Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - STIFEL FINANCIAL CORP | d207516dex992.htm |

| EX-99.1 - EX-99.1 - STIFEL FINANCIAL CORP | d207516dex991.htm |

| 8-K - 8-K - STIFEL FINANCIAL CORP | d207516d8k.htm |

2nd Quarter 2021 Financial Results Presentation July 28, 2021 Exhibit 99.3

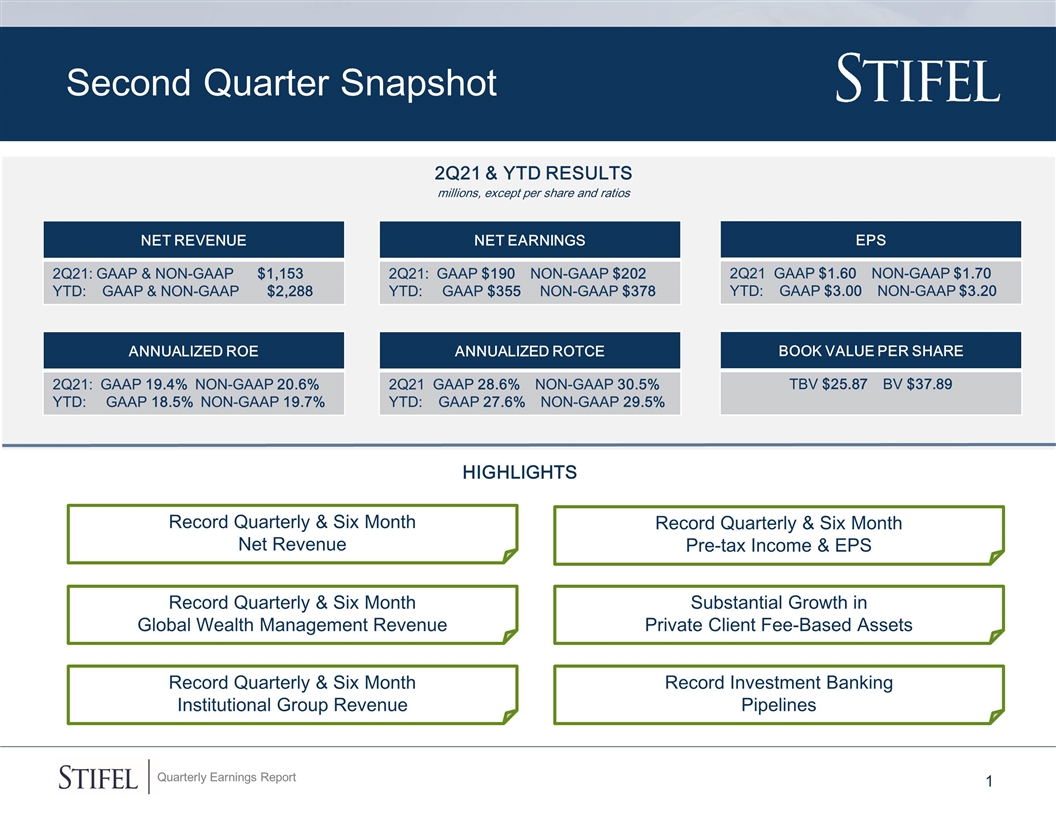

Record Quarterly & Six Month Net Revenue Second Quarter Snapshot 2Q21 & YTD Results millions, except per share and ratios HIGHLIGHTS NET REVENUE 2Q21: GAAP & NON-GAAP $1,153 YTD: GAAP & NON-GAAP $2,288 NET EARNINGS 2Q21: GAAP $190 NON-GAAP $202 YTD: GAAP $355 NON-GAAP $378 EPS 2Q21 GAAP $1.60 NON-GAAP $1.70 YTD: GAAP $3.00 NON-GAAP $3.20 ANNUALIZED ROE 2Q21: GAAP 19.4% NON-GAAP 20.6% YTD: GAAP 18.5% NON-GAAP 19.7% ANNUALIZED ROTCE 2Q21 GAAP 28.6% NON-GAAP 30.5% YTD: GAAP 27.6% NON-GAAP 29.5% BOOK VALUE PER SHARE TBV $25.87 BV $37.89 Record Quarterly & Six Month Pre-tax Income & EPS Record Quarterly & Six Month Global Wealth Management Revenue Record Quarterly & Six Month Institutional Group Revenue Record Investment Banking Pipelines Substantial Growth in Private Client Fee-Based Assets

