Attached files

| file | filename |

|---|---|

| EX-99.3 - ALTITUDE INTERNATIONAL HOLDINGS, INC. | ex99-3.htm |

| EX-99.2 - ALTITUDE INTERNATIONAL HOLDINGS, INC. | ex99-2.htm |

| EX-99.1 - ALTITUDE INTERNATIONAL HOLDINGS, INC. | ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: July 23, 2021

ALTITUDE INTERNATIONAL HOLDINGS, INC.

(Exact name of Registrant as specified in its Charter)

| New York | 000-55639 | 13-3778988 | ||

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer | ||

| of Incorporation) | File Number) | Identification No.) |

4500 SE Pine Valley Street, Port Saint Lucie, FL 34952

(Address of Principal Executive Offices)

(772) 323-0625

(Registrant’s Telephone Number, including area code)

Copy to:

Brunson Chandler & Jones, PLLC

175 South Main Street, Suite 1410

Salt Lake City, Utah 84111

(801) 303-5721

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see general instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Explanatory note: This 8-K/A amends that certain Form 8-K filed on July 23, 2021 and includes additional information on the operations of Breunich Holdings, Inc. (the company acquired through the Share Exchange Agreement) its financial statements.

FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Current Report. We cannot assure you that the forward-looking statements in this Current Report will prove to be accurate, and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this Current Report completely, and it should be read and considered with other reports filed by us with the Securities and Exchange Commission (the “SEC”). Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

NAME REFERENCES

Except as otherwise indicated by context, references to the “Company,” “Altitude,” “we,” “our,” “us” and words of similar import refer to “Altitude International Holdings, Inc.,” a New York entity.

DOCUMENTS INCORPORATED HEREIN BY REFERENCE

See Item 9.01 for documents incorporated herein by reference, including our prior reports or registration statements that have been filed by us with the SEC and that contain information, as applicable, to the information required by Item 501(8) of Form 8-K.

Item 1.01 Entry into Definitive Material Agreement.

On July 6, 2021, Altitude International Holdings, Inc. ( “Altitude” or the “Company”) entered into a Share Exchange Agreement (the “Agreement”) with Breunich Holdings, Inc., a Delaware entity (“BHI”), and the shareholders of BHI. BHI is a holding company with seven operating LLCs, including CMA Soccer, LLC, ITA-USA Enterprise LLC, Trident Water LLC, North Miami Beach Academy LLC, NVL Volleyball Academy LLC, Six Log Cleaning and Sanitizing LLC, and Altitude Wellness LLC.

The Exchange

Pursuant to the terms of the Agreement, the Company agreed to issue 295,986,724 shares of its common stock to the shareholders of BHI in exchange for 100% ownership of BHI. The Company also agreed to issue 51 shares of its Series A preferred stock to Greg Breunich for his services as an officer of BHI.

Item 2.01 Completion of Acquisition or Disposition of Assets.

At the Closing of the Share Exchange Agreement on July 23, 2021, Altitude acquired 100% ownership of BHI as a wholly - owned subsidiary and its six operating companies: CMA Soccer, LLC, ITA-USA Enterprise LLC, Trident Water LLC, North Miami Beach Academy LLC, NVL Volleyball Academy LLC, Six Log Cleaning and Sanitizing LLC, and Altitude Wellness LLC. See above details in Item 1.01. BHI is now operating as a wholly owned subsidiary of the Company.

Item 3.02 Unregistered Sales of Equity Securities

Pursuant to the Share Exchange Agreement, the Company issued 295,986,724 shares of its restricted common stock to the shareholders in BHI on a pro rata basis. These shares were issued pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended pursuant to Section 4(a)(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transactions did not involve a public offering.

The Company also issued fifty-one shares of the Company’s Series A Preferred Stock to Greg Breunich for his services as an officer of the Company. These shares were issued pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended pursuant to Section 4(a)(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transactions did not involve a public offering.

| 2 |

Form 10 Disclosure

Explanatory Note: While the Company was not a shell company prior to the Share Exchange, the Company has chosen to include all Form 10 information related to BHI in this 8-K/A as part of its ongoing efforts in public disclosure.

As disclosed in this report, on July 23, 2021, we acquired Breunich Holdings, Inc., (“BHI”) a Delaware entity and its several operating LLCs: CMA Soccer, LLC, ITA-USA Enterprise, LLC, Trident Water, LLC, North Miami Beach Academy LLC, NVL Volleyball Academy LLC, Six Log Cleaning & Sanitizing LLC, and Altitude Wellness, LLC.

The acquisition of BHI was a material transaction to our existing operations.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of BHI, except that information relating to periods prior to the date of the acquisition of BHI only relate to Altitude, unless otherwise specifically indicated.

BUSINESS

BHI was formed in 2020 as a holding Company and since its inception has acquired several operating subsidiaries: ITA-USA Enterprise, LLC D.B.A. Club Med Academies (“CMA”), CMA Soccer, LLC, NVL Academy LLC, North Miami Beach Academy LLC, Trident Water, LLC, Six Log Cleaning & Sanitizing LLC, and Altitude Wellness, LLC. In January 2021, BHI signed an LOI with Altitude in which the parties agreed to enter into a Share Exchange Agreement. BHI operates in various business divisions through its subsidiaries, mainly within performance training and specialized academic environments. It also manages and operates a subsidiary that manufactures Pure Water Generators utilizing a patented ozonated water treatment technology. This technology produces pure, oxygenated drinking water from the humidity in the air. Because the material operations of BHI take place through and within the businesses of its subsidiaries, the following discussion notes key business information regarding each subsidiary.

ITA-USA Enterprise, LLC D.B.A. Club Med Academies (“CMA”)

Corporate History

ITA-USA Enterprise, LLC (D.B.A. “ Club Med Academies” or “CMA”) was formed in 2010. Currently, CMA and the team reside on a 258-acre property located in Sandpiper Bay, Florida.

| 3 |

Nature of Operations

CMA specializes in the training and education of young aspiring student-athletes from around the world, providing a pathway from middle school to college to the professional ranks. CMA’s proprietary educational model currently focuses on sports and academics. The business model is scalable to other disciplines, i.e., the arts and science sectors. CMA is a tuition-based business and hosts boarding and non-boarding students from approximately 40 nations. The majority of attendees participate on a school year semester basis, residing with CMA 287 - days out of the year. Students arrive in August and finish up in May in a given school year. Others who participate come to the academy weekly throughout the year. CMA hosts Tennis, Golf, and full Academic disciplines of the academy group of companies. Tuitions for the CMA program range from $51,000 non-boarding to $67,000 boarding.

