Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Relay Therapeutics, Inc. | rlay-ex321_9.htm |

| EX-31.2 - EX-31.2 - Relay Therapeutics, Inc. | rlay-ex312_6.htm |

| EX-31.1 - EX-31.1 - Relay Therapeutics, Inc. | rlay-ex311_7.htm |

| EX-10.2 - EX-10.2 - Relay Therapeutics, Inc. | rlay-ex102_8.htm |

| 10-Q - 10-Q - Relay Therapeutics, Inc. | rlay-10q_20210630.htm |

Exhibit 10.5

LEASE

by and between

BMR-HAMPSHIRE, LLC,

a Delaware limited liability company

and

RELAY THERAPEUTICS, INC.,

BioMed Realty form dated 3/8/21

/

Table of Contents

|

1. |

Lease of Premises |

1 |

|

2. |

Basic Lease Provisions |

2 |

|

3. |

Term |

6 |

|

4. |

Possession and Commencement Date. |

7 |

|

5. |

Condition of Premises |

9 |

|

6. |

Rentable Area |

9 |

|

7. |

Rent |

10 |

|

8. |

Rent Adjustments |

11 |

|

9. |

Operating Expenses |

11 |

|

10. |

Taxes on Tenant’s Property |

16 |

|

11. |

Security Deposit |

16 |

|

12. |

Use |

18 |

|

13. |

Rules and Regulations, CC&Rs, Parking Facilities and Common Area |

21 |

|

14. |

Project Control by Landlord |

23 |

|

15. |

Quiet Enjoyment |

24 |

|

16. |

Utilities and Services |

24 |

|

17. |

Alterations |

27 |

|

18. |

Repairs and Maintenance |

30 |

|

19. |

Liens |

32 |

|

20. |

Estoppel Certificate |

33 |

|

21. |

Hazardous Materials |

33 |

|

22. |

Odors and Exhaust |

36 |

|

23. |

Insurance |

37 |

|

24. |

Damage or Destruction |

41 |

|

25. |

Eminent Domain |

43 |

|

26. |

Surrender |

44 |

|

27. |

Holding Over |

45 |

|

28. |

Indemnification and Exculpation |

46 |

|

29. |

Assignment or Subletting |

47 |

|

30. |

Subordination and Attornment |

51 |

|

31. |

Defaults and Remedies |

51 |

|

32. |

Bankruptcy |

56 |

|

33. |

Brokers |

57 |

|

34. |

Definition of Landlord |

57 |

|

35. |

Limitation of Landlord’s Liability |

58 |

|

36. |

Joint and Several Obligations |

58 |

|

37. |

Representations |

59 |

|

38. |

Confidentiality |

59 |

|

39. |

Notices |

60 |

|

40. |

Miscellaneous |

60 |

|

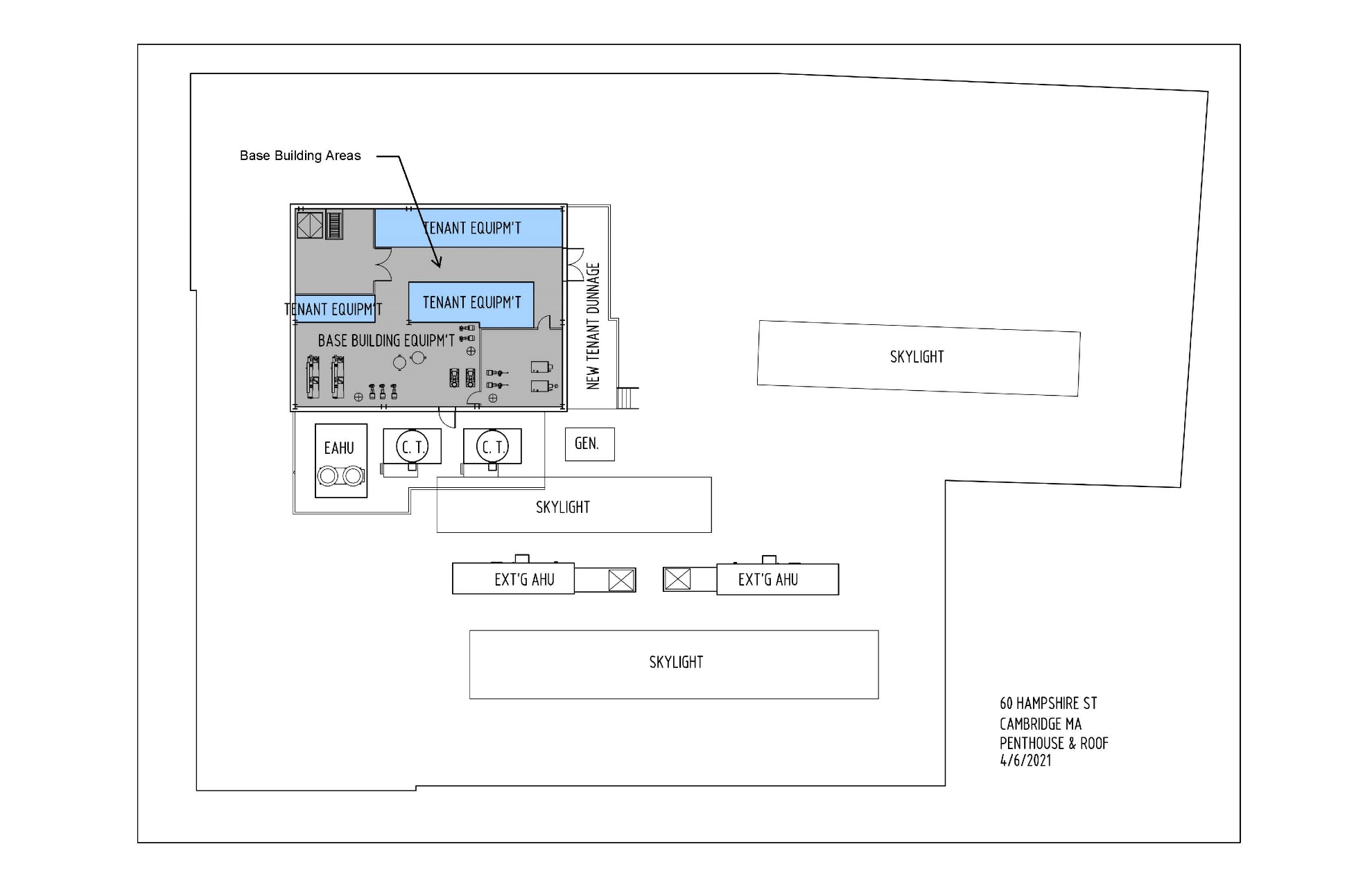

41. |

Rooftop Installation Area |

63 |

ii

LEASE

THIS LEASE (this “Lease”) is entered into as of this 26th day of May, 2021 (the “Execution Date”), by and between BMR-HAMPSHIRE, LLC, a Delaware limited liability company (“Landlord”), and RELAY THERAPEUTICS, INC., a Delaware corporation (“Tenant”).

RECITALS

A.WHEREAS, Landlord owns certain real property and improvements located at 50 and 60 Hampshire Street (also known as 205 Broadway), Cambridge, Middlesex County, Massachusetts (the “Property”), including the buildings located thereon; and

B.WHEREAS, Landlord wishes to lease to Tenant, and Tenant desires to lease from Landlord, certain premises (the “Premises”) being all of the building known as 60 Hampshire Street (the “Building”), pursuant to the terms and conditions of this Lease, as detailed below; and

AGREEMENT

NOW, THEREFORE, Landlord and Tenant, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, agree as follows:

1.1.Effective on the Term Commencement Date (as defined below), Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises, as shown on Exhibit A attached hereto, for use by Tenant in accordance with the Permitted Use (as defined below) and no other uses. The portion of the Property commonly known as 60 Hampshire Street and all landscaping, parking facilities, private drives and other improvements and appurtenances related thereto, including the Building, are hereinafter collectively referred to as the “Project.” The portion of the Property commonly known as 50 Hampshire Street and all landscaping, parking facilities, private drives and other improvements and appurtenances related thereto, including the building located thereon (the “50 Building”), are hereinafter collectively referred to as the “50 Project” and, together with the Project, the “Hampshire Project.” All portions of the 50 Building that are for the non-exclusive use of the tenants of the 50 Building only, and not the tenants of the Hampshire Project generally, such as service corridors, stairways, elevators, public restrooms and public lobbies (all to the extent located in the 50 Building), are hereinafter referred to as “50 Building Common Area.” All portions of the Hampshire Project that are for the non-exclusive use of tenants of the Hampshire Project generally, including driveways, sidewalks, parking areas, landscaped areas, and (to the extent not located in a building) service corridors, stairways, elevators, public restrooms and public lobbies (but excluding the 50 Building Common Area), are hereinafter referred to as “Hampshire Project Common Area.” The Hampshire Project Common Area is sometimes referred to herein as “Common Area.”

