Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Sila Realty Trust, Inc. | ex993-cwconsent07222021.htm |

| EX-99.1 - EX-99.1 - Sila Realty Trust, Inc. | ex991-pressrelease07222021.htm |

| EX-10.5 - EX-10.5 - Sila Realty Trust, Inc. | ex105-consentlettertermloa.htm |

| EX-10.4 - EX-10.4 - Sila Realty Trust, Inc. | ex104-consentlettercredita.htm |

| EX-10.3 - EX-10.3 - Sila Realty Trust, Inc. | ex103-thirdamendmenttoterm.htm |

| EX-10.2 - EX-10.2 - Sila Realty Trust, Inc. | ex102-thirdamendmenttofour.htm |

| EX-10.1 - EX-10.1 - Sila Realty Trust, Inc. | ex101-purchasesaleagreemen.htm |

| 8-K - 8-K - Sila Realty Trust, Inc. | a07202021mapletreesalenavs.htm |

Investor Presentation July 2021

2021Agenda Prepared Remarks Michael A. Seton – Chief Executive Officer and President Kay C. Neely – Chief Financial Officer, Treasurer and Secretary Agenda 2020 Recap Pg. 4 Historical & Anticipated Timeline of the Company Pg. 6 Data Center Portfolio Sale Pg. 8 Updated Net Asset Value Pg. 10 Use of Proceeds - Distributions & Reduced Leverage Pg. 12 Investor Returns Pg. 15 Company Positioning & Portfolio Composition Pg. 17 Healthcare Market Overview Pg. 22 Positioning for Public Market Listing Pg. 25

2021 2020 Recap 3

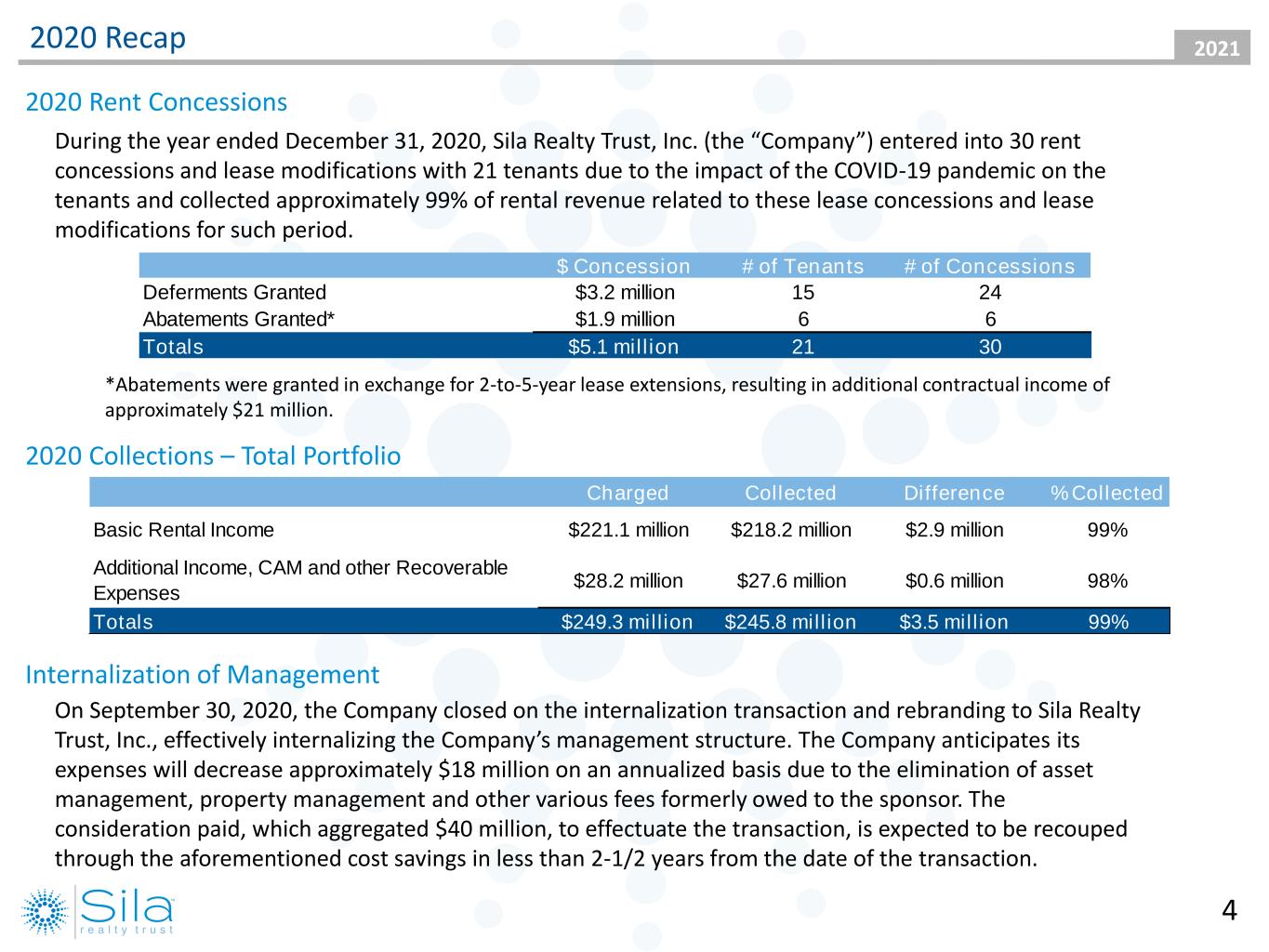

20212020 Recap 2020 Rent Concessions During the year ended December 31, 2020, Sila Realty Trust, Inc. (the “Company”) entered into 30 rent concessions and lease modifications with 21 tenants due to the impact of the COVID-19 pandemic on the tenants and collected approximately 99% of rental revenue related to these lease concessions and lease modifications for such period. 2020 Collections – Total Portfolio 4 Internalization of Management On September 30, 2020, the Company closed on the internalization transaction and rebranding to Sila Realty Trust, Inc., effectively internalizing the Company’s management structure. The Company anticipates its expenses will decrease approximately $18 million on an annualized basis due to the elimination of asset management, property management and other various fees formerly owed to the sponsor. The consideration paid, which aggregated $40 million, to effectuate the transaction, is expected to be recouped through the aforementioned cost savings in less than 2-1/2 years from the date of the transaction. *Abatements were granted in exchange for 2-to-5-year lease extensions, resulting in additional contractual income of approximately $21 million. $ Concession # of Tenants # of Concessions Deferments Granted $3.2 million 15 24 Abatements Granted* $1.9 million 6 6 Totals $5.1 million 21 30 Charged Collected Difference % Collected Basic Rental Income $221.1 million $218.2 million $2.9 million 99% Additional Income, CAM and other Recoverable Expenses $28.2 million $27.6 million $0.6 million 98% Totals $249.3 million $245.8 million $3.5 million 99%

