Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kraton Corp | kra-20210729.htm |

SECOND QUARTER RESULTS SECOND QUARTER / RESULTS FOCUSED ACTIONS DELIVER STRONG PERFORMANCE Kraton Corporation July 29, 2021 #Sustainable Solutions. Endless Innovations.™

SECOND QUARTER RESULTS Forward Looking Statements Some of the written and oral statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often characterized by the use of words such as “outlook,” “reflect,” “remain,” “believes,” “target,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans,” “on track”, “forsees”, “future,” or “anticipates,” or by discussions of strategy, plans, or intentions. The statements in this presentation that are not historical statements, including, but not limited to, statements regarding our expectations as to the continued impact of the COVID-19 pandemic (including governmental and regulatory actions) on demand for our products, on the national and global economy and on our customers, suppliers, employees, business and results of operations, our expectations for our business demand, margin improvement, and growth in 2021, market factors and transportation and logistics trends, our 2021 Adjusted EBITDA, the timing of the incurrence of costs associated with our Berre, France, turnaround, the impact of our diversified portfolio and broad geographic exposure, the impact of and expected realization of announced and future price increases, continued momentum for our REvolution and CirKular+ platforms, expectations about the possibility of bringing BiaXam to market (including receipt of regulatory approvals or the timing thereof), cash generation and expectations for our future consolidated net debt leverage ratio, and the information and the matters described under the caption “Business Outlook by Geography and End Use Application,” are forward looking statements. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from those expressed as forward-looking statements include, but are not limited to the factors set forth in this presentation, in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID-19 pandemic. There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements. In addition, to the extent any inconsistency or conflict exists between the information included in this presentation and the information included in our prior presentations and other filings with the SEC, the information contained in this presentation updates and supersedes such information. Forward-looking statements are based on current plans, estimates, assumptions and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events. With respect to BiaXam, there is no assurance that any planned corporate activity, scientific research or study, regulatory approval, developing, marketing, licensing or selling of products, patent application, allowance or consumer study, to the extent pursued, will be successful or will succeed as currently planned or expected. There is no assurance that any of BiaXam's postulated uses, benefits, or advantages will in fact be realized in any manner or in any part. Disclaimers & Cautionary Note 2 2

SECOND QUARTER RESULTS GAAP Disclaimer This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are defined below. Tables included in this earnings release reconcile each of these non-GAAP financial measures with the most directly comparable U.S. GAAP financial measure. For additional information on the impact of the spread between first-in-first-out (“FIFO”) and Estimated Current Replacement Cost (“ECRC”), see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020. We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by investors, securities analysts, and other interested parties in the evaluation of our performance including period-to-period comparisons and/or that of other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan based incentive compensation payments on our Adjusted EBITDA performance and attainment of net debt reduction, along with other factors. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under U.S. GAAP in the United States. EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding Cariflex, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes, depreciation, and amortization. For each reporting segment, EBITDA represents operating income (loss) before depreciation and amortization, and earnings of unconsolidated joint ventures. Among other limitations EBITDA does not: reflect the significant interest expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements, which can vary from the terms used herein. The calculation of EBITDA in our debt agreements includes adjustments, such as extraordinary, non-recurring or one-time charges, proforma cost savings, certain non-cash items, turnaround costs, and other items included in the definition of EBITDA in the debt agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC, but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We prepare Adjusted EBITDA excluding Cariflex by eliminating from Adjusted EBITDA Cariflex sales, cost of sales, and direct specific fixed costs incurred from January 1, 2020 through March 6, 2020. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated basis, if applicable). Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Adjusted Gross Profit, Adjusted Gross Profit Per Ton, and Adjusted Gross Profit Per Ton, excluding the Berre turnaround: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume (for each reporting segment or on a consolidated basis, as applicable). We further calculate Adjusted Gross Profit Per Ton, excluding the Berre turnaround, by deducting out of gross profit costs associated with the Berre turnaround. We define Adjusted Gross Profit as gross profit excluding certain charges and expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Adjusted Diluted Earnings Per Share: We prepare Adjusted Diluted Earnings per Share by eliminating from Diluted Earnings per Share the impact of a number of non-recurring items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC. Consolidated Net Debt and Consolidated Net Debt, excluding the effect of foreign currency: We define Consolidated Net Debt as total consolidated debt (including debt of KFPC) less consolidated cash and cash equivalents. Management uses Consolidated Net Debt to determine our outstanding debt obligations that would not readily be satisfied by its cash and cash equivalents on hand. Management believes that using Consolidated Net Debt is useful to investors in determining our leverage since we could choose to use cash and cash equivalents to retire debt. We also present Consolidated Net Debt, as adjusted for foreign exchange impact accounts for the foreign exchange effect on our foreign currency denominated debt agreements. Consolidated Net Debt Leverage Ratio: The consolidated net debt leverage ratio is defined as consolidated net debt as of the balance sheet date divided by Adjusted EBITDA for the twelve months then ended. Our use of this term may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Disclaimers & Cautionary Note 3