The golf academy is led by Director Matt Fields, who has worked alongside multiple instructors. Matt previously served as the Director of Golf for the International Junior Golf Academy. Students in the golf program engage in a rigorous training and academic schedule, with daily morning and afternoon golf and academic regimens. Matt and his team continue year in and year out to build and create young, prime time golfers who go on to receive college scholarships (in sport and academics) and in some cases further excel into the professional ranks.

The tennis academy follows the Gabe Jaramillo coaching methodology, employing in-depth cyclical training plans covering all aspects of player development. The tennis program, as well as all the other sports at the academy, requires a long-term outlook for building a sound and complete athlete. Gabe Jaramillo and Greg Breunich have long-standing reputations having developed many of the finest professional athletes ever to play the game of tennis. Many of their tennis players went on to become finest players in the world. There are full-time, short-time, junior, and professional regimens available, each focusing on the building process designed to ensure participants’ long-term success. Over their 40-year history the program has placed thousands of kids into every national college division and trained hundreds of athletes into the professional ranks. Leadership of CMA developed many of the greatest tennis players in the world: Agassi, Sampras, Kournikova, Sharapova, Seles, and the Williams sisters to name a few.

CMA Soccer and CMA volleyball reside in separate LLCs and are modeled like the golf and tennis divisions. All sports at CMA Academy use the CMA on site (further described below).

Industry Operating Environment

Athletes that hope to compete at top professional levels require extensive training and resources from a young age. It can be challenging for the families of those young athletes to find the right balance of high-level academics and consistent athletic training. CMA specializes in ensuring that all its students have access to world-class training, education, facilities, and coaching. CMA’s distinct education-and-training methodology carves out effective practice, training and academic regimens on a daily basis This methodology ensures young athletes reach their ultimate level of development and performance. All CMA athletes advance to play at the collegiate level, and some go on to become professional athletes. The methodology also strongly emphasizes developing the individuals’ learning skills, competitive competence and academic development. Thus, CMA provides a gateway for young, talented athletes to hone their athletic prowess, minds, and overall ability to succeed.

| 4 |

Development

The learning model is shown in the following image.

Competition

CMA’s competitors include IMG Academy, Saddlebrook Preparatory School, Mouratoglou Academy (France), and Evert Tennis Academy.

Marketing and Customers

CMA markets internationally to a target audience of young athletes and their families through websites and social media channels, delivering in -person clinics in specific regions. In addition, CMA has developed a global agent network that refers athletes, students, professional and college teams from Europe, Asia, North America and South America. Their target audience comprises young individuals possessing the passion and drive to excel as collegiate and professional athletes. CMA’s training and education is offered to student-athletes from over 40 nations.

Principal Agreements Affecting Ordinary Business

CMA maintains an Operating and Licensing Agreement (the “Agreement”) with Holiday Village of Sandpiper, Inc., a Florida corporation (“Club Med”), located at 3500 SE Morningside Boulevard, Port St. Lucie, FL 34952. The Agreement stipulates that CMA is allowed to use the facilities at Club Med for its academy and athletic programs. The Agreement runs for a term of one year beginning May 1, 2021 and may be renewed in one-year increments provided both parties mutually agree in writing. CMA agreed to promote, staff, and deliver the academy programs, as well as provide and maintain all necessary supplies and equipment, for CMA clients and students. CMA also provides Club Med with client feedback and complies with all standard operating procedures and guidelines provided by Club Med. Club Med agreed to provide room and board to CMA and repairs and maintenance of all infrastructure utilized by Club Med Academies, including utilities and capital costs associated with Club Med owned facilities. Club Med provides the all-inclusive programming delivered to its resort guests. Both parties are required to maintain insurance policies that will cover their operations, ensure their employees abide by all laws and facility rules, pass background checks, and indemnify each other.

CMA Soccer, LLC

Corporate History

CMA Soccer, LLC (“CMAS”) launched in 2018.

| 5 |

Nature of Operations

CMAS is the soccer division of Club Med Academies. It is operated as a separate LLC under contract with Club Med. CMAS like other CMA programs hosts student-athletes from many nations. CMA utilizes highly specialized training methodologies, blending all the critical elements required to groom a high- level soccer player. Those who attend participate in a 10-hour per day regimen of soccer, academics and athletic development. CMAS is a college and professional-bound program placing its graduates in colleges and professional ranks throughout the USA. It also places graduates in the professional ranks throughout Europe, South America, and Asia. Attendees of the soccer academy train on two international- sized, natural turf fields located at Club Med Sandpiper Bay in Port Lucie, FL. Besides attracting junior, high-performance soccer players, CMAS also draws and hosts global professional teams for preseason training camps at Club Med. (Pachuca – Mexico, Penarole-Uruguay, Inter-Miami – MLS, Washington Spirit – NWSL, and Kansas City WFC – NWSL)

Industry Operating Environment

Athletes that hope to compete at top professional levels require extensive training and resources from a young age. It can be challenging for the families of those young athletes to find the right balance of high-level academics and consistent athletic training. CMAS specializes in ensuring that all its students have access to world-class training, education, facilities, and coaching. CMAS’s distinct education-and-training methodology carves out effective practice, training and academic regimens daily. This methodology ensures young athletes reach their ultimate level of development and performance. Most CMAS athletes advance to play at the collegiate level, and some go on to become professional athletes. The methodology also strongly emphasizes developing the individual’s learning skills, competitive competence and academic development. Thus, CMAS provides a gateway for young, talented athletes to hone their athletic prowess, minds, and overall ability to succeed.

