Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 FY21 Q4 EARNINGS RELEASE - MEREDITH CORP | fy21q4exh99earnings.htm |

| 8-K - 8-K - MEREDITH CORP | mdp-20210812.htm |

Fiscal 2021 Fourth Quarter Earnings Presentation August 12, 2021 Exhibit 99.2

2 Safe Harbor Statement and Non-GAAP Financial Measures CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This presentation contains certain forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, statements related to the timing and benefits of the proposed sale of the Local Media Group, segment reporting, and the Company’s expectations for fiscal 2022 first quarter. Forward-looking statements can be identified by words such as may, should, expects, provides, anticipates, assumes, can, will, meets, could, likely, intends, might, predicts, seeks, would, believes, estimates, plans, continues, guidance or outlook, or variations of these words or similar expressions. Actual results may differ materially from those currently anticipated. Factors that could cause actual results to differ materially from those projected in the forward-looking statements include the following: market conditions; the impact of the COVID-19 pandemic; downturns in global, national, and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients or vendors; the integration of acquired businesses; changes in consumer reading, purchasing, and/or television viewing patterns; increases in paper, postage, printing, syndicated programming, or other costs; changes in television network affiliation agreements; technological developments affecting products or methods of distribution; changes in government regulations affecting the Company's industries; the parties’ ability to consummate the previously announced proposed merger and spin-off; the conditions to the completion of the transactions, including the receipt of approval of Meredith’s shareholders; the regulatory approvals required for the proposed merger not being obtained on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion, and accounting and tax treatments of the transactions; potential inability to retain key employees; Meredith’s ability to operate successfully as a standalone business post-transaction; the ability to obtain financing on the expected terms; changes in interest rates; the consequences of acquisitions and/or dispositions; and Meredith’s ability to comply with the terms of its debt financing. Additional information concerning these and other risk factors can be found in Meredith’s and Gray Television Inc.’s (“Gray”) filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Such risk factors may be amplified by the COVID-19 pandemic and its potential impact on the Company’s business and the global economy. Meredith, SpinCo (defined on the following page) and Gray assume no obligation to update or revise publicly the information in this communication, whether as a result of new information, future events, or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. RATIONALE FOR USE AND ACCESS TO NON-GAAP RESULTS Management uses and presents GAAP and non-GAAP results to evaluate and communicate its performance. While non-GAAP measures should not be construed as alternatives to GAAP measures, management believes these non-GAAP measures are useful as an aid to further understand Meredith’s current performance, performance trends, and financial condition. Free cash flow, earnings from continuing operations before special items, operating profit before special items, consolidated and segment adjusted EBITDA, consolidated and segment adjusted EBITDA margin, comparable revenues, net debt, and net debt leverage are common supplemental measures of performance used by investors and financial analysts. Management believes these measures provide additional analytical tools. Free cash flow is defined as net cash provided by operating activities less capital expenditures. This metric has been included as a measure of the Company’s liquidity and ability to fund its operations. Earnings from continuing operations before special items and operating profit before special items remove the impact of special items on earnings (loss) from continuing operations and operating profit (loss). Consolidated adjusted EBITDA is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation, amortization, and special items. Segment adjusted EBITDA is defined as segment operating profit (loss) and non-operating income (expense), net before depreciation, amortization, and special items. These special items have been removed as they have been deemed to be non-operational in nature. Management does not use adjusted EBITDA as a measure of liquidity or funds available for management’s discretionary use because it excludes certain contractual and nondiscretionary expenditures. Comparable revenues remove the impact of portfolio changes in our magazine business to facilitate year-over-year comparisons. Net debt is defined as carrying value of total long-term debt less cash and cash equivalents. Net debt leverage is defined as net debt divided by the trailing twelve months Adjusted EBITDA. Net debt and net debt leverage provide additional insight to the Company’s financial position. Reconciliations of GAAP to non-GAAP measures are attached to this presentation and at Meredith.com.

