022, data per LBAI S-4 filing Total Asset CAGR: 13.8% Organic Asset CAGR: 11.4% Asset Growth Over Time ($bn)

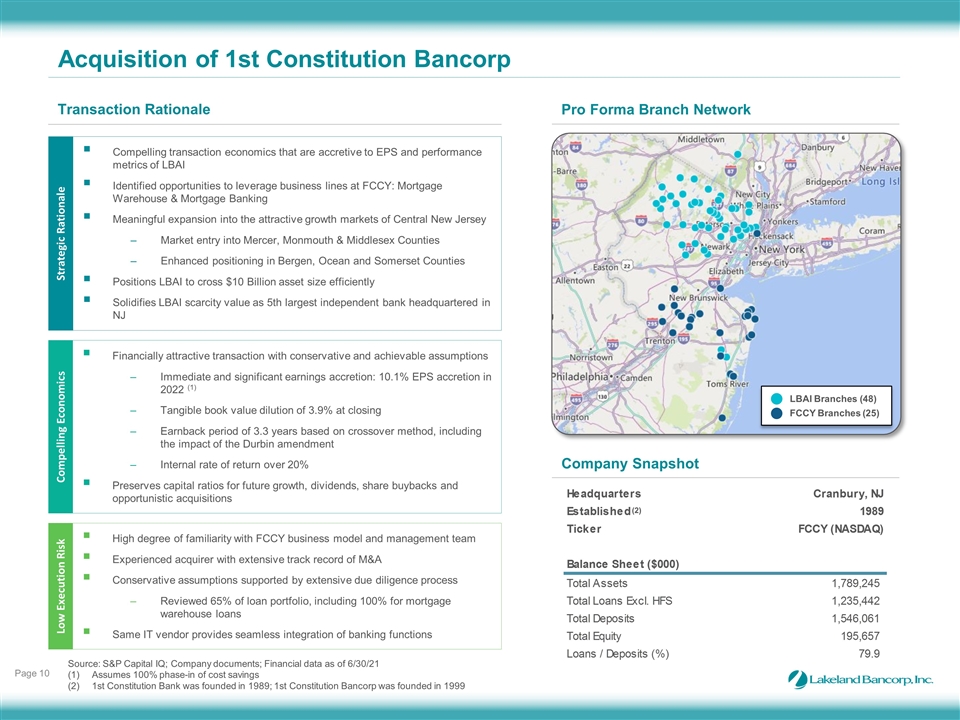

Acquisition of 1st Constitution Bancorp Source: S&P Capital IQ; Company documents; Financial data as of 6/30/21 Assumes 100% phase-in of cost savings 1st Constitution Bank was founded in 1989; 1st Constitution Bancorp was founded in 1999 Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 (2) Company Snapshot Transaction Rationale Financially attractive transaction with conservative and achievable assumptions Immediate and significant earnings accretion: 10.1% EPS accretion in 2022 (1) Tangible book value dilution of 3.9% at closing Earnback period of 3.3 years based on crossover method, including the impact of the Durbin amendment Internal rate of return over 20% Preserves capital ratios for future growth, dividends, share buybacks and opportunistic acquisitions Compelling Economics Compelling transaction economics that are accretive to EPS and performance metrics of LBAI Identified opportunities to leverage business lines at FCCY: Mortgage Warehouse & Mortgage Banking Meaningful expansion into the attractive growth markets of Central New Jersey Market entry into Mercer, Monmouth & Middlesex Counties Enhanced positioning in Bergen, Ocean and Somerset Counties Positions LBAI to cross $10 Billion asset size efficiently Solidifies LBAI scarcity value as 5th largest independent bank headquartered in NJ Strategic Rationale High degree of familiarity with FCCY business model and management team Experienced acquirer with extensive track record of M&A Conservative assumptions supported by extensive due diligence process Reviewed 65% of loan portfolio, including 100% for mortgage warehouse loans Same IT vendor provides seamless integration of banking functions Low Execution Risk Pro Forma Branch Network LBAI Branches (48) FCCY Branches (25)

