Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DZS INC. | dzsi-8k_20210802.htm |

| EX-99.2 - EX-99.2 - DZS INC. | dzsi-ex992_265.htm |

Exhibit 99.1

|

|

|

Q2 2021

Shareholder Report

|

|

|

|

Q2 2021 Shareholder Report |

|

|

03 |

Shareholder Report |

|

05 |

Target Margin Model |

|

06 |

Long-Term Target Gross Margin Profiles |

|

07 |

Go-to-Market |

|

08 |

Operational Execution |

|

10 |

A Transformative Twelve Months |

|

12 |

Operational Execution |

|

12 |

Balance Sheet |

|

12 |

Acquisition Integration and Development Progress |

|

14 |

Customer Milestones |

|

19 |

DZS Velocity Innovation: XCelerate by DZS |

|

20 |

Transforming Connected Premises into Brilliant Homes and Buildings |

|

22 |

Shaping the Future Through Open Standards and Industry Thought Leadership |

|

24 |

Second Quarter Financial Results |

|

28 |

Third Quarter 2021 and Full Year 2021 Guidance |

|

29 |

Summary |

|

31 |

Conference Call |

|

31 |

Investor Inquiries |

|

32 |

About DZS |

|

32 |

Forward-Looking Statements |

|

32 |

Use of Non-GAAP Financial Information |

|

35 |

Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss) |

|

36 |

Unaudited Condensed Consolidated Balance Sheets |

|

37 |

Unaudited Reconciliation of GAAP to Non-GAAP Results |

|

38 |

Unaudited Reconciliation of GAAP to Non-GAAP Guidance |

|

|

|

|

|

| 2 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Monday, August 2, 2021

DZS Shareholders,

As I mark my first anniversary since joining DZS, I am pleased to share our Q2 2021 Shareholder Report. In this report, we share global trends driving the market segments we service (5G Open RAN, broadband connectivity and software defined networking), progress and milestones we have achieved since our first quarter of 2021 Shareholder Report, financial results for the second quarter 2021, an outlook for the remainder of 2021, and our long-term target financial model framework.

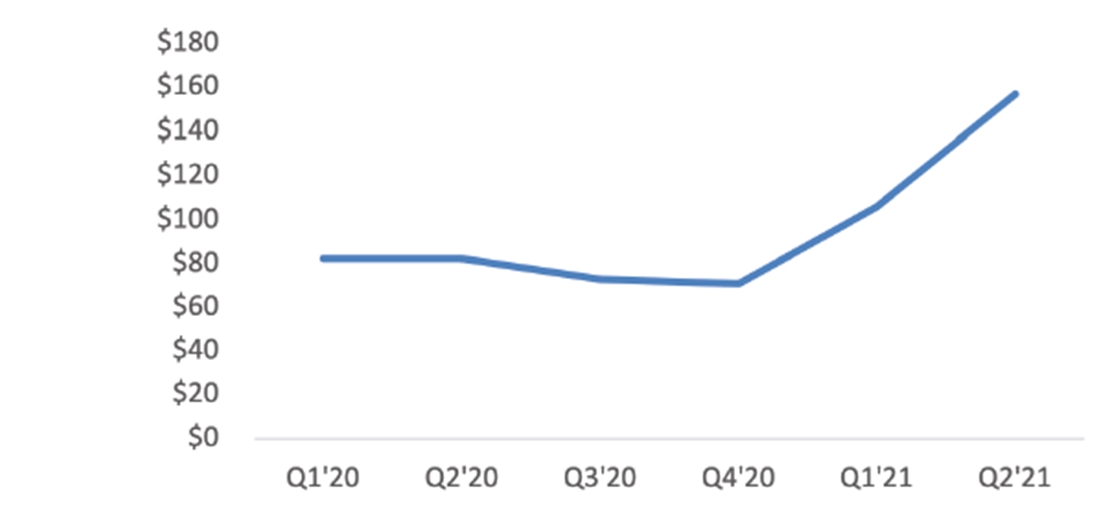

Strong demand for broadband connectivity and 5G mobile transport solutions delivered record orders for the second quarter 2021, which follows record setting orders achieved in the first quarter of 2021. Second quarter 2021 orders of $128 million increased 65% year-over-year and our first half 2021 orders of $245 million represented an 82% year-over-year increase. Record backlog of $160 million at June 30, 2021, represented a 95% increase year-over-year.

