Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIFTH THIRD BANCORP | q22021earningsrelease.htm |

| 8-K - 8-K - FIFTH THIRD BANCORP | fitb-20210722.htm |

1 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Fifth Third Bancorp 2Q21 Earnings Presentation July 22, 2021 Refer to earnings release dated July 22, 2021 for further information.

2 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) effects of the global COVID-19 pandemic; (2) deteriorating credit quality; (3) loan concentration by location or industry of borrowers or collateral; (4) problems encountered by other financial institutions; (5) inadequate sources of funding or liquidity; (6) unfavorable actions of rating agencies; (7) inability to maintain or grow deposits; (8) limitations on the ability to receive dividends from subsidiaries; (9) cyber-security risks; (10) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (11) failures by third-party service providers; (12) inability to manage strategic initiatives and/or organizational changes; (13) inability to implement technology system enhancements; (14) failure of internal controls and other risk management systems; (15) losses related to fraud, theft, misappropriation or violence; (16) inability to attract and retain skilled personnel; (17) adverse impacts of government regulation; (18) governmental or regulatory changes or other actions; (19) failures to meet applicable capital requirements; (20) regulatory objections to Fif th Third’s capital plan; (21) regulation of Fifth Third’s derivatives activities; (22) deposit insurance premiums; (23) assessments for the orderly liquidation fund; (24) replacement of LIBOR; (25) weakness in the national or local economies; (26) global political and economic uncertainty or negative actions; (27) changes in interest rates; (28) changes and trends in capital markets; (29) fluctuation of Fifth Third’s stock price; (30) volatility in mortgage banking revenue; (31) litigation, investigations, and enforcement proceedings by governmental authorities; (32) breaches of contractual covenants, representations and warranties; (33) competition and changes in the financial services industry; (34) changing retail distribution strategies, customer preferences and behavior; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisit ions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events, other natural disasters, or health emergencies (including pandemics); (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; and (44) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases. You should refer to our periodic and current reports filed with the SEC for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Copies of those filings are available at no cost on the SEC’s Web site at www.sec.gov or on our Web site at www.53.com. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 27 through 29 of our 2Q21 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

3 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved • Strong reported and adjusted return metrics, reflecting solid operating results • Adjusted PPNR1 growth of 6% compared to the year-ago quarter • Historically low NCO ratio reflecting improvements in consumer and commercial portfolios • Allowance for credit losses ratio2 of 2.06% down 13 bps sequentially; benefit to credit losses driven by improved macroeconomic environment and strong credit results • Period end loan-to-core deposit ratio of 67% (64% ex. PPP) • Repurchased shares totaling $347 million; capital plans support repurchase of shares totaling approximately $850MM in 2H21 and a quarterly common dividend increase of $0.03 starting in September4 2Q21 highlights Reported1 Adjusted1 ROA Efficiency ratio ROTCE 1.43% 19.7% NIM 2.63%2.63% 1.38% 16.6% 58.0%59.1% ROE 13.5%13.0% excl. AOCI PPNR $836MM$799MM EPS $0.98$0.94 CET13 10.37% For end note descriptions, see end note summary starting on page 32

4 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Net interest income1 T o ta l n e t in te re s t in c o m e ; $ m ill io n s NII NII $ in millions; NIM change in bps $1,1791Q21 2.62% 1Q21 to 2Q21 Reported NII & NIM Walk NIM $1,211 2.63%2Q21 For end note descriptions, see end note summary starting on page 32 Incremental investment portfolio prepayment penalties Wholesale funding actions Government-guaranteed loans purchased from third party Lower yields on loan portfolio 11 3 7 2 12 1 (10) (3) T o ta l n e t in te re s t in c o m e ; $ m ill io n s NII NIM $1,203 $1,179 $1,211 2.75% 2.62% 2.63% 2Q20 1Q21 2Q21 Day count 9 (1) Other market rate & repricing impacts (net of deposit actions) 4 - Other balance sheet composition changes (including loan runoff) (1) (1)

5 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Adjusted noninterest income (excl. securities (gains)/losses)1 Noninterest income • Adjusted noninterest income1 up $9 million, or 1% • Primary drivers: ‒ Other noninterest income (up 56%) ‒ Card and processing revenue (up 9%) ‒ Commercial banking revenue (up 5%) ‒ Partially offset by leasing business revenue (down 30%) and mortgage banking revenue (down 25%) T o ta l n o n in te re s t in c o m e ; $ m ill io n s Noninterest income • Adjusted noninterest income1 up $98 million, or 15% • Primary drivers: ‒ Other noninterest income (up 62%) ‒ Service charges on deposits (up 22%) ‒ Wealth & asset management revenue (up 21%) ‒ Partially offset by mortgage banking revenue (down 35%) 2Q21 vs. 2Q20 2Q21 vs. 1Q21 $650 $749 $741 $670 $759 $768 2Q20 1Q21 2Q21 For end note descriptions, see end note summary starting on page 32

6 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Adjusted noninterest expense1 Noninterest expense • Adjusted noninterest expense1 down $62 million, or 5% • Primary drivers: ‒ Compensation and benefits (down 10%) ‒ Card and processing expense (down 33%) ‒ Marketing expense (down 13%) ‒ Partially offset by an increase in other noninterest expense (10%) T o ta l n o n in te re s t e x p e n s e ; $ m ill io n s • Adjusted noninterest expense1 up $47 million, or 4% • Primary drivers: ‒ Other noninterest expense (up 25%) ‒ Compensation and benefits (up 2%) ‒ Partially offset by card and processing expense (down 31%) and net occupancy expense (down 4%) Noninterest expense 2Q21 vs. 2Q20 2Q21 vs. 1Q21 $1,121 $1,215 $1,153 $1,106 $1,215 $1,153 2Q20 1Q21 2Q21 For end note descriptions, see end note summary starting on page 32

