Attached files

| file | filename |

|---|---|

| EX-99.2 - ASSISTED 4 LIVING, INC. | ex99-2.htm |

| 8-K/A - ASSISTED 4 LIVING, INC. | form8-ka.htm |

Exhibit 99.1

TRILLIUM HEALTHCARE GROUP, LLC

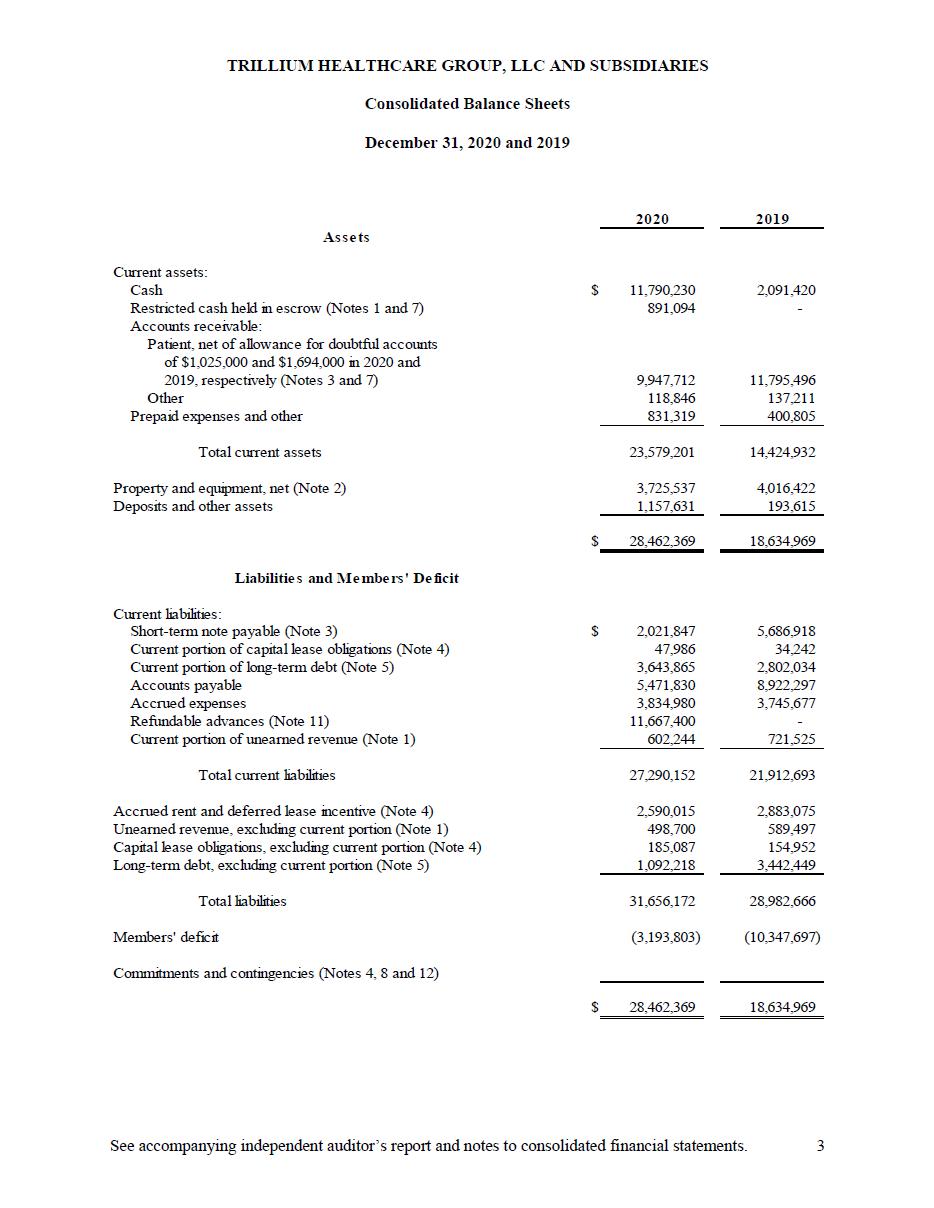

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

March 31, 2021 | December 31, 2020 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 8,849,099 | $ | 11,790,230 | ||||

| Restricted cash | 891,094 | 891,094 | ||||||

| Accounts receivable, net | 8,835,619 | 9,947,712 | ||||||

| Prepaid expenses and other current assets | 733,151 | 950,165 | ||||||

| Total current assets | 19,308,963 | 23,579,201 | ||||||

| Property and equipment, net | 3,556,124 | 3,725,537 | ||||||

| Other long term assets | 1,157,631 | 1,157,631 | ||||||

| Total assets | $ | 24,022,718 | $ | 28,462,369 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | 5,656,449 | 5,471,830 | ||||||

| Notes payable, net of discount current portion | 4,054,306 | 5,665,712 | ||||||

| Accrued Expense | 2,706,111 | 3,834,980 | ||||||

| Advanced payments | 9,181,611 | 11,667,400 | ||||||

| Lease liability, current portion | 220,980 | 47,986 | ||||||

| Deferred revenue | 559,916 | 602,244 | ||||||

| Total current liabilities | 22,379,374 | 27,290,152 | ||||||

| Lease liability, net of current portion | 2,186,871 | 2,775,102 | ||||||

| Deferred revenue, net of current portion | - | 498,700 | ||||||

| Notes payable, net of discount and current portion | 1,472,957 | 1,092,218 | ||||||

