Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Amalgamated Financial Corp. | amal-20210729.htm |

| EX-99.1 - EX-99.1 - Amalgamated Financial Corp. | a202106earningsrelease.htm |

amalgamatedbank.com Member FDIC Amalgamated Financial Corp. Second Quarter 2021 Earnings Presentation July 29, 2021

2 Safe Harbor Statements INTRODUCTION On March 1, 2021 (the “Effective Date”), Amalgamated Financial Corp. (the “Company”) completed its holding company reorganization and acquired all of the outstanding stock of Amalgamated Bank (the “Bank”). In this presentation, unless the context indicates otherwise, references to “we,” “us,” and “our” refer to the Company and the Bank. However, if the discussion relates to a period before the Effective Date, the terms refer only to the Bank. FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act, Section 21E of the Securities Exchange Act of 1934, as amended. any statement that does not describe historical or current facts is a forward-looking statement. These statements generally can be identified by forward-looking terminology, such as “plan,” “seek to,” “outlook,” “guidance,” “may,” “will,” “anticipate,” “should,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “initiatives,” and “intend,” as well as other similar words and expressions of the future. These forward-looking statements include, but are not limited to, our 2021 Guidance and, statements related to future loss/income (included projected non-interest income) of solar tax equity investments. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors, many of which are beyond our control and any or all of which could cause actual results to differ materially from the results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: • negative economic and political conditions that adversely affect the general economy, housing prices, the real estate market, the job market, consumer confidence, the financial condition of our borrowers and consumer spending habits, which may affect, among other things, the level of non-performing assets, charge-offs and provision expense; • the rate of growth (or lack thereof) in the economy and employment levels, as well as general business and economic conditions, coupled with the risk that adverse conditions may be greater than anticipated in the markets that we serve; • the COVID-19 pandemic and its continuing effects on the economic and business environments in which we operate; • continuation of the historically low short-term interest rate environment; • fluctuations or unanticipated changes in interest rates on loans or deposits or that affect the yield curve; • our inability to maintain the historical growth rate of our loan portfolio; • changes in loan underwriting, credit review or loss reserve policies associated with economic conditions, examination conclusions, or regulatory developments either as they currently exist or as they may be affected by conditions associated with the COVID-19 pandemic; • the impact of competition with other financial institutions, many of which are larger and have greater resources, and fintechs, as well as changes in the competitive environment; • our ability to meet heightened regulatory and supervisory requirements; • our ability to grow and retain low-cost core deposits and retain large, uninsured deposits; • any matter that would cause us to conclude that there was impairment of any asset, including intangible assets; • inability to comply with regulatory capital requirements, including those resulting from changes to capital calculation methodologies, required capital maintenance levels or regulatory requests or directives; • risks associated with litigation, including the applicability of insurance coverage; • the risk of not achieving anticipated cost savings related to reduction in the number of branch locations and other expense areas; • a failure in or breach of our operational or security systems or infrastructure, or those of third party vendors or other service providers, including as a result of unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches, the risk of any of which could be exacerbated by employees and others working remotely as a result of the effects of the COVID-19 pandemic; • volatile credit and financial markets both domestic and foreign; • the risk that the preliminary financial information reported herein and our current preliminary analysis could be different when our review is finalized; and • unexpected challenges related to our executive officer transitions and/or retention. Additional factors which could affect the forward-looking statements can be found in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC and available on the SEC’s website at www.sec.gov/. Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. We disclaim any obligation to update or revise any forward-looking statements contained in this presentation, which speak only as of the date hereof, or to update the reasons why actual results could differ from those contained in or implied by such statements, whether as a result of new information, future events or otherwise, except as required by law.

3 Safe Harbor Statements cont. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures including, without limitation, “Core Operating Revenue,” “Core Non-interest Expense,” “Tangible Common Equity,” “Average Tangible Common Equity,” “Core Efficiency Ratio,” “Core Net Income,” “Core ROAA,” and “Core ROATCE.” We believe these non-GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP. Specifically, we believe these non-GAAP financial measures (a) allow management and investors to better assess our performance by removing volatility that is associated with discrete items that are unrelated to our core business, and (b) enable a more complete understanding of factors and trends affecting our business. Non-GAAP financial measures, however, have inherent limitations, are not required to be uniformly applied, and are not audited. Accordingly, these non-GAAP financial measures should not be considered as substitutes for GAAP financial measures, and we strongly encourage investors to review the GAAP financial measures included in this presentation and not to place undue reliance on any single financial measure. In addition, because non-GAAP financial measures are not standardized, it may not be possible to compare the non-GAAP financial measures presented in this presentation with other companies’ non-GAAP financial measures having the same or similar names. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. Reconciliations of non-GAAP financial disclosures to what we believe to be the most directly comparable GAAP measures found in this presentation are set forth in the final pages of this presentation and also may be viewed on the bank’s website, amalgamatedbank.com. You should assume that all numbers presented are unaudited unless otherwise noted.

