Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE - TEXAS CAPITAL BANCSHARES INC/TX | a7212021exhibit991.htm |

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | tcbi-20210720.htm |

© 2021 Texas Capital Bank, N.A. Member FDIC July 21, 2021 Q2-2021 Earnings

2 Forward-looking Statements This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, our financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “forecast,” “could,” “should”, “projects,” “targeted,” “continue,” “intend” and similar expressions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. A number of factors, many of which are beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These factors include, but are not limited to, (1) the credit quality of our loan portfolio, (2) general economic conditions and related material risks and uncertainties in the United States, globally and in our markets and the impact they may have on us and our customers, including the continued impact on our customers from volatility in oil and gas prices as well as the continued impact of the COVID-19 pandemic (and any other pandemic, epidemic or health-related crisis), (3) technological changes, including the increased focus on information technology and cybersecurity and our ability to manage such information systems and the effects of cyber-incidents (including failures, disruptions or security breaches) or those of third-party providers, (4) changes in interest rates and changes in the value of commercial and residential real estate securing our loans, (5) adverse economic or market conditions that could affect the credit quality of our loan portfolio or our operating performance, (6) expectations regarding rates of default and credit losses and the appropriateness of our allowance for credit losses and provision for credit losses, (7) unexpected market conditions, regulatory changes or changes in our credit ratings that could, among other things, cause access to capital market transactions and other sources of funding to become more difficult, (8) the inadequacy of our available funds to meet our obligations, (9) the failure to effectively balance our funding sources with cash demands by depositors and borrowers, (10) material failures of our accounting estimates and risk management processes based on management judgment, (11) failure of our risk management strategies and procedures, including failure or circumvention of our controls, (12) the failure to effectively manage risk, (13) uncertainty regarding the London Interbank Offered Rate and our ability to successfully implement any new interest rate benchmarks, (14) the impact of changing regulatory requirements and legislative changes on our business, (15) the failure to successfully execute our business strategy, including completing planned merger, acquisition or sale transactions, (16) the failure to identify, attract and retain key personnel or the loss of such personnel, (17) increased or more effective competition from banks or other financial service providers in our markets, (18) structural changes in the markets for origination, sale and servicing of residential mortgages, (19) certainty in the pricing of mortgage loans that we purchase, and later sell or securitize, (20) volatility in the market price of our common stock, (21) credit risk resulting from our exposure to counterparties, (22) an increase in the incidence or severity of fraud, illegal payments, security breaches and other illegal acts impacting us, (23) the failure to maintain adequate regulatory capital to support our business, (24) environmental liability or other environmental, social or governance factors that may materially negatively impact the company, (25) severe weather, natural disasters, acts of war or terrorism and other external events and (26) our success at managing the risk and uncertainties involved in the foregoing factors. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