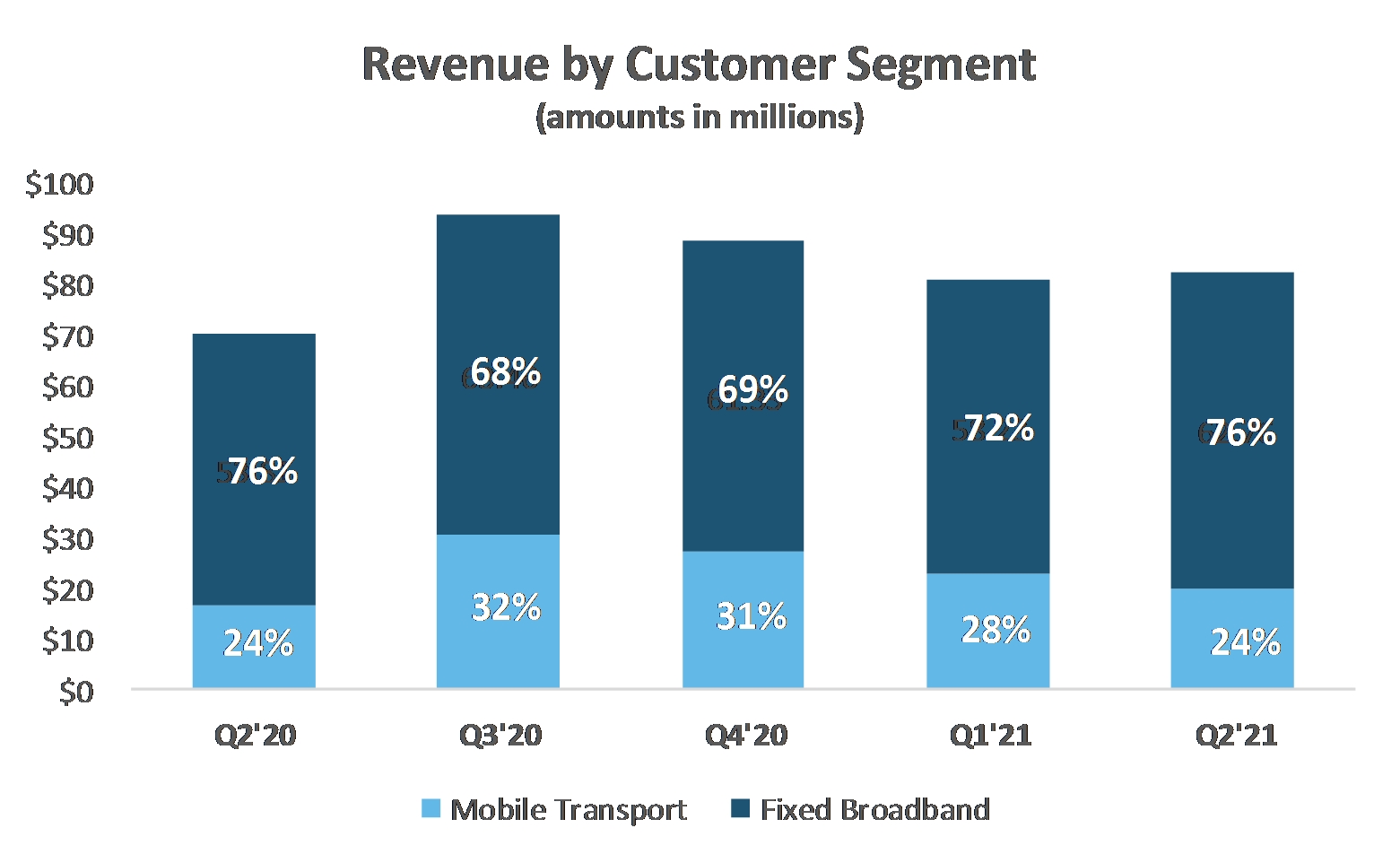

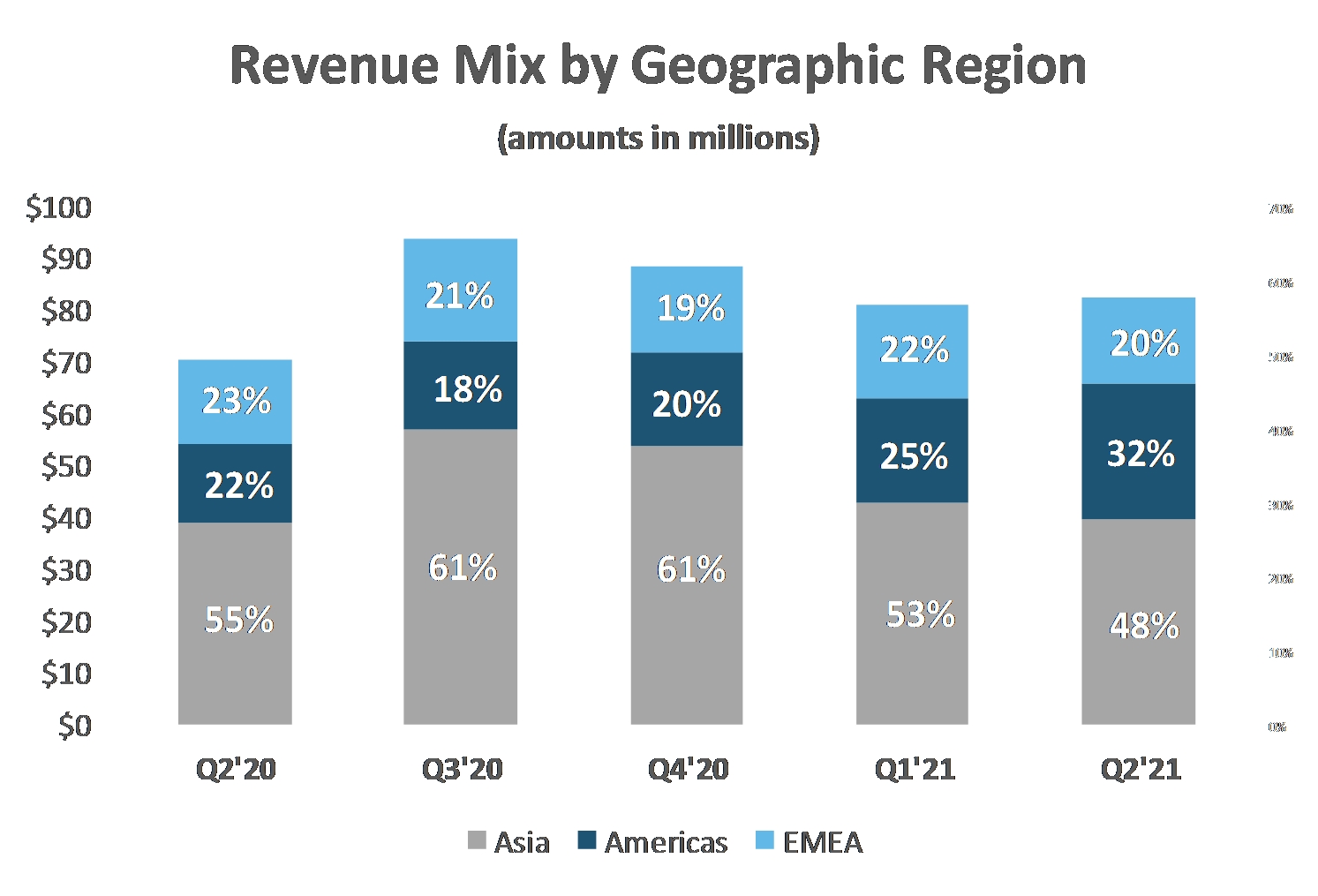

Second quarter 2021 revenue of $82.7 million increased 17.3% year-over-year and our trailing 12-month revenue of $346.4 million increased 29.7%. During the second quarter, revenue for both mobile transport and broadband connectivity demonstrated double digit revenue growth. On a geographic basis, revenue from the Americas in the second quarter increased 75% year-over-year while the Asia and the EMEA regions each were relatively flat. For the trailing twelve months, revenue growth was led by our mobile transport products.

August 2, 2021

|

|

*2021 Annual Revenue reflects the mid-point of guidance as of Aug. 2, 2021.

|

|

|

|

|

| 3 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Record Backlog at the End of Q2

|

|

|

|

|

|

|

End of quarter backlog order value from first quarter 2020 to second quarter 2021. |

|

|

|

|

|

As reflected in our year-to-date revenue, we have been effectively executing our strategic growth initiatives. Our Americas and EMEA (AEMEA) growth strategy is fueled by market share gains through innovation and strategic alignment with service providers and fiber overbuilders as well as U.S. Rural Digital Opportunity Fund (RDOF) and other government broadband incentive programs. The combined AEMEA region delivered revenue of $43.2 million for the second quarter of 2021, an increase of 37% from the second quarter of 2020. Combined revenue for the Americas and EMEA regions exceeded 52% of total revenue, the highest percentage since Q1 of 2018. Within the AEMEA region, North America orders increased 101% in the second quarter of 2021 compared to the same period of 2020. AEMEA’s record performance validates our go-to- market strategy and take-share initiatives in North America, Latin America, and EMEA. Even so, Asia continued to perform extremely well delivering orders that increased 105% year-over-year in the second quarter of 2021. During the first six months of 2021, we recognized 39 new customers balanced across the Americas, EMEA, and Asia. In addition, we received orders in the first half of 2021 from 12 of the top 25 top wireline and wireless telecommunications service providers globally measured by 2020 revenue. |

The combined AEMEA region delivered revenue of $43.2 million for the second quarter of 2021, an increase of 37% from the second quarter of 2020. |

|

|

|

|

|

|

|

|

| 4 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

Target Gross Margin Framework |

|

|

|

|

|

|

|

|

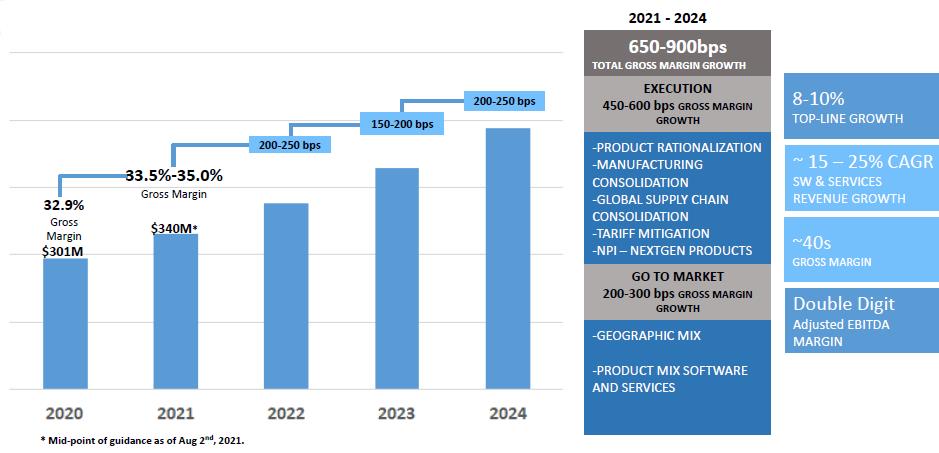

Supply chain pricing, freight and logistics costs, availability, and lead-time challenges continued throughout the second quarter of 2021. While we have delivered strong results over the past 12 months specifically relating to new customer and design wins, record orders, record backlog, and record revenue, our year-over-year supply chain costs consisting of semiconductor components, manufacturing, freight, and logistics costs have increased over the past 12 months. Despite the current supply chain dynamics, we are encouraged by the progress we are making to improve long-term gross margins from recently implemented workstream initiatives and as demonstrated by our adjusted gross margin improvement in the first half of 2021 compared with the second half of 2020. The current gross margin expansion workstreams underway are aimed to deliver 40% gross margin within 2023, representing an improvement of approximately 800bps compared to year-end 2020. On July 15th, the DZS German subsidiary entered into agreements with its workers council, which is expected to achieve favorable long-term cost synergies. These agreements enable DZS to move our Hanover, Germany manufacturing to our Tampa Bay area manufacturing facility and other manufacturing partners, which we estimate will deliver approximately $7 million of annual cost savings. Our long-term gross margin target represents favorability derived from product lifecycle management, supply chain and manufacturing consolidation, higher margin new product introductions, and an increase in software and service revenue. |

The current gross margin expansion workstreams underway are aimed to deliver over 40% gross margin by year end 2023, representing an improvement of approximately 8% improvement compared to year-end 2020. |

|

|

|

|

|

|

|

|

|

|

|

| 5 |

|

|

|

|

Q2 2021 Shareholder Report |

|

We profile our long-term target gross margin plan in two categories:

|

|

1. |

Go-to-Market (Gross margin expansion outlook of 200–300 bps) |

|

|

• |

Our gross margin expansion outlook, together with our go-to-market playbook, requires DZS to secure new design wins, participate in the tailwinds associated with government broadband stimulus programs, such as RDOF, and increase our market share in North America, Western Europe, and the Middle East. |

|

|

|

2. |

Operational Execution (Gross margin expansion outlook of 450–600 bps) |

|

|

|

• |

As part of our gross margin expansion and execution playbook, |

we plan to rationalize and align our product lines, consolidate our manufacturing and supply chain, mitigate tariffs on our products, and fully leverage our new product introduction (NPI) process.

|

|

• |

These operational work-streams are all underway and we currently expect them to flow through our financial statements over the next several years. |

|

Target Gross Margin Model

|

|

|

|

|

| 6 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Go-to-Market (Gross margin expansion outlook range of 200–300 bps)

|

|

1. |

Geographic Mix |

|

|

• |

We expect revenue from North America, Western Europe, and the Middle East to remain strong for the next several years due |

|

to favorable geo-political dynamics (including Huawei and ZTE replacement), and our innovation in the areas of next generation 10 & 25 gig PON, Open RAN mobile transport solutions, and software defined networking solutions.

