Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - HomeStreet, Inc. | hmst-20210726.htm |

Nasdaq: HMST 2nd Quarter 2021 July 26, 2021

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance, business plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, and related to future plans and strategies, anticipated events, outcomes, or trends, as well as a number of assumptions concerning future events, are not historical facts and are identified by words such a “will,” “may,” “could,” “should,” “would,” “believe,” “expect,” anticipate” and similar expressions. Forward-looking statements in this presentation include, among other matters, statements regarding our business plans and strategies, general economic trends, strategic initiatives we have announced, including forecasted reductions in the Company’s cost structure and future run rates, growth scenarios and performance targets and guidance with respect to loans held for investment, average deposits, net interest margin noninterest income and noninterest expense. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual Report on Form 10-K for the year ended December 31, 2020, and in our subsequently quarterly reports on Form 10-Q and Forms 8-K. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward- looking statements. These risks include, without limitation, changes in general political and economic conditions that impact our markets and our business, actions by the Federal Reserve Board and financial market conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital requirements or otherwise constrain our ability to do business, including restrictions that could be imposed by our regulators on certain aspects of our operations, our growth initiatives and acquisition activities, and our capital management plan, risks related to our ability to: retain adequate key personnel to operate our business, realize the expected cost savings from restructuring activities and cost containment measures that we have undertaken or have announced, continue to expand our commercial and consumer banking operations, grow our franchise and capitalize on market opportunities, cost-effectively manage our overall growth efforts to attain the desired operational and financial outcomes, manage the losses inherent in our loan portfolio, improve long-term shareholder value through effective use of our surplus capital, make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to our restrictive and complex regulatory environment and effectively respond to the changes in the global, national, state and local markets caused by or related to the COVID-19 pandemic, and the success of mitigation measures, including vaccine programs. Actual results may fall materially short of our expectations and projections, and we may be unable to execute on our strategic initiatives, or we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to us as of the date hereof, and we do not undertake to update or revise any forward-looking statements for any reason. Non-GAAP Financial Measures Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in the appendix, our SEC filings, and in the earnings release available on our web site. p. 1

Highlights and Developments p. 2 Quarterly Results • Net income of $29.2 million, or $1.37 per share • ROE of 16.3%, ROTCE of 17.2%(1) and ROAA of 1.59% • Efficiency ratio of 62.8%(1) • Net interest margin increased to 3.45% • Cost of deposits of 0.16% on June 30, 2021 • Noninterest bearing deposits: 25.7% of total deposits on June 30, 2021 • Book Value per share of $34.09 and tangible book value per share of $32.53(1) on June 30, 2021 Year to Date Results • Net income of $58.8 million, or $2.72 per share • ROE of 16.4%, ROTCE of 17.2%(1) and ROAA of 1.62% • Efficiency ratio of 61.3%(1) Other Results • Repurchased a total of 565,356 shares at an average price of $44.22 per share during the quarter. Over 5% of shares repurchased since beginning of the year. • Declared and paid a quarterly cash dividend of $0.25 per share HomeStreet’s earnings during the second quarter of 2021 reflected strong underlying performance across all of our lines of business. Our loan portfolio continues to perform well with low levels of delinquencies and problem assets (1) See appendix for reconciliation of non-GAAP financial measures.

p. 3 Focus on growth, profitability and efficiency while emerging as a leading western regional bank • Seattle-based diversified commercial & consumer bank – company founded in 1921 • Serving customers throughout the western United States • 67 bank branches and primary offices • Total assets $7.2 billion Nasdaq: HMST

HomeStreet Turns 100 • On August 18, 2021, HomeStreet, Inc. will celebrate its 100th anniversary • At that time, incorporations were either delivered by horseback, steam wheeler, or train • Of the nearly 2,900 incorporations filed that year, only 33 exist today • Things have changed much during the past century, but HomeStreet has always served its communities with the highest standards and care, surviving the Great Depression, wars, the Thrift Crisis, the Great Recession, and the current pandemic • We don’t know what challenges will face us in the future, but with our culture, employees and loyal customers we feel confident we will continue to thrive p. 4University Village Apartments, Seattle, WA

Seattle Metro Washington Oregon Idaho Utah California Hawaii Southern California Retail deposit branches (61) Primary stand-alone insurance office (1) Primary stand-alone lending centers (5) HomeStreet p. 5 The number of offices depicted does not include satellite offices that have a limited number of staff which report to a manager located in a separate primary office. Market Focus: • Seattle / Puget Sound & Eastern WA • Southern California • Portland, OR • Hawaiian Islands • San Francisco / Bay Area, CA Strategy: • Grow loan and core deposit portfolios • Optimize capitalization • Grow market share in highly attractive metropolitan markets • Improve operating efficiency • Introduce smart product offerings – fast follower of technology