Development

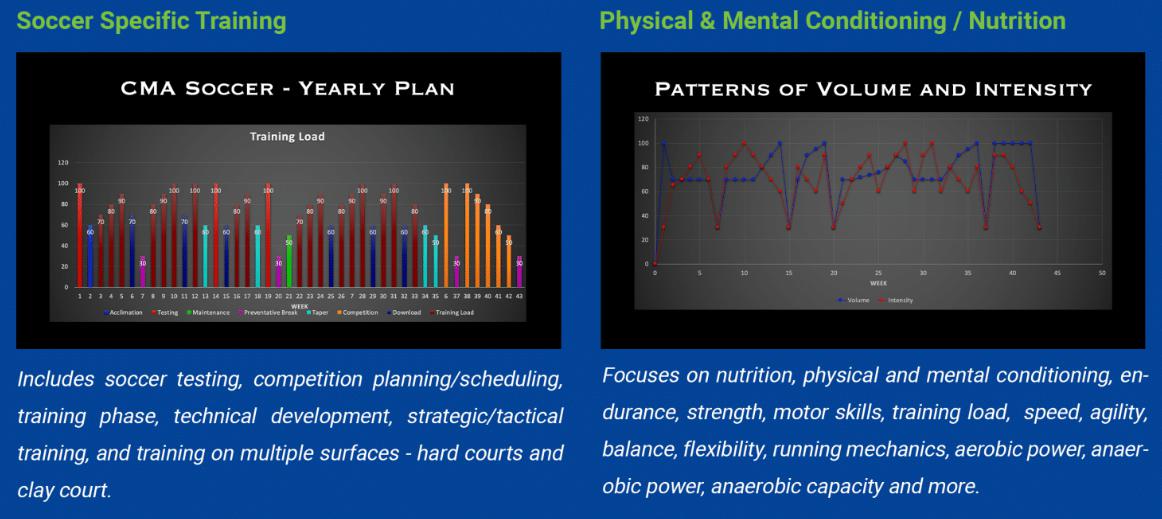

CMA Soccer LLC’s (“CMAS”) learning model is provided in more detail in the following images. CMAS offers both full-time and short-time programs to cater to young athletes with full access to its extensive facilities. Beyond training and academics, CMAS also employs an Academy Life team to instill the holistic growth and development of all students. This ensures the athletes feel confident and secure in the safe, calm, friendly environment. Just as CMA provides competitive, comprehensive national and global sports platforms critical for athletes’ development, CMAS does the same. This ensures the sufficient exposure of information to maximize long-term results.

CMAS uses a holistic and comprehensive approach to develop talented soccer athletes. The following images help illustrate various components of CMAS’s offering to its students and their families. Its main objective ensures that the foundational components are geared towards developing the athletes’ learning skills and competitive competence.

| 6 |

| 7 |

Competition

CMAS’s competitors include IMG Academy and Montverde.

Marketing and Customers

CMAS markets internationally to a target audience of young soccer players and their families through websites and social media channels, delivering in -person clinics in specific regions. In addition, CMAS has developed a global agent network that refers athletes, students, professional and college teams from Europe, Asia, North America and South America. Their target audience comprises boy and girls possessing the passion and drive to excel as collegiate and professional soccer players. CMAS’s training and education is offered to student-athletes from over 40 nations. Soccer in general in the United States has a well-developed club system. CMA Soccer’s integrated school and training program is a perfect fit for clubs across America and provides a highly targeted growth opportunity for Altitude’s stock or business.

Because CMA offers training and education to student-athletes from around the world, CMA provides support through its academic model in language and cultural awareness as students acclimate to CMA’s unique environment. CMA’s brand and reputation are synonymous with high achievement, family environment, and developing a well-rounded individual.

Principal Agreements Affecting Ordinary Business

None.

NVL Volleyball Academy LLC

Corporate History

NVL Volleyball Academy (“NVL”) LLC began operations in 2014 and is the beach volleyball and indoor volleyball tuition-based operation for CMA.

| 8 |

Nature of Operations

Most athletes in this program, with a few exceptions, are from the USA and are women. There is a significant opportunity for college scholarships for attendees. The facilities include eight sand volleyball courts and an offsite indoor gym. Most students participate and compete in both beach and indoor volleyball, which in turn expands their scholarship opportunities. All programming is run similar to the other CMA disciplines. Students train for two morning hours, attend school for two morning hours, break for lunch, attend school for two afternoon hours, train for three afternoon hours, break for dinner, and attend school for two evening hours, respectively. Title 9 offers a lot of opportunity for women’s sports in college. All athletes receive some form of a scholarship to attend college, whether for sports or academics.

Industry Operating Environment

Athletes that hope to compete at top professional levels require extensive training and resources from a young age. It can be challenging for the families of those young athletes to find the right balance of high-level academics and consistent athletic training. NVL specializes in ensuring that all its students have access to world-class training, education, facilities, and coaching. NVL’s distinct education-and-training methodology carves out effective practice, training and academic regimens daily This methodology ensures young athletes reach their ultimate level of development and performance. All NVL athletes advance to play at the collegiate level, and some go on to become professional athletes. The methodology also strongly emphasizes developing the individuals’ learning skills, competitive competence and academic development. Thus, NVL provides a gateway for young, talented athletes to hone their athletic prowess, minds, and overall ability to succeed.

Development

NVL Volleyball Academy (“NVL”) LLC’s learning model is provided in more detail in the following images. NVL offers both full-time and short-time programs to cater to young athletes with full access to its extensive facilities. Beyond training and academics, NVL also employs an Academy Life team to instill the holistic growth and development of all students. This ensures the athletes feel confident and secure in the safe, calm, friendly environment. Just as CMA provides competitive , comprehensive national and global sports platforms critical for athletes’ development, NVL does the same. This ensures the sufficient exposure of information to maximize long-term results.

| 9 |

Competition

NVL’s competitors include the local volleyball club network and other Beach Volleyball operators around the USA.

Marketing and Customers

NVL markets mainly in the US and Canada to a target audience of young volleyball players and their families through word of mouth, websites and social media channels as well as delivering in-person clinics in specific regions. There are significant opportunities in Europe, Caribbean and some South and Central American countries too. NVL is experiencing a pick-up in its full time boarding and non-boarding programs. Volleyball until recent years has generally been a local club operation. NVL’s focus is the female volleyball player looking to attend a boarding school with a strong competitive volleyball program. NVL provides both indoor and beach volleyball – a broader market reach as well as greater scholarship opportunities for the individuals that attend. NVL’s leadership and coaching staff have competed at the highest level of competition both indoor and on the beach. They’ve played for their national team, or as all Americans and professionals.

Because NVL offers training and education to student-athletes from around the world, NVL provides support through its academic model in language and cultural awareness as students acclimate to NVL’s unique environment. NVL’s brand and reputation is synonymous with high achievement, family environment, and developing a well-rounded individual.

Principal Agreements Affecting Ordinary Business

None.

North Miami Beach Academy LLC

| 10 |

Corporate History

North Miami Beach Academy LLC was formed in February 2010. Through a bid process, the City of North Miami Beach awarded the right to operate a stand-alone park to North Miami Beach Academy (NMBA) in February 2017. The park is where world-famous Nick Bollettieri began his career. NMBA is a stand-alone tennis and academic academy and park operating separately from CMA and its affiliates. NMBA intends to work with the city of North Miami Beach to redevelop the park and build a boutique academy in Miami’s greater metropolitan area offering sports, arts, sciences, and academics.

