Attached files

| file | filename |

|---|---|

| 8-K - EXHIBIT 8-K - Bank First Corp | tm2125462d1_8k.htm |

Exhibit 99.1

| To our shareholders, In this newsletter, I wanted to provide you with updates on our many building projects. At Bank First, we invest heavily in our facilities for several reasons. First, for our employees to perform at their highest level, they need to work in a comfortable, safe and professional environment. Our facilities team ensures all branch HVAC systems provide consistent and comfortable interior temperatures while continually refreshing our buildings with outside air. Recently, we installed ionizers at all of our branches to kill airborne bacteria and viruses. Our new buildings feature abundant natural light and, when possible, we try to bring additional natural light when we remodel our existing facilities. Our branches are a reflection of our communities. We feature stone, metal, glass and wood in our building designs which allows us to create a professional working atmosphere for our bankers and customers. As a relationship-based bank, we utilize local architects and contractors and whenever possible, customers of Bank First. In addition, we support local artists by featuring artwork that celebrates the uniqueness of each of our communities. In addition, we pride ourselves in using sustainable construction designs and methods when building or remodeling our offices. We use natural light to illuminate our branches as much as possible and augment that with LED lighting, creating a warm and inviting interior space that minimizes energy use. The lobbies of our new and remodeled offices feature flooring created from recycled tires in the heavy traffic areas and we compliment it with natural tile and traditional carpeting manufactured in an environmentally friendly way. We have recently completed, or will soon complete, remodeling projects in Manitowoc, Cedarburg, Tomah and Waupaca. At our corporate headquarters in Manitowoc, we are about to complete a project to upgrade all our lighting to LEDs. This project includes the installation of the bank’s first electric vehicle recharging stations. We have received many positive comments from our bankers, customers and community leaders celebrating the new environments that have been created in Cedarburg, Waupaca and Tomah. We are preparing to begin remodeling projects at our Watertown, Seymour and Clintonville branches. There are two new construction projects we are excited to announce. First, we will begin construction of a new 13,100 square foot operations center in Manitowoc near I-43, just north of Highway 151. The proximity to I-43 will allow us to more effectively recruit employees from beyond Manitowoc County. This new operations center is located on a nine-acre parcel of land in the Manitowoc Industrial Park, giving us plenty of room for future expansion. Our corporate headquarters will remain on N. 8th Street in Manitowoc and continue to serve customers, along with one of our busiest offices located on Custer Street in Manitowoc. Finally, we are excited to announce we are in the process of securing a seven- acre site on the north side of Green Bay which will replace our Ashwaubenon branch and will house our business banking team and support staff. We plan to begin construction of this new office by next summer. We are planning to feature the next generation of sustainable construction methods and materials, making it our most ecologically friendly branch to date. Bank First is a “relationship-based bank” and as such we are an institution in each of the communities we serve. As banking continues to change, our branches must evolve with our products and services. Michael B. Molepske, CEO and President (920) 652-3202 MESSAGE FROM THE CEO Ticker: BFC www.BankFirstWI.bank AUGUST 2021 SHAREHOLDER NEWS Kelly Fischer joins UFS Board of Directors Kelly Fischer, Chief Operating Officer at Bank First, has been elected to the board of directors at UFS, LLC. As a founding owner of UFS, Bank First has representation on the board of directors. Mike Molepske has transitioned his position on the board to Fischer. Molepske has served on the UFS board since 2008 and as chairman of the board since 2019. During his tenure, UFS has grown from a local core provider to a regional technology outfitter in the FinTech space with a focus on innovative cybersecurity, managed IT, and cloud services. “It has been an honor to serve on the board of directors at UFS over the past 13 years,” Molepske stated. “Kelly’s expertise leading our operations team along with our IT department has more than qualified her for her new appointment to the board. She has the essential skills and knowledge to represent Bank First, community banks as a whole, and assist UFS in furthering its success.” “Our promise as a relationship- based bank is to provide innovative products and services that are value driven and UFS has been vital to our innovation strategy,” stated Fischer. “Through my role at Bank First, I have been privileged to work with the team at UFS for over 20 years and am honored to be selected to serve on the board. I am excited to work with fellow board members, the management team, and dedicated employees at UFS and look forward to contributing to its ongoing success in advocating for the needs of community banks.” MIKE MOLEPSKE KELLY FISCHER ( i _/ Bankfirst CORPORATION |