28.73 30.15 31.42 31.31 32.53 $0.30 $0.45 $0.60 $0.85 $1.10 $- $0.50 $1.00 $1.50 $2.00 $24 $26 $28 $30 $32 $34 2Q20 3Q20 4Q20 1Q21 2Q21 TBVPS Cummulative Dividends Shareholder Value and Active Capital Management Growth in Tangible Book Value per Share(1)(2) p. 6 (1) Source: Bloomberg (2) See appendix for reconciliation of non-GAAP financial measures. • TBVPS increased 23.5% since June 30, 2019 11.8% 9.2% 5.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 2019 2020 2021 YTD Shares repurchased % of Stock O/S beginning of period Share Repurchases 2019 2020 2021 Total Total (in 000's) 98,025$ 58,020$ 50,000$ 206,045$ Average Price 30.76$ 26.31$ 44.39$ 31.61$

Shareholder Returns p. 7 Since IPO 5-Year 3-Year 1-Year YTD HomeStreet 291% 111% 56% 69% 22% KBW Regional Banking Index (KRX) 184% 71% 15% 71% 28% Above / (Below) KRX 107 PPT 40 PPT 41 PPT (2) PPT (6) PPT Total Shareholder Returns (1) (TSR) at a Glance (1) Source: Bloomberg

$51.5 $55.7 $56.0 $54.5 $58.0 3.12% 3.20% 3.26% 3.29% 3.45% 2Q20 3Q20 4Q20 1Q21 2Q21 Net Interest Income Net Interest Margin Net Interest Income & Margin p. 8 $ Millions • Increasing net interest margin • Stable funding costs • PPP loan forgiveness (15 basis point impact in 2021 Q2)

$6.67 $6.97 $6.88 $6.74 $6.78 3.74% 3.66% 3.65% 3.60% 3.70% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $1 $2 $3 $4 $5 $6 $7 $8 2Q20 3Q20 4Q20 1Q21 2Q21 Investment Securities Loans Average Yield Interest-Earning Assets p. 9 Average Balances $ Billions Average Rate Percent

$5.07 $5.19 $5.09 $4.92 $4.88 0.81% 0.62% 0.52% 0.42% 0.35%0.51% 0.36% 0.29% 0.21% 0.16% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $1 $2 $3 $4 $5 $6 2Q20 3Q20 4Q20 1Q21 2Q21 Total Borrowings Interest Bearing Deposits Average Rate Period End Cost of Deposits Interest-Bearing Liabilities Average Balances p. 10 $ Billions Average Rate Percent

23% 23% 23% 24% 26% 57% 57% 57% 57% 57% 20% 20% 20% 19% 17% $- $1 $2 $3 $4 $5 $6 $7 2Q20 3Q20 4Q20 1Q21 2Q21 Time Deposits Interest-Bearing Transaction & Savings Deposits Noninterest-Bearing Transaction & Savings Deposits Deposits p. 11 $5.66 $5.82 $5.82 $6.13 $6.09 Period End Balances $ Billions During the second quarter of 2021, consumer and business noninterest-bearing deposit accounts grew by 8%

$36.6 $36.2 $44.0 $38.8 $28.2 -$10 $0 $10 $20 $30 $40 $50 2Q20 3Q20 4Q20 1Q21 2Q21 Other Deposit Fees Loan Servicing Income Net Gain on Commercial & CRE Loan Sales Net Gain on Single Family Loan Sales Noninterest Income p. 12 $ Millions Other consists of insurance agency commissions, swap income, gain (loss) on sale of securities, and other miscellaneous income

303 566 517 561 564 512 393 442 340 537 573 629 624 5632.67% 3.15% 5.47% 4.92% 4.80% 5.12% 4.03% 1% 2% 3% 4% 5% 6% $200 $300 $400 $500 $600 $700 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Rate Locks Loans Closed GOS Margin Single Family Loan Sales p. 13 $ Millions

32% 26% 26% 25% 17% 10% 15% 20% 25% 30% 35% 40% 2Q20 3Q20 4Q20 1Q21 2Q21 Single Family Mortgage Banking: % of Total Revenues p. 14

30% 40% 50% 60% 70% 80% 90% 100% 200 250 300 350 400 450 500 550 600 650 700 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Impact of Closings/Locks Rate locks Loan Closings SFMB Efficiency Ratio Single Family Mortgage Banking (SFMB) Analysis p. 15 40% 50% 60% 70% 80% 90% 100% Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Efficiency Ratios SFMB Excluding SFMB Consolidated (1) SFMB expenses do not include allocation of indirect expenses. (2) Second quarter 2021 SFMB efficiency ratio impacted by an imbalance between loans closed and rate locks. Revenues are predominately recognized at rate lock while expenses are predominately recognized at loan closing. (3) See appendix for reconciliation of Non-GAAP measures.

0% 1% 2% 3% 4% 5% 6% 7% $0 $100 $200 $300 $400 $500 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 DUS Sales CRE Sales DUS Margin CRE Margin Commercial Real Estate Loan Sales $ Millions p. 16 DUS margin in 2020 and 2021 periods excludes impact of periodic credit adjustments.

$57.7 $58.1 $64.8 $56.6 $52.8 55.5 55.7 58.7 56.6 . 987 999 1,013 1,013 997 900 1,00 1,10 1,20 1,30 $0 $10 $20 $30 $40 $50 $60 $70 2Q20 3Q20 4Q20 1Q21 2Q21 General, Administrative and Other Information services Occupancy Compensation & Benefits Core Noninterest Expense (1) FTE $52.8 Noninterest Expense p. 17 $ Millions (1) See appendix for reconciliation of non-GAAP financial measures. 2Q21 amounts include a $1.9 million recovery of legal costs.

