Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VALMONT INDUSTRIES INC | pressrelease20210626.htm |

| 8-K - 8-K - VALMONT INDUSTRIES INC | vmi-20210721.htm |

© 2021 Valmont® Industries, Inc. Valmont Industries, Inc. Second Quarter Earnings Presentation July 22, 2021

Disclosure Regarding Forward-Looking Statements These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries including the continuing and developing effects of COVID-19 including the effects of the outbreak on the general economy and the specific economic effects on the Company’s business and that of its customers and suppliers, competitor responses to the Company’s products and services, the overall market acceptance of such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. July 22, 20212 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation

| Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 20213 STEVE KANIEWSKI PRESIDENT & CHIEF EXECUTIVE OFFICER

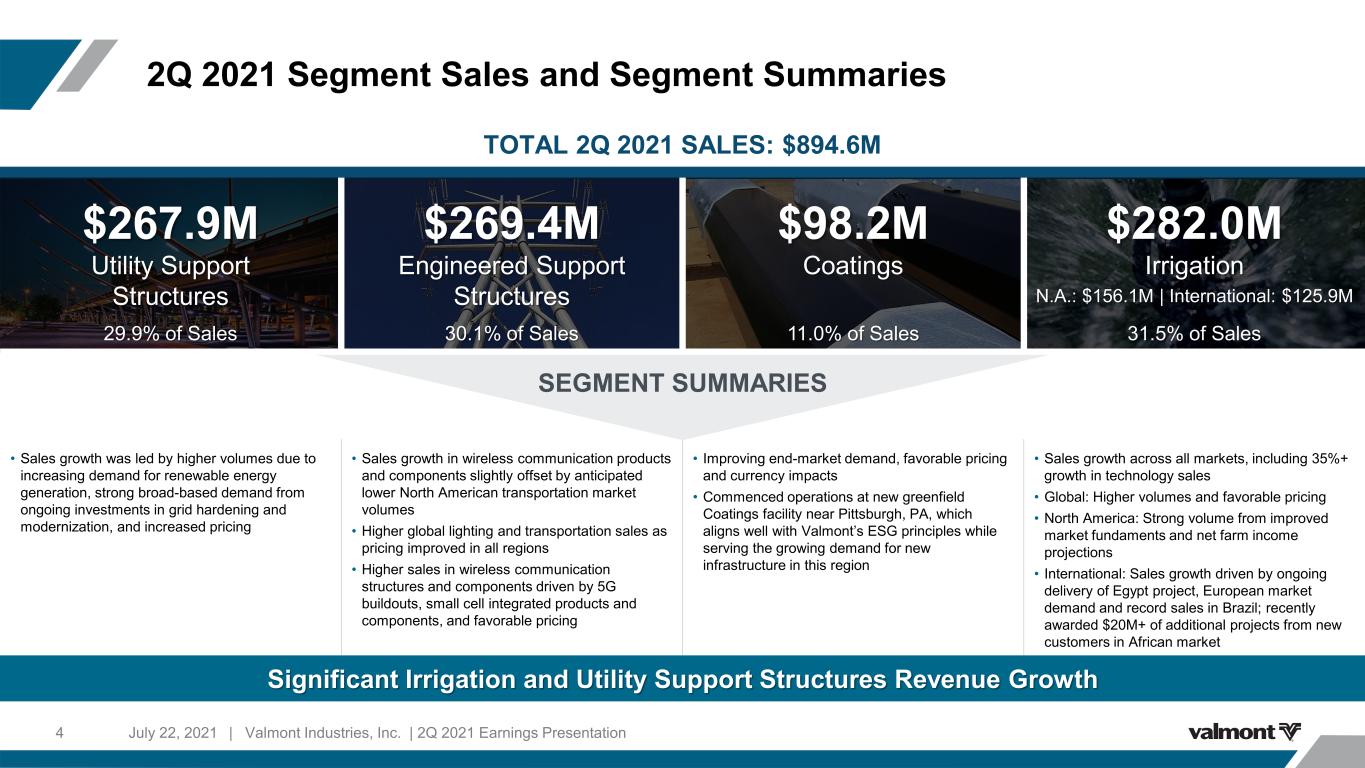

2Q 2021 Segment Sales and Segment Summaries July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation4 Significant Irrigation and Utility Support Structures Revenue Growth • Sales growth was led by higher volumes due to increasing demand for renewable energy generation, strong broad-based demand from ongoing investments in grid hardening and modernization, and increased pricing • Sales growth in wireless communication products and components slightly offset by anticipated lower North American transportation market volumes • Higher global lighting and transportation sales as pricing improved in all regions • Higher sales in wireless communication structures and components driven by 5G buildouts, small cell integrated products and components, and favorable pricing • Improving end-market demand, favorable pricing and currency impacts • Commenced operations at new greenfield Coatings facility near Pittsburgh, PA, which aligns well with Valmont’s ESG principles while serving the growing demand for new infrastructure in this region • Sales growth across all markets, including 35%+ growth in technology sales • Global: Higher volumes and favorable pricing • North America: Strong volume from improved market fundaments and net farm income projections • International: Sales growth driven by ongoing delivery of Egypt project, European market demand and record sales in Brazil; recently awarded $20M+ of additional projects from new customers in African market SEGMENT SUMMARIES TOTAL 2Q 2021 SALES: $894.6M $267.9M $269.4M $98.2M $282.0M Utility Support Structures Engineered Support Structures Coatings Irrigation N.A.: $156.1M | International: $125.9M 29.9% of Sales 30.1% of Sales 11.0% of Sales 31.5% of Sales

