Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Checkmate Pharmaceuticals, Inc. | d195262d8k.htm |

Heating Up Cancer Immunotherapy August 2021 Exhibit 99.1

Forward Looking Statement Certain statements in this presentation (“Presentation”) that are not statements of historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such forward-looking statements include those regarding Checkmate Pharmaceuticals, Inc.’s (“Checkmate,” the “Company,” “we,” “our” or “us”) product candidate, including its development and therapeutic potential and the advancement of our clinical and preclinical pipeline; expectations regarding the results and analysis of data; expectations regarding the timing, initiation, implementation and success of our planned clinical trials for CMP-001; the benefits and related implications of current and future partnerships and/or collaborations; and future market opportunities, future results of operations and financial position, including potential milestones, our cash runway, business strategy, plans and objectives for future operations. Forward-looking statements use words like “believes,” “plans,” “expects,” “intends,” “will,” “would,” “anticipates,” “estimates,” or the negative of these terms and similar words or expressions. Although the Company believes that such statements are based on reasonable assumptions within the bounds of its knowledge of its business and operations, forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. You should exercise caution in interpreting and relying on forward-looking statements because they are subject to significant risks, uncertainties and other factors which are, in some cases, beyond the Company’s control. These statements are based on current expectations or objectives that are inherently uncertain, especially in the case of an enterprise with limited operating history. In light of these uncertainties, and the assumptions underlying the expectations and other forward-looking statements expressed, the forward-looking events and circumstances discussed in the accompanying materials may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward‐looking statements. You should not place undue reliance on any forward-looking statements included in this Presentation. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, the occurrence of certain events or otherwise. As a result of these risks and others, actual results could vary significantly from those anticipated in this Presentation, and our financial condition and results of operations could be materially adversely affected. This Presentation includes information related to market opportunity as well as cost and other estimates obtained from internal analyses and external sources. The internal analyses are based upon management’s understanding of market and industry conditions and have not been verified by independent sources. Similarly, the externally sourced information has been obtained from sources the Company believes to be reliable, but the accuracy and completeness of such information cannot be assured. Neither the Company, nor any of its respective officers, directors, managers, employees, agents, or representatives, (i) make any representations or warranties, express or implied, with respect to any of the information contained herein, including the accuracy or completeness of this Presentation or any other written or oral information made available to any interested party or its advisor (and any liability therefore is expressly disclaimed), (ii) have any liability from the use of the information, including with respect to any forward-looking statements, or (iii) undertake to update any of the information contained herein or provide additional information as a result of new information or future events or developments. This Presentation also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. These forward-looking statements are subject to risks and uncertainties, including those related to the development of our product candidate, any delays in our ongoing or planned preclinical or clinical trials, the impact of the ongoing COVID-19 pandemic on our business, operations, clinical supply and plans, the risks inherent in the drug development process, the risks regarding the accuracy of our estimates of expenses and timing of development, our capital requirements and the need for additional financing, and obtaining, maintaining and protecting our intellectual property. Further information concerning the Company, including a number of material risks and uncertainties, are described in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), including in our most recent quarterly report on Form 10-Q filed with the SEC as well as subsequent filings and reports filed by the Company with the SEC.

Investment Highlights Vidutolimod (CMP-001) is an innate immune modulator with the potential to become a backbone of I/O combinations 28% ORR in PD-1 refractory melanoma1 70% pathologic response in PD-1 naïve neoadjuvant melanoma and 90% RFS at 1 year2 17.5% ORR in PD-1 refractory melanoma as monotherapy3 Targeting approval in front line metastatic and PD-1 refractory melanoma Fast Track and Orphan Drug Designation Pursuing head & neck and non-melanoma skin cancers 1. CMP-001 plus pembrolizumab, data cutoff September 30, 2020 (includes post-progression responders); N=98 2. Davar, SITC 2020, data cutoff October 1, 2020 3 CMP-001 monotherapy, data cutoff September 30, 2020; N=40 Melanoma topline data anticipated late 2022/1H 2023 Head & neck cancer Ph2 data maturing throughout 2022 Non-melanoma skin cancer interim Ph2 data 2H 2022 Differentiated Therapeutic Extensive and Consistent Clinical Data Multiple Value Driving Catalysts Robust Development Strategy TLR9 agonist Indication expansion >200 patients Melanoma registration

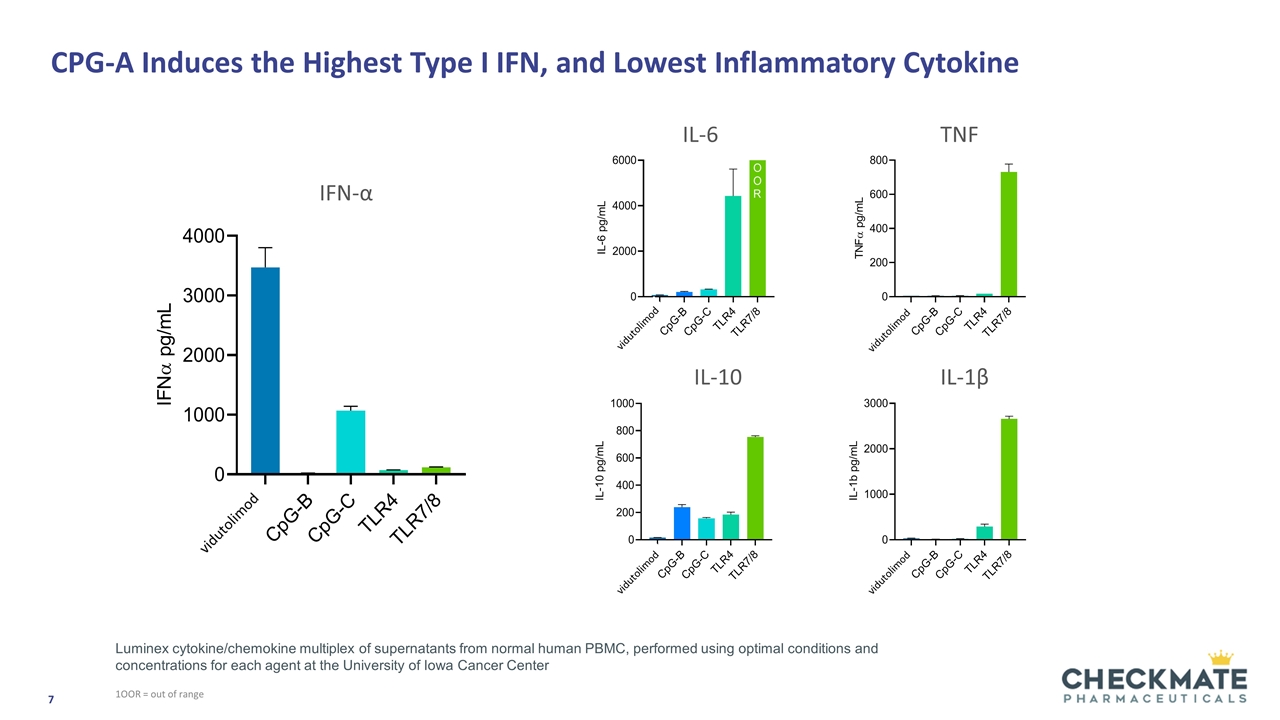

Potential to Extend the Benefits of Cancer Immunotherapy to More Patients 1Source: Evaluate Pharma 2Ribas, A., et al., Cancer Discovery, 2021 3Lemke-Miltner, C.D., et al., J Immunol, 2020. 204 (5): 1386-1394 Problem Checkpoint inhibitors have revolutionized cancer immunotherapy PD-1 checkpoint inhibitors Very effective, when they work Generated >$20B in WW sales in 20201 Unfortunately, effect is largely limited to patients with active T-cell response (“hot tumors”) Solution Vidutolimod has the potential to turn “cold tumors” hot Induced significantly higher levels of type I interferons than other immune modulators potentially leading to a stronger anti-tumor T cell response2,3

