Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Griffin-American Healthcare REIT III, Inc. | gahr-20210901.htm |

LETTER FROM THE PRESIDENT September 1, 2021 Investing in America’s Largest and Fastest-Growing Industry.8 Dear Fellow Stockholder: Griffin-American Healthcare REIT III, or GAHR III, recently filed its Quarterly Report on Form 10-Q with the U.S. Securities and Exchange Commission, or SEC, and I am pleased to provide you with an update on the company’s progress. First, we are very excited about the proposed tri-party transaction between our company, Griffin-American Healthcare REIT IV, or GAHR IV, and American Healthcare Investors, or AHI. As we announced on June 24, 2021, GAHR III entered into a definitive merger agreement pursuant to which the company will be acquired by GAHR IV in a tax-free, stock-for- stock transaction that will create a combined company with a gross investment value of approximately $4.2 billion6 in healthcare real estate assets. Upon completion of the merger, or the REIT merger, the newly combined company, to be renamed American Healthcare REIT, Inc., will be the 11th largest healthcare-focused real estate investment trust globally.9 In connection with the REIT merger, GAHR III also entered into a definitive agreement to acquire the business and operations of AHI, one of the co-sponsors of both our company and GAHR IV, and the external advisor of both REITs. This acquisition is expected to take place just prior to the completion of the REIT merger, although completion of this acquisition is not a condition to completing the REIT merger. The result of these transactions will be the creation of a combined, self-managed company with a large and diverse property portfolio led by an experienced management team. Once the transactions are completed, American Healthcare REIT is expected to benefit from significant annual operational cost savings of approximately $21.0 million, which will help support an anticipated annual distribution rate of $0.40 per share for the combined company, and position the combined company for a successful listing on a national stock exchange in 2022.10 We expect the proposed transactions to close in the fourth quarter of 2021, subject to certain closing conditions, including the approval of the REIT merger by both GAHR III and GAHR IV stockholders. You should have already received proxy materials regarding the transactions and we urge you to cast your votes as soon as possible. Voting is easy – simply return your completed voting card by mail, go online to www.proxyvote.com or call 855-928-4498. Additional information about the proposed merger is available on our website at www. HealthcareREIT3.com. As we have reported since the start of the COVID-19 pandemic in March 2020, the company has confronted a host of challenges in regards to portfolio occupancy, revenue and expenses, particularly within our senior housing properties and skilled nursing facilities, and the second quarter of 2021 was no different. Our medical office buildings continued to perform well during the second quarter with impressive tenant retention. We have also experienced a significant recovery in occupancy within our “senior housing – managed,” or RIDEA,1 and sizable “integrated senior health campuses” portfolios, although these components of our portfolio will take some time before their occupancy levels and financial performance recover to pre-pandemic levels. We remain optimistic and confident in our recovery from the worst of the pandemic, but continue to closely monitor the assorted variants of COVID-19 that have emerged in recent months and their potential impact on our operations as the national effort to expand the vaccination rate and develop effective medical treatments continues. Finally, in light of the proposed merger with GAHR IV that we expect to be completed in October 2021, our board of directors has authorized a distribution for the month of September 2021 to stockholders of record as of the close of business on September 17, 2021 in an