SECOND QUARTER RESULTS 4 Second quarter 2021 results in line with expectations Second Quarter 2021 Highlights • Second quarter of 2021 results reflect continued positive market fundamentals and improved demand contributing to double digit volume growth • Polymer segment sales volume up 10.9% compared to Q2'20 • Chemicals segment sales volume up 32.3% compared to Q2'20 • Continued to actively address inflationary pressures through price increases, consistent with our Price Right strategy • Expect further price realization and margin improvement in second half of 2021 • Successfully completed the statutory turnaround at the Berre, France, site, which occurs approximately every six years • Q2'21 turnaround costs were $16.9 million ($19.7 million YTD) • Reduced consolidated debt by $14.1 million and consolidated net debt(1) by $11.5 million • Awarded Platinum status by EcoVadis, placing Kraton in top 1% of all companies evaluated • Continued focus on Section 3 approval from the EPA, which we anticipate could provide for broader commercialization opportunities for BiaXamTM 1. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

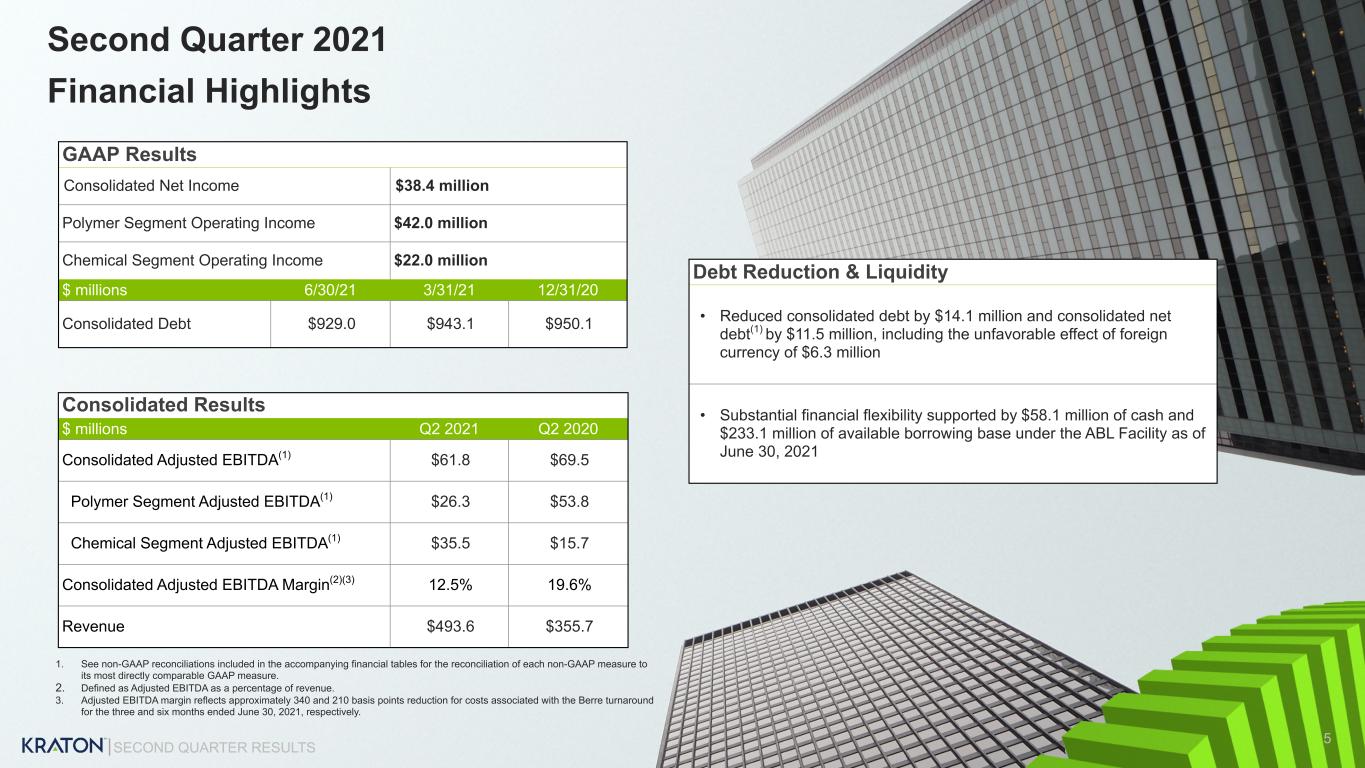

SECOND QUARTER RESULTS Consolidated Results $ millions Q2 2021 Q2 2020 Consolidated Adjusted EBITDA(1) $61.8 $69.5 Polymer Segment Adjusted EBITDA(1) $26.3 $53.8 Chemical Segment Adjusted EBITDA(1) $35.5 $15.7 Consolidated Adjusted EBITDA Margin(2)(3) 12.5% 19.6% Revenue $493.6 $355.7 Second Quarter 2021 Financial Highlights GAAP Results Consolidated Net Income $38.4 million Polymer Segment Operating Income $42.0 million Chemical Segment Operating Income $22.0 million $ millions 6/30/21 3/31/21 12/31/20 Consolidated Debt $929.0 $943.1 $950.1 Debt Reduction & Liquidity • Reduced consolidated debt by $14.1 million and consolidated net debt(1) by $11.5 million, including the unfavorable effect of foreign currency of $6.3 million • Substantial financial flexibility supported by $58.1 million of cash and $233.1 million of available borrowing base under the ABL Facility as of June 30, 2021 1. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2. Defined as Adjusted EBITDA as a percentage of revenue. 3. Adjusted EBITDA margin reflects approximately 340 and 210 basis points reduction for costs associated with the Berre turnaround for the three and six months ended June 30, 2021, respectively. 5