|

|

• |

Revenue from North America, Western Europe, and the Middle East historically delivers higher gross margin compared with Asia, Central/Eastern Europe, and Latin America. |

|

|

|

2. |

Product Mix |

|

|

• |

With the introduction of the DZS Velocity and DZS Chronos portfolios in the first quarter of 2021, we have created a range of innovative, differentiated product designs that carry higher margins. Continued rationalization of our existing product lines that standardizes on a unified, streamlined systems approach is anticipated to contribute to higher margins. We expect the mix of our core hardware sales going forward to increasingly favor these new higher margin platforms. |

|

|

|

• |

During the first quarter of 2021, we accelerated our software strategy with the acquisition of RIFT. This acquisition significantly advanced the development of the DZS Cloud platform for network orchestration, automation, and analytics for wireline and 4/5G wireless networks, including 5G service management with network slicing. |

|

|

|

• |

During the second half of 2021, we plan to expand our access orchestration, automation, service assurance, and data analytics solutions portfolio to our broadband connectivity customer base. We believe the DZS Cloud suite will unlock new value for our service provider customers. As we ramp software sales over the next few years, we expect to benefit from higher software margins and reoccurring license, maintenance, and service revenue. |

|

|

|

• |

Over the past 12 months, we have developed and enhanced service assurance offerings along with customer care policies, programs, and global pricing. |

|

|

|

|

|

|

| 7 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

|

• |

DZS is also expanding professional services offerings to encompass network design, on-site engineering/technical support services, managed services, and equipment furnishing and installation (EF&I). Over the past six months, our services attachment rate has increased because of these new programs and focus. |

|

Operational Execution (Gross margin expansion outlook range of 450–600 bps)

|

|

1. |

Product Rationalization |

|

|

• |

In the second half of 2020, we initiated our ongoing workstream consisting of global product rationalization and research & development (R&D) assessment, to align with our mobile-edge transport, broadband connectivity, software, and service technology pillars. We expect these workstreams will drive operating and cost of goods savings through the elimination of product redundancy and lower bill of material (BOM) costs. |

|

|

|

2. |

Consolidating Manufacturing |

|

|

• |

During the first half of 2021, we announced plans to discontinue manufacturing in our Hanover, Germany facility, transitioning it to a sales, R&D, and services center by year-end 2021. The anticipated cost savings and associated improvement in product margins |

|

are expected to be fully realized in 2022. Our products that were previously manufactured in Hanover are expected to be consolidated into our Tampa Bay area manufacturing facility as well as with various other global contract manufacturing partners.

|

|

3. |

Supply Chain Consolidation |

|

|

• |

Following the merger of Dasan Networks Solutions and Zhone Technologies in 2016, we inherited numerous original design manufacturer (ODM), contract manufacturing (CM), semiconductor and component partner relationships. By strategically aligning with fewer partners, we anticipate innovation synergies, favorable cost savings, and improved global scale. |

|

|

|

|

|

|

| 8 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

|

4. |

Tariff Mitigation |

|

|

• |

As part of our supply chain consolidation and alignment strategy, we are working with CM and ODM partners to transition manufacturing to facilities in low tariff countries such as Vietnam, Malaysia, and India. We designed this effort to reduce and mitigate tariff burdens and align with requirements of service providers, corporate enterprises, and municipalities/governments worldwide. |

|

|

|

5. |

New Product Introduction (NPI) |

|

|

• |

We anticipate higher margins from a new NPI governance process with increased emphasis on next generation and differentiated broadband connectivity, mobile-edge transport, software defined solutions, and enhanced services. |

|

|

|

|

|

|

| 9 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

A Transformative Twelve Months |

|

|

|

|

|

My first priorities after joining DZS included strengthening our executive leadership team, expanding our research & development initiatives, upgrading our sales organization, and instilling an entrepreneurial, customer- first, relentless performance-oriented culture. During the first half of 2021 in particular, our transformation has attracted top executive, management, and sales talent from companies across our industry: |

During the first half of 2021 in particular, our transformation has attracted top executive, management, and sales talent from companies across our industry. |

|

|

|

|

|

|

|

We have secured more new customers in the first half of 2021 than all of 2020. Our new customer and sales funnel include mobile operators, incumbent local exchange carriers (ILECs), fiber overbuilders, utility cooperatives, wireless internet service providers (WISPs), and municipalities. Both our existing and prospective customers appear to be accelerating their growth through government broadband stimulus programs such as RDOF that enable investment in next generation fiber based broadband solutions. Today, 12 of the world’s top 25 wireline and wireless telecommunications service providers based on 2020 revenue are DZS customers.

|

Today, 12 of the world’s top 25 wireline and wireless telecommunications service providers based on 2020 revenue are DZS customers. |

|

|

|

|

|

| 10 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

Misty Kawecki, Chief Financial Officer |

|

|

|

|

|

|

|

|

Today, I am thrilled to announce another strong addition to |

Misty exemplifies the entrepreneurial, customer- |

|

our executive leadership team who can guide us through our next phase of growth. DZS has named telecom finance veteran Misty Kawecki as Chief Financial Officer, effective immediately. Ms. Kawecki brings over 24 years of progressive finance and accounting experience at Big 4 accounting firms and public, private, and private equity-owned companies to the role and will serve as a strategic advisor to me and the Board of Directors. She succeeds Tom Cancro, who served as CFO since 2019. I have worked closely with Misty in previous CEO roles both at Imagine Communications and GENBAND. Prior to DZS, Ms. Kawecki served as CFO and head of operations at MediaKind, a large-scale media platform (Mediaroom) spin-out from Ericsson. Before joining MediaKind, she served as the Chief Accounting Officer at Imagine Communications and prior to that, she held Vice President of finance roles at GENBAND and McAfee (Intel). She started her career at EY and has a master’s degree in accounting from Texas Tech University. |

first, ultra-fast paced culture we have built, and I am confident that she will excel in this role. |

|

|

|

|

|

|

|

|

|

|

|

| 11 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

Operational Execution |

|

|

|

|

|

Our operations, supply chain, finance, human resources, and information technology teams are delivering strong near-term results including favorable inventory turns, fewer days sales outstanding (DSOs), improved employee benefits and total reward programs, integration of ERP/EPM systems, and increased product and EBITDA margins. We accomplished approximately five inventory turns during the second quarter of 2021. DSOs of 94 days for the second quarter of 2021 compared with 129 days in the second quarter of 2020. |

|

|

|

|

|

Balance Sheet During first half of 2021, we have strengthened the DZS balance sheet and become debt-free as a result of a series of initiatives including our $64.4 million gross proceeds equity raise in the first quarter of 2021, improved DSOs, better management of days payables outstanding, inventory turns near five times annually, and alignment with high quality service provider customers. The improvement in our balance sheet enables more flexibility to thoughtfully pursue organic innovation and accretive M&A. Acquisition Integration and During the first quarter of 2021, DZS acquired coherent optics innovator Optelian Access Networks Corporation (Optelian) and software defined orchestration, automation, and network slicing provider RIFT. The integration and further development of these new product lines are delivering an expanded portfolio of mobile and broadband connectivity solutions. The Optelian acquisition was the catalyst for our new “O-series” carrier grade optical networking products with 100 Gigabits per second (Gbps) and above capability and environmentally hardened Dense Wavelength Division Multiplexing (DWDM) coherent optics. This strategically expanded our DZS Chronos and DZS Velocity portfolios with robust, high capacity, and flexible solutions at the network edge.

|

During first half of 2021, we have strengthened the DZS balance sheet and become debt-free as a result of a series of initiatives including our $64.4 million gross proceeds equity raise in the first quarter of 2021, improved DSOs, better management of days payables outstanding, inventory turns near five times, and alignment with high quality service provider customers. |

|

|

|

|

|

| 12 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

O-series products feature designs supporting remote and far edge deployment scenarios. As 5G and 10 Gbps services proliferate around the world, we believe increasing bandwidth and edge computing requirements will accelerate demand for the DZS O-series. We are seeing traction with the O-series at Tier 1 customers, as well as interest from new customers in adjacent spaces such as cable operators. |

|

|

|

|

|

|

|

|

|

We are seeing the O- series gaining traction at Tier 1 customers, as well as providing value to new customers in adjacent |

