Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SOUTH STATE Corp | ssb-20210722xex99d1.htm |

| 8-K - 8-K - SOUTH STATE Corp | ssb-20210722x8k.htm |

Exhibit 99.2

| Investor Presentation Friday, July 23, 2021 Atlantic Capital Bancshares to Merge with SouthState Corporation Exhibit 99.2 |

| FORWARD LOOKING STATEMENTS AND ADDITIONAL INFORMATION 2 Statements included in this communication, which are not historical in nature are intended to be, and are hereby identified as, forward-looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements about the benefits of the proposed merger of SouthState and Atlantic Capital, including future financial and operating results (including the anticipated impact of the transaction on SouthState’s and Atlantic Capital’s respective earnings and tangible book value), statements related to the expected timing of the completion of the merger, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “scheduled,” “plans,” “intends,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of SouthState or Atlantic Capital to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others:(1) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized;(2) disruption to the parties’ businesses as a result of the announcement and pendency of the merger;(3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement;(4) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses;(5) the failure to obtain the necessary approvals by the shareholders of South State or Atlantic Capital;(6) the amount of the costs, fees, expenses and charges related to the merger;(7) the ability by each of SouthState and Atlantic Capital to obtain required governmental approvals of the merger (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction);(8) reputational risk and the reaction of each company's customers, suppliers, employees or other business partners to the merger;(9) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the merger;(10) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events;(11) the dilution caused by South State’s issuance of additional shares of its common stock in the merger;(12) general competitive, economic, political and market conditions, and (13) other factors that may affect future results of Atlantic Capital and SouthState including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Board of Governors of the Federal Reserve System and Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. Additional factors which could affect future results of SouthState and Atlantic Capital can be found in SouthState’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and Atlantic Capital’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. SouthState and Atlantic Capital disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Important Information About the Merger and Where to Find It SouthState intends to file a registration statement on Form S-4 with the SEC to register the shares of SouthState’s common stock that will be issued to Atlantic Capital’s shareholders in connection with the transaction. The registration statement will include a proxy statement of Atlantic Capital that also constitutes a prospectus of SouthState. The definitive proxy statement/prospectus will be sent to the shareholders of Atlantic Capital in connection with the proposed merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by SouthState or Atlantic Capital through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of South State or Atlantic Capital at : Before making any voting or investment decision, investors and security holders of Atlantic Capital are urged to read carefully the entire registration statement and proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation SouthState, Atlantic Capital and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of SouthState can be found in SouthState's definitive proxy statement in connection with its 2021 annual meeting of shareholders, as filed with the SEC on March 8, 2021, and other documents subsequently filed by SouthState with the SEC. Information about the directors and executive officers of Atlantic Capital can be found in Atlantic Capital's definitive proxy statement in connection with its 2021 annual meeting of shareholders, as filed with the SEC on April 9, 2021, and other documents subsequently filed by Atlantic Capital with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. SouthState Corporation Atlantic Capital Bancshares, Inc. 1101 First Street South 945 East Paces Ferry Road NE Winter Haven, Florida 33800 Atlanta, Georgia 30326 Attention: Investor Relations Attention: Investor Relations (863) 293-4710 (404) 995-6050 |

