Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Playtika Holding Corp. | a2021q2ex991-earningsrelea.htm |

| 8-K - 8-K - Playtika Holding Corp. | pltk-20210804.htm |

© 2020 Playtika Ltd. All Rights Reserved. SECOND QUARTER 2021 Earnings Presentation August 4th | 2021

LEGAL DISCLAIMER Forward-Looking Statements This presentation contains forward-looking statements. All statements contained in this presentation other than statements of historical facts, including statements regarding our business strategy, plans, market growth and our objectives for future operations, are forward-looking statements. The words “may,” “will,” “should,” “expect,” “would,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements contained in this presentation include, but are not limited to, , future revenues, expenses, and capital requirements; the implementation of our business model and strategic plans and initiatives including increased focus on in-house game development; our ability to improve on our user metrics and our ability among others. We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and prospects and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions, including business, regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about us. Because forward-looking statements are inherently subject to risks and uncertainties, including our ability to compete in the market; our future relationship with third-party platforms, such as the iOS App Store and the Google Play Store; our ability to successfully launch new games and enhance our existing games that are commercially successful; continued growth in demand for in-app purchases in mobile games; our ability to acquire and integrate new games and content; the ability of our games to generate revenues;; capital expenditures and investments in our infrastructure; our use of working capital in general; retaining existing players, attracting new players and increasing the monetization of our player base; our ability to successfully manage our game economies; maintaining a technology infrastructure that can efficiently and reliably handle increased player usage, fast load times and the deployment of new features and products; attracting and retaining qualified employees and key personnel; maintaining, protecting and enhancing our intellectual property; protecting our players’ information and adequately addressing privacy concerns; our ability to expand into new markets and distribution platforms; and successfully acquiring and integrating companies and assets. Because some of these risks and uncertainties cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward- looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Additional factors that may cause future events and actual results, financial or otherwise, to differ, potentially materially, from those discussed in or implied by the forward-looking statements include the risks and uncertainties discussed in our filings with the Securities and Exchange Commission. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur, and reported results should not be considered as an indication of future performance. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Except as required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. This presentation also contains estimates and other statistical data made by independent parties and by Playtika relating to market size and growth and other data about Playtika’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures of us, including Adjusted EBITDA and Adjusted EBITDA Margin. A "non-GAAP financial measure" is defined as a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. You should not consider these non-GAAP financial measures in isolation, or as a substitute for analysis of results as reported under GAAP. For information regarding the non-GAAP financial measures used by us, and for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, see the Appendix to this presentation. Presentation Title 2