C&I (1) 19% CRE Perm Nonowner 14% Multifamily 37% Construction All Types 9% Home Equity & Other 6% Single Family 15% Loan Portfolio p. 18 A highly diversified loan portfolio by product and geography. Multifamily 62% Industrial 8% Office 13% Retail 11% Other 6% Permanent CRE by Property Type: $3.2 Billion (1) Custom Home Construction 28% Multifamily Construction 9% CRE 5% Residential Construction 46% Land & Lots 12% Construction by Property Type: $484 Million Loan Composition: $5.4 Billion (1) - Includes owner occupied CRE

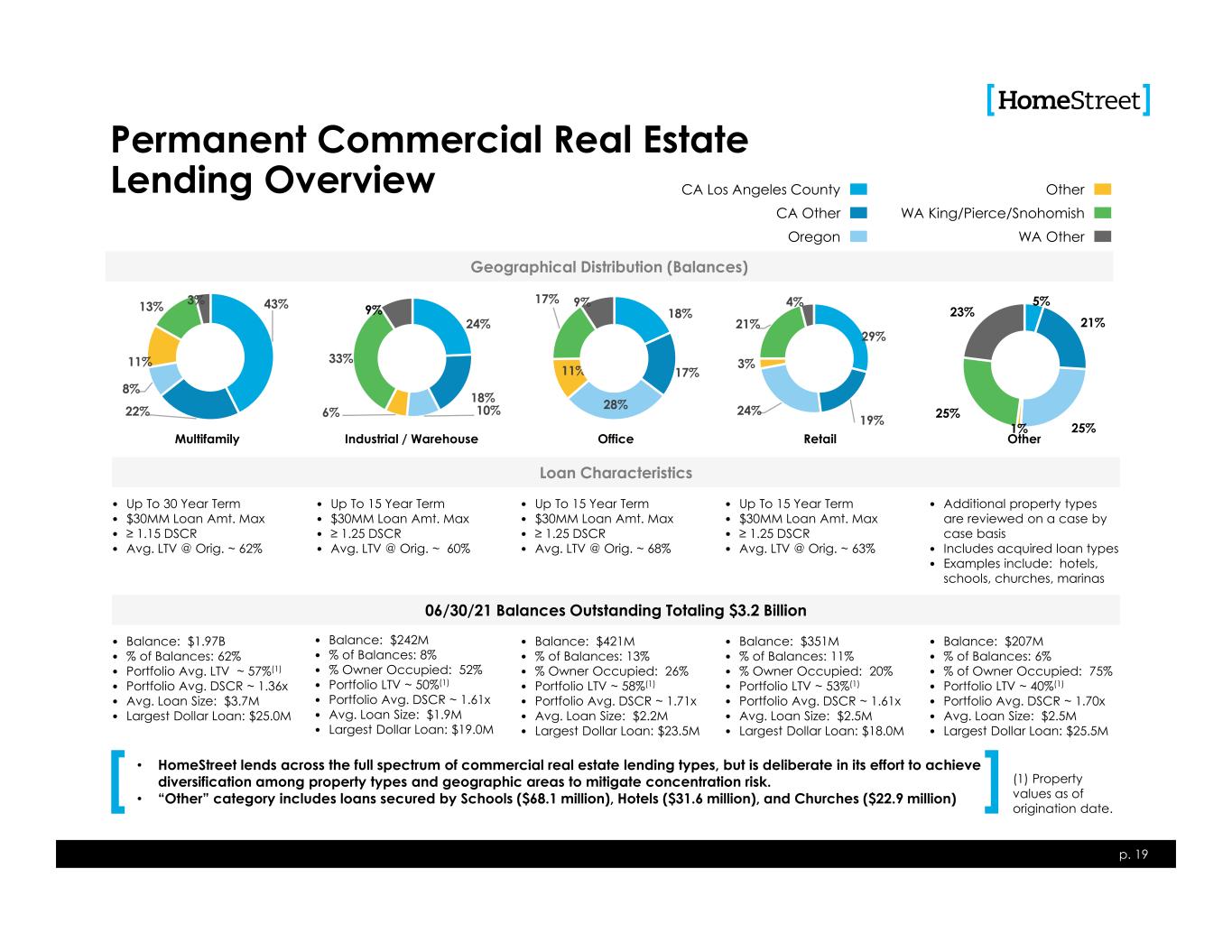

Permanent Commercial Real Estate Lending Overview • Up To 30 Year Term • $30MM Loan Amt. Max • ≥ 1.15 DSCR • Avg. LTV @ Orig. ~ 62% p. 19 Loan Characteristics • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 60% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 68% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 63% • Additional property types are reviewed on a case by case basis • Includes acquired loan types • Examples include: hotels, schools, churches, marinas • Balance: $1.97B • % of Balances: 62% • Portfolio Avg. LTV ~ 57%(1) • Portfolio Avg. DSCR ~ 1.36x • Avg. Loan Size: $3.7M • Largest Dollar Loan: $25.0M 06/30/21 Balances Outstanding Totaling $3.2 Billion • Balance: $242M • % of Balances: 8% • % Owner Occupied: 52% • Portfolio LTV ~ 50%(1) • Portfolio Avg. DSCR ~ 1.61x • Avg. Loan Size: $1.9M • Largest Dollar Loan: $19.0M • Balance: $421M • % of Balances: 13% • % Owner Occupied: 26% • Portfolio LTV ~ 58%(1) • Portfolio Avg. DSCR ~ 1.71x • Avg. Loan Size: $2.2M • Largest Dollar Loan: $23.5M • Balance: $351M • % of Balances: 11% • % Owner Occupied: 20% • Portfolio LTV ~ 53%(1) • Portfolio Avg. DSCR ~ 1.61x • Avg. Loan Size: $2.5M • Largest Dollar Loan: $18.0M • Balance: $207M • % of Balances: 6% • % of Owner Occupied: 75% • Portfolio LTV ~ 40%(1) • Portfolio Avg. DSCR ~ 1.70x • Avg. Loan Size: $2.5M • Largest Dollar Loan: $25.5M 43% 22% 8% 11% 13% 3% Geographical Distribution (Balances) Multifamily 24% 18% 10%6% 33% 9% Industrial / Warehouse 18% 17% 28% 11% 17% 9% Office 29% 19% 24% 3% 21% 4% Retail 5% 21% 25%1% 25% 23% Other CA Los Angeles County CA Other Oregon Other WA King/Pierce/Snohomish WA Other (1) Property values as of origination date. • HomeStreet lends across the full spectrum of commercial real estate lending types, but is deliberate in its effort to achieve diversification among property types and geographic areas to mitigate concentration risk. • “Other” category includes loans secured by Schools ($68.1 million), Hotels ($31.6 million), and Churches ($22.9 million)

