Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Novelis Inc. | nvl-20210804.htm |

| EX-99.1 - EX-99.1 PRESS RELEASE - Novelis Inc. | novelisq1fy22results.htm |

© 2021 Novelis NOVELIS Q1 FISCAL YEAR 2022 EARNINGS CONFERENCE CALL August 4, 2021 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer Exhibit 99.2

© 2021 Novelis SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this presentation are statements about our expectations that impacts of the semi-conductor shortage on OEM production will be short, and our ability to reach our long-term carbon neutrality goals and expand our business. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; risks arising out of our acquisition of Aleris Corporation, including uncertainties inherent in the acquisition method of accounting; disruption to our global aluminum production and supply chain as a result of COVID-19; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; the risks of pandemics or other public health emergencies, including the continued spread and impact of, and the governmental and third party response to, the ongoing COVID-19 outbreak; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2021. 2

© 2021 Novelis HIGHLIGHTS Top priority remains the safety, health and well-being of our employees, facilities and communities Diversified portfolio enabling strong shipment performance On a trailing twelve-month basis, Novelis has exceeded $2.0 billion of Adjusted EBITDA Rapid reduction in net leverage to 2.5x Achieved $100 million in run-rate synergies since acquisition Continued focus on strategic organic capital expansion projects to capture market growth 3 3,067 3,188 3,274 3,273 3,613 3,812 FY17 FY18 FY19 FY20 FY21 TTM Q1FY22 1,085 1,215 1,368 1,472 1,714 2,016 FY17 FY18 FY19 FY20 FY21 TTM Q1FY22 TTM Adjusted EBITDA ($ millions) TTM Shipments (kilotonnes) FY17 FY18 FY19 FY20 FY21 TTM Q1FY22 Free cash flow from cont. operations FCF from CO before capex ($ millions) 632 1,225 585 761 994 1,330 Trailing Twelve Month (TTM) ended June 30, 2021

© 2021 Novelis END MARKET OUTLOOK 4 Beverage Can Customers continue to request increased volumes in all regions Demand driven by ongoing high off-premise consumption and package mix shift driven by preference for sustainable beverage packaging options Significant canmaker capacity expansions announced next 2-3 years across all regions Automotive Semi-conductor shortage to have limited short-term impact on OEM production and sheet demand Strong demand driven by new program adoption and increased consumer preference for SUVs, pick-up trucks, electric vehicles and premium vehicles Specialty Favorable housing fundamentals in the US and Europe driving strong B&C demand Strong demand across markets, including electronics, heat exchangers, container and transportation products Aerospace Vaccine rollout a positive, but do not expect significant improvement in CY21 as consumer air travel remains restricted Heavily overstocked Aerospace supply chain; bookings improving but recovery could be prolonged and uneven 2021 market demand* % of Q1 Shipments 58% 23% 17% 2% *CY 2021 vs 2020 estimated end market growth, Novelis internal estimates 3-6% 5-10% 5-10% 20-25%

© 2021 Novelis ORGANIC PROJECTS UPDATE 5 Increasing global automotive capacity to ~1 million tonnes 300kt new finishing capacity commissioning in US & China Customer qualification and ramp- up in line with expectations Brazil recycling & rolling expansion on track 100kt recycling and rolling expansion begin to commission in Q2FY22 Cast first ingot in new Brazil remelt area in July, 2021 First ingot cast at new remelt line in Pinda, Brazil

© 2021 Novelis FINALIZING CHINA EXPANSION PLANS Maintain current aerospace & commercial plate production capacity ~$375 million, 3-year capital investment Expand Zhenjiang to produce automotive cold coils to feed Changzhou CASH lines Automotive casting house Recycling capability Hot mill upgrade New cold mill Other required buildings, facilities, etc 6 Fully integrate automotive business in Asia Access to local sourcing and structural cost advantage Maintain first mover advantage & leading market position in China Develop closed loop recycling in China to support our sustainability strategy Unlocks capacity at UAL to serve growing Specialty and Can markets At least $100 million in synergies

© 2021 Novelis 85 100 >120 65 >100 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 Acquisition base case estimate Run-rate actuals through Q1FY22 Current forecast Run-Rate Acquisition Synergies ($ millions) Combination Strategic (China) INTEGRATION UPDATE 7 Achieved $100 million in run-rate combination cost synergies through Q1FY22 Increase total synergies forecast above $220 million Strategic synergies will exceed $100 million Combination cost synergies will exceed $120 million