Nature of Operations

NMBA is a local park operation with the City of North Miami Beach, providing junior, adult, and family programming for city residents. In addition to the local park deliverables, NMBA operates a non-boarding tennis and academic academy. NMBA’s tuition currently costs $37,000 for school and training. The academic academy offers K-12 education with an emphasis on college preparation and global blended learning. The academy focuses on creating a dynamic learning culture by combining the development of practical skills of the individual with the measurement of a competitive platform like tennis.

Industry Operating Environment

Athletes that hope to compete at top professional levels require extensive training and resources from a young age. It can be challenging for the families of those young athletes to find the right balance of high-level academics and consistent athletic training. NBMA provides a combined experience of a K-12 education as well as high-level training in tennis. NBMA specializes in ensuring that all its students have access to world-class training, education, facilities, and coaching. NBMA’s distinct education-and-training methodology carves out effective practice, training and academic regimens daily. This methodology ensures young athletes reach their ultimate level of development and performance in tennis. Many NBMA athletes have gone on to become professional athletes. The methodology also strongly emphasizes developing the individuals’ learning skills, competitive competence and academic development. Thus, NBMA provides a gateway for young, talented athletes to hone their athletic prowess, minds, and overall ability to succeed.

Development

NMBA offers a fully accredited academic school from grades K through 12 as well as a tennis academy to its student population. With high-level instructors and an exclusive development contract with the City of North Miami Beach, NMBA focuses on training the next generation of athletes to find success in the classroom and on the tennis court. The program operates at Judge Arthur Snyder Tennis Center in North Miami Beach.

Competition

NMBA’s competitors include other Miami local city and private school programs.

Marketing and Customers

NMBA is a unique academy operation in the heart of North Miami Beach. The market initiative targets a 20-minute radius around the Academy address. The location is very close to Adventura, Sunny Isles and Bal Harbor. The demographics in this area have an extremely high culturally diverse draw and a broad array of wealthy customers. Word of mouth, websites, social media channels and the high demographic local market deliver the traffic for this business. The business has significant margin opportunity on small revenue, low volume, low cost. Public park relationships represent a significant growth opportunity for Altitude’s academy businesses.

Principal Agreements Affecting Ordinary Business

The agreement with the City of North Miami Beach and the bid process every 3-4 years.

Trident Water, LLC

| 11 |

Corporate History

Trident Water Company (“TWC”) was founded in the summer of 2019, and we believe it is positioned to take a prominent position in the marketplace.

In June 2021, Trident Water Company acquired Patent No. 7272947 to protect its intellectual property regarding ozone purification in Atmospheric Water Generators. Prior to that, Trident operated under a licensing agreement.

Nature of Operations

TWC manufactures Atmospheric Water Generators (“AWGs”). They range from smaller residential, light commercial, and heavy-duty military-grade machines. The machines supply up to 12, 100, and 200 gallons of water per day. AWGs produce pure water through the condensation process. The competitive advantage of TWC’s patented ozone purification process is that it keeps the water and the system free from contaminants. The water is then put through filters replenishing the calcium and magnesium minerals to make what we believe is the finest drinking water on the market today. The patented EnviroGuard™ (Ozone Generator) purification process assists the natural water cycle by infusing Ozone into the water produced from the air’s humidity. After approximately 20 minutes, the Ozone (O3) then reverts into oxygen (O2), adding additional oxygen into every glass of water. In the final step, the process adds the minerals calcium and magnesium to raise the pH (7.6 to 8.1 on average) and provides a great taste. TWC’s process is green, sustainable, and lowers the carbon footprint. The United States Military has recently become a prominent client of TWC. Other noted industry sectors in need of quality water solutions are targets of TWC such as humanitarian organizations, NGOs, FEMA and sustainable real estate development.

Industry Operating Environment

AWGs extract water from humid ambient air and render it potable, making it safe for drinking. TWC uses its patented process to distinguish itself from the competition by not only providing potable water but adds the element of providing oxygenated water. TWC can provide the benefits of oxygenated water. It allows for better absorption for the body’s cells based on osmosis through a sustainable product that can make water even in areas where it may not always be readily available. Thus, TWC operates within the pure water generation industry as well as the oxygenated water industry, carving out a unique niche product market for customers.

Development

TWC offers several levels of its AWGs at various price points, enabling it to target a larger variety of potential customers. The largest output machine is functional for large entities and institutions, whereas the smallest output model is suited for a small commercial or residential environments. The variety of products with the same patented process in each of them allows TWC to create a varied customer base and to effectively market to more entities and interested parties.

| 12 |

Competition

TWC’s competitors include Genaq, Watergen USA, SunToWater Technologies, and Synergy Science.

Marketing and Customers

TWC targets consumers that regularly rely on creative ways to obtain pure water, including the United States Armed Forces. The current pricing of the different models is aimed at commercial entities that are looking to differentiate their water sourcing and options. The patented process within the AWGs appeals to forward-thinking, environmentally conscious clients, and this creates a new niche market in which TWC operates.

Principal Agreements Affecting Ordinary Business

None.

Six Log Cleaning & Sanitizing LLC

Corporate History

Six Log Cleaning & Sanitizing (“SLCS”) was formed in 2020 to acquire Big Russ Cleaning. Big Russ Cleaning has serviced 55 H&R Block stores from Vero Beach, FL, to Fort Lauderdale, FL. Each year, Big Russ Cleaning has increased revenues. SLCS recently expanded the services to H&R Block to include weekly fogging and sanitizing services. It also provides sanitation services to CMA.

Nature of Operations

SLCS provides a wide variety of services to its corporate customers, including but not limited to general office cleaning, carpet cleaning, window cleaning, and other janitorial protocols. Fogging to prevent and protect against exposure to various bacteria, fungi, and viruses is another SLCS offering. SLCS carries numerous products for sanitizing using an electrostatic fogger to protect offices and their employees for an extended period of time depending on the client’s needs.

Industry Operating Environment

SLCS operates within the commercial cleaning industry and offers high-end cleaning services. Its current contract with H&R Block stores showcases its ability to navigate a large contract and makes it marketable as a scalable service. Additionally, its inclusion of fogging is a unique and important offering in the current climate surrounding the COVID-19 virus and the heightened disinfecting and cleaning standards of many businesses.

Development

SLCS uses high-quality cleaning and disinfecting products to conduct a thorough and effective service throughout a commercial space. The service values a high attention to detail, evident in its inclusion of fogging in its services to create long-term protection and disinfection on high contact surfaces and offices. SLCS is also evaluating certain air purification systems using ozone to combat the potential COVID virus for its customers.