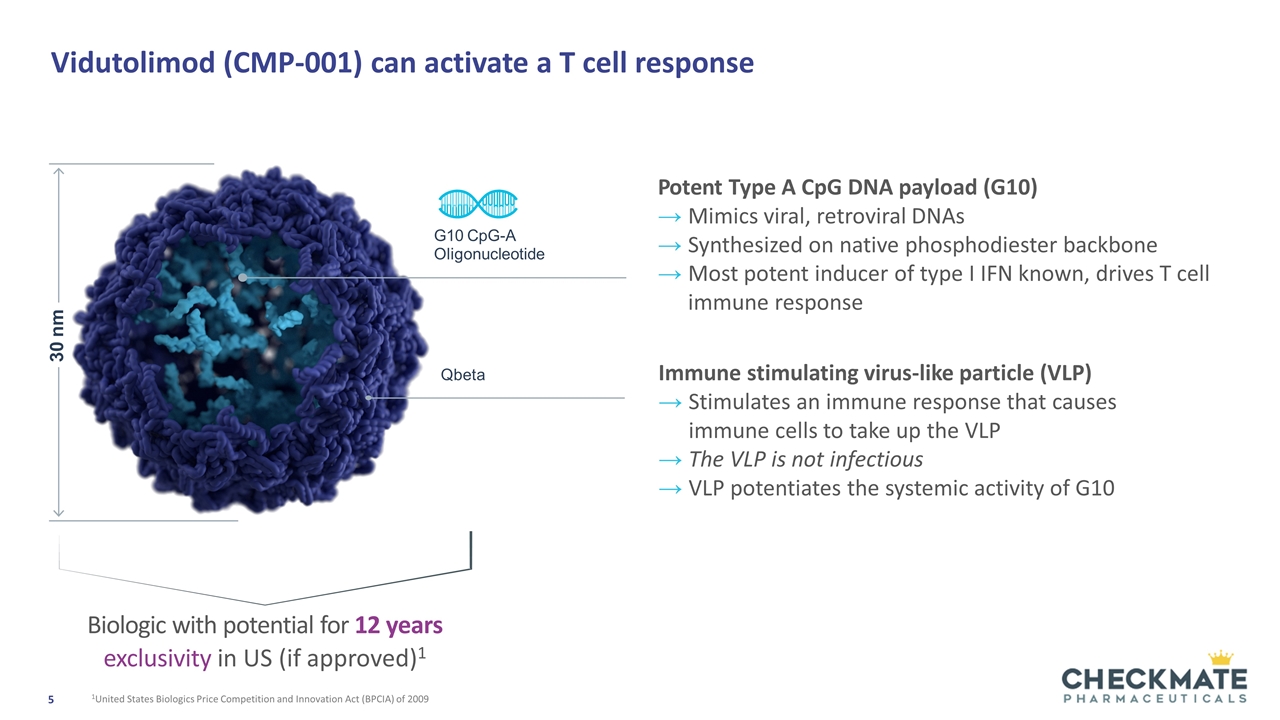

Vidutolimod (CMP-001) can activate a T cell response 30 nm Qbeta Potent Type A CpG DNA payload (G10) Mimics viral, retroviral DNAs Synthesized on native phosphodiester backbone Most potent inducer of type I IFN known, drives T cell immune response G10 CpG-A Oligonucleotide Immune stimulating virus-like particle (VLP) Stimulates an immune response that causes immune cells to take up the VLP The VLP is not infectious VLP potentiates the systemic activity of G10 Biologic with potential for 12 years exclusivity in US (if approved)1 1United States Biologics Price Competition and Innovation Act (BPCIA) of 2009

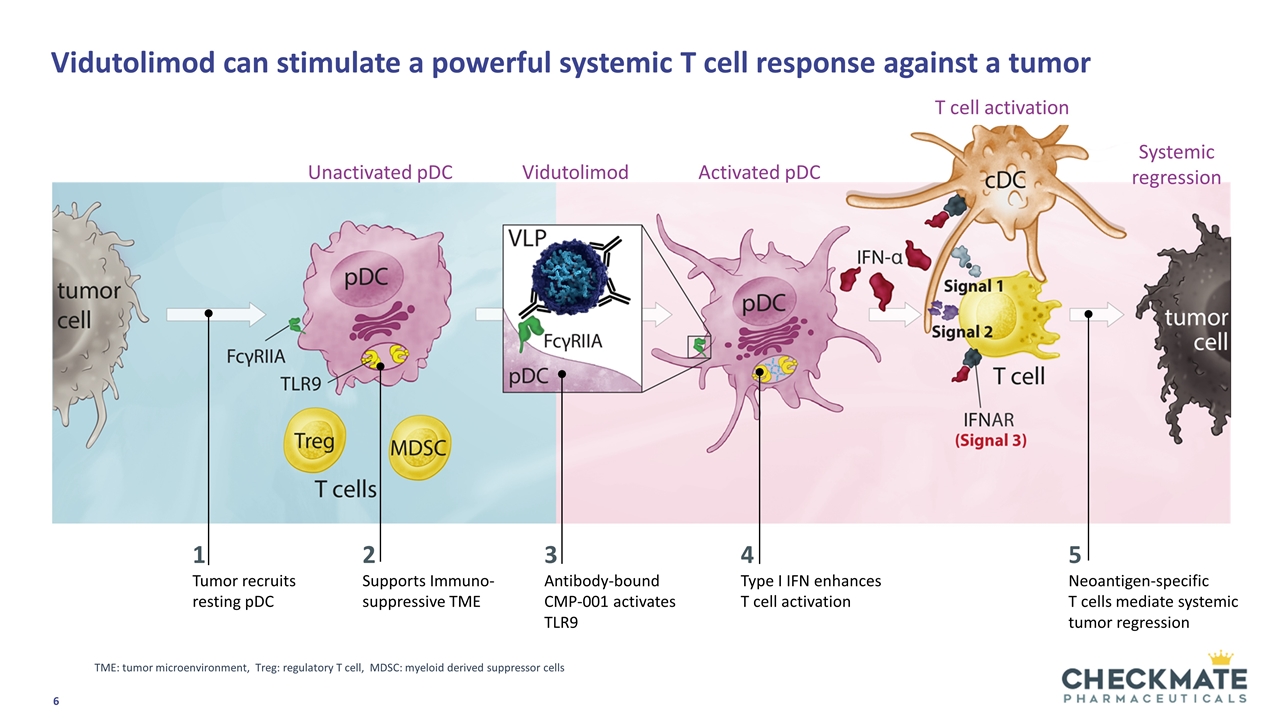

1 Tumor recruits resting pDC 2 Supports Immuno-suppressive TME 3 Antibody-bound CMP-001 activates TLR9 4 Type I IFN enhances T cell activation 5 Neoantigen-specific T cells mediate systemic tumor regression TME: tumor microenvironment, Treg: regulatory T cell, MDSC: myeloid derived suppressor cells Unactivated pDC Activated pDC Systemic regression T cell activation Vidutolimod can stimulate a powerful systemic T cell response against a tumor Vidutolimod

CPG-A Induces the Highest Type I IFN, and Lowest Inflammatory Cytokine 1OOR = out of range IFN-α IL-6 TNF IL-10 IL-1β Luminex cytokine/chemokine multiplex of supernatants from normal human PBMC, performed using optimal conditions and concentrations for each agent at the University of Iowa Cancer Center