2Q21 Highlights 4 (1) See non-GAAP disclosures on pages 21-22 (2) Pre-tax, pre-provision income is defined as net interest income plus non-interest income less non-interest expense INCOME STATEMENT • GAAP net income of $0.33 per diluted share; core net income of $0.32 per diluted share(1) • Pre-tax, pre-provision income(2) of $15.9 million compared to $13.1 million in 1Q21 • Core pre-tax, pre-provision income of $15.6 million compared to $14.1 million in 1Q21 • Efficiency ratio of 66.35% in 2Q21, compared to 71.53% in 1Q21 (1) o Efficiency ratio is unfavorably impacted 2 pct pts and 6 pct pts from equity method investments in solar initiatives in 2Q21 and 1Q21 respectively BALANCE SHEET • Deposits increased $189.9 million compared to 1Q21 primarily due to continued growth in political deposits and new relationships in core markets • Property Assessed Clean Energy (PACE) grew $94.2 million to $545.8 million in 2Q21 primarily from Commercial PACE • Loans decreased $85.4 million primarily due to existing customer refinancing, and C&I paydowns CAPITAL • Repurchased approximately 154,000 shares, or $2.5 million of common stock • Capital ratios remained strong with CET1 of 13.63% and Tier 1 Leverage of 7.93% • Tangible book value of $17.07 compared to $16.75 as of 1Q21

Priscilla Sims Brown – President and CEO 5 EARLY OBSERVATIONS • Significant opportunities to better tell the story of Amalgamated’s mission to an increasing market of receptive listeners • Expand and grow the Amalgamated brand to gain share and drive business • Develop opportunities to expand our lending platform into attractive segments which fit our core mission • Pair growth opportunities with continued emphasis on underwriting and credit management practices • Evaluate geographic expansion through both organic opportunities and/or M&A

26.4 50.1 68.0 86.7 58.4 2017 2018 2019 2020 Jun YTD Trends 6 KEY FINANCIAL TRENDS THROUGH 2Q21 ($ in millions) (1) Compounded Annual Growth Rate (“CAGR”) (2) Jun YTD 2021 Pre-tax Pre-Provision earnings are annualized (3) Pre-tax Pre-provision Earnings, excluding the impact of equity method investments for solar initiatives, was $79.3 million in 2020, and $69.3 million in 2021 annualized 8.4% CAGR(1) 18.8% CAGR(1) 22.0% CAGR(1) Pre-tax Pre-Provision Earnings(2)(3) Ending Deposits NPA / Total Assets Loans + PACE 3,439 3,447 3,137 264 421 546 2,780 3,211 3,703 3,868 3,683 2017 2018 2019 2020 2Q21 3,233 4,105 4,641 5,339 5,910 2017 2018 2019 2020 2Q21 2.20% 1.27% 1.25% 1.38% 1.08% 2017 2018 2019 2020 2Q21

Deposit Portfolio 7 TOTAL DEPOSITS ($ in millions) 2Q21 HIGHLIGHTS • Total ending deposits increased $189.9 million compared to 1Q21 due to post-election rebound in political deposits and new relationships in core markets • Total average deposits increased $155.7 million • $123.0 million of average non-interest bearing deposits increase primarily due to political deposits • Non-interest bearing deposits represented 50% of ending deposits in 2Q21, compared to 49% in 1Q21 $5,431 $5,890 $5,572 $5,580 $5,735 $5,870 $6,021 $5,339 $5,720 $5,910 2Q20 3Q20 4Q20 1Q21 2Q21 Average End of Period

8 HISTORICAL TREND ($ in millions) Political Deposits $85 $124 $156 $242 $321 $416 $398 $182 $271 $419 $511 $579 $775 $1,101 $1,212 $603 $692 $791 $824 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 7/23

Interest Earning Assets 9 INTEREST EARNING ASSETS OF $6.3B AS OF JUNE 30, 2021 We maintain a diverse, low risk profile of interest earning assets C&I, Consumer and Other $0.9 B Securities & IB Deposits $3.1 B Multifamily & Commercial Real Estate $1.2 B Residential $1.1 B • No fossil fuel exposure • $278mm of government guaranteed loans • $194mm residential solar loans with strong credit profiles • Predominantly NYC properties with low LTV • $848mm agency securities • $1,031mm of non-agency securities • $546mm of PACE securities with low LTV • All non-agency securities are top of the capital structure • $170mm of resell agreements and other • $539mm of cash deposits at Bank • 99% first lien mortgages • Low LTV • 81/19% originated to purchased portfolio $6.3 B as of 2Q21

Loans and Held-to-Maturity Securities 10 TOTAL LOANS AND PACE (HTM) ($ in millions) HELD-TO-MATURITY SECURITIES ($ in millions) • Total loans decreased $85.4 million, or -2.6% compared to 1Q21 due to continued prepayment activity and paydowns on commercial revolvers • 2Q21 Yield of 3.82%; a decrease of one basis point compared to 1Q21 and a decrease of 15 bps compared to 2Q20 • PACE securities of $545.8 million increased $94.2 million from $451.6 million in 1Q21 2Q21 HIGHLIGHTS $323 $367 $421 $452 $546 $47 $74 $73 $80 $79 $370 $441 $494 $531 $625 - 200 400 600 2Q20 3Q20 4Q20 1Q21 2Q21 PACE (HTM) Non PACE HTM $3,638 $3,554 $3,447 $3,223 $3,137 3.97% 3.97% 4.04% 3.83% 3.82% 1.00% 3.00% 5.00% 7.00% 1,500 2,000 2,500 3,000 3,500 2Q20 3Q20 4Q20 1Q21 2Q21 Total Loans, net Loan Yield

