Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DRIL-QUIP INC | drq-8k_20210729.htm |

| EX-99.1 - EX-99.1 - DRIL-QUIP INC | drq-ex991_8.htm |

Second QUARTER 2021 Supplemental Earnings Information dril-quip.com | NYSE: DRQ Exhibit 99.2 DRIL-QUIP

Forward-Looking Statements The information furnished in this presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, the effects of the COVID-19 pandemic, and the effects of actions taken by third parties including, but not limited to, governmental authorities, customers, contractors and suppliers, in response to the ongoing COVID-19 pandemic, the impact of actions taken by the Organization of Petroleum Exporting Countries (OPEC) and non-OPEC nations to adjust their production levels, the general volatility of oil and natural gas prices and cyclicality of the oil and gas industry, declines in investor and lender sentiment with respect to, and new capital investments in, the oil and gas industry, project terminations, suspensions or scope adjustments to contracts, uncertainties regarding the effects of new governmental regulations, the Company’s international operations, operating risks, the impact of our customers and the global energy sector shifting some of their asset allocation from fossil-fuel production to renewable energy resources, goals, projections, estimates, expectations, market outlook, forecasts, plans and objectives, including revenue and new product revenue, capital expenditures and other projections, project bookings, bidding and service activity, acquisition opportunities, forecasted supply and demand, forecasted drilling activity and subsea investment, liquidity, cost savings, and share repurchases and are based on assumptions, estimates and risk analysis made by management of Dril-Quip, Inc. (“Dril-Quip”) in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. No assurance can be given that actual future results will not differ materially from those contained in the forward-looking statements in this presentation. Although Dril-Quip believes that all such statements contained in this presentation are based on reasonable assumptions, there are numerous variables of an unpredictable nature or outside of Dril-Quip’s control that could affect Dril-Quip’s future results and the value of its shares. Each investor must assess and bear the risk of uncertainty inherent in the forward-looking statements contained in this presentation. Please refer to Dril-Quip’s filings with the Securities and Exchange Commission (“SEC”) for additional discussion of risks and uncertainties that may affect Dril-Quip’s actual future results. Dril-Quip undertakes no obligation to update the forward-looking statements contained herein. Use of Non-GAAP Financial Measures Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA and Free Cash Flow are non-GAAP measures. Adjusted Net Income and Adjusted Diluted EPS are defined as net income (loss) and earnings per share, respectively, excluding the impact of foreign currency gains or losses as well as other significant non-cash items and certain charges and credits. Adjusted EBITDA is defined as net income excluding income taxes, interest income and expense, depreciation and amortization expense, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and items that can be considered non-recurring. Free Cash Flow is defined as net cash provided by operating activities less net cash used in the purchase of property, plant and equipment. We believe that these non-GAAP measures enable us to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of our capital structure from our operating structure and certain other items including those that affect the comparability of operating results. In addition, we believe that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. These measures do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial information supplements should be read together with, and is not an alternative or substitute for, our financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measure can be found in the appendix. Use of Website Investors should note that Dril-Quip announces material financial information in SEC filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip’s website is not part of this presentation. Cautionary Statement 1 DRIL-QUIP

2 Dril-Quip Investment Highlights Dril-Quip Leading Manufacturer of Highly Engineered Drilling & Production Equipment Technically Innovative, Environmentally Responsible Products & First-class Service Strong Financial Position Historically Superior Margins to Peers Results Driven Management Team DRIL-QUIP

Progress Toward United Nations Sustainable Development Goals 3 Community involvement and investment in STEM education through ASME INSPIRE STEM Readiness program 23% of recent new hires globally have been women and 16% of our executives and senior management positions are women Global footprint provides a platform to increase access to affordable, reliable energy & transition to cleaner sources Helping customers reduce their carbon footprint and minimize environmental impact through investing in technology and R&D