Prospera Technologies Update: Continuing to Expand Our Irrigation Technology Leadership 5 Finding New Ways to Use Less Inputs in Order to Achieve Higher Crop Yields July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation Strong Value Proposition • Accelerating innovation through investments in recurring revenue services • Expect recurring revenue sales to grow to 50%+ per year over next 3-5 years • Expect acquisition to be accretive to the segment beginning in 2023 Unique Technology • Highly-differentiated solution focused on in-season crop performance that is able to go beyond traditional irrigated acres • Used on 5,300+ fields today on a variety of crops including corn, soybeans, potatoes, wheat, onions, alfalfa and tomatoes Entrepreneurial Spirit and Key Talent Additions • 100 highly-talented and motivated employees, including experts in data science and machine-learning Key Stats Founded 2014 Headquarters Austin, TX R&D Center Tel Aviv, Israel Transaction Details Price $300M Financing Cash + Revolving Credit Facility Closed May 2021 Award-winning, Global Leader in AI and Machine-Learning

6 July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation “Class of One” Industry-Recognized Status Accelerated Growth and New Product Innovations in Solar Business Total Projects Awarded in 2Q 2021 ($72M) Valmont Solar Solutions - Utility • Awarded projects totaling $47M in 2Q 2021 • 30+ orders for the North American Market over past 18 months • Completed several sunbelt region projects Valmont Solar Solutions - Agriculture • Awarded 3 Ag solar projects in 2Q 2021 equating to $25M • Launching in North America this fall at Husker Harvest Days • Collaborating with the Utility solar team and world-class Valley dealer network • Delivering integrated solutions to support ag players in their markets

ESG Excellence as a Foundation 7 ESG Continues to be a Strategic Priority with the Mindset of Conserving Resources and Improving Life | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Reiterating Our 2021 Investor Day ESG Initiatives ENVIRONMENTAL Sustainably building upon a foundation focused on managing risks and improving efficiencies ISS Quality Score Previous Today 6 2 SOCIAL Empowering our workforce, customers and communities ISS Quality Score Previous Today 6 3 GOVERNANCE Operating ethically and managing oversight through open collaboration ISS Quality Score Previous Today 2 2 Recent Recognition of Our ESG Efforts – Improvement in ISS Quality Scores

AVNER APPLBAUM EVP & CHIEF FINANCIAL OFFICER | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 20218

2Q 2021 Financial Summary July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation9 Sales Operating Income Diluted EPS GAAP Adjusted1 GAAP Adjusted1 29.9% 90.2% 38.4% 172.6% 53.0% • Record second quarter sales; significantly higher in Irrigation and Utility Support Structures • Record global backlog of more than $1.34B, reflecting strong market demand • Operating income growth driven by: ‒ Higher volumes in Irrigation ‒ Improved operating performance including record quarterly results for Engineered Support Structures • Strong operating income and a more favorable adj. tax rate of 22.5% realized through the execution of certain tax planning strategies • GAAP results for 2020 include a $16.6 million goodwill & tradename impairment ($0.77 per share) $M, except for per share amounts $82.6 $43.4 $90.9 $65.7 2021 2020 2021 2020 $894.6 $688.8 2021 2020 $2.89 $1.06 $3.06 $2.00 2021 2020 2021 2020 1Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

Sales Operating Income 15.8% GAAP Adjusted1 2Q 2021 Results | Utility Support Structures 10 ($M) Key Statistics 2020 Sales $ 231.3 Intersegment Sales (2.8) Volume 28.6 Pricing/Mix 8.5 Acquisitions/Divestiture - Currency Translation 2.3 2021 Sales $ 267.9 $267.9 $231.3 2021 2020 COMMENTARY • Higher volumes due to increasing demand for renewable energy generation and utilities’ continued investments in grid resiliency • Strong volumes, increased pricing and improved operational performance more than offset by ongoing impact of rapidly rising raw material costs – could not yet be recovered through pricing mechanisms July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation $15.0 $21.7 $21.2 $25.3 2021 2020 2021 2020 1Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

Sales Operating Income1 6.3% 2Q 2021 Results | Engineered Support Structures July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation11 ($M) $269.4 $253.4 2021 2020 $31.9 $4.8 $22.9 2021 2020 2020 Adj. COMMENTARY • Record sales and operating income, led by a focus on pricing actions, cost optimization, and the benefits of previous restructuring actions • Operations teams continue to drive performance improvement across the segment through improved productivity and product quality, and better ship-complete and on-time (SCOT) delivery metrics • Higher wireless communication structures and components sales and commercial lighting sales offset lower volumes in North American transportation markets Key Statistics 2020 Sales $ 253.4 Intersegment Sales (4.5) Volume (2.4) Pricing/Mix 11.4 Acquisitions/Divestiture - Currency Translation 11.5 2021 Sales $ 269.4 1Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

2Q 2021 Results | Coatings July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation12 ($M) COMMENTARY • Sales increase was driven by an improving macro-environment compared to last year, favorable pricing and FX • Higher volumes, favorable pricing and operational efficiencies more than offset the impact of raw material cost inflation Key Statistics 2020 Sales $ 80.0 Intersegment Sales 3.2 Volume 6.0 Pricing/Mix 5.1 Acquisitions/Divestiture 0.1 Currency Translation 3.8 2021 Sales $ 98.2 Sales Operating Income1 22.7% $98.2 $80.0 2021 2020 $14.7 $10.1 $10.4 2021 2020 2020 Adj. 1Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