Competition

SLCS’s competitors include Ace Cleaning Systems and ClarityFresh.

Marketing and Customers

SLCS focuses on customers that would issue larger contracts, such as H&R Block, wherein SLCS is able to clean multiple commercial locations and build a relationship with the customer by showing high -level cleaning performance at each location.

Principal Agreements Affecting Ordinary Business

None.

| 13 |

Existing and Probable Government Regulation to Our Current and Intended Business

Exchange Act

We are subject to the following regulations of the Exchange Act, and applicable securities laws, rules and regulations promulgated under the Exchange Act by the SEC. Compliance with these requirements of the Exchange Act increases our legal and accounting costs.

Smaller Reporting Company

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

Sarbanes/Oxley Act

We are also subject to the Sarbanes-Oxley Act of 2002 (the “Sarbanes/Oxley Act”). The Sarbanes/Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes/Oxley Act will substantially increase our legal and accounting costs.

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act like we are to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in SEC Regulation 14A. Matters submitted to shareholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our shareholders with the information outlined in Schedules 14A (where proxies are solicited) or 14C (where consents in writing to the action have already been received or are anticipated to be received) of SEC Regulation 14, as applicable; and preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies are forwarded to our shareholders.

We are also required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in Current Reports on Form 8-K.

Number of Total Employees and Number of Full-Time Employees

Following the Closing of the Share Exchange Agreement, Altitude and its subsidiaries will have 60 full time employees and 4 part time employees.

The numbers of employees will expand as the company grows, depending on Altitude’s financial condition and the receptiveness to our products in the market. Currently, market prospecting and sales development work is being carried out by the Board, our partners, and our Ambassadors with no salaries being paid.

Reports to Security Holders

You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find all the reports that we have filed electronically with the SEC at their Internet site www.sec.gov.

RISK FACTORS

As we are a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information under this item; however, we believe this information may be of value to our shareholders for this filing. We reserve the right not to provide risk factors in our future filings. Our primary risk factors and other considerations include:

Risks Related to the Company

Altitude International operates in an environment that involves many risks and uncertainties. The risks and uncertainties described in this section are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described actually occur, our business, operating results and financial position could be adversely affected.

| 14 |

Both academies depend heavily on student and parent buy-in to our teaching and training styles, methods, and facilities, and a lack of interest could jeopardize our revenue and success model.

We are fully reliant on the trust of students and their families to attend our academies, both CMA and NMBA, in order to better succeed with their athletic and academic careers. However, we follow a strict training and educational schedule to create success. If potential families and their student athletes do not see the value in our academies and our methods, they may not attend our school and we may suffer enrollment shortages, ultimately impacting our revenues and profitability. While we cater to the highest levels of athletes and have had a history of success with our programming and goals, this is still a possibility and a risk consistent with any specialized schooling program.

Our academies require diligent teachers, faculty, trainers, and coaches in order for our student athletes to succeed, and our inability to retain or hire qualified, top-level staff may impact our ability to be successful.

CMA and NBMA employ a variety of faculty and staff to keep our facilities running and successful. We pride ourselves on having high quality instructors both in the academic classroom and on the athletic training fields to build our student athletes into high performers in all settings. However, a variety of factors may cause our current staff to leave our academies and pursue other opportunities, which we may or may not have control over. It is also a possibility that we may be unable to attract the most qualified, successful candidates to openings at our academies, which may cause staffing issues and reduce student success. While we do everything in our power to create competitive salaries and benefits offerings, a positive workplace environment, and other perks, this is a risk with any specialized schooling program.

Our academies are based in Florida, which can experience various severe weather patterns and natural disasters, possibly placing our facilities at risk of damage or destruction.

Each year, Florida faces different types of weather storms and the volatility of each varies. Our academies have been built to sustain this type of weather to ensure minimal amount of damage but given Florida’s geographical location in line of hurricanes and other possible natural disasters, this is a risk unique to our academies. Any damage or destruction of our facilities, including but not limited to training fields and equipment, could create unexpected time and financial expenditures that would impact our revenues and operating results.

The current climate around school safety is of the utmost importance to us, but if we cannot maintain or prevent various safety issues from occurring, this may impact our revenues and success in retaining student athletes.

Our academies and facilities take various precautions to encourage the mental health and safety of all our students and faculty. However, the national climate around school safety is challenging at the current moment. While we do everything in our power to ensure the safety, care, and protection of our students, faculty, and facilities, an incident that impacts this safety may create unexpected impacts on our operations and share prices.

North Miami Beach Academy’s plans for development with the city of North Miami Beach may fall through, and this may jeopardize or reduce our ability to expand our programs and facilities.

Our current plans to develop more facilities and training areas for tennis in coordination with the City of North Miami Beach may fall through, despite our best efforts to ensure that does not happen. Any number of factors could contribute to delays, adjustments, or cancellations in our plans, including but not limited to, zoning issues, permits, lack of interest, or changes in funds. If our plans for development were to face delays, changes, or stops, this may create an impact on our brand reputation and relationships.

The popularity of the sports we offer training in at our academies may vary in popularity and interest among young athletes, which may cause our student retention or enrollment to fluctuate or impact our students’ abilities to earn scholarships.

Our academies train future athletes in tennis, soccer, golf, and volleyball, and we hope to increase our success over time by continuing to develop the best athletes and facilities, furthering our brand reputation. However, the popularity and interest in these particular sports may decrease, and while we do not see this as a particularly strong possibility, it nonetheless could impact our revenues and student retention or acceptance.

If we cannot successfully market our academies, products, and services, our revenue may decrease and impact our business successes.

Our brands rely heavily on positive recognition and successful marketing campaigns. While we employ the best possible teams of staff to take on our marketing efforts and present our products, services, and academies with honesty and positivity, other influences may jeopardize our marketing efforts. This may impact our financial earnings and future solvency.

| 15 |

Our revenues and profitability can fluctuate from period to period and are often difficult to predict due to factors beyond our control.