3 Safe Harbor Statement and Non-GAAP Financial Measures ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication is not a solicitation of a proxy from any shareholder of the Company. In connection with the proposed merger and spin-off, the Company intends to file relevant materials with the SEC), including a proxy statement. In addition, the new public company to be spun-off and which will retain the name Meredith Corporation (“SpinCo”) intends to file a registration statement on Form 10 with respect to its common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SPINCO, GRAY, THE PROPOSED MERGER, AND THE SPIN-OFF. The proxy statement and Form 10, and other relevant materials (when they become available), and any other documents filed by the Company, SpinCo, and Gray with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. The documents filed by the Company may also be obtained for free from the Company’s Investor Relations web site (http://ir.meredith.com) or by directing a request to the Company’s Shareholder/Financial Analyst contact, Mike Lovell, Executive Director of Corporate Communications, at 515-284-3622. PARTICIPANTS IN THE SOLICITATION The Company and Gray and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the security holders of the Company in connection with the proposed merger and spin-Off. Information about Gray’s directors and executive officers is available in Gray’s definitive proxy statement, dated March 25, 2021, for its 2021 annual meeting of shareholders. Information about the Company’s directors and executive officers is available in the Company’s definitive proxy statement, dated September 25, 2020, for its 2020 annual meeting of shareholders. Other information regarding the participants and description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and Form 10 registration statement regarding the proposed merger and spin-Off that the Company and SpinCo will file with the SEC when they become available.

4 • Digital: Advertising, licensing, and digital consumer revenues delivered record results – Digital advertising revenues surpass magazine for 3rd straight quarter; CPMs up though partially offset by slightly lower sessions – Consumer related revenues post double-digit growth, enabled by performance marketing, strong partnerships, and proprietary digital platform • Magazine: Strong consumer engagement; Newsstand strength drives circulation revenue growth – Newsstand revenue growth driven by more titles and stronger consumer demand – Subscription performance benefiting from subscription solicitation growth in channels that drive high lifetime subscriber value • Broadcast: Core non-political advertising and retransmission performance drives revenue growth – Core non-political advertising revenue up 50%, driven by professional services, automotive, and gaming categories – Continued improved retransmission performance driven by recent renewals and annual fee escalators • Total Company: Revenue growth and positive cost leverage control drive margin accretion – Growing digital and non-political advertising revenues are particularly accretive due to relatively high fixed cost nature – Net leverage ratio reduced. Cash in bank grew despite $67 million warrant redemption by former preferred equity partner 4Q'21 Highlights

5 FY’21 – A Transformational Year • Strategic Highlights: – Digital advertising revenues surpass magazine advertising for first time in Company history – LMG sale at strong 10x valuation sets stage for achieving future Meredith financial objectives – Future Meredith well-positioned with attractive assets, strong balance sheet, and balanced capital structure enabling growth investments and shareholder returns • Operational Highlights: – NMG adjusted EBITDA growth and margin expansion as digital advertising, licensing, and digital and other consumer driven revenue deliver record performance; Magazine achieves 4 points advertising market share growth – LMG record performance driven by $192 million political advertising related, including digital sources, and continued retransmission revenue growth – Delivers record $399 million Cash Flow from Operating Activities and $363 million Free Cash Flow – Reduces net leverage ratio to 3.7x at 6/30/21 from 5.3x at prior year-end

• Revenue: Up 17%, or $107 – Advertising: Strong digital and non-political spot growth, partially offset by magazine declines due to challenged categories – Consumer: Led by licensing, retransmission, and newsstand • Adjusted EBITDA(1): Up 55%, or $44 – Strong digital, non-political, and consumer revenues, along with positive cost leverage, partially offset by lower magazine advertising revenues • Free Cash Flow(2): Down 55%, or $63 – Prior-year unusually strong due to COVID-19-related volatility 6 4Q’21 & FY’21 Consolidated Financial Summary 4Q'21 YoY Change FY'21 YoY Change Revenue Advertising related $ 338.4 30% $ 1,525.6 9% Consumer related 354.5 7% 1,370.6 2% Other 25.0 24% 81.2 (20%) Total Revenue $ 717.9 17% $ 2,977.4 5% Adjusted EBITDA (1) $ 123.6 55% $ 682.9 25% Adjusted EBITDA (1) % 17% 4pts 23% 4pts Free Cash Flow (2) $ 51.2 (55%) $ 363.4 45% QUARTERLY & FULL YEAR FINANCIALS 4Q’21 HIGHLIGHTS F represents favorable improvements greater than 100%. U represents unfavorability greater than -100%. All % variance figures are compared to prior-year period. (1) Adjusted EBITDA is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation, amortization, and special items. See the Appendix for supplemental disclosures regarding non-GAAP financial measures. (2) Free Cash Flow is defined as net cash provided by operating activities less capital expenditures. ($ in millions) • Revenue: Up 5%, or $129 – Advertising: Strong digital and political demand, partially offset by magazine declines due to challenged categories – Consumer: Driven by retransmission, licensing, performance marketing • Adjusted EBITDA(1): Up 25%, or $135 – Stronger digital and political demand, along with positive cost leverage, partially offset by lower magazine-related performance • Free Cash Flow(2): Up 45%, or $112 – In-line with revenue and adjusted EBITDA growth FY’21 HIGHLIGHTS