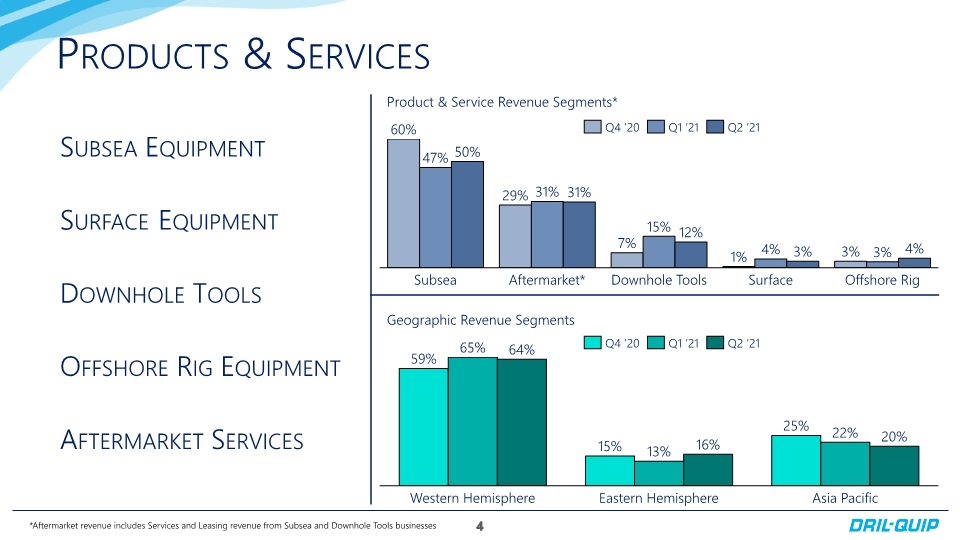

Products & Services 4 Product & Service Revenue Segments* 59% 13% Asia Pacific Western Hemisphere Eastern Hemisphere 65% 64% 16% 15% 25% 22% 20% 47% 4% Subsea Aftermarket* Surface Downhole Tools Offshore Rig 60% 3% 50% 29% 31% 31% 7% 15% 12% 1% 4% 3% 3% Q4 ’20 Q1 ’21 Q2 ’21 Q4 ’20 Q1 ’21 Q2 ’21 Geographic Revenue Segments *Aftermarket revenue includes Services and Leasing revenue from Subsea and Downhole Tools businesses

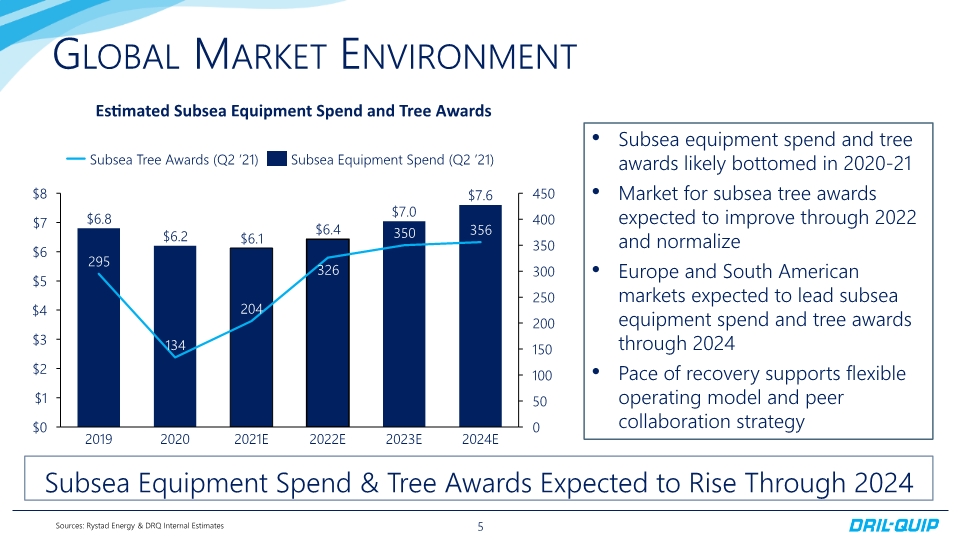

Global Market Environment 5 Sources: Rystad Energy & DRQ Internal Estimates Subsea Equipment Spend & Tree Awards Expected to Rise Through 2024 Subsea equipment spend and tree awards likely bottomed in 2020-21 Market for subsea tree awards expected to improve through 2022 and normalize Europe and South American markets expected to lead subsea equipment spend and tree awards through 2024 Pace of recovery supports flexible operating model and peer collaboration strategy Estimated Subsea Equipment Spend and Tree Awards 2023E $7.6 2022E 2019 2024E 2020 $7.0 2021E Subsea Tree Awards (Q2 ’21) Subsea Equipment Spend (Q2 ’21) $0 $1 $2 $3 $4 $5 $6 $7 $8 0 50 100 150 200 250 300 350 400 450 295 $6.8 134 $6.2 204 $6.1 326 $6.4 350 356 DRIL-QUIP