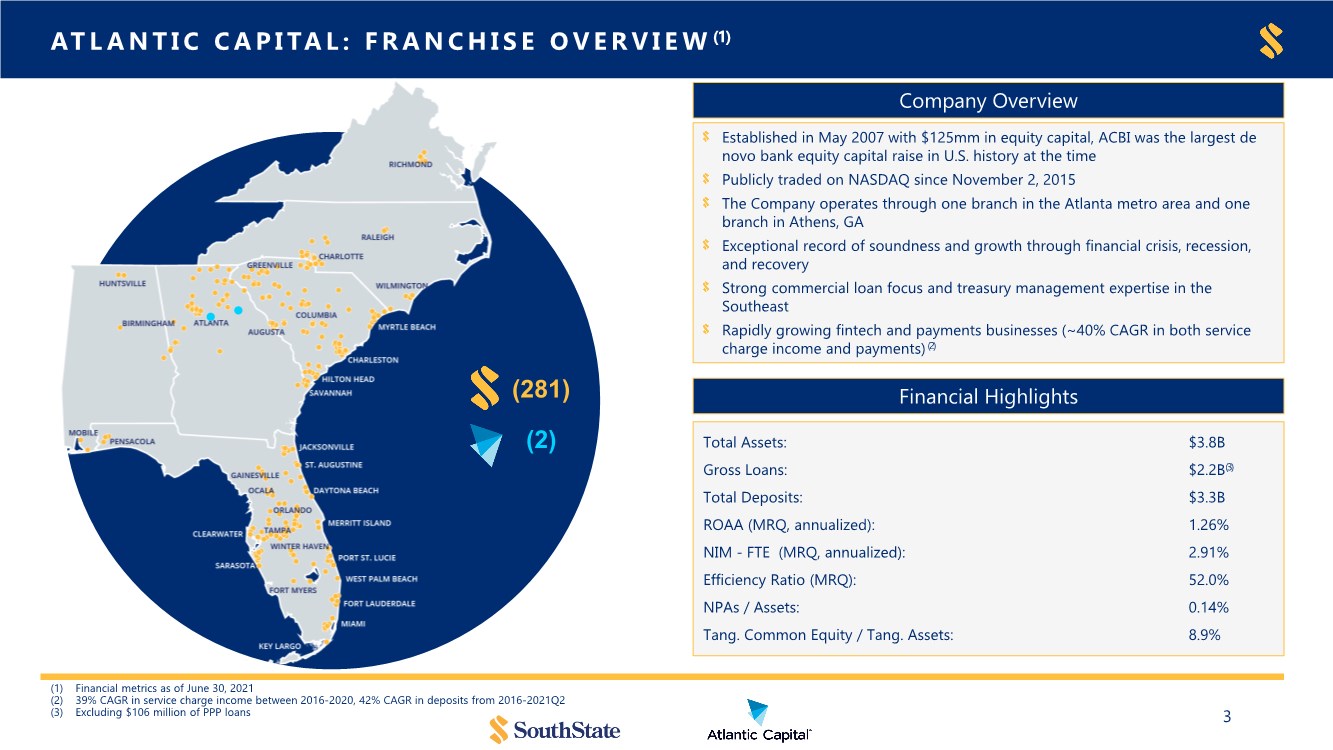

| ATLANTIC CAPITAL: FRANCHISE OVERVIEW (1) 3 (281) (2) (1) Financial metrics as of June 30, 2021 (2) 39% CAGR in service charge income between 2016-2020, 42% CAGR in deposits from 2016-2021Q2 (3) Excluding $106 million of PPP loans Financial Highlights Established in May 2007 with $125mm in equity capital, ACBI was the largest de novo bank equity capital raise in U.S. history at the time Publicly traded on NASDAQ since November 2, 2015 The Company operates through one branch in the Atlanta metro area and one branch in Athens, GA Exceptional record of soundness and growth through financial crisis, recession, and recovery Strong commercial loan focus and treasury management expertise in the Southeast Rapidly growing fintech and payments businesses (~40% CAGR in both service charge income and payments) (2) Total Assets: Gross Loans: Total Deposits: ROAA (MRQ, annualized): NIM - FTE (MRQ, annualized): Efficiency Ratio (MRQ): NPAs / Assets: Tang. Common Equity / Tang. Assets: $3.8B $2.2B(3) $3.3B 1.26% 2.91% 52.0% 0.14% 8.9% Company Overview |

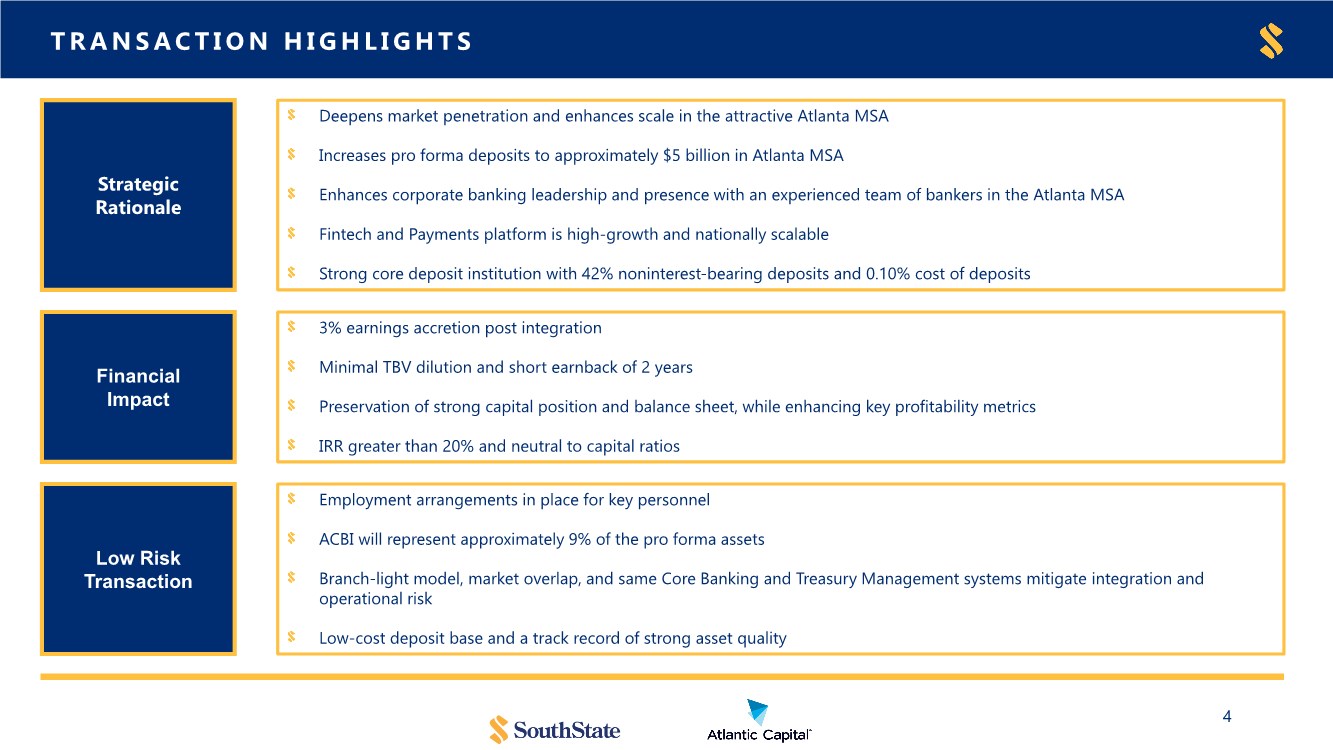

| TRANSACTION HIGHLIGHTS 4 Strategic Rationale Financial Impact Low Risk Transaction Deepens market penetration and enhances scale in the attractive Atlanta MSA Increases pro forma deposits to approximately $5 billion in Atlanta MSA Enhances corporate banking leadership and presence with an experienced team of bankers in the Atlanta MSA Fintech and Payments platform is high-growth and nationally scalable Strong core deposit institution with 42% noninterest-bearing deposits and 0.10% cost of deposits Employment arrangements in place for key personnel ACBI will represent approximately 9% of the pro forma assets Branch-light model, market overlap, and same Core Banking and Treasury Management systems mitigate integration and operational risk Low-cost deposit base and a track record of strong asset quality 3% earnings accretion post integration Minimal TBV dilution and short earnback of 2 years Preservation of strong capital position and balance sheet, while enhancing key profitability metrics IRR greater than 20% and neutral to capital ratios |

