Attached files

| file | filename |

|---|---|

| EX-99.1 - FOOT LOCKER, INC. PRESS RELEASE (WSS), DATED AUGUST 2, 2021 - FOOT LOCKER, INC. | exhibit99-1_wss.htm |

| EX-99.2 - FOOT LOCKER, INC. PRESS RELEASE (ATMOS), DATED AUGUST 2, 2021 - FOOT LOCKER, INC. | exhibit99-2_atmos.htm |

| EX-2.1 - STOCK PURCHASE AGREEMENT, DATED AUGUST 1, 2021 - FOOT LOCKER, INC. | exhibit2-1_stockpurchag.htm |

| 8-K - 8-K - FOOT LOCKER, INC. | n2655_8k-x1.htm |

Exhibit 99.3

Two Strategic Transactions to Accelerate Global Growth August 2, 2021 1

Disclosure Regarding Forward-Looking Statements Certain statements and information herein may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The words “believe,” “expect,” “anticipate,” “plan,” “predict,” “intend,” “seek,” “foresee,” “should,”“would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “likely,” “guidance,” “goal,” “model,” “target,” “budget” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. Statements may be forward looking even in the absence of these particular words. Examplesofforward-looking statements include, but are not limited to, statements regarding the proposed acquisition of WSS and atmos(the “Proposed Transactions”), expected synergies and other benefits from and costs in connection with the Proposed Transactions, estimated financial metrics giving effect to the Proposed Transactions, our financial position, business strategy,and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number ofrisks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-lookingstatements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: our ability to fund our planned capital investments; the impact of volatility in the financial markets or other global economic factors; difficulties in appropriately allocating capital and resources among our strategic opportunities; our ability to realize the expected benefits from recent acquisitions or the Proposed Transactions;costs in connection with the Proposed Transactions; the consummation of or failure to consummate the Proposed Transactions and the timing thereof; costs in connection with the ProposedTransactions; integration of operations and results subsequent to the Proposed Transactions; the continuing effects of each of the coronavirus pandemic (COVID-19) and social unrest on our financial results; the impact of government regulation, including changes in law; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement. Use of Projections The financial, operational, industry and market projections, estimates and targets in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Foot Locker Inc.’s, WSS’s and atmos’scontrol. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial, operational, industry and market projections, estimates and targets,including assumptions, risks and uncertainties described in “Forward-looking Statements” above. 2

AGENDA 1 Foot Locker, Inc. Growth Strategy 2 Overview of atmosand Strategic Benefits 3 Overview of WSS and Strategic Benefits 4 Summary of Transactions 3

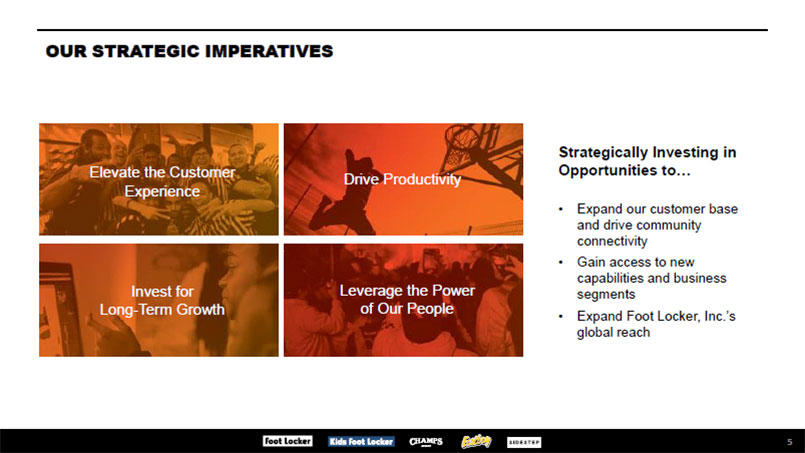

OUR MISSION: To fuel a shared passion for self-expression OUR VISION: OUR STRATEGIC IMPERATIVES To create unrivaled experiences for our consumers OUR POSITION: To be at the heart of the sport and sneaker communities

OUR STRATEGIC IMPERATIVES Strategically Investing in Opportunities to •Expand our customer base and drive community connectivity •Gain access to new capabilities and business segments •Expand Foot Locker, Inc.’s global reach 5

THE FUTURE OF FOOT LOCKER, INC. Driving Profitable Growth by Addressing Key White Spaces in Our Industry Classics Driven Assortment for Full Family Sneaker Culture & Sport Culture Premium Boutique Streetwear 6