Construction Lending Overview • 12 Month Term • Consumer Owner Occupied • Borrower Underwritten similar to Single Family p. 20 Loan Characteristics • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.20 DSC • Portfolio LTV ~ 64% • Liquidity and DSC covenants • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.25 DSC • ≥ 50% pre-leased office/retail • Portfolio LTV ~39% • Liquidity and DSC covenants • 12-18 Month Term • LTC: ≤ 95% Presale & Spec • Leverage, Liquid. & Net Worth Covenants as appropriate • Portfolio LTV ~ 71% • 12-24 Month Term • ≤ 50% -80% LTC • Strong, experienced, vertically integrated builders • Portfolio LTV ~ 66% • Balance: $135M • Unfunded Commitments: $117M • % of Balances: 28% • % of Unfunded Commitments: 25% • Avg. Loan Size: $461K • Largest Dollar Loan: $1.8M 06/30/21 Balances Outstanding Totaling $484 Million • Balance: $43M • Unfunded Commitments: $42M • % of Balances: 9% • % of Unfunded Commitments: 9% • Avg. Loan Size: $5.4M • Largest Dollar Loan: $12.8M • Balance: $25M • Unfunded Commitments: $5M • % of Balances: 5% • % of Unfunded Commitments: 1% • Avg. Loan Size: $8.5M • Largest Dollar Loan: $15.8M • Balance: $224M • Unfunded Commitments: $288M • % of Balances: 46% • % of Unfunded Commitments: 61% • Avg. Loan Size: $339K • Largest Dollar Loan: $9.4M • Balance: $57M • Unfunded Commitments: $23M • % of Balances: 12% • % of Unfunded Commitments: 5% • Avg. Loan Size: $808K • Largest Dollar Loan: $4.0M 27% 14%37% 5% 1% 2% 13% Geographical Distribution (Balances) Custom Home Construction 27% 26%41% 6% Multifamily 30% 0% 62% 8% CRE 22% 14% 3%1% 2% 28% 10% 20% Residential Construction 39% 10% 11%9% 3% 16% 12% Land and Lots Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho Other: AZ, CO Construction lending is a broad category that includes many different loan types, which possess different risk profiles. HomeStreet lends across the full spectrum of construction lending types. Additionally, our expansion into additional markets has provided an opportunity to increase geographic diversification

Commercial Business Lending Overview Commercial Business Balances by Industry Type as of June 30, 2021 p. 21 27% 11% 10%7% 6% 6% 5% 5% 4% 19% Health Care and Social Assistance Manufacturing Professional, Scientific and Technical Services Accomodation and Food Services Construction Finance and Insurance Wholesale Trade Transportation and Warehousing Administrative and Support and Waste Management and Remediation Services All Other $575.1M

Allocation of Allowance by Product Type p. 22 $ Thousands June 30, 2021 December 31, 2020 Allowance for Credit Losses Reserve Amount Reserve Rate Reserve Amount Reserve Rate Non-owner Occupied CRE $9,077 1.19% $8,845 1.07% Multifamily 7,245 0.37% 6,072 0.43% Construction/Land Development Multifamily Construction 500 1.15% 4,903 4.25% Commercial RE Construction 2,022 6.75% 1,670 6.12% Single Family Construction 5,653 2.05% 5,130 1.98% Single Family Construction to Permanent 1,047 0.78% 1,315 0.87% Total CRE Loans 25,544 0.80% 27,935 0.99% Owner Occupied CRE 5,518 1.21% 4,994 1.08% Commercial Business 15,874 4.36% 17,043 4.72% Total C&I 21,392 2.61% 22,037 2.67% Single Family 7,163 1.02% 6,906 0.85% Home Equity and Other 5,798 1.74% 7,416 1.83% Total Consumer Loans 12,961 1.25% 14,322 1.18% Total Allowance for Credit Losses $59,897 1.18% $64,294 1.33% The reserve rate is calculated excluding balances related to loans that are insured by the FHA or guaranteed by the VA or SBA, including PPP loans