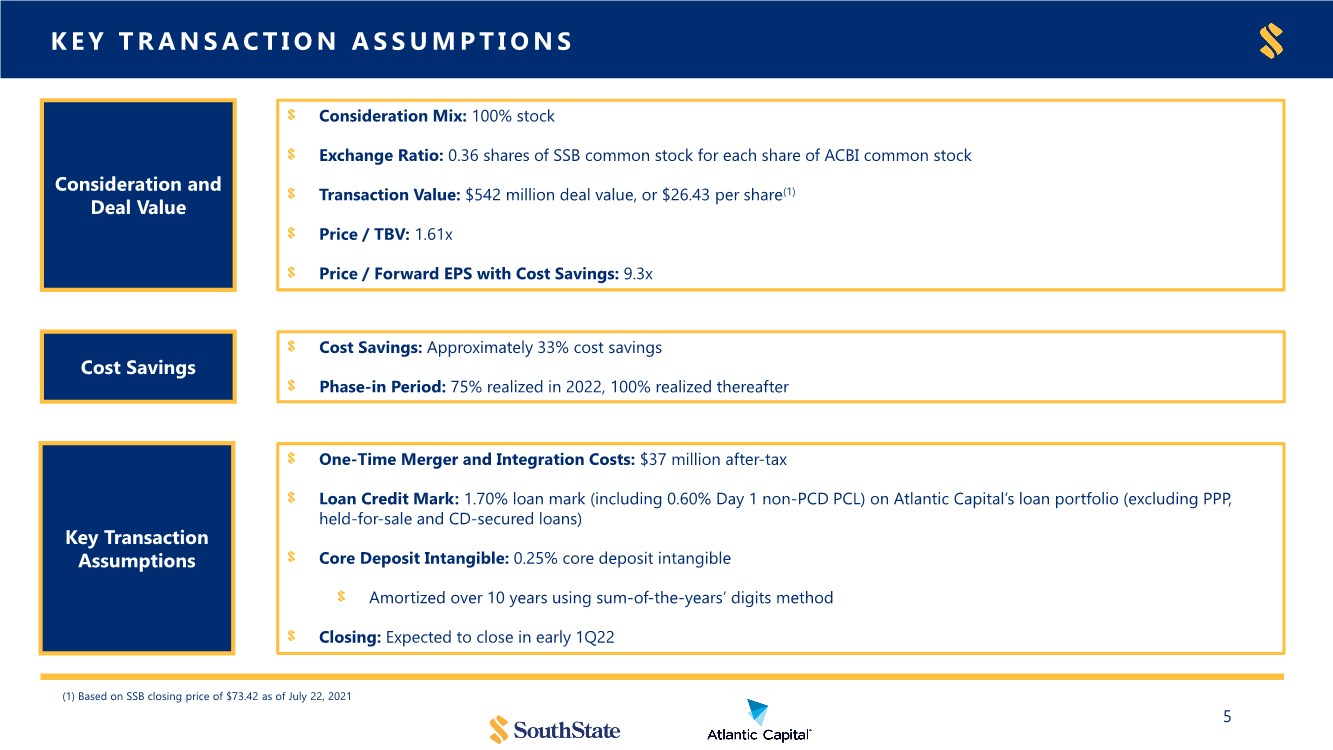

| KEY TRANSACTION ASSUMPTIONS 5 Consideration and Deal Value Key Transaction Assumptions Consideration Mix: 100% stock Exchange Ratio: 0.36 shares of SSB common stock for each share of ACBI common stock Transaction Value: $542 million deal value, or $26.43 per share(1) Price / TBV: 1.61x Price / Forward EPS with Cost Savings: 9.3x Cost Savings: Approximately 33% cost savings Phase-in Period: 75% realized in 2022, 100% realized thereafter One-Time Merger and Integration Costs: $37 million after-tax Loan Credit Mark: 1.70% loan mark (including 0.60% Day 1 non-PCD PCL) on Atlantic Capital’s loan portfolio (excluding PPP, held-for-sale and CD-secured loans) Core Deposit Intangible: 0.25% core deposit intangible Amortized over 10 years using sum-of-the-years’ digits method Closing: Expected to close in early 1Q22 Cost Savings (1) Based on SSB closing price of $73.42 as of July 22, 2021 |