3 Improved Profitability Actions Supporting Commitments Net Interest Income Non-Interest Income Total Revenue Non-Interest Expense PPNR 1 Provision for Credit Losses Income Tax Expense Net Income / (Loss) PPNR 1 / Avg. Assets Efficiency Ratio 2 EPS ROA ROCE $209.9 70.5 280.4 222.3 58.1 (7.6) 0.62% 79.29% $(0.73) (5.48)% 100.0 (0.36)% $(34.3) $200.1 39.1 239.2 88.8 (6.0) 22.9 0.90% 62.85% $1.33 10.08% 150.3 0.73% $71.9 $197.0 30.1 227.1 78.0 (19.0) 23.6 0.81% 65.64% $1.31 9.74% 149.1 0.76% $73.5 Financial Highlights ($M) Q2 2020 Q1 2021 Q2 2021 Key Performance Metrics 1 Net interest income and non-interest income, less non-interest expense; 2 Non-interest expense divided by the sum of net interest income and non-interest income Net income to common of $73.5 million, or $1.31 per diluted share. Steadily improving economic outlook continues to benefit credit trends, driving a material Y-o-Y increase in net income and a modest lift linked quarter Strong loan fees supported Q2-2021 net interest income; however, PPNR1 declined as a result of lower non-interest income attributable to Correspondent Lending transition Non-interest expense was stable Q-o-Q, as the expense base started mixing in favor of salaries & benefits to client-facing professionals and support needed to provide high-touch service. Non-interest expense was materially lower Y-o-Y, due to the one-time actions taken in Q2-2020 to improve the go-forward expense base Despite recent ACL reductions, NPA coverage increased to 2.6x. Net charge-offs were $2.4 million in Q2-2021, and criticized asset balances and composition continue to improve The Bank successfully completed its plan to bring employees back to the office in a safe manner. Appropriate protocols remain in place to ensure ongoing employee safety, but work locations and schedules are now fully back to pre-COVID arrangements Positioning for Balance Sheet Strength Following the first quarter’s capital raise ($300.0 million of preferred) and CRT, the Company completed a $375.0 million sub-debt offering. The capital stack can now provide financial resiliency thru-cycle as we execute our new strategy Meaningful progress targeting higher-cost indexed deposits reduced excess liquidity and improved balance sheet efficiency. Efforts will continue in conjunction with further balance sheet actions as migration towards desired funding composition is realized Investing for Growth and Sustainably Higher Core Earnings Onboarded important leadership hires to continue rounding out an accomplished Executive Management Team, and added more highly talented frontline professionals than at any point in our history Executing on the Correspondent Lending transition will improve run-rate expense base and opportunistic build in the investment portfolio will mitigate the drag from excess liquidity. Full-quarter benefits of both initiatives will noticeably enhance Q3-2021 performance

4 Building a Foundation for Success Rick Rodman Head of Business Banking Madison Simm Head of Mortgage Finance Shannon Jurecka Chief Human Resources Officer Julia Harman Head of Corporate Banking Tim Storms Chief Risk Officer Don Goin Chief Information Officer Nancy McDonnell Head of Treasury Services Our Ongoing Focus on Operational Excellence & Talent Management The now established Operating Committee is meeting weekly to drive execution against our strategic objectives Weekly Balance Sheet Committee meetings to ensure capital is allocated to the right opportunities, while Quarterly Business Reviews drive resource alignment to the businesses in support of client acquisition and high-touch delivery Structured, thoughtful change is empowering bankers and providing them confidence the Bank’s full capabilities stand behind them in support of our clients A conservative approach to capital management and best-in-class risk management will ensure the Bank can support its clients through all market cycles An Ongoing Focus on Operational Excellence & client DeliveryQ2 2021 Leadership AnnouncementsQ1 2021 Leadership Announcements

5 LHI Yield Contribution NIM Contribution Loan Fee Dollars Q2 2020 0.29% 0.13% Q3 2020 0.25% 0.11% Q4 2020 0.46% 0.19% Q1 2021 0.34% 0.13% Q2 2021 0.41% 0.17% $15.7M $12.8M $18.0M $10.5M $12.2M $1.6M $5.1M $3.4M $5.1M 1.00% 0.99% 1.00% 0.98% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Commentary Q2-2021 loan fees (excluding PPP fees) elevated from normalized levels. Steady growth in core levels allows for a stable contribution to LHI yields and NIM Noteworthy Items | Loan Fees and PPP Loan Fees (excl. PPP) PPP Loans Period-end PPP ($M) $715.0 $617.5 $728.1 $364.4 Forgiven PPP ($M) $1.3 $90.2 $88.2 $367.1 Originations & Partial Paydowns, net ($M) ($1.2) ($7.3) $198.8 $3.4 PPP Fees Yield on PPP Loans (excl. Fees) Commentary With the final round of PPP funding closed, quarterly forgiveness drove a net portfolio decline ($363.7 million) that weighed on ending LHI (excluding MFLs) growth. Excluding PPP, Q-o-Q ending LHI growth was $133.1 million Cumulative PPP fees earned since inception total $16.9 million with $8.2 million remaining to be earned. Going forward, quarterly contributions are expected to decline from outsized fees earned in Q2-2021 and Q4-2020