2.Basic Lease Provisions. For convenience of the parties, certain basic provisions of this Lease are set forth herein. The provisions set forth herein are subject to the remaining terms and conditions of this Lease and are to be interpreted in light of such remaining terms and conditions.

2.1.This Lease shall take effect upon the Execution Date and, except as specifically otherwise provided within this Lease, each of the provisions hereof shall be binding upon and inure to the benefit of Landlord and Tenant from the date of execution and delivery hereof by all parties hereto.

2.2.In the definitions below, Rentable Area (as defined below) is expressed in square feet. Rentable Area and “Tenant’s Pro Rata Shares” are all subject to adjustment as provided in this Lease.

|

Definition or Provision |

Means the Following (As of the Term Commencement Date) |

|

Approximate Rentable Area of Premises |

41,474 square feet |

|

Approximate Rentable Area of Building |

41,474 square feet |

|

Approximate Rentable Area of Project |

41,474 square feet |

|

Tenant’s Pro Rata Share of Building |

100% |

|

Tenant’s Pro Rata Share of Project |

100% |

2.3.Monthly and annual installments of Base Rent for the Premises (“Base Rent”) as of the Term Commencement Date (as defined below) will be as follows:

|

Dates/Months of the Term |

Square Feet of Rentable Area |

Base Rent per Square Foot of Rentable Area |

Monthly Base Rent* |

Annual Base Rent |

|

Term Commencement Date – day immediately prior to 1st anniversary of the Term Commencement Date |

41,474 |

$110.00 annually

|

$380,178.33 |

$4,562,140.00 |

2

|

1st anniversary of the Term Commencement Date –day immediately prior to 2nd anniversary of Term Commencement Date |

41,474 |

$113.30 |

$391,583.68 |

$4,699,004.20 |

|

2nd anniversary of Term Commencement Date –day immediately prior to 3rd anniversary of Term Commencement Date |

41,474 |

$116.70 |

$403,334.65 |

$4,840,015.80 |

|

3rd anniversary of Term Commencement Date –day immediately prior to 4th anniversary of Term Commencement Date |

41,474 |

$120.20 |

$415,431.23 |

$4,985,174.80 |

|

4th anniversary of Term Commencement Date –day immediately prior to 5th anniversary of Term Commencement Date |

41,474 |

$123.81 |

$427,908.00 |

$5,134,895,94 |

3

|

5th anniversary of Term Commencement Date –day immediately prior to 6th anniversary of Term Commencement Date |

41,474 |

$127.52 |

$440,730.37 |

$5,288,764.48 |

|

6th anniversary of Term Commencement Date –day immediately prior to 7th anniversary of Term Commencement Date |

41,474 |

$131.35 |

$453,967.49 |

$5,447,609.90 |

|

7th anniversary of Term Commencement Date –day immediately prior to 8th anniversary of Term Commencement Date |

41,474 |

$135.29 |

$467,584.79 |

$5,611,017.46 |

|

8th anniversary of Term Commencement Date –day immediately prior to 9th anniversary of Term Commencement Date |

41,474 |

$139.35 |

$481,616.83 |

$5,779,401.90 |

4

|

9th anniversary of Term Commencement Date –day immediately prior to 10th anniversary of Term Commencement Date |

41,474 |

$143.53 |

$496,063.60 |

$5,952,763.22 |

2.4.Estimated Term Commencement Date: As set forth in Section 4.1

2.5.Estimated Term Expiration Date: The date that is 120 months after the Estimated Term Commencement Date.

2.6.Security Deposit: $1,700,000, subject to adjustment in accordance with the terms hereof.

2.7.Permitted Use: Office and laboratory use in conformity with all federal, state, municipal and local laws, codes, ordinances, rules and regulations of Governmental Authorities (as defined below), committees, associations, or other regulatory committees, agencies or governing bodies having jurisdiction over the Premises, the Building, the Property, the Project, Landlord or Tenant, including both statutory and common law and hazardous waste rules and regulations (“Applicable Laws”)

2.8.Address for Rent Payment:

BMR-Hampshire LLC

Attention Entity 325

P.O. Box 511415

Los Angeles, California 90051-7970

2.9.Address for Notices to Landlord:

BMR-Hampshire LLC

4570 Executive Drive, Suite 400

San Diego, California 92121

Attn: Real Estate Legal Department

2.10.Address for Notices to Tenant:

Prior to the Term Commencement Date:

Relay Therapeutics, Inc.

399 Binney Street

Cambridge, MA 02139

Attn: Brian Adams, General Counsel

5

After the Term Commencement Date:

Relay Therapeutics, Inc.

60 Hampshire Street

Cambridge, MA 02139

Attn: Brian Adams, General Counsel

2.11.Address for Invoices to Tenant:

Prior to the Term Commencement Date:

Relay Therapeutics, Inc.

399 Binney Street

Cambridge, MA 02139

ap@relaytx.com

After the Term Commencement Date:

Relay Therapeutics, Inc.

60 Hampshire Street

Cambridge, MA 02139

ap@relaytx.com

2.12.The following Exhibits are attached hereto and incorporated herein by reference:

|

|

Exhibit A |

Premises |

|

|

Exhibit B |

Work Letter |

|

|

Exhibit B-1 |

Tenant Work Insurance Schedule |

|

|

Exhibit C |

Acknowledgement of Term Commencement Date and Term Expiration Date |

|

|

Exhibit D |

Landlord’s Base Building Work |

|

|

Exhibit E |

Form of Letter of Credit |

|

|

Exhibit F |

Rules and Regulations |

|

|

Exhibit G |

PTDM |

|

|

Exhibit H |

Tenant’s Personal Property |

|

|

Exhibit I |

Form of Estoppel Certificate |

3.Term. The term of the leasehold granted by this Lease (as the same may be earlier terminated in accordance with this Lease, the “Term”) shall commence on the actual Term Commencement Date (as defined in Article 4) and end on the date (the “Term Expiration Date”) that is One Hundred Twenty (120) months after the actual Term Commencement Date, subject to earlier termination of this Lease as provided herein.

6

4.Possession and Commencement Date.

4.1.Landlord shall use commercially reasonable efforts to tender possession of the Premises to Tenant on the Estimated Term Commencement Date (as defined below), with the work (the “Tenant Improvements”) required of Landlord described in the Work Letter attached hereto as Exhibit B (the “Work Letter”) Substantially Complete (as defined below). Within ten (10) days of Tenant approving or having been deemed to approve the Draft Schematic Plans (as defined below) as set forth in Section 2.1 of the Work Letter, Landlord shall provide Tenant with an estimated construction schedule for the Tenant Improvements prepared by the Landlord’s general contractor (the “Estimated TI Construction Schedule”). The “Estimated Term Commencement Date” shall be the set forth in the Estimated TI Construction Schedule as the Substantial Completion date, as such date shall be extended on a day-for-day basis as a result of Force Majeure or a Tenant Delay (as such terms are defined below); provided that, upon Tenant’s request, Landlord and Tenant shall reasonably cooperative to attempt to reduce the number of days required to achieve Substantial Completion in the Estimated TI Construction Schedule. Tenant agrees that in the event such work is not Substantially Complete on or before the Estimated Term Commencement Date for any reason, then (a) this Lease shall not be void or voidable, (b) Landlord shall not be liable to Tenant for any loss or damage resulting therefrom, (c) the Term Expiration Date shall be extended accordingly and (d) Tenant shall not be responsible for the payment of any Base Rent or Tenant’s Adjusted Share of Operating Expenses (as defined below) until the actual Term Commencement Date as described in Section 4.2 occurs. The term “Substantially Complete” or “Substantial Completion” means, with respect to the Tenant Improvements, that (y) the Tenant Improvements are substantially complete in accordance with the Approved Plans (as defined in the Work Letter), except for punch list items, executed by the project architect and the general contractor, and (z) the Premises may be legally occupied for the Permitted Uses pursuant to a temporary certificate of occupancy or its substantial equivalent (such as sign-off on the building permit by the Governmental Authority that issued such permit), to the extent required by Applicable Laws for occupancy of the Premises, a copy of which shall have been delivered by Landlord to Tenant. If Landlord delivers a temporary certificate of occupancy or its substantial equivalent, Landlord shall deliver a permanent certificate of occupancy or its substantial equivalent as may be required so that at all times, Tenant may lawfully occupy the Premises for the Permitted Uses. In the event Substantial Completion of the Tenant Improvements shall occur subsequent to the date which is sixty (60) days following the Estimated Term Commencement Date, Tenant shall receive a credit against Tenant’s obligation to pay Base Rent hereunder from and after such date, on a per diem basis, for each day during the period from the sixty-first (61st) day following the Estimated Term Commencement Date until Landlord has Substantially Completed the Tenant Improvements, provided that such delay does not arise from a Tenant Delay or Force Majeure (both as defined below).