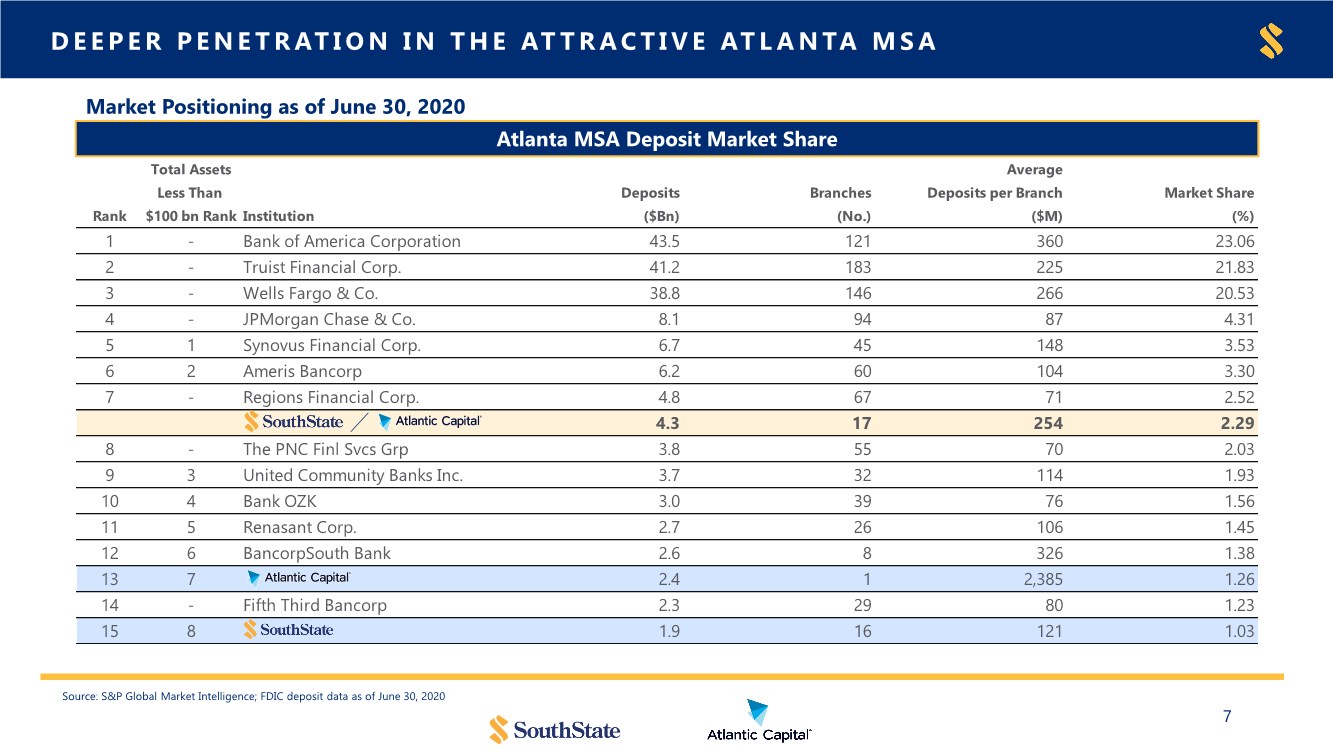

| INTEGRATION PLANS & COMMITMENT TO ATLANTA 6 Atlanta to serve as the headquarters for the Corporate Banking Division Atlanta is currently the headquarters for SSB’s Mortgage and Correspondent Banking Divisions Kurt Shreiner will continue as President of Corporate Financial Services Division Rich Oglesby will remain as a market leader in the Atlanta market Doug Williams will serve as President of the Atlanta Banking Group as well as the Head of Corporate Banking for the company Two Atlantic Capital directors to join the SSB Board SSB will rank 8th in pro forma deposit market share in Atlanta MSA |

| Total Assets Average Less Than Deposits Branches Deposits per Branch Market Share Rank $100 bn Rank Institution ($Bn) (No.) ($M) (%) 1 - Bank of America Corporation 43.5 121 360 23.06 2 - Truist Financial Corp. 41.2 183 225 21.83 3 - Wells Fargo & Co. 38.8 146 266 20.53 4 - JPMorgan Chase & Co. 8.1 94 87 4.31 5 1 Synovus Financial Corp. 6.7 45 148 3.53 6 2 Ameris Bancorp 6.2 60 104 3.30 7 - Regions Financial Corp. 4.8 67 71 2.52 4.3 17 254 2.29 8 - The PNC Finl Svcs Grp 3.8 55 70 2.03 9 3 United Community Banks Inc. 3.7 32 114 1.93 10 4 Bank OZK 3.0 39 76 1.56 11 5 Renasant Corp. 2.7 26 106 1.45 12 6 BancorpSouth Bank 2.6 8 326 1.38 13 7 2.4 1 2,385 1.26 14 - Fifth Third Bancorp 2.3 29 80 1.23 15 8 1.9 16 121 1.03 DEEPER PENETRATION IN THE ATTRACTIVE ATLANTA MSA 7 Source: S&P Global Market Intelligence; FDIC deposit data as of June 30, 2020 Atlanta MSA Deposit Market Share Market Positioning as of June 30, 2020 |