|

O-series MPX-9103 100G OTN Coherent Muxponder |

O-series TMS-1190 Edge Transport System |

spaces such as cable operators. |

|

|

|

|

|

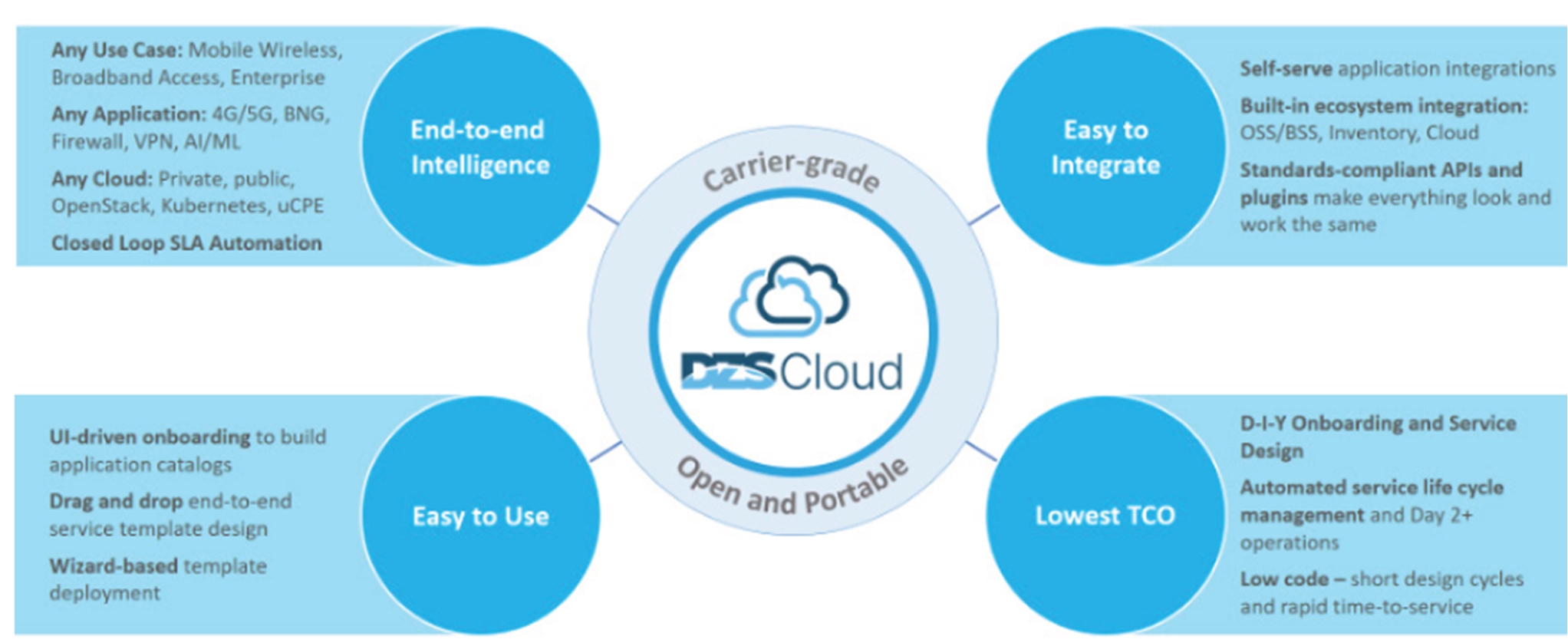

The RIFT acquisition was the key ingredient enabling the introduction of DZS Cloud. The availability of DZS Cloud is fueling a growing pipeline for software defined networking, network orchestration, deployment automation, and data analytics opportunities. DZS Cloud simplifies the deployment of network functions, slices, or services across clouds while building upon our global product footprint. Wi-Fi and network performance analytics provided by our DZS Cloud portfolio were demonstrated at the Fiber Connect Expo in Nashville to an estimated audience of 2,000 North American service provider, fiber over-builders, wireless Internet service provider (WISP) operators and ecosystem participants. |

|

|

DZS Cloud Value Summary

|

|

|

|

|

| 13 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Customer Milestones

Throughout the second quarter of 2021, we accomplished multiple strategic customer milestones across the DZS portfolio, including the following:

10Gig PON

DZS was recently selected by Consolidated Communications Inc. to deliver next generation multi-gigabit services. We believe Consolidated Communications is the largest publicly announced 10Gig PON deployment in the United States to-date.

Consolidated Communications’ five-year expansion plan is expected to deliver advanced fiber services to 1.6 million homes and businesses across seven states utilizing DZS Velocity and XCelerate by DZS broadband connectivity solutions and DZS Helix edge access solutions.

FiberLAN

During the second quarter of 2021, the DZS FiberLAN portfolio was selected for Asia’s First “Luxury Tech Hub Hotel, the new Dolce by Wyndham Hanoi Golden Lake Hotel in Vietnam, delivering broadband, Wi-Fi, IPTV and voice services campus- wide. The DZS FiberLAN solution delivers multi-gigabit broadband, extensive Wi-Fi coverage, UHD video and communications services to hotel guests. The 420-room hotel reports a 38% operational cost savings compared to the former copper-based network. All hotel video, voice, and data services are cloud-based and run over the DZS FiberLAN, minimizing complexity and downtime.

DZS FiberLAN is a Passive Optical LAN solution that extends fiber broadband technology to the enterprise, and is designed to bring

the bandwidth, reliability, security, and cost benefits of fiber-optic technology to large LAN environments. By supporting converged data, voice, and video services at multi-gigabit levels over a single strand of fiber to the end user, FiberLAN reduces the cost of cabling and electronics while enabling higher performance and additional capabilities versus a traditional copper infrastructure.

|

|

|

|

|

| 14 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Government Broadband Stimulus Programs

Bridging the digital divide and upgrading broadband connectivity for economic development reasons have emerged as policy goals for many governments around the world over the past few years. We believe that these programs are natural drivers for DZS, and have been active in cultivating broadband stimulus opportunities around the world.

We have shared a number of proof points publicly since our Q1 2021 shareholder report, including the following:

|

|

• |

Consolidated Communications Inc. (U.S.): DZS’ broadband connectivity portfolio is delivering 10 gigabit PON and next generation Wi-Fi services to a number of Consolidated Communications customers across a 7-state region. We understand that a portion |

|

of Consolidated Communications’ regional broadband deployments will be funded with support from the Rural Digital Opportunities

Fund (RDOF).

|

|

• |

Harrison Rural Electrification Association (HREA) (U.S.): DZS’ broadband connectivity and smart home/business connected premises solutions are enabling multi-gigabit PON services to HREA’s West Virginia serving area. We understand that HREA is leveraging a USDA Rural Development Broadband ReConnect grant to deliver advanced broadband services. |

|

|

|

• |

Empower, Delivered by Craighead Electric (U.S.): This Arkansas electric cooperative has leveraged funding from Connect America Fund 2 (CAF2) to bring a fiber optic network infrastructure and gigabit services offering to over 10,000 locations in the rural northeastern part of the state. Empower has also recently won, as part of a consortium championed by DZS elite partner Irby, RDOF award funds to help the company to continue to expand its gigabit services offering to new underserved areas. Empower is leveraging both the DZS Velocity broadband access portfolio and DZS Helix Edge Access solutions in the connected premises to meet the gigabit services needs of their region in partnership with Irby. |

|

|

|

• |

Vianet (Canada): Vianet is rolling out broadband services to over |

25 rural communities in Ontario leveraging DZS’ Velocity broadband access and Helix connected premises solutions. Vianet recently announced that it was leveraging funds from Canada’s Center of Excellence in Next Generation Networks (CENGN) to bring fiber based broadband services to the underserved citizens of the Township of Carling in rural Ontario.

|

|

|

|

|

| 15 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

|

• |

NetCom BW (Germany): NetCom BW, a subsidiary of EnBW and Germany’s third largest energy company, is leveraging a federal Germany subsidy for “grey area” broadband coverage to bring ultra-fast hyper-broadband services to rural areas in the southern German states of Baden-Wurttemberg and Bavaria. |

|

We expect government stimulus programs to proliferate globally.

As demonstrated by many of the aforementioned proof points, a disproportionate share of DZS stimulus programs exist or are emerging in the North American market. In addition to the RDOF auctions currently underway, which intend to provide over $20 billion in grants to unserved and underserved communities, there are a variety of additional broadband stimulus and incentive programs with equally or even more lofty aspirations. The largest is the ARPA (American Rescue Plan Act) subsidies, which exceed $350 billion of which the broadband network would likely be about 10-15% of that number. The CARES Act (Coronavirus, Aid, Relief and Economic Security Act) also has approximately $125 million earmarked for network infrastructure, as does the Consolidated Appropriations Act that called out $7.5 billion for broadband infrastructure, out of which 10-15% would likely be access. On the horizon, acts like The American Broadband Buildout Act and the Biden Infrastructure Bill could carve out an additional $100 billion for broadband access equipment. In other parts of the world, European countries like Germany and the United Kingdom has also carved out funds for addressing digital divide challenges in their countries, as has Canada with subsidies from the CENGN.

On a similar front, governments like the U.S. and the U.K. are offering billions of dollars to facilitate the removal of Chinese technology and suppliers from communications networks. We believe these government sponsored programs and alignment by service providers and corporate entities will create an opportunity for DZS’ products and solutions for the foreseeable future.

Mobile Transport

The DZS Chronos portfolio announced in the first quarter of 2021 provides a full range of 5G-ready xHaul (fronthaul, midhaul, and backhaul) solutions that are open, software-defined, and field proven. Featuring advanced timing features and environmentally hardened design options, DZS Chronos solutions have been proven in large Open RAN (O-RAN) deployments and offer flexibility to simultaneously support 4G and 5G technologies across packet and optical transport technologies.

|

|

|

|

|

| 16 |

|

|

|

|

Q2 2021 Shareholder Report |

|

DZS O-RAN xHaul mobile-edge solutions are applicable to the Rakuten Communications Platform architecture being offered to service providers around the world. Rakuten has secured partnerships with 16 publicly noted carriers globally who have access to DZS provided mobile transport solutions. To date, Rakuten Mobile is the world’s leading O-RAN deployment and continues to prove the scale and efficiency of the O-RAN model with over 4 million subscribers.