2021 Historical & Anticipated Timeline of the Company 5

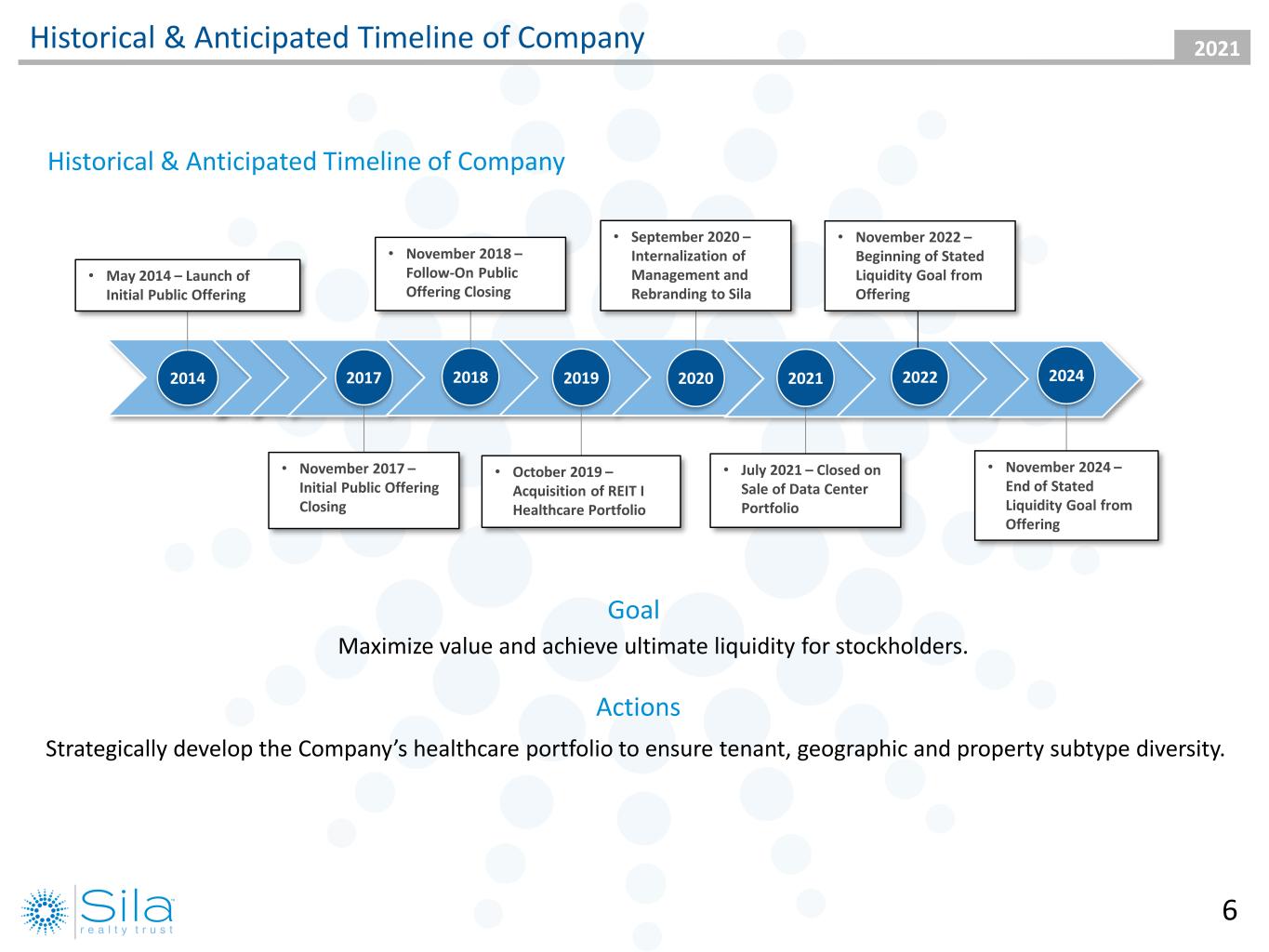

2021 2014 • May 2014 – Launch of Initial Public Offering 2017 • November 2017 – Initial Public Offering Closing 2019 • October 2019 – Acquisition of REIT I Healthcare Portfolio 2018 • November 2018 – Follow-On Public Offering Closing • September 2020 – Internalization of Management and Rebranding to Sila 2020 2021 • July 2021 – Closed on Sale of Data Center Portfolio Historical & Anticipated Timeline of Company 2022 • November 2022 – Beginning of Stated Liquidity Goal from Offering 2024 • November 2024 – End of Stated Liquidity Goal from Offering Historical & Anticipated Timeline of Company Goal Maximize value and achieve ultimate liquidity for stockholders. Actions Strategically develop the Company’s healthcare portfolio to ensure tenant, geographic and property subtype diversity. 6

2021 Data Center Portfolio Sale 7

2021Data Center Portfolio Sale On July 22, 2021, the Company announced the closing the sale of its 29-property data center portfolio (the “Portfolio”), to wholly owned subsidiaries of Mapletree Industrial Trust, for an aggregate sale price of $1.32 billion (the “Portfolio Sale”). The Portfolio Sale includes the entirety of the Company’s data center portfolio, which was strategically assembled over a period of years through on- and off-market acquisitions and represents a substantial gain for the Company. The aggregate sale price generated net cash proceeds of approximately $1.27 billion after transaction costs, loan payoff costs and other prorations, which are being used to distribute meaningful cash liquidity to our stockholders in advance of the liquidity time frame set forth during our offering through a Special Distribution and significantly reduce leverage to position the Company for future growth as a pure-play healthcare REIT. Data Center Portfolio Key Statistics Properties 29 Aggregate Purchase Price $ 949.7m Rentable Square Feet 3.3m Occupancy 88.8% Avg Remaining Lease Term 8.0 Years Annualized Base Rent $ 75.5m 8 Data Center Portfolio Sale As of March 31, 2021

