Attached files

| file | filename |

|---|---|

| 8-K - 8-K - APi Group Corp | d146150d8k.htm |

| EX-99.1 - EX-99.1 - APi Group Corp | d146150dex991.htm |

| EX-10.2 - EX-10.2 - APi Group Corp | d146150dex102.htm |

| EX-10.1 - EX-10.1 - APi Group Corp | d146150dex101.htm |

| EX-2.1 - EX-2.1 - APi Group Corp | d146150dex21.htm |

Exhibit 99.2

APi TO ACQUIRE CHUBB FIRE SECURITY BUSINESS J u l y 2 7 , 2 0 2 1

Forward-Looking Statements and Disclaimers This presentation does not constitute or form part of any offer or invitation to purchase, otherwise acquire, issue, subscribe for, sell or otherwise dispose of any securities, nor any solicitation of any offer to purchase, otherwise acquire, issue, subscribe for, sell, or otherwise dispose of any securities. The release, publication or distribution of this presentation in certain jurisdictions may be restricted by law and therefore persons in such jurisdictions into which this presentation is released, published or distributed should inform themselves about and observe such restrictions. Certain statements in this presentation are forward-looking statements which are based on the APi Group Corporation’s (the “Company”) expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts. These forward-looking statements include, but are not limited to, statements regarding (i) estimates and forecasts of financial and performance metrics; (ii) expectations regarding market opportunity and market share; (iii) potential benefits of the transaction, including the global expansion of the Company’s business, cross-selling and cost synergy opportunities, a positive effect on the Company’s service mix and organic growth and margin expansion opportunities; and (iv) expectations related to the terms and timing of the proposed transaction. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including: (i) economic conditions, competition and other risks that may affect the Company’s future performance, including the impacts of the COVID-19 pandemic on the Company’s business, markets, supply chain, customers and workforce, on the credit and financial markets, on the alignment of expenses and revenues and on the global economy generally; (ii) the inability of the parties to successfully or timely consummate the transaction; ; (iii) failure to realize the anticipated benefits of the transaction; (iv) changes in applicable laws or regulations; (v) the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; and (v) other risks and uncertainties, including those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 under the heading “Risk Factors.” Given these risks and uncertainties, prospective investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures Some of the financial information and data contained in this presentation, such as EBITDA, Adjusted EBITDA and Adjusted EPS have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The Company’s management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance and prospects for future performance and permit investors to compare the Company with its peers, many of which present similar non-GAAP financial measures to investors. While the Company believes these non-GAAP measures are useful in evaluating the Company’s performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

Today’s Speakers Russ Sir Martin E. James E. Becker Franklin Lillie

Executive Summary 1 APi Group to acquire Chubb Fire & Security from Carrier Global Corporation • Creates world’s leading life safety services provider • Expands APi’s protective moat through greater statutorily required service offerings • High free cash flow conversion business with meaningful organic growth & margin expansion opportunities 2 Transforms APi into a global business services company with substantial recurring-revenue • Strengthens APi’s strategic platform and expands the company’s geographic reach • Combined entity will have market leading positions in major geographies with strong organic growth • Expansion into new markets with complementary service offerings, presenting cross selling and synergy opportunities 3 Enterprise value of $3.1 billion, which includes ~$2.9 billion cash & $200 million of assumed liabilities and other adjustments • Expected to be accretive to adjusted EPS pre-synergies • Transaction financed through mix of cash on hand, new debt and equity financing • Fully committed financing with supporting preferred equity investment by Blackstone Group and Viking Global Investors

