Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ALLIANCE DATA SYSTEMS CORP | exhibit_99-1.htm |

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

Alliance DataSecond Quarter 2021 Results Perry BebermanEVP & CFO © 2021 ADS Alliance Data Systems,

Inc. July 29, 2021 Ralph AndrettaPresident & CEO Exhibit 99.2

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as "believe," "expect," "anticipate," "estimate,"

"intend," "project," "plan," "likely," "may," "should" or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements.

Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results, initiation or completion of strategic initiatives

including the proposed spinoff of our LoyaltyOne segment, future dividend declarations, and future economic conditions, including, but not limited to, fluctuation in currency exchange rates, market conditions and COVID-19 impacts related to

relief measures for impacted borrowers and depositors, labor shortages due to quarantine, reduction in demand from clients, supply chain disruption for our reward suppliers and disruptions in the airline or travel industries.We believe that our

expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated results or other

expectations expressed in this release, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors section in our

Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak only

as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated

circumstances or otherwise. 2 Forward-Looking Statements

Continued progress on strategic initiativesBread’s strategic relationship with Fiserv active as of June

30New partner signings, renewals, and strong pipelineModernization and efficiency initiatives on schedule 1 Inflection point for receivables growthCredit sales returned to pre-pandemic levelsImproving consumer confidence and mobility Closely

monitoring COVID conditions 2 Credit performance remains strongReflective of disciplined risk managementPayment rates remain elevated benefiting from economic stimulus 3 Second Quarter 2021 Key Takeaways 3

Second Quarter 2021 Financial Highlights 4 Revenue increased 3% year-over-year, while total expenses

excluding provision for loan loss declined 4%Net Income of $273 million includes a net reserve release of $208 millionCredit sales of $7.4 billion were up 54% year-over-year and up 22% compared to 1Q21Average receivables were down 5%

year-over-year Credit metrics remained strong with a net loss rate of 5.1% for the quarter $1.0B Revenue $273MM Net Income $5.47 Diluted EPS

Strategic Initiatives Update 5

Card Services Brand Partner Highlights 6 Select New Bread Direct Acquisition Partners Select New

Brand Partners Brand Partner Renewals

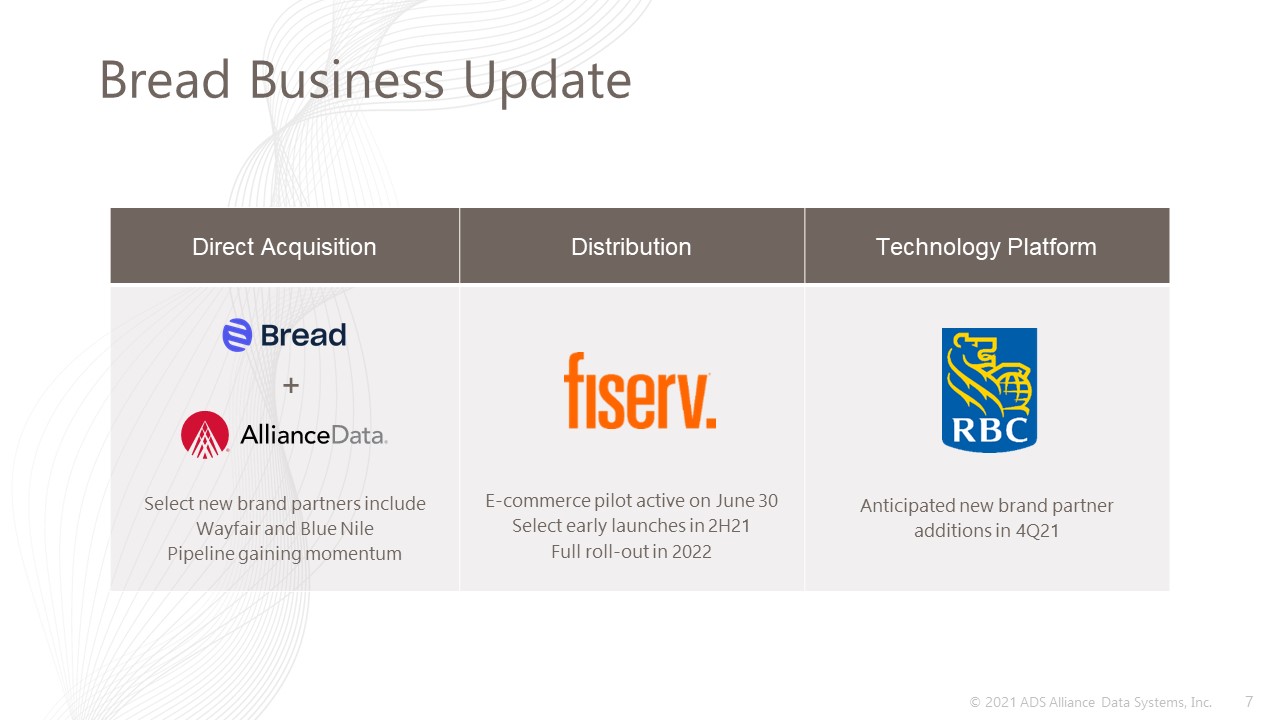

Direct Acquisition Distribution Technology Platform Select new brand partners include Wayfair and Blue

NilePipeline gaining momentum E-commerce pilot active on June 30Select early launches in 2H21 Full roll-out in 2022 Anticipated new brand partner additions in 4Q21 Bread Business Update 7 +

LoyaltyOne® Performance Highlights 8 AIR MILES® reward miles issued and redeemed increased versus 2Q20 as

airline bookings improved and merchandise redemptions remained strongAIR MILES is working with travel partners to offer promotions and redemptions to drive increased Collector travel and tourism as appropriate, leading to optimism in the latter

half of 2021July to-date average daily flight bookings are currently 10x the 1Q21 level, yet remain at 60% - 70% of the pre-pandemic level BrandLoyalty’s new program activity is gaining momentum with a strong pipeline of clients in the second

half of 2021Consumers are actively engaged in loyalty campaigns with particular success in products focused on the home