6 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 LHS (Average) LHS (Period-end) $70.6M $75.5M $95.3M $105.4M $121.1M $1.3M Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 MSR (Period-end) Noteworthy Items | Correspondent Lending Risk Weighted ~50% Risk Weighted 250% (in $ millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 FY 2020 Net Interest Income 24.5 1.5 2.8 1.4 0.9 0.3 30.2 Non-interest Income Brokered Loan Fees 2.6 2.8 5.8 3.9 2.2 0.7 15.1 Servicing Fee Income 4.6 5.9 7.1 8.6 8.8 5.7 26.2 Gain/(Loss) on Sale of LHS (13.0) 39.0 25.2 6.8 5.6 (3.1) 58.0 Non-Interest Expense Salaries & Benefits 3.6 3.5 4.5 3.4 3.0 3.1 15.0 Marketing 0.0 0.0 0.0 0.0 0.0 0.0 0.1 Legal & Professional 0.8 0.6 0.8 0.9 1.0 0.8 3.2 Communications & Tech 0.7 1.4 1.0 1.0 0.4 0.3 4.0 Servicing Related Expenses 16.4 20.1 12.3 15.9 13.0 12.4 64.6 Other Expense 0.5 0.5 0.4 0.7 0.7 0.6 2.2 1 Based on Correspondent Lending’s results during final full-quarter operations (Q1-2021) Historical Contribution Commentary Transition activities progressed on schedule. Salaries & benefits expense and servicing expense continued through the end of the quarter, while the business’s non-interest income declined materially to $3.3 million (vs. $16.6 million in Q1-2021) Volatility expected to be minimal going forward. With only minor LHS and MSR volumes remaining, Correspondent Lending’s impact to Q3-2021 is expected to be minimal The Bank remains committed to re-underwriting its expense base and will act decisively on opportunities to reallocate expense to more profitable, strategically aligned areas. Repositioning of Correspondent Lending’s expense (approximately $70 million annualized 1) towards front-line hires and new products and services has already begun

7 % of Total Deposits 24% 36% 37% 40% 46% 48% 37% IB Deposit Costs 1.41% 0.65% 0.56% 0.48% 0.43% 0.39% 0.32% Yield on Liquidity Assets3 1.26% 0.09% 0.10% 0.10% 0.10% 0.10% 0.15% Q2 2021 EOP $0.2B $0.2B $0.7B $2.3B $3.4B $3.5B $3.8B $6.4B $10.8B $11.0B $10.8B $11.8B $11.6B $6.8B Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Investment Portfolio (Average) Liquidity Assets2 (Average) 9.35% 10.19% 10.53% 0.90% 2.06% 1.52%1.83% 1.79% 2.72% Noteworthy Items | Capital Actions and Liquidity Q4 2020 Q1 2021 Q2 2021 Action Preferred Stock Subordinated Debt $375M issuance, net $150M redemption 12.08% Q2 2021 CET1 Tier 1 Capital Tier 2 Capital 14.77% 14.04% Q2 2021 (Actual) $10.7M $6.3M Commentary Expected capital redemptions occurred later in the quarter, so Q2-2021 preferred dividends and sub-debt interest expense were higher than go-forward levels Capital is now consistent with the go-forward strategy Successful liquidity management and resumption of investment portfolio build is evident in ending balances, and will provide full-quarter benefit starting in Q3-2021 Risk-based Capital Ratios | Consolidated Excess Liquidity 1 Based on contractual rates and no change to outstanding balance; 2 Liquidity assets include Federal funds sold and interest-bearing deposits in other banks; 3 Interest on excess reserves increased to 15bps effective June 17, 2021 Q3 2021 (Projected)1 $10.6M Interest and Dividend Expense $111M redemption $4.3M