7 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved ~$5.4BN in PPP loans ~$3.7BN in PPP loans Securities1 Commercial Interest earning assets Average securities1 and short-term investmentsAverage loan & lease balances Consumer Total loan yield $ in billions; loan & lease balances excluding HFS Short-term investments Taxable securities yield $75.4 $69.0 $67.0 $39.6 $39.8 $40.7 $115.1 $108.9 $107.7 2Q20 1Q21 2Q21 Commercial Consumer Period-end HFI loan & lease balances $0.1 $0.1 $0.0 $0.8 $5.4 $5.7 $0.9 $5.5 $5.7 2Q20 1Q21 2Q21 Period-end HFS loan & lease balances Commercial Consumer $78.9 $69.3 $68.4 $39.6 $39.6 $40.1 $118.5 $109.0 $108.5 3.76% 3.68% 3.63% 2Q20 1Q21 2Q21 $37.0 $36.3 $36.9 $19.8 $32.7 $33.6 $56.8 $69.0 $70.5 3.08% 2.97% 3.06% 2Q20 1Q21 2Q21 $ in billions $ in billions $ in billions ~$5.2BN in PPP loans Totals shown above may not foot due to rounding ~$4.8BN in PPP loans For end note descriptions, see end note summary starting on page 32 ~$3.8BN in PPP loans ~$5.2BN in PPP loans +1% +1% (1%) (13%) QoQ YoY % change +5% NM NM NM QoQ YoY % change +3% +69% +2% Flat QoQ YoY % change +2% +3% (3%) (11%) QoQ YoY % change

8 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Core deposits and wholesale funding Average wholesale funding balancesAverage core deposit balances $79.7 $79.9 $80.7 $73.2 $80.7 $80.7 $152.8 $160.6 $161.4 2Q20 1Q21 2Q21 $74.9 $79.2 $80.3 $71.6 $77.7 $81.2 $146.5 $156.9 $161.5 0.27% 0.06% 0.05% 2Q20 1Q21 2Q21 Commercial Consumer Total IB core deposit rate $ in billions $ in billions Period-end core deposit balances Period-end wholesale funding balances $23.7 $18.4 $16.5 2.27% 2.42% 2.47% 2Q20 1Q21 2Q21 $22.0 $17.9 $14.7 2Q20 1Q21 2Q21 Total wholesale funding Wholesale funding cost Total wholesale fundingCommercial Consumer $ in billions $ in billions Totals shown above may not foot due to rounding +5% +13% +1% +7% QoQ YoY % change Flat +10% +1% +1% QoQ YoY % change (18%) (33%) QoQ YoY % change (10%) (31%) QoQ YoY % change

9 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Well diversified commercial portfolio with several potential risk mitigants to recent stresses COVID-19 high impact portfolios of interest Restaurants ($1.6BN) Hotels ($1.4BN) Retail non- Essential ($1.7BN) Casinos ($1.1BN) Healthcare Facilities ($2.7BN) Leisure Travel ($0.4BN) • Well diversified commercial portfolio favoring large borrowers with a track record of resilience • Proactive portfolio monitoring • COVID-19 high impact portfolio payment deferral rate less than 1% • Excluding PPP, ~60% of C&I COVID-19 high impact portfolio is in shared national credits • High impact portfolio balances shown include approximately $3.0BN in non-owner occupied CRE (see the following page for more information) • No changes to composition or definition of COVID-19 High Impact industries • ~75% of portfolio in QSR, mostly to top-tier brands and national chains • Areas of focus: ~25% dine-in focused; supported by concentration in large scale operators and top performing brands with strong sponsorship, and/or access to capital markets • C&I borrowers with strong performance given e-commerce disruption; composition almost exclusively either investment grade and well-positioned to weather downturn, or market- conforming ABL structures • Areas of focus: Retail driven Non-owner occupied CRE (~$1.0BN) supported by anchor tenant strength, collection rates and liquidity to support re-stabilization • Well diversified with long-term clients across broad sectors including Skilled Nursing, Physician Offices, Behavioral Health, Assisted Living and Surgery/Outpatient Centers, etc. • Areas of focus: Skilled Nursing occupancy supported by top tier national and large regional operators • Well contained to a few large operators; all have been able to access capital markets to bolster liquidity • Areas of focus: Seasonal operations impact the speed of full recovery supported by strong liquidity and access to capital • Clients have strong liquidity positions with continued access to capital markets; experienced management teams have executed significant cost reduction plans; ~67% to regional casino operators (incl. Native American-operated) • Includes casino hotels of approximately $0.7BN • Areas of focus: ~23% global operators (including Las Vegas) supported by scale, liquidity and experienced management teams • 58% to drivable leisure hotels, where RevPAR has generally rebounded • Areas of focus: 42% business-oriented hotels which likely face a multi year re- stabilization but are owned by strong, large scale operators with deep experience and broad resources Key takeaways: Total COVID High Impact Balances: $10.3 billion, or ~9% of total loans & leases down 5% from 1Q21 Total Commercial balances ex. PPP Other ($1.4BN) • Other portfolios impacted by COVID-19, including sports ($0.7), fitness ($0.3), and other leisure & recreation industries not listed above

10 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 86% 5% 6% CRE portfolio is smaller, centrally managed, and well diversified Casinos CRE as a % of total loans and leases Well diversified by property type Non-owner CRE - COVID high impact industries COVID high impact Exposures by property typeTotal loans and leases ex. PPP • Significantly less exposure to CRE (and high volatility CRE) compared to peers • Manage exposures and risk limits centrally • Immaterial exposure to raw land or developed land • Well-diversified by property type with lower exposures to hospitality and retail • Geographic diversification with no significant exposure to any specific MSA Balance Crit Rate $1.4BN Δ in Crit Rate QoQ Other Owner Occupied CRE Non-owner Occupied CRE Hotels Non-essential retail Healthcare Other Total NOO CRE – COVID High Impact $1.0BN $0.1BN $0.2BN $0.4BN $3.0BN - (4%) (3%) - (1%) - 83% 63% 12% 0% 9% 60% Total COVID High Impact (all Commercial) $10.3BN Loan balances ex. PPP 29% (2%) Non-COVID portfolio 3% Note totals shown above may not foot due to rounding 27% 13% 12% 11% 10% 6% 3% 2% 1% 15% Apartment Office Home Builder Hospitality Retail Industrial Student Housing Self Storage For Sale Other

11 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 2.22% 2.50% 2.49% 2.41% 2.19% 2.06% 2Q20 3Q20 4Q20 1Q21 2Q21 2.15% 2.65% Credit quality overview Early stage delinquencies and NPAs1 Net charge-offs (NCOs) ACL as % of portfolio loans and leases 0.52% 0.59% 0.52% 0.43% 0.26% 0.34% 0.13% 0.40% 0.17% 0.10% 0.41% 0.29% 0.44% 0.27% 0.16% 2Q18 2Q19 2Q20 2Q21 Consumer NCO Ratio Commercial NCO Ratio Total NCO Ratio Including MB unamortized loan discount Ex. PPP • ACL ratio of 2.06% decreased 13 bps (ACL declined $159MM) sequentially, driven primarily by improved macroeconomic environment and strong credit results • NCO ratio of 0.16% down 11 bps from the prior quarter and down 28 bps from the year-ago quarter • NPA ratio of 0.61% down 11 bps from the prior quarter • ACL represents 358% of NPLs and 338% of NPAs 2.75% 2.62% 0.52% 0.51% 0.65% 0.72% 0.61% 0.24% 0.35% 0.33% 0.28% 0.26% 2Q18 2Q19 2Q20 2Q21 NPA Ratio 30-89 days past due as a % of Porfolio Loans 2.64% 2.76% 2.53% 2.29% For end note descriptions, see end note summary starting on page 32 2.40% 1Q21 1Q21