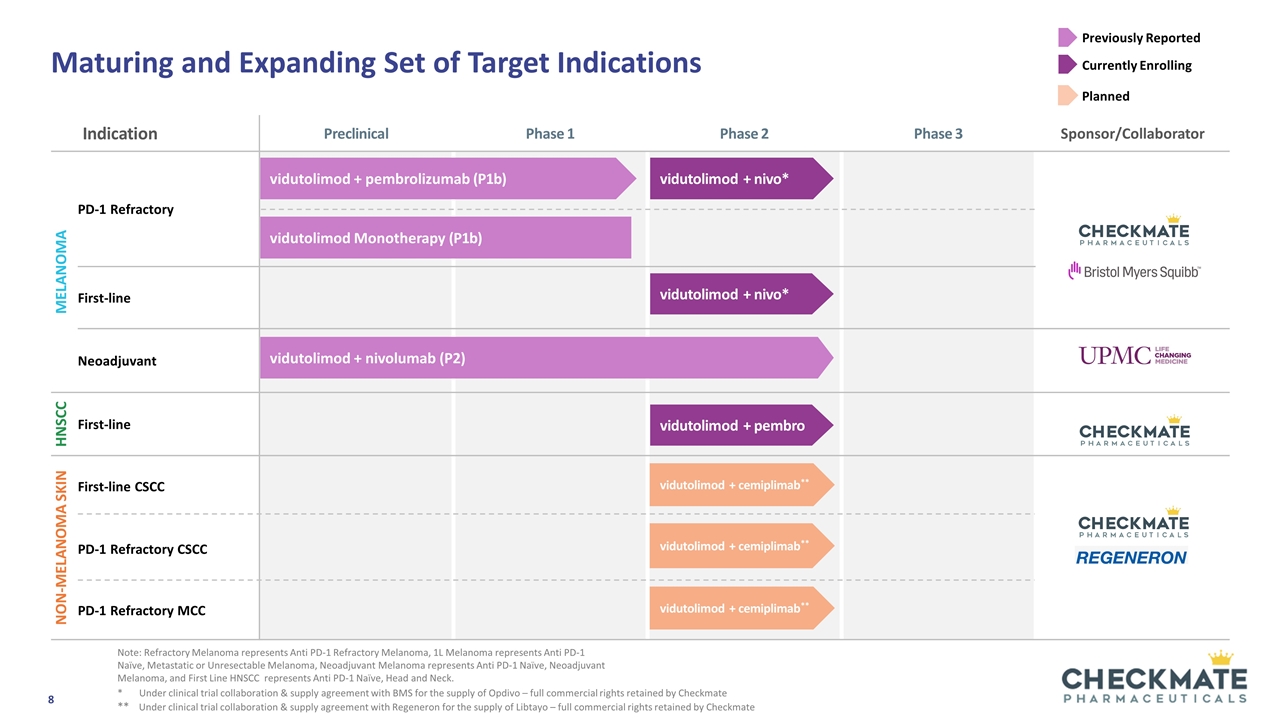

Maturing and Expanding Set of Target Indications Note: Refractory Melanoma represents Anti PD-1 Refractory Melanoma, 1L Melanoma represents Anti PD-1 Naïve, Metastatic or Unresectable Melanoma, Neoadjuvant Melanoma represents Anti PD-1 Naïve, Neoadjuvant Melanoma, and First Line HNSCC represents Anti PD-1 Naïve, Head and Neck. Indication Preclinical Phase 1 Phase 2 Phase 3 Sponsor/Collaborator Melanoma PD-1 Refractory First-line Neoadjuvant HNSCC First-line Non-Melanoma skin First-line CSCC PD-1 Refractory CSCC PD-1 Refractory MCC vidutolimod + pembrolizumab (P1b) vidutolimod + nivo* vidutolimod Monotherapy (P1b) vidutolimod + nivo* Previously Reported Currently Enrolling vidutolimod + nivolumab (P2) vidutolimod + pembro * Under clinical trial collaboration & supply agreement with BMS for the supply of Opdivo – full commercial rights retained by Checkmate ** Under clinical trial collaboration & supply agreement with Regeneron for the supply of Libtayo – full commercial rights retained by Checkmate vidutolimod + cemiplimab** vidutolimod + cemiplimab** vidutolimod + cemiplimab** Planned

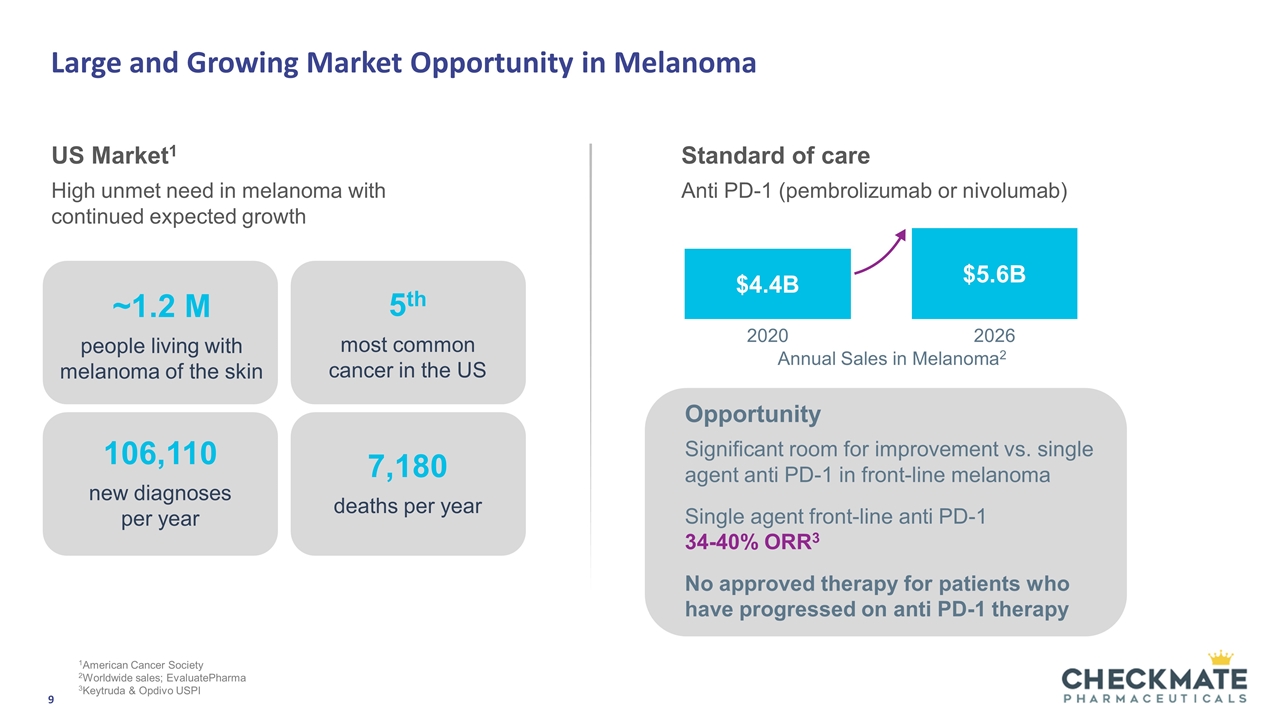

Large and Growing Market Opportunity in Melanoma US Market1 High unmet need in melanoma with continued expected growth Standard of care Anti PD-1 (pembrolizumab or nivolumab) Opportunity Significant room for improvement vs. single agent anti PD-1 in front-line melanoma Single agent front-line anti PD-1 34-40% ORR3 No approved therapy for patients who have progressed on anti PD-1 therapy $4.4B $5.6B 2026 2020 Annual Sales in Melanoma2 ~1.2 M people living with melanoma of the skin 106,110 new diagnoses per year 7,180 deaths per year 5th most common cancer in the US 1American Cancer Society 2Worldwide sales; EvaluatePharma 3Keytruda & Opdivo USPI

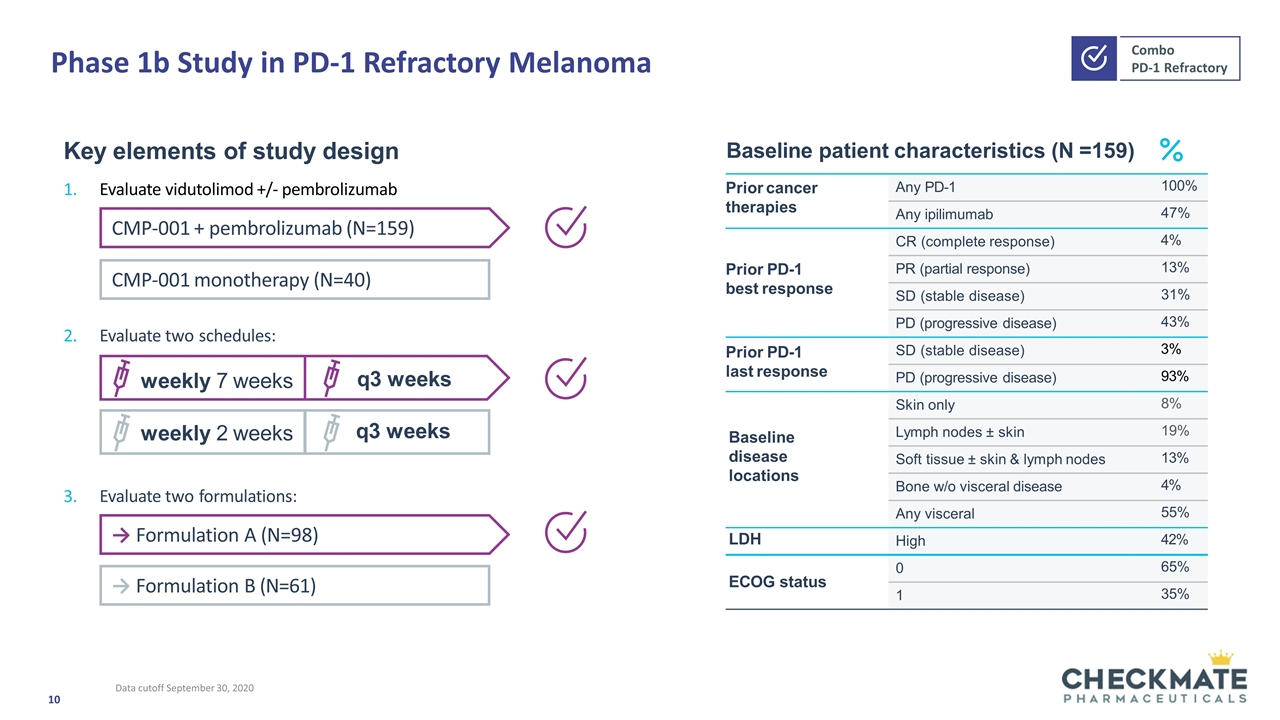

Phase 1b Study in PD-1 Refractory Melanoma Prior cancer therapies Any PD-1 100% Any ipilimumab 47% Prior PD-1 best response CR (complete response) 4% PR (partial response) 13% SD (stable disease) 31% PD (progressive disease) 43% Prior PD-1 last response SD (stable disease) 3% PD (progressive disease) 93% Baseline disease locations Skin only 8% Lymph nodes ± skin 19% Soft tissue ± skin & lymph nodes 13% Bone w/o visceral disease 4% Any visceral 55% LDH High 42% ECOG status 0 65% 1 35% Key elements of study design Evaluate vidutolimod +/- pembrolizumab Evaluate two formulations: Baseline patient characteristics (N =159) weekly 7 weeks q3 weeks weekly 2 weeks q3 weeks CMP-001 monotherapy (N=40) CMP-001 + pembrolizumab (N=159) Evaluate two schedules: → Formulation B (N=61) → Formulation A (N=98) Data cutoff September 30, 2020