| Total liabilities | 26,039,201 | 31,656,172 | ||||||

| Members’ Equity: | ||||||||

| Accumulated deficit | (2,016,484 | ) | (3,193,803 | ) | ||||

| Total Members’ equity | $ | (2,016,484 | ) | $ | (3,193,803 | ) | ||

| Total liabilities and Members’ equity | $ | 24,022,718 | $ | 28,462,369 | ||||

See Notes to Unaudited Condensed Consolidated Financial Statements

TRILLIUM HEALTHCARE GROUP, LLC

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Patient Revenue | $ | 25,362,743 | $ | 22,712,106 | ||||

| Net Revenue | 25,362,743 | 22,712,106 | ||||||

| Cost of services provided | 11,947,091 | 11,471,195 | ||||||

| Gross profit | 13,415,651 | 11,240,911 | ||||||

| Operating expenses | ||||||||

| General and administrative | 11,850,544 | 11,751,203 | ||||||

| Provision for bad debt | 171,164 | 170,469 | ||||||

| Depreciation and amortization expense | 139,079 | 138,461 | ||||||

| Total operating expenses | 12,160,787 | 12,060,133 | ||||||

| Operating income (loss) | 1,254,864 | (819,223 | ) | |||||

| Other income (expense) | ||||||||

| Interest expense | (122,935 | ) | (243,399 | ) | ||||

| Other revenue | 45,396 | 81,014 | ||||||

| Total other income (expense) | (77,539 | ) | (243,399 | ) | ||||

| Net income (loss) | 1,177,325 | (1,062,622 | ) | |||||

See Notes to Unaudited Condensed Consolidated Financial Statements

TRILLIUM HEALTHCARE GROUP, LLC

CONDENSED CONSOLIDATED STATEMENTS OF MEMBERS’ DEFICIT

(UNAUDITED)

| Members’ deficit at December 31, 2019 | (10,347,697 | ) | ||

| Net Income | (1,062,622 | ) | ||

| Members’ deficit at March 31, 2020 | (11,410,319 | ) | ||

| Members’ deficit at December 31, 2020 | (3,193,803 | ) | ||

| Net Income | 1,177,325 | |||

| Members’ deficit at March 31, 2021 | (2,016,478 | ) |

See Notes to Unaudited Condensed Consolidated Financial Statements

TRILLIUM HEALTHCARE GROUP, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities | ||||||||

| Net income (loss) | $ | 1,177,325 | $ | (1,062,622 | ) | |||

| Adjustments to reconcile net (loss) to cash used in operating activities: | ||||||||

| Depreciation and amortization | 139,079 | 138,461 | ||||||

| (Increase) decrease in assets | ||||||||

| Prepaid expenses | 217,014 | 324,937 | ||||||

| Accounts receivable | 1,112,093 | 1,119,800 | ||||||

| Increase (decrease) in liabilities | ||||||||

| Accounts payable | 214,948 | (568,478 | ) | |||||

| Accrued payroll and other expenses | (1,544,106 | ) | (1,010,721 | ) | ||||

| Advance payments | (2,485,789 | ) | - | |||||

| Deferred revenue | (541,028 | ) | (652,742 | ) | ||||

| Cash used in operating activities | (1,710,463 | ) | (1,711,364 | ) | ||||

| Cash flows from financing activities | ||||||||

| Repayment on notes payable | (1,230,668 | ) | 2,303,256 | |||||

| Cash used in financing activities | (1,230,668 | ) | 2,303,256 | |||||

| Net increase (decrease) in cash | (2,941,131 | ) | 591,892 | |||||

| Cash, beginning of year | 11,790,230 | 2,091,420 | ||||||

| Cash, end of period | 8,849,099 | 2,683,312 | ||||||

See Notes to Unaudited Condensed Consolidated Financial Statements

TRILLIUM HEATHCARE GROUP, LLC

NOTES TO CONDENSED CONSOLIDATED FINANICAL STATEMENTS

(UNAUDITED)

NOTE 1 – Organization and Description of Business

Nature of operations - Trillium Healthcare Group, LLC and Subsidiaries (the “Group”) was formed for the purpose of acquiring licenses to operate skilled nursing, independent living, and assisted living facilities. The Group commenced operations on March 1, 2012.

We are headquartered at 5115 East SR 64 Bradenton, Florida 34208

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation – The financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. The accompanying unaudited condensed consolidated financial statements of the Group (“Financial Statements”) have been prepared in accordance with GAAP for interim financial statements. Accordingly, they do not contain all information and footnotes required by accounting principles generally accepted in the United States of America for annual financial statements.

Principles of Consolidation - The consolidated financial statements include the accounts of Trillium Healthcare Group, LLC, and its wholly owned subsidiaries. Significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates and Assumptions - The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The estimates and judgments will also affect the reported amounts for certain revenues and expenses during the reporting period. Actual results could differ from these good faith estimates and judgments.

Cash and Cash Equivalents - The Group considers all short-term investments with an original maturity of three months or less to be cash equivalents.