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

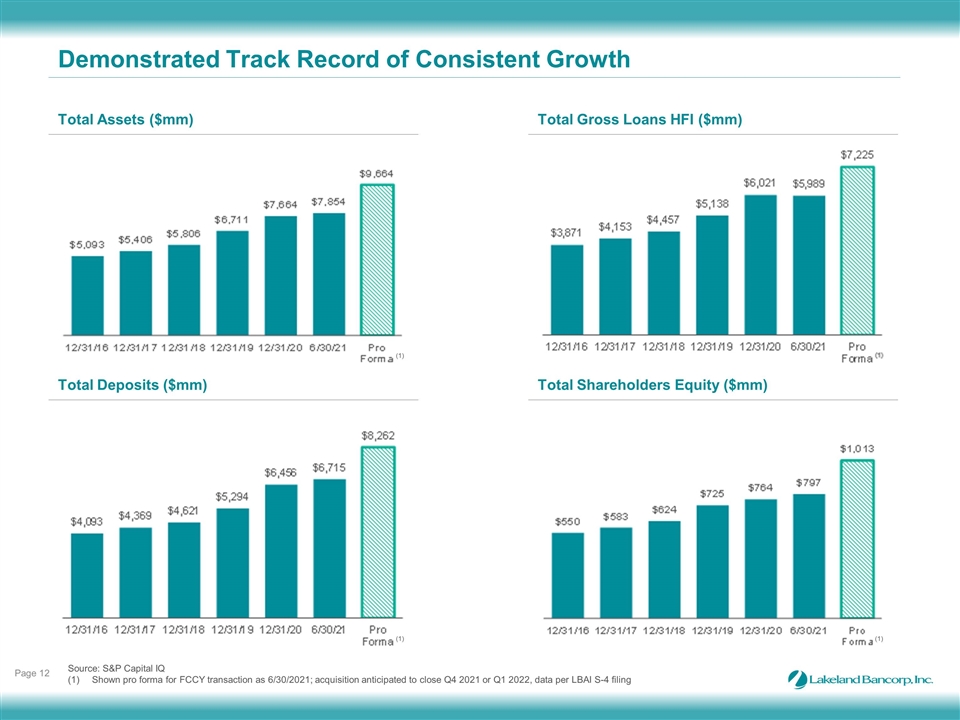

Demonstrated Track Record of Consistent Growth 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ Shown pro forma for FCCY transaction as 6/30/2021; acquisition anticipated to close Q4 2021 or Q1 2022, data per LBAI S-4 filing (1) (1) (1) Total Assets ($mm) Total Gross Loans HFI ($mm) Total Deposits ($mm) Total Shareholders Equity ($mm)

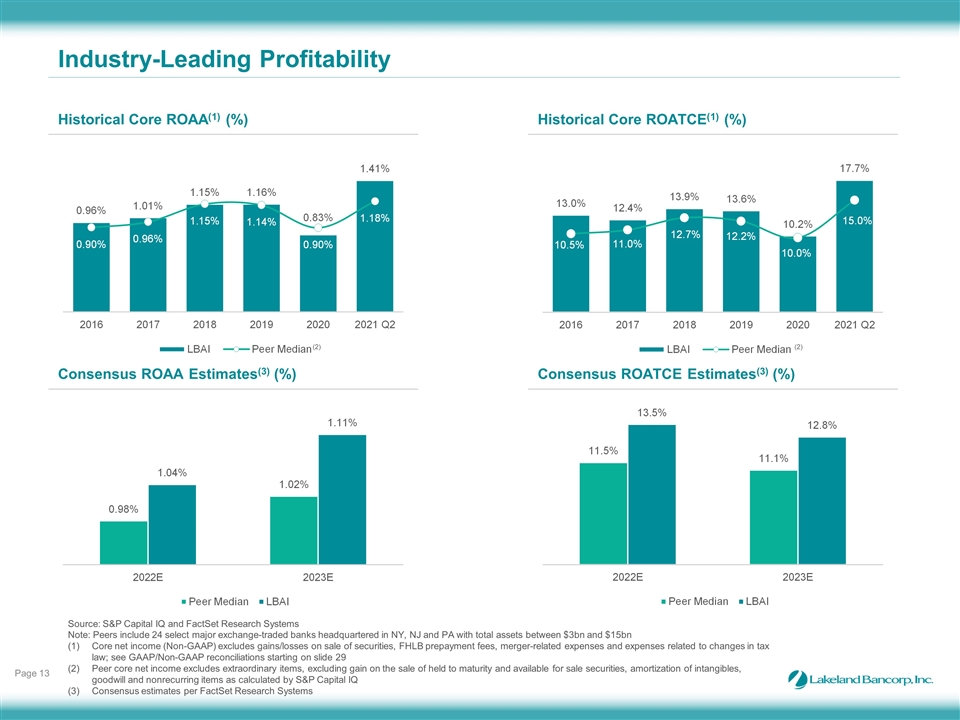

Industry-Leading Profitability 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ and FactSet Research Systems Note: Peers include 24 select major exchange-traded banks headquartered in NY, NJ and PA with total assets between $3bn and $15bn Core net income (Non-GAAP) excludes gains/losses on sale of securities, FHLB prepayment fees, merger-related expenses and expenses related to changes in tax law; see GAAP/Non-GAAP reconciliations starting on slide 29 Peer core net income excludes extraordinary items, excluding gain on the sale of held to maturity and available for sale securities, amortization of intangibles, goodwill and nonrecurring items as calculated by S&P Capital IQ Consensus estimates per FactSet Research Systems Historical Core ROAA(1) (%) Historical Core ROATCE(1) (%) Consensus ROAA Estimates(3) (%) Consensus ROATCE Estimates(3) (%) (2) (2)

