Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CAPITAL SOUTHWEST CORP | q12022earningsrelease.htm |

| 8-K - 8-K - CAPITAL SOUTHWEST CORP | earningsrelease8-k63021.htm |

Q1 2022 Earnings Presentation 5400 Lyndon B. Johnson Freeway, Suite 1300 | Dallas, Texas 75240 | 214.238.5700 | capitalsouthwest.com August 3, 2021 Capital Southwest Corporation

Page 2 Important Notices • These materials and any presentation of which they form a part are neither an offer to sell, nor a solicitation of an offer to purchase, any securities of Capital Southwest. • These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of Capital Southwest. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in Capital Southwest’s public filings with the Securities and Exchange Commission (the "SEC"). • There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Capital Southwest’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by Capital Southwest will be profitable or will equal the performance of these investments. • The information contained herein has been derived from financial statements and other documents provided by the portfolio companies unless otherwise stated. • Past performance is not indicative of future results. In addition, there can be no assurance that unrealized investments will be realized at the expected multiples shown as actual realized returns will depend on, among other factors, future operating results of each of Capital Southwest’s current portfolio companies, the value of the assets and economic conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions on which Capital Southwest’s expected returns are based. In many instances, Capital Southwest will not determine the timing or manner of sale of its portfolio companies. • Capital Southwest has filed a registration statement (which contains the prospectus) with the SEC for any offering to which this communication may relate and may file one or more prospectus supplements to the prospectus in the future. Before you invest in any of Capital Southwest's securities, you should read the registration statement and the applicable prospectus and prospectus supplement(s), including the information incorporated by reference therein, in order to fully understand all of the implications and risks of an offering of Capital Southwest's securities. You should also read other documents Capital Southwest has filed with the SEC for more complete information about Capital Southwest and any offering of its securities. You may get these documents for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, Capital Southwest will arrange to send you any applicable prospectus and prospectus supplement(s) if you request such materials by calling us at (214) 238-5700. These materials are also made available, free of charge, on our website at www.capitalsouthwest.com. Information contained on our website is not incorporated by reference into this communication.

Page 3 • This presentation contains forward-looking statements relating to, among other things, the business, market conditions, financial condition and results of operations of Capital Southwest, the anticipated investment strategies and investments of Capital Southwest, and future market demand. Any statements that are not statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, preceded by, followed by, or include words such as "believe," "expect," "intend," "plan," "should" or similar words, phrases or expressions or the negative thereof. These statements are made on the basis of the current beliefs, expectations and assumptions of the management of Capital Southwest and speak only as of the date of this presentation. There are a number of risks and uncertainties that could cause Capital Southwest’s actual results to differ materially from the forward-looking statements included in this presentation. • These risks include risks related to: changes in the markets in which Capital Southwest invests; changes in the financial, capital, and lending markets; regulatory changes; tax treatment and general economic and business conditions; our ability to operate our wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small business investment company ("SBIC"); and uncertainties associated with the impact from the COVID-19 pandemic, including its impact on the global and U.S. capital markets and the global and U.S. economy, the length and duration of the COVID-19 outbreak in the United States as well as worldwide and the magnitude of the economic impact of that outbreak, the effect of the COVID-19 pandemic on our business prospects and the operational and financial performance of our portfolio companies, including our and their ability to achieve their respective objectives, and the effects of the disruptions caused by the COVID-19 pandemic on our ability to continue to effectively manage our business. • For a further discussion of some of the risks and uncertainties applicable to Capital Southwest and its business, see Capital Southwest’s Annual Report on Form 10-K for the fiscal year ended March 31, 2021 and its subsequent filings with the SEC. Other unknown or unpredictable factors could also have a material adverse effect on Capital Southwest’s actual future results, performance, or financial condition. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements. Capital Southwest does not assume any obligation to revise or to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, or otherwise, except as may be required by law. Forward-Looking Statements

Page 4 Bowen S. Diehl President and Chief Executive Officer Michael S. Sarner Chief Financial Officer Chris Rehberger VP Finance / Treasurer Conference Call Participants