amount equal to an annualized rate of $0.20 per share. This distribution payment Investor Update Second Quarter 2021 Highlights • As of June 30, 2021, the company’s non-RIDEA1 property portfolio achieved a leased percentage of 92.0 percent and weighted average remaining lease term of 6.9 years, while the company’s portfolio of senior housing - RIDEA facilities and integrated senior health campuses achieved a leased percentage of 73.9 percent and 77.4 percent, respectively. Portfolio leverage2 was approximately 47.2 percent. • As of June 30, 2021, the company owned and/ or operated a diversified portfolio of medical office buildings, hospitals, senior housing facilities, skilled nursing facilities, integrated senior health campuses and a real estate-related investment for an aggregate contract purchase price of $3.3 billion3 and which is now estimated to have a value in excess of $3.7 billion.4 • Modified funds from operations, as defined by the Institute for Portfolio Alternatives, attributable to controlling interest, or MFFO, equaled $18.7 million for the quarter ended June 30, 2021, representing a year-over-year decline of 48.7 percent compared to $36.5 million during the second quarter of 2020. The quarterly year-over-year change in MFFO was largely a result of the economic impact of the COVID-19 pandemic on many of our RIDEA assets, particularly in our integrated senior health campuses segment, which continued to experience increased operational costs during the quarter directly tied to the pandemic. (Please see financial reconciliation tables and notes at the end of this update for more information regarding MFFO.) • Funds from operations, as defined by the National Association of Real Estate Investment Trusts, attributable to controlling interest, or FFO, equaled $17.9 million during the second quarter of 2021, as compared to $37.4 million during the second quarter of 2020, representing a year-over-year decline of 52.1 percent. The quarterly year-over-year change in FFO was primarily due to decreased revenues and increased operational expenses directly tied to the COVID-19 pandemic, offset by fluctuations in the fair market value of our interest rate swaps and foreign currency exchange rates (both of which are non-cash items), all of which may not be reflective of ongoing operations. (Please see financial reconciliation tables and notes at the end of this update for more information regarding FFO.) (continued on next page) (continued on next page) Exhibit 99.1

1. The operation of healthcare-related facilities utilizing the structure permitted by the REIT Investment Diversifi cation and Empowerment Act of 2007 is commonly referred to as a “RIDEA” structure. 2. Total debt divided by total market value of real estate and real estate-related investments. Total market value equals the aggregate contract purchase price paid for investments or, for investments appraised subsequent to the date of purchase, the aggregate value reported in the most recent independent appraisals of such investments. 3. Based on aggregate contract purchase price of owned and/or operated real estate and real estate-related investments, including development projects and net of dispositions and principal repayments, as of June 30, 2021. 4. Based on the gross real estate and real estate-related investments value estimated by an independent third-party valuation fi rm as of September 30, 2020 and for properties acquired and developed subsequent to September 30, 2020, the aggregate contract purchase price as of June 30, 2021. 5. For more information, please refer to our Current Report on Form 8-K fi led with the SEC on April 22, 2021 at https://www.sec.gov/ix?doc=/Archives/edgar/ data/1566912/000156691221000020/gahr-20210422.htm. 6. Gross investment value is comprised of acquisition costs and subsequent capital expenditures that pertain to the company’s pro-rata ownership. 