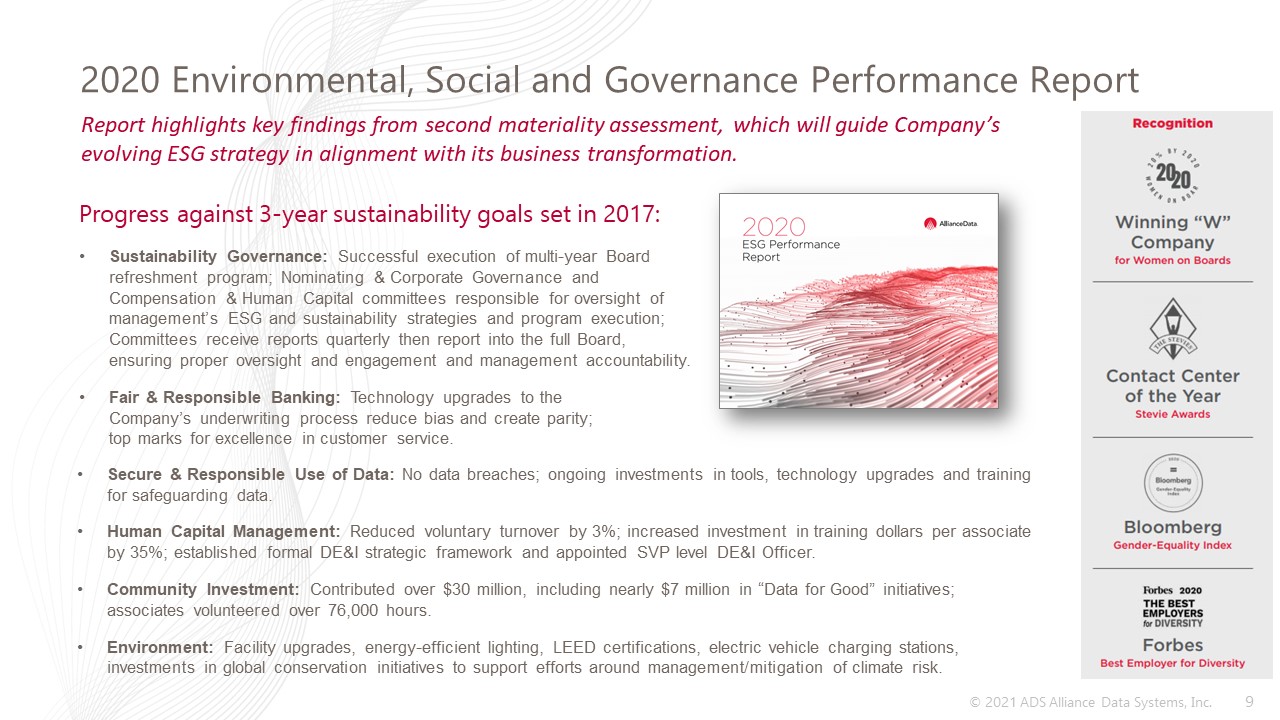

2020 Environmental, Social and Governance Performance Report 9 Report highlights key findings from second

materiality assessment, which will guide Company’s evolving ESG strategy in alignment with its business transformation. Secure & Responsible Use of Data: No data breaches; ongoing investments in tools, technology upgrades and training for

safeguarding data.Human Capital Management: Reduced voluntary turnover by 3%; increased investment in training dollars per associate by 35%; established formal DE&I strategic framework and appointed SVP level DE&I Officer.Community

Investment: Contributed over $30 million, including nearly $7 million in “Data for Good” initiatives; associates volunteered over 76,000 hours. Environment: Facility upgrades, energy-efficient lighting, LEED certifications, electric vehicle

charging stations, investments in global conservation initiatives to support efforts around management/mitigation of climate risk. Sustainability Governance: Successful execution of multi-year Board refreshment program; Nominating &

Corporate Governance and Compensation & Human Capital committees responsible for oversight of management’s ESG and sustainability strategies and program execution; Committees receive reports quarterly then report into the full Board, ensuring

proper oversight and engagement and management accountability.Fair & Responsible Banking: Technology upgrades to the Company’s underwriting process reduce bias and create parity; top marks for excellence in customer service. Progress against

3-year sustainability goals set in 2017:

