Attached files

Exhibit 10.23

OFFICE LEASE

by and between

ELEVATE SABINE, LLC,

a Texas limited liability company

(as “Landlord”)

and

HIPPO ANALYTICS INC.,

a Delaware corporation

(as “Tenant”)

Waterloo Central

Austin, Texas

THE DELIVERY OR NEGOTIATION OF THIS DOCUMENT BY LANDLORD OR ITS AGENTS OR ATTORNEYS SHALL NOT BE DEEMED AN OFFER BY LANDLORD TO ENTER INTO ANY TRANSACTION OR RELATIONSHIP WITH ANY PERSON OR PARTY. THIS DOCUMENT SHALL NOT BE BINDING UPON LANDLORD OR ANY AFFILIATE OF LANDLORD OR ITS OR THEIR AGENTS OR ATTORNEYS IN ANY RESPECT, NOR SHALL LANDLORD HAVE ANY OBLIGATIONS OR LIABILITIES TO TENANT UNLESS AND UNTIL BOTH LANDLORD AND TENANT HAVE EXECUTED AND DELIVERED THIS DOCUMENT. UNTIL ANY SUCH FULL EXECUTION AND DELIVERY OF THIS DOCUMENT, EITHER LANDLORD OR TENANT MAY TERMINATE ALL NEGOTIATIONS WITH THE OTHER RELATING TO THE SUBJECT MATTER HEREOF, WITHOUT CAUSE AND FOR ANY REASON, WITHOUT RECOURSE OR LIABILITY.

TABLE OF CONTENTS

| Page | ||||||||

| 1. |

BASIC LEASE PROVISIONS | 1 | ||||||

| 1.1 | Basic Lease Definitions | 1 | ||||||

| 2. |

PROJECT | 4 | ||||||

| 2.1 | Project | 4 | ||||||

| 2.2 | Land | 4 | ||||||

| 2.3 | Landlord’s Work; Delivery Condition | 4 | ||||||

| 2.4 | Base Building | 4 | ||||||

| 2.5 | Amenity Center | 5 | ||||||

| 2.6 | Common Areas | 5 | ||||||

| 2.7 | Premises | 5 | ||||||

| 2.8 | Intentionally Omitted | 7 | ||||||

| 2.9 | Building Standard | 7 | ||||||

| 2.10 | Tenant’s Personal Property | 7 | ||||||

| 3. |

TERM | 7 | ||||||

| 3.1 | Term | 7 | ||||||

| 3.2 | Holdover | 8 | ||||||

| 3.3 | Condition on Expiration | 8 | ||||||

| 4. |

RENT | 12 | ||||||

| 4.1 | Base Rent | 12 | ||||||

| 4.2 | Additional Rent | 12 | ||||||

| 4.3 | Other Taxes | 17 | ||||||

| 4.4 | Terms of Payment | 17 | ||||||

| 4.5 | Late Payment | 17 | ||||||

| 4.6 | Waiver of Tenant Rights and Benefits Under Section 93.012, Texas Property Code | 17 | ||||||

| 5. |

USE & OCCUPANCY | 18 | ||||||

| 5.1 | Use | 18 | ||||||

| 5.2 | Compliance with Laws and Directives | 18 | ||||||

| 5.3 | Occupancy | 19 | ||||||

| 5.4 | Prohibited Persons and Transactions | 19 | ||||||

| 5.5 | Green Building Requirements | 19 | ||||||

| 6. |

SERVICES & UTILITIES | 19 | ||||||

| 6.1 | Standard Services | 19 | ||||||

| 6.2 | Additional Services | 20 | ||||||

| 6.3 | Alternate Electrical Billing | 21 | ||||||

| 6.4 | Telecommunications Services | 21 | ||||||

(i)

| Page | ||||||||

| 6.5 | Interruption of Services | 22 | ||||||

| 6.6 | Recycling | 22 | ||||||

| 7. |

REPAIRS | 23 | ||||||

| 7.1 | Tenant’s Repairs | 23 | ||||||

| 7.2 | Landlord’s Repairs | 23 | ||||||

| 8. |

ALTERATIONS | 24 | ||||||

| 8.1 | Alterations by Tenant | 24 | ||||||

| 8.2 | Alterations by Landlord | 26 | ||||||

| 8.3 | Liens and Disputes | 26 | ||||||

| 9. |

INSURANCE | 26 | ||||||

| 9.1 | Tenant’s Insurance | 26 | ||||||

| 9.2 | Landlord’s Insurance | 28 | ||||||

| 10. |

DAMAGE OR DESTRUCTION | 28 | ||||||

| 10.1 | Damage and Repair | 28 | ||||||

| 10.2 | Rent Abatement | 29 | ||||||

| 11. |

INDEMNITY | 29 | ||||||

| 11.1 | Claims | 29 | ||||||

| 11.2 | Tenant’s Indemnity | 29 | ||||||

| 11.3 | Landlord’s Indemnity | 30 | ||||||

| 11.4 | Affiliates Defined | 30 | ||||||

| 11.5 | Survival of Waivers and Indemnities | 31 | ||||||

| 12. |

CONDEMNATION | 31 | ||||||

| 12.1 | Taking | 31 | ||||||

| 12.2 | Awards | 31 | ||||||

| 13. |

TENANT TRANSFERS | 31 | ||||||

| 13.1 | Terms Defined | 31 | ||||||

| 13.2 | Prohibited Transfers | 32 | ||||||

| 13.3 | Consent Not Required | 32 | ||||||

| 13.4 | Consent Required | 32 | ||||||

| 13.5 | Payments to Landlord | 33 | ||||||

| 13.6 | Effect of Transfers | 33 | ||||||

| 14. |

LANDLORD TRANSFERS | 34 | ||||||

| 14.1 | Landlord’s Transfer | 34 | ||||||

| 14.2 | Subordination | 34 | ||||||

| 14.3 | Attornment | 34 | ||||||

(ii)

| Page | ||||||||

| 14.4 | Estoppel Certificate | 35 | ||||||

| 15. |

DEFAULT AND REMEDIES | 36 | ||||||

| 15.1 | Tenant’s Default and Remedies | 36 | ||||||

| 15.2 | Landlord Remedies | 36 | ||||||

| 15.3 | Landlord’s Default and Remedies | 40 | ||||||

| 15.4 | Enforcement Costs | 41 | ||||||

| 15.5 | WAIVER OF JURY TRIAL | 41 | ||||||

| 15.6 | Force Majeure | 41 | ||||||

| 16. |

LETTER OF CREDIT | 41 | ||||||

| 17. |

MISCELLANEOUS | 42 | ||||||

| 17.1 | Rules and Regulations | 42 | ||||||

| 17.2 | Notice | 42 | ||||||

| 17.3 | Intentionally Deleted | 42 | ||||||

| 17.4 | Building Name | 42 | ||||||

| 17.5 | Entire Agreement | 43 | ||||||

| 17.6 | Counterparts | 43 | ||||||

| 17.7 | Successors | 43 | ||||||

| 17.8 | No Waiver | 43 | ||||||

| 17.9 | Independent Covenants | 43 | ||||||

| 17.10 | Captions | 43 | ||||||

| 17.11 | Authority | 43 | ||||||

| 17.12 | Applicable Law/Venue | 43 | ||||||

| 17.13 | Confidentiality | 43 | ||||||

| 17.14 | Reasonableness | 44 | ||||||

| 17.15 | Time | 44 | ||||||

| 17.16 | Quiet Enjoyment | 44 | ||||||

| 17.17 | Right to Enter Premises | 44 | ||||||

| 17.18 | Tenant’s Signage | 44 | ||||||

| 17.19 | Exhibits | 44 | ||||||

| 17.20 | Financial Statements | 44 | ||||||

| 17.21 | REIT Provisions | 45 | ||||||

| 17.22 | No Light, Air or View Easement | 45 | ||||||

| 17.23 | DTPA Waiver | 45 | ||||||

| 17.24 | Waiver of Tax Protest | 45 | ||||||

| 17.25 | Limitation of Damages | 45 | ||||||

(iii)

Office Lease

Landlord and Tenant enter into this Office Lease (“Lease”) as of the Execution Date, to be effective as of the Effective Date (as defined in Section 17.26 below) on the following terms, covenants, conditions and provisions:

| 1. | BASIC LEASE PROVISIONS |

1.1 Basic Lease Definitions. In this Lease, the following defined terms have the meanings indicated.

| (a) | Execution Date: | July 2, 2020. | ||||||

| (b) | Landlord: | ELEVATE SABINE, LLC, | ||||||

| a Texas limited liability company. | ||||||||

| (c) | Tenant: | HIPPO ANALYTICS INC., | ||||||

| a Delaware corporation. | ||||||||

| (d) | Building: | Waterloo Central | ||||||

| 701 E. 5th St. | ||||||||

| Austin, Texas 78701 | ||||||||

| deemed to contain approximately: 36,041 rentable square feet (“RSF”) of class “A” office space, subject to Section 2.7(c) below. | ||||||||