Property and Equipment - Property and equipment are recorded at cost for acquisitions greater than $5,000. Depreciation is provided using the straight-line method over the estimated useful lives of the assets which range from three to thirty-nine years.

Allowance for Doubtful Accounts - The Group evaluates the collectability of accounts receivable based on certain factors, such as pay type, historical collection trends and aging categories. The Group calculates the provision for bad debts based on the length of time that the receivables are past due. The bad debt percentage that is applied to the receivable balance in each aging category is based on the Group’s historical experience and statutory and other time limits, if any, for each particular pay source, including private, insurance, Medicaid and Medicare.

Accounts Receivable - Net patient revenues are derived from services rendered to patients for long-term care including skilled nursing and assisted living services. All of our skilled nursing, independent living, and assisted living facilities are certified for Medicaid and Medicare health care programs. Net patient revenue is reported at the amount that reflects the consideration the Group expects to be entitled to in exchange for the patient services provided. These amounts are due from patients, governmental programs, and other third-party payors and include variable consideration for retroactive adjustments resulting from settlement of cost reporting audits, reviews or investigations. The Group recognizes net patient revenue as its performance obligations are completed. Routine patient care often includes a bundle of services that are not capable of being distinct. The performance obligations are satisfied over time as the patient simultaneously receives and consumes the benefits of healthcare services provided. Ancillary services, including therapies, which are not included in daily rates for bundled services, are instead treated as separate performance obligations which are satisfied at a point in time when the services are rendered.

Under Medicare and other cost-based reimbursement programs, the facilities are reimbursed for services rendered to cover program patients as determined by reimbursement formulas. The differences between established billing rates and the amounts reimbursable by the programs and patient payments are recorded as contractual adjustments and deducted from revenues. Revenue realizable under third-party payor agreements is subject to change due to examination and retroactive adjustment. Estimated third-party payor settlements are recorded in the period the related services are rendered. The methods of making such estimates are reviewed periodically, and differences between the net amounts accrued and subsequent settlements or estimates of expected settlements are reflected in the current period results of operations.

Accounts receivable from self-pay (private) patients are recorded at currently realizable amounts. Self-pay patients are billed in advance for room and board charges on an ongoing basis and these amounts are included in revenue when the services are performed. The Group considers the patient’s ability and intent to pay the amount of consideration upon admission. Subsequent changes to the patient’s circumstances affecting their ability to pay are recorded as bad debt expense and reported as an operating expense in the accompanying consolidated statement of operations.

For the year ended December 31, 2020 and the three month period ended March 31, 2021, disaggregated net patient service revenues consist of routine skilled nursing and assisted living care recognized over time and ancillary services, including therapies and other services, recognized at a point in time as follows:

| Three month period ended | Three month period ended | |||||||

| March 31, | March 31, | |||||||

| 2021 | 2020 | |||||||

| Routine skilled nursing and assisted living care | 20,794,870 | 21,513,292 | ||||||

| Ancillary services | 945,374 | 1,166,379 | ||||||

Other Revenue | 3,622,499 | 32,435 | ||||||

25,362,743 | 22,712,106 | |||||||

NOTE 3 - Facility Closings and Transfer of Operations

In May 2020, the Group executed a deed of assignment for the benefit of creditors (ABC) for seven entities in Ohio who transferred their operations to another third party operator during 2019. These entities are no longer earning revenue after the transfer of operations and are considered insolvent. Under the terms of the ABC agreements, these insolvent entities transferred legal and equitable title, as well as custody and control of their assets, to a third party trustee who will apply the proceeds from liquidation of the assets to the Group’s creditors in accordance with the terms of the agreements and Ohio state law. At December 31, 2020, and March 31, 2021 restricted funds held in escrow by the trustee totaled approximately $891,000 and is included in the accompanying condensed consolidated balance sheet as restricted cash.

NOTE 4 – Deferred Revenue

In 2015, the operations of six facilities in Nebraska were transferred from the prior operator, an unrelated party, to the Group. The prior operator paid the Group a $2 million fee as compensation for not electing a step up in basis with the Nebraska Department of Health and Human Services. Since a step up in basis would result in a higher rate of reimbursement for depreciation on a prospective basis, the $2 million gain has been deferred and will be amortized over the Group’s current lease term for these facilities which expires May 31, 2027. In August 2019, the Group closed three of the six Nebraska facilities, resulting in acceleration of the gain recognition associated with those facilities. Unearned revenue related to this transaction has been recognized in the accompanying consolidated balance sheets as of December 31, 2020 and March 31, 2021 are as follows:

| Three month period ended | Year ended | |||||||

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Current portion of unearned revenue | 90,792 | 83,916 | ||||||

| Unearned revenue, excluding current portion | 469,124 | 498,700 | ||||||

| 559,916 | 582,616 | |||||||

NOTE 5 – Recently Issued Accounting Pronouncement

In February 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842). The guidance in this ASU supersedes the leasing guidance in Topic 840, Leases. Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the consolidated balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the consolidated statement of operations. In June 2020, the FASB issued ASU No. 2020-05, which deferred the effective date for all entities that have not yet adopted Topic 842 to annual reporting periods beginning after December 15, 2021. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the consolidated financial statements, with certain practical expedients available. As of December 31, 2020 and March 31, 2021 the Group had not adopted the new guidance for lease recognition.