12 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Allowance for credit losses Allowance for loan & lease losses Commercial and industrial loans Commercial mortgage loans Commercial construction loans Commercial leases Total commercial loans and leases Residential mortgage loans Home equity Indirect secured consumer loans Credit card Other consumer loans Total consumer loans Allowance for loan & lease losses Reserve for unfunded commitments1 Allowance for credit losses 85 24 1,224 235 152 109 198 115 809 2,033 189 $2,222 371 744 1.45% 0.74% 1.83% 1.46% 3.34% 0.72% 11.04% 3.77% 1.99% 1.89% 2.06% 1.56% 3.59% Allocation of allowance by product $s in millions 2Q21 • Allowance for credit losses decreased $159 million • Including the impact of the unamortized discount from the MB loan portfolio, the ACL ratio was 2.15% • Furthermore, excluding the impact of PPP, the ACL ratio would have been 2.22% Amount % of portfolio loans & leases For end note descriptions, see end note summary starting on page 32; Note, totals shown above may not foot due to rounding Change in Rate 0.55% (0.14%) 0.58% (0.15%) (0.03%) (0.21%) (0.29%) (0.11%) (0.47%) 0.20% (0.13%) 2.02% 0.34% (0.32%) 0.00% (0.09%) (0.11%) (0.09%) (0.06%) (1.45%) (0.44%) (0.22%) (0.14%) (0.08%) (0.12%) Compared to: 1Q21 CECL Day 1 0.24%

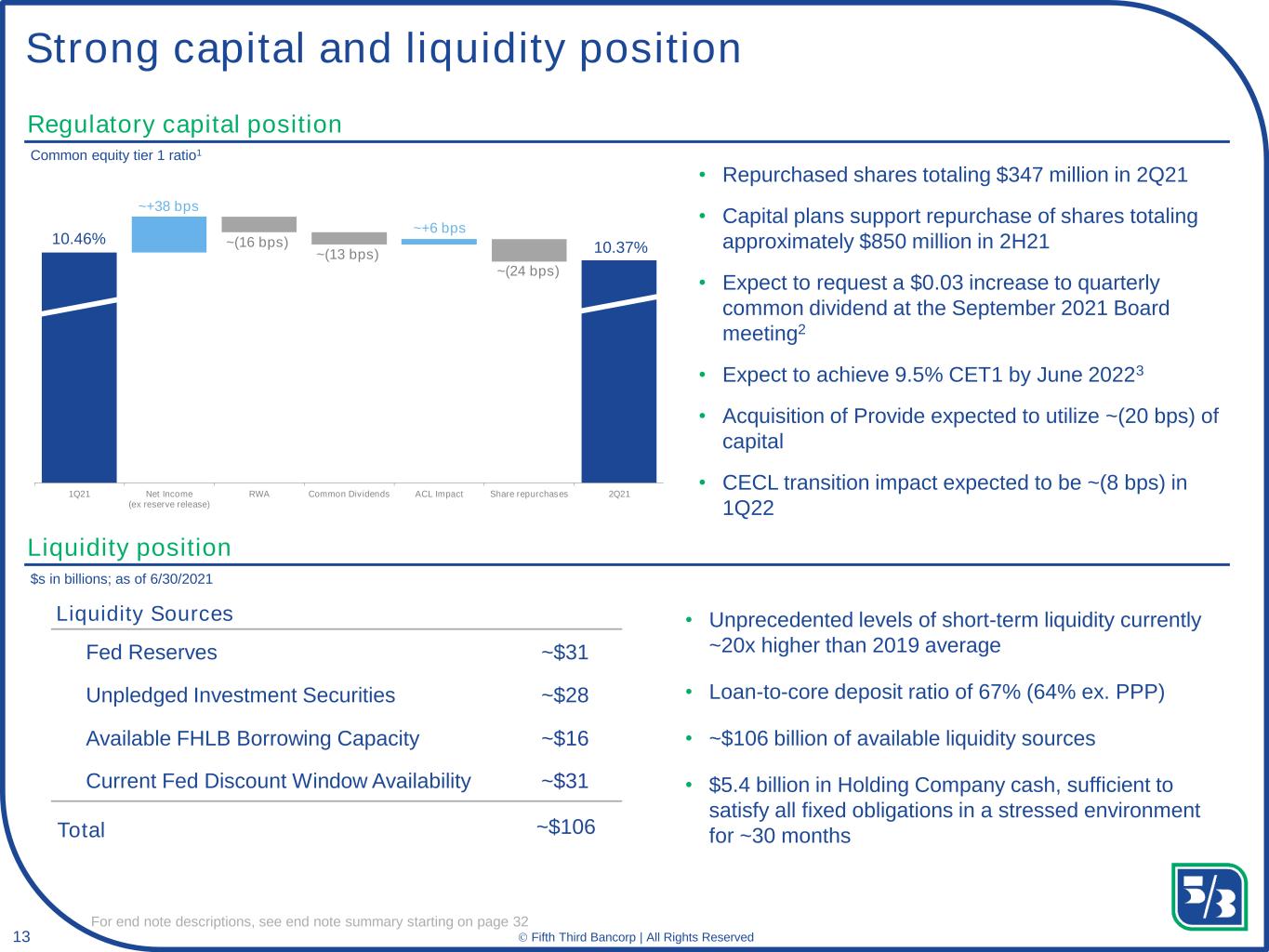

13 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 1Q21 Net Income (ex reserve release) RWA Common Dividends ACL Impact Share repurchases 2Q21 ~+38 bps 10.37% 10.46% • Unprecedented levels of short-term liquidity currently ~20x higher than 2019 average • Loan-to-core deposit ratio of 67% (64% ex. PPP) • ~$106 billion of available liquidity sources • $5.4 billion in Holding Company cash, sufficient to satisfy all fixed obligations in a stressed environment for ~30 months Strong capital and liquidity position Regulatory capital position Fed Reserves Unpledged Investment Securities Available FHLB Borrowing Capacity Current Fed Discount Window Availability Total ~$31 ~$28 ~$16 ~$31 ~$106 Liquidity Sources Liquidity position $s in billions; as of 6/30/2021 • Repurchased shares totaling $347 million in 2Q21 • Capital plans support repurchase of shares totaling approximately $850 million in 2H21 • Expect to request a $0.03 increase to quarterly common dividend at the September 2021 Board meeting2 • Expect to achieve 9.5% CET1 by June 20223 • Acquisition of Provide expected to utilize ~(20 bps) of capital • CECL transition impact expected to be ~(8 bps) in 1Q22 Common equity tier 1 ratio1 ~(16 bps) ~(13 bps) For end note descriptions, see end note summary starting on page 32 ~+6 bps ~(24 bps)