Page 5 • CSWC was formed in 1961, and elected to be regulated as a BDC in 1988 • Publicly-traded on Nasdaq: Common Stock (“CSWC”) • Internally Managed BDC with RIC tax treatment for U.S. federal income tax purposes • September 2015: completed tax free spin off of CSW Industrials ("Spin Off") • April 2021: received SBIC license from the U.S. Small Business Administration • 23 employees based in Dallas, Texas • Total Balance Sheet Assets of $836 MM as of June 30, 2021 • Manage I-45 Senior Loan Fund (“I-45 SLF”) in partnership with Main Street Capital (NYSE: “MAIN”) CSWC Company Overview CSWC is a middle-market lending firm focused on supporting the acquisition and growth of middle-market companies across the capital structure

Page 6 • Q1 2022 Pre-Tax Net Investment Income (“NII”) of $9.4 MM or $0.45 per share • Paid $0.43 per share Regular Dividend and $0.10 per share Supplemental Dividend for the quarter ended June 30, 2021 ◦ Increased Regular Dividend to $0.44 per share and declared $0.10 per share Supplemental Dividend for the quarter ending September 30, 2021 • Investment Portfolio at Fair Value increased to $799 MM from $688 MM in prior quarter ◦ $138.9 MM in total new committed investments ▪ $102.6 MM funded at close ◦ $1.6 MM in total proceeds from one portfolio company exit ◦ $6.1 MM net realized and unrealized appreciation on the portfolio • Raised $28.1 MM in gross proceeds through Equity ATM Program during the quarter ◦ Sold shares at weighted-average price of $26.10 per share, or 163% of the prevailing NAV per share • CSWC SBIC I received $40.0 MM initial leverage commitment from the SBA in May 2021 • $146.7 MM available on Credit Facility, $40.0 MM available on SBA leverage commitment to CSWC SBIC I, and $16.5 MM in cash and cash equivalents as of quarter end Q1 2022 Highlights Financial Highlights

Page 7 • In the last twelve months ended 6/30/2021, CSWC generated $1.84 per share in Pre-Tax NII and paid out $1.67 per share in regular dividends • Cumulative Pre-Tax NII Regular Dividend Coverage of 107% since the 2015 spin-off • Announced Supplemental Dividend Program in June 2018 ◦ Expect to pay $0.10 per share Supplemental Dividend per quarter going forward, subject to Board approval ◦ Undistributed Taxable Income ("UTI") of $0.83 per share as of June 30, 2021 Track Record of Consistent Dividends Continues Dividend Yield – Quarterly Annualized Total Dividend / CSWC Share Price at Qtr. End D iv id en d Pe r Sh ar e $0.45 $0.21 $0.24 $0.26 $0.28 $0.89 $0.44 $0.46 $0.48 $0.49 $0.50 $1.25 $0.51 $0.51 $0.51 $0.51 $0.52 $0.53 $0.54 $0.19 $0.21 $0.24 $0.26 $0.28 $0.29 $0.34 $0.36 $0.38 $0.39 $0.40 $0.40 $0.41 $0.41 $0.41 $0.41 $0.42 $0.43 $0.44 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.26 $0.50 $0.75 Regular Dividend Per Share Supplemental Dividend Per Share Special Dividend Per Share 3/31/17 6/30/17 9/30/17 12/31/17 03/31/18 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 10.6% 5.2% 5.6% 6.3% 6.6% 19.7% 9.3% 9.6% 9.1% 9.4% 9.2% 24.0% 17.9% 15.1% 14.5% 11.5% 9.4% 9.1%

Page 8 History of Value Creation $17.68$17.22$17.38$17.49$17.95$18.26$18.63$19.00$19.54$19.98 $20.90 $21.58$21.99$22.04 $22.71$23.16$23.38$23.07 $21.97$22.30 $23.22 $24.11 $24.90 $26.00 $17.68$17.22$17.34$17.39$17.74$17.88 $17.8 $17.96$18.26$18.44$19.08$18.87$18.84$18.43$18.62$18.58$18.30 $16.74 $15.13$14.95$15.36$15.74$16.01$16.58 $0.00 $0.00 $0.04 $0.10 $0.21 $0.38 $0.83 $1.04 $1.28 $1.54 $1.82 $2.71 $3.15 $3.61 $4.09 $4.58 $5.08 $6.33 $6.84 $7.35 $7.86 $8.37 $8.89 $9.42 Net Asset Value Per Share Cumulative Dividends Paid Per Share 9/30/2015 12/31/2015 3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 $0.00 $3.00 $6.00 $9.00 $12.00 $15.00 $18.00 $21.00 $24.00 $27.00 Total Value (Net Asset Value + Cumulative Dividends Paid) Increase of $8.32 per share at 6/30/2021 from 9/30/2015 Spin-off of CSWI