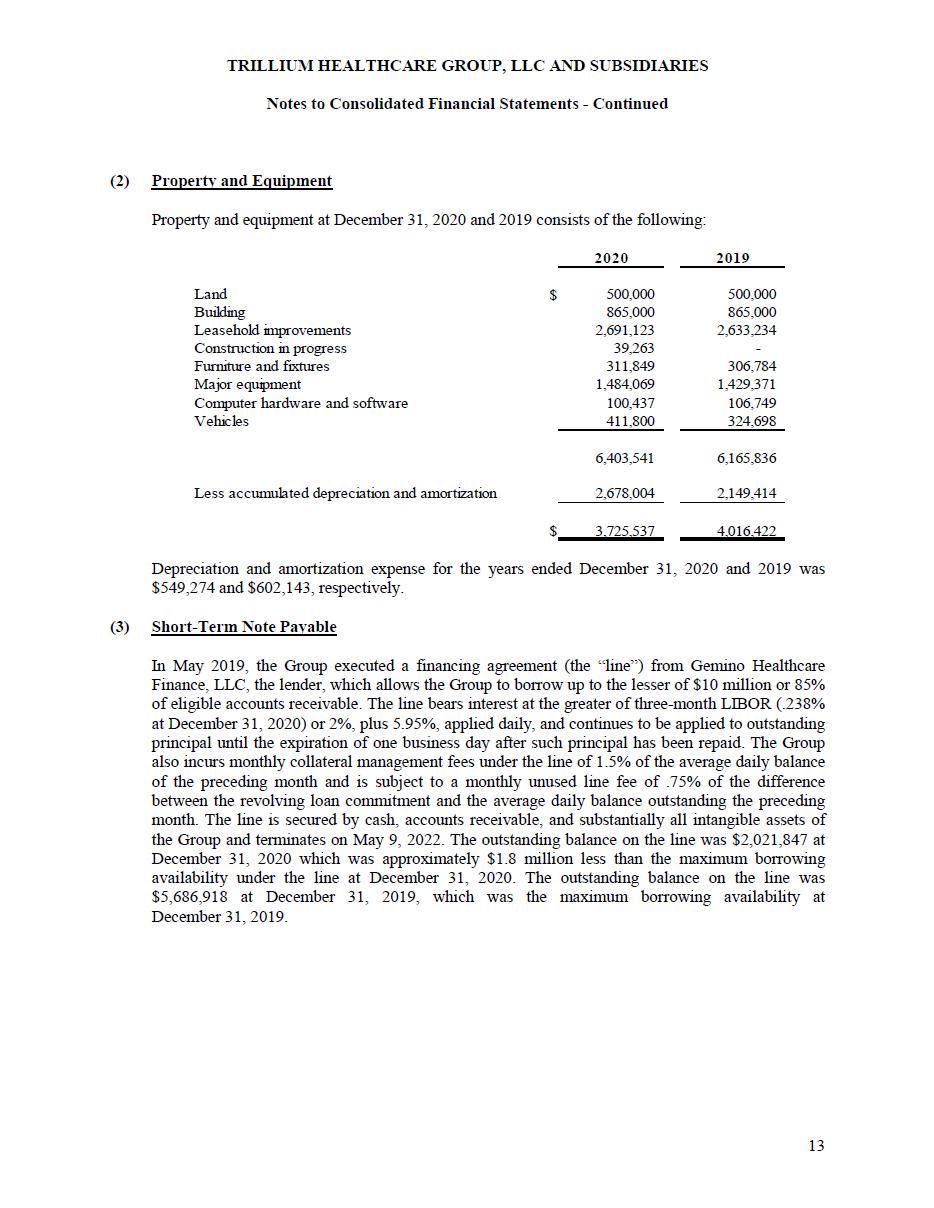

NOTE 6 – Property and Equipment

Property and equipment at December 31, 2020 and March 31, 2021 consist of the following:

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Land | $ | 500,000 | $ | 500,000 | ||||

| Building | 865,000 | 865,000 | ||||||

| Leasehold improvements | 2,691,123 | 2,691,123 | ||||||

| Construction in progress | - | 39,263 | ||||||

| Furniture and fixtures | 311,850 | 311,849 | ||||||

| Major equipment | 1,492,997 | 1,484,069 | ||||||

| Computer hardware and software | 100,437 | 100,437 | ||||||

| Vehicles | 411,800 | 411,800 | ||||||

| 6,373,207 | 6,403,541 | |||||||

| Less accumulated depreciation and amortization | (2,817,083 | ) | (2,678,004 | ) | ||||

| $ | 3,556,124 | $ | 3,725,537 | |||||

Depreciation and amortization expense for the year ended December 31, 2020 and the period ended March 31, 2021 was $549,274 and $139,079, respectively.

