Attached files

| file | filename |

|---|---|

| EX-23.2 - RenovoRx, Inc. | ex23-2.htm |

| EX-5.1 - RenovoRx, Inc. | ex5-1.htm |

| EX-4.2 - RenovoRx, Inc. | ex4-2.htm |

| EX-1.1 - RenovoRx, Inc. | ex1-1.htm |

As filed with the Securities and Exchange Commission on August 11, 2021.

No. 333-258071

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RenovoRx, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 27-1448452 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

4546 El Camino Real, Suite B1

Los Altos, CA 94022

(650)-284-4433

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Shaun Bagai

Chief Executive Officer

RenovoRx, Inc.

4546 El Camino Real, Suite B1

Los Altos, CA 94022

(650)-284-4433

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

Jeffrey J. Fessler Sheppard Mullin Richter & Hampton LLP 30 Rockefeller Plaza New York, New York 10112 (212) 653-8700 |

Robert Charron Charles Phillips Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |||

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |||

| Emerging growth company | [X] | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Proposed

Maximum Aggregate Offering Price(1)(2) | Amount

of Registration Fee | |||||||

| Units, each Unit consisting of one share of common stock, $0.0001 par value per share, and three-quarter Warrant to purchase one share of common stock (3) | $ | 27,657,500 | $ | 3,017.43 | ||||

| (i) Common stock included in the Units (4) | ||||||||

| (ii) Warrants included in the Units (4) | ||||||||

| Pre-funded Units, each Pre-funded Unit consisting of one Pre-funded Warrant to purchase one share of common stock and three-quarter Warrant to purchase one share of common stock (3) | ||||||||

| (i) Pre-funded Warrants included in the Pre-funded Units (4) | ||||||||

| (ii) Warrants included in the Pre-funded Units (3)(4) | ||||||||

| Shares of common stock underlying Pre-funded Warrants included in the Pre-funded Units (4) | ||||||||

| Shares of common stock underlying Warrants included in the Units and the Pre-funded Units (5) | $ | 24,891,750 | $ | 2,715.69 | ||||

| Underwriter’s warrant (6)(7) | ||||||||

| Common stock underlying underwriter’s warrant (6) | $ | 2,904,038 | $ | 316.83 | ||||

| Total | $ | 55,453,288 | $ | 6,049.95 | (8) | |||

(1) Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Includes shares of our common stock and Warrants that the underwriters have the option to purchase to cover over-allotments, if any, of the Units offered hereby.

(3) The proposed maximum aggregate offering price of the Units proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Pre-funded Units offered and sold in the offering, and the proposed maximum aggregate offering price of the Pre-funded Units to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Units sold in the offering. Accordingly, the proposed maximum aggregate offering price of the Units and Pre-funded Units, if any, is $27,657,500 (including the underwriter’s over-allotment option).

(4) Filing fee included with the Units or Pre-funded Units, as applicable.

(5) Pursuant to Staff Compliance and Disclosure Interpretation 240.06, equals the aggregate exercise price of the Warrants.

(6) The registrant has agreed to issue, upon the closing of this offering, an underwriter’s warrant to Roth Capital Partners, LLC entitling it to purchase a number of shares of common stock equal to 5% of the aggregate shares of common stock (including shares of common stock underlying the Warrants and any Pre-funded Warrants) sold in this offering. The exercise price of the underwriter’s warrant will be equal to 120% of the public offering price of the Units offered hereby.

(7) No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act of 1933, as amended.

(8) $4,255.77 was previously paid.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 11, 2021

PRELIMINARY PROSPECTUS

1,850,000 Units, Each Consisting of One Share of Common Stock and Three-Quarter Warrant to Purchase One Share of Common Stock

1,850,000 Pre-funded Units, Each Consisting of a Pre-funded Warrant to Purchase One Share of Common Stock and Three-Quarter Warrant to Purchase One Share of Common Stock

This is our initial public offering. We are offering up to 1,850,000 of units of securities (the “Units”) pursuant to this prospectus. Prior to this offering, there has been no public market for our securities. We anticipate that the initial public offering price of our Units will be between $11.00 and $13.00.

Each Unit consists of (a) one share of our common stock and (b) three-quarter warrant (the “Warrants”) to purchase one share of our common stock at an exercise price equal to $14.40 (120% of initial public offering price per Unit) per share, assuming an initial public offering price of $12.00 per Unit (the midpoint of the price range set forth on the cover of this prospectus) exercisable until the fifth anniversary of the issuance date, and subject to certain adjustment and cashless exercise provisions as described herein.

We are also offering to those purchasers, if any, whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one share of our common stock at an exercise price of $0.0001 per share (each a “Pre-funded Warrant”) and a Warrant. The purchase price of each Pre-funded Unit is equal to the price per Unit being sold to the public in this offering, minus $0.0001. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full.

We are offering up to 1,850,000 Units and up to 1,850,000 Pre-funded Units, in the aggregate not exceeding more than a total of 1,850,000 units. For each Pre-funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Units and Pre-funded Units will not be issued or certificated. The shares of common stock or Pre-funded Warrants, as the case may be, and the Warrants included in the Units or the Pre-funded Units, can only be purchased together in this offering, but the securities contained in the Units or Pre-funded Units will be issued separately and will be immediately separable upon issuance.

We have been approved to have our common stock listed on the Nasdaq Capital Market under the symbol “RNXT” upon our satisfaction of the exchange’s initial listing criteria, including the completion of this offering. If we do not meet all of Nasdaq’s initial listing criteria, we will not complete this offering. We do not intend to apply for any listing of the Warrants or Pre-funded Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Warrants or Pre-funded Warrants.

We are an “emerging growth company” under the federal securities laws and have elected to comply with certain reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Unit | Per Pre-funded Unit | Total | ||||||||||

| Initial public offering price(1) | $ | $ | $ | |||||||||

| Underwriting discounts and commissions(2) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses | $ | $ | $ | |||||||||

(1) The assumed public offering price corresponds to (x) in respect of a Unit, (i) a public offering price per share of common stock of $ and (ii) a public offering price per Warrant of $0.01 and (y) in respect of a Pre-funded Unit (i) a public offering price per Pre-funded Warrant of $ and (ii) a public offering price per Warrant of $0.01.

(2) We refer you to “Underwriting” beginning on page 113 for additional information regarding underwriters’ compensation.

We have granted Roth Capital Partners, LLC, as representative of the underwriters, an option, to purchase an additional 277,500 shares of our common stock and/or Warrants to purchase 208,125 additional shares of common stock from us (being up to 15% of the shares of common stock, including shares of common stock underlying the Pre-funded Warrants, and/or up to 15% of the Warrants sold in this offering), in any combination thereof, for forty-five (45) days from the date of this prospectus, at prices described herein to cover over-allotments, if any, of the Units and the Pre-funded Units offered hereby. See “Underwriting.”

The underwriters expect to deliver the securities to purchasers on or about , 2021.

Sole Book-Running Manager

Roth Capital Partners

Lead Manager

Maxim Group LLC

The date of this prospectus is , 2021

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with information other than that contained in this prospectus. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, the securities offered hereby only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover page of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

This prospectus includes industry data and forecasts that we have obtained from industry publications and surveys, public filings and internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our market position and market estimates are based on independent industry publications, government publications, third party forecasts, management’s estimates and assumptions about our markets and our internal research. While we are not aware of any misstatements regarding the market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in this prospectus.

| -2- |

The following summary highlights information contained elsewhere in this prospectus. It does not contain all of the information you need to consider in making your investment decision. Before making an investment decision, you should read this entire prospectus carefully and you should consider, among other things, the matters set forth under “Risk Factors” and our financial statements and related notes thereto appearing elsewhere in this prospectus. In this prospectus, except as otherwise indicated, “RenovoRx,” the “Company,” “we,” “our,” and “us” refer to RenovoRx, Inc., a Delaware corporation, and its subsidiaries.