Our results of operations in any particular period may not be indicative of results to be expected in future periods, and have historically been, and are expected to continue to be, subject to periodic fluctuations arising from a number of factors, including:

| ● | Introduction and market acceptance of new products and sales trends affecting specific existing products; |

| ● | Variations in product selling prices and costs and the mix of products sold; |

| ● | Size and timing of customer orders, which, in turn, often depend upon the success of our customers’ businesses or specific products; |

| ● | Changes in the market conditions for specialized athletic academic training, water equipment, and cleaning services; |

| ● | Changes in macroeconomic factors; |

| ● | Availability of consumer credit; |

| ● | Timing and availability of products coming from any offshore contract manufacturing suppliers; |

| ● | Seasonality of markets, which vary from quarter-to-quarter and are influenced by outside factors such as overall consumer confidence and the availability and cost of television advertising time; |

| ● | Effectiveness of our media and advertising programs; |

| ● | Restructuring charges; |

| ● | Goodwill and other intangible asset impairment charges; and |

| ● | Legal and contract settlement charges. |

These trends and factors could adversely affect our business, operating results, financial position and cash flows in any particular period.

We rely on the protection and uniqueness of our intellectual property, including our patents, to maintain a competitive advantage in the industry, and if we are unable to protect this property, we may suffer various losses.

Our patented process at TWC is critical to maintaining our competitive advantage in marketing for our product. However, if there is a significant development of similar intellectual property or an inability to litigate to protect our own intellectual property, this could significantly deter our competitive advantage. We may suffer losses including the ability to exclusively use and market our intellectual property, financial losses, reputational suffering, and a lack of client renewal.

Some of our operating expenses are more fixed, which could make it difficult to adjust if we suffer revenue shortfalls.

Many of our operating expenses are relatively fixed. We may not be able to adjust our operating expenses or other costs sufficiently to adequately respond to any revenue shortfalls. If we are unable to reduce operating expenses or other costs quickly in response to any declines in revenue, it would negatively impact our operating results, financial condition and cash flows.

If we cannot anticipate our customer’s preferences or needs, we may lose one or more of our customers, which could negatively impact our revenue and operating results.

Our future success depends on our ability to effectively develop, market and sell new products that respond to new and evolving consumer preferences. Accordingly, our revenues and operating results may be adversely affected if we are unable to develop or acquire rights to new products that satisfy consumer preferences. In addition, any new products that we market may not generate sufficient revenues to recoup their acquisition, development, production, marketing, selling and other costs.

We may not be able to gain new customers or students at our various enterprises, which could limit our revenue and profitability.

We make every effort to attract families and their young athletes to our academies and to find new potential clients in our other ventures, but this is a not a guarantee that those families and potential clients will choose to do business with us. Our academies require a financial and time investment by students and their families, and our other businesses require a similar financial investment into our products and services. If future people and businesses do not find that they are willing or able to make the required investments into our businesses, this may impact our revenue and operating results and create difficulty expanding or continuing our existing efforts.

Government regulatory actions could disrupt our marketing and sales efforts.

Various international and U.S. federal, state and local governmental authorities, including the Federal Trade Commission, the Consumer Product Safety Commission, the Securities and Exchange Commission and the Consumer Financial Protection Bureau, regulate our products, services, and marketing efforts. Our revenue and profitability could be significantly harmed if any of these authorities commence a regulatory enforcement action that interrupts our marketing efforts, results in a product recall or negative publicity, or requires changes in product design or marketing materials.

| 16 |

Our academies, products, and services may be subject to a competitive market and we may see fluctuations in our revenues.

Our academies are not the only specialized athletic training and academic program in the country, and this causes us to be in a competitive market to find students and families excited about becoming a part of our programs. Additionally, our water and cleaning services are part of a larger competitive market as it relates to business services and products. If we are unable to use creative marketing and create brand loyalty to our various enterprises, our revenues and operating results may fluctuate from time to time.

We may be subject to periodic litigation, patent proceedings, and other regulatory processes, which may result in unexpected time and financial expenditures.

From time to time, we may be a defendant in lawsuits and regulatory actions relating to our businesses. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such proceedings. An unfavorable outcome could have a material adverse impact on our business, financial condition and results of operations. In addition, any significant litigation in the future, regardless of its merits, could divert management’s attention from our operations and may result in substantial legal costs.

Because we store various confidential customer and business data, a system security breach may affect our business data and create unexpected time and financial expenditures.

We manage and store various proprietary information and sensitive or confidential data relating to our business, including sensitive and personally identifiable information. Breaches of our security measures or the accidental loss, inadvertent disclosure or unapproved dissemination of proprietary information or sensitive or confidential data about us, or our customers, including the potential loss or disclosure of such information or data as a result of fraud, trickery or other forms of deception, could expose us, our customers or the individuals affected to a risk of loss or misuse of this information, result in litigation and potential liability for us, damage our brand and reputation or otherwise harm our business. In addition, the cost and operational consequences of implementing further data protection measures could be significant.

Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of third parties, create system disruptions or cause shutdowns. Computer programmers and hackers also may be able to develop and deploy viruses, worms and other malicious software programs that attack or otherwise exploit any security vulnerabilities of our systems. In addition, sophisticated hardware and operating system software and applications that we procure from third parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the system. The costs to us to eliminate or alleviate cyber or other security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and our efforts to address these problems may not be successful and could result in interruptions, delays, cessation of service and loss of existing or potential customers that may impede our revenue, manufacturing, distribution or other critical functions.

The effects of the COVID-19 global pandemic are still unknown as it relates to athletics and education, which could have unexpected impacts on our academies.

In March of 2020, we entered into what the health organizations of the world labeled a “global pandemic” of the COVID-19 virus. While we are starting to emerge from many of the social distancing measures we put into place to protect our faculty, students, and families, all of the effects of the COVID-19 pandemic on the world of sports, education, cleaning procedures, and more is unknown. We may have to make costly adjustments to our various business models and operations in order to remain compliant with any changes to current regulatory policies as they relate to our various enterprises, and this may have an impact on our revenue and operating results.

TWC’s AWGs may experience defects or problems that may result in unsafe water production, creating potential insurance and liability risks.

While we make every effort in our testing process to ensure that our AWGs are functioning properly and will continue to perform as expected for the duration of the life of the product, we cannot guarantee that our products will not ever face complications. This may at times cause the water being produced to be unsafe or not up to the standard and quality we advertise. This may create liability risks for us and may impact our ability to maintain our insurance policy. Our insurance premiums may increase, which may negatively impact our financial goals.

If CMA cannot maintain its current agreement with Club Med, we may have to move our facilities elsewhere and this may impact financial goals if the lease ends unexpected.