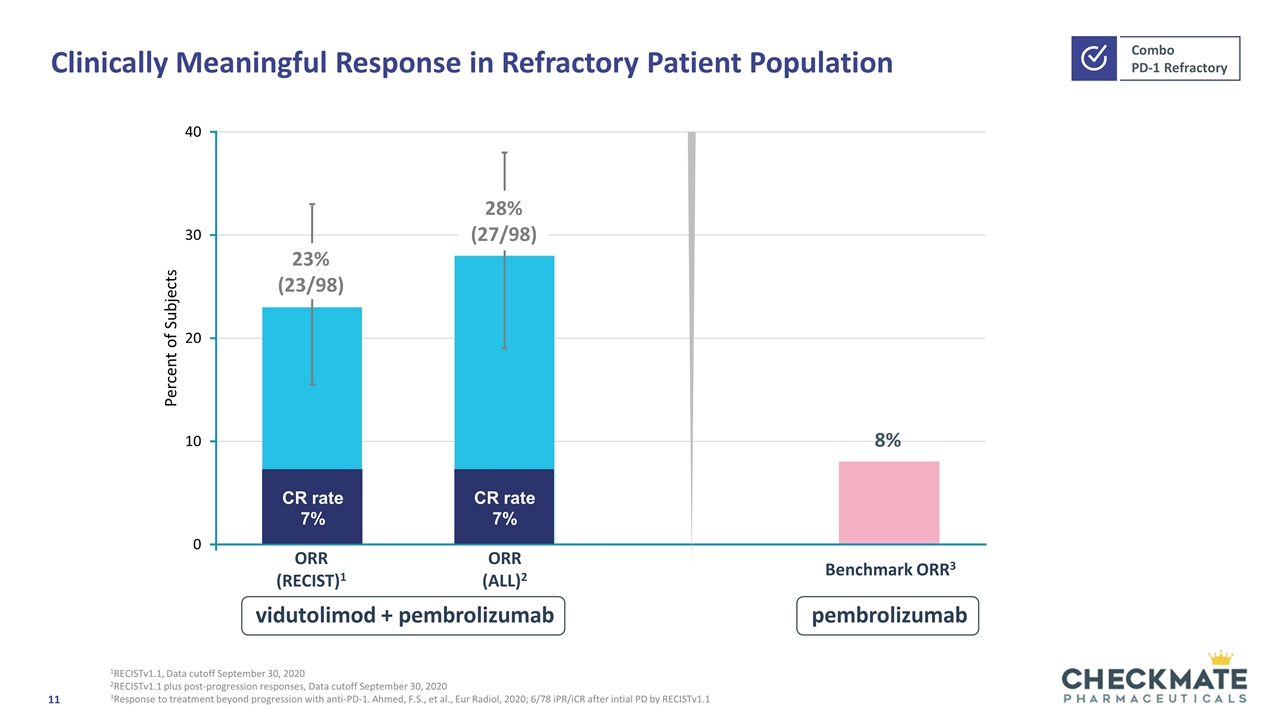

Clinically Meaningful Response in Refractory Patient Population 1RECISTv1.1, Data cutoff September 30, 2020 2RECISTv1.1 plus post-progression responses, Data cutoff September 30, 2020 3Response to treatment beyond progression with anti-PD-1. Ahmed, F.S., et al., Eur Radiol, 2020; 6/78 iPR/iCR after intial PD by RECISTv1.1 ORR (RECIST)1 ORR (ALL)2 CR rate 7% Benchmark ORR3 vidutolimod + pembrolizumab pembrolizumab CR rate 7%

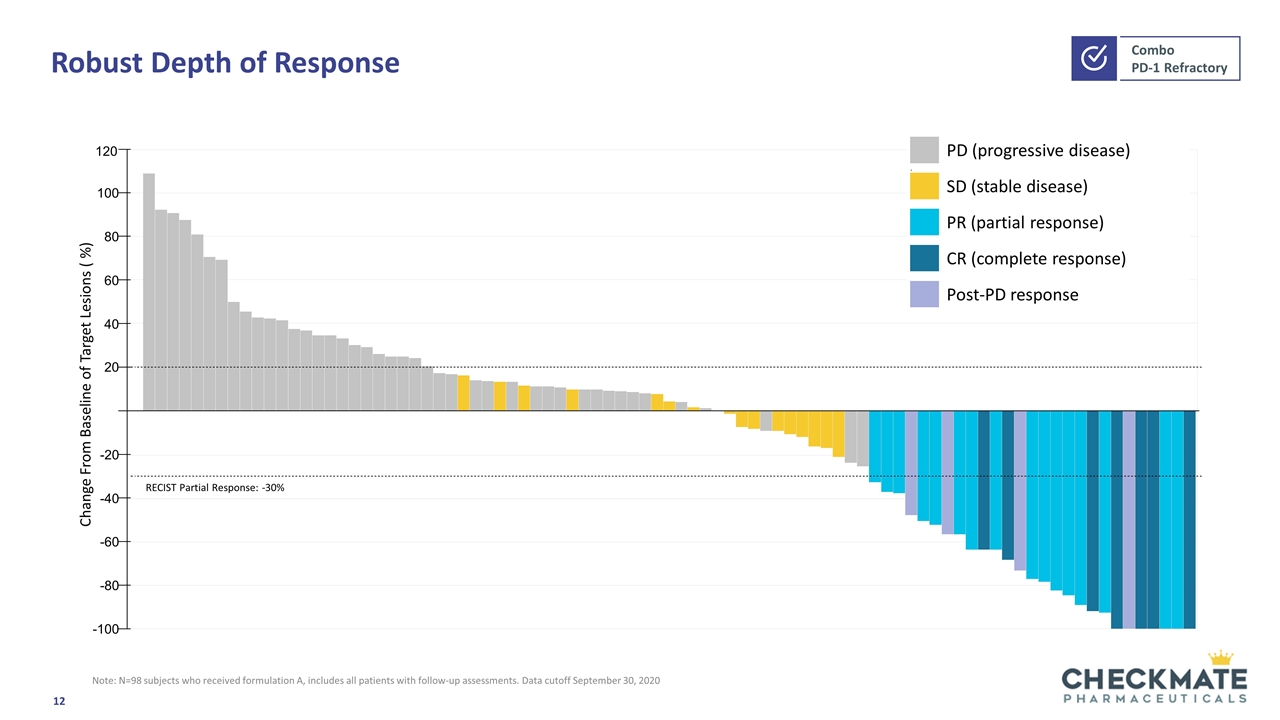

Robust Depth of Response PD (progressive disease) . SD (stable disease) PR (partial response) CR (complete response) Post-PD response Change From Baseline of Target Lesions ( %) 120 100 80 60 40 20 -20 -40 -60 -80 -100 RECIST Partial Response: -30% Note: N=98 subjects who received formulation A, includes all patients with follow-up assessments. Data cutoff September 30, 2020

