Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Southern States Bancshares, Inc. | d121570dex231.htm |

| EX-5.1 - EX-5.1 - Southern States Bancshares, Inc. | d121570dex51.htm |

| EX-1.1 - EX-1.1 - Southern States Bancshares, Inc. | d121570dex11.htm |

Table of Contents

As filed with the United States Securities and Exchange Commission on July 30, 2021

Registration No. 333-257915

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Southern States Bancshares, Inc.

(Exact name of registrant as specified in its charter)

| Alabama | 6022 | 26-2518085 | ||

| (State or other jurisdiction of Incorporation or organization) |

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number) |

615 Quintard Ave.

Anniston, AL 36201

(256) 241-1092

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Stephen W. Whatley

Chairman and Chief Executive Officer

Southern States Bancshares, Inc.

615 Quintard Ave.

Anniston, AL 36201

(256) 241-1092

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael D. Waters Clinton H. Smith Jones Walker LLP 420 20th Street North Suite 1100 Birmingham, AL 35203 (205) 244-5210 (205) 244-5410 (facsimile) |

Ralph F. MacDonald, III, Esq. Jones Day 1221 Peachtree St., N.E. Suite 400 Atlanta, Georgia 30361 (404) 521-3939 (404) 581-8330 (facsimile) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common stock, $5.00 par value per share |

2,300,000 | $21.00 | $48,300,000 | $5,269.53(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares of common stock to be sold by the selling stockholders and shares of common stock that may be purchased by the underwriters pursuant to their option to purchase additional shares in this offering. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| (3) | The registrant previously paid a registration fee of $3,818.50 in relation to its filing of its initial registration statement on Form S-1 (File No. 333-257915) on July 15, 2021. The registrant has paid the remaining balance of $1,451.03 herewith. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor is it soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 30, 2021

PRELIMINARY PROSPECTUS

2,000,000 Shares

Common Stock

This is the initial public offering of shares of common stock of Southern States Bancshares, Inc. We are a bank holding company for Southern States Bank, an Alabama state-chartered commercial bank with executive offices in Anniston, Alabama.

We are offering 996,429 shares of our voting common stock. The selling stockholders identified in this prospectus are offering an additional 1,003,571 shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no established public trading market for our common stock. We have applied to list our common stock on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “SSBK.” We currently estimate that the initial public offering price per share of our common stock will be between $19.00 and $21.00 per share.

We are an “emerging growth company” under applicable federal securities law and, as such, will be subject to reduced public company reporting requirements. See “Implications of Being an Emerging Growth Company.”

Investing in our common stock involves risks. See “Risk Factors,” beginning on page 25, for a discussion of certain risks that you should consider before investing in our common stock.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| Proceeds to the selling stockholders before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding the underwriting discounts and commissions and certain expenses payable to the underwriters by us. |

The underwriters have an option for a period of 30 days to purchase up to an additional 300,000 shares of our common stock from us on the same terms set forth above.

Neither the Securities and Exchange Commission, nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Our common stock is not a deposit and is not insured or guaranteed by the FDIC or any other governmental agency.

The underwriters expect to deliver the shares of our common stock to purchasers on or about , 2021 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| KEEFE, BRUYETTE & WOODS A Stifel Company |

TRUIST SECURITIES |

Co-Managers

| Hovde Group, LLC | Performance Trust Capital Partners, LLC |

The date of this Prospectus is , 2021

Table of Contents

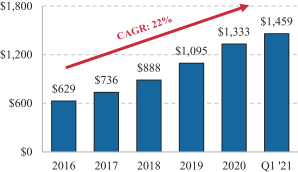

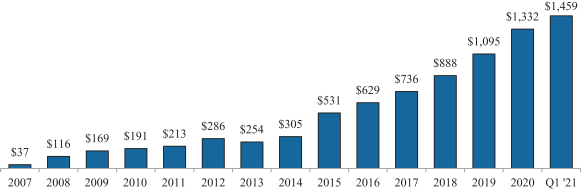

TOTAL ASSETS

(Dollars in millions)

Table of Contents

| Page | ||||

| 1 | ||||

| 14 | ||||

| Selected Historical Consolidated Financial Data and Other Information |

16 | |||

| 21 | ||||

| 25 | ||||

| 52 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

61 | |||

| 100 | ||||

| 111 | ||||

| 119 | ||||

| 129 | ||||

| 132 | ||||

| 134 | ||||

| 140 | ||||

| 152 | ||||

| 154 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| F-1 | ||||

i

Table of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Neither we, the selling stockholders nor the underwriters take responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of our common stock offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. Neither we, the selling stockholders nor the underwriters are making an offer of shares of our common stock in any state, country or other jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any free writing prospectus that we provide to you is accurate as of any date other than the date of the applicable document regardless of its time of delivery or the time of any sales of our common stock. Our business, financial condition, results of operations and cash flows may have changed since the date of the applicable document.

Unless otherwise indicated, this prospectus describes the specific details regarding this offering, which we refer to as the “offering,” and the terms and conditions of our common stock, $5.00 par value per share, which we refer to as “common stock,” being offered hereby and the risks of investing in our common stock. For additional information, please see the section entitled “Where You Can Find More Information.”

You should not interpret the contents of this prospectus or any free writing prospectus that we authorize to be delivered to you to be legal, business, financial or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

Basis of Presentation

In this prospectus, “we,” “our,” “us,” “Southern States Bancshares,” “Southern States,” or “the Company” refers to Southern States Bancshares, Inc., an Alabama corporation, and all consolidated subsidiaries including Southern States Bank, an Alabama banking corporation, unless the context indicates that we refer only to the parent company, Southern States Bancshares. In this prospectus, “Bank” or “Southern States Bank” refers to Southern States Bank, our wholly-owned bank subsidiary.

Industry and Market Data

This prospectus includes industry and market data, forecasts and information that we have prepared based, in part, upon data, forecasts and information that we obtained from regulatory sources, periodic industry publications, third-party studies and surveys, as well as filings of public companies in our industry, internal company surveys and other independent information publicly available to us. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe information regarding the industry and market data to be reliable and are not aware of any inaccuracies as of the date of this prospectus, we have not independently verified this information and this information could prove to be inaccurate or incomplete. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties, including possible future corrections and updates. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. We believe our internal research is reliable, even though such research has not been verified by any independent sources. Our estimates involve risks and uncertainties that are subject to

ii

Table of Contents

change based on various factors. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus. See “Risk Factors.” Trademarks used in this prospectus are the property of their respective owners, although for presentational convenience, we may not use the ® or the TM symbols to identify such trademarks.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933 (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we are required to present only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations, and provide less than five years of selected financial data in this prospectus; |

| • | we are exempt from the requirement to obtain an attestation report from auditors on management’s assessment of internal control over financial reporting under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”); |

| • | we are not required to comply with any new requirements adopted by the Public Accounting Oversight Board (“PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosures regarding our executive compensation; and |

| • | we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We will cease to be an emerging growth company upon the earliest of: (i) the last day of the fiscal year in which we have at least $1.07 billion in annual gross revenues, (ii) the date on which we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (the last day of the fiscal year in which we have more than $700 million in market value of our common stock held by non-affiliates as of the prior June 30), (iii) the date on which we issue more than $1.00 billion of non-convertible debt during the prior three-year period, or (iv) the last day of the fiscal year following the fifth anniversary of our initial public offering. We may choose to take advantage of some but not all of these reduced burdens. We have elected to adopt certain of the reduced disclosure requirements described above for purposes of the registration statement of which this prospectus is a part.

We expect to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports we will file with the U.S. Securities and Exchange Commission (“SEC”) and proxy statements that we use to solicit proxies from our stockholders. As a result, the information that we provide to our stockholders may be different than what you might receive from public reporting companies from which you hold equity interests. In addition, the JOBS Act permits us to take advantage of an extended transition period for complying with new or revised accounting standards affecting public companies. We have elected to use this extended transition period, which means that the financial statements included in this prospectus, as well as any financial statements that we file in the future, may not be subject to all new or revised accounting standards generally applicable to public companies for the transition period as long as we remain an emerging growth company or until we affirmatively and irrevocably opt out of the extended transition period under the JOBS Act. As a result, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards on a non-delayed basis.

iii

Table of Contents

This summary highlights selected information contained in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and our historical financial statements and the accompanying notes included in this prospectus before deciding to invest in our common stock.