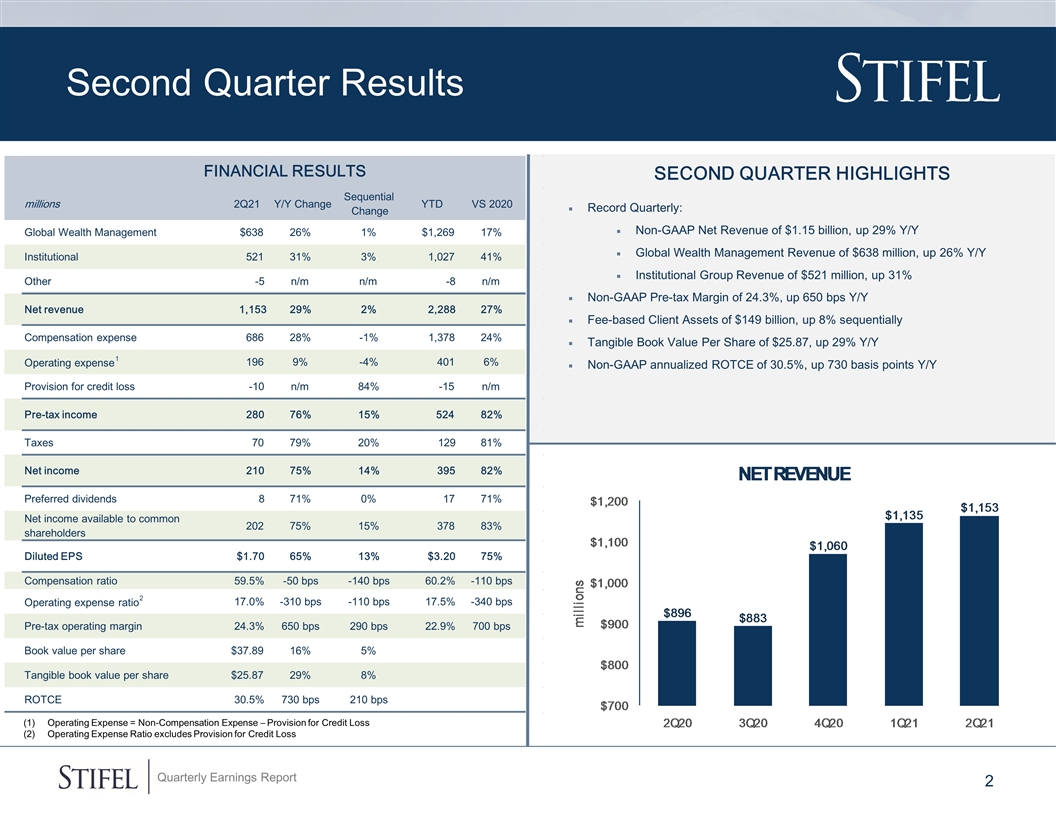

Second Quarter Results SECOND QUARTER HIGHLIGHTS Record Quarterly: Non-GAAP Net Revenue of $1.15 billion, up 29% Y/Y Global Wealth Management Revenue of $638 million, up 26% Y/Y Institutional Group Revenue of $521 million, up 31% Non-GAAP Pre-tax Margin of 24.3%, up 650 bps Y/Y Fee-based Client Assets of $149 billion, up 8% sequentially Tangible Book Value Per Share of $25.87, up 29% Y/Y Non-GAAP annualized ROTCE of 30.5%, up 730 basis points Y/Y Operating Expense = Non-Compensation Expense – Provision for Credit Loss Operating Expense Ratio excludes Provision for Credit Loss) millions 2Q21 Y/Y Change Sequential Change YTD VS 2020 Global Wealth Management $638 26% 1% $1,269 17% Institutional 521 31% 3% 1,027 41% Other -5 n/m n/m -8 n/m Net revenue 1,153 29% 2% 2,288 27% Compensation expense 686 28% -1% 1,378 24% Operating expense 1 196 9% -4% 401 6% Provision for credit loss -10 n/m 84% -15 n/m Pre-tax income 280 76% 15% 524 82% Taxes 70 79% 20% 129 81% Net income 210 75% 14% 395 82% Preferred dividends 8 71% 0% 17 71% Net income available to common shareholders 202 75% 15% 378 83% Diluted EPS $1.70 65% 13% $3.20 75% Compensation ratio 59.5% -50 bps -140 bps 60.2% -110 bps Operating expense ratio 2 17.0% -310 bps -110 bps 17.5% -340 bps Pre-tax operating margin 24.3% 650 bps 290 bps 22.9% 700 bps Book value per share $37.89 16% 5% Tangible book value per share $25.87 29% 8% ROTCE 30.5% 730 bps 210 bps FINANCIAL RESULTS

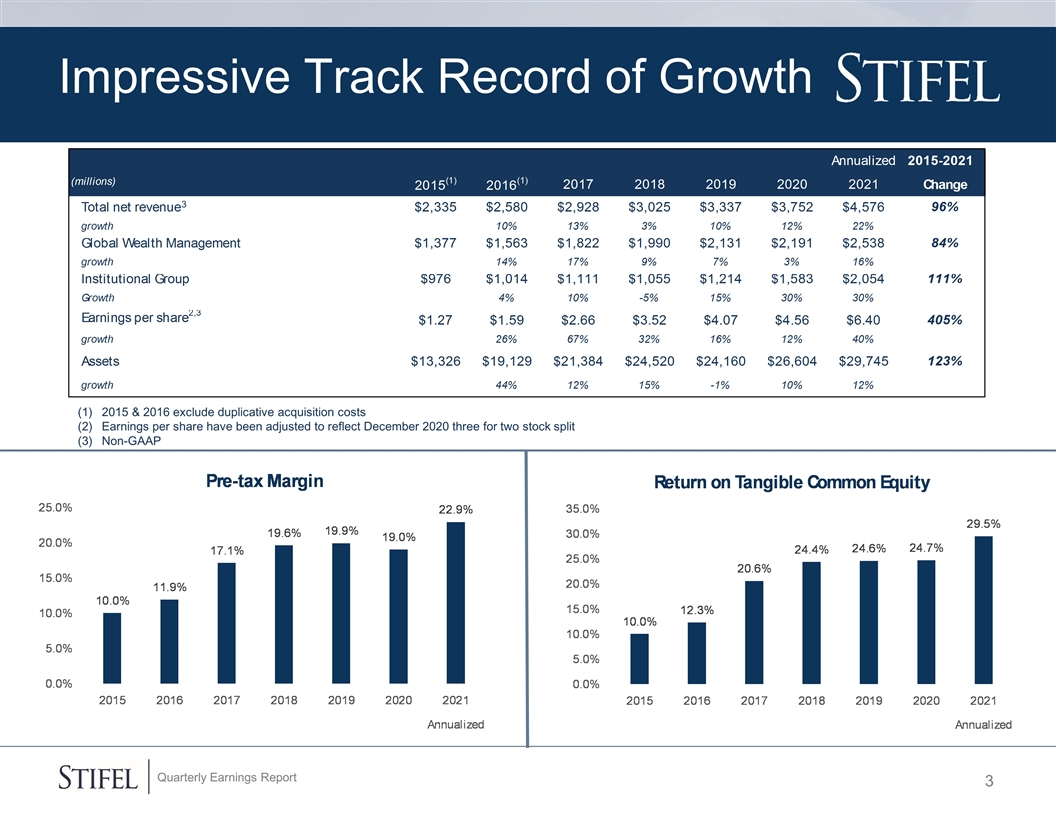

Impressive Track Record of Growth 2015 & 2016 exclude duplicative acquisition costs Earnings per share have been adjusted to reflect December 2020 three for two stock split Non-GAAP 3