Sales Operating Income1 57.6% 144.0% 2Q 2021 Results | Irrigation July 22, 202113 ($M) $42.0 $42.9 $22.4 2021 2021 Adj 20202021 2020 $156.1 $125.9 $99.0 $51.6 North America International COMMENTARY • Strong global agricultural market fundamentals continue to drive positive farmer sentiment • In North America, strong market fundamentals and improved net farm income projections contributed to sales growth • Ongoing deliveries of the large Egypt project, and higher sales in Brazil and Europe led international sales growth • Significantly higher volumes and favorable pricing slightly offset by $3.1M of higher R&D expense for strategic technology growth investments, including product development • 1H 2021 technology solutions sales of $50.0M grew 55.0% YoY | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation Key Statistics 2020 Sales $ 150.6 Intersegment Sales 0.3 Volume 89.7 Pricing/Mix 38.6 Acquisitions/Divestiture 1.1 Currency Translation 1.7 2021 Sales $ 282.0 1Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

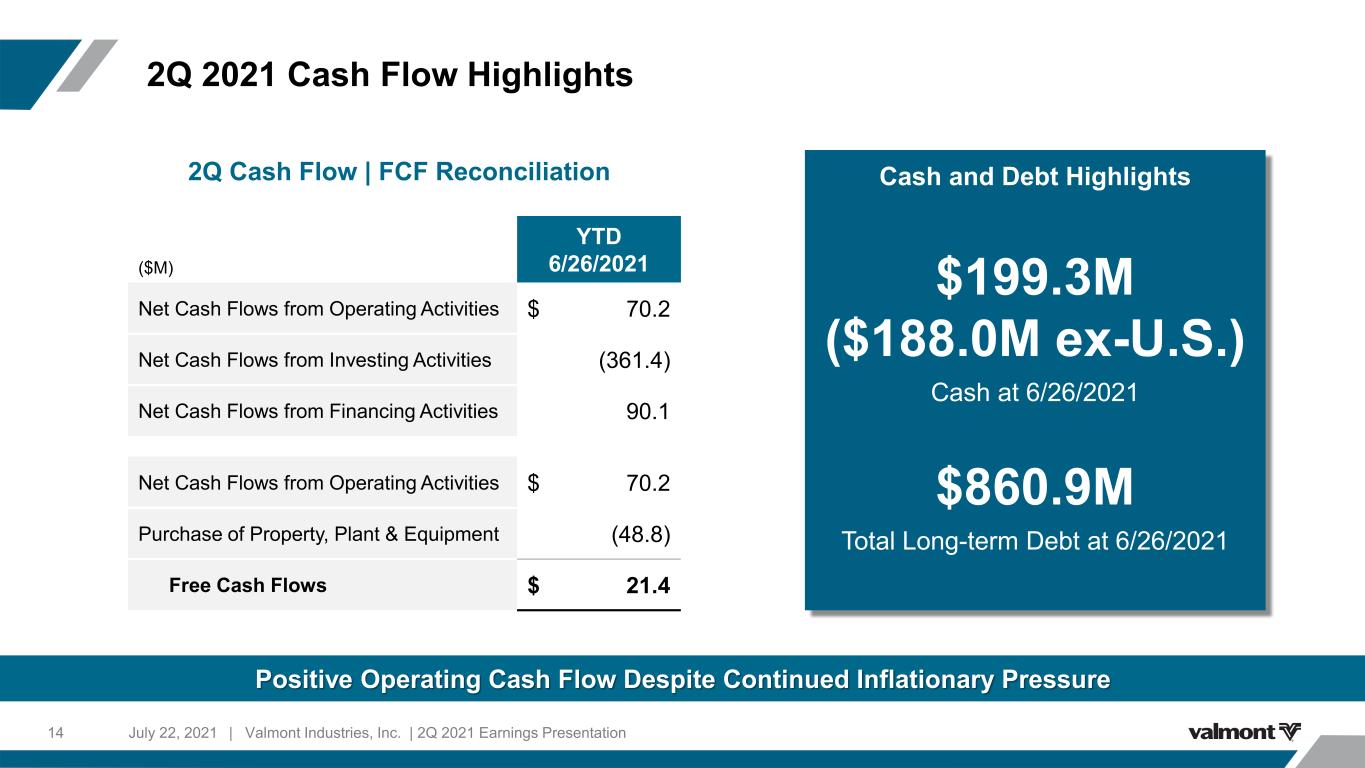

2Q 2021 Cash Flow Highlights July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation14 Positive Operating Cash Flow Despite Continued Inflationary Pressure ($M) YTD 6/26/2021 Net Cash Flows from Operating Activities $ 70.2 Net Cash Flows from Investing Activities (361.4) Net Cash Flows from Financing Activities 90.1 Net Cash Flows from Operating Activities $ 70.2 Purchase of Property, Plant & Equipment (48.8) Free Cash Flows $ 21.4 2Q Cash Flow | FCF Reconciliation Cash and Debt Highlights $199.3M ($188.0M ex-U.S.) Cash at 6/26/2021 $860.9M Total Long-term Debt at 6/26/2021