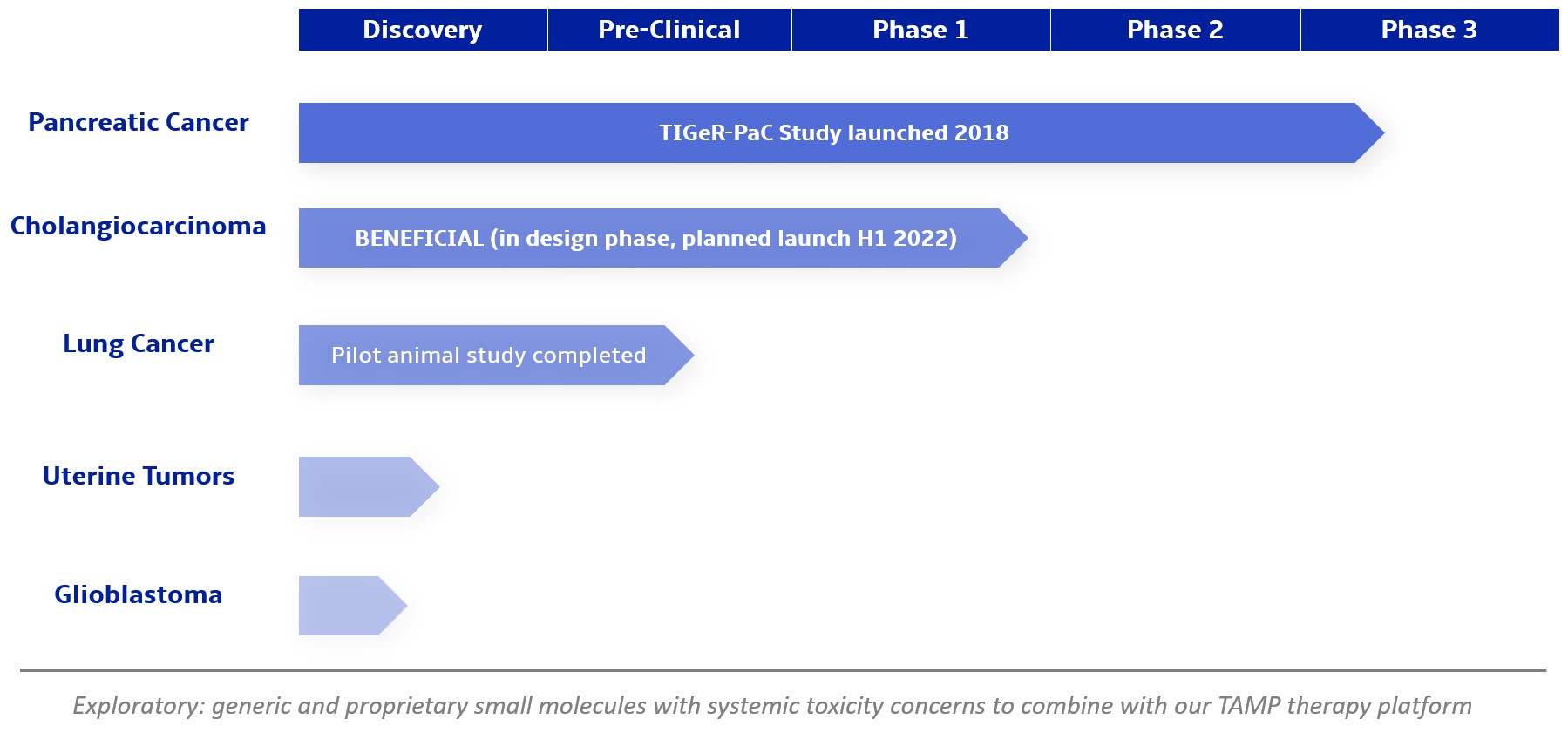

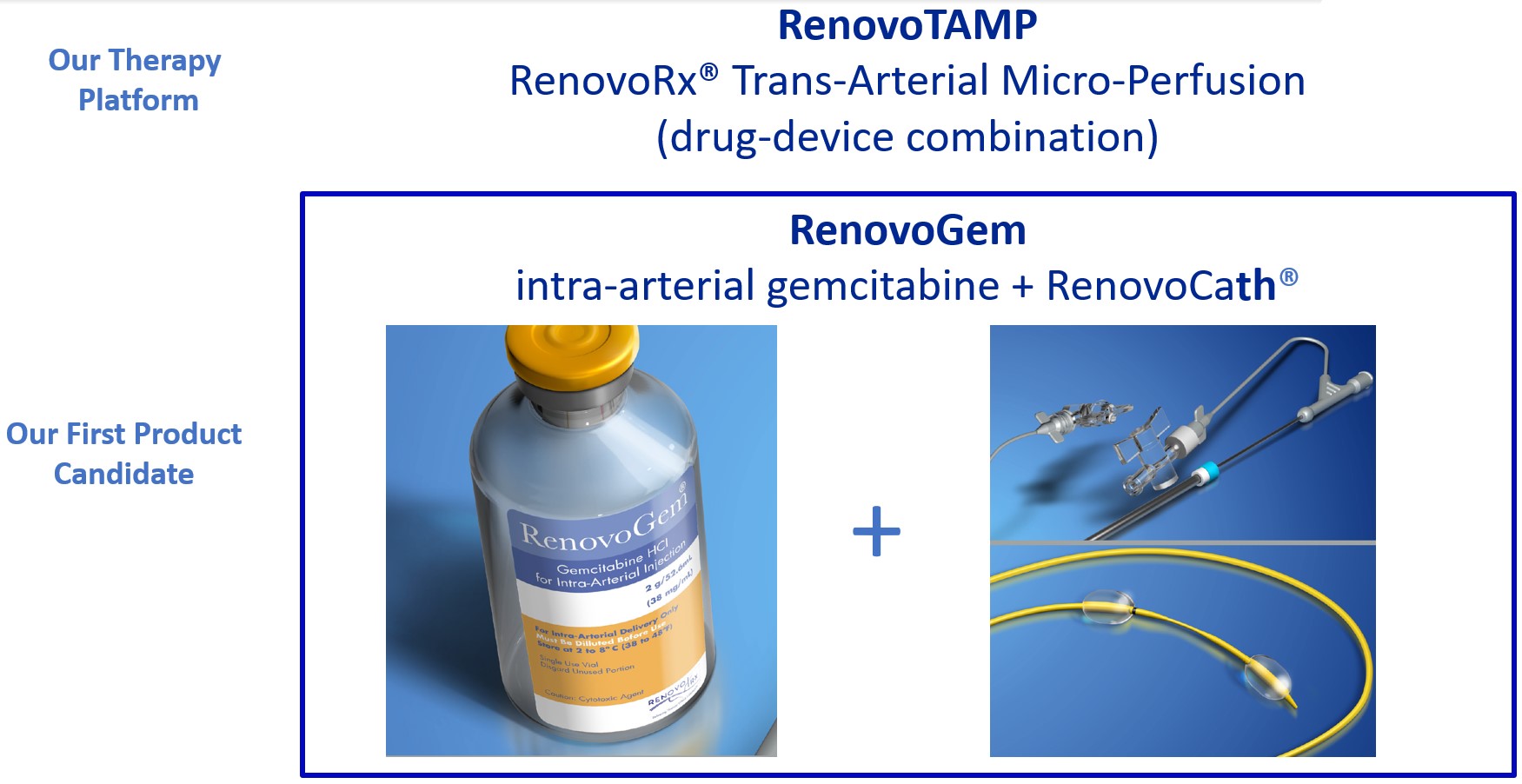

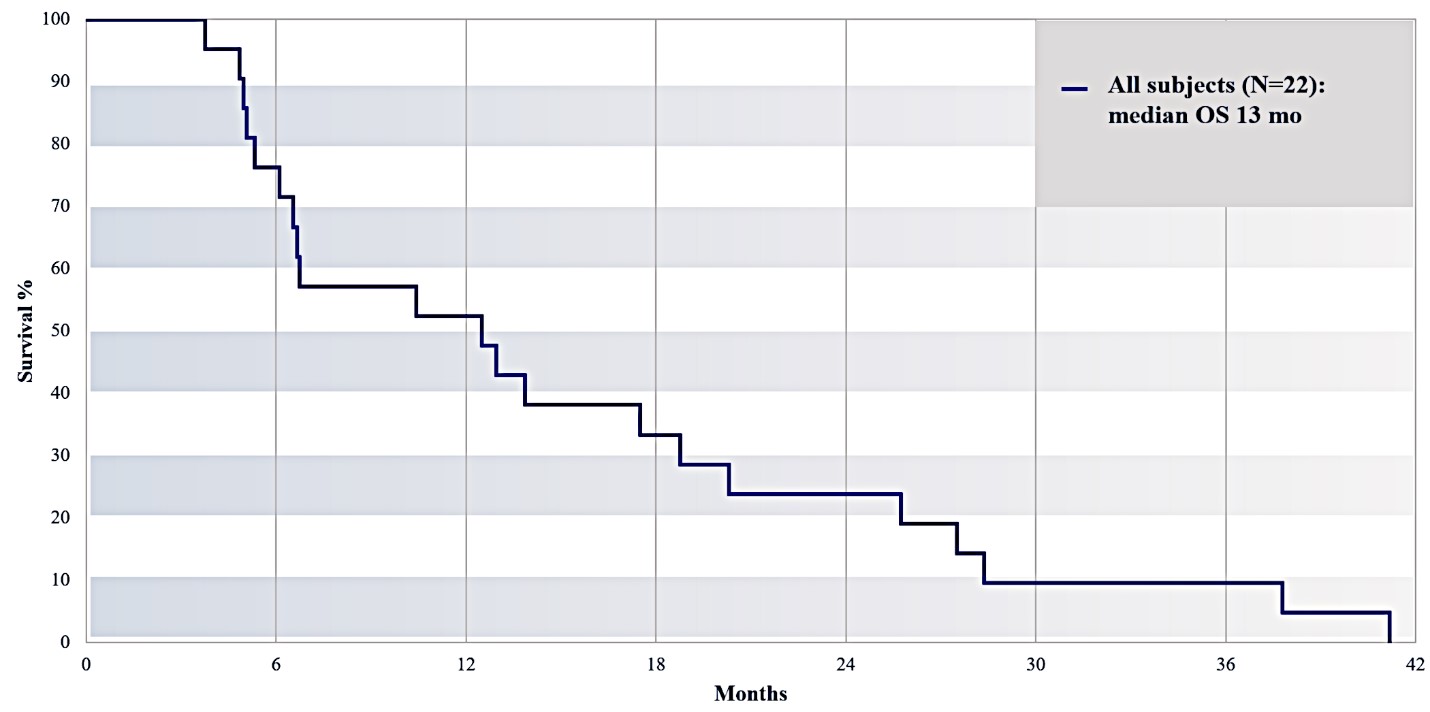

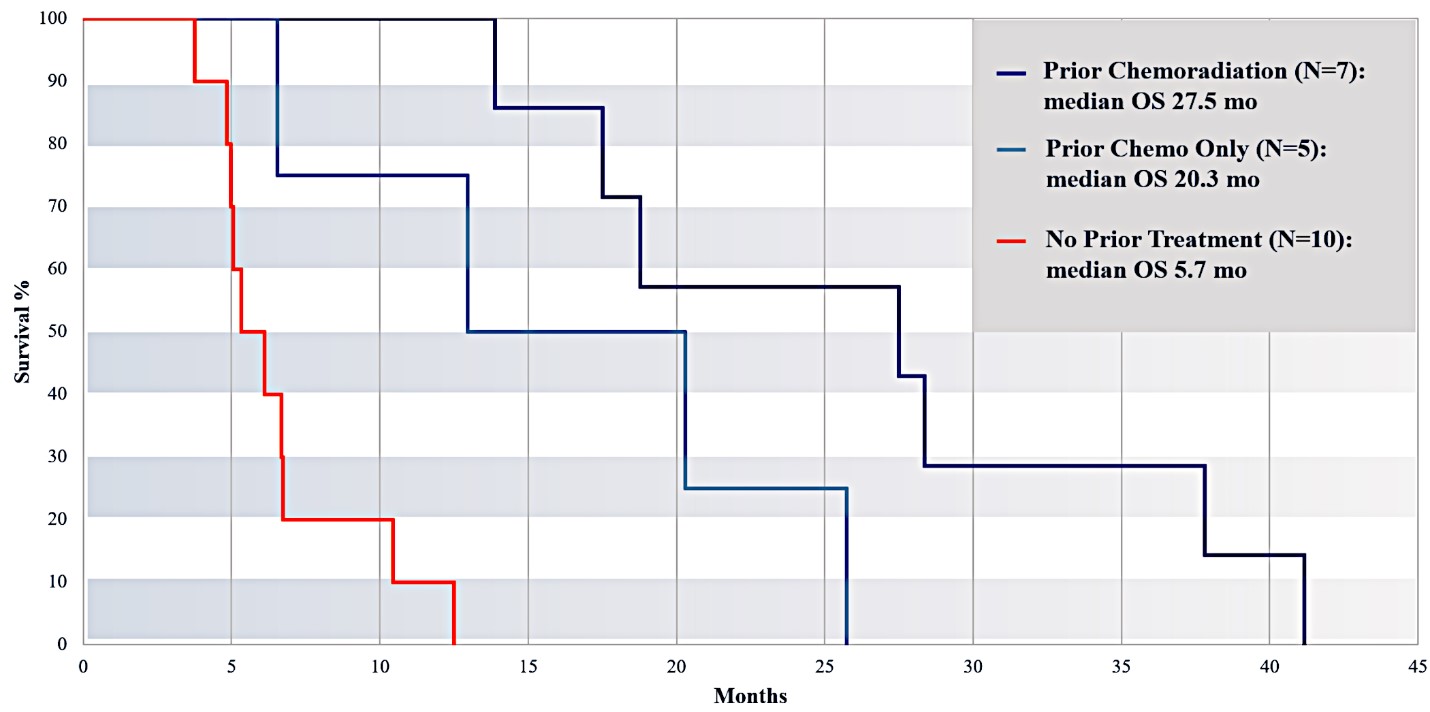

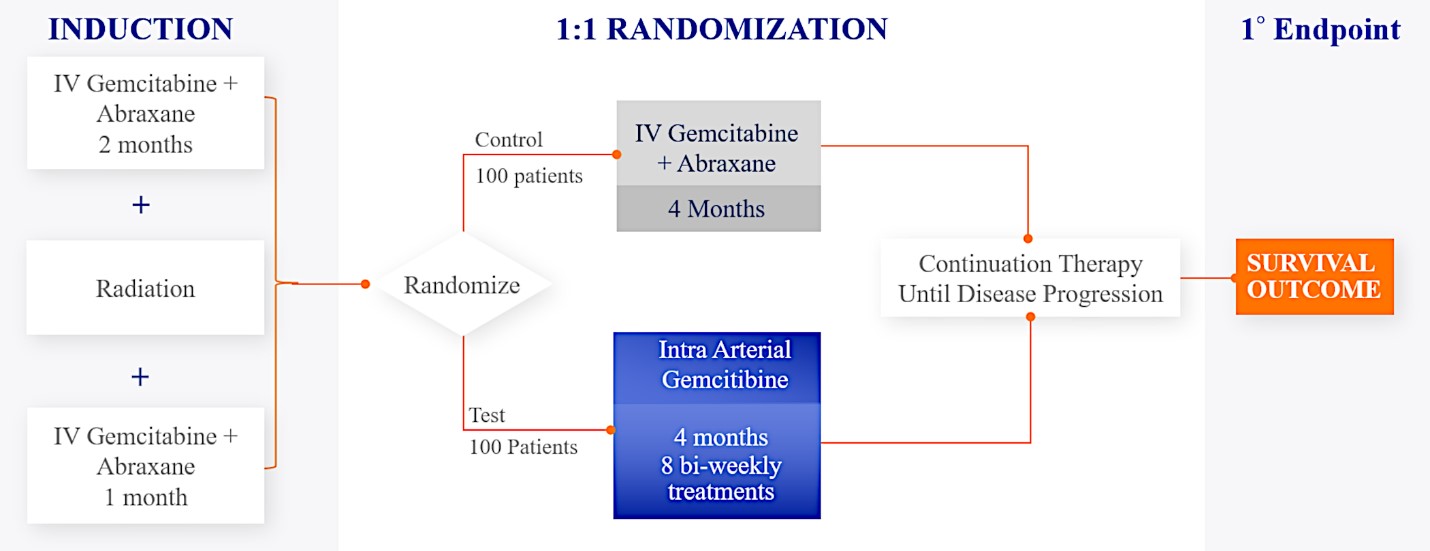

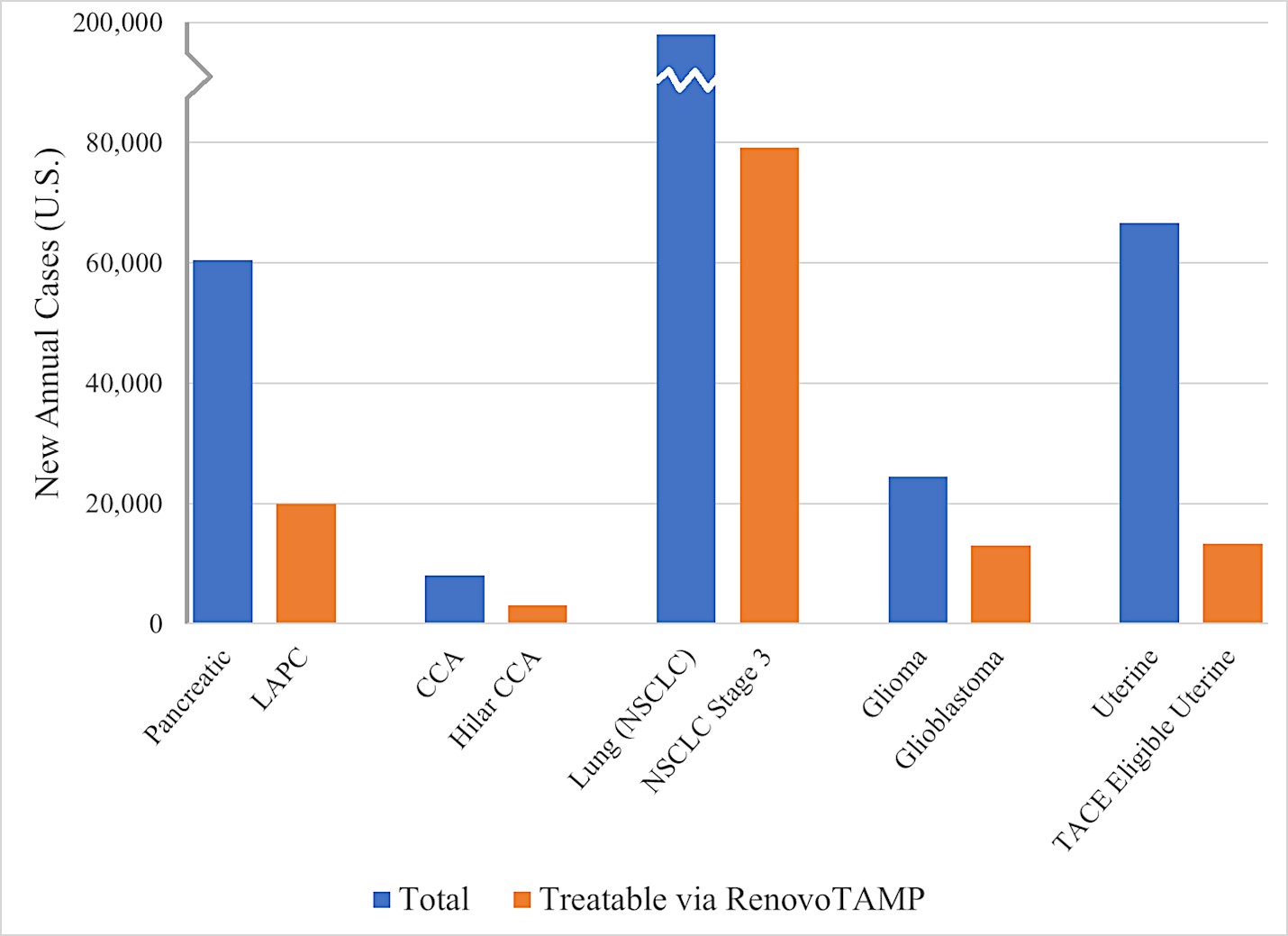

Overview

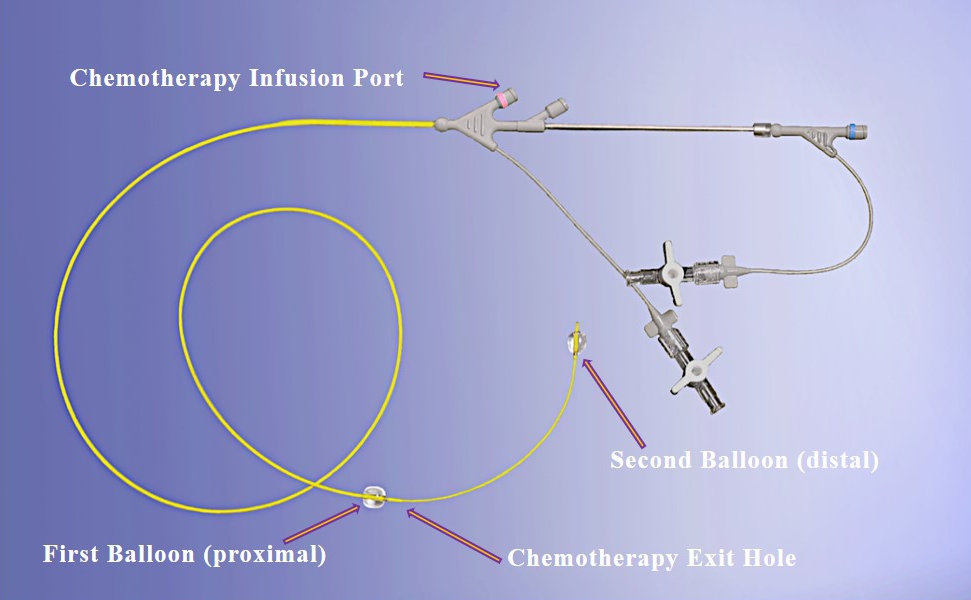

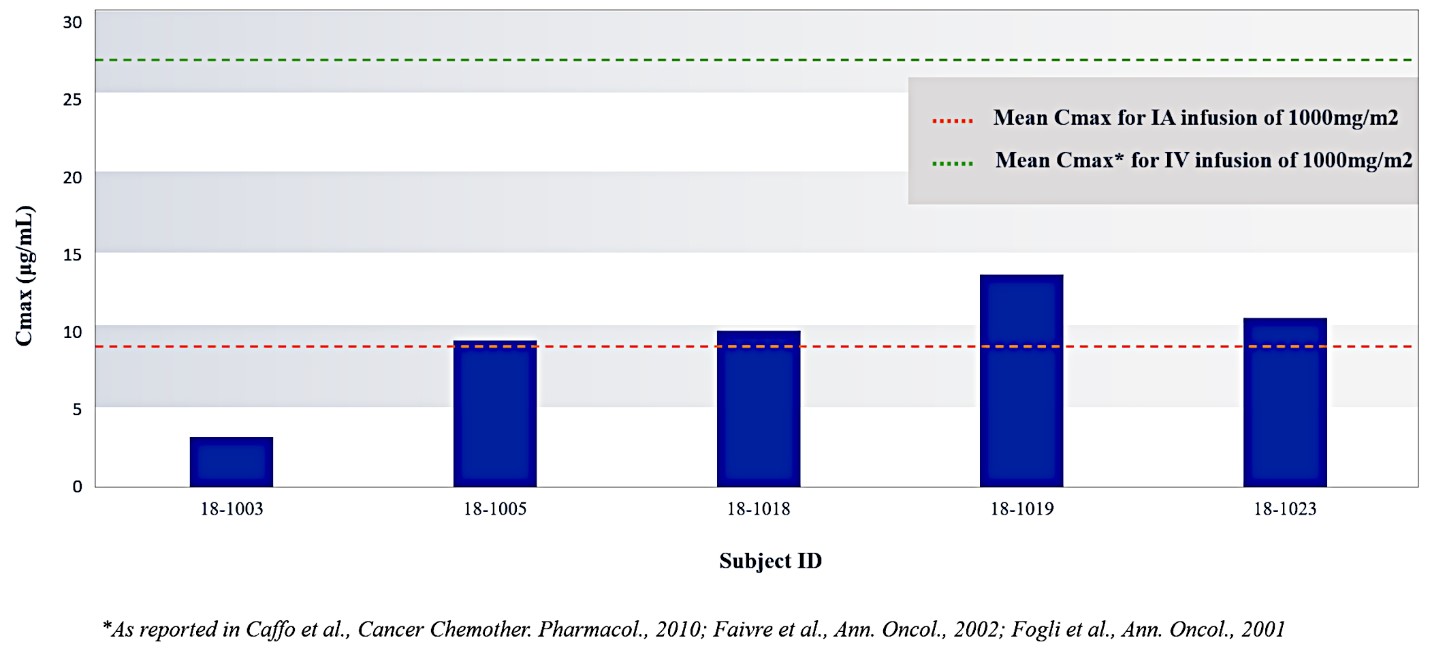

We are a clinical-stage biopharmaceutical company focused on developing therapies for the local treatment of solid tumors and conducting a Phase 3 registrational trial for our lead product candidate RenovoGem™. Our therapy platform, RenovoRx Trans-Arterial Micro-Perfusion, or RenovoTAMP™ utilizes approved chemotherapeutics with validated mechanisms of action and well-established safety and side effect profiles, with the goal of increasing their efficacy, improving their safety, and widening their therapeutic window. RenovoTAMP combines our patented U.S. Food and Drug Administration, or FDA, cleared delivery system, RenovoCath®, with small molecule chemotherapeutic agents that can be forced across the vessel wall using pressure, targeting these anti-cancer drugs locally to the solid tumors. While we anticipate investigating other chemotherapeutic agents for intra-arterial delivery via RenovoTAMP, our clinical work to date has focused on gemcitabine, which is a generic drug. Our first product candidate, RenovoGem, is a drug and device combination consisting of intra-arterial gemcitabine and RenovoCath. FDA has determined that RenovoGem will be regulated as, and if approved we expect will be reimbursed as, a new oncology drug product. We have secured FDA Orphan Drug Designation for RenovoGem in our first two indications: pancreatic cancer and cholangiocarcinoma (bile duct cancer, or CCA). We have