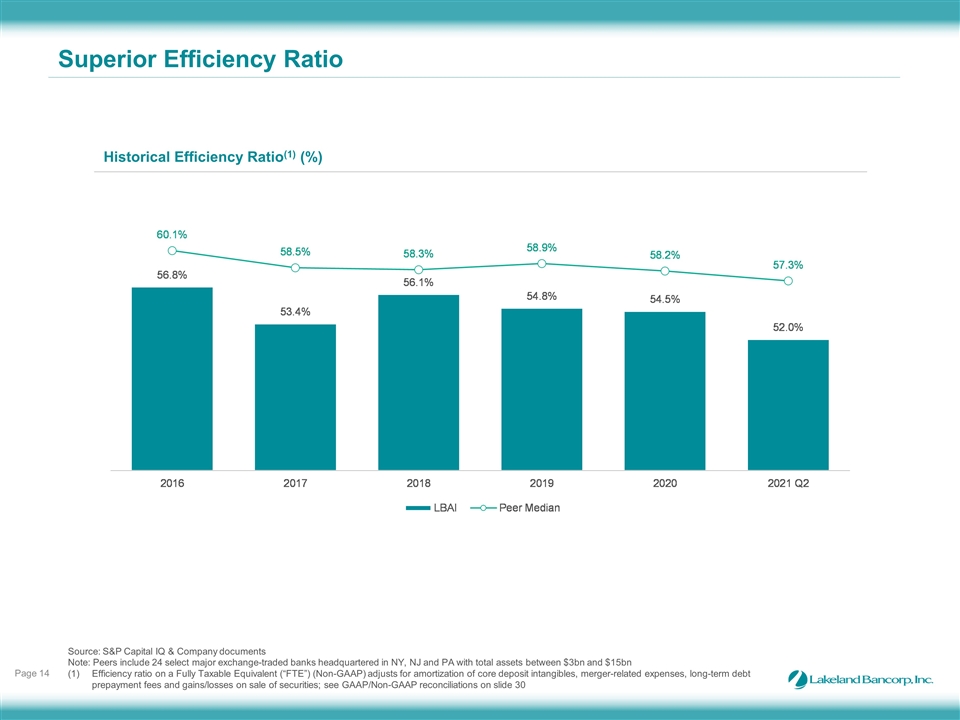

Superior Efficiency Ratio 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ & Company documents Note: Peers include 24 select major exchange-traded banks headquartered in NY, NJ and PA with total assets between $3bn and $15bn Efficiency ratio on a Fully Taxable Equivalent (“FTE”) (Non-GAAP) adjusts for amortization of core deposit intangibles, merger-related expenses, long-term debt prepayment fees and gains/losses on sale of securities; see GAAP/Non-GAAP reconciliations on slide 30 Historical Efficiency Ratio(1) (%)

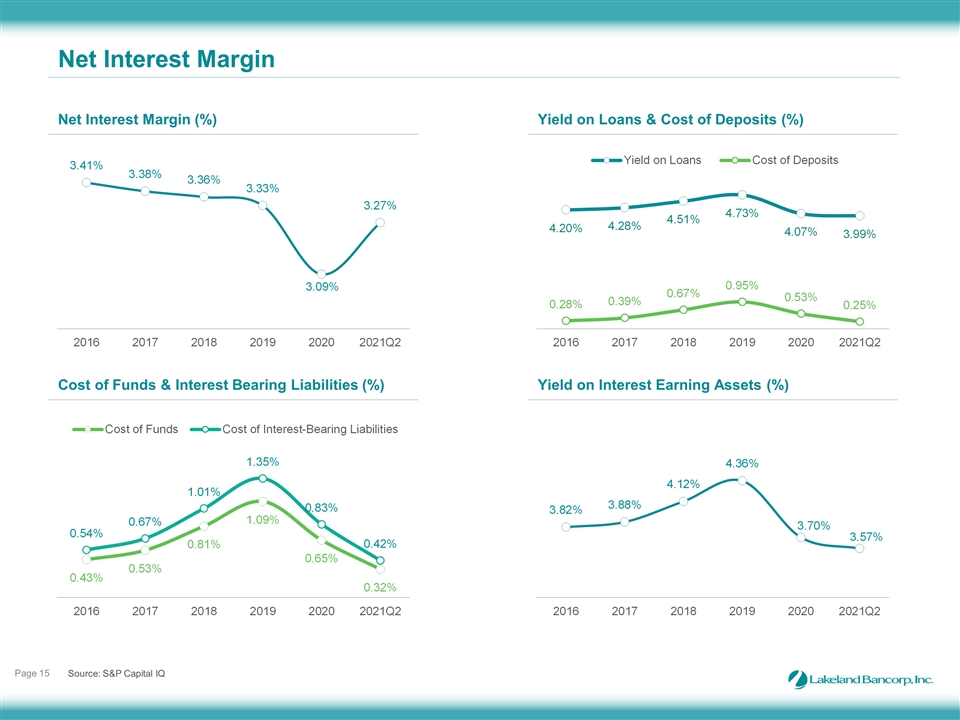

Net Interest Margin Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ Net Interest Margin (%) Yield on Loans & Cost of Deposits (%) Yield on Interest Earning Assets (%) Cost of Funds & Interest Bearing Liabilities (%)