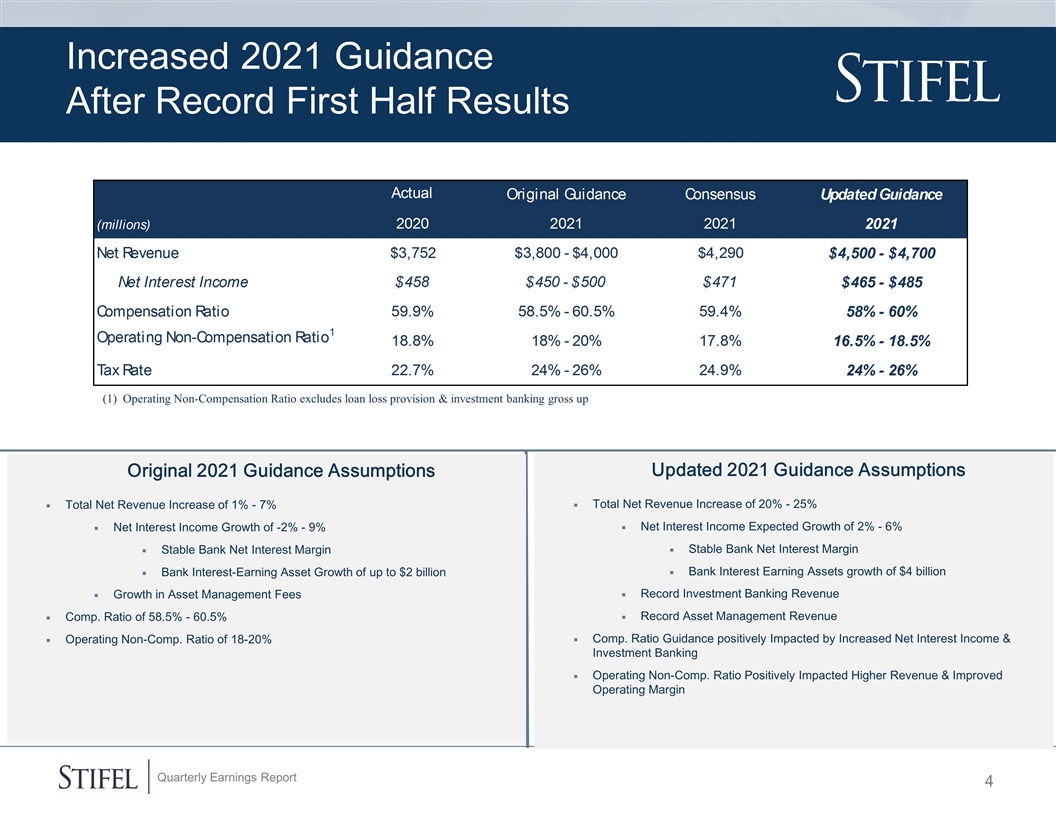

Increased 2021 Guidance After Record First Half Results Original 2021 Guidance Assumptions Total Net Revenue Increase of 1% - 7% Net Interest Income Growth of -2% - 9% Stable Bank Net Interest Margin Bank Interest-Earning Asset Growth of up to $2 billion Growth in Asset Management Fees Comp. Ratio of 58.5% - 60.5% Operating Non-Comp. Ratio of 18-20% (1) Operating Non-Compensation Ratio excludes loan loss provision & investment banking gross up Updated 2021 Guidance Assumptions Total Net Revenue Increase of 20% - 25% Net Interest Income Expected Growth of 2% - 6% Stable Bank Net Interest Margin Bank Interest Earning Assets growth of $4 billion Record Investment Banking Revenue Record Asset Management Revenue Comp. Ratio Guidance positively Impacted by Increased Net Interest Income & Investment Banking Operating Non-Comp. Ratio Positively Impacted Higher Revenue & Improved Operating Margin

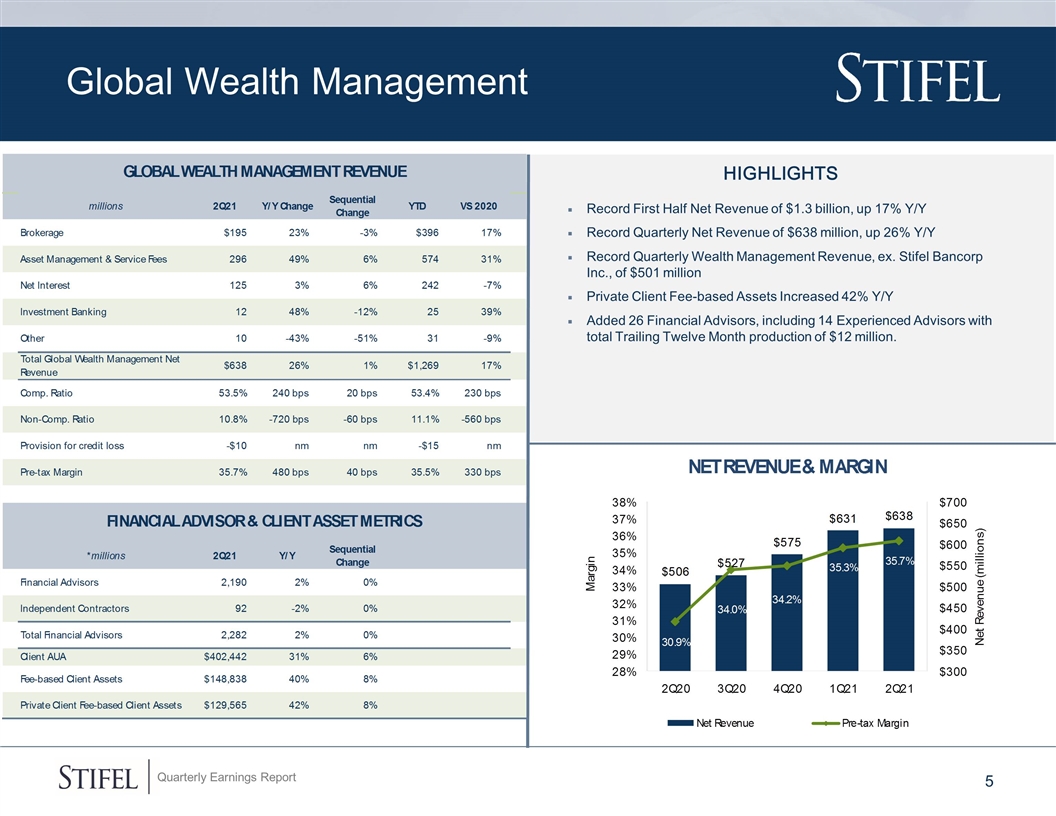

HIGHLIGHTS Record First Half Net Revenue of $1.3 billion, up 17% Y/Y Record Quarterly Net Revenue of $638 million, up 26% Y/Y Record Quarterly Wealth Management Revenue, ex. Stifel Bancorp Inc., of $501 million Private Client Fee-based Assets Increased 42% Y/Y Added 26 Financial Advisors, including 14 Experienced Advisors with total Trailing Twelve Month production of $12 million. Global Wealth Management