Balanced Approach to Capital Allocation July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation15 $49 $313 $22 $20 Capital Expenditures Acquisitions Share Repurchases Dividends 2021 YTD Capital Deployment: $404M Capital Expenditures • 2021 CapEx expected to be $110M - $120M • Investments to support strategic growth initiatives and Industry 4.0 advanced manufacturing Acquisitions • Strategic fit + market expansion • Returns exceeding cost of capital within 3 years Share Repurchases • Opportunistic approach, supported by FCF • Repurchased 42,150 shares in 2Q at an average price of $248.47 per share • ~$126M remains on current authorization as of 6/26/21 Dividends • 11% dividend increase announced February 2021 • Payout ratio target: 22% of earnings • Current payout: ~20% G ro w in g O ur B us in es s R et ur ni ng C as h to Sh ar eh ol de rs

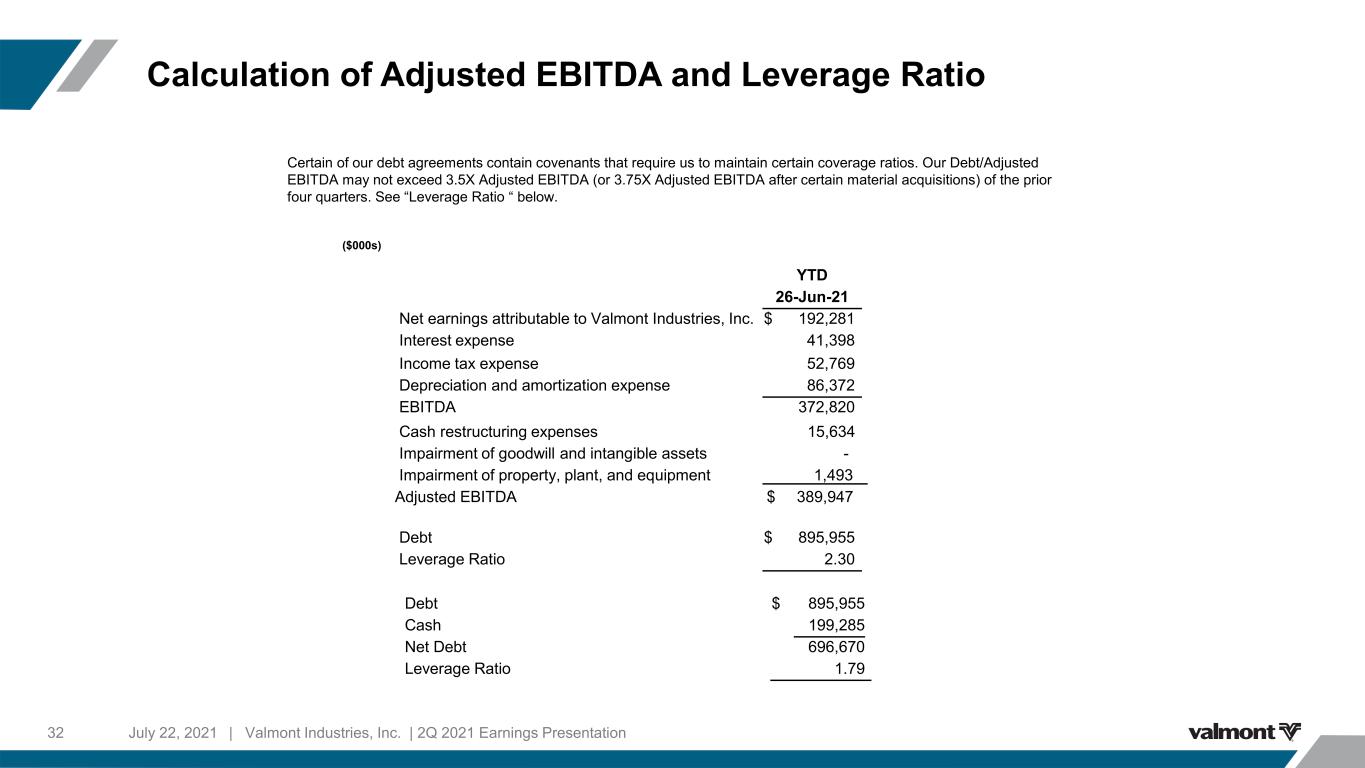

Strong Balance Sheet and Liquidity July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation16 Cash $199.3M Total Debt (Long-term) $860.9M Shareholders’ Equity $1,321.5M Total Debt to Adj. EBITDA1 2.3x Available Credit under Revolving Credit Facility2 $452.9M Cash $199.3M Total Available Liquidity $652.2M AS OF JUNE 26, 2021 ► Long-term debt of $860.9M, mostly fixed-rate, with long-dated maturities to 2044 and 2054 ► Capital allocation strategy has not changed, and the primary focus is to maintain liquidity to support operations and maintain investment grade credit rating − Purchased $10.5M of company stock in Q2, and $126.4M remains on current authorization 1 See slide 32 for calculation of Adjusted EBITDA and Leverage Ratio. 2 $600M Total Revolver less borrowings and Standby LC”s of $147M.