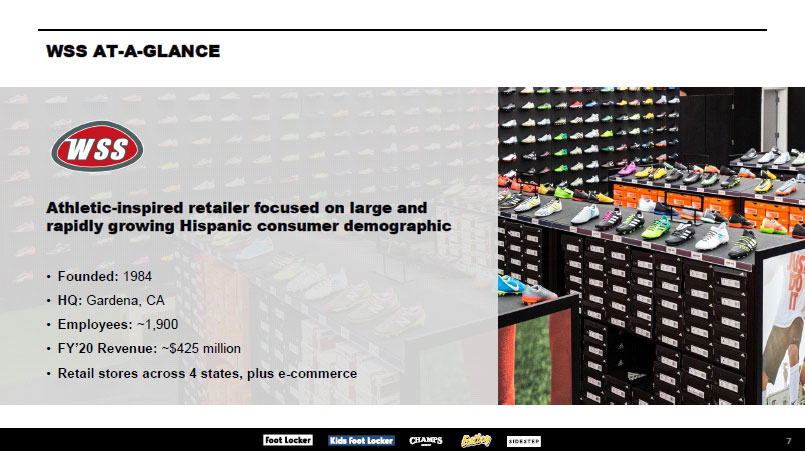

WSS AT-A-GLANCE Athletic-inspired retailer focused on large and rapidly growing Hispanic consumer demographic •Founded: 1984 •HQ: Gardena, CA •Employees: ~1,900 •FY’20 Revenue: ~$425 million •Retail stores across 4 states, plus e-commerce 7

WSS’S STRONG 100% OFF-MALL RETAIL FOOTPRINT GEOGRAPHIC STRENGTH IN KEY MARKETS WITH RAPIDLY GROWING CUSTOMER BASES TOTAL STORES California72 Texas13 Nevada4 Arizona4 93 8

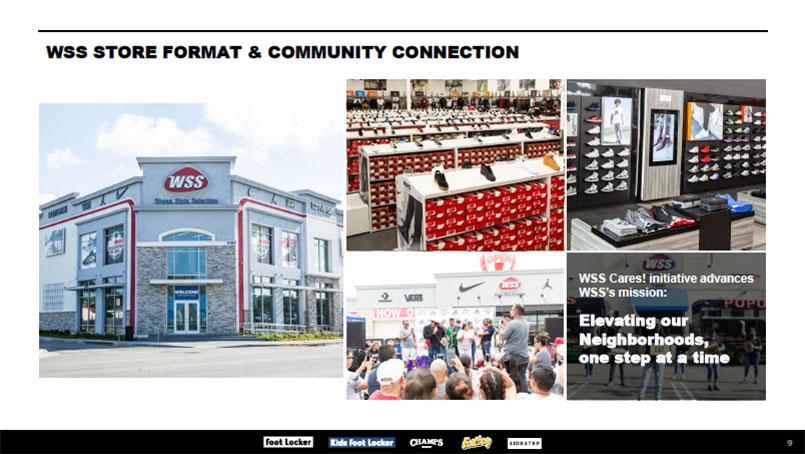

WSS STORE FORMAT & COMMUNITY CONNECTION WSS Cares! initiative advances WSS’s mission: Elevating our Neighborhoods, one step at a time 9