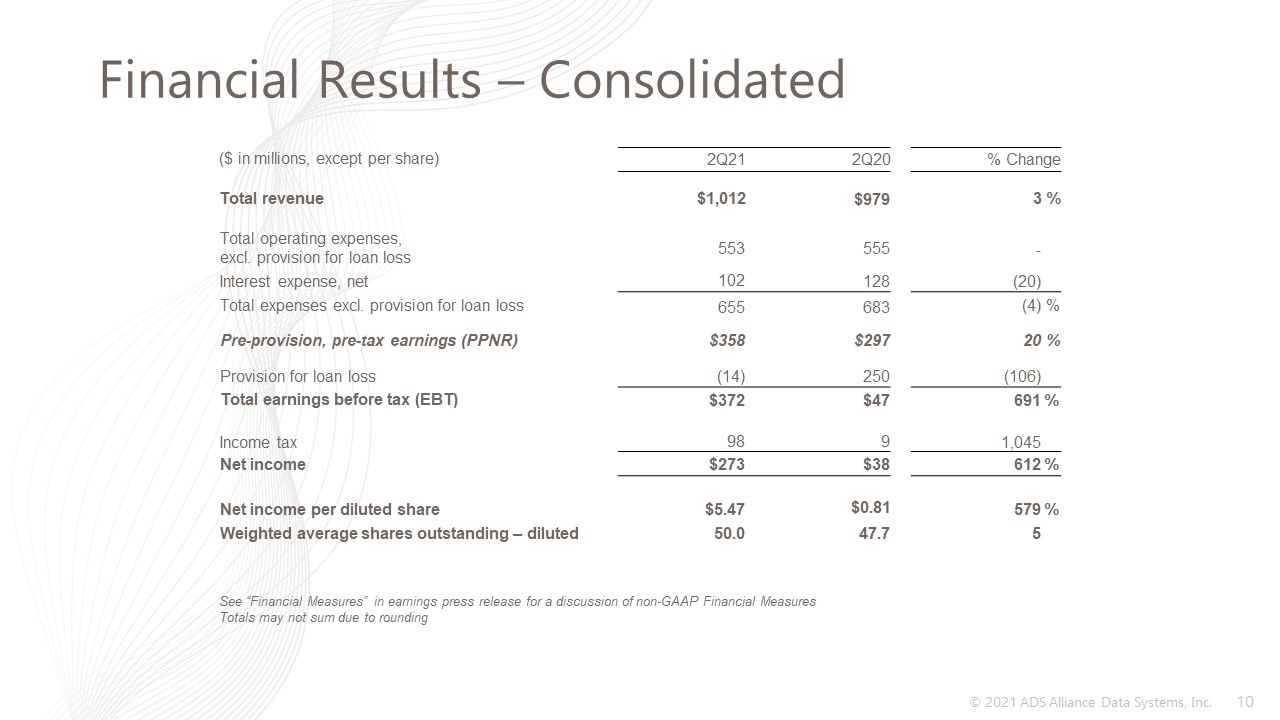

Financial Results – Consolidated 10 ($ in millions, except per share) 2Q21 2Q20 % Change Total

revenue $1,012 $979 3 % Total operating expenses, excl. provision for loan loss 553 555 - Interest expense, net 102 128 (20) Total expenses excl. provision for loan

loss 655 683 (4) % Pre-provision, pre-tax earnings (PPNR) $358 $297 20 % Provision for loan loss (14) 250 (106) Total earnings before tax (EBT) $372 $47 691 % Income tax 98 9

1,045 Net income $273 $38 612 % Net income per diluted share $5.47 $0.81 579 % Weighted average shares outstanding – diluted 50.0 47.7 5 See “Financial Measures” in earnings press release for

a discussion of non-GAAP Financial MeasuresTotals may not sum due to rounding

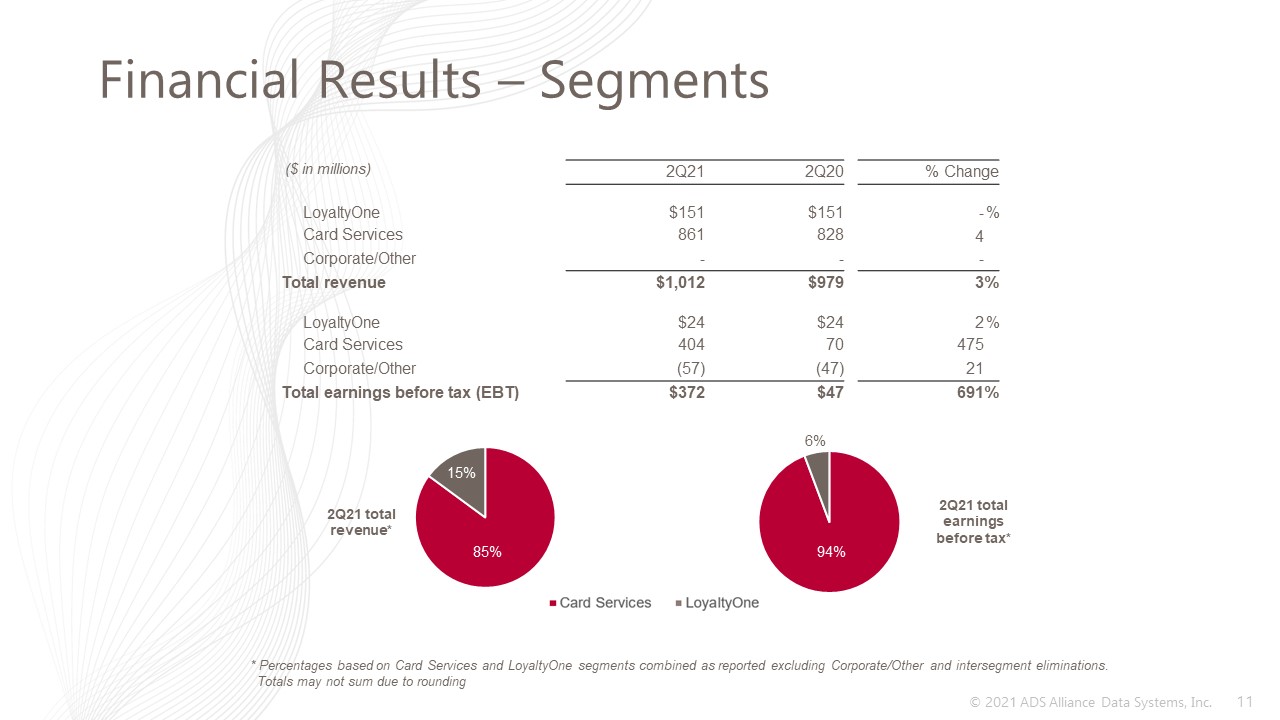

Financial Results – Segments 11 2Q21 total revenue* 2Q21 total earnings before tax* * Percentages

based on Card Services and LoyaltyOne segments combined as reported excluding Corporate/Other and intersegment eliminations. Totals may not sum due to rounding ($ in millions) 2Q21 2Q20 % Change LoyaltyOne $151 $151 - % Card

Services 861 828 4 Corporate/Other - - - Total revenue $1,012 $979 3 % LoyaltyOne $24 $24 2 % Card Services 404 70 475 Corporate/Other (57) (47) 21 Total earnings before tax