Transaction Overview & Strategic Rationale

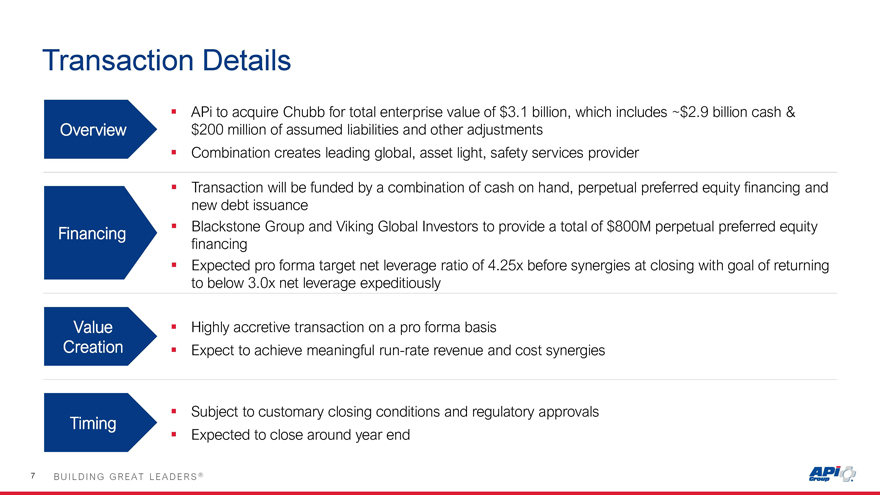

Transaction Details APi to acquire Chubb for total enterprise value of $3.1 billion, which includes ~$2.9 billion cash & Overview $200 million of assumed liabilities and other adjustments Combination creates leading global, asset light, safety services provider Transaction will be funded by a combination of cash on hand, perpetual preferred equity financing and new debt issuance Financing Blackstone Group and Viking Global Investors to provide a total of $800M perpetual preferred equity financing Expected pro forma target net leverage ratio of 4.25x before synergies at closing with goal of returning to below 3.0x net leverage expeditiously Value Highly accretive transaction on a pro forma basis Creation Expect to achieve meaningful run-rate revenue and cost synergies Subject to customary closing conditions and regulatory approvals Timing Expected to close around year end

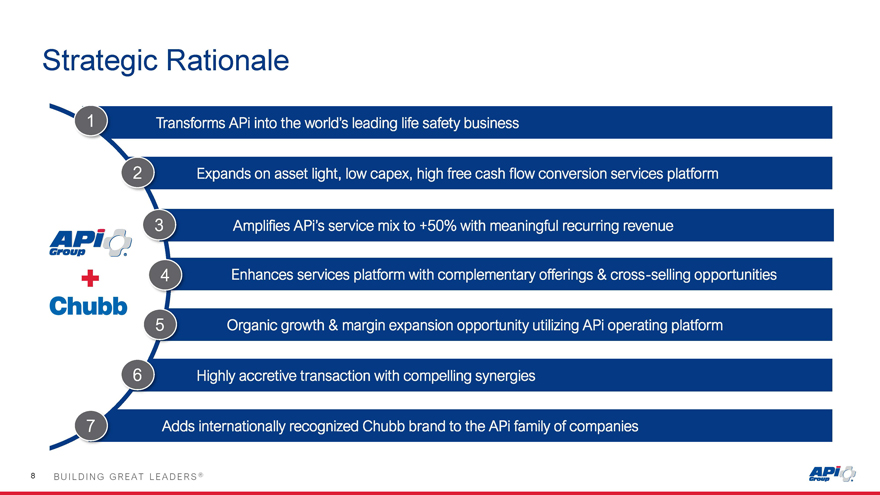

Strategic Rationale 1 Transforms APi into the world’s leading life safety business 2 Expands on asset light, low capex, high free cash flow conversion services platform 3 Amplifies APi’s service mix to +50% with meaningful recurring revenue 4 Enhances services platform with complementary offerings & cross-selling opportunities 5 Organic growth & margin expansion opportunity utilizing APi operating platform 6 Highly accretive transaction with compelling synergies 7 Adds internationally recognized Chubb brand to the APi family of companies