2Q 2021 / Full Year 2021 Outlook and Key Assumptions 17 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 PREVIOUS FY21 OUTLOOK1 KEY ASSUMPTIONS • Favorable foreign currency translation impact of ~2% of Net Sales • Expect 2H21 tax rate of ~25.0%; no tax law changes • CapEx to be in the range of $110M - $120M to support strategic growth initiatives and Industry 4.0 advanced manufacturing initiatives • No closures of large manufacturing facilities, workforce disruptions, or significant supply chain interruptions 9% – 14% Increase in Net Sales YoY 1 Exclusive of potential future restructuring activities. 2 Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document. $9.30 – $10.00 GAAP Diluted EPS 27% – 30% Increase in Irrigation Segment Sales YoY 16% – 19% Increase in Net Sales YoY $9.90 – $10.60 GAAP Diluted EPS 45% – 50% Increase in Irrigation Segment Sales YoY CURRENT FY21 OUTLOOK1 N/A Adj. Diluted EPS2 $10.40 – $11.10 Adj. Diluted EPS2

2021 Segment Outlook July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation18 Positive Momentum Across all Businesses USS • Expect quality of earnings to meaningfully improve in 3Q and 2H 2021 as pricing becomes more aligned with steel cost inflation • Strong backlog indicative of long-term market drivers of grid resiliency and the increasing use of renewable energy ESS • Expect some short-term softness in North American transportation markets, and improved demand for commercial lighting • Demand for wireless communication structures and components remains strong; expect sales to grow 15% - 20%, in line with market expectations COATINGS • End-market demand correlates closely to general economic trends • Focusing on pricing excellence and providing value to customers IRRIGATION • Expect 45-50% sales growth YoY, based on global underlying ag fundamentals, the estimated timing of deliveries of the large Egypt project, and another record sales year in Brazil • 3Q 2021 is a lower sales quarter due to normal business seasonality • Deliveries of the large project for Egypt began in 4Q 2020, which will affect YoY growth comparisons • Continue to raise prices to offset inflationary pressures

Fundamental Market Drivers Remain Resilient 19 Record Backlog of More than $1.3B at the End of the Second Quarter | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 COATINGS IRRIGATION • Closely following general macro- economic trends • Global preservation of critical infrastructure over the long-term • Increased number of economies actively fighting costs of corrosion will drive need to extend life of steel products globally over the long-term • Fits well within ESG principles • Global ag market fundamentals remain strong • Net farm income improvements are driving positive farmer sentiment • Improved demand along with strength across international markets and the large project in Egypt is providing a good line of sight into 2022 • Critical need for infrastructure investment provides very good economic stimulus • Solid long-term market trends for road construction and single-family housing • Carriers’ investments support work and school-at-home and macro buildouts in suburban and rural communities, aligning with favorable trends in residential construction • Strong backlog demonstrates ongoing demand and necessity for renewables, grid hardening and expanding ESG focus within utility industry • Well-positioned to be a preferred strategic partner with utilities and developers for their renewable energy goals ESSUSS

Ability to navigate and capitalize on challenging market dynamics demonstrates the strength and sustainability of our business and long-term strategy, favorable end- market trends and strong price leadership in the marketplace Remain focused on the execution of our strategy fueled by our dedicated and talented team of 10,000 employees and our differentiated business model Accelerating growth through investments in innovation, technology and IoT through our acquisitions of Prospera Technologies and PivoTrac, which builds on our overall strategy to grow recurring revenue services Summary 20 Poised and Well Positioned to Capture Growth and Drive Shareholder Value in the Future | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 01 02 03