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

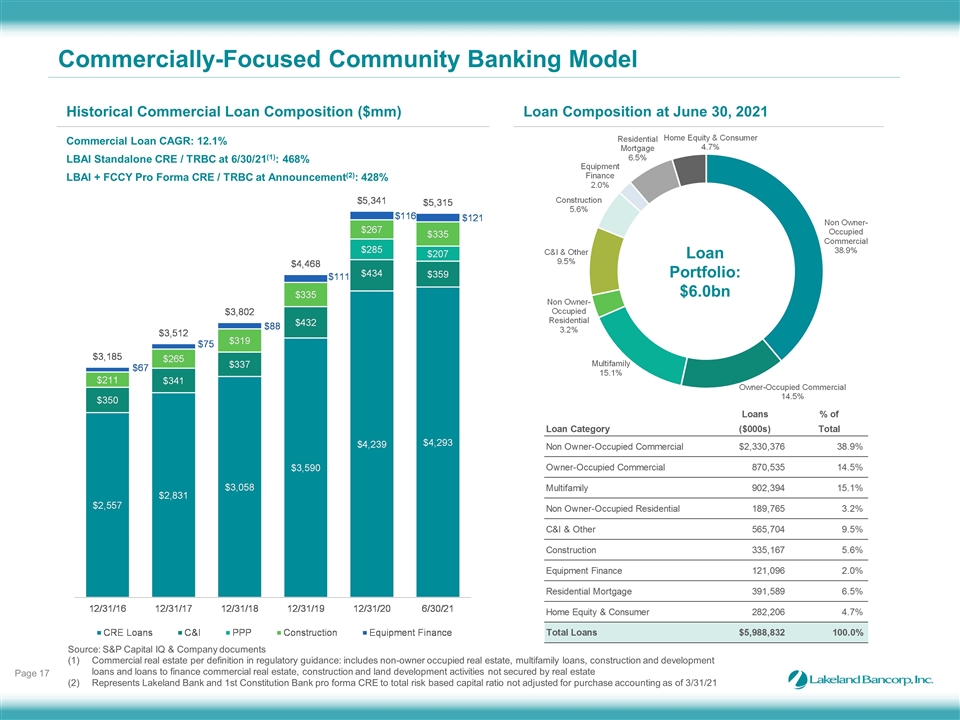

Commercially-Focused Community Banking Model 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Historical Commercial Loan Composition ($mm) Loan Composition at June 30, 2021 Loan Portfolio: $6.0bn Source: S&P Capital IQ & Company documents Commercial real estate per definition in regulatory guidance: includes non-owner occupied real estate, multifamily loans, construction and development loans and loans to finance commercial real estate, construction and land development activities not secured by real estate Represents Lakeland Bank and 1st Constitution Bank pro forma CRE to total risk based capital ratio not adjusted for purchase accounting as of 3/31/21 Commercial Loan CAGR: 12.1% LBAI Standalone CRE / TRBC at 6/30/21(1): 468% LBAI + FCCY Pro Forma CRE / TRBC at Announcement(2): 428%