Company Overview

We are a bank holding company headquartered in Anniston, Alabama. We operate primarily through our wholly-owned subsidiary, Southern States Bank, an Alabama banking corporation formed in 2007. The Bank is a full service community banking institution, which offers an array of deposit, loan and other banking-related products and services to businesses and individuals in our communities. Our franchise is focused on personalized, relationship-driven service combined with local market management and expertise to serve small and medium size businesses and individuals. We believe that these services will build stronger, growing communities that will drive our success. As of March 31, 2021, we had total assets of $1.5 billion, gross loans of $1.1 billion, total deposits of $1.3 billion and total stockholders’ equity of $144.6 million.

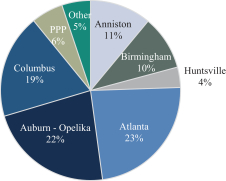

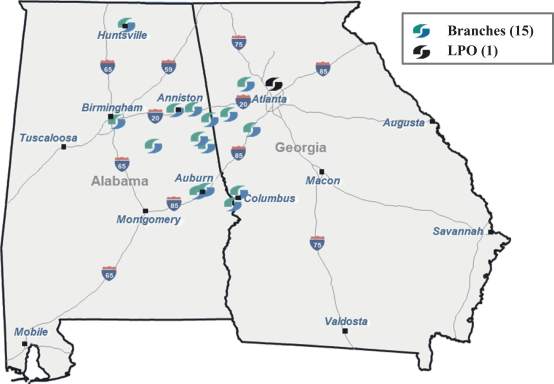

We provide banking services from 15 offices in Alabama and Georgia. Our primary service areas in Alabama are Anniston, Auburn, Birmingham and Huntsville with a presence extending into Calhoun, Lee, Jefferson, Talladega, Madison, Cleburne and Randolph Counties of Alabama and their surrounding areas. In Georgia, we serve the Columbus metropolitan statistical area (“MSA”), as well as Carroll, Coweta, and Dallas Counties in the greater Atlanta MSA. The Bank also operates a loan production office (“LPO”) in Atlanta, Georgia.

Recent Developments

Our unaudited consolidated financial statements as of and for the three and six month periods ended June 30, 2021, are not yet available. Our independent registered public accounting firm, Mauldin and Jenkins, LLC, has not performed any review procedures with respect to this preliminary financial information.

The following preliminary financial information should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes to those financial statements for prior periods, as well as “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” included elsewhere in this prospectus.

Selected Financial Highlights

| • | Total assets were $1.5 billion as of June 30, 2021, representing a $55.2 million, or 3.8%, increase from March 31, 2021 and a $218.3 million, or 16.8%, increase from $1.3 billion as of June 30, 2020. |

| • | Gross loans, net of unearned income, were $1.1 billion as of June 30, 2021, a $14.3 million, or 1.3%, increase compared to $1.1 billion as of March 31, 2021 and a $113.7 million, or 11.6%, increase compared to $983.9 million as of June 30, 2020. During the quarter ended June 30, 2021, we received net PPP loan payoffs of $23.1 million. Gross loans, net of unearned income (excluding PPP loans), were $1.1 billion as of June 30, 2021, representing a $37.4 million, or 3.7%, increase compared to $1.0 billion as of March 31, 2021 and a $147.6 million, or 16.2%, increase compared to $912.2 million as of June 30, 2020. There is currently only one loan for $3.1 million in deferral, and such deferral ends in October 2021. |

1

Table of Contents

| • | Total deposits were $1.3 billion as of June 30, 2021, representing a $52.6 million, or 4.2%, increase from March 31, 2021 and a $199.8 million, or 18.0%, increase compared to $1.1 billion as of June 30, 2020. This growth is substantially comprised of core deposits. |

| • | Asset quality improved with nonperforming assets to total assets of 0.81% as of June 30, 2021, down from 0.97% and 1.40% as of March 31, 2021 and June 30, 2020, respectively. The allowance for loan losses to total loans (excluding PPP loans) was 1.25% as of June 30, 2021 compared to 1.23% as of March 31, 2021 and 1.15% as of June 30, 2020. Net charge-offs were $16,000 for the three months ended June 30, 2021, compared to $4,000 for the three months ended March 31, 2021 and net recoveries of $3,000 for the three months ended June 30, 2020. Net charge-offs were $20,000 for the six months ended June 30, 2021, compared to net recoveries of $137,000 for the six months ended June 30, 2020. |

| • | Total shareholders’ equity was $148.9 million as of June 30, 2021, up 3.0% from $144.6 million as of March 31, 2021 and up 11.1% from $134.0 million as of June 30, 2020. |

| • | As of June 30, 2021, we exceeded the minimum requirements to be well-capitalized for bank regulatory purposes, with a total risk-based capital ratio of 11.15%, a tier 1 risk-based capital ratio of 10.10%, a common equity tier 1 capital ratio of 10.10%, and a tier 1 leverage ratio of 8.57%. |

Results of Operation

| • | We had net income of $3.9 million for the three months ended June 30, 2021, compared to net income of $5.7 million for the three months March 31, 2021, a decrease of $1.8 million, or 31.6%, and $2.9 million for the three months ended June 30, 2020, an increase of $1.0 million, or 34.5% compared to the same period a year earlier. The decrease from the three months ended March 31, 2021 was substantially the result of a $2.8 million gain on the sale of a USDA loan in the first quarter of 2021. We had net income of $9.6 million for the six months ended June 30, 2021 compared to net income of $5.6 million for the six months ended June 30, 2020, an increase of $4.0 million, or 71.4%, also substantially the result of the $2.8 million gain on the sale of the USDA loan. Excluding the gain on sale of the USDA loan, net income in the first six months of 2021 increased $1.2 million, or 21.4%. The increases in net income for both the three and six months ended June 30, 2021 compared to the same periods ended June 30, 2020 were primarily the result of higher net interest income, which was fueled by higher loan growth. This was partially offset by an increase in noninterest expense for the three and six months ended June 30, 2021, which was the result of an investment in human capital as we develop the metro Atlanta market. |

| • | Net interest margin was 3.75% (3.67% without PPP loans) for the three months ended June 30, 2021, compared to 3.97% (3.79% without PPP loans) for the three months ended March 31, 2021 and 3.31% (3.41% without PPP loans) for the three months ended June 30, 2020. Net interest margin was 3.85% (3.73% without PPP loans) for the six months ended June 30, 2021, compared to 3.56% (3.62% without PPP loans) for the six months ended June 30, 2020. |

| • | Our earnings per common share were $0.51 for the three months ended June 30, 2021, compared to $0.74 for the three months March 31, 2021 and $0.38 for the three months ended June 30, 2020. Our earnings per share was $1.25 for the six months ended June 30, 2021, compared to $0.73 for the six months ended June 30, 2020. Our diluted earnings per common share was $0.50 for the three months ended June 30, 2021, compared to $0.73 for the three months March 31, 2021 and $0.37 for the three months ended June 30, 2020. Our diluted earnings per share was $1.23 for the six months ended June 30, 2021, compared to $0.72 for the six months ended June 30, 2020. |

| • | Our annualized return on average assets (“ROAA”) was 1.05% for the three months ended June 30, 2021, compared to 0.93% for the three months ended June 30, 2020. Our annualized ROAA was 1.35% |

2

Table of Contents

| for the six months ended June 30, 2021, which reflects the gain on sale of the USDA loan in the first quarter of 2021, compared to 0.95% for the six months ended June 30, 2020. Excluding such gain on sale, our annualized ROAA for the first six months of 2021 was 0.96%. |

| • | Our annualized return on average equity (“ROAE”) was 10.62% for the three months ended June 30, 2021, compared to 8.92% for the three months ended June 30, 2020. Our annualized ROAE was 13.31% for the six months ended June 30, 2021, compared to 8.87% for the six months ended June 30, 2020. Excluding the gain on sale of the USDA loan in 2021, our annualized ROAE was 9.41% in the first six months of 2021. |

Redemption of Subordinated Notes

| • | On June 23, 2021, we redeemed all our $4.5 million in outstanding subordinated notes (the “Subordinated Notes”) that had a 6.625% fixed rate of interest at the date of redemption. We used proceeds from our line of credit (the “Line of Credit”) from First Horizon Bank to redeem the Subordinated Notes. Our Line of Credit bears interest at three-month LIBOR plus 2.50%. |

Dividend

On July 21, 2021, we declared a dividend of $0.09 per share, payable on August 11, 2021 to holders of record as of July 29, 2021. Purchasers of common stock in this offering will not receive the dividend.