In addition to O-RAN, innovative DZS Chronos solutions are supporting advanced fiber-based 5G network connectivity, backhaul, and cell

site router deployments with Softbank, LGU+, KDDI, SK Broadband,

and others. By partnering with these 5G network operators, to provide open, and standards-based solutions, DZS is accelerating the pace of 5G adoption, O-RAN adoption, and enabling “Freedom of Choice” for customers.

MSO Market Expansion

For cable operators, Distributed Access Architecture (DAA) standards provide a familiar and contemporary approach to distribute network functions from headend sites deeper into access networks. This architecture demands ample 10 Gbps fiber- based packet networking capacity for connecting to Remote PHY (R-PHY) devices that enable 10-Gig class services for customers. The DZS O-series technology has emerged as a tool of interest to cable operators where fiber-deep and distributed / virtualized network initiatives are being considered.

Our newly launched optical transport products include the DZS O-series MPX-9103 100G OTN Muxponder. We believe this product will enable operators to enhance their R-PHY infrastructures to meet emerging 10 and 100+ Gbps transport requirements, while supporting 5G mobile xHaul and advanced enterprise services. The MPX-9103 uses coherent optics technology for DWDM transport networks to provide operators with long-reach transport in extended temperature, outside plant conditions at the far edge of the network.

|

|

|

|

|

| 17 |

|

|

|

|

Q2 2021 Shareholder Report |

|

DZS Cloud

Our network orchestration and software automation solutions are gaining traction with Tier I service providers, providing differentiation for DZS

as an end-to-end solutions provider and facilitating insertion of DZS hardware into new networks.

Today, DZS offers a commercial, carrier-grade network-slicing enabled orchestration platform complementing our position with network devices supporting O-RAN and 5G networks.

Our initial deployment with TELUS continues to progress, and we received a testimonial from CTO Ibrahim Gedeon who was part of our inaugural Horizons Investor and Analyst Day.

We also recently announced a new partnership with global datacenter and telecom solution provider Quanta Cloud Technology (QCT). The partnership builds upon DZS Cloud offerings with a converged system blueprint for edge cloud to provide what we believe will be a better 5G service deployment experience for joint QCT and DZS customers.

This collaboration will define blueprints for a converged rack-level

or cluster-level solution with integration of DZS Cloud automation, orchestration, and provisioning capability, DZS-provided carrier-grade networking products, and QCT-provided compute and storage solutions optimized for edge cloud deployments. These solution blueprints combine DZS transport, telco edge cloud, and cloud-native software defined network expertise with QCT’s established datacenter and NFV infrastructure capabilities to provide optimized solutions for emerging FlexRAN and 5G use cases.

As service providers adopt new software-centric and distributed access architectures, we believe they will opt-out of traditional closed and proprietary solutions, embracing standards-based open approaches. This creates opportunities for DZS to drive a transformation to a software defined networking and automation architecture with robust orchestration that accommodates a multi-vendor network environment through DZS Cloud.

We have been demonstrating DZS Cloud capabilities that include multi-vendor orchestration, 5G slicing, deployment automation, and data analytics to prospective customers, ecosystem partners, and as part of showcase events such as Fiber Connect 2021.

|

|

|

|

|

| 18 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

DZS Velocity Innovation: XCelerate by DZS |

|

|

|

|

|

The DZS Velocity portfolio, launched in the first quarter of 2021, offers service providers advanced fiber access technologies and SDN-enabled operational models, featuring high performance, open software-centric platforms with flexibility for either centralized or distributed network transformation architectures. |

|

|

|

|

|

|

XCelerate by DZS demonstrates our commitment to innovation, enabling |

|

|

service providers to |

|

The DZS Velocity solution portfolio includes a unified range of products enabled by sdNOS, a modern SDN-enabled network operating system (NOS) designed to support the range of capabilities required for fiber-based broadband access systems, switches, and routers. The recently introduced XCelerate by DZS line of products extend the DZS Velocity solutions with “system-on-a-card” designs that bring ultra-performance 10G-class advanced services together with Any Service, Any Port (ASAP) flexibility. XCelerate by DZS demonstrates our commitment to innovation, enabling service providers to leverage software defined capabilities of each port, regardless of the form factor and chassis configuration to support XGS- PON, GPON, and 10 Gbps Ethernetservices. The “system-on-a-card” architecture of XCelerate by DZS products provide the option of non- blocking performance for all attached ports and services, maximizing the longevity and service flexibility for newly installed or upgraded systems. |

leverage software defined capabilities of each port regardless of the form factor and chassis configuration to support XGS-PON, GPON, and 10 Gbps Ethernet services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 19 |

|

|

|

|

Q2 2021 Shareholder Report |

|

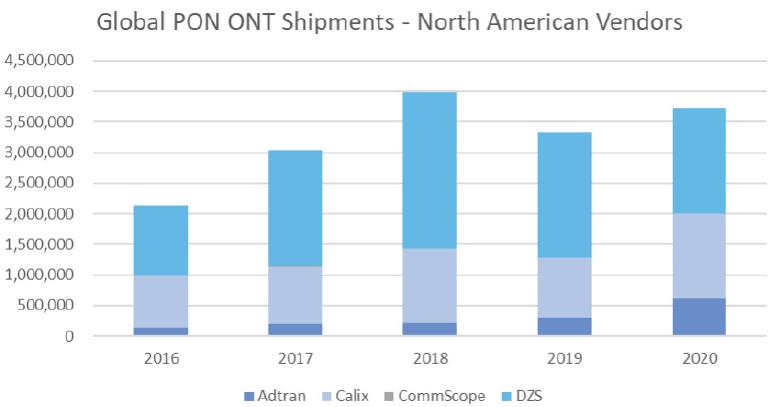

Transforming Connected Premises into Brilliant Homes and Buildings

DZS has a long history of innovation and success delivering solutions designed for customer premises. By offering a wide variety of connect premises solutions such as optical network terminals (ONTs), residential/enterprise gateways, and Wi-Fi enable devices, all of which complement our central/distributed fiber access solutions, DZS was recently recognized by Omdia as the No. 1 ONT supplier globally based on shipments among suppliers based in North America every year since 2016.

(Source – Omdia, Fiber and Copper Access Equipment Units: 1Q 2021, June 2021, Results are not an endorsement of DZS. Any reliance on these results is at the third-party’s own risk).

The DZS Helix connected premises solution portfolio consists of a wide variety of edge access ONTs, smart gateways, and home Wi-Fi devices for residences and enterprises alike. The DZS Helix portfolio integrates with DZS Cloud to deliver analytics, orchestration, access management, and decision-support required to launch new services and improve the end customer experience for emerging 5G, 10 Gigabit, and Wi-Fi 6-enabled networks.

|

|

|

|

|

| 20 |

|

|

|

|

Q2 2021 Shareholder Report |

|

|

The DZS Helix portfolio enables operators to deliver value added service offerings with pay-as-you-grow flexibility in conjunction with the DZS Cloud suite: • Fiber as a Utility: DZS ONTs offer a range of speeds, from 500 Mbps to 10 Gbps, integrated PON fiber management, and outdoor models hardened to operate at extreme temperatures. The breadth of the DZS Helix portfolio offers solutions ideal for high density urban deployments as well remote environments. • Service Assurance: DZS Customer Premises Equipment (CPE) offers a set of advanced troubleshooting capabilities and tools that ensure delivery of critical services, including Internet, voice, and IPTV. With DZS Cloud CPE Manager, users have remote access performance monitoring, transparent transport of services, voice services with SIP, and MGCP, as well as TR-143 performance testing that exceeds 500 Megabits per second. Some DZS Helix models are Metro Ethernet Forum certified, offering high levels of commercial viability and standards for business services. • Advanced Services and Whole Building Coverage: With new models available now supporting Wi-Fi 6, DZS solutions are optimized to offer carrier-grade Wi-Fi, home network management, and intelligent CPE capabilities, including support for up and downstream multi-user MIMO, power over Ethernet, 10 Gbps data rates, and Easy Mesh 2.0. When combined with DZS Cloud, the DZS Helix portfolio supports advanced decision tools, analytics, and client management over wireless, including tools for customer care, marketing, and service creation. |

The DZS Helix portfolio enables operators to deliver value added service offerings with pay-as-you-grow flexibility in conjunction with the DZS Cloud suite. |

|

|

|

|

|

When combined with DZS Cloud, the DZS Helix portfolio supports advanced decision tools, analytics, and client management over wireless, including tools for customer care, marketing, and service creation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 21 |

|

|

|

|

Q2 2021 Shareholder Report |

|

The DZS Helix portfolio is complemented by DZS Cloud service management intelligence to enable premium broadband experiences and services

Shaping the Future Through Open Standards and Industry Thought Leadership

During the second quarter of 2021, I joined the Board of Directors for The Alliance for Telecommunications Industry Solutions (ATIS) and DZS became a founding member of Next G Alliance, both of which are chaired by AT&T’s Chief Technology Officer, Andre Fuetsch. ATIS is

a leading standards organization dedicated to advancing innovation and transformation in the ICT industry. Next G Alliance is a newly formed organization that unites companies in the industry in a shared commitment to advance 5G and align on the foundation for subsequent 6G technology.