© 2021 Novelis FINANCIAL HIGHLIGHTS

© 2021 Novelis Q1 FISCAL 2022 FINANCIAL HIGHLIGHTS Net income from continuing operations $303 million, compared to net loss $61 million Excluding tax-effected special items*, net income of $260 million compared to $22 million $63 million loss on discontinued operations reflects fair value write-down of Duffel Sales up 59% to record $3.9 billion Total FRP Shipments up 26% to 973kt Strong market demand for beverage packaging, specialty and B&C Automotive shipments more than double Adjusted EBITDA up 119% to $555 million Record EBITDA even after excluding $47 million favorable decision in Brazil tax litigation Adjusted EBITDA per ton $570 $522 per ton, excluding non-recurring tax litigation benefit 9 Q1FY22 vs Q1FY21 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs. See today’s earnings press release for a reconciliation of special items. Quarterly Adjusted EBITDA trend ($ millions) 253 455 501 505 555 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 774 923 933 983 973 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Quarterly Shipments trend (kilotonnes)

© 2021 Novelis Q1 ADJUSTED EBITDA BRIDGE 10 $ Millions 253 200 84 (22) (37) 17 60 555 Q1FY21 Volume Price/Mix Operating Cost SG&A & R&D FX Other Q1FY22 Soft prior year comparison impacted by peak COVID-related customer business interruptions Automotive market recovery relative to prior year, but dampened by semiconductor shortages in FY22 Includes $47 million favorable decision in Brazil tax litigation Favorable metal prices mitigating inflation and production increases Variable & share- based compensation

© 2021 Novelis Q1 SEGMENT RESULTS 11 Q1 Shipments +32% EBITDA +121% Continued strong beverage packaging demand Higher automotive, specialty and B&C shipments compared to PY customer shutdowns Increased production and inflation cost mostly offset by favorable metal$78 $172 0 50 100 150 200 250 300 350 $0 $50 $100 $150 $200 $250 Q1FY21 Q1FY22 Shipments (kts) Adjusted EBITDA ($ millions) N o rt h A m er ic a E ur o pe Q1 Shipments +32% EBITDA +410% Higher automotive and specialty shipments compared to PY customer shutdowns Increased production and inflation costs partially offset by favorable metal Favorable FX translation $20 $102 0 50 100 150 200 250 300 $0 $25 $50 $75 $100 $125 $150 Q1FY21 Q1FY22