SECOND QUARTER RESULTS 1. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2. Defined as Adjusted EBITDA as a percentage of revenue.. 3. Adjusted EBITDA margin reflects approximately 600 and 380 basis points reduction for costs associated with the Berre turnaround for the three and six months ended June 30, 2021, respectively. Note: May not foot due to rounding. 6 Polymer Segment Q2 2021 and YTD Results Broad-based demand recovery across all regions for Specialty Polymers and higher paving & roofing sales for Performance Polymers Three Months Ended June 30, Six Months Ended June 30, 2021 2020 Change 2021 2020 Change Volume (kT) 83.8 75.5 8.2 158.5 146.3 12.2 Revenue $278.4 $203.9 $74.6 $519.6 $444.2 $75.4 Operating Income $42.0 $16.8 $25.2 $81.8 $34.7 $47.1 Adjusted EBITDA(1) $26.3 $53.8 $(27.5) $63.8 $105.0 $(41.2) Adjusted EBITDA Margin(2)(3) 9.5% 26.4% (1,690) bps 12.3% 23.6% (1,130) bps $ millions Q2’21 Q2’20vs YTD 2021 YTD 2020vs • Adjusted EBITDA(1) down $27.5 million, reflecting Berre turnaround costs of $16.9 million, higher raw material costs, and absence of favorable raw material trends in the year ago quarter, partially offset by higher sales volumes • Sales volume up 10.9% ◦ Specialty Polymers volume up 14.6%, with demand recovery across all regions, particularly into consumer durables and automotive applications ◦ Performance Products volume up 12.6%, reflecting higher sales into paving and roofing and adhesive applications • Adjusted Gross Profit(1) of $615 per ton vs. $1,040 per ton in Q2’20, approximately 50% of the decrease attributable to the Berre turnaround • Adjusted EBITDA(1) down $41.2 million, reflecting the Q1 2020 disposition of Cariflex, Berre turnaround costs, higher raw material costs, and absence of favorable raw material trends primarily in the second quarter of 2020, partially offset by higher sales volumes • Sales volume up 8.3%, or 11.9% excluding Cariflex ◦ Specialty Polymers volume up 19.4%, primarily driven by demand recovery across all regions ◦ Performance Products volume up 9.8%, reflecting higher sales into paving and roofing and adhesive applications ◦ Isoprene Rubber down 6.5% due to timing • Adjusted Gross Profit(1) of $711 per ton vs. $1,056 per ton in 2020, approximately 50% of the decrease attributable to the Berre turnaround and disposition of the Cariflex business