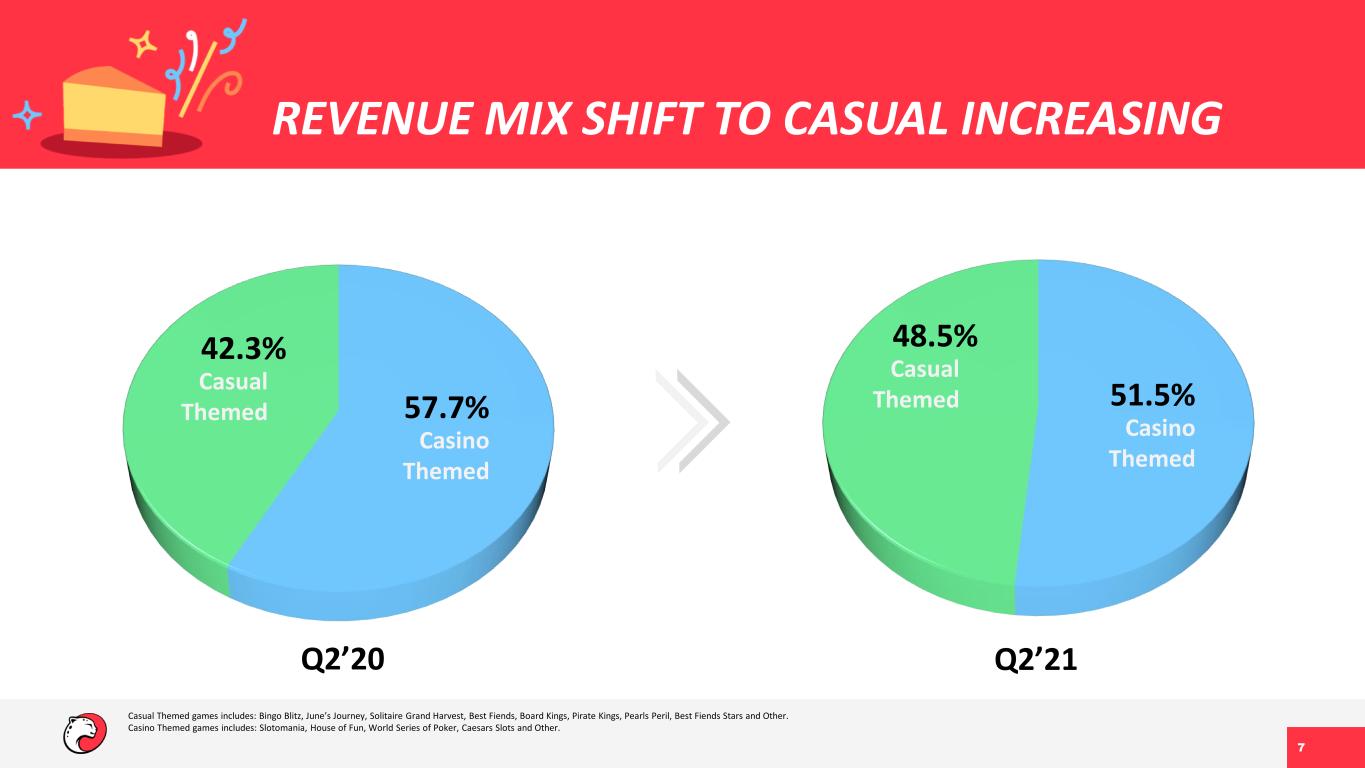

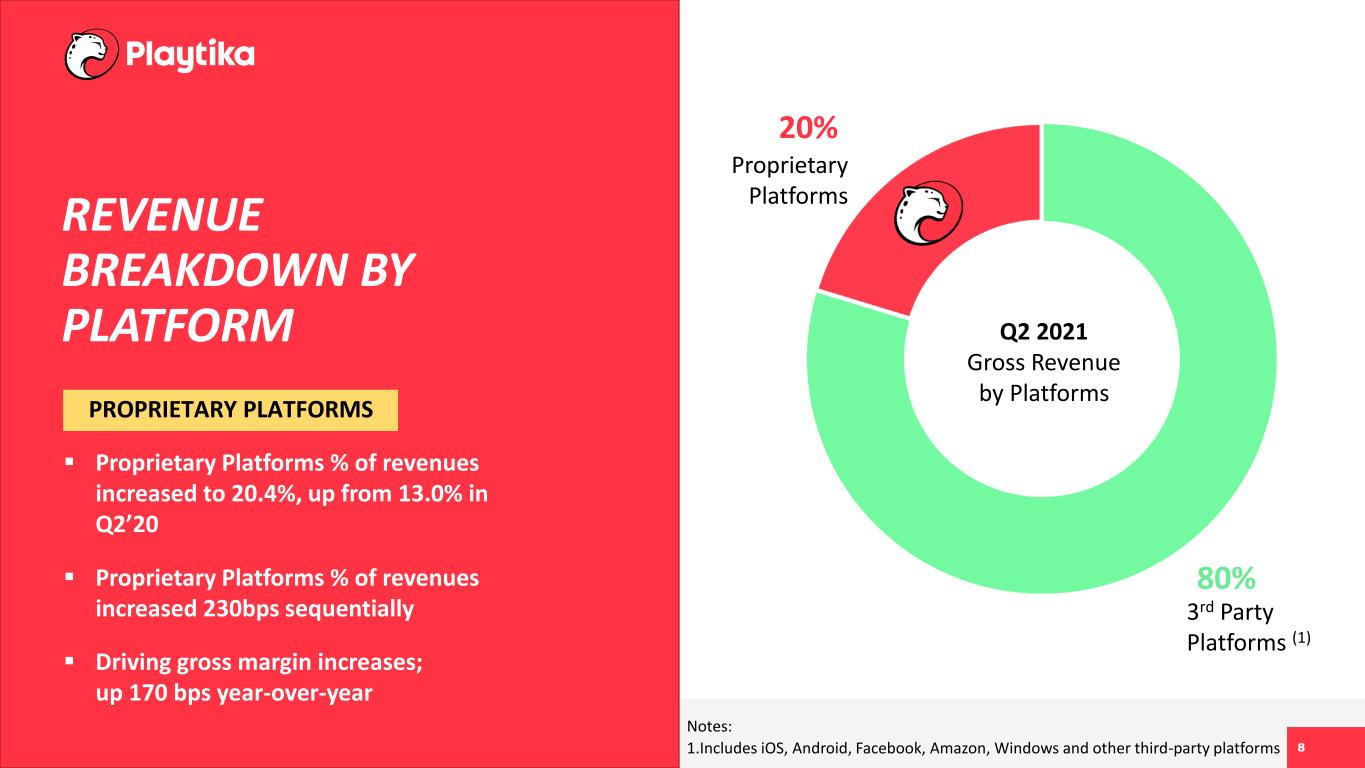

SECOND QUARTER HIGHLIGHTS Delivered strong organic revenue growth of 1.3% on top of all-time-high comparable in Q2’20 Daily Player Conversion increased to 2.9%, up from 2.7% in Q2’20 Solitaire Grand Harvest, Bingo Blitz and Board Kings grew 61%, 20%, and 18% year-over-year, respectively Continued growth in casual games, now representing 48.5% of overall revenues, compared to 42.3% in Q2’20 Proprietary platform revenue grew to 20.4% of overall revenues, up from 13.0% in Q2’20 SWITCHCRAFT: The Magical Match 3 & Mystery Story. New game global launch slated for Q4’21 from our Wooga game studio 3