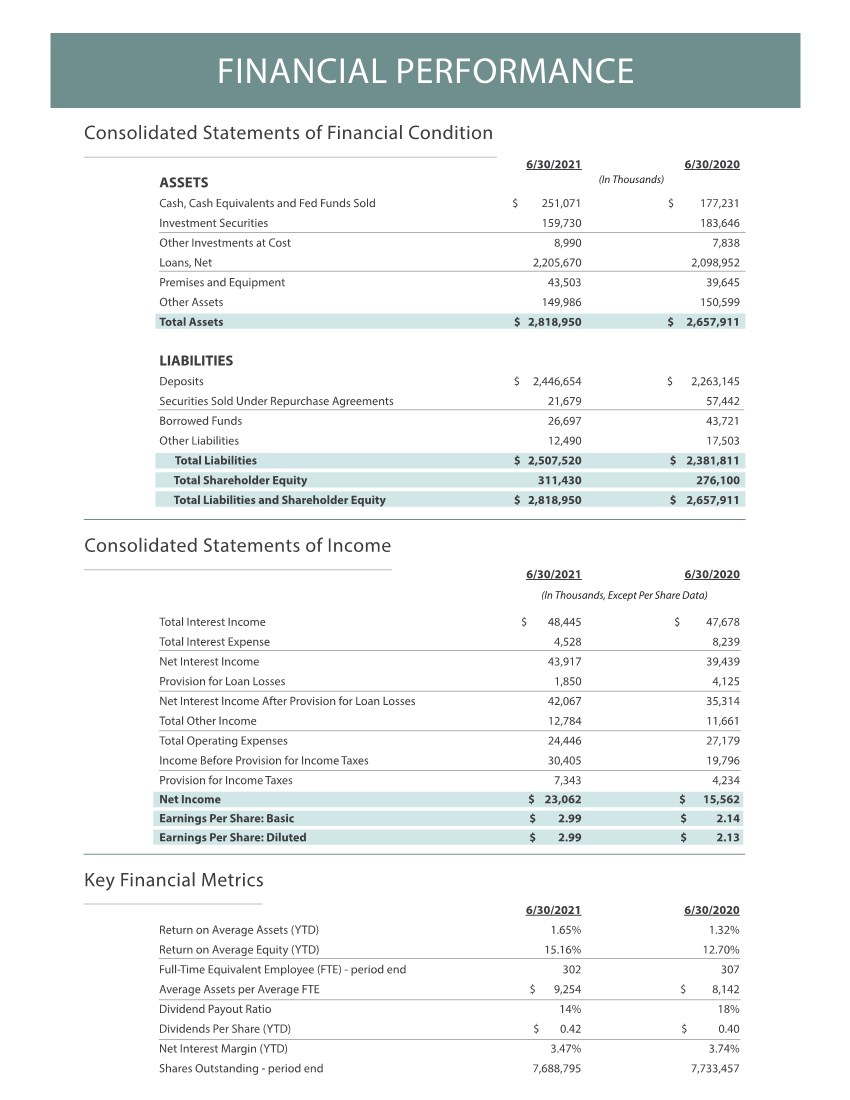

| Total assets for the Company were $2.82 billion at June 30, 2021, compared to $2.66 billion at June 30, 2020. Loans at June 30, 2021 totaled $2.23 billion, growing $110.2 million on a year-over-year basis. Deposits were $2.45 billion at June 30, 2021, growing $183.5 million over that same time frame. Loans originated through the Paycheck Protection Program (“PPP”), which was designed to support small businesses through the turbulent economic environment created by the COVID-19 pandemic (“COVID”), totaled $127.3 million and $278.1 million at June 30, 2021 and 2020, respectively. It is anticipated that most loans originated under PPP will be forgiven and repaid by the Small Business Administration (“SBA”), which administered the program. Through June 30, 2021, the SBA had forgiven and repaid $254.0 million of the $381.3 million in loans originated by the Company under PPP. Excluding the impact of balances from PPP, loans increased by 14.4% year-over-year. Earnings per share for the six-months ended June 30, 2021, was $2.99, an increase of 39.7% compared to the same period in 2020. Year- to-date net income was $23.1 million, compared to $15.6 million for the same period during 2020. Net interest income before provision for loan losses increased by $4.5 million over the first six months of 2021 to $43.9 million. Provision for loan losses totaled $1.9 million for the first six months of 2021, down from $4.1 million for the same period during 2020. The elevated loan loss provision during the first half of 2020 was primarily due to uncertainty related to COVID. Strong asset quality metrics exhibited within the Company’s loan portfolio through the first half of 2021 have allowed a reduction in these provisions. Total non-interest income was $12.8 million for the first six months of 2021, compared to $11.7 million for the prior year period, an increase of $1.1 million. Net gains on sales of mortgage loans and servicing income created from servicing sold loans increased by $4.2 million from $2.5 million for the first six months of 2020 to $6.7 million for the same period in 2021, the result of robust secondary market loan originations during the first six months of 2021 compared to the same period in 2020. Sales of $36.6 million in U.S. Treasury notes during the second quarter of 2020 led to a gain on sale of securities totaling $3.1 million. There were no similar sales of investments during the first half of 2021. Non-interest expense decreased by $2.7 million, or 10.1%, to $24.4 million for the six-months ended June 30, 2021. The Company incurred a gain on sale and valuation of foreclosed properties totaling $0.2 million during the first half of 2021 which compared favorably to a loss of $1.4 million in this area during the first half of 2020. In addition, expenses directly related to the acquisition of Timberwood Bancorp Inc., added $0.8 million to non-interest expense during the first half of 2020, primarily in relation to personnel expense, data processing and outside professional fees. Finally, due to the falling interest rate environment