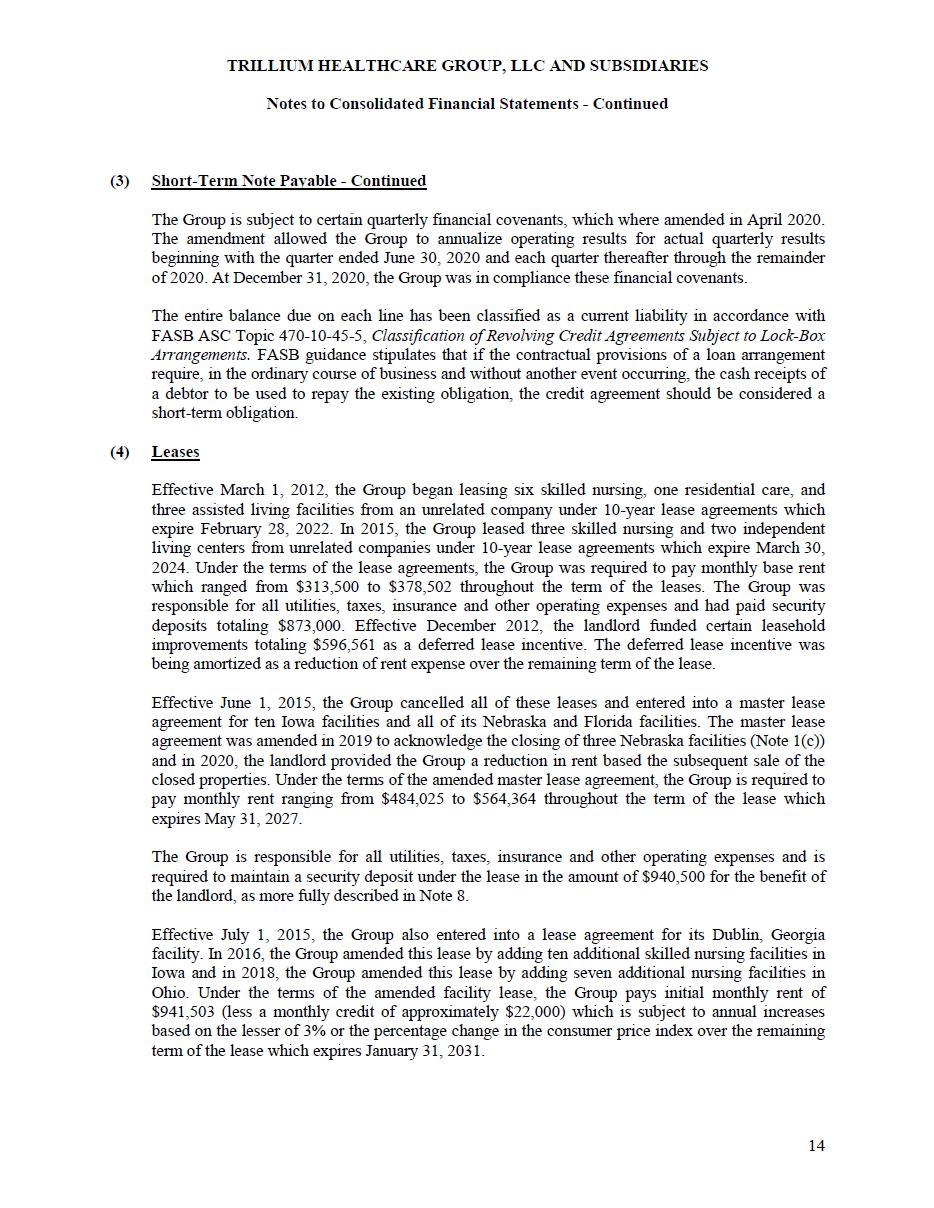

NOTE 7 – Short-Term Note Payable

In May 2019, the Group executed a financing agreement (the “line”) from Gemino Healthcare Finance, LLC, the lender, which allows the Group to borrow up to the lesser of $10 million or 85% of eligible accounts receivable. The line bears interest at the greater of three-month LIBOR (.238% at December 31, 2020) or 2%, plus 5.95%, applied daily, and continues to be applied to outstanding principal until the expiration of one business day after such principal has been repaid. The Group also incurs monthly collateral management fees under the line of 1.5% of the average daily balance of the preceding month and is subject to a monthly unused line fee of .75% of the difference between the revolving loan commitment and the average daily balance outstanding the preceding month. The line is secured by cash, accounts receivable, and substantially all intangible assets of the Group and terminates on May 9, 2022. The outstanding balance on the line was $2,021,847 at December 31, 2020 and $2,021,618 at March 31, 2021.

The Group is subject to certain quarterly financial covenants, which where amended in April 2020. The amendment allowed the Group to annualize operating results for actual quarterly results beginning with the quarter ended June 30, 2020 and each quarter thereafter through the remainder of 2020. At December 31, 2020 and March 31, 2021, the Group was in compliance these financial covenants.

The entire balance due on each line has been classified as a current liability in accordance with FASB ASC Topic 470-10-45-5, Classification of Revolving Credit Agreements Subject to Lock-Box Arrangements. FASB guidance stipulates that if the contractual provisions of a loan arrangement require, in the ordinary course of business and without another event occurring, the cash receipts of a debtor to be used to repay the existing obligation, the credit agreement should be considered a short-term obligation.