14 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Current expectations FY 2021 compared to FY 2020 (including HFS) Loans & leases Average: stable Net interest income1 Noninterest income1 up 7 – 8% (or up 8 – 9% excluding the TRA impacts) Noninterest expense1 up 2 – 3% (including ~$50MM expected in 2021 servicing expenses from recent consumer loan purchases, as well as expenses related to the Provide acquisition) down ~1% (FY20 baseline: $4.79BN) As of July 22, 2021; please see cautionary statements on page 2 (FY20 baseline: $2.92BN) (FY20 baseline: $4.55BN) Net charge-off ratio 20 – 25 bps Effective tax rate 22 – 23% For end note descriptions, see end note summary starting on page 32; totals shown above may not foot due to rounding • Includes expected PPP impacts • Reflects impact of previous consumer loan purchases (~$3.7BN in GNMA forbearance pools added since December 2020, incl. ~$1BN in April 2021) • Assumes commercial line utilization improves from 31% to 32% by YE21 • NII guidance assumes relatively stable securities balances

15 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Current expectations Third quarter 2021 compared to Second quarter 2021 Net interest income1 Noninterest income1 Noninterest expense1 down ~1% excluding potential Fifth Third Foundation donation and Momentum marketing program (2Q21 baseline: $768MM) (2Q21 baseline: $1.153BN) (including HFS) Loans & leases Average: down ~1% (up ~1% excl. PPP impacts) down ~2% (down ~1% excl. PPP impacts) (2Q21 baseline: $1.211BN) relatively stable As of July 22, 2021; please see cautionary statements on page 2 For end note descriptions, see end note summary starting on page 32 • Reflects impact of previous consumer loan purchases • NII guidance assumes relatively stable securities balances Net charge-off ratio 15 - 20 bps

16 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Fifth Third value proposition Generating strong relationship growth in all our markets with a focus on our Southeast expansion, and on continually improving the digital experience Diversified and growing fee revenues to support profitability and generate strong returns Investing for long-term outperformance (people, processes, technology) while still delivering strong financial results Focused on deploying capital into organic growth opportunities, paying a strong dividend, non-bank opportunities and share repurchases; Bank acquisitions remain a lower priority Maintaining a disciplined approach to rate and credit risk management Significantly different bank compared to the Fifth Third from a decade ago (credit, capital, management, culture) 1 2 3 4 5

17 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Appendix

18 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Living our purpose guided by our vision and values Our Vision Be the One Bank people most value and trust Our Core Values Our Purpose To improve the lives of our customers and the well-being of our communities Work as One Bank Take Accountability Be Respectful Act with Integrity Our purpose, vision, and core values support our commitment to generating sustainable value for stakeholders

19 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Committed to generating sustainable value Environmental, Social, and Governance (ESG) actions and impact Actions Impact 2020 ESG Report Available on investor relations website World’s Most Ethical Companies Recognized by Ethisphere in 2021 Most Responsible Companies Recognized by Newsweek in 2020 America’s Best Large Employers Recognized by Forbes in 2021 100% Score Disability Equality Index in 2021 Outstanding Rating on our most recent CRA exam 100% Score Human Rights Campaign Corporate Equality Index for sixth consecutive year A- Leadership Band 2019 & 2020 CDP surveys Green Power Leadership 2020 award from Environmental Protection Agency Winning “W” Company Recognized by 2020 Women on Boards (2020WOB) For end note descriptions, see end note summary starting on page 32. $41.6BN Delivered against 2016 $32BN community commitment1 $18 Minimum wage per hour (since 2019) 2.6M+ People educated through our L.I.F.E. programs2 59% Women in workforce; 40% Board diversity3 Carbon neutral In 2020 for our operations, including scopes 1, 2 and 3 (business travel). First regional U.S. bank to achieve neutrality $5.4BN In lending and financing to renewable energy projects towards our $8BN sustainable financing goal by 20254 ESG Committee Established in 2020, reports to Nominating & Corporate Governance Committee