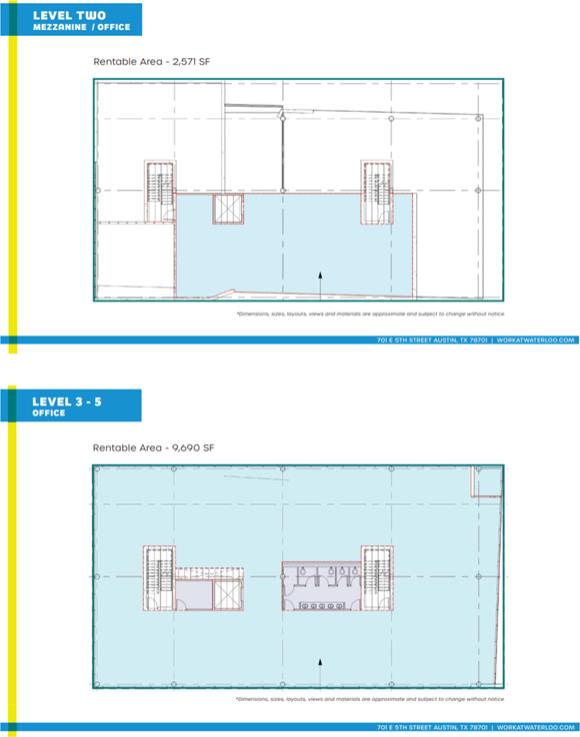

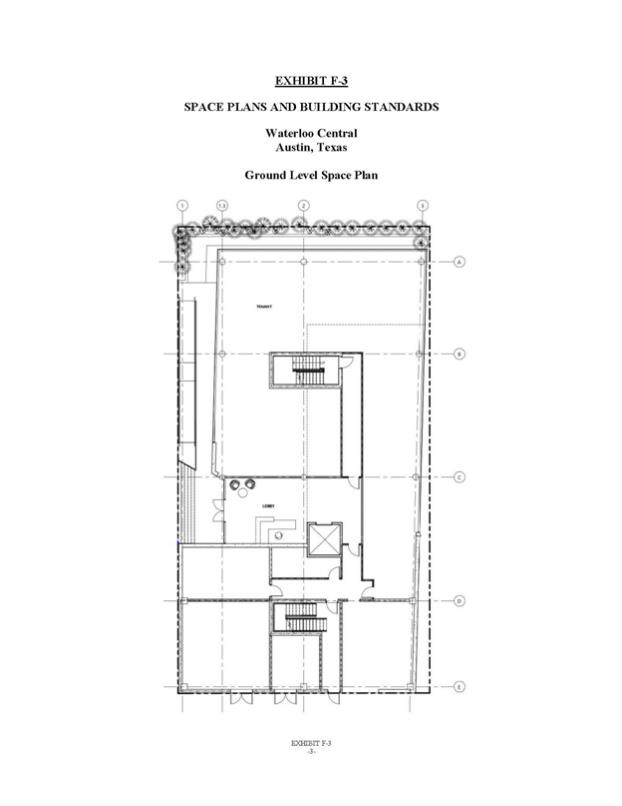

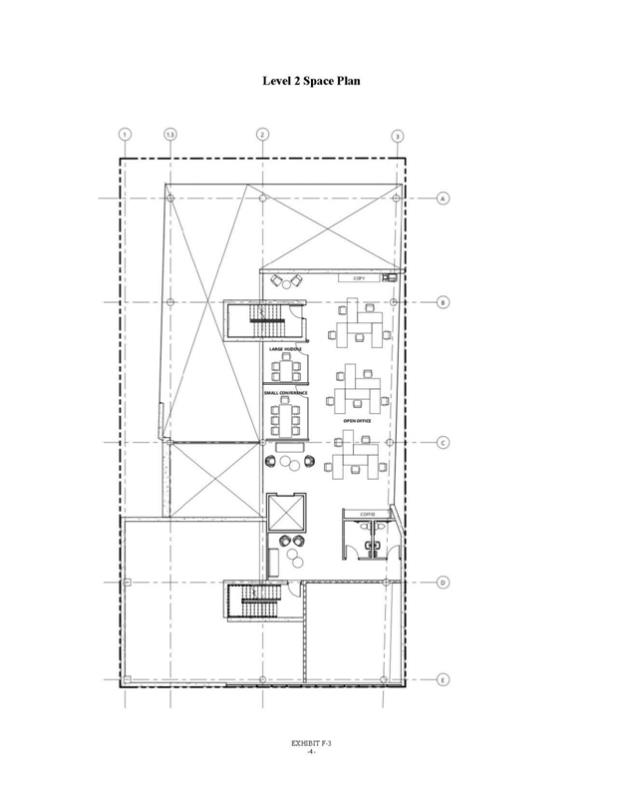

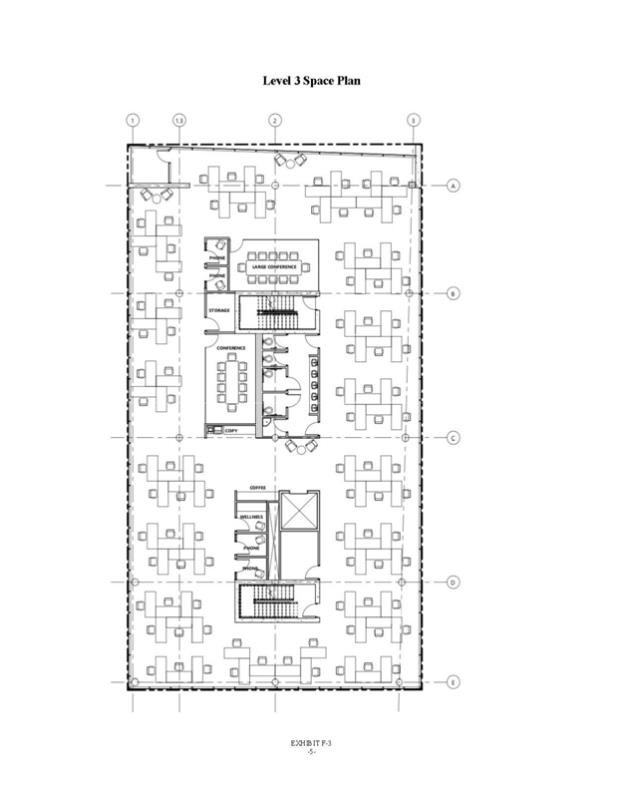

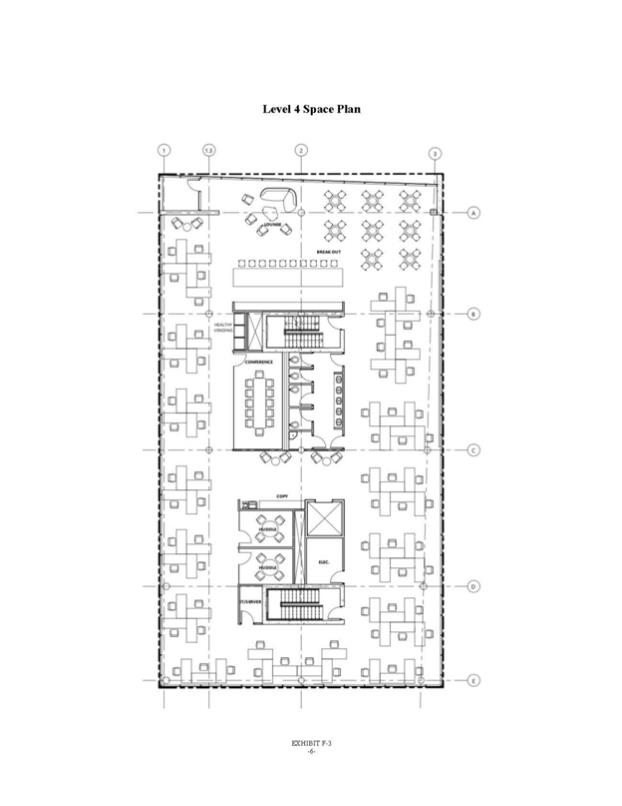

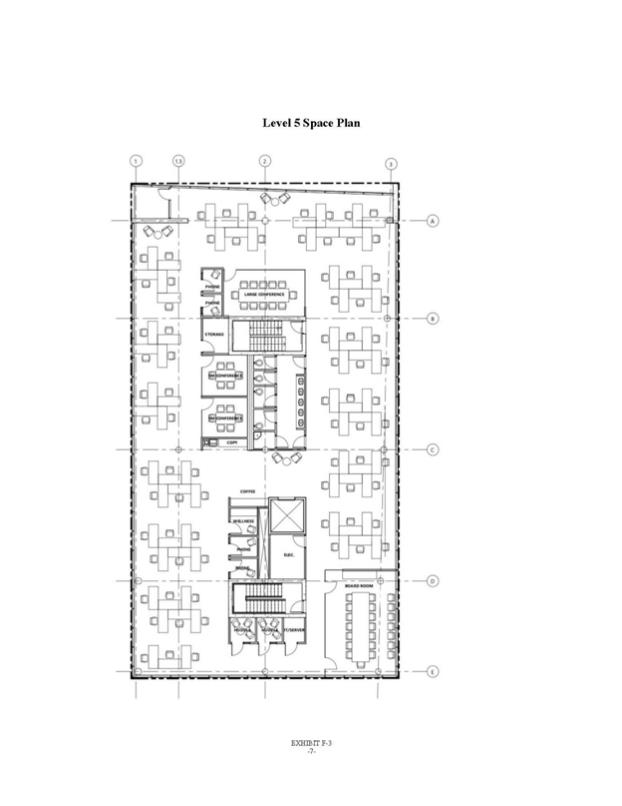

| (e) | Premises: | The “Premises” shall consist of the entire 2nd, 3rd, 4th, and 5th floors, consisting of approximately 31,700 RSF, as depicted on EXHIBIT A, attached hereto. The Premises are subject to re-measurement pursuant to Section 2.7(c) below. | ||||||

| (f) | Use: | General administrative non-governmental office use consistent with that of a first-class office building, including, without limitation, the conduct of periodic training sessions and other uses typical of other insurance companies. | ||||||

| (g) | Term: | The ninety-six (96) month period commencing on the Commencement Date and expiring on the Expiration Date. | ||||||

| (h) | Delivery Date: | The date that Landlord delivers possession of the Premises to Tenant in the Delivery Condition (defined in Section 2.3). The estimated Delivery Date is September 1, 2021. | ||||||

| (i) | Commencement Date: | The earlier to occur of (i) the occupancy of any portion of the Premises for the purpose conducting business therein for the Use or (ii) two (2) weeks after Landlord’s Work (as hereinafter defined) is substantially complete. | ||||||

| (j) | Expiration Date: | The day immediately prior to the ninety-sixth (96th) month anniversary of the Commencement Date, provided that if the Commencement Date occurs on a date other than the first day of a calendar month, then the Expiration Date will be the last day of the calendar month in which the ninety-sixth (96th) month anniversary of the Commencement Date occurs. | ||||||

| (k) | Lease Year: | Each Lease Year shall be successive twelve (12) month periods, with the first Lease Year beginning on the Commencement Date and expiring on the last day of the calendar month following the expiration of twelve months. | ||||||

| (l) | Base Rent: | The following amounts payable in accordance with Article 4: | ||||||

| Months |

Annual Base Rent Rate per RSF |

Annual Base Rent | Monthly Base Rent | |||||||||

| 01 – 04 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

| 05 – 12 | $ | 42.00 | $ | 1,331,400.00 | $ | 110,950.00 | ||||||

| 13 – 24 | $ | 43.26 | $ | 1,371,342.00 | $ | 114,278.50 | ||||||

| 25 – 36 | $ | 44.56 | $ | 1,412,482.26 | $ | 117,706.86 | ||||||

| 37 – 48 | $ | 45.90 | $ | 1,454,928.56 | $ | 121,244.05 | ||||||

| 49 – 60 | $ | 47.28 | $ | 1,498,680.90 | $ | 124,890.08 | ||||||

| 61 –72 | $ | 48.69 | $ | 1,543,412.77 | $ | 128,617.73 | ||||||

| 73 – 84 | $ | 50.15 | $ | 1,589,777.19 | $ | 132,481.43 | ||||||

| 85 – 96 | $ | 51.65 | $ | 1,637,447.65 | $ | 136,453.97 | ||||||

| The above reference to “Months” shall refer to full calendar months. If the Commencement Date occurs on a date other than the first day of a calendar month, then Base Rent for the initial partial Month (which shall be prorated for such partial month based on the annual rate of $42.00 per RSF) shall be due and payable on the first day of Month 5. | ||||||||

| (m) | Tenant’s Share: | 87.96%. | ||||||

| (n) | Prepaid Rent: | $155,858.33. The Prepaid Rent will be due within two (2) business days after the Effective Date and will be applied against the first installment of Rent coming due under this Lease. | ||||||