(EBT) $372 $47 691 %

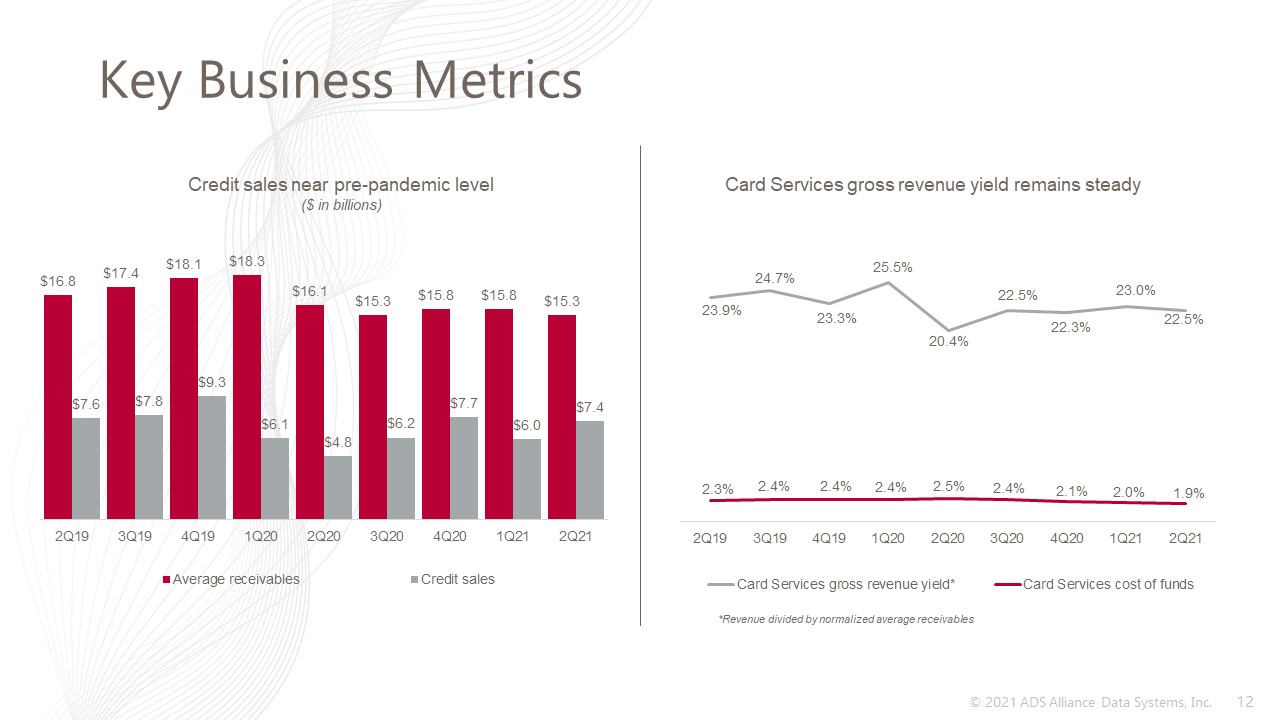

Key Business Metrics 12 Card Services gross revenue yield remains steady Credit sales near pre-pandemic

level($ in billions) *Revenue divided by normalized average receivables

Credit Quality and Allowance 13 Reserve rate ($ in Millions) Net loss rate Delinquency rate 5 year Max

rate: 7.6% 5 year Min rate: 4.7% 5 year Avg rate: ~6.0% Historic quarterly range for the last five years * Net loss rate impacted by pandemic-related consumer relief program. ** Calculated as a percentage of allowance for loan loss to end of

period credit card and loan receivables Revolving Credit Risk Distribution _____________________EOP receivables: $19,463 ALLL balance: $1,815Reserve rate: 9.3% CECL Day 1: 1/1/20

Full Year 2020Actuals Full Year 2021Outlook Commentary Average receivables $16,367 million Down

mid-single-digits Flat year-over-year in 2H21Expect year-end receivables to be in line with year-end 2020Credit sales up double-digits in 2021 Total revenue$4,521 million Down low-single-digits LoyaltyOne full year revenue growth in 20211Q21

Card Services revenue suppressed with receivable balances rebuilding from pandemic-related reductionsCard Services gross revenue yield remains steady Total expenses*(Excludes provision for loan loss)$2,861 million Flat Includes accelerated

digital investment and an increase in marketing spend from depressed levels in 2020Impacted by Bread® & Fiserv investment transition expenses Net loss rate2020 = 6.6% Net loss rate in the low 5% range 2021 Financial Outlook 14 * Total

expenses represent total operating expenses excluding provision for loan loss plus total interest expense, net

In addition to the results presented in accordance with generally accepted accounting principles, or GAAP,

the Company may present financial measures that are non-GAAP measures, such as pre-provision earnings before taxes, adjusted EBITDA, adjusted EBITDA, net of funding costs, core earnings and core earnings per diluted share (core EPS). Adjusted

EBITDA eliminates the uneven effect across all reportable segments of non-cash depreciation of tangible assets and amortization of intangible assets, including certain intangible assets that were recognized in business combinations, and the

non-cash effect of stock compensation expense. In addition, adjusted EBITDA eliminates the effect of the strategic transaction costs, asset impairments, and restructuring and other charges. Adjusted EBITDA, net is equal to adjusted EBITDA less

securitization funding costs and interest expense on deposits. Similarly, core earnings and core EPS eliminate non-cash or non-operating items, including, but not limited to, stock compensation expense, amortization of purchased intangibles,

non-cash interest, strategic transaction costs, asset impairments, and restructuring and other charges. The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the Company’s reported GAAP results,

provide useful information to investors regarding the Company’s performance and overall results of operations. 15 Financial Measures