Investment Securities 11 SECURITIES – BOOK VALUE(1) ($ millions) (1) Securities book value excludes unrealized Available for Sale (AFS) gain / loss on sale (2) MBS/ABS does not include PACE assessments • Investment Securities totaled $2.4 billion book value for 2Q21 • Securities increased $225.6 million in 2Q21 compared to 1Q21 with continued mix shift toward non-agency partially from PACE assessment growth • Non-agency securities in 2Q21 include $545.8 million of PACE assessments, which are non-rated • 84.2% of all non-agency MBS/ABS securities are AAA rated and 99.97% are A rated or higher(2); all CLO’s are AAA rated • As of 2Q21 average subordination for the C&I CLOs is 42.8% 2Q21 HIGHLIGHTS $746 $728 $755 $889 $1,031 $323 $367 $421 $452 $546 $864 $829 $832 $858 $848$1,933 $1,924 $2,008 $2,199 $2,425 2.59% 2.24% 2.21% 2.18% 2.15% -1.00% 1.00% 3.00% 5.00% 7.00% 9.00% - 500 1,000 1,500 2,000 2,500 2Q20 3Q20 4Q20 1Q21 2Q21 Non-Agency PACE Agency Yield

Net Interest Income and Margin 12 NET INTEREST INCOME & MARGIN ($ millions) • Net interest income is $42.0 million, compared to $41.8 million in 1Q21 • 2Q21 NIM at 2.75%; a decrease of 10 bps and 35 bps, compared to 1Q21 and 2Q20, respectively • NIM is negatively impacted by approximately 19 bps due to the high-level of cash on the balance sheet • Loan prepayment penalties favorably impacted NIM by 3 bps in 2Q21, compared to 4 bps and 2 bps in 1Q21 and 2Q20, respectively 2Q21 HIGHLIGHTS $44.4 $45.2 $45.7 $41.8 $42.0 3.10% 2.88% 3.06% 2.85% 2.75% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 25.0 30.0 35.0 40.0 45.0 50.0 2Q20 3Q20 4Q20 1Q21 2Q21 Net Interest Income Net Interest Margin