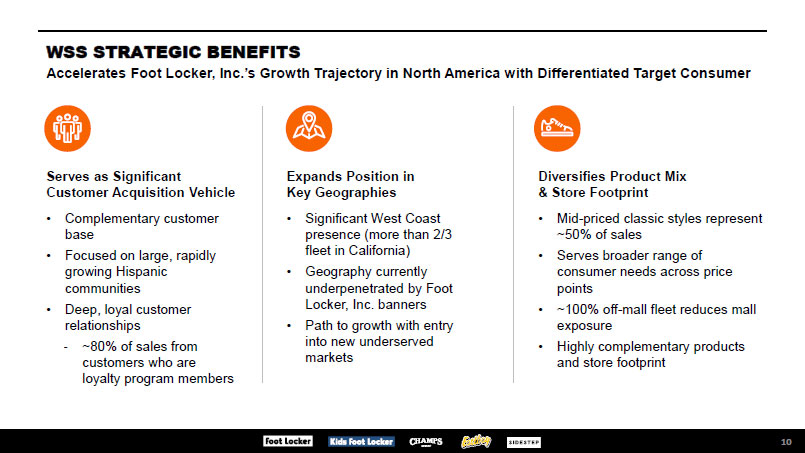

WSS STRATEGIC BENEFITS Accelerates Foot Locker, Inc.’s Growth Trajectory in North America with Differentiated Target Consumer Serves as Significant Customer Acquisition Vehicle •Complementary customer base •Focused on large, rapidly growing Hispanic communities •Deep, loyal customer relationships -~80% of sales from customers who are loyalty program members Expands Position in Key Geographies •Significant West Coast presence (more than 2/3 fleet in California) •Geography currently underpenetrated by Foot Locker, Inc. banners •Path to growth with entry into new underserved markets Diversifies Product Mix & Store Footprint •Mid-priced classic styles represent ~50% of sales •Serves broader range of consumer needs across price points •~100% off-mall fleet reduces mall exposure •Highly complementary products and store footprint 10

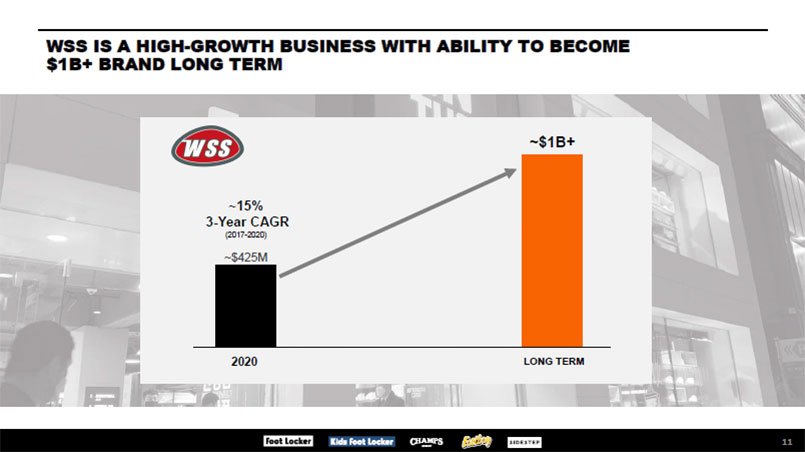

WSS IS A HIGH-GROWTH BUSINESS WITH ABILITY TO BECOME $1B+ BRAND LONG TERM ~15% 3-Year CAGR (2017-2020) ~$425M 2020 ~$1B+ LONG TERM 11

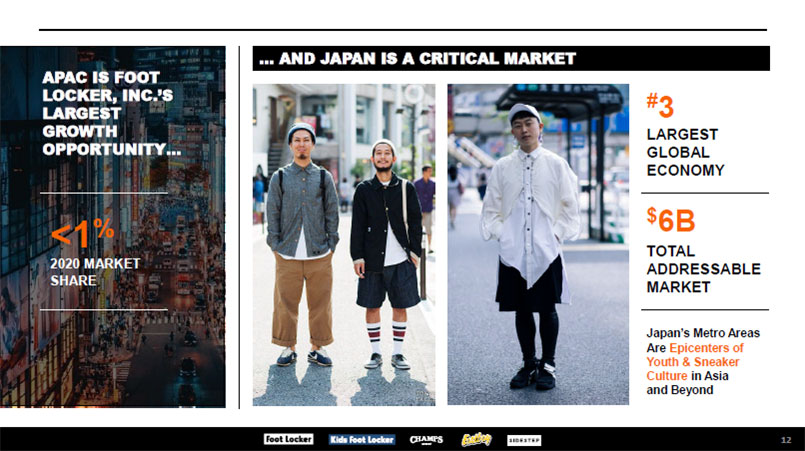

AND JAPAN IS A CRITICAL MARKET APAC IS FOOT LOCKER, INC.’S LARGEST GROWTH OPPORTUNITY… <1% 2020 MARKET SHARE #3 LARGEST GLOBAL ECONOMY $6B TOTAL ADDRESSABLE MARKET Japan’s Metro Areas Are Epicenters of Youth & Sneaker Culture in Asia and Beyond 12