completed our RR1 Phase 1/2 and RR2 observational registry studies, with 20 and 25 patients respectively, in locally advanced pancreatic cancer, or LAPC. These studies demonstrated a median overall survival of 27.9 months in patients treated with RenovoGem and radiation. Based on previous large randomized clinical trials, the expected survival of LAPC patients is 12-15 months in patients receiving only intravenous (IV) systemic chemotherapy or IV chemotherapy plus radiation (which are both considered standard of care). Unlike the randomized trials that established these standard-of-care results, our RR1 and RR2 clinical trials did not prospectively control the standard of care therapy received prior to RenovoTAMP. Based on FDA safety review of our Phase 1/2 study the FDA allowed us to proceed to evaluate RenovoGem within our Phase 3 registration Investigational New Drug, or IND, clinical trial. Our Phase 3 trial is over 40% enrolled as of July 15, 2021 and we expect to report data from a planned interim data readout in the second half of 2022. We intend to evaluate RenovoGem in a second indication in a Phase 2/3 trial in hilar CCA (cancer that occurs in the bile ducts that lead out of the liver and join with the gallbladder, also called extrahepatic cholangiocarcinoma, or HCCA). We plan to propose the trial to the FDA and potentially launch in the first half of 2022. In addition, we may evaluate RenovoGem in other indications, potentially including locally advanced lung cancer, locally advanced uterine tumors, and glioblastoma (an aggressive type of cancer that can occur in the brain or spinal cord). To date, we have used gemcitabine, but in the future we may develop other chemotherapeutic agents for intra-arterial delivery via RenovoCath.