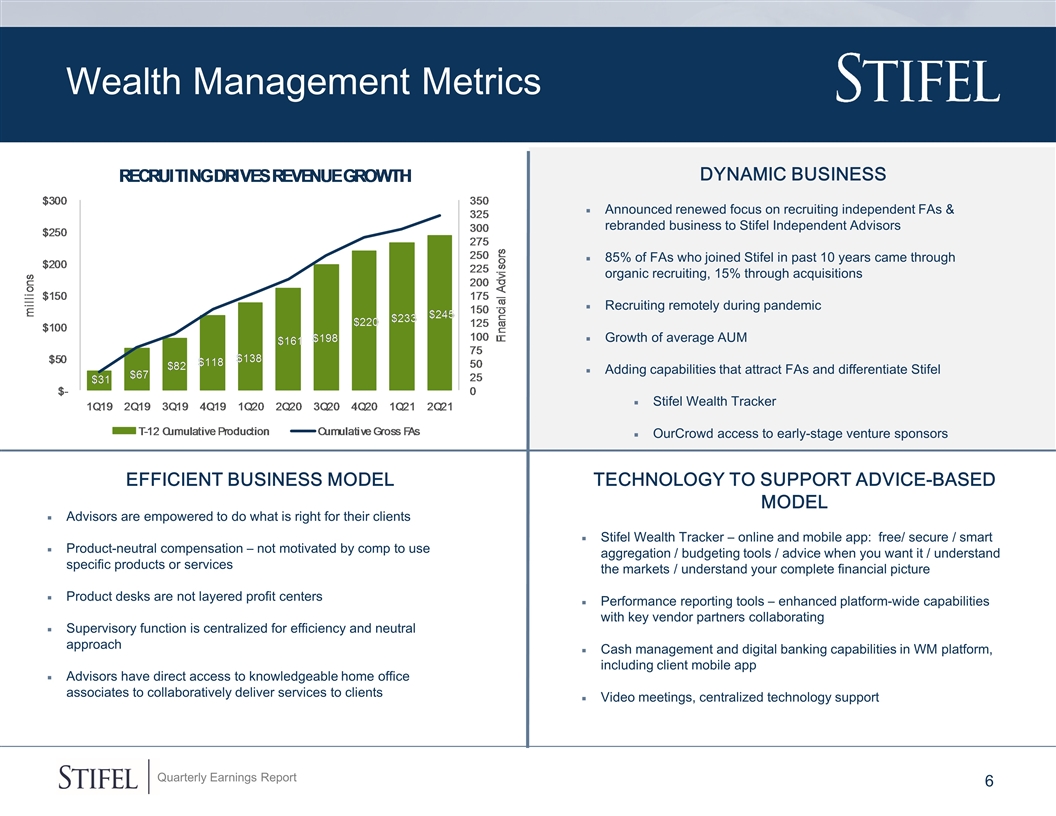

Wealth Management Metrics EFFICIENT BUSINESS MODEL Advisors are empowered to do what is right for their clients Product-neutral compensation – not motivated by comp to use specific products or services Product desks are not layered profit centers Supervisory function is centralized for efficiency and neutral approach Advisors have direct access to knowledgeable home office associates to collaboratively deliver services to clients Technology to support advice-based model Stifel Wealth Tracker – online and mobile app: free/ secure / smart aggregation / budgeting tools / advice when you want it / understand the markets / understand your complete financial picture Performance reporting tools – enhanced platform-wide capabilities with key vendor partners collaborating Cash management and digital banking capabilities in WM platform, including client mobile app Video meetings, centralized technology support DYNAMIC BUSINESS Announced renewed focus on recruiting independent FAs & rebranded business to Stifel Independent Advisors 85% of FAs who joined Stifel in past 10 years came through organic recruiting, 15% through acquisitions Recruiting remotely during pandemic Growth of average AUM Adding capabilities that attract FAs and differentiate Stifel Stifel Wealth Tracker OurCrowd access to early-stage venture sponsors