Chubb Meets Our Stated Investment Criteria KEY INVESTMENT CRITERIA ✓ ✓ ✓ ✓ ✓ Rec Market Leaders History of Strong Experienced Profile with Divers Value Accretive Niche Markets Cash Flow Gener Management Te End Market Expo 1 Combination forms wo Low capital intensity Incentivized and align Recurring revenue ba Compelling valuation at leading life safety servi business, with strong leadership team with with long-term visibilit ~13.3x LTM Adjusted provider cash flow conversion performance culture EBITDA including synergies Well diversified across consistent with APi Leading fire and secu Stable margin profile geographies, end mar Transaction is expected to market positions in ea organic expansion Re-energized team as and clients be immediately accretive to top 6 geographies opportunity business shifts from n APi Product-agnostic ser core to strategic prior Global trusted brand Over 60% of Chubb’s offerings and strong Meaningful revenue and strong, tenured custo revenue is recurring in Robust entrepreneurial relationships with key cost synergy opportunities relationships nature at branch level

Chubb Business Overview

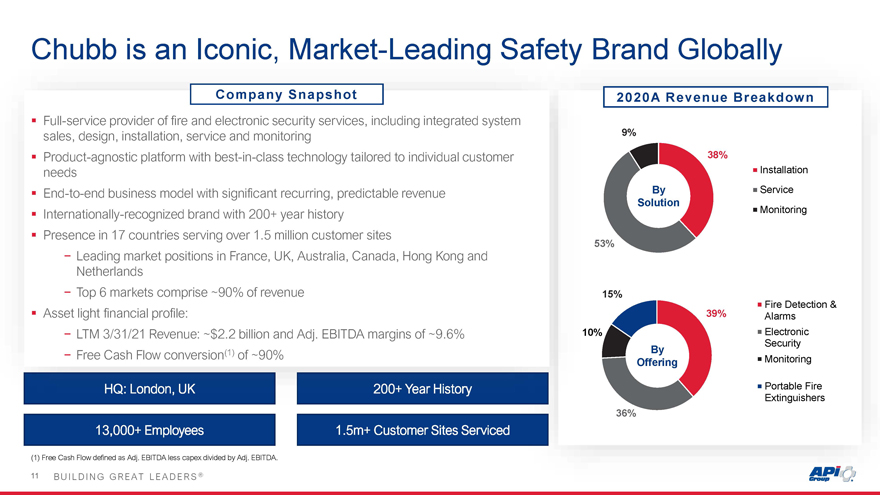

Chubb is an Iconic, Market-Leading Safety Brand Globally Company Snapshot 2020A Revenue Breakdown Full-service provider of fire and electronic security services, including integrated system sales, design, installation, service and monitoring 9% Product-agnostic platform with best-in-class technology tailored to individual customer 38% needs Installation End-to-end business model with significant recurring, predictable revenue By Service Solution Internationally-recognized brand with 200+ year history Monitoring Presence in 17 countries serving over 1.5 million customer sites 53%—Leading market positions in France, UK, Australia, Canada, Hong Kong and Netherlands—Top 6 markets comprise ~90% of revenue 15% 39% Fire Detection & Asset light financial profile: Alarms—LTM 3/31/21 Revenue: ~$2.2 billion and Adj. EBITDA margins of ~9.6% 10% Electronic Security—Free Cash Flow conversion(1) of ~90% By Monitoring Offering Portable Fire Extinguishers 36% 13,000+ Employees 1.5m+ Customer Sites Serviced (1) Free Cash Flow defined as Adj. EBITDA less capex divided by Adj. EBITDA.