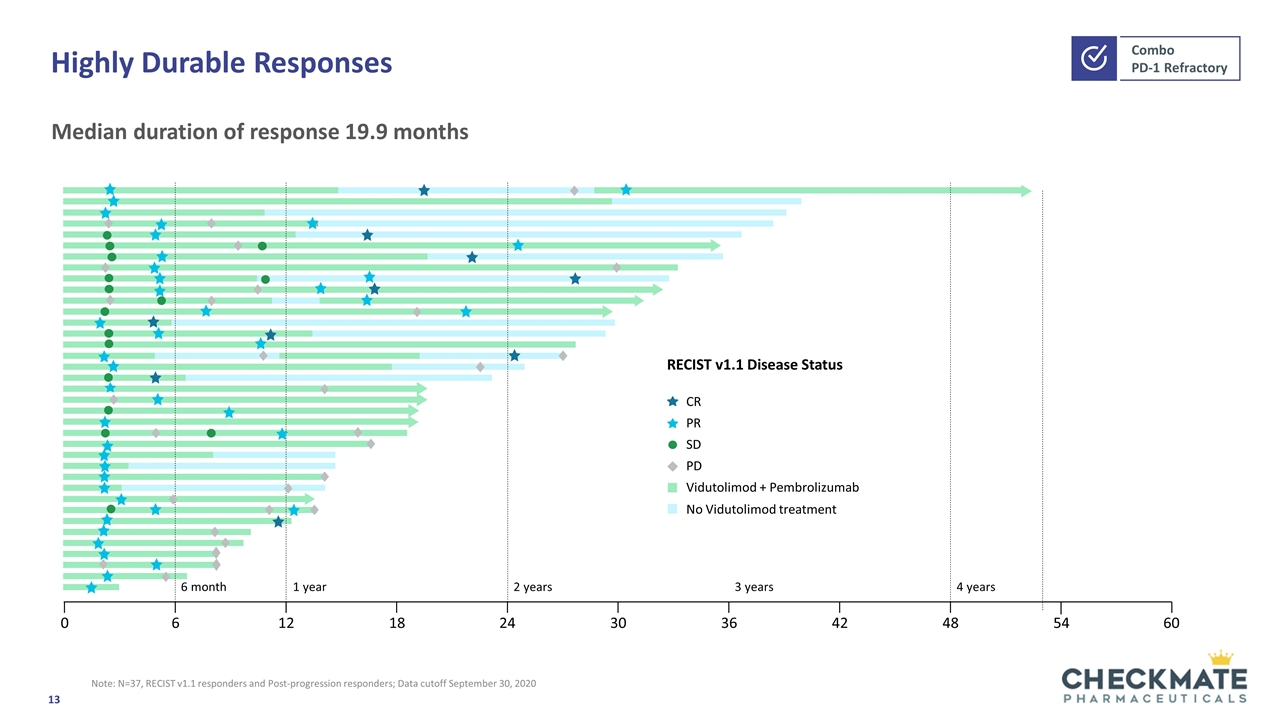

Highly Durable Responses Note: N=37, RECIST v1.1 responders and Post-progression responders; Data cutoff September 30, 2020 Median duration of response 19.9 months RECIST v1.1 Disease Status CR PR SD PD Vidutolimod + Pembrolizumab No Vidutolimod treatment 6 month 1 year 2 years 3 years 4 years 0 6 12 18 24 30 36 42 48 54 60

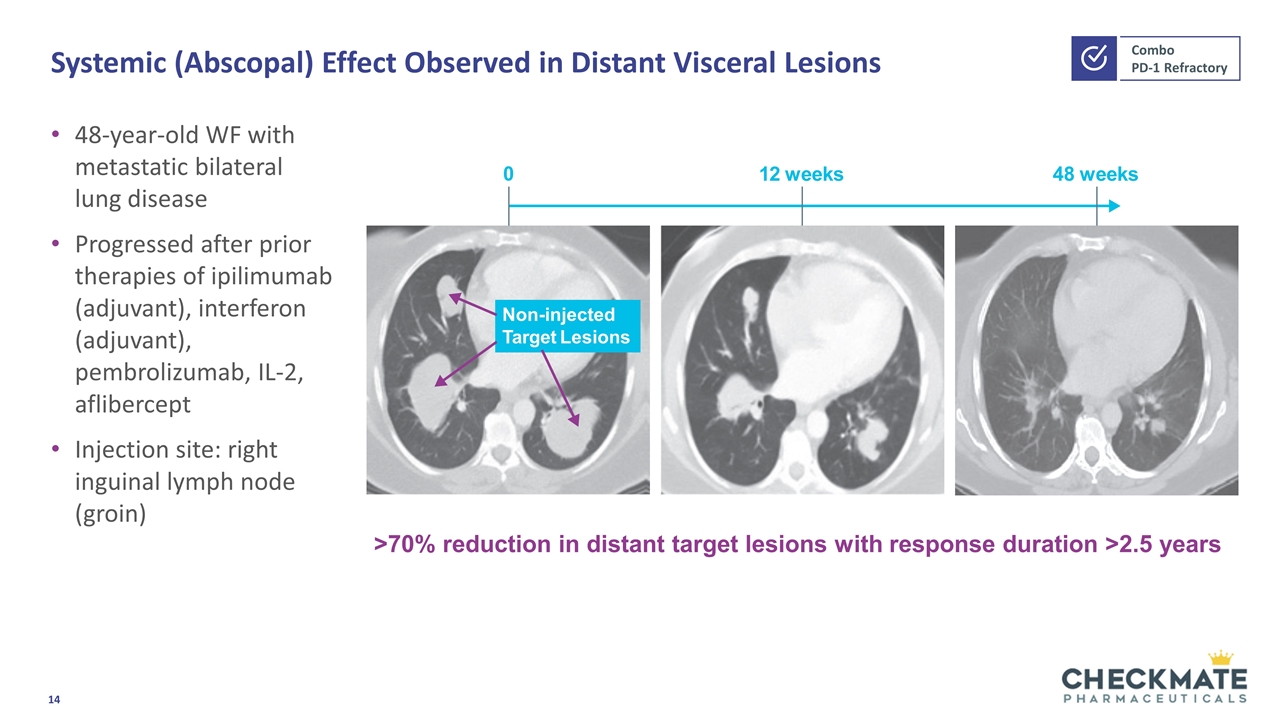

Systemic (Abscopal) Effect Observed in Distant Visceral Lesions 48-year-old WF with metastatic bilateral lung disease Progressed after prior therapies of ipilimumab (adjuvant), interferon (adjuvant), pembrolizumab, IL-2, aflibercept Injection site: right inguinal lymph node (groin) Non-injected Target Lesions 12 weeks 0 48 weeks >70% reduction in distant target lesions with response duration >2.5 years

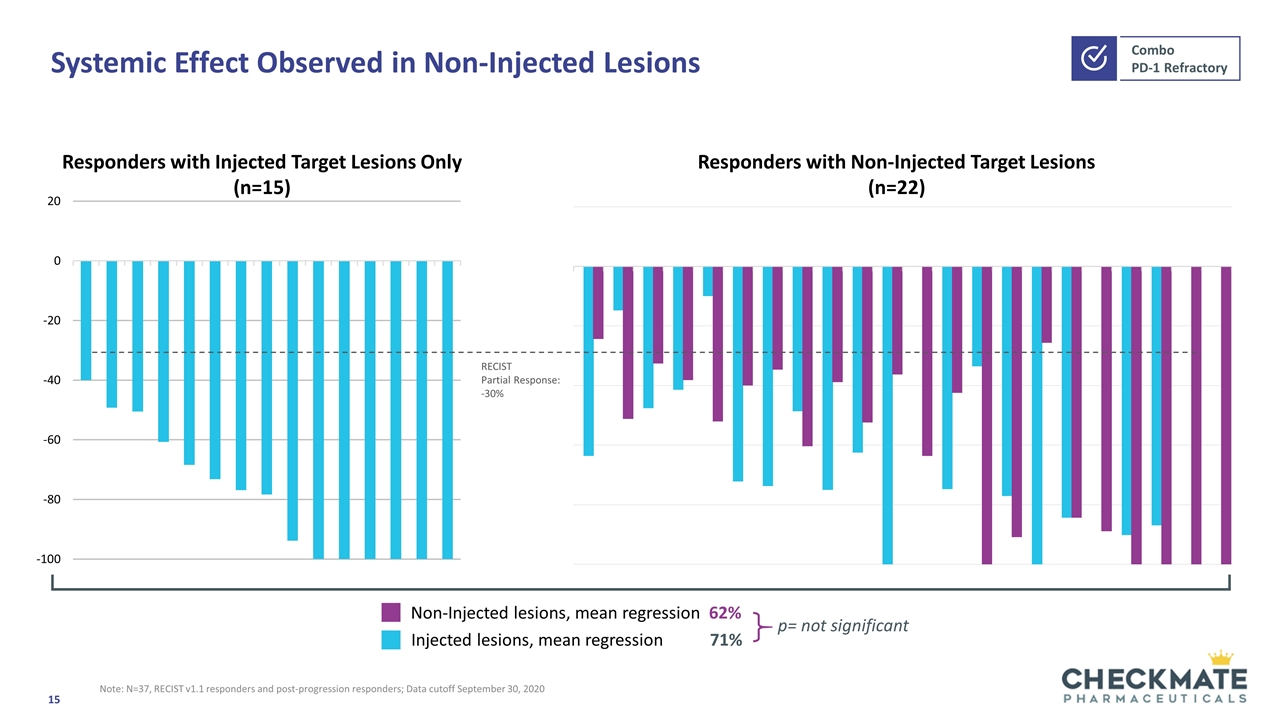

Systemic Effect Observed in Non-Injected Lesions Injected lesions, mean regression 71% Non-Injected lesions, mean regression 62% Responders with Injected Target Lesions Only (n=15) Responders with Non-Injected Target Lesions (n=22) RECIST Partial Response: -30% Note: N=37, RECIST v1.1 responders and post-progression responders; Data cutoff September 30, 2020 p= not significant