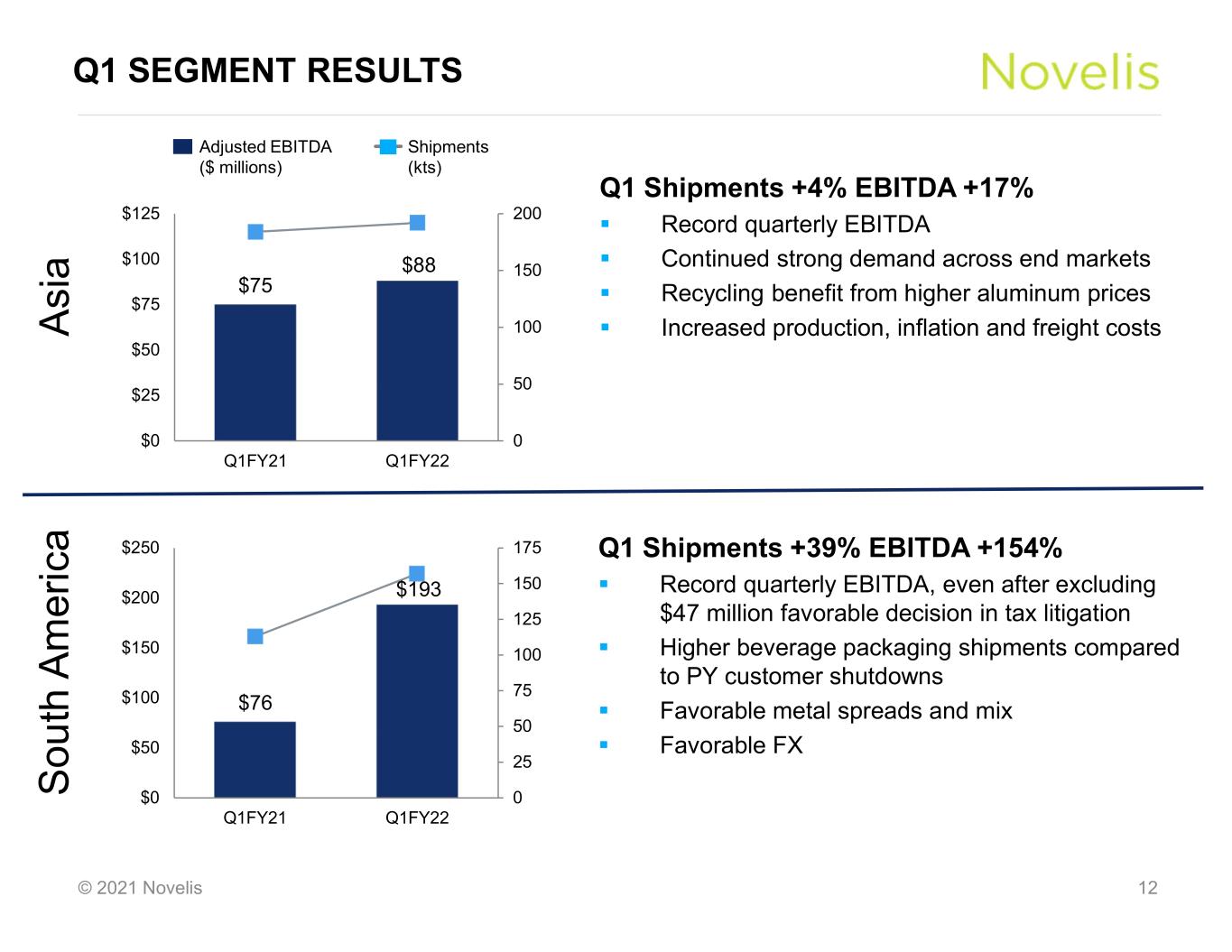

© 2021 Novelis Q1 Shipments +39% EBITDA +154% Record quarterly EBITDA, even after excluding $47 million favorable decision in tax litigation Higher beverage packaging shipments compared to PY customer shutdowns Favorable metal spreads and mix Favorable FX Q1 Shipments +4% EBITDA +17% Record quarterly EBITDA Continued strong demand across end markets Recycling benefit from higher aluminum prices Increased production, inflation and freight costs Q1 SEGMENT RESULTS 12 $75 $88 0 50 100 150 200 $0 $25 $50 $75 $100 $125 Q1FY21 Q1FY22 A si a S ou th A m er ic a Shipments (kts) Adjusted EBITDA ($ millions) $76 $193 0 25 50 75 100 125 150 175 $0 $50 $100 $150 $200 $250 Q1FY21 Q1FY22

© 2021 Novelis FREE CASH FLOW AND NET LEVERAGE 13 Q1 FY22 Q1 FY21 Adjusted EBITDA 555 253 Interest paid (52) (65) Taxes paid (61) (61) Capital expenditures (101) (112) Metal price lag 54 (23) Working capital & other (425) (138) Free cash flow from continuing operations (30) (146) Free cash flow from discontinued operations (3) (5) Free cash flow (33) (151) Free cash flow from continuing operations before capex 73 (34) $ Millions Higher Adjusted EBITDA and favorable metal price lag largely offset by significant working capital pressure from aluminum price increase Rapid reduction in net leverage to 2.5x, down from 3.8x at acquisition close in Q1FY21 Maintain very strong liquidity of $2.3 billion at June 30, 2021 Net Leverage ratio Net debt/TTM Adjusted EBITDA 2.5x Q1FY22 1.0 2.0 3.0 4.0 5.0 2.1x at end of FY20 3.8x at acquisition close Q1FY21

© 2021 Novelis DEBT REDUCTION & REFINANCING 14 On track to meet $2.6 billion gross debt reduction plan between Q1FY21 and end of FY22 ~$2 billion repaid in FY21 $124 million Aleris Zhenjiang term loans repaid in Q1FY22 Remaining $524 million of 2017 term loan balance to be repaid prior to maturity in 2022 In July 2021, refinanced $1.5 billion 5.875% Sr Unsecured Notes due 2026 New 5-year $750 million 3.25% Sr Unsecured notes due 2026 New 10-year $750 million 3.875% Sr Unsecured notes due 2031 Reduces interest by $35 million annually and provides balance sheet flexibility S&P Global Ratings raised its credit rating on Novelis to 'BB’ from 'BB-’ on July 22, 2021 5.6 8.0 7.3 6.6 6.0 5.9 Q4FY20 Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Gross Principal Debt $ billions Debt Maturity Profile* $ millions 1,500 524 765 499 750 1,600 750 593 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 ABL Revolver 2017 Term Loans 2020 Term Loans 2021 Term Loans Sr Unsecured Notes Sr Unsecured Green Notes *Debt maturity profile principal as of 6/30/21, excludes short-term borrowings, lease obligations, and $77 million China bank loans; adjusted for $1.5 billion Sr Unsecured Notes refinancing July 2021 to close August 2021