-2-

| (o) | Security Deposit: A security deposit in cash to be held or applied in accordance with Section 16.1 in the total amounts listed below: | |||||

| • Within two (2) business days after the Effective Date: $467,575 | ||||||

| • Within two (2) business days after Landlord gives Tenant notice of the Top Out Date, together with an invoice for the additional security deposit and Landlord’s wiring instructions: $701,362.50 | ||||||

| • Within two (2) business days after Landlord gives Tenant notice of Substantial Completion, together with an invoice for the additional security deposit and Landlord’s wiring instructions: $935,150 | ||||||

| (p) | Notice Address: For each party, the following address(es): | |||||

| To Landlord |

To Tenant | |||||

| Elevate Sabine, LLC | Hippo Analytics Inc. | |||||

| 901 W. 9th Street | P.O. Box 909 | |||||

| Suite 110 | Austin, Texas 78707 | |||||

| Austin, Texas 78703 | Attn: CEO | |||||

| Attn: Chris Skyles | ||||||

| with a copy of notices of default to: | with a copy of notices of default to: | |||||

| Rigby Slack Lawrence Berger + | Hippo Analytics Inc. | |||||

| Comerford, PLLC | P.O. Box 909 | |||||

| 3500 Jefferson St., Suite 330 | Austin, Texas 78707 | |||||

| Austin, TX 78731 | Attn: General Counsel | |||||

| Attn: Cathleen C. Slack | ||||||

| (q) | Billing Address: For each party, the following address: | |||||

| For Landlord |

For Tenant | |||||

| Elevate Sabine, LLC | Hippo Analytics Inc. | |||||

| 901 W. 9th Street | P.O. Box 909 | |||||

| Suite 110 | Austin, Texas 78707 | |||||

| Austin, Texas 78703 | Attn: CFO | |||||

| Attn: Chris Skyles | ||||||

-3-

| (r) | Brokers: | Elevate Growth Partners (“Landlord’s Broker”), whose right to a commission to be paid by Landlord is subject to a separate written agreement with Landlord. | ||||||

| (s) | Parking Allotment: | 100 unreserved parking spaces in the parking garage located at 601 E. 5th St., Austin, Texas 78701, subject to the terms of EXHIBIT D attached hereto. | ||||||

| 2. | PROJECT |

2.1 Project. The Land and all improvements thereon, including the Building and Premises (as defined in Article 1 and below), and the Common Areas (as defined below) are collectively referred to as the “Project.”

2.2 Land. “Land” means the real property described on EXHIBIT B attached hereto Landlord represents and warrants to Tenant that the Land is owned in fee by Landlord. The Land is subject to expansion or reduction after the Execution Date.

2.3 Landlord’s Work; Delivery Condition.

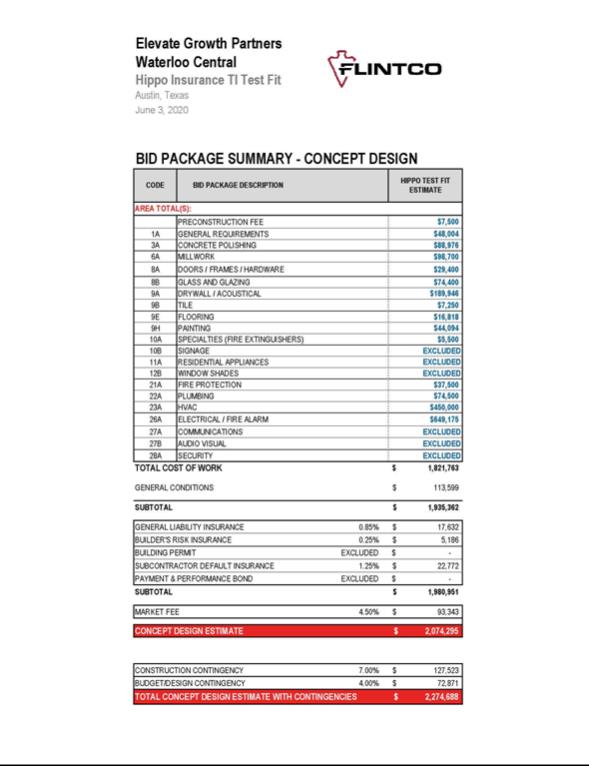

(a) Landlord’s Work. Subject to and in accordance with the requirements of this Lease, Landlord shall construct the Building shell improvements described on EXHIBIT F-1 attached hereto (the “Shell Improvements”) and all tenant improvements described on EXHIBIT F-2 attached hereto (the “Tenant Improvements”). The Shell Improvements, the Tenant Improvements and all work conducted by Landlord in connection therewith will be referred to herein collectively as the “Landlord’s Work.” Landlord’s Work will be deemed “substantially complete” when Landlord has obtained (i) a certificate from Landlord’s architect stating that the Landlord’s Work is substantially complete and (ii) a certificate of occupancy, temporary certificate of occupancy, signed-off permit cards, or other similar governmental approval with respect to the Shell Improvements and the Tenant Improvements. The “Top Out” of the Building will be deemed complete when Landlord’s Contractor has completed the structural concrete frame for the entire Building, and the corresponding date upon which Top Out is accomplished is referred to herein as the “Top Out Date”.

(b) Delivery Condition. The “Delivery Condition” means that Landlord’s Work is substantially complete.

2.4 Base Building. “Base Building” means the Building Structure and Mechanical Systems, collectively, defined as follows:

(a) Building Structure. “Building Structure” means the foundations, floor/slabs, roofs, exterior walls, exterior glass and mullions, columns, beams, shafts (including elevator shafts), stairs, stairwells, elevators, Building mechanical, electrical and telephone closets, Common Areas, public areas, and any other structural components in the Building. The Building Structure excludes the Leasehold Improvements (and similar improvements to other premises) and the Mechanical Systems.

-4-

(b) Mechanical Systems. “Mechanical Systems” means, without limitation, the mechanical, electronic, physical or informational systems generally serving the Building or Common Areas, including the sprinkler, plumbing, heating, ventilating, air conditioning, lighting, communications, drainage, sewage, waste disposal, vertical transportation, fire/life safety and security systems, if any.

2.5 Amenity Center. During the Term, Tenant, and Tenant’s officers, directors, managers, and/or employees (collectively, the “Tenant Parties”) will have a non-exclusive right to use the subgrade amenity space located in the Building (the “Amenity Center”) subject to the terms of this Lease and the continued operation of the Amenity Center (it being understood that Landlord shall be under no obligation to retain the Amenity Center as an amenity at the Project). Tenant acknowledges and agrees that the Tenant Parties’ use of the Amenity Center is voluntary and, in consideration of the use of the Amenity Center, shall be undertaken by the Tenant Parties at their sole risk. The cost to operate the Amenity Center (including fair market rent for the Amenity Center as reasonably determined by Landlord) will be included in Expenses; provided, however, that if the RSF within the Amenity Center is included in the service and amenity area used to determine the RSF within the Premises, then rent for the Amenity Center will be excluded from Expenses (but other operational costs will continue to be included in Expenses). NEITHER LANDLORD NOR LANDLORD’S PARTNERS, OFFICERS, DIRECTORS, MANAGERS, SERVANTS, AGENTS AND/OR EMPLOYEES (COLLECTIVELY, THE “RELEASED PARTIES”) SHALL BE LIABLE FOR ANY CLAIMS (AS DEFINED IN SECTION 11.1 BELOW) ARISING OUT OF OR CONNECTED WITH THE TENANT PARTIES’ USE OF THE AMENITY CENTER AND ITS FACILITIES AND SERVICES. TENANT DOES HEREBY EXPRESSLY FOREVER WAIVE, RELEASE AND DISCHARGE THE RELEASED PARTIES FROM ANY AND ALL LIABILITY ARISING FROM ALL SUCH CLAIMS, INCLUDING LIABILITY FROM ALL ACTS OF ACTIVE OR PASSIVE NEGLIGENCE, ON THE PART OF THE RELEASED PARTIES, EXCEPT TO THE EXTENT SUCH CLAIM ARISES FROM THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY OF THE RELEASED PARTIES. THIS SECTION 2.5 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE.

2.6 Common Areas. Tenant will have a non-exclusive right to use the Common Areas subject to the terms of this Lease. “Common Areas” means those interior and exterior common and public areas on the Land and in the Building (and appurtenant easements) from time-to-time designated by Landlord for the non-exclusive use by Tenant in common with Landlord, other tenants and occupants, and their employees, agents and invitees, including any parking facilities on the Land or otherwise serving the Building that are owned or leased by Landlord.