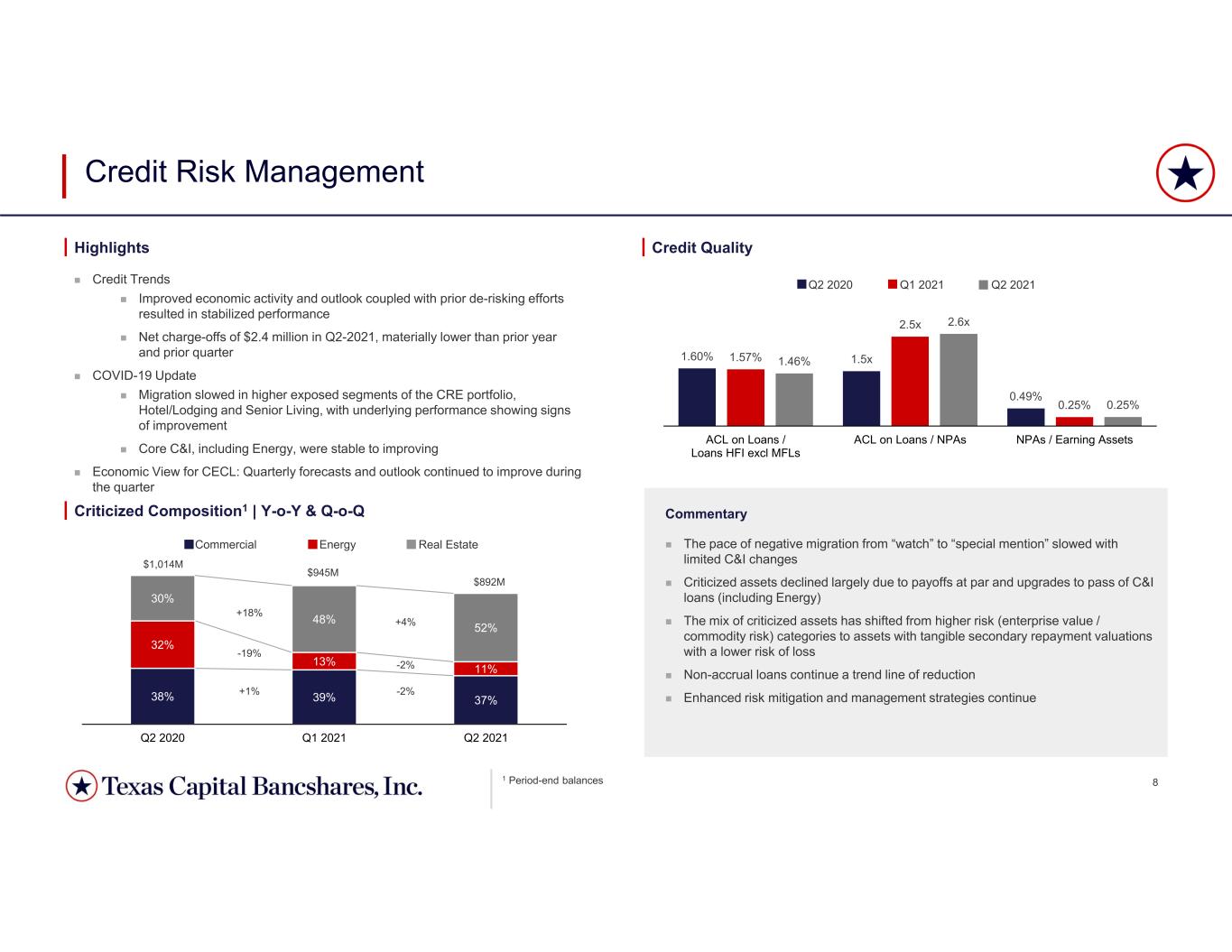

8 38% 39% 37% 32% 13% 11% 30% 48% 52% Q2 2020 Q1 2021 Q2 2021 Commercial Energy Real Estate +18% -19% +1% +4% -2% -2% $1,014M $945M $892M 1.60% 1.5x 0.49% 1.57% 2.5x 0.25% 1.46% 2.6x 0.25% ACL on Loans / Loans HFI excl MFLs ACL on Loans / NPAs NPAs / Earning Assets Credit Risk Management Credit Trends Improved economic activity and outlook coupled with prior de-risking efforts resulted in stabilized performance Net charge-offs of $2.4 million in Q2-2021, materially lower than prior year and prior quarter COVID-19 Update Migration slowed in higher exposed segments of the CRE portfolio, Hotel/Lodging and Senior Living, with underlying performance showing signs of improvement Core C&I, including Energy, were stable to improving Economic View for CECL: Quarterly forecasts and outlook continued to improve during the quarter Q2 2020 Q1 2021 Q2 2021 Criticized Composition1 | Y-o-Y & Q-o-Q Highlights Credit Quality Commentary The pace of negative migration from “watch” to “special mention” slowed with limited C&I changes Criticized assets declined largely due to payoffs at par and upgrades to pass of C&I loans (including Energy) The mix of criticized assets has shifted from higher risk (enterprise value / commodity risk) categories to assets with tangible secondary repayment valuations with a lower risk of loss Non-accrual loans continue a trend line of reduction Enhanced risk mitigation and management strategies continue 1 Period-end balances