7 4Q’21 National Media Group Performance Summary FINANCIAL RESULTS 4Q'21 YoY Change Revenue Digital advertising $ 123.1 80% Magazine advertising 100.7 (6%) Subscription/newsstand 188.5 7% Digital consumer/licensing 55.8 19% Other (incl. affinity) 46.8 2% Total Revenue $ 514.9 16% Adjusted EBITDA (1) $ 93.1 95% Adjusted EBITDA (1) % 18% 7pts F represents favorable improvements greater than 100%. U represents unfavorability greater than -100%. All % variance figures are compared to prior-year period. Digital Advertising by Channel metrics shown as the last 12 months. (1) Segment adjusted EBITDA is defined as segment operating profit (loss) and non-operating income (expense), net before depreciation, amortization, and special items. See the Appendix for supplemental disclosures regarding non-GAAP financial measures. ($ in millions) • Food and Home sessions lower, partially offset by Entertainment (PEOPLE) and Travel (Travel + Leisure) strength DIGITAL METRICS • Flexible and shorter advertising lead times, engaged audiences, and premium 1st party data driving digital performance • Magazine advertising reflects improving sequential spending in prescription drug, travel, and retail categories compared to 3Q’21 • Strong consumer brand awareness and Apple News+, Walmart, and Amazon relationships driving Digital consumer/Licensing growth 1.98 1.89 4Q’20 4Q’21 • Licensing: Apple News+; Walmart • Digital and Other Consumer Driven: Performance marketing V% (4)% V% $47 $56 28 34 19 22 4Q'20 4Q'21 20% Licensing/Digital Consumer • Majority continues to be sold directly, a key differentiator as advertising and marketing partners realize a stronger return on investment from having access to Meredith’s full suite of capabilities Direct Open Programmatic Licensing Digital consumer 17% ~ ~40%~60% Digital Advertising by Channel # Sessions (billions)

8 4Q’21 Local Media Group Performance Summary FINANCIAL RESULTS 4Q'21 YoY Change Revenue Non-political spot advertising $ 72.6 50% Political spot advertising 1.7 (73%) Retransmission 95.9 5% Digital, third party, and other 33.7 57% Total Revenue $ 203.9 22% Adjusted EBITDA (1) $ 54.7 44% Adjusted EBITDA (1) % 27% 4pts F represents favorable improvements greater than 100%. U represents unfavorability greater than -100%. All % variance figures are compared to prior-year period. (1) Segment adjusted EBITDA is defined as segment operating profit (loss) and non-operating income (expense), net before depreciation, amortization, and special items. See the Appendix for supplemental disclosures regarding non-GAAP financial measures. ($ in millions) HIGHLIGHTS • Stronger non-political spot ad revenue driven by professional services, automotive, and gaming categories, which collectively grew 57 percent • Political spot declines, as expected, due to off-year political cycle • Third party revenues improve, reflecting new category development • Retransmission revenue growth driven by renewals & annual escalation TRANSACTION UPDATE • $2.825 billion sale price representing 10x valuation • Good progress toward obtaining regulatory approvals • On July 14th, Gray announced agreement to sell sole overlapping station (WJRT-TV, Flint, MI) • Transaction on track for fourth quarter CY’21 close, as expected