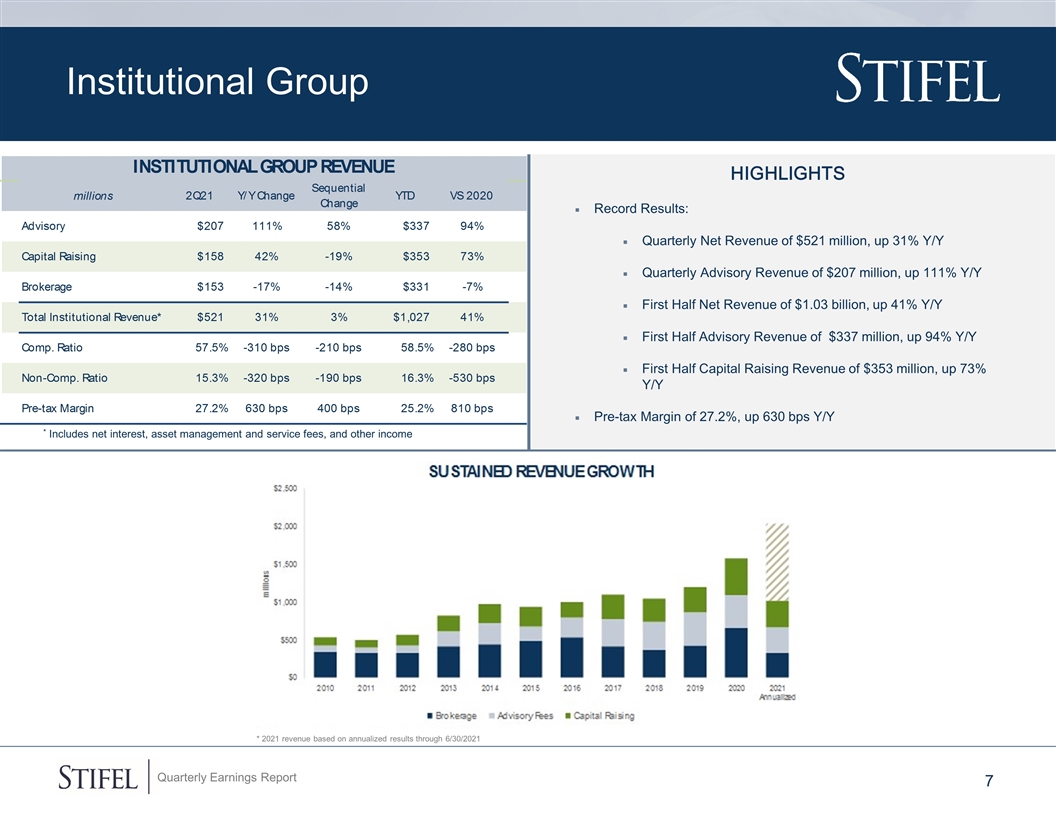

Institutional Group * Includes net interest, asset management and service fees, and other income HIGHLIGHTS Record Results: Quarterly Net Revenue of $521 million, up 31% Y/Y Quarterly Advisory Revenue of $207 million, up 111% Y/Y First Half Net Revenue of $1.03 billion, up 41% Y/Y First Half Advisory Revenue of $337 million, up 94% Y/Y First Half Capital Raising Revenue of $353 million, up 73% Y/Y Pre-tax Margin of 27.2%, up 630 bps Y/Y * 2021 revenue based on annualized results through 6/30/2021

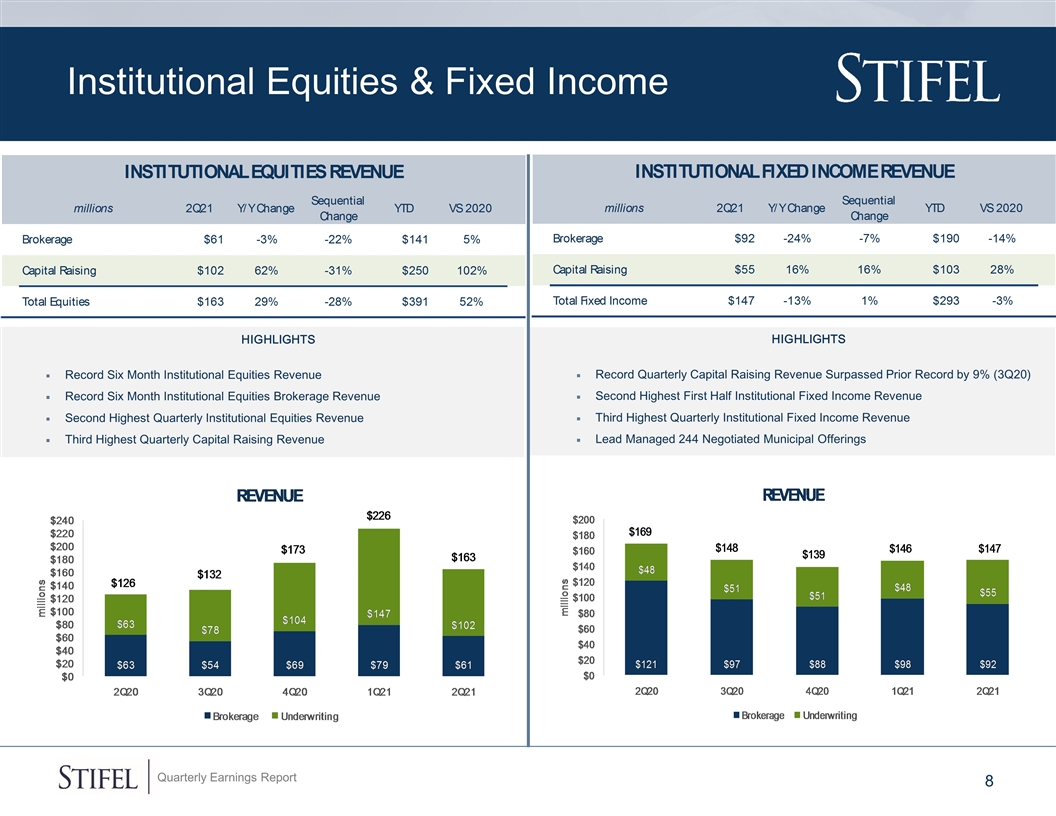

highlights Record Quarterly Capital Raising Revenue Surpassed Prior Record by 9% (3Q20) Second Highest First Half Institutional Fixed Income Revenue Third Highest Quarterly Institutional Fixed Income Revenue Lead Managed 244 Negotiated Municipal Offerings Institutional Equities & Fixed Income highlights Record Six Month Institutional Equities Revenue Record Six Month Institutional Equities Brokerage Revenue Second Highest Quarterly Institutional Equities Revenue Third Highest Quarterly Capital Raising Revenue Bar chart header numbers are a graphic