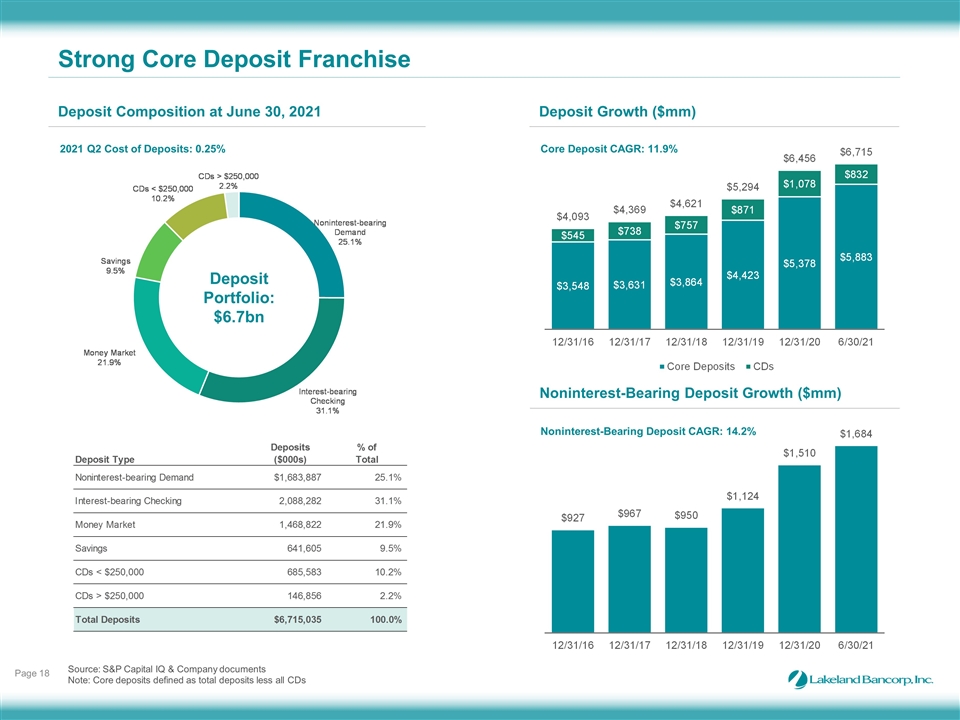

Strong Core Deposit Franchise Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Noninterest-Bearing Deposit Growth ($mm) 2021 Q2 Cost of Deposits: 0.25% Core Deposit CAGR: 11.9% Noninterest-Bearing Deposit CAGR: 14.2% Source: S&P Capital IQ & Company documents Note: Core deposits defined as total deposits less all CDs Deposit Portfolio: $6.7bn Deposit Composition at June 30, 2021 Deposit Growth ($mm)

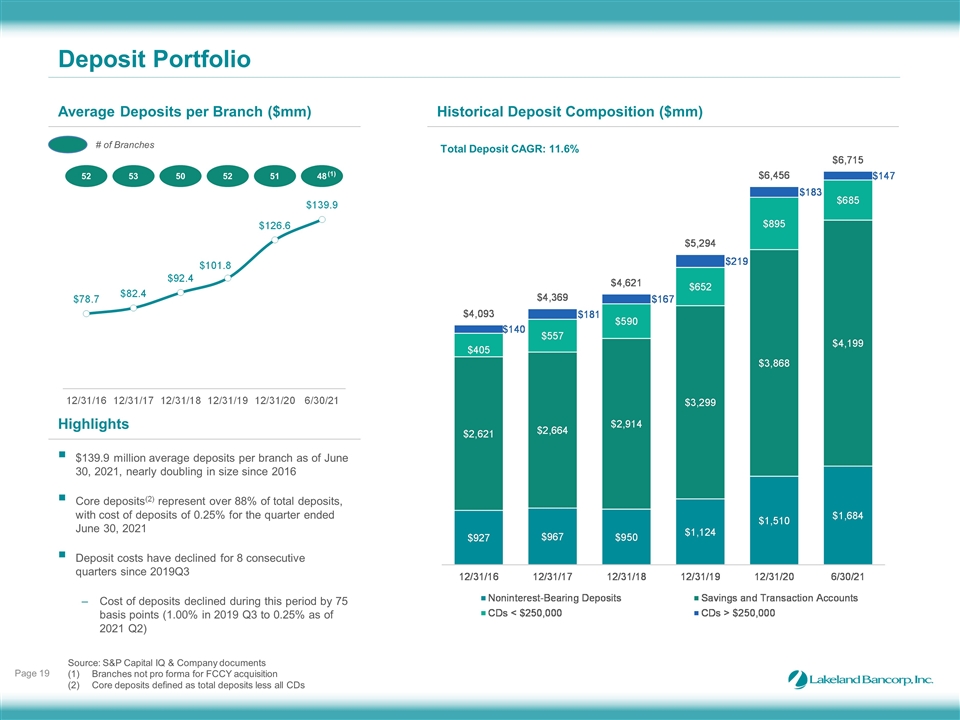

Deposit Portfolio 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ & Company documents Branches not pro forma for FCCY acquisition Core deposits defined as total deposits less all CDs Highlights $139.9 million average deposits per branch as of June 30, 2021, nearly doubling in size since 2016 Core deposits(2) represent over 88% of total deposits, with cost of deposits of 0.25% for the quarter ended June 30, 2021 Deposit costs have declined for 8 consecutive quarters since 2019Q3 Cost of deposits declined during this period by 75 basis points (1.00% in 2019 Q3 to 0.25% as of 2021 Q2) 52 53 50 52 51 48 # of Branches (1) Average Deposits per Branch ($mm) Historical Deposit Composition ($mm) Total Deposit CAGR: 11.6%