Outlook

Key Drivers Guidance Metric 2 to 3 Quarter Outlook Comments Loans Held for Investment Increasing • Increases in commercial real estate • Offset by PPP forgiveness Average Deposits Stable • Growth in consumer and business customers • Offset by use of Round 2 PPP funds Net Interest Margin Stable • PPP loan forgiveness • Lower cost of funds as deposits continue to reprice down • Partially offset by lower loan yields Noninterest Income Decreasing • Lower single family volume and profit margin Noninterest Expense Flat • Lower compensation expense from lower single family loan volumes • Offset by new technology initiatives and resumption of normalized marketing spend • Excludes impact of $1.9 million legal reimbursement in Q2 p. 24 The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk Factors,” in our most recent SEC filings including our Annual Report on Form 10-K, and our quarterly reports on Form 10-Q, for a list of factors that may cause us to deviate from our plans or to fall short of our expectations.

Appendix

Loans Held for Investment Balance Trend p. 26 Balances $ Millions June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Non-owner Occupied CRE $762 14% $766 14% $830 16% $847 16% $868 16% Multifamily 1,967 37% 1,521 29% 1,428 27% 1,327 25% 1,306 24% Construction / Land Development 484 9% 532 10% 554 11% 591 11% 630 12% Total CRE Loans $3,213 60% $2,819 53% $2,811 54% $2,765 52% $2,804 52% Owner Occupied CRE $458 8% $473 9% $467 9% $462 9% $463 8% Commercial Business 575 11% 758 14% 646 12% 684 13% 697 13% Total C&I Loans $1,033 19% $1,231 23% $1,113 21% $1,146 22% $1,160 21% Single Family $812 15% $875 17% $915 17% $937 18% $983 18% Home Equity and Other 335 6% 366 7% 405 18% 446 8% 485 9% Total Consumer Loans $1,147 21% $1,242 24% $1,320 25% $1,383 26% $1,468 27% Total Loans Held for Investment $5,393 100% $5,292 100% $5,244 100% $5,294 100% $5,432 100%

Loan Originations and Advances Trend p. 27 Originations and Advances $ Millions June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Non-owner Occupied CRE $14 2% $8 1% $18 2% $23 4% $4 1% Multifamily 514 56% 283 37% 354 48% 273 44% 191 23% Construction / Land Development 184 20% 166 22% 172 23% 153 25% 138 16% Total CRE Loans $711 78% $457 59% $544 74% $449 73% $333 40% Owner Occupied CRE $9 1% $33 4% $21 3% $15 2% $6 - Commercial Business 83 9% 164 22% 41 6% 35 6% 339 41% Total C&I loans $92 10% $197 26% $62 9% $50 8% $345 41% Single Family $78 9% $95 12% $103 14% $84 14% $122 15% Home Equity and Other 30 3% 20 3% 25 3% 29 5% 32 4% Total Consumer loans $108 12% $115 15% $128 17% $113 19% $154 19% Total $912 100% $769 100% $734 100% $612 100% $833 100%

Results of Operations Quarter Ended $ Thousands, Except Per Share Data June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Net Interest Income $57,972 $54.517 $56,048 $55,684 $51,496 Provision for Credit Losses (4,000) - - - 6,469 Noninterest Income 28,224 38,833 43,977 36,155 36,602 Noninterest Expense 52,815 56,608 64,770 58,057 57,652 Income Before Income Tax 37,381 36,742 35,255 33,782 23,977 Total 29,157 29,663 27,598 26,349 18,904 Income per Share – Diluted $1.37 $1.35 $1.25 $1.15 $0.81 Core Net Income (1) Total 29,157 29,663 32,384 28,187 20,155 Income per Share – Diluted $1.37 $1.35 $1.47 $1.23 $0.86 ROAA 1.59% 1.65% 1.47% 1.40% 1.05% Core ROAA(1) 1.59% 1.65% 1.73% 1.50% 1.12% ROAE 16.3% 16.4% 15.3% 14.6% 10.9% ROATCE(1) 17.2% 17.3% 16.2% 15.5% 11.6% Core ROATCE(1) 17.2% 17.3% 19.0% 16.6% 12.4% Net Interest Margin 3.45% 3.29% 3.26% 3.20% 3.12% Efficiency Ratio (1) 62.8% 60.0% 56.1% 59.9% 62.6% Full-Time-Equivalent Employees 997 1,013 1,013 999 987 Tier 1 Leverage Ratio (Bank) 9.95% 10.01% 9.79% 9.40% 9.79% Total Risk-Based Capital (Bank) 14.36% 14.84% 14.76% 13.95% 14.08% Tier 1 Leverage Ratio (Company) 9.78% 9.83% 9.65% 9.34% 9.73% Total Risk-Based Capital (Company) 13.59% 14.05% 14.00% 13.33% 13.48% p. 28 (1) See appendix for reconciliation of these non-GAAP financial measures.