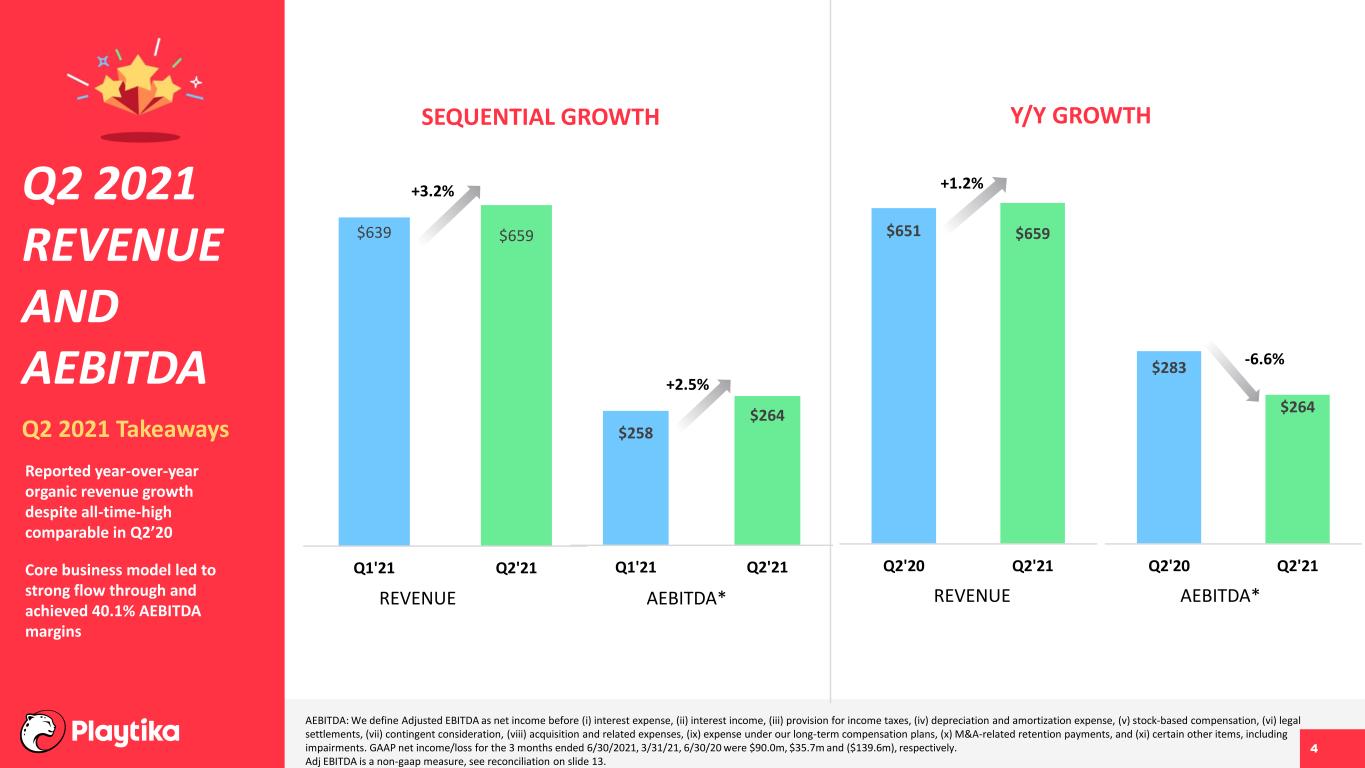

$639 $659 Q1'21 Q2'21 $283 $264 Q2'20 Q2'21 $651 $659 Q2'20 Q2'21 $258 $264 Q1'21 Q2'21 REVENUE +2.5% +3.2% +1.2% -6.6% SEQUENTIAL GROWTH Y/Y GROWTH AEBITDA* REVENUE AEBITDA* AEBITDA: We define Adjusted EBITDA as net income before (i) interest expense, (ii) interest income, (iii) provision for income taxes, (iv) depreciation and amortization expense, (v) stock-based compensation, (vi) legal settlements, (vii) contingent consideration, (viii) acquisition and related expenses, (ix) expense under our long-term compensation plans, (x) M&A-related retention payments, and (xi) certain other items, including impairments. GAAP net income/loss for the 3 months ended 6/30/2021, 3/31/21, 6/30/20 were $90.0m, $35.7m and ($139.6m), respectively. Adj EBITDA is a non-gaap measure, see reconciliation on slide 13. Q2 2021 REVENUE AND AEBITDA Reported year-over-year organic revenue growth despite all-time-high comparable in Q2’20 Core business model led to strong flow through and achieved 40.1% AEBITDA margins Q2 2021 Takeaways 4