7. For more information, please refer to our Current Report on Form 8-K fi led with the SEC on June 24, 2021 at https://www.sec.gov/ix?doc=/Archives/edgar/ data/1566912/000119312521198335/d147619d8k.htm. 8. Based on “Occupational Outlook Handbook” United States Department of Labor, Bureau of Labor Statistics. September 1, 2020. https://www.bls.gov/ooh/ healthcare/home.htm. 9. Based on gross investment value as of March 31, 2021, as provided by KeyBanc Capital Markets. 10. Distributions to stockholders will be determined by the combined company’s board of directors and are dependent upon a number of factors. There can be no assurance that distributions will be paid at this rate, if at all. Additionally, there can be no guarantee that the combined company will effect a listing of its common stock or any other type of liquidity event by the end of 2022, or at all. • Net loss during the second quarter of 2021 was $(8.0) million, compared to net income of $20.8 million during the second quarter of 2020. The quarterly year-over-year change in net income (loss) was largely due to the economic impact of the COVID-19 pandemic and fl uctuations in the fair market value of our interest rate swaps and foreign currency exchange rates (as discussed above). (Please see fi nancial reconciliation tables and notes at the end of this update for more information regarding net income (loss).) • Net operating income, or NOI, totaled $49.5 million for the quarter ended June 30, 2021, a decline of approximately 31.6 percent compared to second quarter 2020 NOI of $72.4 million. The quarterly year-over-year change in NOI was largely a result of the economic impact of the COVID-19 pandemic as discussed above. (Please see fi nancial reconciliation tables and notes at the end of this update for more information regarding NOI.) • The company declared and paid daily distributions equal to an annualized rate of $0.20 per share to stockholders of record from June 1 to June 30, 2021.5 • On June 24, 2021, the company announced that it had entered in a defi nitive merger agreement pursuant to which it would be acquired by GAHR IV in a tax-free, stock-for-stock transaction that will create a combined company with a gross investment value of approximately $4.2 billion6 in healthcare real estate assets. The company also announced that it has entered into a defi nitive agreement to acquire substantially all of the business and operations of AHI, one of its co-sponsors, the acquisition of which is expected to take place immediately prior to the completion of the merger with GAHR IV.7 • In light of the proposed merger with GAHR IV, which the company expects to close in October 2021, and to facilitate the payment of the company’s September 2021 distribution to stockholders prior to such close, the board of directors has authorized a distribution to stockholders of record as of the close of business on September 17, 2021. The distribution will be equal to $0.01643835 per share of common stock, which for the month of September 2021 is equivalent to an annualized distribution of $0.20 per share. The distribution will be paid in cash on or about September 20, 2021. will be made in cash on or about September 20, 2021 so that our stockholders will receive their authorized distribution for September 2021 prior to the expected closing of the merger. We believe that the proposed transactions provide a truly exciting prospect for the company and its stockholders, and we look toward the future with enthusiasm. Thank you for your continued support. Kind regards, Danny Prosky President and Chief Operating Offi cer (continued from previous page) Certain statements contained herein may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including statements with respect to: the tri-party transaction, REIT merger or acquisition of AHI being consummated in October 2021, or at all, and the results of such proposed events; future distributions; the ability of the combined company to achieve the expected operational effi ciencies and cost savings or to engage in a listing on a national stock exchange in 2022, or at all; the effects of the COVID-19 pandemic and our ability to recover from such pandemic; and our expectations regarding our portfolio occupancy and performance. We intend for all forward- looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable by law. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to, the following: the ability of GAHR III or GAHR IV to obtain the approval of the REIT merger from its stockholders or the failure to satisfy the other closing conditions of the REIT merger; our strength and fi nancial condition and uncertainties relating to the fi nancial strength of our current and future real estate investments; uncertainties regarding the severity and duration of the COVID-19 pandemic and its effects; uncertainties relating to changes in general economic and real estate conditions; uncertainties regarding changes in the healthcare industry; uncertainties relating to the implementation of recent healthcare legislation; and other risk factors as outlined in our company’s periodic reports, as fi led with the SEC. Forward-looking statements in this document speak only as of the date on which such statements were made, and undue reliance should not be placed on such statements. We undertake no obligation to update any such statements that may become untrue because of subsequent events.

PORTFOLIO AT-A-GLANCE (As of June 30, 2021) PROPERTY PORTFOLIO Real Estate Investments Property Type Acquisition Date Location Gross Leasable Area (Sq Ft) Leased %(6) Aggregate Contract Purchase Price DeKalb Professional Center MOB Jun 2014 Lithonia, GA 19,000 81% $2,830,000 Country Club Medical Office Building MOB Jun 2014 Stockbridge, GA 17,000 100% $2,775,000 Acworth Medical Complex MOB Jul 2014 Acworth, GA 39,000 89% $6,525,000 Wichita KS Medical Office Building MOB Sep 2014 Wichita, KS 39,000 100% $8,800,000 Delta Valley Assisted Living Facility Portfolio Senior Housing Sep 2014 & Jan 2015 AR, MS 127,000 100% $21,450,000 Lee's Summit MO Medical Office Building MOB Sep 2014 Lee's Summit, MO 39,000 100% $6,750,000 Carolina Commons Medical Office Building MOB Oct 2014 Indian Land, SC 58,000 74% $12,000,000 Mount Olympia Medical Office Building Portfolio MOB Dec 2014 FL, IL 23,000 100% $9,900,000 Southlake TX Hospital(2) Hospital Dec 2014 Southlake, TX 142,000 100% $128,000,000 East Texas Medical Office Building Portfolio MOB Dec 2014 TX 393,000 96% $68,500,000 Premier Medical Office Building MOB Dec 2014 Novi, MI 45,000 91% $12,025,000 Independence Medical Office Building Portfolio MOB Jan 2015 KY, MA, NJ, NY 477,000 96% $135,000,000 King of Prussia PA Medical Office Building MOB Jan 2015 King of Prussia, PA 72,000 65% $18,500,000 North Carolina Assisted Living Facility Portfolio Senior Housing — RIDEA Jan & Jun 2015, Jan 2017, Aug 2018 & Mar 2019 NC 272,000 63% $113,856,000 Orange Star Medical Portfolio MOB/Hospital Feb 2015 CO, TX 183,000 98% $57,650,000 Kingwood Medical Office Building Portfolio MOB Mar 2015 Kingwood, TX 43,000 100% $14,949,000 Mt Juliet TN Medical Office Building MOB Mar 2015 Mount Juliet, TN 46,000 75% $13,000,000 Purchase Price(1) (2): $3.3 billion Buildings & Integrated Senior Health Campuses(2): 220 Gross Leasable Area (Sq Ft)(2): 14.2 million Leased(3): 92% Weighted Average Remaining Lease Term(3): 6.9 years Portfolio Leverage(4): 47.2% PORTFOLIO SUMMARY PORTFOLIO ASSET MIX (Based on NOI by segment for the six months ended June 30, 2021) Integrated Senior Health Campuses(5)(8) 32.6% Hospitals 6.9% Senior Housing 9.4% Skilled Nursing 8.7% Medical Office Buildings 33.7% Senior Housing – RIDEA 8.7%