Page 9 CORE: Lower Middle Market (“LMM”): CSWC led or Club Deals ◦ Companies with EBITDA between $3 MM and $20 MM ◦ Typical leverage of 2.0x – 4.0x Debt to EBITDA through CSWC debt position ◦ Commitment size up to $30 MM with hold sizes generally $10 MM to $25 MM ◦ Both Sponsored and Non-sponsored deals ◦ Securities include first lien, unitranche, second lien and subordinated debt ◦ Frequently make equity co-investments alongside CSWC debt OPPORTUNISTIC: Upper Middle Market (“UMM”): Syndicated or Club, First and Second Lien ▪ Companies typically have in excess of $20 MM in EBITDA ▪ Typical leverage of 3.0x – 5.5x Debt to EBITDA through CSWC debt position ▪ Hold sizes generally $5 MM to $15 MM ▪ Floating rate first and second lien debt securities ▪ More liquid assets relative to LMM investments ▪ Provides flexibility to invest/divest opportunistically based on market conditions and liquidity position Two Pronged Investment Strategy

Page 10 Credit Portfolio Heavily Weighted Towards LMM and First Lien Investments LMM and First Lien Investments are 87% and 90% of the credit portfolio, respectively, as of 6/30/2021 Credit Portfolio Heavily Weighted to First LienRobust LMM Credit Portfolio Growth $ (M ill io ns ) $272 $337 $351 $368 $382 $387 $456 $474 $487 $521 $531 $573 $671 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 0.0 200.0 400.0 600.0 800.0 LMM UMM 73% 27% $ (M ill io ns ) $272 $337 $351 $368 $382 $387 $456 $474 $487 $521 $531 $573 $671 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 $0.0 $200.0 $400.0 $600.0 $800.0 Sub-DebtSecond LienFirst Lien 6% 85% 9% 74% 26% 7% 86% 7% 4% 86% 10% 77% 23% 86% 10% 4% 87% 9% 4% 22% 78% 24% 76% 87% 9% 4% 24% 76% 19% 81% 90% 8% 2% 90% 8% 2% 16% 84% 90% 8% 2% 15% 85% 18% 82% 91% 7% 2% 91% 7% 2% 14% 86% 12% 88% 92% 6% 2% 90% 8% 2% 13% 87%

Page 11 $138.9 MM in total new committed investments to eight new portfolio companies Q1 2022 Originations Note: Market refers to Upper Middle Market (“UMM”) and Lower Middle Market (“LMM”) (1) The investment is structured as a split lien term loan, which provides the Company with a first lien priority on certain assets of the obligor and a second lien priority on different assets of the obligor (2) Unfunded Commitments consist of $13.5 MM in revolving loans and $22.8 in delayed draw term loans Portfolio Originations Q1 2022 Name Industry Type Market Total Debt Funded at Close ($000s) Total Equity Funded at Close ($000s) Unfunded Commitments at Close ($000s) Debt Spread Debt Yield to Maturity Shearwater Research, Inc. Consumer Products & Retail First Lien LMM $13,863 $1,011 $5,708 6.25% 7.96% NWN Parent Holdings, LLC Software & IT Services First Lien UMM $13,200 $— $1,800 6.50% 8.23% NeuroPsychiatric Hospitals, LLC Healthcare Services First Lien LMM $15,000 $— $15,000 8.00% 9.50% FoodPharma Subsidiary Holdings, LLC Food, Agriculture & Beverage First Lien LMM $5,000 $750 $10,500 6.50% 8.34% Camin Cargo Control, Inc. Energy Services (Midstream) First Lien UMM $6,000 $— $— 6.50% 8.77% Crafty Apes, LLC Media, Marketing & Entertainment First Lien - Last Out LMM $10,000 $— $2,000 6.46% 7.75% Student Resource Center Education First Lien LMM $20,000 $2,000 $1,333 8.00% 9.96% Hybrid Promotions, LLC Consumer Products & Retail Split Lien (1) LMM $15,750 $— $— 8.25% 10.12% Total / Weighted Average $98,813 $3,761 $36,341 (2) 7.27% 9.03% • $102.6 MM funded at close