CMA currently operates on Club Med’s property and its operating agreement is critical in keeping our facilities expenses low. However, the agreement is only in effect for one year with the potential to renew for one-year increments, and both Club Med and CMA must agree to a renewal in writing. If Club Med is dissatisfied for any reason with CMA and its operations at the end of the agreement term, they may not renew the agreement. This would create large financial expenditures as the academy would have to relocate to a new site and would likely result in negative impacts on operating results. Additionally, it may impact the quality of facilities available to CMA students and faculty, which could lead to reduced enrollment rates. While CMA puts extensive effort and resources into maintaining a positive mutual relationship with Club Med for the benefit of renewing the agreement, this is not something that can be guaranteed.

| 17 |

TWC may face production delays, manufacturing problems, or other issues that may result in delivery delays, breach of contract, or negative publicity which may impact our ability to retain customers and effectively market our products.

TWC relies heavily on its manufacturing partners and staff to ensure that all manufacturing, testing, and delivery of products goes smoothly. However, there may be unexpected challenges or delays to this process which could result in delivery or manufacturing issues. With its largest commercial partnerships and contracts, TWC must maintain its end of the agreement to deliver properly functioning AWGs to the client on time, and if delays impact this, the client may have cause for a breach of contract suit. Additionally, large amounts of delays and problems may create negative publicity around TWC that can impact ability to attract and retain customers.

Risks Related to Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the over-the-counter Bulletin Board quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

| ● | variations in our operating results; |

| ● | changes in expectations of our future financial performance, including financial estimates by securities analysts and investors; |

| ● | changes in operating and stock price performance of other companies in our industry; |

| ● | additions or departures of key personnel; and |

| ● | future sales of our common stock. |

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained.

This situation is attributable to many factors, including the fact that we are a small company which is relatively unknown to stock analysts, stockbrokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until we become more seasoned and viable. Consequently, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be able to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

| 18 |

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Exchange Act which imposes additional sales practice requirements on brokers-dealers who sell our securities. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) Sales Practice Requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

We will continue to incur increased costs and compliance risks as a result of remaining a public company.

We will continue to incur costs associated with our public company reporting requirements. We also anticipate that we will incur costs associated with corporate governance requirements, including certain requirements under the Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and FINRA. Like many smaller public companies, we face a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting and the independent auditors to attest to the effectiveness of such internal controls and the evaluation performed by management. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. The Public Company Accounting Oversight Board, or PCAOB, has adopted documentation and attestation standards that the independent auditors must follow in conducting its attestation under Section 404. We are currently preparing for compliance with Section 404; however, there can be no assurance that we will be able to effectively meet all of the requirements of Section 404 as currently known to us in the currently mandated timeframe. Any failure to implement effectively new or improved internal controls, or to resolve difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet reporting obligations or result in management being required to give a qualified assessment of our internal controls over financial reporting or our independent auditors providing an adverse opinion regarding management’s assessment. Any such result could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

| 19 |

We also expect these new rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our Board of Directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Sales of our currently issued and outstanding stock may become freely tradable pursuant to rule 144 and may dilute the market for your shares and have a depressive effect on the price of the shares of our common stock.

A majority of the outstanding shares of our common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information concerning the number of shares our common stock owned beneficially as of June 24, 2021 (after the Exchange and Closing) by: (i) our directors and executive officer; and (ii) each person or group of persons known by us to beneficially own more than 5% of our outstanding shares of common stock. Unless otherwise indicated, the shareholders listed below possess sole voting and investment power with respect to the shares they own.

| 5% Shareholders | ||||||

| Name of Beneficial Owner | Title of Class | Amount and Nature of Beneficial Ownership (1) |

Percent of Class after the Merger (%) (2) | |||

| David Vincent | Common Stock | 10,461,686 | 2.95% | |||

| Lesley Visser (3) | Common Stock | 22,728,294 | 6.40% | |||

| Robert Kanuth (3) | Common Stock | 22,728,294 | 6.40% | |||

| Greg Whyte | Common Stock | 3,065,000 | 0.86% | |||

| Greg Anthony | Common Stock | 20,000,000 | 5.63% | |||

| Gabe Jaramillo | Common Stock | 42,408,342 | 11.95% | |||

| Greg Breunich (4) | Common Stock Preferred Stock |

79,342,137 51 |

22.35% 100% | |||

| Peter Duvinage | Common Stock | 18,025,117 |

5.08% | |||

| Scott Del Mastro | Common Stock | 44,072,629 |

12.42% | |||

| (1) | SEC Rule 13d-3 generally provides that beneficial owners of securities include any person who, directly or indirectly, has or shares voting power and/or investment power with respect to such securities, and any person who has the right to acquire beneficial ownership of such security within 60 days. Any securities not outstanding which are subject to such options, warrants or conversion privileges exercisable within 60 days are treated as outstanding for the purpose of computing the percentage of outstanding securities owned by that person. Such securities are not treated as outstanding for the purpose of computing the percentage of the class owned by any other person. At the present time there are no outstanding options or warrants. | |

| (2) | Based on 354,983,405 total shares issued and outstanding following the share exchange agreement. | |

| (3) | Ms. Visser and Mr. Kanuth are married and own their shares jointly. | |

| (4) | Mr. Breunich owns 51 shares of preferred stock with voting rights equal to (x) 0.019607 multiplied by the total issued and outstanding shares of Common Stock eligible to vote at the time of the respective vote (the “Numerator”), divided by (y) 0.49, minus (x) the Numerator. |

| 20 |

DIRECTORS AND EXECUTIVE OFFICERS

There have been several significant changes to the Company’s Board of Directors since the filing of our last Annual Report on Form 10-K. On June 27, 2017, pursuant to the Closing of the Share Exchange Agreement, a new officer and two new directors were appointed and our former officer and one of our directors resigned. The following sets forth information about our directors and executive officers as of the date of this report, immediately following the Share Exchange.

| NAME | AGE | POSITION | ||

| Greg Breunich | 62 | CEO, Chairman, and Acting CFO | ||

| Greg Anthony | 52 | Director, President and CCO | ||

| Lesley Visser | 67 | Director | ||

| Gregory Whyte | 53 | Director | ||

| Robert Kanuth | 73 | Director | ||

| David Vincent | 71 | Director | ||

| Gabe Jaramillo | 65 | Director and Executive Vice President | ||

| Scott Del Mastro | 54 | Director |

Background of Executive Officer and Directors

Greg Breunich, Chairman, Chief Executive Officer and Acting Chief Financial Officer

Mr. Breunich created and began building the IMG Academy in 1978, at the age of 21. Under his stewardship and service as the Senior Vice President and Managing Director, IMG became the international gold standard in elite athletic training and education, producing some of the most famous athletes in the world. Breunich left IMG in 2009 and for the last ten years has been developing his next generation of sports academies in Port St. Lucie and North Miami Beach. He is the co-founder of Nick Bollettieri Tennis Academy, Founder of the David Leadbetter Golf Academy, IMG Soccer Academy, IMG Basketball Academy, IMG Baseball Academy, IMG International Performance Institute, IMG Academy (Pendleton School), Bollettieri Sports Medicine Institute, IMG Mountain Sports Academy (Speed Skiing, Snow Boarding, FreeStyle), Bollettieri Development Co., Academy Park Development Company, IMG Academy Golf and Country Club, Legends Bay Development Co., Legends Cove Development Co. He co-developed Sagemont Online High School (a private labeled University of Miami Online High School later acquired re-named Kaplan Online High School) & Virtual Sage (online academic curriculum publishing company), Med Group Development Company, Celebrity Auto Company, JMC Landscaping, North Miami Beach Academy, Trident Water Company, and numerous other development companies and real estate partnerships.