1. Based on aggregate contract purchase price of owned and/or operated real estate and a real estate-related investment, including completed development projects and net of dispositions and principal repayments, as of June 30, 2021. 2. Includes owned, leased or joint venture properties. 3. Excluding our senior housing — RIDEA facilities and our integrated senior health campuses. As of June 30, 2021, our senior housing — RIDEA facilities and integrated senior health campuses were 73.9% and 77.4% leased, respectively, and substantially all of our leases with residents at such properties are for a term of one year or less. 4. Total debt divided by total market value of real estate and a real estate-related investment. Total market value equals the aggregate contract purchase price paid for investments, or for investments appraised subsequent to the date of purchase, the aggregate value reported in the most recent independent appraisals of such investments. 5. Calculated based on our 67.6% pro-rata ownership of Trilogy’s total net operating income for the six months ended June 30, 2021. 6. Leased percentage as of June 30, 2021 includes all leased space of the respective property including master leases, except for our senior housing — RIDEA facilities and our integrated senior health campuses where leased percentage represents resident occupancy on the available units of the senior housing — RIDEA facilities or integrated senior health campuses. 7. As of June 30, 2021, we owned and/or operated 120 integrated senior health campuses including completed development projects through a majority-owned subsidiary of Trilogy. 8. Integrated senior health campuses include a range of senior care, including assisted living, memory care, independent living, skilled nursing services and certain ancillary businesses, and operate under a RIDEA structure. Real Estate Investments Property Type Acquisition Date Location Gross Leasable Area (Sq Ft) Leased %(6) Aggregate Contract Purchase Price Homewood AL Medical Office Building MOB Mar 2015 Homewood, AL 30,000 43% $7,444,000 Paoli PA Medical Plaza MOB Apr 2015 Paoli, PA 99,000 90% $24,820,000 Glen Burnie MD Medical Office Building MOB May 2015 Glen Burnie, MD 77,000 85% $18,650,000 Marietta GA Medical Office Building MOB May 2015 Marietta, GA 41,000 100% $13,050,000 Mountain Crest Senior Housing Portfolio Senior Housing — RIDEA May, Jun, Jul & Nov 2015 IN, MI 585,000 74% $75,035,000 Mount Dora Medical Center MOB May 2015 Mount Dora, FL 51,000 19% $16,300,000 Nebraska Senior Housing Portfolio Senior Housing — RIDEA May 2015 NE 282,000 57% $66,000,000 Pennsylvania Senior Housing Portfolio Senior Housing — RIDEA Jun 2015 PA 260,000 85% $87,500,000 Southern Illinois Medical Office Building Portfolio MOB Jul 2015, Dec 2017 & Apr 2018 Waterloo, IL 41,000 82% $12,712,000 Napa Medical Center MOB Jul 2015 Napa, CA 65,000 89% $15,700,000 Chesterfield Corporate Plaza MOB Aug 2015 Chesterfield, MO 226,000 98% $36,000,000 Richmond VA Assisted Living Facility Senior Housing — RIDEA Sep 2015 North Chesterfield, VA 210,000 83% $64,000,000 Crown Senior Care Portfolio Senior Housing Sep, Oct & Dec 2015 & Nov 2016 Isle of Man & United Kingdom 155,000 100% $68,085,000 Washington D.C. Skilled Nursing Facility Skilled Nursing Oct 2015 Washington, DC 134,000 100% $40,000,000 Trilogy(2)(7) Integrated Senior Health Campuses(8) Various IN, KY, MI, OH 8,642,000 77% $1,754,233,000 Stockbridge GA Medical Office Building II MOB Dec 2015 Stockbridge, GA 46,000 82% $8,000,000 Marietta GA Medical Office Building II MOB Dec 2015 Marietta, GA 22,000 62% $5,800,000 Naperville Medical Office Building MOB Jan 2016 Naperville, IL 69,000 85% $17,385,000 Lakeview IN Medical Plaza(2) MOB Jan 2016 Indianapolis, IN 163,000 91% $20,000,000 Pennsylvania Senior Housing Portfolio II Senior Housing — RIDEA Feb 2016 Palmyra, PA 125,000 96% $27,500,000 Snellville GA Medical Office Building MOB Feb 2016 Snellville, GA 42,000 93% $8,300,000 Lakebrook Medical Center MOB Feb 2016 Westbrook, CT 25,000 76% $6,150,000 Stockbridge GA Medical Office Building III MOB Mar 2016 Stockbridge, GA 43,000 91% $10,300,000 Joplin MO Medical Office Building MOB May 2016 Joplin, MO 85,000 86% $11,600,000 Austell GA Medical Office Building MOB May 2016 Austell, GA 39,000 100% $12,600,000 Middletown OH Medical Office Building MOB Jun 2016 Middletown, OH 103,000 85% $19,300,000 Fox Grape Skilled Nursing Facility Portfolio Skilled Nursing Jul & Nov 2016 MA 349,000 100% $79,500,000 Voorhees NJ Medical Office Building MOB Jul 2016 Voorhees, NJ 48,000 76% $11,300,000 Norwich CT Medical Office Building Portfolio MOB Dec 2016 Norwich, CT 56,000 87% $15,600,000 New London CT Medical Office Building MOB May 2017 New London, CT 27,000 98% $4,850,000 Middletown OH Medical Office Building II MOB Dec 2017 Middletown, OH 32,000 80% $4,600,000 PROPERTY PORTFOLIO (continued) PORTFOLIO AT-A-GLANCE (As of June 30, 2021)