Our History and Growth

The Bank was organized on August 23, 2007 by a group of financial executives and prominent business leaders with a shared vision to invest in highly experienced people and technology to offer high levels of personal service to our clients. Chartered with approximately $31 million of common equity, the Bank opened its Anniston, Alabama headquarters along with an office in Opelika, Alabama. We opened our Birmingham office six months later in February 2008.

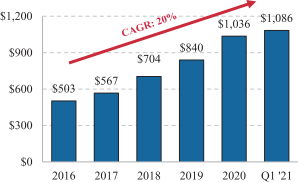

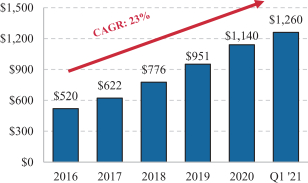

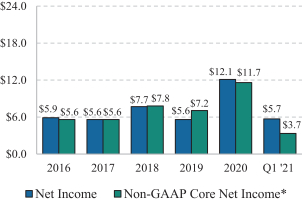

In the following years, our growth has been driven by expansion in existing markets and into new markets. Over the last five years, we have an asset compound annual growth rate (“CAGR”) of over 20% while maintaining profitability, credit quality and prudent capital management. The following information summarizes our history and the tables illustrate our balance sheet and income statement growth as well as trends in other performance metrics as of or for the years ended December 31, 2016 through 2020, and the three months ended March 31, 2021:

| • | On May 18, 2012, we acquired Alabama Trust Bank’s Sylacauga, Alabama branch and approximately $40 million in core deposits through an FDIC-assisted transaction. |

| • | We opened full-service de novo branches in Huntsville, Alabama and Carrollton, Georgia in January and June of 2015, respectively, along with an LPO in Atlanta, Georgia in August 2015. |

| • | In October 2015, we completed our acquisition of Columbus Community Bank in Columbus, Georgia and subsequently opened a second Columbus location in December 2015. We have successfully grown our deposits in this market from approximately $100 million at the time of acquisition to $233 million as of March 31, 2021. |

| • | In 2016, we completed two rounds of private growth capital, issuing $4.5 million in subordinated debt in June and another $41.2 million in equity in December to several institutional investors. All outstanding Subordinated Notes were repaid in June 2021. In January 2017, we raised $3.4 million of common equity from local investors. We used the proceeds from these transactions to improve our capital ratios and to support our growth. Using the newly issued capital, our loans grew by 40.4% during 2017 and 2018 and deposits grew by 49.2% during the same period. We also opened a full service branch in Newnan, Georgia and hired four experienced lenders in Georgia. |

3

Table of Contents

| • | On May 8, 2019, we announced the acquisition of Wedowee, Alabama based East Alabama Financial Group, Inc. (“East Alabama”) and its subsidiary bank, Small Town Bank (“Small Town Bank”) and closed the transaction in September of 2019. The aggregate consideration paid was approximately $24.0 million in cash and the issuance of 1,142,846 shares of common stock. As of June 30, 2019, Small Town Bank had $240.6 million in assets, $120.8 million in gross loans and $199.9 million in deposits, of which $192.1 million were core deposits. Small Town Bank operated six branches along the Alabama-Georgia border, and the acquisition allowed us to enter three new counties: Cleburne and Randolph County, Alabama and Paulding County, Georgia. Small Town Bank also operated a branch in Carroll County, Georgia, which we combined with an existing branch, and an LPO in Oxford, Alabama, which we consolidated with our branch there to expand our existing Anniston footprint. |

| • | In 2020, we achieved record net income of approximately $12.1 million, which represents a 116% increase from 2019. We also had significant balance sheet and customer growth in 2020; our total assets increased 22%, deposits increased 20%, noninterest bearing deposits increased 52% and loans increased 15%, excluding Paycheck Protection Program (“PPP”) loans. Since March 2020, we have been an active participant in the PPP, providing 420 existing customers $71.7 million in loans through the first program and $26.2 million through the second program. In aggregate, we anticipate the realization $3.7 million in fees from this program. Over the course of the pandemic, we granted deferrals on 396 loans totaling $280.1 million, or approximately 28.0% of our loan portfolio. As of March 31, 2021, only two loans totaling $1.1 million remain. |

| Total Assets ($mm)

|

Total Loans ($mm)

| |

|

|

| |

| Total Deposits ($mm)

|

Net Income ($mm)

| |

|

|

|

| * | Core net income is a non-GAAP financial measure. Please see “Non-GAAP Financial Measures” for a definition of core net income and a reconciliation of core net income to its most directly comparable GAAP financial measure. |

4

Table of Contents

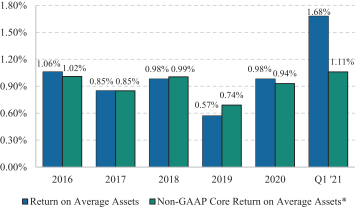

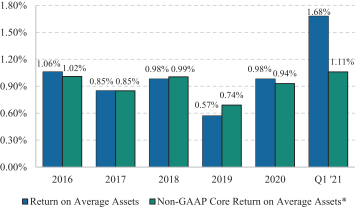

Return on Average Assets (%)

| * | Core return on average assets is a non-GAAP financial measure. Please see “Non-GAAP Financial Measures” for a definition of core return on average assets and a reconciliation of core return on average assets to its most directly comparable GAAP financial measure. |

Business Strategy

Our business strategy is to deliver best-in-class customer service and to be the most trusted bank serving our markets, while maintaining our asset quality and profitability. We intend to execute our strategic plan through the following:

| • | Continuing Our Organic Growth Strategy. Organic loan and deposit growth have been our primary tenet since establishing the Bank, and we believe it is paramount in driving long-term stockholder value. We seek to continue to focus on organic growth throughout our footprint by deepening ties within our communities, building upon current client relationships and further leveraging the extensive experience of our senior management team, board of directors and commercial bankers. We have successfully grown our balance sheet with loan growth of 103.2% (excluding PPP loans) and deposit growth of 142.3% since 2016. We believe that our teams of engaged, experienced employees will continue to be an important factor in cultivating relationships with current and potential clients and driving growth. In addition to our employee focus, we have made significant investments in technology and risk management systems, and we believe that we have developed an infrastructure that can support significant additional growth with minimal capital investment. |

| • | Emphasizing Commercial Banking in Local Communities. We intend to continue operating as a community banking organization focused on meeting the specific needs of small and medium-sized businesses and individuals in our market areas. We will continue to provide a high degree of responsiveness and a wide variety of banking products and services to our customers. We are focused on being a dominant bank in the smaller markets we serve and a competitive player in our larger metropolitan markets. Our consistent corporate message is that the success of our communities and their businesses and individuals will drive the success of the Bank. |

| • | Pursuing Strategic Growth Opportunities through Acquisitions and New Market Development. We anticipate continuing to selectively pursue future acquisitions and new market expansions to supplement organic growth in our legacy markets. Our organic growth has been complemented by synergistic acquisitions and de novo expansion. We seek to expand our operations in attractive and adjacent markets with experienced banking teams that are a cultural fit and knowledgeable of our target client base. We may also make acquisitions or open additional offices in our existing markets. We seek acquisitions that |