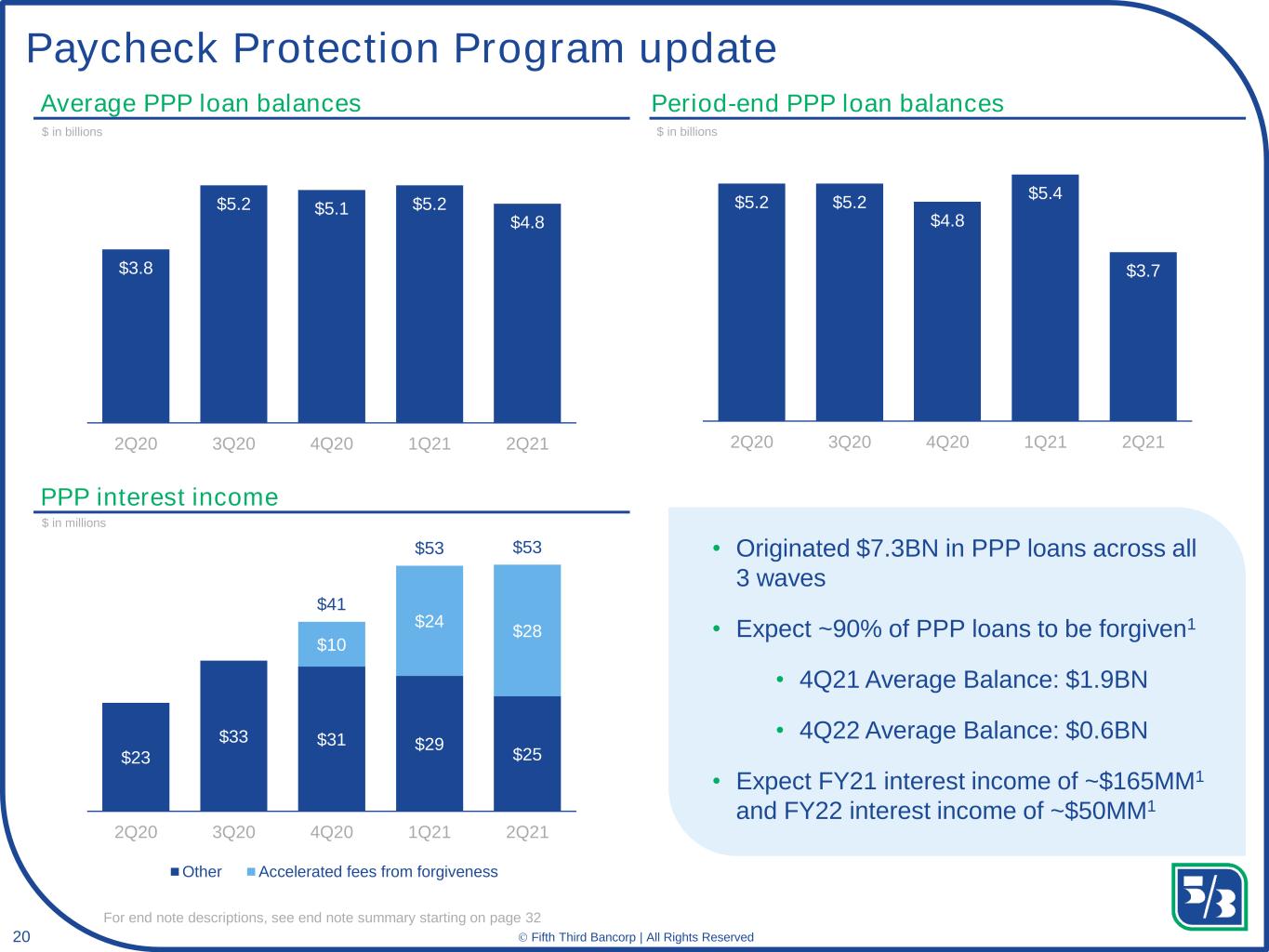

20 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved For end note descriptions, see end note summary starting on page 32 $3.8 $5.2 $5.1 $5.2 $4.8 2Q20 3Q20 4Q20 1Q21 2Q21 Average PPP loan balances Period-end PPP loan balances $5.2 $5.2 $4.8 $5.4 $3.7 2Q20 3Q20 4Q20 1Q21 2Q21 $23 $33 $31 $29 $25 $10 $24 $28 $41 $53 $53 2Q20 3Q20 4Q20 1Q21 2Q21 Other Accelerated fees from forgiveness PPP interest income • Originated $7.3BN in PPP loans across all 3 waves • Expect ~90% of PPP loans to be forgiven1 • 4Q21 Average Balance: $1.9BN • 4Q22 Average Balance: $0.6BN • Expect FY21 interest income of ~$165MM1 and FY22 interest income of ~$50MM1 $ in millions $ in billions $ in billions Paycheck Protection Program update

21 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 0% 69% 25% 3% 3% 100% Fix | 0% Variable 67% Fix | 33% Variable Balance sheet positioning Investment portfolio $21.3BN fixed 3 | $42.0BN variable 1,2 Commercial loans1,2,3 Consumer loans1 Long-term debt4 $33.1BN fixed | $7.6BN variable 1 $10.1BN fixed | $2.2BN variable4 • 1ML based: 54%7 • 3ML based: 7%7 • Prime based: 5%7 • Other based: 1%7,10 • Weighted avg. life: 1.7 years1,3 • 1ML based: 2%8 • 12ML based: 2%8 • Prime based: 14%8 • Weighted avg. life: 3.1 years1 • 1ML based: 6%9 • 3ML based: 9%9 • Weighted avg. life: 4.3 years C&I 37% Fix | 63% Variable Coml. mortgage 19% Fix | 81% Variable Coml. lease 100% Fix | 0% Variable Resi mtg.& construction 96% Fix | 4% Variable Auto/Indirect 100% Fix | 0% Variable Home equity 8% Fix | 92% Variable Senior debt 87% Fix | 13% Variable Sub debt 65% Fix | 35% Variable Auto securiz. proceeds 100% Fix | 0% VariableComl. construction 1% Fix | 99% Variable Credit card 10% Fix | 90% Variable Other 63% Fix | 37% Variable Other 87% Fix | 13% Variable • 58% allocation to bullet/ locked-out cash flow securities • Yield: 3.11%5 • Effective duration of 4.96 Net unrealized pre-tax gain: $1.9BN • 98% AFS11 Level 1 100% Fix | 0% Variable Level 2A Non-HQLA/ Other • The information above incorporates the impact of $11BN in cash flow hedges ($8BN in C&I receive-fixed swaps, $3BN in floors with a 2.25% strike against 1ML) as well as ~$1.5BN fair value hedges associated with long term debt (receive-fixed swaps) • The impacts of PPP loans (given the expected temporary nature) are excluded Includes $3.2BN non-agency CMBS (All super-senior, AAA-rated securities; 64.1% WA LTV, ~41% credit enhancement) 0% For end note descriptions, see end note summary starting on page 32; totals shown above may not foot due to rounding 70% 16% 9% 5% 11% 37% 8% 4% 40% 22% 57% 21%

22 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Well positioned to benefit from higher rates Estimated NII sensitivity profile and ALCO policy limits Estimated NII sensitivity with deposit beta changes Estimated NII benefit from increased securities balances4,5 NII is asset sensitive in year 1 and year 2 to rising rates. • As of June 30, 2021, 48% of HFI loans were variable rate net of existing hedges (66% of total commercial; 19% of total consumer)1 • ~87% of $45BN commercial portfolio indexed to 1ML have floors at or above 0% • Investment portfolio effective duration of 4.92 • Short-term borrowings represent approximately 10% of total wholesale funding, or 1% of total funding • Approximately $9 billion in non-core funding matures beyond one year Interest rate sensitivity tables leverage the following deposit assumptions: • 37% weighted-average up rate beta on interest-bearing deposit balances3 • No modeled re-pricing lag on deposits • Utilizes forecasted balance sheet with $5BN DDA runoff (per 100 bps rate movement) assumed in up rate scenarios • Weighted interest-bearing deposit floor of 5 bps For end note descriptions, see end note summary starting on page 32 ALCO policy l imit Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 10.8% 22.4% (4.0%) (6.0%) +100 Ramp over 12 months 5.6% 12.4% NA NA % Change in NII (FTE) Betas 25% higher Betas 25% lower Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 8.6% 18.5% 12.9% 26.3% +100 Ramp over 12 months 4.6% 10.5% 6.7% 14.3% % Change in NII (FTE) +$5BN balances +$10BN balances Change in Interest Rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 11.2% 22.8% 11.6% 23.3% +100 Ramp over 12 months 6.2% 13.3% 6.9% 14.3%

