Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Roth CH Acquisition III Co | tm2124501d1_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - Roth CH Acquisition III Co | tm2124501d1_ex99-2.htm |

| 8-K - FORM 8-K - Roth CH Acquisition III Co | tm2124501d1_8k.htm |

Exhibit 99.1

1 Addendum to Investor Presentation August 2021

2 Disclaimer THIS ADDENDUM TO INVESTOR PRESENTATION (THIS “ADDENDUM”) IS AN ADDENDUM TO THE INVESTOR PRESENTATION DATED JUNE 2021, FILED ON JUNE 16, 2021 AS EXHIBIT 99.3 TO THE CURRENT REPORT ON FOR M 8 - K FILED BY ROTH CH ACQUISITION III (“ ROCR ”). CAPITALIZED TERMS USED BUT NOT DEFINED HEREIN HAVE THE MEANINGS SET FORTH IN THE INVESTOR PRESENTATION. THE DISTRIBUTION OF THIS PRESENTATION MAY ALSO BE RESTRICTED BY LAW AND PERSONS INTO WHOSE POSSESSION THIS PRESENTATION COMES SH OULD INFORM THEMSELVES OF AND OBSERVE ANY SUCH RESTRICTIONS. THE RECIPIENT ACKNOWLEDGES THAT IT IS (I) AWARE THAT THE UNITED STATES SECURITIES LAWS PROHIBIT ANY PERSON WHO HAS MATERIAL, NON - PUBLIC INFORMATION CONCERNING A COMPANY FROM PURCHAS ING OR SELLING SECURITIES OF SUCH COMPANY OR FROM COMMUNICATING SUCH INFORMATION TO ANY OTHER PERSON UNDER CIRCUMSTANCES IN WHICH IT IS REASONABLY FORESEEABLE THAT SUCH PERSON IS LIKELY TO PURCHASE OR SELL SUCH SECURITIES, AND (II) FAM ILIAR WITH THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND THE RULES AND REGULATIONS PROMULGATED THEREUNDER (COLLECTIVELY, THE “EXCHANGE ACT”), AND THAT THE RECIPIENT WILL NEITHER USE, NOR CAUSE ANY THIRD PARTY TO USE, THIS PRESENTAT ION OR ANY INFORMATION CONTAINED HEREIN IN CONTRAVENTION OF THE EXCHANGE ACT, INCLUDING, WITHOUT LIMITATION, RULE 10B - 5 HEREUNDER. NO REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED ARE GIVEN IN, OR IN RESPECT OF, THIS PRESENTATION. TO THE FULLEST EXTENT PE RMI TTED BY LAW IN NO CIRCUMSTANCES WILL ROCR, QUALTEK OR ANY OF THEIR RESPECTIVE SUBSIDIARIES, STOCKHOLDERS, AFFILIATES, REPRESENTATIVES, PARTNERS, DIRECTORS, OFFICERS, EMPLOYEES, ADVISERS OR AGENTS BE RESPONSIBLE OR LIABLE FOR ANY DI REC T, INDIRECT OR CONSEQUENTIAL LOSS OR LOSS OF PROFIT ARISING FROM THE USE OF THIS PRESENTATION, ITS CONTENTS, ITS OMISSIONS, RELIANCE ON THE INFORMATION CONTAINED WITHIN IT, OR ON OPINIONS COMMUNICATED IN RELATION THERETO OR OTHERWISE ARISING IN CONNECTION THEREWITH. THIS ADDENDUM DOES NOT PURPORT TO BE ALL - INCLUSIVE OR TO CONTAIN ALL OF THE INFORMATION THAT MAY BE REQUIRED TO MAKE A FULL ANALYSIS OF QUALTEK OR THE PROPOSED BUSINESS COMBINATION. VIEWERS OF THIS ADDENDUM SHOULD EACH MAKE THEIR OWN EVALUATION OF QUALTEK AND OF THE RELEVANCE AND ADEQUACY OF THE INFORMATION AND SHOULD MAKE SUCH OTHER INVESTIGATIONS AS THEY DEEM NECESSARY. FORWARD - LOOKING STATEMENTS CERTAIN STATEMENTS INCLUDED IN THIS ADDENDUM THAT ARE NOT HISTORICAL FACTS ARE FORWARD - LOOKING STATEMENTS FOR PURPOSES