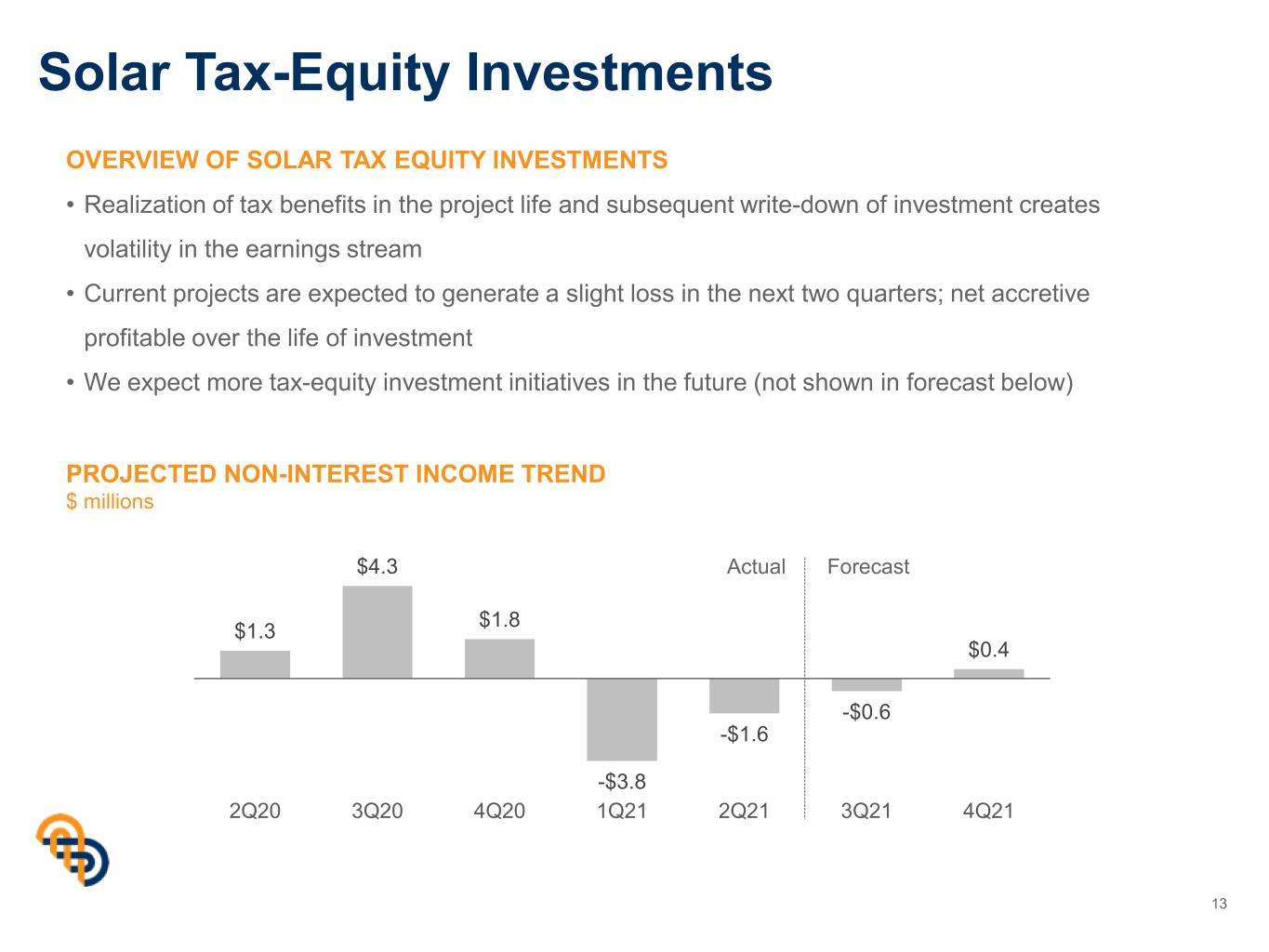

$1.3 $4.3 $1.8 -$3.8 -$1.6 -$0.6 $0.4 (5.0) (3.0) (1.0) 1.0 3.0 5.0 7.0 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Solar Tax-Equity Investments OVERVIEW OF SOLAR TAX EQUITY INVESTMENTS • Realization of tax benefits in the project life and subsequent write-down of investment creates volatility in the earnings stream • Current projects are expected to generate a slight loss in the next two quarters; net accretive profitable over the life of investment • We expect more tax-equity investment initiatives in the future (not shown in forecast below) PROJECTED NON-INTEREST INCOME TREND $ millions 13 Actual Forecast