Page 12 Portfolio Exits Q1 2022 Name Industry Type Market Net Proceeds ($000s) Realized Gain ($000s) IRR Tax Advisors Group, LLC Business Services Equity LMM $1,632 $1,091 34.01% Total / Weighted Average $1,632 $1,091 34.01% Track Record of CSWC Exits Continues • During the quarter, CSWC exited one equity investment, generating total proceeds of $1.6 MM and an IRR of 34.0% • Cumulative IRR of 15.2% on 39 portfolio company exits generating $385.1 MM in proceeds since launch of credit strategy in January 2015 $1.6 MM in total proceeds from one portfolio company exit Note: Market refers to Upper Middle Market (“UMM”) and Lower Middle Market (“LMM”)

Page 13 CSWC Portfolio Asset Mix by Market Maintaining conservative portfolio leverage while receiving attractive risk-adjusted returns Note: All metrics above exclude the I-45 Senior Loan Fund (1) At June 30, 2021, we had equity ownership in approximately 57.1% of our LMM investments (2) The weighted-average annual effective yields were computed using the effective interest rates during the quarter for all debt investments at cost as of June 30, 2021, including accretion of original issue discount but excluding fees payable upon repayment of the debt instruments. As of June 30, 2021, there were two investments on non-accrual status. Weighted-average annual effective yield is not a return to shareholders and is higher than what an investor in shares in our common stock will realize on its investment because it does not reflect our expenses or any sales load paid by an investor (3) Weighted average EBITDA metric is calculated using investment cost basis weighting. For the quarter ended June 30, 2021, three LMM portfolio companies and one UMM portfolio company are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful (4) Includes CSWC debt investments only. Calculated as the amount of each portfolio company’s debt (including CSWC’s position and debt senior or pari passu to CSWC’s position, but excluding debt subordinated to CSWC’s position) in the capital structure divided by each portfolio company’s adjusted EBITDA. Weighted average leverage is calculated using investment cost basis weighting. Management uses this metric as a guide to evaluate relative risk of its position in each portfolio debt investment. For the quarter ended June 30, 2021, three LMM portfolio companies and one UMM portfolio company are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful Investment Portfolio - Statistics Q1 2022 (In Thousands) Lower Middle Market (1) Upper Middle Market Number of Portfolio Companies 49 12 Total Cost $635,315 $94,971 Total Fair Value $641,940 $95,435 Average Hold Size (at Cost) $12,966 $7,914 % First Lien Investments (at Cost) 84.7% 78.6% % Second Lien Investments (at Cost) 6.3% 14.6% % Subordinated Debt Investments (at Cost) 1.9% 0.0% % Equity (at Cost) 7.1% 6.8% Wtd. Avg. Yield (2) 10.1% 9.2% Wtd. Avg. EBITDA of Issuer ($MM's) (3) $10.6 $61.8 Wtd. Avg. Leverage through CSWC Security (4) 4.2x 4.0x

Page 14 Four Loans Upgraded and No Loans Downgraded During the Quarter Investment Rating 3/31/2021 Investment Rating Upgrades Investment Rating Downgrades 6/30/2021 # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) 1 4 $58.5 10.2% 3 $32.6 4.9% 0 $0.0 —% 7 $90.7 13.5% 2 52 $461.2 80.6% 1 $3.1 0.5% 0 $0.0 —% 57 $528.0 78.7% 3 7 $52.9 9.2% 0 $0.0 —% 0 $0.0 —% 6 $52.5 7.8% 4 0 $0.0 —% 0 $0.0 —% 0 $0.0 —% 0 $0.0 —% Wtd. Avg. Investment Rating (at Cost) 2.00 1.96 Credit Portfolio Investment Rating Migration

Page 15 CSWC Portfolio Mix as of 6/30/2021 at Fair Value Current Investment Portfolio (By Type) Current Investment Portfolio (By Industry) Current Investment Portfolio of $798.6 MM continues to be diverse across industries First Lien 76% I-45 SLF LLC 8% Second Lien 7% Subordinated Debt 1% Equity 8% Healthcare Services 11% Media, Marketing, & Entertainment 11% Business Services 11% Consumer Products & Retail 8% I-45 SLF LLC 8% Software & IT Services 7% Distribution 7% Industrial Services 5% Financial Services 4% Healthcare Products 4% Note: I-45 SLF consists of 96% first lien debt