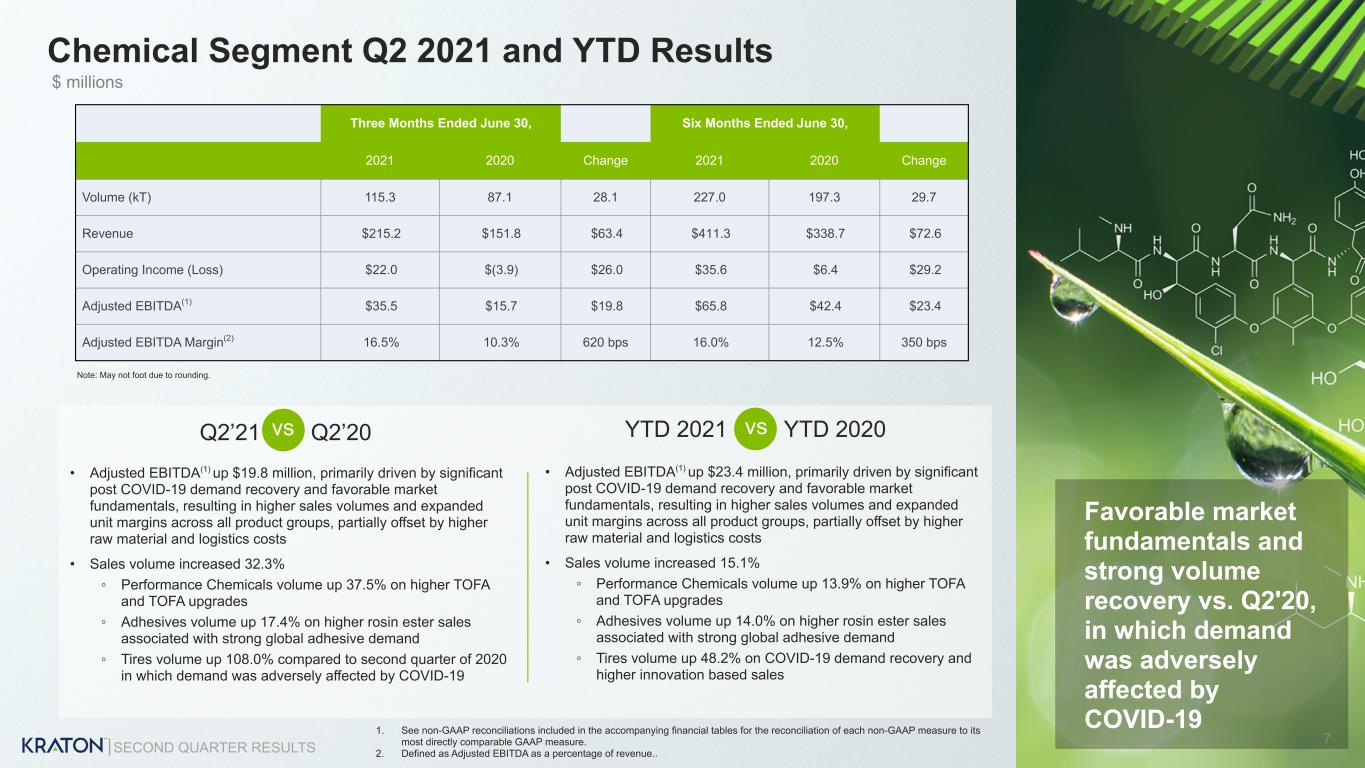

SECOND QUARTER RESULTS 1. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2. Defined as Adjusted EBITDA as a percentage of revenue.. Note: May not foot due to rounding. 7 Chemical Segment Q2 2021 and YTD Results Favorable market fundamentals and strong volume recovery vs. Q2'20, in which demand was adversely affected by COVID-19 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 Change 2021 2020 Change Volume (kT) 115.3 87.1 28.1 227.0 197.3 29.7 Revenue $215.2 $151.8 $63.4 $411.3 $338.7 $72.6 Operating Income (Loss) $22.0 $(3.9) $26.0 $35.6 $6.4 $29.2 Adjusted EBITDA(1) $35.5 $15.7 $19.8 $65.8 $42.4 $23.4 Adjusted EBITDA Margin(2) 16.5% 10.3% 620 bps 16.0% 12.5% 350 bps $ millions Q2’21 Q2’20vs YTD 2021 YTD 2020vs • Adjusted EBITDA(1) up $19.8 million, primarily driven by significant post COVID-19 demand recovery and favorable market fundamentals, resulting in higher sales volumes and expanded unit margins across all product groups, partially offset by higher raw material and logistics costs • Sales volume increased 32.3% ◦ Performance Chemicals volume up 37.5% on higher TOFA and TOFA upgrades ◦ Adhesives volume up 17.4% on higher rosin ester sales associated with strong global adhesive demand ◦ Tires volume up 108.0% compared to second quarter of 2020 in which demand was adversely affected by COVID-19 • Adjusted EBITDA(1) up $23.4 million, primarily driven by significant post COVID-19 demand recovery and favorable market fundamentals, resulting in higher sales volumes and expanded unit margins across all product groups, partially offset by higher raw material and logistics costs • Sales volume increased 15.1% ◦ Performance Chemicals volume up 13.9% on higher TOFA and TOFA upgrades ◦ Adhesives volume up 14.0% on higher rosin ester sales associated with strong global adhesive demand ◦ Tires volume up 48.2% on COVID-19 demand recovery and higher innovation based sales