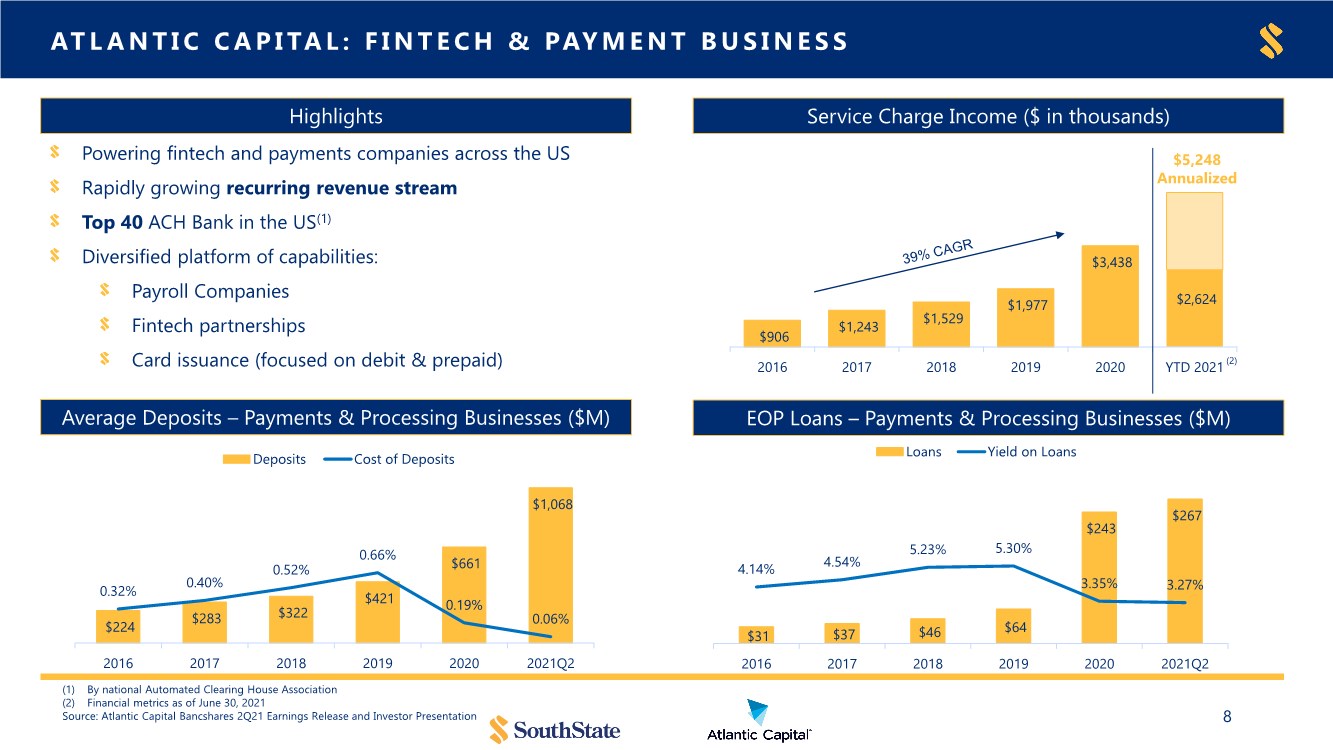

| EOP Loans – Payments & Processing Businesses ($M) ATLANTIC CAPITAL: FINTECH & PAYMENT BUSINESS 8 Powering fintech and payments companies across the US Rapidly growing recurring revenue stream Top 40 ACH Bank in the US(1) Diversified platform of capabilities: Payroll Companies Fintech partnerships Card issuance (focused on debit & prepaid) $224 $283 $322 $421 $661 $1,068 0.32% 0.40% 0.52% 0.66% 0.19% 0.06% $- $400 $800 2016 2017 2018 2019 2020 2021Q2 0.00% 0.50% 1.00% 1.50% Deposits Cost of Deposits $2,624 $906 $1,243 $1,529 $1,977 $3,438 2016 2017 2018 2019 2020 YTD 2021 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $31 $37 $46 $64 $243 $267 4.14% 4.54% 5.23% 5.30% 3.35% 3.27% $- $100 $200 $300 2016 2017 2018 2019 2020 2021Q2 1.00% 3.00% 5.00% 7.00% 9.00% Loans Yield on Loans Highlights Service Charge Income ($ in thousands) Average Deposits – Payments & Processing Businesses ($M) (2) (1) By national Automated Clearing House Association (2) Financial metrics as of June 30, 2021 Source: Atlantic Capital Bancshares 2Q21 Earnings Release and Investor Presentation $5,248 Annualized |

| SUMMARY 9 • Significantly improves market density in the growing and attractive Atlanta MSA • Enhances corporate banking leadership and presence with an experienced team of bankers • Opportunity to expand the rapidly growing Fintech & Payments business lines • Attractive in-market merger |

| Appendix |

| $85,729 $71,802 $62,953 ATLANTIC CAPITAL: ATLANTA’S HOMETOWN BUSINESS BANK 11 Atlanta Market Overview Demographics Companies Headquartered in Atlanta 5.7% 4.7% 3.9% #1 for economic growth potential (among large metro areas) #1 world’s busiest airport #2 moving destination #4 metro area for largest increase in population (2018-2019) 16 Fortune 500 headquarters 70% of all US payments are processed through Georgia C&I Banking: Entrepreneurs and emerging growth companies value experienced commercial bankers attuned to clients’ needs Commercial Real Estate: Established relationships with experienced developers of institutional grade properties Private Banking: Personalized banking service for owners/operators and other private clients Benefits of Enhanced Atlanta Presence Source: S&P Global Market Intelligence, Metro Atlanta Chamber, City Data, Penske and American Transaction Processors Coalition Atlanta Georgia Southeast Projected Population Growth 2021-2026 (%) Projected Median HHI 2026 ($) |