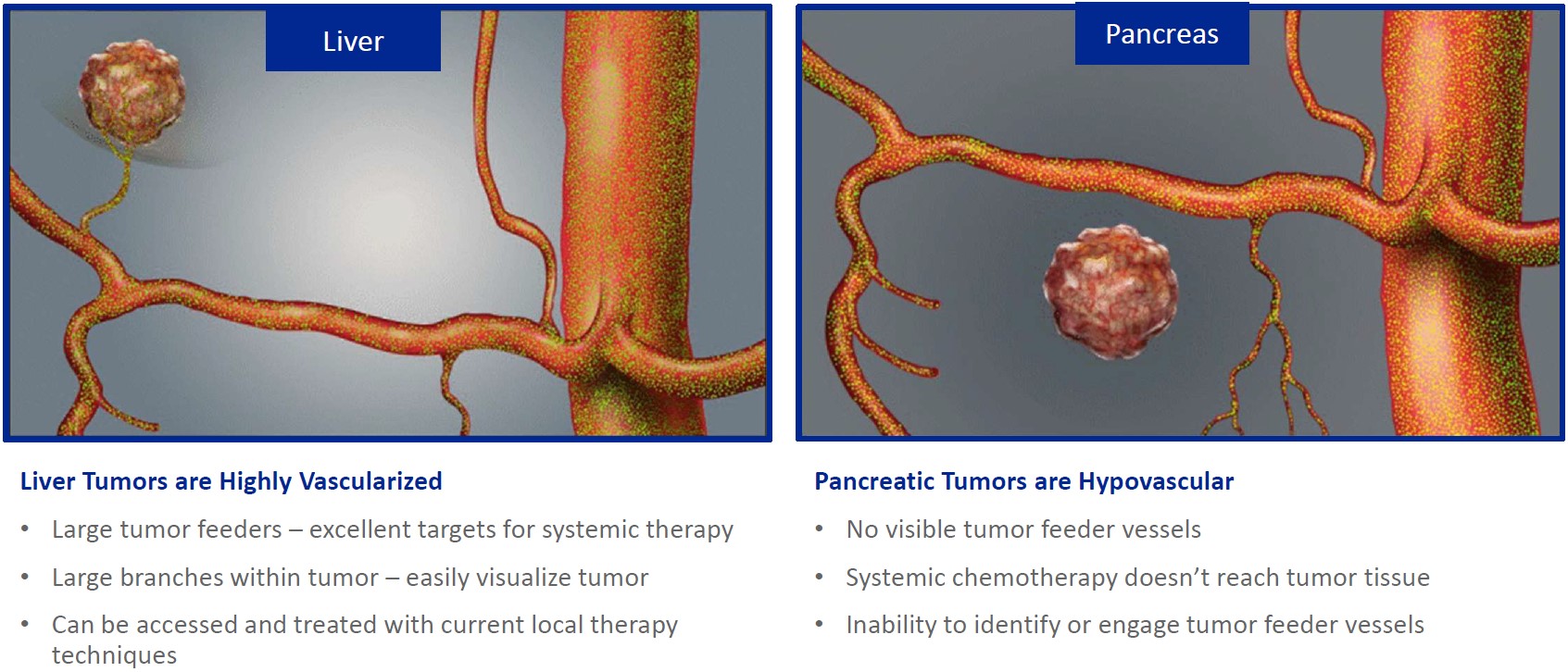

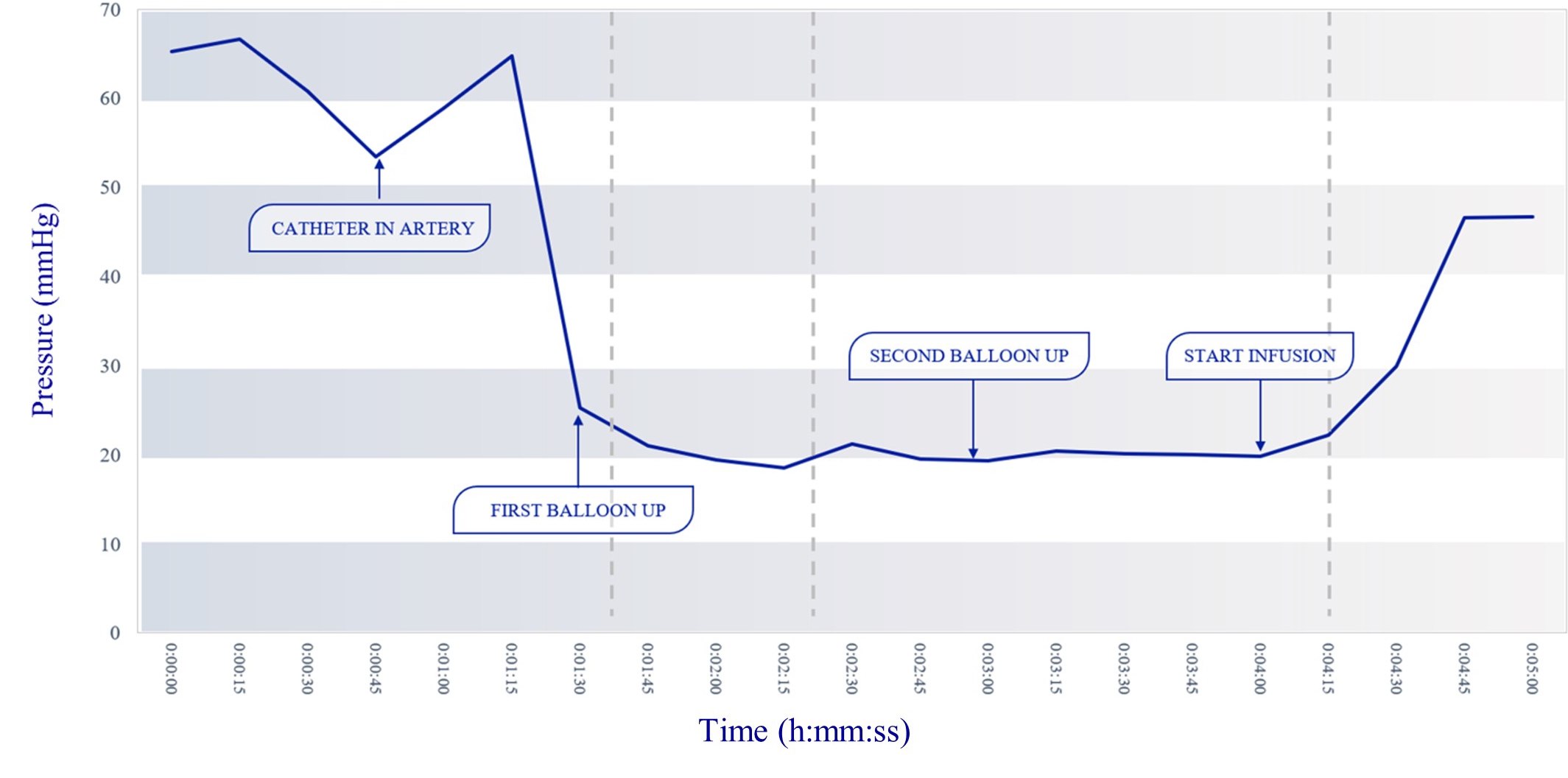

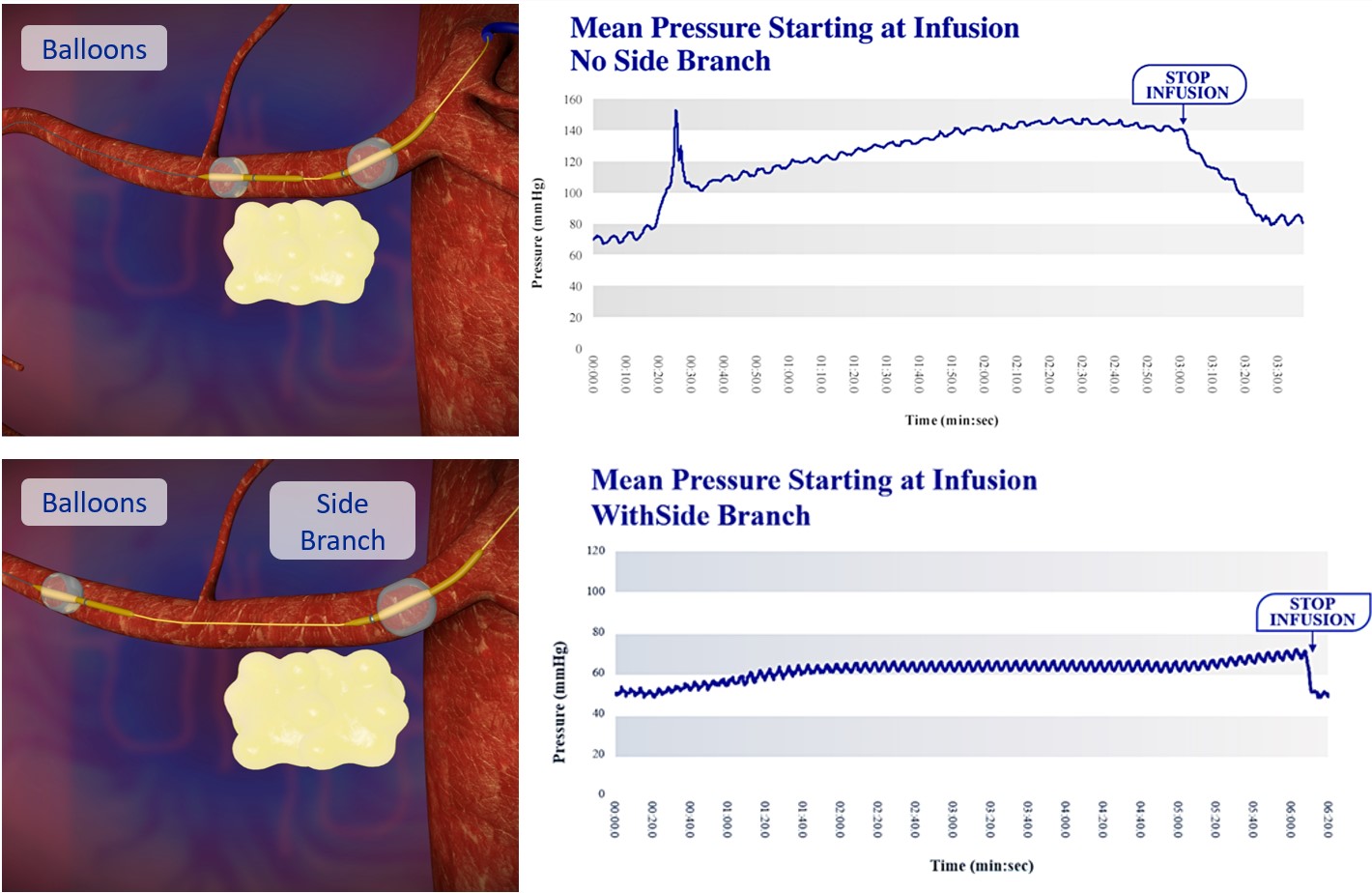

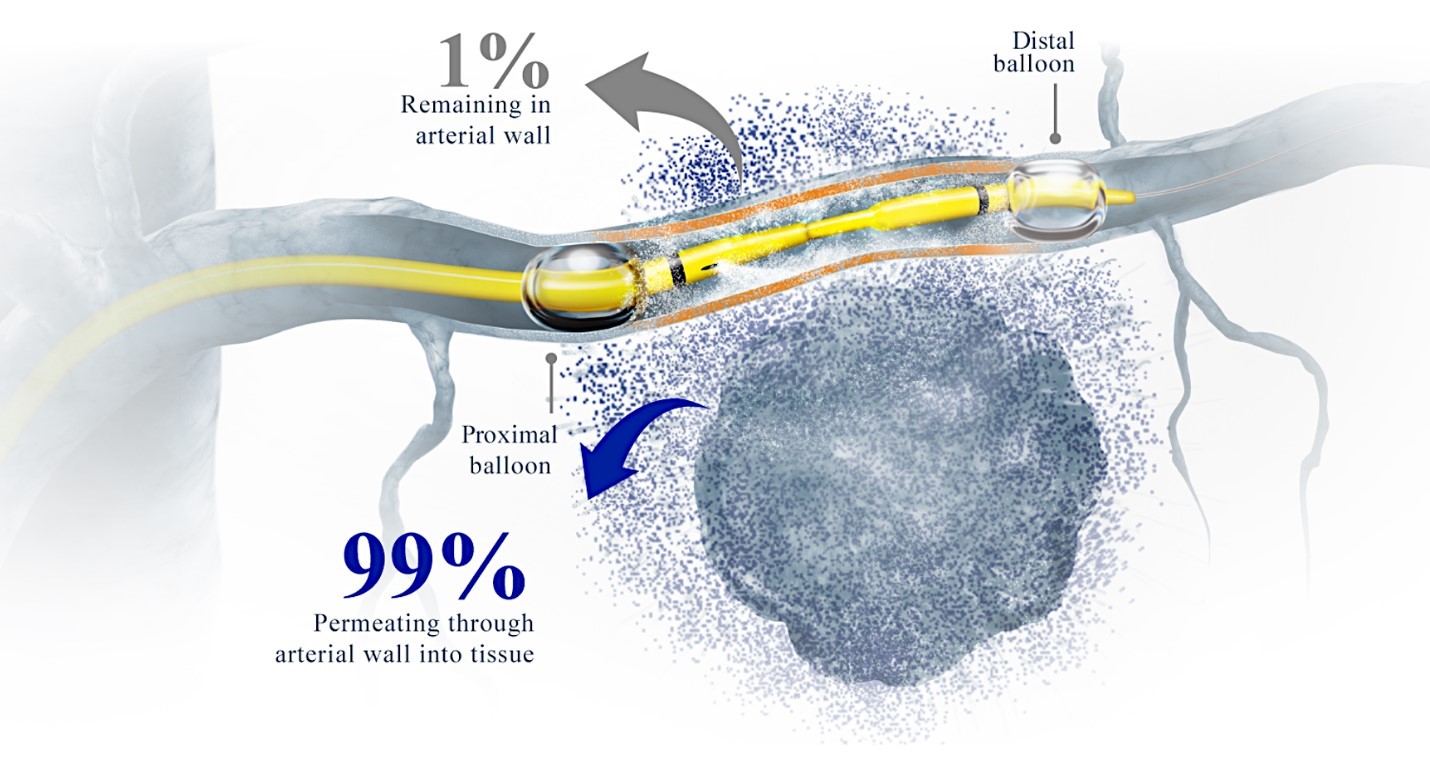

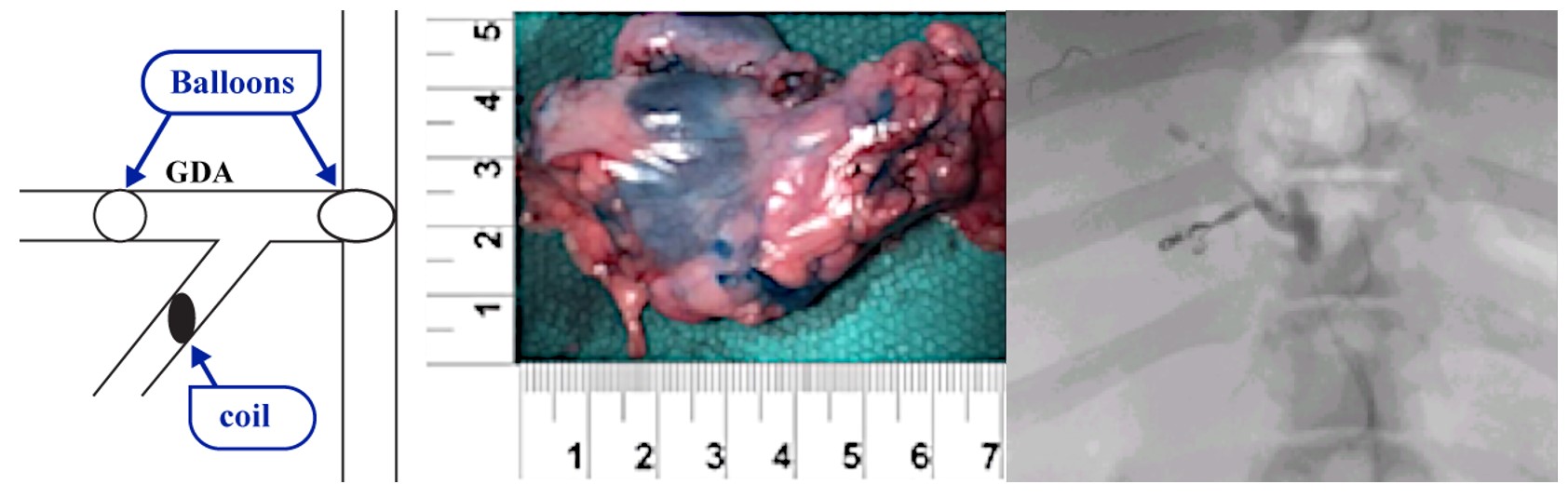

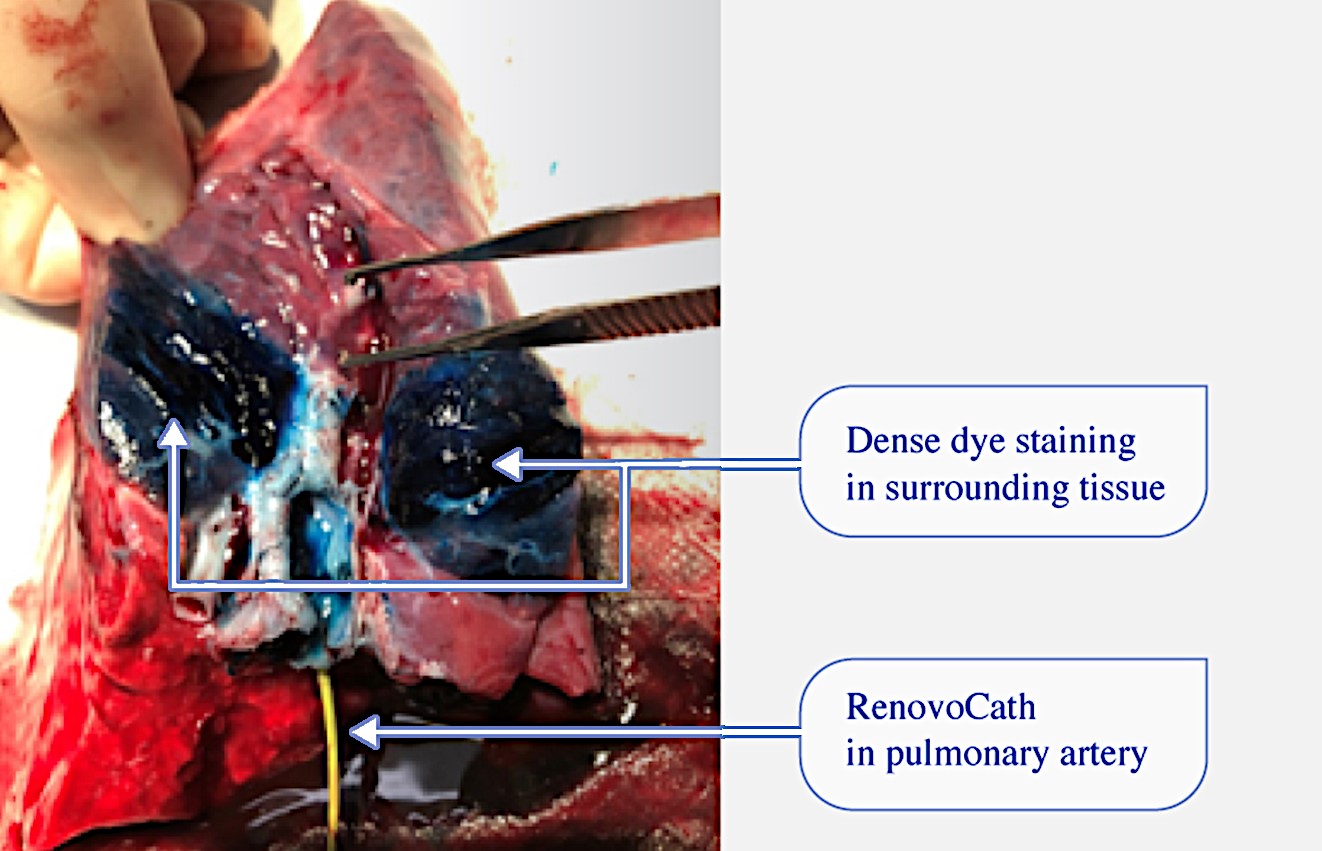

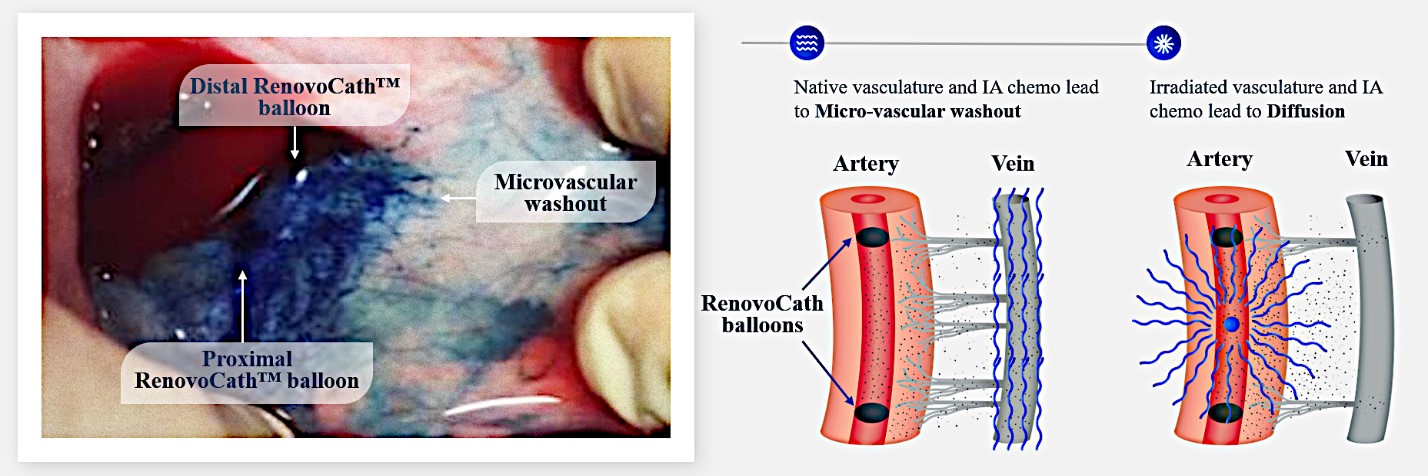

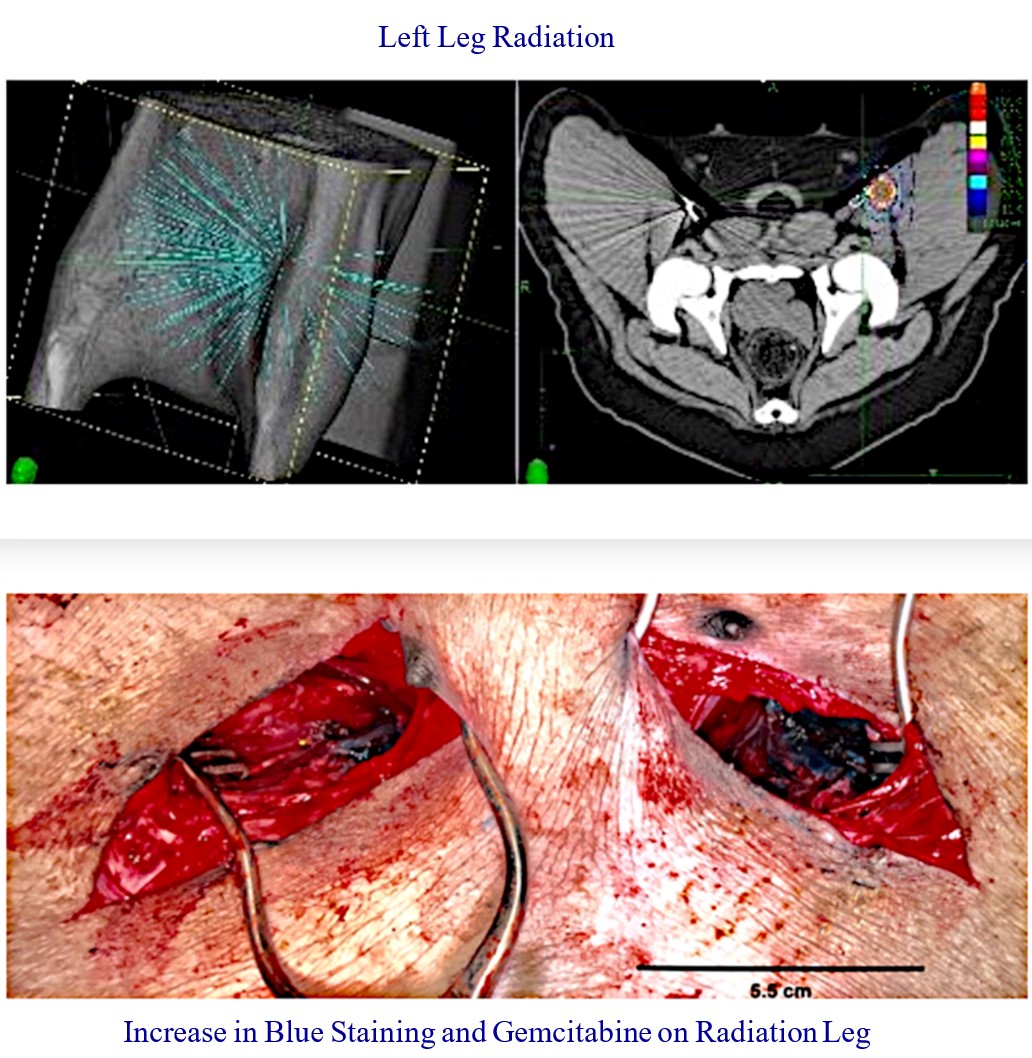

Our RenovoTAMP therapy platform is focused on optimizing drug concentration in solid tumors using approved small molecule chemotherapeutics that enable physicians to isolate segments of the vascular anatomy closest to tumors and force chemotherapy across the blood vessel wall to bathe these difficult-to-reach tumors in chemotherapy. More specifically, our patented approach combines local delivery via our patented RenovoCath delivery system utilizing pressure to force small molecule chemotherapy into the tumor tissue with pre-treatment of the local blood vessels and tissue with standard-of-care radiation therapy to decrease chemotherapy washout. We believe there are many advantages to our approach:

| ● | Application of Approved Small Molecule Chemotherapeutic Agents: We use approved small molecule chemotherapeutic agents such as gemcitabine. | |

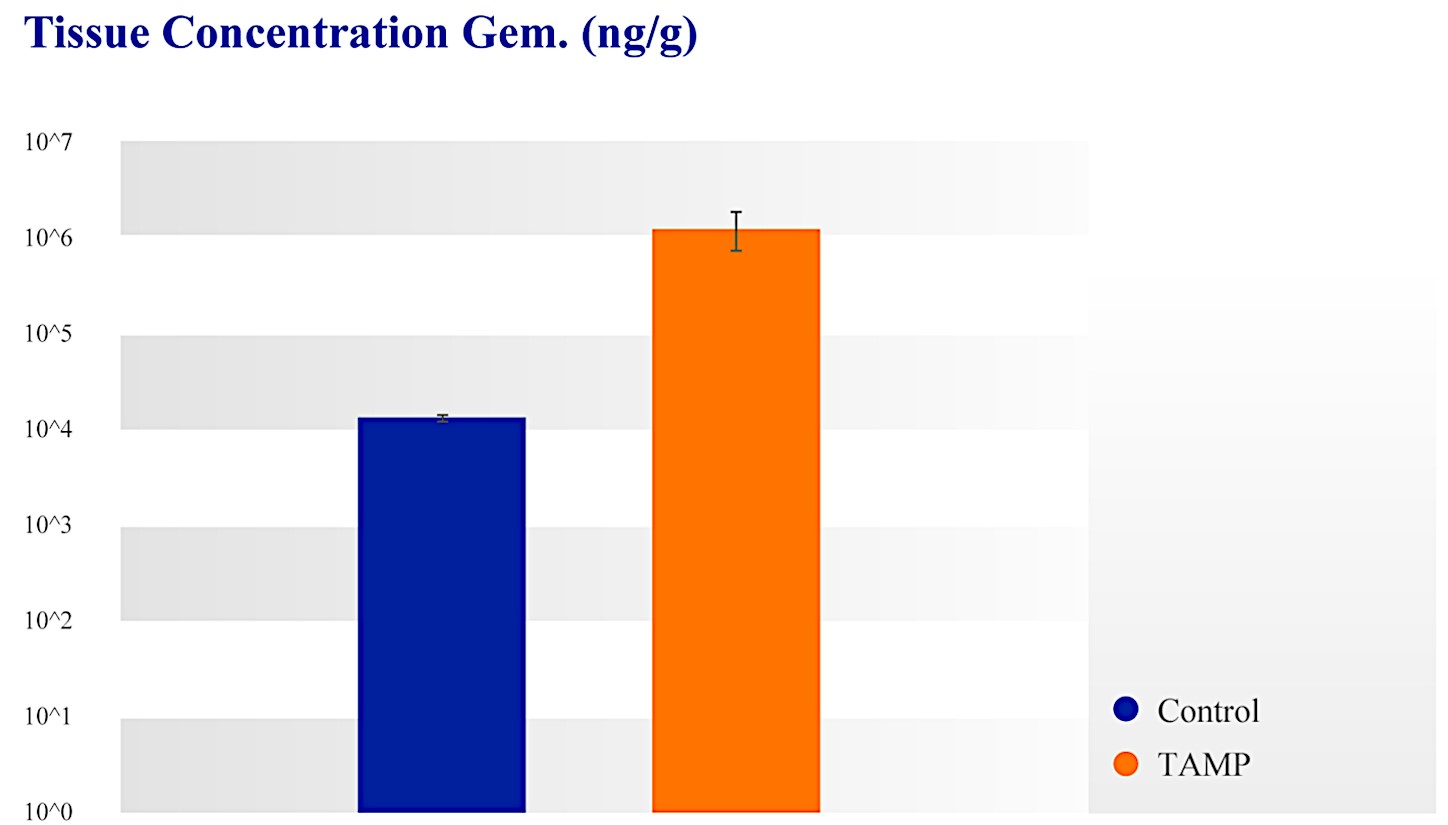

| ● | Targeted Approach: With our approach, we have demonstrated in our clinical studies up to 100 times higher local drug concentration compared to systemic chemotherapy. We believe our approach decreases systemic exposure and improves patient outcomes. | |

| ● | Delivery Method Independent of Tumor Vascularity: We invented a novel combination platform and delivery system to deliver small molecule chemotherapeutic agents in solid tumors resistant to systemic chemotherapy due to lack of tumor blood vessels or tumor feeders. | |

| ● | Broad Application for Solid Tumor Indications: Our platform is not restricted to a single small molecule chemotherapeutic agent or solid tumor type. As such, our platform and delivery system may be applied for use in additional solid tumor indications, including in solid tumors without identifiable tumor feeders. |

| -3- |

Our lead product candidate, RenovoGem, is a combination of gemcitabine and our patented delivery system, RenovoCath, and is regulated by the FDA as a novel oncology drug product. Our RenovoTAMP platform therapy utilizes pressure mediated delivery of gemcitabine across the arterial wall to bathe the pancreatic tumor tissue in 120mL of saline with 1,000mg/m2 of the drug over a 20-minute delivery time (approximately a total of 1,500-2,000mg of drug dependent upon patient Body Surface Area). RenovoCath is an adjustable double balloon catheter designed to isolate the proximal and distal vessel and adjust the distance between the balloons to exclude any branching blood vessel offshoots.