Greg Anthony, Director, Chief Communications Officer and President

Greg Anthony is an American former professional basketball player who is a television analyst for NBA TV and Turner Sports. He played 12 seasons in the National Basketball Association. Anthony also contributes to Yahoo! Sports as a college basketball analyst and serves as a co-host/analyst on SiriusXM NBA Radio. Anthony played his freshman year of college basketball for the University of Portland where he was the WCC Freshman of the Year before transferring to the University of Nevada, Las Vegas. In his junior season with UNLV, the Runnin’ Rebels won the 1990 NCAA Championship game.

Lesley Visser, Director

Lesley Visser is one of the most highly acclaimed female sportscasters of all-time. Her long and prestigious trailblazing career has seen her as the first and only woman to be recognized by the Pro Football Hall of Fame as the 2006 recipient of the Pete Rozelle Radio-Television Award, which recognizes “long-time exceptional contributions to radio and television in professional football.” Visser has been honored with the Compass Award for “changing the paradigm of her business” and was one of the 100 luminaries commemorating the 75th anniversary of the CBS Television Network in 2003. She was named “WISE Woman of the Year” in 2002 and voted the “Outstanding Women’s Sportswriter in America” in 1983 and won the “Women’s Sports Foundation Award for Journalism” in 1992. In 1999, she won the first AWSM Pioneer Award. Visser earned her bachelor’s degree in English from Boston College and received an honorary Doctor of Journalism from her alma mater in May 2007. Lesley Visser is married to Robert Kanuth, a director of the Company.

Greg Whyte, Director

Professor Greg Whyte is a well-known authority on Exercise Physiology and Sports and Exercise Performance in the UK. An internationally recognized expert in the field, Whyte has extensive professional experience assessing, treating and improving the performance of patients, sporting enthusiasts, and athletes ranging from cancer sufferers to celebrities attempting their first mountain summit to gold medal-seeking Olympians.

In 2014, Whyte was awarded an OBE for his services to Sport, Sport Science & Charity, and was voted as one of the Top 10 Science Communicators in the UK by the British Science Council. Whyte is an Olympian in modern pentathlon and is a European and World Championship medalist. He is an expert in the field of sports and exercise science. Graduating from Brunel University, he furthered his studies with an MSc in human performance in the USA and completed his PhD at St. Georges Hospital Medical School, London. Whyte is currently a Professor of Applied Sport and Exercise Science at Liverpool John Moore’s University and Director of Performance at the Centre for Health and Human Performance at 76 Harley Street, London. Whyte’s former roles include Director of Research for the British Olympic Association and Director of Science & Research for the English Institute of Sport.

| 21 |

Whyte is well-known for his involvement in Comic Relief. Since 2006 Whyte has applied his sports science work to assist various celebrities in completing some of the toughest challenges. Whyte has trained, motivated and successfully coached 23 Sport & Comic Relief Challenges including: the comedian David Walliams to swim across the English Channel, the Gibraltar Straits, and the length of the Thames; James Cracknell to run, cycle and swim to Africa; a team of 9 celebrities including Cheryl Cole, Chris Moyles, and Gary Barlow to climb Mt. Kilimanjaro; Eddie Izzard to run a remarkable 43 marathons in 50 days; Christine Bleakley to waterski across the English Channel; Dermot O’Leary, Oly Murrs, and other to cross the driest desert in Africa; John Bishop to complete ‘Bishops Week of Hell’ that involved John cycle, row and run from Paris to London; and Davia McCall in her ‘Beyond Breaking Point’ 506 mile ultra-triathlon. This year, Whyte supported Jo Brand on her ‘Hell of a Walk’ from Hull to Liverpool and Radio 1’s Greg James on his 5 triathlons in 5 cities in 5 days.

In 2019, Whyte trained Claudia Winkleman and Tess Daly for a 24-hour Danceathon and raised over ₤700,000 for Comic Relief. 10 years after Whyte took the original 9 celebrities to Kilimanjaro, he found another 9 celebrities to attempt the challenge, with the list including Dani Dyer, Osi Umenyiora, Dan Walker, Alexander Armstrong, Shirley Ballas, Ed Balls, Jade Thirwall, Leigh-Anne Pinnock, and Anita Rani. Whyte and the celebrities completed the challenge overcoming some obstacles, the main one being altitude sickness.

David Peter Vincent, Director

David Vincent, a Chartered Engineer, is the pioneer of high-performance membrane technology for both altitude training and fire protection markets. For the past thirteen years, David has been the Managing Director at Sporting Edge UK with previous senior management positions at In BT, Andrew Corporation, Scientific Atlanta Inc, and Amstrad plc. He was educated to BSc level in Electrical and Electronic Engineering in Plymouth, England, and at 25 became one of the youngest Chartered Engineers in the country. He has since served on Technical Committees at the British Standards Institute and has registered several patents that improve the performance of simulated altitude systems.

Robert Kanuth, Director

Robert Kanuth, a Harvard graduate, is an owner of Pelican Bay Suites, a hotel on Grand Bahama Island. He is a distinguished investment banker who founded and directed Cranston Securities in the mid-1970’s. Based in his hometown of Columbus, Ohio, Bob added headquarters in Washington, D.C., while doing large scale transactions throughout the United States. The company was sold to insurance giant Kemper Corporation in 1987. He then founded Cranston Development, funding projects which restored and revitalized such cities as Richmond, VA., Savannah, GA., and Pittsburgh, PA. A Harvard alumnus, Kanuth went on to serve in the Army National Guard before launching his compelling financial career. Kanuth is married to Hall of Fame Sportscaster Lesley Visser, a director of the Company.

Gabe Jaramillo, Director and Executive Vice President and Director of Tennis Operations