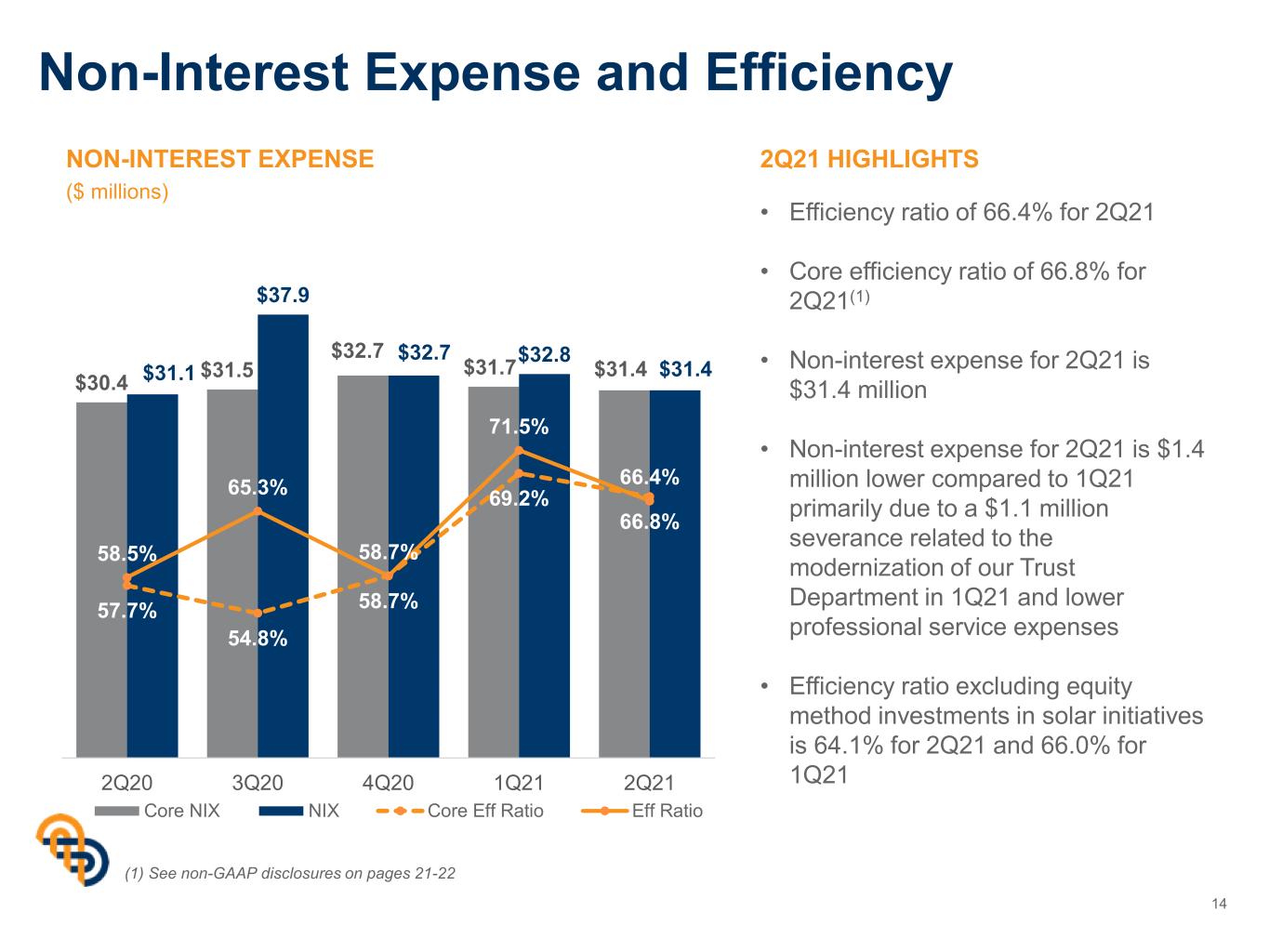

$30.4 $31.5 $32.7 $31.7 $31.4$31.1 $37.9 $32.7 $32.8 $31.4 57.7% 54.8% 58.7% 69.2% 66.8% 58.5% 65.3% 58.7% 71.5% 66.4% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 50.0 2Q20 3Q20 4Q20 1Q21 2Q21 Core NIX NIX Core Eff Ratio Eff Ratio Non-Interest Expense and Efficiency 14 NON-INTEREST EXPENSE ($ millions) • Efficiency ratio of 66.4% for 2Q21 • Core efficiency ratio of 66.8% for 2Q21(1) • Non-interest expense for 2Q21 is $31.4 million • Non-interest expense for 2Q21 is $1.4 million lower compared to 1Q21 primarily due to a $1.1 million severance related to the modernization of our Trust Department in 1Q21 and lower professional service expenses • Efficiency ratio excluding equity method investments in solar initiatives is 64.1% for 2Q21 and 66.0% for 1Q21 2Q21 HIGHLIGHTS (1) See non-GAAP disclosures on pages 21-22

1.36% 1.34% 1.19% 1.13% 1.20% 2Q20 3Q20 4Q20 1Q21 2Q21 Allowance for Loan Losses 15 ALLOWANCE FOR LOAN LOSSES / TOTAL LOANS ALLOWANCE FOR LOAN LOSSES (ALLL) CHANGE FROM 4Q20 TO 2Q21 ($ millions) • Allowance for loan losses totals $38.0 million in 2Q21, or $1.3 million higher compared to 1Q21 primarily due to specific reserves • 2Q21 allowance is $3.6 million lower than 4Q20 due largely to lower loan balances and credit quality improvement 2Q21 HIGHLIGHTS 4Q20 Allowance $41.6 Loan balances (2.4) Changes in credit quality (1.9) Qualitative factors (0.6) 1Q21 Allowance $36.7 Specific reserves 1.4 Changes in credit quality 0.6 Charge-offs 0.3 Loan balances (1.0) 2Q21 Allowance $38.0