during the first half of 2020, management determined that is was prudent to pay off $30.0 million in borrowings from the Federal Home Loan Bank of Chicago which had contractual maturities ranging from August 2022 through August 2024 and contractual interest rates ranging from 1.74% to 1.76%. This repayment resulted in the recognition of a prepayment penalty totaling $1.3 million during the second quarter of 2020, while saving the Company $1.7 million in interest expense over the next four years. Offsetting these positive variances from 2020 to 2021 was the added scale of operations due to the acquisition of Timberwood, causing overall increases in most areas of non-interest expense. Total shareholders’ equity increased by 12.3% to $311.4 million at June 30, 2021, as compared with $276.1 million at June 30, 2020. At its July meeting, the Company’s Board of Directors approved a quarterly dividend of $0.21 per common share and an additional special one- time dividend of $0.29 per common share, to be paid to shareholders of record as of September 22, 2021. SECOND QUARTER KEVIN LEMAHIEU Chief Financial Officer (920) 652-3362 Quarterly Common Stock Cash Dividend The Corporation’s Board of Directors approved a quarterly cash dividend of $0.21 per common share and a special one-time cash dividend of $0.29 per common share. The dividends are payable on October 6, 2021, to shareholders of record as of September 22, 2021. BFC Stock Repurchase Program Bank First has a stock repurchase program under which the Corporation may repurchase shares of outstanding BFC stock. Please contact Mike Molepske at (920) 652-3202 or Shannon Klahn at (920) 652-3222 for further information. Steimle promoted to Regional President Eli Steimle has been promoted to Manitowoc Regional President at Bank First. Eli joined the bank in 2010 as a youth apprentice on the teller line, served as an intern in the treasury management department while attending college, and joined Bank First full time as Business Analyst in 2018. He quickly became a key member of the business banking team and was promoted to Business Banking Officer in 2020. Eli was instrumental in the bank’s involvement in the Small Business Administration’s Paycheck Protection Program and most recently served as Assistant Vice President of Business Banking out of the bank’s Sheboygan office. In his new role, Eli will be responsible for managing the team of bankers in the Manitowoc market, as well as supporting existing and developing new business relationships in the community. Eli received a Bachelor of Business Administration degree and a Master’s degree in Accounting from UW – Madison. He earned his CPA designation in 2018 and is currently pursuing his Master of Business Administration degree at Marquette University. Involved in his community, he currently serves as Vice Chair on the Manitowoc-Two Rivers YMCA Board of Directors. In April 2021, Eli started Hipp Juice in Manitowoc, an unpasteurized cold press juice bar founded to enhance the health movement in his community. STEIMLE Bank First Corporation Financial Results for six months ended June 30, 2021 |