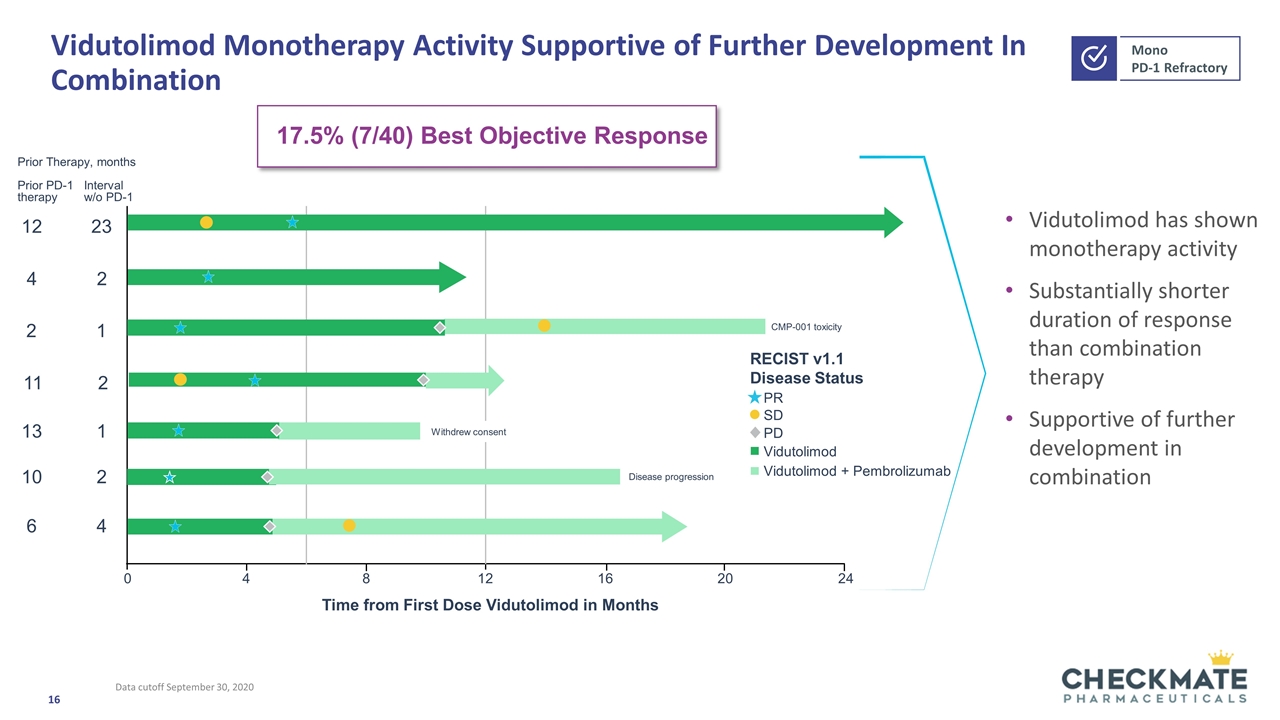

Vidutolimod Monotherapy Activity Supportive of Further Development In Combination Vidutolimod has shown monotherapy activity Substantially shorter duration of response than combination therapy Supportive of further development in combination Data cutoff September 30, 2020 Prior Therapy, months 24 4 16 Time from First Dose Vidutolimod in Months 12 23 PR SD PD Vidutolimod RECIST v1.1 Disease Status Vidutolimod + Pembrolizumab Interval w/o PD-1 Prior PD-1 therapy 17.5% (7/40) Best Objective Response 4 2 6 4 8 12 20 13 1 10 2 Disease progression 0 11 2 2 1 CMP-001 toxicity Withdrew consent

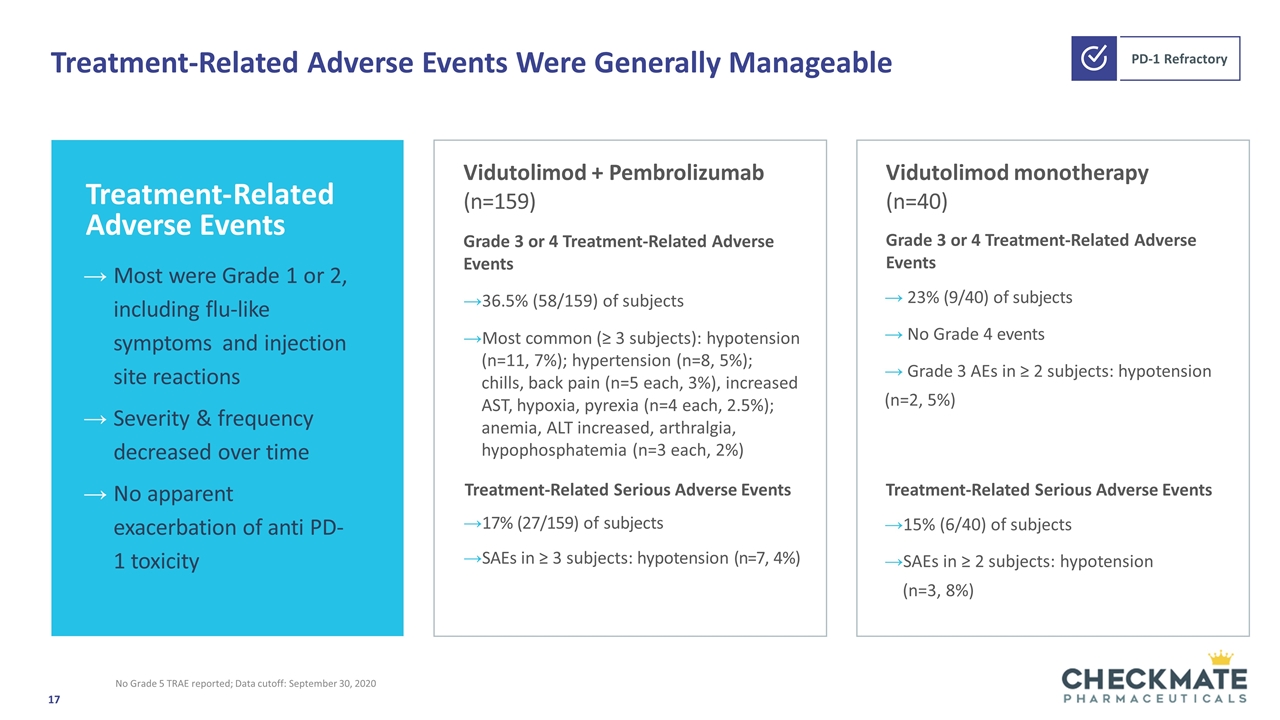

Treatment-Related Adverse Events Were Generally Manageable No Grade 5 TRAE reported; Data cutoff: September 30, 2020 Vidutolimod + Pembrolizumab (n=159) Grade 3 or 4 Treatment-Related Adverse Events 36.5% (58/159) of subjects Most common (≥ 3 subjects): hypotension (n=11, 7%); hypertension (n=8, 5%); chills, back pain (n=5 each, 3%), increased AST, hypoxia, pyrexia (n=4 each, 2.5%); anemia, ALT increased, arthralgia, hypophosphatemia (n=3 each, 2%) Treatment-Related Serious Adverse Events 17% (27/159) of subjects SAEs in ≥ 3 subjects: hypotension (n=7, 4%) Treatment-Related Serious Adverse Events 15% (6/40) of subjects SAEs in ≥ 2 subjects: hypotension (n=3, 8%) Most were Grade 1 or 2, including flu-like symptoms and injection site reactions Severity & frequency decreased over time No apparent exacerbation of anti PD-1 toxicity Treatment-Related Adverse Events Vidutolimod monotherapy (n=40) Grade 3 or 4 Treatment-Related Adverse Events 23% (9/40) of subjects No Grade 4 events Grade 3 AEs in ≥ 2 subjects: hypotension (n=2, 5%)

