Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Mallinckrodt plc | d41435dex993.htm |

| EX-99.5 - EX-99.5 - Mallinckrodt plc | d41435dex995.htm |

| EX-99.4 - EX-99.4 - Mallinckrodt plc | d41435dex994.htm |

| EX-99.2 - EX-99.2 - Mallinckrodt plc | d41435dex992.htm |

| 8-K - 8-K - Mallinckrodt plc | d41435d8k.htm |

Exhibit 99.1 SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Mallinckrodt Pharmaceuticals: Updated FY2021 Forecast and Sources & Uses at Emergence August 2021Exhibit 99.1 SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Mallinckrodt Pharmaceuticals: Updated FY2021 Forecast and Sources & Uses at Emergence August 2021

SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Disclaimers Cautionary Statements Related to Forward-Looking Statements Statements in this document that are not strictly historical, including statements regarding future financial condition and operating results, legal, economic, business, competitive and/or regulatory factors affecting Mallinckrodt’s businesses, and any other statements regarding events or developments the company believes or anticipates will or may occur in the future, may be “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to Mallinckrodt’s business are identified and described in more detail in Part I, Item 1A. Risk Factors in its Annual Report on Form 10-K for the year ended December 25, 2020, filed with the SEC on March 10, 2021. The forward-looking statements made herein speak only as of the date hereof and Mallinckrodt does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law. Non-GAAP Financial Measures When the Company provides its expectation for adjusted net sales and adjusted EBITDA on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures is not available without unreasonable effort. This document contains financial measures, such as adjusted net sales and adjusted EBITDA, which are considered “non-GAAP” financial measures under applicable SEC rules and regulations. Adjusted net sales represents net sales prepared in accordance with GAAP adjusted to remove the impact of the significant legal and environmental charge related to the Medicaid lawsuit and foreign currency fluctuations. Adjusted EBITDA represents amounts prepared in accordance with GAAP and adjusts for certain items that management believes are not reflective of the operational performance of the business. Consolidated adjusted EBITDA represents net income (loss), adjusted for interest expense, net, taxes, depreciation and amortization and certain items that management believes are not reflective of the operational performance of the business and additional adjustments. These adjustments include, but are not limited to, restructuring charges, net; non-restructuring impairment charges; inventory step-up expense; discontinued operations; changes in fair value of contingent consideration obligations; significant legal and environmental charges; divestitures; separation costs; gain on debt extinguishment, net; unrealized gain on equity investment; research & development upfront payments; reorganization items, net; share-based compensation and other items identified by the Company. When the Company provides its expectation for adjusted net sales and adjusted EBITDA on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the ultimate outcome of pending litigation, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. This non-GAAP information should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. 2SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Disclaimers Cautionary Statements Related to Forward-Looking Statements Statements in this document that are not strictly historical, including statements regarding future financial condition and operating results, legal, economic, business, competitive and/or regulatory factors affecting Mallinckrodt’s businesses, and any other statements regarding events or developments the company believes or anticipates will or may occur in the future, may be “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to Mallinckrodt’s business are identified and described in more detail in Part I, Item 1A. Risk Factors in its Annual Report on Form 10-K for the year ended December 25, 2020, filed with the SEC on March 10, 2021. The forward-looking statements made herein speak only as of the date hereof and Mallinckrodt does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law. Non-GAAP Financial Measures When the Company provides its expectation for adjusted net sales and adjusted EBITDA on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures is not available without unreasonable effort. This document contains financial measures, such as adjusted net sales and adjusted EBITDA, which are considered “non-GAAP” financial measures under applicable SEC rules and regulations. Adjusted net sales represents net sales prepared in accordance with GAAP adjusted to remove the impact of the significant legal and environmental charge related to the Medicaid lawsuit and foreign currency fluctuations. Adjusted EBITDA represents amounts prepared in accordance with GAAP and adjusts for certain items that management believes are not reflective of the operational performance of the business. Consolidated adjusted EBITDA represents net income (loss), adjusted for interest expense, net, taxes, depreciation and amortization and certain items that management believes are not reflective of the operational performance of the business and additional adjustments. These adjustments include, but are not limited to, restructuring charges, net; non-restructuring impairment charges; inventory step-up expense; discontinued operations; changes in fair value of contingent consideration obligations; significant legal and environmental charges; divestitures; separation costs; gain on debt extinguishment, net; unrealized gain on equity investment; research & development upfront payments; reorganization items, net; share-based compensation and other items identified by the Company. When the Company provides its expectation for adjusted net sales and adjusted EBITDA on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the ultimate outcome of pending litigation, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. This non-GAAP information should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. 2