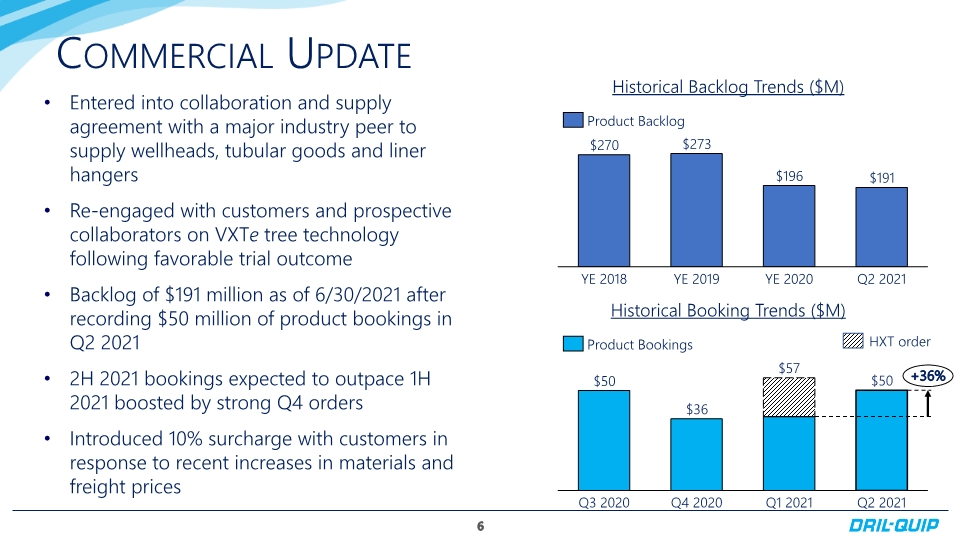

Commercial Update 6 Entered into collaboration and supply agreement with a major industry peer to supply wellheads, tubular goods and liner hangers Re-engaged with customers and prospective collaborators on VXTe tree technology following favorable trial outcome Backlog of $191 million as of 6/30/2021 after recording $50 million of product bookings in Q2 2021 2H 2021 bookings expected to outpace 1H 2021 boosted by strong Q4 orders Introduced 10% surcharge with customers in response to recent increases in materials and freight prices Q2 2021 YE 2019 YE 2018 YE 2020 Historical Backlog Trends ($M) Product Backlog Q2 2021 Q3 2020 Q4 2020 Q1 2021 $57 +36% Historical Booking Trends ($M) Product Bookings HXT order

Q2 2021 Highlights 7 Generated revenue of $80.8 million for the second quarter of 2021; Reported second quarter net loss of $19.1 million, or $0.54 per share, an improvement of $15.3 million, or $0.43 per share, from the first quarter of 2021; Recorded adjusted EBITDA of $2.6 million, or 3.2% of revenue, including a one-time $2.3 million negative impact related to termination of the forge facility lease; Second quarter net cash provided by operating activities of $11.3 million and free cash flow of $8.2 million, or 10.2% of revenue; Booked $50.4 million of new product orders during the second quarter of 2021; and Executed strategic collaboration agreement with a major oilfield service peer for the supply of subsea wellheads, tubular goods, liner hangers and related tools and services. Adjusted EBITDA and free cash flow are non-GAAP measures. See appendix for reconciliation to GAAP measures.

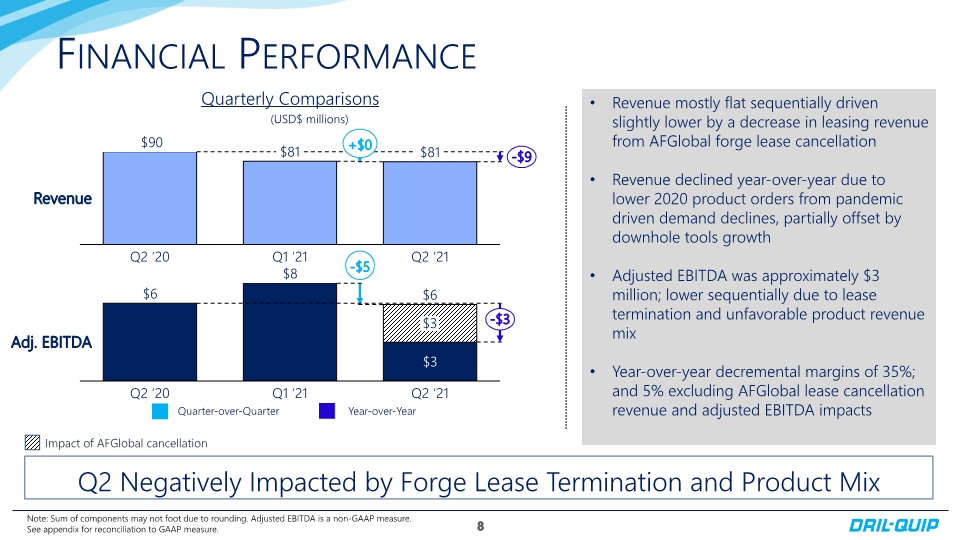

Financial Performance 8 (USD$ millions) Q2 ’20 Q2 ’21 Q1 ’21 Revenue +$0 -$9 Q2 Negatively Impacted by Forge Lease Termination and Product Mix Quarterly Comparisons Note: Sum of components may not foot due to rounding. Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation to GAAP measure. Revenue mostly flat sequentially driven slightly lower by a decrease in leasing revenue from AFGlobal forge lease cancellation Revenue declined year-over-year due to lower 2020 product orders from pandemic driven demand declines, partially offset by downhole tools growth Adjusted EBITDA was approximately $3 million; lower sequentially due to lease termination and unfavorable product revenue mix Year-over-year decremental margins of 35%; and 5% excluding AFGlobal lease cancellation revenue and adjusted EBITDA impacts Adj. EBITDA Q2 ’20 $3 Q1 ’21 Q2 ’21 $6 -$5 -$3

Improve Free Cash Flow Yield 9 Free Cash Flow of ~$19 million through Q2 2021 Improve Free Cash Flow Yield Inventory Reduction Plan • Identified approximately $3 million in component substitutions instead of new purchases Order-to-Cash Improvement • Trade accounts receivable down $25M in 2021 from improved collections Drive Productivity Initiatives through LEAN • Completed outsourcing of downhole tools product line manufacturing Free Cash Flow of ~$19 million through Q2 2021 DRIL-QUIP 9