DZS will be instrumental in the support of ATIS’ Innovation Agenda, which sets the overarching technology strategy, direction, and priorities for the organization in line with the future of the industry. Next G Alliance will focus on emerging technology trends such as 6G, artificial intelligence, context-award identity management, robocall mitigation, cybersecurity, IoT, Smart Cities, distributed ledger/blockchain technology and unmanned aerial vehicles.

|

|

|

|

|

| 22 |

|

|

|

|

Q2 2021 Shareholder Report |

|

In addition to DZS, board members are represented from AT&T, Bell Canada, Ciena, Ericsson, Facebook, InterDigital, JMA Wireless, Microsoft, Nokia, Qualcomm, Samsung, Telus, Telnyx, T-Mobile, U.S. Cellular and Verizon.

|

As DZS continues to innovate in the areas of multi- gigabit broadband access technologies, we recently joined the 25GS-PON MSA Group to promote and |

|

As DZS continues to innovate in the areas of multi- gigabit broadband access technologies, we recently joined the 25GS-PON MSA Group to promote and

accelerate the development of 25 Gigabit Symmetric Passive Optical Network technology. GS-PON has become the foundation for broadband access networks.

Members include many of the leading players in the next generation fiber access ecosystem:

|

|

|

|

|

| 23 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Second Quarter Financial Results

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||||||

|

Key Financial Results |

|

June 30, 2021 |

|

|

March 31, 2021 |

|

|

June 30, 2020 |

|

|

June 30, 2021 |

|

|

June 30, 2020 |

|

|||||

|

|

|

($ in millions, except per share amounts) |

|

|||||||||||||||||

|

Net revenue |

|

$ |

82.7 |

|

|

$ |

81.0 |

|

|

$ |

70.5 |

|

|

$ |

163.7 |

|

|

$ |

118.0 |

|

|

GAAP Net income (loss) |

|

|

(3.3 |

) |

|

|

(23.2 |

) |

|

|

(0.2 |

) |

|

|

(26.5 |

) |

|

|

(8.9 |

) |

|

Non-GAAP Net income (loss)(1) |

|

|

(0.9 |

) |

|

|

2.5 |

|

|

|

2.0 |

|

|

|

1.6 |

|

|

|

(3.4 |

) |

|

GAAP Net income (loss) per share |

|

|

(0.12 |

) |

|

|

(0.92 |

) |

|

|

(0.01 |

) |

|

|

(1.01 |

) |

|

|

(0.42 |

) |

|

Adjusted Net income (loss) per share(1) |

|

|

(0.03 |

) |

|

|

0.10 |

|

|

|

0.09 |

|

|

|

0.06 |

|

|

|

(0.16 |

) |

|

Adjusted EBITDA(1) |

|

|

(0.4 |

) |

|

|

3.6 |

|

|

|

3.2 |

|

|

|

3.2 |

|

|

|

(1.6 |

) |

|

Cash, cash equivalents and restricted |

|

|

61.0 |

|

|

|

63.7 |

|

|

|

47.2 |

|

|

|

61.0 |

|

|

|

47.2 |

|

|

For the second consecutive quarter we recognized record orders and backlog with second quarter 2021 orders of $128 million led by triple digit year-over-year growth in the Asia region, which represented over 60% of total orders booked during the quarter. North America was also a strong market for DZS, as we recognized 105% order growth year-over-year. In the first half of 2021, orders of $245 million increased 82% compared with the first half of 2020, including triple-digit percent growth in North Americas and Asia. Our strong order book continued to drive our revenue performance, with second quarter 2021 revenues of $82.7 million, representing an increase of 17.3% year-over-year and 2.1% growth sequentially over first quarter 2021. Revenue for both our mobile transport and broadband connectivity products remained strong, with a notable increase in shipments of our Helix customer premise products. Combined revenue from customers in the Americas and EMEA regions exceeded 50%, which led to fixed broadband product revenue increasing to 76% of total revenue. While our geographic revenue mix continued to shift towards North America during the quarter, we continued to leverage our strong relationships with Tier 1 service providers in the Asia region, with two customers from the region that each represented 10% or greater of total revenues.

|

Our strong order book continued to drive our revenue performance, with second quarter 2021 revenues of $82.7 million, representing an increase of 17.3% year-over-year and 2.1% growth sequentially over first quarter 2021. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 24 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Second Quarter Financial Results

Sales to customers in Asia represented approximately 48% of revenue

in the second quarter of 2021, or $39.5 million. By comparison, revenue from Asia was

$39.0 million in the year ago period and $42.9 million in the first quarter of 2021. Our performance in the quarter reflected continuing demand for both our next generation mobile edge access transport and broadband connectivity products.

Sales to customers in the Americas region represented 32% of total revenue, or $26.5 million, increasing $11.4 million year-over-year from $15.1 million in the second quarter of 2020 and $6.3 million over the first quarter of 2021. The Americas region is benefiting from expanded activity related to our recently enhanced go-to-market strategy, including an upgraded sales team. Additionally, activity in the Americas region is benefiting from various government-sponsored broadband access spending initiatives, including RDOF, helping to drive demand for fiber access products.

Sales to customers in the EMEA region were $16.7 million, or 20% of total revenue in the second quarter of 2021, a slight increase compared with the $16.4 million achieved in the year ago quarter, but a decline from $17.9 million in the first quarter of 2021.

The year-over-year increase reflects a shift towards fiber-based broadband solutions with customers in the Middle East region. The sequential decline was the result of lower sales to customers in Europe, which was partially offset by increased sales to the Middle East.

|

|

|

|

|

| 25 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Adjusted gross margin was 33.1% in the second quarter compared with 34.4% in the second quarter of 2020 and 35.0% in the first quarter of 2021. Our adjusted gross margin was influenced during the second quarter of 2021 by product mix as we shipped a higher percentage of lower margin products for certain customer projects in the Asia region. Additionally, we recognized a lower percentage of higher margin services revenue.

Our supply chain and operations teams continue to effectively manage

a constrained supply chain environment, enabling DZS to maximize shipments despite elongated lead times. We remain focused on expanding our gross margin profile through a variety of corporate optimization and streamlining efforts, as previously communicated within this report. For example, as noted above, we reached an agreement with the workers council of our German subsidiary to transform our Hanover, Germany manufacturing facility into a sales, service, and R&D center. We anticipate our transition to be completed in the second half of 2021 and as noted above will generate approximately $7 million in annual savings with approximately half of the savings to benefit cost of sales.

GAAP operating expense was $29.6 million in the quarter, compared to

$51.2 million in the first quarter of 2021 and $22.0 million in the second quarter of 2020. GAAP operating expense during the second quarter

of 2021 reflects certain investments in our business to take advantage of future growth opportunities in addition to a full quarter impact of the

|

|

|

|

|

| 26 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Optelian and RIFT acquisitions, which were only partially reflected in the March quarter.

Adjusted operating expense was $27.5 million in the quarter compared with $25.7 million in the first quarter of 2021 and $20.4 million in the second quarter of 2020. The increase on both a sequential and year-over-year basis was largely the result of strategic hiring decisions across sales, product, and research & development in order to accelerate growth and capture market share, as well as higher sales compensation due to better-than-expected sales volumes during the second quarter of 2021. Additionally, adjusted operating expenses reflect a full quarter of expenses associated with the Optelian and RIFT acquisitions.

For the second quarter of 2021, we recognized an adjusted operating loss of ($0.1) million, which compares with an adjusted operating income of $3.9 million, or 5.5% of sales, in the second quarter of 2020 and $2.6 million, or 3.2% of sales in the first quarter of 2021. The year-over-year and sequential declines were the result of lower gross margins combined with the increase in operating expenses, partially offset by the increase in sales volumes.

Our GAAP net loss was ($3.3) million, or ($0.12) loss per diluted share. This compares to a GAAP net loss of ($23.2) million, or ($0.92) per share, in the first quarter of 2021 and a loss of ($0.2) million, or ($0.01) per share, in the second quarter of 2020.

Adjusted net loss in the second quarter of 2021 was $(0.9) million, or

($0.03) per share. By comparison, we recognized an adjusted net income of $2.5 million, or $0.10 per share, in the first quarter of 2021 and an adjusted net income of

$2.0 million, or $0.09 per share in the second quarter of 2020.