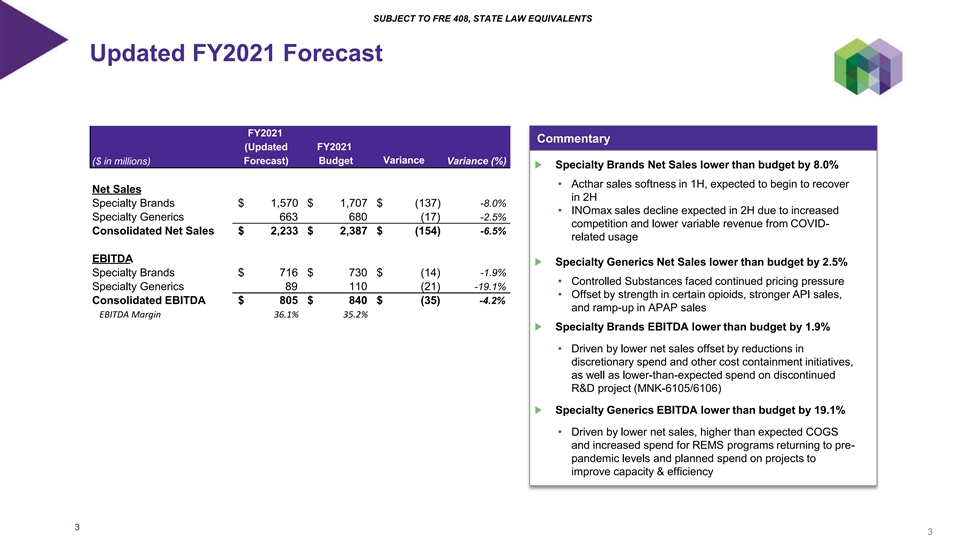

SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Updated FY2021 Forecast FY2021 Commentary (Updated FY2021 Forecast) Budget Variance Variance (%) ($ in millions) Specialty Brands Net Sales lower than budget by 8.0% • Acthar sales softness in 1H, expected to begin to recover Net Sales in 2H Specialty Brands $ 1,570 $ 1,707 $ (137) -8.0% • INOmax sales decline expected in 2H due to increased Specialty Generics 663 680 (17) -2.5% competition and lower variable revenue from COVID- Consolidated Net Sales $ 2,233 $ 2,387 $ (154) -6.5% related usage EBITDA Specialty Generics Net Sales lower than budget by 2.5% Specialty Brands $ 716 $ 730 $ (14) -1.9% • Controlled Substances faced continued pricing pressure Specialty Generics 89 110 (21) -19.1% • Offset by strength in certain opioids, stronger API sales, Consolidated EBITDA $ 805 $ 840 $ (35) -4.2% and ramp-up in APAP sales EBITDA Margin 36.1% 35.2% Specialty Brands EBITDA lower than budget by 1.9% • Driven by lower net sales offset by reductions in discretionary spend and other cost containment initiatives, as well as lower-than-expected spend on discontinued R&D project (MNK-6105/6106) Specialty Generics EBITDA lower than budget by 19.1% • Driven by lower net sales, higher than expected COGS and increased spend for REMS programs returning to pre- pandemic levels and planned spend on projects to improve capacity & efficiency 3 3