2021 Strategic Growth Pillars 10 2021 Strategic Growth Pillars Peer-to-Peer Collaboration • Entered into collaboration and supply agreement with peer for subsea wellheads, tubular goods and liner hangers Downhole Tool Market Expansion • Several new tender submissions for XPak liner hanger in Latin America and other deepwater markets Expansion of Power of e-Series Technology • DXe wellhead connector gaining traction in North Sea harsh environment shallow water market DRIL-QUIP 10

Executing Downhole Tool Growth Strategy 11 Executing Downhole Tool Growth Strategy Global Deepwater • Actively bidding and participating in peer collaboration projects in the Caribbean and Norwegian markets Latin America • Signed a contract to deliver 18” x 22” liner hanger systems over the next three years in Brazil Middle East • First XPak expandable liner hanger run in United Arab Emirates • Awarded major offshore gas project in Saudi Arabia DRIL-QUIP 11

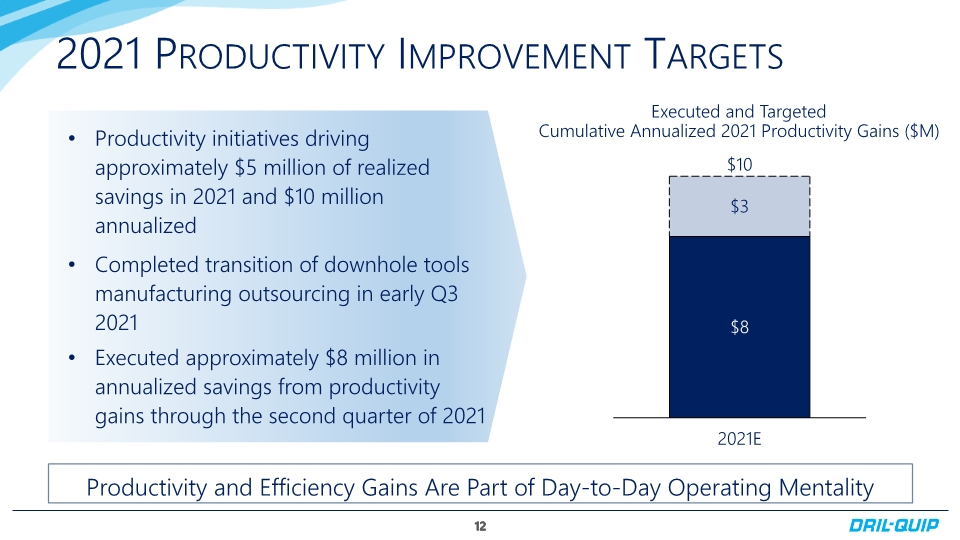

2021 Productivity Improvement Targets 12 Productivity initiatives driving approximately $5 million of realized savings in 2021 and $10 million annualized Completed transition of downhole tools manufacturing outsourcing in early Q3 2021 Executed approximately $8 million in annualized savings from productivity gains through the second quarter of 2021 $10 2021E Executed and Targeted Cumulative Annualized 2021 Productivity Gains ($M) Productivity and Efficiency Gains Are Part of Day-to-Day Operating Mentality

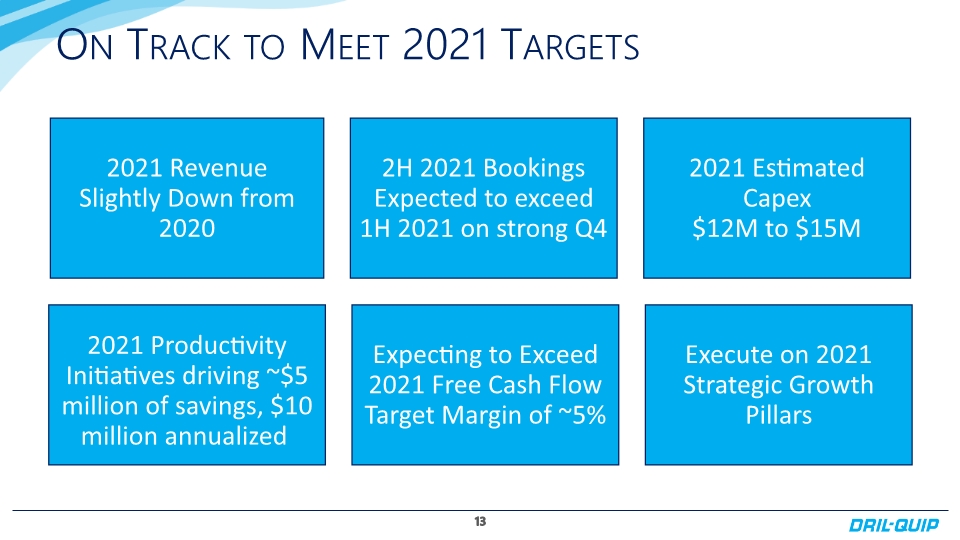

On Track to Meet 2021 Targets 13 On Track to Meet 2021 Targets 2021 Revenue Slightly Down from 2020 2H 2021 Bookings Expected to exceed 1H 2021 on strong Q4 2021 Estimated Capex $12M to $15M 2021 Productivity Initiatives driving ~$5 million of savings, $10 million annualized Expecting to Exceed 2021 Free Cash Flow Target Margin of ~5% Execute on 2021 Strategic Growth Pillars DRIL-QUIP 13