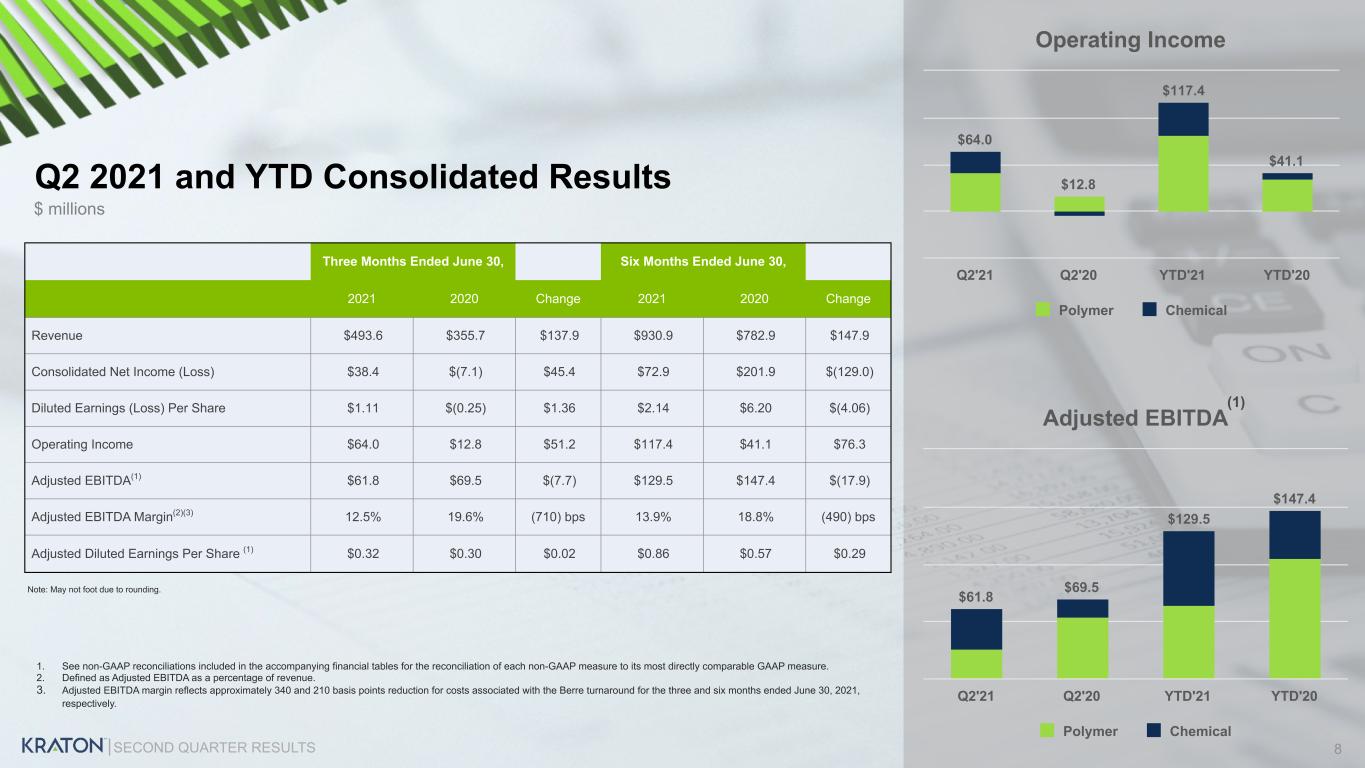

SECOND QUARTER RESULTS Adjusted EBITDA $61.8 $69.5 $129.5 $147.4 Polymer Chemical Q2'21 Q2'20 YTD'21 YTD'20 1. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2. Defined as Adjusted EBITDA as a percentage of revenue. 3. Adjusted EBITDA margin reflects approximately 340 and 210 basis points reduction for costs associated with the Berre turnaround for the three and six months ended June 30, 2021, respectively. 8 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 Change 2021 2020 Change Revenue $493.6 $355.7 $137.9 $930.9 $782.9 $147.9 Consolidated Net Income (Loss) $38.4 $(7.1) $45.4 $72.9 $201.9 $(129.0) Diluted Earnings (Loss) Per Share $1.11 $(0.25) $1.36 $2.14 $6.20 $(4.06) Operating Income $64.0 $12.8 $51.2 $117.4 $41.1 $76.3 Adjusted EBITDA(1) $61.8 $69.5 $(7.7) $129.5 $147.4 $(17.9) Adjusted EBITDA Margin(2)(3) 12.5% 19.6% (710) bps 13.9% 18.8% (490) bps Adjusted Diluted Earnings Per Share (1) $0.32 $0.30 $0.02 $0.86 $0.57 $0.29 $ millions Q2 2021 and YTD Consolidated Results Note: May not foot due to rounding. Operating Income $64.0 $12.8 $117.4 $41.1 Polymer Chemical Q2'21 Q2'20 YTD'21 YTD'20 (1) 8