5

Table of Contents

| provide meaningful financial benefits, long-term organic growth opportunities and economies of scale without compromising asset quality to the overall organization. Generally, we seek acquisitions of banks with $250.0 million to $750.0 million of assets headquartered in Alabama, Georgia, and select southeastern Tennessee markets, with an emphasis along the I-20, I-85 and I-75 corridors. Currently, we believe that there are approximately 103 potential banks that meet our size and location targets. |

| • | Funding Asset Growth through Core Deposits and Relationship Banking. We fund our loan growth primarily through low-cost core customer deposits. Our ratio of core deposits (total deposits less time deposits greater than $250,000) were 97.4% of total deposits as of March 31, 2021. Our loan to deposit ratio, excluding PPP, as of March 31, 2021 was 81.1%. The strength of our deposit franchise results from our development and maintenance of long-standing customer relationships. Our relationship managers and branch managers actively seek lending relationships with our existing depositors. Today, we believe approximately 65% of our lending relationships have deposits with our bank and our top 25 loans all have deposit relationships as of March 31, 2021. Additionally, we attract deposits from our commercial customers by providing them with personal service, a broad suite of commercial banking and treasury management products and convenient services such as remote deposit capture and commercial internet banking. |

| • | Leveraging Technology to Enhance the Client Experience and Improve Productivity. We provide client convenience through the use of technology and our mobile banking applications, along with our strategically placed banking locations. Since our founding, we have made significant investments in technology to offer online and mobile banking products that we believe are comparable to those offered by many similar-sized competitors and those of the nation’s largest banks. We utilize Jack Henry & Associates, Inc. (“Jack Henry”) as a core processing service provider that we believe can support our growth plan. We also leverage technology solutions to manage cyber security risks and data privacy. In addition to client-facing technology, significant investments have been made in the technology and software utilized by our employees. This technology and software enables our employees to be more productive by enhancing workflow and internal and external management reporting, removing unnecessary steps and reducing manual errors. For example, in 2020, we initiated a new customer platform through Jack Henry, which allows for electronic signatures on new and existing deposit accounts. In 2021, we are implementing a new lending platform to provide more digital capabilities to our borrowers and create internal efficiencies throughout our loan underwriting and processing. |

Competitive Strengths

We believe that the following strengths will help us execute our business strategy:

| • | Experienced and Invested Leadership. Our board of directors has decades of combined business experience from a variety of backgrounds. Our directors actively participate in and support community activities, which we believe significantly benefit our business development efforts. Our executive leadership team is comprised of established industry veterans with a track record of profitable growth, operating efficiencies and strong risk management. Collectively, our directors and senior executives own approximately 15.0% of the total common stock outstanding as of March 31, 2021, excluding stock held by a private equity fund with a representative on our board of directors. |

| • | Stephen W. Whatley, founder of the Bank, serves as Chief Executive Officer of Southern States, a position he has held since 2007, and Chairman of the Board of Southern States, a position he has held since 2014. Prior to founding Southern States, Mr. Whatley served as Market President at Colonial Bank covering several counties in East Alabama and West Georgia. Mr. Whatley has over 40 years of experience in the banking industry in multiple states across the country. |

6

Table of Contents

| • | Mark Chambers serves as President of Southern States. Mr. Chambers has worked at Southern States since 2007, including as Senior Executive Vice President and President of the Southeast Region. He has served as President since 2019. Mr. Chambers held the position of Market President (Auburn and Opelika, Alabama) at Wachovia Bank before his time at Southern States. He has over 30 years of banking experience. |

| • | Lynn Joyce serves as Senior Executive Vice President and Chief Financial Officer of Southern States. She has held this position since joining Southern States in 2013. Prior to joining Southern States, Ms. Joyce served in various positions with First Financial Bank, Bessemer, Alabama, which was publicly traded on NASDAQ, and prior to that worked in public accounting at a national firm. |

| • | Greg Smith is Senior Executive Vice President and Chief Risk Officer, positions he has held since 2019. From 2006 until 2019, he served as Senior Vice President and Chief Credit Officer of Southern States. Prior to joining Southern States, he worked as Commercial Loan Officer and Market President (Anniston, Alabama) at Regions Bank, a regional bank. Mr. Smith has over 30 years of experience in the banking industry. |

| • | Jack Swift is Senior Executive Vice President and Chief Operating Officer of Southern States. He has held this position since 2019. Previously, he served as Senior Executive Vice President and President of the Central Region of Southern States from 2006 until 2019. Prior to joining Southern States, Mr. Swift worked as Senior Vice President at Colonial Bank. Mr. Swift has over 30 years of experience in the banking industry. |

In addition to our executive leadership team, we believe that we are supported by a deep and talented bench of market leaders, many of whom have been with us for much of our existence.

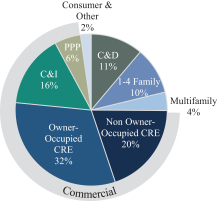

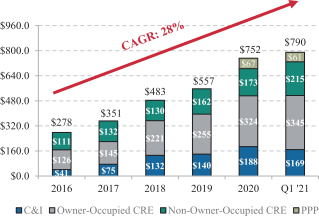

| • | Diversified Loan Portfolio. We have an attractive, commercially focused loan portfolio, with 15.6% commercial and industrial, or C&I, loans, 31.7% owner-occupied commercial real estate, or CRE loans, 19.8% non-owner-occupied CRE loans, and 10.0% one- to-four-family residential loans at March 31, 2021. Approximately 47.3% of our loan portfolio is comprised of owner-operated business loans, which includes C&I and owner-occupied CRE loans on a combined basis, and 34.8% of our portfolio consists of loans for investor-owned properties and projects, which includes non-owner-occupied CRE loans, multi-family loans and construction and land development loans, or C&D loans, on a combined basis. We have had loan growth of 18.2% CAGR, excluding PPP, since 2016. Our loans are in market, except where we follow a local loan customer out of market. We believe that our knowledgeable and prudent approach to commercial lending results in relatively lower losses caused by defaults. |

7

Table of Contents

| Loan Portfolio

|

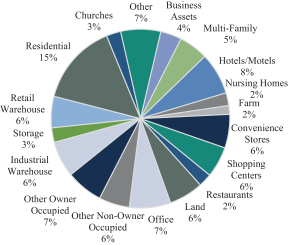

Commercial and CRE Loan Portfolio

| |

|

|

| |

| Loans by Geography*

|

CRE by Type

| |

|

|

| |

| * | Other markets include Sylacauga, Wedowee, Ranburne, Roanoke and Heflin; Atlanta includes the Carrolton, Newnan and Dallas markets |

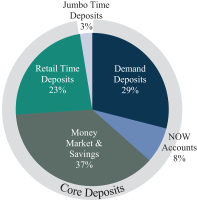

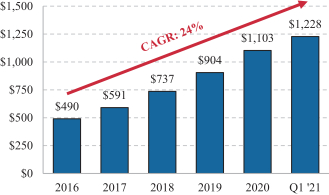

| • | Core-Deposit Base. We have built a strong core deposit base by providing quality products and services to customers in our market areas. We offer retail deposit services through our existing branch network, as well as mobile and online banking services. Core deposits totaled $1.2 billion, or 97.4% of total deposits, and noninterest-bearing deposits totaled $365.1 million, or 28.9% of total deposits, as of March 31, 2021. Our commercial lending has led to strong core deposit growth with a 24.1% CAGR since 2016. Our cost of total deposits was 0.39% for the three months ended March 31, 2021. |