Appendix

Key Business Metrics 17 2Q21 2Q20 2Q21 vs 1Q21 2Q21 vs 2Q20 1Q21 LoyaltyOne (in

millions) AIR MILES reward miles issued 1,139 1,053 8% 1,112 2% AIR MILES reward miles redeemed 800 608 32% 739 8% Card Services ($ in millions) Credit

sales $7,401 $4,799 54% $6,043 22% Average receivables $15,282 $16,116 (5)% $15,785 (3)% Normalized average receivables* $15,282 $16,204 (6)% $15,785 (3)% End of period

receivables $15,724 $15,809 (1)% $15,537 1% Total gross revenue yield %** 22.5% 20.4% 2.1% 23.0% (0.5)% Cost of funds 1.9% 2.5% (0.6)% 2.0% (0.1)% Principal loss rate 5.1% 7.6% (2.5)% 5.0% 0.1% Reserve

rate 10.4% 13.3% (2.9)% 11.9% (1.5)% Delinquency rate 3.3% 4.3% (1.0)% 3.8% (0.5)% Return on equity 36% 15% 21% 27% 9% *Normalized average receivables includes held-for-sale receivables**Revenue divided by normalized

average receivables

Key Business Metrics – Quarterly 18 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 LoyaltyOne

(in millions) AIR MILES reward miles issued 1,423 1,344 1,486 1,316 1,053 1,240 1,355 1,112 1,139 AIR MILES reward miles redeemed 1,050 1,078 1,199 994 608 687 838 739 800 Card

Services ($ in millions) Credit sales $7,551 $7,824 $9,297 $6,099 $4,799 $6,152 $7,657 $6,043 $7,401 Average receivables $16,798 $17,449 $18,096 $18,294 $16,116 $15,300 $15,759 $15,785 $15,282 Normalized

average receivables* $18,335 $19,299 $19,368 $18,553 $16,204 $15,356 $15,759 $15,785 $15,282 End of period receivables $17,615 $17,928 $19,463 $17,732 $15,809 $15,599 $16,784 $15,537 $15,724 Total gross revenue yield

%** 23.9% 24.7% 23.3% 25.5% 20.4% 22.5% 22.3% 23.0% 22.5% Cost of funds 2.3% 2.4% 2.4% 2.4% 2.5% 2.4% 2.1% 2.0% 1.9% Principal loss rate 6.1% 5.6% 6.3% 7.0% 7.6% 5.8% 6.0% 5.0% 5.1% Reserve

rate 5.7% 5.9% 6.0% 12.1% 13.3% 13.3% 12.0% 11.9% 10.4% Delinquency rate 5.2% 5.9% 5.8% 6.0% 4.3% 4.7% 4.4% 3.8% 3.3% Return on equity 31% 28% 23% 18% 15% 14% 16% 27% 36% *Normalized average receivables includes

held-for-sale receivables**Revenue divided by normalized average receivables

Financial Results – Quarterly 19 ($ in millions, except per

share) 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Total revenue $1,348 1,438 $1,461 $1,382 $979 $1,050 $1,110 $1,085 $1,012 Total operating expenses, excl. provision for loan loss 754 836 771 562

555 552 699 548 553 Interest expense, net 143 140 142 139 128 115 113 109 102 Total expenses excl. provision for loan loss 897 976 913 701 683 667 812 657 655 Pre-provision, pre-tax earnings

(PPNR) $451 $462 $548 $681 $297 $384 $299 $428 $358 Provision for loan loss 257 297 381 656 250 208 152 33 (14) Total earnings before tax (EBT) $194 $164 $167 $25 $47 $176 $146 $394

$372 Income tax 51 43 37 (5) 9 43 53 108 98 Income from continuing operations $142 $122 $130 $30 $38 $133 $93 $286 $273 Income from continuing operations per diluted

share $2.71 $2.41 $2.74 $0.63 $0.81 $2.79 $1.93 $5.74 $5.47 Weighted average shares outstanding –

diluted 52.6 50.4 47.6 47.7 47.7 47.8 48.4 49.8 50.0 ************************************************************************************************************************************************************************************************** (Including

discontinued operations) Net income (loss) $139 $(108) $98 $30 $38 $133 $12 $286 $273 Net income (loss) per diluted share $2.64 $(2.13) $2.05 $0.63 $0.81 $2.79 $0.25 $5.74 $5.47 See “Financial Measures” in

earnings press release for a discussion of non-GAAP Financial MeasuresTotals may not sum due to rounding