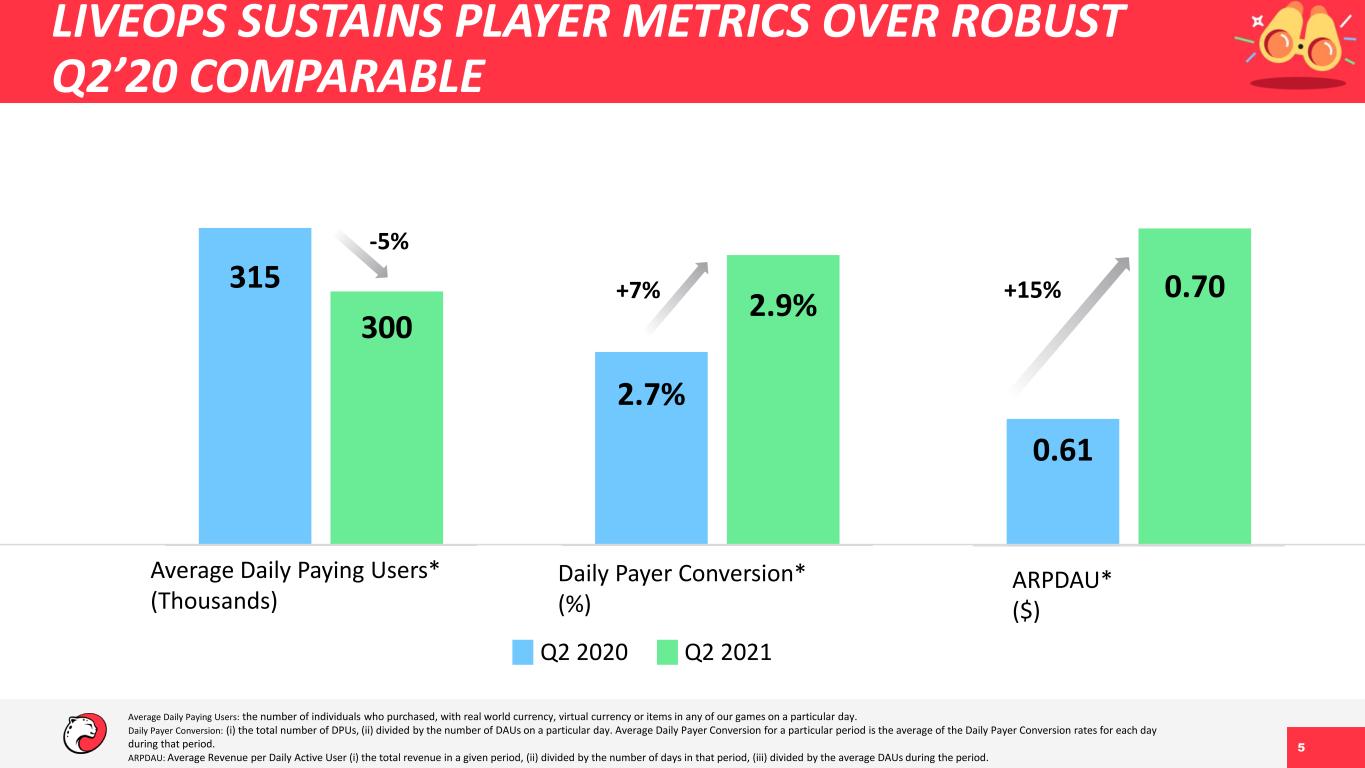

0.61 0.70+15% ARPDAU* ($) 2.7% 2.9% +7% Daily Payer Conversion* (%) 315 300 -5% Average Daily Paying Users* (Thousands) LIVEOPS SUSTAINS PLAYER METRICS OVER ROBUST Q2’20 COMPARABLE Q2 2021Q2 2020 Average Daily Paying Users: the number of individuals who purchased, with real world currency, virtual currency or items in any of our games on a particular day. Daily Payer Conversion: (i) the total number of DPUs, (ii) divided by the number of DAUs on a particular day. Average Daily Payer Conversion for a particular period is the average of the Daily Payer Conversion rates for each day during that period. ARPDAU: Average Revenue per Daily Active User (i) the total revenue in a given period, (ii) divided by the number of days in that period, (iii) divided by the average DAUs during the period. 5