dril-quip.com | NYSE: DRQ APPENDIX APPENDIX dril-quip.com | NYSE: DRQ

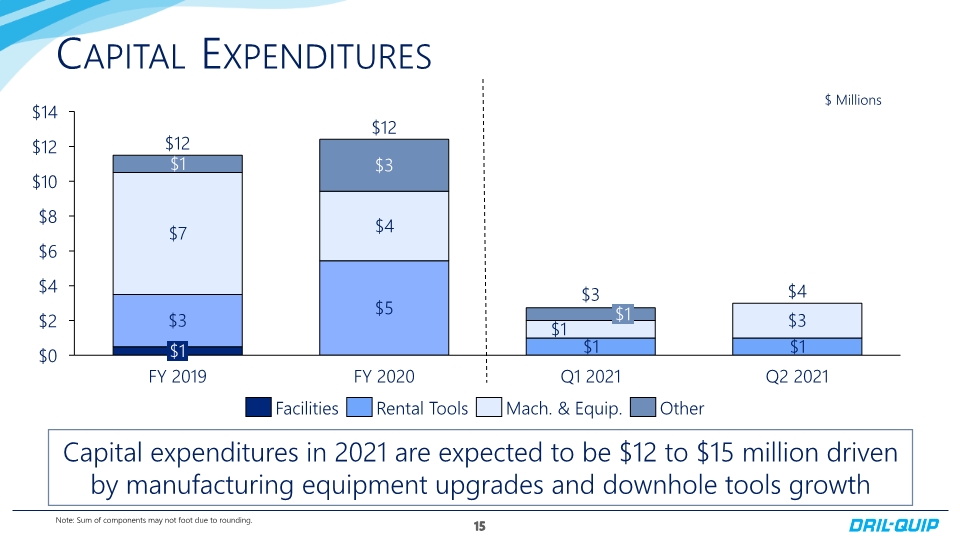

Capital Expenditures 15 FY 2019 $1 FY 2020 $1 Q1 2021 Q2 2021 $12 $12 $3 $4 Capital expenditures in 2021 are expected to be $12 to $15 million driven by manufacturing equipment upgrades and downhole tools growth Note: Sum of components may not foot due to rounding. Rental Tools Facilities Mach. & Equip. Other $ Millions

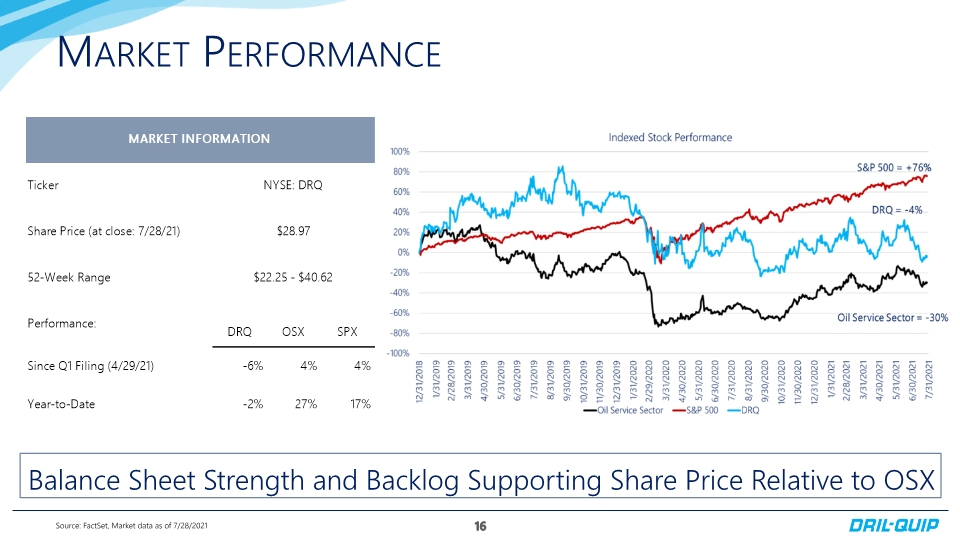

Market Performance 16 Source: FactSet, Market data as of 7/28/2021 Balance Sheet Strength and Backlog Supporting Share Price Relative to OSX Market Performance UPDATE Balance Sheet Strength and Backlog Supporting Share Price Relative to OSX Source: FactSet, Market data as of 7/28/2021 MARKET INFORMATION Ticker NYSE: DRQ Share Price (at close: 4/27/21) $30.05 52-Week Range $22.25 - $40.62 Performance: DRQ OSX SPX Since Q4 Filing (2/26/21) -12% -9% 10% Year-to-Date 1% 15% 11% [BAR CHART] DRIL-QUIP 16