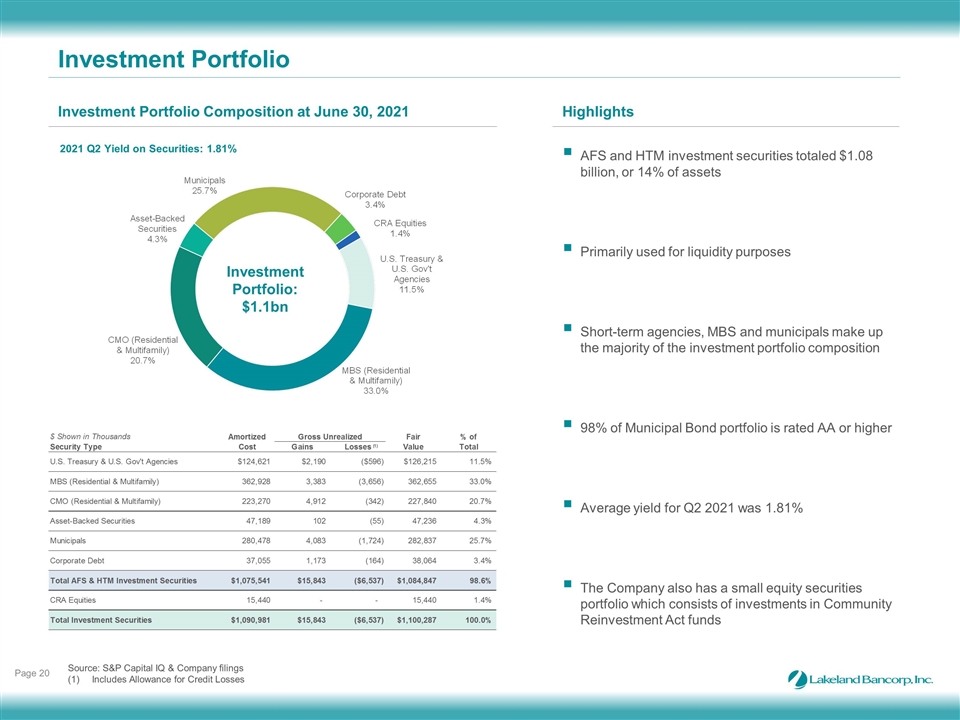

Investment Portfolio Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ & Company filings Includes Allowance for Credit Losses Investment Portfolio: $1.1bn 2021 Q2 Yield on Securities: 1.81% AFS and HTM investment securities totaled $1.08 billion, or 14% of assets Primarily used for liquidity purposes Short-term agencies, MBS and municipals make up the majority of the investment portfolio composition 98% of Municipal Bond portfolio is rated AA or higher Average yield for Q2 2021 was 1.81% The Company also has a small equity securities portfolio which consists of investments in Community Reinvestment Act funds Investment Portfolio Composition at June 30, 2021 Highlights

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

Asset Quality Overview 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 NPAs(1) / Assets (%) Reserves / Loans (%) Reserves / NPLs(1) (%) NPAs decreased by 47% to $22.6 million at 6/30/21 compared to $42.8 million at 12/31/20 Q2 and YTD 2021 results were favorably impacted by benefits for credit losses of $6.0 million and $8.6 million, respectively As of 3/31/21, no loans were on COVID-related deferrals as remaining loan deferments expired and borrowers resumed pre-deferral loan payments Q2 2021 included the sale of nonperforming residential mortgages and consumer loans totaling $5.0 million Recent Highlights Source: S&P Capital IQ and Company filings NPAs and NPLs include non-accrual purchased credit deteriorated loans from December 31, 2020 onward as well as TDRs

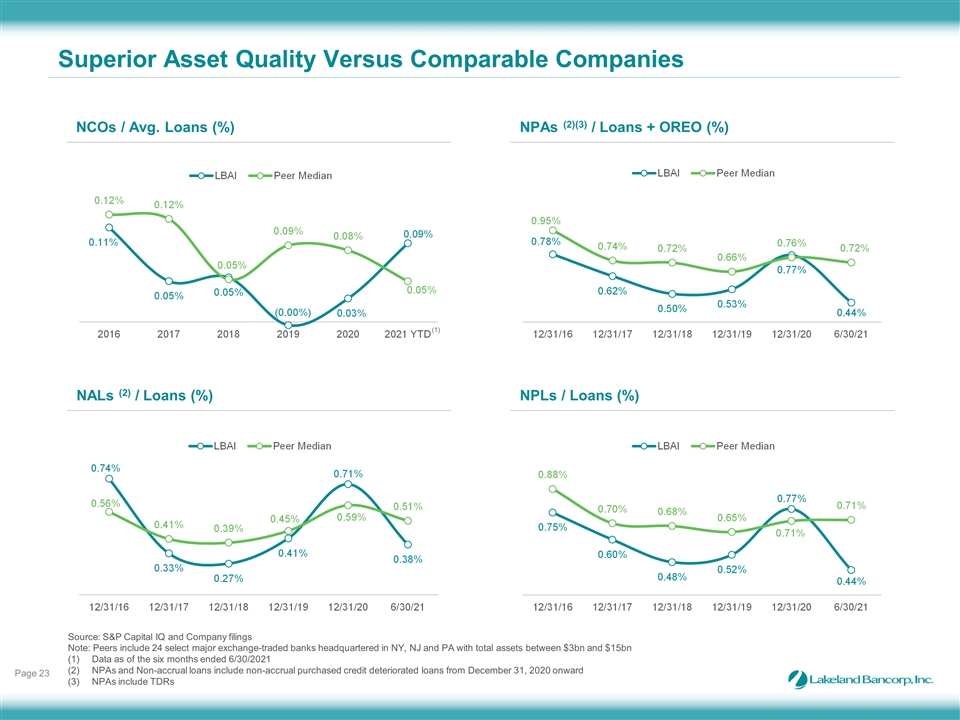

Superior Asset Quality Versus Comparable Companies 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 NCOs / Avg. Loans (%) NPAs (2)(3) / Loans + OREO (%) NALs (2) / Loans (%) NPLs / Loans (%) Source: S&P Capital IQ and Company filings Note: Peers include 24 select major exchange-traded banks headquartered in NY, NJ and PA with total assets between $3bn and $15bn Data as of the six months ended 6/30/2021 NPAs and Non-accrual loans include non-accrual purchased credit deteriorated loans from December 31, 2020 onward NPAs include TDRs (1)