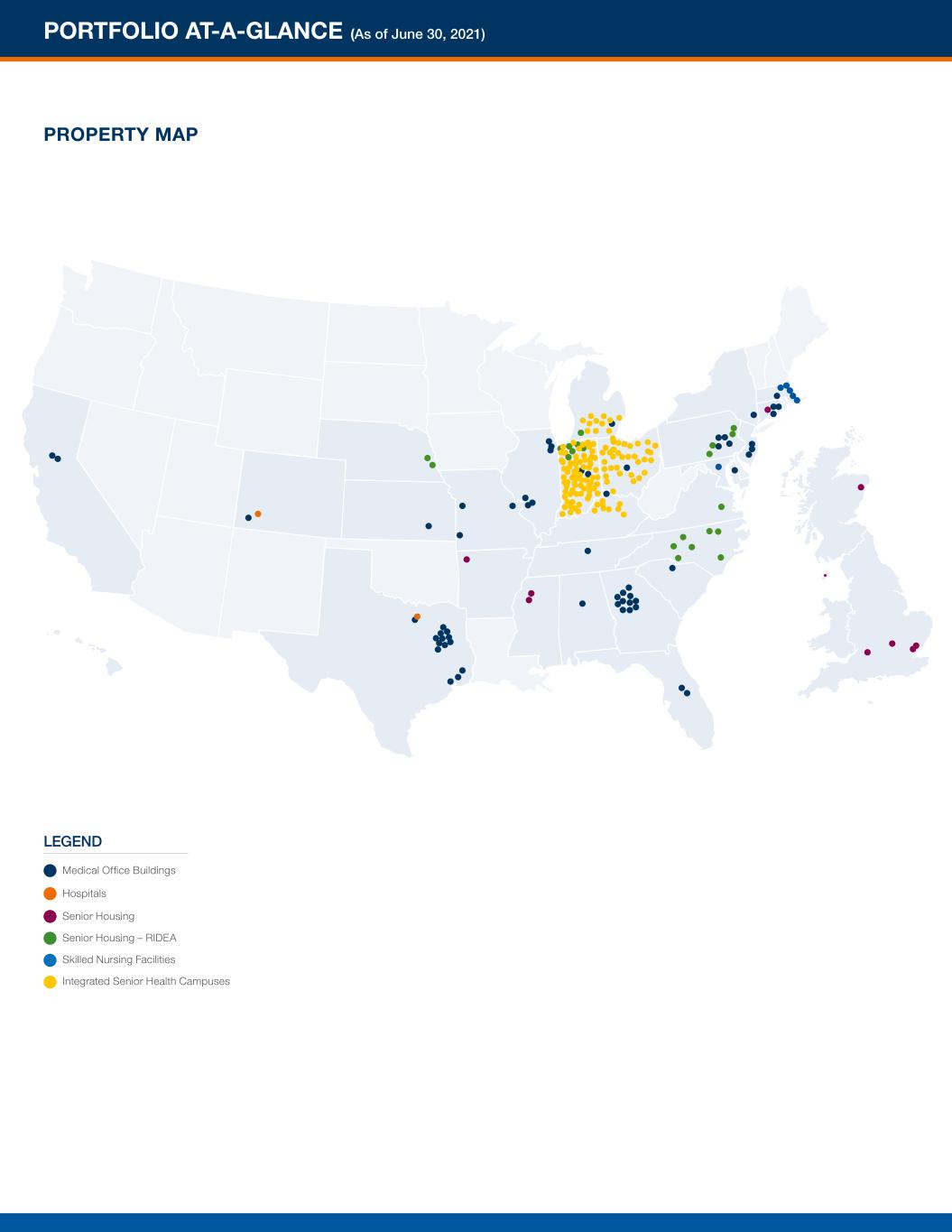

PROPERTY MAP LEGEND Hospitals Senior Housing Medical Office Buildings Senior Housing – RIDEA Skilled Nursing Facilities Integrated Senior Health Campuses PORTFOLIO AT-A-GLANCE (As of June 30, 2021)

(1) In evaluating investments in real estate, we differentiate the costs to acquire the investment from the operations derived from the investment. Such information would be comparable only for publicly registered, non-listed real estate investment trusts that have completed their acquisition activity and have other similar operating characteristics. By excluding business acquisition expenses that have been deducted as expenses in the determination of accounting principles generally accepted in the United States, or GAAP, net income or loss, we believe MFFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. Business acquisition expenses include payments to third parties. (2) Under GAAP, above- and below-market leases are assumed to diminish predictably in value over time and amortized, similar to depreciation and amortization of other real estate-related assets that are excluded from FFO. However, because real estate values and market lease rates historically rise or fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, we believe that by excluding charges relating to the amortization of above- and below-market leases, MFFO may provide useful supplemental information on the performance of the real estate. (3) Under GAAP, direct closing costs are amortized over the term of our debt security investment as an adjustment to the yield on our debt security investment. This may result in income recognition that is different than the contractual cash flows under our debt security investment. By adjusting for the amortization of the closing costs related to our debt security investment, MFFO may provide useful supplemental information on the realized economic impact of our debt security investment terms, providing insight on the expected contractual cash flows of such debt security investment, and aligns results with management’s analysis of operating performance. (4) Under GAAP, as a lessor, rental revenue is recognized on a straight-line basis over the terms of the related lease (including rent holidays). As a lessee, we record amortization of right-of- use assets and accretion of lease liabilities for our operating leases. This may result in income or expense recognition that is significantly different than the underlying contract terms. By adjusting such amounts, MFFO may provide useful supplemental information on the realized economic impact of lease terms, providing insight on the expected contractual cash flows of such lease terms, and aligns results with our analysis of operating performance. (5) The loss associated with the early extinguishment of debt primarily relates to the write-off of unamortized deferred financing fees and other fees. We believe that adjusting for such non- recurring losses provides useful supplemental information because such charges (or losses) may not be reflective of on-going business transactions and operations and is consistent with management’s analysis of our operating performance. (6) Under GAAP, we are required to include changes in fair value of our derivative financial instruments in the determination of net income or loss. We believe that adjusting for the change in fair value of our derivative financial instruments to arrive at MFFO is appropriate because such adjustments may not be reflective of on-going operations and reflect unrealized impacts on value based only on then current market conditions, although they may be based upon general market conditions. The need