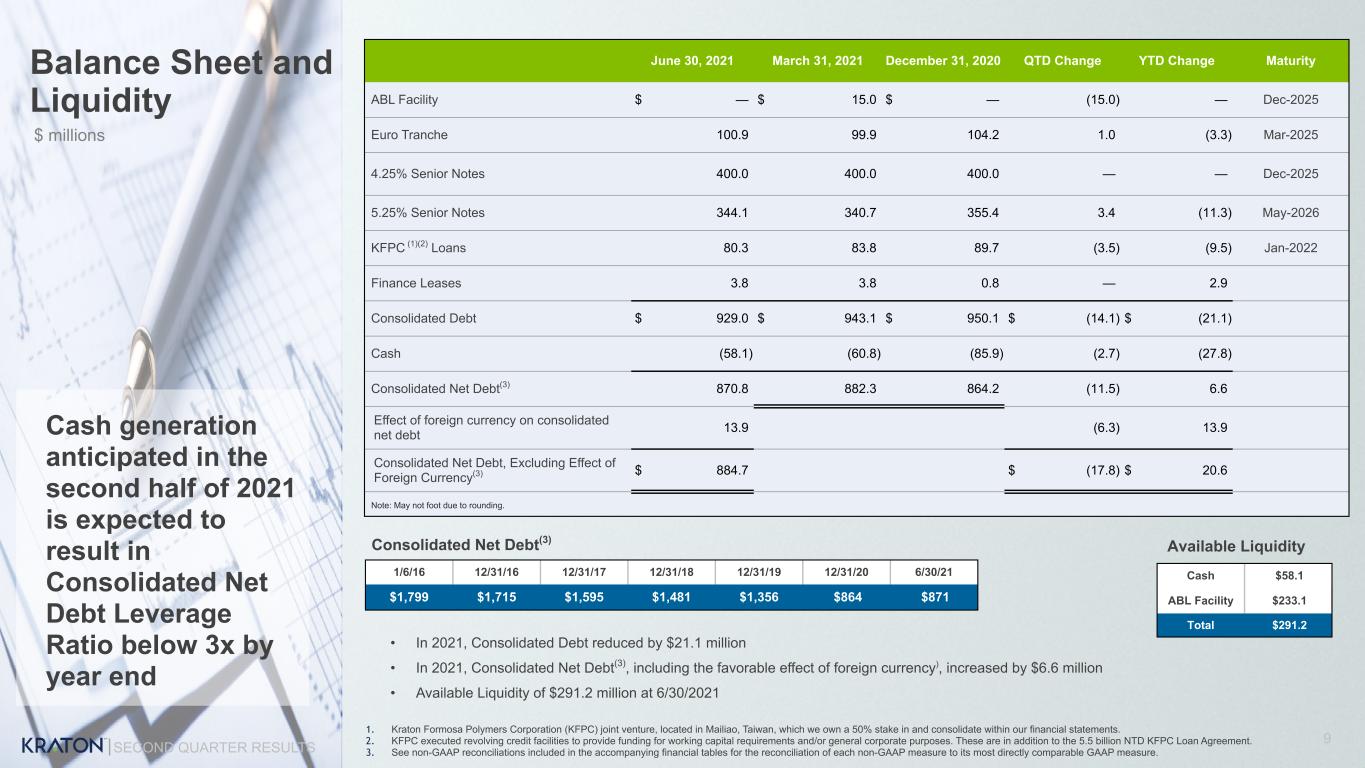

SECOND QUARTER RESULTS June 30, 2021 March 31, 2021 December 31, 2020 QTD Change YTD Change Maturity ABL Facility $ — $ 15.0 $ — (15.0) — Dec-2025 Euro Tranche 100.9 99.9 104.2 1.0 (3.3) Mar-2025 4.25% Senior Notes 400.0 400.0 400.0 — — Dec-2025 5.25% Senior Notes 344.1 340.7 355.4 3.4 (11.3) May-2026 KFPC (1)(2) Loans 80.3 83.8 89.7 (3.5) (9.5) Jan-2022 Finance Leases 3.8 3.8 0.8 — 2.9 Consolidated Debt $ 929.0 $ 943.1 $ 950.1 $ (14.1) $ (21.1) Cash (58.1) (60.8) (85.9) (2.7) (27.8) Consolidated Net Debt(3) 870.8 882.3 864.2 (11.5) 6.6 Effect of foreign currency on consolidated net debt 13.9 (6.3) 13.9 Consolidated Net Debt, Excluding Effect of Foreign Currency(3) $ 884.7 $ (17.8) $ 20.6 9 • In 2021, Consolidated Debt reduced by $21.1 million • In 2021, Consolidated Net Debt(3), including the favorable effect of foreign currency), increased by $6.6 million • Available Liquidity of $291.2 million at 6/30/2021 1. Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and consolidate within our financial statements. 2. KFPC executed revolving credit facilities to provide funding for working capital requirements and/or general corporate purposes. These are in addition to the 5.5 billion NTD KFPC Loan Agreement. 3. See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 1/6/16 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 $1,799 $1,715 $1,595 $1,481 $1,356 $864 $871 Consolidated Net Debt(3) Balance Sheet and Liquidity Cash generation anticipated in the second half of 2021 is expected to result in Consolidated Net Debt Leverage Ratio below 3x by year end Note: May not foot due to rounding. $ millions Available Liquidity Cash $58.1 ABL Facility $233.1 Total $291.2

SECOND QUARTER RESULTS Key End Uses Sector Polymer % Revenue Chemical % Revenue Prior Market View Current Market View Adhesive & Packaging 21% 27% Medical, Personal Care & Hygiene 11% 0% Infrastructure 34% 10% Consumer Durables 14% 6% General Industrial 9% 46% Automotive, Tires 9% 7% Oilfield 2% 4% Well Diversified Portfolio *Analysis based on Q2 2021 TTM revenues. 10 Business Outlook by Geography and End Use Application Favorable WeaknessNeutral Geographic Diversification EMEA 18% Europe 37% Americas 45%

SECOND QUARTER RESULTS APPENDIX 11

SECOND QUARTER RESULTS Polymer - Revenue by Geography and End Use TTM June 30, 2021 Segment Revenue by Geography Segment Revenue by End Use Americas 48% EMEA 31% Asia Pacific 21% Industrial 7% Adhsv & Pkg 19% Consumer 21% Healthcare 4% Energy & Fuels 1% Automotive & Tires 10% Isoprene Rubber 5% Paving & Roofing 30% Other 3% 12