23 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved $8 $8 $8 $8 $8 $8 $8 $7 $7 $7 $3 $3 $2 $1 $1 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $11 $11 $11 $11 $11 $11 $11 $10 $10 $10 $6 $6 $5 $4 $1 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Floors Swaps ($3BN @ 2.25% 1-month LIBOR strike) ($8BN receive fixed / pay 1-month LIBOR) Cash flow hedges continue to protect NIM for next 3+ years Notional value of cash flow hedges ($ Billions) Cash flow hedges Hedges expected to generate an annual NII benefit of ~$300MM through 4Q22 relative to an unhedged position1 Assuming no change to 1ML beyond 7/21/2021 Actual For end note descriptions, see end note summary starting on page 32 Blended rate of swaps will continue to improve throughout time: • 2Q21-4Q22: 3.02% • 1Q23-3Q23: 3.08% • 4Q23-1Q24: 3.09% • 2Q24: 3.14% • 3Q24-4Q24: 3.20%

24 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Strong liquidity profile $ millions – excl. Retail Brokered & Institutional CDs Unsecured debt maturities Heavily core funded Demand 31% Interest checking 22% Savings/ MMDA 25% Consumer time 1% Foreign Office <1% Non-core deposits <1% Short term borrowings 1% Other liabilities 3% Equity 11% Long- term debt 6% Holding company: • Holding Company cash as of June 30, 2021: $5.4B • Cash currently sufficient to satisfy all fixed obligations in a stressed environment for ~30 months (debt maturities, common and preferred dividends, interest, and other expenses) without accessing capital markets, relying on dividends from subsidiaries or any other actions • The Holding Company did not issue long-term debt in 2Q21 • $250MM of Holding Company debt was redeemed in 2Q21 Bank entity: • The Bank did not issue long-term debt in 2Q21 • $2.05BN of Bank entity debt was redeemed in 2Q21 • Available and contingent borrowing capacity (2Q21): ‒ FHLB ~$15.9B available, ~$16.1B total ‒ Federal Reserve ~$31.4B Redemptions: • Fifth Third delivered notice on July 7th of its intent to exercise the 30-day par call option on $850MM of Bank entity debt maturing in 3Q21 As of 6/30/2021 2021 2022 2023 2024 2025 2026 on Fifth Third Bancorp Fifth Third Bank Fifth Third Financial Corp $1,150 $3,987 $1,500 $850 $1,500 $2,250

25 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved $95 $93 $47 $89 $81 $63 $66 $66 $59 $59 ($1) ($8) ($13) $18 ($3) ($58) ($75) ($75) ($81) ($73) $99 $76 $25 $85 $64 2Q20 3Q20 4Q20 1Q21 2Q21 Mortgage banking results $ millions Mortgage banking net revenue Mortgage originations and margins • Mortgage banking revenue decreased $21 million from the prior quarter and decreased $35 million from year-ago quarter • $5.0 billion in originations, up 46% compared to the year-ago quarter and up 7% from the prior quarter; 33% purchase volume Origination fees and gains on loan sale Gross servicing fees MSR decayNet MSR Valuation Note: totals shown above may not foot due to rounding $ billions Originations HFS Originations HFI $2.41 $3.42 $2.91 $3.62 $3.69 $1.01 $1.11 $1.03 $1.06 $1.31 $3.42 $4.53 $3.94 $4.68 $5.00 2Q20 3Q20 4Q20 1Q21 2Q21 3.81% 3.76% 2.85% 2.50% 2.13% 1.42% 1.99% 2.36%Gain-on-sale margin Gain-on-sale margin represents gains on all loans originated for sale divided by salable originations. Rate lock margin Rate lock margin represents gains recorded associated with salable rate locks divided by salable rate locks. 1.70% 1.65%

26 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved $44 $45 $22 $11 4Q21 4Q22 4Q23 4Q24 Estimated potential GAAP noninterest income recognition1,2 Future TRA payment schedule $ Millions; pre-tax For end note descriptions, see end note summary starting on page 32

27 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Key Priorities • Invest in a differentiated and digitally-enabled TM experience • Scale success in managed services • Accelerate growth in embedded payments • Introduce vertical versions of managed services, e.g., Healthcare Treasury Management transformation has delivered strong results and is well-positioned for future success 3.5X fees for Fifth Third Managed Services client vs. average TM client 33% Portfolio revenue from clients using Fifth Third Managed Services 12% CAGR Managed Services Ecosystem Fee Revenue since 2017 2020: Healthcare Payments 2018: Expert AR 2017: Expert AP 2015: Cash Logistics solutions (Cash Vault Direct, CPS recyclers) Evolution of Managed Services 2.2% 2.3% 2.3% 2.4% 2.7% 2.9% 3.7% 4.6% 4.8% 5.5% 5.6% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 FITB Peer 10 • TM product relationships with 35 of Fortune 100 companies • ~9,500 clients Fifth Third Treasury Management At a Glance Top quartile fee generation Total deposit fees less consumer OD, maintenance, and ATM fees as a % of adjusted total revenue; last twelve months ended 1Q21 • Fifth Third has a #4-7 market share rank for most TM products 2017 2021E Managed Services Ecosystem Revenue

