Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Well Corp | d140118d8k.htm |

| EX-99.1 - EX-99.1 - American Well Corp | d140118dex991.htm |

Amwell Acquisition Summaries of: 1) Silver Cloud Heath and, 2) Conversa Health July 28, 2021 Exhibit 99.2

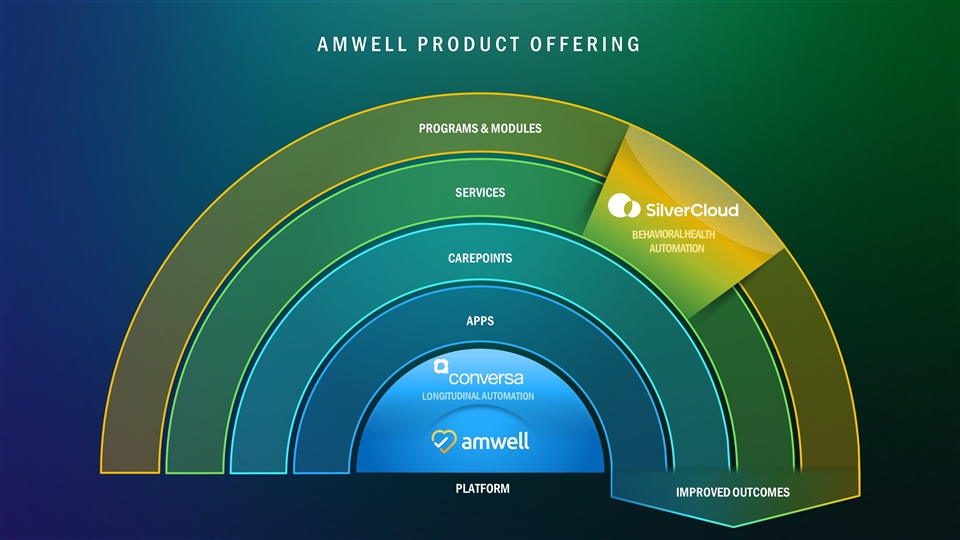

AMWELL PRODUCT OFFERING APPS CAREPOINTS SERVICES PROGRAMS & MODULES PLATFORM IMPROVED OUTCOMES LONGITUDINAL AUTOMATION BEHAVIORAL HEALTH AUTOMATION

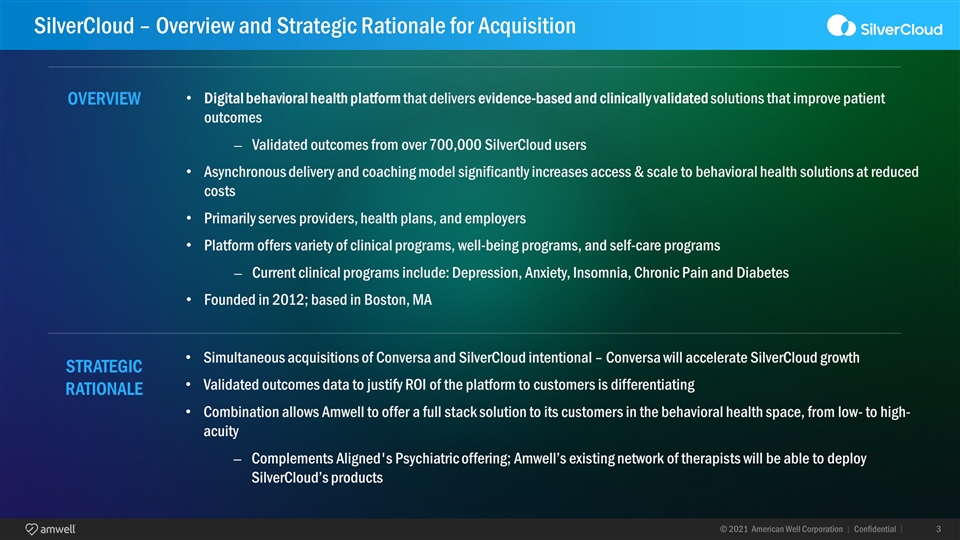

SilverCloud – Overview and Strategic Rationale for Acquisition OVERVIEW Digital behavioral health platform that delivers evidence-based and clinically validated solutions that improve patient outcomes Validated outcomes from over 700,000 SilverCloud users Asynchronous delivery and coaching model significantly increases access & scale to behavioral health solutions at reduced costs Primarily serves providers, health plans, and employers Platform offers variety of clinical programs, well-being programs, and self-care programs Current clinical programs include: Depression, Anxiety, Insomnia, Chronic Pain and Diabetes Founded in 2012; based in Boston, MA STRATEGIC RATIONALE Simultaneous acquisitions of Conversa and SilverCloud intentional – Conversa will accelerate SilverCloud growth Validated outcomes data to justify ROI of the platform to customers is differentiating Combination allows Amwell to offer a full stack solution to its customers in the behavioral health space, from low- to high-acuity Complements Aligned's Psychiatric offering; Amwell’s existing network of therapists will be able to deploy SilverCloud’s products