2021 Updated Net Asset Value 9

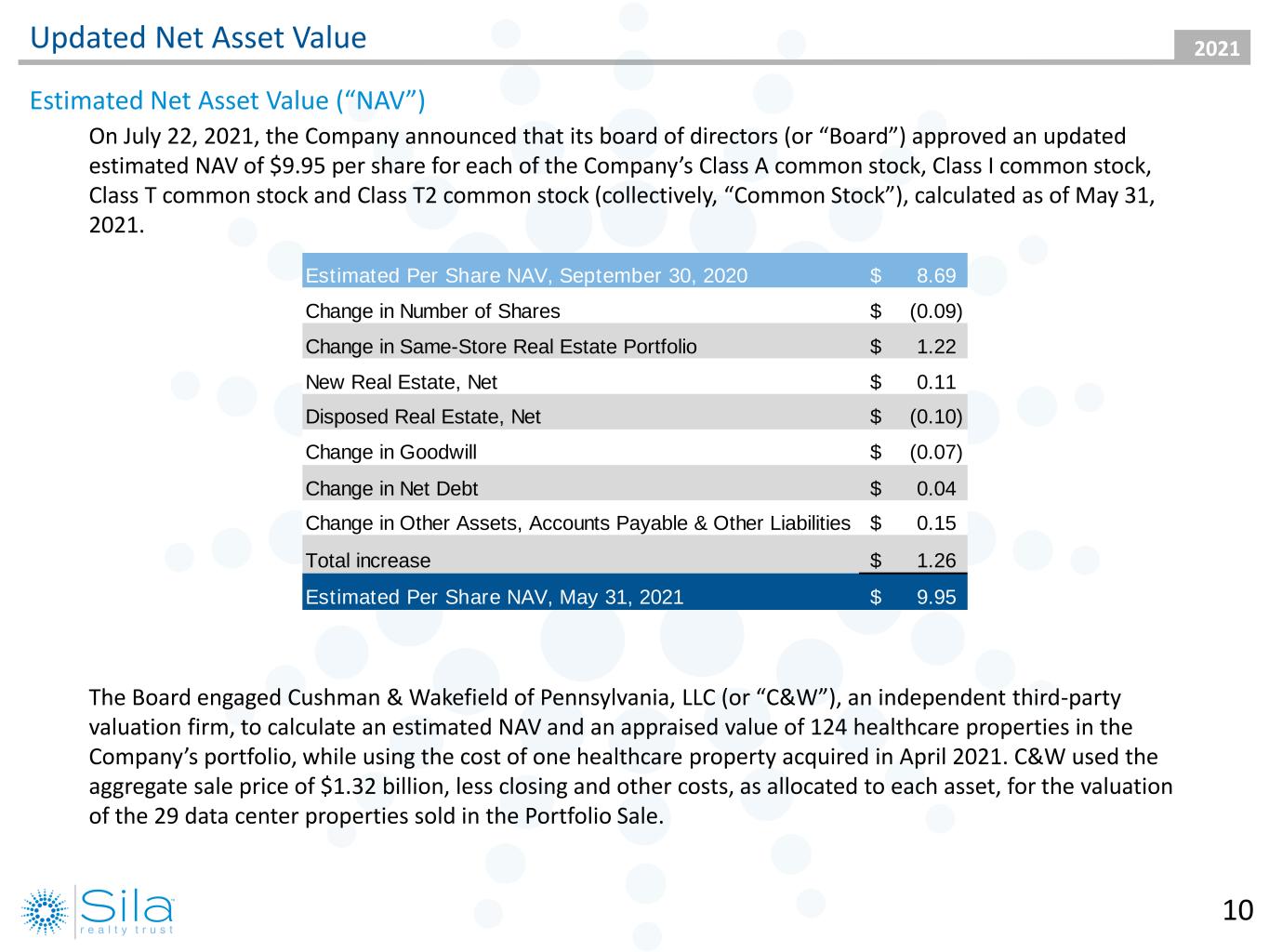

2021Updated Net Asset Value On July 22, 2021, the Company announced that its board of directors (or “Board”) approved an updated estimated NAV of $9.95 per share for each of the Company’s Class A common stock, Class I common stock, Class T common stock and Class T2 common stock (collectively, “Common Stock”), calculated as of May 31, 2021. Estimated Net Asset Value (“NAV”) 10 The Board engaged Cushman & Wakefield of Pennsylvania, LLC (or “C&W”), an independent third-party valuation firm, to calculate an estimated NAV and an appraised value of 124 healthcare properties in the Company’s portfolio, while using the cost of one healthcare property acquired in April 2021. C&W used the aggregate sale price of $1.32 billion, less closing and other costs, as allocated to each asset, for the valuation of the 29 data center properties sold in the Portfolio Sale. Estimated Per Share NAV, September 30, 2020 8.69$ Change in Number of Shares (0.09)$ Change in Same-Store Real Estate Portfolio 1.22$ New Real Estate, Net 0.11$ Disposed Real Estate, Net (0.10)$ Change in Goodwill (0.07)$ Change in Net Debt 0.04$ Change in Other Assets, Accounts Payable & Other Liabilities 0.15$ Total increase 1.26$ Estimated Per Share NAV, May 31, 2021 9.95$