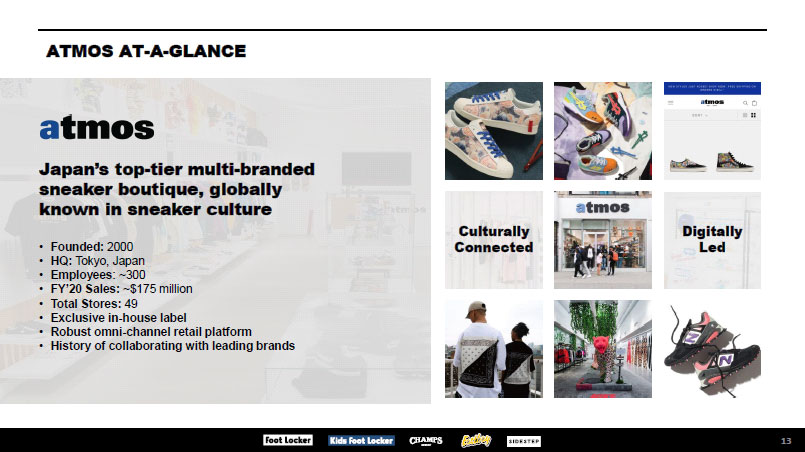

ATMOS AT-A-GLANCE Japan’s top-tier multi-branded sneaker boutique, globally known in sneaker culture •Founded: 2000 •HQ: Tokyo, Japan •Employees: ~300 •FY’20 Sales: ~$175 million •Total Stores: 49 •Exclusive in-house label •Robust omni-channel retail platform •History of collaborating with leading brands 13

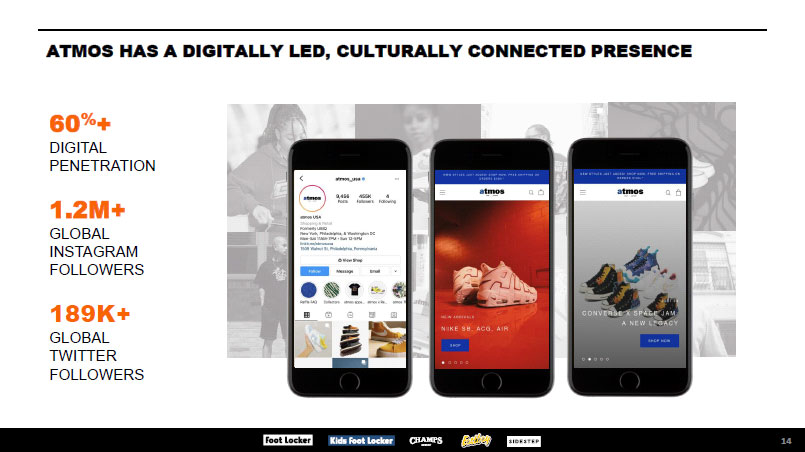

ATMOS HAS A DIGITALLY LED, CULTURALLY CONNECTED PRESENCE 60%+ DIGITAL PENETRATION 1.2M+ GLOBAL INSTAGRAM FOLLOWERS 189K+ GLOBAL TWITTER FOLLOWERS 14

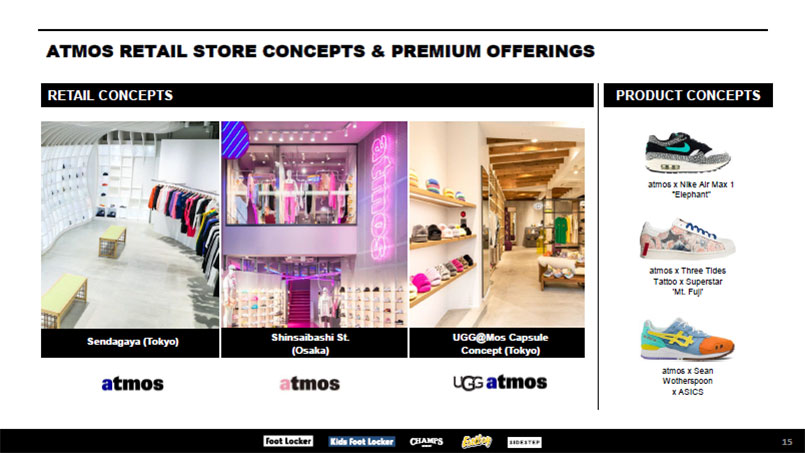

ATMOS RETAIL STORE CONCEPTS & PREMIUM OFFERINGS RETAIL CONCEPTS PRODUCT CONCEPTS Sendagaya (Tokyo) Shinsaibashi St. (Osaka) UGG@Mos Capsule Concept (Tokyo) atmosx Nike Air Max 1 “Elephant” atmosx Three Tides Tattoo x Superstar ‘Mt. Fuji’ atmosx Sean Wotherspoon x ASICS 15