While the field of oncology has seen progress in treating a handful of deadly cancers over the last few decades, there is a common limitation in chemotherapy: enhanced dosing of the drug to impact the tumor while minimizing systemic toxicity. The characteristics of the vasculature, within and surrounding the tumor, can be a limiting step in this goal. For example, LAPC and HCCA are more difficult to treat due to the lack of blood vessels that feed these tumors, making it difficult to expose tumors to chemotherapy, which is typically delivered intravenously. Trans-arterial chemoembolization (TACE) is an established first line therapy for certain solid tumors. A key component of this approach is to identify and isolate vessels feeding the tumor, known as tumor feeders. However, in patients with pancreatic cancer, no tumor feeder vessels are visible during angiography. In the absence of visible tumor feeders, we can introduce drugs directly across the arterial wall into the surrounding tissue via pressurized diffusion.

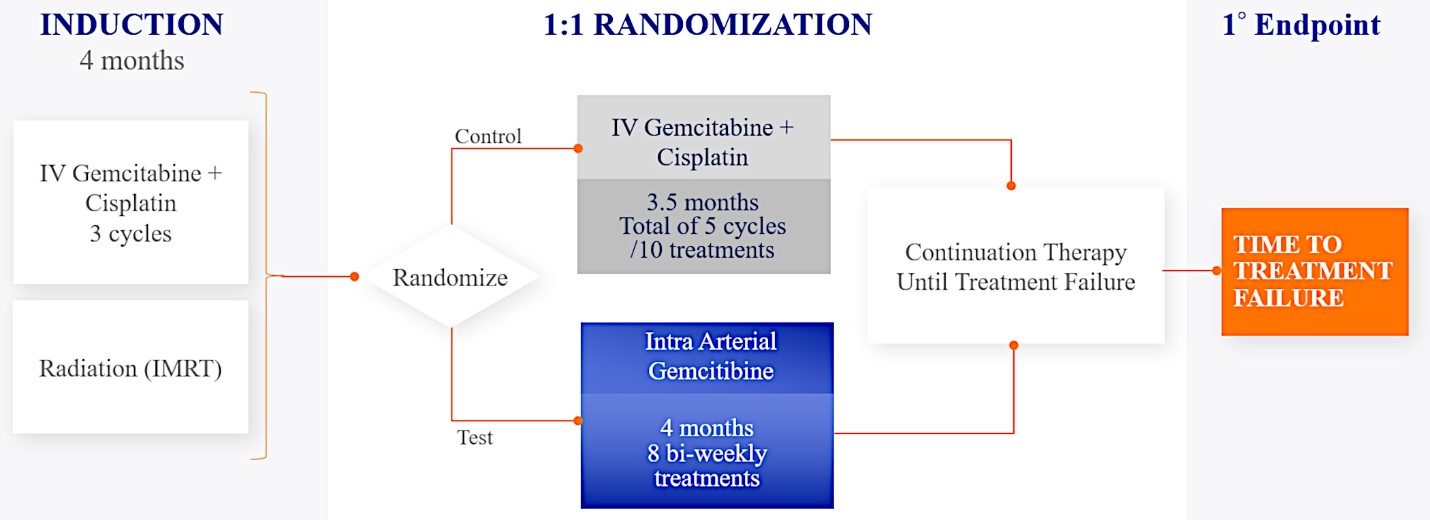

We are currently evaluating RenovoGem in patients with LAPC in a Phase 3 trial entitled “Targeted Intra-arterial Gemcitabine vs. Continuation of IV (intravenous) Gemcitabine Plus Nab-Paclitaxel Following Induction With Sequential IV Gemcitabine Plus Nab-Paclitaxel and Radiotherapy for Locally Advanced Pancreatic Cancer”, or TIGeR-PaC, trial at 28 US and Belgian sites. The trial is designed to enroll 340 subjects. 145 patients were enrolled as of July 15, 2021. A planned interim data readout is expected during the second half of 2022. We have secured Orphan Drug Designation for RenovoGem, which would provide us with seven years of exclusivity to market intra-arterial use of gemcitabine for LAPC upon New Drug Application, or NDA, approval.

In addition, we intend to evaluate RenovoGem in patients with HCCA, and we have secured FDA Orphan Drug Designation for this indication. We intend to potentially pursue additional indications including locally advanced lung cancer, locally advanced uterine tumors, and glioblastoma.