2021 Use of Proceeds 11

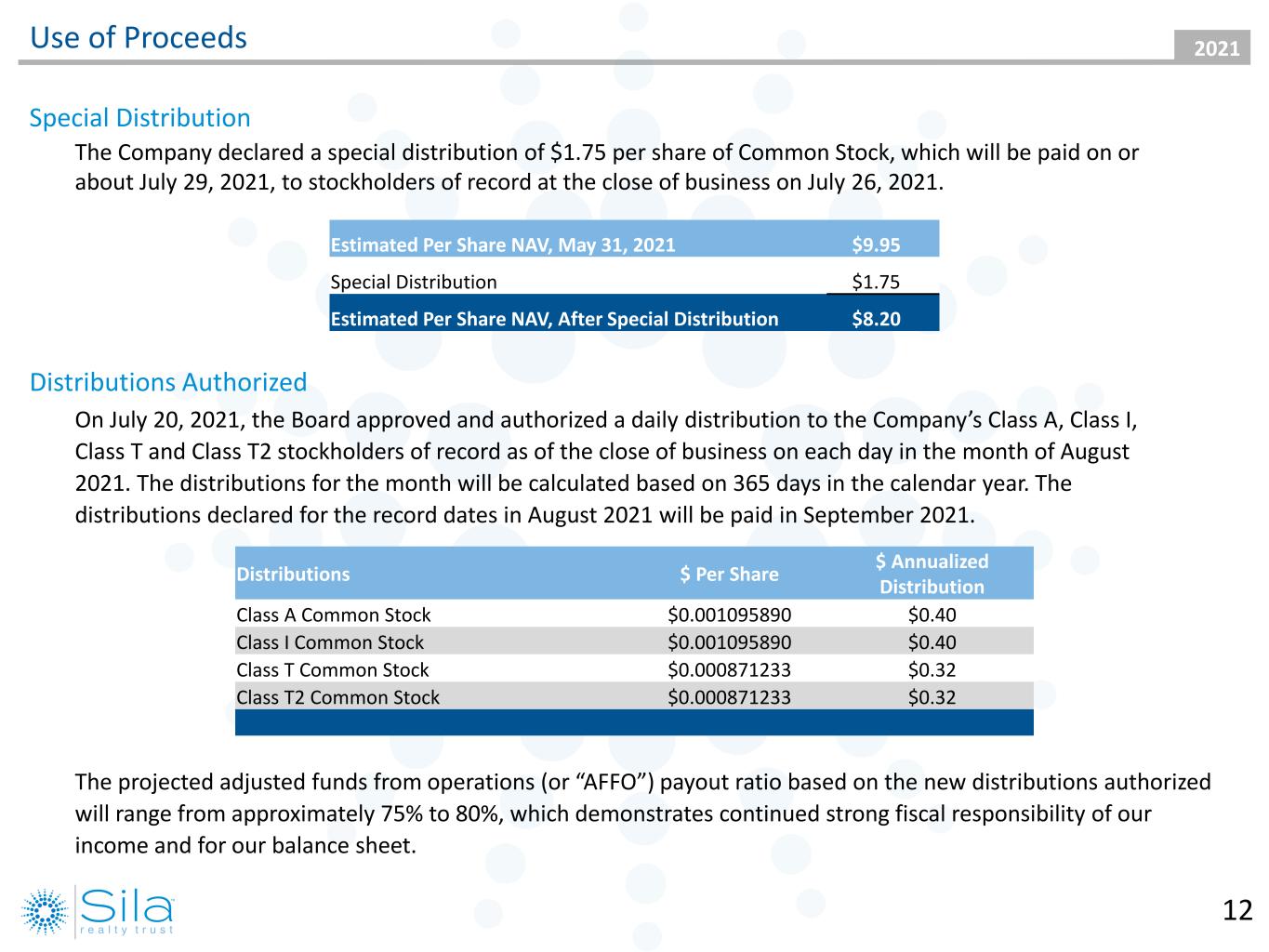

2021Use of Proceeds 12 Distributions Authorized On July 20, 2021, the Board approved and authorized a daily distribution to the Company’s Class A, Class I, Class T and Class T2 stockholders of record as of the close of business on each day in the month of August 2021. The distributions for the month will be calculated based on 365 days in the calendar year. The distributions declared for the record dates in August 2021 will be paid in September 2021. Special Distribution The Company declared a special distribution of $1.75 per share of Common Stock, which will be paid on or about July 29, 2021, to stockholders of record at the close of business on July 26, 2021. Estimated Per Share NAV, May 31, 2021 $9.95 Special Distribution $1.75 Estimated Per Share NAV, After Special Distribution $8.20 The projected adjusted funds from operations (or “AFFO”) payout ratio based on the new distributions authorized will range from approximately 75% to 80%, which demonstrates continued strong fiscal responsibility of our income and for our balance sheet. Distributions $ Per Share $ Annualized Distribution Class A Common Stock $0.001095890 $0.40 Class I Common Stock $0.001095890 $0.40 Class T Common Stock $0.000871233 $0.32 Class T2 Common Stock $0.000871233 $0.32

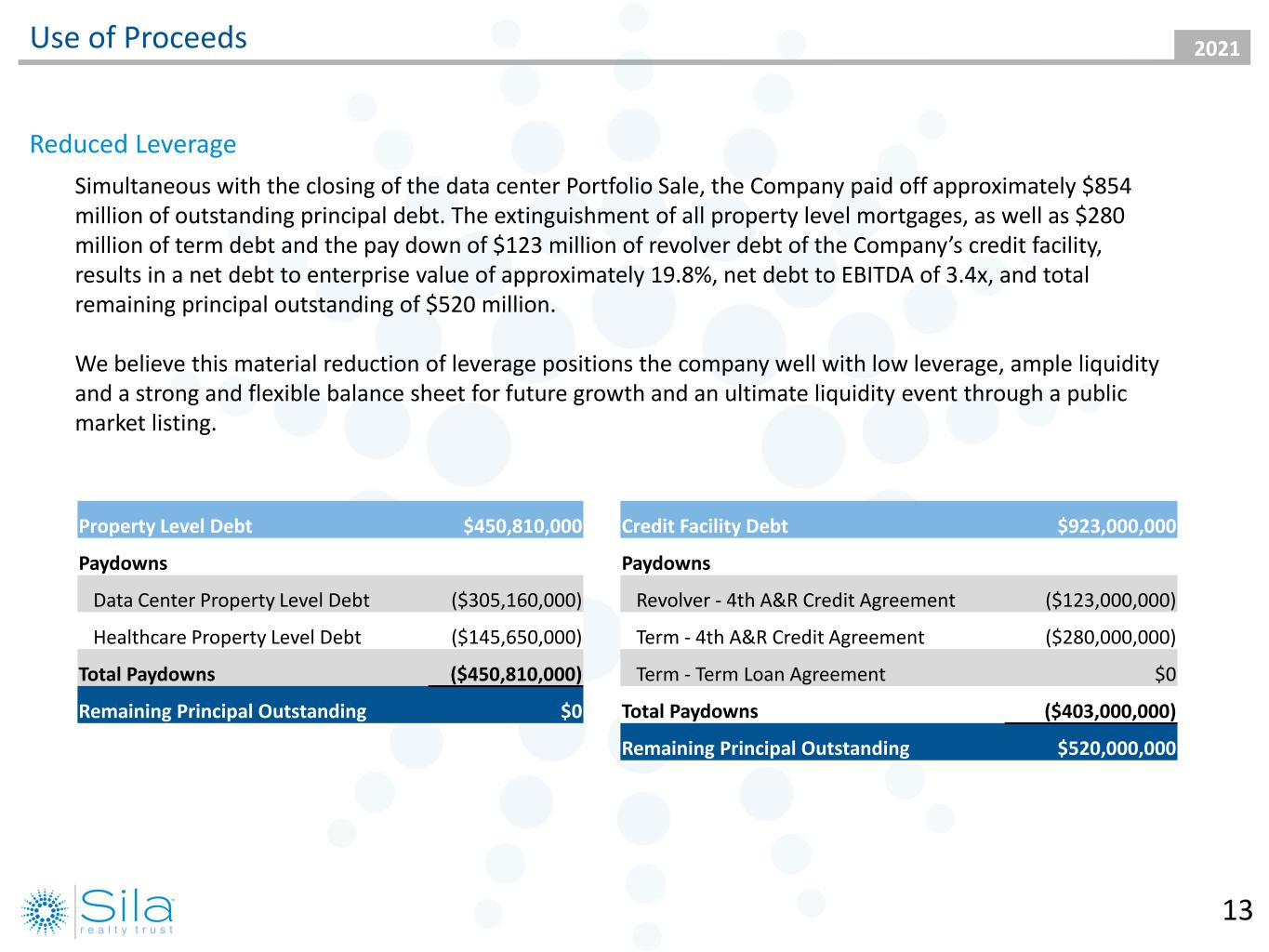

2021Use of Proceeds 13 Reduced Leverage Simultaneous with the closing of the data center Portfolio Sale, the Company paid off approximately $854 million of outstanding principal debt. The extinguishment of all property level mortgages, as well as $280 million of term debt and the pay down of $123 million of revolver debt of the Company’s credit facility, results in a net debt to enterprise value of approximately 19.8%, net debt to EBITDA of 3.4x, and total remaining principal outstanding of $520 million. We believe this material reduction of leverage positions the company well with low leverage, ample liquidity and a strong and flexible balance sheet for future growth and an ultimate liquidity event through a public market listing. Property Level Debt $450,810,000 Paydowns Data Center Property Level Debt ($305,160,000) Healthcare Property Level Debt ($145,650,000) Total Paydowns ($450,810,000) Remaining Principal Outstanding $0 Credit Facility Debt $923,000,000 Paydowns Revolver - 4th A&R Credit Agreement ($123,000,000) Term - 4th A&R Credit Agreement ($280,000,000) Term - Term Loan Agreement $0 Total Paydowns ($403,000,000) Remaining Principal Outstanding $520,000,000