2.7 Premises. Landlord leases to Tenant the Premises subject to the terms of this Lease. Except as provided elsewhere in this Lease, by taking possession of the Premises Tenant accepts the Premises in its “as is” condition and with all faults, and the Premises is deemed in good order, condition, and repair. Except as set forth below, Landlord does not make and Tenant does not rely upon any representation or warranty of any kind, express or implied, with respect to the condition of the Premises (including habitability or fitness for any particular purpose of the

-5-

Premises). TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, LANDLORD HEREBY DISCLAIMS, AND TENANT WAIVES THE BENEFIT OF, ANY AND ALL IMPLIED WARRANTIES, INCLUDING IMPLIED WARRANTIES OF HABITABILITY AND FITNESS OR SUITABILITY FOR A PARTICULAR PURPOSE, EXCEPT AS OTHERWISE EXPRESSLY STATED HEREIN. The Premises includes the Leasehold Improvements and excludes certain areas, facilities and systems, as follows:

(a) Leasehold Improvements. “Leasehold Improvements” means all non-structural improvements in the Premises or exclusively serving the Premises, and any structural improvements to the Building made to accommodate Tenant’s particular use of the Premises. The Leasehold Improvements may be installed by Landlord or Tenant under this Lease at the cost of either party. The Leasehold Improvements include: (1) interior walls and partitions (including those surrounding structural columns entirely or partly within the Premises); (2) the interior one-half of walls that separate the Premises from adjacent areas designated for leasing; (3) the interior drywall on exterior structural walls, and walls that separate the Premises from the Common Areas; (4) stairways and stairwells connecting parts of the Premises on different floors, except those required for emergency exiting; (5) the frames, casements, doors, windows and openings installed in or on the improvements described in (1-4), or that provide entry/exit to/from the Premises; (6) all hardware, fixtures, cabinetry, railings, paneling, woodwork and finishes in the Premises or that are installed in or on the improvements described in (1-5); (7) if any part of the Premises is on the ground floor, the ground floor exterior windows (including mullions, frames and glass); (8) integrated ceiling systems (including grid, panels and lighting); (9) carpeting and other floor finishes; (10) kitchen, rest room, lavatory or other similar facilities that exclusively serve the Premises (including plumbing fixtures, toilets, sinks and built-in appliances); (11) if any part of the Premises encompasses an entire floor of the Building, the elevator lobby, corridors and restrooms located on such floor; and (12) the sprinkler, plumbing, heating, ventilating, air conditioning, lighting, communications, security, drainage, sewage, waste disposal, vertical transportation, fire/life safety, and other mechanical, electronic, physical or informational systems that exclusively serve the Premises.

(b) Exclusions from the Premises. The Premises does not include: (1) the roof of the Building and any areas above the finished ceiling or integrated ceiling systems, or below the finished floor coverings that are not part of the Leasehold Improvements, (2) janitor’s closets, (3) stairways and stairwells to be used for emergency exiting or as Common Areas, (4) rooms for Mechanical Systems or connection of telecommunications equipment, (5) vertical transportation shafts, (6) vertical or horizontal shafts, risers, chases, flues or ducts, (7) elevator banks, and (8) any easements or rights to natural light, air or view.

(c) Re-measurement. Landlord and Tenant agree that the figures for the RSF within the Building and the Premises as set forth in Section 1.1 are estimates, Landlord will re-measure the Premises or Building using BOMA ANSI Z65.1-2017, Method “B” at any time prior to the date that is thirty (30) days following the Delivery Date. In connection with any remeasurement of the Premises or Building, Landlord will use the load factor for the Building (as reasonably determined by Landlord) to determine the rentable square footage of the Premises and Building. Landlord and Tenant will, within thirty (30) days following completion of the re-measurement, enter into an amendment to this Lease to account for such new measurements.

-6-

2.8 Building Warranty. Landlord represents to Tenant that, as of the Commencement Date, the Shell Improvements and the Tenant Improvements will be free from material defect, except to the extent any defects therein exist as a result of any negligence or willful misconduct of Tenant or Tenant’s agents, employees, contractors, subcontractors, or licensees. However, if Tenant does not deliver written notice to Landlord of any breach of the representation set forth in this Section 2.8 within one (1) year following the Commencement Date, then Tenant will be deemed to have inspected and accepted the same in their present condition, and the correction of any subsequently discovered defects will be the obligation of the applicable party pursuant to the other provisions of this Lease (and the cost thereof will be governed by the other provisions of this Lease). If a breach of the foregoing representation exists, and Tenant timely (i.e., within one (1) year following the Commencement Date) delivers written notice to Landlord setting forth in reasonable detail a description of such breach, Landlord will, as Tenant’s sole and exclusive remedy, rectify the same at Landlord’s expense within a reasonable period of time following Landlord’s receipt of notice of the applicable defect.

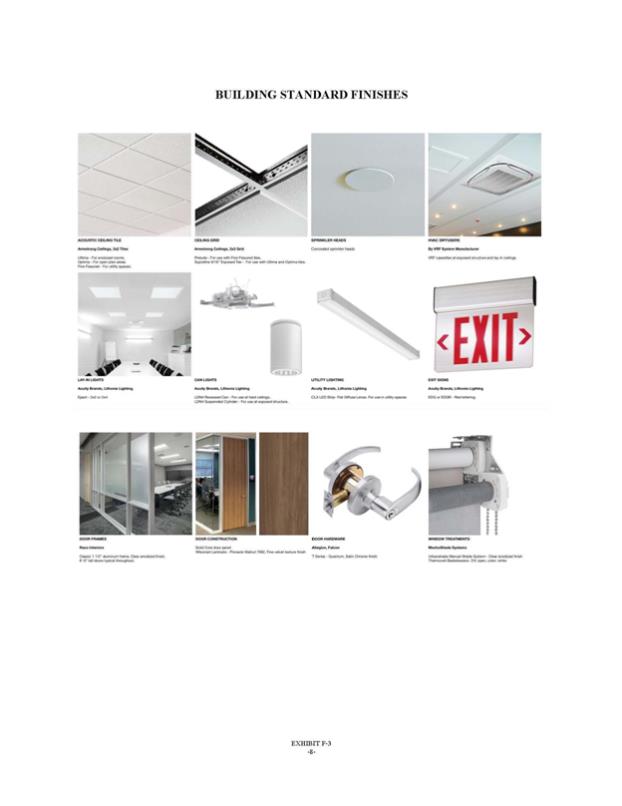

2.9 Building Standard. “Building Standard” means the minimum or exclusive type, brand, quality or quantity of materials Landlord designates for use in the Building prior to execution of this Lease and as further described in EXHIBIT F-3, subject to reasonable modification from time to time thereafter.

2.10 Tenant’s Personal Property. “Tenant’s Personal Property” means those trade fixtures, furnishings, equipment, work product, inventory, stock-in-trade and other tangible personal property of Tenant that are not permanently affixed to the Project in a way that they become a part of the Project and will not, if removed, substantially impair the value of the Leasehold Improvements that Tenant is required to deliver to Landlord at the end of the Term under Section 3.3.

2.11 Agreements Affecting the Project. Landlord represents and warrants that as of the Execution Date and as of the Effective Date, there are no agreements entered into by Landlord or of record affecting the Project that might have any material adverse impact on Tenant’s use of or access to the Premises. Landlord agrees not to enter into any agreement affecting the Project that might have any material adverse impact on Tenant’s use of or access to the Premises without Tenant’s prior written consent.

3. TERM

3.1 Term. “Term” means the period that begins on the Commencement Date and ends on the Expiration Date, subject to renewal, extension or earlier termination as may be further provided in this Lease or otherwise agreed to by Landlord and Tenant in writing. “Month” means a full calendar month of the Term.

-7-

(a) FF&E Period. Tenant may not enter the Premises for any purpose without Landlord’s consent, which shall not be unreasonably withheld, until Landlord tenders the Premises to Tenant. For a two (2) week period following the Delivery Date (the “FF&E Period”), subject to the terms of this Lease and provided that Tenant has delivered to Landlord evidence that the insurance required to be maintained by Tenant pursuant to this Lease (including covering Landlord as a beneficiary under such insurance) is in full force and effect, Tenant shall have access to the Building, Premises and elevators for the installation of fixtures, furniture, office equipment, cabling and other items necessary for Tenant to conduct its business. During the FF&E Period, Tenant shall comply with and be subject to all terms and provisions of this Lease, except those provisions requiring the payment of Base Rent and Additional Rent.

(b) Confirmation of Term. Landlord shall notify Tenant of the Commencement Date using a Notice of Lease Term (“NLT”) in the form attached to this Lease as EXHIBIT E. Tenant shall execute and deliver to Landlord the NLT within ten (10) business days after its receipt, but Tenant’s failure to do so will not reduce Tenant’s obligations or Landlord’s rights under this Lease.

3.2 Holdover. If Tenant keeps possession of the Premises after the end of the Term (a “Holdover”) without Landlord’s prior written consent (which may be withheld in its sole and absolute discretion), then in addition to the remedies available elsewhere under this Lease or by applicable law, Tenant will be a tenant at sufferance and must comply with all of Tenant’s obligations under this Lease, except that (i) during the first month of Holdover, Tenant will pay one hundred twenty-five percent (125%) of the monthly Base Rent and last payable under this Lease and one hundred percent (100%) of the Additional Rent, and (ii) thereafter, Tenant will pay one hundred fifty percent (150%) of the monthly Base Rent last payable under this Lease and one hundred percent (100%) of the Additional Rent; provided, however, that such monthly Base Rent and Additional Rent shall be prorated for any partial month of Holdover. If the Holdover continues after Landlord has provided to Tenant thirty (30) days prior written notice to vacate the Premises, then Tenant shall be liable for, and shall indemnify and defend Landlord from and against, all claims and damages that Landlord suffers as a result of Tenant’s failure to return possession of the Premises to Landlord at the end of the Term, including consequential and indirect damages. Landlord’s deposit of Tenant’s Holdover payment will not constitute Landlord’s consent to a Holdover or create or renew any tenancy.

3.3 Condition on Expiration. By the end of the Term, Tenant will return possession of the Premises to Landlord vacant, free of Tenant’s Personal Property, in broom-clean condition, and with all Leasehold Improvements in good working order and repair (excepting ordinary wear and tear and damage due to casualty not caused by Tenant and not required to be repaired by Tenant or by condemnation), except that Tenant will remove Tenant’s Wiring and those Leasehold Improvements and Alterations (as such terms are defined herein) that Landlord requires to be removed at the end of the Term (with Landlord to make such determination at the time that Landlord approves the plans and specifications for the particular alteration or improvement); provided, however, that Tenant shall have no obligation to remove the Tenant Improvements or any normal and customary office improvements. If Tenant fails to return possession of the Premises to Landlord in this condition, Tenant shall reimburse Landlord for the costs incurred to put the Premises in the condition required under this Section 3.3. Tenant’s Personal Property left behind in the Premises for more than five (5) business days after the end of the Term will be considered abandoned and Landlord may move, store, retain or dispose of these items at Tenant’s cost.