8

Table of Contents

| Deposit Portfolio

|

Core Deposits ($mm)

| |

|

|

|

| • | History of Successful Acquisitions. We have pursued a strategy of disciplined organic and acquisitive growth. Since 2012, we have successfully completed three acquisitions, including one bank purchased from the FDIC and two whole-bank acquisitions. Our management team has demonstrated success in identifying and integrating strategic transactions that either added density to our footprint or expanded our presence into attractive markets to ultimately build long-term stockholder value. Following each transaction, we retained the majority of the acquired deposit and desired lending relationships, which we believe reflects the strength of our relationship-based community banking focus and the quality of our established integration processes. When negotiating a transaction, we are disciplined on price and structure in order to manage the initial tangible book value dilution and earnback period. We modeled our two whole-bank acquisitions of Columbus Community Bank and Small Town Bank on a projected 3-year or less tangible book value earnback period with double digit accretion to projected earnings per share. We believe our approach to acquisitions and the availability of a publicly traded stock after this offering will position us well to be the acquirer of choice for other institutions in our target markets. |

| • | Prudent Credit Risk Management. We have a culture of well-developed risk management procedures at all levels of our organization. Our loan portfolio is primarily originated from borrowers within our footprint and is subject to a rigorous credit evaluation process that seeks to balance responsiveness with prudent underwriting and pricing practices. A centralized credit underwriting group underwrites all credit exposures, ensuring consistent application of credit standards. We have established processes to monitor our loan portfolio on a regular basis. Our management team and board of directors have established concentration limits by loan type, industry, and related borrowers, which are regularly reviewed in light of current conditions in our targeted market areas to mitigate developing risk areas within our loan portfolio and to ensure that the asset quality of our loan portfolio remains strong. Our CRE, C&D, and hospitality loans as a percentage of total capital at March 31, 2021 was 338.4%, 147.7%, and 54.0%, respectively. When credit issues arise, our management team takes an active approach in handling the problem. For example, we capped our hospitality loans at existing levels in January 2020 given market conditions, and similarly capped our multifamily loans in September 2020; both measures are still in effect today. We monitor our loan loss reserve and seek to maintain an adequate reserve for future losses. |

| • | Stockholder Focus. We started the Bank with a strategic plan to provide consistent, long-term growth and returns to our stockholders. Our tangible book value per share increased 16.1% from December 31, 2019 to March 31, 2021, while increasing dividends and generating strong returns on capital. We changed from an annual to a quarterly dividend in April 2020 when we declared a $0.08 dividend per share. In January 2021, we increased our quarterly dividend to $0.09 per share. We believe that our experienced leadership team, commitment to organic and acquisitive growth, and prudent risk management will allow us to consistently build value for our stockholders. |

9

Table of Contents

Our Markets

We provide banking services from 15 offices in Alabama and in the Atlanta and Columbus, Georgia MSAs. Our markets are a mix of higher-growth areas and stable markets with strong core deposits. We have a top five deposit market share in four counties of operation and have outperformed the deposit growth in the majority of our markets. We find strength in the stability of our rural markets coupled with higher growth potential in metropolitan areas such as Atlanta, Birmingham, Huntsville and Auburn. Below is a description of our operations in the MSAs and selected counties:

| Market Area* |

Total Population 2021 (Estimated) |

Projected Population Change 2021-2026 (%) |

Projected Median Household Income 2026 ($) |

Projected Household Income Change 2021-2026 (%) |

Unemployment Rate** (%) |

|||||||||||||||

| Anniston-Oxford MSA |

112,767 | (1.2 | ) | 52,934 | 7.9 | 3.4 | ||||||||||||||

| Atlanta-Sandy Springs-Alpharetta MSA |

6,137,994 | 5.9 | 75,740 | 12.2 | 3.9 | |||||||||||||||

| Auburn-Opelika MSA |

167,412 | 4.6 | 56,718 | 8.7 | 2.4 | |||||||||||||||

| Birmingham-Hoover MSA |

1,094,169 | 0.4 | 69,086 | 13.1 | 2.6 | |||||||||||||||

| Columbus MSA |

321,811 | 2.1 | 54,764 | 9.7 | 4.2 | |||||||||||||||

| Huntsville MSA |

481,729 | 4.3 | 72,962 | 7.2 | 2.2 | |||||||||||||||

| Cleburne County, AL |

14,883 | 0.2 | 48,082 | 6.8 | 2.2 | |||||||||||||||

| Randolph County, AL |

22,747 | 0.5 | 49,772 | 6.6 | 2.2 | |||||||||||||||

| Talladega County, AL |

79,589 | (0.7 | ) | 47,451 | 7.3 | 3.6 | ||||||||||||||

| Market Area*** |

Market Rank |

Deposit Market Share (%) |

Number of Branches |

Market Deposits ($mm) |

Deposits Per Branch ($mm) |

YoY Deposit Growth (%) |

||||||||||||||||||

| Anniston-Oxford MSA |

5 | 10.7 | 1 | 234.4 | 234.4 | (11.7 | ) | |||||||||||||||||

| Atlanta-Sandy Springs-Alpharetta MSA |

49 | 0.1 | 3 | 140.9 | 50.0 | 28.4 | ||||||||||||||||||

| Auburn-Opelika MSA |

7 | 6.7 | 2 | 239.5 | 119.8 | 40.3 | ||||||||||||||||||

| Birmingham-Hoover MSA |

31 | 0.1 | 1 | 48.3 | 48.2 | (9.6 | ) | |||||||||||||||||

| Columbus MSA |

6 | 1.4 | 2 | 171.4 | 85.7 | (3.7 | ) | |||||||||||||||||

| Huntsville MSA |

22 | 0.5 | 1 | 49.7 | 49.7 | 29.3 | ||||||||||||||||||

| Cleburne County, AL |

2 | 31.3 | 2 | 51.6 | 25.8 | (9.4 | ) | |||||||||||||||||

| Randolph County, AL |

1 | 35.7 | 2 | 125.4 | 62.7 | 5.3 | ||||||||||||||||||

| Talladega County, AL |

5 | 5.3 | 1 | 52.2 | 52.2 | 29.3 | ||||||||||||||||||

| * | Demographic data provided by Claritas based on U.S. Census data |

| ** | Source: U.S. Bureau of Labor Statistics for MSAs; Alabama Department of Labor for counties; data as of May 2021 |

| *** | Source: FDIC; Deposit data as of 6/30/20 |

Atlanta, Georgia. The Atlanta MSA is the ninth largest metro area in the United States with a 2020 population of 6.1 million. Atlanta has strong demographics and is projected by the U.S. Census Bureau to exceed the national average in population growth, median 2021 household income and change in household income from 2021 to 2026. Atlanta was voted the second best city for people between the ages of 21 and 36 by Money.com, and it was also ranked the thirteenth Best Places for Business and Careers by Forbes. In 2020, Atlanta was the number one growth leader for becoming a metro area tech hub and was voted the number three metro area for corporate headquarters by Business Facilities. In fact, it serves as the headquarters of 16 Fortune 500 companies including Coca-Cola, Home Depot, UPS, WestRock and Delta Air Lines. The Atlanta MSA is home to multiple universities and professional sports teams. Businesses are attracted to Atlanta by its strong economic opportunities, talent-rich labor pool, and position as the central hub of the Southeast.

10

Table of Contents

Auburn-Opelika, Alabama. The Auburn-Opelika MSA was the fourth-highest ranked MSA in the country in terms of migration growth, according to U-Haul’s ‘2020 Migration Trends’ study. In addition to being home to Auburn University, the largest employer in the MSA, accounting for approximately a quarter of the city’s workforce, The East Alabama Medical Center, a Wal-Mart Distribution Center, Mando America Corporation, and Briggs & Stratton, have helped make Auburn-Opelika the second fastest growing MSA in Alabama.

Birmingham, Alabama. Birmingham is the largest market in Alabama by population and has a history of strong economic performance. In 2020, Birmingham was one of the cities with the lowest cost of living in America. Its healthcare, financial services and materials industries have continued to drive economic development and to attract new corporations across all sectors. Birmingham ranks in the top ten as a moving destination for new college graduates based on an April 2020 report by Smartasset Financial Technology. Also, Birmingham was the number eight best city for jobs in 2020 per Glassdoor. The most prominent companies headquartered in the city are Altec Industries, Encompass Health, Vulcan Materials and Alabama Power. Additionally, University of Alabama Birmingham serves as an international leader in health care and as one of the top transplant centers in the world.