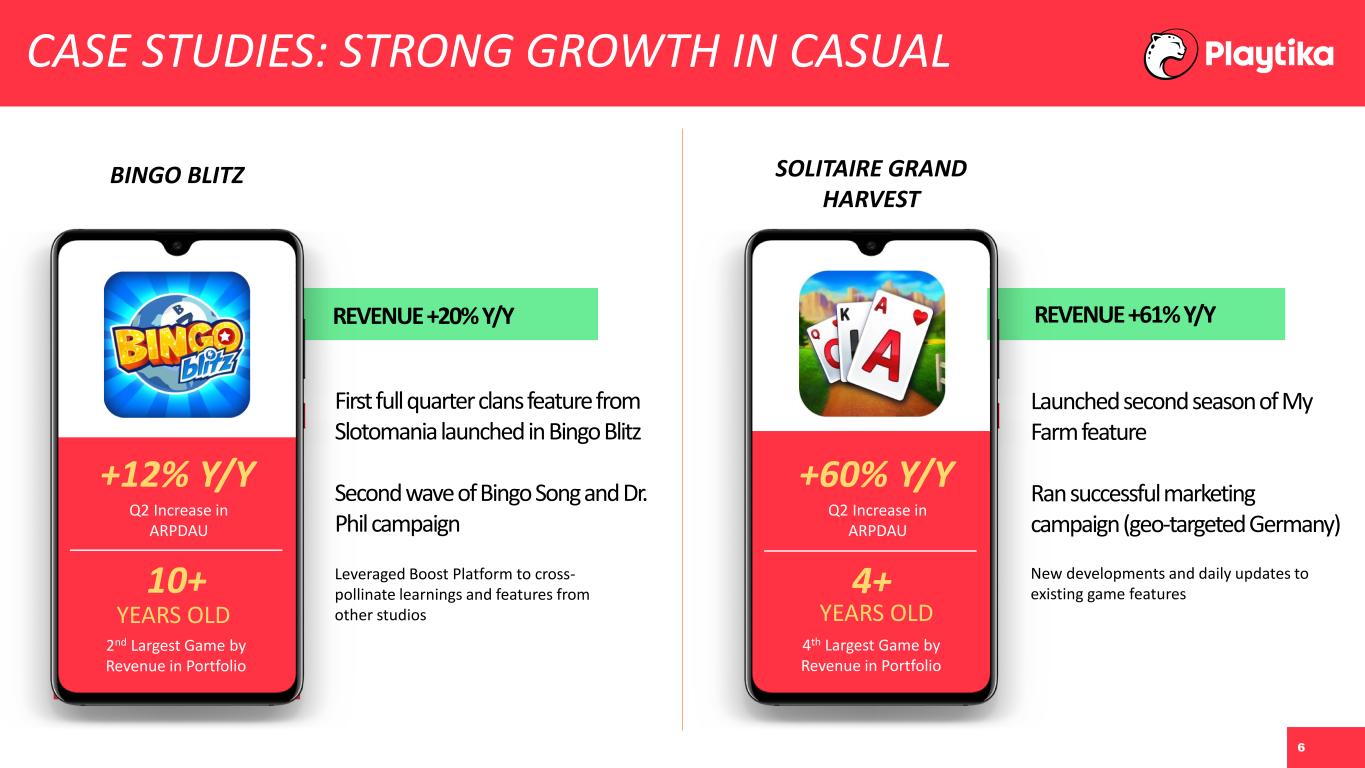

CASE STUDIES: STRONG GROWTH IN CASUAL BINGO BLITZ First full quarter clans feature from Slotomania launched in Bingo Blitz Second wave of Bingo Song and Dr. Phil campaign Leveraged Boost Platform to cross- pollinate learnings and features from other studios SOLITAIRE GRAND HARVEST Launched second season of My Farm feature Ran successful marketing campaign (geo-targeted Germany) New developments and daily updates to existing game features10+ +12% Y/Y 2nd Largest Game by Revenue in Portfolio Q2 Increase in ARPDAU 4+ 4th Largest Game by Revenue in Portfolio +60% Y/Y Q2 Increase in ARPDAU REVENUE +20% Y/Y REVENUE +61% Y/Y YEARS OLD YEARS OLD 6

REVENUE MIX SHIFT TO CASUAL INCREASING Casual Themed 42.3% Casino Themed 57.7% Q2’20 Q2’21 Casual Themed 48.5% Casino Themed 51.5% Casual Themed games includes: Bingo Blitz, June’s Journey, Solitaire Grand Harvest, Best Fiends, Board Kings, Pirate Kings, Pearls Peril, Best Fiends Stars and Other. Casino Themed games includes: Slotomania, House of Fun, World Series of Poker, Caesars Slots and Other. 7

REVENUE BREAKDOWN BY PLATFORM Q2 2021 Gross Revenue by Platforms Notes: 1.Includes iOS, Android, Facebook, Amazon, Windows and other third-party platforms 3rd Party Platforms (1) Proprietary Platforms ▪ Proprietary Platforms % of revenues increased to 20.4%, up from 13.0% in Q2’20 ▪ Proprietary Platforms % of revenues increased 230bps sequentially ▪ Driving gross margin increases; up 170 bps year-over-year 20% 80% PROPRIETARY PLATFORMS 8