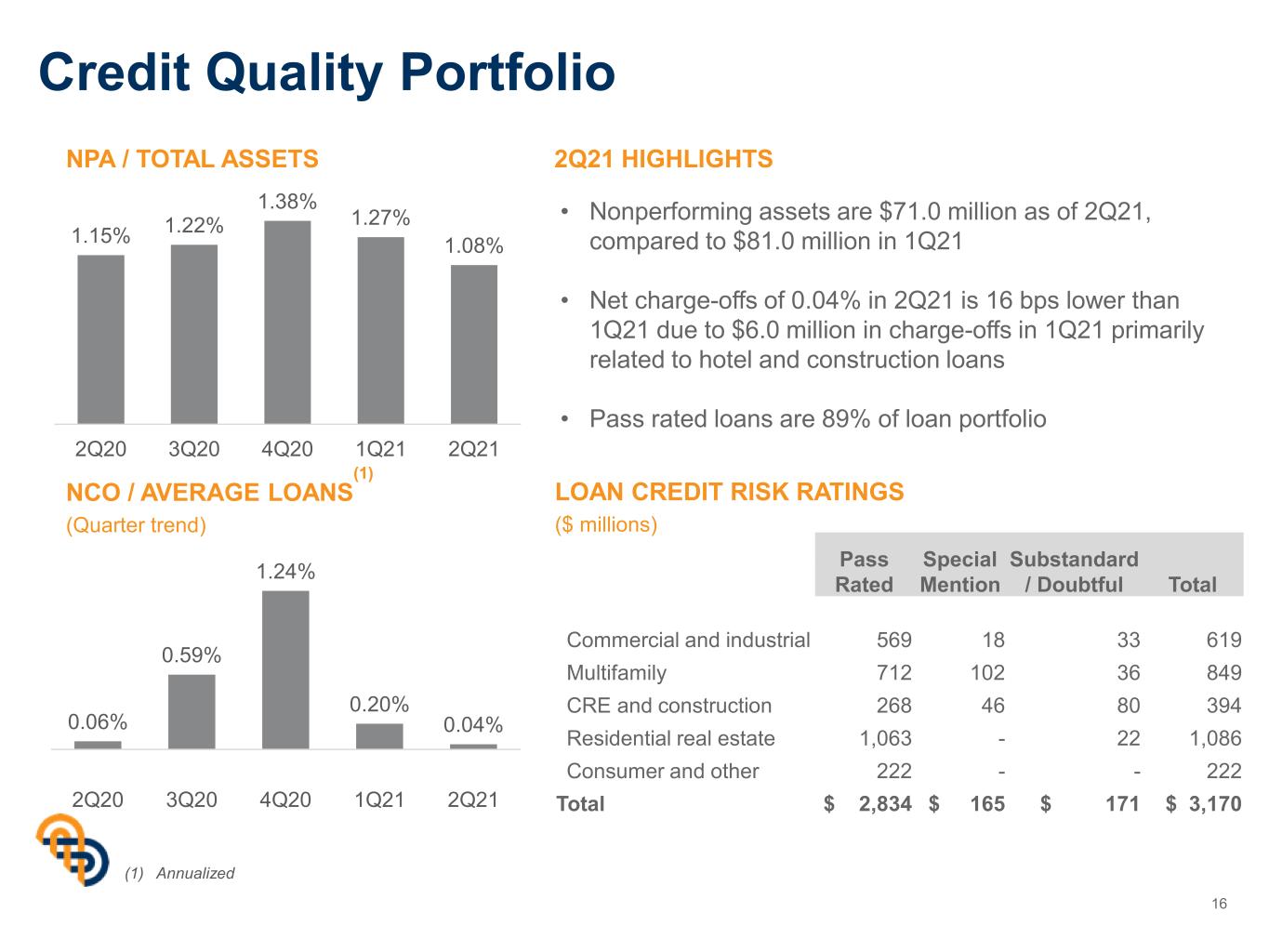

0.06% 0.59% 1.24% 0.20% 0.04% 2Q20 3Q20 4Q20 1Q21 2Q21 1.15% 1.22% 1.38% 1.27% 1.08% 2Q20 3Q20 4Q20 1Q21 2Q21 Credit Quality Portfolio 16 NPA / TOTAL ASSETS NCO / AVERAGE LOANS (1) (Quarter trend) 2Q21 HIGHLIGHTS • Nonperforming assets are $71.0 million as of 2Q21, compared to $81.0 million in 1Q21 • Net charge-offs of 0.04% in 2Q21 is 16 bps lower than 1Q21 due to $6.0 million in charge-offs in 1Q21 primarily related to hotel and construction loans • Pass rated loans are 89% of loan portfolio (1) Annualized LOAN CREDIT RISK RATINGS ($ millions) Pass Rated Special Mention Substandard / Doubtful Total Commercial and industrial 569 18 33 619 Multifamily 712 102 36 849 CRE and construction 268 46 80 394 Residential real estate 1,063 - 22 1,086 Consumer and other 222 - - 222 Total $ 2,834 $ 165 $ 171 $ 3,170