-8-

3.4 Option to Extend Term.

(a) Exercise of Extension Option. Subject to the terms and conditions of this Section 3.4, Landlord hereby grants Tenant one (1) option (the “Extension Option”) to extend the Term as to all, but not less than all, of the Premises, for a period of five (5) years (the “Extension Term”) commencing on the day after the Expiration Date of the initial Term. Tenant shall exercise the Extension Option, if at all, only by written notice (the “Extension Notice”) delivered to Landlord not less than ten (10) months and not more than fifteen (15) months prior to the Expiration Date. If Tenant does not timely exercise an Extension Option, then such Extension Option and any subsequent Extension Option will automatically terminate and be null and void. Tenant’s exercise of the Extension Option shall be irrevocable by Tenant. The terms and conditions of Tenant’s lease of the Premises during the Extension Term shall be the same terms and conditions of the Lease, including Landlord’s obligation to provide parking as provided in the Lease, as in effect immediately prior to the commencement of the Extension Term, except as follows:

(i) The Base Rent for the Extension Term shall be one hundred percent (100%) of the Market Rate. The “Market Rate shall be the prevailing per annum base rent rate per RSF (determined on a “net” lease basis), in renewal transactions for space of comparable size, location and conditions in the Building and other multi-story office buildings in the Central Business District of Austin, Texas constructed after 2004. When determining the aforesaid Market Rate by reference to comparable renewal transactions, the base rents provided for in such comparable transactions shall be adjusted to reflect the differences between the other terms of such comparable transactions and the other terms of the renewal to which the Market Rate is to be applicable. For example, if such comparable transactions provided for free rent, then in determining the aforesaid Market Rate to be applicable to any renewal with respect to which Tenant does not receive any free rent or any other substantially equivalent concession (or a lesser amount of free rent or substantially equivalent concession) the base rents provided for in such comparable transactions shall be equitably adjusted downward;

(ii) Tenant shall be entitled to receive the concessions or allowances included by Landlord in determining the Market Rate (however Landlord will be under no obligation to provide any such concessions or allowances);

(iii) No abatements or allowances applicable to any period prior to the subject Extension Term; or other concessions applicable during any period prior to the Extension Term, if any, shall apply during the Term unless expressly agreed by Landlord;

(iv) The Premises shall be accepted by Tenant for the Extension Term in its “AS IS” condition and “WITH ALL FAULTS” unless expressly agreed otherwise by Landlord; and

(v) There shall be no remaining rights or options to renew or extend the Term after the exercise of the Extension Option.

-9-

(b) Market Rate Notice/Exercise. Within thirty (30) days after Landlord receives Tenant’s Extension Notice, Landlord shall deliver a written notice (“Market Rate Proposal”) to Tenant specifying Landlord’s good faith and reasonable estimate of the Market Rate, including, in Landlord’s sole discretion, any improvement allowances, concessions, parking or other market considerations to lease as provided in Section 3.4(a) above for the Extension Term. Tenant, within fifteen (15) days after Landlord delivers the Market Rate Proposal, shall either (x) give Landlord notice of Tenant’s unconditional acceptance of Landlord’s determination of Market Rate for the Extension Term set forth in the Market Rate Proposal (an “Acceptance Notice”), or (y) give Landlord notice of Tenant’s rejection of Landlord’s determination of Market Rate for the Extension Term set forth in the Market Rate Proposal (a “Rejection Notice”). If Tenant timely delivers an Acceptance Notice, then the Market Rate (including, without limitation, the Base Rent for the Extension Term), will be as set forth in the Market Rate Notice. If Tenant does not timely deliver an Acceptance Notice or a Rejection Notice, Tenant will be deemed to have timely delivered an Acceptance Notice. If Tenant timely delivers a Rejection Notice, then the date Landlord receives such Rejection Notice will be deemed the “Arbitration Commencement Date” and the Market Rate will be determined as follows:

(i) Landlord and Tenant shall negotiate in good faith to try to agree upon the Market Rate for at least twenty (20) days following the Arbitration Commencement Date;

(ii) If Landlord and Tenant cannot agree on the Market Rate, then, within thirty (30) days after the Arbitration Commencement Date, Landlord and Tenant will select a “Qualified Appraiser” (defined below) to determine the Market Rate in accordance with the definition provided above. If Landlord and Tenant cannot agree upon a Qualified Appraiser within said thirty (30) day period, either Landlord or Tenant may elect to have the Qualified Appraiser appointed by the American Arbitration Association or its successor organization.

(iii) Within ten (10) days of when the Qualified Appraiser is appointed, Landlord and Tenant will each submit to the Qualified Appraiser its estimate of the Market Rate applicable to the Extension Term. If Landlord’s and Tenant’s submitted estimates are within five percent (5%) of each other, then the two estimates will be averaged together and the resulting amount will be the Market Rate applicable to the Extension Term. If Landlord’s submitted estimate of the Market Rate is more than five percent (5%) greater than Tenant’s submitted estimate, then the Market Rate for the Extension Term will be determined as follows: the Qualified Appraiser shall, within thirty (30) days of being appointed to serve hereunder, determine which of the Landlord’s or Tenant’s estimates most closely approximates the Market Rate and the estimate so selected shall be deemed to be the Market Rate for all purposes; provided, however, in no event will the Base Rent payable during the Extension Term be less than the Base Rent payable during the first year of the initial Term. The Qualified Appraiser must select either Landlord’s estimate or Tenant’s estimate and may not select an average of the two or any other amount. Landlord and Tenant each hereby covenants and agrees that the Market Rate determined in accordance with the foregoing procedures shall be binding upon each of them.

(iv) For purposes hereof, the term “Qualified Appraiser” shall mean and refer to a licensed real estate broker who: (x) has been actively involved in office leasing transactions over the previous ten (10) years in the market area in which the Premises are located; (y) has no personal stake or interest in the outcome of the appraisal; and (z) has not worked for either Landlord or Tenant in the previous five (5) years. The cost of the appraisal hereunder shall be borne equally by Landlord and Tenant.

-10-

(c) Termination. Tenant’s rights under this Section 3.4 shall automatically terminate: (i) in the event that Tenant does not timely and properly exercise the Extension Option; or (ii) if the Lease or Tenant’s right to possession of the Premises is terminated; or (iii) Tenant exercises any right to terminate the Lease or to reduce the Premises, or (iv) an assignment or a sublease of more than 60% of the Premises for substantially all of the then-remaining unelapsed Term occurs (other than a Permitted Transfer). Each of such termination events shall, at Landlord’s option, apply to terminate the Extension Option whether or not Tenant may have theretofore delivered an otherwise valid Extension Notice. Landlord may, at its option, waive any termination event.

(d) Conditions. Tenant’s exercise of the Extension Option is conditioned upon: (i) Tenant not being in Default at the time of exercise of the Extension Option and on the commencement date of the Extension Term, and (ii) Tenant or a Permitted Transferee must be in occupancy of at least seventy percent (70%) of the RSF within the Premises. Additionally, if all of such conditions are not satisfied on the day preceding the commencement of the Extension Term, then, at Landlord’s sole option, the Extension Notice shall be null and void, the Term shall not be extended and the Lease will expire upon the then scheduled Expiration Date.

(e) Prohibition on Assignment. Tenant’s rights under this Section 3.4 are personal to Tenant and may not be assigned or transferred, and any attempted assignment or transfer in violation of this restriction shall be null and void; provided, however, that (i) Tenant’s rights under this Section 3.4 shall inure to the benefit and may be exercised by a successor in interest to Tenant by merger or consolidation provided that such successor is a Permitted Transferee, and (ii) Tenant may assign its rights under this Section 3.4 to any Permitted Transferee to whom Tenant assigns all of its right, title and interest under this Lease. Any other attempted assignment or transfer by Tenant of its rights under the Section 3.4 shall be null and void and of no force and effect.

(f) Lease Amendment. Upon Tenant’s exercise of the Extension Option, and subject to the terms and conditions of this Section 3.4, the Term shall be extended for the Extension Term without the necessity of the execution of any further instrument or document, although if requested by Landlord or Tenant, Landlord and Tenant shall enter into a written agreement modifying and supplementing the Lease in accordance with the provisions hereof; provided, however that Landlord’s failure to prepare or Tenant’s failure to execute such amendment shall not affect the validity of the exercise of the Extension Option or alter Tenant’s or Landlord’s obligations during the Extension Term as determined hereby.

(g) Time of Essence. With respect to all dates for exercising any rights and the performance of any obligations in connection with the exercise or implementation of the Extension Option, time shall be of the essence.

3.5 Delay in Delivery Date. If for any reason other than Tenant Delays (as defined below), the Delivery Date has not occurred by May 1, 2022, then in addition to the postponement of the Commencement Date, Tenant shall be entitled to a credit against Base Rent in the amount of $7,396.67 for each day from and including May 1, 2022, through the day immediately preceding the Delivery Date. A “Tenant Delay” means any delay in the completion of the Landlord’s Work arising from the negligent or willful acts or omissions of Tenant or Tenant’s agents, employees, or contractors, or Tenant’s failure to comply with any deadlines required under this Lease, including but not limited to plan review periods set forth in EXHIBIT F.

-11-

| 4. | RENT |

4.1 Base Rent. Tenant shall prepay one (1) Month’s installment of Base Rent (as a portion of the Prepaid Rent) within two (2) business days after the Effective Date, to be applied against the Rent first due under this Lease. During the Term, Tenant shall pay all Base Rent in advance, in monthly installments, on the first (1st) day of each Month. Base Rent for any partial Month will be prorated. Notwithstanding the foregoing, during the first four (4) full Months of the Term, Base Rent shall be abated. If the Commencement Date occurs on a date other than the first day of a calendar month, then Base Rent for the initial partial Month shall be due and payable on the first day of the fifty (5th) full Month of the Term.

4.2 Additional Rent. Tenant’s obligation to pay Taxes and Expenses under this Section 4.2 is referred to in this Lease as “Additional Rent.” Tenant shall prepay one (1) Month’s installment of Additional Rent (as a portion of the Prepaid Rent) within two (2) business days after the Effective Date, to be applied against Additional Rent first due under this Lease.