2021 Investor Returns 14

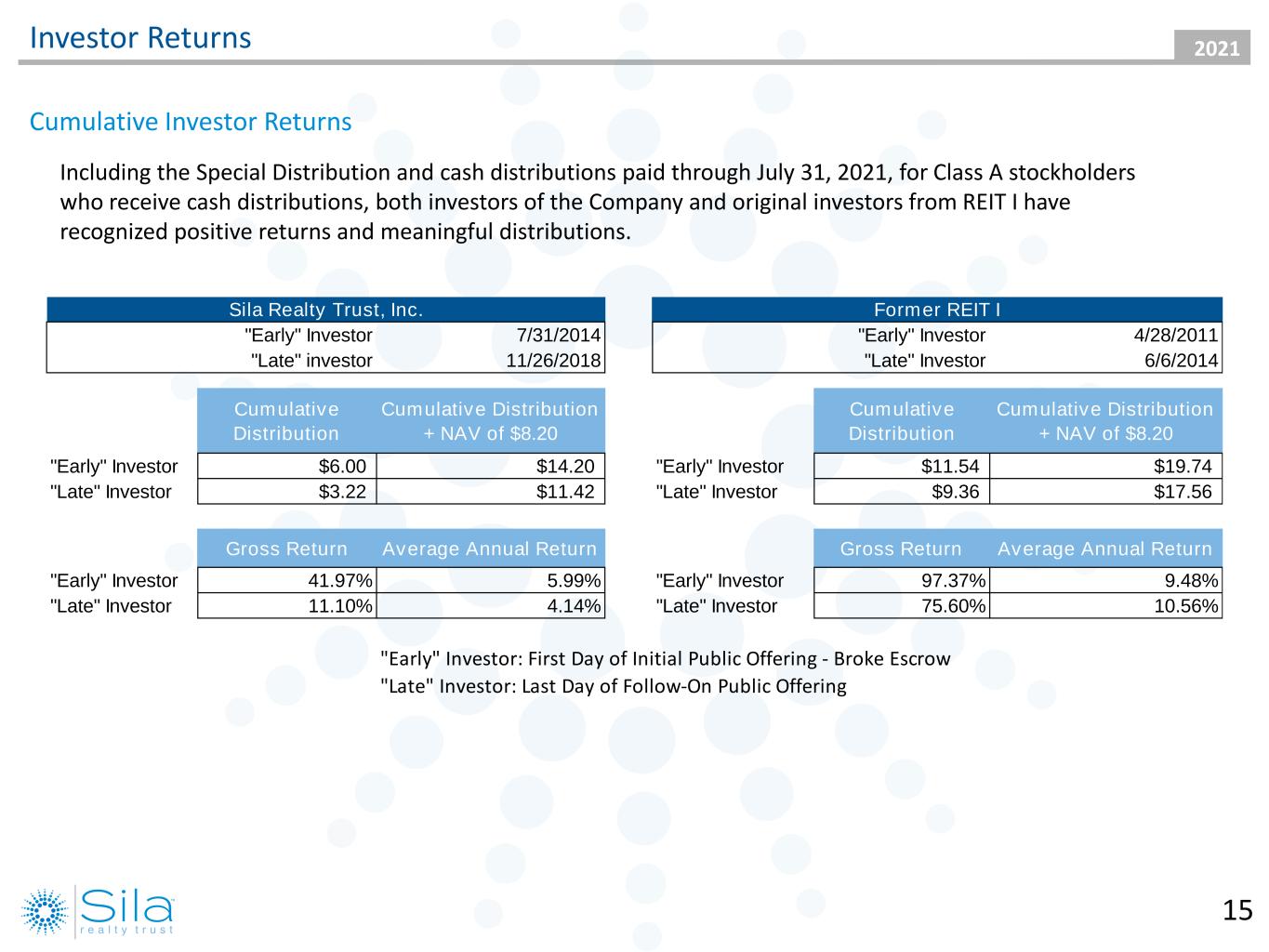

2021Investor Returns 15 Cumulative Investor Returns Including the Special Distribution and cash distributions paid through July 31, 2021, for Class A stockholders who receive cash distributions, both investors of the Company and original investors from REIT I have recognized positive returns and meaningful distributions. "Early" Investor 7/31/2014 "Early" Investor 4/28/2011 "Late" investor 11/26/2018 "Late" Investor 6/6/2014 Cumulative Distribution Cumulative Distribution + NAV of $8.20 Cumulative Distribution Cumulative Distribution + NAV of $8.20 "Early" Investor $6.00 $14.20 "Early" Investor $11.54 $19.74 "Late" Investor $3.22 $11.42 "Late" Investor $9.36 $17.56 Gross Return Average Annual Return Gross Return Average Annual Return "Early" Investor 41.97% 5.99% "Early" Investor 97.37% 9.48% "Late" Investor 11.10% 4.14% "Late" Investor 75.60% 10.56% "Early" Investor: First Day of Initial Public Offering - Broke Escrow "Late" Investor: Last Day of Follow-On Public Offering Former REIT ISila Realty Trust, Inc.