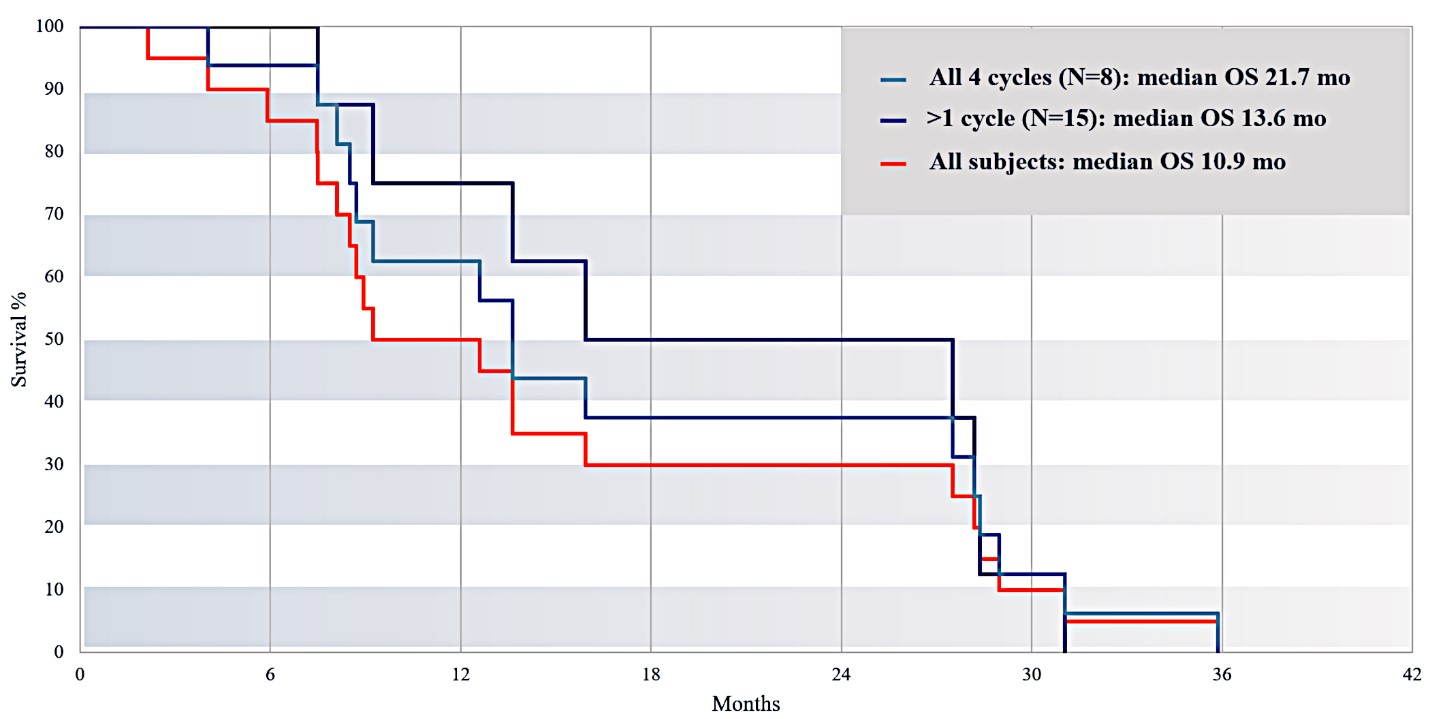

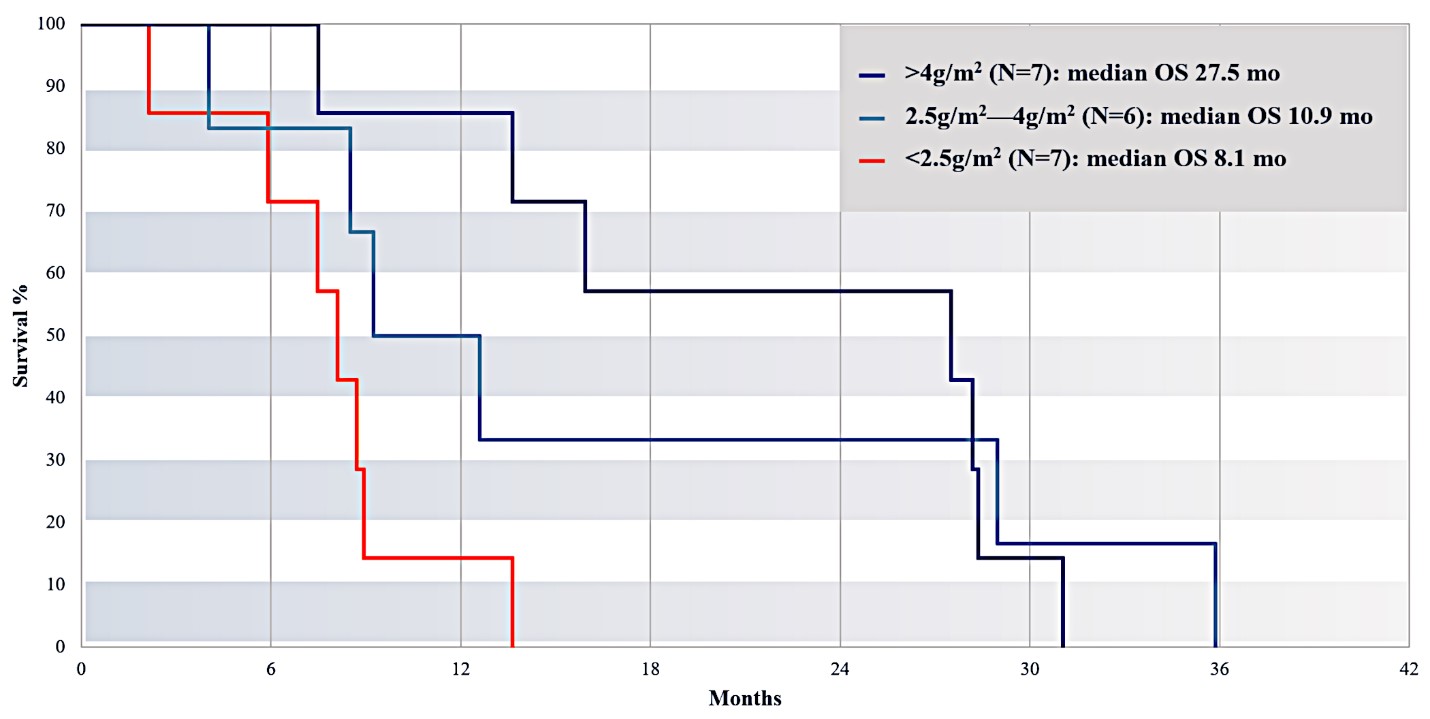

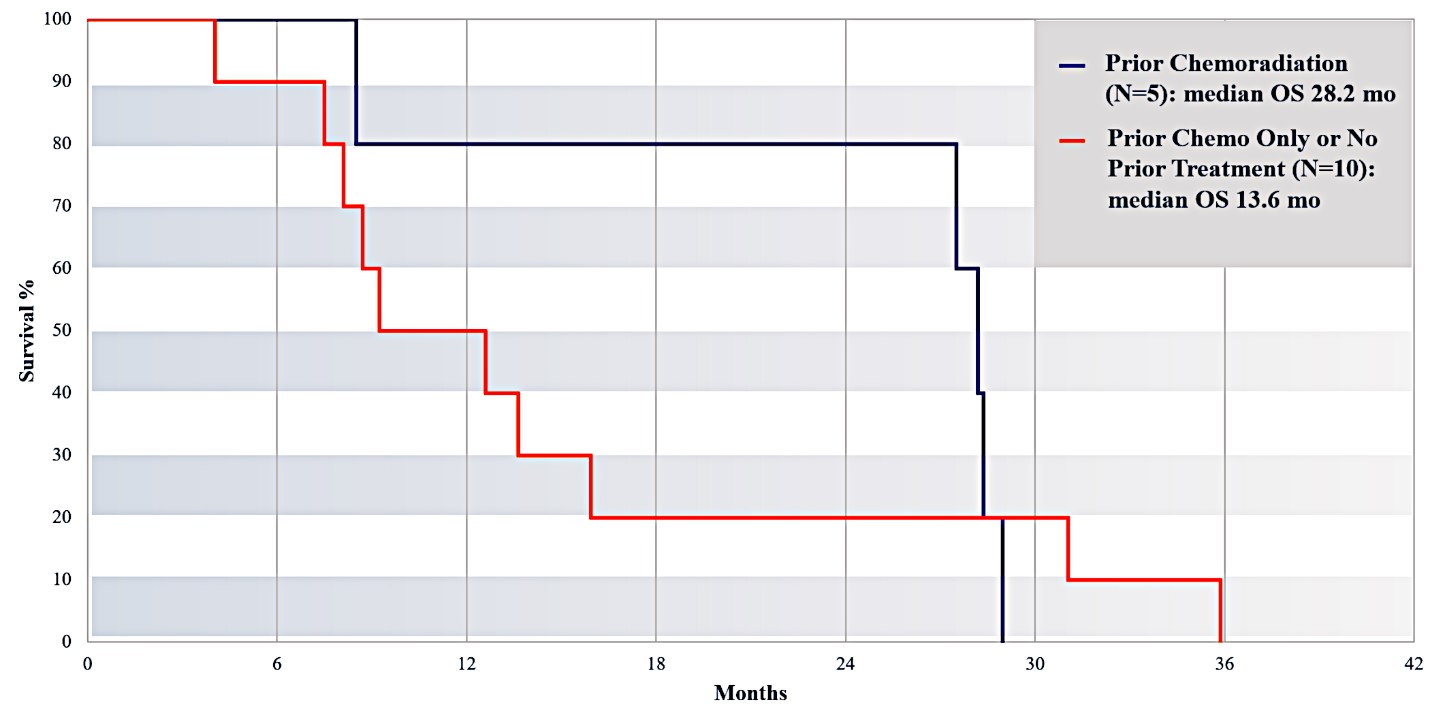

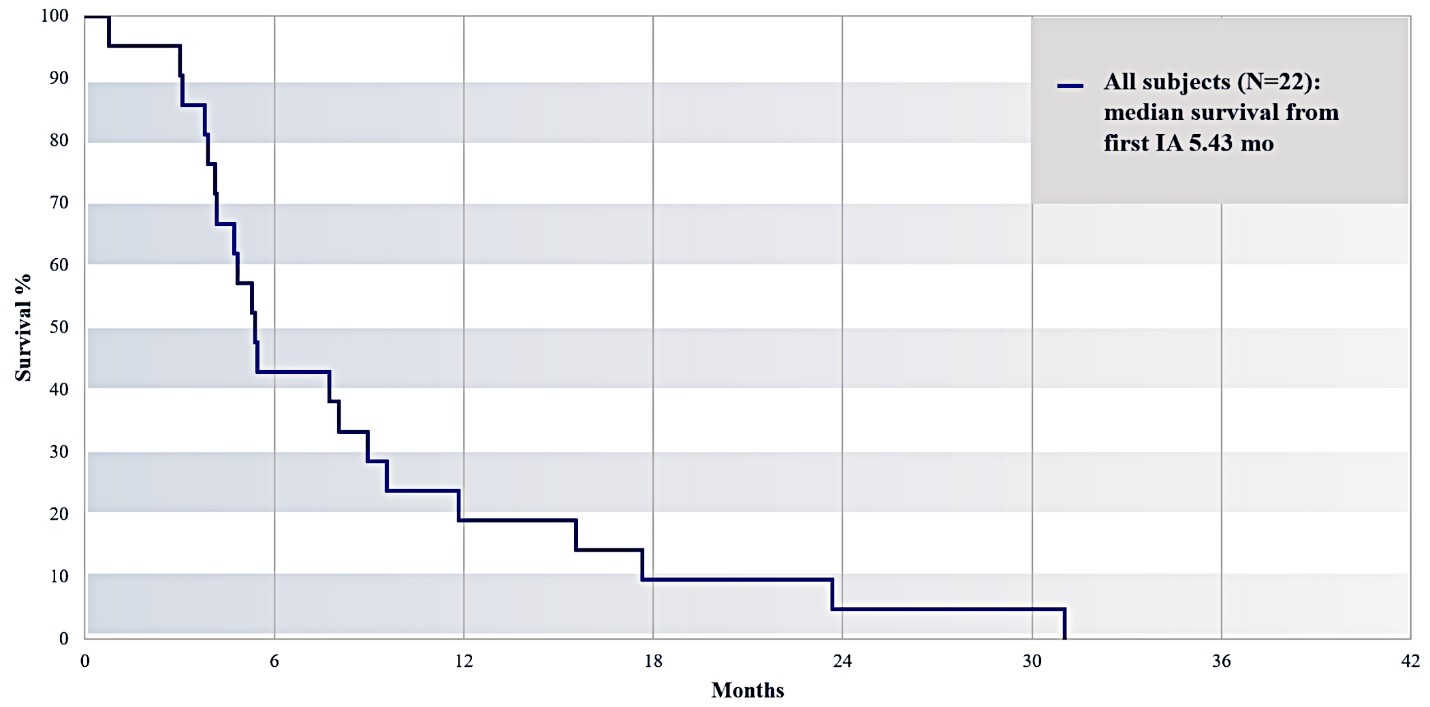

For our initial indication, LAPC, we have completed two studies. We launched RR1, our first-in-human, dose escalation, Phase 1/2 safety study in May 2015 to evaluate our RenovoTAMP platform by delivering intra-arterial gemcitabine via our patented RenovoCath delivery system. In this safety study, 20 patients with a diagnosis of Stage 3 pancreatic cancer were enrolled. We established the maximum tolerated dose of 1000mg/m2 of intra-arterial gemcitabine delivered via RenovoCath. The most common serious adverse events were neutropenia followed by sepsis. After completion of enrollment and demonstration of an early survival efficacy signal in this study, we launched our RR2 observational registry study in June 2016. The key inclusion criteria was a diagnosis of advanced or borderline resectable pancreatic adenocarcinoma confirmed by histology or cytology. The primary endpoints were survival, tumor response and performance of RenovoCath. A combination analysis of these two studies demonstrated that survival in “all comers” (n=31) receiving at least one cycle (two treatments over one month) was 29% at two years. Looking at the prior-radiation therapy subset (n=10), 24-month survival was 60% with a median overall survival (mOS) of 27.9 months. This compares favorably both to IV chemotherapy alone, with 24-month survival of 12%, and to chemotherapy + radiation with 24-month survival of 5% and mOS of 12-15 months as demonstrated in historical studies.

We intend to submit our proposed Phase 2/3 clinical trial to evaluate RenovoGem in HCCA, BENEFICIAL, to the FDA as part of a pre-IND submission in the fourth quarter of 2021 and to launch the clinical trial in the first half of 2022. Intra-venous (IV), or systemic, delivery of gemcitabine has been considered standard of care for several solid tumors, and the drug’s anti-cancer tumor effects are well profiled. We intend to explore the application of our RenovoTAMP platform in additional indications including locally advanced lung cancer, locally advanced uterine cancer, and glioblastoma. We have completed and presented data on a lung cancer application in pre-clinical studies, and additional pre-clinical experiments in lung cancer may be conducted. Beyond our initial anti-cancer product candidate, RenovoGem, multiple small molecule therapeutics could be incorporated into our RenovoTAMP platform, and we will opportunistically look to develop other potential product candidates.

Our management team, Board of Directors, and Scientific Advisors provide us with expertise across multiple sectors to drive success through clinical development and subsequent commercialization of our novel therapy platform. Our Chief Executive Officer, Shaun Bagai, has extensive experience running clinical trials as well as launching, creating, and developing new markets for novel therapies at Trans Vascular, Medtronic, Ardian, and HeartFlow. Dr. Ramtin Agah, our Co-Founder and Chief Medical Officer, is a practicing cardiovascular specialist who has 20 years of research experience in vascular biology and disease in both academia and industry. Our Board of Directors includes a wide range of public and private company management and Board experience including drug/device combination and oncology experience. Clinical advisors include experts in surgical oncology, interventional radiology, radiation oncology, and medical oncology. Dr. Daniel Von Hoff, a medical oncologist, was instrumental as the Principal Investigator who brought to market standard of care therapies for pancreatic cancer. Dr. Mike Pishvaian, also a medical oncologist, has extensive experience in running oncology studies and is an Associate sociate Professor, and Department of Oncology Director of the Gastrointestinal, Developmental Therapeutics, and Clinical Research Programs at the NCR Kimmel Cancer Center at Sibley Memorial Hospital Johns Hopkins University School of Medicine. Dr. Pishvaian is the Principal Investigator/Global Study Chair of our TIGeR-PaC Phase 3 study. Dr. Peter Muscarella is a surgical oncologist and the Director of Pancreatic Surgery, General Surgery Site Director, Weiler Hospital Associate Program Director, and General Surgery Residency Training Program at Montefiore Medical Center, Bronx, NY. Dr. Karyn Goodman serves as our Radiation Monitor for our TIGeR-PaC Phase 3 study and Professor and Vice Chair of Clinical Research, Department of Radiation Oncology at the Icahn School of Medicine at Mount Sinai, and Associate Director of Clinical Research at the Tisch Cancer Institute at Mount Sinai. We have two interventional radiology scientific advisors: Dr. Reza Malek, Neurointerventional Radiologist at Minimally Invasive Surgical Solutions and Dr. Jacob Cynamon, Professor of Clinical Radiology of the Albert Einstein College of Medicine, Chief of the Division of Vascular and Interventional Radiology, and Program Director of the Vascular and Interventional Radiology Fellowship Program at the Montefiore Medical Center, Bronx, NY.

| -4- |

Summary Risk Factors

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

| ● | We are a clinical stage company and may never earn a profit. |

| ● | We will need to raise substantial additional capital to develop and commercialize RenovoGem, and our failure to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts. As a result, there is substantial doubt about our ability to operate as a going concern. |

| ● | Our product candidates’ commercial viability remains subject to current and future preclinical studies, clinical trials, regulatory approvals, and the risks generally inherent in the development of a pharmaceutical product candidate. If we are unable to successfully advance or develop our product candidates, our business will be materially harmed. |

| ● | Our product candidates may exhibit undesirable side effects when used alone or in combination with other approved pharmaceutical products or investigational new drugs, which may delay or preclude further development or regulatory approval or limit their use if approved. |

| ● | If the results of preclinical studies or clinical trials for our product candidates are negative, we could be delayed or precluded from the further development or commercialization of our product candidates, which could materially harm our business. |

| ● | If we are unable to satisfy regulatory requirements, we may not be able to commercialize our product candidates. |

| ● | If our product candidates are unable to compete effectively with marketed drugs targeting similar indications as our product candidates, our commercial opportunity will be reduced or eliminated. We may delay or terminate the development of our product candidates at any time if we believe the perceived market or commercial opportunity does not justify further investment, which could materially harm our business. |

| ● | Our future success depends on our ability to retain our key personnel and to attract, retain, and motivate qualified personnel. |

| ● | If we are unable to protect our intellectual property effectively, we may be unable to prevent third parties from using our technologies, which would impair our competitive advantage. |

| ● | The patents issued to us may not be broad enough to provide any meaningful protection, one or more of our competitors may develop more effective technologies, designs, or methods without infringing our intellectual property rights and one or more of our competitors may design around our proprietary technologies. |

| -5- |

| ● | The market price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our common stock in this offering. |

| ● | We have broad discretion in the use of our cash and cash equivalents, including the net proceeds we receive in this offering, and may not use them effectively. | |

| ● | Holders of our Warrants will have no rights as shareholders until they acquire shares of our common stock, if ever, except as set forth in the Warrants. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our securities.