As used herein, “Tenant Delay” shall mean and refer to any delay in the Estimated Term Commencement Date or in the completion of the Tenant Improvements arising from acts or omissions of Tenant or any Tenant Party (as defined in Section 21.1 below), including, without limitation, arising from any accommodation of a Tenant initiated request (e.g., a Tenant requested change to the Estimated TI Construction Schedule or to the Approved Schematic Design, as defined below). Tenant acknowledges and agrees that Tenant Delays shall include any additional delays which would not have occurred but for such Tenant Delay, including (without limitation) the occurrence of any delay due to Force Majeure (as defined below) that would not have affected

7

the Estimated Term Commencement Date or completion of the Base Building Work or Tenant Improvements had there been no Tenant Delay.

4.2.The “Term Commencement Date” shall be the later of (a) the Estimated Term Commencement Date and (b) the day Landlord tenders possession of the Premises to Tenant with the Tenant Improvements Substantially Complete. If possession is delayed by a Tenant Delay, then the Term Commencement Date shall be the date that the Term Commencement Date would have occurred but for such delay. Tenant shall execute and deliver to Landlord written acknowledgment of the actual Term Commencement Date and the Term Expiration Date within ten (10) days after Tenant takes occupancy of the Premises, in the form attached as Exhibit C hereto. Failure to execute and deliver such acknowledgment, however, shall not affect the Term Commencement Date or Landlord’s or Tenant’s liability hereunder. Failure by Tenant to obtain any governmental licensing or similar governmental approval of the Premises required to be obtained by Tenant for the Permitted Use by Tenant shall not serve to extend the Term Commencement Date.

4.3.Upon at least seven (7) day’s prior written notice from Tenant, Landlord may permit (in Landlord’s reasonable discretion) Tenant to enter upon the Premises prior to the Term Commencement Date for the purpose of installing fixtures, furnishings or equipment; provided, Tenant shall furnish to Landlord evidence satisfactory to Landlord in advance that insurance coverages required of Tenant under the provisions of Article 23 are in effect, and such entry shall be subject to all the terms and conditions of this Lease other than the payment of Base Rent or Tenant’s Adjusted Share of Operating Expenses (as defined below); and provided, further, that if the Term Commencement Date is delayed due to such early access, then the Term Commencement Date shall be the date that the Term Commencement Date would have occurred but for such delay. For the avoidance of doubt, it shall be reasonable for Landlord to deny a Tenant request for entry if, in Landlord’s reasonable discretion, such entry will interfere with the Base Building Work or the Tenant Improvements.

4.4.Landlord shall cause the Tenant Improvements to be constructed in the Premises pursuant to the Work Letter at a cost to Landlord not to exceed Six Million Two Hundred Twenty-One Thousand One Hundred Dollars ($6,221,100.00) (based upon One Hundred Fifty Dollars ($150.00) per square foot of Rentable Area (as defined below)) (the “TI Allowance”). The TI Allowance may be applied to the costs of the Tenant Improvements for (m) construction, (n) project management by Landlord (which fee shall equal three percent (3%) of the TI allowance, (o) commissioning of mechanical, electrical and plumbing systems by a licensed, qualified commissioning agent hired by Landlord, and review of such party’s commissioning report by a licensed, qualified commissioning agent hired by Tenant, (p) space planning, architect, engineering and other related services performed by third parties unaffiliated with Tenant, (q) building permits and other taxes, fees, charges and levies by Governmental Authorities (as defined below) for permits or for inspections of the Tenant Improvements, and (r) costs and expenses for labor, material, equipment and fixtures. In no event shall the TI Allowance be used for (w) payments to Tenant or any affiliates of Tenant, (x) the purchase of any furniture, personal property or other non-building system equipment, (y) costs arising from any default by Tenant of its obligations under this Lease or (z) costs that are recoverable by Tenant from a third party (e.g., insurers, warrantors, or tortfeasors).

8

4.5.To the extent that the total projected cost of the Tenant Improvements (as projected by Landlord) exceeds the TI Allowance (such excess, the “Excess TI Costs”), Tenant shall pay the costs of the Tenant Improvements on a pari passu basis with Landlord as such costs are paid, in the proportion of Excess TI Costs payable by Tenant to the TI Allowance payable by Landlord. In no event shall any unused TI Allowance entitle Tenant to a credit against Rent payable under this Lease.

5.Condition of Premises. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the condition of the Premises, the Building or the Project, or with respect to the suitability of the Premises, the Building or the Project for the conduct of Tenant’s business. Tenant acknowledges that (a) it is fully familiar with the condition of the Premises and agrees, subject to the completion of the Tenant Improvements, to take the same in its condition “as is” as of the Term Commencement Date and (b) Landlord shall have no obligation to alter, repair or otherwise prepare the Premises for Tenant’s occupancy or to pay for or construct any improvements to the Premises, except for performance of the Tenant Improvements. Tenant’s taking of possession of the Premises shall, except as otherwise agreed to in writing by Landlord and Tenant, conclusively establish that the Tenant Improvements are Substantially Complete, and the Premises, the Building and the Project were at such time in good, sanitary and satisfactory condition and repair, except for punchlist items, provided, however, that except to the extent to which Tenant shall have given Landlord notice of any Punch List Items not later than two (2) weeks after the Term Commencement Date, Tenant shall be deemed conclusively to have approved the completion of the Tenant Improvements and Tenant shall have no claim that Landlord has failed to perform any of the Tenant Improvements. Notwithstanding the foregoing, Landlord shall complete certain base building improvements (Landlord’s Base Building Work) in accordance with Exhibit D attached hereto. For the avoidance of doubt, the substantial completion of Landlord’s Base Building Work shall not be required as a condition to the Term Commencement Date, but Landlord will use commercially reasonable efforts to substantially complete the Landlord’s Base Building Work by December 31, 2021, provided, however, that if there is a delay in the substantial completion of the Landlord’s Base Building Work for any reason Landlord, and its agents, partners or employees, shall not have any liability to Tenant in connection with such delay, nor shall the Lease be affected in any way.

6.1.The term “Rentable Area” shall reflect such areas as reasonably calculated by Landlord’s architect, as set forth in Section 2.2 as the same may be reasonably adjusted from time to time by Landlord in consultation with Landlord’s architect to reflect actual changes to the Building or the Project, as applicable. Notwithstanding the foregoing to the contrary, in no event shall the Rentable Area of the Premises, the Building or the Project be deemed to have increased unless due to a change in the outer dimensions of the exterior walls of the same. The parties stipulate and agree that as of the Term Commencement Date, the Rentable Area for the Premises is 41,474 square feet, as measured in accordance with the provisions of this Section 6.

6.2.The Rentable Area of the Building is generally determined by making separate calculations of Rentable Area applicable to each floor within the Building and totaling the Rentable Area of all floors within the Building. The Rentable Area of a floor is computed by measuring to the outside finished surface of the permanent outer Building walls. The full area calculated as

9

previously set forth is included as Rentable Area, without deduction for columns and projections or vertical penetrations, including stairs, elevator shafts, flues, pipe shafts, vertical ducts and the like, as well as such items’ enclosing walls.

6.3.The term “Rentable Area,” when applied to the Premises, is that area equal to the usable area of the Premises, plus an equitable allocation of Rentable Area within the Building that is not then utilized or expected to be utilized as usable area, including that portion of the Building devoted to corridors, equipment rooms, restrooms, elevator lobby, atrium and mailroom .

6.4.The Rentable Area of the Project is the total Rentable Area of all buildings within the Project.

6.5Review of allocations of Rentable Areas as between tenants of the Hampshire Project shall be made as frequently as Landlord deems appropriate, including in order to facilitate an equitable apportionment of Operating Expenses (as defined below). If such review is by a licensed architect and allocations are certified by such licensed architect as being correct, then Tenant shall be bound by such certifications. Landlord hereby confirms that the 50 Building contains 202,023 rentable square feet and that the 60 Building contains 41,474 rentable square feet.

7.1.Tenant shall pay to Landlord as Base Rent for the Premises, commencing on the Term Commencement Date, the sums set forth in Section 2.3, subject to the rental adjustments provided in Article 8 hereof. Base Rent shall be paid in equal monthly installments as set forth in Section 2.3, subject to the rental adjustments provided in Article 8 hereof, each in advance on the first day of each and every calendar month during the Term.