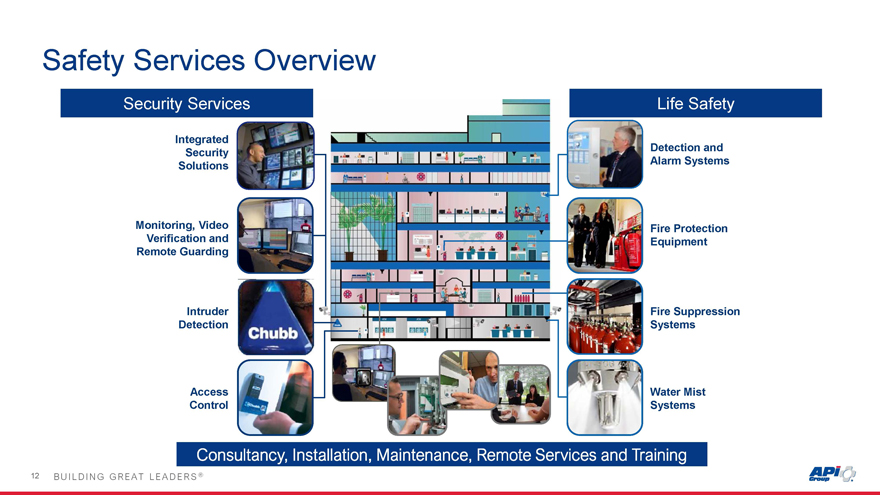

Safety Services Overview Security Services Life Safety Integrated Detection and Security Alarm Systems Solutions Monitoring, Video Fire Protection Verification and Equipment Remote Guarding Intruder Fire Suppression Detection Systems Access Water Mist Control Systems Consultancy, Installation, Maintenance, Remote Services and Training

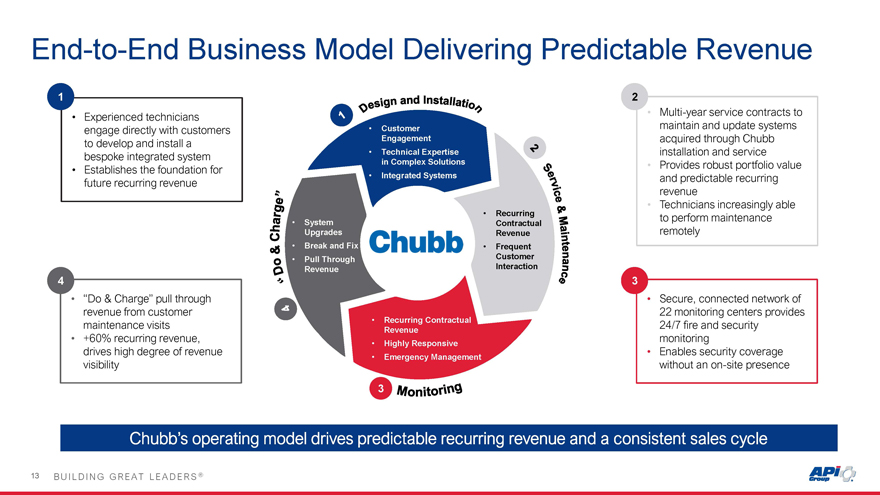

End-to-End Business Model Delivering Predictable Revenue 1 2 technicians • Multi-year service contracts to • Experienced engage directly with customers • Customer maintain and update systems to develop and install a Engagement acquired through Chubb bespoke integrated system • Technical Expertise installation and service in Complex Solutions • Provides robust portfolio value • Establishes the foundation for • Integrated Systems and predictable recurring future recurring revenue revenue • Technicians increasingly able • Recurring to perform maintenance • System Contractual Upgrades Revenue remotely • Break and Fix • Frequent • Pull Through Customer Revenue Interaction 4 3 • “Do & Charge” pull through • Secure, connected network of revenue from customer • Recurring Contractual 22 monitoring centers provides maintenance visits 24/7 fire and security Revenue • +60% recurring revenue, monitoring • Highly Responsive drives high degree of revenue • Enables security coverage • Emergency Management visibility without an on-site presence 3 Chubb’s operating model drives predictable recurring revenue and a consistent sales cycle