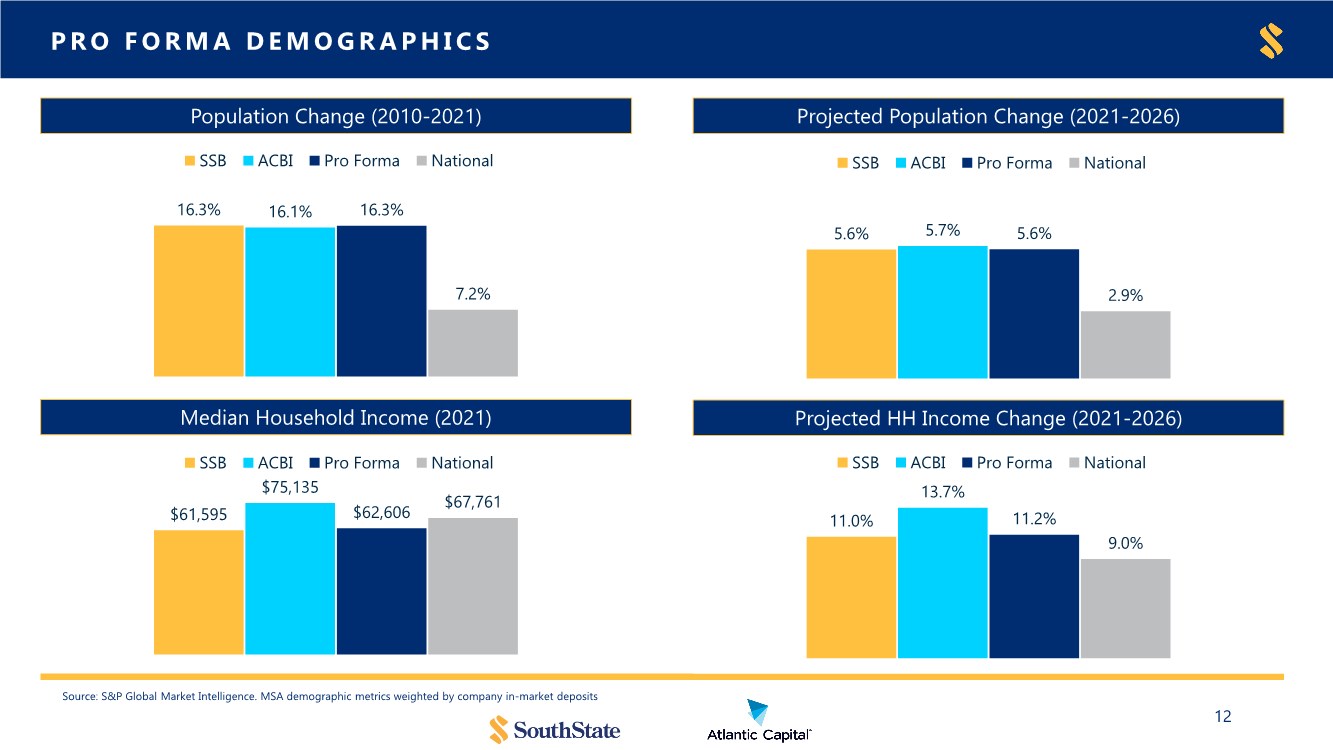

| Projected HH Income Change (2021-2026) PRO FORMA DEMOGRAPHICS 12 Source: S&P Global Market Intelligence. MSA demographic metrics weighted by company in-market deposits Population Change (2010-2021) Projected Population Change (2021-2026) Median Household Income (2021) 16.3% 16.1% 16.3% 7.2% SSB ACBI Pro Forma National 5.6% 5.7% 5.6% 2.9% SSB ACBI Pro Forma National $61,595 $75,135 $62,606 $67,761 SSB ACBI Pro Forma National 11.0% 13.7% 11.2% 9.0% SSB ACBI Pro Forma National |