Adjusted EBITDA for the second quarter of 2021 was a loss of $0.4 million. This compares to an adjusted EBITDA of $3.6 million in the prior quarter and an adjusted EBITDA of $3.2 million in the second quarter of 2020.

|

|

|

|

|

| 27 |

|

|

|

|

Q2 2021 Shareholder Report |

|

Balance Sheet Highlights

|

|

|

June 30, |

|

|

September 30, |

|

|

December 31, |

|

|

March 31, |

|

|

June 30, |

|

|||||

|

($ in millions) |

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2021 |

|

|

2021 |

|

|||||

|

Cash, cash equivalents and restricted cash |

|

$ |

47.2 |

|

|

$ |

40.4 |

|

|

$ |

54.4 |

|

|

$ |

63.7 |

|

|

$ |

61.0 |

|

|

Debt |

|

$ |

56.8 |

|

|

$ |

51.5 |

|

|

$ |

43.5 |

|

|

$ |

1.8 |

|

|

$ |

— |

|

|

DSO |

|

|

129 |

|

|

|

105 |

|

|

|

105 |

|

|

|

98 |

|

|

|

94 |

|

|

Inventory |

|

$ |

48.2 |

|

|

$ |

43.9 |

|

|

$ |

39.6 |

|

|

$ |

41.1 |

|

|

$ |

50.6 |

|

|

Inventory Turns |

|

4.2x |

|

|

5.6x |

|

|

5.6x |

|

|

5.1x |

|

|

4.7x |

|

|||||

|

Cash (including cash equivalents and restricted cash) at June 30, 2021 was $61.0 million compared with $63.7 million at March 31, 2021 and $47.2 million at June 30, 2020. During the first quarter, we raised $59.5 million in net proceeds related to issuing 4.6 million shares in an equity follow-on offering and subsequently paid down the majority of our debt. During the second quarter of 2021 we repaid $1.8 million of term debt and are now debt free. Inventory turns of 4.7x during the second quarter of 2021 were impacted by an inventory increase of $10.3 million sequentially to $50.6 million as we build inventory to support strong demand. Days sales outstanding (DSOs) have been an area of focus over the past eighteen months and improved to 94 days at June 30, 2021, a dramatic improvement from 129 days in the year ago quarter.

Third Quarter 2021 and Full Year 2021 Guidance We have engaged in several initiatives over the past 12-months, including investing in our business and enhancing the management team, sales force, and engineering and operations teams, that have improved relationships with existing customers and unlocked opportunities with new customers (including a number of Tier I’s), driving our pipeline and order book. Following two consecutive quarters of record orders and backlog levels, our revenue and customer demand visibility is at elevated levels reflecting increased mobile and fixed broadband investments by communications service providers due to the surge in network usage and internet traffic derived from telecommuting, remote learning, remote healthcare, and an increase in e- gaming and streaming video. Dialogue between our sales, sales operations, and operations teams has been outstanding enabling excellent overall corporate execution. |

During the second quarter of 2021 we repaid $1.8 million of term debt and are now debt free. |

|

|

|

|

|

|

|

|

| 28 |

|

|

|

|

Q2 2021 Shareholder Report |

|

For the second half of 2021, we anticipate continued strong demand across our mobile transport and broadband connectivity platforms, particularly in the Asia region. We anticipate several new customer programs to rollout or accelerate in the 2nd half of the year contributing to our improved 2nd half revenue outlook.

Offsetting strengthening demand, we anticipate elevated freight, logistics and expedite costs to persist, somewhat limiting our ability to expand our margin profile. As a result of the increased visibility and strong operational execution, we are increasing our full year 2021 revenue guidance from a previous range of

$320-340 million up to a new range of $330-350 million.

We are providing Q3 and full-year 2021 guidance in the following table, which reflects our outlook as of the date of this shareholder report:

|

|

|

Q3 2021 |

|

|

Full Year 2021 |

|

||||||||||

|

|

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

||||

|

|

|

($ in millions) |

|

|||||||||||||

|

Net revenue |

|

$ |

85.0 |

|

|

$ |

90.0 |

|

|

$ |

330.0 |

|

|

$ |

350.0 |

|

|

Adjusted Gross margin %(1) |

|

|

33.0 |

% |

|

|

34.5 |

% |

|

|

33.5 |

% |

|

|

35.0 |

% |

|

Adjusted Operating expenses(1) |

|

|

28.0 |

|

|

|

27.0 |

|

|

|

108.0 |

|

|

|

106.0 |

|

|

Adjusted EBITDA(1) |

|

|

0.0 |

|

|

|

4.0 |

|

|

|

6.0 |

|

|

|

14.0 |

|

(1) Item represents a non-GAAP financial measure; see discussion below, as well as a reconciliation to the comparable GAAP measure in the financial tables to this shareholder letter.

Summary

DZS total addressable market grew following two acquisitions in the first quarter, Optelian and RIFT, which we believe opened the fast-growing SDN Orchestration and Controller software market, as well as the Cable Broadband Access Remote PHY and MAC PHY Device markets to the company. This strategic M&A increased our aggregate total addressable market to over $97 billion, growing at a 9.3% compound annual rate (sources: Omdia Cable Broadband Equipment Forecast – 2020-2026, February 2021; Omdia Carrier SDN Forecast – 2H 2020, November 2020; Omdia Macrocell Mobile Backhaul Equipment Tracker 2H20, December 2020; Omdia Fiber and Copper Access Equipment Forecast – 2018-2026, February 2021; Omdia Macrocell Mobile Backhaul Equipment Tracker 2H20, December 2020; Omdia Fiber and Copper Access Equipment Forecast – 2018 2026, February 2021; Results are not an endorsement of DZS. Any reliance on these results is at the third-party’s own risk).

The forecast data from which we build this estimate is updated bi-annually, so we are not making any formal adjustments, but we believe the market trends that form the foundations of this estimate have only grown

|

|

|

|

|

| 29 |

|

|

|

|

Q2 2021 Shareholder Report |

|

stronger. Addressable market conditions remain favorable because of the number of countries formally banning and/or assessing security concerns with Chinese OEMs continuing to grow, the continued rise in 5G O-RAN networks, and an increase in the total number of government sponsored broadband initiatives not only in the U.S. complementing the $9.2 billion phase I RDOF as well as government sponsored broadband initiatives increasing in other markets globally. In addition, competitive intensity in the mobile and fixed broadband access market globally is continuing to trend favorably. We have performed extraordinarily well in leveraging our strong customer relationships and a robust ecosystem of supply chain partners to maintain or exceed our delivery commitments with limited disruptions during this challenging time of stressed global supply chains. However, we remain cautious about supply chain headwinds that may continue to challenge the industry for the next several quarters.

The Covid-induced broadband pivot from a useful utility to an important lifeline connection for work, play and medical care has enhanced the DZS growth profile. As one of a limited few full scale end-to-end broadband access suppliers not based in China, DZS sits in a prime position to capitalize on this essential evolution of broadband services across mobile and fixed broadband networks. Investments made in the first quarter

of 2021 are very strategic and allow us to transition from a traditional hardware- centric organization to a software-driven business model. They also help establish new business opportunities with service providers globally, particularly with marquee customers and prospects.

DZS is moving into a new phase now, with our management team set, our product innovations rapidly coming to market, the tailwinds of our market continuing to remain strong. Customer alignment has been strengthening and our employees are embracing our long-term vision. Now as I enter my second year at the helm, I’m excited to move from laying foundations for the company, to a period of acceleration and excellence in execution.

Please be sure to keep an eye out for us at the following upcoming investor events:

|

|

• |

August 18th – B Riley Securities Summer Summit |

|

|

• |

August 31st / September 1st – Jefferies Semis, IT Hardware, and Communications Infrastructure Summit |

|

|

|

• |

September 8th – Wolfe Research TMT Conference |

|

|

• |

November 16th – Needham Security, Networking, and Communications Conference |

|

|

|

|

|

|

| 30 |

|

|

|

|

Q2 2021 Shareholder Report |

|

In closing, we want to thank the employees of DZS, our customers who place their trust in us every day, and our shareholders for their continued confidence in and commitment to DZS. The leadership team is fully committed to delivering the best financial performance possible, balancing short term and long-term strategic decisions with the goal of creating and sustainably growing shareholder value.

Sincerely,

Charlie Vogt President & CEO

Conference Call

DZS will host a conference call to discuss its second quarter financial results on Tuesday, August 3, 2021 at 10:00 a.m. (ET).

Conference call details:

Date: Tuesday, August 3, 2021 Time: 10:00 a.m. Eastern time zone

U.S. dial-in number: 877-742-9182 International number: +1-602-563-8857 Conference ID: 7377148

Webcast link: https://edge.media-server.com/mmc/p/zeibyqp3

Investor Inquiries

Ted Moreau

Vice President, Investor Relations

ir@dzsi.com

|

|

|

|

|

| 31 |

|

Q2 2021 Shareholder Report |

About DZS

DZS Inc. (NSDQ: DZSI) is a global leader in optical and packet-based mobile transport, broadband connectivity and software defined networking. With more than 20 million products inservice and customers and alliance partners spanning more than 100 countries, DZS is helping many of the world’s most advanced and innovative service providers and enterprises leverage the power of 5G, 10gig fixed broadband, and software defined networks to deliver cutting-edge services and lead in their markets.