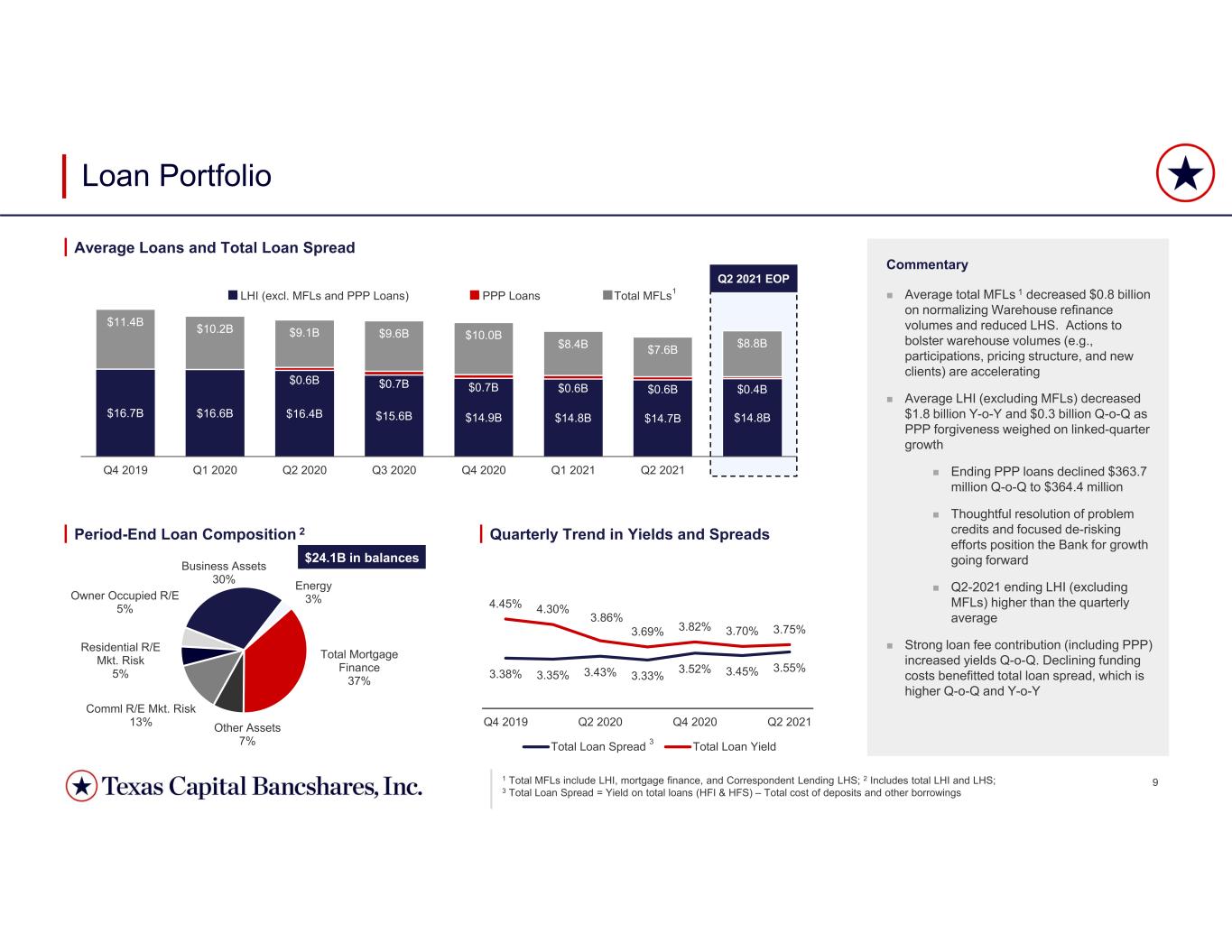

9 Q2 2021 EOP $16.7B $16.6B $16.4B $15.6B $14.9B $14.8B $14.7B $14.8B $0.6B $0.7B $0.7B $0.6B $0.6B $0.4B $11.4B $10.2B $9.1B $9.6B $10.0B $8.4B $7.6B $8.8B Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 LHI (excl. MFLs and PPP Loans) PPP Loans Total MFLs Business Assets 30% Energy 3% Total Mortgage Finance 37% Other Assets 7% Comml R/E Mkt. Risk 13% Residential R/E Mkt. Risk 5% Owner Occupied R/E 5% Loan Portfolio 1 Period-End Loan Composition 2 Quarterly Trend in Yields and Spreads 1 Total MFLs include LHI, mortgage finance, and Correspondent Lending LHS; 2 Includes total LHI and LHS; 3 Total Loan Spread = Yield on total loans (HFI & HFS) – Total cost of deposits and other borrowings $24.1B in balances Average Loans and Total Loan Spread Commentary Average total MFLs 1 decreased $0.8 billion on normalizing Warehouse refinance volumes and reduced LHS. Actions to bolster warehouse volumes (e.g., participations, pricing structure, and new clients) are accelerating Average LHI (excluding MFLs) decreased $1.8 billion Y-o-Y and $0.3 billion Q-o-Q as PPP forgiveness weighed on linked-quarter growth Ending PPP loans declined $363.7 million Q-o-Q to $364.4 million Thoughtful resolution of problem credits and focused de-risking efforts position the Bank for growth going forward Q2-2021 ending LHI (excluding MFLs) higher than the quarterly average Strong loan fee contribution (including PPP) increased yields Q-o-Q. Declining funding costs benefitted total loan spread, which is higher Q-o-Q and Y-o-Y 3.38% 3.35% 3.43% 3.33% 3.52% 3.45% 3.55% 4.45% 4.30% 3.86% 3.69% 3.82% 3.70% 3.75% Q4 2019 Q2 2020 Q4 2020 Q2 2021 Total Loan Spread Total Loan Yield3