7.2.In addition to Base Rent, Tenant shall pay to Landlord as additional rent (“Additional Rent”) at times hereinafter specified in this Lease (a) Tenant’s Adjusted Share (as defined below) of Operating Expenses (as defined below), (b) the Property Management Fee (as defined below), and (c) any other amounts that Tenant assumes or agrees to pay under the provisions of this Lease that are owed to Landlord, including any and all other sums that may become due by reason of any default of Tenant or failure on Tenant’s part to comply with the agreements, terms, covenants and conditions of this Lease to be performed by Tenant, after notice and the lapse of any applicable cure periods.

7.3.Base Rent and Additional Rent shall together be denominated “Rent.” Rent shall be paid to Landlord, without abatement, deduction or offset (except as expressly set forth herein), in lawful money of the United States of America to the address set forth in Section 2.8 or to such other person or at such other place as Landlord may from time designate in writing. In the event the Term commences or ends on a day other than the first day of a calendar month, then the Rent for such fraction of a month shall be prorated for such period on the basis of the number of days in the month and shall be paid at the then-current rate for such fractional month.

7.4.Except as expressly set forth herein, Tenant’s obligation to pay Rent shall not be discharged or otherwise affected by (a) any Applicable Laws now or hereafter applicable to the Premises, (b) any other restriction on Tenant’s use, (c) except as expressly provided herein, any

10

casualty or taking or (d) any other occurrence; and Tenant waives all rights now or hereafter existing to terminate or cancel this Lease or quit or surrender the Premises or any part thereof, or to assert any defense in the nature of constructive eviction to any action seeking to recover rent. Tenant’s obligation to pay Rent with respect to any period or obligations arising, existing or pertaining to the period prior to the date of the expiration or earlier termination of the Term or this Lease shall survive any such expiration or earlier termination; provided, however, that nothing in this sentence shall in any way affect Tenant’s obligations with respect to any other period.

8.1.Base Rent shall be subject to an annual upward adjustment of three percent (3%) of the then-current Base Rent. The first such adjustment shall become effective commencing on the first (1st) annual anniversary of the Term Commencement Date, and subsequent adjustments shall become effective on every successive annual anniversary during the initial Term.

9.1.As used herein, the term “Operating Expenses” shall include:

(a)Government impositions, including property tax costs consisting of real and personal property taxes (including amounts due under any improvement bond upon the Building or the Project (including the parcel or parcels of real property upon which the Building, the other buildings in the Project and areas serving the Building and the Project are located)) or assessments in lieu thereof imposed by any federal, state, regional, local or municipal governmental authority, agency or subdivision (each, a “Governmental Authority”); taxes on or measured by gross rentals received from the rental of space in the Project; taxes based on the square footage of the Premises, the Building or the Project, as well as any parking charges, utilities surcharges or any other costs levied, assessed or imposed by, or at the direction of, or arising from Applicable Laws or interpretations thereof, promulgated by any Governmental Authority in connection with the use or occupancy of the Project or the parking facilities serving the Project; taxes on this transaction or any document to which Tenant is a party creating or transferring an interest in the Premises; any fee for a business license to operate an office building; and any expenses, including the reasonable cost of attorneys or experts, reasonably incurred by Landlord in seeking reduction by the taxing authority of the applicable taxes, less tax refunds obtained as a result of an application for review thereof; and

(b)All other costs of any kind paid or incurred by Landlord in connection with the operation or maintenance of the Building and the Project, which shall include Project office rent at fair market rental for a commercially reasonable amount of space for Project management personnel, to the extent an office used for Project operations is maintained at the Project, plus customary expenses for such office, and costs of repairs and replacements to improvements within the Project as appropriate to maintain the Project as required hereunder, including costs of funding such reasonable reserves as Landlord, consistent with good business practice, may establish to provide for future repairs and replacements, or as any Lender (as defined below) may require; costs of utilities furnished to the Common Area; sewer fees; cable television; trash collection; cleaning, including windows; heating, ventilation and air-conditioning (“HVAC”); maintenance of landscaping and grounds; snow removal; maintenance of drives and parking areas; maintenance

11

of the roof; security services and devices; building supplies; maintenance or replacement of equipment utilized for operation and maintenance of the Project; license, permit and inspection fees; sales, use and excise taxes on goods and services purchased by Landlord in connection with the operation, maintenance or repair of the Building or Project systems and equipment; telephone, postage, stationery supplies and other expenses incurred in connection with the operation, maintenance or repair of the Project; accounting, legal and other professional fees and expenses incurred in connection with the Project; costs of furniture, draperies, carpeting, landscaping supplies, snow removal and other customary and ordinary items of personal property provided by Landlord for use in Common Area or in the Project office; Project office rent or rental value for a commercially reasonable amount of space, to the extent an office used for Project operations is maintained at the Project, plus customary expenses for such office; capital expenditures, in each case amortized over the useful life thereof, as reasonably determined by Landlord, in accordance with generally accepted accounting principles; costs of complying with Applicable Laws (except to the extent such costs are incurred to remedy non-compliance as of the Execution Date with Applicable Laws); costs to keep the Project in compliance with, or costs or fees otherwise required under or incurred pursuant to any CC&Rs (as defined below), including condominium fees; insurance premiums, including premiums for commercial general liability, property casualty, earthquake, terrorism and environmental coverages; portions of insured losses paid by Landlord as part of the deductible portion of a loss pursuant to the terms of insurance policies; service contracts; costs of services of independent contractors retained to do work of a nature referenced above; and costs of compensation (including employment taxes and fringe benefits) of all persons who perform regular and recurring duties connected with the day-to-day operation and maintenance of the Project, its equipment, the adjacent walks, landscaped areas, drives and parking areas, including janitors, floor waxers, window washers, watchmen, gardeners, sweepers, plow truck drivers, handymen, and engineering/maintenance/facilities personnel.

(c)Notwithstanding the foregoing, Operating Expenses shall not include any net income, franchise, capital stock, estate or inheritance taxes, or taxes that are the personal obligation of Tenant or of another tenant of the Project; any leasing commissions; expenses that relate to preparation of rental space for a tenant; the cost of any advertising, promotional or marketing expenses for the Building or the Project; expenses of initial development and construction, including grading, paving, landscaping and decorating (as distinguished from maintenance, repair and replacement of the foregoing); costs of constructing additions to the Building or the Project or new buildings within the Project; legal expenses relating to other tenants; legal, auditing and professional fees paid or incurred in connection with negotiations for leases, finances, refinancings, sales, acquisitions, or further development of the Project; costs of repairs to the extent reimbursed by payment of insurance proceeds received by Landlord or which are covered by warranties, or guarantees; fines or penalties incurred as a direct result of Landlord’s willful violations of Applicable Laws; principal and interest upon loans to Landlord or secured by a mortgage or deed of trust covering the Project or a portion thereof (provided that interest upon a government assessment or improvement bond payable in installments shall constitute an Operating Expense under Subsection 9.1(a)); salaries of executive officers of Landlord; depreciation claimed by Landlord for tax purposes (provided that this exclusion of depreciation is not intended to delete from Operating Expenses actual costs of repairs and replacements and reasonable reserves in regard thereto that are provided for in Subsection 9.1(b)); taxes that are excluded from Operating Expenses by the last sentence of Subsection 9.1(a); costs or expenses incurred in connection with the financing or sale of the Project or any portion thereof; payments or subsidies for retail operators

12

in the Project; political or charitable contributions; costs expressly excluded from Operating Expenses elsewhere in this Lease or that are charged to or paid by Tenant under other provisions of this Lease; professional fees and disbursements and other costs and expenses related to the ownership (as opposed to the use, occupancy, operation, maintenance or repair) of the Project; and any item that, if included in Operating Expenses, would involve a double collection for such item by Landlord. To the extent that Tenant uses more than Tenant’s Pro Rata Share of any item of Operating Expenses, Tenant shall pay Landlord for such excess in addition to Tenant’s obligation to pay Tenant’s Pro Rata Share of Operating Expenses (such excess, together with Tenant’s Pro Rata Share, “Tenant’s Adjusted Share”).

9.2Tenant shall pay to Landlord on the first day of each calendar month of the Term, as Additional Rent, (a) the Property Management Fee (as defined below), and (b) Landlord’s estimate of Tenant’s Adjusted Share of Operating Expenses with respect to the Building and the Project, as applicable, for such month.

(w)The “Property Management Fee” shall equal three percent (3%) of Base Rent due from Tenant. Tenant shall pay the Property Management Fee in accordance with Section 9.2 with respect to the entire Term, including any extensions of the Term, or any holdover periods, regardless of whether Tenant is obligated to pay Base Rent, Operating Expenses or any other Rent with respect to any such period or portion thereof.