OF THE SAFE HARBOR PROVISIONS UNDER THE UNITED STATES PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD - LOOKING STATEMENTS GENERALLY ARE ACCOMPANIED BY WORDS SUCH AS “BELIEVE,” “MAY,” “WILL,” “ESTIMATE,” “CONTINUE,” “ANTICIPATE,” “INTEND ,” “EXPECT,” “SHOULD,” “WOULD,” “PLAN,” “PREDICT,” “POTENTIAL,” “SEEM,” “SEEK,” “FUTURE,” “OUTLOOK,” “MODEL,” “TARGET,” “GOAL,” AND SIMILAR EXPRESSIONS THAT PREDICT OR INDICATE FUTURE EVENTS OR TRENDS OR THAT ARE NOT STATEMENTS OF HISTORICAL MATTERS. THESE FORWARD - LOO KING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS REGARDING ESTIMATES AND FORECASTS OF OTHER FINANCIAL AND PERFORMANCE METRICS AND PROJECTIONS OF MARKET OPPORTUNITY. THESE STATEMENTS ARE BASED ON VARIOUS ASSUMPTIONS, WHETHER OR NOT IDENTIFIED IN THIS ADDENDUM, AND ON THE CURRENT EXPECTATIONS OF ROCR’S AND QUALTEK’S MANAGEMENT AND ARE NOT PREDICTIONS OF ACTUAL PERFORMANCE. THESE FORWARD - LOOKING STATEMENTS ARE PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY AND ARE NOT INTE NDED TO SERVE AS, AND MUST NOT BE RELIED ON BY ANY INVESTOR AS, A GUARANTEE, AN ASSURANCE, A PREDICTION OR A DEFINITIVE STATEMENT OF FACT OR PROBABILITY. ACTUAL EVENTS AND CIRCUMSTANCES ARE DIFFICULT OR IMPOSSIBLE TO PREDICT AND WILL DIF FER FROM ASSUMPTIONS. MANY ACTUAL EVENTS AND CIRCUMSTANCES ARE BEYOND THE CONTROL OF ROCR AND QUALTEK. THESE FORWARD - LOOKING STATEMENTS ARE SUBJECT TO A NUMBER OF RISKS AND UNCERTAINTIES, INCLUDING CHANGES IN DOMESTIC AND FOREIGN BUSINES S, MARKET, FINANCIAL, POLITICAL AND LEGAL CONDITIONS; THE INABILITY OF THE PARTIES TO SUCCESSFULLY OR TIMELY CONSUMMATE THE PROPOSED BUSINESS COMBINATION, INCLUDING THE RISK THAT ANY REQUIRED REGULATORY APPROVALS ARE NOT OBTAINED, ARE DE LAYED OR ARE SUBJECT TO UNANTICIPATED CONDITIONS THAT COULD ADVERSELY AFFECT THE COMBINED COMPANY OR THE EXPECTED BENEFITS OF THE PROPOSED BUSINESS COMBINATION OR THAT THE APPROVAL OF THE STOCKHOLDERS OF ROCR OR QUALTEK IS NOT OBT AIN ED; FAILURE TO REALIZE THE ANTICIPATED BENEFITS OF THE PROPOSED BUSINESS COMBINATION; RISKS RELATING TO THE UNCERTAINTY OF THE PROJECTED FINANCIAL INFORMATION WITH RESPECT TO QUALTEK; RISKS RELATED TO THE ORGANIC AND INORGANIC GROWTH OF QUALTEK’S BUSINESS; RISKS RELATED TO QUALTEK’S ACQUISITIONS, INCLUDING POTENTIAL ACQUISITIONS; AND THE TIMING OF EXPECTED BUSINESS MILESTONES; THE EFFECTS OF COMPETITION ON QUALTEK’S FUTURE BUSINESS; THE AMOUNT OF REDEMPTION REQUESTS MADE BY ROCR’S STOCKHOLDERS; THE ABILITY OF ROCR OR THE COMBINED COMPANY TO ISSUE EQUITY OR EQUITY - LINKED SECURITIES OR OBTAIN DEBT FINANCING IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION OR IN THE FUTURE, AND THOSE FACTORS DISCUSSED IN ROCR’S PROSPECTUS RELATING TO ITS INITIAL PUBLIC OFFERING, WHICH WAS FILED WITH THE SEC ON MARCH 4, 2021, UNDER THE HEADING “RISK FACTORS,” AND OTHER DOCUMENTS