Q&A 21 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

APPENDIX 22 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

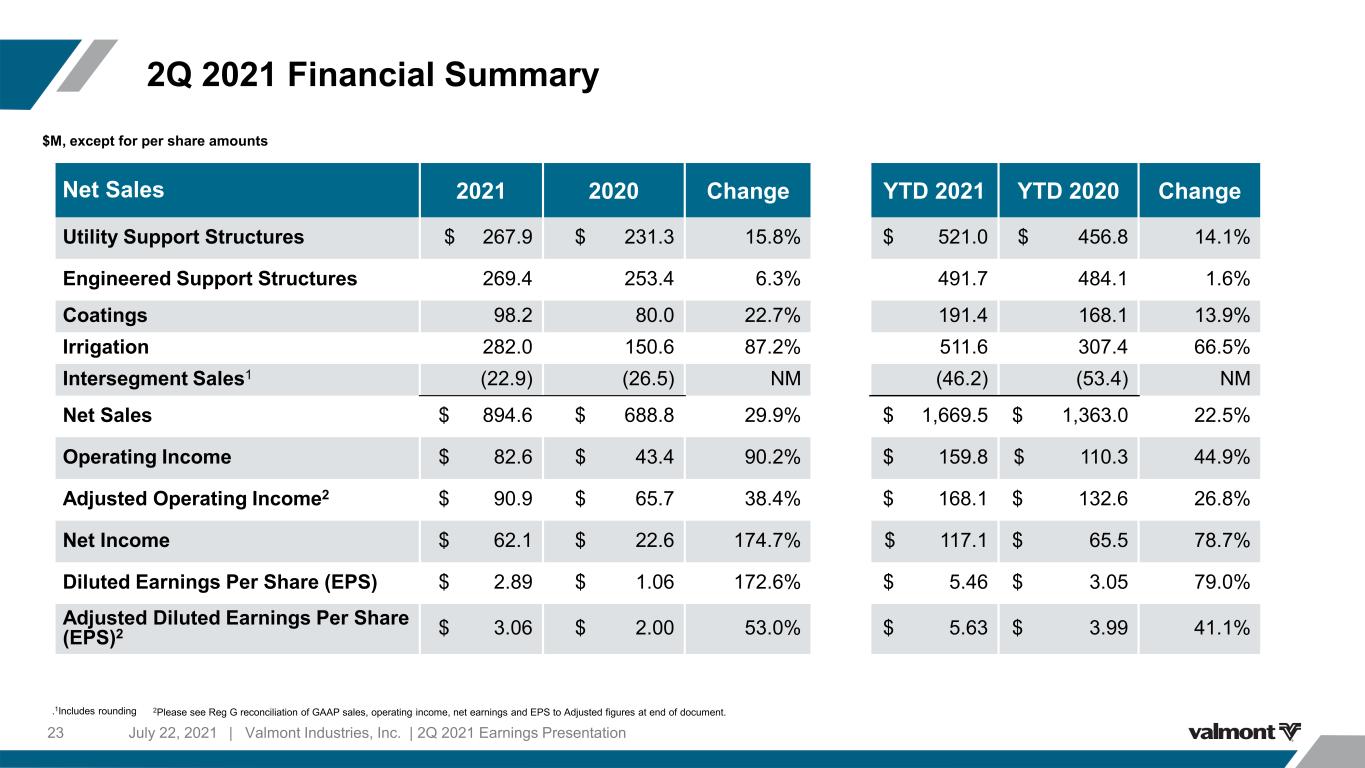

2Q 2021 Financial Summary 23 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Net Sales 2021 2020 Change YTD 2021 YTD 2020 Change Utility Support Structures $ 267.9 $ 231.3 15.8% $ 521.0 $ 456.8 14.1% Engineered Support Structures 269.4 253.4 6.3% 491.7 484.1 1.6% Coatings 98.2 80.0 22.7% 191.4 168.1 13.9% Irrigation 282.0 150.6 87.2% 511.6 307.4 66.5% Intersegment Sales1 (22.9) (26.5) NM (46.2) (53.4) NM Net Sales $ 894.6 $ 688.8 29.9% $ 1,669.5 $ 1,363.0 22.5% Operating Income $ 82.6 $ 43.4 90.2% $ 159.8 $ 110.3 44.9% Adjusted Operating Income2 $ 90.9 $ 65.7 38.4% $ 168.1 $ 132.6 26.8% Net Income $ 62.1 $ 22.6 174.7% $ 117.1 $ 65.5 78.7% Diluted Earnings Per Share (EPS) $ 2.89 $ 1.06 172.6% $ 5.46 $ 3.05 79.0% Adjusted Diluted Earnings Per Share (EPS)2 $ 3.06 $ 2.00 53.0% $ 5.63 $ 3.99 41.1% $M, except for per share amounts .1Includes rounding 2Please see Reg G reconciliation of GAAP sales, operating income, net earnings and EPS to Adjusted figures at end of document.

Steel Material Index Trends 2020-2021 YTD 24 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Since last quarter, the AMM material index has increased from $1,190 to $1,500; an increase of 310 points or 26.1%. Source: FastMarketsAMM.

State Transportation Investment Funding Measures 25 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 • State legislators in 44 states introduced 188 transportation funding measures in the first half of 2021 • Funding Approved in 2021 Legislative Session: $29,383,725,783 • One-time funding bills, including allocation of federal Covid-19 relief funds, were approved in twelve states for a total of $23.4 billion Source: Transportation Investment Advocacy Center.

State Transportation Investment Funding Measures by Type 26 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Source: Transportation Investment Advocacy Center.

5G Adoption Forecast and Capex Spend Post-COVID 27 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Source: GSM Association.

U.S. Net Farm Income July 22, 202128 Source: USDA Farm Income Data, Updated February 5, 2021 10 11 13 12 14 22 46 25 83 71 49 64 68 61 75 86 0 20 40 60 80 100 120 140 2014 2015 2016 2017 2018 2019 2020F 2021F Net Farm Income w/ Government Payments Dir. Gov't Payments NFI, less Gov't Payments 93 76 62 82 ($ B) 82 83 121 111 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation

U.S. Net Cash Farm Income by Year July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation29 Source: USDA, American Farm Bureau Federation