SECOND QUARTER RESULTS IRSA PERFORMANCE PRODUCTSSPECIALTY POLYMERS Re ve nu e by G eo gr ap hy Re ve nu e by P ro du ct G ro up Asia Pacific 56% Americas 44% Asia Pacific 35% EMEA 24% Americas 41% Asia Pacific 8% EMEA 41% Americas 51% Isoprene Rubber 100% Other 3% Automotive & Tires 26% Paving & Roofing 1% Industrial 14% Healthcare 11% Energy & Fuels 2% Adhsv & Packaging 2% Consumer 41% Paving & Roofing 53% Industrial 2% Energy & Fuels 1% Adhsv & Pkg 33% Consumer 8% Other 3% Polymer - Revenue by Geography and Product Group TTM June 30, 2021 13

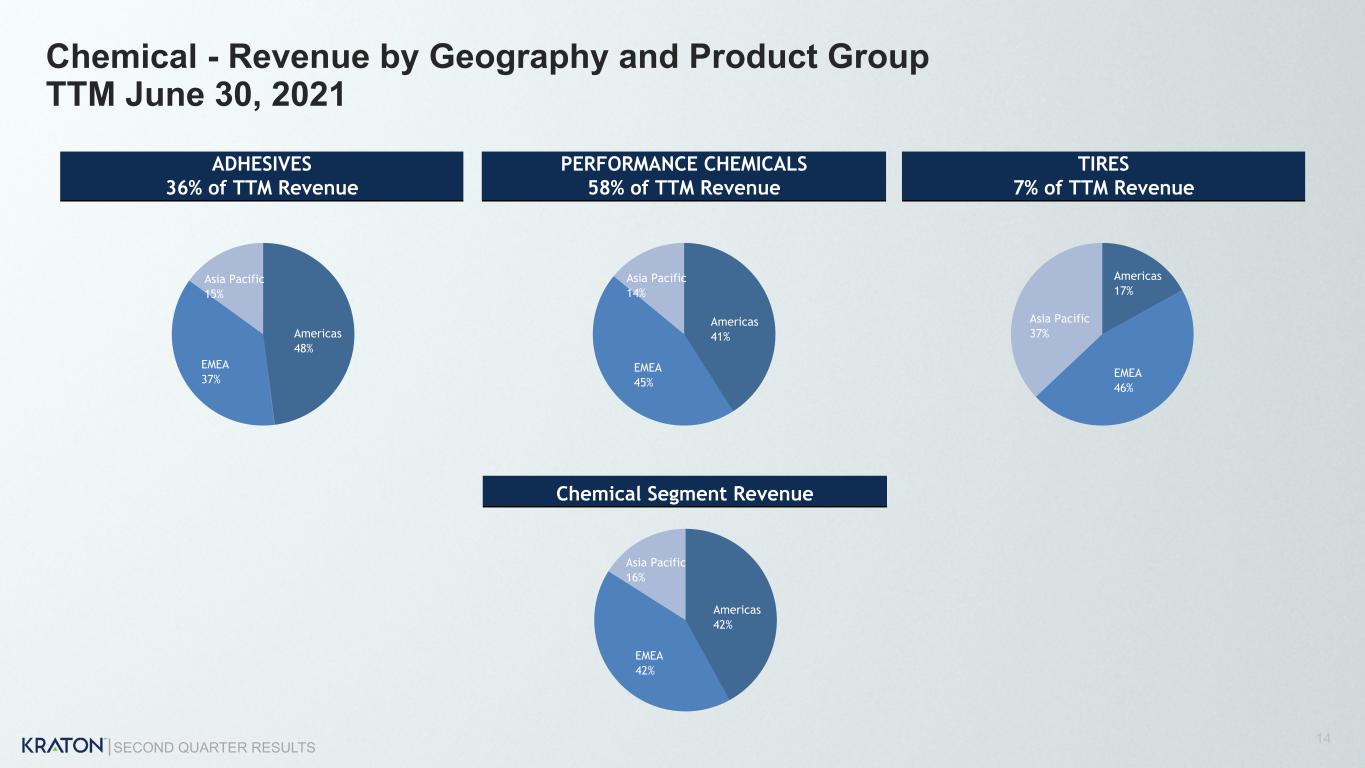

SECOND QUARTER RESULTS ADHESIVES 36% of TTM Revenue TIRES 7% of TTM Revenue Chemical Segment Revenue PERFORMANCE CHEMICALS 58% of TTM Revenue Americas 48% EMEA 37% Asia Pacific 15% Americas 17% EMEA 46% Asia Pacific 37% Americas 42% EMEA 42% Asia Pacific 16% Americas 41% EMEA 45% Asia Pacific 14% Chemical - Revenue by Geography and Product Group TTM June 30, 2021 14

SECOND QUARTER RESULTS Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 (In thousands) Gross profit $ 79,436 $ 57,845 $ 161,421 $ 126,576 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs — — — 387 Non-cash compensation expense 130 114 276 285 Spread between FIFO and ECRC (28,035) 20,575 (48,910) 27,320 Adjusted gross profit (non-GAAP) $ 51,531 $ 78,534 $ 112,787 $ 154,568 Sales volume (kilotons) 83.8 75.5 158.5 146.3 Adjusted gross profit per ton (non-GAAP)(a) $ 615 $ 1,040 $ 711 $ 1,056 Polymer Segment Reconciliation of Gross Profit to Non-GAAP Financial Measures 15 (a) Adjusted gross profit per ton for the three months ended June 30, 2021, excluding $16.9 million of costs associated with the Berre turnaround ($202), would have been $817 and for the six months ended June 30, 2021, excluding $19.7 million of costs associated with the Berre turnaround ($125), would have been $836.