OF ROCR FILED, OR TO BE FILED, WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”). IF AN Y O F THESE RISKS MATERIALIZE OR OUR ASSUMPTIONS PROVE INCORRECT, ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THE RESULTS IMPLIED BY THESE FORWARD - LOOKING STATEMENTS. THERE MAY BE ADDITIONAL RISKS THAT NEITHER ROCR NOR QUALTEK PRESENTLY KNOW OR THAT ROCR AND QUALTEK CURRENTLY BELIEVE ARE IMMATERIAL THAT COULD ALSO CAUSE ACTUAL RESULTS TO DIFFER FROM THOSE CONTAINED IN THE FORWARD - LOOKING STATEMENTS. IN ADDITION, FORWARD - LOOKING STATEMENTS REFLECT ROCR’S AND QUALTEK’S EXPECTATIONS, PLANS OR FORECASTS OF FUTURE EVENTS AND VIEWS AS OF THE DATE OF THIS ADDENDUM. ROCR AND QUALTEK ANTICIPATE THAT SUBSEQUENT EVENTS AND DEVELOPMENTS WILL CAUSE ROCR’S AND QUALTEK’S ASSESSMENTS TO CHANGE. HOWEVER, WHILE ROCR AND QUALTEK MAY EL ECT TO UPDATE THESE FORWARD - LOOKING STATEMENTS AT SOME POINT IN THE FUTURE, ROCR AND QUALTEK SPECIFICALLY DISCLAIM ANY OBLIGATION TO DO SO. THESE FORWARD - LOOKING STATEMENTS SHOULD NOT BE RELIED UPON AS REPRESENTING ROCR’S AND QUALTEK’ S ASSESSMENTS AS OF ANY DATE SUBSEQUENT TO THE DATE OF THIS ADDENDUM. ACCORDINGLY, UNDUE RELIANCE SHOULD NOT BE PLACED UPON THE FORWARD - LOOKING STATEMENTS.

3 Disclaimer USE OF PROJECTIONS THIS ADDENDUM CONTAINS PROJECTED FINANCIAL INFORMATION WITH RESPECT TO QUALTEK. SUCH PROJECTED FINANCIAL INFORMATION CONSTITUTES FORWARD - LOOKI NG INFORMATION AND IS FOR ILLUSTRATIVE PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS NECESSARILY BEING INDICATIVE OF FUTURE RESULTS. THE ASSUMPTIONS AND ESTIMATES UNDERLYING SUCH FINANCIAL FORECAST INFORMATION ARE INHERENT LY UNCERTAIN AND ARE SUBJECT TO A WIDE VARIETY OF SIGNIFICANT BUSINESS, ECONOMIC, COMPETITIVE AND OTHER RISKS AND UNCERTAINTIES. SEE “FORWARD - LOOKING STATEMENTS” ABOVE. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THE RESULTS CONTEMPLATED BY THE FINANCIAL FORECAST INFORMATION CONTAINED IN THIS ADDENDUM, AND THE INCLUSION OF SUCH INFORMATION IN THIS ADDENDUM SHOULD NOT BE REGARDED AS A REPRESENTATION BY ANY PERSON THAT THE RESULTS REFLECTED IN SUCH FORECASTS WILL BE ACHIEVED. IN PA RTI CULAR, THERE CAN BE NO ASSURANCE THAT QUALTEK’S HISTORICAL RETURNS FROM PAST ACQUISITIONS WILL BE ACHIEVED ON FUTURE ACQUISITIONS. NEITHER THE INDEPENDENT AUDITORS OF ROCR NOR THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FI RM OF THE COMPANY AUDITED, REVIEWED, COMPILED OR PERFORMED ANY PROCEDURES WITH RESPECT TO THE PROJECTIONS FOR THE PURPOSE OF THEIR INCLUSION IN THIS ADDENDUM AND, ACCORDINGLY, NEITHER OF THEM EXPRESSED AN OPINION OR PROVIDED ANY OTHER FORM OF ASSURANCE WITH RESPECT THERETO FOR THE P URP OSE OF THIS ADDENDUM. THERE ARE NUMEROUS FACTORS RELATED TO THE MARKETS IN GENERAL OR THE IMPLEMENTATION OF ANY OPERATIONAL STRATEGY THAT CANNOT BE FULLY ACCOUNTED FOR WITH RESPECT