© 2021 Novelis OUTLOOK & SUMMARY

© 2021 Novelis SUMMARY 16 Exceptional performance driven by diversified product portfolio, operational excellence, and global presence Favorable demand trends for aluminum FRP across most end markets continue Integration of Aleris driving synergies and value capture Significant opportunities to continue to invest and grow with our customers Working across the value chain to enhance the sustainability of our products

© 2021 Novelis THANK YOU QUESTIONS?

© 2021 Novelis APPENDIX

© 2021 Novelis (in $ m) Q1 Q2 Q3 Q4 FY21 Q1 FY22 Net income (loss) attributable to our common shareholder (79) (37) 176 176 236 240 - Noncontrolling interests - - 1 - 1 - - Income tax provision (29) 68 80 119 238 108 - Interest, net 67 69 63 59 258 56 - Depreciation and amortization 118 141 137 147 543 134 EBITDA 77 241 457 501 1,276 538 - Unrealized (gain) loss on derivatives 33 (6) (13) (3) 11 4 - Realized loss (gain) on derivative instruments not included in segment income 3 1 (2) (1) 1 (1) - Adjustment to reconcile proportional consolidation 14 15 13 14 56 14 - (Gain) loss on sale of fixed assets (2) - 2 1 1 - - Loss (gain) on extinguishment of debt - - - 14 14 (2) - Purchase price accounting adjustments 28 1 - - 29 - - Loss from discontinued operations, net of tax 18 11 18 4 51 63 - Loss on sale of discontinued operations, net of tax - 170 - - 170 - - Restructuring and impairment, net 1 7 20 1 29 (2) - Metal price lag (income) expense 20 12 - (26) 6 (54) - Business acquisition and other integration costs 11 - - - 11 - - Other, net 50 3 6 - 59 (6) Adjusted EBITDA $253 $455 $501 $505 $1,714 $555 NET INCOME RECONCILIATION TO ADJUSTED EBITDA 19

© 2021 Novelis FREE CASH FLOW AND LIQUIDITY 20 (in $ m) Q1 Q2 Q3 Q4 FY21 Q1 FY22 Cash provided by (used in) operating activities – continuing operations (123) 496 275 561 1,209 65 Cash provided by (used in) investing activities – continuing operations (2,643) (183) (101) (152) (3,079) (94) Plus: Cash used in Acquisition of a business, net of cash acquired 2,550 64 - - 2,614 - Plus: Accrued merger consideration 70 (60) (10) - - - Less: Proceeds from sale of assets and business, net of transaction fees, cash income taxes and hedging - (2) (2) - (4) (1) Free cash flow from continuing operations $(146) $315 $162 $409 $740 $(30) Net cash used in operating activities – discontinued operations (15) (16) (47) (4) (82) (3) Net cash provided by investing activities – discontinued operations 10 207 140 - 357 - Less: Proceeds from sale of assets and businesses, net of transaction fees, cash income taxes and hedges - discontinued operations - (223) (180) - (403) - Free cash flow $(151) $283 $75 $405 $612 $(33) Capital expenditures 112 114 107 152 485 101 (in $ m) Q1 Q2 Q3 Q4 FY21 Q1 FY22 Cash and cash equivalents 1,729 1,627 1,164 998 998 872 Cash and cash equivalents of discontinued operations 89 - - - - - Availability under committed credit facilities 308 1,005 1,226 1,223 1,223 1,380 Liquidity $2,126 $2,632 $2,390 $2,221 $2,221 $2,252

© 2021 Novelis NET DEBT 21 (in $ m) Q1 Q2 Q3 Q4 FY21 Q1 FY22 Long-term debt, net of current portion 5,671 6,767 6,295 5,653 5,653 4,960 Current portion of long-term debt 50 55 59 71 71 541 Short-term borrowings 2,176 393 151 236 236 359 Cash and cash equivalents (1,729) (1,627) (1,164) (998) (998) (872) Net debt $6,168 $5,588 $5,341 $4,962 $4,962 $4,988