APi + Chubb Stronger Together

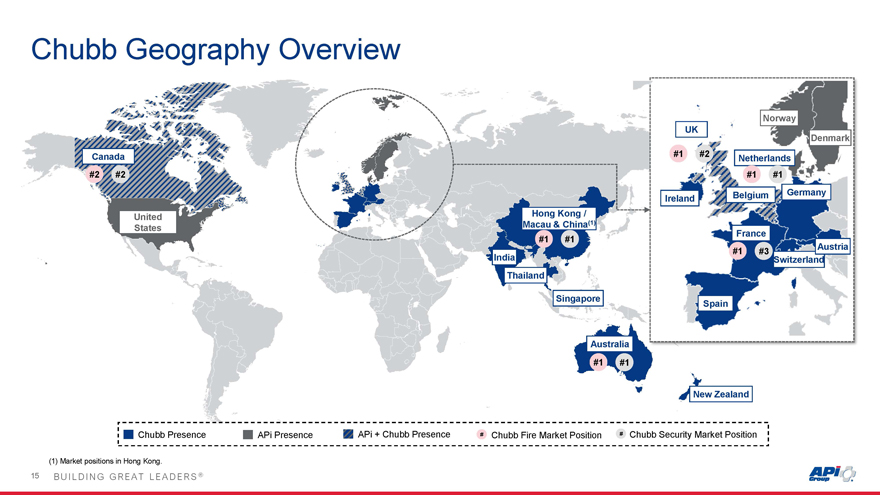

Chubb Geography Overview Norway UK Denmark Canada #1 #2 Netherlands #2 #2 #1 #1 Belgium Germany Ireland United Hong Kong / Macau & China(1) States France #1 #1 Austria #1 #3 India Switzerland Thailand Singapore Spain Australia #1 #1 New Zealand Chubb Presence APi Presence APi + Chubb Presence # Chubb Fire Market Position # Chubb Security Market Position (1) Market positions in Hong Kong.

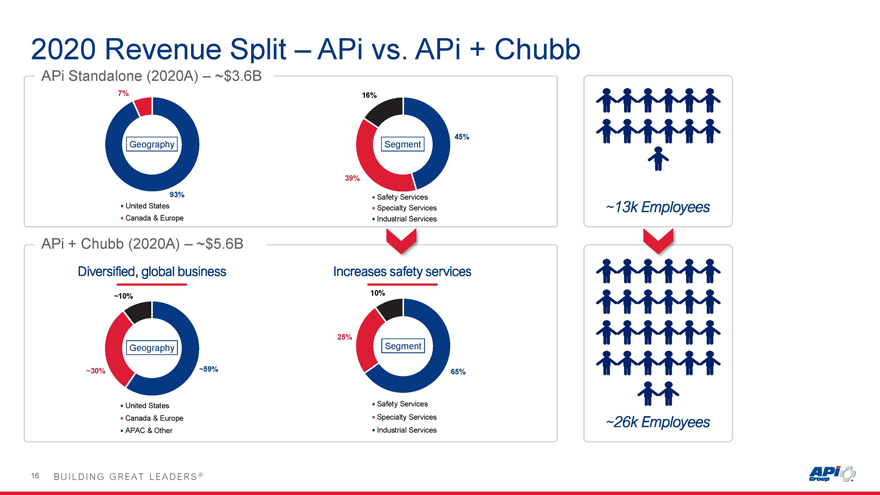

2020 Revenue Split – APi vs. APi + Chubb APi Standalone (2020A) – ~$3.6B 7% 16% Geography Segment 45% 39% 93% Safety Services United States Specialty Services ~13k Employees Canada & Europe Industrial Services APi + Chubb (2020A) – ~$5.6B Diversified, global business Increases safety services ~10% 10% 25% Geography Segment ~30% ~59% 65% United States Safety Services Canada & Europe Specialty Services ~26k Employees APAC & Other Industrial Services