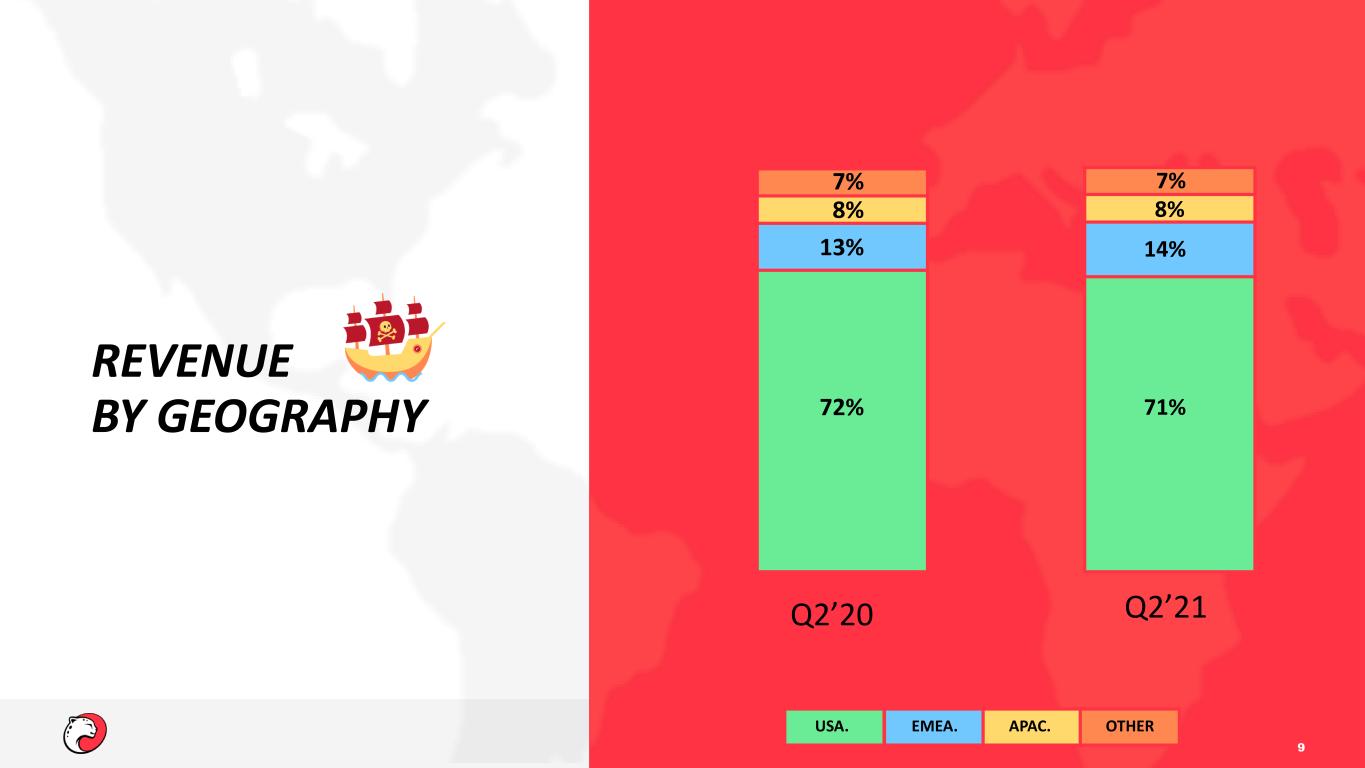

REVENUE BY GEOGRAPHY USA. EMEA. APAC. OTHER Q2’20 Q2’21 71% 14% 8% 7% 72% 13% 8% 7% 9

NEW GAME LAUNCH AHEAD OF SCHEDULE ▪ SWITCHCRAFT is a mystery-themed, Match-3 game differentiated through unique and compelling storylines. Global launch in Q4’21. ▪ Developed by our studio in Berlin, creators of our hit title, June’s Journey ▪ Hundreds of spellbinding puzzles that unlock a thrilling urban fantasy full of mystery ▪ Additional new Casual title planned for 2022 10

FY2021 Adjusted EBITDA guidance of $1.0 billion Reiterating Prior FY2021 Guidance1 GUIDANCE Revenue guidance of $2.6 billion $2.6B $1.0B 1) Prior FY’21 guidance of Revenue of $2.6 billion and Adjusted EBITDA of $1.0 billion was provided on our Q1’21 earnings call on 5/11/21. Prior FY’21 guidance of Revenue of $2.44 billion and Adjusted EBITDA of $920 million was provided on our Q4’20 earnings call on 2/25/21. 11