TO THE P ROJ ECTIONS HEREIN. ANY TARGETS OR ESTIMATES ARE THEREFORE SUBJECT TO A NUMBER OF IMPORTANT RISKS, QUALIFICATIONS, LIMITATIONS AND EXCEPTIONS THAT COULD MATERIALLY AND ADVERSELY AFFECT ROCR AND THE COMPANY’S PERFORMANCE. MOREOVER, ACTUAL EV ENT S ARE DIFFICULT TO PROJECT AND OFTEN DEPEND UPON FACTORS THAT ARE BEYOND THE CONTROL OF ROCR AND THE COMPANY AND ITS AFFILIATES. A RECONCILIATION OF NON - GAAP FINANCIAL MEASURES IN THIS ADDENDUM TO THE MOST DIRECTLY COMPARABLE UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”) FINANCIAL MEASURES IS NOT INC LUD ED, BECAUSE, WITHOUT UNREASONABLE EFFORT, THE COMPANY IS UNABLE TO PREDICT WITH REASONABLE CERTAINTY THE AMOUNT OR TIMING OF NON - GAAP ADJUSTMENTS THA T ARE USED TO CALCULATE THESE NON - GAAP FINANCIAL MEASURES. FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES THE FINANCIAL INFORMATION AND DATA CONTAINED IN THIS ADDENDUM IS UNAUDITED AND DOES NOT CONFORM TO REGULATION S - X. ACCORDINGLY, SUCH INFORMATION AND DATA MAY NOT BE INCLUDED IN, MAY BE ADJUS TED IN OR MAY BE PRESENTED DIFFERENTLY IN, ANY PROXY STATEMENT OR REGISTRATION STATEMENT TO BE FILED BY ROCR WITH THE SEC, AND SUCH DIFFERENCES MAY BE MATERIAL. IN PARTICULAR, AL L Q UALTEK PROJECTED FINANCIAL INFORMATION INCLUDED HEREIN IS PRELIMINARY AND SUBJECT TO RISKS AND UNCERTAINTIES. ANY VARIATION BETWEEN QUALTEK’S ACTUAL RESULTS AND THE PROJECTED FINANCIAL INFORMATION INCLUDED HEREIN MAY BE MATERIAL. SOME OF THE FINANCIAL INFORMATION AND DATA CONTAINED IN THIS ADDENDUM, SUCH AS ADJUSTED EBITDA , HAVE NOT BEEN PREPARED IN ACCORDANCE WITH UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”). ROCR AND QUALTEK BE LIEVE THAT THE USE OF THESE NON - GAAP FINANCIAL MEASURES PROVIDES AN ADDITIONAL TOOL FOR INVESTORS TO USE IN EVALUATING HISTORICAL OR PROJECTED OPERATI NG RESULTS AND TRENDS IN AND IN COMPARING QUALTEK’S FINANCIAL MEASURES WITH OTHER SIMILAR COMPANIES, MANY OF WHICH PRESENT SIMILAR NON - GAAP FINANCIAL MEASURES TO INVESTORS. MANAGEMENT DOES NOT CONSIDER THESE NON - GAAP MEASURES IN ISOLATION OR A S AN ALTERNATIVE TO FINANCIAL MEASURES DETERMINED IN ACCORDANCE WITH GAAP. THE PRINCIPAL LIMITATION OF THESE NON - GAAP FINANCIAL MEASURES IS THAT THEY EXCLUDE SIGNIFICANT EXPENSES AND REVENUE THAT ARE REQUIRED BY GAAP TO BE RECORDED IN QUA LTE K’S FINANCIAL STATEMENTS. IN ADDITION, THEY ARE SUBJECT TO INHERENT LIMITATIONS AS THEY REFLECT THE EXERCISE OF JUDGMENTS BY MANAGEMENT ABOUT WHICH EXPENSE AND REVENUE ITEMS ARE EXCLUDED OR INCLUDED IN DETERMINING THESE NON - GAAP FINANCIAL M EASURES. IN ORDER TO COMPENSATE FOR THESE LIMITATIONS, MANAGEMENT PRESENTS HISTORICAL NON - GAAP FINANCIAL MEASURES IN CONNECTION WITH GAAP RESULTS. YOU SHOULD REVIEW QUALTEK’S AUDITED FINANCIAL STATEMENTS, WHICH WILL BE INCLUDED IN THE PROXY STATEMENT TO BE FILED BY ROCR. HOWEVER, NOT ALL