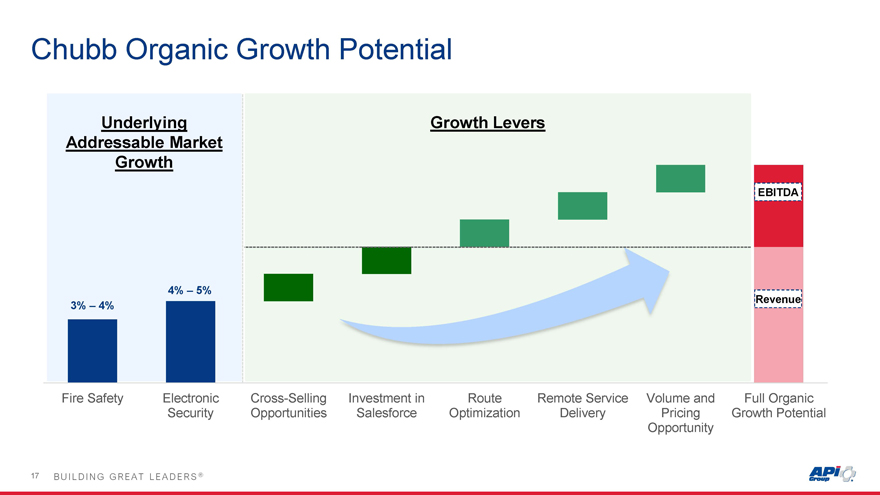

Chubb Organic Growth Potential Underlying Growth Levers Addressable Market Growth EBITDA 4% – 5% Revenue 3% – 4% Fire Safety Electronic Cross-Selling Investment in Route Remote Service Volume and Full Organic Security Opportunities Salesforce Optimization Delivery Pricing Growth Potential Opportunity

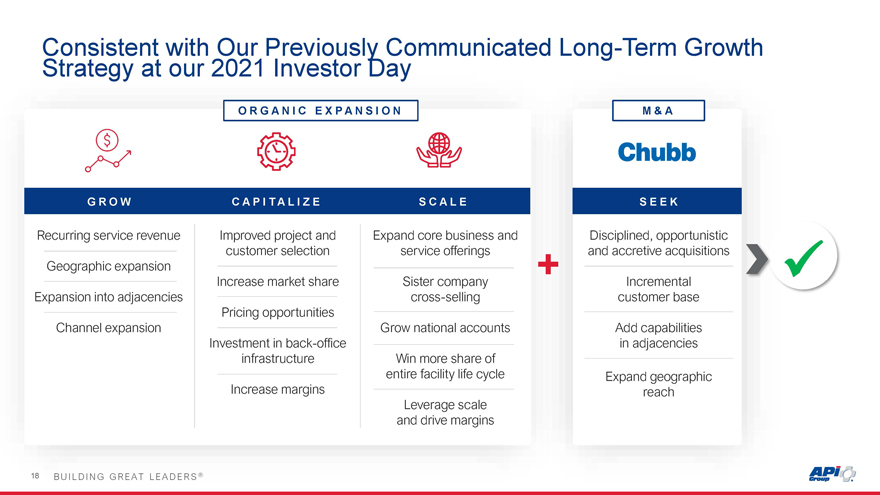

Consistent with Our Previously Communicated Long-Term Growth Strategy at our 2021 Investor Day O R G A N I C E X P A N S I O N M & A G R O W C A P I T A L I Z E S C A L E SEEK Recurring service revenue Improved project and Expand core business and Disciplined, opportunistic customer selection service offerings and accretive acquisitions Geographic expansion + ✓ Increase market share Sister company Incremental Expansion into adjacencies cross-selling customer base Pricing opportunities Channel expansion Grow national accounts Add capabilities Investment in back-office in adjacencies infrastructure Win more share of entire facility life cycle Expand geographic Increase margins reach Leverage scale and drive margins