(x)Within ninety (90) days after the conclusion of each calendar year (or such longer period as may be reasonably required by Landlord not to exceed 180 days), Landlord shall furnish to Tenant a statement showing in reasonable detail the actual Operating Expenses, Tenant’s Adjusted Share of Operating Expenses, and the cost of providing utilities to the Premises for the previous calendar year (“Landlord’s Statement”). Any additional sum due from Tenant to Landlord shall be due and payable within thirty (30) days after receipt of an invoice therefor. If the amounts paid by Tenant pursuant to this Section exceed Tenant’s Adjusted Share of Operating Expenses for the previous calendar year, then Landlord shall credit the difference against the Rent next due and owing from Tenant; provided that, if the Lease term has expired, Landlord shall accompany Landlord’s Statement with payment for the amount of such difference.

(y)Any amount due under this Section for any period that is less than a full month shall be prorated for such fractional month on the basis of the number of days in the month.

9.2.Landlord or an affiliate(s) of Landlord may own other property(ies) adjacent to the Project or its neighboring properties (collectively, “Neighboring Properties”). In connection with Landlord performing services for the Project pursuant to this Lease, similar services may be performed by the same vendor(s) for Neighboring Properties. In such a case, or in the case of any real estate or personal property taxes or other impositions or taxes charged or assessed by a Governmental Authority for the Hampshire Project as a whole, Landlord shall reasonably allocate to each building and the Project the costs for such services based upon the ratio that the square footage of the building or the Project (as applicable) bears to the total square footage of all of the Neighboring Properties or buildings within the Neighboring Properties for which the services are performed, unless the scope of the services performed for any building or property (including the Building and the Project) is disproportionately more or less than for others, in which case Landlord shall equitably allocate the costs based on the scope of the services being performed for each

13

building or property (including the Building and the Project). For clarity, in the case of any Operating Expenses (including without limitation real estate or personal property taxes or other impositions or taxes charged or assessed by a Governmental Authority for the Hampshire Project as a whole) that apply to the Hampshire Project as a whole (as opposed to allocated specifically to each of the Project and the 50 Project or to each of the Building and the 50 Building), Landlord shall reasonably allocate to the Project and the 50 Project the costs of such Operating Expenses based upon the ratio that the square footage of Rentable Area of each of the Building and the 50 Building, respectively, bears to the total square footage of Rentable Area of all of the buildings in the Hampshire Project, or such other equitable allocation as Landlord reasonably determines.

9.3.Landlord’s annual statement shall be final and binding upon Tenant unless Tenant, within sixty (60) days after Tenant’s receipt thereof, shall contest any item therein by giving written notice to Landlord, specifying each item contested and the reasons therefor; provided that Tenant shall in all events pay the amount specified in Landlord’s annual statement, pending the results of the Independent Review and determination of the Accountant(s), as applicable and as each such term is defined below. If, during such sixty (60)-day period, Tenant reasonably and in good faith questions or contests the correctness of Landlord’s statement of Tenant’s Adjusted Share of Operating Expenses, Landlord shall provide Tenant with reasonable access to Landlord’s books and records to the extent relevant to determination of Operating Expenses, and such information as Landlord reasonably determines to be responsive to Tenant’s written inquiries. In the event that, after Tenant’s review of such information, Landlord and Tenant cannot agree upon the amount of Tenant’s Adjusted Share of Operating Expenses, then Tenant shall have the right to have an independent public accounting firm hired by Tenant on an hourly basis and not on a contingent-fee basis (at Tenant’s sole cost and expense) and approved by Landlord (which approval Landlord shall not unreasonably withhold or delay) audit and review such of Landlord’s books and records for the year in question as directly relate to the determination of Operating Expenses for such year (the “Independent Review”), but not books and records of entities other than Landlord. Landlord shall make such books and records available at the location where Landlord maintains them in the ordinary course of its business. Landlord need not provide copies of any books or records. Tenant shall commence the Independent Review within fifteen (15) days after the date Landlord has given Tenant access to Landlord’s books and records for the Independent Review. Tenant shall complete the Independent Review and notify Landlord in writing of Tenant’s specific objections to Landlord’s calculation of Operating Expenses (including Tenant’s accounting firm’s written statement of the basis, nature and amount of each proposed adjustment) no later than sixty (60) days after Landlord has first given Tenant access to Landlord’s books and records for the Independent Review. Landlord shall review the results of any such Independent Review. The parties shall endeavor to agree promptly and reasonably upon Operating Expenses taking into account the results of such Independent Review. If, as of the date that is sixty (60) days after Tenant has submitted the Independent Review to Landlord, the parties have not agreed on the appropriate adjustments to Operating Expenses, then the parties shall engage a mutually agreeable independent third party accountant with at least ten (10) years’ experience in commercial real estate accounting in the Cambridge, Massachusetts area (the “Accountant”). If the parties cannot agree on the Accountant, each shall within ten (10) days after such impasse appoint an Accountant (different from the accountant and accounting firm that conducted the Independent Review) and, within ten (10) days after the appointment of both such Accountants, those two Accountants shall select a third (which cannot be the accountant and accounting firm that conducted the Independent Review). If either party fails to timely appoint an Accountant,

14

then the Accountant the other party appoints shall be the sole Accountant. Within ten (10) days after appointment of the Accountant(s), Landlord and Tenant shall each simultaneously give the Accountants (with a copy to the other party) its determination of Operating Expenses, with such supporting data or information as each submitting party determines appropriate. Within ten (10) days after such submissions, the Accountants shall by majority vote select either Landlord’s or Tenant’s determination of Operating Expenses. The Accountants may not select or designate any other determination of Operating Expenses. The determination of the Accountant(s) shall bind the parties. If the parties agree or the Accountant(s) determine that the Operating Expenses actually paid by Tenant for the calendar year in question exceeded Tenant’s obligations for such calendar year, then Landlord shall, at Tenant’s option, either (a) credit the excess to the next succeeding installments of estimated Additional Rent or (b) pay the excess to Tenant within thirty (30) days after delivery of such results. If the parties agree or the Accountant(s) determine that Tenant’s payments of Operating Expenses for such calendar year were less than Tenant’s obligation for the calendar year, then Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such results. If the Independent Review reveals or the Accountant(s) determine that the Operating Expenses billed to Tenant by Landlord and paid by Tenant to Landlord for the applicable calendar year in question exceeded by more than five percent (5%) what Tenant should have been billed during such calendar year, then Landlord shall pay the reasonable cost of the Independent Review. In all other instances, Tenant shall pay the cost of the Accountant(s).

9.4.Tenant shall not be responsible for Operating Expenses with respect to any time period prior to the Term Commencement Date. Tenant’s responsibility for Tenant’s Adjusted Share of Operating Expenses shall continue to the latest of (a) the date of termination of the Lease, and (b) the date Tenant has fully vacated the Premises, and (c) if termination of the Lease is due to a default by Tenant, the date the Lease would have naturally expired but for such termination due to a default by Tenant or any earlier date, if any, that Landlord enters into a new lease for any portion of the Premises and such new tenant commences paying rent thereunder.

9.5.Operating Expenses for the calendar year in which Tenant’s obligation to share therein commences and for the calendar year in which such obligation ceases shall be prorated on a basis reasonably determined by Landlord. Expenses such as taxes, assessments and insurance premiums that are incurred for an extended time period shall be prorated based upon the time periods to which they apply so that the amounts attributed to the Premises relate in a reasonable manner to the time period wherein Tenant has an obligation to share in Operating Expenses.

9.6.Within thirty (30) days after the end of each calendar month or thirty (30) days after Tenant receives notice of an invoice, Tenant shall submit to Landlord an invoice, or, in the event an invoice is not available, an itemized list, of all costs and expenses that (a) Tenant has incurred (either internally or by employing third parties) during the prior month and (b) for which Tenant reasonably believes it is entitled to reimbursements from Landlord pursuant to the terms of this Lease.

9.7In the event that the Hampshire Project is less than fully occupied during a calendar year, Tenant acknowledges that Landlord may extrapolate Operating Expenses for the shared portions of the Hampshire Project that vary depending on the occupancy of the Hampshire Project, as applicable, to equal Landlord’s reasonable estimate of what such Operating Expenses would have been had the Hampshire Project, as applicable, been ninety-five percent (95%) occupied

15

during such calendar year; provided, however, that Landlord shall not recover more than one hundred percent (100%) of Operating Expenses.

10.Taxes on Tenant’s Property.

10.1.Tenant shall be solely responsible for the payment of any and all taxes levied upon (a) personal property and trade fixtures located at the Premises and (b) any gross or net receipts of or sales by Tenant, and shall pay the same prior to delinquency.

10.2.If any such taxes on Tenant’s personal property or trade fixtures are levied against Landlord or Landlord’s property or, if the assessed valuation of the Building, the Property or the Project is increased by inclusion therein of a value attributable to Tenant’s personal property or trade fixtures, and if Landlord, after written notice to Tenant, pays the taxes based upon any such increase in the assessed value of the Building, the Property or the Project, then Tenant shall, upon demand, repay to Landlord the taxes so paid by Landlord.