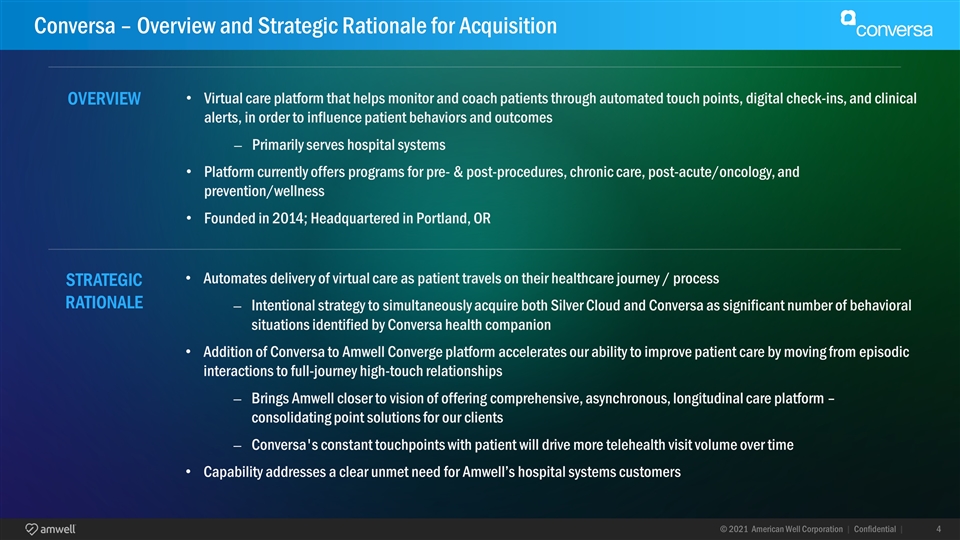

Conversa – Overview and Strategic Rationale for Acquisition Virtual care platform that helps monitor and coach patients through automated touch points, digital check-ins, and clinical alerts, in order to influence patient behaviors and outcomes Primarily serves hospital systems Platform currently offers programs for pre- & post-procedures, chronic care, post-acute/oncology, and prevention/wellness Founded in 2014; Headquartered in Portland, OR STRATEGIC RATIONALE Automates delivery of virtual care as patient travels on their healthcare journey / process Intentional strategy to simultaneously acquire both Silver Cloud and Conversa as significant number of behavioral situations identified by Conversa health companion Addition of Conversa to Amwell Converge platform accelerates our ability to improve patient care by moving from episodic interactions to full-journey high-touch relationships Brings Amwell closer to vision of offering comprehensive, asynchronous, longitudinal care platform – consolidating point solutions for our clients Conversa's constant touchpoints with patient will drive more telehealth visit volume over time Capability addresses a clear unmet need for Amwell’s hospital systems customers OVERVIEW