Capital Position Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ See GAAP/Non-GAAP reconciliations on slide 30 Tangible Common Equity / Tangible Assets(1) (%) CET1 Ratio (%) Tier 1 Risk-Based Ratio (%) Total Risk-Based Capital Ratio (%)

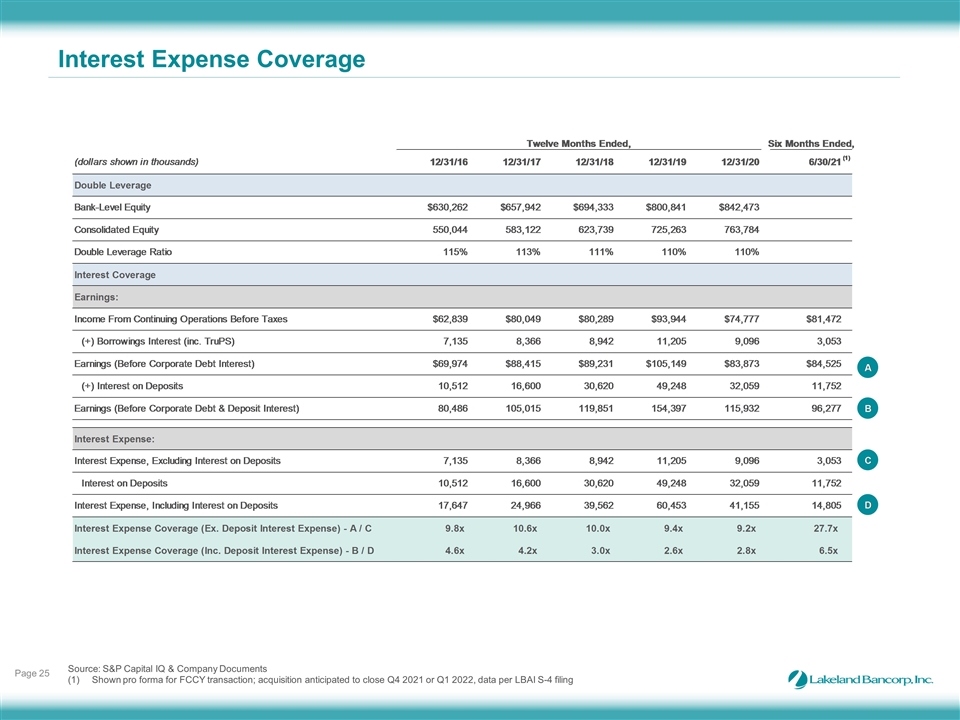

Interest Expense Coverage 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: S&P Capital IQ & Company Documents Shown pro forma for FCCY transaction; acquisition anticipated to close Q4 2021 or Q1 2022, data per LBAI S-4 filing

Table of Contents 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Company Overview 1 Risk Management & Capital Position 4 Appendix 5 Financial Highlights 2 Loan, Deposit and Securities Portfolio 3