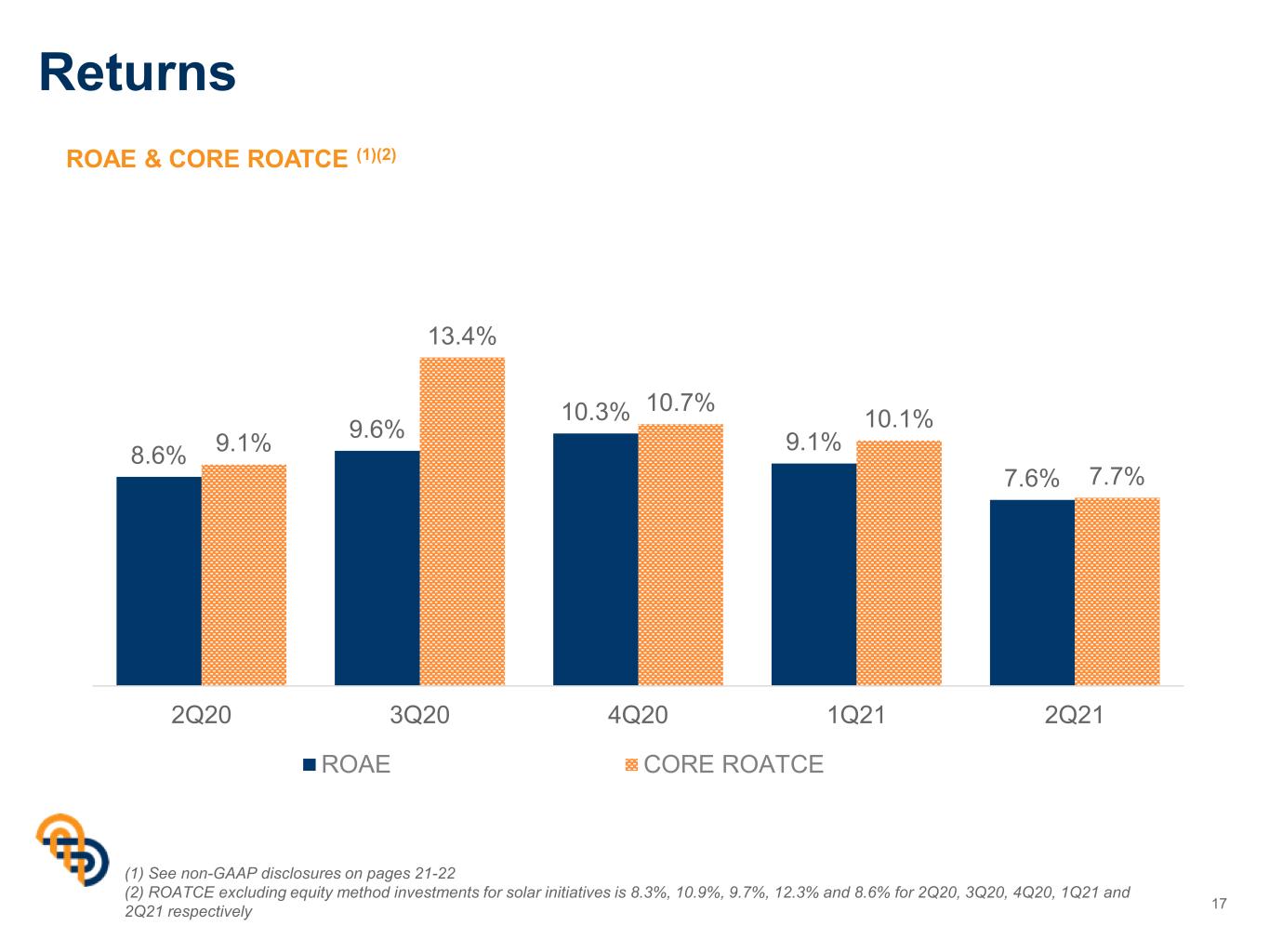

Returns 17 (1) See non-GAAP disclosures on pages 21-22 (2) ROATCE excluding equity method investments for solar initiatives is 8.3%, 10.9%, 9.7%, 12.3% and 8.6% for 2Q20, 3Q20, 4Q20, 1Q21 and 2Q21 respectively ROAE & CORE ROATCE (1)(2) 8.6% 9.6% 10.3% 9.1% 7.6% 9.1% 13.4% 10.7% 10.1% 7.7% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 2Q20 3Q20 4Q20 1Q21 2Q21 ROAE CORE ROATCE

Capital 18 TIER 1 LEVERAGE RATIO COMMON EQUITY TIER 1 RATIO • Regulatory capital ratios remain strong • Tier 1 leverage ratio of 7.93% as of 2Q21 • Common Equity Tier 1 Capital of 13.63% • Tier 1 leverage ratio is 11 bps lower due to approximately $190 million in excess cash from strong deposit growth and 2bps lower due to cumulative effect of equity method investments for solar initiatives 2Q21 HIGHLIGHTS 7.69% 7.39% 7.97% 8.06% 7.93% 2Q20 3Q20 4Q20 1Q21 2Q21 12.32% 12.76% 13.11% 13.70% 13.63% 2Q20 3Q20 4Q20 1Q21 2Q21

2021 Guidance 19 2021 FINANCIAL OUTLOOK • Core Pre-tax pre-provision earnings of $66 million to $72 million • Excludes impact of solar tax equity income/(loss) and any future non-core items • Net Interest Income of $168 million to $174 million • No change in Fed rate targets

Appendix

Reconciliation of Non-GAAP Financials 21 As of and for the Three Months Ended As of and for the Six Months Ended (in thousands) June 30, 2021 March 31, 2021 June 30, 2020 June 30, 2021 June 30, 2020 Core operating revenue Net Interest income $ 41,991 $ 41,844 $ 44,439 $ 83,836 $ 89,127 Non-interest income 5,327 4,000 8,671 9,327 17,789 Less: Branch sale loss (gain) (1) - - 34 - (1,394) Less: Securities gain, net (321) (18) (486) (339) (985) Core operating revenue $ 46,997 $ 45,826 $ 52,658 $ 92,824 $ 104,537 Core non-interest expense Non-interest expense $ 31,395 $ 32,793 $ 31,068 $ 64,189 $ 63,339 Less: Branch closure expense (2) - - (695) - (2,051) Less: Severance (3) - (1,090) - (1,090) (76) Core non-interest expense $ 31,395 $ 31,703 $ 30,373 $ 63,099 $ 61,212 Core net income Net Income (GAAP) $ 10,408 $ 12,189 $ 10,374 $ 22,598 $ 19,919 Less: Branch sale (gain) (1) - - 34 - (1,394) Less: Securities loss (gain) (321) (18) (486) (339) (985) Add: Branch closure expense (2) - - 695 - 2,051 Add: Severance (3) - 1,090 - 1,090 76 Less: Tax on notable items 86 (271) (61) (196) 64 Core net income (non-GAAP) $ 10,173 $ 12,990 $ 10,556 $ 23,153 $ 19,731 (1) Fixed Asset branch sale in March 2020 (2) Occupancy and other expense related to closure of branches during our branch rationalization (3) Salary and COBRA expense reimbursement expense for positions eliminated