© 2020 Playtika Ltd. All Rights Reserved. APPENDIX 12

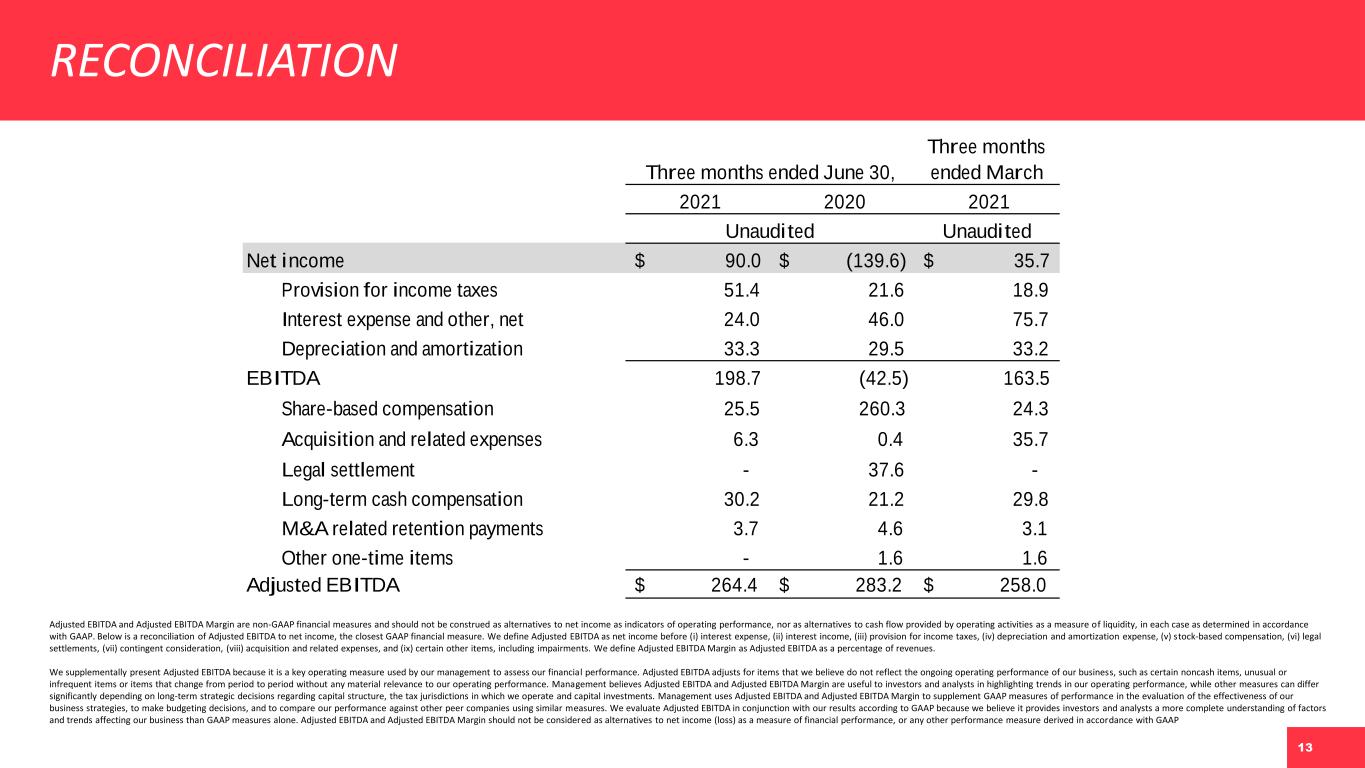

RECONCILIATION Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures and should not be construed as alternatives to net income as indicators of operating performance, nor as alternatives to cash flow provided by operating activities as a measure of liquidity, in each case as determined in accordance with GAAP. Below is a reconciliation of Adjusted EBITDA to net income, the closest GAAP financial measure. We define Adjusted EBITDA as net income before (i) interest expense, (ii) interest income, (iii) provision for income taxes, (iv) depreciation and amortization expense, (v) stock-based compensation, (vi) legal settlements, (vii) contingent consideration, (viii) acquisition and related expenses, and (ix) certain other items, including impairments. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenues. We supplementally present Adjusted EBITDA because it is a key operating measure used by our management to assess our financial performance. Adjusted EBITDA adjusts for items that we believe do not reflect the ongoing operating performance of our business, such as certain noncash items, unusual or infrequent items or items that change from period to period without any material relevance to our operating performance. Management believes Adjusted EBITDA and Adjusted EBITDA Margin are useful to investors and analysts in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses Adjusted EBITDA and Adjusted EBITDA Margin to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against other peer companies using similar measures. We evaluate Adjusted EBITDA in conjunction with our results according to GAAP because we believe it provides investors and analysts a more complete understanding of factors and trends affecting our business than GAAP measures alone. Adjusted EBITDA and Adjusted EBITDA Margin should not be considered as alternatives to net income (loss) as a measure of financial performance, or any other performance measure derived in accordance with GAAP 2021 2020 2021 Net income $ 90.0 $ (139.6) $ 35.7 Provision for income taxes 51.4 21.6 18.9 Interest expense and other, net 24.0 46.0 75.7 Depreciation and amortization 33.3 29.5 33.2 EBITDA 198.7 (42.5) 163.5 Share-based compensation 25.5 260.3 24.3 Acquisition and related expenses 6.3 0.4 35.7 Legal settlement - 37.6 - Long-term cash compensation 30.2 21.2 29.8 M&A related retention payments 3.7 4.6 3.1 Other one-time items - 1.6 1.6 Adjusted EBITDA $ 264.4 $ 283.2 $ 258.0 Three months ended June 30, Unaudited Unaudited Three months ended March 13