11.1.Tenant shall deposit with Landlord on or before the Execution Date the sum set forth in Section 2.6 (the “Security Deposit”), which sum shall be held by Landlord as security for the faithful performance by Tenant of all of the terms, covenants and conditions of this Lease to be kept and performed by Tenant. If Tenant Defaults (as defined below) with respect to any provision of this Lease, including any provision relating to the payment of Rent, then Landlord may (but shall not be required to) use, apply or retain all or any part of the Security Deposit for the payment of any Rent or any other sum in default, or to compensate Landlord for any other loss or damage that Landlord may suffer by reason of Tenant’s default. If any portion of the Security Deposit is so used or applied, then Tenant shall, within ten (10) days following demand therefor, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount, and Tenant’s failure to do so shall be a material breach of this Lease. The provisions of this Article shall survive the expiration or earlier termination of this Lease.

11.2.If, on or after the second (2nd) anniversary of the Term Commencement Date: (a) Tenant has not been in Default under this Lease prior to such date, and (b) Tenant has a net worth equal to or greater than its net worth as of the date hereof (the “SD Reduction Obligations”), then Tenant, within ninety (90) days after such date so long as no Default is then existing and Tenant’s net worth remains equal to or greater than its net worth as of the date hereof, may notify Landlord in writing that it wishes to decrease the Security Deposit to $1,140,000.00 (the “Reduced Security Deposit”). Within ten (10) Business Days following Landlord’s receipt of such notice, Landlord shall (x) confirm in writing that the SD Reduction Obligations have been satisfied and that the Security Deposit shall be deemed to equal the Reduced Security Deposit, or (y) provide Tenant with satisfactory written evidence that such SD Reduction Obligations have not been satisfied. Upon Landlord’s confirmation that the SD Reduction Obligations have been satisfied, (i) if the Security Deposit is in the form of cash, Landlord shall return to Tenant the excess amount within ten (10) Business Days following Landlord’s correspondence in the immediately preceding sentence, or (ii) if the Security Deposit is in the form of the L/C Security, the Tenant may provide to Landlord, and Landlord shall accept, a replacement L/C Security in the amount of the Reduced Security Deposit.

16

11.3.In the event of bankruptcy or other debtor-creditor proceedings against Tenant, the Security Deposit shall be deemed to be applied first to the payment of Rent and other charges due Landlord for all periods prior to the filing of such proceedings.

11.4.Landlord may deliver to any purchaser of Landlord’s interest in the Premises the funds deposited hereunder by Tenant, and thereupon Landlord shall be discharged from any further liability with respect to such deposit. This provision shall also apply to any subsequent transfers.

11.5.If Tenant shall not be in default of any obligation required to be performed by Tenant as of the expiration or earlier termination of this Lease, then the Security Deposit, or any balance thereof, shall be returned to Tenant (or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder) within sixty (60) days after the expiration or earlier termination of this Lease.

11.6.If the Security Deposit shall be in cash, Landlord shall hold the Security Deposit in an account at a banking organization selected by Landlord; provided, however, that Landlord shall not be required to maintain a separate account for the Security Deposit, but may intermingle it with other funds of Landlord. Landlord shall be entitled to all interest and/or dividends, if any, accruing on the Security Deposit. Landlord shall not be required to credit Tenant with any interest for any period during which Landlord does not receive interest on the Security Deposit.

11.7.The Security Deposit may be in the form of cash, a letter of credit or any other security instrument acceptable to Landlord in its sole discretion. Tenant may at any time, except when Tenant is in Default (as defined below), deliver a letter of credit (the “L/C Security”) as the entire Security Deposit, as follows:

(a)If Tenant elects to deliver L/C Security, then Tenant shall provide Landlord, and maintain in full force and effect throughout the Term and until the date that is two (2) months after the then-current Term Expiration Date, a letter of credit in the form of Exhibit E issued by an issuer reasonably satisfactory to Landlord, in the amount of the Security Deposit, with an initial term of at least one year. Landlord may require the L/C Security to be re-issued by a different issuer at any time during the Term if Landlord reasonably believes that the issuing bank of the L/C Security is or may soon become insolvent; provided, however, Landlord shall return the existing L/C Security to the existing issuer immediately upon receipt of the substitute L/C Security. If any issuer of the L/C Security shall become insolvent or placed into FDIC receivership, then Tenant shall immediately deliver to Landlord (without the requirement of notice from Landlord) substitute L/C Security issued by an issuer reasonably satisfactory to Landlord, and otherwise conforming to the requirements set forth in this Article. As used herein with respect to the issuer of the L/C Security, “insolvent” means the determination of insolvency as made by such issuer’s primary bank regulator (i.e., the state bank supervisor for state chartered banks; the OCC or OTS, respectively, for federally chartered banks or thrifts; or the Federal Reserve for its member banks). If, at the Term Expiration Date, any Rent remains uncalculated or unpaid, then (i) Landlord shall with reasonable diligence complete any necessary calculations, (ii) Tenant shall extend the expiry date of such L/C Security from time to time as Landlord reasonably requires and (iii) in such extended period, Landlord shall not unreasonably refuse to consent to an appropriate reduction of the L/C Security.

17

(b)If Tenant delivers to Landlord satisfactory L/C Security in place of the entire Security Deposit, Landlord shall remit to Tenant any cash Security Deposit Landlord previously held.

(c)Landlord may draw upon the L/C Security, and hold and apply the proceeds in the same manner and for the same purposes as the Security Deposit, if (i) an uncured Default (as defined below) exists, (ii) as of the date that is thirty (30) days before any L/C Security expires (even if such scheduled expiry date is after the Term Expiration Date) Tenant has not delivered to Landlord an amendment or replacement for such L/C Security, reasonably satisfactory to Landlord, extending the expiry date to the earlier of (1) two (2) months after the then-current Term Expiration Date or (2) the date that is one year after the then-current expiry date of the L/C Security, (iii) Tenant fails to pay (when and as Landlord reasonably requires) any bank charges for Landlord’s transfer of the L/C Security or (iv) the issuer of the L/C Security ceases, or announces that it will cease, to maintain an office in the city where Landlord may present drafts under the L/C Security (and fails to permit drawing upon the L/C Security by overnight courier or facsimile). This Section does not limit any other express provisions of this Lease allowing Landlord to draw the L/C Security under specified circumstances.

(d)Tenant shall not seek to enjoin, prevent, or otherwise interfere with Landlord’s draw under L/C Security in accordance with this Lease. Landlord shall hold the proceeds of any draw in the same manner and for the same purposes as a cash Security Deposit. In the event of a wrongful draw, the parties shall cooperate to allow Tenant to post replacement L/C Security simultaneously with the return to Tenant of the wrongfully drawn sums, and Landlord shall upon request confirm in writing to the issuer of the L/C Security that Landlord’s draw was erroneous.

(e)If Landlord transfers its interest in the Premises, then Tenant shall at Tenant’s expense, within five (5) business days after receiving a request from Landlord, deliver (and, if the issuer requires, Landlord shall consent to) an amendment to the L/C Security naming Landlord’s grantee as substitute beneficiary. If the required Security Deposit changes while L/C Security is in force, then Tenant shall deliver (and, if the issuer requires, Landlord shall consent to) a corresponding amendment to the L/C Security.

12.1.Tenant shall use the Premises for the Permitted Use, and shall not use the Premises, or permit or suffer the Premises to be used, for any other purpose without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion. Tenant shall be prohibited from using the Premises or any portion of the Property for the sale, distribution or production of marijuana.