2021 Company Positioning and Portfolio Composition 16

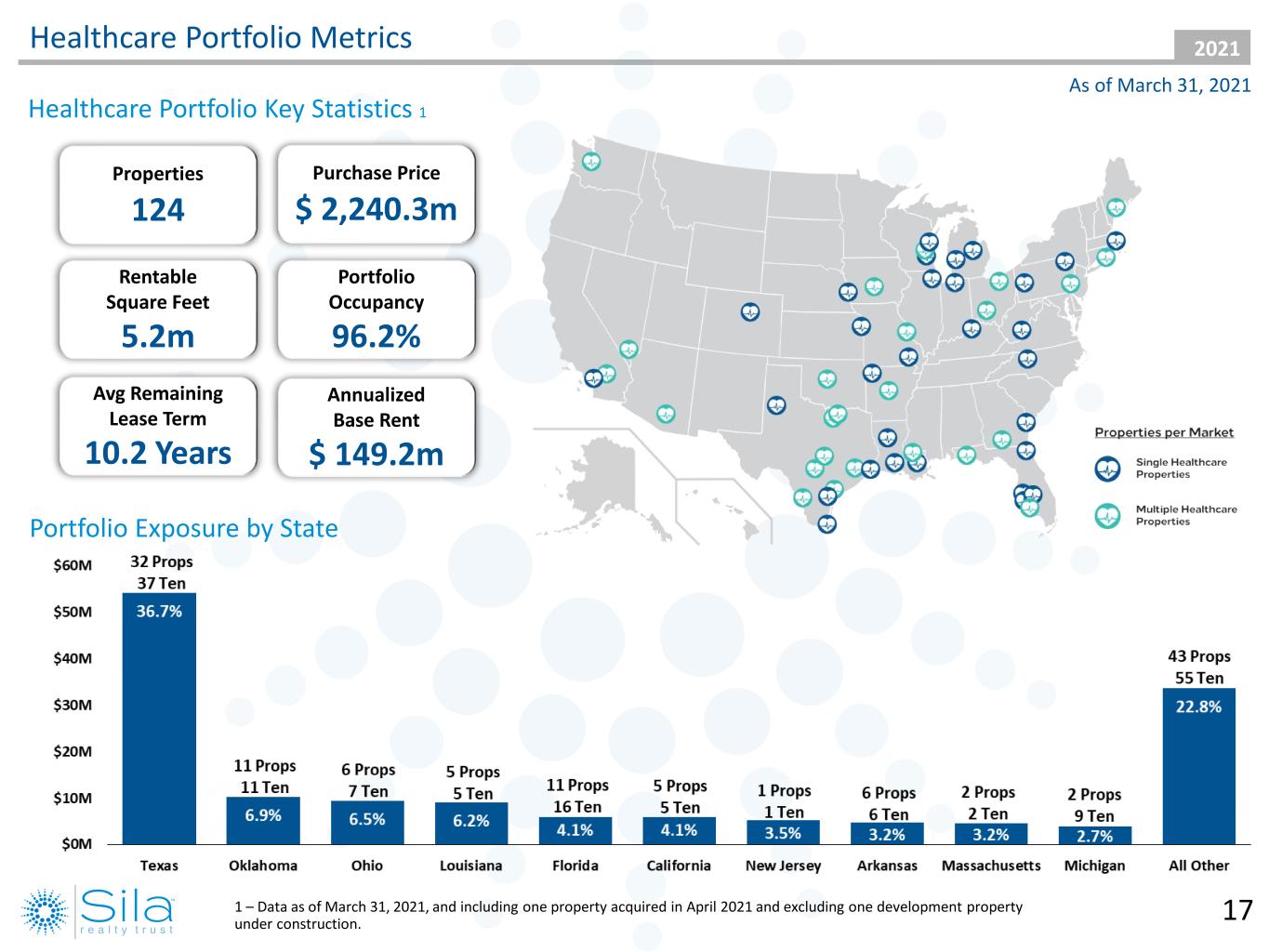

2021Healthcare Portfolio Metrics Healthcare Portfolio Key Statistics 1 Portfolio Exposure by State Properties 124 Purchase Price $ 2,240.3m Annualized Base Rent $ 149.2m Rentable Square Feet 5.2m Portfolio Occupancy 96.2% Avg Remaining Lease Term 10.2 Years 171 – Data as of March 31, 2021, and including one property acquired in April 2021 and excluding one development property under construction. As of March 31, 2021

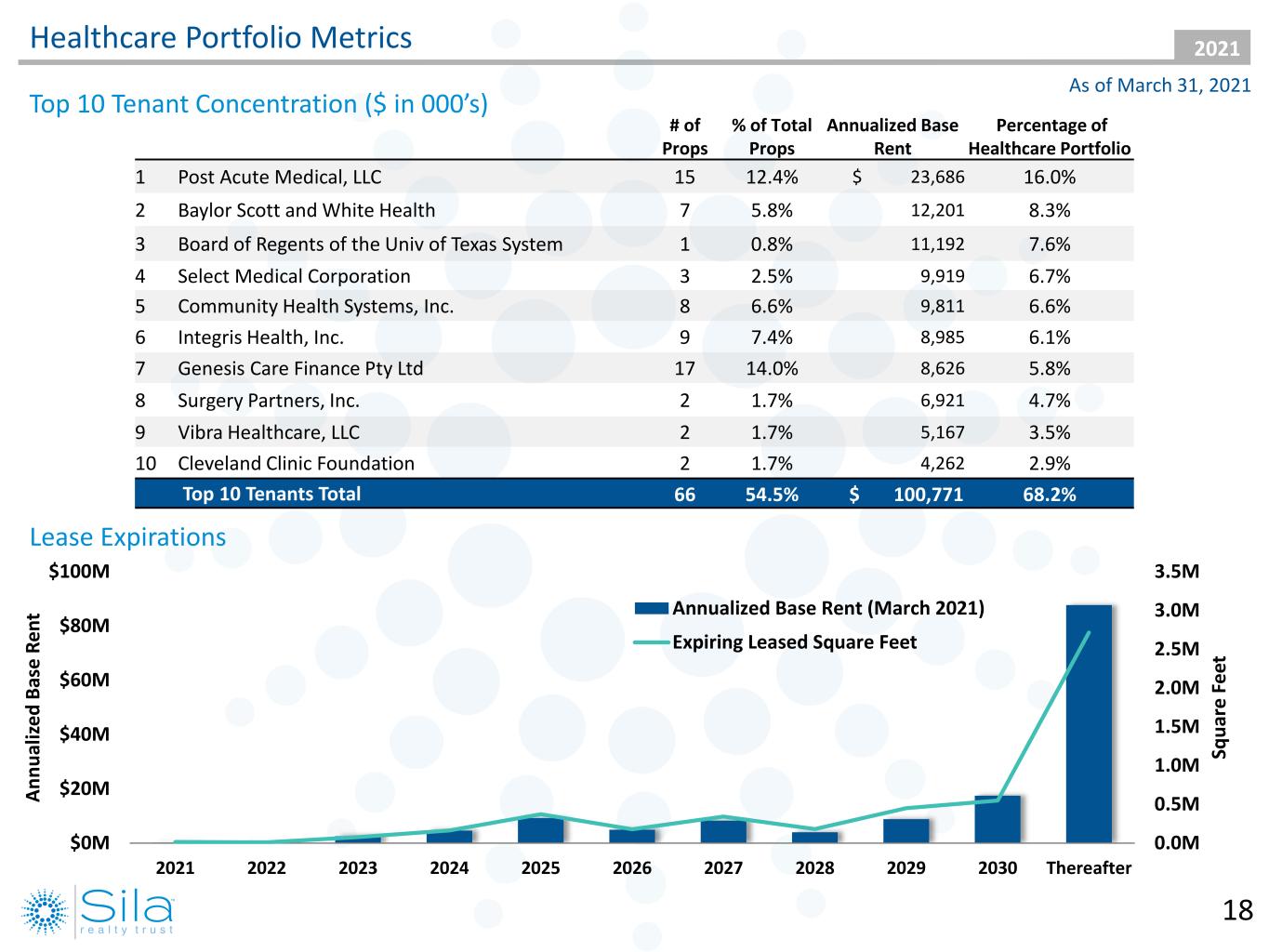

2021Healthcare Portfolio Metrics Lease Expirations # of Props % of Total Props Annualized Base Rent Percentage of Healthcare Portfolio 1 Post Acute Medical, LLC 15 12.4% $ 23,686 16.0% 2 Baylor Scott and White Health 7 5.8% 12,201 8.3% 3 Board of Regents of the Univ of Texas System 1 0.8% 11,192 7.6% 4 Select Medical Corporation 3 2.5% 9,919 6.7% 5 Community Health Systems, Inc. 8 6.6% 9,811 6.6% 6 Integris Health, Inc. 9 7.4% 8,985 6.1% 7 Genesis Care Finance Pty Ltd 17 14.0% 8,626 5.8% 8 Surgery Partners, Inc. 2 1.7% 6,921 4.7% 9 Vibra Healthcare, LLC 2 1.7% 5,167 3.5% 10 Cleveland Clinic Foundation 2 1.7% 4,262 2.9% Top 10 Tenants Total 66 54.5% $ 100,771 68.2% Top 10 Tenant Concentration ($ in 000’s) 0.0M 0.5M 1.0M 1.5M 2.0M 2.5M 3.0M 3.5M $0M $20M $40M $60M $80M $100M 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Thereafter Sq u ar e Fe et A n n u al iz ed B as e R en t Annualized Base Rent (March 2021) Expiring Leased Square Feet 18 As of March 31, 2021