4Q'20 3Q'21 4Q'21 • Cash grew 4 percent sequentially from 3Q’21, inclusive of 1.625M preferred equity-related warrant redemption at $67 • $0 currently utilized on $350 revolver (5th consecutive quarter) • Free Cash Flow reflects earnings growth and strong cash conversation driven by continued working capital improvements; down vs. prior year on a tough comp as collections significantly outpaced revenue in the COVID period • Net debt leverage ratio 3.7x at June 30, 2021 9 Free Cash Flow & Liquidity QUARTERLY FREE CASH FLOW (1) $479 $578 $588 $231 $240 $347 $347 $347 Cash, Ending Balance Unused Revolver @ 6/30/20 @ 3/31/2021 @ 6/30/21 Used Revolver $— $— $— Note: Liquidity is presented inclusive of outstanding letters of credit totaling $3.1 at 4Q'20, $2.7 at 3Q'21 and $2.7 at 4Q'21. ($ in millions) LIQUIDITY CapEx $10 $8 $10 $114 $68 $51 (1) Free Cash Flow is defined as net cash provided by operating activities less capital expenditures. See the Appendix for supplemental disclosures regarding non-GAAP financial measures. $132

10 FY’22 Segment Reporting Update ($ in billions) • 1Q’22 Meredith plans to report three financial segments: (Digital, Magazine, Local Media) • The 1Q FY’22 10Q will reflect these changes on a retrospective basis • New segment revenue composition to include: Magazine Magazine Advertising Third Party Advertising Subscription Newsstand Affinity Marketing Other Consumer Projects/Other Digital Digital Advertising Third Party Advertising Affinity Marketing Licensing Digital Consumer Other $3.0 $3.0 (1) MNI and PeopleTV currently reside in Local Media, but will remain with MDP post LMG sale; MNI and PEOPLE TV accounted for $91 million of FY’21 revenues, and will be included in the Magazine segment as Third Party revenues, and in the Digital segment as Licensing revenues, respectively. (2) These amounts are estimates and may differ, perhaps materially, from amounts ultimately allocated to SpinCo in ‘carve-out” (which would be subject to audit) or pro forma financial statements that may be presented in future public filings by Meredith or SpinCo. Magazine $1.0 $2.0 $1.0 $0.7 $1.3Magazine(2) Digital(2) Current Segments Pro Forma New Segments SEGMENT DETAIL AND COMMENTARY ~ ~ FY’21 REVENUES ~ National Media Local Media(1) ~ ~

11 Closing Thoughts 2 1 3 4 Looking into 1Q FY’22: Continuing digital, non-political spot growth, and magazine down low to mid-teens; Inflation + strategic investments drive marginally higher costs Local Media Group sale to Gray Television on-track for fourth quarter calendar 2021 close; Expected to better position Meredith for future growth Digital and consumer related revenue growth driven by powerful brands, proprietary technology platform, and reach to ~95% of American women Magazine consumer demand remains stable while advertising environment is uncertain

Appendix

13 Comparative Revenues Reconciliation - Comparable Change % excludes the impact to National Media Group results due to transitioning Rachel Ray Every Day and Traditional Home to premium newsstand titles and closing Family Circle magazine. 2021 2020 Twelve months ended June 30, As Reported As Reported Portfolio Changes Comparable Comparable Change % In millions Advertising related................................................................ $ 1,525.6 $ 1,399.0 $ (20.7) $ 1,378.3 11% Consumer related................................................................. 1,370.6 1,348.7 (19.0) 1,329.7 3% Other..................................................................................... 81.2 100.9 — 100.9 (20%) Total Revenue....................................................................... $ 2,977.4 $ 2,848.6 $ (39.7) $ 2,808.9 6% National Media Group Magazine advertising............................................................ $ 426.5 $ 553.5 $ (20.7) $ 532.8 (20%) Digital advertising................................................................. 491.8 376.8 — 376.8 31% Subscription / newsstand...................................................... 714.7 762.6 (19.0) 743.6 (4%) Digital consumer / licensing.................................................. 215.8 170.8 — 170.8 26% Other..................................................................................... 174.7 217.9 — 217.9 (20%) Total Revenues..................................................................... $ 2,023.5 $ 2,081.6 $ (39.7) $ 2,041.9 (1%) Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures

Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures Special Items The tables on pages 15 through 20 show results of operations as reported under GAAP and excluding the special items. Results of operations excluding the special items are non-GAAP measures. Management’s rationale for presenting non-GAAP measures is included on page 2 of this presentation. Adjusted EBITDA Consolidated adjusted EBITDA, which is reconciled to net earnings (loss) in the following tables, is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation, amortization, and special items. Segment adjusted EBITDA is a measure of segment operating profit (loss) and non-operating income (expense), net before depreciation, amortization, and special items. Segment adjusted EBITDA margin is defined as segment adjusted EBITDA divided by segment revenues. Net Debt Net debt is defined as carrying value of total long-term debt less cash and cash equivalents. Net Debt Leverage Net debt leverage is defined as net debt divided by the trailing twelve months consolidated Adjusted EBITDA. Free Cash Flow Free cash flow is defined as net cash provided by operating activities less additions to property, plant, and equipment. 14

15 Three months ended June 30, 2021 National Media Local Media Unallocated Corporate Total (In millions) Revenues........................................................................................................................................................................... $ 514.9 $ 203.9 Net earnings............................................................................................................................................................................................................................................................... $ 36.7 Income tax expense.................................................................................................................................................................................................................................................... 3.4 Interest expense, net.................................................................................................................................................................................................................................................. 37.9 Non-operating income, net........................................................................................................................................................................................................................................ (2.9) Operating profit................................................................................................................................................................. $ 70.6 $ 47.7 $ (43.2) 75.1 Special items included in operating profit Transaction costs.......................................................................................................................................................... — — 13.9 13.9 Integration and restructuring costs.............................................................................................................................. — — 3.5 3.5 Severance and related benefit costs............................................................................................................................ 0.3 — — 0.3 Total special items included in operating profit................................................................................................................ 0.3 — 17.4 17.7 Operating profit before special items (non-GAAP)........................................................................................................... 70.9 47.7 (25.8) 92.8 Non-operating income, net............................................................................................................................................... 0.6 0.3 2.0 2.9 Special item included in non-operating income, net - pension settlements.................................................................... — — (0.7) (0.7) Depreciation and amortization......................................................................................................................................... 21.6 6.7 0.3 28.6 Adjusted EBITDA (non-GAAP)............................................................................................................................................ $ 93.1 $ 54.7 $ (24.2) $ 123.6 Segment operating margin................................................................................................................................................ 13.7 % 23.4 % Segment adjusted EBITDA margin..................................................................................................................................... 18.1 % 26.8 % Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures