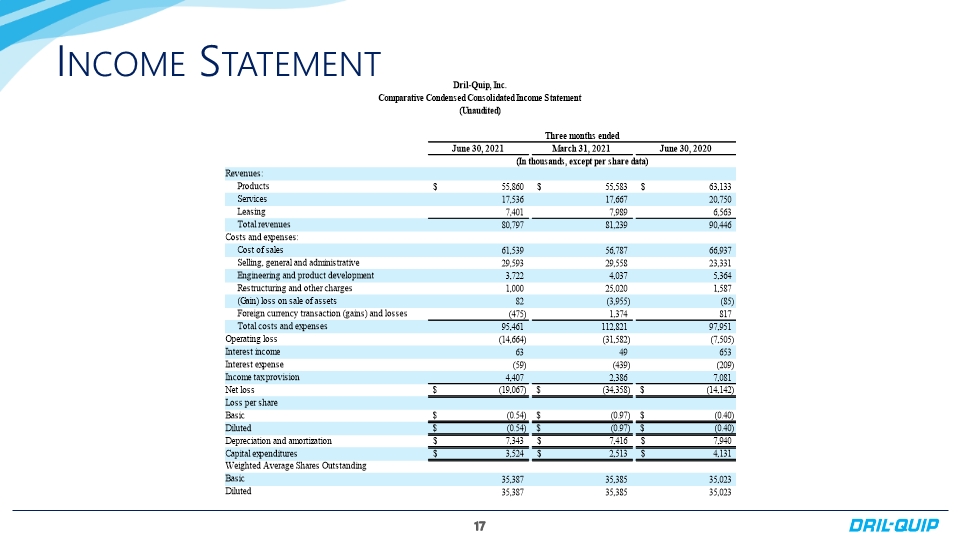

Income Statement 17 Income Statement Dril-Quip, Inc. Comparative Condensed Consolidated Income Statement (Unaudited) June 30, 2021 March 31, 2021 June 30, 2020 Revenues: Products 55,860 $ 55,583 $ 63,133 $ Services 17,536 17,667 20,750 Leasing 7,401 7,989 6,563 Total revenues 80,797 81,239 90,446 Costs and expenses: Cost of sales 61,539 56,787 66,937 Selling, general and administrative 29,593 29,558 23,331 Engineering and product development 3,722 4,037 5,364 Restructuring and other charges 1,000 25,020 1,587 (Gain) loss on sale of assets 82 (3,955) (85) Foreign currency transaction (gains) and losses (475) 1,374 817 Total costs and expenses 95,461 112,821 97,951 Operating loss (14,664) (31,582) (7,505) Interest income 63 49 653 Interest expense (59) (439) (209) Income tax provision 4,407 2,386 7,081 Net loss (19,067) $ (34,358) $ (14,142) $ Loss per share Basic (0.54) $ (0.97) $ (0.40) $ Diluted (0.54) $ (0.97) $ (0.40) $ Depreciation and amortization 7,343 $ 7,416 $ 7,940 $ Capital expenditures 3,524 $ 2,513 $ 4,131 $ Weighted Average Shares Outstanding Basic 35,387 35,385 35,023 Diluted 35,387 35,385 35,023 (In thousands, except per share data) Three months ended DRIL-QUIP 17

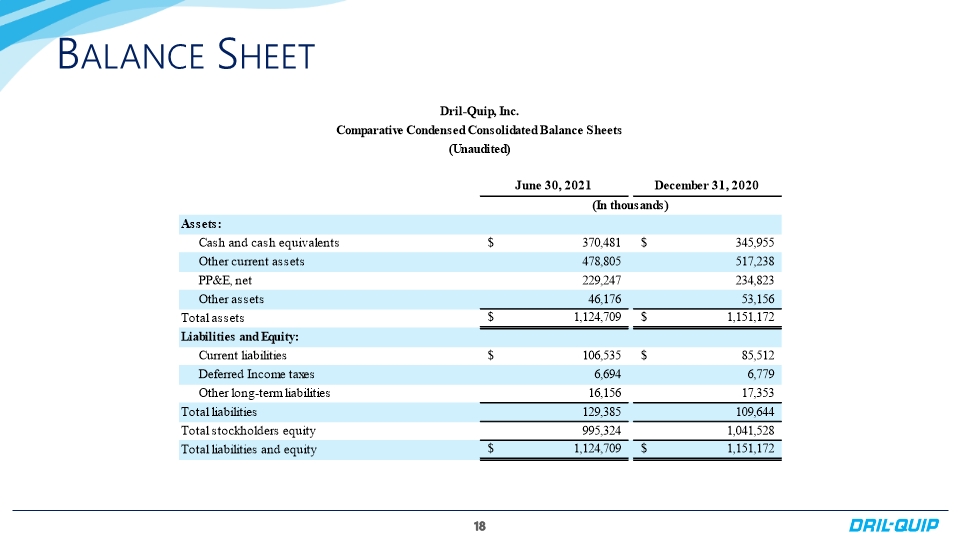

Balance Sheet 18 Balance Sheet Dril-Quip, Inc. Comparative Condensed Consolidated Balance Sheets (Unaudited) June 30, 2021December 31, 2020Assets: Cash and cash equivalents 370,481 $ 345,955 $ Other current assets 478,805 517,238 PP&E, net 229,247 234,823 Other assets 46,176 53,156 Total assets 1,124,709 $ 1,151,172 $ Liabilities and Equity: Current liabilities 106,535 $ 85,512 $ Deferred Income taxes 6,694 6,779 Other long-term liabilities 16,156 17,353 Total liabilities 129,385 109,644 Total stockholders equity 995,324 1,041,528 Total liabilities and equity 1,124,709 $ 1,151,172 $ (In thousands) DRIL-QUIP 18