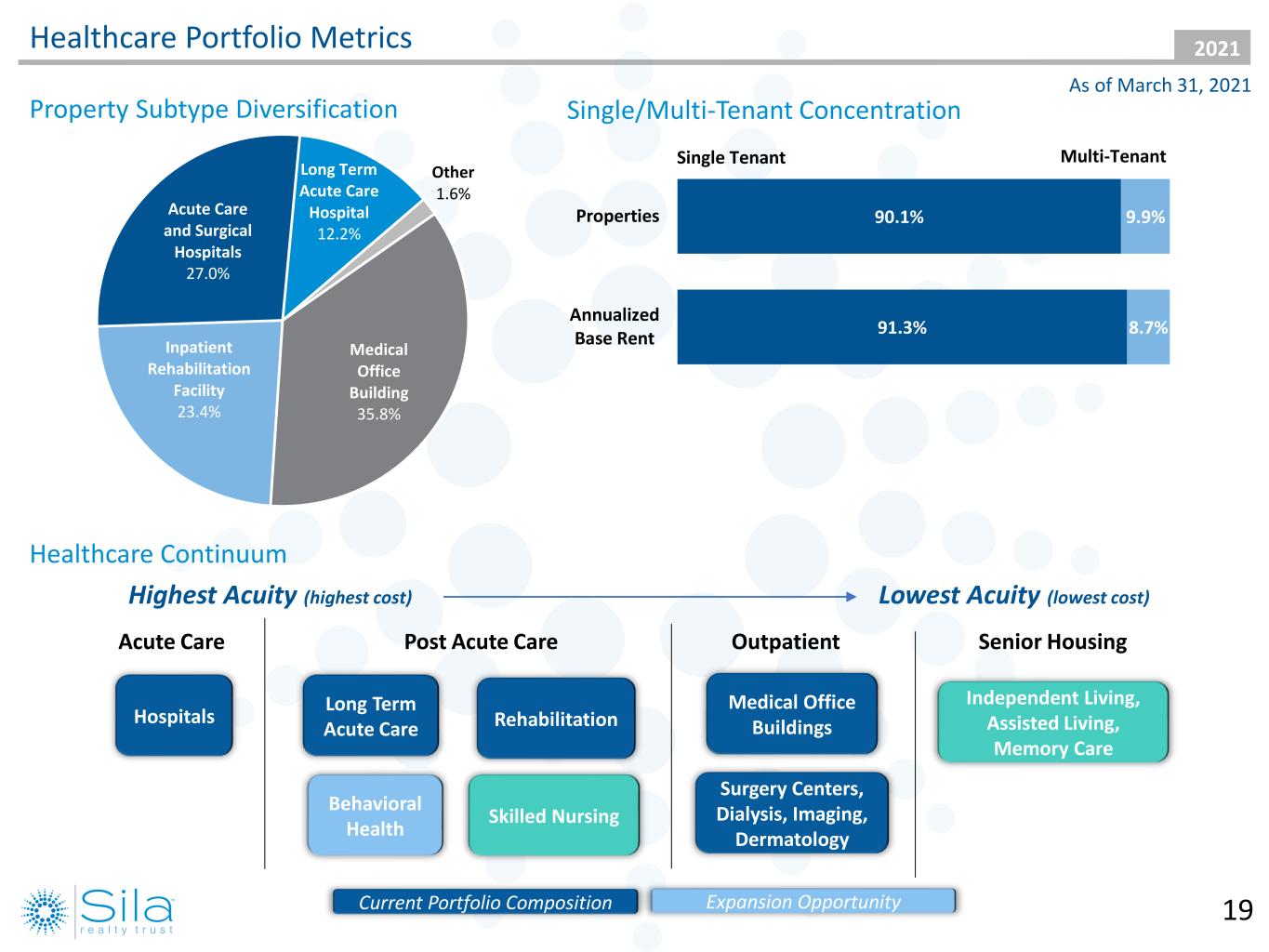

2021 Acute Care Post Acute Care Outpatient Senior Housing Healthcare Portfolio Metrics Highest Acuity (highest cost) Lowest Acuity (lowest cost) Hospitals Long Term Acute Care Behavioral Health Rehabilitation Skilled Nursing Medical Office Buildings Surgery Centers, Dialysis, Imaging, Dermatology Independent Living, Assisted Living, Memory Care Current Portfolio Composition Expansion Opportunity Property Subtype Diversification Single/Multi-Tenant Concentration Medical Office Building 35.8% Inpatient Rehabilitation Facility 23.4% Acute Care and Surgical Hospitals 27.0% Long Term Acute Care Hospital 12.2% Other 1.6% 90.1% 91.3% 9.9% 8.7% Properties Annualized Base Rent Single Tenant Multi-Tenant Healthcare Continuum 19 As of March 31, 2021

2021Key Portfolio Drivers Company Strategy - Market leading providers with dominant market share - Strong financial foundation with high rent coverage ratios or other credit enhancements - Hospital or health system affiliations - Providers with demonstrated experience at adapting to the rapidly changing healthcare sector - Diverse payor mix - On campus or off campus facilities in retail-type locations - Strong visibility and access with ample parking - High growth areas near population clusters that are convenient to the patients/customers - Near and convenient to the tenant’s patient referral sources - Large patient catchment areas - Essential to provide care to the communities they serve - Class A/recent construction or renovation - Single or multi-tenant facilities with strong anchor tenants - Specialized facilities with substantial tenant buildout - Long weighted average lease terms with annual rent escalations - Synergistic tenancy with built in referral patterns 20 Locations Tenants Facilities