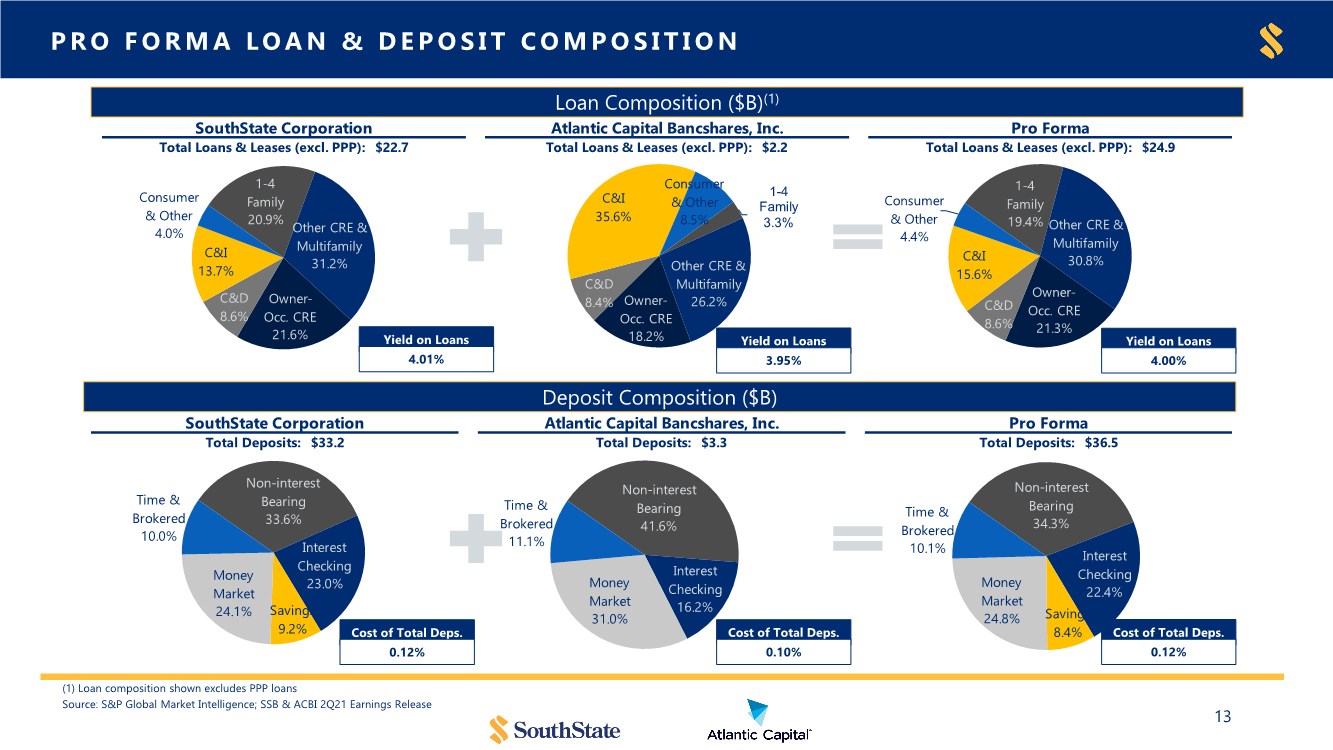

| SouthState Corporation Atlantic Capital Bancshares, Inc. Pro Forma Total Loans & Leases (excl. PPP): $22.7 Total Loans & Leases (excl. PPP): $2.2 Total Loans & Leases (excl. PPP): $24.9 Pro Forma Yield on Loans Calc Pro Forma CRE Concentration 1-4 Family 20.9% Other CRE & Multifamily 31.2% Owner- Occ. CRE 21.6% C&D 8.6% C&I 13.7% Consumer & Other 4.0% 1-4 Family 3.3% Other CRE & Multifamily 26.2% Owner- Occ. CRE 18.2% C&D 8.4% C&I 35.6% Consumer & Other 8.5% 1-4 Family 19.4% Other CRE & Multifamily 30.8% Owner- Occ. CRE 21.3% C&D 8.6% C&I 15.6% Consumer & Other 4.4% SouthState Corporation Atlantic Capital Bancshares, Inc. Pro Forma Total Deposits: $33.2 Total Deposits: $3.3 Total Deposits: $36.5 Pro Forma Cost of Deposits Calc Pro Forma Cost of Funds Calc Non-interest Bearing 33.6% Interest Checking 23.0% Savings 9.2% Money Market 24.1% Time & Brokered 10.0% Non-interest Bearing 41.6% Interest Checking 16.2% Money Market 31.0% Time & Brokered 11.1% Non-interest Bearing 34.3% Interest Checking 22.4% Savings 8.4% Money Market 24.8% Time & Brokered 10.1% PRO FORMA LOAN & DEPOSIT COMPOSITION 13 Loan Composition ($B)(1) Deposit Composition ($B) (1) Loan composition shown excludes PPP loans Source: S&P Global Market Intelligence; SSB & ACBI 2Q21 Earnings Release Yield on Loans 4.01% Yield on Loans 3.95% Yield on Loans 4.00% Cost of Total Deps. 0.12% Cost of Total Deps. 0.10% Cost of Total Deps. 0.12% |