NOTE 8 – Leases

Effective March 1, 2012, the Group began leasing six skilled nursing, one residential care, and three assisted living facilities from an unrelated company under 10-year lease agreements which expire February 28, 2022. In 2015, the Group leased three skilled nursing and two independent living centers from unrelated companies under 10-year lease agreements which expire March 30, 2024. Under the terms of the lease agreements, the Group was required to pay monthly base rent which ranged from $313,500 to $378,502 throughout the term of the leases. The Group was responsible for all utilities, taxes, insurance and other operating expenses and had paid security deposits totaling $873,000. Effective December 2012, the landlord funded certain leasehold improvements totaling $596,561 as a deferred lease incentive. The deferred lease incentive was being amortized as a reduction of rent expense over the remaining term of the lease.

Effective June 1, 2015, the Group cancelled all of these leases and entered into a master lease agreement for ten Iowa facilities and all of its Nebraska and Florida facilities. The master lease agreement was amended in 2019 to acknowledge the closing of three Nebraska facilities (Note 1(c)) and in 2020, the landlord provided the Group a reduction in rent based the subsequent sale of the closed properties. Under the terms of the amended master lease agreement, the Group is required to pay monthly rent ranging from $484,025 to $564,364 throughout the term of the lease which expires May 31, 2027.

The Group is responsible for all utilities, taxes, insurance and other operating expenses and is required to maintain a security deposit under the lease in the amount of $940,500 for the benefit of the landlord.

Effective July 1, 2015, the Group also entered into a lease agreement for its Dublin, Georgia facility. In 2016, the Group amended this lease by adding ten additional skilled nursing facilities in Iowa and in 2018, the Group amended this lease by adding seven additional nursing facilities in Ohio. Under the terms of the amended facility lease, the Group pays initial monthly rent of $941,503 (less a monthly credit of approximately $22,000) which is subject to annual increases based on the lesser of 3% or the percentage change in the consumer price index over the remaining term of the lease which expires January 31, 2031.

In 2018, the Group financed the acquisition of three vehicles under capital lease agreements with original lease terms of seven years. In 2020, the Group financed the acquisition of an additional 2 vehicles under capital lease agreements with original lease terms of five years. The Group also leases certain equipment under non-cancelable operating leases which expire over various dates through 2030.

Future minimum lease payments under non-cancelable operating leases (with initial or remaining lease terms in excess of one year) and the present value of future minimum capital lease payments as of December 31, 2020 are as follows:

| Year Ending December 31, | Capital Leases | Operating Leases | Total | |||||||||

| 2021 (9 months) | 41,170 | 8,119,484 | 8,160,654 | |||||||||

| 2022 | 54,893 | 10,922,385 | 10,977,278 | |||||||||

| 2023 | 54,893 | 11,029,081 | 11,083,974 | |||||||||

| 2024 | 53,920 | 11,153,600 | 11,207,520 | |||||||||

| 2025 | 33,703 | 11,278,754 | 11,312,457 | |||||||||

| Thereafter | - | 36,195,652 | 36,195,652 | |||||||||

| 197,409 | 80,579,472 | 80,776,881 | ||||||||||

NOTE 9 – Long-Term Debt

Long-term debt consists of the following at December 31, 2020 and March 31, 2021:

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Mortgage note payable to a commercial bank, payable in equal installments of principal and interest of $6,799; through July 2020, with a final balloon payment originally due in August 2020 extended to January 2021; note bears interest at 4.25; secured by real property and guaranteed by members. | - | 885,705 | ||||||

| Non-interest bearing note payable with a vendor; payable in 36 equal monthly principal installments of $33,099 from October 2019 through September 2022. | 595,787 | 695,084 | ||||||

| Note payable with a vendor; payable in 36 equal monthly installments of principal and interest of $20,911 from October 2019 through September 2022; note bears interest at a rate of 6%. | 359,105 | 415,884 | ||||||

| Note payable with a vendor; payable in 36 equal monthly installments of principal and interest of $69,568 from October 2019 through September 2022; note bears interest at a rate of 6%. | 1,194,681 | 1,383,574 | ||||||

| Note payable with a vendor; payable in 36 equal monthly installments of principal and interest of $36,206 from October 2019 through September 2022; note bears interest at a rate of 6%. | 1,058,626 | 1,058,626 | ||||||

| Non-interest bearing note payable with a vendor; payable in 36 equal monthly principal installments of $9,587 from October 2019 through September 2022. | 297,210 | 297,210 | ||||||

| Total Long-term debt | 3,505,409 | 4,736,083 | ||||||

| Less current portion | (2,032,452 | ) | (3,643,865 | ) | ||||

| Long-term debt, excluding current portion | $ | 1,472,957 | $ | 1,092,218 | ||||

In 2019, certain vendors agreed to extend payment terms by converting $5,774,957 of accounts payable balances to long-term debt bearing interest at rates ranging from 0% to 6%.

The vendor notes payable with outstanding balances of $1,058,626 and $297,210 at December 31, 2020, described above, are specific to the Group’s wholly owned subsidiaries which operated in Ohio. The subsidiaries ceased payments on these notes in the first quarter of 2020 and are considered to be in default. As a result of the default, the outstanding balances are considered payable on demand and have been reflected as a component of the current portion of long-term debt in the accompanying consolidated balance sheet. These debt obligations are subject to the terms of the assignment for the benefit of creditor actions described in Note 3.