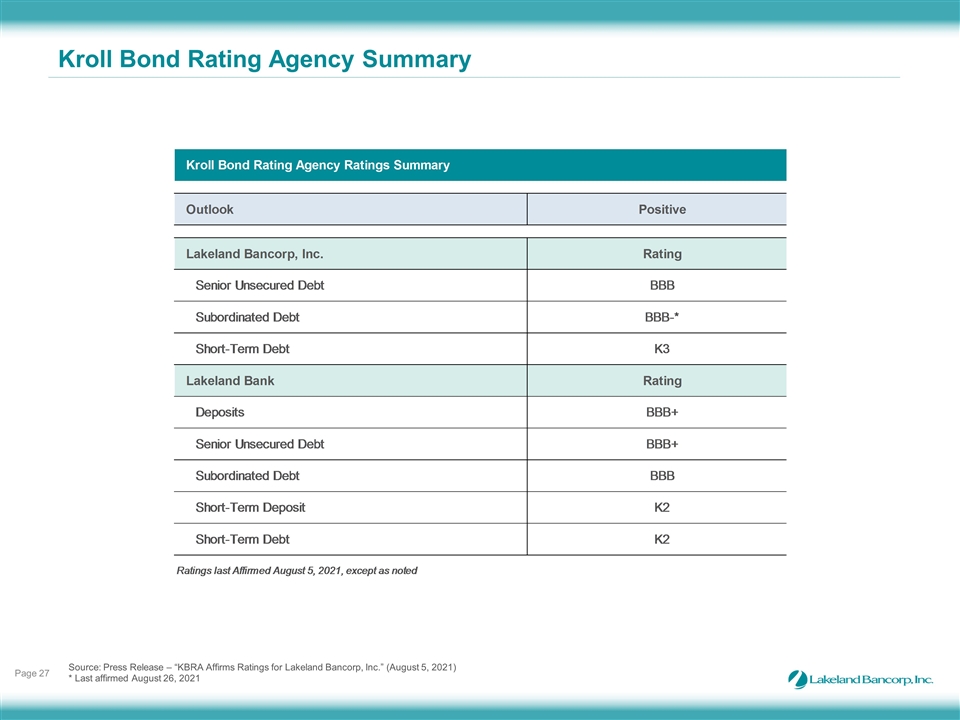

Kroll Bond Rating Agency Summary Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234 Source: Press Release – “KBRA Affirms Ratings for Lakeland Bancorp, Inc.” (August 5, 2021) * Last affirmed August 26, 2021

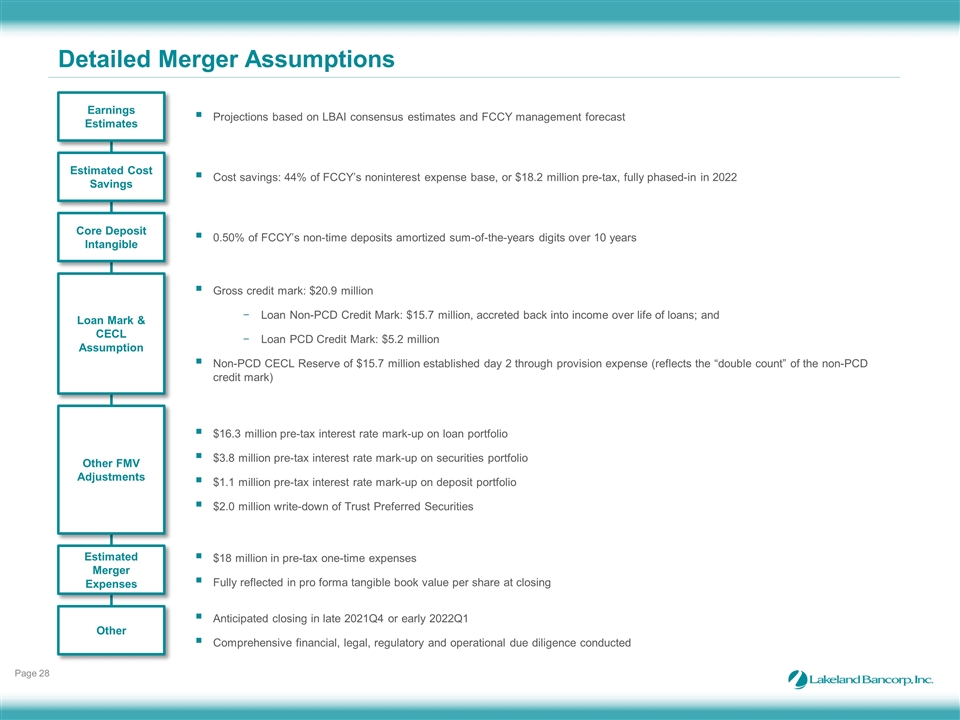

Detailed Merger Assumptions Page Projections based on LBAI consensus estimates and FCCY management forecast Earnings Estimates Estimated Cost Savings Core Deposit Intangible Loan Mark & CECL Assumption Other FMV Adjustments Estimated Merger Expenses Other Cost savings: 44% of FCCY’s noninterest expense base, or $18.2 million pre-tax, fully phased-in in 2022 0.50% of FCCY’s non-time deposits amortized sum-of-the-years digits over 10 years Gross credit mark: $20.9 million Loan Non-PCD Credit Mark: $15.7 million, accreted back into income over life of loans; and Loan PCD Credit Mark: $5.2 million Non-PCD CECL Reserve of $15.7 million established day 2 through provision expense (reflects the “double count” of the non-PCD credit mark) $16.3 million pre-tax interest rate mark-up on loan portfolio $3.8 million pre-tax interest rate mark-up on securities portfolio $1.1 million pre-tax interest rate mark-up on deposit portfolio $2.0 million write-down of Trust Preferred Securities $18 million in pre-tax one-time expenses Fully reflected in pro forma tangible book value per share at closing Anticipated closing in late 2021Q4 or early 2022Q1 Comprehensive financial, legal, regulatory and operational due diligence conducted 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234

GAAP / Non-GAAP Reconciliations Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234

GAAP / Non-GAAP Reconciliations (Continued) Page 0, 140, 153 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 14, 137, 119 8, 176, 152 96, 194, 80 166, 182, 64 215, 237, 234