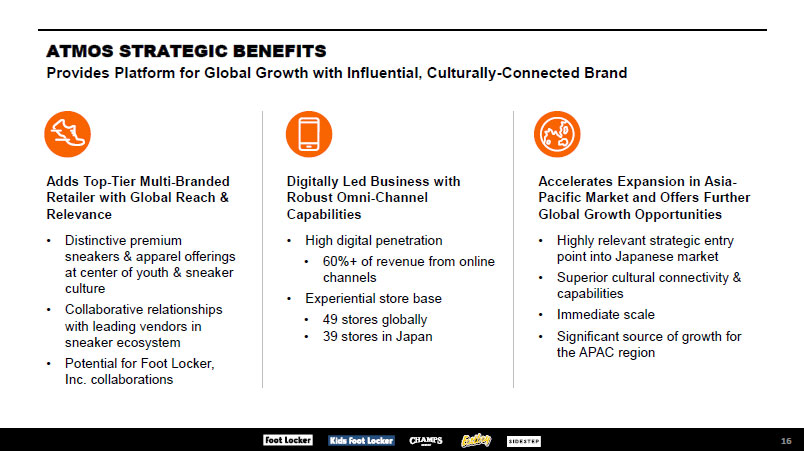

ATMOS STRATEGIC BENEFITS Provides Platform for Global Growth with Influential, Culturally-Connected Brand Adds Top-Tier Multi-Branded Retailer with Global Reach & Relevance •Distinctive premium sneakers & apparel offerings at center of youth & sneaker culture •Collaborative relationships with leading vendors in sneaker ecosystem •Potential for Foot Locker, Inc. collaborations Digitally Led Business with Robust Omni-Channel Capabilities •High digital penetration •60%+ of revenue from online channels •Experiential store base •49 stores globally •39 stores in Japan Accelerates Expansion in Asia-Pacific Market and Offers Further Global Growth Opportunities •Highly relevant strategic entry point into Japanese market •Superior cultural connectivity & capabilities •Immediate scale •Significant source of growth for the APAC region 16

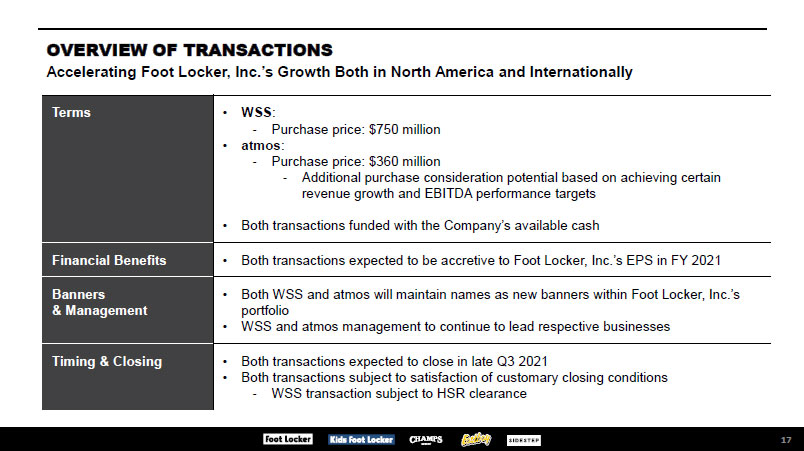

OVERVIEW OF TRANSACTIONS Accelerating Foot Locker, Inc.’s Growth Both in North America and Internationally Terms •WSS: -Purchase price: $750 million •atmos: -Purchase price: $360 million -Additional purchase consideration potential based on achieving certain revenue growth and EBITDA performance targets •Both transactions funded with the Company’s available cash Financial Benefits •Both transactions expected to be accretive to Foot Locker, Inc.’s EPS in FY 2021 Banners & Management •Both WSS and atmoswill maintain names as new banners within Foot Locker, Inc.’s portfolio •WSS and atmosmanagement to continue to lead respective businesses Timing & Closing •Both transactions expected to close in late Q3 2021 •Both transactions subject to satisfaction of customary closing conditions -WSS transaction subject to HSR clearance 17

CONTINUED FOCUS ON OUR STRATEGIC IMPERATIVES Elevate the Customer Experience Drive Productivity Invest for Long-Term Growth Leverage the Power of Our People Accelerating global growth and creating additional value for all Foot Locker, Inc. stakeholders 18