Huntsville, Alabama. Huntsville is home to the Redstone Arsenal, which includes the U.S. Space and Rocket Center, NASA’s Marshall Space Flight Center, and the United States Army Aviation and Missile Command. Huntsville’s focus on space and technology attracts well-regarded professionals and businesses alike. Over 40% of the city has obtained a Bachelor’s Degree or higher education, ranking it among the top-educated cities in the nation. Huntsville is one of the top 10 best cities for jobs in STEM by Forbes, and employers in Huntsville hire the third most high-tech employees in the county. The city was voted Top Ten Best Places for Business and Careers by Forbes with strong projected economic growth. The largest employer in Huntsville is the U.S. Army, but NASA and Boeing combine for nearly 9,000 employees as well. Huntsville’s median household income is second to Atlanta in our markets. The City of Huntsville is the second largest city and the fastest growing major city in Alabama.

Columbus, Georgia. Columbus is the third most populous MSA in Georgia. The most notable employer is Fort Benning Military Base, located just south of the city, which employs over 40,000 people. The Columbus Chamber of Commerce estimates that Ft. Benning has an economic impact of more than $4 billion on the surrounding area. Other companies headquartered in Columbus include Aflac and the Total Systems group of Global Payments.

Corporate Information

Our principal executive office is located at 615 Quintard Avenue, Anniston, Alabama 36201, and our telephone number is (256) 241-1092. We maintain an Internet website at www.southernstatesbank.net. The information contained on or accessible from our website is not part of this prospectus and is not incorporated by reference herein.

Summary Risk Factors

You should carefully consider the risks described under “Risk Factors” beginning on page 25 of this prospectus, as well as other information included in this prospectus, including our financial statements and the notes thereto, before making an investment decision. These risks include, but are not limited to:

Risks Related to Our Business

| • | The long-term effects of the current COVID-19 pandemic are unknown, continue to evolve, and could ultimately impact general economic activity, financial resources, demand for banking services, and result in governmental responses, which could result in negative effects on our business, financial condition, liquidity and results of operations. |

11

Table of Contents

| • | We may face risks in participating as a lender in the PPP program. |

| • | Our business is concentrated in, and largely dependent upon, the continued growth of, and economic conditions in, the markets where we operate. |

| • | Our profitability is vulnerable to interest rate fluctuations. |

| • | The elimination of the London Interbank Offered Rate (“LIBOR”) and its replacement by other benchmark rates and the market acceptance of alternative indexes could adversely impact our business and results of operations. |

| • | We could suffer losses from a decline in the credit quality of our assets. |

| • | A significant portion of our loan portfolio is secured by real estate, and events that negatively impact the real estate market (such as the impact of COVID-19 on the hospitality industry) could negatively affect our business. |

| • | Our allowance for estimated loan losses may not be adequate, which may require us to take a charge to earnings and adversely impact our financial condition and results of operations. |

| • | Acquisitions may disrupt our business and dilute stockholder value, and integrating acquired companies may be more difficult, costly, or time-consuming than we expect. |

| • | Our financial performance will be negatively impacted if we are unable to execute our growth strategy, including branch expansions into new markets. |

| • | Our liquidity needs might adversely affect our financial condition and results of operations. |

| • | We may not be able to adequately measure and limit the credit risks associated with our loan portfolio, which could adversely affect our profitability. |

| • | As a community banking institution, we have smaller lending limits and different lending risks than certain of our larger, more diversified competitors. |

| • | Our business success and growth depends significantly on key management personnel and our ability to attract and retain key people. |

Risks Related to Banking Regulation

| • | The banking industry is subject to extensive regulation. |

| • | Banking agencies periodically conduct examinations, and failure to comply with any supervisory actions could result in materially adverse effects. |

| • | FDIC deposit insurance assessments may materially increase in the future, which would have an adverse effect on earnings. |

| • | Banks are subject to minimum capital requirements by regulators. |

| • | The Federal Reserve may require us to commit capital resources to support the Bank. |

| • | The Bank may need to raise additional capital in the future, including as a result of potential increased minimum capital thresholds established by regulators, but that capital may not be available when it is needed or may be dilutive to stockholders. |

| • | The Company is an entity separate and distinct from the Bank. |

| • | The Bank is the Company’s principal asset, and all of the Bank’s outstanding stock has been pledged to secure a line of credit. |

12

Table of Contents

| • | The Company depends on dividends from the Bank, and a bank’s ability to pay dividends is subject to restriction. |

| • | The banking industry is highly competitive and technology in the industry is continually evolving. |

Risks Related to this Offering and an Investment in Our Common Stock

| • | No prior public market exists for our common stock, and an active, liquid market for our common stock may not develop or be sustained following this offering. |

| • | The market price of our common stock may be subject to substantial fluctuations. |

| • | Institutional holders own a significant amount of our common stock. |

| • | Future sales or the availability for sale of substantial amounts of our common stock in the public market could adversely affect the prevailing market price of our common stock and could impair our ability to raise capital through future sales of equity securities. |

| • | Investors in this offering will experience immediate and substantial dilution. |

| • | We have broad discretion in the use of the net proceeds from this offering, and our use of those proceeds may not yield a favorable return on your investment. |

| • | The rights of our common stockholders are subordinate to the rights of the holders of any debt and may be subordinate to any series of preferred stock that we may issue in the future. |

| • | Our corporate governance documents, and certain corporate and banking laws applicable to us, could make a takeover more difficult, which could adversely affect our common stock. |

| • | There are also substantial regulatory limitations on changes of control of bank holding companies that may discourage investors from purchasing shares of our common stock. |

| • | We are an “emerging growth company” and subject to reduced SEC reporting requirements. |

| • | Any deficiencies in our financial reporting or internal controls could materially and adversely affect our business and the market price of our common stock. |

| • | Securities analysts may not initiate or continue coverage on us. |

| • | An investment in our common stock is not an insured deposit and is subject to risk of loss. |

General Risk Factors

We are also subject to a number of general risks as described in “Risk Factors—General Risk Factors,” which could adversely affect our business.

13

Table of Contents

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our common stock. You should carefully read this entire prospectus before investing in our common stock including “Risk Factors” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| Common stock offered by us |

996,429 shares (or 1,296,429 shares if the underwriters exercise in full their option to purchase additional shares of our common stock). |

| Common stock offered by selling stockholders |

1,003,571 shares. |

| Common stock outstanding immediately after completion of this offering |

8,712,857 shares of common stock (or 9,012,857 shares if the underwriters exercise in full their option to purchase additional shares of our common stock). |

| Use of proceeds |

Assuming an initial public offering price of $20.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus, we estimate that the net proceeds to us from the sale of our common stock in this offering will be $16.7 million (or $22.3 million if the underwriters exercise in full their option to purchase additional shares of our common stock), after deducting the estimated underwriting discounts and commissions and offering expenses. We intend to use the net proceeds for general corporate purposes, which may include capital and liquidity to support our growth, and potential acquisitions of other banks or closely related businesses. |

| We will not receive any proceeds from the sale of shares by selling stockholders. |

| See “Use of Proceeds” for more information. |

| Dividends |

Our stockholders are entitled to receive dividends on common stock only if, when and as declared by our board of directors from funds legally available therefor under Alabama corporate law and as limited by our banking regulators. We have paid a regular annual cash dividend on our common stock since 2012. We declared and paid dividends of $0.08 per share following the quarters ended March 31, 2020, June 30, 2020 and September 31, 2020 and a dividend of $0.09 per share following the quarters ended December 31, 2020 and March 31, 2021. On July 21, 2021, we declared a dividend of $0.09 per share, payable on August 11, 2021 to holders of record as of July 29, 2021. Purchasers of common stock in this offering will not receive the dividend. However, any future determination relating to dividends will be made at the discretion of our board of directors and will depend on our financial condition, liquidity, results of operations and other factors deemed relevant by our board of directors. See “Dividend Policy” and “Risk Factors.” |

14

Table of Contents

| Directed share program |

At our request, the underwriters have reserved for sale at the initial public offering price approximately 5.2% of the shares offered hereby for Company and Bank executive officers and directors. The number of shares available for sale to the general public will be reduced to the extent such persons purchase reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered hereby. Directors and executive officers have expressed an intent to buy approximately $2.1 million of shares in the offering through the directed share program. See “Underwriting—Directed Share Program.” |

| Listing |

We have applied to list our common stock with NASDAQ under the trading symbol “SSBK.” |

| Risk factors |

Investing in our common stock involves risks. See “Risk Factors,” beginning on page 25, for a discussion of factors that you should carefully consider before making an investment decision. |

Except as otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after the completion of this offering is based on 7,716,428 shares outstanding as of July 30, 2021, and:

| • | includes 43,389 shares of unvested restricted stock and excludes 501,492 shares of stock subject to unexercised stock options; |

| • | assumes no exercise by the underwriters of their option to purchase additional shares of our common stock; and |

| • | assumes that all shares reserved under the Directed Share Program are purchased in such program or otherwise sold in the offering. This does not include any shares purchased by our directors, executive officers and principal stockholders in the offering, including through the Directed Share Program. |

Following this offering, holders of non-voting common stock are expected to convert non-voting common stock into voting common stock and hold an aggregate of 9.9% of the outstanding shares of Southern States voting common stock. See “Principal and Selling Stockholders.”