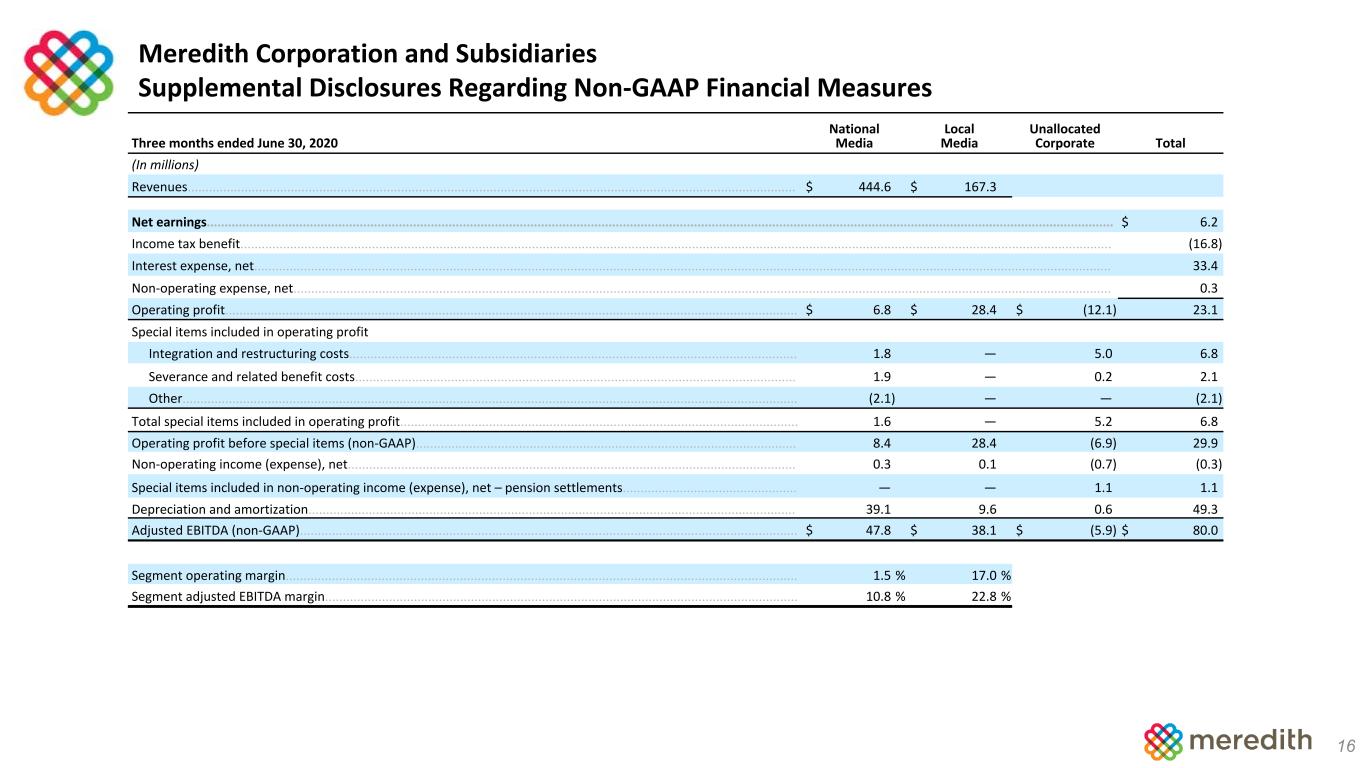

16 Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures Three months ended June 30, 2020 National Media Local Media Unallocated Corporate Total (In millions) Revenues........................................................................................................................................................................... $ 444.6 $ 167.3 Net earnings............................................................................................................................................................................................................................................................... $ 6.2 Income tax benefit..................................................................................................................................................................................................................................................... (16.8) Interest expense, net................................................................................................................................................................................................................................................. 33.4 Non-operating expense, net...................................................................................................................................................................................................................................... 0.3 Operating profit................................................................................................................................................................. $ 6.8 $ 28.4 $ (12.1) 23.1 Special items included in operating profit Integration and restructuring costs.............................................................................................................................. 1.8 — 5.0 6.8 Severance and related benefit costs............................................................................................................................ 1.9 — 0.2 2.1 Other............................................................................................................................................................................. (2.1) — — (2.1) Total special items included in operating profit................................................................................................................ 1.6 — 5.2 6.8 Operating profit before special items (non-GAAP)........................................................................................................... 8.4 28.4 (6.9) 29.9 Non-operating income (expense), net.............................................................................................................................. 0.3 0.1 (0.7) (0.3) Special items included in non-operating income (expense), net – pension settlements................................................. — — 1.1 1.1 Depreciation and amortization......................................................................................................................................... 39.1 9.6 0.6 49.3 Adjusted EBITDA (non-GAAP)............................................................................................................................................ $ 47.8 $ 38.1 $ (5.9) $ 80.0 Segment operating margin................................................................................................................................................ 1.5 % 17.0 % Segment adjusted EBITDA margin..................................................................................................................................... 10.8 % 22.8 %

17 Twelve months ended June 30, 2021 National Media Local Media Unallocated Corporate Total (In millions) Revenues........................................................................................................................................................................... $ 2,023.5 $ 958.8 Net earnings............................................................................................................................................................................................................................................................... $ 306.6 Income tax expense.................................................................................................................................................................................................................................................... 87.0 Interest expense, net.................................................................................................................................................................................................................................................. 178.6 Non-operating income, net........................................................................................................................................................................................................................................ (10.8) Operating profit................................................................................................................................................................. $ 351.2 314.0 (103.8) 561.4 Special items included in operating profit Gain on the sale of businesses and assets.................................................................................................................... (97.6) — — (97.6) Severance and related benefit costs............................................................................................................................ 6.7 7.3 0.6 14.6 Integration and restructuring costs.............................................................................................................................. 0.6 — 12.8 13.4 Transaction costs.......................................................................................................................................................... — — 22.0 22.0 Other............................................................................................................................................................................. (1.2) — (1.0) (2.2) Total special items included in operating profit................................................................................................................ (91.5) 7.3 34.4 (49.8) Operating profit before special items (non-GAAP)........................................................................................................... 259.7 321.3 (69.4) 511.6 Non-operating income, net............................................................................................................................................... 6.3 1.0 3.5 10.8 Special items included in the non-operating income, net................................................................................................ Pension settlements..................................................................................................................................................... — — 1.1 1.1 Gain on investment...................................................................................................................................................... (3.6) — — (3.6) Total special items included in non-operating income, net.............................................................................................. (3.6) — 1.1 (2.5) Depreciation and amortization......................................................................................................................................... 129.9 31.5 1.6 163.0 Adjusted EBITDA (non-GAAP)............................................................................................................................................ $ 392.3 $ 353.8 $ (63.2) $ 682.9 Segment operating margin................................................................................................................................................ 17.4 % 32.7 % Segment adjusted EBITDA margin..................................................................................................................................... 19.4 % 36.9 % Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures