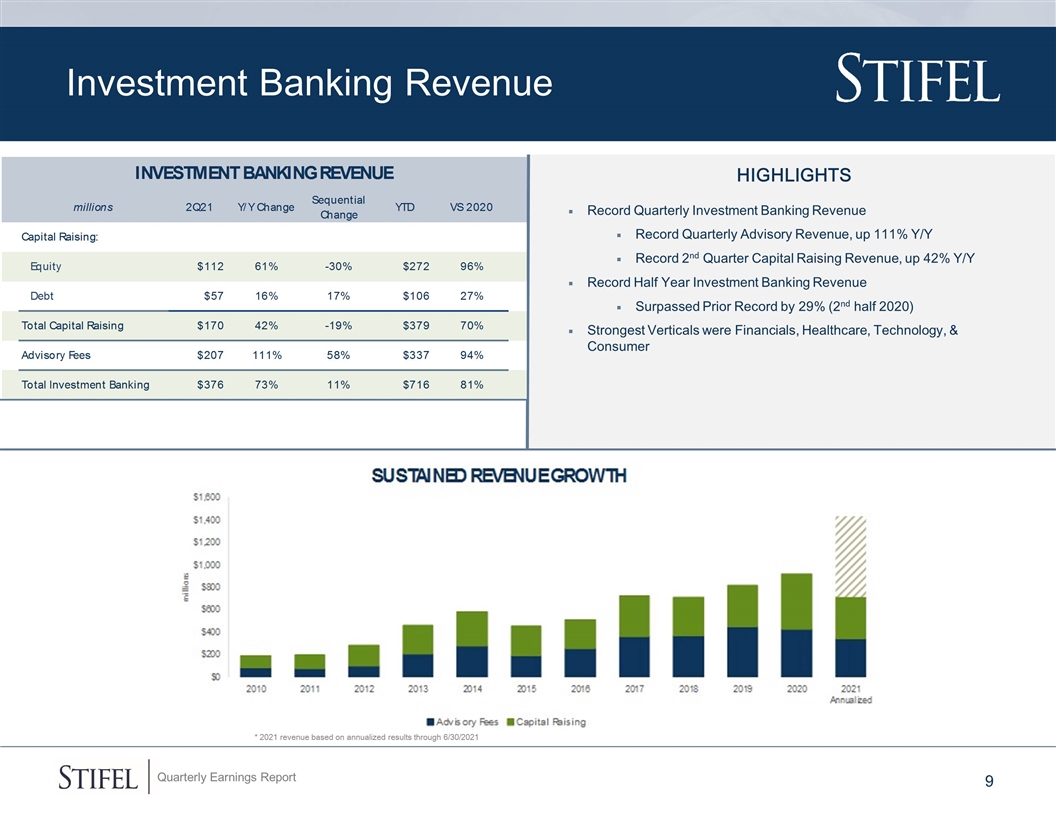

Investment Banking Revenue Highlights Record Quarterly Investment Banking Revenue Record Quarterly Advisory Revenue, up 111% Y/Y Record 2nd Quarter Capital Raising Revenue, up 42% Y/Y Record Half Year Investment Banking Revenue Surpassed Prior Record by 29% (2nd half 2020) Strongest Verticals were Financials, Healthcare, Technology, & Consumer Bar chart header numbers are a graphic * 2021 revenue based on annualized results through 6/30/2021

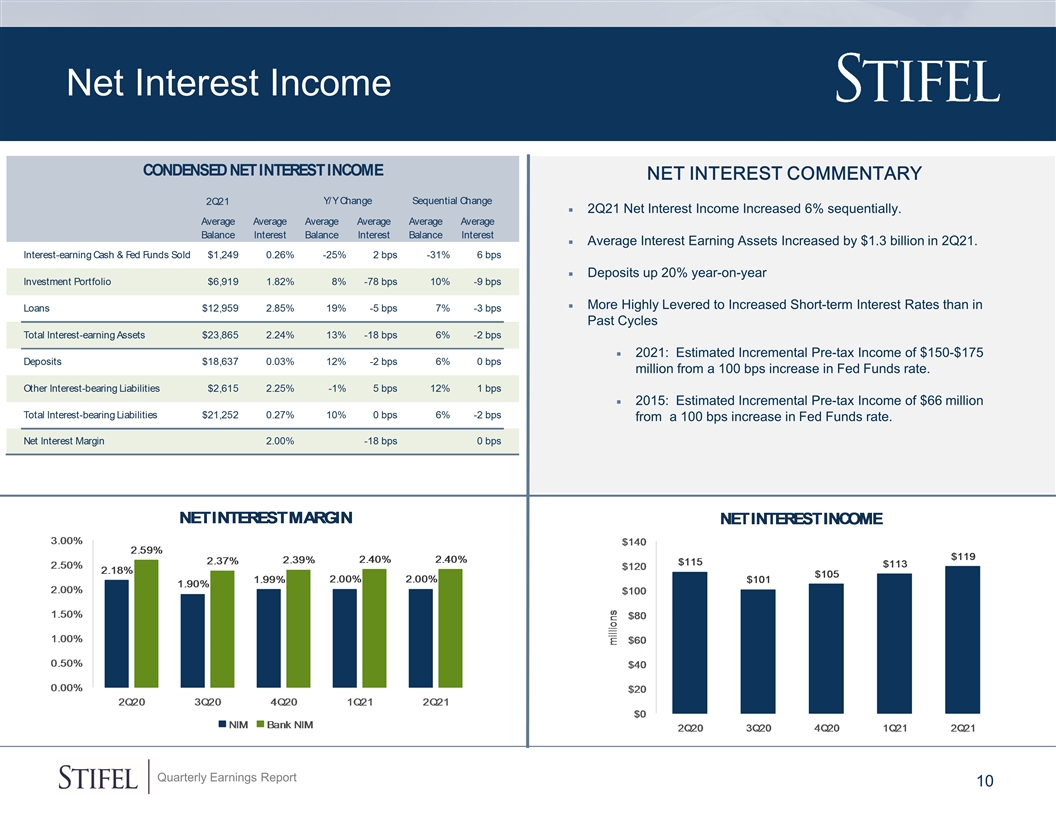

Net Interest Income Net Interest commentary 2Q21 Net Interest Income Increased 6% sequentially. Average Interest Earning Assets Increased by $1.3 billion in 2Q21. Deposits up 20% year-on-year More Highly Levered to Increased Short-term Interest Rates than in Past Cycles 2021: Estimated Incremental Pre-tax Income of $150-$175 million from a 100 bps increase in Fed Funds rate. 2015: Estimated Incremental Pre-tax Income of $66 million from a 100 bps increase in Fed Funds rate.