Page 16 I-45 Portfolio Overview Current I-45 Portfolio (By Industry) I-45 loan portfolio of $169.6 MM is 96% first lien with average hold size of 2.6% of the I-45 portfolio (1) Through I-45 security (2) One portfolio company is excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful Telecommunications Services: Consumer Current I-45 Portfolio (By Type) I-45 Portfolio Statistics (In Thousands) 9/30/2020 12/31/2020 3/31/2021 6/30/2021 Total Investments at Fair Value $177,527 $159,598 $164,351 $169,610 Fund Leverage (Debt to Equity) at Fair Value 1.39x 1.07x 1.27x 1.40x Number of Issuers 42 38 36 38 Wtd. Avg. Issuer EBITDA $66,879 $73,384 $77,649 $77,851 Avg. Investment Size as a % of Portfolio 2.4% 2.6% 2.8% 2.6% Wtd. Avg. Net Leverage on Investments (1)(2) 4.7x 4.7x 4.4x 4.8x Wtd. Avg. Spread to LIBOR 6.3% 6.1% 6.0% 6.0% Wtd. Avg. Duration (Yrs) 3.1 3.1 3.0 3.0 96% 4% First Lien Second Lien Telecommunications Healthcare Services Consumer Products and Retail High Tech Industries 14% 13% 13% 10%9% Business Services

Page 17 Income Statement (In Thousands, except per share amounts) Quarter Ended 9/30/20 Quarter Ended 12/31/20 Quarter Ended 3/31/21 Quarter Ended 6/30/21 Investment Income Interest Income $13,882 $14,687 $15,078 $15,601 Dividend Income 1,860 2,916 1,661 2,657 Fees and Other Income 943 1,437 434 321 Total Investment Income $16,685 $19,040 $17,173 $18,579 Expenses Cash Compensation $1,961 $2,444 $1,631 $1,432 Share Based Compensation 853 771 708 1,076 General & Administrative 1,370 1,325 1,278 1,677 Total Expenses (excluding Interest) $4,184 $4,540 $3,617 $4,185 Interest Expense $4,397 $4,528 $4,688 $4,955 Pre-Tax Net Investment Income $8,104 $9,972 $8,868 $9,439 Taxes and Gain / (Loss) Income Tax Benefit (Expense) $215 $(1,455) $(852) $(396) Net realized gain (loss) on investments (1,279) (127) (1,583) (952) Net increase (decrease) in unrealized appreciation of investments 9,636 7,271 4,243 7,051 Realized losses on extinguishment of debt (286) (262) (459) — Net increase (decrease) in net assets resulting from operations $16,390 $15,399 $10,217 $15,142 Weighted Average Diluted Shares Outstanding 18,600 19,135 20,376 21,202 Pre-Tax NII Per Diluted Weighted Average Share $0.44 $0.52 $0.44 $0.45

Page 18 Operating Leverage Trend Continue to realize operating efficiencies of internally managed structure Period Ending To ta l A ss et s ( $M M ) O perating Expenses as % of A vg A ssets $284 $326 $417 $552 $585 $736 $836 4.9% 4.2% 3.7% 3.0% 2.8% 2.4% 2.3% FY 16 FY 17 FY 18 FY 19 FY 20 FY 21 Q1 FY 22 $0 $200 $400 $600 $800 2% 3% 4% 5% 6% Total Assets Operating Expenses(1) as % of Average Total Assets Note: Operating Leverage calculated as last twelve months operating expenses (excluding interest expense) divided by average annual assets (1) Operating expenses exclude interest expense

Page 19 $16.01 $0.45 $(0.43) $(0.10) $0.03 $0.02 $0.23 $0.47 $(0.10) $16.58 3/31/2021 NAV/Share Pre- Tax Net I nvest ment In come Regular Dividend Supplem ental Dividend Net C hange in UMM Debt (I nclu des I-4 5) Net C hange in LMM Debt Net C hange in Equity Portfo lio Accr etio n fro m Equity Iss uance Other (1) 6/30/2021 NAV/Share $14 $14.5 $15 $15.5 $16 $16.5 $17 NAV per Share Bridge from Quarter Ended 3/31/2021 Earnings / Dividends $(0.08) per Share Investment Portfolio $0.28 per Share Corporate $0.37 per Share (1) Other consists primarily of dilution from annual RSU issuance of $(0.10)