10 Q2 2021 EOP $15.5B $15.4B $17.0B $17.5B $17.9B $17.5B $15.6B $13.4B $1.8B $2.3B $2.9B $2.4B $1.8B $1.6B $1.2B $1.2B $10.9B $10.0B $10.9B $12.2B $13.2B $14.4B $15.1B $14.2B Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Interest-bearing Core Interest-bearing Brokered DDAs 0.42% 0.34% 0.29% 0.24% 0.20% 0.45% 0.38% 0.33% 0.29% 0.29% Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Avg Cost of Deposits Total Funding Costs Deposits and Fundings Amount Matured Amount Maturing Funding Costs Brokered CDs Average Deposits Balances Commentary Interest-bearing deposits declined meaningfully as a result of targeted actions to reduce higher-cost indexed deposits. Ending balances $2.2 billion lower than average balance indicate significant momentum going into Q3-2021 Average DDA balances increased Q-o-Q ($0.7 billion) and Y-o-Y ($4.2 billion). Ending balance are below the quarterly average due to normal intra-month activity Brokered deposit balances have continued to mature without replacement. The portfolio will continue to be managed in line with strategic funding composition goals The Bank’s $1.2 billion of brokered CDs have a blended cost of 21bps Average deposit costs declined Q-o-Q, but total funding costs remained stable as the full-quarter cost of the CRT’s credit-linked notes offset improvements in deposits Higher-cost indexed portfolios will continue to be aggressively managed to reduce both costs and volumes $0.2B $0.2B $0.1B $0.3B 1.30% 0.22% 0.25% 0.35% Q2 2021 Q3 2021 Q4 2021 Q1 2022 Rate