(a) Taxes. For each calendar year during the Term, Tenant shall pay, in the manner described below, Tenant’s Share of Taxes paid or payable by Landlord for that calendar year. “Taxes” means the total costs incurred by Landlord for: (1) real and personal property taxes and assessments (including ad valorem and general or special assessments) levied on the Project and Landlord’s personal property used in connection with the Project; (2) margin taxes, and taxes on rents or other income derived from the Project that may be enacted after the Execution Date; (3) capital and place-of-business taxes; (4) taxes, assessments or fees in lieu of the taxes described in (1-3); and (5) the reasonable costs incurred to reduce the taxes described in (1-4). Taxes excludes federal income taxes and taxes paid under Section 4.3, any death taxes, gift, inheritance, and estate taxes, or interest (due to late payment) or penalties on any Taxes.

(b) Expenses. For each calendar year during the Term, Tenant shall pay in the manner described below Tenant’s Share of the Expenses paid or incurred by Landlord for that calendar year. “Expenses” means the total costs reasonably incurred by Landlord to operate, manage, administer, equip, secure, protect, repair, replace, refurbish, clean, maintain, decorate and inspect the Project, including a market fee to manage the Project not to exceed five percent (5%) of the gross revenue of the Project. Expenses that vary with occupancy will be calculated as if the Building is one hundred percent (100%) occupied and operating and all such services are provided to all tenants.

| (1) | Expenses include, without limitation: |

| (A) | Standard Services provided under Section 6.1; |

| (B) | Repairs and maintenance performed under Section 7.2; |

| (C) | Insurance maintained under Section 9.2 (including deductibles paid); |

-12-

| (D) | Wages, salaries and benefits of personnel performing services typically performed by a property manager, to the extent they render services to the Project; |

| (E) | Costs of operating the Building amenities; |

| (F) | Amortization installments of costs required to be capitalized and incurred to: |

| (i) | Comply with laws, but only to the extent such compliance relates to laws which are amended, become effective, or are interpreted or enforced differently after the date of this Lease (“Government Mandated Expenses”); or |

| (ii) | Reduce other Expenses or the rate of increase in other Expenses (“Cost-Saving Expenses”). |

| (G) | A management fee as specified above in this Section 4.2(b). |

| (2) | Expenses exclude: |

| (A) | Taxes; |

| (B) | Mortgage payments (principal and interest), ground lease rent, and costs of financing or refinancing the Building; |

| (C) | Commissions, advertising costs, attorney’s fees and costs of improvements in connection with leasing space in the Building; |

| (D) | Costs reimbursed by insurance proceeds, warranties or guarantees, or by tenants of the Building (other than as Additional Rent or similar pass through provision in such other tenants’ leases) or any other third party; |

| (E) | Depreciation; |

| (F) | Except for the costs identified in Section 4.2(b)(1)(F), costs required to be capitalized according to sound real estate accounting and management principles, consistently applied; |

| (G) | Collection costs and legal fees paid in disputes with tenants; |

| (H) | Costs to maintain and operate the entity that is Landlord (as opposed to operation and maintenance of the Project); |

| (I) | Costs of performing additional services to or for tenants to any extent that such services exceed those provided by Landlord to Tenant without charge hereunder; |

| (J) | Amounts payable by Landlord for damages or which constitute a fine, interest, or penalty, including interest or penalties for any late payments of operating costs; |

| (K) | Costs representing an amount paid for services or materials to an affiliate of Landlord to any extent such amount exceeds the amount that would be paid for such services or materials at the then existing market rates to a person or entity that is not an affiliate of Landlord; |

| (L) | Bad debt loss, rent loss, or reserves for bad debts or rent loss; |

-13-

| (M) | Governmental charges, impositions, penalties or any other costs incurred by Landlord in order to clean-up, remediate, remove or abate any Hazardous Materials if such Hazardous Materials were installed or deposited in or on the Project in violation of then applicable law by Landlord or any third party (other than Tenant, its employees or agents) at any time or exist at the Building prior to the Delivery Date; and |

| (N) | Costs of work necessary to correct conditions not in compliance with any applicable laws as of the Delivery Date (taking into account any grandfathered code exception and based on then current interpretations of applicable laws). |

(c) Cost Pools. Landlord shall have the right, from time to time, to equitably allocate some or all of the Expenses or Taxes for the Project among different portions or occupants of the Project (the “Cost Pools”), in Landlord’s reasonable discretion. Such Cost Pools may include, but shall not be limited to, the office space tenants and retail space tenants of the Building, if applicable. The Expenses and Taxes within each such Cost Pool shall be allocated and charged (without duplication) to the tenants within such Cost Pool in an equitable manner.

(d) Amortization and Accounting Principles.

| (1) | Each item of Government Mandated Expenses will be fully amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over the number of years, not to exceed ten (10), that Landlord reasonably projects the item of Expenses will be productive for its intended use, without replacement, but properly repaired and maintained. |

| (2) | Each item of Cost-Saving Expenses will be fully amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over the number of years that Landlord reasonably estimates for the present value of the projected savings in Expenses (discounted at the Amortization Rate) to equal the cost. |

| (3) | Any item of Expenses of significant cost that is not required to be capitalized but is unexpected or does not typically recur may, in Landlord’s discretion, be amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over a number of years determined by Landlord. |

| (4) | “Amortization Rate” means the prime rate of Citibank, N.A. (or a comparable financial institution selected by Landlord), plus three percent (3%). |

| (5) | Landlord will otherwise use sound real estate accounting and management principles, consistently applied, to determine Additional Rent. |

-14-

(e) Estimates and Payments. Each calendar year, Landlord will reasonably estimate and advise Tenant in writing of Additional Rent that may be payable with respect to such calendar year. Tenant will pay the estimated Additional Rent in advance, in monthly installments, on the first day of each month, until the estimate is revised by Landlord. Landlord may reasonably revise its estimate during a calendar year and the monthly installments after the revision will be paid based on the revised estimate. The aggregate estimates of Additional Rent paid by Tenant in a calendar year is the “Estimated Additional Rent.” The Estimated Additional Rent for the 2021 calendar year is $17.00 per RSF. Without limiting Landlord’s other rights hereunder and at law, Additional Rent not paid within ten (10) days of when due shall be subject to the Late Charge set forth in Section 4.5 below.

(f) Settlement. As soon as practical after the end of each calendar year that Additional Rent is payable, Landlord will give Tenant a statement of the actual Additional Rent for the calendar year (“Statement”). The statement of the actual Additional Rent is conclusive, binds Tenant, and Tenant waives all rights to contest the statement, except for items of Additional Rent to which Tenant objects by giving written notice to Landlord (“Objection Notice”) within one hundred eighty (180) days after receipt of Landlord’s statement; however, Tenant’s objection will not relieve Tenant from its obligation to pay Additional Rent pending resolution of any objection. If the actual Additional Rent exceeds the Estimated Additional Rent for the calendar year, Tenant shall pay the underpayment to Landlord in a lump sum as Rent within thirty (30) days after receipt of Landlord’s statement of Additional Rent. If the Estimated Additional Rent exceeds the actual Additional Rent for the calendar year, then Landlord shall credit the overpayment against Rent next due or if the Lease has expired Landlord shall reimburse same to Tenant within thirty (30) days of delivery of such statement of Additional Rent.

(g) Tenant’s Audit Right. Provided that no Default (as defined below) then exists, if Tenant timely delivers an Objection Notice to Landlord, Tenant will have the right, at Tenant’s sole cost and expense, except as otherwise set forth below, to cause a Qualified Person (as defined below) to review supporting data for any portion of the Statement of annual Expenses delivered by Landlord in accordance with the procedure set forth below; however in no event may Tenant review or audit income tax records of Landlord or similar financial records related to Landlord as a business entity.

| (i) | As part of the Objection Notice, Tenant shall deliver a written notice to Landlord specifying the portions of the Statement that are claimed to be incorrect. In no event shall Tenant be entitled to withhold, deduct, or offset any monetary obligation of Tenant to Landlord under this Lease (including without limitation, Tenant’s obligation to make all payments of rent and all payments of Tenant’s Expenses) pending the completion of and regardless of the results of any review of records under this Section. The right of Tenant under this Section 4.2(g) may only be exercised once for any Statement, and any audit of Landlord’s records must be completed within one hundred twenty (120) days after when Tenant delivers the Objection Notice, subject to extension for Force Majeure. Landlord will reasonably cooperate with Tenant in connection with any audit. If Tenant fails to timely deliver an Objection Notice or to meet any of the other above conditions, the right of Tenant under this Section 4.2(g) for a particular Statement shall be deemed waived. |

-15-

| (ii) | Landlord will maintain its records for the Project at a location in Austin, Texas (or Landlord will make such records available in Austin, Texas). Except as otherwise set forth herein, Tenant agrees that any review of records under this Section 4.2(g) shall be at the sole expense of Tenant and shall be conducted by a Qualified Person. Tenant acknowledges and agrees that any records reviewed under this Section 4.2(g) constitute confidential information of Landlord, which shall not be disclosed to anyone other than the Qualified Person performing the review, the principals of Tenant who receive the results of the review, Tenant’s employees, or in connection with any legal action between Tenant and Landlord or in connection with which Tenant is compelled to make such disclosure by a court of competent jurisdiction. |

| (iii) | Any errors disclosed by the review shall be promptly corrected by Landlord, provided, however, that if Landlord disagrees with any such claimed errors, Landlord shall have the right to cause another review to be made by a Qualified Person, at Landlord’s sole cost. In the event of a disagreement between the two (2) reviews, the two (2) Qualified Persons who conducted Landlord’s and Tenant’s reviews shall jointly designate a third (3rd) Qualified Person, the cost of which shall be split evenly between Landlord and Tenant (except as otherwise indicated in this Lease), to conduct a review of Landlord’s records. The review of such third (3rd) Qualified Person shall be deemed correct and binding upon the parties. In the event that the final results of such review of Landlord’s records reveal that Tenant has overpaid obligations for the preceding period, the amount of such overpayment shall be credited against Tenant’s subsequent installment obligations to pay the estimated Expenses. If Tenant has overpaid by more than five percent (5%), Landlord shall pay the reasonable out-of-pocket cost of the review of Landlord’s records by Tenant’s Qualified Person and the reasonable out-of-pocket cost of the review of Landlord’s records by the third (3rd) Qualified Person. If the third (3rd) Qualified Person determines that Landlord did not overstate Expenses, then Tenant shall pay the reasonable out-of-pocket cost of the review of Landlord’s records by Landlord’s Qualified Person and the reasonable out-of-pocket cost of the review of Landlord’s records by the third (3rd) Qualified Person. If this Lease has expired, Landlord shall return the amount of such overpayment to Tenant within thirty (30) days after such reviews have been made. In the event that such results show that Tenant has underpaid its obligations for a preceding period, the amount of such underpayment shall be paid by Tenant to Landlord within thirty (30) days after such review is made. A “Qualified Person” means an accountant or other person experienced in accounting for income and expenses of office projects engaged solely on terms which do not entail any compensation based or measured in any way upon any savings in rent or reduction in Expenses achieved through the inspection process. |

-16-

4.3 Other Taxes. Upon demand, Tenant will reimburse Landlord for taxes paid by Landlord on (a) Tenant’s Personal Property, (b) Rent, (c) Tenant’s occupancy of the Premises, or (d) this Lease. If Tenant cannot lawfully reimburse Landlord for these taxes, then to the extent not prohibited by applicable law, the Base Rent will be increased to yield to Landlord the same amount after these taxes were imposed as Landlord would have received before these taxes were imposed.