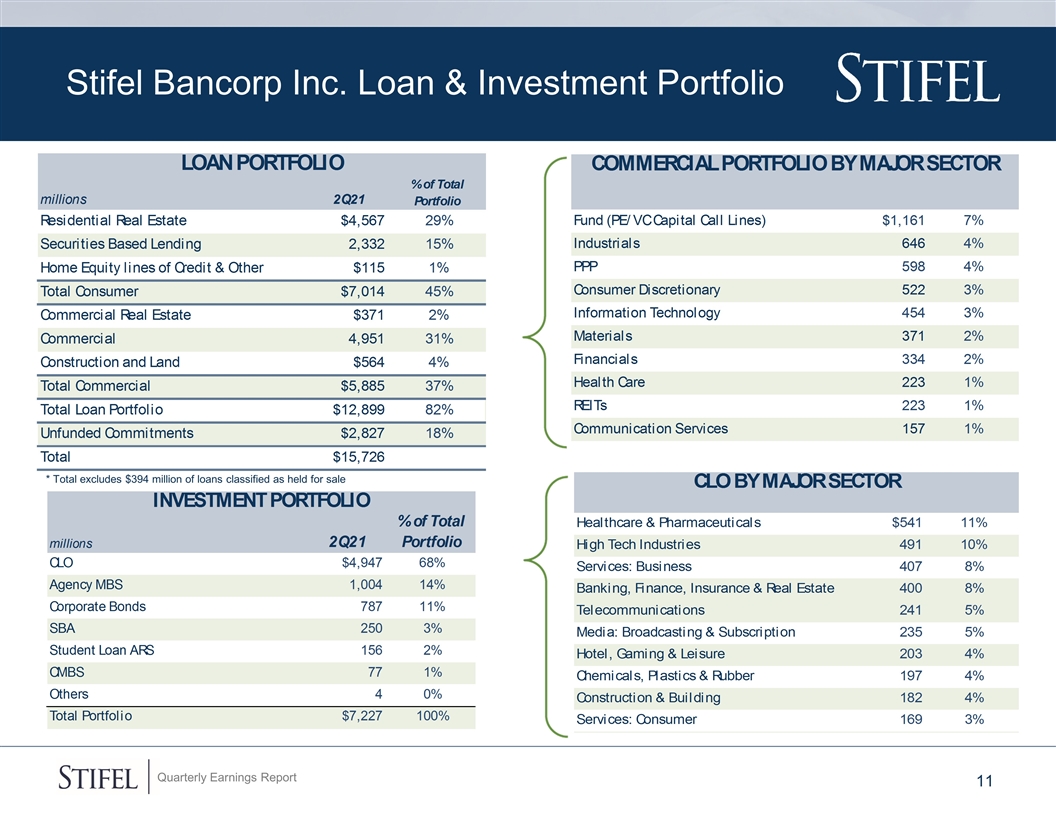

Stifel Bancorp Inc. Loan & Investment Portfolio * Total excludes $394 million of loans classified as held for sale

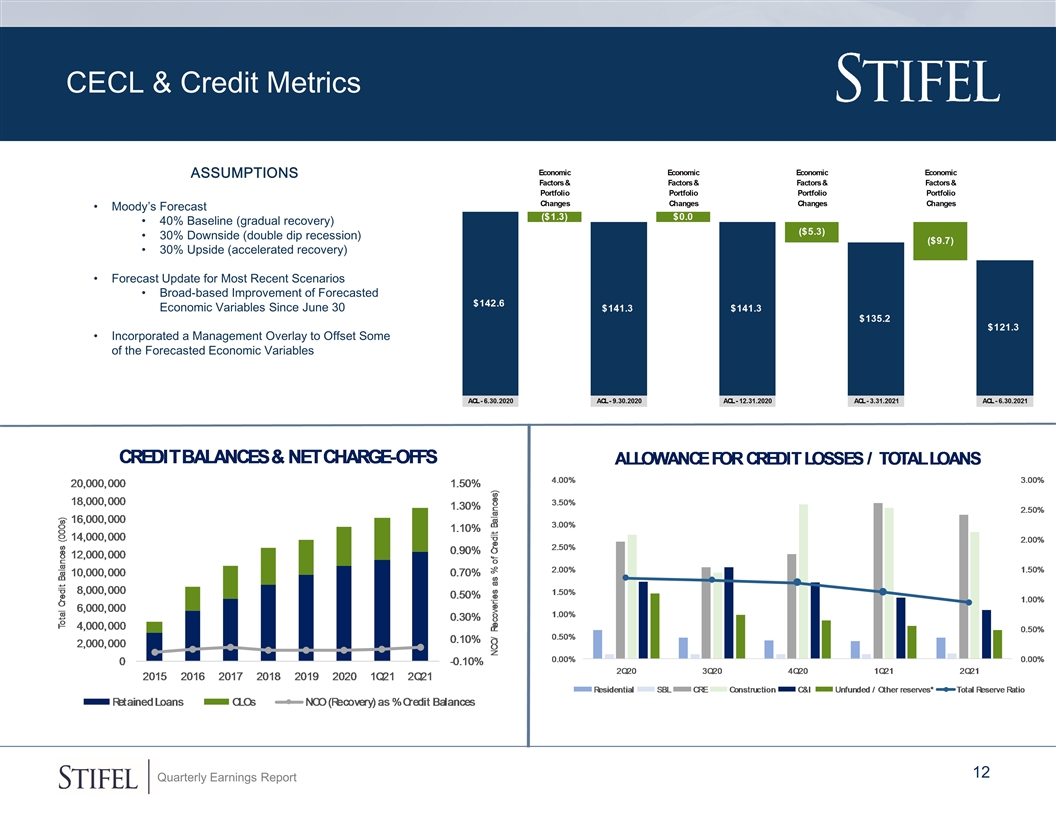

CECL & Credit Metrics ASSUMPTIONS Moody’s Forecast 40% Baseline (gradual recovery) 30% Downside (double dip recession) 30% Upside (accelerated recovery) Forecast Update for Most Recent Scenarios Broad-based Improvement of Forecasted Economic Variables Since June 30 Incorporated a Management Overlay to Offset Some of the Forecasted Economic Variables