Selected Balance Sheet and Other Data Quarter Ended $ Thousands, except per share data June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 Jun. 30, 2020 Loans Held For Sale $225,241 $390,223 $361,932 $421,737 $303,546 Loans Held for Investment, net 5,332,626 5,227,727 5,179,886 5,229,477 5,367,278 Allowance for Credit Losses 59,897 64,047 64,294 64,892 65,000 Investment Securities 1,007,658 1,049,105 1,076,364 1,111,468 1,171,821 Total Assets 7,167,951 7,265,191 7,237,091 7,409,641 7,351,118 Deposits 6,086,527 6,131,233 5,821,559 5,815,690 5,656,321 Borrowings 50,000 84,500 322,800 514,590 713,590 Long-Term Debt 125,932 125,885 125,838 125,791 125,744 Total Shareholders’ Equity 708,731 701,463 717,750 696,306 694,649 Other Data: Book Value per Share $34.09 $32.84 $32.93 $31.66 $30.19 Tangible Book Value per Share(1) $32.53 $31.31 $31.42 $30.15 $28.73 Shares Outstanding 20,791,659 21,360,514 21,796,904 21,994,204 23,007,400 Loans to Deposit Ratio 92.3% 92.7% 96.3% 98.3% 101.4% Asset Quality: ACL to Total Loans 1.18%(2) 1.34%(2) 1.33%(2) 1.33%(2) 1.30%(2) ACL to Nonaccrual Loans (2) 287.5% 297.3% 310.3% 307.2% 296.7% Nonaccrual Loans to Total Loans 0.39% 0.41% 0.40% 0.40% 0.40% Nonperforming Assets to Total Assets 0.31% 0.32% 0.31% 0.30% 0.31% Nonperforming Assets $22,319 $23,025 $22,097 $22,084 $22,642 p. 29 (1) See appendix for reconciliation of these non-GAAP financial measures. (2) The reserve ratio is calculated excluding balances related to loans that are insured by the FHA or guaranteed by the VA or SBA, including PPP loans

Credit Quality p. 30 $ Thousands June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 HMST Group Median HMST Group Median HMST Group Median HMST Group Median HMST Group Median Nonperforming Assets(1) $22,319 -- $23,025 -- $22,097 -- $22,084 -- $22,642 -- Nonperforming Loans $20,835 -- $21,541 -- $20,722 -- $21,126 -- $21,907 -- OREO $1,484 -- $1,484 -- $1,375 -- $958 -- $735 -- Nonperforming Assets/Total Assets(1) 0.31% (3) 0.32% 0.22% 0.31% 0.23% 0.30% 0.22% 0.31% 0.26% Nonperforming Loans/Total Loans 0.39% (3) 0.41% 0.34% 0.40% 0.33% 0.40% 0.33% 0.40% 0.34% Total Delinquencies/Total Loans 0.61% (3) 0.65% 0.54% 0.67% 0.52% 0.76% 0.56% 0.94% 0.59% Total Delinquencies/Total Loans, Adjusted(2) 0.36% (3) 0.39% 0.49% 0.39% 0.44% 0.42% 0.53% 0.51% 0.47% ACL/Nonperforming Loans (NPLs) 287.5% (3) 297.3% 418.94% 310.30% 349.70% 307.20% 414.08% 296.7% 406.10% (1) Nonperforming assets includes nonaccrual loans and OREO; excludes performing TDRs. (2) Total delinquencies and total loans – adjusted (net of Ginnie Mae EBO loans (FHA/VA loans) and guaranteed portion of SBA loans). (3) Not available at time of publication. The credit comparison group -- selected in consultation with our regulators, comprising banks with similar geographic footprint and loan portfolio characteristics -- consists of: Alpine Bank, Avidbank, Banc of California, Bank of Marin, Bank of the Sierra, Banner Bank, Cashmere Valley Bank, Cathay Bank, Central Valley Community Bank, Coastal Community Bank, Commercial Bank of California, CTBC Bank Corp., Exchange Bank, Farmers & Merchants Bank of Long Beach, First Choice Bank, First Financial Northwest Bank, Five Star Bank, Heritage Bank, Heritage Bank of Commerce, Kitsap Bank, Manufacturers Bank, Mechanics Bank, Montecito Bank & Trust, Oak Valley Community Bank, Opportunity Bank of Montana, Pacific Mercantile Bank, Pacific Premier Bank, Pacific Western Bank, Peoples Bank, Poppy Bank, Preferred Bank, Royal Business Bank, Silvergate Bank, Sunwest Bank, Tri Counties Bank, Umpqua Bank, Washington Federal Bank NA, and Washington Trust Bank. This group is not used for any other comparative purposes by HomeStreet.