4.4 Terms of Payment. “Rent” means all amounts payable by Tenant under this Lease and the Exhibits, including without limitation Base Rent, Additional Rent, and charges for any Additional Services (as defined in Section 6.2). If a time for payment of an item of Rent is not specified in this Lease, then Tenant will pay such item of Rent within thirty (30) days after receipt of Landlord’s statement or invoice. Unless otherwise provided in this Lease, Tenant shall pay Rent without notice, demand, deduction, abatement or setoff, in lawful U.S. currency, at Landlord’s Billing Address. Neither Landlord’s failure to send an invoice nor Tenant’s failure to receive an invoice for Base Rent (and installments of Estimated Additional Rent) will relieve Tenant of its obligation to timely pay Base Rent (and installments of Estimated Additional Rent). Each partial payment by Tenant shall be deemed a payment on account; and, no endorsement or statement on any check or any accompanying letter shall constitute an accord and satisfaction, or affect Landlord’s right to collect the full amount due. No payment by Tenant to Landlord will be deemed to extend the Term or render any notice, pending suit or judgment ineffective. By notice to the other, each party may change its Billing Address.

4.5 Late Payment. If Landlord does not receive any item of Rent within five (5) days of when due, including without limitation Base Rent, Additional Rent, and charges for any Additional Services, then Tenant shall pay Landlord a “Late Charge” of five percent (5%) of the overdue amount. Notwithstanding the foregoing, the first occurrence of any delinquent payment by Tenant under this Lease in any twelve (12) month period shall give rise to a late charge only if Tenant fails to cure such delinquency within five (5) business days after written notice from Landlord thereof. Tenant agrees that the Late Charge is not a penalty, and will compensate Landlord for costs not contemplated under this Lease that are impracticable or extremely difficult to fix. Landlord’s acceptance of a Late Charge does not waive any Tenant default arising from such late payment.

4.6 Waiver of Tenant Rights and Benefits Under Section 93.012, Texas Property Code. Landlord and Tenant are knowledgeable and experienced in commercial leasing transactions and agree that the provisions of this Lease for determining all charges, amounts, and Additional Rent payable by Tenant (including, without limitation, payments under this Section 4.6), are commercially reasonable and valid even though such methods may not state a precise mathematical formula for determining such charges. Accordingly, Tenant voluntarily and knowingly waives all rights and benefits of a tenant under Section 93.012, Texas Property Code, as such section now exists or as may be hereafter amended or succeeded. Nothing contained in this waiver however is intended to limit or impair, except as otherwise expressly set forth in this Lease to the contrary, any other remedy available to Tenant under the Lease or at law or in equity (other than Section 93.012, Texas Property Code). In addition, nothing in this Section 4.6 shall constitute a waiver of Tenant’s right to dispute and/or initiate a claim disputing Landlord’s methods of calculating or determining Expenses and/or Landlord’s calculation or determination of Additional Rent.

-17-

| 5. | USE & OCCUPANCY |

5.1 Use. Tenant shall use and occupy the Premises only for the Use. Landlord does not represent or warrant that the Project is suitable for the conduct of Tenant’s particular business. Landlord advises Tenant that any modifications to the Base Building or other alterations or equipment that may be necessary (as determined by Landlord) to accommodate a density level of more than one person per every 250 rentable square feet (the “Density Standard”) in any portion of the Premises will be Tenant’s responsibility (e.g., increased HVAC and electrical loads), whenever occurring throughout the initial Term or Extension Term, as applicable.

5.2 Compliance with Laws and Directives.

(a) Tenant’s Compliance. Subject to the remaining terms of this Lease, Tenant shall comply at Tenant’s expense with all directives of Landlord’s insurers or laws concerning:

| (1) | The Leasehold Improvements (except that Landlord shall be responsible for making any required structural changes or changes to the Building’s life safety system unless such required changes arise from Tenant’s occupancy of the Premises in excess of the Density Standard) and Alterations, |

| (2) | Tenant’s use or occupancy of the Premises, |

| (3) | Tenant’s employer/employee obligations, |

| (4) | A condition created by Tenant, |

| (5) | Tenant’s or its invitees’ failure to comply with this Lease, |

| (6) | The negligence of Tenant, its agents, contractors, employees, servants, invitees, vendors, licensees or Tenant’s Affiliates, or |

| (7) | Any chemical wastes, contaminants, pollutants or substances that are hazardous, toxic, infectious, flammable or dangerous, or regulated by any local, state or federal statute, rule, regulation or ordinance for the protection of health or the environment (“Hazardous Materials”) that are introduced to the Project, handled or disposed by Tenant or its Affiliates, or any of their contractors. |

(b) Landlord’s Compliance. Subject to the remaining terms of this Lease, Landlord shall comply at Landlord’s cost with all directives of Landlord’s insurers or laws concerning the Project other than those that are Tenant’s obligation under Section 5.2(a). The costs of compliance under this Section 5.2(b) will be included in Expenses to the extent allowed under Section 4.2.

-18-

5.3 Occupancy. Tenant shall not interfere with Building services or other tenants’ rights to quietly enjoy their respective premises or the Common Areas. Tenant shall not make or continue any nuisance, including any objectionable odor, noise, fire hazard, vibration, or wireless or electromagnetic transmission. Tenant will not maintain any Leasehold Improvements or use the Premises in a way that increases the cost of insurance required under Section 9.2, or requires insurance in addition to the coverage required under Section 9.2.

5.4 Prohibited Persons and Transactions. Tenant represents and warrants to Landlord that (a) Tenant is currently in compliance with and shall at all times during the Term (including any extension thereof) remain in compliance with the regulations of the Office of Foreign Asset Control (the “OFAC”) of the Department of the Treasury (including those named on the OFAC’s Specially Designated and Blocked Persons List) and any statute, executive order (including the September 24, 2001, Executive Order No. 13224 Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit or Support Terrorism (the “Executive Order”)), or other governmental action relating thereto; and (b) Tenant is not, and will not be, a person with whom Landlord is restricted from doing business under the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA Patriot Act), H.R. 3152, Public Law 107-56 and the Executive Order and regulations promulgated thereunder and including persons and entities named on the OFAC Specially Designated Nations and Blocked Persons List.

5.5 Green Building Requirements. Tenant shall faithfully observe and comply with all of the green building requirements set forth in EXHIBIT G to this Lease.

| 6. | SERVICES & UTILITIES |

6.1 Standard Services.

(a) Standard Services Defined. “Standard Services” means:

| (1) | Heating, ventilation and air-conditioning (“HVAC”) for the interior Common Areas and Premises in an amount determined by Tenant, with Tenant having the right and ability to control such HVAC services upon demand, subject to reimbursable costs addressed Section 6.2(a). |

| (2) | Water from the public utility for use in Common Area rest rooms and in the Premises; |

| (3) | Janitorial services to the Premises and interior Common Areas five (5) days a week, except Holidays, to the extent reasonably determined by Landlord; as used herein, the term “Holidays” shall mean New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day, and other legal holidays commonly observed in similar class office buildings in the locale of the Building; |

| (4) | Access to the Premises and the Amenity Center (by at least one (1) passenger elevator if not on the ground floor), subject to Building rules and regulations, Landlord’s security procedures, and events of emergency, fire or other casualties; |

-19-

| (5) | Building standard bulbs are provided to Tenant (specialty bulbs will be billed to Tenant as set forth in Section 6.2 below); |

| (6) | Labor to replace fluorescent tubes and ballasts or LED bulbs, tubes and ballasts in Building Standard light fixtures in the Premises; and |

| (7) | Electricity from Landlord’s selected provider(s) for lighting in the Common Areas and to the Premises in amounts reasonably determined by Landlord for lighting and the operation of machines and equipment typically used in connection with general office use (e.g., copiers). |

(b) Standard Services Provided. During the Term, Landlord shall provide the Standard Services to Tenant. The cost of the Standard Services shall be included in Expenses. Landlord is not responsible for any inability to provide Standard Services due to either: the concentration of personnel or equipment in the Premises; or Tenant’s use of equipment in the Premises that is not customary office equipment, has special cooling requirements, or generates heat.

6.2 Additional Services. “Additional Services” means utilities or services in excess of the Standard Services set forth in Section 6.1. Tenant shall not use any Additional Services without Landlord’s prior written consent. If Landlord so consents, any such Additional Services shall be subject to the terms and conditions of this Section 6.2. Tenant agrees to pay for any Additional Services within thirty (30) days after receipt of an invoice or statement from Landlord. If Tenant fails to timely pay for any Additional Services, in addition to Landlord’s other remedies under the Lease including application of the Late Charge set forth in Section 4.5, Landlord may discontinue the Additional Services.

(a) HVAC. Tenant shall have the right to control the delivery of HVAC to the Premises at any time as Tenant elects. The HVAC system will be monitored by Landlord, and if Tenant has HVAC delivered to the Premises in excess of 80 hours per week (the “HVAC Threshold”), Tenant shall pay to Landlord a fee of $20.00 per hour in excess of the HVAC Threshold. Landlord shall invoice Tenant quarterly for such excess usage.

(b) Lighting. Landlord will furnish non-Building Standard lamps, bulbs, ballasts and starters that are part of the Leasehold Improvements for purchase by Tenant at Landlord’s cost. Landlord will install non-Building Standard lighting items at Landlord’s actual cost.