NOTE 10 – Management Company

Trillium Healthcare Consulting, LLC charges each of the facilities a management fee equal to 5% of net patient revenues. Management fees are charged for managing the operations of the Facilities including but not limited to accounting, collecting, setting of rates and charges and general administration. For the year ended December 31, 2020 and the three month period ended March 31, 2021, management fees totaled $5,394,672 and $1,269,273 respectively. For the year ended December 31, 2020 and the three month period ended March 31, 2021, additional management fees were charged for billing services provided to certain facilities in the amount of $718,024 and $158,214 respectively. All management fees have been eliminated in the consolidation.

NOTE 11 – Concentrations and Credit Risks

The Group maintains cash balances at a commercial bank and these balances may exceed the federal deposit insurance limit at times throughout the year. The uninsured cash balances at December 31, 2020 and March 31, 2021 were approximately $12,523,000 and $8,855,561, respectively.

NOTE 12 – Paycheck Protection Program

The Group applied for and received three forgivable Paycheck Protection Program (“PPP”) loans of $3,410,000, $1,765,000 and $3,550,000 as provided under the Coronavirus Aid, Relief and Economic Security (“CARES”) Act and the loans were funded on April 15, 2020, April 16, 2020, and April 22, 2020, respectively. Under the terms of the loans, the balances are forgivable to the extent the proceeds are used for certain qualifying costs for the 24 week coverage period from the date of the first disbursements of the loans and that certain employment levels are maintained. To the extent a portion of the loan does not meet the criteria to be forgiven, such amounts are due and payable in monthly installments beginning on the date the loan forgiveness amounts are communicated to the Group or 10 months after the end of the loan forgiveness coverage periods and carry an interest rate of 1%.

Through December 31, 2020, the Group fully utilized the proceeds on qualifying costs and such amounts have been reported as federal grant income in the accompanying consolidated statement of operations. A formal request for forgiveness was submitted for all three loans upon the conclusion of the coverage period outlined above. In November 2020, the Group received legal notice of release of the $1,765,000 obligation. In 2021 the Group received legal releases of the outstanding $3,410,000 and $3,550,000 loans.

NOTE 13 – Government Support – CARES Act Funding

The U.S. government enacted several laws beginning in March 2020 designed to help the nation respond to COVID-19, a disease caused by the novel coronavirus which was characterized as a pandemic by the World Health Organization. The new laws impact healthcare providers in a variety of ways, but the largest legislation providing monetary relief is the CARES Act. A component of the CARES Act includes the Provider Relief Fund (“PRF”) which provides funding to skilled nursing providers and other Medicare and Medicaid enrolled providers to cover any unreimbursed healthcare-related expenses or lost revenue attributable to the public health emergency resulting from COVID-19.

During the second, third, and fourth quarters of 2020, the Group received disbursements from the PRF which totaled approximately $13,045,000. These funds come with terms and condition certifications in which all providers are required to submit documents to ensure the funds will be used for healthcare-related expenses or lost revenue attributable to COVID-19 as defined in PRF terms and conditions. Of the $13,045,000 of funds received, the Group recorded $4.94 million of government stimulus income for the year ended December 31, 2020 determined on a systematic basis in line with the recognition of specific expenses and lost revenues for which the grants are intended to compensate.

The Group’s assessment of whether the terms and conditions for amounts received have been met for income recognition and the Group’s related income calculation considered all frequently asked questions and other interpretive guidance issued through the date the consolidated financial statements were available for issuance by the US. Department of Health and Human Services (“HHS”), but are subject to audit by HHS.

As of December 31, 2020, and the period ended March 31, 2021 amounts not recognized as income are $8.1 million and $3.5 million, respectively, and are reflected in the current liability section of the Group’s consolidated balance sheet.

Additionally, as part of the CARES Act, the legislation included an expansion of the Medicare Accelerated and Advance Payment Program. The expanded Medicare Accelerated and Advance Payment Program is a streamlined version of existing policy that allows the Medicare Administrative Contractors (“MAC’s”) to issue up to three months of advance Medicare payments to help increase cash flow and liquidity to Medicare Part A and Part B providers in certain circumstances that include national emergencies. The Group received approximately $3,420,000 as part of this program. On October 8, 2020, as part of the Continuing Appropriations Act 2021 and Other Extensions Act, Centers for Medicare & Medicaid Services (“CMS”) amended the repayment terms for the accelerated and advance payments. These funds will begin to be applied against claims for services provided to Medicare patients after approximately one year from the date the funds were received. During the first eleven months after repayment begins, repayment will occur through an automatic recoupment of twenty-five percent of Medicare payments. During the succeeding six months, repayment will occur through an automatic recoupment of fifty percent of Medicare payments. Any remaining balance that was not paid through the recoupment process within twenty-nine months of receipt of the funds will be required to be paid on-demand, subject to an interest rate of four percent. As of December 31, 2020, the accelerated Medicare payments are recognized as a refundable advance in the accompanying consolidated balance sheet since the related performance obligations have not been satisfied. As of March 31, 2021 the accelerated Medicare payments are recognized on the condensed consolidated balance sheet as an advance payment in the amount of approximately $5.6 million.