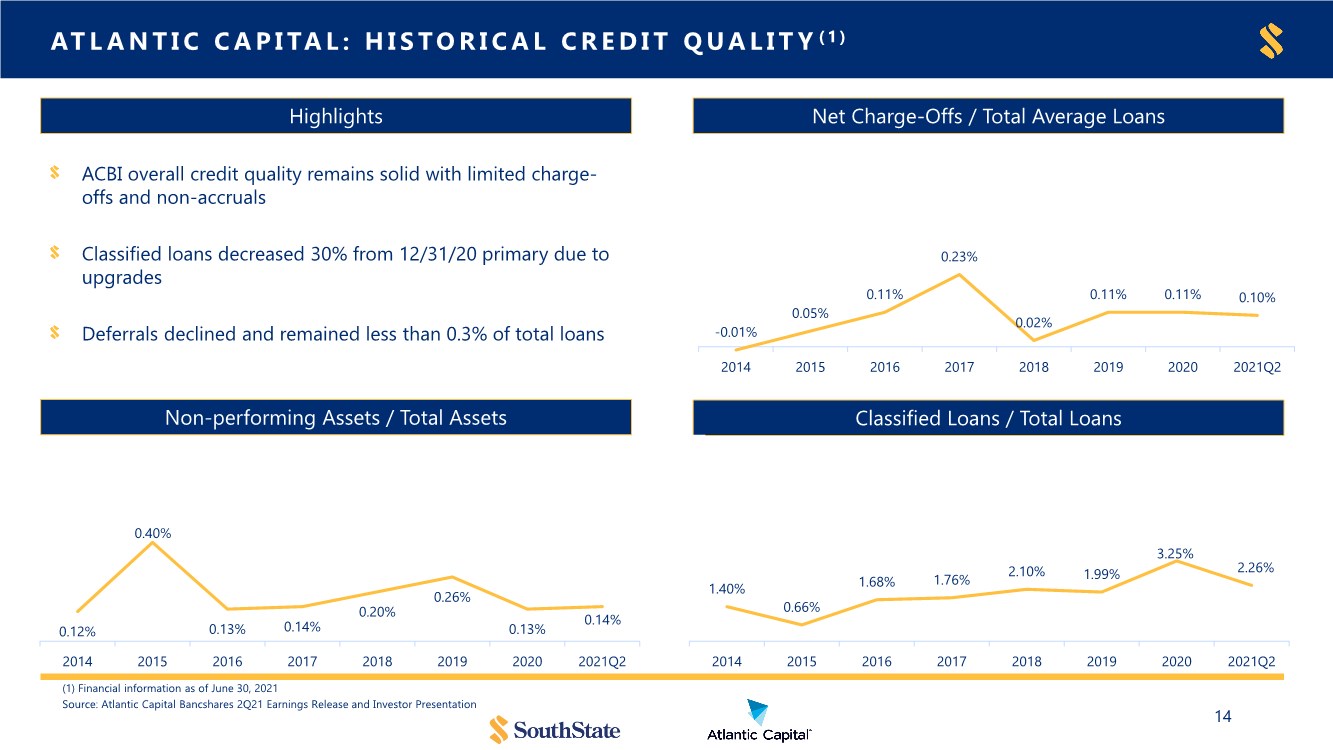

| Classified Loans / Total Loans ATLANTIC CAPITAL: HISTORICAL CREDIT QUALITY ( 1 ) 14 ACBI overall credit quality remains solid with limited charge- offs and non-accruals Classified loans decreased 30% from 12/31/20 primary due to upgrades Deferrals declined and remained less than 0.3% of total loans 0.12% 0.40% 0.13% 0.14% 0.20% 0.26% 0.13% 0.14% 2014 2015 2016 2017 2018 2019 2020 2021Q2 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% (1) Financial information as of June 30, 2021 Source: Atlantic Capital Bancshares 2Q21 Earnings Release and Investor Presentation Highlights Net Charge-Offs / Total Average Loans Non-performing Assets / Total Assets -0.01% 0.05% 0.11% 0.23% 0.02% 0.11% 0.11% 0.10% 2014 2015 2016 2017 2018 2019 2020 2021Q2 -0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 1.40% 0.66% 1.68% 1.76% 2.10% 1.99% 3.25% 2.26% 2014 2015 2016 2017 2018 2019 2020 2021Q2 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% |

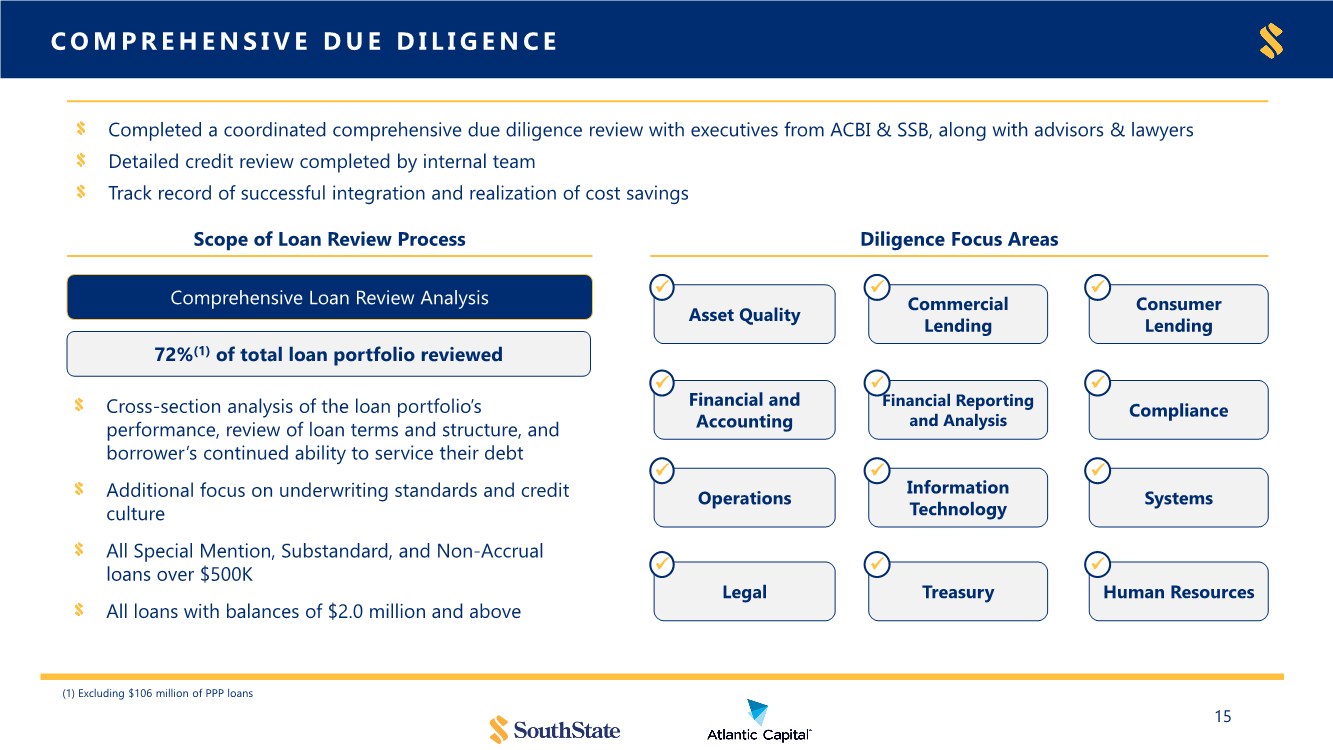

| COMPREHENSIVE DUE DILIGENCE 15 Completed a coordinated comprehensive due diligence review with executives from ACBI & SSB, along with advisors & lawyers Detailed credit review completed by internal team Track record of successful integration and realization of cost savings Comprehensive Loan Review Analysis 72%(1) of total loan portfolio reviewed Cross-section analysis of the loan portfolio’s performance, review of loan terms and structure, and borrower’s continued ability to service their debt Additional focus on underwriting standards and credit culture All Special Mention, Substandard, and Non-Accrual loans over $500K All loans with balances of $2.0 million and above Scope of Loan Review Process Diligence Focus Areas Asset Quality ✓ Commercial Lending ✓ Financial and Accounting ✓ Financial Reporting and Analysis ✓ Operations ✓ Information Technology ✓ Legal ✓ Treasury ✓ Consumer Lending ✓ Compliance ✓ Systems ✓ Human Resources ✓ (1) Excluding $106 million of PPP loans |

|