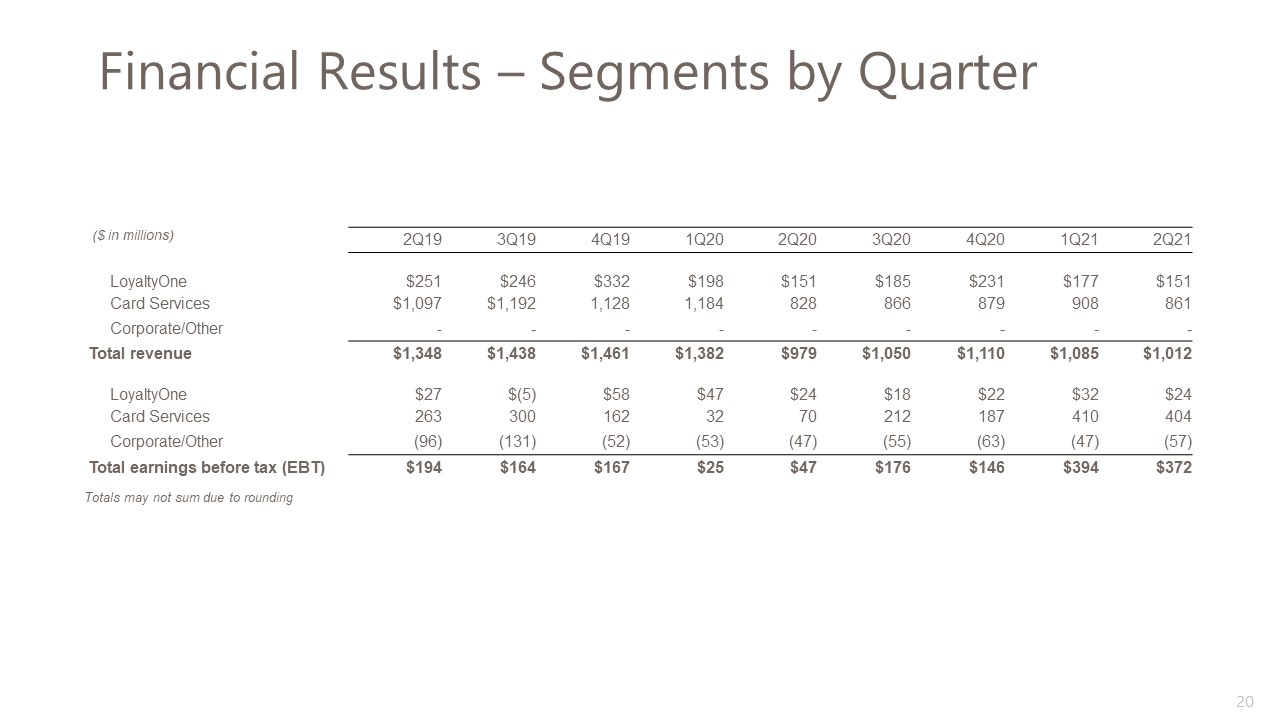

Financial Results – Segments by Quarter 20 ($ in

millions) 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 LoyaltyOne $251 $246 $332 $198 $151 $185 $231 $177 $151 Card Services $1,097 $1,192 1,128 1,184 828 866 879 908 861

Corporate/Other - - - - - - - - - Total revenue $1,348 $1,438 $1,461 $1,382 $979 $1,050 $1,110 $1,085 $1,012 LoyaltyOne $27 $(5) $58 $47 $24 $18 $22 $32 $24 Card

Services 263 300 162 32 70 212 187 410 404 Corporate/Other (96) (131) (52) (53) (47) (55) (63) (47) (57) Total earnings before tax (EBT) $194 $164 $167 $25 $47 $176 $146 $394 $372 Totals may not sum due to rounding

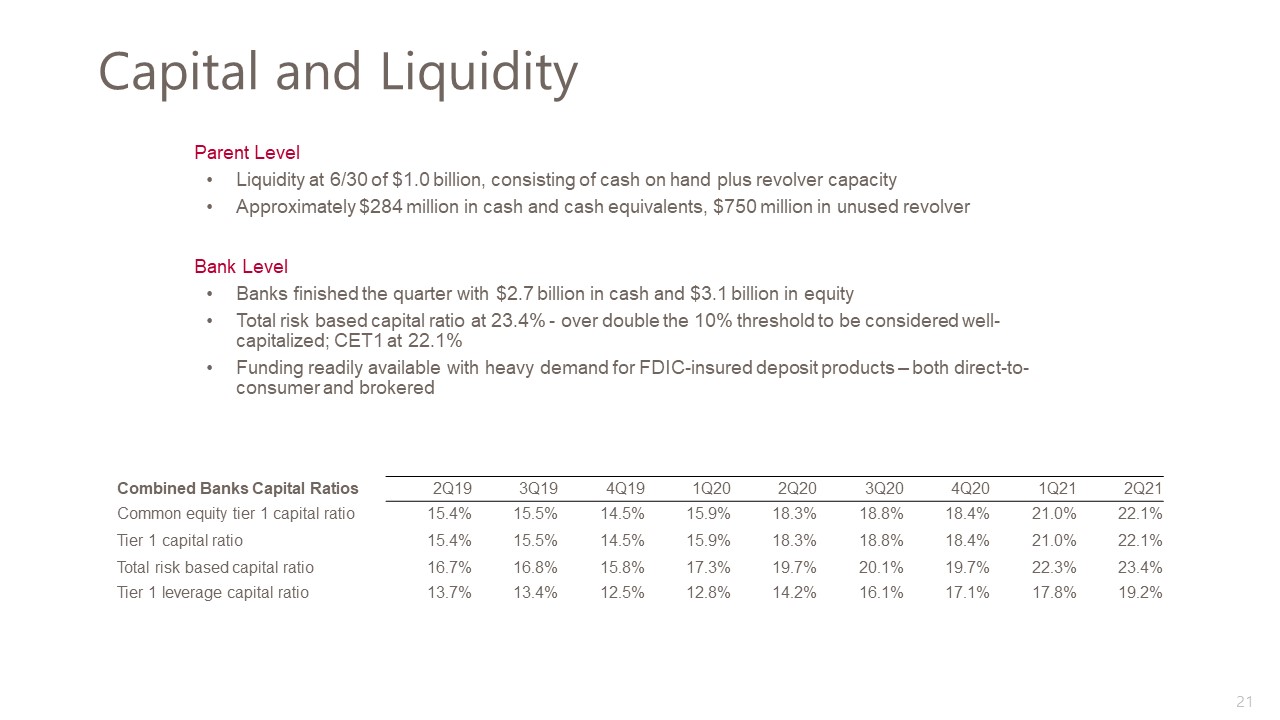

Capital and Liquidity 21 Combined Banks Capital

Ratios 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Common equity tier 1 capital ratio 15.4% 15.5% 14.5% 15.9% 18.3% 18.8% 18.4% 21.0% 22.1% Tier 1 capital

ratio 15.4% 15.5% 14.5% 15.9% 18.3% 18.8% 18.4% 21.0% 22.1% Total risk based capital ratio 16.7% 16.8% 15.8% 17.3% 19.7% 20.1% 19.7% 22.3% 23.4% Tier 1 leverage capital

ratio 13.7% 13.4% 12.5% 12.8% 14.2% 16.1% 17.1% 17.8% 19.2% Parent Level Liquidity at 6/30 of $1.0 billion, consisting of cash on hand plus revolver capacity Approximately $284 million in cash and cash equivalents, $750 million in

unused revolverBank LevelBanks finished the quarter with $2.7 billion in cash and $3.1 billion in equityTotal risk based capital ratio at 23.4% - over double the 10% threshold to be considered well-capitalized; CET1 at 22.1%Funding readily

available with heavy demand for FDIC-insured deposit products – both direct-to-consumer and brokered