2011-2020 Historical Free Cash Flow1 July 22, 2021 | Valmont Industries, Inc. | 2Q 2021 Earnings Presentation30 10 Year Average FCF is $154M; Last 5 Years Has Averaged $151M 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Net cash flows from operating activities $ 149.7 $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 Net cash flows from investing activities (84.1) (136.7) (131.7) (256.9) (48.2) (53.0) (49.6) (155.4) (168.1) (104.0) Net cash flows from financing activities (45.9) (16.4) (37.4) (136.8) (32.0) (95.2) (220.0) (162.1) (98.9) (173.8) Net cash flows from operating activities $ 149.7 $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 Purchase of plant, property, and equipment (83.1) (97.1) (106.8) (73.0) (45.5) (57.9) (55.3) (72.0) (97.4) (106.7) Free Cash flows 66.6 100.0 289.7 101.1 226.8 174.9 77.8 81.0 210.2 209.6 Net earnings attributed to Valmont Industries, Inc. $ 228.3 $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 173.2 $ 116.2 $ 94.4 $ 153.8 $ 140.7 Adjusted net earnings attributed to Valmont Industries, Inc.1 $ 162.3 N/A $ 295.1 $ 187.7 $ 131.7 $ 137.6 $ 158.4 $ 123.0 N/A 163.8 Free Cash Flow Conversion - GAAP 0.29 0.43 1.04 0.55 5.66 1.01 0.67 0.86 1.37 1.49 Free Cash Flow Conversion - Adjusted 0.41 N/A 0.98 0.53 1.71 1.27 0.49 0.66 N/A 1.28 1) Reconciliation of Net Earnings to Adjusted Figures Net earnings attributed to Valmont Industries, Inc. $ 228.3 $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 173.2 $ 116.2 $ 94.4 $ 153.8 $ 140.7 Change in valuation allowance against deferred tax assets (66.0) — — — 7.1 (20.7) 41.9 — — — Impairment of long-lived assets — — 12.2 — 61.8 1.1 — 28.6 — 23.1 Reversal of contingent liability — — — — — (16.6) — — — — Other non-recurring expenses (non-cash) 18. 8.1 — — — — — Deconsolidation of Delta EMD, after-tax and NCI — — 4.4 — — — — — — — Noncash loss from Delta EMD shares — — — 3.8 4.6 0.6 0.2 — — — Adjusted net earnings attributed to Valmont Industries, Inc. $ 162.3 $ 234.1 $ 295.1 $ 187.7 $ 131.7 $ 137.6 $ 158.4 $ 123.0 $ 153.8 $ 163.8 ($M) 1 Adjusted earnings for purposes of calculating FCF conversion may not agree to the adjusted net earnings. The difference is due to cash restructuring, debt refinancing, or other non-recurring expenses which were settled in cash in the year of occurrence.

Years of rapid raw material cost inflation GAAP 0.29X 0.43X 1.04X 0.55X 5.66X 1.01X 0.67X 0.86X 1.37X 1.49X Adj. 0.41X N/A 0.98X 0.53X 1.71X 1.27X 0.49X 0.66X N/A 1.28X 2011 – 2020 Free Cash Flow1 ($M) 67 100 290 101 227 175 78 81 210 210 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 10-yr Avg. $154M GAAP 1.34X Adj. 0.91X Historical FCF Conversion by Year1 Strong Free Cash Flow throughout the Cycle 31 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 1 We use the non-GAAP measure of FCF, which we define as GAAP net cash flows from operating activities reduced by capex. We believe that FCF is a useful performance measure for management and useful to investors as the basis for comparing our performance with other companies. Our measure of FCF may not be directly comparable to similar measures used by other companies.

Calculation of Adjusted EBITDA and Leverage Ratio 32 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021 Certain of our debt agreements contain covenants that require us to maintain certain coverage ratios. Our Debt/Adjusted EBITDA may not exceed 3.5X Adjusted EBITDA (or 3.75X Adjusted EBITDA after certain material acquisitions) of the prior four quarters. See “Leverage Ratio “ below. YTD 26-Jun-21 Net earnings attributable to Valmont Industries, Inc. $ 192,281 Interest expense 41,398 Income tax expense 52,769 Depreciation and amortization expense 86,372 EBITDA 372,820 Cash restructuring expenses 15,634 Impairment of goodwill and intangible assets - Impairment of property, plant, and equipment 1,493 Adjusted EBITDA $ 389,947 Debt $ 895,955 Leverage Ratio 2.30 Debt $ 895,955 Cash 199,285 Net Debt 696,670 Leverage Ratio 1.79 ($000s)

Summary of Effect of Significant Non-Recurring Items on Reported Results 33 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

Summary of Effect of Significant Non-Recurring Items on Reported Results 34 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