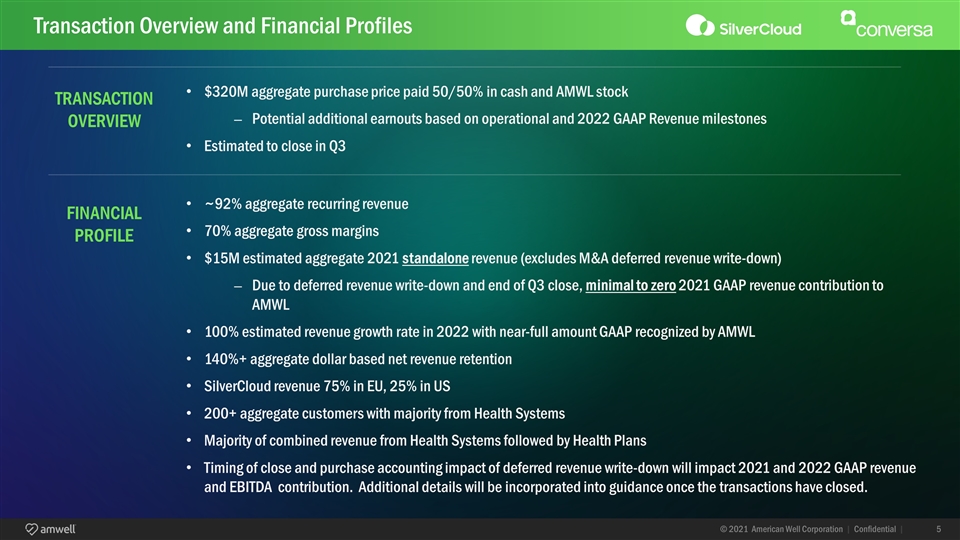

Transaction Overview and Financial Profiles $320M aggregate purchase price paid 50/50% in cash and AMWL stock Potential additional earnouts based on operational and 2022 GAAP Revenue milestones Estimated to close in Q3 FINANCIAL PROFILE ~92% aggregate recurring revenue 70% aggregate gross margins $15M estimated aggregate 2021 standalone revenue (excludes M&A deferred revenue write-down) Due to deferred revenue write-down and end of Q3 close, minimal to zero 2021 GAAP revenue contribution to AMWL 100% estimated revenue growth rate in 2022 with near-full amount GAAP recognized by AMWL 140%+ aggregate dollar based net revenue retention SilverCloud revenue 75% in EU, 25% in US 200+ aggregate customers with majority from Health Systems Majority of combined revenue from Health Systems followed by Health Plans Timing of close and purchase accounting impact of deferred revenue write-down will impact 2021 and 2022 GAAP revenue and EBITDA contribution. Additional details will be incorporated into guidance once the transactions have closed. TRANSACTION OVERVIEW

Forward-Looking Statements This presentation contains forward-looking statements about us and our industry that involve substantial risks and uncertainties and are based on our beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations, financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” or “would,” or the negative of these words or other similar terms or expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our beliefs and assumptions only as of the date of this presentation. These statements, and related risks, uncertainties, factors and assumptions, include, but are not limited to: weak growth and increased volatility in the telehealth market; inability to adapt to rapid technological changes; increased competition from existing and potential new participants in the healthcare industry; changes in healthcare laws, regulations or trends and our ability to operate in the heavily regulated healthcare industry; our ability to comply with federal and state privacy regulations; the significant liability that could result from a cybersecurity breach; and other factors described under ‘Risk Factors’ in our most recent form 10-K filed with the SEC. These risks are not exhaustive. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on factors that could cause actual results to differ materially from the results anticipated by our forward-looking statements is included in the reports we have filed or will file with the Securities and Exchange Commission. These filings, when available, are available on the investor relations section of our website at investors.amwell.com and on the SEC’s website at www.sec.gov. Non-GAAP Financial Measures To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, of US GAAP, we use adjusted EBITDA, which is a non-U.S GAAP financial measure to clarify and enhance an understanding of past performance. We believe that the presentation of adjusted EBITDA enhances an investor’s understanding of our financial performance. We further believe that adjusted EBITDA is a useful financial metrics to assess our operating performance from period-to-period by excluding certain items that we believe are not representative of our core business. We use certain financial measures for business planning purposes and in measuring our performance relative to that of our competitors. We utilize adjusted EBITDA as the primary measure of our performance. We calculate adjusted EBITDA as net loss adjusted to exclude (i) interest income and other income, net, (ii) tax benefit and expense, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) public offering expenses, (vi) acquisition-related income and expenses, (vii) litigation expenses related to the defense of our patents in the patent infringement claim filed by Teladoc and (viii) other items affecting our results that we do not view as representative of our ongoing operations, including direct and incremental expenses associated with the COVID-19 pandemic. We believe adjusted EBITDA is a commonly used by investors to evaluate our performance and that of our competitors. However, our use of the term adjusted EBITDA may vary from that of others in our industry. Adjusted EBITDA should not be considered as an alternative to net loss before taxes, net loss, loss per share or any other performance measures derived in accordance with U.S. GAAP as measures of performance. Adjusted EBITDA has important limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations of adjusted EBITDA include (i) adjusted EBITDA does not properly reflect capital commitments to be paid in the future, and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and adjusted EBITDA does not reflect these capital expenditures. Our IPO and acquisition-related expenses, including legal, accounting and other professional expenses, reflect cash expenditures and we expect such expenditures for acquisitions to recur from time to time. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. In evaluating adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. Adjusted EBITDA should not be considered as an alternative to loss before benefit from income taxes, net loss, earnings per share, or any other performance measures derived in accordance with U.S. GAAP. When evaluating our performance, you should consider adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. Other than with respect to GAAP Revenue, the Company only provides guidance on a non-GAAP basis. The Company does not provide a reconciliation of forward-looking Adjusted EBITDA (non-GAAP) to GAAP net income (loss), due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation because other deductions (such as COVID expenses and acquisition related expenses) used to calculate projected net income (loss) vary dramatically based on actual events, the Company is not able to forecast on a GAAP basis with reasonable certainty all deductions needed in order to provide a GAAP calculation of projected net income (loss) at this time. The amount of these deductions may be material and, therefore, could result in projected GAAP net income (loss) being materially less than projected Adjusted EBITDA (non-GAAP). Disclaimer