to reflect the change in fair value of our derivative financial instruments is a continuous process and is analyzed on a quarterly basis in accordance with GAAP. (7) We believe that adjusting for the change in foreign currency exchange rates provides useful information because such adjustments may not be reflective of on-going operations. (8) Includes all adjustments to eliminate the unconsolidated entities’ share or noncontrolling interests’ share, as applicable, of the adjustments described in notes (1) – (7) above to convert our FFO to MFFO. FINANCIAL RECONCILIATION (For The Three and Six Months Ended June 30, 2021 and 2020) FFO and MFFO Reconciliation Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net (loss) income $ (7,961,000) $ 20,787,000 $ (24,234,000) $ 13,004,000 Add: Depreciation and amortization related to real estate — consolidated properties 26,357,000 24,572,000 52,080,000 49,659,000 Depreciation and amortization related to real estate — unconsolidated entities 762,000 764,000 1,568,000 1,508,000 Loss on dispositions of real estate investments 42,000 — 377,000 — Impairment of real estate investments 3,335,000 3,233,000 3,335,000 8,335,000 Net loss (income) attributable to noncontrolling interests 283,000 (7,027,000) 4,709,000 (9,154,000) Less: Depreciation, amortization, impairments and loss on dispositions — noncontrolling interests (4,891,000) (4,888,000) (9,656,000) (9,682,000) FFO attributable to controlling interest $ 17,927,000 $ 37,441,000 $ 28,179,000 $ 53,670,000 Business acquisition expenses(1) $ 2,750,000 $ 19,000 $ 3,998,000 $ 253,000 Amortization of above- and below-market leases(2) 212,000 16,000 248,000 35,000 Amortization of closing costs(3) 49,000 41,000 96,000 81,000 Change in deferred rent(4) (148,000) (376,000) (482,000) (404,000) Loss on debt extinguishment(5) 5,000 — 2,293,000 — (Gain) loss in fair value of derivative financial instruments(6) (1,775,000) (749,000) (3,596,000) 7,434,000 Foreign currency (gain) loss(7) (238,000) 183,000 (653,000) 3,248,000 Adjustments for unconsolidated entities(8) 148,000 238,000 319,000 554,000 Adjustments for noncontrolling interests(8) (197,000) (321,000) (1,168,000) (831,000) MFFO attributable to controlling interest $ 18,733,000 $ 36,492,000 $ 29,234,000 $ 64,040,000 Weighted average common shares outstanding — basic and diluted 193,858,026 194,123,913 193,857,452 194,484,214 Net (loss) income per common share — basic and diluted $ (0.04) $ 0.11 $ (0.13) $ 0.07 FFO attributable to controlling interest per common share — basic and diluted $ 0.09 $ 0.19 $ 0.15 $ 0.28 MFFO attributable to controlling interest per common share — basic and diluted $ 0.10 $ 0.19 $ 0.15 $ 0.33 Net Operating Income Reconciliation Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net (loss) income $ (7,961,000) $ 20,787,000 $ (24,234,000) $ 13,004,000 General and administrative 7,343,000 7,781,000 14,600,000 14,355,000 Business acquisition expenses 2,750,000 19,000 3,998,000 253,000 Depreciation and amortization 26,357,000 24,572,000 52,080,000 49,659,000 Interest expense 16,715,000 16,903,000 35,259,000 43,620,000 Loss on dispositions of real estate investments 42,000 — 377,000 — Impairment of real estate investments 3,335,000 3,233,000 3,335,000 8,335,000 Loss (income) from unconsolidated entities 901,000 (694,000) 2,672,000 210,000 Foreign currency (gain) loss (238,000) 183,000 (653,000) 3,248,000 Other income (191,000) (521,000) (463,000) (1,076,000) Income tax expense (benefit) 495,000 119,000 658,000 (3,092,000) Net operating income $ 49,548,000 $ 72,382,000 $ 87,629,000 $ 128,516,000