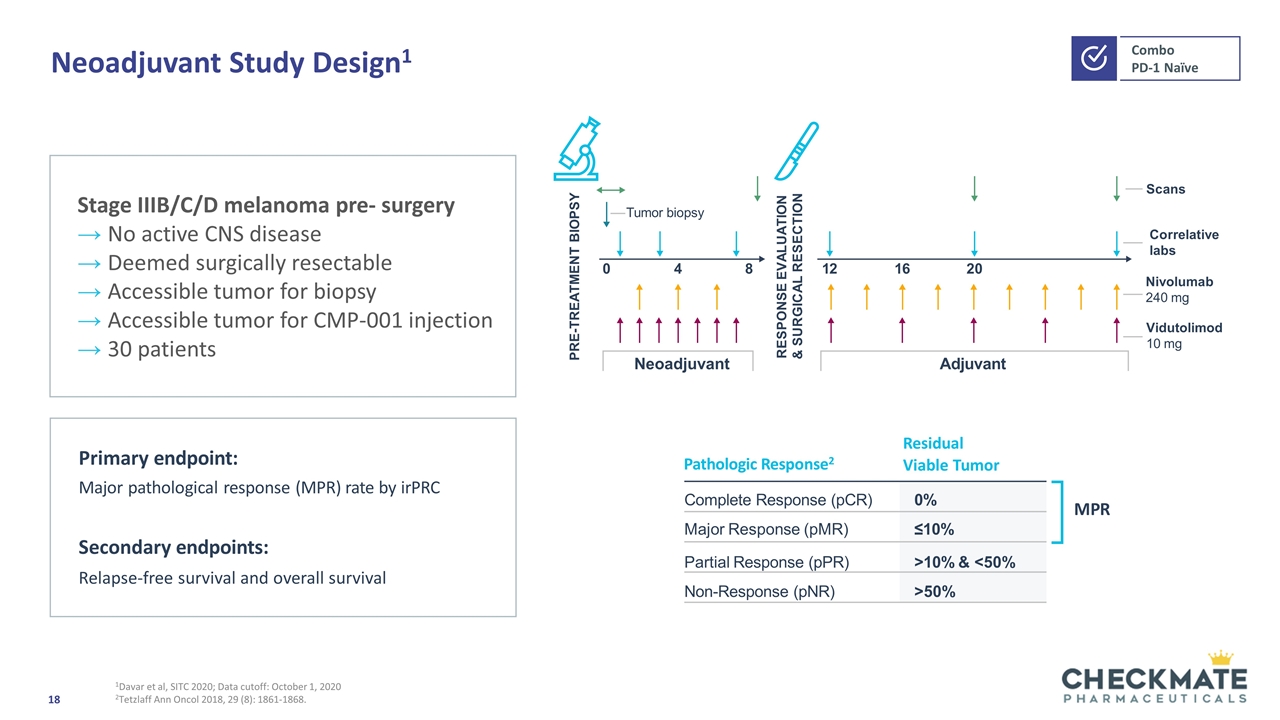

Neoadjuvant Study Design1 1Davar et al, SITC 2020; Data cutoff: October 1, 2020 2Tetzlaff Ann Oncol 2018, 29 (8): 1861-1868. Pathologic Response2 Residual Viable Tumor MPR Complete Response (pCR) 0% Major Response (pMR) ≤10% Partial Response (pPR) >10% & <50% Non-Response (pNR) >50% Primary endpoint: Major pathological response (MPR) rate by irPRC Secondary endpoints: Relapse-free survival and overall survival Neoadjuvant Adjuvant Tumor biopsy 121620 8 4 0 PRE-TREATMENT BIOPSY RESPONSE EVALUATION & SURGICAL RESECTION Scans Correlative labs Vidutolimod 10 mg Nivolumab 240 mg Stage IIIB/C/D melanoma pre- surgery No active CNS disease Deemed surgically resectable Accessible tumor for biopsy Accessible tumor for CMP-001 injection 30 patients

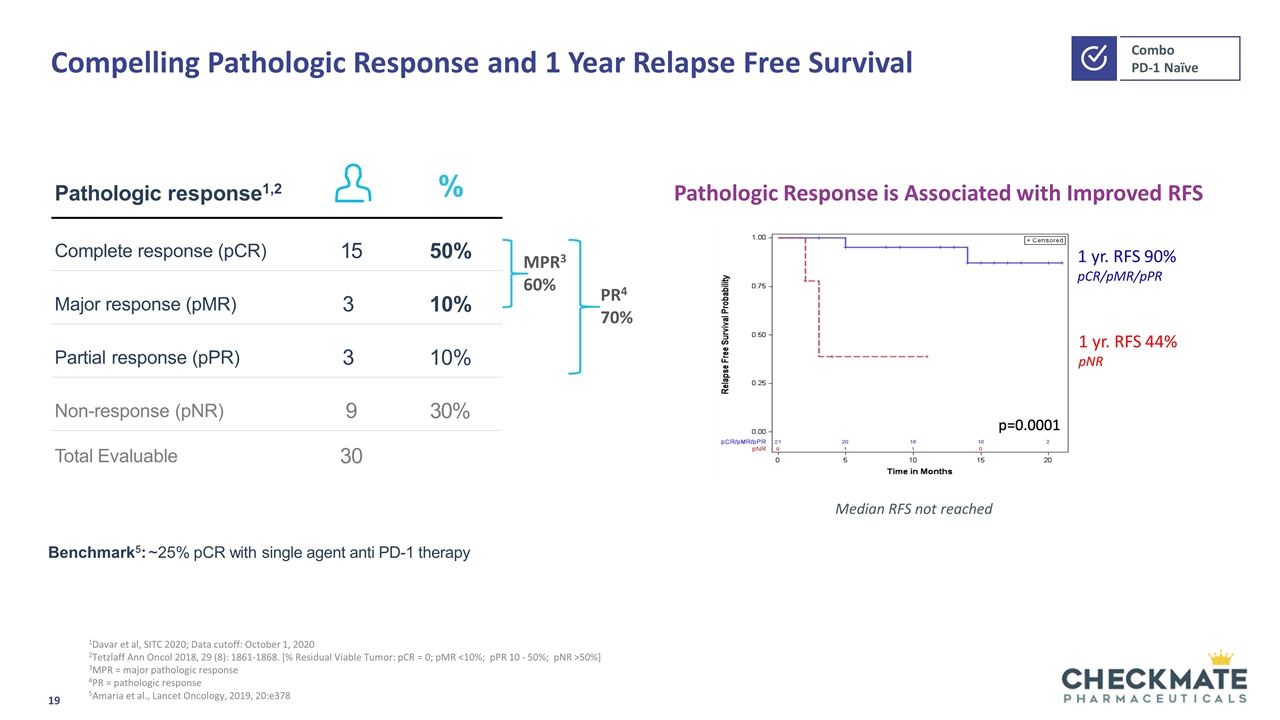

Compelling Pathologic Response and 1 Year Relapse Free Survival 1Davar et al, SITC 2020; Data cutoff: October 1, 2020 2Tetzlaff Ann Oncol 2018, 29 (8): 1861-1868. [% Residual Viable Tumor: pCR = 0; pMR <10%; pPR 10 - 50%; pNR >50%] 3MPR = major pathologic response 4PR = pathologic response 5Amaria et al., Lancet Oncology, 2019, 20:e378 Pathologic response1,2 % Complete response (pCR) 15 50% Major response (pMR) 3 10% Partial response (pPR) 3 10% Non-response (pNR) 9 30% Total Evaluable 30 Pathologic Response is Associated with Improved RFS 1 yr. RFS 90% pCR/pMR/pPR 1 yr. RFS 44% pNR Median RFS not reached MPR3 60% PR4 70% Benchmark5: ~25% pCR with single agent anti PD-1 therapy