2021 Healthcare Market Overview 21

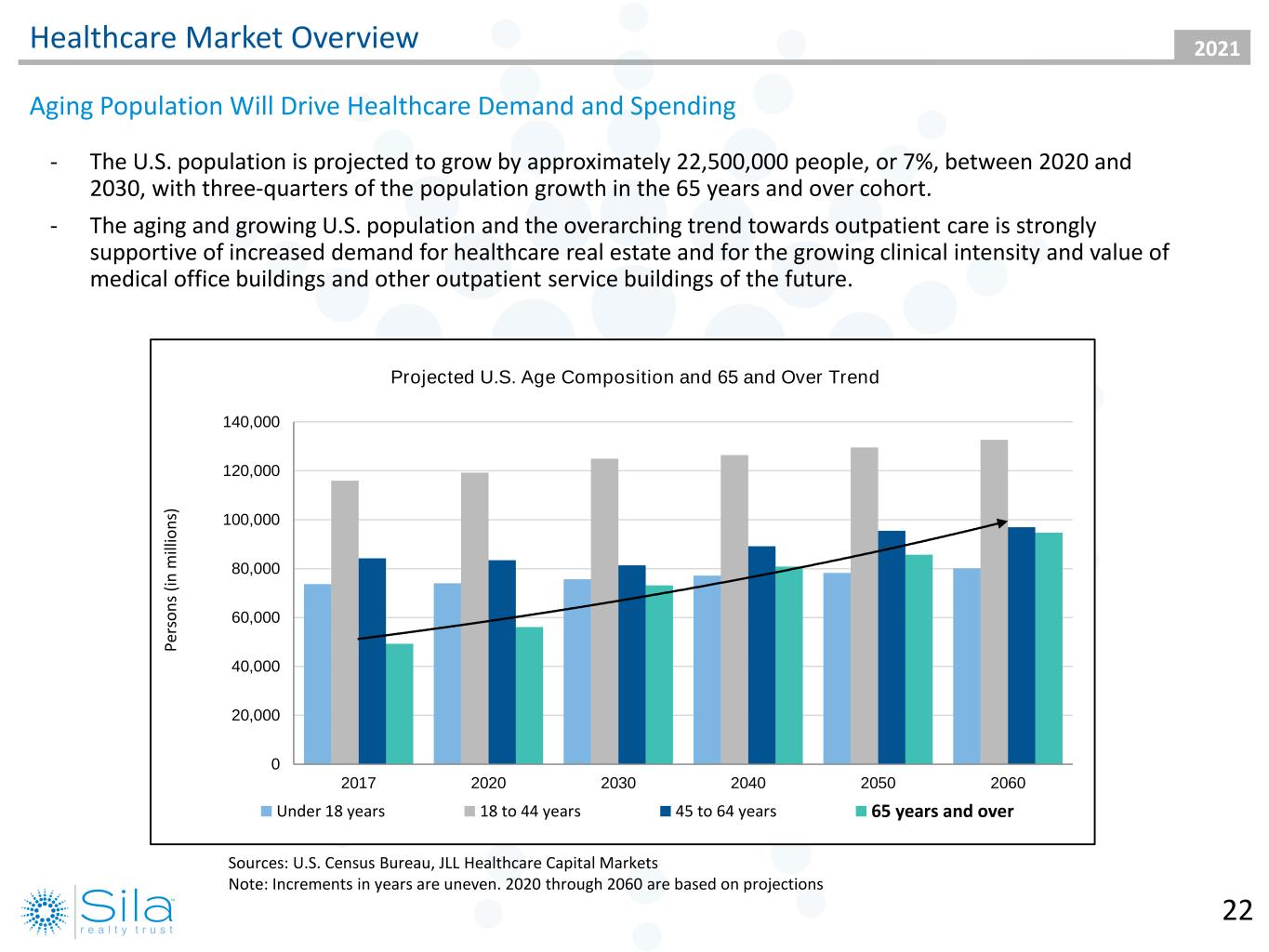

2021Healthcare Market Overview Aging Population Will Drive Healthcare Demand and Spending - The U.S. population is projected to grow by approximately 22,500,000 people, or 7%, between 2020 and 2030, with three-quarters of the population growth in the 65 years and over cohort. - The aging and growing U.S. population and the overarching trend towards outpatient care is strongly supportive of increased demand for healthcare real estate and for the growing clinical intensity and value of medical office buildings and other outpatient service buildings of the future. 22 Sources: U.S. Census Bureau, JLL Healthcare Capital Markets Note: Increments in years are uneven. 2020 through 2060 are based on projections 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2017 2020 2030 2040 2050 2060 P er so n s (i n m ill io n s) Projected U.S. Age Composition and 65 and Over Trend Under 18 years 18 to 44 years 45 to 64 years 65 years and over

2021Healthcare Market Overview Outpatient Healthcare Growth - Gone are the days of health systems focused on making money from “heads in beds”, with the aggregate outpatient share of total hospital revenue growing from 28% in 1994 to over 50% in 2020. - Nearly 4 of 5 healthcare expenditure dollars is spent by the 65 years and over group, who view conveniently located hospitals and outpatient healthcare facilities as extremely or very important when choosing their living community. - The COVID-19 pandemic put a spotlight on outpatient care in an acute care setting, with the healthcare crisis accelerating the trends in increased care in locations such as medical office buildings, ambulatory surgery centers and other outpatient facilities. 23 Sources: Deloitte, AHA annual survey and Medicare cost reports, JLL Capital Markets

2021 Positioning for Public Market Listing 24

2021Positioning for Public Market Listing The completion of the data center Portfolio Sale marks another key step in Sila Realty Trust’s transformation to a pure-play healthcare REIT. The Company’s resilient healthcare portfolio, diversified by geography and tenancy, coupled with a strong balance sheet, significant net worth, low leverage and ample liquidity for growth and further diversification, enhances optionality for a liquidity event through a public market listing. We will continue to seek to acquire and own healthcare real estate across the continuum of care, with a focus on assets with strong demographic, economic and social drivers. We appreciate the continued support of our stockholders through the strategic evolution of Sila Realty Trust, Inc. 25

Investor Relations IR@silarealtytrust.com 833-404-4107 Thank you for joining us!

2021Disclosures Forward Looking Statements Certain statements contained herein, other than historical fact, including the Company’s anticipated expenses and cost savings following the internalization transaction, anticipated timing for a liquidity event, use of proceeds from the sale of the data center properties, including special distributions and projected AFFO, reduction of debt and leverage positions and resulting liquidity, and the Company’s continuing focus on healthcare real estate, may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provided by the same. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties. No forward-looking statement is intended to, nor shall it, serve as a guarantee of future performance. You can identify the forward-looking statements by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will” and other similar terms and phrases, including references to assumptions and forecasts of future results projected growth of U.S. aging population and anticipated healthcare trends. Forward-looking statements are subject to various risks and uncertainties and factors that could cause actual results to differ materially from the company’s expectations, and investors should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond the company’s control and could materially affect the company’s results of operations, financial condition, cash flows, performance or future achievements or events, including those described under the section entitled Part I, Item 1A. “Risk Factors” of our 2020 Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Non-GAAP Measures This presentation contains certain financial information not derived in accordance with the United States generally accepted accounting principles (GAAP). These items may include, but are not limited to, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted funds from operations (AFFO), and net debt. These measures (and the methodologies used to derive them) may not be comparable to those used by other companies. Management considers each item an important measure of operating and financial performance and believes they are frequently used by interested parties in the evaluation of real estate investment trusts. These measures should not be considered as alternatives, or superior measures, to net income or loss as an indicator of the company's performance and should be considered only as a supplement to net income or loss and cash flows from operating, investing or financing activities as measure of profitability and/or liquidity, computed in accordance with GAAP. For definitions and reconciliations of these non- GAAP financial measures, see under “Non-GAAP Financial Measure” in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021.