IU-HC294(090121) www.HealthcareREIT3.com | 949.270.9200 © 2021 Griffin-American Healthcare REIT III, Inc. All rights reserved. HC3-IU133461 (0921) FFO and MFFO Reconciliation Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Net (loss) income $ (7,961,000) $ 20,787,000 $ (24,234,000) $ 13,004,000 Add: Depreciation and amortization related to real estate — consolidated properties 26,357,000 24,572,000 52,080,000 49,659,000 Depreciation and amortization related to real estate — unconsolidated entities 762,000 764,000 1,568,000 1,508,000 Loss on dispositions of real estate investments 42,000 — 377,000 — Impairment of real estate investments 3,335,000 3,233,000 3,335,000 8,335,000 Net loss (income) attributable to noncontrolling interests 283,000 (7,027,000) 4,709,000 (9,154,000) Less: Depreciation, amortization, impairments and loss on dispositions — noncontrolling interests (4,891,000) (4,888,000) (9,656,000) (9,682,000) FFO attributable to controlling interest $ 17,927,000 $ 37,441,000 $ 28,179,000 $ 53,670,000 Business acquisition expenses(1) $ 2,750,000 $ 19,000 $ 3,998,000 $ 253,000 Amortization of above- and below-market leases(2) 212,000 16,000 248,000 35,000 Amortization of closing costs(3) 49,000 41,000 96,000 81,000 Change in deferred rent(4) (148,000) (376,000) (482,000) (404,000) Loss on debt extinguishment(5) 5,000 — 2,293,000 — (Gain) loss in fair value of derivative financial instruments(6) (1,775,000) (749,000) (3,596,000) 7,434,000 Foreign currency (gain) loss(7) (238,000) 183,000 (653,000) 3,248,000 Adjustments for unconsolidated entities(8) 148,000 238,000 319,000 554,000 Adjustments for noncontrolling interests(8) (197,000) (321,000) (1,168,000) (831,000) MFFO attributable to controlling interest $ 18,733,000 $ 36,492,000 $ 29,234,000 $ 64,040,000 Weighted average common shares outstanding — basic and diluted 193,858,026 194,123,913 193,857,452 194,484,214 Net (loss) income per common share — basic and diluted $ (0.04) $ 0.11 $ (0.13) $ 0.07 FFO attributable to controlling interest per common share — basic and diluted $ 0.09 $ 0.19 $ 0.15 $ 0.28 MFFO attributable to controlling interest per common share — basic and diluted $ 0.10 $ 0.19 $ 0.15 $ 0.33 Additional Information and Where to Find It In connection with the proposed merger, GAHR IV filed with the SEC a registration statement on Form S-4 containing a Joint Proxy Statement/Prospectus jointly prepared by GAHR III and GAHR IV, and other related documents. The Joint Proxy Statement/Prospectus contains important information about the merger and related matters. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED BY GAHR III AND GAHR IV WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT GAHR III, GAHR IV AND THE PROPOSED MERGER. Investors and stockholders of GAHR III and GAHR IV may obtain free copies of the registration statement, the Joint Proxy Statement/Prospectus and other relevant documents filed by GAHR III and GAHR IV with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by GAHR III and GAHR IV with the SEC are also available free of charge on GAHR III’s and GAHR IV’s websites at http://www.healthcarereit3.com and http://www.healthcarereitiv.com, respectively. Participants in Solicitation Relating to the Merger GAHR III and GAHR IV and their respective directors and officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding GAHR III’s directors and executive officers can be found in GAHR III’s 2020 Annual Report on Form 10-K filed with the SEC on March 25, 2021. Information regarding GAHR IV’s directors and executive officers can be found in GAHR IV’s 2020 Annual Report on Form 10-K filed with the SEC on March 26, 2021. Additional information regarding the interests of such potential participants is included in the Joint Proxy Statement/Prospectus and other relevant documents filed with the SEC in connection with the merger. These documents are available free of charge on the SEC’s website and from GAHR III or GAHR IV, as applicable, using the sources indicated above. No Offer or Solicitation This communication and the information contained herein does not constitute an offer to sell or the solicitation of an offer to buy or sell any securities or a solicitation of a proxy or of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This communication may be deemed to be solicitation material in respect of the proposed merger. MERGER PROPOSED - YOUR VOTE IS NEEDED! Call: 855.928.4498 to vote your proxy today or visit: www.proxyvote.com