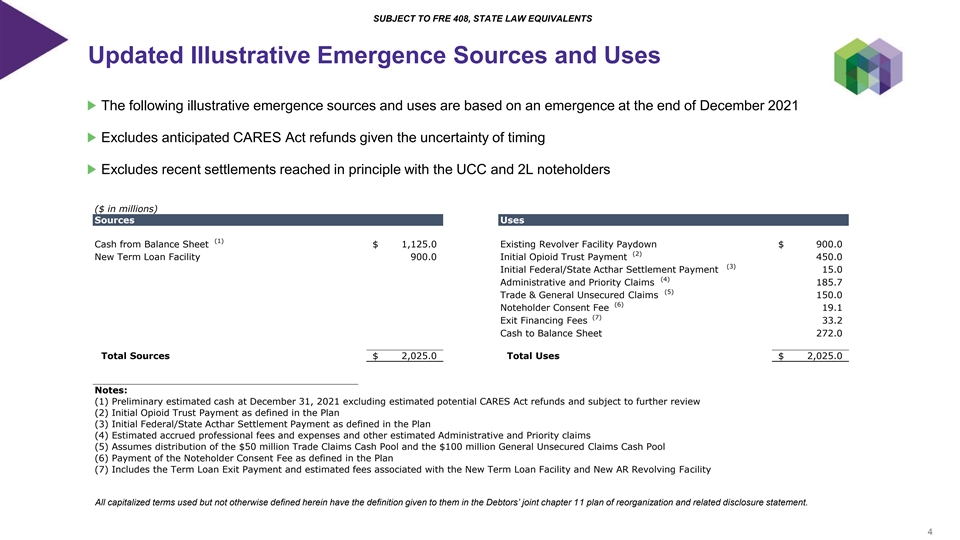

SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Updated Illustrative Emergence Sources and Uses The following illustrative emergence sources and uses are based on an emergence at the end of December 2021 Excludes anticipated CARES Act refunds given the uncertainty of timing Excludes recent settlements reached in principle with the UCC and 2L noteholders ($ in millions) Sources Uses (1) Cash from Balance Sheet $ 1,125.0 Existing Revolver Facility Paydown $ 900.0 (2) New Term Loan Facility 900.0 Initial Opioid Trust Payment 450.0 (3) Initial Federal/State Acthar Settlement Payment 15.0 (4) Administrative and Priority Claims 185.7 (5) Trade & General Unsecured Claims 150.0 (6) Noteholder Consent Fee 19.1 (7) Exit Financing Fees 33.2 Cash to Balance Sheet 272.0 Total Sources $ 2,025.0 Total Uses $ 2,025.0 Notes: (1) Preliminary estimated cash at December 31, 2021 excluding estimated potential CARES Act refunds and subject to further review (2) Initial Opioid Trust Payment as defined in the Plan (3) Initial Federal/State Acthar Settlement Payment as defined in the Plan (4) Estimated accrued professional fees and expenses and other estimated Administrative and Priority claims (5) Assumes distribution of the $50 million Trade Claims Cash Pool and the $100 million General Unsecured Claims Cash Pool (6) Payment of the Noteholder Consent Fee as defined in the Plan (7) Includes the Term Loan Exit Payment and estimated fees associated with the New Term Loan Facility and New AR Revolving Facility All capitalized terms used but not otherwise defined herein have the definition given to them in the Debtors’ joint chapter 11 plan of reorganization and related disclosure statement. 4SUBJECT TO FRE 408, STATE LAW EQUIVALENTS Updated Illustrative Emergence Sources and Uses The following illustrative emergence sources and uses are based on an emergence at the end of December 2021 Excludes anticipated CARES Act refunds given the uncertainty of timing Excludes recent settlements reached in principle with the UCC and 2L noteholders ($ in millions) Sources Uses (1) Cash from Balance Sheet $ 1,125.0 Existing Revolver Facility Paydown $ 900.0 (2) New Term Loan Facility 900.0 Initial Opioid Trust Payment 450.0 (3) Initial Federal/State Acthar Settlement Payment 15.0 (4) Administrative and Priority Claims 185.7 (5) Trade & General Unsecured Claims 150.0 (6) Noteholder Consent Fee 19.1 (7) Exit Financing Fees 33.2 Cash to Balance Sheet 272.0 Total Sources $ 2,025.0 Total Uses $ 2,025.0 Notes: (1) Preliminary estimated cash at December 31, 2021 excluding estimated potential CARES Act refunds and subject to further review (2) Initial Opioid Trust Payment as defined in the Plan (3) Initial Federal/State Acthar Settlement Payment as defined in the Plan (4) Estimated accrued professional fees and expenses and other estimated Administrative and Priority claims (5) Assumes distribution of the $50 million Trade Claims Cash Pool and the $100 million General Unsecured Claims Cash Pool (6) Payment of the Noteholder Consent Fee as defined in the Plan (7) Includes the Term Loan Exit Payment and estimated fees associated with the New Term Loan Facility and New AR Revolving Facility All capitalized terms used but not otherwise defined herein have the definition given to them in the Debtors’ joint chapter 11 plan of reorganization and related disclosure statement. 4