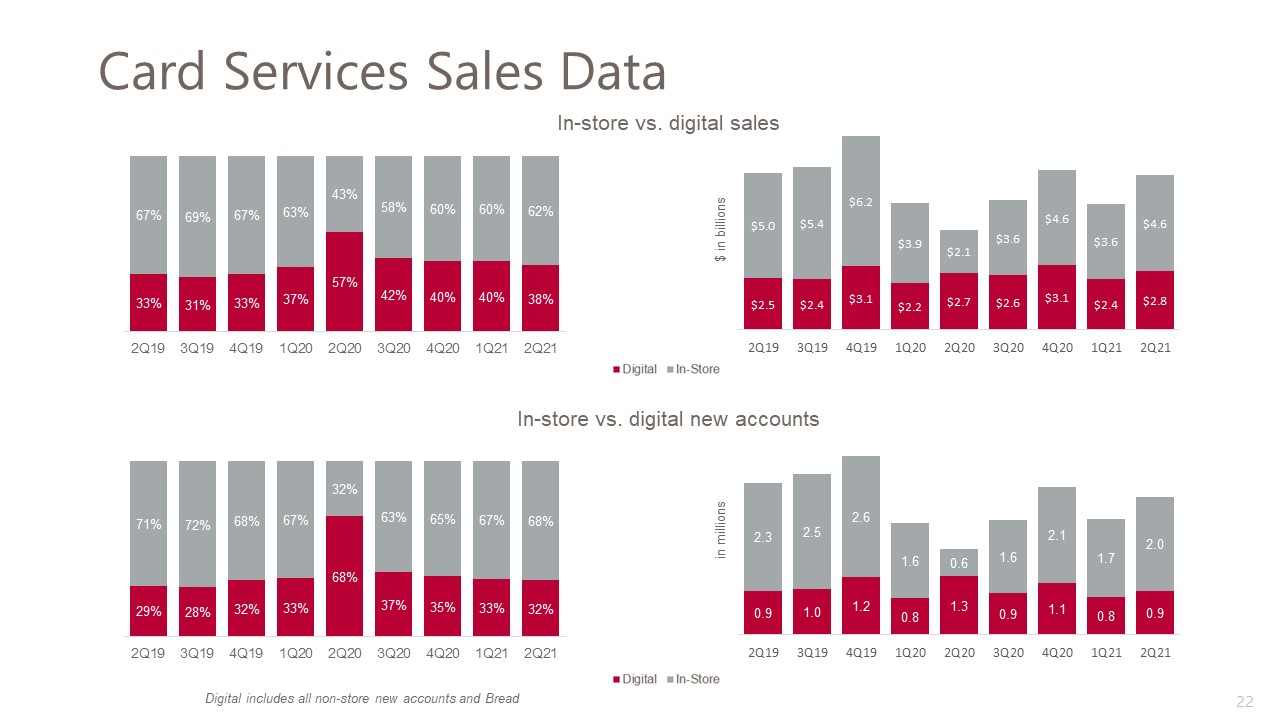

Card Services Sales Data 22 In-store vs. digital sales Digital includes all non-store new accounts and

Bread $ in billions In-store vs. digital new accounts in millions

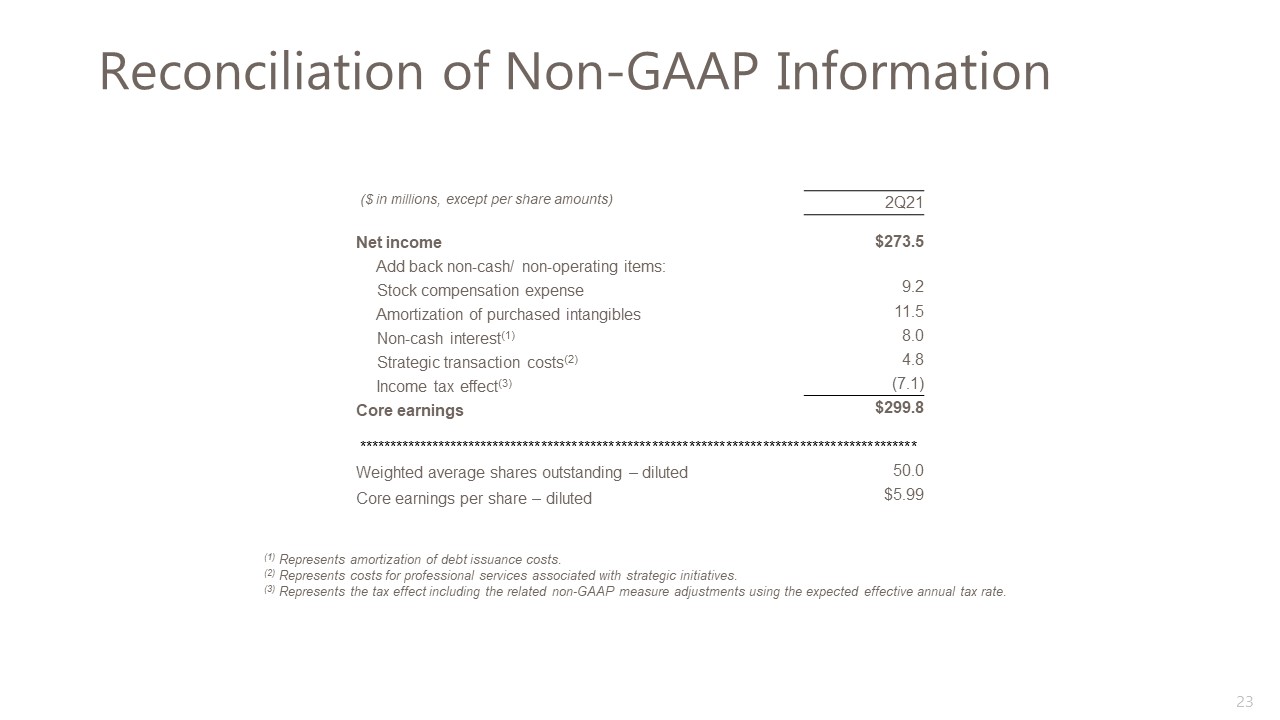

Reconciliation of Non-GAAP Information 23 (1) Represents amortization of debt issuance costs.(2)