SECOND QUARTER RESULTS Three Months Ended June 30, 2021 Three Months Ended June 30, 2020 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income (loss) attributable to Kraton $ 36,411 $ (7,968) Net income attributable to noncontrolling interest 1,940 887 Consolidated net income (loss) 38,351 (7,081) Add (deduct): Income tax (benefit) expense 12,881 6,659 Interest expense, net 10,417 13,466 Earnings of unconsolidated joint venture (135) (128) Loss on extinguishment of debt — 141 Other income (expense) 2,493 (251) Disposition and exit of business activities — 25 Operating income (loss) $ 41,968 $ 22,039 64,007 $ 16,762 $ (3,931) 12,831 Add (deduct): Depreciation and amortization 12,776 18,940 31,716 12,948 18,394 31,342 Disposition and exit of business activities — — — (25) — (25) Other income (expense) (3,015) 522 (2,493) (16) 267 251 Loss on extinguishment of debt — — — (141) — (141) Earnings of unconsolidated joint venture 135 — 135 128 — 128 EBITDA (a) 51,864 41,501 93,365 29,656 14,730 44,386 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) (103) 780 677 1,551 468 2,019 Disposition and exit of business activities (c) — — — 25 — 25 Loss on extinguishment of debt — — — 141 — 141 Non-cash compensation expense 2,595 — 2,595 1,897 — 1,897 Spread between FIFO and ECRC (28,035) (6,782) (34,817) 20,575 493 21,068 Adjusted EBITDA $ 26,321 $ 35,499 $ 61,820 $ 53,845 $ 15,691 $ 69,536 (a) Included in EBITDA are Isoprene Rubber sales to Daelim under the IRSA. Sales under the IRSA are transacted at cost and include the amortization of non-cash deferred income of $3.9 million for the three months ended June 30, 2020, which represents revenue deferred until the products are sold under the IRSA. (b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. (c) Reflects adjustment to assets disposed of in the Cariflex transaction. Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures 16

SECOND QUARTER RESULTS Six Months Ended June 30, 2021 Six Months Ended June 30, 2020 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income (loss) attributable to Kraton $ 69,640 $ 200,118 Net income attributable to noncontrolling interest 3,304 1,821 Consolidated net income (loss) 72,944 201,939 Add (deduct): Income tax (benefit) expense 21,642 (29,893) Interest expense, net 21,364 30,927 Earnings of unconsolidated joint venture (255) (229) Loss on extinguishment of debt — 14,095 Other income (expense) 1,685 (578) Disposition and exit of business activities — (175,189) Operating income (loss) $ 81,827 $ 35,553 117,380 $ 34,687 $ 6,385 41,072 Add (deduct): Depreciation and amortization 25,600 37,673 63,273 26,295 36,220 62,515 Disposition and exit of business activities — — — 175,189 — 175,189 Other income (expense) (2,733) 1,048 (1,685) 39 539 578 Loss on extinguishment of debt — — — (14,095) — (14,095) Earnings of unconsolidated joint venture 255 — 255 229 — 229 EBITDA (a) 104,949 74,274 179,223 222,344 43,144 265,488 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 2,228 2,752 4,980 11,699 1,230 12,929 Disposition and exit of business activities — — — (175,189) — (175,189) Loss on extinguishment of debt — — — 14,095 — 14,095 Non-cash compensation expense 5,519 — 5,519 4,745 — 4,745 Spread between FIFO and ECRC (48,910) (11,273) (60,183) 27,320 (1,973) 25,347 Adjusted EBITDA $ 63,786 $ 65,753 $ 129,539 $ 105,014 $ 42,401 $ 147,415 Adjusted EBITDA excluding Cariflex $ 63,786 $ 65,753 $ 129,539 $ 94,670 $ 42,401 $ 137,071 Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures (a) Included in EBITDA are Isoprene Rubber sales to Daelim under the IRSA. Sales under the IRSA are transacted at cost and include the amortization of non-cash deferred income of $7.6 million and $7.2 million for the six months ended June 30, 2021 and 2020, respectively, which represents revenue deferred until the products are sold under the IRSA. (b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. 17

SECOND QUARTER RESULTS Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Diluted Earnings (Loss) Per Share $ 1.11 $ (0.25) $ 2.14 $ 6.20 Transaction, acquisition related costs, restructuring, and other costs (a) 0.02 0.05 0.12 0.31 Disposition and exit of business activities — 0.02 — (4.94) Loss on extinguishment of debt — — — 0.34 Tax restructuring — (0.09) — (2.03) Spread between FIFO and ECRC (0.81) 0.57 (1.40) 0.69 Adjusted Diluted Earnings Per Share (non-GAAP) $ 0.32 $ 0.30 $ 0.86 $ 0.57 (a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. Reconciliation of Diluted EPS to Adjusted Diluted EPS 18