15

Table of Contents

Selected Historical Consolidated Financial Data and Other Information

The following tables set forth selected historical consolidated financial information for each of the periods indicated. The selected historical financial information as of and for the years ended December 31, 2020 and 2019, except for the selected ratios, is derived from our audited financial statements included elsewhere in this prospectus. The selected historical financial information as of and for the years ended December 31, 2018, 2017 and 2016, except for the selected ratios, is derived from our audited financial statements not included in this prospectus. The selected historical financial information as of March 31, 2021, and for the three months ended March 31, 2021 and 2020, except for the selected ratios, is derived from our unaudited financial statements included elsewhere in this prospectus. The selected financial data as of March 31, 2020, except for the selected ratios, is derived from our unaudited financial statements not included in this prospectus.

You should read the information set forth below in conjunction with the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Capitalization,” as well as our consolidated financial statements and the related notes included elsewhere in this prospectus.

| As of and for the Three Months Ended March 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

||||||||||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||||||

| Interest Income |

$ | 13,677 | $ | 12,509 | $ | 50,285 | $ | 46,955 | $ | 37,193 | $ | 29,567 | $ |

26,327 |

| |||||||||||||

| Interest Expense |

1,393 | 2,727 | 8,708 | 12,106 | 7,528 | 3,858 | |

3,190 |

| |||||||||||||||||||

| Net Interest Income |

12,284 | 9,782 | 41,577 | 34,849 | 29,665 | 25,709 | |

23,136 |

| |||||||||||||||||||

| Provision for Loan Losses |

750 | 800 | 3,300 | 5,700 | 2,196 | 1,315 | |

1,016 |

| |||||||||||||||||||

| Noninterest Income |

4,496 | 2,402 | 8,541 | 6,710 | 3,464 | 3,072 | |

4,176 |

| |||||||||||||||||||

| Merger Related Expenses |

— | — | — | 3,373 | — | — | |

— |

| |||||||||||||||||||

| Other Noninterest Expense |

8,532 | 7,886 | 32,185 | 24,398 | 20,924 | 18,081 | |

17,234 |

| |||||||||||||||||||

| Income before Income Taxes |

7,498 | 3,498 | 14,633 | 8,088 | 10,009 | 9,385 | |

9,062 |

| |||||||||||||||||||

| Income Tax Expense |

1,817 | 823 | 2,526 | 2,486 | 2,296 | 3,785 | |

3,200 |

| |||||||||||||||||||

| Net Income |

5,681 | 2,675 | 12,107 | 5,602 | 7,713 | 5,600 | |

5,862 |

| |||||||||||||||||||

| Balance Sheet Data (Period End): |

||||||||||||||||||||||||||||

| Cash and Cash Equivalents |

$ | 170,728 | $ | 109,517 | $ | 84,907 | $ | 115,235 | $ | 86,428 | $ | 68,528 | $ |

41,571 |

| |||||||||||||

| Securities |

106,217 | 76,021 | 114,001 | 59,947 | 52,133 | 53,483 | |

42,153 |

| |||||||||||||||||||

| Loans held for sale |

2,268 | 11,940 | 5,696 | 2,578 | 233 | 851 | |

1,573 |

| |||||||||||||||||||

| Loans, net of unearned income(1) |

1,083,274 | 887,731 | 1,030,115 | 837,441 | 703,746 | 566,333 | |

501,283 |

| |||||||||||||||||||

| Allowance for Loan Losses |

12,605 | 10,199 | 11,859 | 9,265 | 7,833 | 5,754 | |

4,949 |

| |||||||||||||||||||

| Loans, net |

1,070,669 | 877,532 | 1,018,256 | 828,176 | 695,913 | 560,579 | |

496,334 |

| |||||||||||||||||||

| Goodwill |

16,862 | 16,862 | 16,862 | 16,862 | 6,041 | 6,041 | |

6,041 |

| |||||||||||||||||||

| Other Intangibles |

1,698 | 1,961 | 1,764 | 2,027 | 334 | 462 | |

590 |

| |||||||||||||||||||

16

Table of Contents

| As of and for the Three Months Ended March 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

||||||||||||||||||||||||||||

| Total Assets |

1,459,236 | 1,170,381 | 1,332,506 | 1,095,491 | 887,607 | 735,531 | |

628,578 |

| |||||||||||||||||||

| Deposits |

1,260,044 | 1,004,252 | 1,139,661 | 950,513 | 775,785 | 621,600 | |

520,058 |

| |||||||||||||||||||

| FHLB Advances |

31,900 | 20,850 | 30,900 | — | 7,500 | 16,510 | |

19,279 |

| |||||||||||||||||||

| Other Borrowings |

12,480 | 12,473 | 12,468 | 12,462 | 4,462 | 4,446 | |

4,430 |

| |||||||||||||||||||

| Other Liabilities |

10,212 | 5,408 | 8,821 | 5,879 | 4,385 | 3,164 | |

2,778 |

| |||||||||||||||||||

| Total Liabilities |

1,314,636 | 1,042,983 | 1,191,850 | 968,854 | 792,131 | 645,719 | 546,546 | |||||||||||||||||||||