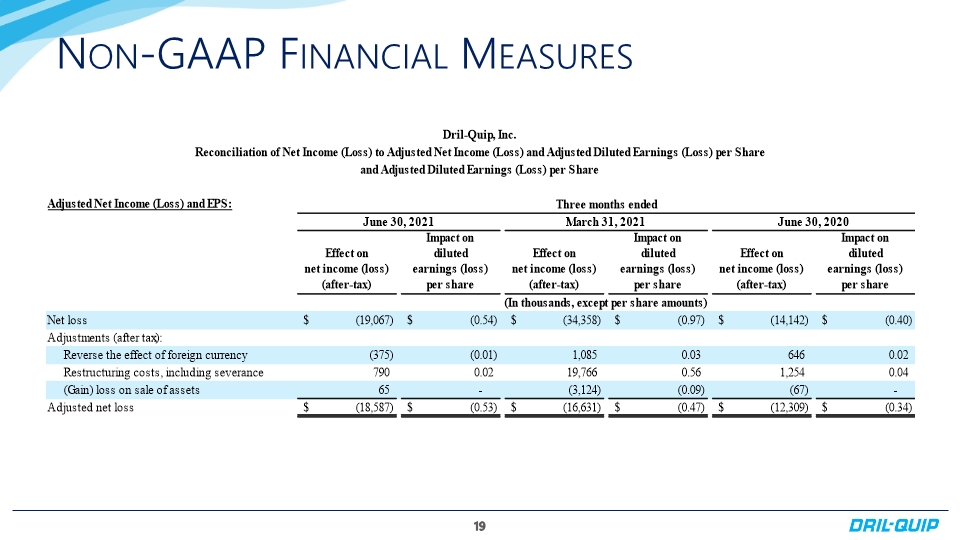

Non-GAAP Financial Measures 19 Non-GAAP Financial Measures Dril-Quip, Inc. Reconciliation of Net Income (Loss) to Adjusted Net Income and Adjusted Diluted Earnings per Share and Adjusted Diluted Earnings per Share Adjusted Net Income and EPS: Three months ended June 30, 2021 March 31, 2021 June 30, 2020 Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share Net loss (19,067) $ (0.54) $ (34,358) $ (0.97) $ (14,142) $ (0.40) $ Adjustments (after tax): Reverse the effect of foreign currency (375) (0.01) 1,085 0.03 646 0.02 Restructuring costs, including severance 790 0.02 19,766 0.56 1,254 0.04 (Gain) loss on sale of assets 65 - (3,124) (0.09) (67) - Adjusted net loss (18,587) $ (0.53) $ (16,631) $ (0.47) $ (12,309) $ (0.34) (In thousands, except per share amounts) DRIL-QUIP 19

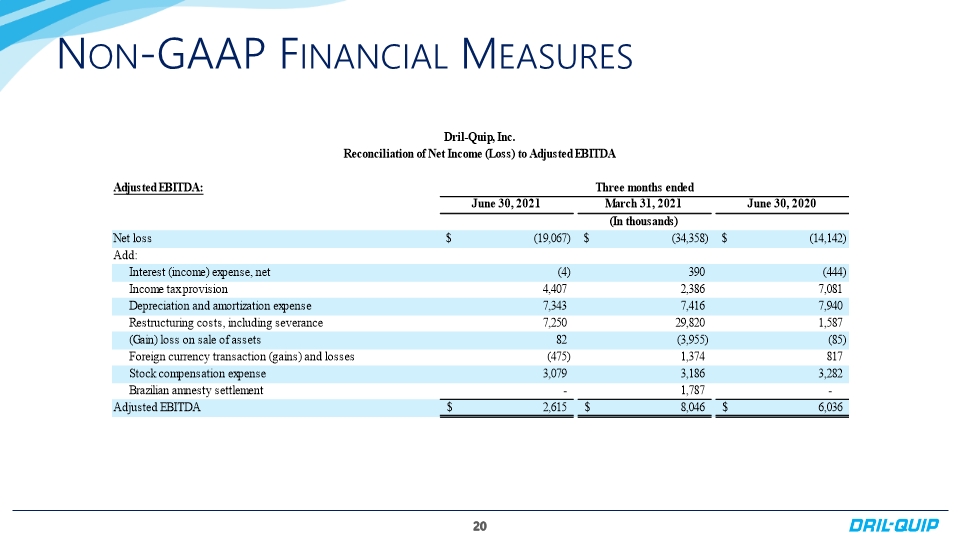

Non-GAAP Financial Measures 20 Non-GAAP Financial Measures Dril-Quip, Inc. Reconciliation of Net Income (Loss) to Adjusted EBITDA (In thousands) Adjusted EBITDA: June 30, 2021 March 31, 2021 June 30, 2020 Net loss (19,067) $ (34,358) $ (14,142) $ Add: Interest (income) expense, net (4) 390 (444) Income tax provision 4,407 2,386 7,081 Depreciation and amortization expense 7,343 7,416 7,940 Restructuring costs, including severance 7,250 29,820 1,587 (Gain) loss on sale of assets 82 (3,955) (85) Foreign currency transaction (gains) and losses (475) 1,374 817 Stock compensation expense 3,079 3,186 3,282 Brazilian amnesty settlement - 1,787 - Adjusted EBITDA 2,615 $ 8,046 $ 6,036 DRIL-QUIP 20