OF THE INFORMATION NECESSARY FOR A QUANTITATIVE RECONCILIATION OF THE FORWARD - LOOKING NON - GAAP FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES IS AVA ILABLE WITHOUT UNREASONABLE EFFORTS AT THIS TIME. IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND WHERE TO FIND IT IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION, ROCR WILL FILE A PRELIMINARY PROXY STATEMENT (THE “PROXY STATEMENT”) WITH THE SEC, WHICH WILL BE DISTRIBUTED TO HOLDERS OF ROCR’S COMMON STOCK IN CONNECTI ON WITH ROCR’S SOLICITATION OF PROXIES FOR THE VOTE BY ROCR’S STOCKHOLDERS WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION AND OTHER MATTERS TO BE DESCRIBED IN THE PROXY STATEMENT. ROCR WILL MAIL A DEFINITIVE PROXY STATEMENT, WHEN AVAILABLE, TO ITS STOCKHOLDERS. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, ANY AMENDMENTS THERETO AND ANY OTHER DOCUMENTS FILED WI TH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE BECAUSE THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ROCR, QUALTEK AND THE PROPOSED BUSINESS COMBINATION. INVESTORS AND SECURITY HOLDERS MAY OBTAIN FREE COPIES OF THE PRELIMINARY PROXY STATEMENT AND DEFINITIVE PROXY STATEMENT (WHEN AVAILABLE) AND OTHER DOCUMENTS FILED WITH THE SEC BY ROCR THROUGH THE WEBSITE MAINTAINED BY THE SEC AT HTTP://WWW.SEC.GOV, OR BY DIRECTING A REQUEST TO ROCR AT 888 SAN CL EMENTE DRIVE, SUITE 400, NEWPORT BEACH, CA 92660. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORI TY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. PARTICIPANTS IN THE SOLICITATION ROCR AND QUALTEK AND THEIR RESPECTIVE DIRECTORS AND CERTAIN OF THEIR RESPECTIVE EXECUTIVE OFFICERS AND OTHER MEMBERS OF MANAG EME NT AND EMPLOYEES MAY BE CONSIDERED PARTICIPANTS IN THE SOLICITATION OF PROXIES WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION. INFORMATION ABOUT THE DIRECTORS AND EXECUTIVE OFFICERS OF ROCR IS SET FORTH IN THE PROXY STATEMENT. ADDITIONAL INFORMATION REGARDING THE PARTICIPANTS IN THE PROXY SOLICITATION AND A DESCRIPTION OF THEIR DIRECT AND INDIRECT INTERESTS, BY SECURITY HOLDINGS OR OTHERWISE, ARE INCLUDED IN THE PROXY STATEMENT AND OTHER RELEVANT MATERIALS TO BE FILED WITH THE SEC REGARDING THE PROPOSED BUSINESS COMBINA TIO N WHEN THEY BECOME AVAILABLE. STOCKHOLDERS, POTENTIAL INVESTORS AND OTHER INTERESTED PERSONS SHOULD READ THE PROXY STATEMENT CAREFULLY BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS. YOU MAY OBTAIN FREE COPIES OF THESE DOCUMENTS AS INDICATED ABOVE. NO OFFER OR SOLICITATION THIS ADDENDUM SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES, NOR SHALL THERE BE ANY SALE OF S ECU RITIES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION. NO OFFERING OF SECURITIES WILL BE MADE EXCE PT BY MEANS OF A PROSPECTUS MEETING THE REQUIREMENTS OF THE SECURITIES ACT OF 193 3, AS AMENDED, OR AN EXEMPTION THEREFROM .