11 9.9% 7.0% 7.6%8.4% 5.0% 3.3% 2Q20 1Q21 2Q21 $0.2B $3.4B $3.5B 4.31% 1.23% 1.29% Q2 2020 Q1 2021 Q2 2021 Avg. Investment Portfolio Yield on investment Q2-2021 Earnings Overview N et In te re st In co m e B al an ce S he et M an ag em en t Commentary Continued refinance normalization and Correspondent Lending transition drove an overall decline in mortgage finance interest income. Warehouse origination volumes were trending favorably late-quarter Strong loan fees (ex. PPP), continued deposit cost reductions in our core lines of business, and targeted reductions in costly excess liquidity drove a slight lift in NIM FHLB costs were expectedly lower and higher- cost CDs matured without replacement to help offset full-quarter credit-linked note costs Commentary After a temporary pause, deployment of excess liquidity into the investment portfolio continued. Ending balances increased $0.4 billion Q-o-Q and new securities were secured at favorable yields, both of which should benefit Q3-2021 results Portfolio balances will be maintained at current levels going forward Net interest income and NIM continued to benefit from loan floors, but at the expense of asset sensitivity. Once past an initial 100bp move, benefits to NII are nearer to prior year levels Avg. Investment Portfolio & Yield NII Shock Sensitivity | 12-month Net Interest Income & Margin Net Interest Margin Detail (bps) $209.9M $200.1M $197.0M 2.30% 2.09% 2.10% Q2 2020 Q1 2021 Q2 2021 Q 1 20 21 Q 2 20 21 Lo an s (n et P PP ) Li qu id A ss et Ba la nc es Li qu id A ss et Yi el ds PP P Lo an s Yi el ds O th er Fu nd in g C os ts 18.3% 12.0% 10.9% Loans at Floor1 29% 48% 49% Floor Yield 4.00% 3.87% 3.82% +100bps Shock +200bps Shock 1 Floors stated as a percentage of floating rate loans, excluding leases and Mortgage Finance loans

12 $100.8M $87.5M $86.8M Q2 2020 Q1 2021 Q2 2021 $222.3M $150.3M $149.1M Q2 2020 Q1 2021 Q2 2021 $2.5M $4.7M $4.6M $2.3M $2.9M $3.1M $1.5M $0.5M $0.5M Q2 2020 Q1 2021 Q2 2021 Deposit Service Charges Wealth Management Swap Fees $6.3M $8.1M $8.3M Q2-2021 Earnings Overview N on -in te re st in co m e N on -in te re st e xp en se Commentary Brokered loan fees, servicing income, and GOS related to the Correspondent Lending transition weighed on total non-interest income ($13.2 million lower Q-o-Q). Impacts going forward will be negligible Service charges on deposits were stable Q-o-Q, and wealth management fees continued to improve on client acquisition and attractive market levels Modest Q-o-Q improvements in card-related fees and capital markets fees, both of which will be an area of focus as we work to expand fee-generating products and capitalize on market opportunities Commentary Salaries and employee benefits decreased modestly Q-o-Q, despite normal seasonal improvements. Correspondent Lending transition reductions beginning in Q3-2021, will support new-hire costs and other investments for the next few quarters Marketing expense increased $0.2 million Q-o-Q, but targeted liquidity reductions will benefit future quarters’ marketing fees and FDIC expense Other non-interest expense was higher Q-o-Q, primarily due to a $2.1 million write-off of unamortized issuance costs upon redemption of sub-debt in Q2-2021 Non-interest Expense Salary & Employee Benefits Non-interest Income Fee Income Details $70.5M $39.1M $30.1M Q2 2020 Q1 2021 Q2 2021

13 Looking to the Future Diverse, well-established lines of business balanced with differentiated national businesses and core market offerings reflective of the relationship banking approach synonymous with Texas Capital since inception. Our focus is on businesses providing stable, thru-cycle earnings and attractive risk- adjusted returns Organic growth model developed by hand selecting top talent fosters unique cultural alignment, innovation mindset, and client-centric focus. Bias towards action enables rapid transformation consistent with dynamic market Branch-lite since formation, a limited physical footprint enables capital allocation for core treasury focus and digital offerings - compatible with accelerating client preferences Best-in-class Mortgage Finance business provides balance sheet optionality, strong risk-adjusted returns, and natural hedge to asset-sensitive commercially-oriented model Re-establishing a culture of clear communication, transparency and accountability. Delivering on our commitments is and will remain paramount Franchise Highlights Texas Capital Strategic Update Call We look forward to the discussion September 1, 2021 3:30PM Central