| Total Stockholders’ Equity |

144,600 | 127,398 | 140,656 | 126,637 | 95,475 | 89,812 | |

82,033 |

| |||||||||||||||||||

| Per Share Data: |

||||||||||||||||||||||||||||

| Shares of common stock issued and outstanding |

7,716,428 | 7,675,024 | 7,678,195 | 7,650,772 | 6,483,183 | 6,475,950 | |

5,418,724 |

| |||||||||||||||||||

| Basic Weighted average shares outstanding |

7,681,578 | 7,654,192 | 7,673,085 | 6,840,411 | 6,473,652 | 6,208,498 | |

3,284,848 |

| |||||||||||||||||||

| Diluted weighted average shares outstanding |

7,794,859 | 7,791,229 | 7,765,863 | 6,901,621 | 6,515,173 | 6,246,065 | |

3,308,890 |

| |||||||||||||||||||

| Basic earnings per share |

0.74 | 0.35 | 1.58 | 0.82 | 1.19 | 0.90 | |

1.70 |

| |||||||||||||||||||

| Diluted earnings per share |

0.73 | 0.34 | 1.56 | 0.81 | 1.18 | 0.89 | |

1.69 |

| |||||||||||||||||||

| Book Value Per Share |

18.74 | 16.60 | 18.32 | 16.55 | 14.73 | 13.87 | |

15.14 |

| |||||||||||||||||||

| Dividends Per Share(2) |

0.09 | — | 0.24 | 0.31 | 0.29 | 0.27 | |

0.25 |

| |||||||||||||||||||

| Performance Ratios: |

||||||||||||||||||||||||||||

| Return on Average Assets(3) |

1.68 | % | 0.96 | % | 0.98 | % | 0.57 | % | 0.98 | % | 0.85 | % | |

1.06 |

% | |||||||||||||

| Return on Average Stockholders’ Equity(4) |

16.11 | % | 8.46 | % | 9.49 | % | 5.22 | % | 8.29 | % | 6.31 | % | |

12.69 |

% | |||||||||||||

| Net Interest Margin |

3.97 | % | 3.85 | % | 3.64 | % | 3.81 | % | 4.06 | % | 4.24 | % | |

4.53 |

% | |||||||||||||

| Efficiency Ratio(5) |

50.15 | % | 68.90 | % | 65.18 | % | 66.85 | % | 63.12 | % | 62.84 | % | |

63.80 |

% | |||||||||||||

| Noninterest Income / Average Assets(3) |

1.33 | % | 0.86 | % | 0.69 | % | 0.68 | % | 0.44 | % | 0.47 | % | |

0.76 |

% | |||||||||||||

| Noninterest Expense / Average Assets(3) |

2.53 | % | 2.84 | % | 2.59 | % | 2.82 | % | 2.66 | % | 2.75 | % | |

3.12 |

% | |||||||||||||

| Yield on Loans |

4.87 | % | 5.43 | % | 4.93 | % | 5.68 | % | 5.43 | % | 5.25 | % | |

5.53 |

% | |||||||||||||

| Cost of Deposits |

0.39 | % | 1.04 | % | 0.74 | % | 1.34 | % | 1.03 | % | 0.60 | % | |

0.52 |

% | |||||||||||||

| Loans to Deposits |

85.97 | % | 88.40 | % | 90.39 | % | 88.12 | % | 90.04 | % | 90.17 | % | |

95.49 |

% | |||||||||||||

| Credit Quality Ratios: |

||||||||||||||||||||||||||||

| Nonperforming Assets to Total Assets(6) |

0.97 | % | 1.63 | % | 1.03 | % | 1.90 | % | 0.50 | % | 0.17 | % | |

0.34 |

% | |||||||||||||

17

Table of Contents

| As of and for the Three Months Ended March 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

||||||||||||||||||||||||||||

| Nonperforming Assets to Total Loans and OREO(6) |

1.29 | % | 2.14 | % | 1.32 | % | 2.47 | % | 0.63 | % | 0.22 | % | |

0.42 |

% | |||||||||||||

| Nonperforming Loans to Total Loans |

0.36 | % | 1.55 | % | 0.34 | % | 1.65 | % | 0.55 | % | 0.13 | % | |

0.40 |

% | |||||||||||||

| Allowance for Loan Losses to Total Loans |

1.16 | % | 1.15 | % | 1.15 | % | 1.11 | % | 1.11 | % | 1.02 | % | |

0.99 |

% | |||||||||||||

| Allowance for Loan Losses to Nonperforming Loans |

326.81 | % | 74.03 | % | 338.00 | % | 67.13 | % | 202.20 | % | 761.78 | % | |

244.70 |

% | |||||||||||||

| Net Loan Charge-offs to Average Loans(7) |

0.00 | % | -0.02 | % | 0.10 | % | 0.57 | % | 0.02 | % | 0.10 | % | |

-0.04 |

% | |||||||||||||

| Capital Ratios: |

||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital Ratio(8) |

10.19 | % | 10.67 | % | 10.63 | % | 11.24 | % | 11.50 | % | 13.59 | % | |

13.44 |

% | |||||||||||||

| Tier 1 Leverage Ratio |

9.21 | % | 10.06 | % | 9.24 | % | 9.78 | % | 10.58 | % | 12.19 | % | |

12.80 |

% | |||||||||||||

| Tier 1 Risk-based Ratio |

10.19 | % | 10.67 | % | 10.63 | % | 11.24 | % | 11.50 | % | 13.59 | % | |

13.44 |

% | |||||||||||||

| Total Risk-based Capital Ratio |

11.60 | % | 12.09 | % | 12.09 | % | 12.68 | % | 13.07 | % | 15.25 | % | |

15.09 |

% | |||||||||||||

| Composition of Loan Portfolio: |

||||||||||||||||||||||||||||

| Owner-occupied Commercial Real Estate |

$ | 344,731 | $ | 292,073 | $ | 324,047 | $ | 255,305 | $ | 221,099 | $ | 144,784 | $ |

125,853 |

| |||||||||||||

| Nonowner- occupied Commercial Real Estate |

214,818 | 153,919 | 173,413 | 161,830 | 130,194 | 131,782 | |

111,020 |

| |||||||||||||||||||

| Commercial and Industrial |

169,311 | 155,014 | 187,839 | 139,765 | 132,061 | 74,896 | |

41,252 |

| |||||||||||||||||||

| Construction and Development |

121,199 | 114,774 | 102,559 | 93,011 | 77,197 | 82,217 | |

94,745 |

| |||||||||||||||||||

| 1-4 Family |

109,299 | 111,644 | 107,690 | 119,010 | 96,939 | 94,164 | |

90,951 |

| |||||||||||||||||||

| Multi-Family |

42,584 | 28,362 | 44,522 | 33,302 | 28,087 | 24,264 | |

22,345 |

| |||||||||||||||||||

| Consumer and other loans |

9,200 | 11,066 | 9,644 | 11,955 | 7,479 | 7,131 | |

6,293 |

| |||||||||||||||||||

| PPP loans |

60,846 | — | 66,556 | — | — | — | — | |||||||||||||||||||||

| Agriculture |

15,473 | 22,656 | 17,463 | 24,811 | 12,243 | 8,347 | |

9,817 |

| |||||||||||||||||||

18

Table of Contents

| As of and for the Three Months Ended March 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

||||||||||||||||||||||||||||

| Composition of Deposits: |

||||||||||||||||||||||||||||

| NOW Accounts |

$ | 95,187 | $ | 81,009 | $ | 102,428 | $ | 89,126 | $ | 41,881 | $ | 37,749 | $ |

28,227 |

| |||||||||||||

| Noninterest- bearing Demand |

365,114 | 197,869 | 290,867 | 188,270 | 117,413 | 111,064 | |

98,704 |

| |||||||||||||||||||

| Savings |

46,495 | 32,654 | 42,731 | 31,362 | 8,581 | 11,023 | |

7,452 |

| |||||||||||||||||||

| Money Market Accounts |

424,804 | 335,385 | 373,329 | 283,625 | 269,986 | 221,773 | |

163,970 |

| |||||||||||||||||||

| Certificates of Deposit—$250,000 and Less(9) |

296,042 | 313,594 | 293,707 | 311,888 | 298,652 | 209,002 | |

191,718 |

| |||||||||||||||||||

| Certificates of Deposit—More than $250,000 |

32,402 | 43,741 | 36,599 | 46,242 | 39,272 | 30,989 | |

29,987 |

| |||||||||||||||||||

| Non-GAAP Financial Measures:(10) |

||||||||||||||||||||||||||||

| Core Net Income |

3,750 | 2,411 | 11,722 | 7,272 | 7,757 | 5,572 | 5,615 | |||||||||||||||||||||

| Core Return on Average Assets |

1.11 | % | 0.87 | % | 0.94 | % | 0.74 | % | 0.99 | % | 0.85 | % | 1.02 | % | ||||||||||||||

| Pretax Pre-provision Core |

5,673 | 3,946 | 17,420 | 15,091 | 12,264 | 10,662 | 9,715 | |||||||||||||||||||||

| Pretax Pre-provision Core Return on Average Assets |

1.68 | % | 1.42 | % | 1.40 | % | 1.53 | % | 1.56 | % | 1.62 | % | 1.76 | % | ||||||||||||||

| Tangible Common Equity |

126,040 | 108,575 | 122,030 | 107,748 | 89,100 | 83,309 | 75,402 | |||||||||||||||||||||

| Diluted Core Earnings Per Share |

0.48 | 0.31 | 1.51 | 1.05 | 1.19 | 0.89 | 1.70 | |||||||||||||||||||||

| Tangible Book Value Per Share |

16.34 | 14.15 | 15.89 | 14.08 | 13.74 | 12.86 | 13.92 | |||||||||||||||||||||

| Tangible Common Equity to Tangible Assets |

8.75 | % | 9.43 | % | 9.29 | % | 10.01 | % | 10.11 | % | 11.43 | % | 12.12 | % | ||||||||||||||

| Return on Average Tangible Common Equity |

18.51 | % | 9.76 | % | 10.50 | % | 5.78 | % | 8.90 | % | 6.82 | % | 14.83 | % | ||||||||||||||

| Core Return on Average Tangible Common Equity |