Non-GAAP Financial Measures $ Thousands, Except Per Share Data Quarter Ended June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Tangible Book Value per Share Shareholders’ Equity $708,731 $701,463 $717,750 $696,306 $694,649 Less: Goodwill and Other Intangibles (32,295) (32,587) (32,880) (33,222) (33,563) Tangible Shareholders’ Equity $676,436 $668,876 $684,870 $663,084 $661,086 Common Shares Outstanding 20,791,659 21,360,514 21,796,904 21,994,204 23,007,400 Computed Amount $32.53 $31.31 $31.42 $30.15 $28.73 Tangible Common Equity to Tangible Assets Tangible Shareholders’ Equity $676,436 $668,876 $684,870 $663,084 $661,086 Tangible Assets Total Assets $7,167,951 $7,265,191 $7,237,091 $7,409,641 $7,351,118 Less: Goodwill and other intangibles (32,295) (32,587) (32,880) (33,222) (33,563) Net $7,135,656 $7,232,604 $7,204,211 $7,376,419 $7,317,555 Ratio 9.5% 9.2% 9.5% 9.0% 9.0% Core Net Income Net Income $29,157 $29,663 $27,598 $26,349 $18,904 Adjustments (tax effected) Restructuring and Related Charges - - 4,786 1,838 1,697 Contingent Payout - - - - (446) Total $29,157 $29,663 $32,384 $28,187 $20,155 p. 31

Non-GAAP Financial Measures (continued) $ Thousands, Except Per Share Data Quarter Ended June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Return on Average Tangible Equity Average Shareholders’ Equity $718,838 $731,719 $717,666 $716,899 $698,521 Less: Average Goodwill and Other Intangibles (32,487) (32,777) (33,103) (33,447) (33,785) Average Tangible Equity $686,351 $698,942 $684,563 $683,452 $664,736 Net Income $29,157 $29,663 $27,598 $26,349 $18,904 Amortization of Core Deposit Intangibles 229 236 267 266 272 Tangible Income Applicable to Shareholders $29,386 $29,899 $27,865 $26,615 $19,176 Ratio 17.2% 17.3% 16.2% 15.5% 11.6% Return on Average Tangible Equity - Core Average Tangible Equity $686,351 $698,942 $684,563 $683,452 $664,736 Core Net Income $29,157 $29,663 $32,384 $28,187 $20,155 Adjustments Amortization of Core Deposit Intangibles 229 236 267 266 272 Tangible Core Net Income $29,386 $29,899 $32,651 $28,453 $20,427 Ratio 17.2% 17.3% 19.0% 16.6% 12.4% Return on Average Assets - Core Average Assets $7,342,275 $7,310,408 $7,463,702 $7,499,809 $7,207,996 Core Net Income $29,157 $29,663 $32,384 $28,187 $20,155 Ratio 1.59% 1.65% 1.73% 1.50% 1.12% p. 32

Non-GAAP Financial Measures (continued) $ Thousands Quarter Ended June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Efficiency Ratio Noninterest Expense $52,815 $56,608 $64,770 $58,057 $57,652 Adjustments Restructuring Related Charges - - (6,112) (2,357) (2,153) Prepayment of FHLB Advance - - (1,492) - - Legal fees recovery 1,900 - - - - State of Washington Taxes (602) (579) (1,056) (677) (675) Adjusted Total $54,113 $56,029 $56,110 $55,023 $54,824 Total Revenues Net Interest Income $57,972 $54,517 $56,048 $55,684 $51,496 Noninterest Income $28,224 $38,833 $43,977 $36,155 $36,602 Adjustments Contingent Payout - - - - (566) Adjusted Total Revenues $86,196 $93,350 $100,025 $91,839 $87,532 Ratio 62.8% 60.0% 56.1% 59.9% 62.6% Core Diluted Earnings per Share Core Net Income $29,157 $29,663 $32,384 $28,187 $20,155 Fully Diluted Shares 21,287,974 21,961,828 22,103,902 22,877,226 23,479,845 Ratio $1.37 $1.35 $1.47 $1.23 $0.86 Effective Tax Rate Used in Computations Above 22.0% 19.3% 21.7% 22.0% 21.2% Core Noninterest expense Noninterest Expense $52,815 $56,608 $64,770 $58,057 $57,652 Adjustments: Restructuring Related Charges - - (6,112) (2,357) (2,153) Total $52,815 $56,608 $58,658 $55,700 $55,499 p. 33