Page 20 (1) The Credit Facility has an accordion feature that allows for an increase in total commitments up to $400 MM (2) Net of $3.3 MM in letters of credit outstanding (3) Redeemable in whole or in part at any time prior to July 1, 2024, at par plus a "make whole" premium, and thereafter at par (4) Interest rate is fixed shortly after issuance at a market-driven spread over U.S. Treasury Notes with ten-year maturities (5) SBA Leverage Commitment of $40.0 MM expires in September 2025. Actual maturity of debentures outstanding will be based on draw date of each debenture (6) Redeemable in whole or in part at any time prior to October 31, 2025, at par plus a "make whole" premium, and thereafter at par (7) CSWC owns 80% of the equity and 50% of the voting rights of I-45 SLF LLC with a joint venture partner Significant Unused Debt Capacity with Long-Term Duration Earliest debt maturity occurs in December 2023 Facility Total Commitments Interest Rate Maturity Principal Drawn Undrawn Commitment Credit Facility (1) $340.0 MM L + 2.50% subject to certain conditions December 2023 $190.0 MM $146.7 MM (2) October 2024 Notes (3) $125.0 MM 5.375% October 2024 $125.0 MM N/A CSWC SBIC I $40.0 MM TBD (4) September 2025 (5) $0.0 MM $40.0 MM January 2026 Notes (6) $140.0 MM 4.500% January 2026 $140.0 MM N/A I-45 Credit Facility (7) $150.0 MM L + 2.15% March 2026 $107.0 MM $43.0 MM P rin ci pa l P ay m en ts ($ M M ) Long-Term Debt Obligations (Calendar Year) $190.0 $125.0 $247.0 $190.0 $125.0 $140.0 $107.0 Credit Facility October 2024 Notes January 2026 Notes I-45 Credit Facility CY2021 CY2022 CY2023 CY2024 CY2025 CY2026 $0 $50 $100 $150 $200 $250 $300

Page 21 Balance Sheet (In Thousands, except per share amounts) Quarter Ended 9/30/20 Quarter Ended 12/31/20 Quarter Ended 3/31/21 Quarter Ended 6/30/21 Assets Portfolio Investments $631,197 $648,773 $688,432 $798,647 Cash & Cash Equivalents 16,011 43,724 31,613 16,543 Other Assets 17,057 16,337 15,539 20,858 Total Assets $664,265 $708,834 $735,584 $836,048 Liabilities December 2022 Notes $56,339 $36,689 $— $— October 2024 Notes 122,623 122,775 122,879 123,041 January 2026 Notes — 73,410 138,425 138,504 Credit Facility 187,000 150,000 120,000 190,000 Other Liabilities 12,174 13,310 18,029 16,408 Total Liabilities $378,136 $396,184 $399,333 $467,953 Shareholders Equity Net Asset Value $286,129 $312,650 $336,251 $368,095 Net Asset Value per Share $15.36 $15.74 $16.01 $16.58 Debt to Equity 1.28x 1.22x 1.13x 1.23x

Page 22 Portfolio Statistics (1) CSWC utilizes an internal 1 - 4 investment rating system in which 1 represents material outperformance and 4 represents material underperformance. All new investments are initially set to 2. Weighted average investment rating calculated at cost (2) Excludes CSWC equity investment in I-45 Senior Loan Fund (3) At Fair Value Continuing to build a well performing credit portfolio (In Thousands) Quarter Ended 9/30/20 Quarter Ended 12/31/20 Quarter Ended 3/31/21 Quarter Ended 6/30/21 Portfolio Statistics Fair Value of Debt Investments $520,651 $531,103 $572,614 $671,257 Average Debt Investment Hold Size $11,319 $11,300 $11,228 $11,377 Fair Value of Debt Investments as a % of Par 95% 96% 97% 97% % of Investment Portfolio on Non-Accrual (at Fair Value) 1.7% 0.1% —% 1.8% Weighted Average Investment Rating (1) 2.05 2.01 2.00 1.96 Weighted Average Yield on Debt Investments 10.34% 10.64% 10.76% 10.04% Total Fair Value of Portfolio Investments $631,197 $648,773 $688,432 $798,647 Weighted Average Yield on all Portfolio Investments 10.43% 11.20% 10.22% 10.12% Investment Mix (Debt vs. Equity) (2)(3) 91% / 9% 91% / 9% 92% / 8% 91% / 9%