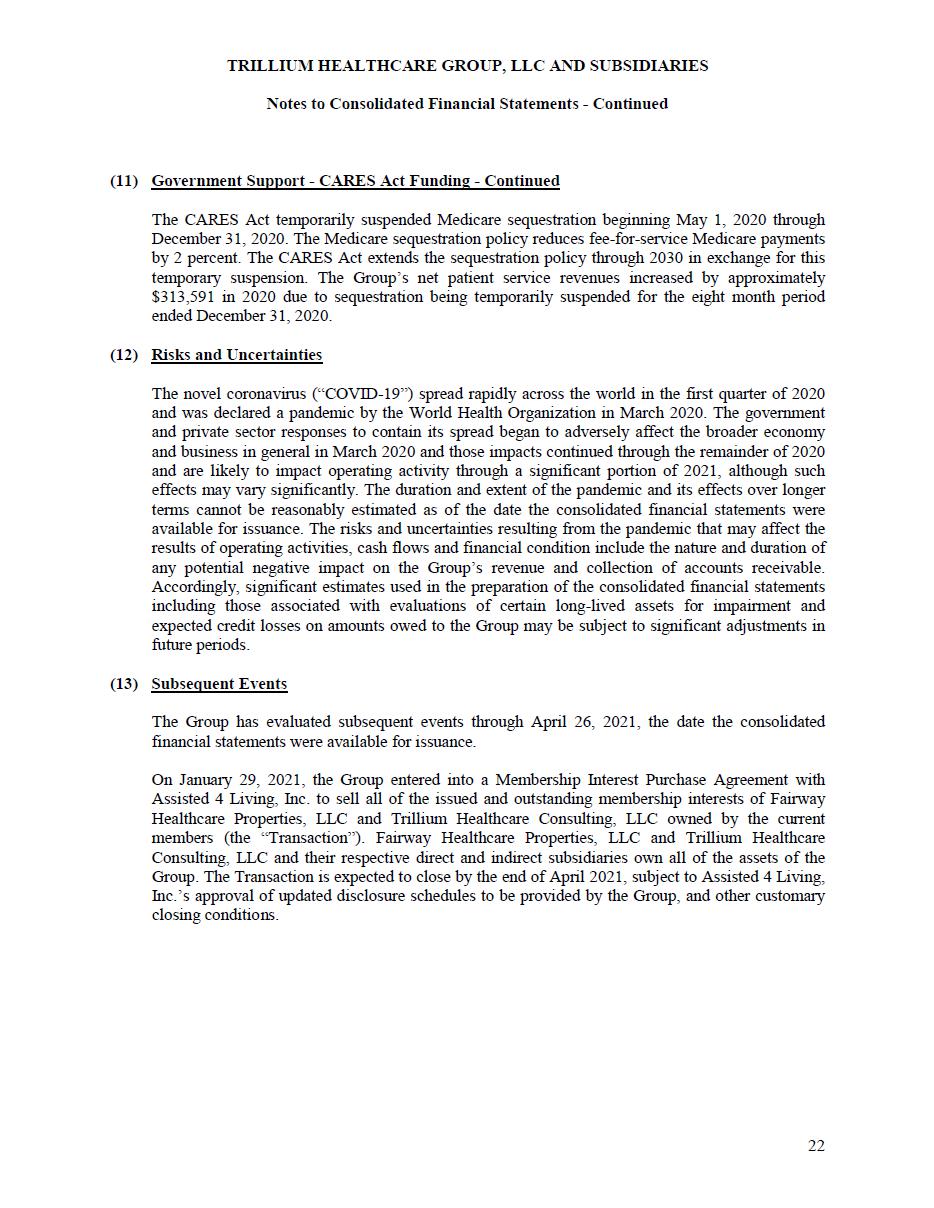

NOTE 14 – Risks and Uncertainty

The novel coronavirus (“COVID-19”) spread rapidly across the world in the first quarter of 2020 and was declared a pandemic by the World Health Organization in March 2020. The government and private sector responses to contain its spread began to adversely affect the broader economy and business in general in March 2020 and those impacts continued through the remainder of 2020 and are likely to impact operating activity through a significant portion of 2021, although such effects may vary significantly. The duration and extent of the pandemic and its effects over longer terms cannot be reasonably estimated as of the date the consolidated financial statements were available for issuance. The risks and uncertainties resulting from the pandemic that may affect the results of operating activities, cash flows and financial condition include the nature and duration of any potential negative impact on the Group’s revenue and collection of accounts receivable. Accordingly, significant estimates used in the preparation of the consolidated financial statements including those associated with evaluations of certain long-lived assets for impairment and expected credit losses on amounts owed to the Group may be subject to significant adjustments in future periods.

NOTE 15 – Subsequent Events

On January 29, 2021, the Group entered into a Membership Interest Purchase Agreement with Assisted 4 Living, Inc. to sell all of the issued and outstanding membership interests of Fairway Healthcare Properties, LLC and Trillium Healthcare Consulting, LLC owned by the current members (the “Transaction”). Fairway Healthcare Properties, LLC and Trillium Healthcare Consulting, LLC and their respective direct and indirect subsidiaries own all of the assets of the Group. The transaction closed on June 10, 2021.