4 Certain Important Updates Relating to Projections • QualTek has provided add’l information to ROCR on its historical and expected financial performance for Q2 and H1 2021, as well as developments on expected and projected financial performance of QualTek for H2 2021, which are set forth on the subsequent slides. • As a result of QualTek’s performance for Q2 and H1 2021, the projections previously disclosed may not be achieved . • While all projections are necessarily speculative, ROCR and QualTek believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation, and therefore the projections set forth herein for 2022 and 2023 are extremely variable, and there is no assurance that such projections will be met. Investors should not place undue reliance on any projections, in particular those for periods further in the future as, by their nature, the further out the projections extend, the less reliable they are.

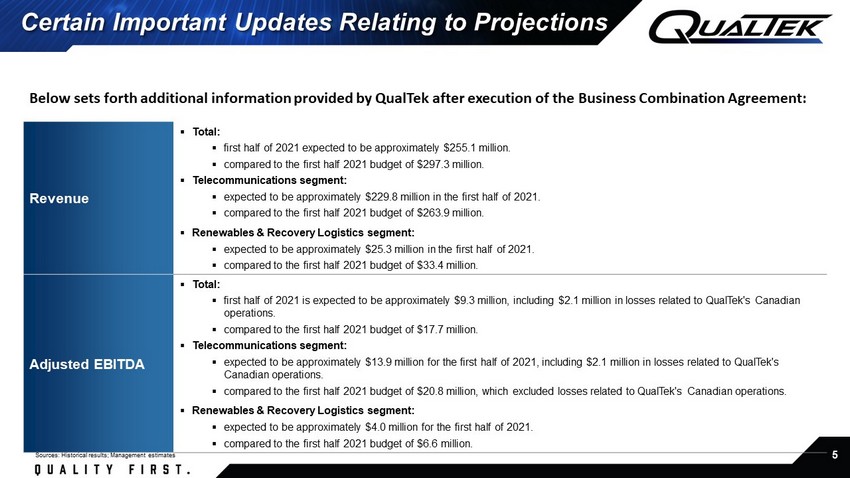

5 Revenue ▪ Total: ▪ first half of 2021 expected to be approximately $255.1 million. ▪ compared to the first half 2021 budget of $297.3 million. ▪ Telecommunications segment: ▪ expected to be approximately $229.8 million in the first half of 2021. ▪ compared to the first half 2021 budget of $263.9 million. ▪ Renewables & Recovery Logistics segment: ▪ expected to be approximately $25.3 million in the first half of 2021. ▪ compared to the first half 2021 budget of $33.4 million. Adjusted EBITDA ▪ Total: ▪ first half of 2021 is expected to be approximately $9.3 million, including $2.1 million in losses related to QualTek's Canadian operations. ▪ compared to the first half 2021 budget of $17.7 million. ▪ Telecommunications segment: ▪ expected to be approximately $13.9 million for the first half of 2021, including $2.1 million in losses related to QualTek's Canadian operations. ▪ compared to the first half 2021 budget of $20.8 million, which excluded losses related to QualTek's Canadian operations. ▪ Renewables & Recovery Logistics segment: ▪ expected to be approximately $4.0 million for the first half of 2021. ▪ compared to the first half 2021 budget of $6.6 million. Certain Important Updates Relating to Projections Sources: Historical results; Management estimates Below sets forth additional information provided by QualTek after execution of the Business Combination Agreement:

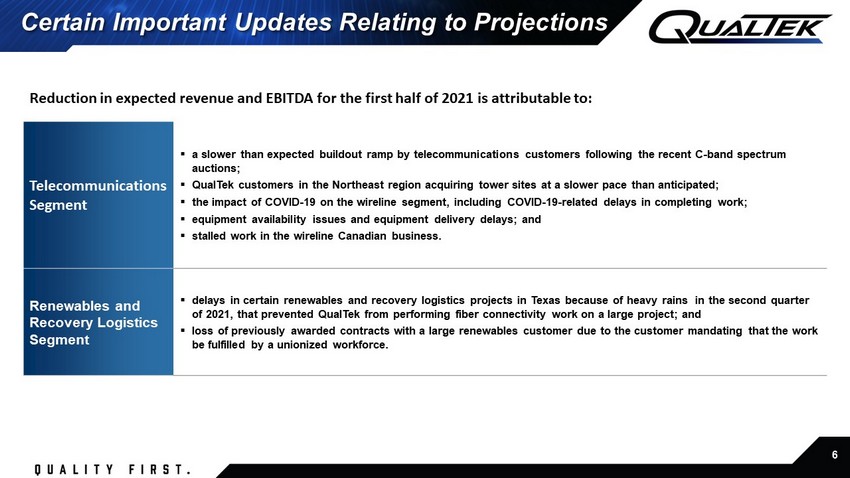