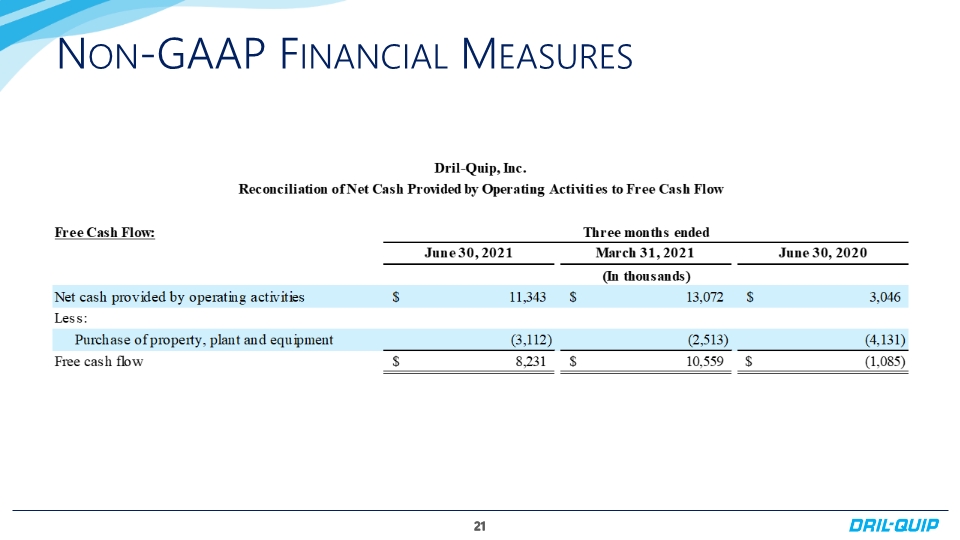

Non-GAAP Financial Measures 21 Non-GAAP Financial Measures Dril-Quip, Inc. Reconciliation of Net Cash Provided by Operation Activities to Free Cash Flow Free Cash Flow: Three months ended June 30, 2021, March 31, 2021 June 30, 2020 Net cash provided by operation activities $ 11,343 $ 13,072 $ 3,046 Less: Purchase of property, plant and equipment (3,112) (2,513) (4,131) Free cash flow $ 8,231 $ 10,559 $ (1,085) DRIL-QUIP 21

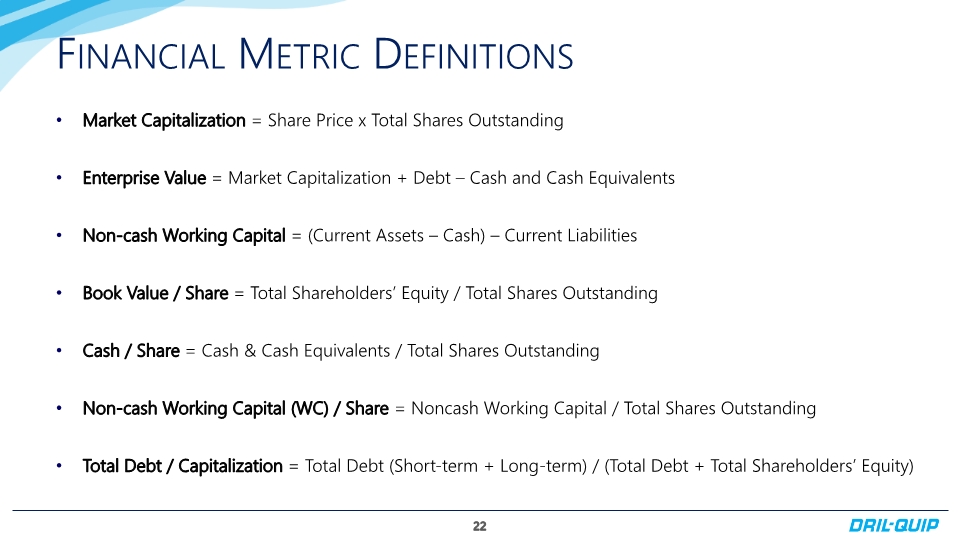

Financial Metric Definitions 22 Market Capitalization = Share Price x Total Shares Outstanding Enterprise Value = Market Capitalization + Debt – Cash and Cash Equivalents Non-cash Working Capital = (Current Assets – Cash) – Current Liabilities Book Value / Share = Total Shareholders’ Equity / Total Shares Outstanding Cash / Share = Cash & Cash Equivalents / Total Shares Outstanding Non-cash Working Capital (WC) / Share = Noncash Working Capital / Total Shares Outstanding Total Debt / Capitalization = Total Debt (Short-term + Long-term) / (Total Debt + Total Shareholders’ Equity)