12.2.Tenant shall not use or occupy the Premises in violation of Applicable Laws; zoning ordinances; or the certificate of occupancy (or its substantial equivalent) issued for the Building or the Project, and shall, upon five (5) days’ written notice from Landlord, discontinue any use of the Premises that is declared or claimed by any Governmental Authority having jurisdiction to be a violation of any of the above, or that in Landlord’s reasonable opinion violates any of the above. Tenant shall take such further actions and execute such further documents in connection with this

18

Lease as are necessary to comply with Applicable Laws relating to privacy, personal information and data security. Tenant acknowledges that Landlord may collect certain personal information (e.g., names, email addresses and contact information) of Tenant’s and its affiliates’ employees (and, if applicable, subcontractors and consultants), and use such information in connection with performing Landlord’s duties and obligations, and exercising its rights under this Lease. Tenant shall not retain, use or disclose any personal information received from Landlord pursuant to this Lease for any purpose other than to perform its duties and obligations, and exercise its rights under this Lease or as required by Applicable Law. In the event of a conflict between this Section and Article 38, this Section shall govern. Tenant shall comply with any direction of any Governmental Authority having jurisdiction that shall, by reason of the nature of Tenant’s use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to the Premises or with respect to the use or occupation thereof, and shall indemnify, defend (at the option of and with counsel reasonably acceptable to the indemnified party(ies)), save, reimburse and hold harmless (collectively, “Indemnify,” “Indemnity” or “Indemnification,” as the case may require) Landlord and its affiliates, employees, agents and contractors; and any lender, mortgagee, ground lessor or beneficiary (each, a “Lender” and, collectively with Landlord and its affiliates, employees, agents and contractors, the “Landlord Indemnitees”) harmless from and against any and all demands, claims, liabilities, losses, costs, expenses, actions, causes of action, damages, suits or judgments, and all reasonable expenses (including reasonable attorneys’ fees, charges and disbursements, regardless of whether the applicable demand, claim, action, cause of action or suit is voluntarily withdrawn or dismissed) incurred in investigating or resisting the same (collectively, “Claims”) of any kind or nature that arise before, during or after the Term as a result of Tenant’s breach of this Section. Notwithstanding the foregoing or any other provision of this Lease, however, Tenant shall not be responsible for compliance with any such laws, regulations, or the like which were in effect prior to the Term Commencement Date requiring (a) structural repairs or modifications; or (b) repairs or modifications to the utility or building service equipment; or (c) installation of new building service equipment, such as fire detection or suppression equipment, unless such repairs, modifications, or installations shall (i) be due to Tenant’s particular manner of use of the Premises (as opposed to lab use generally), or (ii) be due to the negligence or willful misconduct of Tenant or any agent, employee, or contractor of Tenant, or (iii) in connection with any alterations performed by or at the request of Tenant, or (iv) as a result of any breach by Tenant of any of Tenant’s covenants or agreements under this Lease.

12.3.Tenant shall not do or permit to be done anything that will invalidate or increase the cost of any fire, environmental, extended coverage or any other insurance policy covering the Building or the Project, and shall comply with all rules, orders, regulations and requirements of the insurers of the Building and the Project, and Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charged for such policy by reason of Tenant’s failure to comply with the provisions of this Article.

12.4.Tenant shall keep all doors opening onto public corridors closed, except when in use for ingress and egress.

12.5.No additional locks or bolts of any kind shall be placed upon any of the doors or windows by Tenant, nor shall any changes be made to existing locks or the mechanisms thereof without Landlord’s prior written consent. Tenant shall, upon termination of this Lease, return to Landlord all keys to offices and restrooms either furnished to or otherwise procured by Tenant. In

19

the event any key so furnished to Tenant is lost, Tenant shall pay to Landlord the cost of replacing the same or of changing the lock or locks opened by such lost key if Landlord shall deem it necessary to make such change.

12.6.No awnings or other projections shall be attached to any outside wall of the Building. No curtains, blinds, shades or screens shall be attached to or hung in, or used in connection with, any window or door of the Premises other than Landlord’s standard window coverings. Neither the interior nor exterior of any windows shall be coated or otherwise sunscreened without Landlord’s prior written consent, nor shall any bottles, parcels or other articles be placed on the windowsills or items attached to windows that are visible from outside the Premises. No equipment, furniture or other items of personal property shall be placed on any exterior balcony without Landlord’s prior written consent.

12.7.No sign, advertisement or notice (“Signage”) shall be exhibited, painted or affixed by Tenant on any part of the Premises or the Building without Landlord’s prior written consent. Signage shall conform to Landlord’s design criteria established from time to time. For any Signage, Tenant shall, at Tenant’s own cost and expense, (a) acquire all permits for such Signage in compliance with Applicable Laws and (b) design, fabricate, install and maintain such Signage in a first-class condition. Tenant shall be responsible for reimbursing Landlord for costs incurred by Landlord in removing any of Tenant’s Signage upon the expiration or earlier termination of the Lease. Interior signs on entry doors to the Premises and the directory tablet shall be inscribed, painted or affixed for Tenant by Landlord at Tenant’s sole cost and expense, and shall be of a size, color and type and be located in a place acceptable to Landlord. The directory tablet shall be provided exclusively for the display of the name and location of tenants only. Tenant shall not place anything on the exterior of the corridor walls or corridor doors other than Landlord’s standard lettering. At Landlord’s option, Landlord may install any Tenant Signage, and Tenant shall pay all costs associated with such installation within thirty (30) days after demand therefor.

12.8.Tenant may only place equipment within the Premises with floor loading consistent with the Building’s structural design unless Tenant obtains Landlord’s prior written approval. Tenant may place such equipment only in a location designed to carry the weight of such equipment.

12.9.Tenant shall cause any equipment or machinery to be installed in the Premises so as to reasonably prevent sounds or vibrations therefrom from extending into the Common Area or other offices in the Project.

12.10.Tenant shall not (a) do or permit anything to be done in or about the Premises that shall in any way obstruct or interfere with the rights of other tenants or occupants of the Project, or injure or annoy them, (b) use or allow the Premises to be used for immoral, unlawful or objectionable purposes (it being agreed that Tenant’s proposed use as of the date of this Lease is not in violation of this subsection (b), (c) cause, maintain or permit any nuisance or waste in, on or about the Project or (d) take any other action that would in Landlord’s reasonable determination in any manner adversely affect other tenants’ quiet use and enjoyment of their space or adversely impact their ability to conduct business in a professional and suitable work environment. Notwithstanding any other provision herein to the contrary, from and after the Term Commencement Date, Tenant shall be responsible for all liabilities, costs and expenses arising

20

from or in connection with the compliance of the Premises with the Americans with Disabilities Act, 42 U.S.C. § 12101, et seq., and any state and local accessibility laws, codes, ordinances and rules (collectively, and together with regulations promulgated pursuant thereto, the “ADA”) unless such non-compliance was in existence as of the date of this Lease, and Tenant shall Indemnify the Landlord Indemnitees from and against any Claims arising from any such failure of the Premises to comply with the ADA. This Section (as well as any other provisions of this Lease dealing with Indemnification of the Landlord Indemnitees by Tenant) shall be deemed to be modified in each case by the insertion in the appropriate place of the following: “except as otherwise provided in Mass. G.L. Ter. Ed., C. 186, Section 15.” The provisions of this Section shall survive the expiration or earlier termination of this Lease.

12.11.Tenant shall establish and maintain a chemical safety program administered by a licensed, qualified individual in accordance with the requirements of the Massachusetts Water Resources Authority (“MWRA”) and any other applicable Governmental Authority. Tenant shall be solely responsible for all costs incurred in connection with such chemical safety program, and Tenant shall provide Landlord with such documentation as Landlord may reasonably require evidencing Tenant’s compliance with the requirements of (a) the MWRA and any other applicable Governmental Authority with respect to such chemical safety program and (b) this Section. Tenant shall obtain and maintain during the Term (m) any permit required by the MWRA (“MWRA Permit”) and (n) a wastewater treatment operator license from the Commonwealth of Massachusetts with respect to Tenant’s use of the Acid Neutralization Tank (as defined in Section 16.12) in the Building. Tenant shall not introduce anything into the Acid Neutralization Tank (x) in violation of the terms of the MWRA Permit, (y) in violation of Applicable Laws or (z) that would interfere with the proper functioning of the Acid Neutralization Tank. Tenant shall reimburse Landlord within ten (10) business days after demand for any actual costs incurred by Landlord pursuant to this Section 12.11.

13.Rules and Regulations, CC&Rs, Parking Facilities and Common Area.

13.1.Tenant shall have the non-exclusive right, in common with others, to use the Common Area in conjunction with Tenant’s use of the Premises for the Permitted Use, and such use of the Common Area and Tenant’s use of the Premises shall be subject to the rules and regulations adopted by Landlord and attached hereto as Exhibit F, together with such other reasonable rules and regulations as are hereafter promulgated by Landlord in its sole and absolute discretion (the “Rules and Regulations”). Tenant shall and shall ensure that its contractors, subcontractors, employees, subtenants and invitees faithfully observe and comply with the Rules and Regulations. Landlord shall not be responsible to Tenant for the violation or non-performance by any other tenant or any agent, employee or invitee thereof of any of the Rules and Regulations.