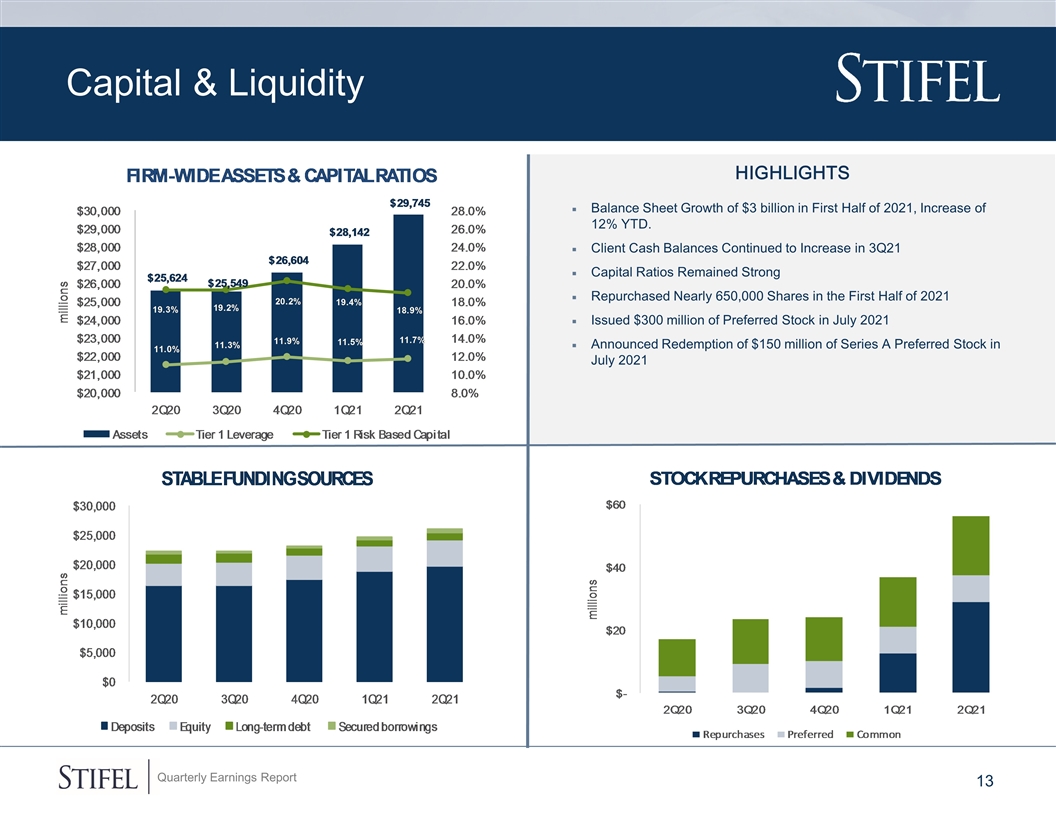

Capital & Liquidity HIGHLIGHTS Balance Sheet Growth of $3 billion in First Half of 2021, Increase of 12% YTD. Client Cash Balances Continued to Increase in 3Q21 Capital Ratios Remained Strong Repurchased Nearly 650,000 Shares in the First Half of 2021 Issued $300 million of Preferred Stock in July 2021 Announced Redemption of $150 million of Series A Preferred Stock in July 2021

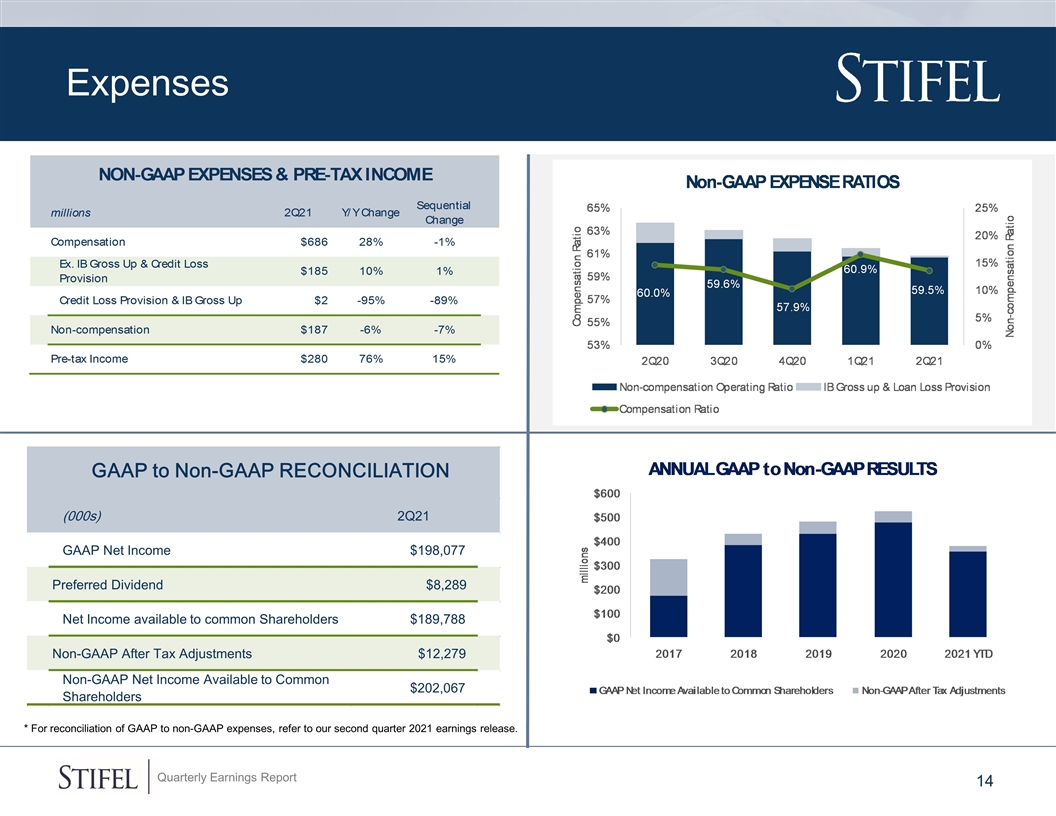

Expenses * For reconciliation of GAAP to non-GAAP expenses, refer to our second quarter 2021 earnings release. Bar chart header numbers are a graphic (000s) 2Q21 GAAP Net Income $198,077 Preferred Dividend $8,289 Net Income available to common Shareholders $189,788 Non-GAAP After Tax Adjustments $12,279 Non-GAAP Net Income Available to Common Shareholders $202,067 GAAP to Non-GAAP RECONCILIATION

Q&A

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. All statements not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. For information about the risks and important factors that could affect the Company’s future results, financial condition and liquidity, see “Risk Factors” in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Forward-looking statements speak only as to the date they are made. The Company disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Statements about the effects of the COVID-19 pandemic on the Company’s business, results, financial position and liquidity may constitute forward-looking statements and are subject to the risk that the actual impact may differ, possibly materially, from what is currently expected. Use of Non-GAAP Financial Measures The Company utilized certain non-GAAP calculations as additional measures to aid in understanding and analyzing the Company’s financial results for the three and six months ended June 30, 2021. Specifically, the Company believes that the non-GAAP measures provide useful information by excluding certain items that may not be indicative of the Company’s core operating results and business outlook. The Company believes that these non-GAAP measures will allow for a better evaluation of the operating performance of the business and facilitate a meaningful comparison of the Company’s results in the current period to those in prior and future periods. Reference to these non-GAAP measures should not be considered as a substitute for results that are presented in a manner consistent with GAAP. These non-GAAP measures are provided to enhance investors' overall understanding of the Company’s current financial performance. The non-GAAP financial information should be considered in addition to, not as a substitute for or as being superior to, operating income, cash flows, or other measures of financial performance prepared in accordance with GAAP. These non-GAAP measures primarily exclude expenses which management believes are, in some instances, non-recurring and not representative of ongoing business. A limitation of utilizing these non-GAAP measures is that the GAAP accounting effects of these charges do, in fact, reflect the underlying financial results of the Company’s business and these effects should not be ignored in evaluating and analyzing its financial results. Therefore, the Company believes that GAAP measures and the same respective non-GAAP measures of the Company’s financial performance should be considered together.