6 Telecommunications Segment ▪ a slower than expected buildout ramp by telecommunications customers following the recent C - band spectrum auctions; ▪ QualTek customers in the Northeast region acquiring tower sites at a slower pace than anticipated; ▪ the impact of COVID - 19 on the wireline segment, including COVID - 19 - related delays in completing work; ▪ equipment availability issues and equipment delivery delays; and ▪ stalled work in the wireline Canadian business. Renewables and Recovery Logistics Segment ▪ delays in certain renewables and recovery logistics projects in Texas because of heavy rains in the second quarter of 2021, that prevented QualTek from performing fiber connectivity work on a large project; and ▪ loss of previously awarded contracts with a large renewables customer due to the customer mandating that the work be fulfilled by a unionized workforce. Certain Important Updates Relating to Projections Reduction in expected revenue and EBITDA for the first half of 2021 is attributable to :

7 Certain Important Updates Relating to Projections • However, some of these negative effects were partially offset by higher than anticipated non - hurricane storm work. In addition, QualTek expects to complete the work affected by the heavy rains in Texas in Q3 2021. • Based on second quarter performance and QualTek's updated outlook for the remainder of the year, QualTek is now projecting Adjusted EBITDA of $85 million to $106 million for the year ending December 31, 2021 . • QualTek has identified a number of acquisitions and other actions it could implement, which could, if completed in H2 2021 , positively impact revenue and EBITDA for 2021 enabling it to meet the original projections for 2021 Adjusted EBITDA and revenue of $106 million and $818 million, respectively. (1 ) • For example, in August 2021, QualTek acquired Broken Arrow Communications, Inc. (“Broken Arrow”). Qualtek is also currently in negotiations with a number of other acquisition targets. (1) QualTek has a track record of successful acquisitions; in the past two - and - a - half years, QualTek has been able to complete six acquisitions. However, there can be no assurance that the negotiations with any pending acquisi tio n targets will lead to the execution of definitive agreements or completion of any acquisitions, and there is no guarantee that if such acquisitions are completed, t hat QualTek will be able to achieve the strategic, operational, financial and other benefits contemplated as part of these acquisitions t o t he full extent expected or in a timely manner.

8 Certain Important Updates Relating to Projections • ROCR and the ROCR Board will continue to evaluate and conduct due diligence on the financial performance of Qualtek through the date of the closing of the Business Combination.