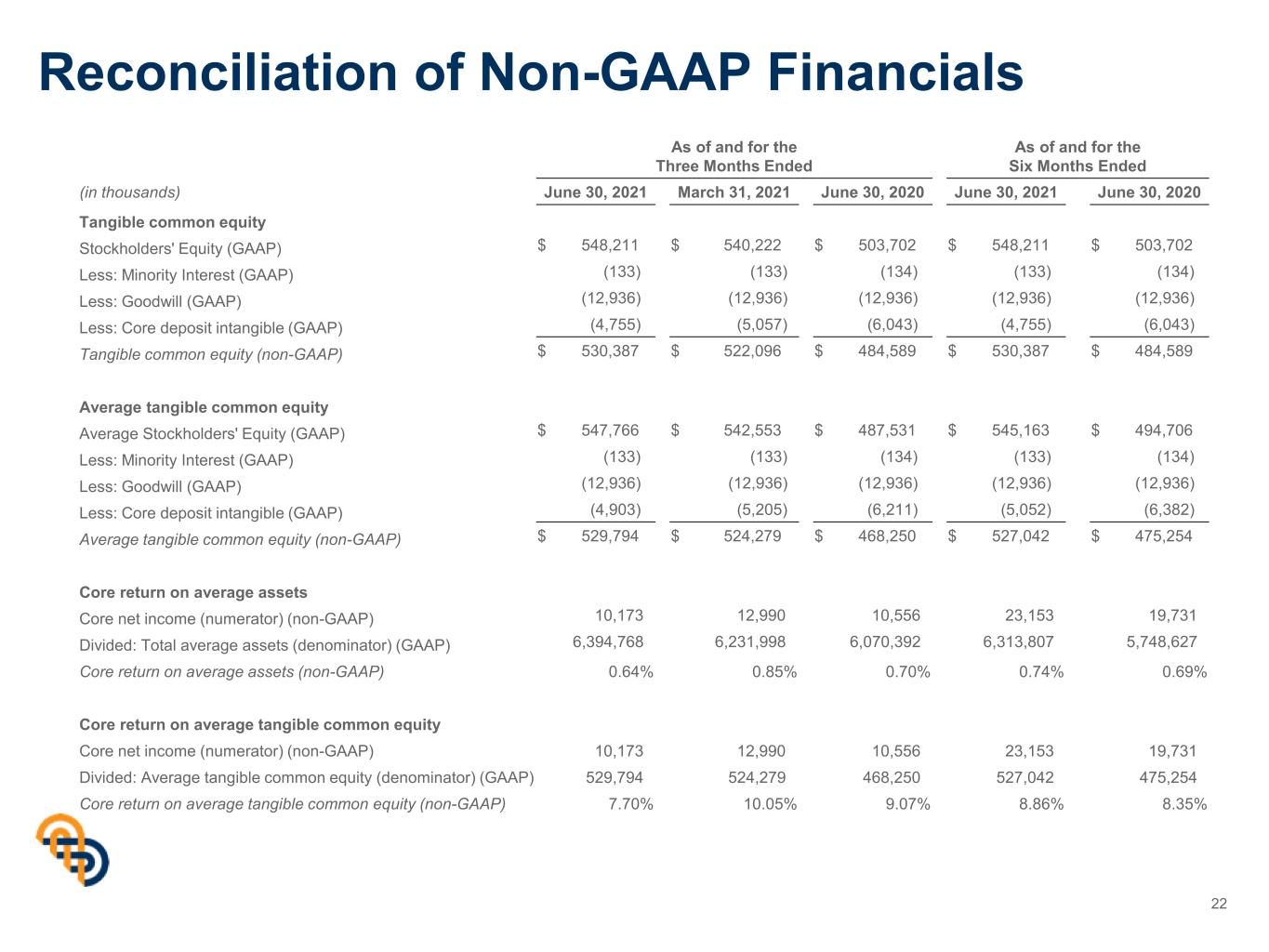

Reconciliation of Non-GAAP Financials 22 As of and for the Three Months Ended As of and for the Six Months Ended (in thousands) June 30, 2021 March 31, 2021 June 30, 2020 June 30, 2021 June 30, 2020 Tangible common equity Stockholders' Equity (GAAP) $ 548,211 $ 540,222 $ 503,702 $ 548,211 $ 503,702 Less: Minority Interest (GAAP) (133) (133) (134) (133) (134) Less: Goodwill (GAAP) (12,936) (12,936) (12,936) (12,936) (12,936) Less: Core deposit intangible (GAAP) (4,755) (5,057) (6,043) (4,755) (6,043) Tangible common equity (non-GAAP) $ 530,387 $ 522,096 $ 484,589 $ 530,387 $ 484,589 Average tangible common equity Average Stockholders' Equity (GAAP) $ 547,766 $ 542,553 $ 487,531 $ 545,163 $ 494,706 Less: Minority Interest (GAAP) (133) (133) (134) (133) (134) Less: Goodwill (GAAP) (12,936) (12,936) (12,936) (12,936) (12,936) Less: Core deposit intangible (GAAP) (4,903) (5,205) (6,211) (5,052) (6,382) Average tangible common equity (non-GAAP) $ 529,794 $ 524,279 $ 468,250 $ 527,042 $ 475,254 Core return on average assets Core net income (numerator) (non-GAAP) 10,173 12,990 10,556 23,153 19,731 Divided: Total average assets (denominator) (GAAP) 6,394,768 6,231,998 6,070,392 6,313,807 5,748,627 Core return on average assets (non-GAAP) 0.64% 0.85% 0.70% 0.74% 0.69% Core return on average tangible common equity Core net income (numerator) (non-GAAP) 10,173 12,990 10,556 23,153 19,731 Divided: Average tangible common equity (denominator) (GAAP) 529,794 524,279 468,250 527,042 475,254 Core return on average tangible common equity (non-GAAP) 7.70% 10.05% 9.07% 8.86% 8.35%

Thank You amalgamatedbank.com Member FDIC