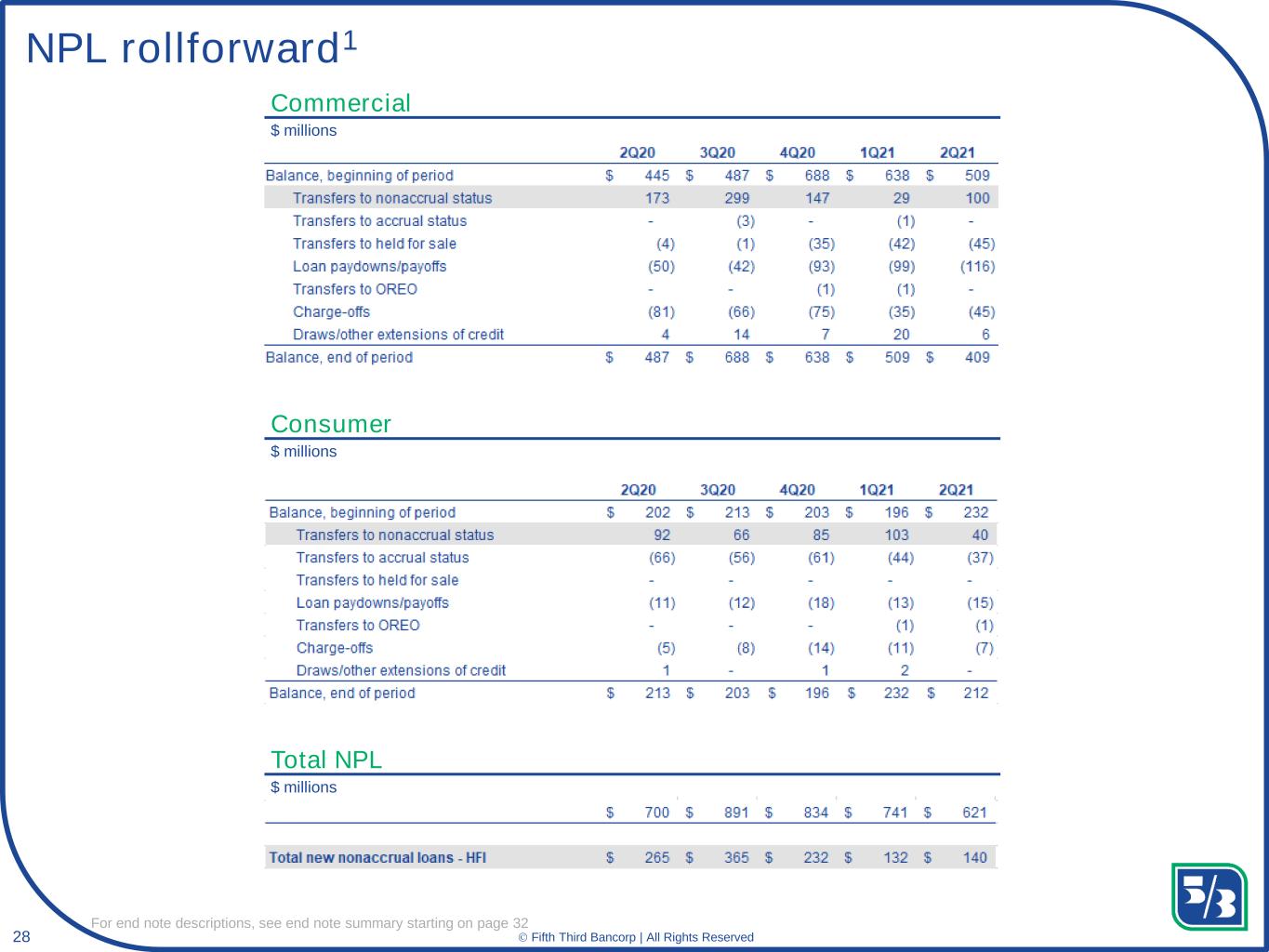

28 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved NPL rollforward1 Commercial Consumer Total NPL $ millions $ millions $ millions For end note descriptions, see end note summary starting on page 32

29 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 2Q21 adjustments and notable items Adjusted EPS of $0.981 2Q21 reported EPS of $0.94 included a negative $0.04 impact from the following notable item: • $37 million pre-tax (~$28 million after-tax2) charge related to the valuation of the Visa total return swap For end note descriptions, see end note summary starting on page 32

30 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Non-GAAP reconciliation For end note descriptions, see end note summary starting on page 32; totals shown above may not foot due to rounding Fifth Third Bancorp and Subsidiaries $ and shares in millions June March December September June (unaudited) 2021 2021 2020 2020 2020 Net income (U.S. GAAP) (a) $709 $694 $604 $581 $195 Net income (U.S. GAAP) (annualized) (b) $2,844 $2,815 $2,403 $2,311 $784 Net income available to common shareholders (U.S. GAAP) (c) $674 $674 $569 $562 $163 Add: Intangible amortization, net of tax 8 9 9 9 9 Tangible net income available to common shareholders (d) $682 $683 $578 $571 $172 Tangible net income available to common shareholders (annualized) (e) $2,735 $2,770 $2,299 $2,272 $692 Net income available to common shareholders (annualized) (f) $2,703 $2,733 $2,264 $2,236 $656 Average Bancorp shareholders' equity (U.S. GAAP) (g) $22,927 $22,952 $23,126 $22,952 $22,420 Less: Average preferred stock (h) (2,116) (2,116) (2,116) (2,007) (1,770) Average goodwill (4,259) 4,259 (4,261) (4,261) (4,261) Average intangible assets and other servicing rights (122) (133) (151) (164) (178) Average tangible common equity (i) $16,430 $16,444 $16,598 $16,520 $16,211 Less: Average accumulated other comprehensive income ("AOCI") (1,968) 2,231 (2,623) (2,919) (2,702) Average tangible common equity, excluding AOCI (j) $14,462 $14,213 $13,975 $13,601 $13,509 Adjustments (pre-tax items) Valuation of Visa total return swap 37 13 30 22 29 Net business acquisition, disposition, and merger-related charges - - 27 - 9 Fifth Third Foundation contribution - - 25 - - Branch and non-branch real estate charges - - 21 19 12 Restructuring severance expense - - - 19 - FHLB debt extinguishment charge - - - - 6 Private equity write-down - - - - - Adjustments - after-tax 1 (k) 28 10 79 46 43 Adjustments - tax-related State tax adjustments - - (13) - - Adjustments - tax-related (l) - - (13) - - Adjusted net income [(a) + (k) + (l)] $737 $704 $670 $627 $238 Adjusted net income (annualized) (m) $2,956 $2,855 $2,665 $2,494 $957 Adjusted net income available to common shareholders [(c) + (k) + (l)] $702 $684 $635 $608 $206 Adjusted net income available to common shareholders (annualized) (n) $2,816 $2,774 $2,526 $2,419 $829 Adjusted tangible net income available to common shareholders [(d) + (k) + (l)] $710 $693 $644 $617 $215 Adjusted tangible net income available to common shareholders (annualized) (o) $2,848 $2,811 $2,562 $2,455 $865 Average assets (p) $206,353 $203,836 $203,930 $202,533 $198,387 Metrics: Return on assets (b) / (p) 1.38% 1.38% 1.18% 1.14% 0.40% Adjusted return on assets (m) / (p) 1.43% 1.40% 1.31% 1.23% 0.48% Return on average common equity (f) / [(g) + (h)] 13.0% 13.1% 10.8% 10.7% 3.2% Adjusted return on average common equity (n) / [(g) + (h)] 13.5% 13.3% 12.0% 11.5% 4.0% Return on average tangible common equity (e) / (i) 16.6% 16.8% 13.9% 13.8% 4.3% Adjusted return on average tangible common equity (o) / (i) 17.3% 17.1% 15.4% 14.9% 5.3% Adjusted return on average tangible common equity, excluding AOCI (o) / (j) 19.7% 19.8% 18.3% 18.1% 6.4% For the Three Months Ended