Represents costs for professional services associated with strategic initiatives.(3) Represents the tax effect including the related non-GAAP measure adjustments using the expected effective annual tax rate. ($ in millions, except per share

amounts) 2Q21 Net income $273.5 Add back non-cash/ non-operating items: Stock compensation expense 9.2 Amortization of purchased intangibles 11.5 Non-cash interest(1) 8.0 Strategic transaction costs(2) 4.8 Income tax

effect(3) (7.1) Core earnings $299.8 ******************************************************************************************* Weighted average shares outstanding – diluted 50.0 Core earnings per share – diluted $5.99

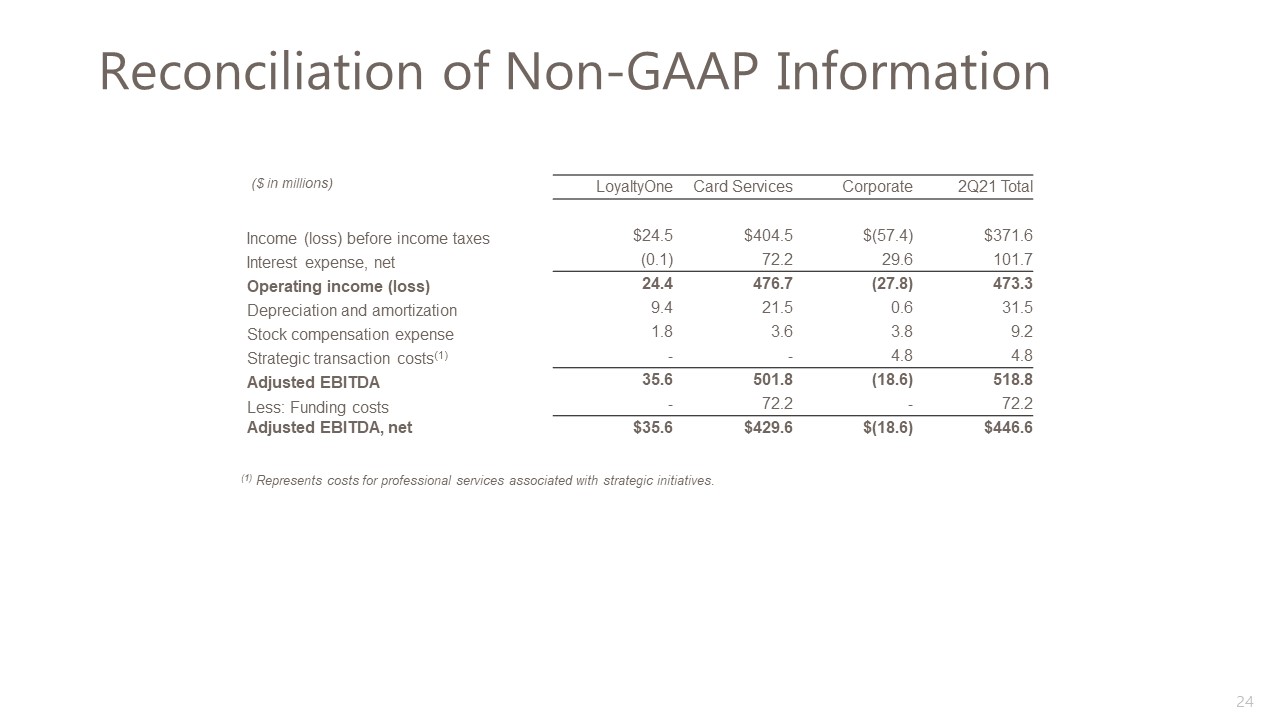

Reconciliation of Non-GAAP Information 24 (1) Represents costs for professional services associated with

strategic initiatives. ($ in millions) LoyaltyOne Card Services Corporate 2Q21 Total Income (loss) before income taxes $24.5 $404.5 $(57.4) $371.6 Interest expense, net (0.1) 72.2 29.6 101.7 Operating income

(loss) 24.4 476.7 (27.8) 473.3 Depreciation and amortization 9.4 21.5 0.6 31.5 Stock compensation expense 1.8 3.6 3.8 9.2 Strategic transaction costs(1) - - 4.8 4.8 Adjusted EBITDA 35.6 501.8 (18.6) 518.8 Less: Funding

costs - 72.2 - 72.2 Adjusted EBITDA, net $35.6 $429.6 $(18.6) $446.6

25 Alliance Data announces spinoff of the LoyaltyOne Segment Proposed spinoff is expected to be tax-free

and will create two independent, publicly traded companies Rationale Leadership Timing Aligns with our strategic transformation to deliver long-term, sustainable growthPositions both companies to invest more deeply in their unique

growth opportunitiesTransaction expected to strengthen Alliance Data’s balance sheet and improve key ratiosCreates standalone data-driven, tech-enabled loyalty solutions provider, “Spinco” Ralph Andretta will remain president and CEO of Alliance

DataCharles Horn will continue to lead LoyaltyOne and will be named President and CEO of SpincoBoard of Directors will be established for Spinco and announced in the coming monthsNo resulting change to Alliance Data Board of Directors Announced

on May 12, 2021Spinoff is expected to be completed in Q4 2021, subject to market conditions and satisfaction of regulatory requirements Spinco will raise debt capital and distribute the funds to Alliance Data for corporate debt reduction as part

of the spinAlliance Data retains ~19% non-controlling interest in Spinco, with the intent to monetize that stake as appropriate for Alliance Data corporate debt reduction4.75% Senior Notes due 2024 & 7.00% Senior Notes due 2026 to remain with

Alliance Data Balance Sheet