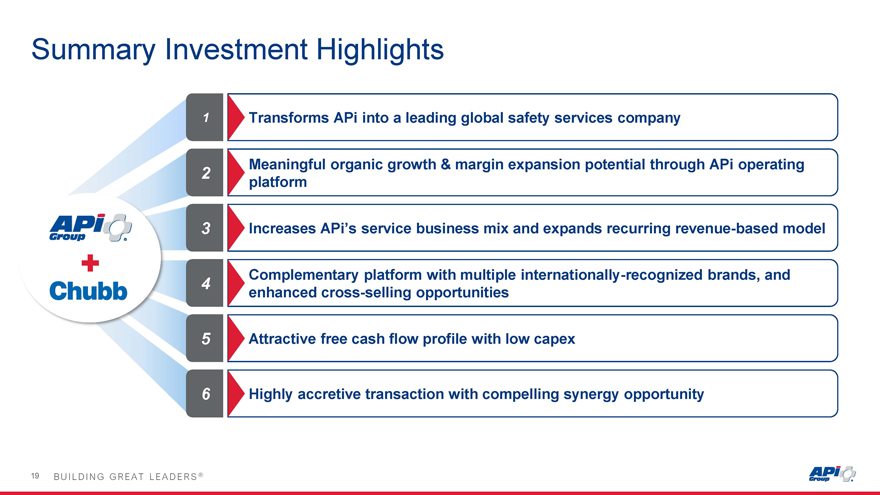

Summary Investment Highlights 1 Transforms APi into a leading global safety services company Meaningful organic growth & margin expansion potential through APi operating 2 platform 3 Increases APi’s service business mix and expands recurring revenue-based model Complementary platform with multiple internationally-recognized brands, and 4 enhanced cross-selling opportunities 5 Attractive free cash flow profile with low capex 6 Highly accretive transaction with compelling synergy opportunity

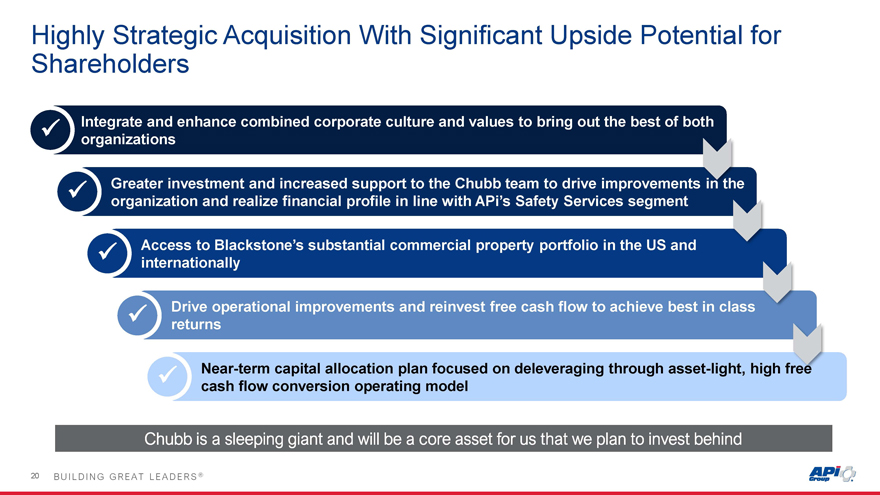

Highly Strategic Acquisition With Significant Upside Potential for Shareholders ✓ Integrate and enhance combined corporate culture and values to bring out the best of both organizations ✓ Greater investment and increased support to the Chubb team to drive improvements e organization and realize financial profile in line with APi’s Safety Services segment ✓ Access to Blackstone’s substantial commercial property portfolio in the US and internationally ✓ Drive operational improvements and reinvest free cash flow to achieve best in class returns ✓ Near-term capital allocation plan focused on deleveraging through asset-light, high cash flow conversion operating model Chubb is a sleeping giant and will be a core asset for us that we plan to invest behind

APi Group