Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - QUICKLOGIC Corp | quicklo20210405_10q.htm |

| EX-32.2 - EXHIBIT 32.2 - QUICKLOGIC Corp | ex_253618.htm |

| EX-32.1 - EXHIBIT 32.1 - QUICKLOGIC Corp | ex_253617.htm |

| EX-31.2 - EXHIBIT 31.2 - QUICKLOGIC Corp | ex_253616.htm |

| EX-31.1 - EXHIBIT 31.1 - QUICKLOGIC Corp | ex_253615.htm |

Exhibit 10.1

THIRD AMENDMENT

TO

AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

This Third Amendment to Loan and Security Agreement is entered into as of August 16, 2021 (the "Amendment"), by and between HERITAGE BANK OF COMMERCE ("Bank") and QUICKLOGlC CORPORATION ("Borrower" ).

RECITALS

Borrower and Bank are parties to that certain Amended and Restated Loan and Security Agreement dated as of December 21, 2018 and as amended from time to time, including pursuant to that certain First Amendment to Amended and Restated Loan and Security Agreement dated as of November 6, 2019 and that certain Second Amendment to Amended and Restated Loan and Security Agreement dated as of December 11, 2020 (collectively, the "Agreement"). The parties desire to address certain Events of Default that have occurred prior to the date hereof and amend the Agreement in accordance with the terms of this Amendment.

NOW, THEREFORE, the parties agree as follows:

1. Borrower acknowledges that there is an existing Event of Default arising from Borrower's failure to comply with minimum cash covenant set forth in Section 6.9(ii) of the Agreement on July 20, 2021 (the "Covenant Default"). Subject to the conditions contained herein and performance by Borrower of all of the terms of the Agreement after the date hereof, Bank waives the Covenant Default. Bank does not waive Borrower's obligations under such section after the date hereof and as amended herein, and Bank does not waive any other failure by Borrower to perform its obligations under the Loan Documents.

|

2. |

Section 6.9 of the Agreement is amended and restated in its entirety to read as follows: |

6.9 Financial Covenants.

(a) Borrower shall maintain at all times a balance of unrestricted cash in the Pledged Account not less than the principal amount of all Advances owing from Borrower to Bank.

(b) In addition to the above, Borrower shall maintain additional unrestricted cash in its accounts at Bank in an amount of at least Three Million Dollars ($3,000,000), measured (i) immediately prior to the funding of any Credit Extension and (ii) at all times that any Advance is outstanding.

3. Borrower represents and warrants that the representations and warranties contained in the Agreement are true and correct as of the date of this Amendment , and that no Event of Default has occurred and is continuing (other than the Covenant Default).

4. Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Agreement. The Agreement , as amended hereby, shall be and remain in full force and effect in accordance with its respective terms and hereby is ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery and performance of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Bank under the Agreement, as in effect prior to the date hereof. Borrower ratifies and reaffirms the continuing effectiveness of all agreements entered into in connection with the Agreement.

5. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a" .pdf' format data file, such signature shall create !l- vapd and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or ".pdf ' signature page were an original hereof.

6. As a condition to the effectiveness of this Amendment, Bank shall have received, in form and substance satisfactory to Bank, the following:

|

(a) |

the original signed Amendment, duly executed by Borrower; |

(b) a waiver and amendment fee equal to $5,000, pluus an amount equal to all Bank Expenses incurred through the date of this Amendment; and

(c) such other documents, and completion of such other matters, as Bank may reasonably deem necessary or appropriate.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

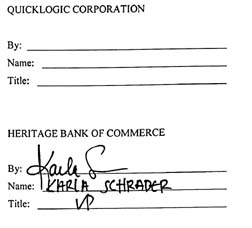

IN WITNESS WHEREOF, the undersigned have executed this Amendment as of the first date above written.

|

|

QUlCKLOGIC CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

Brian C. Faith |

|

|

|

Title: |

CEO |

|

IN WITNESS WHEREOF, the undersigned have executed this Amendment as of the first date above written.