Page 23 Investment Income Detail Constructing a portfolio of investments with recurring cash yield (In Thousands) Quarter Ended 9/30/20 Quarter Ended 12/31/20 Quarter Ended 3/31/21 Quarter Ended 6/30/21 Investment Income Breakdown Cash Interest $11,581 $12,413 $11,668 $13,939 Cash Dividends 1,860 2,916 1,660 2,657 PIK Income 1,761 1,608 2,796 975 Amortization of purchase discounts and fees 543 667 616 688 Management/Admin Fees 198 199 234 227 Prepayment Fees & Other Income 742 1,237 199 93 Total Investment Income $16,685 $19,040 $17,173 $18,579 Key Metrics Cash Income as a % of Investment Income 86% 88% 80% 91% % of Total Investment Income that is Recurring 95% 92% 99% 96%

Page 24 Key Financial Metrics Strong Pre-Tax Net Investment Income and Dividend Yield driven by net portfolio growth and investment performance (1) Return on Equity is calculated as the quarterly annualized Pre-Tax NII, Realized Earnings, or Total Earnings, respectively, divided by equity at the end of the prior quarter (2) Dividend Yield is calculated as the quarterly annualized Total Dividend divided by share price at quarter end Quarter Ended 9/30/20 Quarter Ended 12/31/20 Quarter Ended 3/31/21 Quarter Ended 6/30/21 Key Financial Metrics Pre-Tax Net Investment Income Per Wtd Avg Diluted Share $0.44 $0.52 $0.44 $0.45 Pre-Tax Net Investment Income Return on Equity (ROE)(1) 11.66% 13.57% 11.06% 11.12% Realized Earnings Per Wtd Avg Diluted Share $0.38 $0.44 $0.32 $0.38 Realized Earnings Return on Equity (ROE)(1) 10.13% 11.42% 8.02% 9.53% Earnings Per Wtd Avg Diluted Share $0.88 $0.80 $0.50 $0.71 Earnings Return on Equity (ROE)(1) 23.58% 20.96% 12.74% 17.84% Regular Dividends per Share $0.41 $0.41 $0.42 $0.43 Supplemental/Special Dividends per Share $0.10 $0.10 $0.10 $0.10 Total Dividends per Share $0.51 $0.51 $0.52 $0.53 Dividend Yield (2) 14.52% 11.49% 9.39% 9.13%