(c) Other Utilities and Services. Tenant will pay as Rent the actual cost of utilities or services (other than lighting addressed in Section 6.2(b)) either used by Tenant or provided at Tenant’s request in excess of that provided as part of the Standard Services. Tenant’s excess consumption may be estimated by Landlord unless either Landlord requires or Tenant elects to install Building Standard meters to measure Tenant’s consumption.

-20-

(d) Additional Systems and Metering. Landlord may require Tenant, at Tenant’s expense, to upgrade or modify existing Mechanical Systems serving the Premises or the Leasehold Improvements to the extent necessary to meet Tenant’s excess requirements (including installation of Building Standard meters to measure the same).

(e) Scheduled Rates. Landlord reserves the right, in its reasonable discretion, upon prior notice to Tenant, to periodically increase or otherwise adjust the rates charged for Additional Services to reflect an increase or other adjustment in the rates paid by Landlord to the applicable third party provider(s).

6.3 Alternate Electrical Billing. Landlord may elect at any time during the Term, and continuing for the remainder of the Term, to separately meter Tenant’s total consumption of electricity in the Premises, including lighting and convenience outlets. If Landlord so elects, then Landlord shall notify Tenant of such election and in lieu of including consumption of electricity of tenanted premises in Expenses, Tenant shall pay to Landlord as Rent the actual cost of Tenant’s electricity consumption.

6.4 Telecommunications Services. Tenant will contract directly with third party providers and will be solely responsible for paying for all telephone, data transmission, video and other telecommunication services (“Telecommunication Services”) subject to the following:

(a) Providers. Each Telecommunications Services provider that does not already provide service to the Building shall be subject to Landlord’s reasonable approval. Without liability to Tenant, the license of any Telecommunications Services provider servicing the Building may be terminated by Landlord under the terms of the license, or not renewed upon the expiration of the license. Landlord hereby approves Comcast as a Telecommunications Services provider.

(b) Intentionally Omitted

(c) Tenant Sole Beneficiary. This Section 6.4 is solely for Tenant’s benefit, and no one else shall be considered a third party beneficiary of these provisions.

(d) Removal of Equipment. Any and all telecommunications equipment and other facilities for telecommunications transmission (including, without limitation, all wires, cables, fibers, equipment, and connections for Tenant’s Telecommunications Services (“Tenant’s Wiring”)) and any special equipment installed in the Premises or elsewhere in the Project by or on behalf of Tenant shall be removed prior to the expiration or earlier termination of the Term at Landlord’s sole and absolute discretion and by Tenant at its sole cost or, at Landlord’s election, by Landlord at Tenant’s sole cost, with the cost thereof to be paid as Additional Rent. Landlord shall have the right, however, upon written notice to Tenant given no later than thirty (30) days prior to the expiration or earlier termination of the Term, to require Tenant to abandon and leave in place, without additional payment to Tenant or credit against Rent, any or all of Tenant’s Wiring and related infrastructure, or select components thereof, whether located in the Premises or elsewhere in the Project.

-21-

6.5 Interruption of Services.

(a) Without breaching this Lease, Landlord may:

| (1) | Comply with laws or voluntary government or industry guidelines concerning the services to be provided by Landlord or obtained by Tenant under this Article 6; |

| (2) | Interrupt, limit or discontinue the services to be provided by Landlord or obtained by Tenant under this Article 6 as may be reasonably required during an emergency or Force Majeure event; or |

| (3) | If Landlord gives Tenant reasonable prior notice and uses commercially reasonable efforts not to disturb Tenant’s use of the Premises for the Use, interrupt, limit or discontinue the services to be provided by Landlord or obtained by Tenant under this Article 6 to repair and maintain the Project under Section 7.2. |

(b) Abatement for Interruption of Standard Services. If all or a part of the Premises is untenantable because of an interruption in a utility service that prevents Landlord from providing any of the Standard Services for more than seven (7) consecutive days, then from the eighth (8th) consecutive day of interruption until the Standard Services are restored, Landlord shall abate Tenant’s Base Rent and Additional Rent, subject to the following:

| (1) | Landlord will only abate Base Rent and Additional Rent to the extent the Premises are untenantable and not actually used by Tenant to conduct business; and |

| (2) | either (i) the interruption of Standard Services is within Landlord’s reasonable control to remedy, or (ii) if the interruption of Standard Services is outside Landlord’s reasonable control, Base Rent and Additional Rent will be abated only to the extent the abated Base Rent and Additional Rent is (or would be) covered by insurance Landlord is required to maintain under Section 9.2. |

(c) No Other Liability. Except as provided under Section 6.5(b), Landlord will not be liable in any manner for any interruption in services to be provided by Landlord or obtained by Tenant under this Article 6 (including damage to Tenant’s Personal Property, consequential damages, actual or constructive eviction, or abatement of any other item of Rent).

6.6 Recycling. Tenant covenants and agrees, at its sole cost and expense, to comply with all present and future laws, orders, and regulations of the jurisdiction in which the Building is located and of the federal, municipal, and local governments, departments, commissions, agencies and boards having jurisdiction over the Building to the extent that they or this Lease impose on Tenant duties and responsibilities regarding the collection, sorting, separation, and recycling of trash. Tenant shall pay all costs, expenses, fines, penalties, or damages that may be

-22-

imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this Section 6.6, and, at Tenant’s sole cost and expense, shall indemnify, defend and hold Landlord harmless (including legal fees and expenses) from and against any actions, claims, and suits arising from such noncompliance, using counsel reasonably satisfactory to Landlord, except to the extent caused by the gross negligence or willful misconduct of Landlord or any of its employees or agents.

| 7. | REPAIRS |

7.1 Tenant’s Repairs. Except as provided in Articles 10 and 12 hereof, during the Term Tenant shall, at Tenant’s cost, repair and maintain (and replace, as necessary) the Leasehold Improvements and keep the Premises in good order and condition, excluding the Base Building. Tenant shall be responsible for the costs to repair (and replace, as necessary) any portion of the Project damaged by Tenant or Tenant’s agents, contractors, employees, subtenants or invitees. Tenant’s work under this Section 7.1 (a) is subject to the prior approval and supervision of Landlord, including without limitation, Landlord’s approval of all contractors and subcontractors performing the work, (b) must be performed in compliance with laws and Building rules and regulations, and (c) must be performed in a first-class, lien free and workmanlike manner, using materials not less than Building Standard.

7.2 Landlord’s Repairs. Except as provided in Articles 10 and 12 hereof, during the Term Landlord shall, at Landlord’s cost (but included as Expenses to the extent provided in Section 4.2) repair and maintain (and replace, as necessary) all parts of the Project that are not Tenant’s responsibility to repair and maintain under Section 7.1 (or any other tenant’s responsibility under their respective lease) and keep the Project in good order and condition according to the standards prevailing for comparable office buildings in the area in which the Building is located. Except as provided in Section 7.3, Tenant may not repair or maintain the Project on Landlord’s behalf or offset any Rent for any repair or maintenance of the Project that is undertaken by Tenant. Except as provided in Section 7.3, nothing contained herein grants Tenant the right to perform any maintenance or repair work which is Landlord’s obligation under this Section 7.2.

7.3 Tenant’s Self-Help Right. In the event Landlord fails to commence the repair of the Project as required by Section 7.2, which failure to commence the repair(s) continues at the end of thirty (30) days following receipt by Landlord and any Encumbrance holder (provided Tenant has been provided written notice of the address of such Encumbrance holder) of written notice from Tenant stating with particularity the nature of the required repair (a “Repair Action”) (except (i) in the event of an emergency, in which case no prior notice from Tenant is required, and (ii) if the failure to perform the repair will have a material adverse effect on Tenant’s conduct of its business operations in the Premises (e.g., the failure of the air conditioning system during the summer), in which case only forty-eight (48) hours’ notice shall be required), then, provided Tenant has delivered an additional five (5) business days’ notice to Landlord specifying in 12 point boldface type on the first page of such notice (or it shall not be deemed validly given to Landlord) the following, “YOUR FAILURE TO COMMENCE THE REPAIR ACTION SET FORTH IN THIS NOTICE WITHIN FIVE (5) BUSINESS DAYS SHALL ENTITLE THE UNDERSIGNED TO REPAIR SUCH ITEM AT LANDLORD’S EXPENSE WITHOUT FURTHER NOTICE,” and Landlord or such Encumbrance holder has failed to commence the Repair Action within such five (5) business day period, Tenant may proceed with taking such Repair Action (provided, however, that such additional five (5) business day notice shall not be

-23-

required in the event of an emergency situation that poses an imminent and significant risk of injury to persons or material damage to property or if the failure to perform the repair will have a material adverse effect on Tenant’s conduct of its business operations in the Premises). In the event Tenant takes such Repair Action, Tenant shall use commercially reasonable efforts to use those contractors used by Landlord in the construction of the Project (provided they were identified to Tenant in a writing given to Tenant by Landlord prior to the additional five (5) business day notice concerning such Repair Action for the applicable required work) unless such contractors are unwilling or unable to perform, or timely perform, such work, in which event Tenant may utilize the services of any other qualified, licensed and bondable contractor which normally and regularly performs similar work on similar buildings in Austin, Texas. Landlord shall pay to Tenant the out-of-pocket direct cost of such cure within thirty (30) days following Landlord’s (and, if Tenant has been given prior written notice of the address of any Encumbrance holder, such Encumbrance holder’s) receipt of Tenant’s demand therefor, then Tenant may provide to Landlord and such Encumbrance holder a second written demand therefor (“Second Demand”) which contains the following phrase on the first page of the notice in all capital letters and boldface type (or it shall not be deemed validly delivered to Landlord): “YOUR FAILURE TO REIMBURSE TENANT AS REQUIRED HEREIN WITHIN TEN (10) DAYS SHALL ENTITLE THE UNDERSIGNED TO EXERCISE CERTAIN OFFSET RIGHTS AS SET FORTH IN THE LEASE WITHOUT FURTHER NOTICE.” If Landlord fails to pay to Tenant the amount due to Tenant within ten (10) days following Landlord’s receipt of the Second Demand, then Tenant may offset up to twenty-five percent (25%) from the next installment(s) of Base Rent coming due under this Lease until such time as the full amount owed by Landlord to Tenant has been recovered by Tenant. Tenant shall comply with the other terms and provisions of this Lease if Tenant takes the Repair Action, except that Tenant is not required to obtain Landlord’s consent for such repairs.

| 8. | ALTERATIONS |