| FINANCIAL PERFORMANCE Consolidated Statements of Financial Condition 6/30/2021 6/30/2020 Return on Average Assets (YTD) 1.65% 1.32% Return on Average Equity (YTD) 15.16% 12.70% Full-Time Equivalent Employee (FTE) - period end 302 307 Average Assets per Average FTE $ 9,254 $ 8,142 Dividend Payout Ratio 14% 18% Dividends Per Share (YTD) $ 0.42 $ 0.40 Net Interest Margin (YTD) 3.47% 3.74% Shares Outstanding - period end 7,688,795 7,733,457 Key Financial Metrics 6/30/2021 6/30/2020 ASSETS Cash, Cash Equivalents and Fed Funds Sold $ 251,071 $ 177,231 Investment Securities 159,730 183,646 Other Investments at Cost 8,990 7,838 Loans, Net 2,205,670 2,098,952 Premises and Equipment 43,503 39,645 Other Assets 149,986 150,599 Total Assets $ 2,818,950 $ 2,657,911 LIABILITIES Deposits $ 2,446,654 $ 2,263,145 Securities Sold Under Repurchase Agreements 21,679 57,442 Borrowed Funds 26,697 43,721 Other Liabilities 12,490 17,503 Total Liabilities $ 2,507,520 $ 2,381,811 Total Shareholder Equity 311,430 276,100 Total Liabilities and Shareholder Equity $ 2,818,950 $ 2,657,911 6/30/2021 6/30/2020 Total Interest Income $ 48,445 $ 47,678 Total Interest Expense 4,528 8,239 Net Interest Income 43,917 39,439 Provision for Loan Losses 1,850 4,125 Net Interest Income After Provision for Loan Losses 42,067 35,314 Total Other Income 12,784 11,661 Total Operating Expenses 24,446 27,179 Income Before Provision for Income Taxes 30,405 19,796 Provision for Income Taxes 7,343 4,234 Net Income $ 23,062 $ 15,562 Earnings Per Share: Basic $ 2.99 $ 2.14 Earnings Per Share: Diluted $ 2.99 $ 2.13 Consolidated Statements of Income (In Thousands) (In Thousands, Except Per Share Data) |

| Plans for a new 13,100 sq. ft. Operations Center in Manitowoc announced Bank First recently announced plans to construct a new, environmentally-friendly Operations Center. The new 13,100 square foot facility will be located on a nine-acre lot in the industrial park at the corner of Dufek Drive and West Drive in Manitowoc. The future Operations Center will house some of the bank’s support personnel and will not function as a customer-facing branch. The bank will continue to serve customers out of its Manitowoc locations at 402 North Eighth Street and 2915 Custer Street, as well as surrounding communities. “ We are thrilled to officially announce plans to build our new Operations Center,” stated Mike Molepske. “The addition of this new facility is essential for our future. With our overall rapid bank growth over the past several years, we have simply outgrown our current space for our operations team in Manitowoc. This center will allow us to consolidate a significant portion of our operations staff while continuing to provide exceptional service for our customers.” The ne w Operations Center will feature all LED lighting and will be constructed through a variety of environmentally-friendly methods and systems including the use of carbon-reducing building materials. The HVAC (heating, ventilation, and air conditioning) system will include monitored controls to promote efficiency as well ionizing equipment to assist in eliminating germs and bacteria. Office furniture will consist of SmartTM Ocean chairs made from recycled fishing nets, Terra-Turf flooring made from recycled tires, and Stampino field tile made from 40% pre-consumer recycled content, just to name a few. The property currently hosts a natural landscape of plants and grasses which the bank plans to preserve and maintain. External designs also include a perimeter walking path to encourage employee wellness. Int erior designs for the center include 66 work stations, six offices, four multi-function rooms, and will house the bank’s loan operations department as well as the option to include other departments. While the initial project includes plans for a 13,100 square foot office, space for two 6,000 square foot additions is reserved for planned future use. Sit e work will begin in early fall of 2021 with construction to begin in early spring of 2022. Stauss Architect, LLC is assisting in the design and planning process and Jos. Schmitt Construction will be serving as the General Contractor for the project, both valued customers of Bank First. Major renovations in Tomah, Cedarburg, and Waupaca now complete! While many banks throughout the state of Wisconsin are closing and/or consolidating their offices, Bank First is proud to announce the completion of recent renovations at our Tomah, Cedarburg, and Waupaca offices. The positive feedback from customers at these locations has been extraordinary. Comments include the beauty of the new space(s) and the enjoyment of local artwork on display. Customers in Cedarburg feel as though they are walking into an art museum and appreciate the exceptional quality the renovation has brought to downtown Cedarburg. Additional investments in upgrading our branch network include the offices of Clintonville, Seymour, Watertown, and a new office in Green Bay. Cedarburg ~ W61 N529 Washington Avenue Tomah ~ 110 West Veteran Street Waupaca ~ 111 Jefferson Street COMING SPRING 2022! Let’s stay in touch. Follow us! -~ -->"ir BankFirst ,. •. Ansay & ASSOCIATES Insurance & Benefit Solutions •••LJFS MYM thrive. together. |