31 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Non-GAAP reconciliation For end note descriptions, see end note summary starting on page 32; totals shown above may not foot due to rounding Fifth Third Bancorp and Subsidiaries For the Three Months Ended $ and shares in millions June March December September June (unaudited) 2021 2021 2020 2020 2020 Average interest-earning assets (a) $184,918 $182,715 $182,418 $180,704 $176,224 Net interest income (U.S. GAAP) (b) $1,208 $1,176 $1,182 $1,170 $1,200 Add: Taxable equivalent adjustment 3 3 3 3 3 Net interest income (FTE) (c) $1,211 $1,179 $1,185 $1,173 $1,203 Net interest income (FTE) (annualized) (d) $4,857 $4,782 $4,714 $4,667 $4,838 Noninterest income (U.S. GAAP) (e) $741 $749 $787 $722 $650 Valuation of Visa total return swap 37 13 30 22 29 Net business disposition charges - - 11 - - Branch and non-branch real estate charges - - - 10 12 Private equity write-down - - - - - Adjusted noninterest income (f) $778 $762 $828 $754 $691 Add: Securities (gains)/losses (10) (3) (14) (51) (21) Adjusted noninterest income, (excl. securities (gains)/losses) $768 $759 $814 $703 $670 Noninterest expense (U.S. GAAP) (g) $1,153 $1,215 $1,236 $1,161 $1,121 Fifth Third Foundation contribution - - (25) - - Branch and non-branch real estate charges - - (21) (9) - Business acquisition and merger-related expenses - - (16) - (9) Restructuring severance expense - - - (19) - FHLB debt extinguishment charge - - - - (6) Adjusted noninterest expense (h) $1,153 $1,215 $1,174 $1,133 $1,106 Metrics: Pre-provision net revenue [(c) + (e) - (g)] 799 713 736 734 732 Adjusted pre-provision net revenue [(c) + (f) - (h)] 836 726 839 794 788 Net interest margin (FTE) (d) / (a) 2.63% 2.62% 2.58% 2.58% 2.75% Efficiency ratio (FTE) (g) / [(c) + (e)] 59.1% 63.0% 62.7% 61.3% 60.5% Adjusted efficiency ratio (h) / [(c) + (f)] 58.0% 62.6% 58.3% 58.8% 58.4%

32 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Earnings presentation end notes Slide 3 end notes 1. Reported ROTCE, NIM, pre-provision net revenue, and efficiency ratio are non-GAAP measures: all adjusted figures are non-GAAP measures; see reconciliation on pages 30 and 31 of this presentation and the use of non-GAAP measures on pages 27-29 of the earnings release. 2. Allowance for credit losses as a percentage of portfolio loans and leases. 3. Current period regulatory capital ratios are estimated. 4. Subject to economic conditions and approval by the Board of Directors Slide 4 end notes 1. Results are on a fully-taxable equivalent basis; non-GAAP measure: see reconciliation on pages 30 and 31 of this presentation and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 5 end notes 1. Non-GAAP measure: see reconciliation on pages 30 and 31 of this presentation and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 6 end notes 1. Non-GAAP measure: see reconciliation on pages 30 and 31 of this presentation and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 7 end notes 1. Includes taxable and tax-exempt securities. Slide 11 end notes 1. Excludes HFS loans. Slide 12 end notes 1. 2Q21 commercial and consumer portfolio make up $147M and $42M, respectively, of the total reserve for unfunded commitment Slide 13 end notes 1. Current period regulatory capital ratios are estimated. 2. Subject to economic conditions and approval by the Board of Directors; see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the earnings release. 3. See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 14 end notes 1. Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 15 end notes 1. Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the earnings release. Slide 19 end notes 1. 2016-2020 2. since 2004 3. In terms of ethnicity or gender 4. Since 2012 Slide 20 end notes 1. Represents forward looking statement, please refer to page 2 of this presentation regarding forward-looking non-GAAP measures.

33 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Earnings presentation end notes Slide 21 end notes Note: Data as of 6/30/21. 1. Excludes HFS Loans & Leases. 2. Fifth Third had $11B of variable loans classified as fixed given the impacts of $3BN in floors with a 2.25% 1ML strike and $8BN in receive-fix swaps. 3. Excludes ~$3.7BN in Small Business Administration Paycheck Protection Program (PPP) loans. 4. Fifth Third had $705MM 3ML receive-fix swaps and $750MM 1ML receive-fix swaps outstanding against long-term debt, which are being included in floating long-term debt. 5. Yield of the 2Q21 weighted average taxable and non-taxable (tax equivalent) available for sale portfolio. 6. Effective duration taxable and non-taxable available for sale portfolio. 7. As a percent of total commercial, excluding PPP loans. 8. As a percent of total consumer. 9. As a percent of par. 10. Includes 12ML, 6ML, and Fed Funds based loans. 11. Excludes equity securities Slide 22 end notes Note: Data as of 6/30/21; actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies. 1. Excludes ~$3.7BN in Small Business Administration Paycheck Protection Program (PPP) loans. 2. Effective duration taxable and non-taxable available for sale portfolio. 3. Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel shift in the yield curve. 4. Assumes cash is deployed into bullet securities, which are added evenly over first 12 months of scenario (versus no additions in the base scenario). 5. Securities are priced at par at a 1.35% spread over IORB Slide 23 end notes 1. Represents forward looking statement, please refer to page 2 of this presentation regarding forward-looking non-GAAP measures. Slide 26 end notes 1. Assumes FIS will have sufficient taxable income to utilize TRA related deductions and have a marginal tax rate of 25%. 2. See forward-looking statements on page 2. Slide 28 end notes 1. Loan balances exclude nonaccrual loans HFS. Slide 29 end notes 1. Average diluted common shares outstanding (thousands); 718,085; all adjusted figures are non-GAAP measures; see reconciliation on pages 30 and 31 of this presentation and the use of non-GAAP measures on pages 27-29 of the earnings release. 2. Assumes a 23% tax rate. Slide 30 end notes Note: See pages 27-29 of the earnings release for a discussion on the use of non-GAAP financial measures. 1. Assumes a 23% tax rate, except for merger-related expenses impacted by certain non-deductible items Slide 31 end notes Note: See pages 27-29 of the earnings release for a discussion on the use of non-GAAP financial measures. 1. Assumes a 23% tax rate, except for merger-related expenses impacted by certain non-deductible items