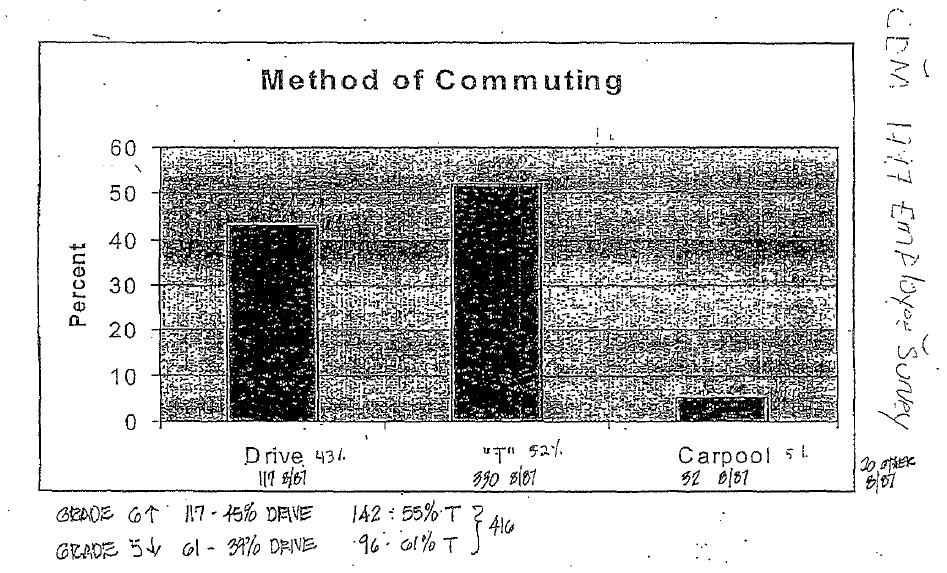

13.2.This Lease is subject to any recorded covenants, conditions or restrictions on the Project or Property, including the Parking and Transportation Demand Management Plan for the Project that was approved on December 14, 2001, and that is attached hereto as Exhibit G with all applicable transfers thereof (the “PTDM”), as the same may be amended, amended and restated, supplemented or otherwise modified from time to time (the “CC&Rs”). Tenant shall, at its sole cost and expense, comply with the CC&Rs. Tenant acknowledges that Tenant, at its sole cost and expense, shall comply with the tenant requirements in the PTDM, including the requirements set forth in the “Alternative Work Programs,” “Public Transportation Incentives,” “Ridesharing

21

Programs” and “Provisions of Bicycle and Pedestrian Amenities” sections thereof. Tenant, at its sole cost and expense, shall also comply with the reporting requirements set forth in the PTDM at Landlord’s request. Any costs incurred by Landlord in connection with the PTDM shall constitute an Operating Expense.

13.3.Notwithstanding anything in this Lease to the contrary, Tenant may not install any security systems (including cameras) outside the Premises or that record sounds or images outside the Premises without Landlord’s prior written consent, which Landlord may withhold in its sole and absolute discretion.

13.4.Tenant agrees to cooperate with Landlord in connection with “Developer’s” performance of the obligations of the “Developer” under the Development Controls and Community Outreach Program for Cambridge Place effective as of July 27, 1998, executed by The Bulfinch Companies, Inc., CCC I Realty Trust, 205 Broadway Realty Trust, Neighbors for a Better Community, Inc., and the McKinnon Company, Inc. (as it may be amended, modified, amended and restated, otherwise supplemented, or superseded from time to time, the “Community Agreement”). Landlord encourages Tenant to participate in programs of civic and charitable giving and the provision of in-kind services and facilities that will extend the benefits of the Project to neighborhood residents, including, by way of example, the charitable and civic connections identified in Section 2.5 of the Community Agreement.

13.5.The Charles River Transportation Management Association (of which Landlord or an affiliate of Landlord is currently a member) provides certain programs to help improve transportation in the Cambridge area. Their website is www.charlesrivertma.org.

13.6.Intentionally Omitted.

13.7.Intentionally Omitted.

13.8.Tenant shall have the right to use Tenant’s Pro Rata Share (i.e., one (1) non-exclusive parking space per 1,000 rentable square feet of the Premises) of parking facilities serving the Hampshire Project in common on an unreserved basis with other tenants of the Hampshire Project during the Term at a cost of Three Hundred Eighty Dollars ($380.00) per parking space per month, which Tenant shall pay simultaneously with payments of Base Rent as Additional Rent, and which amount is subject to periodic market adjustment.

13.9.Tenant agrees not to unreasonably overburden the parking facilities and agrees to cooperate with Landlord and other tenants in the use of the parking facilities. Landlord reserves the right to determine that parking facilities are becoming overcrowded and to limit Tenant’s use thereof, so long as Tenant shall have at all times, Tenant’s Pro Rata Share of such parking. Upon such determination, Landlord may reasonably allocate parking spaces among Tenant and other tenants of the Building or the Project. Nothing in this Section, however, is intended to create an affirmative duty on Landlord’s part to monitor parking.

13.10.Subject to the terms of this Lease including the Rules and Regulations and the rights of other tenants of the Project, Tenant shall have the non-exclusive right to access the freight loading dock, at no additional cost.

22

14.Project Control by Landlord.

14.1.Landlord reserves full control over the Building and the Project to the extent not inconsistent with Tenant’s enjoyment of the Premises as provided by this Lease. This reservation includes Landlord’s right to subdivide the Project or the Hampshire Project; convert the Building and other buildings within the Hampshire Project to condominium units; change the size of the Project by selling all or a portion of the Project or adding real property and any improvements thereon to the Project; grant easements and licenses to third parties; maintain or establish ownership of the Building separate from fee title to the Property; make additions to or reconstruct portions of the Building and the Project; install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Building or the Project pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises, the Building or elsewhere at the Project; and alter or relocate any other Common Area or facility, including private drives, lobbies, entrances and landscaping; provided, however, that such rights shall be exercised in a way that does not materially adversely affect Tenant’s beneficial use and occupancy of the Premises, including the Permitted Use and Tenant’s access to the Premises. Without limiting the foregoing and notwithstanding anything herein to the contrary, Landlord specifically reserves the right to unobstructed access to certain portions of the Premises, 24/7, as shown on Exhibit A as “Base Building Areas,” with or without notice to Tenant.

14.2.Possession of areas of the Premises necessary for utilities, services, safety and operation of the Building is reserved to Landlord; provided that such possession does not materially adversely affect Tenant’s use and occupancy of the Premises.

14.3.Tenant shall, at Landlord’s request, promptly execute such further documents as may be reasonably appropriate to assist Landlord in the performance of its obligations hereunder; provided that Tenant need not execute any document that creates additional liability or costs for Tenant or that deprives Tenant of the quiet enjoyment and use of the Premises as provided for in this Lease.

14.4.Landlord may, at any and all reasonable times during business hours (or during non-business hours, if (a) with respect to Subsections 14.4(u) through 14.4(y), Tenant so requests, and (b) with respect to Subsection 14.4(z), if Landlord so requests), and upon twenty-four (24) hours’ prior notice (which may be oral or by email to the office manager or other Tenant-designated individual at the Premises; but provided that no time restrictions shall apply or advance notice be required if an emergency necessitates immediate entry), enter the Premises to (u) inspect the same and to determine whether Tenant is in compliance with its obligations hereunder, (v) supply any service Landlord is required to provide hereunder, (w) alter, improve or repair any portion of the Building other than the Premises for which access to the Premises is reasonably necessary, (x) post notices of nonresponsibility, (y) access the telephone equipment, electrical substation and fire risers and (z) show the Premises to prospective tenants during the final year of the Term and current and prospective purchasers and lenders at any time, or permit a future tenant of the Premises to inspect and measure the Premises in anticipation of such tenant’s future occupancy of the Premises; provided, however, that Landlord’s entry into the Base Building Areas shall be governed by Section 14.1 and not Section 14.4. In connection with any such alteration, improvement or repair as described in Subsection 14.4(w), Landlord may erect in the Premises or elsewhere in the Project scaffolding and other structures reasonably required for the alteration,

23

improvement or repair work to be performed. Landlord shall provide Tenant with the opportunity to accompany Landlord and its agents at all times during such entry (except in the event of an emergency). In no event shall Tenant’s Rent abate as a result of Landlord’s activities pursuant to this Section; provided, however, that all such activities shall be conducted in such a manner so as to cause as little interference to Tenant as is reasonably possible. Landlord shall at all times retain a key with which to unlock all of the doors in the Premises. If an emergency necessitates immediate access to the Premises, Landlord may use whatever force is necessary to enter the Premises, and any such entry to the Premises shall not constitute a forcible or unlawful entry to the Premises, a detainer of the Premises, or an eviction of Tenant from the Premises or any portion thereof.

15.Quiet Enjoyment. Landlord covenants that Tenant, upon paying the Rent and performing its obligations contained in this Lease, may peacefully and quietly have, hold and enjoy the Premises, free from any claim by Landlord or persons claiming under Landlord, but subject to all of the terms and provisions hereof, provisions of Applicable Laws and rights of record to which this Lease is or may become subordinate. This covenant is in lieu of any other quiet enjoyment covenant, either express or implied.

16.1Tenant shall pay for all water (including the cost to service, repair and replace reverse osmosis, de-ionized and other treated water), gas, heat, light, power, telephone, internet service, cable television, other telecommunications and other utilities supplied to the Premises, together with any fees, surcharges and taxes thereon.