DZS, the DZS logo, and all DZS product names are trademarks of DZS Inc. Other brand and product names are trademarks of their respective holders. Specifications, products, and/or product names are all subject to change.

Forward-Looking Statements

Statements made in this stockholder letter and the earnings call contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. In addition, statements that refer to projections of earnings, revenue, operating expenses, gross profit, costs or other financial items (including non-GAAP measures) in future periods are forward- looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward- looking statements. In addition to the factors discussed in this stockholder letter, factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the company’s SEC filings available at www.sec.gov, including without limitation, the company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and global economic climate may give rise to, or amplify, many of these risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. The company undertakes no obligation to update or revise any forward-looking statements for any reason.

Use of Non-GAAP Financial Information

To supplement DZS’s consolidated financial statements presented in accordance

with GAAP, DZS reports Adjusted Cost of Revenue, Adjusted Gross Margin, Adjusted Operating Expenses, Adjusted Operating Income (Loss), Adjusted (Non-GAAP) Net Income

|

|

|

|

|

| 32 |

|

Q2 2021 Shareholder Report |

attributable to DZS (including on a per share basis), EBITDA, and Adjusted EBITDA, which are non-GAAP measures DZS believes are appropriate to provide meaningful comparison with, and to enhance an overall understanding of DZS’s past financial performance and prospects for the future. DZS believes these non-GAAP financial measures provide useful information to both management and investors

by excluding specific expenses and gains that DZS believes are not indicative of

core operating results. Further, each of these are non-GAAP measures of operating performance used by management, as well as industry analysts, to evaluate operations and operating performance and is widely used in the telecommunications and manufacturing industries. Other companies in the telecommunications and manufacturing industries may calculate these metrics differently than DZS does. The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP.

DZS defines Adjusted Cost of Revenue as GAAP Cost of Revenue less (i) depreciation and amortization,

(ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core product cost,

such as, inventory step-up amortization, any of which may or may not be recurring

in nature. We believe Adjusted Cost of Revenue provides the investor more accurate information regarding the actual cost of our products and services, excluding the impact of costs of revenue that are not routine components of our core product cost, for better comparability of our costs of revenue between periods and to other companies.

DZS defines Adjusted Gross Margin as GAAP Gross Margin less (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, and may or may not be recurring in nature. We believe Adjusted Gross Margin provides the investor more accurate information regarding our core profit margin on sales, excluding the impact of cost of revenue that are not routine components of our core product cost, for better comparability of gross margin between periods and to other companies.

DZS defines Adjusted Operating Expenses as GAAP operating expenses plus or minus

(as applicable) (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, goodwill impairment, impairment of long-lived assets or loss on debt extinguishment, restructuring and other charges, headquarters relocation, executive transition, and bad debt expense, any of which may or may not be recurring in nature. We believe Adjusted Operating Expenses provides the investor more accurate information regarding our core operating expenses, which include research and development costs, selling, general and administrative costs, and amortization of intangible assets, excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines Adjusted Operating Income (Loss) as GAAP Operating Income (Loss) plus or minus (as applicable) (i) depreciation and amortization, (ii) stock based compensation,

|

|

|

|

|

| 33 |

|

Q2 2021 Shareholder Report |

and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition costs, purchase price adjustment, goodwill impairment, impairment of long-lived assets or loss on debt extinguishment, restructuring and other charges, headquarters relocation, executive transition, and bad debt expense, any of which may or may not be recurring in nature. We believe Adjusted Operating Income (Loss) provides the investor more accurate information regarding our core operating Income (Loss), excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines Non-GAAP net income (loss) attributable to DZS as GAAP Net Income plus or minus (as applicable) (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, goodwill impairment, impairment of long-lived assets or loss on debt extinguishment, restructuring and other charges, headquarters relocation, executive transition, and bad debt expense, any of which may or may not be recurring in nature. We believe Non-GAAP net income (loss) attributable to DZS provides the investor more accurate information regarding our core income, excluding the impact of charges that are not routine components of our core product cost or core operating expenses, for better comparability between periods and to other companies.

DZS defines EBITDA as net income (loss) plus or minus (as applicable) (i) interest expense, net, (ii) income tax provision (benefit), and (iii) depreciation and amortization expense. DZS defines Adjusted EBITDA as EBITDA plus or minus (as applicable) (i) stock-based compensation expenses, and (ii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition transaction costs, inventory step-up amortization, purchase price adjustment, goodwill impairment, impairment of long-lived assets, loss on debt extinguishment, restructuring and other charges, headquarters relocation, executive transition, and bad debt expense, any of which may or may not be recurring in nature. DZS believes that EBITDA and Adjusted EBITDA are useful measures because they provide supplemental information to assist investors in comparing the company’s performance across reporting periods on a consistent basis by excluding items that the company does not believe are indicative of its core operating performance, as well as in assessing the sustainable cash-generating ability of the business. In addition, DZS believes these measures are of importance to investors and lenders in assessing the company’s overall capital structure and its ability to borrow additional funds.

A reconciliation of EBITDA and Adjusted EBITDA to each of their respective GAAP counterparts for the three and six-months ended June 30, 2021 and 2020, and three months ended March 31, 2021

is included at the end of the Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss) below. Reconciliations of the other Non-GAAP measures included herein to their GAAP counterparts are provided in the section below entitled “Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Guidance”.

|

|

|

|

|

| 34 |

|

Q2 2021 Shareholder Report |

DZS INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss)

($ in thousands, except per share data)

|

|

|

For the Quarters Ended |

|

|

For the Six Months Ended |

|

||||||||||||||

|

|

|

June 30, 2021 |

|

|

March 31, 2021 |

|

|

June 30, 2020 |

|

|

June 30, 2021 |

|

|

June 30, 2020 |

|

|||||

|

Net revenue |

|

$ |

82,700 |

|

|

$ |

81,031 |

|

|

$ |

70,532 |

|

|

$ |

163,731 |

|

|

$ |

118,012 |

|

|

Cost of revenue |

|

|

55,622 |

|

|

|

52,936 |

|

|

|

46,764 |

|

|

|

108,558 |

|

|

|

78,249 |

|

|

Gross profit |

|

|

27,078 |

|

|

|

28,095 |

|

|

|

23,768 |

|

|

|

55,173 |

|

|

|

39,763 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and product development |

|

|

11,962 |

|

|

|

11,119 |

|

|

|

8,495 |

|

|

|

23,081 |

|

|

|

18,205 |

|

|

Selling, general and administrative |

|

|

18,256 |

|

|

|

31,824 |

|

|

|

13,170 |

|

|

|

50,080 |

|

|

|

26,677 |

|

|

Restructuring and other charges |

|

|

(908 |

) |

|

|

6,252 |

|

|

|

- |

|

|

|

5,344 |

|

|

|

- |

|

|

Impairment of long lived assets |

|

|

- |

|

|

|

1,735 |

|

|

|

- |

|

|

|

1,735 |

|

|

|

- |

|

|

Amortization of intangible assets |

|

|

314 |

|

|

|

262 |

|

|

|

371 |

|

|

|

576 |

|

|

|

743 |

|

|

Total operating expenses |

|

|

29,624 |

|

|

|

51,192 |

|

|

|

22,036 |

|

|

|

80,816 |

|

|

|

45,625 |

|

|

Operating income (loss) |

|

|

(2,546 |

) |

|

|

(23,097 |

) |

|

|

1,732 |

|

|

|

(25,643 |

) |

|

|

(5,862 |

) |

|

Interest income |

|

|

19 |

|

|

|

42 |

|

|

|

14 |

|

|

|

61 |

|

|

|

84 |

|

|

Interest expense |

|

|

(28 |

) |

|

|

(249 |

) |

|

|

(414 |

) |

|

|

(277 |

) |

|

|

(1,057 |

) |

|

Loss on debt extinguishment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,369 |

) |

|

Other income (expense), net |

|

|

(261 |

) |

|

|

972 |

|

|

|

(650 |

) |

|

|

711 |

|

|

|

110 |

|

|

Income (loss) before income taxes |

|

|

(2,816 |

) |

|

|

(22,332 |

) |

|

|

682 |

|

|

|

(25,148 |

) |

|

|

(8,094 |

) |

|

Income tax (benefit) provision |

|

|

463 |

|

|

|

893 |

|

|

|

838 |

|

|

|

1,356 |

|

|

|

833 |

|

|

Net income (loss) |

|

$ |

(3,279 |

) |

|

$ |

(23,225 |

) |

|

$ |

(156 |

) |

|

$ |

(26,504 |

) |

|

$ |

(8,927 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.12 |

) |

|

$ |

(0.92 |

) |

|

$ |

(0.01 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.42 |

) |

|

Diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.92 |

) |

|

$ |

(0.01 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.42 |

) |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

26,982 |

|

|

|

25,252 |

|

|

|

21,529 |

|

|

|

26,120 |

|

|

|

21,502 |

|

|

Diluted |

|

|

26,982 |

|

|

|

25,252 |

|

|

|

21,529 |

|

|

|

26,120 |

|

|

|

21,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net income (loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(3,279 |

) |

|

$ |

(23,225 |

) |

|

$ |

(156 |