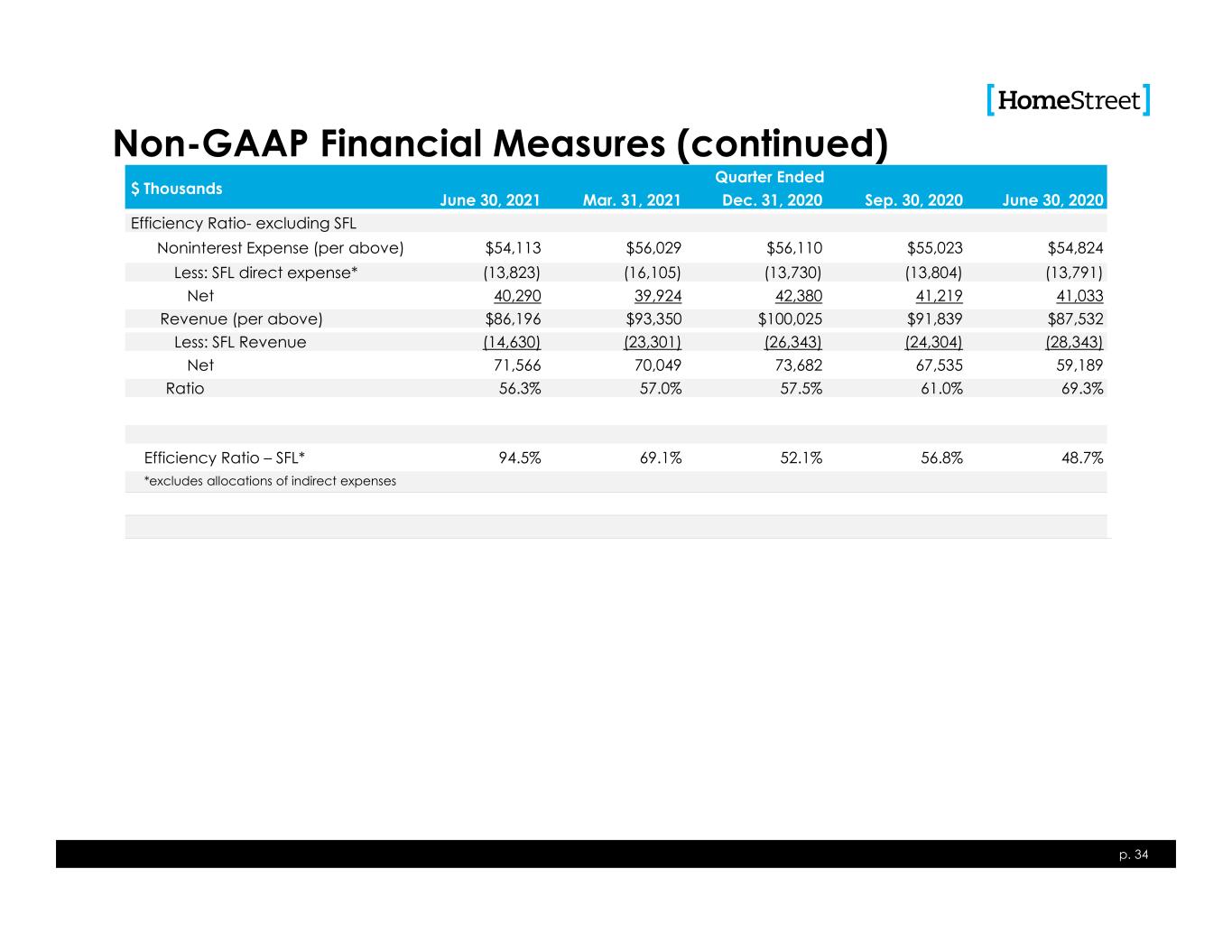

p. 34 Non-GAAP Financial Measures (continued) $ Thousands Quarter Ended June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 June 30, 2020 Efficiency Ratio- excluding SFL Noninterest Expense (per above) $54,113 $56,029 $56,110 $55,023 $54,824 Less: SFL direct expense* (13,823) (16,105) (13,730) (13,804) (13,791) Net 40,290 39,924 42,380 41,219 41,033 Revenue (per above) $86,196 $93,350 $100,025 $91,839 $87,532 Less: SFL Revenue (14,630) (23,301) (26,343) (24,304) (28,343) Net 71,566 70,049 73,682 67,535 59,189 Ratio 56.3% 57.0% 57.5% 61.0% 69.3% Efficiency Ratio – SFL* 94.5% 69.1% 52.1% 56.8% 48.7% *excludes allocations of indirect expenses

Non-GAAP Financial Measures (continued) p. 35 To supplement our unaudited condensed consolidated financial statements presented in accordance with GAAP, we use certain non-GAAP measures of financial performance. These supplemental performance measures may vary from, and may not be comparable to, similarly titled measures provided by other companies in our industry. Non-GAAP financial measures are not in accordance with, or an alternative for, GAAP. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. A non-GAAP financial measure may also be a financial metric that is not required by GAAP or other applicable requirement. We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by providing additional information used by management that is not otherwise required by GAAP or other applicable requirements. Our management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing our operating results and when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate a comparison of our performance to prior periods. We believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. However, these non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures prepared in accordance with GAAP. In the information above, we have provided a reconciliation of, where applicable, the most comparable GAAP financial measures to the non-GAAP measures used in this press release, or a reconciliation of the non-GAAP calculation of the financial measure. In this presentation, we use the following non-GAAP measures: (i) tangible common equity and tangible assets as we believe this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios; (ii) core earnings and core noninterest expense which exclude certain nonrecurring charges primarily related to our discontinued operations and restructuring activities as we believe this measure is a better comparison to be used for projecting future results; and (iii) an efficiency ratio which is the ratio of noninterest expenses to the sum of net interest income and noninterest income, excluding certain items of income or expense and excluding taxes incurred and payable to the state of Washington as such taxes are not classified as income taxes and we believe including them in noninterest expenses impacts the comparability of our results to those companies whose operations are in states where assessed taxes on business are classified as income taxes.