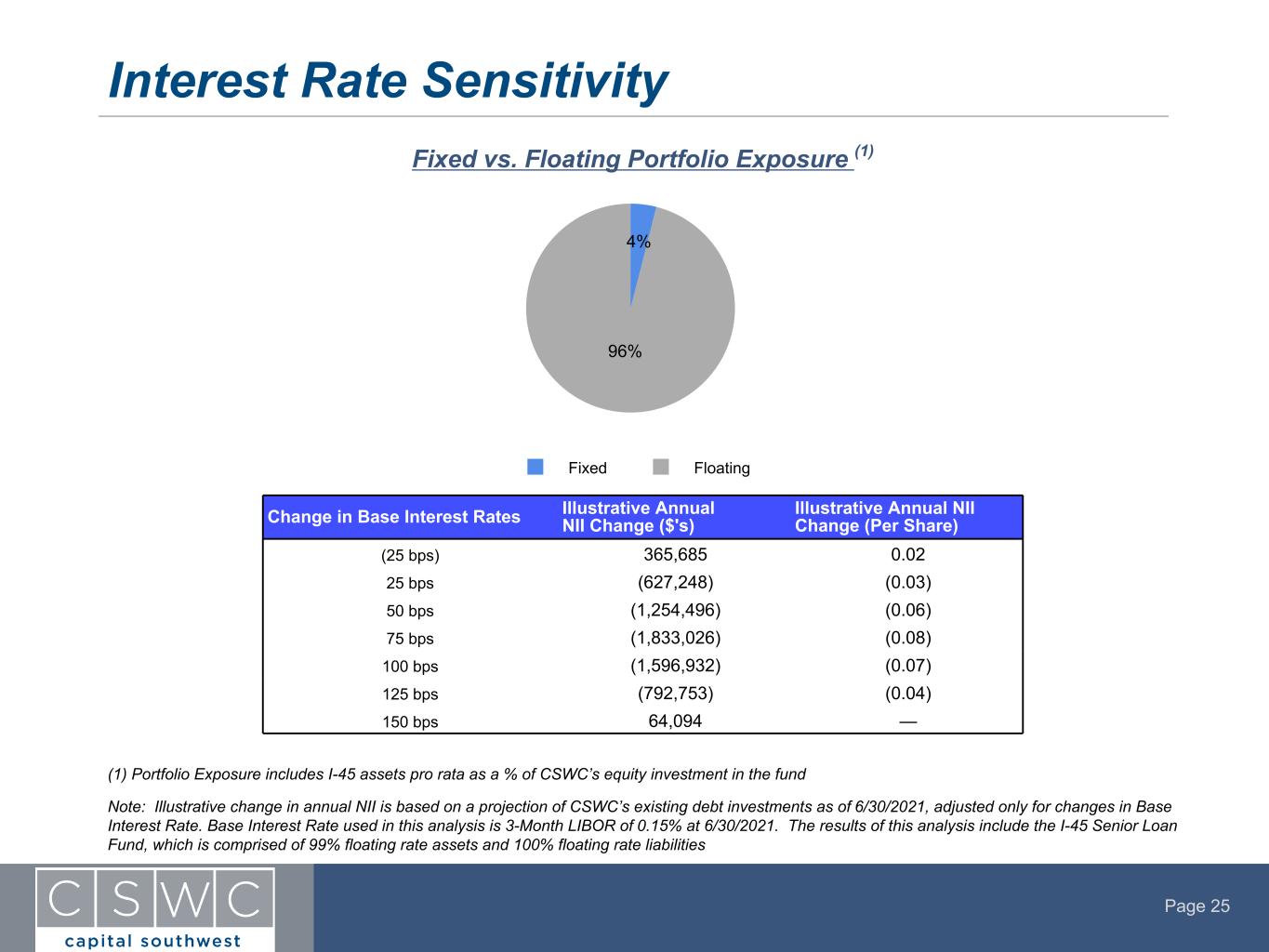

Page 25 Interest Rate Sensitivity Fixed vs. Floating Portfolio Exposure (1) Note: Illustrative change in annual NII is based on a projection of CSWC’s existing debt investments as of 6/30/2021, adjusted only for changes in Base Interest Rate. Base Interest Rate used in this analysis is 3-Month LIBOR of 0.15% at 6/30/2021. The results of this analysis include the I-45 Senior Loan Fund, which is comprised of 99% floating rate assets and 100% floating rate liabilities (1) Portfolio Exposure includes I-45 assets pro rata as a % of CSWC’s equity investment in the fund Change in Base Interest Rates Illustrative Annual NII Change ($'s) Illustrative Annual NII Change (Per Share) (25 bps) 365,685 0.02 25 bps (627,248) (0.03) 50 bps (1,254,496) (0.06) 75 bps (1,833,026) (0.08) 100 bps (1,596,932) (0.07) 125 bps (792,753) (0.04) 150 bps 64,094 — 4% 96% Fixed Floating

Page 26 Corporate Information Board of Directors Senior Management Fiscal Year End Inside Directors Bowen S. Diehl March 31 Bowen S. Diehl President & Chief Executive Officer Independent Directors Independent Auditor David R. Brooks Michael S. Sarner RSM US Chicago, ILChristine S. Battist Chief Financial Officer, Secretary & Treasurer T. Duane Morgan Jack D. Furst Joshua S. Weinstein William R. Thomas Senior Managing Director Corporate Counsel Ramona Rogers-Windsor Eversheds Sutherland (US) LLP Investor Relations Michael S. Sarner Capital Southwest Corporate Offices & Website 214-884-3829 5400 Lyndon B. Johnson Freeway msarner@capitalsouthwest.com Transfer Agent 13th Floor American Stock Transfer & Trust Company, LLC Dallas, TX 75240 Securities Listing 800-937-5449 http://www.capitalsouthwest.com Nasdaq: "CSWC" (Common Stock) www.amstock.com Industry Analyst Coverage Firm Analyst Contact Information Ladenburg Thalmann Mickey M. Schleien, CFA Direct: 305-572-4131 JMP Securities Devin Ryan Direct: 415-835-8900 B. Riley FBR Sarkis Sherbetchyan Direct: 310-689-5221 Hovde Group Bryce Rowe Direct: 804-318-0969 Jefferies Kyle Joseph Direct: 510-418-0754 Raymond James Robert Dodd Direct: 901-579-4560