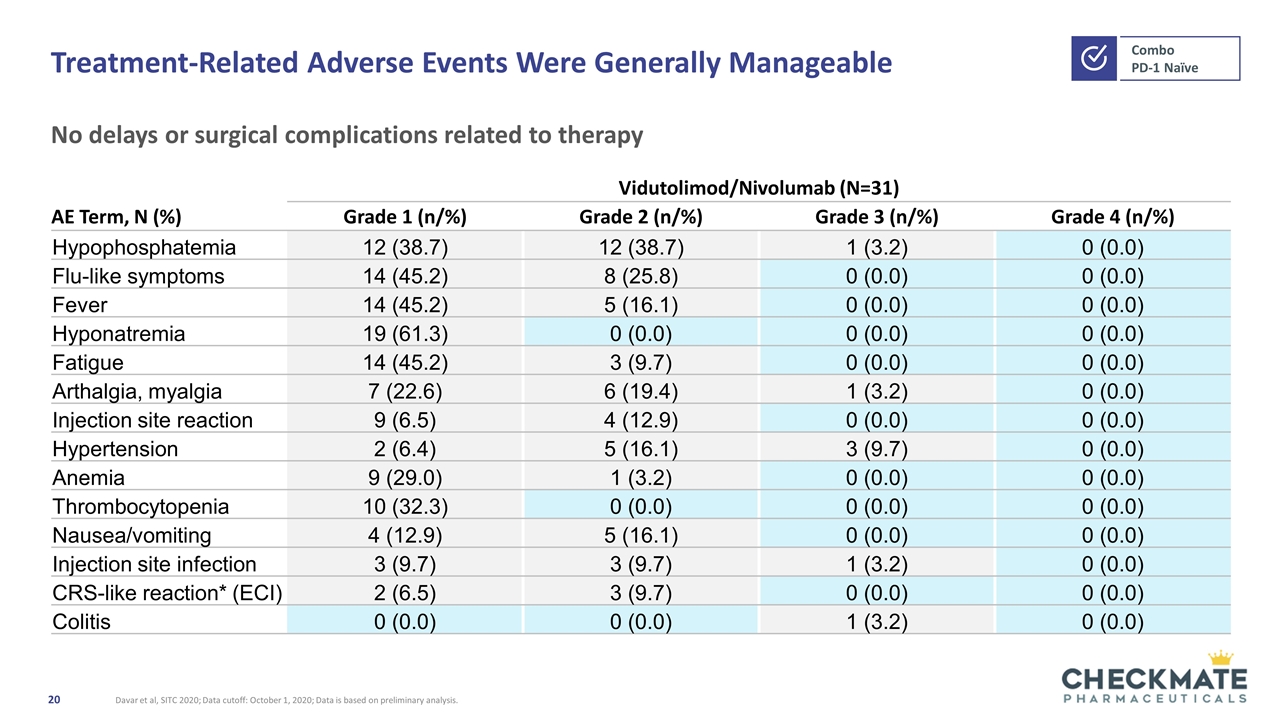

Treatment-Related Adverse Events Were Generally Manageable No delays or surgical complications related to therapy Davar et al, SITC 2020; Data cutoff: October 1, 2020; Data is based on preliminary analysis. Vidutolimod/Nivolumab (N=31) AE Term, N (%) Grade 1 (n/%) Grade 2 (n/%) Grade 3 (n/%) Grade 4 (n/%) Hypophosphatemia 12 (38.7) 12 (38.7) 1 (3.2) 0 (0.0) Flu-like symptoms 14 (45.2) 8 (25.8) 0 (0.0) 0 (0.0) Fever 14 (45.2) 5 (16.1) 0 (0.0) 0 (0.0) Hyponatremia 19 (61.3) 0 (0.0) 0 (0.0) 0 (0.0) Fatigue 14 (45.2) 3 (9.7) 0 (0.0) 0 (0.0) Arthalgia, myalgia 7 (22.6) 6 (19.4) 1 (3.2) 0 (0.0) Injection site reaction 9 (6.5) 4 (12.9) 0 (0.0) 0 (0.0) Hypertension 2 (6.4) 5 (16.1) 3 (9.7) 0 (0.0) Anemia 9 (29.0) 1 (3.2) 0 (0.0) 0 (0.0) Thrombocytopenia 10 (32.3) 0 (0.0) 0 (0.0) 0 (0.0) Nausea/vomiting 4 (12.9) 5 (16.1) 0 (0.0) 0 (0.0) Injection site infection 3 (9.7) 3 (9.7) 1 (3.2) 0 (0.0) CRS-like reaction* (ECI) 2 (6.5) 3 (9.7) 0 (0.0) 0 (0.0) Colitis 0 (0.0) 0 (0.0) 1 (3.2) 0 (0.0)

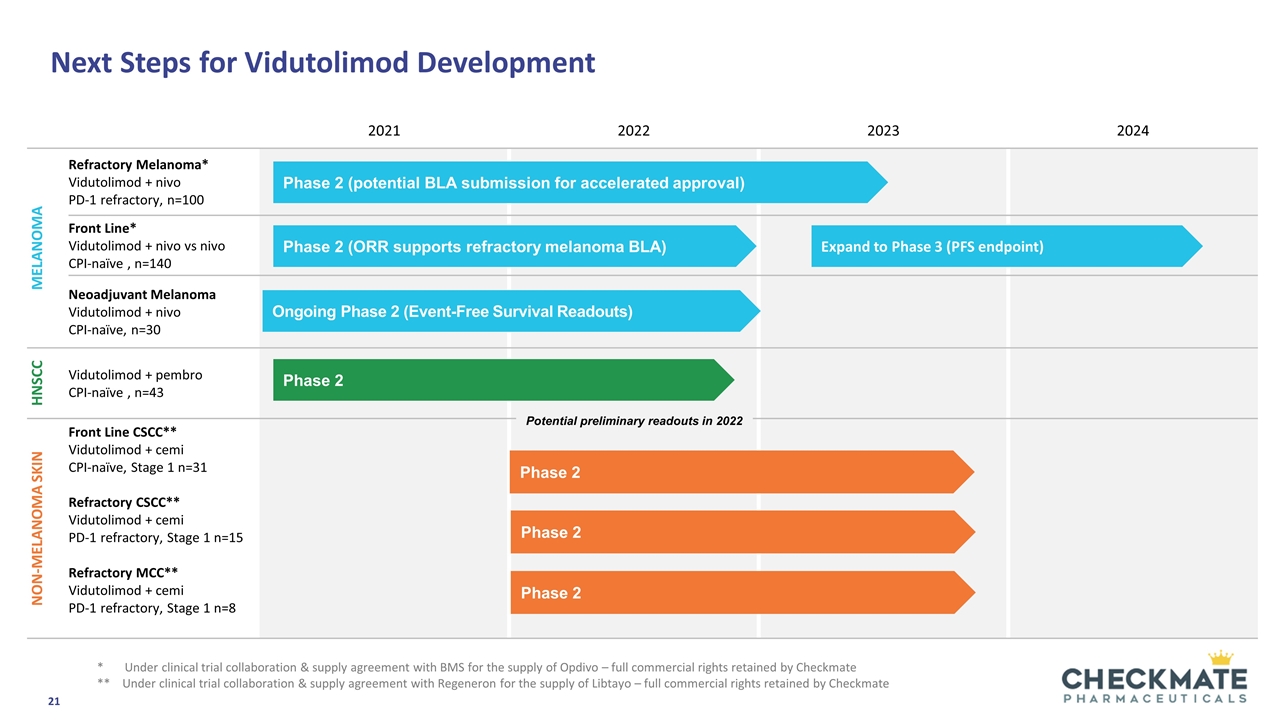

Next Steps for Vidutolimod Development 2021 2022 2023 2024 Melanoma Refractory Melanoma* Vidutolimod + nivo PD-1 refractory, n=100 Front Line* Vidutolimod + nivo vs nivo CPI-naïve , n=140 Neoadjuvant Melanoma Vidutolimod + nivo CPI-naïve, n=30 HNSCC Vidutolimod + pembro CPI-naïve , n=43 Non-melanoma skin Front Line CSCC** Vidutolimod + cemi CPI-naïve, Stage 1 n=31 Refractory CSCC** Vidutolimod + cemi PD-1 refractory, Stage 1 n=15 Refractory MCC** Vidutolimod + cemi PD-1 refractory, Stage 1 n=8 Phase 2 Phase 2 (ORR supports refractory melanoma BLA) Phase 2 (potential BLA submission for accelerated approval) Ongoing Phase 2 (Event-Free Survival Readouts) Expand to Phase 3 (PFS endpoint) * Under clinical trial collaboration & supply agreement with BMS for the supply of Opdivo – full commercial rights retained by Checkmate ** Under clinical trial collaboration & supply agreement with Regeneron for the supply of Libtayo – full commercial rights retained by Checkmate Phase 2 Phase 2 Phase 2 Potential preliminary readouts in 2022

Rich Flow of New Data in 2022 Head and neck cancer potential interim data readouts beginning 1H 2022 Head and neck cancer anticipated full ORR readout 2H 2022 Cutaneous squamous cell and Merkel cell carcinomas potential interim data readouts in 2H 2022 Melanoma registration program topline data readouts expected in late 2022/1H 2023 Multiple Value Generating Milestones in next 6-18 months

Experienced Management Team Headquarters in Cambridge, MA Completed IPO in August 2020 As of March 31, 2021 Cash and Cash equivalents of $111.5M Common stock shares outstanding 21.6 million No debt Cash runway through end of 2022 Corporate Highlights

Investment Highlights Vidutolimod (CMP-001) is an innate immune modulator with the potential to become a backbone of I/O combinations 28% ORR in PD-1 refractory melanoma1 70% pathologic response in PD-1 naïve neoadjuvant melanoma and 90% RFS at 1 year2 17.5% ORR in PD-1 refractory melanoma as monotherapy3 Targeting approval in front line metastatic and PD-1 refractory melanoma Fast Track and Orphan Drug Designation Pursuing head & neck and non-melanoma skin cancers 1. CMP-001 plus pembrolizumab, data cutoff September 30, 2020 (includes post-progression responders); N=98 2. Davar, SITC 2020, data cutoff October 1, 2020 3 CMP-001 monotherapy, data cutoff September 30, 2020; N=40 Melanoma topline data anticipated late 2022/1H 2023 Head & neck cancer Ph2 data maturing throughout 2022 Non-melanoma skin cancer interim Ph2 data 2H 2022 Differentiated Therapeutic Extensive and Consistent Clinical Data Multiple Value Driving Catalysts Robust Development Strategy TLR9 agonist Indication expansion >200 patients Melanoma registration