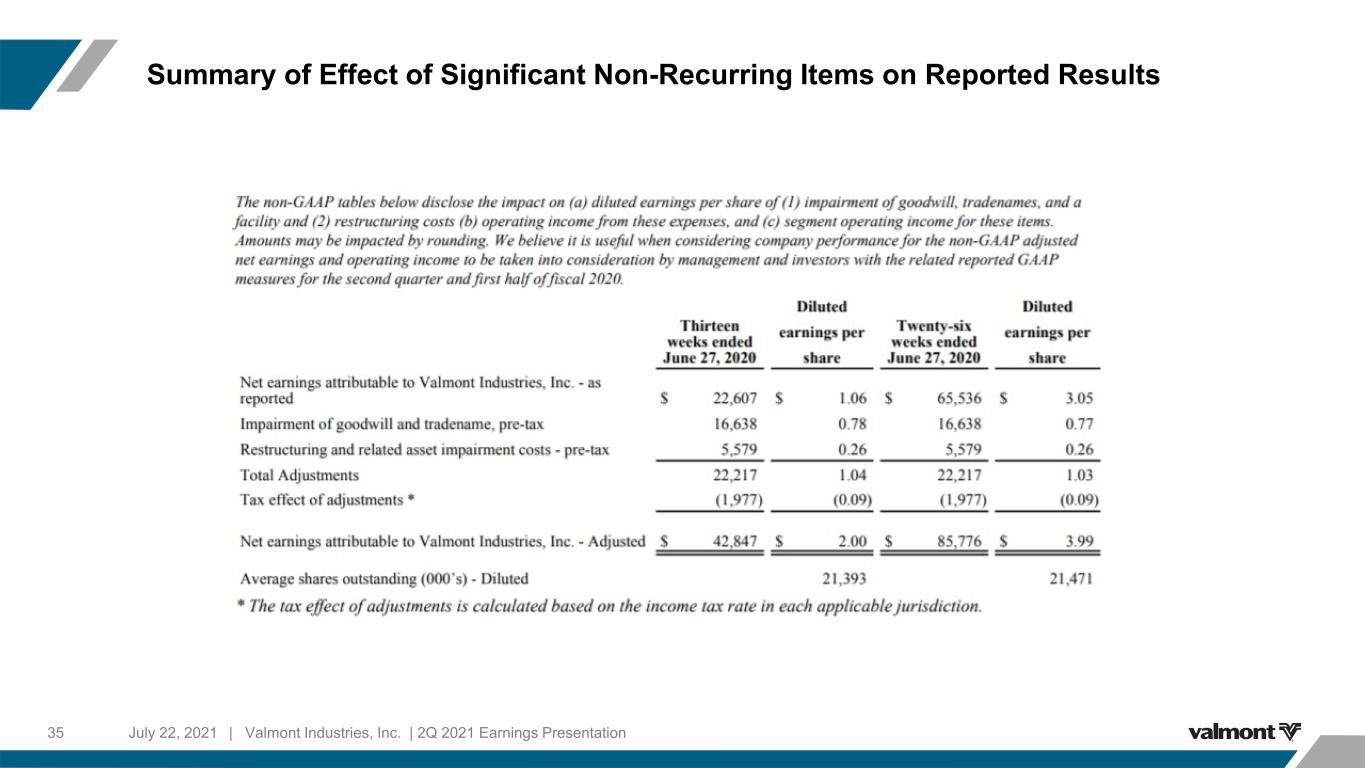

Summary of Effect of Significant Non-Recurring Items on Reported Results 35 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

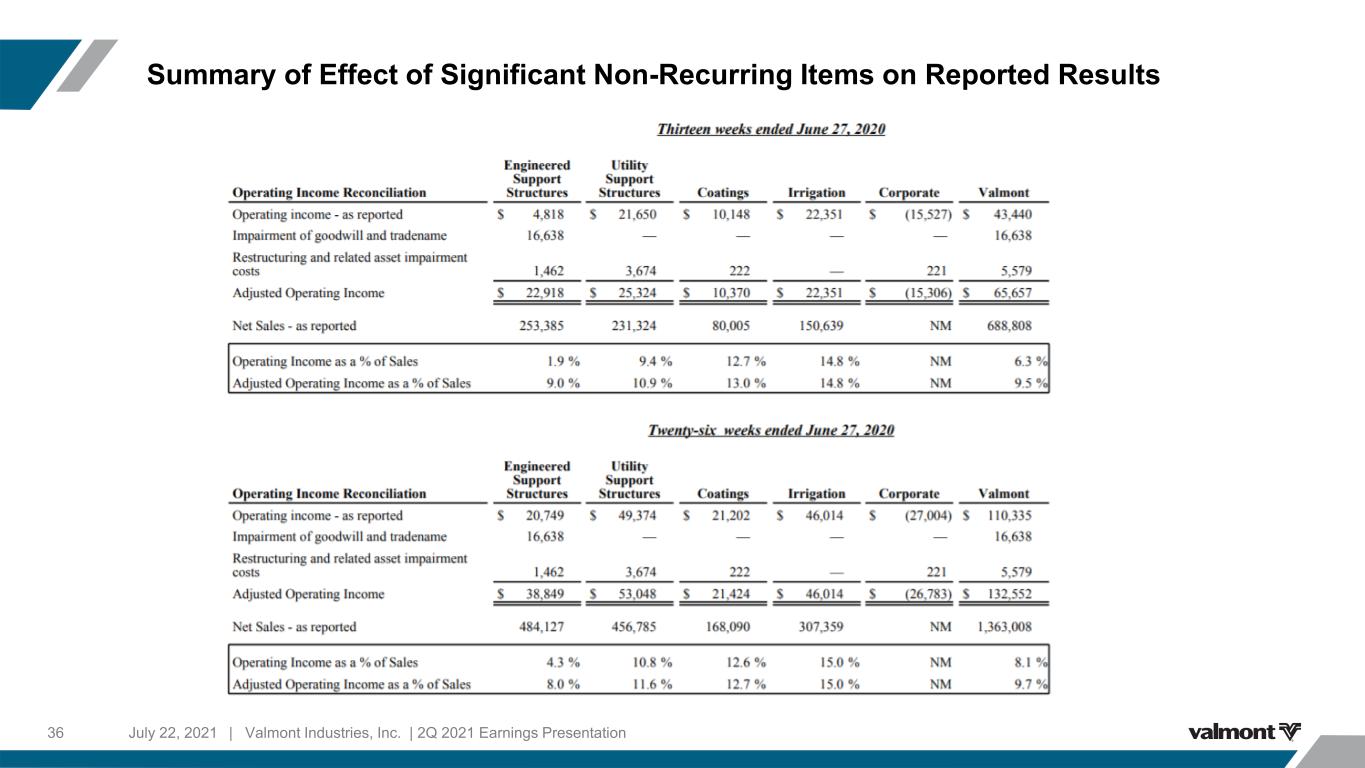

Summary of Effect of Significant Non-Recurring Items on Reported Results 36 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021

Regulation G Reconciliation of Forecasted GAAP and Adjusted Earnings 37 | Valmont Industries, Inc. | 2Q 2021 Earnings PresentationJuly 22, 2021