Corporate Information

We were incorporated in the State of Delaware on December 17, 2012. Our principal executive offices are located at 4546 El Camino Real, Suite B1, Los Altos, CA 94022. Our telephone number is (650) 284-4433. Our website address is https://renovorx.com. Information contained in our website does not constitute any part of, and is not incorporated into, this prospectus.

Implications of Being an Emerging Growth Company

Upon the completion of this offering, we will qualify as an “emerging growth company” under Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we will be permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; | |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | |

| ● | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and | |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company for up to five years from the date of the first sale of equity securities pursuant to an effective registration statement, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

| -6- |

| Units offered by us | Each Unit consists of (a) one share of our common stock, par value $0.0001 per share and (b) three-quarter Warrant to purchase one share of our common stock at an exercise price equal to $14.40 (120% of initial public offering price per Unit) per share, assuming an initial public offering price of $12.00 per Unit (the midpoint of the price range set forth on the cover of this prospectus) exercisable until the fifth anniversary of the issuance date. | |

| ||

| Pre-funded Units offered by us | We are also offering to those purchasers, if any, whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one share of our common stock at an exercise price of $0.0001 per share (each a “Pre-funded Warrant”) and a Warrant. The purchase price of each Pre-funded Unit is equal to the price per Unit being sold to the public in this offering, minus $0.0001. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. We are offering up to 1,850,000 Units and up to 1,850,000 Pre-funded Units, in the aggregate not exceeding more than a total of 1,850,000 units. For each Pre-funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Because we will issue one Warrant as part of each Unit or Pre-funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Units and Pre-funded Units sold. | |

| Over-allotment option | We have granted the representative an option to purchase an additional 277,500 shares of our common stock and/or Warrants to purchase 208,125 additional shares of common stock from us (being up to 15% of the shares of common stock, including shares of common stock underlying the Pre-funded Warrants, and/or up to 15% of the Warrants sold in this offering), in any combination thereof, for forty-five (45) days from the date of this prospectus, at prices described herein to cover over-allotments, if any, of the Units and the Pre-funded Units offered hereby. See “Underwriting.” | |

| Shares of common stock outstanding before this offering(1) | 2,291,557 shares of common stock. | |

| Shares outstanding after this offering | 8,207,572 shares of common stock (or 8,485,072 shares of common stock if the representative exercises its over-allotment option in full), after the sale of 1,850,000 Units in this offering and after the Preferred Stock Conversions and the Note Conversions (as defined below) and assuming no Pre-funded Warrants are sold in this offering. | |

| Use of proceeds | We estimate that we will receive net proceeds of approximately $19.9 million (or approximately $23.0 million if the representative exercises its over-allotment option in full) from the sale of Units by us in this offering assuming an initial public offering price of $12.00 per Unit (the midpoint of the price range set forth on the cover of this prospectus). We plan to use the net proceeds of this offering primarily for completion of our currently ongoing Phase 3 trial for the locally advanced pancreatic cancer indication for RenovoGem, the launch of our Phase 2/3 trial for our second indication of hilar cholangiocarcinoma for RenovoGem, and working capital and general corporate purposes. See “Use of Proceeds.” | |

| Risk factors | Investing in our securities involves a high degree of risk and purchasers of our securities may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our securities. | |

| Proposed trading market and symbol | We

have been approved to list our common stock for trading on the Nasdaq Capital Market under the symbol “RNXT” upon

our satisfaction of the exchange’s initial listing criteria, including the completion of this offering.

We do not intend to apply for any listing of the Warrants or Pre-funded Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a market for the Warrants or Pre-funded Warrants to develop. |

(1) The number of shares outstanding is based on shares outstanding as of June 30, 2021 and excludes the following:

| ● | 992,150 shares of our common stock issuable upon the exercise of outstanding options with a weighted-average exercise price of $0.53 per share; | |

| ● | 708,533 shares of Series A-1 Preferred Stock, 709,219 shares of Series A-2 Preferred Stock, 532,046 shares of Series A-3 Preferred Stock and 1,585,671 shares of Series B Preferred Stock which will convert into 708,533, 709,219, 532,046 and 1,585,671 shares of common stock, respectively, upon the closing of this offering (the “Preferred Stock Conversions”); | |

| ● | 530,546 shares of common stock and 397,901 shares of common stock issuable upon exercise of warrants with an exercise price of $14.40 per share assuming an initial public offering price of $12.00 per Unit (the midpoint of the price range set forth on the cover of this prospectus) to be issued upon conversion of the 2020 Convertible Notes and 2021 Convertible Notes upon the closing of this offering (the “Note Conversions”);

| |

| ● | up to an additional 10,368 shares of our common stock issuable under our 2013 Equity Incentive Plan; and | |

| ● | 161,875 shares of our common stock underlying the underwriter’s purchase option to be issued to the representative of the underwriters in connection with this offering. |

Except as otherwise indicated herein, all information in this prospectus assumes:

| ● | no exercise by the representative of its option to purchase additional shares of our common stock and/or Warrants from us at prices described herein to cover over-allotments, if any, of the Units offered hereby. | |

| ● | no exercise of the Warrants being offered by this prospectus. | |

| ● | no exercise of the underwriter’s warrant. | |

| ● | no sale of Pre-funded Units in this offering. |

| ● | a 1-to-5 reverse stock split of our common stock pursuant to which (i) every 5 shares of outstanding common stock were decreased to one share of common stock, (ii) the number of shares of common stock for which each outstanding warrant or option to purchase common stock is exercisable was proportionally decreased on a 1-to-5 basis, and (iii) the exercise price of each outstanding warrant or option to purchase common stock was proportionately increased on a 1-to-5 basis, (the “Reverse Stock Split”). |

| -7- |

SUMMARY FINANCIAL INFORMATION

The following tables set forth our summary financial data for the periods and as of the dates indicated. The summary statements of operations data for the years ended December 31, 2019 and 2020 have been derived from our audited financial statements included elsewhere in this prospectus. The summary statements of operations data for the three months ended March 31, 2020 and 2021 and the summary balance sheet data as of March 31, 2021 have been derived from our unaudited interim condensed financial statements included elsewhere in this prospectus. Our unaudited interim condensed financial statements have been prepared on a basis consistent with our audited financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected for any other period in the future and our interim results are not necessarily indicative of our expected results for the year ending December 31, 2021. You should read the following summary financial data set forth below in conjunction with our financial statements and the related notes included elsewhere in this prospectus and the information in the section titled Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| 2019 | 2020 | 2020 | 2021 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Statements of Operations Data: | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | 2,997 | $ | 2,386 | $ | 805 | $ | 635 | ||||||||

| General and administrative | 899 | 818 | 248 | 418 | ||||||||||||

| Total operating expenses | 3,896 | 3,204 | 1,053 | 1,053 | ||||||||||||

| Loss from operations | (3,896 | ) | (3,204 | ) | (1,053 | ) | (1,053 | ) | ||||||||

| Interest income (expense), net | 63 | (587 | ) | 2 | (230 | ) | ||||||||||

| Other income (expense), net | 2 | (7 | ) | - | (5 | ) | ||||||||||

| Loss on change in fair value of warrant liability | (8 | ) | - | - | - | |||||||||||

| Gain on loan extinguishment | - | - | - | 140 | ||||||||||||

| Total other income (expense), net | 57 | (594 | ) | 2 | (95 | ) | ||||||||||

| Net loss | $ | (3,839 | ) | $ | (3,798 | ) | $ | (1,051 | ) | $ | (1,148 | ) | ||||

| Net loss per share – basic and diluted | $ | (1.76 | ) | $ | (1.72 | ) | $ | (0.48 | ) | $ | (0.51 | ) | ||||

| Weighted average shares used to compute net loss per share – basic and diluted | 2,177 | 2,214 | 2,195 | 2,242 | ||||||||||||

| Pro forma net loss per share – basic and diluted | $ | (0.68 | ) | $ | (0.53 | ) | $ | (0.18 | ) | $ | (0.19 | ) | ||||

| Weighted average shares used to compute pro forma net loss per share – basic and diluted | 5,686 | 6,066 | 5,865 | 6,094 | ||||||||||||

| (1) | The unaudited pro forma net loss per share for the years ended December 31, 2019 and 2020 and the three months ended March 31, 2020 and 2021 was computed using the weighted-average number of shares of common stock outstanding, including the pro forma effect of the conversion of all outstanding shares of convertible preferred stock and convertible notes into shares of common stock, as if such conversion had occurred at the beginning of the period, or their issuance dates, if later. |

| As of March 31, 2021 | ||||||||||||

| Actual | Pro forma (1) | Pro forma as adjusted (2) | ||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data: | ||||||||||||

| Cash and cash equivalents | $ | 837 | $ | 837 | $ | 20,733 | ||||||

| Working (deficit) capital | (3,636 | ) | 206 | 20,102 | ||||||||

| Total assets | 1,278 | 1,278 | 21,174 | |||||||||

| Convertible note, net | 2,843 | - | - | |||||||||

| Total liabilities | 4,589 | 747 | 747 | |||||||||

| Convertible preferred stock | 12,451 | - | - | |||||||||

| Stockholders’ (deficit) equity | (15,762 | ) | 531 | 20,427 | ||||||||

| (1) | The pro forma balance sheet data gives effect to the Preferred Stock Conversions and the Notes Conversions into 4,066,015 shares of common stock and warrants to purchase 397,901 shares of common stock immediately prior to the closing of this offering. | |

| (2) | The pro forma as adjusted balance sheet data gives effect to the issuance and sale of 1,850,000 Units in this offering at an assumed initial public offering price of $12.00 per Unit, which is the midpoint of the estimated price range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information is illustrative only and will depend on the actual initial public offering price and other terms of this offering determined at pricing. |

| -8- |

An investment in our securities involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase our securities. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. In that event, the trading price of our common stock and the market value of the securities offered hereby could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We are a clinical stage company and may never earn a profit.

We are a clinical stage company and have incurred losses since our formation. As of March 31, 2021, we have an accumulated total deficit of approximately $16.1 million. For both three-month periods ended March 31, 2020 and 2021, we had a net loss of approximately $1.1 million. To date, we have experienced negative cash flow from development of our product candidate, RenovoGem, our platform technology, Renovo Trans-Arterial Micro-Perfusion, or RenovoTAMP, and our RenovoCath delivery system. We have not generated any revenue from operations, and we expect to incur substantial net losses for the foreseeable future as we seek to further develop and commercialize RenovoGem. We cannot predict the extent of these future net losses, or when we may attain profitability, if ever. If we are unable to generate significant revenue from RenovoGem or attain profitability, we will not be able to sustain operations.

Because of the numerous risks and uncertainties associated with developing and commercializing RenovoGem, we are unable to predict the extent of any future losses or when we will attain profitability, if ever. We may never become profitable and you may never receive a return on an investment in our common stock. An investor in our common stock must carefully consider the substantial challenges, risks and uncertainties inherent in the attempted development and commercialization of RenovoGem. We may never successfully commercialize RenovoGem, and our business may not be successful.

We will need to raise substantial additional capital to develop and commercialize RenovoGem, and our failure to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts. If we do not obtain adequate and timely funding, we may not be able to continue as a going concern.

As of March 31, 2021, our cash and cash equivalents were approximately $0.8 million, and our working capital deficit was approximately $3.6 million. Due to our recurring losses from operations and the expectation that we will continue to incur losses in the future, we will be required to raise additional capital to complete the development and commercialization of our product candidates. We have historically relied upon private sales of our equity as well as debt financings to fund our operations. In order to raise additional capital, we may seek to sell additional equity and/or debt securities, obtain a credit facility or other loan or enter into collaborations, licenses or other similar arrangements, which we may not be able to do on favorable terms, or at all. Our ability to obtain additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the development and/or commercialization of our product candidate, restrict our operations or obtain funds by entering into agreements on unfavorable terms. Failure to obtain additional capital at acceptable terms would result in a material and adverse impact on our operations. As a result, there is substantial doubt about our ability to operate as a going concern.

| -9- |

Our financial statements have been prepared on a going concern basis and do not include any adjustments that may result from the outcome of this uncertainty. If we fail to raise additional working capital, or do so on commercially unfavorable terms, it would materially and adversely affect our business, prospects, financial condition and results of operations, and we may be unable to continue as a going concern. If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms, if at all. If we are unable to continue as a going concern, we might have to liquidate our assets and the value we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements, and our shareholders may lose their entire investment in our ordinary shares.

Our product candidates’ commercial viability remains subject to current and future preclinical studies, clinical trials, regulatory approvals, and the risks generally inherent in the development of a pharmaceutical product candidate. If we are unable to successfully advance or develop our product candidate, our business will be materially harmed.

In the near-term, failure to successfully advance the development of our product candidate may have a material adverse effect on us. To date, we have not successfully developed or commercially marketed, distributed, or sold any product candidate. The success of our business depends primarily upon our ability to successfully advance the development of our current and future product candidates through preclinical studies and clinical trials, have the product candidates approved for sale by the FDA or regulatory authorities in other countries, and ultimately have the product candidates successfully commercialized by us or a commercial partner. We cannot assure you that the results of our ongoing preclinical studies or clinical trials will support or justify the continued development of our product candidate, or that we will receive approval from the FDA, or similar regulatory authorities in other countries, to advance the development of our product candidates.