18 Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures Twelve months ended June 30, 2020 National Media Local Media Unallocated Corporate Total (In millions) Revenues........................................................................................................................................................................... $ 2,081.6 $ 769.3 Net loss...................................................................................................................................................................................................................................................................... (234.3) Loss from discontinued operations, net of income taxes.......................................................................................................................................................................................... 25.3 Loss from continuing operations.............................................................................................................................................................................................................................. (209.0) Income tax benefit..................................................................................................................................................................................................................................................... (32.2) Interest expense, net................................................................................................................................................................................................................................................. 145.8 Non-operating expense, net...................................................................................................................................................................................................................................... 1.3 Operating profit (loss)....................................................................................................................................................... $ (167.7) $ 146.0 $ (72.4) (94.1) Special items included in operating profit (loss) Write-down of impaired assets.................................................................................................................................... 367.0 22.3 — 389.3 Integration and restructuring costs.............................................................................................................................. 5.1 — 18.5 23.6 Severance and related benefit costs............................................................................................................................ 8.1 2.3 3.7 14.1 Gain on sale of businesses and assets.......................................................................................................................... (8.7) — — (8.7) Other............................................................................................................................................................................ (2.1) — 0.4 (1.7) Total special items included in operating profit (loss)...................................................................................................... 369.4 24.6 22.6 416.6 Operating profit before special items (non-GAAP)........................................................................................................... 201.7 170.6 (49.8) 322.5 Non-operating income (expense), net.............................................................................................................................. 11.3 1.0 (13.6) (1.3) Special items included in non-operating income (expense), net...................................................................................... Pension settlements..................................................................................................................................................... — — 14.0 14.0 Loss on investment....................................................................................................................................................... 1.1 — — 1.1 Release of lease guarantee.......................................................................................................................................... (8.0) — — (8.0) Total special items included in non-operating income (expense), net............................................................................. (6.9) — 14.0 7.1 Depreciation and amortization......................................................................................................................................... 176.5 38.9 4.5 219.9 Adjusted EBITDA (non-GAAP)........................................................................................................................................... $ 382.6 $ 210.5 $ (44.9) $ 548.2 Segment operating margin............................................................................................................................................... (8.1) % 19.0 % Segment adjusted EBITDA margin.................................................................................................................................... 18.4 % 27.4 %

Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures (In millions) June 30, 2021 June 30, 2020 Adjusted EBITDA for the trailing twelve months ended ......................................................................... $ 682.9 $ 548.2 Long-term debt outstanding.................................................................................................................... 2,791.3 3,045.4 Less: cash and cash equivalents............................................................................................................... (240.2) (132.4) Net debt (non-GAAP)............................................................................................................................... $ 2,551.1 $ 2,913.0 Net debt leverage ratio (non-GAAP)........................................................................................................ 3.7x 5.3x 19

Three Months Three Months Twelve Months March 31, June 30, Variance from June 30, Variance from 2020 2021 2020 Prior Year 2021 2020 Prior Year (In millions) Net cash provided by operating activities..................... $ 76.0 $ 60.8 $ 123.6 (51) % $ 398.6 $ 306.6 30 % Less: additions to property, plant, and equipment....... (7.7) (9.6) (9.8) (2) % (35.2) (55.4) (36) % Free cash flow................................................................ $ 68.3 $ 51.2 $ 113.8 (55) % $ 363.4 $ 251.2 45 % F represents favorable improvements greater than 100%. Meredith Corporation and Subsidiaries Supplemental Disclosures Regarding Non-GAAP Financial Measures 20