Our product candidates must satisfy rigorous regulatory standards of safety and efficacy before we can advance or complete their clinical development, or they can be approved for sale. To satisfy these standards, we must engage in expensive and lengthy preclinical studies and clinical trials, develop acceptable manufacturing processes, and obtain regulatory approval. Despite these efforts, our product candidates may not:

| ● | offer therapeutic or other medical benefits over existing drugs or other product candidates in development to treat the same patient population; |

| ● | be proven to be safe and effective in current and future preclinical studies or clinical trials; |

| ● | have the desired effects; |

| ● | be free from undesirable or unexpected effects; |

| ● | meet applicable regulatory standards; |

| ● | be capable of being formulated and manufactured in commercially suitable quantities and at an acceptable cost; or |

| ● | be successfully commercialized by us or by collaborators. |

We cannot assure you that the results of late-stage clinical trials will be favorable enough to support the continued development of our product candidates. A number of companies in the pharmaceutical and biopharmaceutical industries have experienced significant delays, setbacks and failures in all stages of development, including late-stage clinical trials, even after achieving promising results in preclinical testing or early-stage clinical trials. Accordingly, results from completed preclinical studies and early-stage clinical trials of our product candidates may not be predictive of the results we may obtain in later-stage trials. Furthermore, even if the data collected from preclinical studies and clinical trials involving our product candidates demonstrate a favorable safety and efficacy profile, such results may not be sufficient to support the submission of an NDA to obtain regulatory approval from the FDA in the U.S., or other similar regulatory agencies in other jurisdictions, which is required to market and sell the product.

| -10- |

Our product candidates will require significant additional research and development efforts, the commitment of substantial financial resources, and regulatory approvals prior to advancing into further clinical development or being commercialized by us or collaborators. We cannot assure you that our product candidates will successfully progress through the drug development process or will result in commercially viable products. We do not expect our product candidates to be commercialized by us or collaborators for at least several years.

Our product candidates may exhibit undesirable side effects when used alone or in combination with other approved pharmaceutical products or investigational new drugs, which may delay or preclude further development or regulatory approval or limit their use if approved.

Throughout the drug development process, we must continually demonstrate the safety and tolerability of our product candidates to obtain regulatory approval to further advance clinical development or to market them. Even if our product candidates demonstrate clinical efficacy, any unacceptable adverse side effects or toxicities, when administered alone or in the presence of other pharmaceutical products, which can arise at any stage of development, may outweigh potential benefits. In preclinical studies and clinical trials we have conducted to date, our product candidate’s tolerability profile is based on studies and trials that have involved a small number of subjects or patients over a limited period of time. We may observe adverse or significant adverse events or drug-drug interactions in future preclinical studies or clinical trial candidates, which could result in the delay or termination of development, prevent regulatory approval, or limit market acceptance if ultimately approved.

Raising additional capital may cause dilution to our existing stockholders, including purchasers of common stock in this offering, restrict our operations or require us to relinquish rights to our product candidates on unfavorable terms to us.

We may seek additional capital through a variety of means, including through public or private equity, debt financings or other sources, including up-front payments and milestone payments from strategic collaborations. To the extent that we raise additional capital through the sale of equity or convertible debt or equity securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. Such financing may result in dilution to stockholders, imposition of debt covenants, increased fixed payment obligations or other restrictions that may affect our business. If we raise additional funds through up-front payments or milestone payments pursuant to strategic collaborations with third parties, we may have to relinquish valuable rights to our product candidates or grant licenses on terms that are not favorable to us. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

If the results of preclinical studies or clinical trials for our product candidates, including those that are subject to existing or future license or collaboration agreements, are unfavorable or delayed, we could be delayed or precluded from the further development or commercialization of our product candidates, which could materially harm our business.

In order to further advance the development of, and ultimately receive regulatory approval to sell, our product candidates, we must conduct extensive preclinical studies and clinical trials to demonstrate their safety and efficacy to the satisfaction of the FDA or similar regulatory authorities in other countries, as the case may be. Preclinical studies and clinical trials are expensive, complex, can take many years to complete, and have highly uncertain outcomes. Delays, setbacks, or failures can occur at any time, or in any phase of preclinical or clinical testing, and can result from concerns about safety or toxicity, a lack of demonstrated efficacy or superior efficacy over other similar products that have been approved for sale or are in more advanced stages of development, poor study or trial design, and issues related to the formulation or manufacturing process of the materials used to conduct the trials. The results of prior preclinical studies or clinical trials are not necessarily predictive of the results we may observe in later stage clinical trials. In many cases, product candidates in clinical development may fail to show desired safety and efficacy characteristics despite having favorably demonstrated such characteristics in preclinical studies or earlier stage clinical trials.

| -11- |

In addition, we may experience numerous unforeseen events during, or as a result of, preclinical studies and the clinical trial process, which could delay or impede our ability to advance the development of, receive regulatory approval for, or commercialize our product candidate, including, but not limited to:

| ● | communications with the FDA, or similar regulatory authorities in different countries, regarding the scope or design of a trial or trials; |

| ● | regulatory authorities, including an Institutional Review Board (“IRB”) or Ethical Committee (“EC”), not authorizing us to commence or conduct a clinical trial at a prospective trial site; |

| ● | enrollment in our clinical trials being delayed, or proceeding at a slower pace than we expected, because we have difficulty recruiting patients or participants dropping out of our clinical trials at a higher rate than we anticipated; |

| ● | our third-party contractors, upon whom we rely for conducting preclinical studies, clinical trials and manufacturing of our trial materials, may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner; |

| ● | having to suspend or ultimately terminate our clinical trials if participants are being exposed to unacceptable health or safety risks; |

| ● | IRBs, ECs, or regulators requiring that we hold, suspend or terminate our preclinical studies and clinical trials for various reasons, including non-compliance with regulatory requirements; and |

| ● | the supply or quality of drug material or the supply of our RenovoCath device necessary to conduct our preclinical studies or clinical trials being insufficient, inadequate, or unavailable. |

Even if the data collected from preclinical studies or clinical trials involving our product candidates demonstrate a favorable safety and efficacy profile, such results may not be sufficient to support the submission of an NDA to obtain regulatory approval from the FDA in the U.S., or other similar foreign regulatory authorities in foreign jurisdictions, which is required to market and sell the product.

If third party vendors upon whom we intend to rely on to conduct our preclinical studies or clinical trials do not perform or fail to comply with strict regulations, these studies or trials of our product candidate may be delayed, terminated, or fail, or we could incur significant additional expenses, which could materially harm our business.

We have limited resources dedicated to designing, conducting, and managing preclinical studies and clinical trials. We intend to rely on third parties, including clinical research organizations, consultants, and principal investigators, to assist us in designing, managing, monitoring and conducting our preclinical studies and clinical trials. We intend to rely on these vendors and individuals to perform many facets of the drug development process, including certain preclinical studies, the recruitment of sites and patients for participation in our clinical trials, maintenance of good relations with the clinical sites, and ensuring that these sites are conducting our trials in compliance with the trial protocol, including safety monitoring and applicable regulations. If these third parties fail to perform satisfactorily, or do not adequately fulfill their obligations under the terms of our agreements with them, we may not be able to enter into alternative arrangements without undue delay or additional expenditures, and therefore the preclinical studies and clinical trials of our product candidate may be delayed or prove unsuccessful. Further, the FDA, or other similar foreign regulatory authorities, may inspect some of the clinical sites participating in our clinical trials in the U.S., or our third-party vendors’ sites, to determine if our clinical trials are being conducted according to Good Clinical Practices. If we or the FDA determine that our third-party vendors are not in compliance with, or have not conducted our clinical trials according to, applicable regulations we may be forced to delay, repeat, or terminate such clinical trials.

| -12- |

We have limited capacity for recruiting and managing clinical trials, which could impair our timing to initiate or complete clinical trials of our product candidate and materially harm our business.

We have limited capacity to recruit and manage the clinical trials necessary to obtain FDA approval or approval by other regulatory authorities. By contrast, larger pharmaceutical and bio-pharmaceutical companies often have substantial staff with extensive experience in conducting clinical trials with multiple product candidates across multiple indications. In addition, they may have greater financial resources to compete for the same clinical investigators and patients that we are attempting to recruit for our clinical trials. If potential competitors are successful in completing drug development for their product candidates and obtain approval from the FDA, they could limit the demand to participate in clinical trials of our product candidates.

As a result, we may be at a competitive disadvantage that could delay the initiation, recruitment, timing, completion of our clinical trials and obtaining regulatory approvals, if at all, for our product candidates.

We, and our collaborators, if any, must comply with extensive government regulations in order to advance our product candidates through the development process and ultimately obtain and maintain marketing approval for our products in the U.S. and abroad.

The product candidates that we, or our collaborators, are developing or may develop require regulatory approval to advance through clinical development and to ultimately be marketed and sold and are subject to extensive and rigorous domestic and foreign government regulation. In the U.S., the FDA regulates, among other things, the development, testing, manufacture, safety, efficacy, record-keeping, labeling, storage, approval, advertising, promotion, sale, and distribution of pharmaceutical and biopharmaceutical products. Our product candidates are also subject to similar regulation by foreign governments to the extent we seek to develop or market them in those countries. We, or our collaborators, must provide the FDA and foreign regulatory authorities, if applicable, with preclinical and clinical data, as well as data supporting an acceptable manufacturing process, that appropriately demonstrate our product candidate’s safety and efficacy before it can be approved for the targeted indications. Our product candidates have not been approved for sale in the U.S. or any foreign market, and we cannot predict whether we or our collaborators will obtain regulatory approval for any product candidates we are developing or plan to develop. The regulatory review and approval process can take many years, is dependent upon the type, complexity, novelty of, and medical need for the product candidate, requires the expenditure of substantial resources, and involves post-marketing surveillance and vigilance and potentially post-marketing studies or Phase 4 clinical trials. In addition, we or our collaborators may encounter delays in, or fail to gain, regulatory approval for our product candidate based upon additional governmental regulation resulting from future legislative, administrative action or changes in FDA’s or other similar foreign regulatory authorities’ policy or interpretation during the period of product development. Delays or failures in obtaining regulatory approval to advance our product candidate through clinical development, and ultimately commercialize them, may:

| ● | adversely impact our ability to raise sufficient capital to fund the development of our product candidates; |

| ● | adversely affect our ability to further develop or commercialize our product candidates; |

| ● | diminish any competitive advantages that we or our collaborators may have or attain; and |

| -13- |

| ● | adversely affect the receipt of potential milestone payments and royalties from collaborators, if any, from the sale of our products or product revenues in the future. |

Furthermore, any regulatory approvals, if granted, may later be withdrawn. If we or our collaborators fail to comply with applicable regulatory requirements at any time, or if post-approval safety concerns arise, we or our collaborators may be subject to restrictions or a number of actions, including:

| ● | delays, suspension, or termination of clinical trials related to our products; |

| ● | refusal by regulatory authorities to review pending applications or supplements to approved applications; |

| ● | product recalls or seizures; |

| ● | suspension of manufacturing; |

| ● | withdrawals of previously approved marketing applications; and |

| ● | fines, civil penalties, and criminal prosecutions. |

Additionally, at any time we or our collaborators may voluntarily suspend or terminate the preclinical or clinical development of a product candidate, or withdraw any approved product from the market if we believe that it may pose an unacceptable safety risk to patients, or if the product candidate or approved product no longer meets our business objectives. The ability to develop or market a pharmaceutical product outside of the U.S. is contingent upon receiving appropriate authorization from the respective foreign regulatory authorities. Foreign regulatory approval processes typically include many, if not all, of the risks and requirements associated with the FDA regulatory process for drug development and may include additional risks.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

Our product candidates may not prove to be safe and efficacious in clinical trials and may not meet all the applicable regulatory requirements needed to receive regulatory approval. In order to receive regulatory approval for the commercialization of our product candidates, we must conduct, at our own expense, extensive preclinical testing and clinical trials to demonstrate safety and efficacy of our product candidate for the intended indication of use. Clinical testing is expensive, can take many years to complete, if at all, and its outcome is uncertain. Failure can occur at any time during the clinical trial process.

The results of preclinical studies and early clinical trials of new drugs do not necessarily predict the results of later-stage clinical trials. The design of our clinical trials is based on many assumptions about the expected effects of our product candidate, and if those assumptions are incorrect, they may not produce statistically significant results. Preliminary results may not be confirmed on full analysis of the detailed results of a clinical trial. Product candidates in later stages of clinical development may fail to show safety and efficacy sufficient to support intended use claims despite having progressed through earlier clinical testing. The data collected from clinical trials of our product candidate may not be sufficient to support the filing of an NDA or to obtain regulatory approval in the United States or elsewhere. Because of the uncertainties associated with drug development and regulatory approval, we cannot determine if or when we will have an approved product for commercialization or achieve sales or profits.

| -14- |

Delays in clinical testing could result in increased costs to us and delay our ability to generate revenue.

We may experience delays in clinical testing of our product candidate. We do not know whether planned clinical trials will begin on time, will need to be redesigned or will be completed on schedule, if at all. Clinical trials can be delayed for a variety of reasons, including pandemics, delays in obtaining regulatory approval to commence a clinical trial, in securing clinical trial agreements with prospective sites with acceptable terms, in obtaining IRB approval to conduct a clinical trial at a prospective site, in recruiting patients to participate in a clinical trial or in obtaining sufficient supplies of clinical trial materials, including RenovoCath. Many factors affect patient enrollment, including the size of the patient population, the proximity of patients to clinical sites, the eligibility criteria for the clinical trial, the existing body of safety and efficacy data with respect to the study drug, competing clinical trials, new drugs approved for the conditions we are investigating and health epidemics such as the COVID-19 pandemic. Clinical investigators will need to decide whether to offer their patients enrollment in clinical trials of our product candidate versus treating these patients with commercially available drugs that have established safety and efficacy profiles. Any delays in completing our clinical trials will increase our costs, slow down our product development, timeliness and approval process and delay our ability to generate revenue.

The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA and comparable foreign authorities is unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any product candidate and it is possible that our existing product candidate or any product candidate we may seek to develop in the future will ever obtain regulatory approval may fail to receive regulatory approval.

Our product candidate could fail to receive regulatory approval for many reasons, including the following:

| ● | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| ● | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate is safe and effective for its proposed indication; |

| ● | the results of clinical trials may not meet the level of statistical significance required for approval by the FDA or comparable foreign regulatory authorities; |

| ● | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| ● | the data collected from clinical trials of our product candidates may not be sufficient to support the submission of an NDA or other submission or to obtain regulatory approval in the United States or elsewhere; |

| ● | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; and |

| ● | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

| -15- |

This lengthy approval process as well as the unpredictability of future clinical trial results may result in our failing to obtain regulatory approval to market our product candidates, which would significantly harm our business, results of operations and prospects.

In addition, even if we were to obtain approval, regulatory authorities may approve our product candidates for fewer or more limited indications than we request, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a product candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

We have not previously submitted an NDA to the FDA, nor similar drug approval filings to comparable foreign authorities, for our product candidates, and we cannot be certain that our product candidates will be successful in clinical trials or receive regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations. Even if we successfully obtain regulatory approvals to market one or more of our product candidates, our revenues will be dependent on many factors including the size of the markets in the territories for which we gain regulatory approval and have commercial rights. If the markets for patients that we are targeting for our product candidates are not as significant as we estimate, we may not generate significant revenues from sales of such products, if approved.